HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS

For the years ended December 31, 2024 and 2023

The following Management’s Discussion and Analysis (MD&A) of the financial condition and results of operations should be read together with the consolidated financial statements and accompanying notes thereto of Hydro One Limited (Hydro One or the Company) for the year ended December 31, 2024 (together, the Consolidated Financial Statements). The Consolidated Financial Statements have been prepared in accordance with United States (U.S.) generally accepted accounting principles (GAAP).

The Company has prepared this MD&A in accordance with National Instrument 51-102 - Continuous Disclosure Obligations of the Canadian Securities Administrators. Under the U.S./Canada Multijurisdictional Disclosure System, the Company is permitted to prepare this MD&A in accordance with the disclosure requirements of Canadian securities laws and regulations, which can vary from those of the U.S. This MD&A provides information as at and for the year ended December 31, 2024, based on information available to management as of February 19, 2025.

Included in this MD&A are certain specified financial measures and financial ratios that are not recognized by U.S. GAAP but that are used by management to evaluate the performance of the Company and its businesses. Since these specified financial measures and financial ratios may not have a standardized meaning within U.S. GAAP, results may not be comparable to similar financial measures and financial ratios presented by other entities. These measures and ratios should not be considered in isolation nor as a substitute for analysis of the Company’s financial information reported under U.S. GAAP. See "Non-GAAP Financial Measures" for a discussion of these non-GAAP financial measures and a reconciliation of such measures to the most directly comparable U.S. GAAP measure.

All financial information in this MD&A is presented in Canadian dollars, unless otherwise indicated.

CONSOLIDATED FINANCIAL HIGHLIGHTS AND STATISTICS

| | | | | | | | | | | | | | | |

| | | |

Year ended December 31 (millions of dollars, except as otherwise noted) | | | | | 2024 | 2023 | Change |

| Revenues | | | | | 8,484 | 7,844 | 8.2 | % |

| Purchased power | | | | | 4,143 | 3,652 | 13.4 | % |

Revenues, net of purchased power1 | | | | | 4,341 | 4,192 | 3.6 | % |

| Operation, maintenance and administration (OM&A) costs | | | | | 1,308 | 1,354 | (3.4 | %) |

| Depreciation, amortization and asset removal costs | | | | | 1,066 | 996 | 7.0 | % |

| Financing charges | | | | | 621 | 570 | 8.9 | % |

| Income tax expense | | | | | 181 | 178 | 1.7 | % |

| Net income attributable to common shareholders of Hydro One | | | | | 1,156 | 1,085 | 6.5 | % |

| | | | | | | |

| | | | | | | |

| Basic earnings per common share (EPS) | | | | | $1.93 | $1.81 | 6.6 | % |

| Diluted EPS | | | | | $1.92 | $1.81 | 6.1 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net cash from operating activities | | | | | 2,534 | 2,412 | 5.1 | % |

Funds from operations (FFO)1 | | | | | 2,275 | 2,150 | 5.8 | % |

Annualized FFO to Net Debt1 | | | | | 13.4 | % | 13.8 | % | (0.4 | %) |

| | | | | | | |

| Capital investments | | | | | 3,063 | 2,531 | 21.0 | % |

| Assets placed in-service | | | | | 2,463 | 2,324 | 6.0 | % |

| | | | | | | |

Transmission: Average monthly Ontario 60-minute peak demand (MW) | | | | | 20,659 | 20,806 | (0.7 | %) |

Distribution: Electricity distributed to Hydro One customers (GWh) | | | | | 31,523 | 30,619 | 3.0 | % |

| | | | | | | | |

As at December 31 | 2024 | 2023 |

Net Debt to capitalization ratio1 | 58.4 | % | 57.2 | % |

1 See section “Non-GAAP Financial Measures”.

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

OVERVIEW

Through its wholly-owned subsidiary Hydro One Inc., Hydro One is Ontario’s largest electricity transmission and distribution utility. Hydro One owns and operates substantially all of Ontario’s electricity transmission network and is the largest electricity distributor in Ontario by number of customers. The Company’s regulated transmission and distribution operations are owned by Hydro One Inc. Hydro One delivers electricity safely and reliably to approximately 1.5 million customers across the province of Ontario, and to large industrial customers and municipal utilities. Through its subsidiaries, Hydro One Inc. owns and operates approximately 30,000 circuit kilometres of high-voltage transmission lines and approximately 126,000 circuit kilometres of primary low-voltage distribution lines. Hydro One has three segments: (i) transmission; (ii) distribution; and (iii) other.

For the years ended December 31, 2024 and 2023, Hydro One's segments accounted for the Company's total revenues, as follows:

| | | | | | | | |

| Year ended December 31 | 2024 | 2023 |

| Transmission | 27 | % | 28 | % |

| Distribution | 72 | % | 71 | % |

| Other | 1 | % | 1 | % |

When adjusted for the recovery of purchased power costs, Hydro One’s segments accounted for the Company’s total revenues, net of purchased power,1 for the years ended December 31, 2024 and 2023 as follows:

| | | | | | | | |

| Year ended December 31 | 2024 | 2023 |

| Transmission | 52 | % | 53 | % |

| Distribution | 47 | % | 46 | % |

| Other | 1 | % | 1 | % |

As at December 31, 2024 and 2023, Hydro One’s segments accounted for the Company’s total assets as follows:

| | | | | | | | |

| As at December 31 | 2024 | 2023 |

| Transmission | 59 | % | 60 | % |

| Distribution | 38 | % | 39 | % |

| Other | 3 | % | 1 | % |

Transmission Segment

Hydro One’s transmission business owns and operates Hydro One's transmission system, which accounts for approximately 90% (2023 - 92%) of Ontario’s transmission capacity based on the network component of the revenue requirement2 approved by the Ontario Energy Board (OEB).3 As at December 31, 2024, the Company's transmission business consists of the transmission system operated by Hydro One Inc.'s rate-regulated subsidiaries, Hydro One Networks Inc. (Hydro One Networks), Hydro One Sault Ste. Marie LP (HOSSM), and Chatham x Lakeshore Limited Partnership (CLLP), as well as an approximate 66% interest in B2M Limited Partnership (B2M LP) and an approximate 55% interest in Niagara Reinforcement Limited Partnership (NRLP). The Company’s transmission business is rate-regulated and earns revenues mainly by charging transmission rates that are approved by the OEB.

| | | | | | | | |

| For the year ended December 31 | 2024 | 2023 |

Electricity transmitted1 (MWh) | 140,417,171 | | 137,130,724 | |

| | |

Rate base (millions of dollars) | 16,335 | | 15,336 | |

Capital investments (millions of dollars) | 1,860 | | 1,493 | |

Assets placed in-service (millions of dollars) | 1,431 | | 1,296 | |

1 Electricity transmitted represents total electricity transmitted in Ontario by all transmitters.

| | | | | | | | |

| As at December 31 | 2024 | 2023 |

Transmission lines spanning the province (circuit-kilometres) | 29,935 | | 29,906 | |

1 See section “Non-GAAP Financial Measures”.

2 The network component of the revenue requirement is Hydro One’s portion of the transmission revenue requirement attributed to assets that are used for the common benefit of all Hydro One and non-Hydro One customers in the province.

3 Hydro One owns and operates approximately 94% of the transmission system in Ontario based on the total OEB approved revenue requirement.

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

Distribution Segment

Hydro One’s distribution business is the largest in Ontario and consists of the distribution systems operated by Hydro One Inc.'s rate-regulated subsidiaries, Hydro One Networks and Hydro One Remote Communities Inc. (Hydro One Remotes). The Company’s distribution business earns revenues mainly by charging distribution rates that are approved by the OEB, as well as amounts to recover the cost of purchased power.

| | | | | | | | |

| For the year ended December 31 | 2024 | 2023 |

Electricity distributed to Hydro One customers (GWh) | 31,523 | | 30,619 | |

Electricity distributed through Hydro One lines (GWh)1 | 41,445 | | 40,367 | |

| | |

| | |

Rate base (millions of dollars) | 10,184 | | 9,649 | |

Capital investments (millions of dollars) | 1,185 | | 1,015 | |

Assets placed in-service (millions of dollars) | 1,017 | | 994 | |

1 Units distributed through Hydro One lines represent total distribution system requirements and include electricity distributed to consumers who purchased power directly from the Independent Electricity System Operator (IESO).

| | | | | | | | |

| As at December 31 | 2024 | 2023 |

Distribution lines spanning the province (circuit-kilometres) | 125,533 | | 125,232 | |

Distribution customers (number of customers) | 1,514,690 | | 1,494,595 | |

Other Segment

Hydro One's other segment consists principally of its telecommunications business, which provides telecommunications support for the Company’s transmission and distribution businesses, as well as certain corporate activities.

The telecommunication business is carried out by Hydro One's wholly-owned subsidiary, Acronym Solutions Inc. (Acronym). In addition to supporting Hydro One's regulated business segments, Acronym offers a comprehensive suite of Information Communications Technology solutions within a number of categories (including: Internet & Network, Security, Voice & Collaboration, Cloud and Managed Information Technology (IT)) that extend beyond its fibre optic network, in a competitive commercial market. Acronym is not regulated by the OEB, however Acronym is registered with the Canadian Radio-television and Telecommunications Commission as a non-dominant, facilities-based carrier, providing broadband telecommunications services in Ontario with connections to Montreal, Quebec; Buffalo, New York; and Detroit, Michigan.

Hydro One's other segment also includes the deferred tax asset (DTA) which arose from the revaluation of the tax bases of Hydro One’s assets to fair market value when the Company transitioned from the provincial payments in lieu of tax regime to the federal tax regime at the time of the Company’s initial public offering in 2015. As the DTA is not required to be shared with ratepayers, the Company considers it to not be part of the regulated transmission and distribution segment assets, and it is included in the other segment. Furthermore, Hydro One's other segment also includes Aux Energy Inc., a wholly-owned subsidiary that provides energy solutions to commercial and industrial clients, and Ontario Charging Network LP, a joint venture that owns and operates electric vehicle fast charging stations across Ontario under the Ivy Charging Network brand, as well as certain corporate activities, and is not rate-regulated.

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

PRIMARY FACTORS AFFECTING RESULTS OF OPERATIONS

Transmission Revenues

Transmission revenues primarily consist of regulated transmission rates approved by the OEB which are charged based on the monthly peak electricity demand across Hydro One’s high-voltage network. Transmission rates are designed to generate revenues necessary to construct, upgrade, extend and support a transmission system with sufficient capacity to accommodate maximum forecasted demand and a regulated return on the Company’s investment. Peak electricity demand is primarily influenced by weather and economic conditions. Transmission revenues also include export revenues associated with transmitting electricity to markets outside of Ontario as well as ancillary revenues associated with providing maintenance services to power generators and from third-party land use.

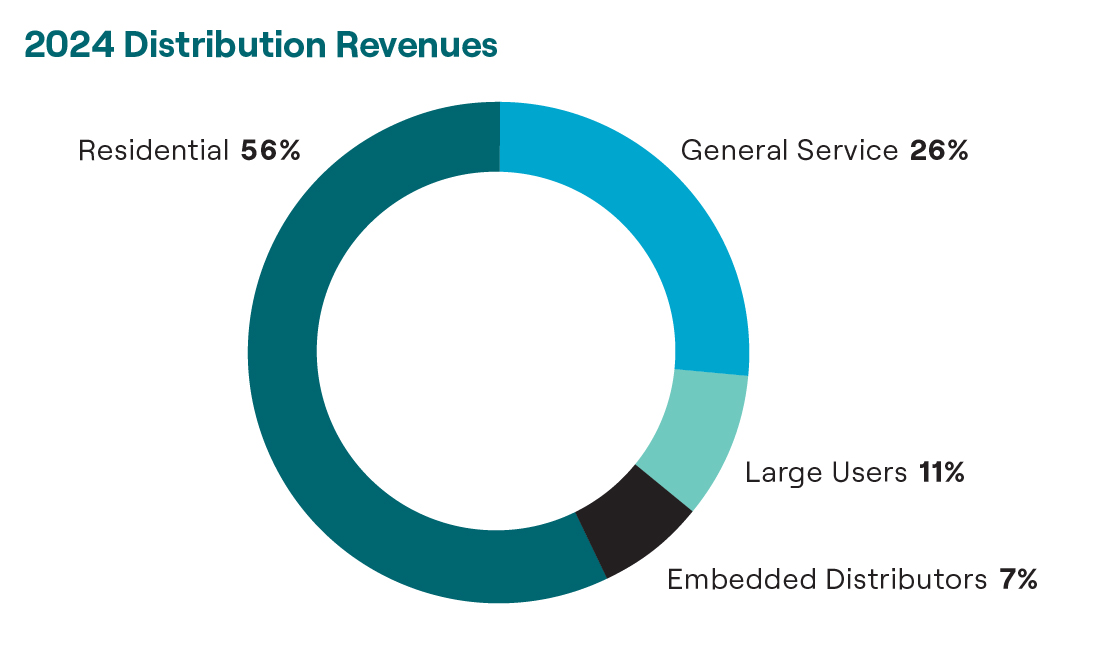

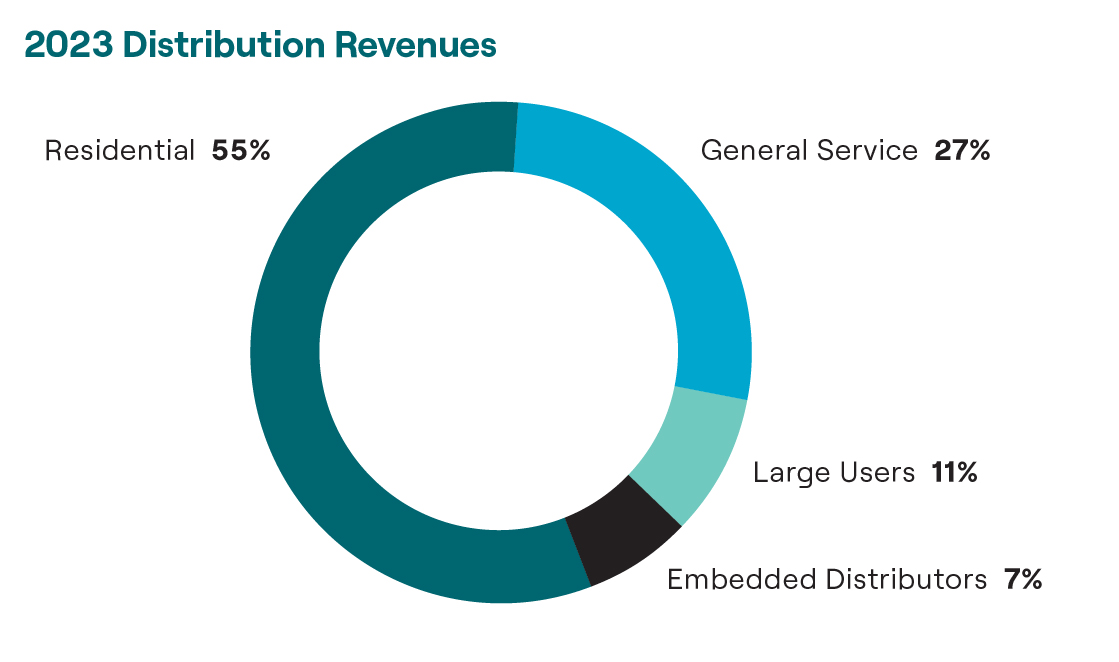

Distribution Revenues

Distribution revenues primarily consist of regulated distribution rates approved by the OEB, as well as the recovery of purchased power costs. Distribution rates are designed to generate revenues necessary to construct and support the local distribution system with sufficient capacity to accommodate existing and new customer demand and a regulated return on the Company’s investment. Accordingly, distribution revenues are influenced by distribution rates, the cost of purchased power, and the amount of electricity the Company distributes. Distribution revenues also include ancillary distribution service revenues, such as fees related to the joint use of Hydro One’s distribution poles by the telecommunications and cable television industries, as well as miscellaneous revenues such as charges for late payments.

Purchased Power Costs

Purchased power costs are incurred by the distribution business and represent the cost of the electricity purchased by the Company for delivery to customers within Hydro One’s distribution service territory. These costs are comprised of: (i) the wholesale commodity cost of energy; (ii) the Global Adjustment, which is the difference between the guaranteed price and the money the generators earn in the wholesale marketplace; and (iii) the wholesale market service and transmission charges levied by the IESO. Hydro One passes on the cost of electricity that it delivers to its customers, and is therefore not exposed to wholesale electricity commodity price risk.

OM&A

OM&A costs are incurred to support the operation and maintenance of the transmission and distribution systems, and include other costs such as property taxes related to transmission and distribution stations and buildings, and the operation of IT systems. Transmission OM&A costs are required to sustain the Company’s high-voltage transmission stations, lines, and rights-of-way, and include preventive and corrective maintenance costs related to power equipment, overhead transmission lines, transmission station sites, and forestry control to maintain safe distances between line spans and trees. Distribution OM&A costs are required to maintain the Company’s low-voltage distribution system to provide safe and reliable electricity to the Company's residential, small business, commercial, and industrial customers across the province. These include costs related to distribution line clearing and forestry control to reduce power outages caused by trees, line maintenance and repair, land assessment and remediation, as well as issuing timely and accurate bills and responding to customer inquiries.

Hydro One manages its costs through ongoing efficiency and productivity initiatives, while continuing to complete planned work programs associated with the development and maintenance of its transmission and distribution networks.

Depreciation, Amortization and Asset Removal Costs

Depreciation and amortization costs relate primarily to the depreciation of the Company’s property, plant and equipment, and amortization of certain intangible assets and regulatory assets. Asset removal costs consist of costs incurred to remove property, plant and equipment where no asset retirement obligations have been recorded on the balance sheet.

Financing Charges

Financing charges relate to the Company’s financing activities and include interest expense on the Company’s long-term debt and short-term borrowings, as well as gains and losses on interest rate swap agreements, foreign exchange or other similar contracts, net of interest earned on short-term investments. A portion of financing charges incurred by the Company is capitalized to the cost of property, plant and equipment associated with the periods during which such assets are under construction before being placed in-service.

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

RESULTS OF OPERATIONS

Net Income

Net income attributable to common shareholders of Hydro One for the year ended December 31, 2024 of $1,156 million is $71 million, or 6.5%, higher than the prior year. Significant influences on the change in net income attributable to common shareholders of Hydro One included:

•higher revenues, net of purchased power,4 resulting from an increase in transmission and distribution revenues due to OEB-approved 2024 rates, differences in regulatory adjustments recorded in each respective period, and higher energy consumption; and

•lower OM&A costs primarily resulting from lower work program expenditures; partially offset by

•higher depreciation, amortization and asset removal costs primarily due to the growth in capital assets as the Company continues to place new assets in-service;

•higher financing charges primarily due to higher interest on long-term debt as well as higher long-term debt, partially offset by a lower average volume of short-term notes outstanding and higher capitalized interest; and

•higher income tax expense, adjusted for net income neutral items, primarily due to lower deductible timing differences and higher pre-tax earnings.

While net income neutral, year-to-date results were also impacted by the cessation of the OEB-approved recovery of DTA amounts previously shared with ratepayers (DTA Recovery Amounts) on June 30, 2023 (see section “Regulation - Deferred Tax Asset” for further details) which resulted in a decrease in revenue, net of purchased power in the current year that has been offset by lower income tax expense.

EPS

EPS was $1.93 for the year ended December 31, 2024, compared to EPS of $1.81 in 2023. The increase in EPS was primarily driven by the impact of higher earnings year-over-year, as discussed above.

A discussion of management's expectations as to the Company's EPS guidance for 2023 to 2027 is contained in the Company's press release dated February 20, 2025 under the heading “Selected Operating Highlights”. This press release is available on SEDAR+ at www.sedarplus.com under the Company's profile and on our website at https://www.hydroone.com/investor-relations.

Revenues

| | | | | | | | | | | | | | | | | |

| | | |

Year ended December 31 (millions of dollars, except as otherwise noted) | | | | | 2024 | 2023 | Change |

| Transmission | | | | | 2,269 | | 2,214 | | 2.5 | % |

| Distribution | | | | | 6,175 | | 5,582 | | 10.6 | % |

| Other | | | | | 40 | | 48 | | (16.7 | %) |

| Total revenues | | | | | 8,484 | | 7,844 | | 8.2 | % |

| | | | | | | |

| Transmission | | | | | 2,269 | | 2,214 | | 2.5 | % |

Distribution revenues, net of purchased power1 | | | | | 2,032 | | 1,930 | | 5.3 | % |

| Other | | | | | 40 | | 48 | | (16.7 | %) |

Total revenues, net of purchased power1 | | | | | 4,341 | | 4,192 | | 3.6 | % |

| | | | | | | |

Transmission: Average monthly Ontario 60-minute peak demand (MW) | | | | | 20,659 | | 20,806 | | (0.7 | %) |

Distribution: Electricity distributed to Hydro One customers (GWh) | | | | | 31,523 | | 30,619 | | 3.0 | % |

1 See section “Non-GAAP Financial Measures”.

4 See section “Non-GAAP Financial Measures”.

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

Transmission Revenues

Transmission revenues increased by 2.5% compared to the year ended December 31, 2023, primarily due to:

•higher revenues resulting from OEB-approved 2024 rates; partially offset by

•net income neutral items, including lower revenue related to the OEB-approved recovery of regulatory assets in the prior period and the cessation of the DTA recovery period (see section “Regulation - DTA” for further details), which are offset in OM&A and income tax expense, respectively; and

•regulatory adjustments in the period, including a higher earnings sharing accrual.

Distribution revenues

Distribution revenues increased by 10.6% compared to the year ended December 31, 2023, primarily due to:

•higher purchased power costs, which are fully recovered from ratepayers and thus net income neutral;

•higher revenues resulting from OEB-approved 2024 rates;

•regulatory adjustments in the period, including a lower earnings sharing accrual; and

•higher energy consumption; partially offset by

•net income neutral items, including costs associated with mutual storm assistance costs recovered from third parties which is offset in OM&A, partially offset by lower revenues associated with the cessation of the DTA Recovery period and lower revenue of Hydro One Remotes, which are offset in income tax expense and OM&A, respectively.

Distribution revenues, net of purchased power,5 increased by 5.3% compared to the same period in the prior year largely due to the factors noted above, adjusted for the recovery of purchased power costs.

OM&A Costs

| | | | | | | | | | | | | | | | | |

| | | |

Year ended December 31 (millions of dollars) | | | | | 2024 | 2023 | Change |

| Transmission | | | | | 475 | | 499 | | (4.8 | %) |

| Distribution | | | | | 721 | | 765 | | (5.8 | %) |

| Other | | | | | 112 | | 90 | | 24.4 | % |

| | | | | 1,308 | | 1,354 | | (3.4 | %) |

Transmission OM&A Costs

Transmission OM&A costs were 4.8% lower than the year ended December 31, 2023, primarily due to:

•lower OM&A associated with the OEB-approved recovery of cost deferrals, which is offset in revenue and therefore net income neutral;

•lower corporate support costs; and

•lower work program expenditures, primarily related to environmental and vegetation management programs.

Distribution OM&A Costs

Distribution OM&A costs were 5.8% lower than the year ended December 31, 2023, primarily due to:

•lower work program expenditures, including forecast environmental expenditures provisioned in the prior year, lower emergency restoration costs and lower spend on IT initiatives;

•regulatory adjustments associated with the forecasted regulatory recovery of certain costs in accordance with the OEB-approved Getting Ontario Connected Act Variance Account;

•lower corporate support costs; and

•net income neutral items, including lower fuel costs of Hydro One Remotes, partially offset by mutual storm assistance costs, both of which are offset in revenue; partially offset by

•higher allowance for doubtful accounts.

Other OM&A Costs

Other OM&A costs were 24.4% higher than the year ended December 31, 2023, including higher costs in Acronym primarily due to higher third party service costs.

Depreciation, Amortization and Asset Removal Costs

Depreciation, amortization and asset removal costs increased by $70 million, or 7.0%, for the year ended December 31, 2024. This increase was primarily due to growth in capital assets as the Company continues to place new assets in-service, consistent with its ongoing capital investment program, and higher asset removal costs.

5 See section “Non-GAAP Financial Measures”.

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

Financing Charges

Financing charges increased by $51 million, or 8.9%, for the year ended December 31, 2024, primarily due to higher interest on long-term debt as a result of higher average debt levels and higher weighted-average interest rates, partially offset by a lower average volume of short-term notes outstanding and higher capitalized interest.

Income Tax Expense

Income taxes are accounted for using the asset and liability method. Current income taxes are recorded based on the income taxes expected to be paid in respect of the current and prior years’ taxable income. Deferred income tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statement carrying amounts and the respective tax basis of assets and liabilities including carryforward unused tax losses and credits.

As prescribed by the regulators, the Company recovers income taxes in revenues from ratepayers based on an estimate of current income tax expense in respect of regulated operations. The amounts of deferred income taxes related to regulated operations, which are considered to be more likely-than-not of recovery from, or refund to, ratepayers in future periods are recognized as deferred income tax regulatory assets or liabilities, with an offset to deferred income tax expense. Therefore, the consolidated income tax expense or recovery for the current period is based on the total current and deferred income tax expense or recovery, net of the regulatory accounting offset to deferred income tax expense arising from temporary differences recoverable from or refundable to customers in the future.

Income tax expense of $181 million for the year ended December 31, 2024, compares to $178 million in 2023. The $3 million increase in income tax expense for the year ended December 31, 2024 was primarily attributable to:

•lower deductible timing differences compared to the prior year; and

•higher pre-tax earnings, adjusted for the net income neutral items; partially offset by

•net income neutral items, including the cessation of the DTA Recovery period and the OEB-approved recovery of cost deferrals recognized as regulatory assets in prior periods, both of which are offset by a corresponding reduction in revenue and therefore net income neutral.

The Company realized an effective tax rate (ETR) of approximately 13.4% for the year ended December 31, 2024 compared to approximately 14.0% realized in 2023. The decrease of 0.6% was primarily attributable to the factors noted above.

SHARE CAPITAL

The common shares of Hydro One are publicly traded on the Toronto Stock Exchange (TSX) under the trading symbol "H". Hydro One is authorized to issue an unlimited number of common shares. The amount and timing of any dividends payable by Hydro One is at the discretion of Hydro One's Board of Directors (Board) and is established on the basis of Hydro One’s results of operations, maintenance of its deemed regulatory capital structure, financial condition, cash requirements, the satisfaction of solvency tests imposed by corporate laws for the declaration and payment of dividends and other factors that the Board may consider relevant. As at February 19, 2025, Hydro One had 599,435,650 issued and outstanding common shares.

The Company is authorized to issue an unlimited number of preferred shares, issuable in series. As at February 19, 2025, the Company had no preferred shares issued and outstanding.

The number of additional common shares of Hydro One that would be issued if all outstanding awards under the share grant plans and the Long-term Incentive Plan were vested and exercised as at February 19, 2025 was 1,693,848.

Common Share Dividends

In 2024, the Company declared and paid cash dividends to common shareholders as follows:

| | | | | | | | | | | | | | |

Date Declared |

Record Date |

Payment Date |

Amount per Share | Total Amount (millions of dollars) |

| February 12, 2024 | March 13, 2024 | March 28, 2024 | $0.2964 | | 178 |

| May 13, 2024 | June 12, 2024 | June 28, 2024 | $0.3142 | | 188 | |

| August 13, 2024 | September 11, 2024 | September 27, 2024 | $0.3142 | | 189 | |

| November 6, 2024 | December 11, 2024 | December 31, 2024 | $0.3142 | | 188 | |

| | | | 743 |

Following the conclusion of the fourth quarter of 2024, the Company declared a cash dividend to common shareholders as follows:

| | | | | | | | | | | | | | |

Date Declared |

Record Date |

Payment Date |

Amount per Share | Total Amount (millions of dollars) |

| February 19, 2025 | March 12, 2025 | March 31, 2025 | $0.3142 | | $188 | |

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

SELECTED ANNUAL FINANCIAL STATISTICS

| | | | | | | | | | | | | | | | | | | | | | | |

Year ended December 31 (millions of dollars, except per share amounts) | | | | | 2024 | 2023 | 2022 |

| Revenues | | | | | 8,484 | | 7,844 | | 7,780 | |

| Net income attributable to common shareholders of Hydro One | | | 1,156 | | 1,085 | | 1,050 | |

| | | | | | | |

| Basic EPS | | | | | $1.93 | $1.81 | $1.75 |

| Diluted EPS | | | | | $1.92 | $1.81 | $1.75 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Dividends per common share declared | | | | | $1.24 | $1.17 | $1.11 |

| | | | | | | | | | | | | | | | | | | | | | | |

As at December 31 (millions of dollars) | | | | | 2024 | 2023 | 2022 |

| Total assets | | | | | 36,682 | | 32,852 | | 31,457 | |

Total non-current financial liabilities1 | | | | | 16,393 | | 14,750 | | 13,073 | |

1 Total non-current financial liabilities include long-term debt, long-term lease obligations, derivative liabilities, and long-term accounts payable and accruals.

Net Income - 2023 compared to 2022

Net income attributable to common shareholders of Hydro One for the year ended December 31, 2023 of $1,085 million was $35 million, or 3.3%, higher than the prior year. Significant influences on the change in net income attributable to common shareholders included:

•higher revenues, net of purchased power,6 resulting from:

•OEB-approved 2023 transmission rates; and

•higher average monthly peak demand and energy consumption; partially offset by

•regulatory adjustments, including the recognition of conservation and demand management (CDM) revenues in the prior year following receipt of the OEB’s Decision and Order approving Hydro One’s Joint Rate Application (JRAP) Settlement Proposal and higher earnings sharing in the current period;

•higher OM&A costs primarily resulting from higher work program expenditures and corporate support costs, partially offset by a lower allowance for doubtful accounts;

•higher depreciation, amortization and asset removal costs primarily due to gains on the disposal of fixed assets recognized in the prior year, as well as higher depreciation resulting from the growth in capital assets as the Company continues to place new assets in-service, consistent with its ongoing capital investment program;

•higher financing charges attributable to higher weighted-average interest rates on long-term debt and short-term notes and a higher volume of long-term debt; and

•lower income tax expense primarily attributable to higher deductible timing differences compared to the prior year.

While net income neutral, the results of operations in the period are also impacted by:

•the OEB-approved recovery of historical cost deferrals recognized as regulatory assets in prior periods which resulted in an increase in revenue that has been offset by higher OM&A and income tax expense; and

•the cessation of the OEB-approved recovery of DTA amounts previously shared with ratepayers on June 30, 2023 which resulted in a decrease to revenue that had been offset by lower income tax expense.

EPS - 2023 compared to 2022

EPS was $1.81 for the year ended December 31, 2023, compared to EPS of $1.75 in 2022. The increase in EPS was primarily driven by the impact of higher earnings year-over-year, as discussed above.

6 See section "Non-GAAP Financial Measures"

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

QUARTERLY RESULTS OF OPERATIONS

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Quarter ended (millions of dollars, except EPS and ratio) | Dec 31, 2024 | Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 |

| Revenues | 2,095 | | 2,192 | | 2,031 | | 2,166 | | 1,979 | | 1,934 | | 1,857 | | 2,074 | |

| Purchased power | 1,060 | | 1,047 | | 940 | | 1,096 | | 990 | | 854 | | 798 | | 1,010 | |

Revenues, net of purchased power1 | 1,035 | | 1,145 | | 1,091 | | 1,070 | | 989 | | 1,080 | | 1,059 | | 1,064 | |

| Net income attributable to common shareholders | 200 | | 371 | | 292 | | 293 | | 181 | | 357 | | 265 | | 282 | |

| | | | | | | | |

| Basic EPS | $0.33 | | $0.62 | | $0.49 | | $0.49 | | $0.30 | | $0.60 | | $0.44 | | $0.47 | |

| Diluted EPS | $0.33 | | $0.62 | | $0.49 | | $0.49 | | $0.30 | | $0.59 | | $0.44 | | $0.47 | |

| | | | | | | | |

Earnings coverage ratio1 | 2.8 | | 2.8 | | 2.8 | | 2.8 | | 2.9 | | 3.0 | | 3.1 | | 3.2 | |

1 See section “Non-GAAP Financial Measures”.

Variations in revenues and net income attributable to common shareholders over the quarters are primarily due to the impact of seasonal weather conditions on customer demand and market pricing, as well as timing of regulatory decisions.

CAPITAL INVESTMENTS

The Company makes capital investments to maintain the safety, reliability and integrity of its transmission and distribution system assets and to provide for the ongoing growth and modernization required to meet the expanding and evolving needs of its customers and the electricity market. This is achieved through a combination of sustaining capital investments, which are required to support the continued operation of Hydro One’s existing assets, and development capital investments, which involve additions to both existing assets and large-scale projects such as new transmission lines and transmission stations.

Assets Placed In-Service

The following table presents Hydro One’s assets placed in-service during the years ended December 31, 2024 and 2023:

| | | | | | | | | | | | | | | | | |

| | | |

Year ended December 31 (millions of dollars) | | | | | 2024 | 2023 | Change |

| Transmission | | | | | 1,431 | | 1,296 | | 10.4 | % |

| Distribution | | | | | 1,017 | | 994 | | 2.3 | % |

| Other | | | | | 15 | | 34 | | (55.9 | %) |

| Total assets placed in-service | | | | | 2,463 | | 2,324 | | 6.0 | % |

Transmission Assets Placed In-Service

Transmission assets placed in-service increased by $135 million, or 10.4%, during the year ended December 31, 2024, compared to the year ended December 31, 2023, primarily due to:

•investments placed in-service for the Chatham to Lakeshore Transmission Line;

•timing of assets placed in-service for station refurbishments and replacements, including the Wilson Transmission Station, the Porcupine Transmission Station, the Kirkland Lake Transmission Station, and the Rexdale Transmission Station, partially offset by the Lambton Transmission Station, the Arnprior Transmission Station, and the Nanticoke Transmission Station in the prior year;

•timing of investments placed in-service for customer-driven work; and

•higher volume of wood pole replacements; partially offset by

•assets placed in-service for development work in the prior year, primarily related to the Barrie Area Transmission Upgrade, the Lennox Transmission Station, and Kapuskasing Area Reinforcement; as well as

•timing of investments placed in-service for IT initiatives.

Distribution Assets Placed In-Service

Distribution assets placed in-service increased by $23 million, or 2.3%, during the year ended December 31, 2024, compared to the year ended December 31, 2023, primarily due to:

•higher volume of wood pole replacements;

•higher volume of storm-related asset replacements;

•timing of investments placed in-service for station and line refurbishments and replacements; and

•assets placed in-service for the Orleans Operation Centre; partially offset by

•timing of investments placed in-service for IT initiatives in the prior year.

Other Assets Placed in-Service

Other assets placed in-service decreased by $19 million, or 55.9%, during the year ended December 31, 2024 compared to the year ended December 31, 2023. The year over year decrease was primarily associated with the partial replacement of Acronym Solutions Inc.’s IT equipment in the prior year.

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

Capital Investments

The following table presents Hydro One’s capital investments during the years ended December 31, 2024 and 2023:

| | | | | | | | | | | | | | | | | |

| | | |

Year ended December 31 (millions of dollars) | | | | | 2024 | 2023 | Change |

| Transmission | | | | | | | |

| Sustaining | | | | | 1,284 | | 1,037 | | 23.8 | % |

| Development | | | | | 467 | | 345 | | 35.4 | % |

| Other | | | | | 109 | | 111 | | (1.8 | %) |

| | | | | 1,860 | | 1,493 | | 24.6 | % |

| Distribution | | | | | | | |

| Sustaining | | | | | 561 | | 397 | | 41.3 | % |

| Development | | | | | 513 | | 488 | | 5.1 | % |

| Other | | | | | 111 | | 130 | | (14.6 | %) |

| | | | | 1,185 | | 1,015 | | 16.7 | % |

| Other | | | | | 18 | | 23 | | (21.7 | %) |

| Total capital investments | | | | | 3,063 | | 2,531 | | 21.0 | % |

Total 2024 capital investments of $3,063 million were largely in-line with the previously disclosed expected amount of $3,152 million.

Transmission Capital Investments

Transmission capital investments increased by $367 million, or 24.6%, during the year ended December 31, 2024 compared to the year ended December 31, 2023, primarily due to:

•higher volume of station refurbishments and equipment replacements;

•investments in the Waasigan Transmission Line;

•lower spend on the Third Line Transmission Station and Sault #3 Circuit;

•higher volume of work on customer connections;

•investments in the St. Clair Transmission Line;

•higher spend on spare transformer purchases;

•higher volume of wood pole replacements; and

•investments in the Orillia Distribution Centre.

Distribution Capital Investments

Distribution capital investments increased by $170 million, or 16.7%, in the year ended December 31, 2024 compared to the year ended December 31, 2023, primarily due to:

•higher spend on line refurbishments and wood pole replacements;

•investments in the Orillia Operation Centre, Orillia Distribution Centre and Orleans Operation Centre;

•higher spend on storm-related asset replacements;

•investments in the Advanced Metering Infrastructure 2.0 system;

•investments in Ontario’s broadband initiative; and

•higher spend on customer connections; partially offset by

•lower spend on IT initiatives.

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

Major Transmission Capital Investment Projects

The following table summarizes the status of significant transmission projects as at December 31, 2024:

| | | | | | | | | | | | | | | | | |

Project Name |

Location |

Type | Anticipated

In-Service Date | Estimated Cost1 | Capital Cost

To Date |

| | | (year) | (millions of dollars) |

| Development Projects: | | |

| | | | | |

| | | | | |

| | | | | |

Centennial Transmission Station2 | Southwestern Ontario | New transmission station and

connection | 2025 | 229 | 56 |

| Islington Transmission Station | Toronto Southern Ontario | New transmission station and

connection | 2025 | 109 | 47 |

Waasigan Transmission Line3 | Thunder Bay-Atikokan-Dryden

Northwestern Ontario | New transmission line and

station expansion | 2027 | 1,200 | 170 |

St. Clair Transmission Line4 | Southwestern Ontario | New transmission line and

station expansion | 2028 | 472 | 88 |

Longwood to Lakeshore

Transmission Line5 | Southwestern Ontario | New transmission line and

station expansion | TBD | TBD | 18 |

Durham Kawartha Power Line6 | Eastern Ontario | New transmission line and

station expansion | TBD | TBD | 8 |

Northeast Power Line6 | Northeastern Ontario | New transmission line and

station expansion | TBD | TBD | 7 |

North Shore Link6 | Northeastern Ontario | New transmission line and

station expansion | TBD | TBD | 4 |

Wawa to Porcupine Transmission Line6,7 | Northeastern Ontario | New transmission line and

station expansion | TBD | TBD | 1 |

Second Longwood to Lakeshore

Transmission Line5 | Southwestern Ontario | New transmission line and

station expansion | TBD | TBD | — | |

Lakeshore to Windsor Transmission Line5 | Southwestern Ontario | New transmission line and

station expansion | TBD | TBD | — | |

| Sustainment Projects: | | | | | |

Bruce B Switching Station Circuit Breaker Replacement8 | Tiverton

Southwestern Ontario | Station sustainment | 2025 | 185 | 175 |

Middleport Transmission Station

Circuit Breaker Replacement | Middleport

Southwestern Ontario | Station sustainment | 2025 | 184 | 162 |

Lennox Transmission Station

Circuit Breaker Replacement | Napanee

Southeastern Ontario | Station sustainment | 2026 | 152 | 142 |

Esplanade x Terauley

Underground Cable Replacement | Toronto

Southern Ontario | Line sustainment | 2026 | 117 | 62 |

Bridgman Transmission Station

Refurbishment | Toronto

Southern Ontario | Station sustainment | 2026 | 108 | 82 |

Bruce A Transmission Station

Switchyard Replacement | Tiverton

Southwestern Ontario | Station sustainment | 2027 | 555 | 318 |

Otto Holden Transmission Station Refurbishment9 | Mattawa

Northeast Ontario | Station sustainment | 2028 | 128 | 34 |

Merivale Transmission Station Replacement and Upgrades10 | Ottawa

Eastern Ontario | Station sustainment and

upgrade | 2029 | 271 | 90 |

Synchronous Optical Network

Telecommunication Replacement | Ontario | Telecommunication sustainment | 2029 | 137 | 12 |

1 Estimated costs are presented gross of any potential contribution from external parties.

2 This Project is part of a two-phase project, which includes the construction of a transmission station and a transmission line to meet the needs of, and is anticipated to be largely funded by, an industrial customer. Phase 1 of the Centennial Transmission Station Project includes a new transmission station in St. Thomas and an approximately 2 km, 230 kV double-circuit transmission line between the new transmission station and an existing transmission station in the city. This phase of the project is anticipated to be in service by 2025. Scope and timing of the second phase, an approximately 20 km, 230 kV double-circuit transmission line from London to St. Thomas, is currently under review.

3 The Waasigan Transmission Line Project includes construction of new transmission lines as well as station enhancements to support energization of the new lines. The estimated cost relates to the development and construction phases of the project and the anticipated in-service date reflects the anticipated completion in 2027, as further discussed in the section “Other Developments - Supporting Critical Transmission Infrastructure in Northwestern Ontario”.

4 The St. Clair Transmission Line Project includes the line and associated facilities and is further discussed in the section “Other Developments - Supporting Critical Infrastructure in Southwestern Ontario”.

5 The capital cost to date relates to the development phase of the project. The scope and timing of these Southwestern Ontario transmission reinforcements are currently under review.

6 The capital cost to date relates to the development phase of the project. The scope and timing of these Northeastern and Eastern Ontario transmission reinforcements are currently under review. Durham Kawartha Power Line was previously referred to as the Greater Toronto Area East Line. Northeast Power Line was previously referred to as the Hanmer to Mississagi Line. North Shore Link was previously referred to as the Mississagi to Third Line Line.

7 The IESO has recommended a target in-service date by 2030 for the Wawa to Porcupine Transmission Line.

8 Major portions of the Bruce B Switching Station Circuit Breaker Replacement were completed and placed in-service in 2025.

9 This project includes asset replacements to meet the needs of the Ontario system as well as a customer funded enhancement.

10 The coordinated project includes both an asset replacement and station expansion. The anticipated in-service dates are between 2026 to 2029.

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

Future Capital Investments

The Company estimates future capital investments based on management’s expectations of the amount of capital expenditures that will be required to provide transmission and distribution services that are efficient, reliable, and provide value for customers, consistent with the OEB’s Renewed Regulatory Framework. The Company includes projects when there is a high degree of confidence that the project will go forward and when there is a thorough estimate of the expected expenditures.

The 2025 to 2027 capital estimates differ from prior disclosures as the Company has updated its plan for current estimate of required broadband investments, timing and pacing of future capital investments, and re-prioritization of work.

The following tables summarize Hydro One’s annual projected capital investments for 2025 to 2027 by business segment and by category:

| | | | | | | | | | | | | | | | | | | | | |

By business segment: (millions of dollars) | | | | 2025 | 2026 | 2027 | |

Transmission1 | | | | 2,284 | | 1,760 | | 1,375 | | |

| Distribution | | | | 1,225 | | 1,061 | | 912 | | |

| Other | | | | 33 | | 47 | | 32 | | |

Total capital investments2 | | | | 3,542 | | 2,868 | | 2,319 | | |

| | | | | | | | | | | | | | | | | | | | | |

By category: (millions of dollars) | | | | 2025 | 2026 | 2027 | |

| Sustainment | | | | 1,733 | | 1,359 | | 1,065 | | |

Development1 | | | | 1,569 | | 1,336 | | 1,096 | | |

Other3 | | | | 240 | | 173 | | 158 | | |

Total capital investments2 | | | | 3,542 | | 2,868 | | 2,319 | | |

1 Figures include investments in certain development projects of Hydro One Networks not included in the investment plan approved by the OEB in the JRAP decision.

2 Since the first quarter of 2022, the Minister of Energy and Electrification (formerly the Minister of Energy) (Minister) has directed the OEB to amend Hydro One Networks’ transmission licence to require it to develop and seek approvals for eight priority transmission lines in Ontario. The future capital investments presented do not include capital expenditures, nor development costs, associated with the following three priority Southwestern Ontario transmission line projects: Longwood to Lakeshore Transmission Line, Second Longwood to Lakeshore Transmission Line, and Lakeshore to Windsor Transmission Line; nor the following four priority Northeastern and Eastern Ontario transmission line projects: North Shore Link, Northeast Power Line, Durham Kawartha Power Line, and Wawa to Porcupine Transmission Line (see section “Other Developments - Supporting Critical Transmission Infrastructure in Northeastern and Eastern Ontario”). Hydro One is currently evaluating the scope and timing of these seven lines.

3 “Other” capital expenditures include investments in fleet, real estate, IT, and operations technology and related functions.

SUMMARY OF SOURCES AND USES OF CASH

Hydro One’s primary sources of cash flows are funds generated from operations, capital market debt issuances and bank credit facilities that are used to satisfy Hydro One’s capital resource requirements, including the Company’s capital expenditures, servicing and repayment of debt, and dividend payments.

| | | | | | | | | | | | | |

| | | |

Year ended December 31 (millions of dollars) | | | | 2024 | 2023 |

| Net cash from operating activities | | | | 2,534 | | 2,412 | |

| Net cash from (used in) financing activities | | | | 1,233 | | (172) | |

| Net cash used in investing activities | | | | (3,130) | | (2,691) | |

| Net change in cash and cash equivalents | | | | 637 | | (451) | |

Net cash from operating activities

Net cash from operating activities increased by $122 million for the year ended December 31, 2024 compared to the same period in 2023. The increase was impacted by various factors, including the following:

•higher pre-tax earnings; and

•changes in regulatory account balances; partially offset by

•increase in net working capital deficiency primarily attributable to higher accrued liabilities, lower receivables from the IESO driven by lower Ontario Electricity Rebate from the IESO, higher cost of power payable to the IESO driven by higher commodity rates charges, partially offset by higher prepaid expenses and higher accounts receivable balances.

Net cash from (used in) financing activities

Net cash from financing activities increased by $1,405 million for the year ended December 31, 2024, compared to the same period of 2023. This increase was impacted by various factors, including the following:

Sources of cash

•the Company issued $2,781 million of long-term debt in 2024, compared to $2,375 million of long-term debt issued in 2023.

•the Company received proceeds of $2,810 million from the issuance of short-term notes in 2024, compared to $6,550 million received in 2023.

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

Uses of cash

•the Company repaid $2,890 million of short-term notes in 2024, compared to $7,650 million repaid in 2023.

•the Company paid common share dividends of $743 million in 2024, compared to dividends of $700 million paid in 2023.

•the Company repaid $700 million of long-term debt in 2024, compared to $731 million repaid in 2023.

Net cash used in investing activities

Net cash used in investing activities for the year ended December 31, 2024 was $439 million higher than the same period of 2023 as a result of higher capital investments. See section “Capital Investments” for comparability of capital investments made by the Company during the year ended December 31, 2024 against the prior year.

LIQUIDITY AND FINANCING STRATEGY

Short-term liquidity is provided through FFO,7 Hydro One Inc.’s commercial paper program, and the Company’s consolidated bank credit facilities. Under the commercial paper program, Hydro One Inc. is authorized to issue up to $2,300 million in short-term notes with a term to maturity of up to 365 days.

As at December 31, 2024, Hydro One Inc. had $200 million in commercial paper borrowings outstanding, compared to $279 million outstanding at December 31, 2023. The Company also has committed, unsecured, and revolving credit facilities (Operating Credit Facilities) with a total available balance of $3,300 million as at December 31, 2024. The Operating Credit Facilities include a pricing adjustment which can increase or decrease Hydro One’s cost of funding based on its performance on certain sustainability performance measures, which are related to Hydro One's sustainability goals. On June 1, 2024, Hydro One increased the committed amount under the Operating Credit Facilities by $750 million and extended the maturity date from 2028 to 2029. No amounts were drawn on the Operating Credit Facilities as at December 31, 2024 or 2023. The Company may use the Operating Credit Facilities for working capital and general corporate purposes. The short-term liquidity under the commercial paper program, the Operating Credit Facilities, available cash on hand and anticipated levels of FFO7 are expected to be sufficient to fund the Company’s operating requirements.

As at December 31, 2024, the Company had long-term debt outstanding in the principal amount of $17,495 million, which included $425 million of long-term debt issued by Hydro One and $17,070 million of long-term debt issued by Hydro One Inc. The long-term debt issued by Hydro One was issued under a previous short form base shelf prospectus. The majority of long-term debt issued by Hydro One Inc. has been issued under its Medium-Term Note (MTN) Program, as further described below. The Company's total long-term debt consists of notes and debentures that mature between 2025 and 2064, and as at December 31, 2024 had a weighted-average term to maturity of approximately 13.7 years (December 31, 2023 - 13.7 years) and a weighted-average coupon rate of 4.2% (December 31, 2023 - 4.1%).

In February 2024, Hydro One Inc. filed a short form base shelf prospectus in connection with its MTN Program, which expires in March 2026. Upon issuance of the short form base shelf prospectus in February 2024, the Company does not qualify for the distribution of any additional notes under the previous MTN Program prospectus that was filed in June 2022.

On August 19, 2024, Hydro One filed the Universal Base Shelf Prospectus with securities regulatory authorities in Canada. The short form base shelf prospectus (Universal Base Shelf Prospectus) allows Hydro One to offer, from time to time in one or more public offerings, debt, equity or other securities, or any combination thereof, during the 25-month period ending in September 2026. As at December 31, 2024, no securities have been issued under the Universal Base Shelf Prospectus.

On November 29, 2024, Hydro One Holdings Limited (HOHL) filed a short form base shelf prospectus (U.S. Debt Shelf Prospectus) with securities regulatory authorities in Canada and the U.S. to replace a previous prospectus that would otherwise have expired in December 2024. The U.S. Debt Shelf Prospectus, expiring in December 2026, allows HOHL to offer, from time to time in one or more public offerings, debt securities, unconditionally guaranteed by Hydro One. As at December 31, 2024, no securities have been issued under the U.S. Debt Shelf Prospectus.

Compliance

As at December 31, 2024, the Company was in compliance with all financial covenants and limitations associated with the outstanding borrowings and credit facilities.

Credit Ratings

Various ratings organizations review the Company’s and Hydro One Inc.’s debt ratings from time to time. These rating organizations may take various actions, positive or negative. The Company cannot predict what actions rating agencies may take in the future. The failure to maintain the Company’s current credit ratings could adversely affect the Company’s financial condition and results of operations, and a downgrade in the Company’s credit ratings could restrict the Company’s ability to access debt capital markets and increase the Company’s cost of debt.

7 See section “Non-GAAP Financial Measures”.

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

On June 10, 2024, S&P Global Ratings upgraded the Company’s long-term debt rating to "A-" from "BBB+", Hydro One Inc.’s long-term debt rating to "A" from "A-", and Hydro One Inc.’s commercial paper rating to "A-1 (Mid)" from "A-1 (Low)". In addition, the outlook on the ratings was revised to stable from positive.

As at December 31, 2024, Hydro One’s long-term debt ratings were as follows:

| | | | | | | | |

| Rating Agency | | Long-term Debt

Rating |

| DBRS Limited | | A |

| S&P Global Ratings | | A- |

As at December 31, 2024, Hydro One Inc.’s long-term and short-term debt ratings were as follows:

| | | | | | | | |

| Rating Agency | Short-term Debt

Rating | Long-term Debt

Rating |

| DBRS Limited | R-1 (low) | A (high) |

| Moody’s Ratings | Prime-2 | A3 |

| S&P Global Ratings | A-1 (Mid) | A |

Effect of Interest Rates

The Company is exposed to fluctuations of interest rates as its regulated return on equity (ROE) is derived using a formulaic approach that takes into account changes in benchmark interest rates for Government of Canada debt and the A-rated utility corporate bond yield spread. The Company issues debt from time to time to refinance maturing debt and for general corporate purposes. The Company is therefore exposed to fluctuations in interest rates in relation to such issuances of debt. See section “Risk Management and Risk Factors - Risks Relating to Hydro One’s Business - Market, Financial Instrument and Credit Risk” for more details.

Pension Plan

In 2024, Hydro One made cash contributions of $75 million to its pension plan, compared to cash contributions of $69 million in 2023. The Company also incurred $57 million of net periodic benefit credit, compared to $93 million of net periodic benefit credit incurred in 2023.

In September 2024, Hydro One filed a triennial actuarial valuation of its pension plan as at December 31, 2023 which is effective for 2024 to 2026. Based on this valuation, Hydro One estimates that total Company pension contributions for 2025, 2026, 2027, 2028, 2029 and 2030 are approximately $78 million, $80 million, $83 million, $86 million, $89 million, and $92 million, respectively. Future minimum contributions beyond 2026 will be updated following the actuarial funding valuation as of December 31, 2026, which is expected to be filed by no later than September 30, 2027. Should Hydro One elect to file a valuation earlier than required, contributions for 2025 and 2026 would also be updated, as applicable.

The Company’s pension benefits obligation is impacted by various assumptions and estimates, such as the discount rate, rate of return on plan assets, rate of cost of living increase and mortality assumptions. A full discussion of the significant assumptions and estimates can be found in the section “Critical Accounting Estimates - Employee Future Benefits”.

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

OTHER OBLIGATIONS

Off-Balance Sheet Arrangements

There are no off-balance sheet arrangements that have, or are reasonably likely to have, a material current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

Summary of Contractual Obligations and Other Commercial Commitments

The following table presents a summary of Hydro One’s debt and other major contractual obligations and commercial commitments:

| | | | | | | | | | | | | | | | | |

As at December 31, 2024 (millions of dollars) |

Total | Less than

1 year |

1-3 years |

3-5 years | More than

5 years |

Contractual obligations (due by year) | | | | | |

| Long-term debt - principal repayments | 17,495 | | 1,150 | | 1,350 | | 1,850 | | 13,145 | |

| Long-term debt - interest payments | 10,429 | | 723 | | 1,343 | | 1,247 | | 7,116 | |

| Short-term notes payable | 200 | | 200 | | — | | — | | — | |

Pension contributions1 | 508 | | 78 | | 163 | | 175 | | 92 | |

| Outsourcing and other agreements | 147 | | 70 | | 49 | | 14 | | 14 | |

| Environmental and asset retirement obligations | 100 | | 14 | | 9 | | 4 | | 73 | |

| | | | | |

| Lease obligations | 59 | | 17 | | 28 | | 12 | | 2 | |

| Long-term software/meter agreement | 10 | | 2 | | 4 | | 4 | | — | |

East-West Tie Limited Partnership4 | 257 | | 257 | | — | | — | | — | |

| Total contractual obligations | 29,205 | | 2,511 | | 2,946 | | 3,306 | | 20,442 | |

| | | | | |

Other commercial commitments (by year of expiry) | | | | | |

| Operating Credit Facilities | 3,300 | | — | | — | | 3,300 | | — | |

Letters of credit2 | 179 | | 179 | | — | | — | | — | |

Guarantees3 | 510 | | 510 | | — | | — | | — | |

| Total other commercial commitments | 3,989 | | 689 | | — | | 3,300 | | — | |

1 Contributions to the Hydro One Pension Plan are based on actuarial reports, including valuations performed at least every three years, and actual or projected levels of pensionable earnings, as applicable. The most recent actuarial valuation was performed effective December 31, 2023 and filed on September 23, 2024.

2 Letters of credit consist of $153 million letters of credit related to retirement compensation arrangements, a $19 million letter of credit provided to the IESO for prudential support, and $7 million in letters of credit for various operating purposes.

3 Guarantees consist of $475 million prudential support provided to the IESO by Hydro One Inc. on behalf of its subsidiaries, as well as $30 million of guarantees provided by Hydro One to ONroute relating to OCN LP (OCN Guarantee) and $5 million relating to Aux Energy Inc.

4 On December 19, 2024, Hydro One Networks entered into an agreement to purchase an approximate 48% interest in the East-West Tie Limited Partnership from affiliates of OMERS Infrastructure Management Inc. (OMERS) and Enbridge Transmission Holdings Inc which is further discussed in section “Other Developments — East-West Tie Limited Partnership.”

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

REGULATION

The following table summarizes the key elements and status of Hydro One’s electricity rate applications: | | | | | | | | | | | | | | |

| Application | Year | Rate Base Approved/Proposed (millions of dollars) | Base Revenue Requirement Approved/Proposed (millions of dollars) | Status |

|

| | | |

| Transmission: | | | |

Hydro One Networks1 | 2024 | 15,342 | 2,073 | Approved in November 2022 |

| 2025 | 16,271 | 2,168 | Approved in November 2022 |

| 2026 | 17,148 | 2,277 | Approved in November 2022 |

| 2027 | 17,940 | 2,362 | Approved in November 2022 |

| B2M LP | 2024 | 462 | 35 | Approved in January 20202 |

| 2025 | 455 | 38 | Approved in November 20243 |

| 2026 | 447 | 38 | Approved in November 20243 |

| 2027 | 440 | 39 | Approved in November 20243 |

| 2028 | 433 | 39 | Approved in November 20243 |

| 2029 | 426 | 37 | Approved in November 20243 |

HOSSM4 | 2017 - 2026 | 218 | 41 | Approved in January 2016 |

| CLLP | 2024 | 200 | n/a | Approved in December 2024 |

| 2025 | 201 | 17 | Approved in November 20243 |

| 2026 | 201 | 17 | Approved in November 20243 |

| 2027 | 199 | 17 | Approved in November 20243 |

| 2028 | 196 | 17 | Approved in November 20243 |

| 2029 | 194 | 16 | Approved in November 20243 |

| NRLP | 2024 | 111 | 9 | Approved in April 20202 |

| 2025 | 110 | 9 | Approved in November 20243 |

| 2026 | 108 | 9 | Approved in November 20243 |

| 2027 | 107 | 9 | Approved in November 20243 |

| 2028 | 105 | 9 | Approved in November 20243 |

| 2029 | 104 | 9 | Approved in November 20243 |

| Distribution: | | | | |

Hydro One Networks1 | 2024 | 9,979 | 1,813 | Approved in November 2022 |

| 2025 | 10,573 | 1,886 | Approved in November 2022 |

| 2026 | 11,153 | 1,985 | Approved in November 2022 |

| 2027 | 11,656 | 2,071 | Approved in November 2022 |

Hydro One Remotes5 | 2023-2027 | 58 | 128 | Approved in March 2023 |

1 Revenue requirements for 2024 to 2027 do not include the impacts of updates filed with the regulator per the annual application process to reflect the latest OEB inflation factors.

2 Base revenue requirement was subject to an approved revenue cap escalator index.

3 Under the agreed-upon revenue requirement framework, there is no longer a requirement for these LPs to file annual update applications with the OEB throughout the rate term; except for a one-time update in 2025. This update will reflect the LPs’ actual cost of long-term debt and for CLLP an adjustment to rate base to reflect actual project expenditures. This will update and set the revenue requirements for 2026 to 2029.

4 HOSSM is under a 10-year deferred rebasing period for years 2017-2026, as approved in the OEB Mergers, Amalgamations, Acquisitions and Divestitures decision dated October 13, 2016. Revenue requirement since 2019 have been subject to an approved revenue cap escalator index.

5 Revenue requirements for 2024 to 2027 will be updated per the annual application process with the regulator to reflect latest OEB inflation factors. Rate increases for Hydro One Remote Communities are effective May 1st of each year.

The following table summarizes the status of Hydro One’s Leave to Construct Applications with the OEB as at December 31, 2024:

| | | | | | | | |

| Application | | Status |

| | |

| Waasigan Transmission Line Project | | Approved in April 20241 |

| St. Clair Transmission Line Project | | Approved in December 20242 |

1 See section “Major Transmission Capital Investment Projects” and “Other Developments - Supporting Critical Infrastructure in Northwestern Ontario.” Under Hydro One’s equity partnership model, Hydro One entered into agreements with First Nations communities that provide them the opportunity to acquire a 50% equity stake in the transmission line component of the project.

2 See section “Major Transmission Capital Investment Projects” and “Other Developments - Supporting Critical Infrastructure in Southwestern Ontario.” Under Hydro One’s equity partnership model, First Nations communities would have an opportunity to acquire a 50% equity stake in the transmission line component of the project.

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

DTA

On April 8, 2021, the OEB rendered a decision approving the recovery of the DTA amounts allocated to ratepayers and included in customer rates for the 2017 to 2021 period, plus carrying charges, over a two-year recovery period from July 1, 2021 to June 30, 2023 (DTA Recovery period). In addition, the DTA Implementation Decision required that Hydro One adjust transmission revenue requirement and the base distribution rates beginning January 1, 2022 to eliminate any further tax savings flowing to customers. The DTA Implementation Decision had no impact on FFO8 for the year ended December 31, 2024 (2023 - increase of $67 million) as the DTA Recovery period ceased on June 30, 2023.

Incremental Cloud Computing Implementation Costs Deferral Account

On November 2, 2023, the OEB established an industry-wide generic deferral account, effective December 1, 2023. This account allows rate-regulated entities, including electricity distributors and transmitters, to record cloud computing implementation costs incurred that are incremental to amounts embedded in base rates as well as any related offsetting savings, if applicable, in a regulatory account for future recovery subject to the approval of the OEB. On March 6, 2024, the OEB commenced a hearing that will consider matters related to the Incremental Cloud Computing Implementation Costs deferral account, including what type of interest rate, if any, should apply. As at December 31, 2024, the Company has recorded approximately $10 million in this account.

B2M LP

On May 23, 2024, Hydro One Networks, on behalf of B2M LP, submitted B2M LP’s five-year Transmission Revenue Requirement Application for the 2025 to 2029 period. On November 21, 2024, the OEB issued a Decision and Order approving B2M LP’s five-year revenue requirement application, which includes a 2025 base revenue requirement of $38 million. Under the agreed-upon revenue requirement framework, there is no longer a requirement for B2M LP to file annual update applications with the OEB throughout the rate term, except for a one-time update in 2025. This update will reflect B2M LP’s actual cost of long-term debt and will set the revenue requirements for the 2026 to 2029 period.

NRLP

On May 23, 2024, Hydro One Networks, on behalf of NRLP, submitted NRLP’s five-year Transmission Revenue Requirement Application for the 2025 to 2029 period. On November 21, 2024, the OEB issued a Decision and Order approving NRLP’s revenue requirement application, which includes a 2025 base revenue requirement of $9.0 million. Under the agreed-upon revenue requirement framework, there is no longer a requirement for NRLP to file annual update applications with the OEB throughout the rate term, except for a one-time update in 2025. This update will reflect NRLP’s actual cost of long-term debt and will set the revenue requirements for the 2026 to 2029 period.

CLLP

On July 12, 2024, Hydro One Networks, on behalf of CLLP, submitted CLLP’s five-year Transmission Revenue Requirement Application for the 2025 to 2029 period. On December 17, 2024, the OEB issued a Decision and Order approving CLLP’s revenue requirement application, which includes a 2025 base revenue requirement of $17 million, effective January 1, 2025. Under the agreed-upon revenue requirement framework, there is no longer a requirement for CLLP to file annual update applications with the OEB throughout the rate term, except for a one-time update in 2025. This update will reflect CLLP’s actual cost of long-term debt and an adjustment to rate base to reflect final project expenditures and will set the revenue requirements for the 2026 to 2029 period.

Building Broadband Faster Act, 2021

In March 2021, the Province of Ontario (Province) introduced Bill 257, Supporting Broadband and Infrastructure Expansion Act, 2021, to create a new act entitled the Building Broadband Faster Act, 2021 (BBFA) that is aimed at supporting the timely deployment of broadband infrastructure within unserved and underserved rural Ontario communities. Bill 257 received Royal Assent on April 12, 2021. Bill 257 amended the Ontario Energy Board Act, 1998 (OEBA) to provide the Province with regulation-making authority regarding the development of, access to, or use of electricity infrastructure for non-electricity purposes. The BBFA Guideline and two regulations informing the legislative changes were also published in 2021, with a third regulation on annual wireline attachment rate for telecommunications carriers issued in December 2021. The most recent Order and Decision from the OEB adjusts the annual wireline attachment rate to $39.14 per attacher per pole, effective January 1, 2025.

In March 2022, the Province introduced Bill 93 (Getting Ontario Connected Act, 2022). Bill 93 received Royal Assent on April 14, 2022. Bill 93 amends the BBFA to ensure that organizations that own underground utility infrastructure near a designated high-speed internet project provide timely access to their infrastructure data, which would allow internet service providers to quickly start work on laying down underground high-speed internet infrastructure.

8 See section “Non-GAAP Financial Measures”.

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

A regulation regarding electricity infrastructure and designated broadband projects under the OEBA (O.Reg. 410/22) came into force on April 21, 2022. On July 7, 2022, the OEB established a deferral account for rate-regulated distributors to record incremental costs associated with carrying out activities pertaining to designated broadband projects. In September 2022, the Company launched its choice-based operating model to provide internet service providers with choices on how to access the Company’s infrastructure in order to effectively execute designated broadband projects. On March 28, 2023, the Province amended the OEBA (O.Reg. 410/22) with respect to performance timelines associated with designated broadband projects.

On August 14, 2023, the third edition of the BBFA Guideline was issued with amendments providing additional guidance to support the implementation of legislative and regulatory requirements, including a framework to support cost sharing for pole attachments and make-ready work.

The Company has developed and adapted an appropriate management framework that meets the government’s objectives, including arrangements to sustain the Company’s revenues and recovery of reasonable associated costs.

On October 31, 2024, the Ministry of Infrastructure announced that it has developed a program to deliver up to $400 million in subsidies to internet service providers (ISPs) for work associated with designated broadband projects. The program is intended to enable ISPs to successfully and safely attach their material and equipment to the Company’s poles to bring connectivity to rural communities as part of a designated broadband project. A portion of the subsidies will be used to reimburse Hydro One Networks on behalf of ISPs for their share of enablement costs incurred to facilitate the program to date (see section “Related Party Transactions”).

Affordable Energy Act, 2024 and Ontario Integrated Energy Plan

In January 2024, the Electrification and Energy Transition Panel, an advisory body to the Province, released its report outlining a roadmap for Ontario’s transition to a clean energy economy. In October 2024, the Province released its vision for Ontario’s energy sector, Ontario’s Affordable Energy Future, outlining key objectives to meet growing electricity demand in Ontario. This vision is intended to help guide the Province’s first integrated energy plan, among other initiatives. In support, Bill 214, Affordable Energy Act, 2024, was introduced and subsequently received Royal Assent on December 4, 2024. The Affordable Energy Act, 2024 amended various statutes, including the Electricity Act and the OEBA, providing a legislative framework to replace the Province’s long-term energy plans (including the 2017 Long-Term Energy Plan), with integrated energy plans. Integrated energy plans are expected to detail actions and policy steps to build an affordable, reliable and clean energy system over the long term. Whereas the focus of the long-term energy plan has been primarily on the electricity system, the integrated energy plan is intended to address all sources of energy. The amendments effected by the Affordable Energy Act, 2024 also allow the Minister, subject to the approval of the Lieutenant Governor in Council, to issue directives to the IESO and OEB setting out implementation requirements relating to the integrated energy plan. From October to December 2024, the Ministry of Energy and Electrification (Ministry) ran a consultation requesting feedback to assist the Province in developing its first plan. The Province’s first integrated energy plan is expected to be released in early 2025.

The changes made by the Affordable Energy Act, 2024 to the OEBA, among other things, also provide the Province with the ability to make regulations specifying amendments to the Distribution System Code and the Transmission System Code in relation to certain cost allocation and cost recovery matters relating to the construction, expansion or reinforcement of distribution systems or transmission systems, or of connections to those systems. The changes made by the Affordable Energy Act, 2024 also allow regulations to be made exempting persons or things from provisions of the Distribution System Code and the Transmission System Code relating to cost allocation or cost recovery, as well as alternative provisions that apply instead.

OTHER DEVELOPMENTS

East-West Tie Limited Partnership

On December 19, 2024, Hydro One Networks entered into an agreement to purchase an approximately 48% interest in the East-West Tie Limited Partnership from affiliates of OMERS Infrastructure Management Inc. (OMERS) and Enbridge Transmission Holdings Inc. (Enbridge). Hydro One Networks has agreed to purchase its interest in the partnership for $257 million in cash, subject to customary adjustments and court approval. The transaction results in a partnership with the remaining owners of the East-West Tie Line – the Bamkushwada Limited Partnership, a consortium of six First Nations, and affiliates of NextEra Energy Canada, LP who own approximately 4% and 48%, respectively. See section “Other Obligations”.

HYDRO ONE LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS (continued)

For the years ended December 31, 2024 and 2023

Northern Ontario Voltage Study

In December 2023, the IESO published its Northern Ontario Voltage Study Report (Bulk System Reactive Requirements in Northern Ontario), which recommended installation of reactive compensation devices at several stations in Northern Ontario to address both current and future system conditions that are expected once new Northern transmission lines are in-service. This study includes projects being developed by Hydro One, including: the East-West Tie Station Expansion, the Waasigan Transmission Line, the Northeast Power Line (previously referred to as the Hanmer to Mississagi Line), and the North Shore Link (previously referred to as Mississagi to Third Line Line).

In March 2024, the Company received a letter from the IESO recommending Hydro One proceed with the implementation of the reactive devices, in line with the timelines identified by the IESO. The Company is currently assessing the impact of this letter.

Chapleau Public Utilities Corporation (Chapleau Hydro) Purchase Agreement

On April 18, 2024, the OEB issued its decision approving Hydro One Networks’ application to acquire Chapleau Hydro, an electricity distribution company located in the Township of Chapleau. On July 31, 2024, Hydro One Networks completed the acquisition of the business and distribution assets of Chapleau Hydro for a purchase price of approximately $2.3 million, subject to adjustments.

Supporting Critical Transmission Infrastructure in Southwestern Ontario

Chatham to Lakeshore Transmission Line Project

On November 24, 2022, the OEB issued its Decision and Order granting Hydro One Networks leave to construct the Chatham to Lakeshore Transmission Line Project, with standard conditions of approval.