- PACK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ranpak (PACK) DEF 14ADefinitive proxy

Filed: 12 Apr 22, 10:12am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under §240.14a-12 |

Ranpak Holdings Corp.

(Exact Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing party: | |

| (4) | Date Filed: | |

April 12, 2022

Dear Fellow Stockholders:

We accomplished a lot in 2021 – not only in our financial results, but also in advancing key initiatives for Ranpak’s long-term success. 2021 was a year of investing in our business for the long term, including big investments in our technical infrastructure, talent, and facilities. I am proud of how we are balancing our focus on strong near-term performance, as well as investments in the business for the long term.

I also want to share that we will soon release our 2021 ESG Impact Report that highlights our continuing commitment to deliver a better world. We are excited for the opportunity to share our progress and demonstrate our leadership in the very important area of ESG.

Finally, I want to cordially invite you to attend the 2022 Annual Meeting of Stockholders of Ranpak Holdings Corp. at www.virtualshareholdermeeting.com/PACK2022 on May 25, 2022 at 10:00 a.m. Eastern time. The meeting will be held virtually, via live webcast.

The matters expected to be acted upon at the Annual Meeting are described in the accompanying Notice of Annual Meeting of Stockholders and this Proxy Statement.

Your vote is important. Please cast your vote as soon as possible over the Internet, by telephone, or by completing and returning your proxy card in the postage-prepaid envelope so that your shares are represented. Your vote will mean that you are represented at the Annual Meeting regardless of whether or not you attend. Returning the proxy does not deprive you of your right to attend the virtual Annual Meeting and to vote your shares then. We will begin mailing the Notice of Internet Availability to our stockholders of record as of March 30, 2022 (the “Record Date”) for the first time on or about April 12, 2022.

Sincerely,

Omar M. Asali

Chairman of the Board of the Directors and

Chief Executive Officer

Ranpak Holdings Corp.

7990 Auburn Road

CONCORD TOWNSHIP, OH 44077

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON May 25, 2022

To the Stockholders of Ranpak Holdings Corp.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of Ranpak Holdings Corp., a Delaware corporation (the “Company”), will be a virtual meeting conducted exclusively via live webcast at www.virtualshareholdermeeting.com/PACK2022 on May 25, 2022, at 10:00 a.m. Eastern time for the following purposes:

| 1. | to elect the four directors named in the Proxy Statement as Class III directors of Ranpak Holdings Corp., each to serve for three years and until his or her successor has been elected and qualified, or until his or her earlier death, resignation or removal; |

| 2. | to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; |

| 3. | to approve a non-binding advisory resolution approving the compensation of the named executive officers; and |

| 4. | to provide a non-binding advisory resolution on the frequency of future advisory votes on the compensation of our named executive officers. |

The Company will also transact such other business as may properly come before the meeting, or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting of Stockholders. Only stockholders who owned common stock of the Company at the close of business on March 30, 2022 (the “Record Date”) can vote at this meeting or any adjournments that take place.

The Board of Directors recommends that you vote:

Proposal No. 1: FOR the election of the four director nominees;

Proposal No. 2: FOR the ratification of the appointment of Deloitte & Touche LLP, as the independent registered public accounting firm;

Proposal No. 3: FOR the approval of the non-binding advisory resolution to approve the compensation of our named executive officers; and

Proposal No. 4: FOR “Every Year” as to the frequency of future advisory votes on the compensation of our named executive officers.

2022 Virtual Annual Stockholder Meeting

The Board of Directors has determined to hold a virtual annual meeting in order to facilitate stockholder attendance and participation by enabling stockholders to participate from any location and at no cost. We believe this is the right choice for Ranpak currently, as it enables engagement with our stockholders, regardless of size, resources, or physical location while safeguarding the health of our stockholders, Board and management. We are committed to ensuring that stockholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend the meeting online, vote your shares electronically and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/PACK2022 at the meeting date and time. The

meeting webcast will begin promptly at 10 a.m. Eastern Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 9:45 a.m., Eastern Time, and you should allow ample time for the check-in procedures. If you experience technical difficulties during the check-in process or during the meeting, please consult the information regarding technical assistance available at www.virtualshareholdermeeting.com/PACK2022 for assistance.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE VIRTUAL MEETING ONLINE, WE ENCOURAGE YOU TO READ THE ACCOMPANYING PROXY STATEMENT AND OUR ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED December 31, 2021, AND SUBMIT YOUR PROXY AS SOON AS POSSIBLE USING ONE OF THE THREE CONVENIENT VOTING METHODS DESCRIBED IN “INFORMATION ABOUT THE PROXY PROCESS AND VOTING” IN THE PROXY STATEMENT. IF YOU RECEIVE MORE THAN ONE SET OF PROXY MATERIALS OR NOTICE OF INTERNET AVAILABILITY BECAUSE YOUR SHARES ARE REGISTERED IN DIFFERENT NAMES OR ADDRESSES, EACH PROXY SHOULD BE SIGNED AND SUBMITTED TO ENSURE THAT ALL OF YOUR SHARES WILL BE VOTED.

Notice and Access

The Notice of Annual Meeting of Stockholders to be held on May 25, 2022, the accompanying Proxy Statement and the Company’s 2021 Annual Report on Form 10-K are available, free of charge, at proxyvote.com.

The Notice contains instructions on how to access our proxy materials and vote over the internet at www.proxyvote.com and how stockholders can receive a paper copy of our proxy materials, including the accompanying Proxy Statement, a proxy card or voting instruction card and our 2021 Annual Report on Form 10-K. Stockholders can also request to receive future proxy materials in printed form by mail or electronically by email by contacting Investor Relations Department at ir@ranpak.com, at 440-354-4445 or at 7990 Auburn Road, Concord Township, OH 44077.

By Order of the Board of Directors

Sara A. Horvath

Vice President, General Counsel & Secretary

April 12, 2022

table of contents

Page

i

Ranpak Holdings Corp.

7990 Auburn Road

CONCORD TOWNSHIP, OH 44077

PROXY STATEMENT

FOR THE 2022 Annual Meeting OF STOCKHOLDERS

May 25, 2022

We have made available our proxy materials because the Board of Directors (the “Board”) of Ranpak Holdings Corp. (referred to herein as the “Company,” “Ranpak,” “we,” “us” or “our”) is soliciting your proxy to vote at our 2022 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 25, 2022, at 10:00 a.m. Eastern time, at www.virtualshareholdermeeting.com/PACK2022.

| · | This Proxy Statement summarizes information about the proposals to be considered at the Annual Meeting and other information you may find useful in determining how to vote. |

| · | The Proxy Card is the means by which you actually authorize another person to vote your shares in accordance with your instructions. |

In addition to solicitations by mail, our directors, officers and employees, without additional remuneration, may solicit proxies by telephone, e-mail and personal interviews. All costs of solicitation of proxies will be borne by us. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and we will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

Pursuant to the rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our Annual Meeting materials, which include this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (the “Form 10-K”), over the internet in lieu of mailing printed copies. We will begin mailing the Notice of Internet Availability to our stockholders of record as of March 30, 2022 (the “Record Date”) for the first time on or about April 12, 2022. The Notice of Internet Availability will contain instructions on how to access and review the Annual Meeting materials and will also contain instructions on how to request a printed copy of the Annual Meeting materials. Additionally, we have provided brokers, dealers, banks, voting trustees and their nominees, at our expense, with additional copies of our proxy materials and the Form 10-K so that our record holders can supply these materials to the beneficial owners of shares of our common stock as of the Record Date. The Form 10-K (and the 2022 Proxy Statement) are available, free of charge, at proxyvote.com and are also available on our website at ir.ranpak.com.

1

Proposal No. 1

Election of Directors

The Company’s Board is presently composed of ten members, who are divided into three classes, designated as Class I, Class II and Class III. One class of directors is elected by the stockholders at each annual meeting to serve a three-year term. Class I directors are Michael Gliedman, Steve Kovach and Alicia Tranen; Class II directors are Thomas Corley, Michael Jones and Robert King; and Class III directors are Omar Asali, Pamela El, Salil Seshadri and Kurt Zumwalt. On April 8, 2022, Mr. Kovach notified the Company of his intention to retire from the Company’s Board, effective June 30, 2022.

Class III directors standing for re-election at the Annual Meeting are Omar Asali, Pamela El, Salil Seshadri and Kurt Zumwalt. Class I and Class II directors will stand for election at the 2023 and 2024 annual meetings of stockholders, respectively.

Each of the nominees for election as Class III directors is currently a director. If elected at the Annual Meeting, each of the nominees for election as Class III directors would serve for three years and until his or her successor is duly elected and qualified, or until his or her earlier death, resignation or removal. If any nominee is unable or unwilling to be a candidate for election, the Board may appoint another nominee or reduce the size of the Board.

The following table sets forth information for the nominees who are currently standing for election:

Name | Age | Director Since |

| Omar Asali | 51 | 2019 |

| Pamela El (1) | 64 | 2020 |

| Salil Seshadri (2) | 45 | 2019 |

| Kurt Zumwalt (3) | 53 | 2020 |

| (1) | Member of Nominating, Environmental, Social & Governance Committee |

| (2) | Chair of the Compensation Committee and member of Nominating, Environmental, Social & Governance Committee |

| (3) | Member of Audit Committee and Nominating, Environmental, Social & Governance Committee |

Set forth below is biographical information for the nominees. The following includes certain information regarding the nominees’ individual experience, qualifications, attributes and skills that led the Board to conclude that they should serve as a director. See page 10 for the biographical information for the other directors not standing for election.

Omar M. Asali, 51, has served as our Chief Executive Officer since August 2019 and Chairman of our board of directors since June 2019. He has also served as the Chairman and Chief Executive Officer of One Madison Group, a permanent capital investment vehicle, since July 2017. Mr. Asali served as President and Chief Executive Officer of HRG from 2015 until 2017, and as President of HRG since 2011. Mr. Asali also served as a director of HRG from 2011 to 2017. Mr. Asali was responsible for overseeing the day-to-day activities of HRG, including M&A activity and overall business strategy. Mr. Asali was also the Vice Chairman of Spectrum Brands and a member of the board of directors of FGL, Front Street Re Cayman Ltd. and NZCH Corporation (formerly, Zap.Com Corporation), each a subsidiary of HRG. Prior to becoming President of HRG, Mr. Asali was a Managing Director and Head of Global Strategy of Harbinger Capital. Prior to that, Mr. Asali was the cohead of Goldman Sachs HFS where he helped manage approximately $25 billion of capital allocated to external managers. Mr. Asali also served as co-chair of the Investment Committee at Goldman Sachs HFS. Before joining Goldman Sachs HFS in 2003, Mr. Asali worked in Goldman Sachs’ Investment Banking Division, providing M&A and strategic advisory services to clients in the High Technology Group. Mr. Asali previously worked at Capital Guidance, a boutique private equity firm. Mr. Asali began his career working for a public accounting firm. Mr. Asali received an M.B.A. from Columbia Business School and a B.S. in Accounting from Virginia Tech. Mr. Asali also currently serves as a director at Pickle Robots, Carbone Fine Food and Virginia Tech Foundation Board.

Mr. Asali’s qualifications to serve on our board of directors include: his substantial experience in mergers and acquisitions, corporate finance and strategic business planning; his track record at HRG and in advising and managing multi-national companies; and his experience serving as a director for various public and private companies.

Pamela El, 64, has served as a director since November 2020. She is the founder of Pam El Consulting which she founded in 2019 and in which position she currently serves. Previously, from 2014 to 2018, Ms. El was EVP and

2

CMO at the National Basketball Association, where she was responsible for global marketing for the NBA, WNBA, and NBA G League. Prior to her tenure at the NBA, from 2013 to 2014, Ms. El was SVP of Marketing for Nationwide Insurance and from 2002 to 2013, Marketing Vice President of State Farm Insurance, where she led sales and marketing strategy for the U.S. and Canada. She earned a B.S. in Mass Communications from Virginia Commonwealth University and was recently inducted into the VCU Communications Hall of Fame, and serves on the boards of Virginia Commonwealth University, Virginia Commonwealth Health System and the national board of WISE (Women in Sports & Events).

Ms. El’s qualifications to serve on our board of directors include: her extensive corporate leadership experience and marketing experience.

Salil Seshadri, 45, has been a member of our board of directors since June 2019. Mr. Seshadri is the Chief Investment Officer and founding partner of JS Capital Management LLC, a private investment firm that he started with Jonathan Soros in January 2012. JS Capital invests across public and private markets with an emphasis on owning a handful of high quality, durable, operating businesses. Prior to joining JS Capital, Mr. Seshadri was a senior member of the investment team of Soros Fund Management, where he served from 2009 to 2011, with a focus on fundamentally oriented investments. Prior to joining Soros Fund Management, Mr. Seshadri was employed for nearly a decade by Goldman Sachs Group, Inc. At Goldman Sachs, Mr. Seshadri served as Vice President in Goldman Sachs’ Hedge Fund Strategies group from 2002 to 2008. Currently, Mr. Seshadri serves as a Board member or Observer for private companies such as WheelsEye, Anello Photonics and Carbone Fine Foods. He also serves on the Investment Committee for the Ethical Culture Fieldston School in New York City. Mr. Seshadri received a B.A. in Economics, with a concentration in Psychology from Columbia University.

Mr. Seshadri’s qualifications to serve on our board of directors include: his strong business and financial acumen, including the ability to read operational financials and balance sheets; his extensive experience as an investor in public and private companies of all sizes across multiple industries; his background evaluating the financial performance of both public and private companies; and his experience as a director and/or a significant stockholder in numerous companies.

Kurt Zumwalt, 53, has been a member of our board of directors since March 2020. Mr. Zumwalt served as Treasurer of Amazon.com from 2014 to August 2019, where he led global cash and portfolio management, debt financing, foreign exchange, risk management and treasury-related technology infrastructure. Prior to joining Amazon.com as assistant treasurer in 2004, he served in various financial and treasury roles at PACCAR, ProBusiness Services, Wind River Systems and Intel Corporation. While Treasurer at Amazon, Mr. Zumwalt was a member of the SEC Filing Disclosure and Enterprise Risk Management Committees as well as on the board of directors of over 100 Amazon Subsidiaries. He currently serves on the board of directors of Omeros Corporation, the United States Tennis Association (USTA) and the USTA Foundation. Mr. Zumwalt received an M.B.A. from the Foster School of Business at the University of Washington and a B.A. from the University of Pennsylvania.

Mr. Zumwalt’s qualifications to serve on our board of directors include: his strong business and financial acumen, including expertise in accounting standards and with financial statements.

THE BOARD RECOMMENDS A VOTE

FOR THE ELECTION OF EACH OF THE ABOVE-NAMED CLASS III NOMINEES.

3

Corporate Governance and ESG Matters

At Ranpak, sustainability is at the center of our enterprise strategy. From our beginning nearly 50 years ago, our business has been built around providing our customers and end-users with effective and more sustainable alternatives to meet their secondary packaging needs. We believe that the manufacture, sale, and use of our packaging solutions directly contribute to the creation of a more sustainable – and more circular – global supply chain. We help our customers and end-users meet their own ESG goals. At the same time, Ranpak is on its own ESG journey as a company. In our third year as a public company, we are still building our ESG analysis and reporting infrastructure. While we have made substantial progress on ESG matters since becoming a public company – we have identified ESG metrics that are material to our business; we collect and analyze significant ESG-related data relating to our internal operations; we have set long-term corporate-level ESG targets; we have assigned oversight of our ESG performance to a committee of our Board; and, in 2022, we will publish our third ESG Impact Report – we acknowledge that we have more to do. Moreover, we are committed to becoming a leader in ESG reporting and performance and continuing our leadership in facilitating the emergence of a more sustainable supply chain.

Board Composition and Director Nominees

Our business and affairs are managed under the direction of our Board. Our Board is currently composed of ten directors. The number of directors is fixed by our Board, subject to the terms of our certificate of incorporation and our bylaws.

Our certificate of incorporation and our bylaws provide for a classified Board consisting of three classes of directors, each serving staggered three-year terms as follows:

| · | Our Class I directors are Messrs. Gliedman and Kovach and Ms. Tranen, with terms expiring at the 2023 annual meeting. On April 8, 2022, Mr. Kovach notified the Company of his intention to retire from the Company’s Board, effective June 30, 2022. |

| · | Our Class II directors are Messrs. Corley, Jones and King, with terms expiring at the 2024 annual meeting. |

| · | Our Class III directors are Messrs. Asali, Seshadri and Zumwalt and Ms. El, and they are nominated for re-election at the Annual Meeting. |

At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following their election. Except as otherwise provided by law and subject to the rights of any class or series of preferred stock, vacancies on our Board (including a vacancy created by an increase in the size of the Board) may be filled only by the affirmative vote of a majority of the remaining directors. A director elected by the Board to fill a vacancy (other than a vacancy created by an increase in the size of the Board) serves for the unexpired term of such director’s predecessor in office and until such director’s successor is elected and qualified. A director appointed to fill a position resulting from an increase in the size of the Board serves until the next annual meeting of stockholders at which the class of directors to which such director is assigned by the Board is to be elected by stockholders and until such director’s successor is elected and qualified. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

In making recommendations to the Company’s Board of nominees to serve as directors, the Nominating, Environmental, Social & Governance Committee will examine each director nominee on a case-by-case basis regardless of who recommended the nominee (including with respect to stockholder recommendations) and will take into account all factors it considers appropriate, including enhanced independence, financial literacy and financial expertise. In evaluating Director nominees, the Board with assistance of the Nominating, Environmental, Social & Governance Committee, evaluates a nominee’s qualities, performance and professional responsibilities, but also the then composition of the Board and the challenges and needs of the Board at that time, including issues of judgment, diversity (including gender or ethnic diversity), age, skills, background and experience. The Nominating, Environmental, Social & Governance Committee does not have a specific director diversity policy, but in practice considers diversity, including age, gender identity, race, sexual orientation, physical ability, ethnicity and perspective, in evaluating candidates for Board membership.

In addition, two of our anchor investors each have the right to designate one observer to our Board.

4

Independence of the Board of Directors

Our Board is currently composed of ten directors, six of whom qualify as independent within the meaning of the independent director guidelines of the New York Stock Exchange (“NYSE”).

Consistent with our Corporate Governance Guidelines and charter of our Nominating, Environmental, Social & Governance Committee, our Board of Directors has made an affirmative determination as to the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, and as a result of this review, and upon the review and recommendation of the Nominating, Environmental, Social & Governance Committee, our Board of Directors has determined that each of Messrs. Corley, King, Seshadri and Zumwalt and Mses. El and Tranen are independent, as defined in the rules of the NYSE.

Board Leadership Structure

Mr. Asali serves as both our Chief Executive Officer and the Chairman of the Board of Directors. The Board of Directors meets in executive session amongst non-management directors at each regularly scheduled quarterly Board meeting, which are presided over by an independent director. We also have fully independent Audit, Nominating, Environmental, Social & Governance, and Compensation committees along with governance practices that promote independent leadership and oversight.

The Board of Directors believes that the foregoing structure achieves an appropriate balance between the effective development of key strategic and operational objectives by the CEO and Chair, and independent oversight of management’s execution of such objectives.

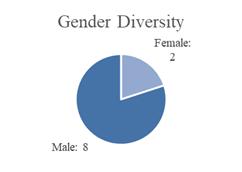

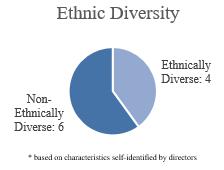

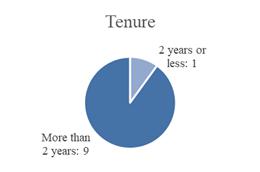

Board Diversity and Attributes

Our Board believes diversity is important and seeks representation across a range of attributes, including gender, race, ethnicity, and professional experience, and regularly assesses our Board’s diversity when identifying and evaluating director candidates. As of December 31, 2021, our Board of Directors consisted of the following:

|  |

|  |

5

Committees of the Board of Directors

Our Board has three fully independent standing committees: the Audit Committee, the Compensation Committee and the Nominating, Environmental, Social & Governance Committee. Each of the committees reports to the Board as they deem appropriate and as the Board may request.

Audit Committee

Our Audit Committee is currently composed of Messrs. King and Zumwalt and Ms. Tranen, with Mr. King serving as the chair of the committee. Our Board has determined that each member of the Audit Committee meet the independence requirements and the financial literacy requirements under the applicable rules and regulations of the SEC and the applicable listing standards of the NYSE. Our Board has determined that all members qualify as “Audit Committee financial experts” as defined under SEC rules.

Our Audit Committee oversees our corporate accounting and financial reporting process. The Audit Committee is also responsible for preparing the audit committee report that SEC rules require to be included in this Proxy Statement. The Audit Committee charter details the principal responsibilities of the Audit Committee, including assisting the Board in its oversight of:

| · | the integrity of the Company’s financial statements and internal controls; |

| · | the qualifications, independence and performance of the Company’s independent auditor; |

| · | the design and implementation of the internal audit function; and |

| · | the Company’s compliance with legal and regulatory requirements. |

Compensation Committee

Our Compensation Committee is composed of Messrs. Seshadri and King and Ms. Tranen, with Mr. Seshadri serving as the chair of the committee. Our Board has determined that each of Messrs. Seshadri and King and Ms. Tranen qualify as independent under the applicable rules of the NYSE, and each are “non-employee directors” as defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Compensation Committee reviews and recommends policies relating to compensation and benefits of our officers and employees. The Compensation Committee charter details the principal responsibilities of the Compensation Committee, including:

| · | reviewing and approving compensation (including equity-based compensation) for the Company’s directors; |

| · | reviewing and approving the compensation of our CEO and each of the Company’s senior executive officers, including: (i) identifying, reviewing and approving corporate goals and objectives relevant to executive officer compensation; and (ii) evaluating each executive officer’s performance in light of such goals and objectives to determine such compensation; |

| · | reviewing the Company’s management succession planning in consultation with our CEO; |

| · | reviewing and evaluating the Company’s executive compensation and benefits plans generally; and |

| · | reviewing and assessing the risks arising from the Company’s employee compensation policies and practices. |

The charter also provides that the Compensation Committee may, in its sole discretion, retain or obtain the advice of a compensation consultant, legal counsel or other adviser and will be directly responsible for the appointment, compensation and oversight of the work of any such adviser. However, before engaging or receiving advice from a compensation consultant, external legal counsel or any other adviser, the Compensation Committee will consider the independence of each such adviser, including the factors required by the NYSE and the SEC. The Compensation Committee may delegate to one or more officers of the Company the authority to make grants and awards or options

6

to any non-Section 16 officer of the Company under such of the Company’s incentive-compensation or other equity-based plans as the Committee deems appropriate and in accordance with the terms of such plans.

Nominating, Environmental, Social & Governance Committee

Our Nominating, Environmental, Social & Governance Committee is currently composed of Messrs. Corley, Seshadri and Zumwalt and Ms. El. Each of Messrs. Corley, Seshadri and Zumwalt and Ms. El is an independent director under the applicable rules of the NYSE relating to Nominating, Environmental, Social & Governance Committee independence.

The Nominating, Environmental, Social & Governance Committee is responsible for making recommendations to the Board regarding candidates for directorships and the size and composition of the Board. The Nominating, Environmental, Social & Governance Committee charter details the principal responsibilities of the Nominating, Environmental, Social & Governance Committee, including:

| · | reviewing and evaluating the size, composition, function and duties of the Board consistent with its needs; |

| · | recommending criteria for the selection of candidates to the Board and its committees, and identifying individuals qualified to become Board members consistent with such criteria, including the consideration of nominees submitted by stockholders; |

| · | recommending to the Board director nominees for election; |

| · | recommending directors for appointment to Board committees; |

| · | making recommendations to the Board as to determinations of director independence; |

| · | overseeing the evaluation of the Board; |

| · | overseeing the Company’s corporate social responsibility program, including its ESG initiatives and related risks; and |

| · | developing and recommending to the Board the Corporate Governance Guidelines and Code of Business Conduct and Ethics for the Company and overseeing compliance with such Guidelines and Code. |

Code of Ethics

We have adopted a Code of Business Conduct and Ethics (the “Code”) applicable to our directors, officers and employees that complies with the rules and requirements of the NYSE. The Company intends to disclose any amendments to or waivers of certain provisions of the Code on its website at ir.ranpak.com within the time period required by the SEC and the NYSE.

Copies of our Code, along with our Corporate Governance Guidelines and the charter of each of our Audit, Compensation and Nominating, Environmental, Social & Governance Committees are available on our website at ir.ranpak.com. Information on or accessible through our website is not part of, or incorporated by reference into, this Proxy Statement. In addition, a copy of the Code will be provided without charge upon request.

Hedging and Pledging Policy

Our Insider Trading Policy covers hedging and pledging. Employees and directors are prohibited from engaging in any hedging transactions (including transactions involving options, puts, calls, prepaid variable forward contracts, equity swaps, collars and exchange funds or other derivatives) that are designed to hedge or speculate on any change in the market value of the Company’s equity securities. We prohibit employees and directors from pledging Company securities in any circumstance, and from holding Company securities on margin or holding Company securities in a margin account.

Meetings and Attendance

Our Board met five times during 2021. The Audit Committee met six times, the Compensation Committee met four times and the Nominating, Environmental, Social & Governance Committee met two times. During 2021, each

7

Board member attended at least 75% of the meetings of the Board and of the committees of the Board on which he or she served. We encourage all of our directors and nominees for director to attend our annual meeting of stockholders; however, attendance is not mandatory. Nine out of the ten directors then in service attended the 2021 annual stockholders meeting.

Stockholder Communications with the Board

Should stockholders or other interested parties wish to communicate with the Board, non-management or independent directors as a group or any specified individual directors, such correspondence should be sent to the attention of Sara Horvath, Secretary at Ranpak, 7990 Auburn Road, Concord Township, Ohio 44077. The Secretary will forward correspondence relating to the Board’s duties or responsibilities to the specified recipient. Correspondence that is unrelated to a director’s duties will be handled at the Secretary’s discretion. Stockholders may also submit recommendations of director candidates by following the same procedures.

Role of the Board in Risk Oversight

The Board oversees our risk management. The Board of Directors, directly and through audit committees carries out this oversight role by reviewing the Company’s policies and practices with respect to risk assessment and risk management, and by discussing with management the risks inherent in the operation of our business.

ESG Reporting

To highlight our commitment to ESG practices, we publish an annual ESG Impact Report. For more information, and a copy of our most recent ESG Impact Report, please visit our website ranpak.com/sustainability.

Board Oversight of Material Environmental and Social Risk

Ranpak takes into account considerations that affect all of our key stakeholders, including our stockholders, customers, employees, communities, regulators and suppliers. In recognition of this, in March 2021, the Company affirmatively expanded the purpose and responsibilities of the then Nominating and Corporate Governance Committee of the Board to oversee, review and assess Ranpak’s corporate social responsibility program and ESG initiatives and accordingly, changed the name of such Committee to the Nominating, Environmental, Social & Governance Committee. The Nominating, Environmental, Social & Governance Committee reviews our ESG reporting, including our annual ESG Impact Report and received regular briefings from our Chief Sustainability Officer. The committee continues to report to our full Board which has ultimate responsibility to oversee material ESG risks and opportunities.

Human Capital Resources and Workforce Diversity

We are a global organization that values life experiences, ideas, and cultures that each of our employees bring to Ranpak, striving to create an atmosphere of acceptance and respect, facilitating an encouraging environment, and helping employees attain professional and educational goals. We are proud to count men and women of all races and ethnicities as members of our Board of Directors, management team, and employee workforce. In 2020, we joined The Board Challenge as a Charter Pledge Partner. The Board Challenge is an initiative to improve diverse representation in corporate U.S. boardrooms. As a Charter Pledge Partner, we acknowledge that we already have diversity in our boardroom and pledge to use our resources to accelerate change within other companies. We utilize interview guides in our hiring processes to help identify different competencies, such as diversity, equity, and inclusion competencies, to ensure that new hires are developed in these areas. Additionally, we developed robust anti-bias training to ensure that every potential candidate is given a fair and merit-based evaluation of their skills.

We strive to maintain an active dialogue with our employees and provide employees a comprehensive benefits package including competitive wages, medical, life, and accident insurance, incentive bonus programs, and a 401(k) plan with an employer matching contribution. We have departmental budgets set aside for training and also provide a tuition reimbursement program for employees seeking bachelors or masters degrees. Certain employees are also eligible for stock-based compensation programs that are designed to encourage long-term performance aligned with Company objectives. In June 2019 and September 2021, every employee (excluding those eligible for stock-based compensation programs) received an equity award, providing a community of employee-owners who can personally share in the reward of our collective success.

8

Note About Website and ESG Impact Reports

The reports mentioned above, or any other information from our website, are not part of, or incorporated by reference into this Proxy Statement. Some of the statements and reports contain cautionary statements regarding forward-looking information that should be carefully considered. Our statements and reports about our objectives may include statistics or metrics that are estimates, make assumptions based on developing standards that may change, and provide aspirational goals that are not intended to be promises or guarantees. The statements and reports may also change at any time and we undertake no obligation to update them, except as required by law.

9

The following table sets forth the name, age as of April 12, 2022, and position of the nominees for election at the Annual Meeting and the other current directors of Ranpak Holdings Corp. whose terms extend past the Annual Meeting. The following also includes certain information regarding our directors’ individual experience, qualifications, attributes and skills and brief statements of those aspects of our directors’ backgrounds that led us to conclude that they are qualified to serve as directors (information for Messrs. Asali, Seshadri, Zumalt and Ms. El is set forth above in “Proposal No. 1 Election of Directors”).

Name | Age | Director Since | Position | Independent |

| Omar M. Asali | 51 | 2019 | Chairman and Chief Executive Officer | |

| Michael A. Jones | 59 | 2019 | Vice Chairman and Managing Director, North America | |

| Thomas F. Corley(3) | 59 | 2019 | Director | ü |

| Pamela El(3) | 64 | 2020 | Director | ü |

| Robert C. King(1)(2) | 63 | 2019 | Director | ü |

| Steve A. Kovach | 64 | 2019 | Director | |

| Salil Seshadri(2)(3) | 45 | 2019 | Director | ü |

| Michael S. Gliedman | 58 | 2020 | Director and Chief Technology Officer | |

| Alicia M. Tranen(1)(2) | 49 | 2019 | Director | ü |

| Kurt Zumwalt (1) (3) | 53 | 2020 | Director | ü |

| (1) | Member of the Audit Committee |

| (2) | Member of the Compensation Committee |

| (3) | Member of the Nominating, Environmental, Social & Governance Committee |

Michael A. Jones, 59, has been a member of our board of directors since July 2017 and has served as our Vice Chairman and Managing Director, North America since September 2019. Mr. Jones served as Chief Customer Officer of Lowe’s Companies, Inc. from May 2014 through October 2016. In this role, Mr. Jones was responsible for store environment, merchandising, customer experience, marketing, strategy and research for Lowe’s U.S. stores operations. Prior to this role, Mr. Jones served as the Chief Merchandising Officer of Lowe’s Companies Inc. since January 2013. In this capacity, Mr. Jones was responsible for both domestic and global sourcing for the merchandising offering for Lowe’s U.S. stores, and U.S. pricing operations. Mr. Jones served as Head of Business Unit Americas and Executive Vice President at Husqvarna AB from June 2011 to January 2013. In this role, Jones led sales, service and manufacturing operations for Husqvarna’s North and Latin American businesses. Prior to this role, Mr. Jones served as Head of Sales and Service for North and Latin America at Husqvarna AB since October 2009. Mr. Jones served as the General Manager of Cooking Products within the appliances division of General Electric (“GE”) from June 2007 to October 2009, and from 1994 to 2007, held various leadership positions with GE in Sales, Service, Product Management and international business. He began his career at GE in appliance builder sales, and held roles with increasing responsibility during his time at GE, including Chief Commercial Officer in Europe, Middle East and Africa and for GE Consumer and Industrial. He is currently on the Board of Johnson C. Smith University, and Children’s National in Washington, DC. Mr. Jones received a B.S. in Business Administration from California Coast University in Santa Ana, California.

Mr. Jones’s qualifications to serve on our board of directors include: his strong business and financial acumen, including the ability to read operational financials and balance sheets; his sell-side and buy-side analyst experience including presentations to analyst and investors and business positioning; his substantial experience in strategy development and extensive leadership positions in various companies.

Thomas F. Corley, 59, has been a member of our board of directors since July 2017. Mr. Corley served as the Executive Vice President, Chief Global Revenue Officer for Catalina responsible for all worldwide engagements, retailer and manufacturer revenue from October 2017 to January 2020. Mr. Corley previously served as Chief Operating Officer of Acosta, Inc. from January 2016 until December 1, 2016. While at Acosta, Mr. Corley oversaw the Sales and Foodservice divisions, designed operating strategies, developed a differentiated sales organization and cultivated excellent customer relationships. Prior to serving at Acosta, Mr. Corley held several senior roles at Kraft

10

Foods Group over a thirty year tenure. Mr. Corley served as an Executive Vice President and President of Retail Sales and Foodservice from October 2012 through July 2015. Prior to that, Mr. Corley served as Senior Vice President of Sales from June 2009 to October 2012. His additional roles at Kraft included Vice President of Walmart/Customer Development Organization, Area Vice President, East Customer Development Organizations and Area Vice President of South Area Field Sales Organization. Mr. Corley has extensive experience with customer collaboration, new business development, field sales commercialization, acquisition integration and organizational development. Mr. Corley also serves on the Board of Directors at PRE-Brands, Carbone Retail Sauce and Whitehouse Foods. He is also a Director at One Madison Group, on the Retail Advisory Board of TRAX USA and a Commercial Advisor for Bowery Farms. He is also a former Board Member/Independent Director for Advantage Sales and Marketing. Mr. Corley received a B.A. in Business Administration and Management from the University of St. Thomas in Minnesota.

Mr. Corley’s qualifications to serve on our board of directors include his 35 years of industry experience, senior leadership roles at Kraft Foods Group, global and data services experience at Catalina and senior relationships across the CPG/Retail industry.

Robert C. King, 63, has been a member of our board of directors since July 2017. Mr. King served as the Chief Executive Officer of CytoSport, Inc. from June 2013 to August 2014. Prior to joining CytoSport, Mr. King served as an Advisor to TSG Consumer Partners from March 2011 to July 2013. Mr. King spent 21 years in the North America Pepsi system from 1989 to 2010. Before joining the North America Pepsi system, Mr. King worked in various sales and marketing positions with E&J Gallo Winery from 1984 to 1989 and with Procter & Gamble from 1980 to 1984. Previously, Mr. King served as an Executive Vice President and President of North America at Pepsi Bottling Group Inc. from November 2008 to 2010, with responsibility for all PBG business in the United States, Canada and Mexico. He served as the President of PBG’s North American business at Bottling Group from December 2006 to November 2008. Mr. King served as the President of North American Field Operations at Pepsi Bottling Group Inc. from October 2005 to December 2006. He served as Senior Vice President and General Manager of Pepsi Bottling Group’s Mid-Atlantic Business Unit from 2002 to 2005. Mr. King has served as a Director and advisor to CytoSport, Island Oasis Frozen Cocktail Co., Inc. and Neurobrands, LLC, a producer of premium functional beverages, and Exal Corporation. Mr. King has been an Executive Advisory Partner at Wind Point Partners and Chairman of Gehl Foods, a WPP portfolio company since May 2015. Mr. King served as a Director of Freshpet Inc. and, currently, he serves as Chairman of Arctic Glacier, a Carlyle LLC portfolio company, since August 2017, and as Chairman of WernerCo, a Triton Partner portfolio company, since June 2020. Mr. King received a B.A. in English from Fairfield University.

Mr. King’s qualifications to serve on our board of directors include: his corporate leadership and public company experience; and his more than 41 years of substantial expertise in managing businesses and operations in the consumer packaged goods industry, including his 21 years in the North America Pepsi system.

Steve A. Kovach, 64, has been a member of our board of directors since June 2019. Mr. Kovach is currently retired. He served as the President and Chief Executive Officer of Ranpak Corp. from August 2012 to June 2017. In this role, Mr. Kovach was responsible for overseeing the day-to-day activities of Ranpak and overall corporate strategy. Prior to that, he was a Senior Vice President and the Chief Financial Officer of Ranpak Corp. from September 1996 to July 2012 and was responsible for all financial reporting and managing Ranpak’s financial management personnel and systems, as well as the company’s human resource and information technology functions. He also served as a Director of Ranpak from April 2002 to June 2017. From July 1988 until July 1993, Mr. Kovach was employed by LDI Corporation in a variety of managerial positions including serving as Vice President, Finance. He was also a Manager, Financial Trading and held other professional positions at BP America from July 1984 to July 1988. Mr. Kovach received an M.B.A. from the University of Chicago and a B.S.B.A. in Finance from Miami University, Ohio.

Mr. Kovach’s qualifications to serve on our board of directors include: his corporate leadership experience, including his experience as the Chief Executive Officer and, prior to that, as the Chief Financial Officer of Ranpak; his substantial expertise in managing businesses, operations and business strategy in the protective packaging industry, including his 21 years as a senior executive at Ranpak; and his extensive experience in corporate finance.

On April 8, 2022, Mr. Kovach notified the Company of his intention to retire from the Company’s Board, effective June 30, 2022.

Michael S. Gliedman, 58, has served as our Chief Technology Officer since March 2020. In this capacity, Mr. Gliedman oversees all aspects of technology for the Company as well as Digital and Corporate Marketing. He has been a member of our board of directors since June 2019. Mr. Gliedman is also Managing Director of Blue Strat

11

Advisors, a technology strategy and digital transformation consulting firm that he founded in November 2017. Previously, Mr. Gliedman was Senior Vice President and Chief Information Officer for the National Basketball Association from July 1999 to July 2017, where he was responsible for identifying and applying technologies to enhance the fan experience, technology strategy formulation, systems design and implementation and cyber-security for the league. Prior to joining the NBA, Mr. Gliedman served as Senior Vice President, Application Development at Viacom from May 1997 to June 1999. Prior to joining Viacom, he was a Principal in the Media & Entertainment practice at Booz Allen & Hamilton, from October 1991 to May 1997. Mr. Gliedman received an M.B.A. with a concentration in Marketing from Columbia Business School and a B.A. in Computer Science from Brandeis University.

Mr. Gliedman’s qualifications to serve on our board of directors include: his extensive experience driving business focused technology initiatives developed through years as a management consultant and as an operator at both Viacom and the NBA; his substantial expertise in digital marketing and social media; and his 18 years of corporate leadership experience as a senior executive at the NBA.

Alicia M. Tranen, 49, has been a member of our board of directors since June 2019. Ms. Tranen is currently the Founder, General Partner and Portfolio Manager of Boulevard Capital Management, which she founded in June 2008. Boulevard Capital Management is an investment fund that primarily invests in public companies. Ms. Tranen is also a Senior Advisor to 3L Capital Management, a growth equity firm based in New York City and Los Angeles. Previously, she served as a Senior Analyst at Cantillon Capital, an $11 billion long-short equity hedge fund, from inception in February 2003 to March 2008. At Cantillon, Ms. Tranen was a senior member of the investment team. Prior to that, she was a Principal at RRE Ventures, a venture capital firm with $500 million in assets, from September 1999 to March 2002. While at RRE Ventures, Ms. Tranen served on the boards of directors, or as an observer to the board, of 10 RRE Ventures portfolio companies. From September 1994 to August 1997, Ms. Tranen was a Research Associate at Fidelity Management & Research Co, where she was responsible for research, analysis and coverage of over 100 public companies. Ms. Tranen currently serves on the Advisory Board of Team Impact Los Angeles. Ms. Tranen received an M.B.A. from Harvard Business School and a B.A. in Economics from Tufts University.

Ms. Tranen’s qualifications to serve on our board of directors include: her strong business and financial acumen, including the ability to read operational financials and balance sheets; her extensive experience as an investor in public companies of all sizes across multiple industries; her background evaluating the financial performance of late stage private companies and public companies; and her experience as a director and/or a significant stockholder in numerous companies.

12

Proposal No. 2

Ratification of Selection of Independent Registered Public Accounting Firm

The Audit Committee of our Board has engaged Deloitte & Touche LLP (“Deloitte”), as our independent registered public accounting firm for the fiscal year ending December 31, 2022, and is seeking ratification of such selection by our stockholders at the Annual Meeting. A representative of Deloitte is expected to be present at the Annual Meeting, and will have an opportunity to make a statement if they desire to do so, and will be available to respond to questions.

Neither our bylaws nor other governing documents or applicable law require stockholder ratification of the selection of Deloitte as our independent registered public accounting firm. However, the Audit Committee is submitting the selection of Deloitte to our stockholders for ratification as a matter of good corporate practice. If our stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain Deloitte. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and our stockholders.

Principal Accountant Fees and Services

The following table provides information regarding the fees incurred to Deloitte during the fiscal year ended December 31, 2021 and during the fiscal year ended December 31, 2020. The Audit Committee approved all of the fees described below.

| Fiscal Year Ended | ||||||||

| December 31, 2021 | December 31, 2020 | |||||||

| Audit Fees (1) | $ | 1,010,589 | $ | 1,076,242 | ||||

| Tax Fees (2) | 266,730 | 251,483 | ||||||

| Audit-Related Fees (3) | 87,126 | 89,145 | ||||||

| All Other Fees (4) | 45,000 | 279 | ||||||

| Total Fees | $ | 1,409,445 | $ | 1,417,179 | ||||

| (1) | Audit fees for years-ended 2021 and 2020 consist of fees billed for professional services rendered for the audit of our year-end consolidated financial statements, and review of the financial statements included in the Company’s Form 10-Q filings and services that are normally provided by Deloitte in connection with regulatory filings. |

| (2) | Fees for professional services performed with respect to tax compliance, tax advice and tax planning. |

| (3) | Fees for assurance and related services that are reasonably related to the performance of the audit or review of our year-end consolidated financial statements and internal controls. Fees for comfort processes in coordination with Company’s registration statements filings. |

| (4) | Fees for year ended 2021 related to consultation on the Company's position as a result of the SEC’s April 2021 guidance on SPAC transactions. Fees for year ended 2020 related to consultation on the Company’s human resources functions in The Netherlands. |

Pre-Approval Policies and Procedures

The Audit Committee is responsible for appointing, setting compensation and overseeing the work of the independent auditors. In recognition of this responsibility, the audit committee shall review and, in its sole discretion, pre-approve all audit and permitted non-audit services to be provided by the independent auditors as provided under the Audit Committee charter. The Audit Committee may delegate its authority to pre-approve services to the Chair of the Committee, provided that such designees present any such approvals to the full Audit Committee at the next Audit Committee meeting.

THE BOARD RECOMMENDS A VOTE FOR RATIFICATION OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

13

Report of the Audit Committee of the Board of Directors

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of Ranpak under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

The primary purpose of the Audit Committee is to oversee our financial reporting processes on behalf of our Board. The Audit Committee’s functions are more fully described in its charter. Management has the primary responsibility for our financial statements and reporting processes, including our systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed with management Ranpak’s audited financial statements as of and for fiscal year 2021.

The Audit Committee has discussed with Deloitte, the Company’s independent registered public accounting firm, the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (the “PCAOB”) and the SEC. In addition, the Audit Committee has received from Deloitte the written disclosures and the letter required by the applicable requirements of the PCAOB regarding Deloitte’s communications with the Audit Committee concerning independence, and has discussed with Deloitte their independence. Finally, the Audit Committee discussed with Deloitte, with and without management present, the scope and results of Deloitte’s audit of Ranpak’s audited financial statements as of and for fiscal year 2021.

Based on these reviews and discussions, the Audit Committee has recommended to our Board that such audited financial statements be included in our Annual Report on Form 10-K for fiscal year 2021 for filing with the SEC. The Audit Committee also has engaged Deloitte as our independent registered public accounting firm for fiscal year 2022 and is seeking ratification of such selection by the stockholders.

Audit Committee

Robert C. King, Chair

Alicia M. Tranen

Kurt Zumwalt

14

Proposal No. 3

Non-Binding Advisory Resolution to Approve the Compensation of the

Named Executive Officers

We are asking our stockholders to vote to approve, on a non-binding advisory basis, the compensation of our named executive officers for 2021 as described in this Proxy Statement, in accordance with the requirements of Section 14A of the Exchange Act. As described in detail under the heading “Compensation Discussion and Analysis,” our executive compensation program is designed to drive and reward performance and align the compensation of our named executive officers with the long-term interests of our stockholders. Please read the “Compensation Discussion and Analysis” and the compensation tables and narrative disclosure that follow for additional details about our executive compensation program, including information about the 2021 compensation of our named executive officers.

This proposal, commonly known as a “say on pay” proposal, gives our stockholders the opportunity to express their views on our named executive officers’ compensation as a whole. This vote is not intended to address any specific element of compensation but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this Proxy Statement. Our Board and our Compensation Committee believe that these policies and practices are effective in implementing our compensation philosophy and in achieving our compensation program objectives.

Accordingly, we are asking our stockholders to vote “For” the following resolution:

RESOLVED, that the stockholders hereby approve, on a non-binding advisory basis, the compensation paid to the Company’s named executive officers, as described in the Company’s Proxy Statement for the 2022 Annual Meeting of Stockholders, pursuant to the compensation disclosure rules of the SEC, including in the Compensation Discussion and Analysis, the compensation tables and the narrative disclosure that accompanies the compensation tables.

Vote Required

The approval of this non-binding advisory proposal requires the affirmative vote of a majority of votes cast. Broker non-votes will not affect the outcome of the proposal as they are not counted as votes cast.

While we intend to carefully consider the voting results of this proposal, this vote is advisory and therefore not binding on the Company, the Compensation Committee or the Board of Directors. The Board of Directors and the Compensation Committee value the opinions of our stockholders and, to the extent there is any significant vote against the named executive officer compensation as disclosed in this Proxy Statement, we will consider those stockholders’ concerns, and the Compensation Committee will evaluate whether any actions are necessary to address those concerns.

THE BOARD RECOMMENDS A VOTE FOR THE APPROVAL OF THE NAMED EXECUTIVE OFFICER COMPENSATION, AS DESCRIBED IN THIS PROXY STATEMENT.

15

Proposal No. 4

Non-Binding Advisory Resolution to Approve the Frequency of Future Advisory Votes on Executive Compensation

As described in Proposal No. 3 above, we are providing our stockholders with the opportunity to cast an advisory vote on the compensation of the Company’s named executive officers.

Section 14A of the Exchange Act requires us, at least once every six years, to allow our stockholders the opportunity to cast an advisory vote on how often we should seek future advisory votes on the compensation of the Company’s named executive officers in our proxy materials for future stockholder meetings. Under this proposal, stockholders may vote to have the “say-on-pay” vote every year, every two years or every three years, or may abstain from voting.

Say on Pay Frequency

After careful consideration, our Board believes that submitting the advisory vote on executive compensation on an annual basis is appropriate for our Company and its stockholders at this time. This determination by our Board was influenced by the fact that meaningful portions of the compensation of our named executive officers are evaluated, adjusted and approved on an annual basis, even though our compensation policies and practices are designed to incentivize our named executive officers to build long-term stockholder value. As part of the annual compensation review process, the Board of Directors believes that stockholder perspectives should be a factor that is taken into consideration by the Board of Directors and the Compensation Committee in making decisions with respect to executive compensation. By providing an advisory vote on executive compensation on an annual basis, our stockholders will be able to provide us with direct input on our compensation philosophy, policies and practices as disclosed in the proxy statement each year. We understand that our stockholders may have different views as to what is the best approach for the Company, and we look forward to hearing from our stockholders on this agenda item every year. Accordingly, our Board of Directors recommends that the advisory vote on executive compensation be held every year. This advisory vote gives you as a stockholder the opportunity to vote on the frequency of advisory votes on executive compensation for the Company’s named executive officers through the following resolution:

RESOLVED, that the stockholders wish the Company to include an advisory vote on the compensation of the Company’s named executive officers pursuant to Rule 14a-21(b) of the Exchange Act:

| · | Every Year; |

| · | Every Two Years; |

| · | Every Three Years; or |

| · | Abstain. |

Vote Required

The option for which the greatest number of votes is cast will be deemed to be the frequency preferred by the stockholders. Broker non-votes will not affect the outcome of the proposal as they are not counted as votes cast.

While we believe that a vote of every year is the best choice for us, you are not voting to approve or disapprove our recommendation of every year, but rather to make your own choice among a vote of once every year, every two years or every three years. You may also abstain from voting on this proposal.

This vote is advisory and therefore not binding on the Company, the Compensation Committee or the Board of Directors. The Board of Directors and the Compensation Committee value the opinions of our stockholders will consider the outcome of the vote when making future decisions regarding the frequency of holding future stockholder advisory votes on the compensation of our named executive officers.

THE BOARD RECOMMENDS A VOTE FOR “EVERY YEAR” FREQUENCY OF FUTURE ADVISORY VOTES ON NAMED EXECUTIVE OFFICER COMPENSATION.

16

Compensation Discussion and Analysis

Overview

This Compensation Discussion and Analysis (the “CD&A”) describes our executive compensation philosophy, process, objectives, and material elements of our compensation program for our “named executive officers” (“NEOs”) for fiscal 2021 who are named in the “Summary Compensation Table.” This CD&A should be read together with the compensation tables and related disclosures set forth below. In 2021, our NEOs and their positions were as follows:

| · | Omar Asali, our Chairman and Chief Executive Officer; |

| · | William Drew, our Senior Vice President and Chief Financial Officer; |

| · | Michael Jones, our Vice Chairman and Managing Director, North America; |

| · | Eric Laurensse, our Managing Director, Europe; and |

| · | Antonio Grassotti, our Managing Director, APAC. |

While the principal purpose of this CD&A is to review the compensation of our NEOs, many of the programs discussed apply to other members of senior management who, together with our NEOs, are collectively referred to herein as our “executive officers” or “executives.”

Executive Summary

Compensation Philosophy and Objectives

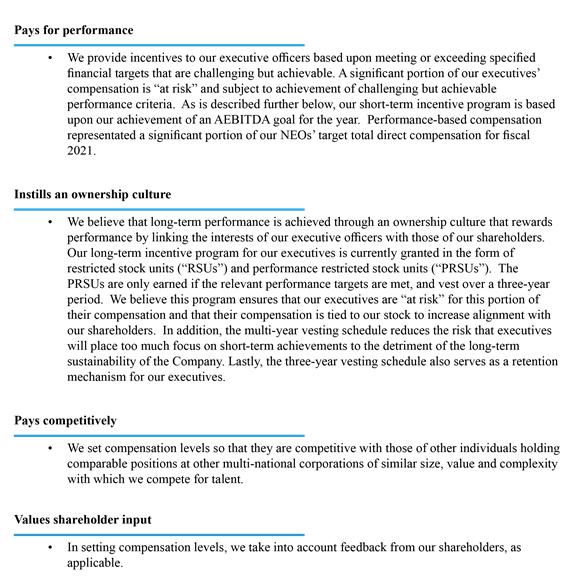

Our compensation program is designed to attract, retain and motivate our executives who drive the Company’s success. We believe that a strong performance-focused executive compensation program is essential to enable the Company to achieve its corporate performance goals in the competitive protective packaging industry and drive stockholder value. We seek to achieve these objectives through a compensation program that:

17

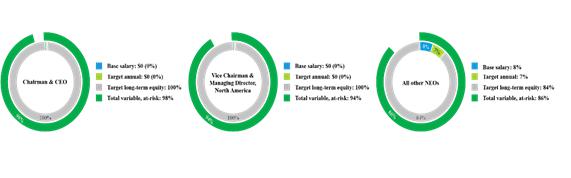

Compensation Elements and Pay Mix

Consistent with our compensation philosophy, the majority of our NEOs’ target total direct compensation in fiscal 2021 was variable and at-risk, reflecting our belief that a significant amount of executive compensation should be tied to performance for executives who bear higher levels of responsibility with respect to overall Company performance. For both our CEO and our Managing Director, North America, 100% of their 2021 total direct compensation was in the form of long-term equity incentive awards, and the majority of that compensation was “at risk” in the form of PRSUs. The remainder was in the form of three-year vesting RSUs. Approximately 86% of the 2021 total direct compensation of our other NEOs was at-risk, consisting of annual cash bonuses and PRSUs, and a large percentage of their compensation was in the form of long-term equity incentive awards (84%). Additionally, and not included in the graphs below, we granted certain of our key employees, including our executive officers, a one-time special long-term incentive grant in 2020 that was subject to stockholder approval of an amendment to our equity plan to increase the share pool under the plan, which we obtained during our 2021 Annual Stockholders Meeting. For further discussion of our special long-term incentive program grant, see below under “Analysis of Fiscal 2021 Compensation—LTIP PRSUs.”

18

| Element | Purpose | Key Characteristics | |

| Fixed | Base Salary | This pay element is intended to provide a fixed component of compensation that is commensurate with each executive’s experience, role and responsibilities.

| Provides a steady source of income to our executive officers in line with the Company’s historic practices (including before we were public) and market practice. The only portion of compensation that is not “at risk”. |

| Variable | Annual Cash Bonus | This element is designed to motivate senior executives and reward the achievement of specific performance goals that support our business strategy.

We note that two of our NEOs, our CEO Omar Asali and our Managing Director, North America Michael Jones, do not receive an annual cash bonus and receive all of their compensation in the form of equity awards. | Payouts are determined based on achievement of AEBITDA targets for 2021, as established by our Board. |

| Annual Equity Incentive Awards | This element is intended to align the interests of executives with long-term stockholder value and serve to attract and retain executive talent. | PRSUs may be earned at 0-150% of target based on achievement of AEBITDA targets for 2021, as established by our Board. Target PRSUs and RSUs vest over a three-year period. | |

| Special Long-Term Incentive Program | This element is designed to provide additional long-term incentive and alignment by tying to multi-year performance goals during performance years 2023-2025. | PRSUs may be earned at 0-300% of target based on achievement of AEBITDA targets for years 2023, 2024 and 2025, as established by our Board. |

19

Executive Compensation Practices

Our executive compensation program and practices are designed to reinforce our pay-for-performance philosophy and incorporate the following corporate governance best practices designed to protect the interests of our stockholders. As the post-pandemic labor market continues to be fluid and dynamic, we will continue to evaluate our compensation program and practices relative to our market peers.

We use traditional compensation elements of base salary, annual cash incentives, long-term equity incentives, and employee benefits to deliver attractive and competitive compensation rewards to our executives for driving stockholder value. Our fiscal 2021 incentive program consisted of regular annual cash bonuses, RSUs and PRSUs. In addition, the special long-term incentive program PRSUs (the “LTIP PRSUs”) are also shown in our disclosure this year. Although these awards were approved and communicated in 2020, due to the stockholder approval occurring in 2021, these awards are deemed to have been granted in 2021 for accounting purposes and are included in our compensation tables as a grant in 2021. The amount of pay that is performance-based for an executive is directly related to the level of responsibility held by the position; accordingly, our highest ranked executive has the most performance-based pay as a percentage of total compensation. We set realistic but challenging goals in our annual cash incentive and long-term performance plans. In each case, if our executive officers fail to meet the threshold pre-determined performance goals, the award will not be earned. In executing our compensation program and determining executive compensation, we are guided by the following corporate governance best practices:

20

Executive Compensation Process

Role of the Compensation Committee, Management and the Board

Role of the Compensation Committee

The Compensation Committee discharges many of the responsibilities of our Board relating to the compensation of our executive officers, including our NEOs, and the non-employee members of our Board. The Compensation Committee has overall responsibility for overseeing our compensation and benefits philosophy and policies generally, overseeing and evaluating the compensation plans, policies and practices applicable to our CEO and our other executive officers, and ensuring that the target total direct compensation opportunities of our executive officers, including our NEOs, are consistent with our compensation philosophy and objectives.

The members of the Compensation Committee are appointed by our Board, and each member is an independent director within the meaning of the independent director guidelines of the NYSE. Currently, the members of the Compensation Committee are Messrs. Seshadri and King and Ms. Tranen, with Mr. Seshadri serving as the chair of the committee.

The Compensation Committee reviews our executive compensation program annually on a calendar year basis, generally in February. The Compensation Committee draws on a number of resources to assist in the evaluation of the various components of our executive compensation program including, but not limited to, input from our CEO and information provided in the public filings of industry peers and similarly situated companies in other industries. In addition, as described below under “Role of the Compensation Consultant,” the Compensation Committee has engaged an independent compensation consultant who will provide advice on the Company’s executive compensation program on a regular basis going forward.

The Compensation Committee relies upon the judgment of its members in making compensation decisions. In addition, the Compensation Committee incorporates judgment in the assessment process to respond to and adjust for the evolving business environment. The members of the Compensation Committee have extensive experience in executive management, as well as compensation practices and policies.

In addition to reviewing and approving executive compensation, our Compensation Committee administers the Ranpak Holdings Corp. 2019 Omnibus Incentive Plan, as amended (the “2019 Omnibus Plan”).

Role of Management

Our CEO typically makes recommendations to our Compensation Committee, attends certain Compensation Committee meetings, and is involved in the process for determining our NEOs’ compensation; provided that the CEO does not make any recommendation as to his own compensation nor does he participate in deliberations about or determinations of his own compensation. Our Compensation Committee considers management recommendations but are not required to follow any recommendations and may adjust compensation up or down as they determine in their discretion. Our Compensation Committee reviews the recommendations of management, and other data in determining each NEO’s total compensation, as well as each individual pay component.

Role of the Compensation Consultant

The Compensation Committee has the authority to engage its own advisors to assist in carrying out its responsibilities and has engaged Frederic W. Cook & Co. (“FW Cook”) as its independent compensation consultant. FW Cook will attend our Compensation Committee meeting in April 2022 and, going forward, will be regularly advising the Compensation Committee on its executive compensation programs and overall compensation design, as well as peer company compensation practices.

21

Use of Comparative Market Data

For purposes of comparing our executive compensation program against the competitive market, the Compensation Committee considers recommendations from the CEO, and obtains input from its compensation consultant. The Compensation Committee does not use a single method or measure in making its compensation decisions, nor does it position compensation levels based upon a specific or target level relative to a peer group or other companies. Nonetheless, the pay practices at other companies are an important factor that the Compensation Committee considers in assessing the reasonableness of compensation and ensuring that our compensation practices are competitive in the marketplace.

Generally, the Compensation Committee evaluates the compensation of our executive officers relative to the median of the competitive market. However, as discussed hereafter, various other factors are taken into consideration in determining our executive officers’ compensation and the Compensation Committee does not target compensation at any specific level relative to the competitive market. When reviewing our current executive compensation arrangements and approving each compensation element and the target total direct compensation opportunity for our executive officers, the Compensation Committee considers the following factors:

| · | Historical compensation levels for our executive officers, including for those executives who were employed with Ranpak before the Ranpak Business Combination, the details of which were described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 filed with the SEC on March 3, 2021, compensation levels received when Ranpak was a private company; |

| · | Each individual executive officer’s skills, experience and qualifications relative to other similarly-situated executives at other comparable companies in our industry; |

| · | Our performance against the financial and operational objectives established by the Compensation Committee and our Board; |

| · | The compensation practices of our competitors; and |

| · | The recommendations provided by our CEO with respect to the compensation of our other executive officers. |

Analysis of Fiscal 2021 Compensation

In 2021, the principal elements of our executive compensation program were as follows:

| · | Base salary; |

| · | Annual cash bonus; |

| · | Annual equity incentive awards in the form of RSUs and PRSUs; and |

| · | Special LTIP PRSUs. |

Base Salary

Base salary represents the fixed portion of the compensation of our executive officers, including our NEOs, and is an important element of compensation intended to attract and retain highly talented individuals. Our CEO and our Managing Director, North America do not receive a base salary and instead are compensated entirely in the form of equity awards, as discussed further below.

The initial base salaries for our executive officers were set taking into account historical compensation for each executive officer prior to the Ranpak Business Combination, the details of which were described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 filed with the SEC on

22