Exhibit 99.1

Quarterly report Q3 2021

Dear shareholders,

In recent weeks, there have been many upheavals at Biofrontera, which also affect me personally and which I would like to explain to you, dear shareholders, as some of you have been “long-standing companions” of Biofrontera. For this reason, I would like to take this opportunity to provide you with a more detailed explanation of the decision-making process and the resulting actions.

It has become increasingly impossible for Biofrontera AG to actively and flexibly structure the financial basis of the company due to the blocking that has existed for years in the implementation of the Authorized Capital resolved by you, the shareholders, at various Annual General Meetings.

Especially after the exceptional situation of the Corona pandemic, which we have managed to cope with successfully on the expense side as well as on the sales side, we must make the best possible use of the resulting growth momentum. Biofrontera’s future clearly lies in the US market, as this is where we have the greatest growth potential with our product. Significantly increasing marketing and sales efforts here is therefore the cornerstone for successful corporate growth. However, due to the situation described above, the investments required for rapid growth in the US market can no longer be provided by Biofrontera AG. The financial independence of Biofrontera Inc. was therefore the only sensible way to consistently pursue our expansion strategy, which we have been successfully pursuing for years.

With the independent IPO of our US subsidiary Biofrontera Inc. at the end of October, we have created the prerequisites for it to now be able to grow and develop flexibly and independently of the financing options of Biofrontera AG, so that it can effectively exploit the great potential of the US market. The German Biofrontera companies will benefit directly from this growth through the license and supply agreement. Therefore, it is irrelevant whether Biofrontera Inc. is still a controlled subsidiary or not. On the contrary, the shares in Biofrontera Inc. held by Biofrontera AG have become marketable through the IPO and can be used flexibly to finance Biofrontera AG if required. A capital increase of the Biofrontera AG has therefore become unnecessary for a long time.

Since the USA represents by far the largest sales market for the entire Biofrontera Group, the role of the growth engine within the Group is assigned to Biofrontera Inc. The course for future growth of the entire Biofrontera Group will be determined in Biofrontera Inc. After originally agreeing to extend my term of office on the Management Board of Biofrontera AG only until December 31, 2022, I have now decided to remain at the disposal of the Biofrontera Group for a further three years. I would like to devote these three years where I see the greatest possible benefit for the company. Thus, on November 10, 2021, I submitted my request for early retirement as CEO and member of the Management Board to the Supervisory Board of Biofrontera AG.

Thus, in the best interest of all Biofrontera companies, I will fully devote myself to my duties as Executive Chairman of Biofrontera Inc. in the future. While I will continue to be a part of the company, I would like to take this opportunity to thank you very much for the trust you have placed in me and the entire company over the years. I hope that in the future, the seeds that have been planted over many years will finally come to fruition!

The succession plan was initiated by the Supervisory Board when my contract was extended about a year ago, and we are confident that the appointment will be made in such a way that they reflect the strategic approach of Biofrontera AG.

Best regards,

Prof. Dr. Hermann Lübbert

| Biofrontera AG Quarterly report Q3 2021 | 1 |

Quarterly report Q3 2021

Summary of the business performance in the nine months of 2021

On the back of a strong business recovery in the second as well as the third quarter of 2021, Biofrontera AG can look back on an encouraging nine-month period. The company was able to overcome the pandemic-related constraints on business growth for the most part over the course of the year. As a result, both the sales teams and the employees in the subsidiaries were less restricted by the pandemic containment measures. Despite this relief, however, the impact was still felt during the summer. Some restrictions on patient and sales force office visits increased again with the onset of fall.

While the company benefited in revenue terms from photodynamic therapy with daylight, or daylight PDT for short, in the German market last year, even in the midst of the pandemic, and our sales in Germany have grown even this year, the pandemic set us back significantly last year in our key market the USA as a result of the corona measures. In the reporting period, however, Biofrontera was able to create new sales momentum, particularly in the U.S., so that marketing gradually picked up over the last two quarters and we were even able to post growth compared to the pre-pandemic years. However, we were unable to fully offset the decline in sales in the USA in the first three months, which were much more affected by the pandemic.

The Biofrontera Group generated total sales of EUR 18.5 million in the period January 1 to September 30, 2021, compared to EUR 20.8 million in 2020, a decrease of approximately 11%. However, total revenue in the prior-year period included a one-time payment of EUR 6.0 million received by the company under a licensing agreement. Revenues from product sales in the first nine months of 2020 were EUR 14.3 million, representing an increase of approximately 29% for the same period in 2021.

The comparison with product sales in 2019 shows that since the beginning of 2021, product sales in all markets have been back at pre-pandemic levels, despite the fact that the first few months were still heavily impacted by the pandemic, particularly in the USA. Sales in the USA also showed only a decline of around 9% since the start of the year compared with 2019. As already outlined above, this decline was largely attributable to the weak sales months of January and February due to the pandemic, as well as the first half of March this year. In addition, sales of Aktipak® and Xepi® were largely absent in the current year. Year-to-date product sales in Germany were up approximately 20% and approximately 22% in the rest of the European market compared to 2019.

In the third quarter, the company generated total sales of EUR 5.38 million, around 14% more than in the third quarter of 2020 (EUR 4.7 million). At EUR -4.9 million, the operating result decreased compared to the third quarter of 2020 (EUR -4.0 million). EBITDA, on the other hand, improved by around EUR 0.8 million to EUR -3.9 million year-on-year (previous year: EUR -4.7 million).

In the USA, the company generated revenues from product sales of EUR 3.75 million in the third quarter of 2021, compared to EUR 2.75 million in the same period of the previous year (+36%). The USA remains the largest sales market for Ameluz®, where around 67% of total sales were generated in this quarter as well. The encouraging growth in sales clearly shows that PDT has also returned to the daily business of dermatologists as a result of the increased opening of doctors’ offices. The company is now using this continuous sales recovery to gain a stronger competitive edge once again and to win market share from cryotherapy, which is still by far the most widely used treatment option for actinic keratosis in the United States.

Sales development in Germany in the months of July, August, and September 2021 was more subdued compared to the previous year period. The rather rainy weather during these months, as well as the resurgence in travel after the height of the pandemic, had a particularly negative impact on the use of daylight PDT with Ameluz®. German product sales amounted to EUR 1.21 million in the third quarter of 2021 compared to EUR 1.53 million in 2020, a decrease of approximately 21%. In the rest of Europe, Biofrontera achieved product sales of EUR 439 thousand compared to EUR 384 thousand in the third quarter of 2020, an increase of 14%. In Europe, Biofrontera was able to add another licensing partner. After Galenica AB had already started with the distribution of Ameluz® and BF-RhodoLED® in the Scandinavian countries by mid-year, a license has now also been granted for Poland to Medac Gesellschaft für klinische Spezialpräparate mbH. The one-time payment of EUR 50 thousand paid to the company upon conclusion of the contract is included in European sales.

| Biofrontera AG Quarterly report Q3 2021 | 2 |

Quarterly report Q3 2021

Xepi®, our second product in the US portfolio, was difficult to promote during the pandemic and has seen little promotion over the past three months due to a delay in product delivery. This time was used to work on product positioning and to prepare a new campaign. Following the restocking of the pharmacies’ inventories, our sales force is now able to start promoting the product again at full strength.

The aim of Biofrontera’s commercial and clinical development strategy is to successively improve the adaptation of Ameluz® to market requirements and patient needs and to expand its use for further indications. The full treatment and market potential of Ameluz will only be unlocked with appropriate approval extensions. Biofrontera’s task in the coming years is therefore clear: intensifying sales and marketing activities must be accompanied by the clinical trials required for these extensions to the approval.

Two planned studies to expand the US approval of Ameluz® are already in the starting blocks and are expected to commence patient recruitment this year. One pertains to the safety data required by the FDA for the use of 3 tubes of Ameluz® in a PDT session. The second study is about evaluating the efficacy of Ameluz®-PDT in moderate to severe forms of acne in adults. Furthermore, in October, Biofrontera received US approval for the new, larger BF-RhodoLED® XL PDT lamp, which can now be used to illuminate larger areas, enabling the simultaneous treatment of multiple, spaced-out areas of actinic keratosis.

The third quarter was also characterized by preparations for the initial public offering (IPO) of Biofrontera Inc. in the USA. The public listing then took place on October 29, and the associated access to one of the largest capital markets ensures Biofrontera Inc. the possibility of further financing independent of Biofrontera AG against the backdrop of the more growth-oriented U.S. corporate law. As the past has shown, such financing opportunities cannot be achieved by Biofrontera AG, which is restricted in many respects by the framework of German capital market and corporate law. Biofrontera AG continues to hold its shares in Biofrontera Inc. which, however, have become valuable as a result of the IPO and could be sold if financing is required after the expiry of a 6-month holding period to which the AG has committed itself.

Unchanged from the ownership structure of Biofrontera Inc., Biofrontera AG benefits immediately from the growing Ameluz® sales in the USA. Under a license agreement, Biofrontera AG will receive up to 50% of Ameluz® sales in the form of a transfer price. This share applies up to an annual turnover of 30 million dollars and decreases to 40% between annual turnover of 30 and 50 million dollars and to 30% above that. The sliding scale considers Biofrontera Inc.’s distribution costs, which increase with higher sales. In parallel with the introduction of the sliding scale in the license agreement between the German companies and Biofrontera Inc., Biofrontera AG and its German subsidiaries are, in contrast to previous agreements, only obligated to conduct a clearly defined clinical trial program. Biofrontera Inc. initially has no right to the results of further developments by the German Biofrontera Group and would have to acquire a license for them. Therefore, the costs associated with the US commercialization in the German Biofrontera companies increase with growing sales significantly less than the commercialization costs of Biofrontera Inc. which is why the staggering of the transfer price is justified.

With the IPO of Biofrontera Inc., the capital raised can now be used for further growth and to further expand our presence in the US market. Through the license and supply agreement, Biofrontera AG also benefits from a strengthening of Biofrontera Inc. in the US market. Both companies can only grow and develop successfully together as well as independently with the help of a sufficiently financed Biofrontera Inc.

| Biofrontera AG Quarterly report Q3 2021 | 3 |

Key figures in accordance with IFRS

| in EUR thousands | | Jan 1- Sep 30, 2021 | | Jan 1- Sep 30, 2020 | | Jan 1- Sep 30, 2021 | | Jan 1- Sep 30, 2020 | |

| | unaudited | | unaudited | | unaudited | | unaudited | |

| Results of operations | | | | | | | | | |

| Sales revenue | | 18,473 | 100% | 20,829 | 100% | 5,379 | 100% | 4,713 | 100% |

| Gross profit on sales | | 15,761 | 85% | 18,262 | 88% | 4,680 | 87% | 3,637 | 77% |

| Result on operations | | (12,574) | (68)% | (8,364) | (40)% | (4,991) | (93)% | (4,036) | (86)% |

| EBITDA | | (9,680) | (52)% | (5,410) | (26)% | (3,912) | (73)% | (4,713) | (100)% |

| EBIT | | (12,139) | (66)% | (9,993) | (48)% | (4,748) | (88)% | (5,474) | (116)% |

| Earnings (loss) before tax | | (14,629) | (79)% | (11,635) | (56)% | (5,795) | (108)% | (6,401) | (136)% |

| Earning (loss) after tax | | (14,672) | (79)% | (12,027) | (58)% | (5,800) | (108)% | (6,456) | (137)% |

| in EUR thousands | September 30, 2021 | | September 30, 2020 | |

| unaudited | | unaudited | |

| Net assets | | | | |

| Total assets | 69,228 | | 56,391 | |

| Non-current assets | 29,224 | | 30,264 | |

| Cash and cash equivalents | 29,539 | | 16,546 | |

| Other current assets | 10,465 | | 9,580 | |

| Non-current liabilites | 21,578 | | 40,730 | |

| Current liabilities | 31,755 | | 8,286 | |

| Equity | 15,895 | | 7,375 | |

| | Sep 30, 2021 unaudited | Sep 30, 2020 unaudited |

| Number of employees | 167 | 155 |

| | |

| Biofrontera Shares | | |

Number of shares outstanding | 56,717,385 | 44,849,365 |

| Share price (Xetra closing price in EUR) | 2.36 | 3.46 |

| Biofrontera AG Quarterly report Q3 2021 | 4 |

Biofrontera Group financial position and performance

Results of operations

Revenue

In the period from January 1 to September 30, 2021, the Biofrontera Group generated total revenues of EUR 18,473 thousand, a decrease of 11% compared to EUR 20,829 thousand in the same period of the previous year. Revenues from product-only sales were EUR 18,473 thousand, an increase of 29% compared to product revenues of EUR 14,337 thousand in the first nine months of 2020.

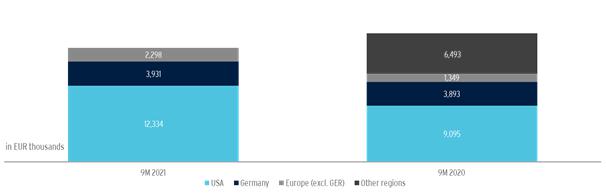

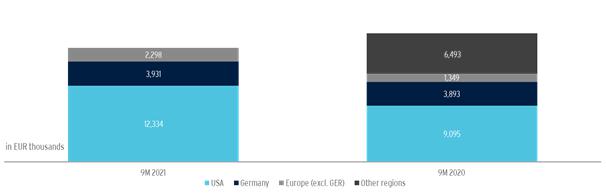

In the U.S., product revenues of EUR 12,334 thousand were generated during the reporting period, an increase of 36% compared to the same period last year (EUR 9,095 thousand). Sales of Xepi® were negligible in the reporting period. The development of sales from product revenues in 2020 and early 2021 was strongly influenced by the impact of the coronavirus crisis, particularly in the USA. While sales in the USA in January and February 2021 were still significantly below the previous year’s sales due to the pandemic, the Biofrontera Group has recorded a considerable year-on-year sales recovery from mid-March 2021 onwards.

In comparison, sales of EUR 3,931 thousand in the first nine months in Germany were at the same level as in the same period of the previous year (EUR 3,893 thousand). In other European countries, sales increased by 64% from EUR 1,349 thousand in 2020 to EUR 2,208 thousand in the reporting period.

No revenues were generated from other regions in the reporting period. In the prior-year period, these amounted to EUR 6,493 thousand and included a one-time payment of EUR 6,000 thousand received by the Company under a license agreement with the Japanese dermatology company Maruho Co., Ltd.

Gross profit on sales

Gross profit decreased by EUR 2,501 thousand to EUR 15,761 thousand in the first nine months of 2021, compared to EUR 18,262 thousand in the same period of the previous year. The gross margin decreased from 88% to 85%. This is mainly due to the revenues from licenses (one-time payment) of EUR 6,000 thousand included in the prior-year figure, which are not offset by any directly attributable cost of sales.

| Biofrontera AG Quarterly report Q3 2021 | 5 |

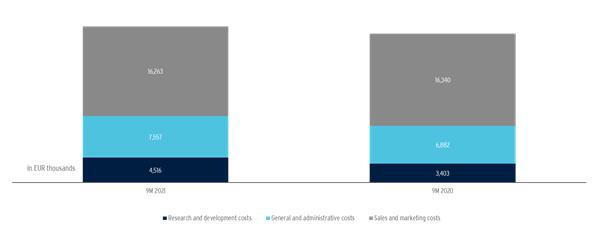

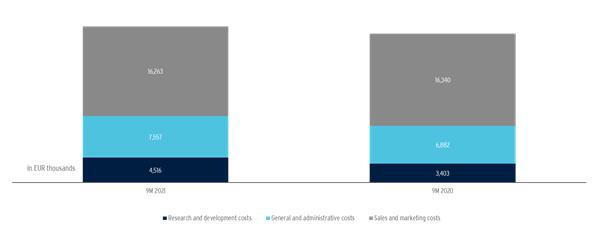

Research and development costs

Research and development costs increased by EUR 1,113 thousand to EUR 4,516 thousand in the first nine months of 2021 compared to the previous year (EUR 3,403 thousand), mainly due to the recommencement of clinical trial activities, which had to be mostly suspended in the previous year due to pandemic-related restrictions. Research and development expenses include costs for clinical trials, but also regulatory affairs expenses, i.e., for the granting, maintenance, and extension of our marketing authorizations.

General and administrative costs

General and administrative expenses amounted to EUR 7,557 thousand in the first nine months of 2021 (previous year: EUR 6,882 thousand), an increase of EUR 674 thousand. This was mainly due to the cost-cutting measures implemented in the previous year as a result of the COVID-19-pandemic and the increase in the provision for litigation costs for the DUSA legal proceedings in the USA.

Sales and marketing costs

Sales and marketing expenses amounted to EUR 16,263 thousand in the first nine months of 2021 and were thus at the level of the previous year (EUR 16,340 thousand). This is mainly due to the effects of the cost-saving measures implemented in the previous year as a result of the COVID 19 pandemic, which were offset by the non-cash impairment of the Xepi® license in the amount of EUR 2,001 thousand in the first quarter of 2020.

Selling expenses include the costs for our own sales force in Germany, Spain, the United Kingdom, and the United States as well as marketing expenses.

EBIT and EBITDA

In the 2021 financial year, EBITDA and EBIT have been introduced as key performance indicators for reporting purposes. Both have become established internationally as target figures and replace the previously reported figure of profit from operating activities.

Group EBITDA includes earnings before interest, taxes, depreciation of property, plant and equipment and amortization of intangible assets and decreased by EUR 4,270 thousand to a loss of EUR 9,670 thousand in the first nine months of 2021 compared to a loss of EUR 5,410 thousand in the prior-year period, mainly due to the aforementioned one-time effect from the license payment of EUR 6,000 thousand included in the previous year’s earnings as well as the aforementioned non-cash impairment loss of EUR 2,001 thousand on the Xepi® license.

EBIT includes earnings before interest and taxes and decreased by EUR 2,146 thousand to a loss of EUR 12,139 thousand compared to a loss of EUR 9,993 thousand in the prior-year period.

| Biofrontera AG Quarterly report Q3 2021 | 6 |

Net interest result

Net interest income amounted to a loss of EUR 2,490 thousand in the first nine months of 2021 ( prior-year period: loss of EUR 1,642 thousand) and mainly includes the interest expense for the EIB loan (EUR 1,774 thousand, prior-year period: EUR 1,316 thousand) as well as the fair value changes of the purchase price liability for the acquisition of Cutanea Life Sciences, Inc. in the amount of EUR 422 thousand (prior-year period: EUR 302 thousand) and the performance component of the EIB loan in the amount of EUR 85 thousand (prior-year period: income of EUR 439 thousand).

Income tax

This item includes actual income taxes of EUR 43 thousand (prior-year period: EUR 73 thousand) and no deferred tax expenses (prior-year period: EUR 319 thousand) from the utilization of tax loss carryforwards at Biofrontera Pharma GmbH.

Net assets of the Biofrontera Group

Net assets

Total assets increased from EUR 56,391 thousand as of December 31, 2020 to EUR 69,228 thousand as of September 30, 2021, mainly due to the capital increase in February 2021 with gross proceeds of EUR 24.7 million.

The fully paid-in share capital of the parent company, Biofrontera AG, amounted to EUR 56,717 thousand as of September 30, 2021. It was divided into 56,717,385 registered shares with a notional value of EUR 1.00 each. Total equity as of September 30, 2021 amounted to EUR 15,895 thousand compared to EUR 7,375 thousand as of December 31, 2020.

| in EUR thousands | September 30, 2021 | | December 31, 2020 | |

| unaudited | | | |

| Non-current assets | 29,224 | | 30,264 | |

| Current financial assets | 33,727 | | 20,579 | |

| Other current assets | 6,278 | | 5,547 | |

| Total assets | 69,228 | | 56,391 | |

| | | | | |

| Equity | 15,895 | | 7,375 | |

| Non-current liabilities | 21,578 | | 40,730 | |

| Current financial liabilities | 26,057 | | 2,852 | |

| Other current liabilities | 5,698 | | 5,434 | |

| Total equity and liabilities | 69,228 | | 56,391 | |

Non-current assets

Non-current assets amounting to a total of EUR 29,224 thousand (December 31, 2020: EUR 30,264 thousand) include the recognized deferred tax assets on tax loss carryforwards at Biofrontera Pharma GmbH in the amount of EUR 7,525 thousand (December 31, 2020: EUR 7,525 thousand) and the acquired Xepi™ license in the amount of EUR 16,316 thousand (December 31, 2020: EUR 16,720 thousand).

Current financial assets

Current financial assets totaled EUR 33,727 thousand as of September 30, 2021. This includes cash and cash equivalents of EUR 29,539 thousand (December 31, 2020: EUR 16,546 thousand), and trade receivables of EUR 2,815 thousand (December 31, 2020: EUR 3,501 thousand).

| Biofrontera AG Quarterly report Q3 2021 | 7 |

Other current assets

Other current assets amounted to EUR 6,278 thousand as of September 30, 2021 (December 31, 2020: EUR 5,547 thousand) and mainly include inventories and accounting deferrals in the amount of EUR 2,000 thousand (December 31, 2020: EUR 817 thousand).

Equity

According to IFRS, the Group reports equity amounting to EUR 15,895 thousand as of September 30, 2021, compared to EUR 7,375 thousand as of December 31, 2020. The equity ratio increased from 13% to 23%.

Non-current liabilities

Non-current liabilities include financial debt (EUR 2,000 thousand; December 31, 2020: EUR 22,736 thousand), as well as the other non-current financial liability from the purchase price for Cutanea Life Sciences, Inc. (EUR 19,252 thousand; December 31, 2020: EUR 17,811 thousand). Also included in non-current liabilities are liabilities from the stock appreciation rights program in the amount of EUR 327 thousand (December 31, 2020: EUR 183 thousand).

Non-current financial debt includes liabilities from leases to be recognized in accordance with IFRS 16 in the amount of EUR 2,000 thousand (December 31, 2020: EUR 2,657 thousand). The company has terminated the EIB loan prematurely in order to repay the full amount of EUR 20 million, including interest and other fees, before the end of the financial year 2021. The EIB loan including the performance component is now reported under current financial liabilities.

Current financial liabilities

Current financial liabilities include in particular trade payables of EUR 3,322 thousand (December 31, 2020: EUR 1,623 thousand), and current financial debt of EUR 22,624 thousand (December 31, 2020: EUR 1,139 thousand).

Current financial debt includes the EIB loan incl. performance component in the amount of EUR 19,541 thousand (December 31, 2020: EUR 18,076 thousand), the unconverted shares of the convertible bond 2017/2022 in the amount of EUR 2,023 thousand (December 31, 2020: EUR 2,003 thousand), and liabilities from leases to be recognized in accordance with IFRS 16 in the amount of EUR 920 thousand (December 31, 2020: EUR 1,057 thousand).

Other current liabilities

Other current liabilities amounted to EUR 5,698 thousand (December 31, 2020: EUR 5,434 thousand) and primarily comprise provisions of EUR 3,271 thousand (December 31, 2020: EUR 3,042 thousand) and accrued liabilities of EUR 1,820 thousand (December 31, 2020: EUR 1,736 thousand).

Financial position of the Biofrontera Group

Cash and cash equivalents

Cash and cash equivalents amounted to EUR 29,539 thousand as of September 30, 2021 (December 31, 2020: EUR 16,546 thousand).

The IPO of Biofrontera Inc. in October generated gross emission proceeds of USD 18 million (see ad hoc announcement of November 2, 2021). From today’s perspective, this provides the Biofrontera Group with sufficient liquidity in the form of cash and liquid Biofrontera Inc. shares to implement the Group’s strategy over the next 12 months.

The Company has terminated the EIB loan prematurely (see ad hoc announcement of November 3, 2021) in order to repay the loan in full, including interest and other fees, during the 2021 financial year.

| Biofrontera AG Quarterly report Q3 2021 | 8 |

Outlook

At the time of publication of this interim statement, the Company continues to maintain the general conditions published in the “Outlook and Forecast” section of the Annual Report 2020 as well as the forecast of the key performance indicators relevant to management for the financial year 2021. Thus, the Group continues to anticipate revenue from the sale of products of between EUR 25 million and EUR 32 million in fiscal year 2021. Our sales and thus business activities continue to depend heavily on the infection situation and the general pandemic situation in the sales markets.

EBITDA and EBIT have been introduced as key performance indicators in our reporting starting in 2021. Both have become established internationally as target metrics and replace the previously reported performance indicator of profit from operating activities. The Biofrontera Group continues to expect EBITDA of EUR -11 to -14 million and EBIT of EUR -13 to -16 million in 2021.

Details on the prognosis can be found in the Annual Report 2020, which is published on the website of Biofrontera AG at http://www.biofrontera.com/en/investors/financial-reports.

| Biofrontera AG Quarterly report Q3 2021 | 9 |

Consolidated interim financial statements as of September 30, 2021

Assets

| in EUR thousands | September 30, 2021 | | December 31, 2020 | |

| unaudited | | | |

| Non-current assets | | | | |

| Tangible assets | 4,216 | | 5,051 | |

| Intangible assets | 17,484 | | 17,688 | |

| Deferred Taxes | 7,525 | | 7,525 | |

| Total non-current assets | 29,224 | | 30,264 | |

| | | | | |

| Current assets | | | | |

| Current financial assets | | | | |

| Trade receivables | 2,815 | | 3,501 | |

| Other financial assets | 1,372 | | 531 | |

| Cash and cash equivalents | 29,539 | | 16,546 | |

| Total current financial assets | 33,727 | | 20,579 | |

| | | | | |

| Other current assets | | | | |

| Inventories | 4,256 | | 4,673 | |

| Income tax reimbursement claims | 0 | | 5 | |

| Other assets | 2,022 | | 869 | |

| Total other current assets | 6,278 | | 5,547 | |

| | | | | |

| Total current assets | 40,004 | | 26,126 | |

| Total assets | 69,228 | | 56,391 | |

| Biofrontera AG Quarterly report Q3 2021 | 10 |

Equity and liabilities

| in EUR thousand | September 30, 2021 | | December 31. 2020 | |

| unaudited | | | |

| Equity | | | | |

| Subscribed capital | 56,717 | | 47,748 | |

| Capital reserve | 137,363 | | 123,493 | |

| Capital reserve from foreign currency conversion adjustments | 2,219 | | 1,866 | |

| Loss carried forward | (165,732) | | (152,709) | |

| Loss for the period | (14,672) | | (13,023) | |

| Total equity | 15,895 | | 7,375 | |

| | | | | |

| Non-current liabilities | | | | |

| Financial debt | 2,000 | | 22,736 | |

| Other provisions | | | | |

| Other financial liabilities | 19,579 | | 17,994 | |

| Total non-current liabilities | 21,578 | | 40,730 | |

| | | | | |

| Current liabilities | | | | |

| Current financial liabilities | | | | |

| Trade payables | 3,322 | | 1,623 | |

| Current financial debt | 22,624 | | 1,139 | |

| Other financial liabilities | 112 | | 90 | |

| Total current financial liabilities | 26,057 | | 2,852 | |

| | | | | |

| Other current liabilities | | | | |

| Income Tax | | | | |

| Other provisions | 3,271 | | 3,042 | |

| Other current liabilities | 2,426 | | 2,392 | |

| Total other current liabilities | 5,698 | | 5,434 | |

| | | | | |

| Total current liabilities | 31,755 | | 8,286 | |

| Total equity and liabilities | 69,228 | | 56,391 | |

| Biofrontera AG Quarterly report Q3 2021 | 11 |

Consolidated interim statements of comprehensive income for the nine months ended September 30, 2021

| in EUR thousand | Jan 1 - Sep 30, 2021 | | Jan 1 - Sep 30, 2020 | | Jan 1 - Sep 30, 2021 | | Jul 1 - Sep 30, 2020 | |

| unaudited | | unaudited | | unaudited | | unaudited | |

| Sales revenue | 18,473 | | 20,829 | | 5,379 | | 4,713 | |

| Cost of sales | (2,712) | | (2,567) | | (699) | | (1,076) | |

| Gross profit from sales | 15,761 | | 18,262 | | 4,680 | | 3,637 | |

| | | | | | | | | |

| Operating expenses | | | | | | | | |

| Research and development costs | (4,516) | | (3,403) | | (1,595) | | (1,014) | |

| General and administrative costs | (7,5579) | | (6,882) | | (2,004) | | (2,470) | |

| Sales and marketing costs | (16,263) | | (16,340) | | (6,072) | | (4,189) | |

| Result from operations | (12,574) | | (8,364) | | (4,991) | | (4,036) | |

| | | | | | | | | |

| Amortization and depreciation | 2,459 | | 4,583 | | 836 | | 761 | |

| Other Expenses | (203) | | (2,022) | | (61) | | (1,720) | |

| Other Income | 638 | | 393 | | 305 | | 283 | |

| EBITDA | (9,680) | | (5,410) | | (3,912) | | (4,713) | |

| Amortization and depreciation | (2,459) | | (4,583) | | (836) | | (761) | |

| EBIT | (12,139) | | (9,993) | | (4,748) | | (5,474) | |

| Effective interest expenses | (700) | | (1,411) | | (502) | | (604) | |

| Interest expenses | (1,802) | | (691) | | (547) | | (252) | |

| Interest income | 11 | | 460 | | 3 | | (72) | |

| | | | | | | | | |

| Result before tax | (14,629) | | (11,635) | | (5,795) | | (6,401) | |

| Income tax | 43 | | 392 | | 6 | | 54 | |

| Result for the period | (14,672) | | (12,027) | | (5,800) | | (6,456) | |

| | | | | | | | | |

Items which may in future be regrouped into the profit and loss statement under certain conditions, | | | | | | | | |

Translation differences resulting from the conversion of foreign business operations | 2,219 | | 1,124 | | 68 | | 958 | |

| Total result for the period | (12,453) | | (10,903) | | (5,732) | | (5,498) | |

| | | | | | | | | |

| Basic and diluted earnings per share in EUR | (0,26) | | (0,24) | | | | | |

| Biofrontera AG Quarterly report Q3 2021 | 12 |