Management’s Discussion & Analysis

For the three and six months ended June 30, 2021 and 2020

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

MANAGEMENT’S DISCUSSION AND ANALYSIS

This Management’s Discussion and Analysis (“MD&A”) dated July 28, 2021 for Kirkland Lake Gold Ltd. (the “Company”) and as defined in the section entitled “Business Overview”, contains information that management believes is relevant to an assessment and understanding of the Company’s consolidated financial position and the results of its consolidated operations for the three and six months ended June 30, 2021 and 2020. The MD&A should be read in conjunction with the unaudited Condensed Interim Consolidated Financial Statements for the three and six months ended June 30, 2021 and 2020, the annual audited Consolidated Financial Statements for the years ended December 31, 2020 and 2019, which were prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board ("IASB"), as well as the annual MD&A and Annual Information Form ("AIF") for the year ended December 31, 2020.

FORWARD LOOKING STATEMENTS

This MD&A may contain forward-looking statements and should be read in conjunction with the risk factors described in the “Risk and Uncertainties” and “Forward Looking Statements” sections at the end of this MD&A and as described in the Company’s Annual Information Form for the year ended December 31, 2020. Additional information including this MD&A, Interim Financial Statements for the three and six months ended June 30, 2021, the audited Consolidated Financial Statements for the year ended December 31, 2020, the Company’s Annual Information Form for the year ended December 31, 2020, and press releases have been filed electronically through the System for Electronic Document Analysis and Retrieval (“SEDAR”), the Electronic Data Gathering, Analysis and Retrieval system ("EDGAR"), and are available online under the Kirkland Lake Gold Ltd. profile at www.sedar.com, www.sec.gov/edgar, www.asx.com.au and on the Company’s website (www.kl.gold).

NON – IFRS MEASURES

Certain non-IFRS measures are included in this MD&A, including adjusted net cash provided by operating activities, free cash flow, adjusted free cash flow, operating cash costs and operating cash costs per ounce sold, sustaining and growth capital expenditures, all-in sustaining costs (“AISC”) and AISC per ounce sold, average realized gold price per ounce sold, adjusted net earnings and adjusted net earnings per share, earnings before interest, taxes and depreciation and amortization (“EBITDA”) and working capital. In the gold mining industry, these are common performance measures but may not be comparable to similar measures presented by other issuers. The Company believes that these measures, in addition to information prepared in accordance with IFRS, provides investors with useful information to assist in their evaluation of the Company’s performance and ability to generate cash flow from its operations. Accordingly, these measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. For further information, refer to the “Non-IFRS Measures” section of this MD&A.

The following additional abbreviations may be used throughout this MD&A: General and Administrative Expenses (“G&A”); Plant and Equipment (“PE”); Gold (“Au”); Troy Ounces (“oz”); Grams per Tonne (“g/t”); Million Tonnes (“Mt”); Square Kilometre (“km2”); Metres (“m”); Kilo Tonnes (“kt”); and Life of Mine (“LOM”). Throughout this MD&A the reporting periods for the three months ended June 30, 2021 and June 30, 2020 are abbreviated as Q2 2021 and Q2 2020 respectively, while the reporting period for the three months ended March 31, 2021 is abbreviated as Q1 2021.

REPORTING CURRENCY

All amounts are presented in U.S. dollars ("$") unless otherwise stated. References in this document to “C$” are to Canadian dollars and references to "A$" are to Australian dollars. Unless otherwise specified, all tabular amounts are expressed in thousands of U.S. dollars, except per share or per ounce amounts.

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

TABLE OF CONTENTS

| | | | | |

| BUSINESS OVERVIEW | 3 |

| FOREIGN EXCHANGE RATES | 3 |

| EXECUTIVE SUMMARY | 4 |

| FULL-YEAR 2021 GUIDANCE | 11 |

| LONG-TERM OUTLOOK | 14 |

| EXTERNAL PERFORMANCE DRIVERS | 15 |

| REVIEW OF FINANCIAL PERFORMANCE | 17 |

| REVIEW OF OPERATING MINES | 24 |

| GROWTH AND EXPLORATION | 31 |

| REVIEW OF FINANCIAL CONDITION AND LIQUIDITY | 33 |

| OFF-BALANCE SHEET ARRANGEMENTS | 33 |

| OUTSTANDING SHARE AND CONVERTIBLE EQUITY INFORMATION | 34 |

| QUARTERLY INFORMATION | 34 |

| COMMITMENTS AND CONTINGENCIES | 34 |

| RELATED PARTY TRANSACTIONS | 34 |

| CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS | 35 |

| ACCOUNTING POLICIES AND BASIS OF PRESENTATION | 35 |

| NON-IFRS MEASURES | 35 |

| INTERNAL CONTROL OVER FINANCIAL REPORTING AND DISCLOSURE CONTROLS AND PROCEDURES | 43 |

| RISKS AND UNCERTAINTIES | 43 |

| FORWARD LOOKING STATEMENTS | 43 |

| INFORMATION CONCERNING ESTIMATES OF MINERAL RESERVES AND MEASURED, INDICATED AND INFERRED RESOURCES | 44 |

| TECHNICAL INFORMATION | 45 |

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

BUSINESS OVERVIEW

Kirkland Lake Gold Ltd. (individually, or collectively with its subsidiaries, as applicable, the “Company” or “Kirkland Lake Gold”) is a growing, Canadian, U.S. and Australian-listed, gold producer with assets in Canada and Australia. The Company’s production is anchored by three high-quality, cornerstone assets. These assets include two high-grade, low-cost underground mining operations, the Macassa mine (“Macassa”) located in northeastern Ontario, Canada and the Fosterville mine (“Fosterville”), located in the state of Victoria, Australia, as well as the Detour Lake Mine (“Detour Lake”), a large-scale open-pit mining operation located in Northern Ontario. Detour Lake was obtained by the Company on January 31, 2020 through the acquisition of Detour Gold Corporation (“Detour Gold”). The Company also owns the Holt Complex, which includes three wholly owned mines, the Taylor mine (“Taylor”), Holt mine (“Holt”) and Holloway mine (“Holloway”), as well as a central milling facility, the Holt mill. Operations at the Holt Complex were suspended effective April 2, 2020 and are currently on care and maintenance. The Company’s business portfolio also includes assets in the Northern Territory of Australia. These assets, which are comprised of the Cosmo mine (“Cosmo”), Union Reefs mill (“Union Reefs”) as well as a number of exploration properties, are also currently on care and maintenance.

The Company conducts extensive exploration activities on its land holdings in Canada and Australia. The current exploration programs are focused on extending known zones of mineralization and testing for new discoveries in order to increase the level of Mineral Resources and Mineral Reserves at its three operating assets in support of future organic growth.

Kirkland Lake Gold is focused on delivering superior value for its shareholders, and all stakeholders of the Company, and maintaining a position within the gold mining industry as a sustainable, low-cost producer. Over the last two years, the Company has achieved both significant production growth and increased levels of profitability and cash flow. Through the effective operation and advancement of expansion and exploration programs at the Company’s profitable, cash flow generating assets, Kirkland Lake Gold is well positioned to achieve further increases in shareholder value.

A key component of the Kirkland Lake Gold’s business is its commitment to responsible mining. Consistent with this commitment, the Company is an industry leader in reducing greenhouse gas emissions, has made significant investments to enhance the safety and minimize the impacts of tailings facilities, and has increased the effectiveness of its reclamation programs. Early in 2021, the Company pledged to achieve net-zero carbon emissions by 2050 or earlier and followed that pledge with a commitment to invest $75 million per year for five years on technology, innovation and in providing community support. Key areas of focus for these investments is advancing and commercializing alternative fuels and energies, creating the mines of the future through greater use of digitization, automation, connectivity, and investing in communities in such key areas as mental health, homelessness, addiction, senior care and youth training and development.

FOREIGN EXCHANGE RATES

After weakening sharply against the US dollar in Q1 2020, concurrent with the emergence of the COVID-19 pandemic, the Canadian and Australian dollars began strengthening against the US dollar starting in Q2 2020 with this trend continuing through the remainder of 2020 and into Q2 2021. As a result, the average exchange rates for Q2 2021 included C$ to US$ of 1.23 and A$ to US$ of 1.30. These exchange rates compared to 1.39 and 1.52, respectively, in Q2 2020 and 1.27 and 1.29, respectively, in Q1 2021. Compared to Q2 2020, changes in exchange rates in Q2 2021 resulted in an increase in operating cash costs(1) of approximately $15 million, operating cash costs per ounce sold(1) of $45, and AISC per ounce sold(1) of $70, sustaining capital expenditures(1) of approximately $8 million and growth capital expenditures(1) of approximately $8 million. Compared to Q1 2021, exchange rate changes increased operating cash costs(1) by approximately $3 million, operating cash costs per ounce sold(1) by $10 and AISC per ounce sold(1) by $13, sustaining capital expenditures(1) of approximately $1 million and growth capital expenditures(1) of approximately $2 million. For YTD 2021, the average exchange rates included C$ to US$ of $1.25 and A$ to US$ of $1.30, which compared to $1.36 and $1.52, respectively, in YTD 2020. Compared to YTD 2020, exchange rate in YTD 2021 increased operating cash costs(1) by approximately $28 million, operating cash costs per ounce sold(1) by $40 and AISC per ounce sold(1) by $60, sustaining capital expenditures(1) of approximately $13 million and growth capital expenditures(1) of approximately $10 million.

(1)The Foreign Exchange Rates discussion includes references to Non-IFRS measures. The definition and reconciliation of these Non-IFRS measures are included on pages 35-42 of this MD&A.

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

EXECUTIVE SUMMARY

The MD&A document provides a detailed review of information relevant to an assessment and understanding of the Company’s consolidated financial position and the results of its consolidated operations. This section is intended to assist readers interested in a condensed, summary review of the Company's performance for the three and six months ended June 30, 2021. This section should be read in conjunction with the remainder of the MD&A, which discusses among other things, risk factors impacting the Company.

| | | | | | | | | | | | | | | | | | | | |

| (in 000's of dollars, except per share amounts) | Three Months Ended | | Six Months Ended |

| June 30, 2021 | June 30, 2020 | March 31, 2021 | | June 30, 2021 | June 30, 2020 |

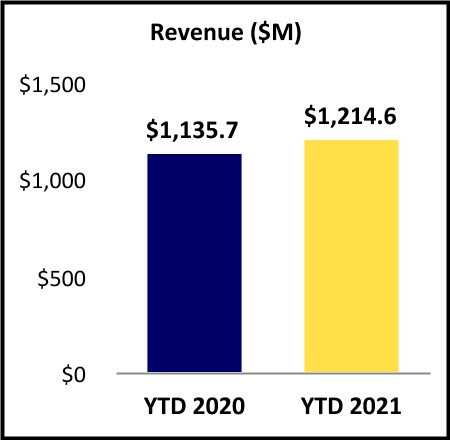

| Revenue | $662,736 | | $580,975 | | $551,846 | | | $1,214,582 | | $1,135,713 | |

| Production costs | 159,726 | | 141,415 | | 170,081 | | | 329,807 | | 303,007 | |

| Earnings before income taxes | 339,126 | | 225,282 | | 235,983 | | | 575,109 | | 519,807 | |

| Net earnings | $244,167 | | $150,232 | | $161,193 | | | $405,360 | | $353,110 | |

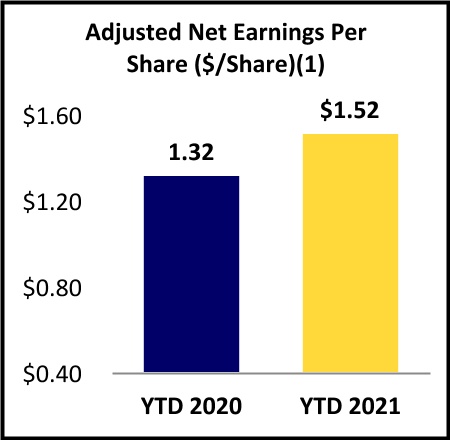

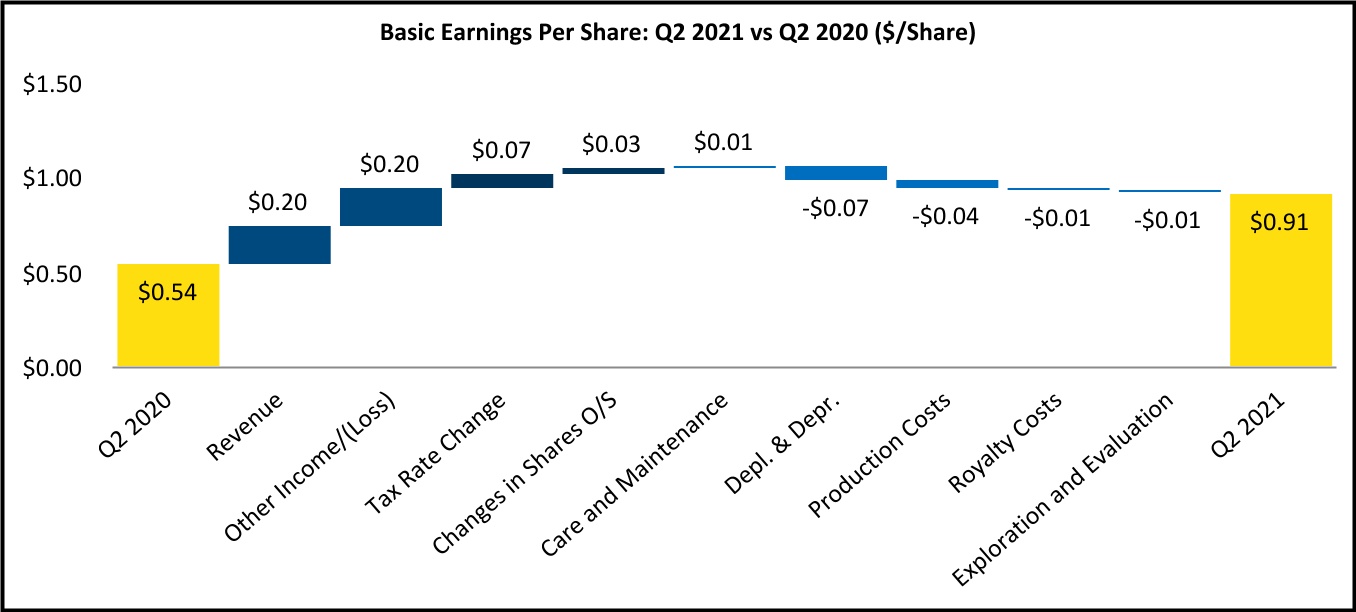

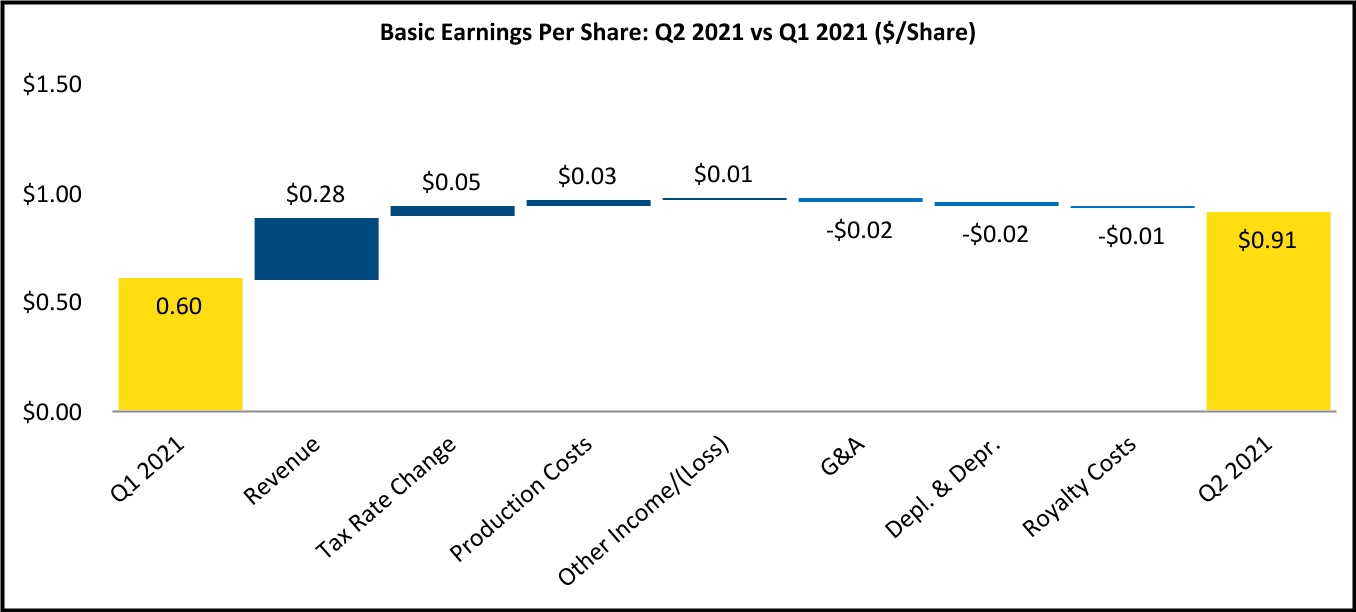

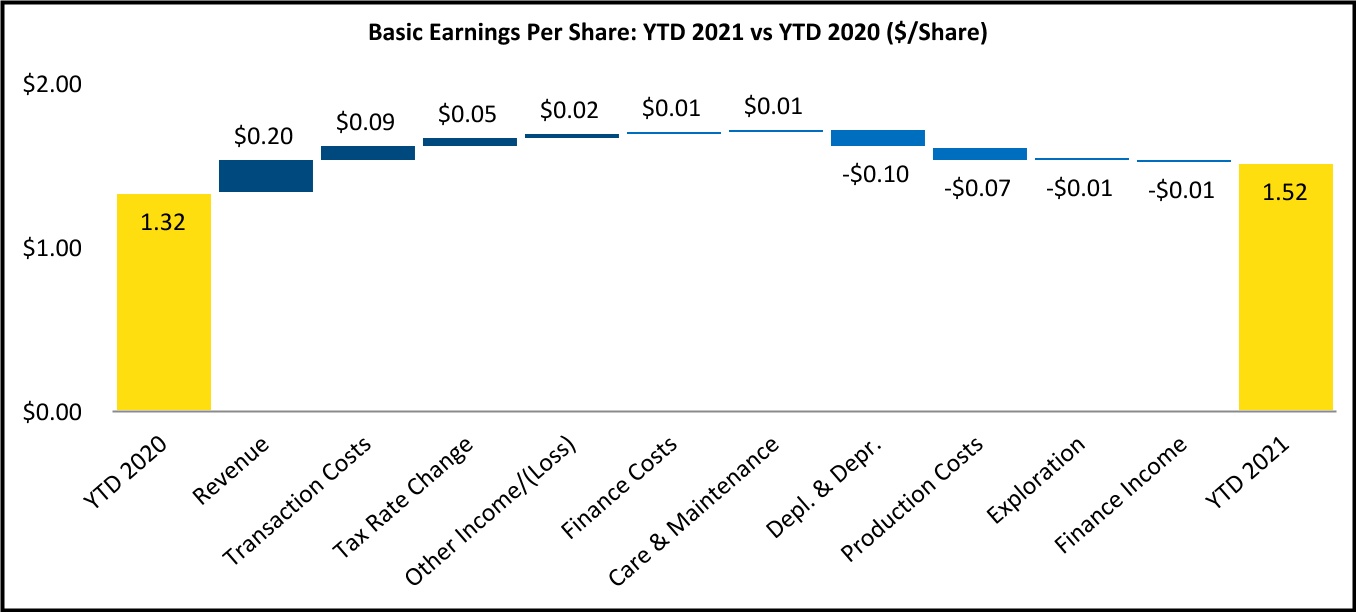

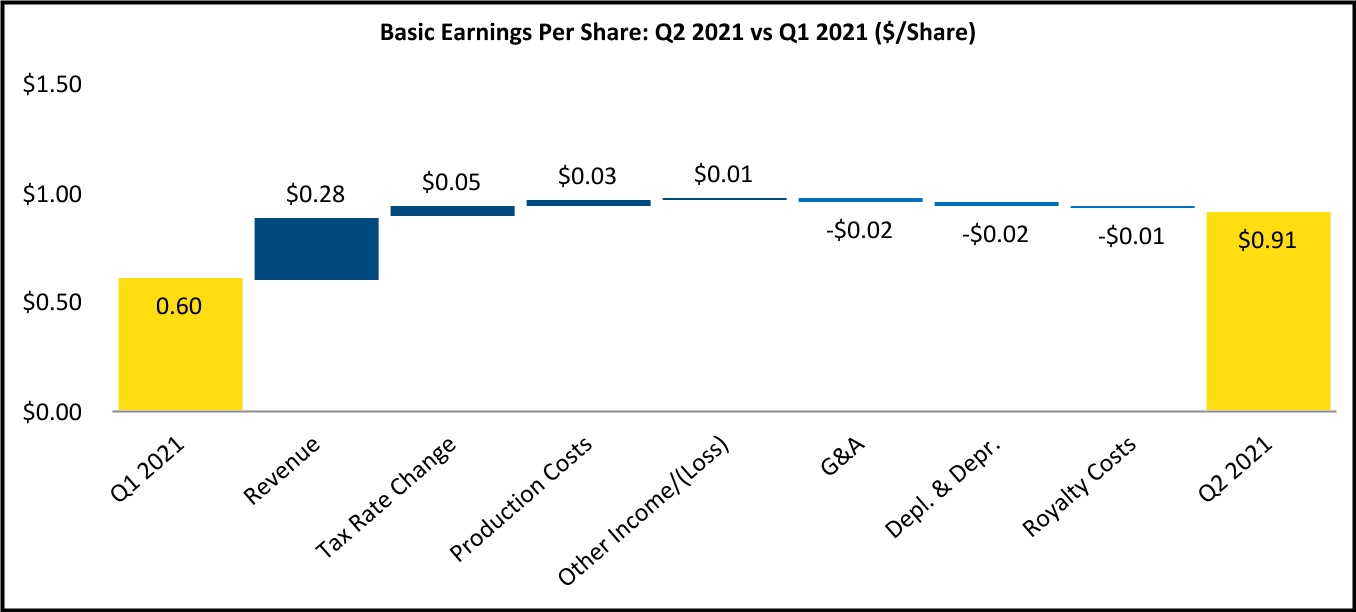

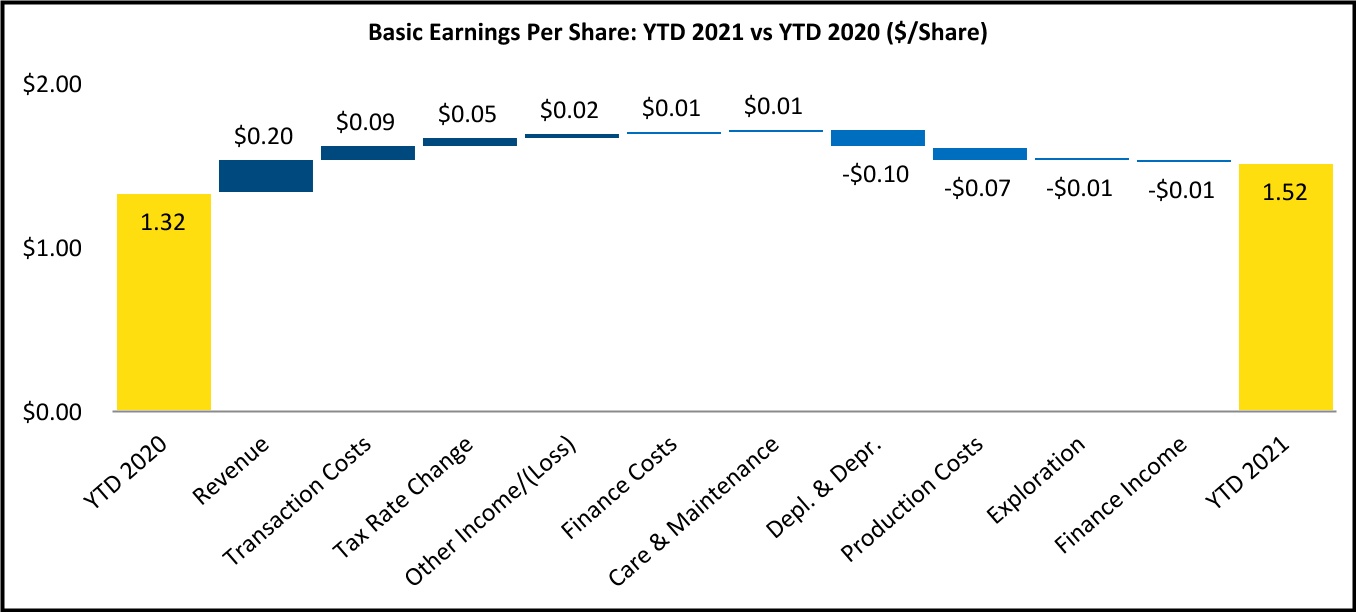

| Basic earnings per share | $0.91 | | $0.54 | | $0.60 | | | $1.52 | | $1.32 | |

| Diluted earnings per share | $0.91 | | $0.54 | | $0.59 | | | $1.51 | | $1.32 | |

| Cash flow from operating activities | $330,571 | | $222,234 | | $208,174 | | | $538,744 | | $463,740 | |

| Cash investment on mine development and PPE | $199,344 | | $128,155 | | $165,475 | | | $364,819 | | $238,792 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| (in 000's of dollars, except per share amounts) | Three Months Ended | | Six Months Ended |

| June 30, 2021 | June 30, 2020 | March 31, 2021 | | June 30, 2021 | June 30, 2020 |

| Tonnes milled | 6,143,064 | 5,863,282 | 5,952,141 | | 12,095,204 | 9,981,386 |

| Average Grade (g/t Au) | 2.0 | 1.8 | 1.7 | | 1.8 | 2.1 |

| Recovery (%) | 95.3 | % | 95.8 | % | 95.1 | % | | 94.5 | % | 95.8 | % |

| Gold produced (oz) | 379,195 | 329,770 | 302,847 | | 682,042 | 660,634 |

| Gold Sold (oz) | 364,575 | 341,390 | 308,029 | | 672,605 | 685,976 |

Averaged realized price ($/oz sold)(1) | $1,814 | $1,716 | $1,788 | | $1,802 | $1,651 |

Operating cash costs per ounce sold ($/oz sold)(1) | $431 | $374 | $542 | | $482 | $407 |

AISC ($/oz sold)(1) | $780 | $751 | $846 | | $810 | $763 |

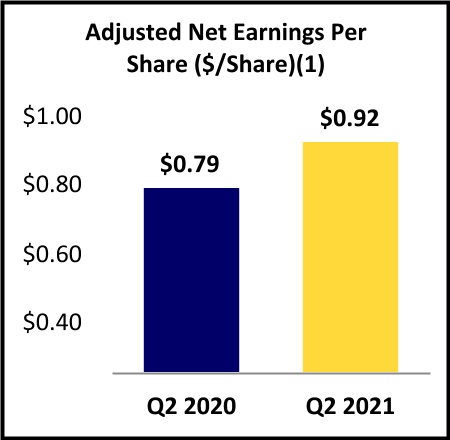

Adjusted net earnings(1) | $246,937 | $219,345 | $167,768 | | $414,704 | $398,514 |

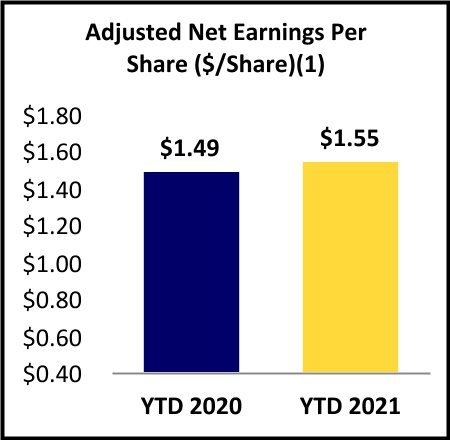

Adjusted net earnings per share(1) | $0.92 | $0.79 | $0.63 | | $1.55 | $1.49 |

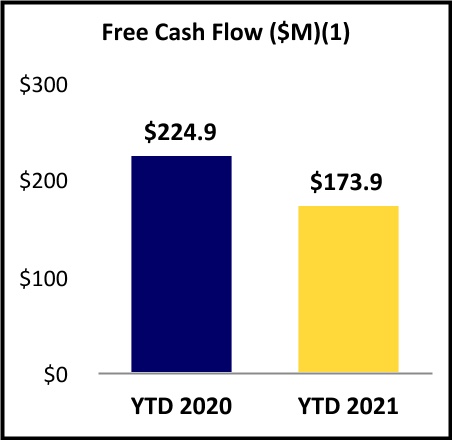

Free cash flow(1) | $131,227 | $94,079 | $42,699 | | $173,925 | $224,948 |

(1)Non-IFRS - the definition and reconciliation of these Non-IFRS measures are included on pages 35-42 of this MD&A.

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

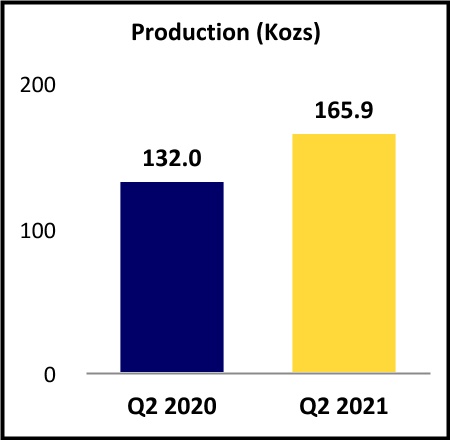

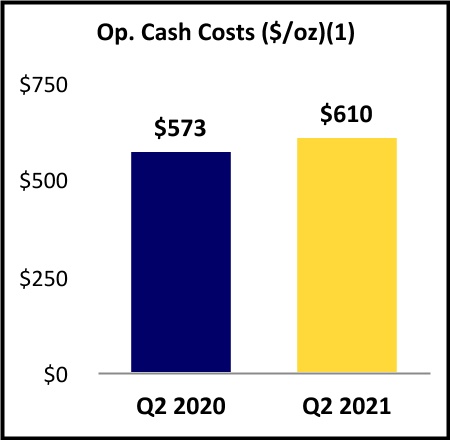

Q2 2021 Operating Performance

(1)Non-IFRS - the definition and reconciliation of these Non-IFRS measures are included on pages 35-42 of this MD&A.

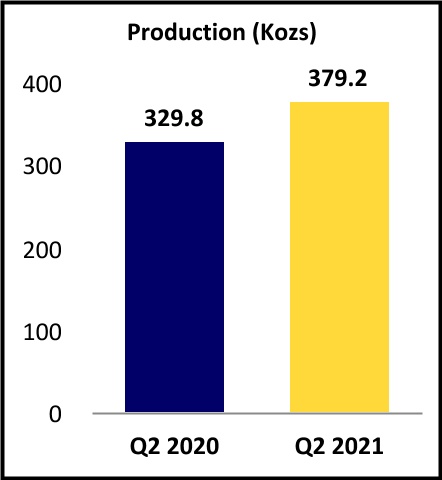

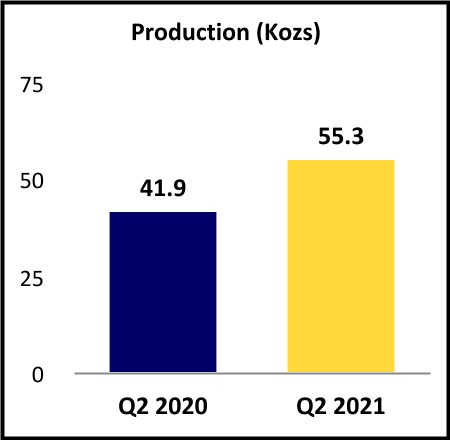

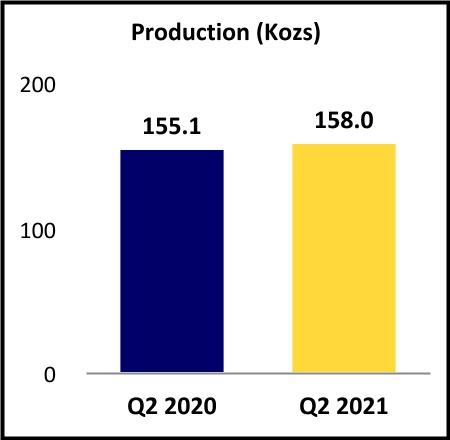

Gold production in Q2 2021 totalled 379,195 ounces, a 15% increase from 329,770 ounces in Q2 2020 and 25% higher than 302,847 ounces the previous quarter. Production in Q2 2021 exceeded target levels largely reflecting the favourable impact of continued grade outperformance and changes to mine sequencing at Fosterville. Production at Fosterville of 157,993 ounces increased from 155,106 ounces for the same period in 2020 and 108,679 ounces in Q1 2021. Production at Detour Lake was a quarter record totaling 165,880 ounces, 26% higher than 131,992 ounces in Q2 2020 and a 13% increase from 146,731 ounces in Q1 2021, while production at Macassa increased to 55,322 ounces, 32% higher than 41,865 ounce in Q2 2020 and a 17% increase from 47,437 ounces in Q1 2021. Comparisons to Q2 2020 for both Detour Lake and Macassa are impacted by the fact that both mines were transitioned to reduced operations for most of last year’s second quarter as part of the Company’s COVID-19 response, which resulted in lower than planned grades and throughput levels at both mines.

Production costs in Q2 2021 totalled $159.7 million versus $141.4 million (including $13.4 million of COVID-19 related costs) in Q2 2020 and $170.1 million (including $2.9 million of COVID-19 related costs) the previous quarter. Stronger Canadian and Australian dollars against the US dollar compared to Q2 2020 accounted for the increase in production costs from the same period in 2020, while the reduction from Q1 2021 was largely related to higher capitalized stripping and lower processing costs at Detour Lake.

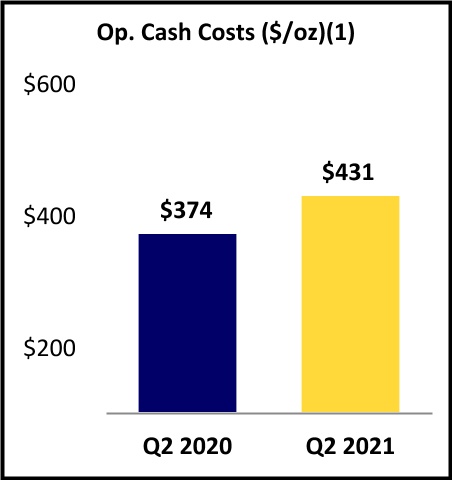

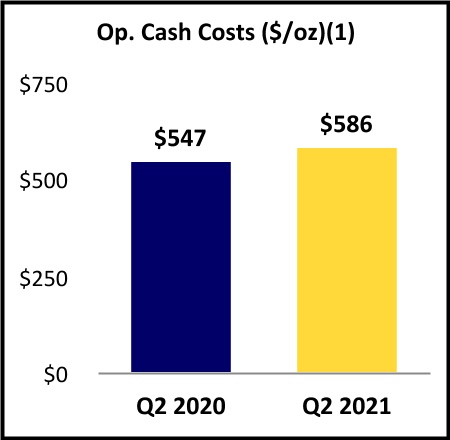

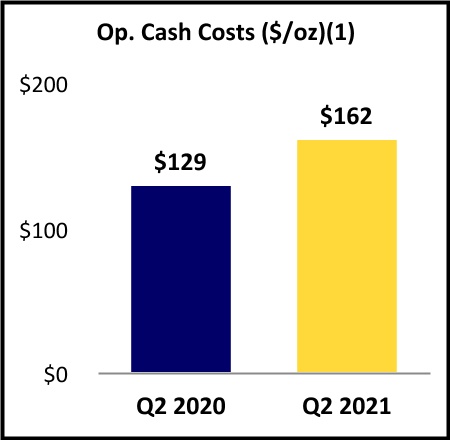

Operating cash costs per ounce sold(1) averaged $431 in Q2 2021 compared to $374 in Q2 2020 and $542 in Q1 2021. Excluding the impact of exchange rate changes, operating cash costs per ounce sold(1) in Q2 2021 were largely unchanged from the same period in 2020. Operating cash costs per ounce sold(1) at Fosterville averaged $162 versus $129 in Q2 2020 and $228 the previous quarter with a strong Australian dollar accounting for the majority of the increase from Q2 2020, and the remainder mainly due to the impact of higher mining costs and a lower average grade in Q2 2021. The improvement from Q1 2021 largely related to the impact of a significant improvement in the average grade on sales volumes quarter over quarter. Operating cash cost per ounce sold(1) at Detour Lake averaged $610 in Q2 2021 versus $573 for in Q2 2020 and $748 the previous quarter, while operating cash costs per ounce sold(1) at Macassa averaged $586 compared to $547 in Q2 2020 and $699 in Q1 2021. For both Detour Lake and Macassa, the increase versus Q2 2020 resulted from a stronger Canadian dollar, with operating cash costs per ounce sold(1) improving year over year excluding the impact of exchange rates.

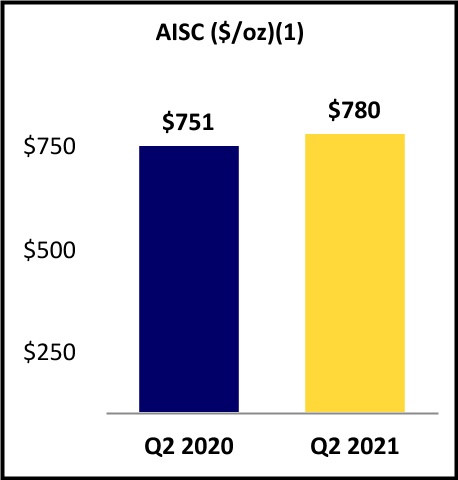

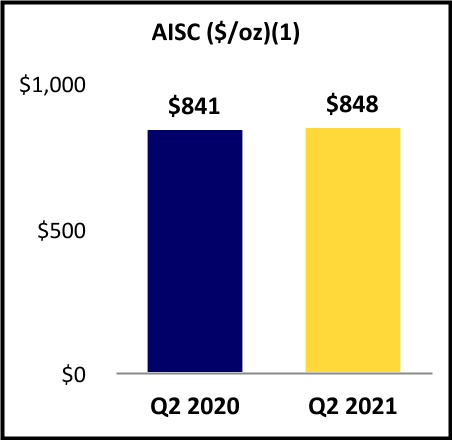

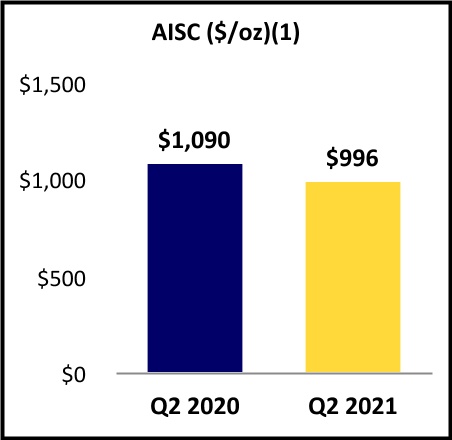

AISC per ounce sold(1) averaged $780 in Q2 2021 compared to $751 in Q2 2020 and $846 in Q1 2021. AISC per ounce sold(1) in Q2 2021 was significantly better than target levels largely driven by higher than planned production and sales at Fosterville. The increase in AISC per ounce sold(1) compared to Q2 2020 was largely driven by stronger Canadian and Australian dollars in Q2 2021. Excluding exchange rate changes, AISC per ounce sold(1) improved by approximately 5% year over year, largely reflecting the favourable impact of higher average grades and sales volumes at Detour Lake and Macassa. Contributing to the improvement in AISC per ounce sold from the previous quarter was the favourable impact of increased sales volumes at all three of the Company’s operating mines. AISC per ounce sold(1) at Fosterville averaged $353 compared to $273 in Q2 2020 and $423 in Q1 2021. In Canada, AISC per ounce sold(1) at Detour Lake averaged $996 in Q2 2021 versus $1,090 in Q2 2020 and $1,064 in Q1 2021, while AISC per ounce sold(1) at Macassa averaged $848 in Q2 2021 compared to $841 in Q2 2020 and $947 in Q1 2021.

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

Q2 2021 Financial Results and Condition

(1)Non-IFRS - the definition and reconciliation of these Non-IFRS measures are included on pages 35-42 of this MD&A.

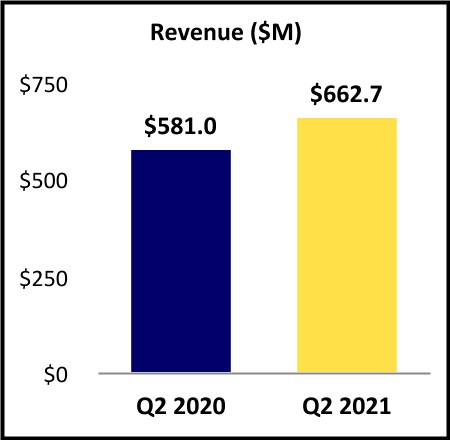

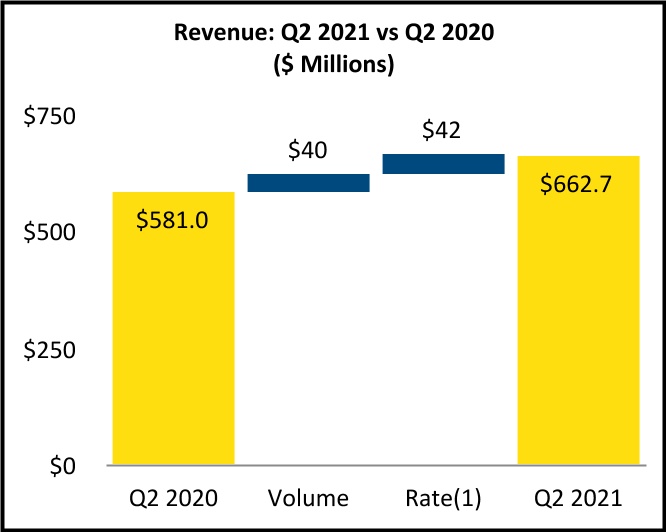

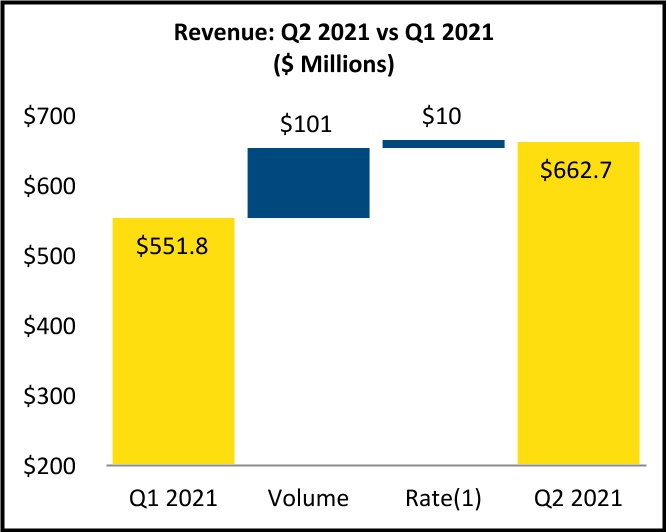

Revenue in Q2 2021 totalled $662.7 million, an $81.8 million or 14% increase from Q2 2020 and $110.9 million or 20% higher than the previous quarter. Of the increase from Q2 2020, $41.7 million related to rate factors, mainly reflecting a 6% increase in the average realized gold price(1) to $1,814 per ounce in Q2 2021, with the remaining $40 million of revenue growth resulting from higher gold sales (364,575 ounces versus 341,390 ounces in Q2 2020). Contributing to the $110.9 million increase in revenue from Q1 2021 was $101 million related to an 18% increase in gold sales from 308,029 ounces the previous quarter, with an additional $10 million of revenue growth due to rate factors, mainly reflecting an increase in the average realized gold price(1) from $1,788 per ounce in Q1 2021.

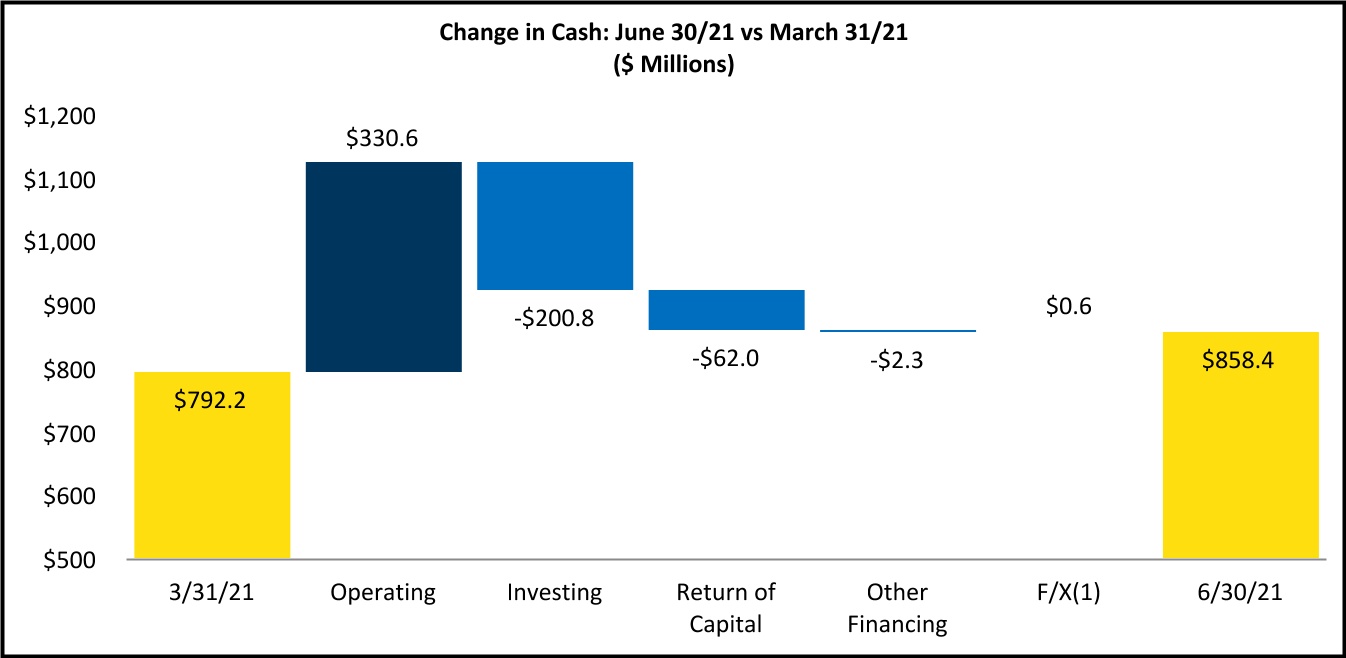

Net cash provided by operating activities in Q2 2021 totalled $330.6 million, a 49% increase from $222.2 million in Q2 2020 and 59% higher than $208.2 million the previous quarter. The increase in net cash provided by operations activities from Q2 2020 mainly resulted from strong earnings growth and the impact of changes in non-cash operating working capital(1) and lower income taxes paid. During Q2 2021, a $98 million tax payment was made in Australia representing the final tax instalment for the 2020 tax year, which compared to a final tax instalment payment of $132.6 million in Q2 2020 related to the 2019 tax year. Higher net earnings and changes in non-cash operating working capital(1) mainly accounted for the increase in net cash provided by operating activities compared to Q1 2021, with these factors only partially offset by an increase in income taxes paid reflecting the $98 million income tax payment in Australia in Q2 2021.

Free cash flow(1) totalled $131.2 million in Q2 2021, a 39% increase from $94 million in Q2 2020 and more than triple the $42.7 million of free cash flow(1) in Q1 2021. Strong growth in net cash provided by operating activities more than offset higher levels of capital expenditures, in accounting for the increase in free cash flow from both prior periods.

Net earnings in Q2 2021 was a record $244.2 million, a 63% increase from $150.2 million in Q2 2020 and 51% higher than $161.2 million the previous quarter. Compared to Q2 2020, the increase in net earnings was driven by higher revenue, the favourable impact of other income of $2.0 million in Q2 2021 versus other loss of $80.2 million for the same period in 2020, with other loss in Q2 2020 mainly resulting from $72.8 million of foreign exchange losses, as well as a lower effective tax rate in Q2 2021 versus Q2 2020. The lower effective tax rate in Q2 2021 mainly reflected favourable tax adjustments during the quarter resulting from re-assessments of income taxes paid in prior years. These factors more than offset higher production costs and depletion and depreciation expense in Q2 2021 compared to Q2 2020. Strong revenue growth also largely accounted for higher net earnings compared to the previous quarter, with lower production costs and a reduction in the effective tax rate also contributing to the increase.

Earnings per share was a record $0.91 in Q2 2021, 69% higher than $0.54 in Q2 2020 and 52% higher than $0.60 in Q1 2021. The increase from both prior periods resulted mainly from higher net earnings, with higher earnings per share compared to Q2 2020 also reflecting a reduction in average shares outstanding to 267.1 million in Q2 2021 from 277.1 million for the same period in 2020. The reduction in average shares outstanding versus Q2 2020 result from the repurchase of 10.3 million shares since the beginning of Q2 2020 through the Company’s normal course issuer bid (“NCIB”).

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

Adjusted net earnings(1) in Q2 2021 totalled $246.9 million ($0.92 per share), an increase of 13% from adjusted net earnings(1) of $219.3 million ($0.79 per share) in Q2 2020 and 47% higher than $167.8 million ($0.63 per share) the previous quarter. There was no material difference between net earnings and adjusted net earnings(1) in Q2 2021. The difference between net earnings and adjusted net earnings(1) in Q2 2020 related to the exclusion from adjusted net earnings(1) of foreign exchange losses, COVID-19 related costs and restructuring costs resulting from the suspension of business activities in the Northern Territory and the Holt Complex in April 2020. The difference between net earnings and adjusted net earnings(1) in Q1 2021 mainly related to the exclusion from adjusted net earnings(1) of write-offs related to property, plant and equipment at Holt Complex, foreign exchange gains, as well as COVID-19 related costs.

Capital expenditures(1) in Q2 2021 totalled $163.9 million, with sustaining capital expenditures(1) accounting for $81.4 million and growth capital expenditures(1) totalling $82.5 million. Of the $82.5 million of growth capital expenditures(1) in Q2 2021, $52.9 million was at Detour Lake, with $29.0 million related to deferred stripping and the remainder to continued progress with key growth projects and business improvement initiatives. Growth capital expenditures(1) at Macassa totalled $27.0 million, with $12.9 million related to the #4 Shaft project, which ended the quarter over a month ahead of schedule and on track for completion in late 2022. The remaining growth capital expenditures(1) at Macassa in Q2 2021 largely related to underground development in support of the #4 Shaft project and expenditures for an ongoing ventilation expansion project. Growth capital expenditures(1) at Fosterville totalled $2.1 million, which largely related to construction of a surface refrigeration plant.

Exploration expenditures totalled $45.7 million, including $38.7 million of capitalized expenditures and $7.0 million of expensed exploration expenditures, which compared to $25.0 million ($22.6 million of capitalized expenditures and $2.4 million of expensed expenditures) in Q2 2020 and $42.4 million million ($36.9 of capitalized expenditures and $5.5 million of expensed expenditures) the previous quarter. During Q2 2021, the Company reported additional encouraging drilling results at Detour Lake, including new wide, high-grade intersections in the Saddle Zone, which further confirmed the continuity of the mineralized corridor (800 metres along strike and 800 metres to depth) between the Main Pit and planned West Pit location and highlighted the potential for significant growth in both open-pit and underground Mineral Resources. Subsequent to the end of Q2 2021, the Company reported additional encouraging drill results at Detour Lake and also released new drilling results at Macassa, including wide, high-grade intersections outside of existing Mineral Resources in multiple directions around the South Mine Complex (“SMC”). The results also included high-grade intersections near the contact of the SMC and the Amalgamated Break and identified potential new areas of high-grade mineralization to the southeast and footwall to the SMC.

Committed to returning capital to shareholders

◦Normal Course Issuer Bid (“NCIB): The Company renewed the NCIB in June 2021 (the "2021 NCIB"); Under the NCIB, the Company is eligible to repurchase up to 26,694,105 shares between June 9, 2021 and June 8, 2022

◦Automatic Share Purchase Plan (“ASPP”): Subsequent to renewing the 2021 NCIB, the Company introduced an ASPP under which a designated broker may purchase up to 5,000,000 shares at its sole discretion based on the purchasing parameters set out by the Company, until the expiry of the 2021 NCIB on June 8, 2022; until all of the shares are purchased under the ASPP or the 2021 NCIB; or until the ASPP is terminated by the Company in accordance with the provisions of the ASPP.

◦$62.0 million returned to shareholders: During Q2 2021, $62.0 million was returned to shareholders, including $50.1 million for the payment of the Q1 2021 quarterly dividend of $0.1875 per share on April 14, 2021 to shareholders of record on March 31, 2021, with $12.0 million being used to repurchase 300,000 shares in June pursuant to the 2021 NCIB (all shares were repurchased through the ASPP); subsequent to June 30, 2021, 945,000 shares repurchased in July 2021 for $37.7 million.

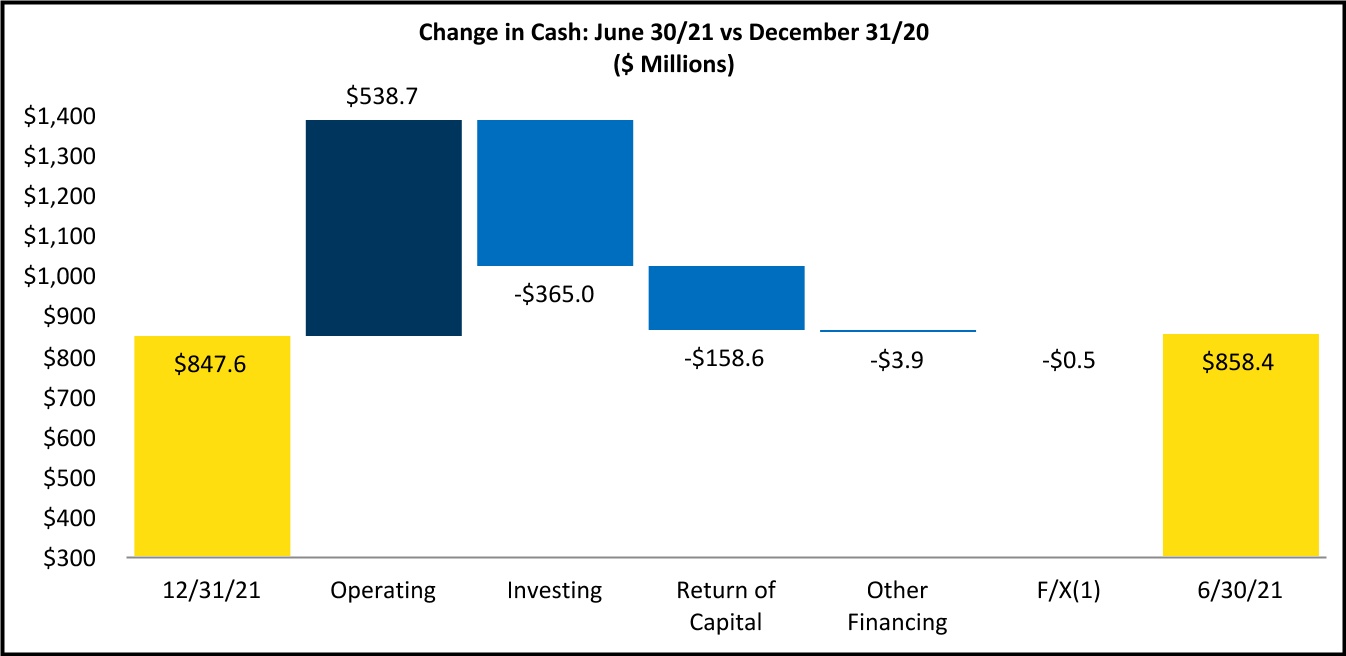

Cash Position at June 30, 2021 totalled $858.4 million with no debt versus $792.2 million at March 31, 2021 and $847.6 million at December 31, 2020. The increase in cash during Q2 2021 largely resulted from strong cash flow, which was only partially offset by higher capital expenditures and income tax paid in Q2 2021, as well as the $62.0 million of cash returned to shareholders during the quarter.

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

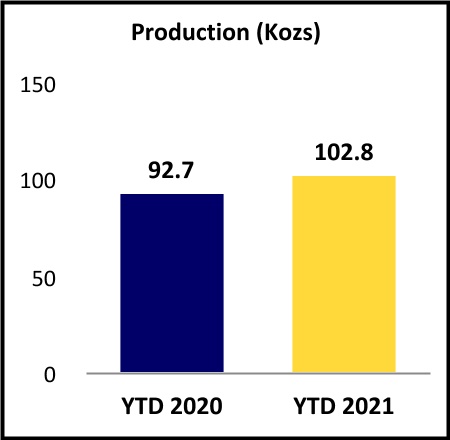

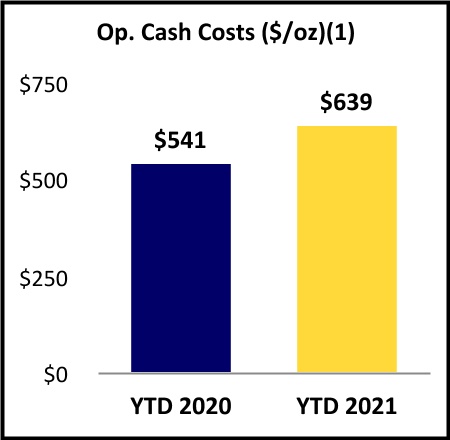

YTD 2021 Operating Performance

(1)Non-IFRS - the definition and reconciliation of these Non-IFRS measures are included on pages 35-42 of this MD&A.

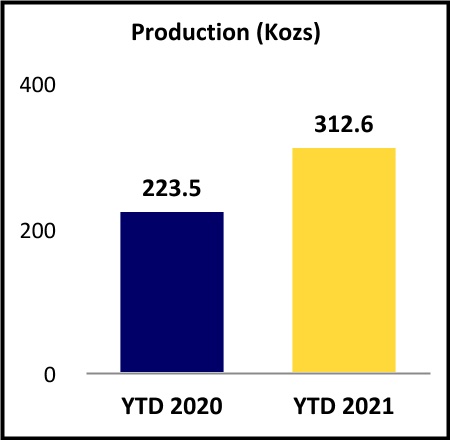

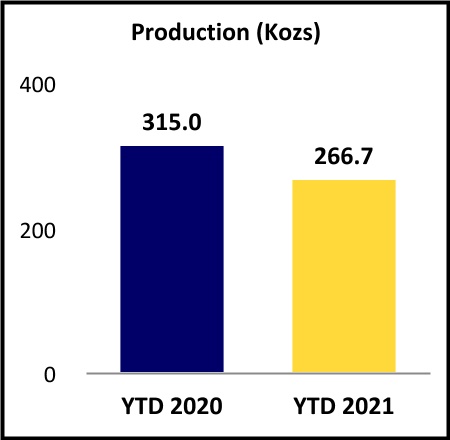

Gold production in YTD 2021 totalled 682,042 ounces, a 3% increase from YTD 2020 reflecting higher production at Detour Lake and Macassa. Production at Detour Lake totalled 312,611 ounces versus 223,547 ounces for five months in YTD 2020 after the Detour Lake acquisition on January 31, 2020 (270,043 ounces for full YTD 2020)). On a comparable basis, higher levels of production at Detour Lake mainly reflected a 12% improvement in the average grade resulting from mine sequencing as well as the impact of processing low-grade stockpiles during Q2 2020 while the mine was on reduced operations as part of the Company’s COVID-19 response. Production at Macassa in YTD 2021 totalled 102,759 ounces, an 11% increase from the same period in 2020 reflecting a higher average grade and increased tonnes processed. At Fosterville, production totalled 266,672 ounces compared to 314,970 ounces for YTD 2020. The change in production from YTD 2020 reflected a lower average grade consistent with the Company’s previously stated plan to reduce production in the Swan Zone by increasing mining activities in other, lower-grade, areas of the mine, with the intention of creating a more sustainable operation over a longer period while the Company continues its extensive exploration program. Production in YTD 2020 included 29,391 ounces from the Holt Complex, almost all of which was in the first quarter prior to operations being suspended effective April 2, 2020.

Production costs in YTD 2021 totalled $329.8 million (including $3.8 million of COVID-19 related costs) versus $303.0 million (including $13.4 million of COVID-19 related costs) in YTD 2020. The increase in production costs year over year mainly reflected stronger Canadian and Australian dollars in YTD 2021 versus the same period in 2020. Included in production costs in YTD 2020 was $173.6 million at Detour Lake for the five months ended June 30, 2020 (production costs totalled $196.3 million at Detour Lake for the full YTD 2020). The impact of only five months of production costs at Detour Lake was offset by $36.1 million of production costs included in YTD 2020 related to the Holt Complex.

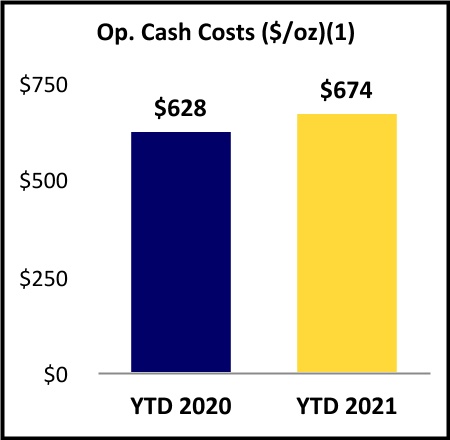

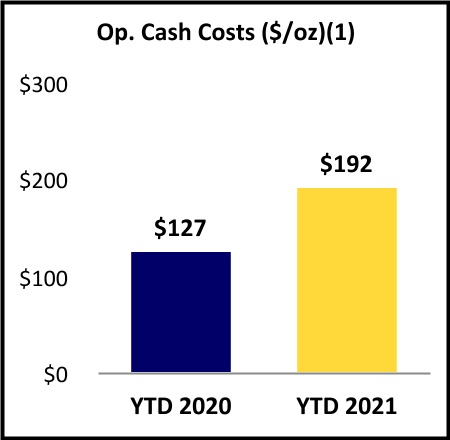

Operating cash costs per ounce sold(1) averaged $482 in YTD 2021 compared to $407 for the same period in 2020 with stronger Canadian and Australian dollars in YTD 2021 accounting for the majority of the increase. Operating cash costs per ounce sold(1) at Fosterville averaged $192 in YTD 2021 versus $127 in YTD 2020, with a strong Australian dollar, higher mine production costs reflecting increased tonnes drawn and the impact of a lower average grade on sales volumes in YTD 2021 largely accounting for the increase. Operating cash costs per ounce sold(1) at Detour Lake averaged $674 in YTD 2021 versus $628 in YTD 2020, with the increase reflecting a stronger Canadian dollar in YTD 2021. Excluding the impact of exchange rates, operating cash costs per ounce sold(1) at Detour Lake improved year over year reflecting the favourable impact of a higher average grade and tonnes processed on sales volumes, which more than offset higher mining and milling costs compared to YTD 2020. At Macassa, operating cash costs per ounce sold(1) averaged $639 compared to $541 for the same period in 2020 with the increase reflecting a stronger Canadian dollar in YTD 2021 as well as increased mine operating costs, partially offset by the favourable impact of a higher average grade and increased tonnes processed on sales volumes.

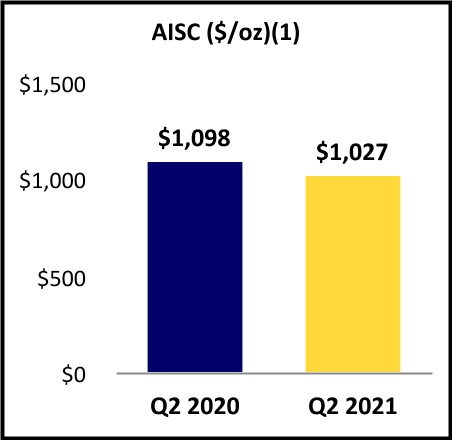

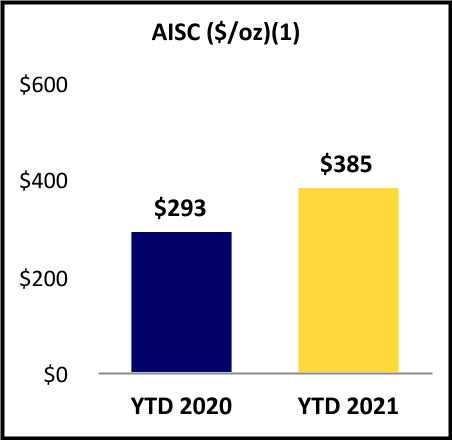

AISC per ounce sold(1) averaged $810 in YTD 2021 compared to $763 in YTD 2020, with the increase resulting from the stronger Canadian and Australian dollars year over year. AISC per ounce sold(1) at Fosterville averaged $385 versus $293 in YTD 2020 with the increases largely reflecting exchange rate changes as well as the impact of a lower average grade on sales volumes. AISC per ounce sold(1) at Detour Lake averaged $1,027, a 6% improvement from $1,098 in YTD 2020 as the impact

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

of a stronger Canadian dollar was more than offset by lower sustaining capital expenditures(1) in YTD 2021 largely due to reduced expenditures for deferred stripping, with the majority of these expenditures in 2021 being included in growth capital expenditures(1). AISC per ounce sold(1) at Macassa averaged $895 versus $846 for the same period in 2020. Excluding the impact of a stronger Canadian dollar, AISC per ounce sold(1) at Macassa improved by approximately 8% year over year driven by higher sales volumes as well as lower sustaining capital expenditures(1) due largely to reduced levels of capital development and maintenance costs in YTD 2021.

YTD 2021 Financial Results

(1)Non-IFRS - the definition and reconciliation of these Non-IFRS measures are included on pages 35-42 of this MD&A.

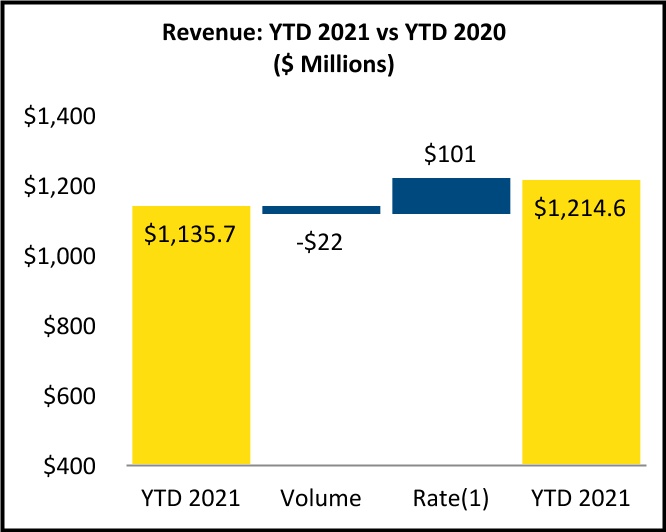

Revenue in YTD 2021 totalled $1,214.6 million, an increase of $78.9 million or 7% from $1,135.7 million in YTD 2020. The increase in revenue was driven by a 9% increase in the average realized gold price(1), to $1,802 per ounce in YTD 2021 from $1,651 per ounce for the same period in 2020, which resulted in revenue growth from rate factors of $101 million. Partially offsetting the impact of a higher average realized gold price(1) was a reduction of $22 million related to lower gold sales. Gold sales in YTD 2021 totalled 672,605 ounces compared to 685,976 ounces in YTD 2020.

Net cash provided by operating activities in YTD 2021 totalled $538.7 million, a 16% increase from $463.7 million in YTD 2020 mainly reflecting solid growth in net earnings compared to YTD 2020.

Free cash flow(1) totalled $173.9 million versus $224.9 million in YTD 2020 as the impact of increased net cash provided by operating activities was more than offset by higher levels of capital expenditures as the Company advanced a number of significant growth projects, mainly at Macassa and Detour Lake, in YTD 2021.

Net earnings in YTD totalled $405.4 million ($1.52 per share), a 15% increase from $353.1 million ($1.32 per share) in YTD 2020. The increase in net earnings compared to the same period a year earlier mainly reflected revenue growth, the impact of $33.8 million of transaction fees in YTD 2020 related to the Detour Gold acquisition, and a lower effective tax rate in YTD 2021. These factors were only partially offset by higher production costs and depletion and depreciation expense.

Adjusted net earnings(1) totalled $414.7 million ($1.55 per share) similar to the net earnings for the period, with the difference mainly reflecting the exclusion from adjusted net earnings of write-offs related to property, plant and equipment at Holt Complex in Q1 2021, costs related to non-operating assets, mainly in the Northern Territory and COVID-19 related costs, partially offset by the exclusion of foreign exchange gains. The difference between net earnings and adjusted net earnings(1) for YTD 2020 reflected the exclusion from adjusted net earnings(1) of the $33.8 million of transaction fees related to the Detour Gold acquisition, as well as costs related to the Company’s COVID-19 response, restructuring costs and severance expense.

Capital expenditures(1) in YTD 2021 totalled $270.7 million, with sustaining capital expenditures(1) accounting for $141.9 million and growth capital expenditures(1) totalling $128.8 million. Of the $128.8 million of growth capital expenditures(1) in YTD 2021, $80.7 million related to Detour Lake with deferred stripping accounting for $43.9 million and the remainder largely due to mobile equipment procurement and investments in key projects to increase processing capacity and enhance

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

surface infrastructure. Growth capital expenditures(1) at Macassa totalled $43.0 million, with $21.8 million related to the #4 Shaft project, which remained ahead of schedule at June 30, 2021 and was on track for completion in late 2022. Growth capital expenditures(1) at Fosterville totalled $3.8 million, mainly related to construction of a surface refrigeration plant and land procurement.

Exploration expenditures totalled $88.1 million, including $75.6 million of capitalized expenditures and $12.5 million of expensed exploration expenditures, which compared to $59.6 million of exploration and evaluation expenditures in YTD 2020, including $51.3 million of capitalized expenditures and $8.3 million of expensed exploration expenditures.

$158.6 million returned to shareholders, including $100.3 million for two quarterly dividends, both totalling $0.1875 per share, with the Q4 2020 payment made on January 14, 2021 to shareholders of record on December 31, 2020 and the Q1 2021 quarterly dividend paid on April 14, 2021 to shareholder of record on March 31, 2021. An additional $58.3 million was used to repurchase 1,374,100 shares through the Company’s NCIB, with 1,074,100 shares repurchased in January 2021 for $46.3 million, and 300,000 shares repurchased in June for $12.0 million under the NCIB and introduction of the ASPP. The 300,000 shares repurchased in June were all purchased through the ASPP.

Q2 2021 – Other Key Highlights

Progress towards key value-creation catalysts

◦Detour Lake: After releasing a new technical report and life-of-mine plan (“LOMP”) on March 31, 2021(2), which included significant production growth and improved unit costs compared to previous operating experience, Detour Lake continued to achieve significant exploration success and advance key growth projects during Q2 2021. The full impact of exploration success achieved and business improvement initiatives undertaken since the acquisition of Detour Lake will be included in a new technical report and LOMP targeted for release during the first half of 2022. The Company expects the new technical report and LOMP to include significant value creation opportunities for the Detour Lake operation.

◦Macassa: The #4 Shaft project remained over a month ahead of schedule at the end of Q2 2021 and was on track for completion in late 2022. Once completed, production at Macassa is targeted to grow to over 400,000 ounces per year at significantly improved unit costs. In addition, working conditions will be improved at the mine, with total ventilation expected to more than double. The new shaft will also promote future exploration activities as the Company works to continue to grow the SMC and to explore the Main/’04 Break and Amalgamated Break across the Kirkland Lake camp.

◦Fosterville: In addition to achieving stronger than expected operating results in both Q2 2021 and YTD 2021, other key areas of progress were achieved during YTD 2021 in support of future exploration and operating success. In the Lower Phoenix System, a new drill drive (Drill Drive 3912) was completed in June 2021 with five underground drills being deployed by the end of the month to test the down-plunge extension of the Swan Zone. In addition, the twin exploration drive from Fosterville to Robbin’s Hill reached a total of 5,557 metres of advance as of June 30, 2021, with underground drilling of Robbin’s Hill targets now expected to commence in Q3 2021.

Commitment to Responsible Mining: Early in 2021, the Company pledged to achieve net-zero carbon emissions by 2050 or earlier and followed that pledge with a commitment to invest $75 million per year for five years on technology, innovation and in providing community support. During Q2 2021, progress was achieved in a number of key areas in support of the Company’s responsible mining commitments. In the area of community support, the Company launched a $12 million Australian Community Partnership Program to support post-COVID recovery services in the Bendigo area, with partnerships entered into to date including: Haven Home Safe; Bendigo Foodshare; Bendigo Tech School – Girls in STEAM; Bendigo Basketball Stadium; North Central Local Learning and Employment Network (LLEN); and Axedale Camp Getaway. In Kirkland Lake, Ontario, the Company committed $4.1 million to fund multiple projects at the Kirkland Lake Hospital, including the redevelopment of the hospital’s Emergency Department, as well as the procurement of significant equipment encompassing mammography, ultrasound, and point-of-care laboratory equipment. Building on its leadership in minimizing and reducing carbon emissions, the Company took additional steps in Q2 2021 to achieve further reductions, including completing third-party greenhouse gas audits of its operations and improving tracking and modeling of emissions levels. In addition, the Company continued to build its battery-powered fleet at Macassa, adding a second Z-50 haul truck, the world’s first 50-tonne battery-powered underground haul truck.

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

COVID-19 Response: The Company’s health and safety protocols related to the COVID-19 pandemic remained in place throughout Q2 2021 and were enhanced with the roll out of vaccination programs for employees at Macassa and Detour Lake. In Kirkland Lake, the Company worked with the local health unit to make vaccines available to all employees at Macassa, with Detour Lake running vaccination clinics at the Cochrane Bus Terminal for employees, contractors and members of the local community starting in late June.

In late April 2021, 11 workers (employees and contractors) at Macassa’s near-surface exploration ramp project tested positive for the COVID-19 virus. The event was classified as an outbreak under the criteria followed by the local health unit. During the outbreak, work on the exploration ramp was suspended for approximately seven days while the entire project workforce was tested using rapid testing kits. Work resumed at the project with no additional transmissions being reported and the outbreak was deemed resolved by the local health unit on May 12, 2021.

At Detour Lake, 9 workers (employees and contractors) tested positive for COVID-19 in late May, which was also classified as an outbreak by the local health unit. During this time, the Company added additional resources to complete rapid testing in the camp at Detour, completing more than 1,000 tests in less than 36 hours. Two additional positive results were identified as a result of this testing. The outbreak was declared resolved on June 4, 2021 and no further positive tests have occurred since the outbreak in May.

(1)The Executive Summary section includes references to Non-IFRS measures. The definition and reconciliation of these Non-IFRS measures are included on pages 35-42 of this MD&A.

(2)Readers are referred to the Company’s Press Release dated February 25, 2021 and the Company’s NI 43-101 Technical Report entitled “Detour Lake Operation, Ontario, Canada, NI 43-101 Technical Report” effective December 31, 2020 as filed with the applicable regulatory authorities and the detailed Mineral Reserve and Mineral Resource estimates and footnotes set out therein.

FULL-YEAR 2021 GUIDANCE - ISSUED ON DECEMBER 10, 2020

The Company’s full-year guidance for 2021 was announced in a press release dated December 10, 2020 and was maintained at the Company’s Q1 2021 board meeting on May 5, 2021. Included in the Company’s consolidated guidance for the year is target production of 1,300,000 – 1,400,000 ounces (1,369,652 ounces produced in 2020), operating cash costs per ounce sold(1) of $450 – $475 ($404 in 2020) and AISC per ounce sold(1) of $790 – $810 ($800 in 2020). The Company’s full-year guidance assumes strong production growth and improved unit costs at both Detour Lake and Macassa compared to 2020, partially offset by lower production and higher unit costs at Fosterville as the mine transitions to a lower-grade, higher-tonnage production profile reflecting efforts by the Company to create a more sustainable operation by extending the production life of the Swan Zone. Also included in full-year 2021 consolidated guidance is higher growth capital expenditures,(1) with the expected increase mainly at Detour Lake reflecting a shift of deferred stripping costs from sustaining capital expenditures(1) to growth capital expenditures(1) as well as plans to complete a number of growth capital projects, including investments in mill improvements, increased tailings capacity, completion of an assay lab (construction commenced in 2020), and air strip and other enhancements to site infrastructure. Exploration expenditure guidance for full-year 2020 totals $170 – $190 million, with extensive exploration programs being carried out at all three of the Company’s cornerstone assets.

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

Full-Year 2021 Guidance

| | | | | | | | | | | | | | |

($ millions unless otherwise stated)(1) | Macassa | Detour Lake | Fosterville | Consolidated |

| Gold production (kozs) | 220 – 255 | 680 – 720 | 400 – 425 | 1,300 - 1,400 |

Operating cash costs/ounce sold ($/oz)(2) | $450 - $470 | $580 - $600 | $230 - $250 | $450 - $475 |

AISC/ounce sold ($/oz)(2) | | | | $790 - $810 |

Operating cash costs ($M)(2) | | | | $600 - $630 |

| Royalty costs ($M) | | | | $82 - $88 |

Sustaining capital ($M)(2)(3) | | | | $280 - $310 |

Growth capital ($M)(2)(3) | | | | $250 - $275 |

Exploration ($M)(4) | | | | $170 - $190 |

Corporate G&A ($M)(5) | | | | $50 - $55 |

(1)The Company’s 2021 guidance assumes an average gold price of $1,800 per ounce as well as a US$ to C$ exchange rate of 1.31 and a US$ to A$ exchange rate of 1.39. Assumptions used for the purposes of guidance may prove to be incorrect and actual results may differ from those anticipated.

(2)See “Non-IFRS Measures” set out starting on page 35 of this MD&A for further details. The most comparable IFRS Measure for operating cash costs, operating cash costs per ounce sold and AISC per ounce sold is production costs, as presented in the Consolidated Statements of Operations and Comprehensive Income, and total additions and construction in progress for sustaining and growth capital.

(3)Capital expenditures exclude capitalized depreciation.

(4)Exploration expenditures include capital expenditures related to infill drilling for Mineral Resource conversion, capital expenditures for extension drilling outside of existing Mineral Resources and expensed exploration. Also includes capital expenditures for the development of exploration drifts.

(5)Excludes share-based payment expense (including expense related to share price changes).

YTD 2021 Results

| | | | | | | | | | | | | | |

($ millions unless otherwise stated)(1) | Macassa | Detour Lake | Fosterville | Consolidated |

| Gold production (kozs) | 102,759 | 312,611 | 266,672 | 682,042 |

Operating cash costs/ounce sold ($/oz)(2) | $639 | $674 | $192 | $482 |

AISC/ounce sold ($/oz)(2) | | | | $810 |

Operating cash costs ($M)(2) | | | | $324.1 |

| Royalty costs ($M) | | | | $40.8 |

Sustaining capital ($M)(2)(3) | | | | $141.9 |

Growth capital ($M)(2)(3) | | | | $128.8 |

Exploration ($M)(4) | | | | $88.1 |

Corporate G&A ($M)(5) | | | | $30.4 |

(1)Average exchange rates in YTD 2021 included a US$ to C$ exchange rate of 1.25 and a US$ to A$ exchange rate of 1.30.

(2)See “Non-IFRS Measures” set out starting on page 35 of this MD&A for further details. The most comparable IFRS Measure for operating cash costs, operating cash costs per ounce sold and AISC per ounce sold is production costs, as presented in the Consolidated Statements of Operations and Comprehensive Income, and total additions and construction in progress for sustaining and growth capital.

(3)Capital expenditures exclude capitalized depreciation.

(4)Exploration expenditures include capital expenditures related to infill drilling for Mineral Resource conversion, capital expenditures for extension drilling outside of existing Mineral Resources and expensed exploration. Also includes capital expenditures for the development of exploration drifts.

(5)Excludes share-based payment expense (including expense related to share price changes).

▪Gold production in YTD 2021 totalled 682,042 ounces, with the Company ending the first half of 2021 on track to achieve the top half the full-year 2021 consolidated production guidance of 1,300,000 – 1,400,000 ounces. Production at Fosterville of 266,672 ounces exceeded target levels in YTD 2021 largely due to significant grade outperformance in the Swan Zone as well as well as changes to mine sequencing during Q2 2021 with high-grade Swan Zone stopes initially planned for Q4 2021 being advanced into Q2 2021. Based on the operation’s performance in YTD 2021, and expectations for the remainder of the year, Fosterville is expected to meet, and potentially beat, the full-year guidance range of 400,000 – 425,000 ounces. Production at Detour Lake in YTD 2021 totalled 312,611 ounces, in line with expected levels. Detour Lake is targeting higher levels of mill throughput and continued improvement in average grades over the balance of 2021 with the operation continuing to target full-year 2021 production of 680,000 – 720,000 ounces. Production at Macassa in YTD 2021 totalled 102,759 ounces, slightly below target levels for the first half of the year. The Company expects higher grades at Macassa over the remainder of 2021 with the mine continuing to target full-year 2021 production of 220,000 – 255,000 ounces.

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

▪Production costs for Q2 2021 totalled $329.8 million, while operating cash costs(1) totalled $324.1 million, in line with target levels.

▪Operating cash costs per ounce sold(1) for YTD 2021 averaged $482, better than planned levels for the first half of the year mainly due to the favourable impact on sales volumes of significant grade outperformance at Fosterville. At June 30, 2021, the Company was well positioned to achieve the full-year 2021 consolidated operating cash costs per ounce(1) guidance of $450 – $475. Operating cash costs per ounce sold(1) at Fosterville averaged $192 in YTD 2021 compared to full-year 2021 guidance of $230 – $250. While operating cash costs per ounce sold(1) are expected to increase in the second half of the year at Fosterville, reflecting lower production and sales volumes, the mine entered the third quarter on track to achieve, and potentially beat, its guidance for full-year 2021. Operating cash costs per ounce sold(1) at Detour Lake averaged $674, higher than the guidance range of $580 – $600. With production on track to increase during the second half of the year, reflecting both higher grades and increased tonnes processed, operating cash costs per ounce sold(1) at Detour Lake are targeted to improve, with full-year 2021 guidance remaining at $580 – $600. Operating cash costs per ounce sold(1) at Macassa averaged $639 in YTD 2021 versus full-year 2021 guidance of $450 – $470. While Macassa is positioned for significant improvement in operating cash costs per ounce sold(1) during the second half of 2021, driven largely by higher average grades and increased production and sales volumes, operating cash costs per ounce sold(1) for full-year 2021 are now expected to exceed the existing guidance range. As indicated above, the Company continues to target full-year 2021 consolidated operating cash costs per ounce sold(1) of $450 – $475.

▪AISC per ounce sold(1) for YTD 2021 averaged $810, better than target levels of the first half of the year and in line with full-year 2021 guidance of $790 – $810. The better than expected AISC per ounce sold(1) in YTD 2021 resulted from higher than planned sales volumes at Fosterville, where AISC per ounce sold(1) averaged $385 in YTD 2021, driven largely by significant grade outperformance in the Swan Zone. AISC per ounce sold(1) at Fosterville is expected to increase over the balance of 2021 reflecting lower sales volumes and average grades compared to YTD 2021 levels, while AISC per ounce sold(1) at Detour Lake ($1,027 in YTD 2021) and Macassa ($895 in YTD 2021) are targeted to improve during the final two quarters of 2021. The Company continues to target full-year 2021 consolidated AISC per ounce sold(1) of $790 – $810.

▪Royalty costs for YTD 2021 totalled $40.8 million and continues to target full-year 2021 royalty costs of $82 – $88 million.

▪Sustaining capital expenditures(1) for YTD 2021 totalled $141.9 million, excluding capitalized depreciation, below target levels for the first half of the year, largely reflecting lower than planned capital development and mobile equipment procurement at both Macassa and Fosterville. Sustaining capital expenditures(1) are expected to increase in the second half of 2021 with the Company continuing to target $280 – $310 for full-year 2021.

▪Growth capital expenditures(1) totalled $128.8 million for YTD 2021 (excluding capitalized exploration) compared to full-year 2021 guidance of $250 – $275 million. Of growth capital expenditures(1) in YTD 2021, $80.7 million were at Detour Lake, including $43.9 million related to deferred stripping with the remaining $36.8 million related to the procurement of mobile equipment and projects involving the tailing management area, process plant as well as construction of a new assay lab and airfield. Growth capital expenditures(1) at Macassa totalled $43.0 million, with $21.8 million related to the #4 Shaft project, which reached 5,600 feet of advance as at June 30, 2021, and $10.0 million for a ventilation expansion project involving development of two ventilation raises. Growth capital expenditures(1) at Fosterville totalled $3.8 million largely related to construction of a surface refrigeration plant and land procurement. The Company continues to target full-year 2021 growth capital expenditures(1) of $250 – $275 million.

▪Exploration expenditures for YTD 2021 totalled $88.1 million (including capitalized exploration). Of the $88.1 million of exploration expenditures in YTD 2021, $43.7 million was at Fosterville where drilling and development continued in the Lower Phoenix System, as well as at Robbin’s Hill, Cygnet and Harrier. Exploration expenditures at Macassa in YTD 2021 totalled $21.9 million with drilling mainly targeting the continued expansion of the SMC and testing targets along the Amalgamated Break. Detour Lake accounted for $19.3 million of exploration expenditures in YTD 2021, with remaining exploration expenditures mainly related to drilling at Holt Complex and regional targets in Northern Ontario.

▪Corporate G&A expense for YTD 2021 totalled $30.4 million, with the Company continuing to target full-year 2021 Corporate G&A costs of $50 – $55 million.

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

Foreign Exchange Rate Impact of Performance Against Guidance

The Company’s full-year 2021 guidance is based on assumed an average US$ to C$ exchange rate of 1.31 and a US$ to A$ exchange rate of 1.39. After weakening against the US dollar early in 2020 with the outbreak of the COVID-19 pandemic, both the Canadian and Australian dollars began strengthening in the second half of the year and strengthened further early in 2021. As a result, the Company’s average exchange rates for YTD 2021 included a US$ to C$ exchange rate of 1.25 and a US$ to A$ exchange rate of $1.30. The impact of the stronger Canadian and Australian dollars on key performance measures in YTD 2021 versus YTD 2020 is outlined in the section entitled “Foreign Exchange Rates” earlier in this MD&A. Should the US$ to C$ and US$ to A$ exchange rates remain at levels existing at June 30, 2021 (See “External Performance Drivers” section below) for the remainder of the year, the Company would expect to finish 2021 around the top end of its full-year 2021 consolidated guidance ranges for operating cash costs(1), operating cash costs per ounce sold(1), AISC per ounce sold(1), sustaining capital expenditures(1) and growth capital expenditures(1).

(1)The Full-Year 2021 Guidance section includes references to Non-IFRS measures. The definition and reconciliation of these Non-IFRS measures are included on pages 35-42 of this MD&A.

LONG-TERM OUTLOOK

Kirkland Lake Gold is committed to generating returns for shareholders, and all stakeholders, by achieving high levels of operational excellence, investing in future growth and value creation, both at its existing cornerstone assets and through potential acquisitions, continuing to return capital to shareholders. and by maintaining an overriding commitment to responsible mining. The Company has achieved significant growth over the last several years, increasing production from 596,405 ounces in 2017 to 1,369,652 ounces in 2020. The Company continues to target significant organic growth in production and/or mine life, including through the completion of the Macassa #4 Shaft project, multiple projects at Detour Lake and the Robbin’s Hill exploration drive at Fosterville, as well as through continued exploration success at all three of these assets. The Company will also selectively pursue growth and value creation through additional external transactions where it sees an opportunity to enhance the value of assets by investing capital, exploring and applying the Company’s extensive technical expertise.

The acquisition of Detour Gold on January 31, 2020 was an important development for the Company in its efforts to generate long-term value and attractive returns. Detour Lake is a large-scale, high-quality asset with significant current production, attractive growth potential and substantial unit-cost improvement opportunities. The 2021 Detour Lake Technical Report and 2021 LOMP, issued on March 31, 2021, included solid production growth compared to previous mine plans, low unit costs and a 22-year production life. While important milestones, they are expected to be superseded by a new technical report and mine plan in 2022 that the Company expects will include significant value creation potential by incorporating the considerable exploration success achieved at Detour Lake as well as the full impact of business improvement initiatives undertaken since the acquisition.

Another key commitment for the Company is returning capital to shareholders through dividends and share repurchases. A total of $1.1 billion was returned to shareholder from the beginning of 2020 to July 28, 2021, including $828.4 million used to repurchase 21.2 million shares through the Company’s NCIB and $266.2 million in quarterly dividend payments. The Company tripled the quarterly dividend in 2020 through two dividend increases, from $0.06 per share when the year began to $0.1875 per share effective the Q4 2020 dividend payment, which was made on January 14, 2021 to shareholders of record on December 31, 2020. Since then, the Company has made two additional quarterly dividend payments of $0.1875 per share, the Q1 2021 payment on April 14, 2021 to shareholders of record on March 31, 2021, and the Q2 2021 dividend payment on July 14, 2021 to shareholders of record on June 30, 2021.

Recognizing that a fundamental requirement for long-term value creation is maintaining social license to operate, the Company has made substantial progress in its reporting and disclosures around Environment, Social and Governance issues, publishing its updated Sustainability Report for 2020/2021, including Sustainable Accounting Standards Board (“SASB”) disclosures and metrics for Metals and Mining. Consistent with its commitment to responsible mining, in early 2021 the Company pledged to achieve net-zero carbon emissions by 2050 or earlier and followed that pledge with a commitment to invest $75 million per year for five years on technology, innovation and in providing community support. Key areas of focus for these investments is advancing and commercializing alternative fuels and energies, creating the mines of the future through greater use of digitization, automation, connectivity, and investing in communities in such key areas as mental health, homelessness, addiction, senior care and youth training and development.

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

Kirkland Lake Gold’s significant financial strength and solid financial position provides financial flexibility to support the Company in executing all aspects of its long-term, value-creation strategy.

EXTERNAL PERFORMANCE DRIVERS

The Company’s results of operations, financial position, financial performance and cash flows are affected by various business conditions and trends. The variability of gold prices, fluctuating currency rates and increases and/or decreases in costs of materials and consumables associated with the Company’s mining activities are the primary economic factors that have impacted financial results during the three and six months ended June 30, 2021. The Company’s key internal performance drivers are production volumes and costs which are discussed throughout this MD&A. The key external performance drivers are the price of gold and foreign exchange rates.

Gold Price

The price of gold is a significant external factor affecting profitability and cash flow of the Company and therefore, the financial performance of the Company is expected to be closely linked to the price of gold. The price of gold is subject to volatile fluctuations over short periods of time and can be affected by numerous macroeconomic conditions, including supply and demand factors, value of the US dollar, interest rates, and global economic and political issues.

At June 30, 2021, the gold price closed at $1,763 per ounce (based on the closing price on the London Bullion Market Association (“LBMA”) pm fix), which compared to the closing gold price of $1,888 per ounce on December 31, 2020 and $1,768 per ounce at June 30, 2020. The Company’s average realized gold price(1) for Q2 2021 was $1,814 per ounce versus $1,716 per ounce in Q2 2020 and $1,788 per ounce the previous quarter. For YTD 2021, the averaged realized gold price was $1,802 per ounce versus $1,651 per ounce for the same period in 2020.

Kirkland Lake Gold does not have a precious metals hedging program and management believes the Company is well positioned to benefit from potential increases in the price of gold while continuing to focus on cost management and mine efficiencies from its existing mines in order to mitigate against gold price decreases.

Foreign Exchange Rates

The Company’s reporting currency is the US dollar; however, the operations are located in Canada and Australia. The functional currency of the Company and its Canadian subsidiaries up to December 31, 2020 was the Canadian dollar; the functional currency for all of the Australian subsidiaries is the Australian dollar. Consequently, the Company’s operating results are influenced significantly by changes in the US dollar exchange rates against these currencies. Weakening or strengthening Canadian and Australian dollars respectively decrease or increase costs in US dollar terms at the Company’s Canadian and Australian operations, as a large portion of the operating and capital costs are denominated in Canadian and Australian dollars.

The Company elected to change the tax reporting currency of its Canadian subsidiaries from the Canadian to the United States dollar effective January 1, 2021. This change in tax reporting currency resulted in a re-assessment of the primary and secondary factors under IAS 21 “The Effects of Changes in Foreign Exchange Rates” and led to the conclusion that the functional currency of the Canadian entities is the United States dollar. Effective December 31, 2020, the functional currency of the Company's Canadian entities changed from the Canadian dollar to the United States dollar, with the change applied on a prospective basis.

As at June 30, 2021, the US dollar closed at $1.2395 against the Canadian dollar (compared to $1.3572 at June 30, 2020 and $1.2731 at December 31, 2020) and at $1.3335 against the Australian dollar (compared to $1.4489 at June 30, 2020 and $1.2997 at December 31, 2020). The average rates for Q2 2021 for the US dollar against the Canadian and Australian dollars were $1.2282 and $1.2990, respectively, versus $1.3850 and $1.5214, respectively, in Q2 2020 and $1.2657 and $1.2943, respectively, the previous quarter.

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

As with gold prices, currency rates can be volatile and fluctuations can occur as a result of different events, including and not limited to, global economies, government intervention, interest rate changes and policies of the U.S., Canadian and Australian governments. As at June 30, 2021, the Company did not have a foreign exchange hedging program in place.

(1)The External Performance Drivers section includes references to Non-IFRS measures. The definition and reconciliation of these Non-IFRS measures are included on pages 35-42 of this MD&A.

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

REVIEW OF FINANCIAL PERFORMANCE

The following discussion provides key summarized consolidated financial and operating information for the three and six months ended June 30, 2021 and 2020, as well as for the three months ended March 31, 2021.

| | | | | | | | | | | | | | | | | | | | |

| (in thousands of dollars, except per share amounts) | Three Months Ended | | Six Months Ended |

| June 30, 2021 | June 30, 2020 | March 31, 2021 | | June 30, 2021 | June 30, 2020 |

| | | | | | |

| Revenue | $662,736 | $580,975 | | $551,846 | | | $1,214,582 | | $1,135,713 | |

| | | | | | |

| Production costs | (159,726) | (141,415) | | (170,081) | | | (329,807) | | (303,007) | |

| Royalty expense | (22,369) | (19,258) | | (18,394) | | | (40,763) | | (40,507) | |

| Depletion and depreciation | (111,348) | (82,586) | | (104,100) | | | (215,448) | | (175,425) | |

| Earnings from mine operations | 369,293 | 337,716 | | 259,271 | | | 628,564 | | 616,774 | |

| | | | | | |

| Expenses | | | | | | |

General and administrative1 | (20,184) | | (20,137) | | (12,343) | | | (32,527) | | (32,699) | |

| Transaction costs | — | | — | | — | | | — | | (33,838) | |

| Exploration | (7,079) | | (2,384) | | (5,486) | | | (12,565) | | (8,315) | |

| Care and maintenance | (4,093) | | (6,570) | | (4,196) | | | (8,289) | | (9,460) | |

| Rehabilitation costs | (286) | | (2,448) | | 760 | | | 474 | | (2,448) | |

| Earnings from operations | 337,651 | | 306,177 | | 238,006 | | | 575,657 | | 530,014 | |

| | | | | | |

| Finance and other items | | | | | | |

| Other income (loss), net | 2,016 | | (80,164) | | (1,424) | | | 592 | | (7,959) | |

| Finance income | 297 | | 1,119 | | 247 | | | 544 | | 3,715 | |

| Finance costs | (838) | | (1,850) | | (846) | | | (1,684) | | (5,963) | |

| | | | | | |

| Earnings before income taxes | 339,126 | | 225,282 | | 235,983 | | | 575,109 | | 519,807 | |

| Current income tax expense | (45,279) | | (59,020) | | (42,971) | | | (88,250) | | (129,150) | |

| Deferred tax expense | (49,680) | | (16,030) | | (31,819) | | | (81,499) | | (37,547) | |

| | | | | | |

| Net earnings | $244,167 | | $150,232 | | $161,193 | | | $405,360 | | $353,110 | |

| | | | | | |

| Basic earnings per share | $0.91 | $0.54 | $0.60 | | $1.52 | $1.32 |

| Diluted earnings per share | $0.91 | $0.54 | $0.59 | | $1.51 | $1.32 |

| | | | | | |

| Weighted average number of common shares outstanding (in 000's) | | | | | | |

| Basic | 267,074 | | 277,066 | | 267,111 | | | 267,092 | | 267,242 | |

| Diluted | 267,189 | | 277,265 | | 267,907 | | | 267,961 | | 267,453 | |

(1)General and administrative expense for Q2 2021 (Q2 2020 and Q1 2021) include general and administrative expenses of $16.9 million ($12.5 million and $13.5 million) and share based payment expense (recovery) of $3.3 million ($7.7 million and ($1.1) million).

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

Revenue

(1)Rate factors include the impact of changes in the average realized gold price(1) as well as any impact related to changes in foreign exchange rates. In Q2 2021, rate factors increased revenue by $42 million versus Q2 2020, which included a $36 million favourable impact from an increase in the average realized gold price(1) and a $6 million impact from exchange rate changes. Compared to Q1 2021, rate factors increased revenue by $10 million, virtually all of which related to a higher average realized gold price(1) compared to the previous quarter.

Revenue in Q2 2021 totalled $662.7 million, an $81.2 million or 14% from Q2 2020. Contributing to the change in revenue from Q2 2020 was $42 million favourable impact from rate factors, mainly reflecting a 6% increase in the average realized gold price(1) to $1,814 per ounce in Q2 2021 from $1,716 per ounce for the same period in 2020. The remaining $40 million of the increase in revenue year over year resulted from a 7% increase in gold sales, to 364,575 ounces from 341,390 ounces in Q2 2020. Gold sales at Detour Lake increased 22% from Q2 2020, to 166,374 ounces from 136,182 ounces for the same period in 2020, while gold sales at Macassa rose 25%, to 55,601 ounces versus 44,328 ounces in Q2 2020. At Fosterville, despite higher production, gold sales in Q2 2021 were 9% lower, at 142,600 ounces versus 157,251 ounces in Q2 2020. Gold sales in Q2 2020 also included 3,629 ounces from the Holt Complex where operations were suspended effective April 2, 2020.

Revenue in Q2 2021 increased $110.9 million or 20% from revenue of $551.8 million the previous quarter. Contributing to the $110.9 million increase in revenue was $101 million related to an 18% increase in gold sales to 364,575 ounces from 308,029 ounces in Q1 2021. Gold sales at Detour Lake increased 18% from 141,112 ounces in Q1 2021, with gold sales at Fosterville and Macassa increasing 21% and 12%, respectively, from 117,450 ounces and 49,467 ounces, respectively, for the previous quarter. The remaining $10 million of revenue growth compared to Q1 2021 was attributable to rate factors, reflecting an increase in the average realized gold price(1) to $1,814 per ounce from $1,788 per ounce the previous quarter.

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

(1)Rate factors include the impact of changes in the average realized gold price(1) as well as any impact related to changes in foreign exchange rates. In YTD 2021, rate factors increased revenue by $101 million versus YTD 2020, which included a $102 million favourable impact from an increase in the average realized gold price(1) and a $1 million reduction related to exchange rates

Revenue in YTD 2021 totalled $1,214.6 million, an increase of $78.9 million or 7% from $1,135.7 million in YTD 2020. The increase in revenue was driven by a 9% increase in the average realized gold price,(1) to $1,802 per ounce in YTD 2021 from $1,651 per ounce for the same period in 2020, which resulted in revenue growth from rate factors of $101 million. Partially offsetting the impact of a higher average realized gold price(1) was a reduction of $22 million related to lower gold sales. Gold sales in YTD 2021 totalled 672,605 ounces compared to 685,976 ounces in YTD 2020. The reduction in gold sales reflected two factors, including lower sales at Fosterville (260,050 ounces compared to 311,003 ounces in YTD 2020) consistent with the mine’s plan to reduce production in the Swan Zone by increasing mining activities in other, lower-grade, areas of the mine, with the intention of creating a more sustainable operation over a longer period; as well as the contribution of 33,242 ounces of gold sales from the Holt Complex related to production prior to operations being suspended effective April 2, 2020. These factors more than offset the favourable impact of a 25% increase in gold sales at Detour Lake (307,486 ounces compared to 246,638 ounces for the five months ending June 30, 2020) and 10% growth in sales at Macassa, to 105,069 ounces from 95,093 for the same period in 2020.

Net Earnings and Adjusted Net Earnings(1)

Net Earnings and Earnings Per Share

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

Net earnings in Q2 2021 totalled $244.2 million ($0.91 per share), a $94.0 million or 63% increase from $150.2 million ($0.54 per share) in Q2 2020 and a 51% increase from $161.2 million ($0.60 per share) the previous quarter. Compared to Q2 2020, the increase in net earnings was driven by higher revenue and the favourable impact of other income of $2.0 million in Q2 2021 versus other loss of $80.2 million for the same period in 2020, with other loss in Q2 2020 mainly resulting from $72.8 million of foreign exchange losses. On an after-tax basis, the increase in revenue contributed $54.5 million or $0.20 per share to net earnings growth. Similarly, the $82.2 million pre-tax change in other income/loss compared to Q2 2020 increased net earnings by $54.8 million or $0.20 per share on an after-tax basis. Also contributing to higher net earnings versus Q2 2020 was a reduction in the effective tax rates, to 28.0% from 33.3% in last year’s second quarter, which increased net earnings by $18.0 million after tax or $0.07 per share. The lower effective tax rate in Q2 2021 mainly reflected favourable adjustments resulting from re-assessments of prior year tax returns. Partially offsetting these favourable factors were higher production costs (reduced net earnings by $12.2 million after tax or $0.04 per share) and depletion and depreciation expense (reduced net earnings by $19.2 million after tax or $0.07 per share).

Q2 2021 net earnings of $244.2 million ($0.91 per share) was $83.0 million or 51% higher than $161.2 million ($0.60 per share) the previous quarter. The main driver of higher net earnings compared to Q1 2021 was the strong growth in revenue, which had a $75.7 million or $0.28 per share after tax favourable impact. Also contributing to the increase in net earnings were a lower effective tax rate (28.0% versus 31.7% in Q1 2021), which increased net earnings by $12.5 million after tax or $0.05 per share and lower production costs, which increased net earnings by $7.1 million after tax or $0.03 per share. Partially offsetting these factors were higher corporate G&A costs ($5.4 million after tax or $0.02 per share) and increased depletion and depreciation expense ($4.9 million after tax or $0.02 per share).

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

Net earnings in YTD totalled $405.4 million ($1.52 per share), a 15% increase from $353.1 million ($1.32 per share) in YTD 2020. The increase in net earnings compared to the same period a year earlier mainly reflected revenue growth, which increased net earnings by $53.6 million after tax or $0.20 per share. In addition, $33.8 million of transaction fees in YTD 2020 related to the Detour Gold acquisition, had a favourable impact of $23.0 million after tax or $0.09 per share on the comparison of net earnings in YTD 2021 to YTD 2020. Also contributing to higher net earnings was a lower effective tax rate in YTD 2021 (29.5% in YTD 2021 versus 32.1% in YTD 2020), which increased net earnings by $14.7 million after tax or $0.05 per share. Partially offsetting these factors were higher depletion and depreciation expense and production costs, which reduced net earnings by $27.2 million after tax or $0.10 per share and $18.2 million or $0.07 per share, respectively.

Adjusted Net Earnings(1)

Adjusted net earnings(1) in Q2 2021 totalled $246.9 million ($0.92 per share), similar to net earnings for the quarter. Adjusted net earnings(1) in Q2 2021 increased 13% from $219.3 million ($0.79 per share) in Q2 2020 and were 47% higher than $167.8 million ($0.63 per share) the previous quarter. The small difference between net earnings and adjusted net earnings(1) in Q2 2021 reflected the exclusion from adjusted net earnings of systems implementation costs of $4.1 million ($3.0 million after tax), costs attributed to non-operating assets, mainly in the Northern Territory, of $4.1 million ($2.9 million after tax), COVID-19 related costs of $0.9 million ($0.6 million after tax) and severance expense of $1.3 million ($1.0 million after tax). These factors were largely offset by the exclusion from adjusted net earnings(1) of $2.6 million ($1.8 million after tax) of foreign exchange gains and $3.5 million ($3.1 million after tax) of unrealized gains on warrants issued. The difference between net earnings and adjusted net earnings(1) in Q2 2020 related to the exclusion from adjusted net earnings(1) of $72.8 million ($56.3 million after tax) of foreign exchange losses, due to a strengthening of the Canadian and Australian dollars against the US dollar during the quarter, as well as $13.4 million ($9.2 million after tax) of costs related to the Company’s COVID-19 response, mainly related to labour costs during periods of reduced or suspended operations, as well as $5.3 million ($3.7 million after tax) of restructuring costs, mainly resulting from the suspension of business activities in the Northern Territory and at Holt Complex. The difference between net earnings and adjusted net earnings(1) in Q1 2021 mainly reflected the exclusion from adjusted net earnings(1) of write-offs related to property, plant and equipment at Holt Complex of $6.5 million ($4.5 million after tax) and $5.7 million of foreign exchange gains ($4.0 million after tax), both of which are included in other loss/income, care and maintenance costs of $4.2 million ($2.9 million after tax) and $2.9 million ($2.0 million after tax) of COVID-19 costs mainly at Detour Lake.

Q2 2021 MANAGEMENT’S DISCUSSION AND ANALYSIS

Adjusted net earnings(1) in YTD 2021 totalled $414.7 million ($1.55 per share), which compared to net earnings of $405.4 million ($1.52 per share). The difference between net earnings and adjusted net earnings(1) in YTD 2021 mainly reflected the exclusion from adjusted net earnings(1) of the $6.5 million ($4.5 million after-tax) of write-offs at Holt Complex in Q1 2021, costs related to non-operating assets of $8.3 million ($5.8 million after tax), systems implementation costs of $4.1 million ($3.0 million after tax) in Q2 2021 and $3.8 million ($2.6 million after tax) of COVID-19 costs. These factors were partially offset by the exclusion from adjusted net earnings(1) of $8.2 million ($5.8 million after tax) of foreign exchange gains, mainly in Q1 2021. The difference between net earnings and adjusted net earnings(1) for YTD 2020 reflected the exclusion from adjusted net earnings(1) of the $33.8 million ($24.9 million after tax) of transaction fees related to the Detour Gold acquisition, as well as costs related to the Company’s COVID-19 response of $13.4 million ($9.2 million after tax), restructuring costs of $5.3 million ($3.7 million after tax) and severance expense of $3.7 million ($2.6 million after tax).

Cash and Cash Flows

(1)Related to impact of foreign exchange rate changes on cash held by Australian entities in foreign currencies.