| ATTORNEYS AT LAW 777 EAST WISCONSIN AVENUE MILWAUKEE, WI 53202-5306 414.271.2400 TEL 414.297.4900 FAX WWW.FOLEY.COM WRITER’S DIRECT LINE CLIENT/MATTER NUMBER 103159-0101 |

May 4, 2022

VIA EDGAR SYSTEM Mr. Daniel F. Duchovny Special Counsel Office of Mergers & Acquisitions Division of Corporation Finance U.S. Securities and Exchange Commission 100 F Street, N.E. Washington, D.C. 20549-3628 | |

Re: American Vanguard Corp.

Preliminary Proxy Statement filed by Cruiser Capital Advisors, LLC, Keith M.

Rosenbloom, Cruiser Capital Master Fund LP, Metamorphosis VI LLC,

Patrick E. Gottschalk, and Mark R. Bassett

Filed April 27, 2022

File No. 001-13795

Dear Mr. Duchovny:

We are writing this letter on behalf of Cruiser Capital Advisors, LLC, Keith M. Rosenbloom, Cruiser Capital Master Fund LP, Metamorphosis VI LLC, Patrick E. Gottschalk, and Mark R. Bassett (the “Reporting Parties”).

Set forth below are the Reporting Parties’ responses to the May 3, 2022 comments of the Staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) with respect to the preliminary proxy statement referenced above. The items set forth below (in bold italics) express the comments of the Staff, and following such comments are the Reporting Parties’ responses (in regular type). We are attaching a PDF file of the draft, revised preliminary proxy statement with the language revised in response to your comments highlighted in yellow.

Preliminary Proxy Statement

What do the Cruiser Director Nominees Hope to Achieve?, page 3

| 1. | Please clarify whether your nominees have a plan to achieve their stated goals. |

Response: We have revised the preliminary proxy statement to provide this clarification:

AUSTIN BOSTON CHICAGO DALLAS DENVER | DETROIT HOUSTON JACKSONVILLE LOS ANGELES MADISON | MEXICO CITY MIAMI MILWAUKEE NEW YORK ORLANDO | SACRAMENTO SALT LAKE CITY SAN DIEGO SAN FRANCISCO SILICON VALLEY | TALLAHASSEE TAMPA WASHINGTON, D.C. BRUSSELS TOKYO |

U.S. Securities and Exchange Commission

May 4, 2022

Page 2

“To achieve the aims discussed above, the Cruiser Stockholder Nominees have a multifaceted plan to improve the Company’s EBITDA performance. The plan includes such things as market participation and customer engagement plans, price/volume management tools and tactics, operational efficiency programs focused on reducing consumables and improving asset throughout, and organizational effectiveness. Implementation of the plan will benefit from the extensive operational experience Dr Bassett and Mr Gottschalk have running multiple industrial manufacturing businesses. A foundation of the plan is dependent on dealing forthrightly with employees and shareholders.”

| 2. | Please revise your proxy statement to provide additional information on the amount of board fees referenced at the top of page 4. |

Response: We have revised the preliminary proxy statement to provide additional information:

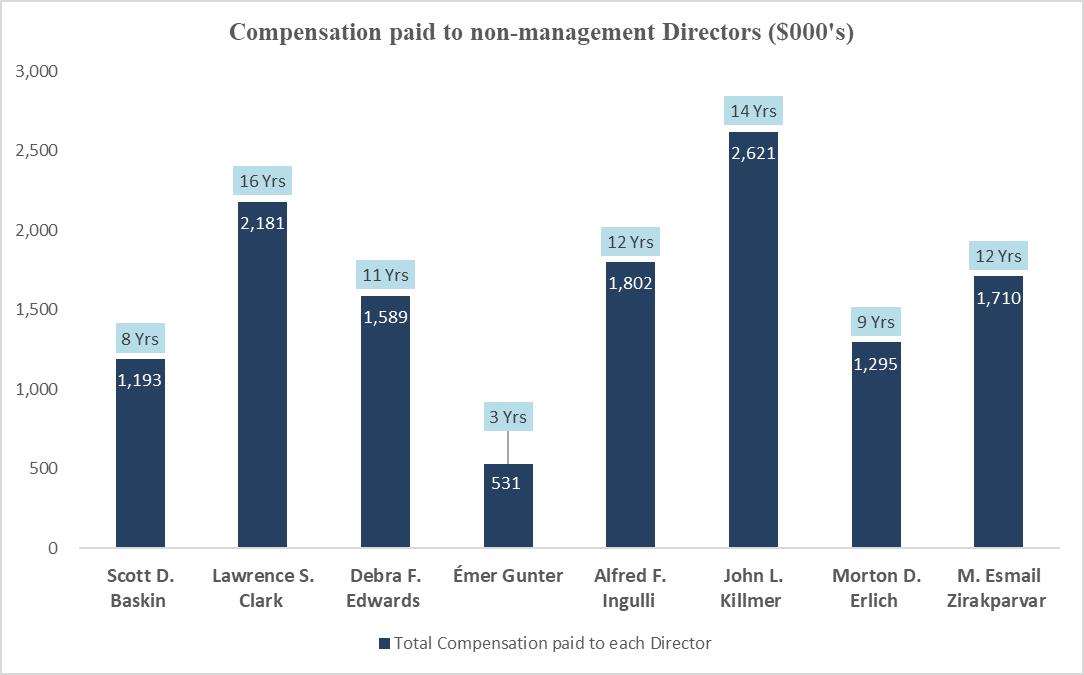

Historical Compensation of the Board’s current non-Management Directors:

Source: Information derived from Company proxy statements filed between 2002 to 2021.

Note that Lawrence S. Clark is not standing for re-election, he resigned in December 2021.

Includes entire compensation paid during all years of service.

U.S. Securities and Exchange Commission

May 4, 2022

Page 3

Historical Compensation of the Board’s current Directors

| ($’000) | Eric G. Wintemute (CEO & Chairman)* | Scott D. Baskin | Lawrence S. Clark ** | Debra F. Edwards | Émer Gunter | Alfred F. Ingulli | John L. Killmer | Morton D. Erlich | M. Esmail Zirakparvar |

| Total | $20,161 | $1,193 | $2,181 | $1,589 | $531 | $1,802 | $2,621 | $1,295 | $1,710 |

| Tenure | 28 | 8 | 16 | 11 | 3 | 12 | 14 | 9 | 12 |

Source: Information derived from Company proxy statements filed between 2002 to 2021.

Includes entire compensation paid during all years of service, except for Eric Wintermute for whom the compensation is from the time he was named Chairman (2011 to 2021)

*Served on the Board for 28 years, and was appointed Chairman in June 2011

** Served as a Director till 2021

Background of the Solicitation, page 6

| 3. | Please revise the disclosure in this section to describe the events surrounding your apparent decision to nominate only three candidates instead of the four indicated in your March 7, 2022 notice to the company. |

Response: We have revised the preliminary proxy statement to provide this information:

“On March 14, 2022 Mr. Rosenbloom discussed with Mr. Wintemute Cruiser’s desire to help the Company by providing the Board with independent, highly accomplished business people who would be aligned with shareholders through their ownership of AVD shares that they had purchased with their own money, versus having their stock ownership simply granted to them by the Board. Mr. Rosenbloom noted that the directors were executives who could help implement an efficiency plan that could increase operating margins without firing people or reducing headcount. We were clear with Mr. Wintemute on several occasions in our meeting on March 14, in follow-up emails, in our presentation to the Board on April 11, 2022, and again during Mr. Rosenbloom’s interview on April 12 that Cruiser’s preference was to present four qualified directors to the Board and have the Board choose some or all of them to help the Company. Once it was apparent to us that the Board had no desire to engage in constructive dialogue with the Cruiser Stockholder Nominees, Cruiser decided that it would need to run a contested slate. As such, Cruiser felt it was in the Company’s best interest to have one not two director nominees with similar capital markets expertise, and similar financial analysis and shareholder perspectives.”

Proposal 1. Election of Directors, page 9

| 4. | Please disclose the names of the companies “Mr. Rosenbloom has helped ...add highly qualified members to their Board rooms, seeking to improve stockholder value at those companies.” |

U.S. Securities and Exchange Commission

May 4, 2022

Page 4

Response: We have revised the preliminary proxy statement to provide this information:

“Over the past several years, Mr. Rosenbloom has helped the Boards of several public companies (The Dow Chemical Company; A. Schulman, Inc. and Ashland Global Holdings Inc.) source and add highly qualified members to their Board rooms, seeking to improve stockholder value at those companies.”

| 5. | With a view toward revised disclosure, please tell us why, in light of the plurality voting standard to be used for the election of directors, “stockholders will not be able to abstain from voting in the election of directors.” |

Response: We have revised the preliminary proxy statement to delete this statement, and provide this information:

“The following will not be counted as votes cast and will have no effect on the election of any director nominee: (1) a share whose ballot is marked as withheld; (2) a share otherwise present at the Annual Meeting but for which there is an abstention; and (3) a share otherwise present at the Annual Meeting as to which a shareholder gives no authority or direction (other than a share voted pursuant to a signed proxy card on which the shareholder has not indicated any voting direction). Abstentions will be counted as present and entitled to vote for purposes of determining the presence of a quorum at the Annual Meeting.”

Proposal 3. Approval of the 2022 Stock Incentive Plan, page 12

| 6. | We note that you “...have been disappointed with AVD’s ....(4) the dilutive effect of its incentive stock plan...” while you also recommend a vote for the approval of the 2022 stock incentive plan. Please address this apparent contradiction. |

Response: We have revised the preliminary proxy statement to provide this information:

“We are soliciting stockholders to vote FOR this Proposal. While we have been disappointed with the dilutive effect of AVD’s incentive stock plan, particularly over the last five years, we are not privy to the specifics of the number of these shares that have been promised or allocated and to which executives, and do not feel we have sufficient information to make a recommendation against the Proposal. Our hope would be to offset this dilution through share repurchases.”

Form of Proxy Card, page A-4

| 7. | Please revise your proxy card to indicate how signed but unmarked proxy cards will be voted. |

U.S. Securities and Exchange Commission

May 4, 2022

Page 5

Response: We have revised the preliminary proxy card to provide this information:

“If you sign and return a BLUE proxy card or otherwise vote as directed herein, but do not mark how your shares are to be voted, the individuals named as proxies herein will vote your shares in accordance with the above recommendations of Cruiser Capital Master Fund LP.”

| 8. | We note the proposal number 5 included in your form of proxy card. We also note that the company has not included an adjournment proposal in its proxy materials. Please advise or revise. |

Response: We have revised the preliminary proxy card to delete this proposal.

* * * * *

If you have any questions with respect to any of the foregoing, please contact the undersigned at (414) 297-5596.

Very truly yours,

/s/ Peter D. Fetzer

Peter D. Fetzer