The information in this prospectus/offer to exchange is not complete and may be changed. RhythmOne may not complete the exchange offer and issue these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus/offer to exchange is not an offer to sell or a solicitation to sell these securities in any jurisdiction where such offer, sale or solicitation is not permitted.

PRELIMINARY — SUBJECT TO COMPLETION, DATED DECEMBER 18, 2017

Offer to Exchange

Each

Outstanding Share of Common Stock

of

YuMe, Inc.

For

$1.70 Cash and 0.7325 Ordinary Shares of RhythmOne plc

by

Redwood Merger Sub I, Inc.

a wholly-owned subsidiary of

RhythmOne plc

RhythmOne plc, a public limited company incorporated and registered in England and Wales with company number 06223359 (“RhythmOne” or the “Company”), through Redwood Merger Sub I, Inc., a corporation incorporated under the laws of Delaware and a wholly-owned subsidiary of RhythmOne (“Purchaser”), is offering to acquire all of the outstanding common stock (the “YuMe Shares”) of YuMe, Inc., a corporation incorporated under the laws of Delaware (“YuMe”), upon the terms and subject to the conditions set out in this prospectus/offer to exchange and in the related letter of transmittal, which terms and conditions are referred to in this prospectus/offer to exchange together, as each may be amended or supplemented from time to time, as the “Offer”.

Pursuant to the Agreement and Plan of Merger and Reorganization, dated September 4, 2017, by and among RhythmOne, Purchaser, Redwood Merger Sub II, Inc. (“Merger Sub Two”), and YuMe (the “Merger Agreement”), YuMe stockholders are being offered a combination of cash and stock consideration for their YuMe Shares. For each YuMe Share held, YuMe stockholders are being offered (i) $1.70 in cash without interest (the “Cash Consideration”) and (ii) 0.7325 ordinary shares of RhythmOne (“RhythmOne Shares”), which gives effect to the10-for-1 share consolidation of RhythmOne Shares implemented on September 25, 2017 (the “Share Consideration”, together with the Cash Consideration, the “Transaction Consideration”).

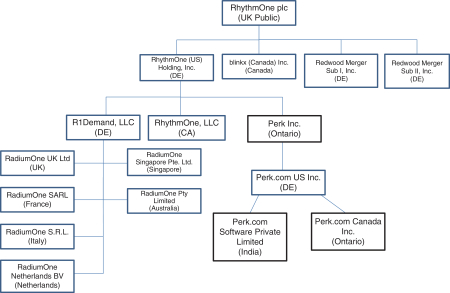

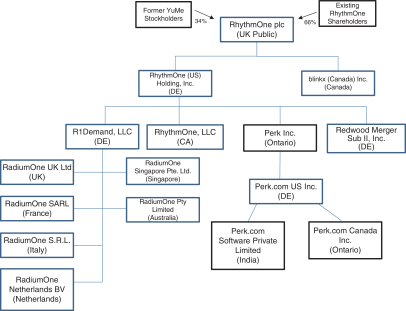

The Offer is the first step in RhythmOne’s plan to acquire control of, and ultimately all of the outstanding equity in, YuMe. As a second step in such plan, if the Offer is completed, pursuant to the terms and subject to the conditions of the Merger Agreement, as soon as practicable following the consummation of the Offer, RhythmOne intends to consummate a merger of Purchaser with and into YuMe, with YuMe surviving the merger as a wholly-owned subsidiary of RhythmOne (the “First Merger”). Immediately following the First Merger, the surviving corporation will merge with and into Merger Sub Two, with the Merger Sub Two surviving the Second Merger as a wholly-owned subsidiary of RhythmOne (the “Second Merger” and together with the First Merger, the “Mergers,” and the Mergers together with the Offer, the “Transactions”).

The purpose of the First Merger is for RhythmOne to acquire all YuMe Shares that it did not acquire in the Offer. In the First Merger, each outstanding YuMe Share that was not acquired by Purchaser in the Offer (other than certain dissenting, converted and cancelled shares as described further in this prospectus/offer to exchange) will be converted into the right to receive the Transaction Consideration. After the First Merger, YuMe, as the surviving corporation, will be a wholly-owned subsidiary of RhythmOne, and the former stockholders of YuMe will no longer have any direct ownership interest in the surviving corporation. The First Merger will be governed by Section 251(h) of the General Corporation Law of the State of Delaware (the “DGCL”). Accordingly, if the Offer is completed (such that Purchaser owns at least a majority of the outstanding YuMe Shares), no stockholder vote will be required to complete the First Merger.

If the Offer is successful and the First Merger is completed, holders of YuMe Shares who have not properly tendered in the Offer, and who otherwise comply with the applicable procedures for demanding appraisal under Section 262 of the DGCL, will be entitled to seek appraisal for the “fair value” of their YuMe Shares as determined by the Delaware Court of Chancery. To exercise appraisal rights, a YuMe stockholder must strictly comply with all of the procedures under the DGCL. These procedures are described more fully in the section of this prospectus/offer to exchange entitled “The Offer —Appraisal Rights.”

YUME’S BOARD OF DIRECTORS HAS UNANIMOUSLY DETERMINED THAT THE MERGER AGREEMENT AND THE OFFER ARE ADVISABLE AND FAIR TO AND IN THE BEST INTERESTS OF YUME, HAS APPROVED THE MERGER AGREEMENT AND RECOMMENDS THAT YUME STOCKHOLDERS TENDER THEIR YUME SHARES INTO THE OFFER.

The completion of the Offer is subject to certain conditions, including that at least a majority of the issued and outstanding YuMe Shares are tendered in the Offer, which calculation includes the YuMe Shares resulting from the net exercise of all options that are vested as of immediately prior to the effective time of the First Merger (the “Effective Time”)) and that have an exercise price less than the value of the Transaction Consideration determined in accordance with the Merger Agreement (the “Minimum Tender Condition”). RhythmOne and Purchaser may not, without the prior written consent of YuMe, amend, modify or waive the Minimum Tender Condition. A detailed description of the terms and conditions of the Offer appears under “The Offer” and “The Merger Agreement — Conditions to the Offer” in this prospectus/offer to exchange.

THE OFFER WILL COMMENCE ON●. THE OFFER, AND YOUR RIGHT TO WITHDRAW YUME SHARES YOU TENDER IN THE OFFER, WILL EXPIRE AT THE TIME THAT IS ONE MINUTE FOLLOWING 11:59 P.M. PACIFIC TIME ON●, 2018, UNLESS THE EXPIRATION TIME OF THE OFFER IS EXTENDED. SHARES TENDERED PURSUANT TO THE OFFER MAY BE WITHDRAWN AT ANY TIME PRIOR TO THE EXPIRATION OF THE OFFER.

RhythmOne is an “emerging growth company” and a “foreign private issuer” under applicable U.S. securities laws and is eligible for reduced reporting requirements.

The YuMe Shares are listed on the New York Stock Exchange (the “NYSE”). The RhythmOne Shares are admitted to trading on the London Stock Exchange plc’s AIM market (“AIM”). Prior to the completion of the Offer, RhythmOne will apply to the London Stock Exchange plc for approval for admission to trading on AIM the RhythmOne Shares to be issued as partial consideration to YuMe stockholders. Admission will be subject to RhythmOne satisfying the AIM rules (the “AIM Rules”). Following the completion of the Offer and the Mergers, to the extent permitted under applicable law and stock exchange regulations, RhythmOne intends to delist the YuMe Shares from the NYSE.

FOR A DISCUSSION OF RISK FACTORS THAT YOU SHOULD CAREFULLY CONSIDER IN EVALUATING THE OFFER AND THE OTHER TRANSACTIONS, SEE “RISK FACTORS” BEGINNING ON PAGE 35 OF THIS PROSPECTUS/OFFER TO EXCHANGE.

THIS DOCUMENT IS IMPORTANT AND YOU ARE ENCOURAGED TO READ THIS ENTIRE DOCUMENT AND THE RELATED LETTER OF TRANSMITTAL CAREFULLY, INCLUDING THE ANNEXES AND INFORMATION REFERRED TO OR INCORPORATED BY REFERENCE INTO THIS DOCUMENT.

THIS PROSPECTUS/OFFER TO EXCHANGE IS NOT AN OFFER TO SELL SECURITIES AND IS NOT A SOLICITATION OF AN OFFER TO BUY SECURITIES, NOR SHALL THERE BE ANY SALE OR PURCHASE OF SECURITIES PURSUANT HERETO, IN ANY JURISDICTION IN WHICH SUCH OFFER, SALE OR SOLICITATION IS NOT PERMITTED OR WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH JURISDICTION.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES TO BE ISSUED IN CONNECTION WITH THE OFFER OR THE OTHER TRANSACTIONS OR HAS PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS PROSPECTUS/OFFER TO EXCHANGE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE IN THE UNITED STATES.

The date of this prospectus/offer to exchange is , 2017.