0001714562 GAME:CADExercisePriceMember GAME:LiabilityWarrantsMember ifrs-full:TopOfRangeMember 2019-09-01 2020-08-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended August 31, 2022 |

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from ____________________ to ____________________ |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-39389

Engine Gaming and Media, Inc.

(Exact name of Registrant as specified in its charter)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

2110 Powers Ferry Road SE, Suite 450, Atlanta, GA 30339

(Address of principal executive offices)

Michael Munoz, (212) 931-1200, mmunoz@franklymedia.com

2110 Powers Ferry Road SE, Suite 450, Atlanta, GA 30339

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Shares | | GAME | | Nasdaq Capital Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act: N/A

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 15,803,875 Common Shares.

Indicate by check mark if the Company is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the Company is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☒ No ☐

Indicate by check mark whether the Company (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the Company was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Company has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Company was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the Company is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | | Accelerated filer ☐ |

| Non-accelerated filer ☒ | | Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the Company has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued By the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to previous question, indicate by check mark which financial statement item the Company has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the Company is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

TABLE OF CONTENTS

INTRODUCTION

In this Annual Report on Form 20-F (the “Annual Report”), the term “Company”, or “Engine” refers to Engine Gaming and Media, Inc. and its subsidiaries as a whole, unless otherwise specified or the context otherwise requires.

Information contained in this Annual Report is given as of August 31, 2022, the fiscal year end of Company, unless otherwise specifically stated.

Market and industry data used throughout this Annual Report was obtained from various publicly available sources. Although the Company believes that these independent sources are generally reliable, the accuracy and completeness of such information are not guaranteed and have not been verified due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and the limitations and uncertainty inherent in any statistical survey of market size, conditions and prospects.

Statements made in this Registration Statement concerning the contents of any contract, agreement or other document are summaries of such contracts, agreements or documents and are not complete descriptions of all of their terms. If we file any of these documents as an exhibit to this Registration Statement, you may read the document itself for a complete description of its terms.

Unless otherwise indicated in this Annual Report, references to “$”, “US$” or “U.S. dollars” are to United States dollars, references to “Canadian dollars” or “CDN$” are to the currency of Canada, and references to “EUR”, “€” or “Euros” are to European Euros.

The following table sets forth the rate of exchange for the Canadian dollar, expressed in United States dollars in effect at various times.

| Canadian Dollars to U.S. Dollars | | Year Ended August 31, 2022 | | | Year Ended August 31, 2021 | |

| High for period | | | 0.8111 | | | | 0.8306 | |

| Low for period | | | 0.7612 | | | | 0.7465 | |

| Average rate for period | | | 0.7863 | | | | 0.7887 | |

| Rate at end of period | | | 0.7627 | | | | 0.7926 | |

As of December 28, 2022, the closing exchange rate for Canadian dollars in terms of the United States dollar, as quoted by the Bank of Canada, was CDN$1.00 = US$0.7372.

The following table sets forth the rate of exchange for the Canadian dollar, expressed in Euros in effect at various times.

| Canadian Dollars to Euros | | Year Ended August 31, 2022 | | | Year Ended August 31, 2021 | |

| High for period | | | 0.7754 | | | | 0.6840 | |

| Low for period | | | 0.6649 | | | | 0.6357 | |

| Average rate for period | | | 0.7167 | | | | 0.6598 | |

| Rate at end of period | | | 0.7598 | | | | 0.6709 | |

As of December 28, 2022, the closing exchange rate for Canadian dollars in terms of Euros, as quoted by the Bank of Canada, was CDN$1.00 = EUR€0.6934.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains “forward-looking statements” and “forward-looking information” within the meaning of United States and Canadian securities laws (collectively, “forward-looking statements”). These statements relate to future events or future performance and reflect the Company’s expectations and assumptions regarding such future events and performance. In particular, all statements, other than historical facts, included in this Annual Report that address activities, events or developments that management of the Company expect or anticipate will or may occur in the future are forward-looking statements, including but not limited to, statements with respect to:

| ● | financial, operational and other projections and outlooks as well as statements or information concerning future operation plans, objectives, performance, revenues, growth, acquisition strategy, profits or operating expenses; |

| ● | the Company’s ability to successfully execute its business plan; |

| ● | any expectation of regulatory approval and receipt of certifications with respect to the Company’s current and proposed business transactions; |

| ● | expectations regarding existing products and plans to develop, implement or adopt new technology or products; |

| ● | the expectation of obtaining new customers for the Company’s products and services, as well as expectations regarding expansion and acceptance of the Company’s brand and products to new markets; |

| ● | estimates and projections regarding the industry in which the Company operates and adoption of technologies, including expectations regarding the growth and impact of esports; |

| ● | requirements for additional capital and future financing options; |

| ● | the risks inherent in international operations; |

| ● | marketing plans; |

| ● | the Company’s ability to compete with its competitors and their technologies; |

| ● | the Company’s reliance on key executives and the ability to attract and retain qualified personnel; |

| ● | the availability of intellectual property protection for the Company’s products, and the Company’s ability to expand and exploit its intellectual property; |

| ● | statements related to the expected or potential impact of the novel coronavirus (“COVID-19”) pandemic; |

| ● | the completion of and the Company’s use of the proceeds of any offering; and |

| ● | other expectations of the Company. |

Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

Such statements, made as of the date hereof, reflect the Company’s current views with respect to future events and are based on information currently available to the Company and are subject to and involve certain known and unknown risks, uncertainties, assumptions and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed in or implied by such forward-looking statements. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected.

When relying on forward-looking statements to make decisions, readers should ensure that the preceding information, the risk factors described herein under in Item 3.D – Risk Factors, and the contents of this Annual Report are all carefully considered. These forward-looking statements are made as of the date of this Annual Report, and, except as may be required by law, the Company disclaims any obligation or undertaking to publicly release any updates or revisions to any forward-looking statements contained herein to reflect any change in expectations, estimates and projections with regard thereto or any changes in events, conditions or circumstances on which any statement is based. Readers should not place undue importance on forward-looking statements and should not rely upon this information as of any other date. In addition to the disclosure contained herein, for more information concerning the Company’s various risks and uncertainties, please refer to the Company’s periodic public filings available under its profile on the SEC’s (as defined below) Electronic Data Gathering, Analysis and Retrieval system (“EDGAR”) at www.sec.gov and the Canadian System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com.

STATUS AS AN EMERGING GROWTH COMPANY

We are an “emerging growth company” as defined in Section 3(a) of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”) by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. We will continue to qualify as an “emerging growth company” until the earliest to occur of: (a) the last day of the fiscal year during which we had total annual gross revenues of US$1,235,000,000 (as such amount is indexed for inflation every 5 years by the United States Securities and Exchange Commission (“SEC”)) or more; (b) the last day of our fiscal year following the fifth anniversary of the date of the first sale of equity securities pursuant to an effective registration statement under the United States Securities Act of 1933, as amended (the “Securities Act”); (c) the date on which we have, during the previous 3-year period, issued more than US$1,000,000,000 in non-convertible debt; or (d) the date on which we are deemed to be a “large accelerated filer”, as defined in Exchange Act Rule 12b-2. We expect to continue to be an emerging growth company for the immediate future.

Generally, a registrant that registers any class of its securities under Section 12 of the Exchange Act is required to include in the second and all subsequent annual reports filed by it under the Exchange Act a management report on internal control over financial reporting and, subject to an exemption available to registrants that are neither an “accelerated filer” or a “large accelerated filer” (as those terms are defined in Exchange Act Rule 12b-2), an auditor attestation report on management’s assessment of internal control over financial reporting. However, for so long as we continue to qualify as an emerging growth company, we will be exempt from the requirement to include an auditor attestation report on management’s assessment of internal controls over financial reporting in its annual reports filed under the Exchange Act, even if we were to qualify as an “accelerated filer” or a “large accelerated filer”. In addition, Section 103(a)(3) of the Sarbanes-Oxley Act of 2002 (the “SOX”) has been amended by the JOBS Act to provide that, among other things, auditors of an emerging growth company are exempt from any rules of the Public Company Accounting Oversight Board requiring a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the company.

Foreign Private Issuer Filings

We are considered a “foreign private issuer” pursuant to Rule 405 promulgated under the Securities Act. In our capacity as a foreign private issuer, we are exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act and the rules under the Exchange Act with respect to their purchases and sales of our shares. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as United States companies whose securities are registered under the Exchange Act. In addition, we are not required to comply with Regulation FD, which restricts the selective disclosure of material information. For as long as we are a “foreign private issuer” we intend to file our annual financial statements on Form 20-F and furnish our quarterly financial statements on Form 6-K to the SEC for so long as we are subject to the reporting requirements of Section 13(g) or 15(d) of the Exchange Act. However, the information we file or furnish may not be the same as the information that is required in annual and quarterly reports on Form 10-K or Form 10-Q for United States domestic issuers. Accordingly, there may be less information publicly available concerning us than there is for a company that files as a domestic issuer.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We are required to determine our status as a foreign private issuer on an annual basis at the end of our second fiscal quarter. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by United States residents and any of the following three circumstances applies: (1) the majority of our executive officers or directors are United States citizens or residents; (2) more than 50% of our assets are located in the United States; or (3) our business is administered principally in the United States. If we lose our “foreign private issuer status” we would be required to comply with Exchange Act reporting and other requirements applicable to United States domestic issuers, which are more detailed and extensive than the requirement for foreign private issuers.

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

The Company’s operations and financial performance are subject to the normal risks of its industry and are subject to various factors which are beyond the control of the Company. Certain of these risk factors are described below. The risks described below are not the only ones facing the Company. Additional risks not currently known to the Company, or that it currently considers immaterial, may also adversely impact the Company’s business, operations, financial results or prospects, should any such other events occur.

Risks Associated with the Business and Industry of the Company

Liquidity concerns and future financings

Although the Company has been successful in the past in financing its activities, there can be no assurance that it will be able to obtain additional financing as and when needed in the future to execute its business plan and future operations. The ability of the Company to arrange such financing in the future will depend in part upon the prevailing capital market conditions as well as the business performance of the Company. It may be difficult or impossible for the Company to obtain financing on commercially acceptable terms. This may be further complicated by the limited market liquidity for shares of smaller companies such as the Company, restricting access to some institutional investors. There is a risk that interest rates will increase given the current historical low level of interest rates. An increase in interest rates could result in a significant increase in the amount that the Company pays to service future debt incurred by the Company and affect the Company’s ability to fund ongoing operations.

Failure to obtain additional financing on a timely basis could also result in delay or indefinite postponement of further development of its products. Such delay would have a material and adverse effect on the Company’s business, financial condition and results of operations.

The Company may not be able to successfully execute its business plan

The execution of the Company’s business plan poses many challenges and is based on a number of assumptions. The Company may not be able to successfully execute its business plan. If the Company’s business plan is more costly than anticipated or there are significant cost overruns, certain products and development activities may be delayed or eliminated or the Company may be compelled to secure additional funding (which may or may not be available) to execute its business plan. The Company cannot predict with certainty its future revenues or results from its operations. If the assumptions on which revenue or expenditure forecasts are based change, the benefits of the Company’s business plan may change as well. In addition, the Company may consider expanding its business beyond what is currently contemplated in its business plan. Depending on the financing requirements of a potential acquisition or new product opportunity, the Company may be required to raise additional capital through the issuance of equity or debt. If the Company is unable to raise additional capital on acceptable terms, the Company may be unable to pursue a potential acquisition or new product opportunity.

Difficulties integrating acquisitions and strategic investments

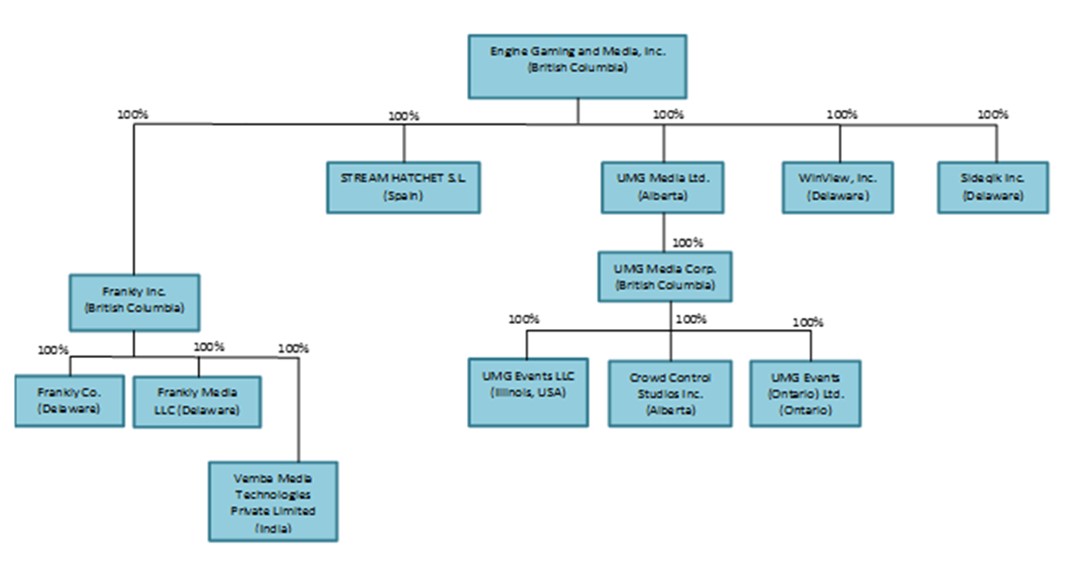

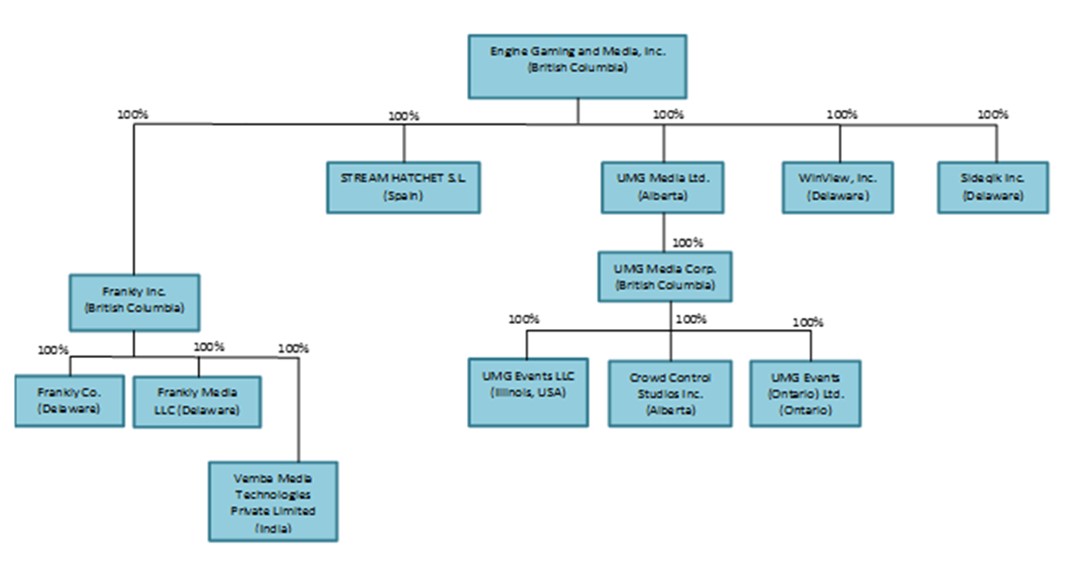

The Company has acquired businesses, personnel and technologies in the past and expects to continue to pursue acquisitions, such as the completed acquisitions of Frankly Inc. (“Frankly”), WinView, Inc,. (“WinView”), Stream Hatchet S.L (“Stream Hatchet”), SideQik, Inc. (“SideQik”), and other investments that are complementary to the existing business, and expanding the employee base and the breadth of the Company’s offerings. The Company’s ability to grow through future acquisitions will depend on the availability of suitable acquisition and investment candidates at an acceptable cost, the ability to compete effectively to attract these candidates and the availability of financing to complete larger acquisitions. Since the Company expects the esports industry to consolidate in the future, the Company may face significant competition in executing its growth strategy. Future acquisitions or investments could result in potential dilutive issuances of equity securities, use of significant cash balances or incurrence of debt, and contingent liabilities or amortization expenses related to goodwill and other intangible assets, any of which could adversely affect the financial condition and results of operations of the Company. The benefits of an acquisition or investment may also take considerable time to develop, and the Company cannot be certain that any particular acquisition or investment will produce the intended benefits.

The above risks and difficulties, if they materialize, could disrupt the Company’s ongoing business, distract management, result in the loss of key personnel, increase expenses and otherwise have a material adverse effect on the Company’s business, results of operations and financial performance.

Management of growth

The Company has grown rapidly since its inception and it plans to continue to grow at a rapid pace. This growth has put significant demands on the Company’s processes, systems and personnel.

The Company may be subject to growth-related risks including capacity constraints and pressure on its internal systems and controls. The ability of the Company to manage growth effectively will require it to continue to implement and improve its operational and financial systems and to expand, train and manage its employee base. Managing the Company’s growth will require significant expenditures and allocation of valuable management resources. The inability of the Company to deal with this growth may have a material adverse effect on the Company’s business, financial condition, results of operations and prospects.

The Company may continue to have reduced cash reserves

The Company expects its cash reserves will be reduced due to future operating losses, working capital requirements, capital expenditures, and potential acquisitions and other investments by its business, and the Company cannot provide certainty as to how long its cash reserves will last or that it will be able to access additional capital when necessary.

The Company expects to incur continued losses and generate negative cash flow until it can produce sufficient revenues to cover its costs. The Company may never become profitable. Even if the Company does achieve profitability, it may be unable to sustain or increase profitability in the future. For the reasons discussed in more detail below, there are substantial uncertainties associated with the Company achieving and sustaining profitability. The Company expects its cash reserves will be reduced due to future operating losses, and working capital requirements, and the Company cannot provide certainty as to how long its cash reserves will last or that it will be able to access additional capital if and when necessary.

Competition

The Company’s failure to compete successfully in its various markets could have a material adverse effect on the Company’s business, financial condition and results of operations. The market for the various types of product and service offerings of the Company is very competitive and rapidly changing. The Company faces competition from other esports businesses, many of which are larger and better funded than the Company. There can be no guarantee that the Company’s current and future competitors will not develop similar or superior services to the Company’s products and services which may render the Company uncompetitive. Increasing competition could result in fewer future customers, reduced revenue, reduced sales margins and loss of market share, any one of which could harm the business of the Company.

Players in the current market face a vast array of entertainment choices. Other forms of entertainment, such as offline, traditional online, personal computer and console games, television, movies, sports and the Internet are much larger and more well-established markets and may be perceived by the Company’s customers to offer greater variety, affordability, interactivity and enjoyment. These other forms of entertainment compete for the discretionary time and income of the Company’s customers. If the Company is unable to sustain sufficient interest in its products and services in comparison to other forms of entertainment, including new forms, the business model may no longer be viable.

For a detailed description of the competitive environment faced by the Company, see Item 4.B. – Business Overview – Competitive Conditions.

Security and privacy breaches

Security or privacy breaches may result in an interruption of service or a reduced quality of service, which could increase the Company’s costs or result in a reduction in the use of the Company’s services by its customers. The Company’s systems may be vulnerable to physical break-ins, computer viruses, attacks by computer hackers or similar disruptive problems. If unauthorized users gain access to the Company’s databases, they may be able to steal, publish, delete or modify sensitive information that is stored or transmitted on the Company’s networks and which the Company is required by its contracts to keep confidential. A security or privacy breach could result in an interruption of service or a reduced quality of service. Confidential information internal to the Company may also be disclosed to unauthorized personnel who may use such information in a manner adverse to the Company’s interests. Hackers may attempt to “flood” the network, thereby preventing legitimate network traffic or to disrupt the network, thereby preventing access to a service or preventing a particular individual from accessing a service. The Company may therefore be required to make significant expenditures in connection with corresponding corrective or preventive measures. In addition, a security or privacy breach may harm the Company’s reputation and cause its customers to reduce their use of the Company’s services, which could harm the Company’s revenue and business prospects. In addition, the Company’s revenue may be adversely affected by un-captured usage, in the event that the Company’s system is “hacked”, resulting in transmissions that may not be detected by its billing system. Further, the increase in traffic as a result of such unauthorized “hacking” may slow or overload the Company’s transmission network, thereby adversely affecting the overall quality of services which the Company provides to its paying customers. If the Company incurs any such losses or liabilities, the Company’s operating results, financial condition, business and prospects may be adversely affected.

The development of high-quality products requires substantial up-front expenditures

Consumer preferences for games are usually cyclical and difficult to predict, and even the most successful titles remain popular for only limited periods of time, unless refreshed with new content or otherwise enhanced. In order to remain competitive, the Company must continuously develop new products or enhancements to existing products. The amount of lead time and cost involved in the development of high-quality products is increasing, and the longer the lead time involved in developing a product and the greater the allocation of financial resources to such product, the more critical it is that the Company accurately predicts consumer demand for such product. If its future products do not achieve expected consumer acceptance or generate sufficient revenues upon introduction, the Company may not be able to recover the substantial development and marketing costs associated with those products.

Rapid technological changes

Rapid technological changes may increase competition and render the Company’s technologies, products or services obsolete or cause the Company to lose market share. The online gaming, influencer and media software industries is subject to rapid and significant changes in technology, frequent new service introductions and evolving industry standards. Such changes may adversely affect the Company’s revenue. There can be no assurance that the Company can improve the features, functionality, reliability and responsiveness of infrastructure. Similarly, the technologies that the Company employs may become obsolete or subject to intense competition from new technologies in the future. If the Company fails to develop, or obtain timely access to, new technologies, or if it fails to obtain the necessary licenses for the provision of services using these new technologies, the Company may lose market share, and its results of operations would be adversely affected.

Failure to license necessary third party software for use in the Company’s products and services, or failure to successfully integrate third party software, could cause delays or reductions in the Company’s sales, or errors or failures of the Company’s service

The Company licenses third party software that it incorporates into its products and services. In the future, the Company might need to license other software to enhance its products and meet evolving customer requirements. These licenses may not continue to be available on commercially reasonable terms or at all. Some of this technology could be difficult to replace once integrated. The loss of, or inability to obtain, these licenses could result in delays or reductions of the Company’s applications until it identifies, licenses and integrates or develops equivalent software, and new licenses could require the Company to pay higher royalties. If the Company is unable to successfully license and integrate third party technology, it could experience a reduction in functionality and/or errors or failures of the Company’s products, which may reduce demand for its products and services.

Third-party licenses may expose the Company to increased risks, including risks associated with the integration of new technology, the impact of new technology integration on existing technology, open source software disclosure risks, the diversion of resources from the development of the Company’s own proprietary technology, and inability to generate revenue from new technology sufficient to offset associated acquisition and maintenance costs.

Proprietary protection and intellectual property disputes

Protection of the trade secrets, copyrights, trademarks, domain names and other product rights of the Company are important to its success. The Company protects its intellectual property rights by relying on trademark protection, common law rights as well as contractual restrictions. However, many of the Company’s proprietary technologies are currently unpatented nor has the Company made any applications for such intellectual property registrations and has no present intention to do so in the near future. As such, the current steps that it takes to protect its intellectual property, including contractual arrangements, may not be sufficient to prevent the misappropriation of its proprietary information or deter independent development of similar technologies by others.

Should the Company decide to register its intellectual property in one or more jurisdictions, it will be an expensive and time consuming process and there is no assurance that the Company will be successful in any or all of such jurisdictions. The absence of registered intellectual property rights, or the failure to obtain such registrations in the future, may result in the Company being unable to successfully prevent its competitors from imitating its solutions or using some or all of its processes. Even if patents and other registered intellectual property rights were to be issued to the Company, its intellectual property rights may not be sufficiently comprehensive to prevent its competitors from developing similar competitive products and technologies.

Litigation may be necessary to enforce the intellectual property rights of the Company. Any litigation of this nature, regardless of outcome or merit, could result in substantial costs, adverse publicity or diversion of management and technical resources, any of which could adversely affect the business and operating results of the Company. Moreover, due to the differences in foreign patent, trademark, copyright and other laws concerning proprietary rights, the Company’s intellectual property may not receive the same degree of protection in foreign countries as it would in Canada or the United States. The Company’s failure to possess, obtain or maintain adequate protection of its intellectual property rights for any reason could have a material adverse effect on its business, results of operations and financial condition.

The Company may also face allegations that it has infringed the trademarks, copyrights, patents and other intellectual property rights of third parties, including from its competitors and former employers of the Company’s personnel. Whether a product infringes a patent or other intellectual property right involves complex legal and factual issues, the determination of which is often uncertain.

System failures, delays and other technical problems

System failures, delays and other technical problems could harm the Company’s reputation and business, causing the Company to lose customers and expose it to customer liability. The Company may experience failures or interruptions of its systems and services, or other problems in connection with its operations as a result of, amongst other things:

| | ● | damage to, or failure of, its computer software or hardware or its infrastructure and connections; |

| | ● | data processing errors by its systems; |

| | ● | computer viruses or software defects; and |

| | ● | physical or electronic break-ins, sabotage, intentional acts of vandalism and similar events. |

If the Company cannot adequately ensure that its network services perform consistently at a high level or otherwise fail to meet its customers’ expectations:

| | ● | it may experience damage to its reputation, which may adversely affect its ability to attract or retain customers who participate in online esports tournaments; |

| | ● | its operating expenses or capital expenditures may increase as a result of corrective actions that the Company must perform; or |

| | ● | one or more of its significant contracts may be terminated early, or may not be renewed. |

Transmission of User Data

The Company transmits and stores a large volume of data. The Company is subject to legislation and regulations on the collection, storage, retention, transmission, and use of user-data that it collects. The Company’s efforts to protect the personal information of its users, partners and clients may be unsuccessful due to the actions of third parties, software bugs or technical malfunctions, employee error or malfeasance, or other factors. In addition, third parties may attempt to fraudulently induce employees or users to disclose information in order to gain access to the Company’s data, users’ data, partners’ data or clients’ data. If any of these events occur, users’, partners’ or clients’ information could be accessed or disclosed improperly. Any incidents involving the unauthorized access to or improper use of the information of users or incidents involving violation of the Company’s terms of service or policies could damage the Company’s reputation and brands and diminish its competitive position. Moreover, affected users, clients or governmental authorities could initiate legal or regulatory action against the Company in connection with such incidents, which could cause the Company to incur significant expense and liability or result in orders or consent decrees forcing the Company to modify its business practices and remediate the effects of any such incidents of unauthorized access or use. Any of these events could have a material adverse effect on the Company’s prospects, businesses, financial condition or results of operations.

Data collection risks

The Company partially relies on data captured by Stream Hatchet for its revenues and for assessing the performance of some of its brands. Capturing accurate data is subject to various limitations. For example, Stream Hatchet may need to collect certain data from mobile carriers or other third parties such as various viewing platforms, which limits the Company’s ability to verify the reliability of such data. Further, Stream Hatchet may not be able to collect any data from third parties at all. Failure to capture accurate data or an incorrect assessment of this data may materially harm business and operating results.

Global economy

The business of the Company is subject to general economic conditions. Adverse changes in general economic and market conditions could adversely impact demand for the Company’s products, prices, revenue, operating costs, results of financing efforts, and the timing and extent of capital expenditures.

Foreign operational risks

A significant portion of the business and operations of the Company is conducted in foreign jurisdictions, including the United States, and Spain. As such, the Company’s business and operations may be adversely affected by changes in foreign government policies and legislation or social instability and other factors which are not within the control of the Company, including, but not limited to, renegotiation or nullification of existing contracts or licenses, changes in policies, regulatory requirements or the personnel administering them, economic sanctions, risk of terrorist activities, revolution, border disputes, implementation of tariffs and other trade barriers and protectionist practices, volatility of financial markets, labour disputes and other risks arising out of foreign governmental sovereignty over the areas in which the Company’s business is conducted. The Company’s operations may also be adversely affected by laws and policies of such foreign jurisdictions affecting foreign trade, taxation and investment.

If the Company’s operations are disrupted and/or the economic integrity of its contracts is threatened for unexpected reasons, its business may be harmed. In the event of a dispute arising in connection with the Company’s operations in a foreign jurisdiction where the Company conducts or will conduct its business, the Company may be subject to the exclusive jurisdiction of foreign courts or may not be successful in subjecting foreign persons to the jurisdictions of the courts of Canada or enforcing Canadian judgments in such other jurisdictions. The Company may also be hindered or prevented from enforcing its rights with respect to a governmental instrumentality because of the doctrine of sovereign immunity. Accordingly, the Company’s activities in foreign jurisdictions could be substantially affected by factors beyond their control, any of which could have a material adverse effect on the Company. The Company believes that its management is sufficiently experienced to manage these risks.

Regulation

The Company is subject to general business regulations and laws as well as regulations and laws specifically governing the internet, gaming, e-commerce and electronic devices. Existing and future laws and regulations may impede the Company’s growth or strategy. These regulations and laws cover taxation, privacy, data protection, pricing, content, copyrights, distribution, mobile communications, consumer protection, web services, wagering, the provision of online payment services, websites and the characteristics and quality or products and services. Unfavourable changes in regulations and laws could decrease demand for the Company’s events, online offering and merchandise, increase its cost of doing business or otherwise have a material adverse effect on the Company’s reputation, popularity, results of operations and financial condition.

The Company has never paid dividends and may not do so in the foreseeable future

The Company has never paid cash dividends on the common shares in its capital (the “Common Shares”). Currently, the Company intends to retain its future earnings, if any, to fund the development and growth of its business, and does not anticipate paying any cash dividends on its Common Shares in the near future. As a result, shareholders will have to rely on capital appreciation, if any, to earn a return on investment in any Common Shares in the foreseeable future.

The market price for Common Shares has been volatile in the past, and may be subject to fluctuations in the future

The market price of the Common Shares may be volatile and subject to wide fluctuations in response to numerous factors, many of which are beyond the Company’s control. This volatility may affect the ability of holders of Common Shares to sell their securities at an advantageous price. Market price fluctuations in the Common Shares may be due to the Company’s operating results failing to meet expectations of securities analysts or investors in any period, downward revision in securities analysts’ estimates, adverse changes in general market conditions or economic trends, acquisitions, dispositions or other material public announcements by the Company or its competitors, along with a variety of additional factors. These broad market fluctuations may adversely affect the market price of the Common Shares.

Financial markets historically at times experienced significant price and volume fluctuations that have particularly affected the market prices of equity securities of companies and that have often been unrelated to the operating performance, underlying asset values or prospects of such companies. Accordingly, the market price of the Common Shares may decline even if the Company’s operating results, underlying asset values or prospects have not changed. Additionally, these factors, as well as other related factors, may cause decreases in asset values that are deemed to be other than temporary, which may result in impairment losses. There can be no assurance that continuing fluctuations in price and volume will not occur. If such increased levels of volatility and market turmoil continue, the Company’s operations could be adversely impacted and the trading price of the Common Shares may be materially adversely affected.

Emerging diseases, like COVID-19, may adversely affect the Company’s operations, suppliers, or customers

Emerging diseases, like COVID-19, and government actions to address them, may adversely affect the Company’s operations, suppliers, or customers. The COVID-19 pandemic continues to evolve rapidly and, as a result, it is difficult to accurately assess its continued magnitude, outcome and duration, but it could:

| | ● | worsen economic conditions, which could negatively impact access to capital; |

| | | |

| | ● | reduce consumer spending; |

| | | |

| | ● | limit the Company’s employees from travelling which could affect the execution of the Company’s business plan given the Company is multi-jurisdictional; or |

| | | |

| | ● | result in governmental regulation adversely impacting the Company’s business |

all of which could have a material adverse effect on the Company’s business, financial condition and results of operations, which could be rapid and unexpected.

Retention and acquisition of new CMS platform customers

Our financial performance and operations are dependent in part on retaining our current CMS platform customers and acquiring new CMS platform customers. We currently serve a large number of customers with our CMS platform and a typical customer contract runs for multiple years. However, we compete with the other technology providers in the market and increasing competition may affect our ability to retain current and acquire new customers. Any number of factors could potentially negatively affect our customer retention or acquisition. For example, a current customer may request products or services that we currently do not provide and may be unwilling to wait until we can develop or source such additional features. Other factors that affect our ability to retain or acquire new CMS platform customers include:

| | ● | customers increasingly use competing products or services; |

| | ● | we fail to introduce new and improved products or if we introduce new products or services that are not favorably received; |

| | ● | we are unable to continue to develop new products and services that work with a variety of mobile operating systems and networks and/or that have a high level of market acceptance; |

| | ● | there are changes in customer preference; |

| | ● | there is consolidation or vertical integration of our customers; |

| | ● | there are changes in customer sentiment about the quality or usefulness of our products and services; |

| | ● | there are adverse changes in our products that are mandated by legislation, regulatory authorities, or litigation, including settlements or consent decrees; |

| | ● | technical or other problems prevent us from delivering our products in a rapid and reliable manner; |

| | ● | we fail to provide adequate customer service to our customers; or |

| | ● | we, our software developers, or other companies in our industry are the subject of adverse media reports or other negative publicity. |

Exposure to advertising marketplace

A significant portion of our projected revenue is generated from the sale of national and local online advertising inventory, which is dependent on available advertising inventory and market demand and prices for such inventory. A decline in available supply of advertising inventory, general demand for advertising inventory and general economic conditions may materially and adversely affect our advertising revenue. Changes in advertising technologies, rules and regulations may also have a material adverse effect on our advertising revenue.

A significant portion of our projected revenue is generated from the sale of national and local online advertising inventory, the majority of which we sell on an automated basis through real-time bidding. We also sell a small portion of our inventory to premium direct advertising customers to whom we provide guaranteed advertisement inventory. Our advertising revenue is dependent on the amount of advertising inventory that is available to us to sell and market demand and prices for such inventory.

The amount of advertising inventory available for us to sell is affected by many variables including but not limited to:

| | ● | the negotiated amount of inventory we receive from our current CMS customers; |

| | ● | the amount of additional inventory our current CMS customers permit us to sell on their behalf; |

| | ● | our ability to acquire inventory to sell on behalf of parties that are not customers of our CMS; |

| | ● | the amount of inventory available on our owned and operated properties; |

| | ● | the amount of end-user traffic to our customers’ and our online properties; and |

| | ● | the specific type of advertising to be sold, such as display, video or mobile advertising. |

While we endeavor to maximize the amount of inventory, we are able to sell, some of the foregoing variables, and by extension the amount of inventory we may sell, are affected by market forces and other contingencies that we do not control.

The other principal component of gross advertising revenue is the price at which advertising inventory may be sold. To a large extent, the prices we are able to achieve for our advertising inventory are a product of the market supply and demand, which may vary based on several factors including ad size, ad type, geographic region and time of year. At a macro level, advertising spending is also sensitive to overall economic conditions, and our advertising revenues will be adversely affected if advertisers respond to weak and uncertain economic conditions, for example as a result of disruptions from COVID-19, by reducing their budgets or changing their spending patterns. There are limitations on the amount that we can compensate for fluctuations in the prevailing market prices for advertising inventory. Any reduction in spending by existing or potential advertisers and a decline in available advertising inventory or demand for such inventory would negatively affect our advertising revenue and could affect our ability to grow our advertising customer base.

Volatility of Revenues and Expenses

We may experience wide fluctuations in reported revenue and earnings from one period to another due to seasonality in revenue streams, short-term nature of some customer agreements and engagements, gain or loss of customer agreements, one-time other non-recurring revenues and expenses. Additionally, we may experience wide-fluctuations in revenues and expenses due to required accounting treatment of certain non-cash items, including the accounting treatment of the liability for our outstanding warrants and convertible debt. Because of the nascent nature and stage of some of our assets, investments, and intangibles, and difficulty in assessing their valuation, we may be required from time to time to impair, write down or otherwise adjust the carrying value of these assets, investments and intangibles, and such impairments and write-downs may have a material impact on our reported earnings.

Cybersecurity threats

A cyber incident is an intentional or unintentional event that could threaten the integrity, confidentiality or availability of the Company’s information resources. These events include, but are not limited to, unauthorized access to information systems, a disruption to our information systems, or loss of confidential information. Engine’s primary risks that could result directly from the occurrence of a cyber incident include operational interruption, damage to our public image and reputation, and/or potentially impact the relationships with our customers.

We have implemented processes, procedures and controls to mitigate these risks, including, but not limited to, firewalls and antivirus programs and training and awareness programs on the risks of cyber incidents. These procedures and controls do not guarantee that the financial results may not be negatively impacted by such an incident.

Proposed legislation in the U.S. Congress, including changes in U.S. tax law, and the recently enacted Inflation Reduction Act of 2022 may adversely impact the Company and the value of the Common Shares.

Changes to U.S. tax laws (which changes may have retroactive application) could adversely affect the Company or holders of the Common Shares. In recent years, many changes to U.S. federal income tax laws have been proposed and made, and additional changes to U.S. federal income tax laws are likely to continue to occur in the future.

The U.S. Congress is currently considering numerous items of legislation which may be enacted prospectively or with retroactive effect, which legislation could adversely impact the Company’s financial performance and the value of the Common Shares. Additionally, states in which the Company operates or owns assets may impose new or increased taxes. If enacted, most of the proposals would be effective for 2022 or later years. The proposed legislation remains subject to change, and its impact on the Company and purchasers of the Common Shares is uncertain.

In addition, the Inflation Reduction Act of 2022 was recently signed into law and includes provisions that will impact the U.S. federal income taxation of corporations. Among other items, this legislation includes provisions that will impose a minimum tax on the book income of certain large corporations and an excise tax on certain corporate stock repurchases that would be imposed on the corporation repurchasing such stock. It is unclear how this legislation will be implemented by the U.S. Department of the Treasury and the Company cannot predict how this legislation or any future changes in tax laws might affect the Company or purchasers of the Common Shares.

Risks Related to Our Securities

The Company’s Foreign Private Issuer status under United States Securities Laws.

The Company is a “foreign private issuer”, under applicable United States federal securities laws, and is, therefore, not subject to the same requirements that are imposed upon United States domestic issuers by the SEC. Under the Exchange Act, the Company is subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of United States domestic reporting companies. As a result, the Company does not file the same reports that a United States domestic issuer would file with the SEC, although the Company is required to file with or furnish to the SEC the continuous disclosure documents that it is required to file in Canada under Canadian securities laws. In addition, the Company’s officers, directors, and principal shareholders are exempt from the reporting and short-swing profit recovery provisions of Section 16 of the Exchange Act. Therefore, the Company’s shareholders may not know on as timely a basis when the Company’s officers, directors and principal shareholders purchase or sell Common Shares, as the reporting periods under the corresponding Canadian insider reporting requirements are longer.

As a foreign private issuer, the Company is exempt from the rules and regulations under the Exchange Act related to the furnishing and content of proxy statements. The Company is also exempt from Regulation FD, which prohibits issuers from making selective disclosures of material non-public information. While the Company complies with the corresponding requirements relating to proxy statements and disclosure of material non-public information under Canadian securities laws, these requirements differ from those under the Exchange Act and Regulation FD and shareholders should not expect to receive the same information at the same time as such information is provided by United States domestic companies. In addition, the Company may not be required under the Exchange Act to file annual and quarterly reports with the SEC as promptly as U.S. domestic companies whose securities are registered under the Exchange Act.

In order to maintain its status as a foreign private issuer, a majority of the Common Shares must be either directly or indirectly owned by non-residents of the United States unless the Company also satisfies one of the additional requirements necessary to preserve this status. The Company may in the future lose its foreign private issuer status if a majority of its Common Shares are held in the United States and if the Company fails to meet the additional requirements necessary to avoid loss of its foreign private issuer status. The regulatory and compliance costs under United States federal securities laws as a United States domestic issuer may be significantly more than the costs incurred as a Canadian foreign private issuer using the standard foreign form or as Canadian foreign private issuer eligible to use the multi-jurisdictional disclosure system adopted by the securities regulatory authorities in United States and Canada (“MJDS”). If the Company is not a foreign private issuer, it would not be eligible to use the MJDS or other foreign issuer forms and would be required to file periodic and current reports and registration statements on United States domestic issuer forms with the SEC, which are more detailed and extensive than the forms available to a foreign private issuer.

The Company is an emerging growth company and relies on exemptions from certain disclosure requirements which may make its Common Shares less attractive to investors.

The Company is an “emerging growth company” as defined in section 3(a) of the Exchange Act (as amended by the JOBS Act, enacted on April 5, 2012), and the Company will continue to qualify as an emerging growth company until the earliest to occur of: (a) the last day of the fiscal year during which the Company has total annual gross revenues of US$1,235,000,000 (as such amount is indexed for inflation every five years by the SEC) or more; (b) the last day of the fiscal year of the Company following the fifth anniversary of the date of the first sale of common equity securities of the Company pursuant to an effective registration statement under the Securities Act, as amended; (c) the date on which the Company has, during the previous three year period, issued more than US$1,000,000,000 in non-convertible debt; and (d) the date on which the Company is deemed to be a “large accelerated filer”, as defined in Rule 12b-2 under the Exchange Act. The Company will qualify as a large accelerated filer (and would cease to be an emerging growth company) at such time when on the last business day of its second fiscal quarter of such year the aggregate worldwide market value of its common equity held by non-affiliates will be US$700,000,000 or more.

For so long as the Company remains an emerging growth company, it is permitted to and intends to rely upon exemptions from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include not being required to comply with the auditor attestation requirements of Section 404 of SOX. The Company cannot predict whether investors will find its Common Shares less attractive because the Company relies upon certain of these exemptions. If some investors find the Common Shares less attractive as a result, there may be a less active trading market for the Common Shares and the Common Share price may be more volatile. On the other hand, if the Company no longer qualifies as an emerging growth company, the Company would be required to divert additional management time and attention from the Company’s development and other business activities and incur increased legal and financial costs to comply with the additional associated reporting requirements, which could negatively impact the Company’s business, financial condition and results of operations.

Our failure to meet the continued listing requirements Nasdaq could result in a delisting of our securities.

On June 23, 2022, we received a letter from the Listing Qualifications Department of The Nasdaq Stock Market LLC indicating that, based upon the closing bid price of our Common Shares for the 30 consecutive business day period prior to June 23, 2022, we did not meet the minimum bid price of $1.00 per share required for continued listing on the Nasdaq Capital Market (“Nasdaq”) pursuant to Nasdaq Listing Rule 5550(a)(2). The letter also indicated that we will be provided with a compliance period of 180 calendar days, or until December 20, 2022 (the “Compliance Period”), in which to regain compliance pursuant to Nasdaq Listing Rule 5810(c)(3)(A). On December 21, 2022 we received a 180 calendar day extension to the initial Compliance Period.

In order to regain compliance with Nasdaq’s minimum bid price requirement, our Common Shares must maintain a minimum closing bid price of $1.00 for at least ten consecutive business days during the Compliance Period. In the event we do not regain compliance by the end of the Compliance Period, we may be eligible for additional time to regain compliance. To qualify, we will be required to meet the continued listing requirement for the market value of its publicly held shares and all other initial listing standards for Nasdaq, with the exception of the bid price requirement, and will need to provide written notice of our intention to cure the deficiency during the second compliance period, including by effecting a reverse stock split if necessary. If we meet these requirements, we may be granted an additional 180 calendar days to regain compliance. However, if it appears to Nasdaq that we will be unable to cure the deficiency, or if we are not otherwise eligible for the additional cure period, Nasdaq will provide notice that our Common Shares will be subject to delisting.

If we fail to satisfy the continued listing requirements of Nasdaq, such as minimum bid price requirements, Nasdaq may take steps to delist our Common Shares. Such a delisting would have a materially adverse effect on the price of our Common Shares, impair the ability to sell or purchase our Common Shares when persons wish to do so, and materially adversely affect our ability to raise capital or pursue strategic restructuring, refinancing or other transactions on acceptable terms, or at all. Delisting from Nasdaq could also have other negative results, including the potential loss of institutional investor interest and fewer business development opportunities, as well as a limited amount of news and analyst coverage. In the event of a delisting, we would attempt to take actions to restore our compliance with Nasdaq’s listing requirements, but we can provide no assurance that any such action taken by us would allow our securities to become listed again, stabilize the market price or improve the liquidity of our securities, prevent our Common Shares from dropping below the Nasdaq minimum bid price requirement or prevent future non-compliance with Nasdaq’s listing requirements.

| ITEM 4. | INFORMATION ON THE COMPANY |

| A. | History and Development of the Company |

Name, Address and Incorporation

The Company was incorporated as “Stratton Capital Corp.” under the Business Corporations Act (Ontario) pursuant to articles of incorporation on April 8, 2011. On October 19, 2016, the Company filed Articles of Amendment changing its name from “Stratton Capital Corp.” to “Millennial Esports Corp.”

On June 7, 2019, the Company filed Articles of Amendment to effect a consolidation of the Common Shares on the basis of one post-consolidation Common Share for every fifteen pre-consolidation Common Shares. On October 17, 2019, the Company filed Articles of Amendment to (i) change its name from “Millennial Esports Corp.” to “Torque Esports Corp.”, and (ii) to effect a consolidation of the Common Shares on the basis of one post-consolidation Common Share for every five pre-consolidation Common Shares.

On August 13, 2020, the Company filed Articles of Amendment to (i) change its name from “Torque Esports Corp.” to “Engine Gaming and Media, Inc.”, and (ii) to effect a consolidation of the Common Shares on the basis of one post-consolidation Common Share for every fifteen pre-consolidation Common Shares.

On December 18, 2020, the Company filed a Continuance Application with the British Columbia Registrar of Companies to continue into British Columbia under the Business Corporation Act (British Columbia) (the “BCBCA”).

On October 19, 2021, the Company changed its name from “Engine Media Holdings, Inc.” to “Engine Gaming and Media, Inc.”

The head office of the Company is located at 2110 Powers Ferry Road SE, Suite 450, Atlanta, GA 30339 and the registered office of the Company is located at 77 King Street West, Suite 3000, PO Box 95, Toronto, Ontario M5K 1G8, telephone number +1(647)725-7765.

The Company is a reporting issuer in the provinces of Alberta, British Columbia, Ontario, Saskatchewan, Manitoba, New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland. The Common Shares are listed and posted for trading on the TSX Venture Exchange (the “TSXV”) under the trading symbol “GAME” and on Nasdaq under the symbol “GAME”.

The SEC maintains an internet site (http://www.sec.gov) that contains report, proxy and information statements and other information regarding issuers that file electronically with the SEC. Such information can also be found on the Company’s website (http://www.enginegaming.com).

Three Year History

The following is a description of how the business of the Company developed over the three most recently completed financial years and the current financial year.

Fiscal Year Ended August 31, 2020

Frankly Arrangement and WinView Merger

On March 10, 2020, the Company, Frankly and WinView announced that they had entered into a business combination agreement dated March 9, 2020 (the “Business Combination Agreement”) where the three companies agreed to form an integrated news, gaming, sports and esports platform (the “FW Transaction”).

On May 8, 2020, the Company acquired all of the issued and outstanding common shares of Frankly in exchange for consideration of one Engine Common Share for each Frankly common share acquired, pursuant to a court approved plan of arrangement under the BCBCA, resulting in the issuance of 2,216,607 Common Shares upon closing the business combination. All outstanding convertible securities of Frankly were exchanged for equivalent securities of the Company (other than outstanding warrants to purchase common shares of Frankly, which remain outstanding and have the terms of such securities adjusted to reflect the exchange ratio). The Company also concurrently indirectly acquired WinView, pursuant to a statutory merger under the laws of the State of Delaware, with WinView securityholders receiving an aggregate of 1,759,997 Common Shares of the Company as well as certain contingent consideration. The contingent consideration entitles WinView holders to proceeds from the enforcement of WinView’s patent portfolio, equal to 50% of the net license fees, damages awards or settlement amounts collected from third parties, with such payments to be calculated after deduction of certain amounts. In connection with the transaction, it was announced that the combined company would be co-led by Darren Cox and Frankly Chief Executive Officer Lou Schwartz, and WinView Executive Chairman Tom Rogers, who also served as Chairman of Frankly, would serve as Executive Chairman of the combined company.

For more information on the FW Transaction, see the Company’s business acquisition report dated November 13, 2020 on www.sedar.com.

Convertible Debentures

On August 19, 2020, the Company closed a first tranche of a non-brokered private placement of convertible debentures in the amount of US$5,750,000 (“2020 Convertible Debentures”). The 2020 Convertible Debentures will mature 24 months from the date of issuance and bear interest at a rate of 5% per annum (subject to the following adjustments), payable on maturity. At the Company’s option, interest under the 2020 Convertible Debentures is payable in kind in Common Shares at an issue price which would be based on the trading price of the Common Shares at the time of such interest payment. The interest rate under the 2020 Convertible Debentures will increase from 5% to 10% per annum on a prospective basis on December 19, 2020, if a public offering has not occurred by that date. The 2020 Convertible Debentures holders may convert all or a portion of the principal amount of the 2020 Convertible Debentures into units of the Company at a price equal to the lesser of (a) US$11.25 per unit, and (b) if such conversion occurs after a public offering of securities by the Company, a 15% discount to the public offering price, provided that such conversion price shall not be less than US$7.50 per unit. Notwithstanding the foregoing, if by December 19, 2020, the Company has not obtained registration rights in the United States to allow sale in the United States of the Common Shares of the Company and the exercise of Warrants of the Company to be issued pursuant to the conversion of the 2020 Convertible Debentures, holders of 2020 Convertible Debentures may convert such convertible debentures into units at US$7.50 per unit. As of December 19, 2020, the Company had not obtained registration rights in the United States. As such, the conversion price is US$7.50 per unit and the interest rate increased to 10% on December 19, 2020.

Each unit is comprised of one Common Share and one-half of one warrant, with each Warrant exercisable into one Common Share of the Company at an exercise price of US$15.00 per share for a period of three years from the issuance of the 2020 Convertible Debentures. Under certain circumstances, the Company shall be entitled to call for the exercise of any outstanding Warrants in the event.

Acquisition of Interest in One Up Group

On August 25, 2020, Engine announced it completed the acquisition of a 20.48% interest in mobile gaming company One Up Group, LLC (“One Up”). One Up operates the OneUp mobile app, which allows gamers to organize and play one-on-one matches with other gamers and compete for money. The purchase price was satisfied with the issuance of principal amount US$3 million convertible debentures, having the same terms as the 2020 Convertible Debentures, except that references therein to US$7.50 have been changed to US$9.50.

Fiscal Year Ended August 31, 2021

Financings

On September 15, 2020, the Company closed the final tranche of 2020 Convertible Debentures in the amount of US$1,901,393.

On October 16, 2020, the Company announced that it closed a first tranche of principal amount US$1,050,000 of the first US$2,000,000 draw of a US$8,000,000 stand-by convertible debenture facility (“Standby Debentures”). The Standby Debentures have substantially similar terms as the 2020 Convertible Debentures, described above, except the following: (i) the references therein to a minimum US$7.50 conversion price have been changed to US$8.90; and (ii) the Standby Debentures are only convertible into Common Shares of the Company, not units.

On October 16, 2020, the Company announced that it closed a principal US$1 million convertible debenture financing which has similar terms to the 2020 Convertible Debentures, described above, except the references therein to US$7.50 have been changed to US$7.80.

On November 20, 2020, the Company announced that it closed the final tranche of the previously announced US$2,000,000 draw of the Standby Debentures, for total proceeds of US$950,000. In connection with the Standby Debentures, the Company issued 224,719 Warrants, with each Warrant exercisable into a Common Share at an exercise price of US$15.00 until November 20, 2024.

On December 2, 2020, the Company announced that its wholly-owned subsidiaries Frankly Media LLC and Frankly have amended the existing secured credit facility (as amended, the “EB Loan”) with arm’s length lender EB Acquisition Company, LLC (the “EB Lender”), in connection with the advance of an additional US$1,000,000 under the EB Loan, which is convertible at the option of the EB Lender, at a conversion price per share of US$11.25. The credit limit under the EB Loan of US$5 million is now fully drawn. In connection with the amendment, the maturity date of the EB Loan has been extended from January 5, 2021 until January 5, 2022. Additionally, the Company has guaranteed the obligations under the EB Loan and has granted a security interest in favour of the EB Lender over the assets of the Company. In consideration of the extension of the maturity date, the Company has agreed to issue to the EB Lender an aggregate of 6,666 Common Shares and an amendment fee of US$100,000 which forms part of the outstanding principal under the EB Loan. The Common Shares issuable will be subject to a hold period expiring four months and a day following the date of issuance, as well as restrictions on transfer under applicable securities laws.

On January 8, 2021 the Company settled convertible debentures (the “Debt Settlements”) of an aggregate principal amount of US$10,726,393 in outstanding convertible debentures through the issuance of 1,430,186 units at a deemed price of US$7.50 per unit, with each unit consisting of a Common Share and three-quarters of a warrant, with each whole Warrant exercisable into a Common Share at an exercise price of US$15.00 per share for a period of three years. Included in the Debt Settlements was the US$3,000,000 convertible debenture that was issued in connection with the Company’s acquisition of an interest in One Up.

On December 23, 2020, the Company announced its intention to complete a non-brokered private placement of up to approximately 3,300,000 units at a price of US$7.50 per unit for gross proceeds of up to US$25,000,000 (“December 2020 Private Placement”). Each Unit consists of one Common Share and one-half of one common share purchase warrant. Each whole Warrant entitles the holder to acquire one additional Common Share of the Company at a price of US$15.00 per share for a period of 3 years provided that: (i) if the Common Shares are listed for trading on Nasdaq, (ii) the Company completes an offering of securities under a short form prospectus for an aggregate amount of at least US$30,000,000, and (iii) the closing price of the Common Shares on Nasdaq is US$30.00 or greater for a period of 15 consecutive trading days, then the Company may accelerate the expiry date of the warrants to the 30th day after the date written notice is provided to the holders.

On January 8, 2021, the Company closed the first tranche of the December 2020 Private Placement for aggregate gross proceeds of US$10,540,883 and 1,405,451 units were issued. The Company paid cash commissions to eligible finders totaling US$284,989 and also issued the following securities as partial payment of commissions to finders: 36,948 units; and, 74,947 finders warrants, with each finder warrant exercisable into a common share at an exercise price of US$15.00 per share for 3 years subject to the same acceleration terms described above.

In January and February 2021, the Company completed multiple tranches of equity financings totaling 4,371,767 units at an issue price of US$7.50 per unit, for gross proceeds of US$32,788,253. Each unit consisted of one Common Share and one-half of one Common Share purchase warrant. Each whole Warrant entitles the holder to acquire one additional share of the Company at a price of US$15.00 per share for a period of 3 years provided that: (i) if the Common Shares are listed for trading on Nasdaq, (ii) the Company completes an offering of securities under a short form prospectus for an aggregate amount of at least $30,000,000, and (iii) the closing price of the Common Shares on Nasdaq is $30.00 or greater for a period of 15 consecutive trading days, then the Company may accelerate the expiry date of the warrants to the 30th day after the date written notice is provided to the holders.

On February 26, 2021 the EB Lender converted the EB Loan into a US$5,000,000 secured convertible debenture, which is convertible into units of the Company at a conversion price of US$10.25 per unit. Each such unit is comprised of one Common Share and one-half of one common share purchase warrant, with each whole Warrant exercisable into a Common Share at an exercise price of US$15.00 per share for a period of three years from the issuance of the convertible debenture.

On March 25, 2021, the Company filed a final short form base shelf prospectus (with the securities regulators in each province of Canada, except for the Province of Québec) (the “Base Shelf Prospectus”) and a corresponding shelf registration statement on Form F-10 with the SEC. The prospectus and registration statement allow the Company to offer up to US$150 million of common shares, preference shares, warrants, subscription receipts, debt securities, units, or any combination thereof during the 25-month period that the shelf prospectus is effective.

On June 7, 2021, the Company received approval to list its shares on Nasdaq. The Company’s Common Shares commenced trading on Nasdaq on June 17, 2021.

On August 10, 2021, the Company entered into an at-the-market Equity Distribution Agreement (the “Equity Distribution Agreement”) with Canaccord Genuity LLC (“Canaccord”), on behalf of itself and co-sales agents Oppenheimer & Co. Inc. and B. Riley Securities, Inc., to establish an at-the-market equity program (the “ATM Program”). Under the ATM Program, the Company will have the flexibility through the expiration date of its Base Shelf Prospectus to issue up to US$50 million of Common Shares as needed to support the Company’s ongoing business activities. Any Common Shares sold under the ATM Program will be sold at the prevailing market price at the time of sale, when sold through Nasdaq. No Common Shares will be offered or sold in Canada. As of the date hereof, the Company has not yet issued any shares under the ATM Program.

Patent Lawsuits against DraftKings and FanDuel