UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number: 333-222784

JINXUAN COKING COAL LIMITED

(Exact Name of Registrant as Specified in its Charter)

N/A

(Translation of Registrant’s Name into English)

Cayman Islands

(Jurisdiction of Incorporation or Organization)

Xiangyang Guo, Chief Executive Officer

Jinxuan Coking Coal Limited

South Zhonghuan Street 529, C-12, rooms 1204 and 1205

Taiyuan, Shanxi, PRC

+ 86 – 351 – 7020402

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | | Name of Each Exchange on Which Registered |

| Ordinary shares, par value $0.001 | | None |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

An aggregate of 13,333,334 Ordinary Shares, par value US$0.001 per share, as of April 25, 2018.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨Nox

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes¨Nox

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YesxNo¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YesxNo¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAPx | | International Financial Reporting Standards as issued by the International Accounting Standards Board¨ | | Other ¨ |

| * | If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17¨Item 18¨ |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨Nox

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes¨No¨

TABLE OF CONTENTS

INTRODUCTION

Unless the context otherwise requires, in this annual report on Form 20-F references to:

| • | “we,” “us,” “our,” “Company,” or similar terms refer to Jinxuan Coking Coal Limited, a Cayman Islands company; |

| • | “China” or the “PRC” are to the People’s Republic of China, excluding Taiwan and the special administrative regions of Hong Kong and Macau for the purposes of this annual report only; |

| • | “BVI” British Virgin Islands; |

| • | “Securities Exchange Commission,” “SEC,” “Commission” or similar terms refer to the Securities Exchange Commission; |

| • | “Exchange Act” refers to the Securities Exchange Act of 1934; |

| • | “fiscal year” are to the period from January 31 of each calendar year to December 31 of the following calendar year; |

| • | “Securities Act” refers to the Securities Act of 1933; |

| • | “GAAP” are to generally accepted accounting principles in the United States, or U.S. GAAP; |

| • | “Sarbanes-Oxley Act” refers to the Sarbanes-Oxley Act of 2002; |

| • | “OTC” are OTC Markets Group, Inc.; |

| | • | “Shares” or “Ordinary Share” are our Ordinary Shares, par value $0.001 per share; |

| • | “IPO” or “Offering” are to the initial public offering by the Company of up to 1,000,000 Ordinary Shares, par value $0.001 per share, at $0.08 per share; |

| • | “RMB” or “Renminbi” are to the legal currency of China; |

| | • | “US$,” “U.S. dollars,” or “dollars” are to the legal currency of the United States; |

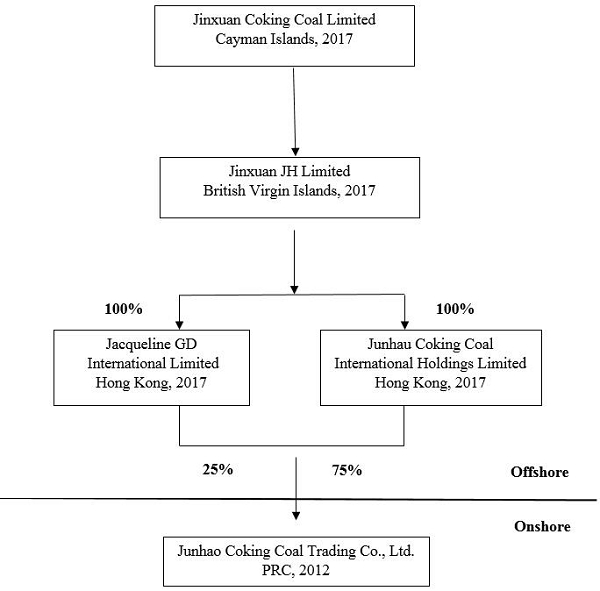

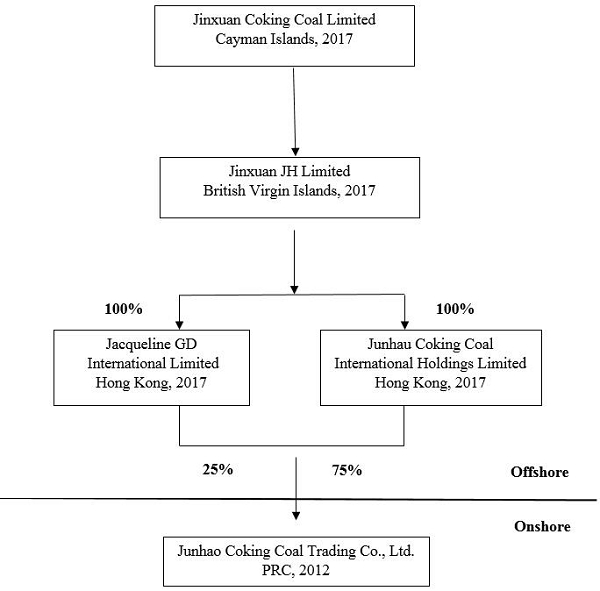

| | • | “Jacqueline HK” are to Jacqueline G.D International Limited, our wholly owned subsidiary incorporated in Hong Kong which holds 25% of Liulin Junhao’s equity interest; |

| | • | “Junhao HK” are to Junhao Coking Coal International Holding Limited, our wholly owned subsidiary incorporated in Hong Kong which holds 75% of Liulin Junhao’s equity interest; |

| • | “Liulin Junhao” or “WFOE” are to Liulin Junhao Coal Trade Co. Ltd., a wholly owned PRC subsidiary of the Company; and |

| • | “Jinxuan BVI” are to Jinxuan JH Limited, a limited company formed in British Virgin Islands, our British Virgin Islands subsidiary. |

GLOSSARY OF SELECTED MINING TERMS

Anthracite coal. A hard natural coal containing few volatile hydrocarbons which burns slowly and gives intense heat almost without flame.

Ash. Impurities consisting of silica, iron, alumina and other incombustible matter that are contained in coal. Since ash increases the weight of coal, it adds to the cost of handling and can affect the burning characteristics of coal.

Bituminous coal. A common type of coal with moisture content less than 20% by weight. It is dense and black and often has well-defined bands of bright and dull material.

British thermal unit, or "Btu". A measure of the thermal energy required to raise the temperature of one pound of pure liquid water one degree Fahrenheit at the temperature at which water has its greatest density (39 degrees Fahrenheit).

Coke. A hard, dry carbon substance produced by heating coal to a very high temperature in the absence of air. Coke is used in the manufacture of iron and steel. Its production results in a number of useful by-products.

Hard coking coal. Hard coking coal is a type of metallurgical coal that is a necessary ingredient in the production of strong coke. It is evaluated based on the strength, yield and size distribution of coke produced from such coal which is dependent on rank and plastic properties of the coal. Hard coking coals trade at a premium to other coals due to their importance in producing strong coke and as they are a limited resource.

Industrial coal. Coal generally used as a heat source in the production of lime, cement, or for other industrial uses and is not considered thermal coal or metallurgical coal.

Metallurgical coal. The various grades of coal with suitable carbonization properties to make coke or be used as a pulverized injection ingredient for steel manufacture, including hard coking coal (see definition above), semi-soft coking coal (SSCC) and PCI coal (see definition below). Also known as "met" coal, its quality depends on four important criteria: (1) volatility, which affects coke yield; (2) the level of impurities including sulfur and ash, which affect coke quality; (3) composition, which affects coke strength; and (4) other basic characteristics that affect coke oven safety. Met coal typically has particularly high Btu characteristics but low ash and sulfur content.

Nitrogen oxide (NOx). Produced as a gaseous by-product of coal combustion. It is a harmful pollutant that contributes to smog.

PCI Coal. Coal used by steelmakers for pulverized coal injection (PCI) into blast furnaces to use in combination with the coke used to produce steel. The use of PCI allows a steel maker to reduce the amount of coke needed in the steel making process.

Preparation plant. Preparation plants are usually located on a mine site, although one plant may serve several mines. A preparation plant is a facility for crushing, sizing and washing coal to remove impurities and prepare it for use by a particular customer. The washing process has the added benefit of removing some of the coal's sulfur content.

Reserve. That part of a mineral deposit that could be economically and legally extracted or produced at the time of the reserve determination.

Sulfur. One of the elements present in varying quantities in coal that contributes to environmental degradation when coal is burned. Sulfur dioxide is produced as a gaseous by-product of coal combustion.

Thermal coal. Coal used by power plants and industrial steam boilers to produce electricity, steam or both. It generally is lower in Btu heat content and higher in volatile matter than metallurgical coal.

Tons. A "short" or net ton is equal to 2,000 pounds. A "metric" ton is approximately 2,205 pounds; a "long" or British ton is equal to 2,240 pounds. Unless otherwise indicated, the metric ton is the unit of measure referred to in this document. The international standard for quoting price per ton is based in U.S. dollars per metric ton.

Discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

This annual report on Form 20-F includes our audited consolidated financial statements for the years ended December 31, 2015, 2016 and 2017.

This annual report contains translations of certain Renminbi amounts into U.S. dollars at specified rates. Unless otherwise stated, the translation of Renminbi into U.S. dollars has been made at RMB6.7547 to US$1.00, the noon buying rate in effect on December 31, 2017 as set forth in the H.10 Statistical Release of the Federal Reserve Board. We make no representation that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, the rates stated below, or at all. The PRC government imposes controls over its foreign currency reserves in part through direct regulation of the conversion of Renminbi into foreign exchange and through restrictions on foreign trade. On April 20, 2018, the noon buying rate was RMB 6.2945 to US$1.00.

We are in the process of offering up to 1,000,000 Ordinary Shares at $0.08 per share pursuant to our IPO. We have not received any proceeds from the IPO as of the date of this annual report on Form 20-F.

Part I

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

Item 3. KEY INFORMATION

A.Selected Financial Data

The following table sets forth selected historical statements of operations for the years ended December 31, 2017 and 2016, and balance sheet data as of December 31, 2017 and 2016, which have been derived from our audited consolidated financial statements included elsewhere in this annual report. The consolidated financial statements are prepared and presented in accordance with GAAP. Historical results are not necessarily indicative of the results for any future periods.

The selected consolidated statements of comprehensive income data for the year ended December 31, 2017 and 2016.

Selected Statements of Operations Information:

| | | For Year

ended December 31, | | | For Year

ended December 31, | |

| | | 2017 | | | 2016 | |

| | | US$ | | | US$ | |

| | | | | | | |

| Statements of Comprehensive Income Data: | | | | | | | | |

| Revenue | | $ | 179,757 | | | $ | 19,589,747 | |

| Cost of revenue | | | 99,274 | | | | 17,200,450 | |

| Gross profit | | | 80,483 | | | | 2,389,297 | |

| Selling expenses | | | 104,730 | | | | 1,121,950 | |

| Administrative expenses | | | 722,291 | | | | 260,715 | |

| Results from operating activities | | | (746,538 | ) | | | 1,006,632 | |

| Net other income | | | 878 | | | | 478 | |

| (Loss) profit before tax | | | (745,660 | ) | | | 1,007,110 | |

| Tax expenses | | | - | | | | 257,549 | |

| (Loss) profit for the year | | | (745,660 | ) | | | 749,561 | |

| Foreign currency translation gain (loss) | | | 65,254 | | | | (80,262 | ) |

| Comprehensive (loss) income for the year | | | (680,406 | ) | | | 669,299 | |

| | | | | | | | | |

| Basic and dilutive (loss) earnings per share | | | (0.056 | ) | | | 0.056 | |

Selected Balance Sheet Information:

| | | As of December

31, 2017 | | | As of December

31, 2016 | |

| | | US$ | | | US$ | |

| | | | | | | |

| Statements of Financial Position Data: | | | | | | | | |

| Cash and cash equivalents | | | 4,116 | | | | 55,798 | |

| Total assets | | | 1,357,988 | | | | 2,239,495 | |

| Total equity | | | 746,426 | | | | 1,426,832 | |

| Current liabilities | | | 611,562 | | | | 812,642 | |

| Total liabilities | | | 611,562 | | | | 812,642 | |

Exchange Rate Information

Our business is primarily conducted in China and all of our revenues are received, and all of our expenses are paid, and denominated in RMB. Capital accounts of our condensed financial statements are translated into United States dollars from RMB at their historical exchange rates when the capital transactions occurred. Assets and liabilities are translated at the exchange rates as of the balance sheet date. Income and expenditures are translated at the average exchange rate of the period. RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into United States dollars at the rates used in translation.

The following table sets forth information concerning exchange rates between the RMB and the United States dollar for the periods indicated.

| | | Period Ended December 31, (1) | | | Average (2) | |

| 2015 | | | 6.4778 | | | | 6.2869 | |

| 2016 | | | 6.9430 | | | | 6.6549 | |

| 2017 | | | 6.7547 | | | | 6.6423 | |

| 2018 (through April 30, 2017) | | | 6.3393 | | | | 6.3478 | |

| January, 2017 | | | 6.8768 | | | | 6.8907 | |

| February, 2017 | | | 6.8665 | | | | 6.8694 | |

| March, 2017 | | | 6.8832 | | | | 6.8940 | |

| April, 2017 | | | 6.8900 | | | | 6.8876 | |

| May, 2017 | | | 6.8098 | | | | 6.8843 | |

| June, 2017 | | | 6.7793 | | | | 6.8066 | |

| July, 2017 | | | 6.7362 | | | | 6.7718 | |

| August, 2017 | | | 6.5888 | | | | 6.6670 | |

| September, 2017 | | | 6.6533 | | | | 6.5690 | |

| October, 2017 | | | 6.6328 | | | | 6.6264 | |

| November, 2017 | | | 6.6090 | | | | 6.6200 | |

| December, 2017 | | | 6.5127 | | | | 6.5942 | |

| January, 2018 | | | 6.3339 | | | | 6.4364 | |

| February, 2018 | | | 6.3294 | | | | 6.3162 | |

| March, 2018 | | | 6.2881 | | | | 6.3220 | |

| April, 2018 | | | 6.3393 | | | | 6.2975 | |

| (1) | The exchange rates reflect the noon buying rate in effect in New York City for cable transfers of RMB as released by the People’s Bank of China. |

| (2) | Annual averages are calculated from month-end rates. Monthly averages are calculated using the average of the daily rates during the relevant period. |

B.Capitalization and Indebtedness

Not applicable.

C.Reasons for the Offer and Use of Proceeds

Not applicable.

D.Risk Factors

Risks Relating to our Business and Industry

Our limited operating history makes evaluating our business difficult.

Incepted in 2012, we started generating revenue in the year ended December 31, 2015. Thus, our limited operating history may not provide a meaningful basis for you to evaluate our business, financial performance and prospects. We are, and expect for the foreseeable future to be, subject to all the risks and uncertainties, inherent in a new business. Accordingly, you should consider our prospects in light of the costs, uncertainties, delays and difficulties frequently encountered by companies with a limited operating history. In particular, you should consider that there is a significant risk that we may not be able to:

·restore and maintain profitability;

· preserve our leading position in the market of high quality blended coking coal;

· acquire and retain customers;

· attract, train, motivate and retain qualified personnel;

· keep up with evolving industry standards and market developments;

· successfully implement our marketing and growth strategy;

· respond to competitive market conditions;

· maintain adequate control of our expenses;

· manage our relationships with our suppliers and customers; or

·protect our proprietary technologies.

If we are unsuccessful in addressing any of these risks, our business may be materially and adversely affected.

We may continue to incur losses, negative cash flows from operating activities and net current liabilities in the future. If we are not able to return to profitability or raise sufficient capital to cover our capital needs, we may not continue as a going concern.

We incurred a net loss of $745,660 for the year ended December 31, 2017 as compared to net gain of $749,561 for the year ended December 31, 2016, as our sales in 2017 was limited due to significant impact to our access to raw coking coal supply in 2017 by coal production limitations imposed by various levels of the PRC governments and we incurred IPO related expenses in 2017. In 2015, we recorded a net loss of $12,993, as we began our operations in 2015. Our ability to achieve profitability depends on the competitiveness of our products and services as well as our ability to control costs and to provide new products and services to meet the market demands and attract new customers. Due to the numerous risks and uncertainties associated with our business, we may not be able to achieve profitability in the short-term or long-term.

In addition, our net cash used in operations for the year ended December 31, 2017 was $875,222, net cash provided by operations for the year ended December 31, 2016 was $1,242,537, and net cash used in operations for the year ended December 31, 2017 was $18,648. The net cash used in operating activities for the year ended December 31, 2017 included $380,233 IPO related expenses and $104,743 for selling expenses. See “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Results of Operations.” We cannot assure you that our liquidity position will improve in the future. If we are unsuccessful at generating revenues through more sales of our blending coking coal products, we may continue to incur losses, negative cash flows from operating activities and net current liabilities, which may materially and adversely affect our business, prospects, liquidity, financial condition and results of operations.

If we are unable to achieve profitability or raise sufficient capital to cover our capital needs, we may not continue as a going concern. There can be no assurance that we can obtain additional financing. Our ability to obtain additional financing is subject to a number of factors, which may be beyond our control. See “—We may not be able to obtain additional financing to support our business and operations, and our equity or debt financings may have an adverse effect on our business operations and share price.”

Our consolidated financial statements for each of the three years ended December 31, 2017, 2016 and 2015 included in this annual report beginning on page F-1 have been prepared based on the assumption that we will continue on a going concern basis. The auditors of our consolidated financial statements have included in their audit reports an explanatory paragraph relating to substantial doubt about our ability to continue as a going concern. Our consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts of liabilities that might result from the outcome of this uncertainty.

We are primarily a holding company and depend on distributions from our subsidiaries to meet our financial obligations.

Our company has an offshore holding structure commonly used by corporations seeking public offering in a foreign jurisdiction with operations in China. We own Liulin Junhao directly through Jinxuan BVI. Our operations are conducted exclusively through Liulin Junhao, in which we own 100% of the equity interest at the date of this annual report. The operations of Liulin Junhao are our sole source of revenues. We have no operations independent of those of Liulin Junhao. As a result, we are dependent upon the performance of Liulin Junhao and will be subject to the financial, business and other factors affecting such subsidiary as well as general economic and financial conditions. As substantially all of our operations are conducted through our subsidiary, we are dependent on the cash flow of our subsidiary to meet our obligations.

Because virtually all of our assets are held by Liulin Junhao, the claims of our shareholders will be structurally subordinate to all existing and future liabilities and obligations, and trade payables of such subsidiary. In the event of a bankruptcy, liquidation or reorganization of the Company, our assets and those of our subsidiaries’ will be available to satisfy the claims of our shareholders only after all of Liulin Junhao’s liabilities and obligations have been paid in full.

Our future operating results have been and may continue to be affected by fluctuations in raw material prices. We may not be able to pass on cost increases to customers.

We are subject to short-term coking coal price volatility and have purchased and may continue to have to purchase raw coking coal at higher prices. Our operating profits may be negatively affected by fluctuations in the price of raw coking coal. In the past, we have been able to pass the cost increase of raw coking coal on to customers but may not be able to do so in the future. This may adversely affect our gross margins and profitability. Our sales agreements with customers generally contain provisions that permit the parties to adjust the contract price of the blended coking coal upward or downward at specified times or if market spot price of coking coal fluctuates significantly. However, in the event that raw materials we sourced for specific customers increased to such extent and we fail to agree on a price with our customer under these provisions or otherwise pass on cost increases to the customers, many agreements permit customers to terminate the contract or refuse to buy all of the quantities contracted for. Market prices for raw coking coal fluctuate in most regions in China. Additionally, high quality raw coking coal is critical to our maintaining operating efficiencies and delivering blended coking coal to our customers that meets their specifications. Since high quality raw coking coal is more limited in supply, its price tends to be more volatile. A general rise in coking coal prices also may adversely affect the price of, and demand for, coke and products made with coke such as iron, steel and concrete. This may in turn lead to a fall in demand for our products.

If we are unable to successfully operate and manage our production operations, we may experience a decrease in revenues.

As we ramp up our production operations to accommodate our planned growth, we may encounter difficulties associated with increasing production scale, including shortages of qualified personnel to operate our equipment or manage manufacturing operations, as well as shortages of key raw materials for our products. In addition, we may also experience difficulties in producing sufficient quantities of products or in achieving desired product quality. If we are unable to successfully operate and manage our production operations to meet our needs, we may not be able to provide our customers with the quantity or quality of products they require in a timely manner. This could cause us to lose customers and result in reduced revenues.

Our future capital needs are uncertain and we may need to raise additional funds in the future.

In addition to the proceeds of the IPO that we expect to receive, we may require additional cash resources in the future due to changed business conditions or other future developments. We cannot assure you that our revenues will be sufficient to meet our operational needs and capital requirements in the future. In the past, we have not encountered difficulties in obtaining financing. However, we cannot assure you that financing will be available in amounts or on terms acceptable to us. Our future capital needs and other business reasons could require us to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity or equity-linked securities could result in additional dilution to our shareholders. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations or our ability to pay dividends to our shareholders.

Our success depends substantially on the continued retention of certain key personnel and our ability to hire and retain qualified personnel in the future to support our growth and execute our business strategy.

If one or more of our senior executives or other key personnel are unable or unwilling to continue in their present positions, our business may be disrupted and our financial condition and results of operations may be materially and adversely affected. While we depend on the abilities and participation of our current management team generally, we rely particularly upon Xiangyang Guo, our CEO, and Liqin Yang, our CFO, who are responsible for the development and implementation of our business plan. The loss of the services of Xiangyang Guo, our CEO, and Liqin Yang, our CFO, for any reason could significantly adversely impact our business and results of operations. Competition for senior management and in the coal industry in the PRC is intense and the pool of qualified candidates is limited. We cannot assure you that the services of our senior executives and other key personnel will continue to be available to us, or that we will be able to find a suitable replacement for them if they were to leave.

If the legality or validity of the lease of the collective-owned land use rights is challenged, there may be disruption to our operation and such disruption could have a material adverse effect on our results of operations.

Our operation is based in a location leased from a related party, Liulin Hongxing Coking Coal Trade Co., Ltd. (“Hongxing”), who has the collective-owned land use rights of a parcel of land (about 62,826 square meters) in Bandi Village from September 2003 to September 2023. According to the PRC Laws on Land Administration, the collective-owned land use right shall not be leased, conveyed, or rented for non-agricultural construction, except in the case of legal transfer of the land that conforms to the comprehensive land use plan and is carried out legally by enterprises as a result of bankruptcy or acquisition.

Under current PRC laws on Land Administration the collective-owned land use rights and our lease may be subject to disputes or challenges by the relevant governmental departments and could be deemed unenforceable.

If the legality or validity of our leases become subject to disputes or challenges, we may need to suspend at least part of our operation on the respective land areas. We may incur costs and losses if we are required to remove our operation and the requisite machinery. We could also lose our rights to use the land and our business, financial condition and results of operations could be materially and adversely affected. See “Item 4. Information on the Company—B. Business Overview—Properties and Facilities” for more information.

A significant portion of our revenue is concentrated on a few large customers, and we do not have long-term customer supply agreements with our key customers and rely upon our longstanding relationship with them. If we lose one or more of our customers, our results of operations may be adversely and materially impacted.

For year ended December 31, 2017, we served two customers, Shanxi Jinquan Energy Co. Ltd and Liulin County Xin’an Yuanda Coking Coal Co. Ltd, consisting of 46% and 54% of our sales revenue, respectively. For the year ended December 31, 2016, 89.3% of our total sales were from four key customers, Shanxi Coking Coal Trade Co., Ltd., Hongxing, Shanxi Tianli Zhicheng Trading Co., Ltd and Shanxi Meijin Material Supply Co., Ltd. As a consequence, we may have large amounts of collectibles from these large customers. Additionally, all of our customers send us supply orders specifying the characteristics of blended coking coals that they require, and we supply them on an order-to-order basis without long-term supply agreements. If we lose one or more large customers like these, our sales revenue will decrease and our financial condition and results of operations may be materially adversely impacted.

We had sourced our raw materials primarily from a limited number of suppliers. If we lose one or more of the suppliers, our operation may be disrupted, and our results of operations may be adversely and materially impacted.

For the year ended December 31, 2017, we did not source raw coking coal from our suppliers and relied upon our raw coking coal reserves. In 2016, we sourced 28% of our raw materials from one supplier, and 72% from a second supplier. In 2015, we sourced 100% of our raw materials from one supplier. If we lose one or more suppliers and are unable to swiftly engage new suppliers, our production operation may continue to be disrupted and/or suspended, and we may not be able to deliver finished products to our customers on time. We may also have to pay a higher price to source from a different supplier on short notice. While we are actively searching for and negotiating with new suppliers and we are actively identifying and discussing with supplier targets to merge and/or acquire, there is no guarantee that we will be able to locate appropriate new suppliers and/or supplier merger targets in our desired timeline. As such, our results of operations may be adversely and materially impacted.

The suppliers that we sourced from were not able to provide us with the raw materials quantities we needed due to the coking coal production restrictions in the PRC. If we do not find reliable suppliers able to source us the quantity of raw materials we need in times of production restriction, our results of operations may be adversely and materially impacted.

For the year ended December 31, 2017, we have experienced significant difficulties in securing the quantity of raw materials coking coal needed to meet our customers’ needs, primarily due to the coking coal production limitations imposed both at the PRC national level, which resulted in an approximately 4% reduction in January to May of 2017 compared to the same period in 2016, and particularly at the Shanxi provincial level. Because we are a comparatively smaller customer, the major suppliers we previously sourced from have prioritized supply for other larger customers. While we have quickly transitioned our strategy to establish relationship with other suppliers who can either prioritize our orders or have better access to raw materials in times of production restriction, we cannot guarantee we will not encounter this in the near future, in which case, our operations will be disrupted and our revenues significantly and adversely impacted.

Increases in transportation costs could make our operations less competitive and result in the loss of customers.

Coal producers and processors depend upon rail, barge, trucking, overland conveyor and other systems to deliver coal to markets. We typically transport coal raw materials from our suppliers, and as such, increases in transportation costs will lead to less competitive pricing for our blended coking coal products. Additionally, since we arrange to transport our blended coking coal to our customers from our facilities to the point of use, any disruption of these transportation services because of weather-related problems, strikes, lock-outs or other events could temporarily impair our ability to supply coal to customers and thus could adversely affect our results of operations. For example, the high volume of raw coal shipped from all Shanxi Province mines could create temporary congestion on the rail systems servicing that region. If transportation for our blended coking coal becomes unavailable or uneconomic for our customers, our ability to sell blended coking coal could suffer. Transportation costs can represent a significant portion of the total cost of blended coal. Since our customers typically pay that cost, it is a critical factor in a distant customer’s purchasing decision. If transportation costs from our facilities to the customer’s facilities are not competitive, the customer may elect to purchase from another company.

We may not be able to meet quality specifications required by our customers and as a result could incur economic penalties or cancelled agreements which would reduce our sales and profitability.

Most of our blended coking coal sales agreements contain provisions requiring us to deliver coking coal meeting quality thresholds for certain characteristics such as BTUs, sulfur content, ash content, volatility and ash fusion temperature. If we are not able to meet these specifications, because, for example, we are not able to source coal of the proper quality, we may incur economic penalties, including price adjustments, the rejection of deliveries or termination of the contracts.

We do not have any registered patents or other intellectual property and we may not be able to maintain the confidentiality of our blending processes.

We have no patents covering our blending processes and we rely on the confidentiality of our blending processes in producing a competitive product. The confidentiality of our know-how may not be maintained and we may lose any meaningful competitive advantage which might arise through our proprietary processes.

Our insurance coverage may not be adequate. Any material loss to our properties or assets may have a material adverse effect on our financial condition and operations.

We and our subsidiaries and operating company are insured in amounts that may not adequately cover the risks of our business operations. As a result, any material loss or damage to our properties or other assets, or personal injuries arising from our business operations in excess of our insurance coverage may have a material adverse effect on our financial condition and operations.

Import of blended coking coal from other countries may continue to increase and may result in our obtaining lower prices for our products and/or reduced quantities in demand for our products.

Imported coking coal consisted of 11% and 8% of total coking coal consumption in the PRC in 2016 and 2017, respectively, and imported coking coal is increasingly used to bridge the supply and demand gap in the PRC market. Other than regulatory factors, the main obstacle in the slow growth of imported coking coal in the PRC is because the majority of coke making furnaces are configured to receive only coking coal with characteristics specific to the coking coal produced in the PRC, and re-configuration of the furnaces for them to receive imported coking coal is currently high. If more furnaces undergo re-configuration and new furnaces are put in use, imported coking coal may increasingly make up the coking coal consumption in the PRC. More inflow of imported coking coal may result in lower prices for our products and/or reduced quantities in demand for our products.

Because we are a Cayman Islands corporation and all of our business is conducted in the PRC, you may be unable to bring an action against us or our officers and directors or to enforce any judgment you may obtain.

We are incorporated in the Cayman Islands and conduct our operations primarily in China. Substantially all of our assets are located outside of the United States. In addition, all of our directors and officers reside outside of the United States. As a result, it may be difficult or impossible for you to bring an action against us or against these individuals in the Cayman Islands or in China in the event that you believe we have violated your rights, either under United States federal or state securities laws or otherwise, or if you have a claim against us. Even if you are successful in bringing an action of this kind, the laws of the Cayman Islands and of China may not permit you to enforce a judgment against our assets or the assets of our directors and officers.

Our lack of effective internal controls over financial reporting may affect our ability to accurately report our financial results or prevent fraud which may affect the market for and price of our Ordinary Share.

To implement Section 404 of the Sarbanes-Oxley Act of 2002, the SEC adopted rules requiring public companies to include a report of management on the company’s internal control over financial reporting. Prior to filing of our registration statement and prospectus, we were not subject to these rules. As a result, we do not have in place effective disclosure controls and procedures or internal controls over financial reporting. See “Item 15. Controls and Procedures—Internal Control over Financial Reporting.” We are subject to the requirement that we maintain internal controls and that management perform periodic evaluation of the effectiveness of the internal controls. Effective internal control over financial reporting is important to prevent fraud. As a result, our business, financial condition, results of operations and prospects, as well as the market for and trading price of our Ordinary Shares, may be materially and adversely affected if we do not have effective internal controls. We do not presently have the financial resources or personnel to develop or implement systems that would provide us with the necessary information on a timely basis so as to be able to implement financial controls. As a result, we may not discover any problems in a timely manner and current and potential shareholders could lose confidence in our financial reporting, which would harm our business and the trading price of our Ordinary Shares. The absence of internal controls over financial reporting may inhibit investors from purchasing our shares and may make it more difficult for us to raise funds in a debt or equity financing.

Because we are an “emerging growth company,” we may not be subject to requirements that other public companies are subject to, which could affect investor confidence in us and our Ordinary Shares.

We are an “emerging growth company,” as defined in the JOBS Act, and we intend to take advantage of certain exemptions from disclosure and other requirements applicable to other public companies that are not emerging growth companies including, most significantly, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act for so long as we are an emerging growth company. As a result, if we elect not to comply with such auditor attestation requirements, our investors may not have access to certain information they may deem important. See “Item 4.Information on the Company—A. History and Development of the Company— Emerging Growth Company Status.”

Substantial declines in coking coal prices may reduce our revenues, and sustained prices at those levels or lower levels may further reduce our revenues and adversely affect our operating results, cash flows, financial condition, and stock price.

Our results of operations are substantially dependent upon the prices we receive for our coking coal. The price for coking coal in the PRC market fluctuates significantly, ranging from RMB510 (approximately $75.22) to RMB1,177 (approximately $173.61) per ton in the years of 2015 and 2016. The price for coking coal in the PRC market ranged from RMB928 (approximately $137.39) to RMB1,528 (approximately $226.21) per ton in the year of 2017. Those prices depend upon factors beyond our control (some of which are described in more detail in other risk factors below), including:

| · | the demand for domestic and foreign coking coal, which depends significantly on the demand for steel; |

| · | the price restriction and/or production restriction for the coal industry and/or the steel industry; |

| · | the price and availability of natural gas and other alternative fuels; |

| · | competition from other suppliers of coking coal; |

| · | the regulatory and tax environment for our industry and those of our customers; and |

| · | the proximity to and availability, reliability and cost of transportation facilities. |

Fluctuating coking coal prices in the PRC may impose significant challenges for us to adjust our operation and production to meet the demands of our customers and ensure our access to raw materials, and may materially adversely affect our operating results and cash flows.

Lower demand for coking coal by PRC steel producers would reduce our revenues and could further reduce the price of our coking coal.

We produce coking coal that is used by PRC coke manufacturers to supply to the PRC steel industries. Any deterioration in conditions in the PRC steel industry, including the demand for steel and the continued financial viability of the industry, would reduce the demand for our coking coal. In addition, foreign steel industry increasingly relies on processes to make steel that do not use coke, such as electric arc furnaces or pulverized coal processes. If this trend becomes more popular in the PRC, the amount of coking coal that we sell and the prices that we receive for it may decrease, thereby reducing our revenues and adversely impacting our earnings.

Competition within the coal industry may adversely affect our ability to sell coking coal, and excess production capacity in the industry could put downward pressure on coal prices.

We compete with numerous other coking coal producers in various regions of the PRC and to a lesser extent, coking coal producers from other countries. See “Item 4. Information on the Company—B. Business Overview—Competition” for more information relating to the competitive landscape of the industry in which we compete. This competition affects the prices we are able to sell our products, and our ability to retain or attract customers. In addition, if the currencies of our foreign competitors decline against the RMB, those competitors may be able to offer lower prices to our customers than we can.

In the past, high demand for coal and attractive pricing brought new investors to the coal industry, leading to the development of new mines and added production capacity. Subsequent overcapacity in the industry has contributed, and may continue to contribute, to lower coal prices. In addition, lower coal prices set by our competitors may also put downward pressure on coal prices.

Our ability to collect payments from our customers could be impaired if their creditworthiness and financial health deteriorates.

Our ability to receive payment for coking coal sold and delivered depends on the continued creditworthiness and financial health of our customers. Competition with other coal suppliers could force us to extend credit to customers and on terms that could increase the risk we bear on payment default.

Our industry is heavily regulated and we may not be able to remain in compliance with all such regulations and we may be required to incur substantial costs in complying with such regulation.

We are subject to extensive regulation by China’s national, provincial, county and local authorities in jurisdictions in which our products are manufactured or sold, regarding the manufacturing, storage, and distribution of our product, such as the environment protection laws, the tax laws and the labor contract laws. See “Item 4. Information on the Company – B. Business Overview—Regulations.”

We may not be able to comply with current laws and regulations, or any future laws and regulations. To the extent that new regulations are adopted, we will be required to adjust our activities in order to comply with such regulations. We may be required to incur substantial costs in order to comply. Our failure to comply with applicable laws and regulations could subject us to civil remedies, including fines, injunctions, recalls or seizures, as well as potential criminal sanctions, which could have a material and adverse effect on our business, operations and finances. Changes in applicable laws and regulations may also have a negative impact on our sales.

New legislation or administrative regulations (or judicial interpretations of existing laws and regulations), including proposals related to the protection of the environment that would further regulate and tax the coal industry, may also require us and our customers to change operations significantly or incur increased costs.

Our business operation may be materially and negatively affected by economic policy involving the coal industry promulgated by the Shanxi provincial government.

Due to various circumstances in the coal industry, such as over-extraction, inappropriate extraction and persistent safety issues experienced by smaller mining operations in Shanxi Province, the Shanxi provincial government has vowed to recoup and is in the process of recouping the Shanxi coal industry with prerogatives of restricting coal output and closing down smaller mining operations in mass. Shanxi provincial authorities have promulgated various guidance and policies that limit the total quantity of coal mined by coal mining companies in Shanxi, and output requirement for mining companies in Shanxi which have resulted in industry consolidation and closing of smaller mines, and in turn a lower total quantity of coal output. While there are uncertainties as to the specific effect of such policies, restricting coal output may limit our access to raw materials needed in our production process, and we may not be able to deliver the amount of coking coal under existing sales orders or at a price acceptable to the customers. If the remaining larger coal mines who survive the industry consolidation in Shanxi decide to use its bargaining power, this may increase the prices we are able to negotiate for such raw materials, this may negatively impact our access to raw materials, and in turn our results of operations.

Terrorist attacks or military conflict could result in disruption of our business.

Terrorist attacks and threats, escalation of military activity in response to such attacks or acts of war may negatively affect our business, financial condition and results of operations. Our business is affected by general economic conditions, fluctuations in consumer confidence and spending, and market liquidity, which can decline as a result of numerous factors outside of our control, such as terrorist attacks and acts of war. Future terrorist attacks, rumors or threats of war, actual conflicts involving China or its allies, or military or trade disruptions affecting our customers may materially adversely affect our operations. As a result, there could be delays or losses in transportation and deliveries of our products to our customers, decreased sales of coal and extensions of time for payment of accounts receivable from customers. Strategic targets such as energy-related assets may be at greater risk of terrorist attacks than other targets. In addition, disruption or significant increases in energy prices could result in government-imposed price controls. Any, or a combination, of these occurrences could have a material adverse effect on Liulin Junhao’s business, financial condition and results of operations.

Risks Relating to Doing Business in the PRC

Changes in the policies of the PRC government could have a significant impact upon our ability to operate profitably in the PRC.

We conduct all of our operations and all of our revenue is generated in the PRC. Accordingly, economic, political and legal developments in the PRC will significantly affect our business, financial condition, results of operations and prospects. Policies of the PRC government can have significant effects on economic conditions in the PRC and the ability of businesses to operate profitably. Our ability to operate profitably in the PRC may be adversely affected by changes in policies by the PRC government, including changes in laws, regulations or their interpretation.

Because our business is dependent upon government policies that encourage a market-based economy, change in the political or economic climate in the PRC may impair our ability to operate profitably, if at all.

Although the PRC government has been pursuing a number of economic reform policies for more than two decades, the PRC government continues to exercise significant control over economic growth in the PRC. Because of the nature of our business, we are dependent upon the PRC government pursuing policies that encourage private ownership of businesses. We cannot assure you that the PRC government will pursue policies favoring a market oriented economy or that existing policies will not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting political, economic and social life in the PRC.

We may not be able to distribute our assets upon liquidation and dividend payment will be subject to restrictions under Chinese foreign exchange rule.

Our assets are located inside China. Under the laws governing foreign investment enterprises in China, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to both the relevant government agency’s approval and supervision as well as the foreign exchange control. This may generate additional risk for our investors in case of liquidation.

Governmental control of currency conversion may limit our ability to utilize our net revenues effectively.

The PRC government imposes controls on the convertibility of the RMB into foreign currencies and, in certain cases, the remittance of currency out of China. We receive substantially all of our net revenues in RMB. As an offshore holding company of our PRC subsidiary, the majority of our net revenues are received in RMB. Similarly, as our operation is primarily based in the PRC and our suppliers are primarily based in Shanxi Province presently, most of our future payments are also likely to continue to be in the form of RMB. As such, we believe restrictions on the transfer of cash into and out of China, as well as on the exchange of currency will not materially impede our ability to use cash in our operations. Under our current corporate structure, our company in the Cayman Islands relies on dividend payments from our PRC subsidiary to fund any cash and financing requirements we may have. Under existing PRC foreign exchange regulations, payments of current account items, such as profit distributions and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval from SAFE by complying with certain procedural requirements. Therefore, our PRC subsidiary is able to pay dividends in foreign currencies to us without prior approval from SAFE, subject to the condition that the remittance of such dividends outside of the PRC complies with certain procedures under PRC foreign exchange regulation, such as the repayment of loans denominated in foreign currencies. But approval from or registration with appropriate government authorities is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the overseas investment registrations by the beneficial owners of our company who are PRC residents.

In light of the flood of capital outflows of China in 2016 due to the weakening RMB, the PRC government has imposed more restrictive foreign exchange policies and stepped up scrutiny of major outbound capital movement. More restrictions and substantial vetting process are put in place by SAFE to regulate cross-border transactions falling under the capital account. The PRC government may at its discretion further restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to pay dividends in foreign currencies to our shareholders, including holders of our Ordinary Shares.

Regulations relating to offshore investment activities by PRC residents may limit our ability to acquire PRC companies and could adversely affect our business.

In July 2014, SAFE promulgated the Circular on Issues Concerning Foreign Exchange Administration Over the Overseas Investment and Financing and Roundtrip Investment by Domestic Residents Via Special Purpose Vehicles, or Circular 37, which replaced Relevant Issues Concerning Foreign Exchange Control on Domestic Residents’ Corporate Financing and Roundtrip Investment through Offshore Special Purpose Vehicles, or Circular 75. Circular 37 requires PRC residents to register with local branches of SAFE in connection with their direct establishment or indirect control of an offshore entity, referred to in Circular 37 as a “special purpose vehicle” for the purpose of holding domestic or offshore assets or interests. Circular 37 further requires amendment to a PRC resident’s registration in the event of any significant changes with respect to the special purpose vehicle, such as an increase or decrease in the capital contributed by PRC individuals, share transfer or exchange, merger, division or other material event. Under these regulations, PRC residents’ failure to comply with specified registration procedures may result in restrictions being imposed on the foreign exchange activities of the relevant PRC entity, including the payment of dividends and other distributions to its offshore parent, as well as restrictions on capital inflows from the offshore entity to the PRC entity, including restrictions on its ability to contribute additional capital to its PRC subsidiaries. Further, failure to comply with the SAFE registration requirements could result in penalties under PRC law for evasion of foreign exchange regulations.

Bingshan Guo, Xiangyang Guo, Yonghong Che, Haigang Yan, and Ji Li, who are our beneficial owners and are PRC residents, have initiated the application for the initial foreign exchange registrations. However, as the promulgation of Circular 37 is relatively recent, it is unclear how these regulations will be interpreted and implemented. We cannot assure you that our ultimate shareholders who are PRC residents will in the future provide sufficient supporting documents required by the SAFE or complete the required registration with the SAFE in a timely manner, or at all. Any failure by any of our shareholders who is a PRC resident, or is controlled by a PRC resident, to comply with relevant requirements under these regulations could subject us to fines or sanctions imposed by the PRC government, including restrictions on Liulin Junhao’s ability to pay dividends or make distributions to us and on our ability to increase our investment in the Liulin Junhao.

Because our business is conducted in RMB and the price of our Ordinary Shares is quoted in United States dollars, changes in currency conversion rates may affect the value of investments.

Our business is conducted in the PRC, our books and records are maintained in RMB, which is the currency of the PRC, and the financial statements that we file with the SEC and provide to our shareholders are presented in United States dollars. Changes in the exchange rate between the RMB and dollar affect the value of our assets and the results of our operations in United States dollars. The value of the RMB against the United States dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC’s political and economic conditions and perceived changes in the economy of the PRC and the United States. Any significant revaluation of the RMB may materially and adversely affect our cash flows, revenue and financial condition.

Regulatory bodies of the United States may be limited in their ability to conduct investigations or inspections of our operations in China.

From time to time, we may receive requests from certain U.S. agencies to investigate or inspect our operations, or to otherwise provide information. While we will be compliant with these requests from these regulators, there is no guarantee that such requests will be honored by those entities who provide services to us or with whom we associate, especially as those entities are located in China. Furthermore, under current PRC laws, an on-site inspection of our facilities by any of these regulators may be limited or disallowed, and therefore be difficult to facilitate.

Under the PRC Enterprise Income Tax Law, or the EIT Law, we may be classified as a “resident enterprise” of China, which could result in unfavorable tax consequences to us and our non-PRC shareholders.

The EIT Law and its implementing rules provide that enterprises established outside of China whose “de facto management bodies” are located in China are considered “resident enterprises” under PRC tax laws. The implementing rules promulgated under the EIT Law define the term “de facto management bodies” as a management body which substantially manages, or has control over the business, personnel, finance and assets of an enterprise. In April 2009, the State Administration of Taxation, or SAT, issued a circular, known as Circular 82, which provides certain specific criteria for determining whether the “de facto management bodies” of a PRC-controlled enterprise that is incorporated offshore is located in China. However, there are no further detailed rules or precedents governing the procedures and specific criteria for determining “de facto management body.” Although our board of directors and management are located in the PRC, it is unclear if the PRC tax authorities would determine that we should be classified as a PRC “resident enterprise.”

If we are deemed as a PRC “resident enterprise,” we will be subject to PRC enterprise income tax on our worldwide income at a uniform tax rate of 25%, although dividends distributed to us from our existing PRC subsidiary and any other PRC subsidiaries which we may establish from time to time could be exempt from the PRC dividend withholding tax due to our PRC “resident recipient” status. This could have a material and adverse effect on our overall effective tax rate, our income tax expenses and our net income. Furthermore, dividends, if any, paid to our shareholders may be decreased as a result of the decrease in distributable profits. In addition, if we were considered a PRC “resident enterprise”, any dividends we pay to our non-PRC investors, and the gains realized from the transfer of our Ordinary Shares may be considered income derived from sources within the PRC and be subject to PRC tax, at a rate of 10% in the case of non-PRC enterprises or 20% in the case of non-PRC individuals (in each case, subject to the provisions of any applicable tax treaty). It is unclear whether holders of our Ordinary Shares would be able to claim the benefits of any tax treaties between their country of tax residence and the PRC in the event that we are treated as a PRC resident enterprise. This could have a material and adverse effect on our business operations.

If we become directly subject to the scrutiny, criticism and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, stock price and reputation.

U.S. public companies that have substantially all of their operations in China have been the subject of intense scrutiny, criticism and negative publicity by investors, financial commentators and regulatory agencies, such as the SEC. Much of the scrutiny, criticism and negative publicity has centered on financial and accounting irregularities and mistakes, a lack of effective internal controls over financial accounting, inadequate corporate governance policies or a lack of adherence thereto and, in many cases, allegations of fraud. As a result of the scrutiny, criticism and negative publicity, the publicly traded stock of many U.S. listed Chinese companies sharply decreased in value and, in some cases, has become virtually worthless. Many of these companies are now subject to shareholder lawsuits and SEC enforcement actions and are conducting internal and external investigations into the allegations. It is not clear what effect this sector-wide scrutiny, criticism and negative publicity will have on us, our business and our stock price. If we become the subject of any unfavorable allegations, whether such allegations are proven to be true or untrue, we will have to expend significant resources to investigate such allegations and/or defend our company. This situation will be costly and time consuming and distract our management from developing our growth. If such allegations are not proven to be groundless, we and our business operations will be severely affected.

The disclosures in our reports and other filings with the SEC and our other public pronouncements are not subject to the scrutiny of any regulatory bodies in the PRC.

We are regulated by the SEC and our reports and other filings with the SEC are subject to SEC review in accordance with the rules and regulations promulgated by the SEC under the Securities Act and the Exchange Act. Our SEC reports and other disclosure and public pronouncements are not subject to the review or scrutiny of any PRC regulatory authority. For example, the disclosure in our SEC reports and other filings are not subject to the review by China Securities Regulatory Commission, a PRC regulator that is responsible for oversight of the capital markets in China. Accordingly, you should review our SEC reports, filings and our other public pronouncements with the understanding that no local regulator has done any review of us, our SEC reports, other filings or any of our other public pronouncements.

The ownership of our Ordinary Shares is concentrated among a small number of shareholders, and if our principal shareholders, director and officers choose to act together, they may be able to significantly influence management and operations, which may prevent us from taking actions that may be favorable to you.

Our ownership is concentrated among a small number of shareholders, including our founder, director, officers and entities related to these persons. Accordingly, these shareholders, acting together, will have the ability to exert substantial influence over all matters requiring approval by our shareholders, including the election and removal of directors and any proposed merger, consolidation or sale of all or substantially all of our assets. This concentration of ownership could have the effect of delaying, deferring or preventing a change in control of the Company or impeding a merger or consolidation, takeover or other business combination that could be favorable to you.

The requirements of being a public company may strain our resources and divert management’s attention.

Compliance with the Exchange Act and the Sarbanes-Oxley Act and other applicable securities rules and regulations will increase our legal and financial compliance costs, make some activities more difficult, time-consuming, or costly, and increase demand on our systems and resources. As a result, management’s attention may be diverted from other business concerns, which could harm our business and operating results. In addition, complying with public company disclosure rules makes our business more visible, which we believe may result in threatened or actual litigation, including by competitors and other third parties. If such claims are successful, our business and operating results could be harmed, and even if the claims do not result in litigation or are resolved in our favor, these claims, and the time and resources necessary to resolve them, could divert the resources of our management and harm our business and operating results.

We will incur increased costs as a result of being a public company, particularly after we cease to qualify as an “emerging growth company.”

We are a public company and incur significant legal, accounting and other expenses that we did not incur as a private company. The Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the SEC, impose various requirements on the corporate governance practices of public companies. As an “emerging growth company” pursuant to the JOBS Act, we may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. We expect these rules and regulations to increase our legal and financial compliance costs and to make some corporate activities more time-consuming and costly. After we are no longer an “emerging growth company,” we expect to incur significant additional expenses and devote substantial management effort toward ensuring compliance increased disclosure requirements.

Our Ordinary Shares are considered a “penny stock” which is subject to restrictions on marketability, so you may not be able to sell your shares.

The SEC has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share or an exercise price of less than $5.00 per share, subject to specific exemptions. The market price of our Ordinary Shares is currently less than $5.00 per share and therefore is designated as a “penny stock” according to SEC rules. This designation requires any broker or dealer selling these securities to disclose some information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. These rules may restrict the ability of brokers or dealers to sell the Ordinary Shares and may affect the ability of investors to sell their shares. These regulations may likely have the effect of limiting the trading activity of the Company’s Ordinary Shares and reducing the liquidity of an investment in its Ordinary Shares. In addition, investors may find it difficult to obtain accurate quotations of the Ordinary Shares and may experience a lack of buyers to purchase our Company’s stock or a lack of market makers to support the stock price.

If our Ordinary Shares becomes tradable in the secondary market, we will be subject to the penny stock rules adopted by the Securities and Exchange Commission that require brokers to provide extensive disclosure to their customers prior to executing trades in penny stocks. These disclosure requirements may cause a reduction in the trading activity of our Ordinary Shares, which in all likelihood would make it difficult for our shareholders to sell their shares.

Substantial future sales of our Ordinary Shares or the anticipation of future sales of our Ordinary Shares in the public market could cause the price of our Ordinary Shares to decline.

Sales of substantial amounts of our Ordinary Shares in the public market after the consummation of our initial public offering, or the perception that these sales could occur, could cause the market price of our Ordinary Shares to decline. An aggregate of 13,333,334 Ordinary Shares are outstanding before the consummation of our initial public offering and 14,333,334 Ordinary Shares will be outstanding immediately after the consummation of our initial public offering if the total offering amount is raised. The Ordinary Shares outstanding after our initial public offering will be available for sale upon the expiration of the lock-up period ending 180 days after the commencement of sales of our initial public offering, subject to certain restrictions. Any or all of these shares may be released prior to the expiration of the lock-up period at the discretion of the underwriter. Sales of these shares into the market could cause the market price of our Ordinary Shares to decline.

Our shareholders may face significant restrictions on the resale of our securities due to state “Blue Sky” laws.

Each state has its own securities laws, often called “blue sky” laws, which (i) limit sales of securities to a state’s residents unless the securities are registered in that state or qualify for an exemption from registration, and (ii) govern the reporting requirements for broker-dealers doing business directly or indirectly in the state. Before a security is sold in a state, there must be a registration in place to cover the transaction, or the transaction must be exempt from registration. The applicable broker must be registered in that state.

We do not know whether our securities will be registered or exempt from registration under the laws of any state. A determination regarding registration will be made by those broker-dealers, if any, who agree to serve as the market-makers for our Ordinary Shares. There may be significant state blue sky law restrictions on the ability of investors to sell, and on purchasers to buy, our securities. You should therefore consider the resale market for our Ordinary Shares to be limited, as you may be unable to resell your shares without the significant expense of state registration or qualification.

Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our shareholders have limited protections against interested director transactions, conflicts of interest and similar matters.

The Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York and NYSE AMEX Equities exchanges and the Nasdaq Stock Market, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities which are listed on those exchanges or the Nasdaq Stock Market. Because we are not presently required to comply with many of the corporate governance provisions, we have not yet adopted these measures.

We do not currently have independent audit or compensation committees. As a result, the board of directors has the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our shareholders without protections against interested director transactions, conflicts of interest and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

If the price of our Ordinary Shares is volatile once our Ordinary Shares commence trading on the OTC market, purchasers of Ordinary Shares could incur substantial losses.

The price of our Ordinary Shares is likely to be volatile, once our Ordinary Shares commence trading on the OTC market. As a result of this volatility, investors may not be able to sell their shares of Ordinary Shares at or above the initial public offering price. The price for our Ordinary Shares may be influenced by many factors, including general economic, industry and market conditions.

A decline in the market price of our Ordinary Shares could cause investors to lose some or all of their investment and may adversely impact our ability to attract and retain employees and raise additional capital. In addition, shareholders may initiate securities class action lawsuits if the market price of our shares drops significantly, which may cause us to incur substantial costs and could divert the time and attention of our management.

Moreover, we cannot assure you that any securities analysts will initiate or maintain research coverage of our company and of Ordinary Shares. We do not control analysts or the content and opinions included in their reports. The price of our Ordinary Shares could decline if one or more equity research analysts downgrade our Ordinary Shares or if analysts issue other unfavorable commentary or cease publishing reports about us or our business.

We do not intend to pay cash dividends on our Ordinary Shares in the foreseeable future.

We do not anticipate paying any cash dividends in the foreseeable future. We currently intend to retain our future earnings, if any, to fund the development and growth of our business. In addition, the right of holders of our Ordinary Shares to receive dividends declared by our board of directors may be restricted to the extent we issue preferred shares with dividend rights superior to those of our Ordinary Shares.

Shares of the Company’s Ordinary Shares represent equity interests and are subordinate to existing and future indebtedness.

Our Ordinary Shares represent equity interests in our Company and, as such, rank junior to any indebtedness of our Company now existing or created in the future, as well as to the rights of any preferred shares that may be issued in the future. In the future, we may incur substantial amounts of debt and other obligations that will rank senior to our Ordinary Shares or to which our Ordinary Shares will be structurally subordinated.

If we cease to qualify as a foreign private issuer, we would be required to comply fully with the reporting requirements of the Exchange Act applicable to U.S. domestic issuers, and we would incur significant additional legal, accounting and other expenses that we would not incur as a foreign private issuer.

As a foreign private issuer, we are exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements, and our officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we arenot be required under the Exchange Act to file periodic reports and financial statements with the SEC as frequently or as promptly as United States domestic issuers, and we are not be required to disclose in our periodic reports all of the information that United States domestic issuers are required to disclose. While we are currently qualified as a foreign private issuer, we may cease to qualify as a foreign private issuer in the future.

Anti-takeover provisions in our amended and restated memorandum of association and articles of association may discourage, delay or prevent a change in control.

Some provisions of our amended and restated memorandum and articles of association, may discourage, delay or prevent a change in control of our company or management that shareholders may consider favorable, including, among other things, the following:

| · | provisions that authorize our board of directors to issue shares with preferred, deferred or other special rights or restrictions without any further vote or action by our shareholders; and |

| · | provisions that restrict the ability of our shareholders to call meetings and to propose special matters for consideration at shareholder meetings. |

Our board of directors may decline to register transfers of Ordinary Shares in certain circumstances.

Our board of directors may, in its sole discretion, decline to register any transfer of any Ordinary Share which is not fully paid up or on which we have a lien. Our directors may also decline to register any transfer of any Ordinary Shares unless (i) the instrument of transfer is lodged with us, accompanied by the certificate for the shares to which it relates and such other evidence as our board of directors may reasonably require to show the right of the transferor to make the transfer; (ii) the instrument of transfer is in respect of only one class of shares; (iii) the instrument of transfer is properly stamped, if required; (iv) in the case of a transfer to joint holders, the number of joint holders to whom the share is to be transferred does not exceed four; (v) the shares conceded are free of any lien in favor of us; or (vi) a fee of such sum as our board of directors may from time to time require, is paid to us in respect thereof.