EXPLANATORY NOTE

This Post-Qualification Offering Circular Amendment No. 1 (this “Offering Circular Amendment No. 1”) amends the offering circular of Carolina Complete Health Network, Inc. qualified on March 12, 2018, and as may be further amended and supplemented from time to time (the “Offering Circular”), to add, update and/or replace information contained in the Offering Circular.

Post-Qualification Offering Circular Amendment No. 1

File No. 024-10799

PART II

OFFERING CIRCULAR DATED APRIL 26, 2018

Carolina Complete Health Network, Inc.

222 N. Person Street, Suite 010, Raleigh, NC 27601

919-719-4161

Up to 20,000 Shares of

Class P Common Stock

This Offering Circular relates to the offer and sale by Carolina Complete Health Network, Inc., a Delaware corporation (“CCHN,” “we,” “us” or “our”), of one, but not more than one, share of our Class P Common Stock, $0.01 par value per share (such class, the “Class P Common Stock” and the shares so offered, the “Provider Shares”), to each person who meets the eligibility criteria described herein, up to an aggregate amount of $15,000,000 (the “Offering”).

CCHN was formed as a wholly-owned subsidiary of the North Carolina Medical Society (the “NCMS”) in Delaware on May 19, 2016. CCHN’s primary purpose is to build and operate a network of health care professionals (the “Provider Network”) who will provide medical services under a patient-focused Medicaid health plan (the “Health Plan”) in response to the pending implementation of Medicaid reform in North Carolina. A North Carolina licensed insurance company, Carolina Complete Health, Inc. (“Carolina Complete Health”), will operate the Health Plan. The Health Plan will be owned and operated pursuant to a joint venture (the “Joint Venture”) among the NCMS, CCHN, Centene Corporation (“Centene”) and Centene Health Plan Holdings, Inc., a subsidiary of Centene (“Centene Sub,” and together with the NCMS, CCHN and Centene, the “Joint Venture Parties”). The closing of the Joint Venture transactions is expected to occur after September 1, 2018. See “The Joint Venture.” We maintain principal executive offices at 222 N. Person Street, Suite 010, Raleigh, NC 27601. The phone number for these offices is 919-719-4161. Our website address is www.cch-network.com.

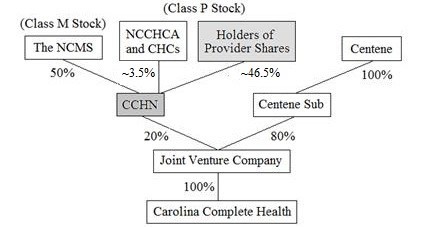

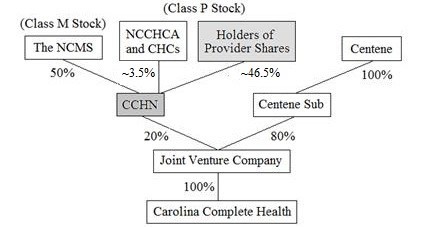

The Provider Shares offered in the Offering represent in the aggregate a 46.5 percent direct equity interest in CCHN. The NCMS will at all times hold a 50 percent direct equity interest in CCHN through its ownership of Class M Common Stock, $0.01 par value per share (the “Class M Common Stock”). The subscription price for a Provider Share is $750.00. The Provider Shares are not listed on any national securities exchange or on the over-the-counter inter-dealer quotation system, and there is no market for the Provider Shares. See “Description of Capital Stock.”

Investment in a Provider Share involves significant risk, and you may be required to hold your investment for an indefinite period of time. You should purchase this security only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 6 of this Offering Circular.

We commenced the Offering of the Provider Shares promptly after the date this Offering Circular was qualified. The Offering will terminate at the earliest of (1) the date at which the total offering amount has been sold, (2) March 12, 2021, the date that is three years after this Offering was qualified by the Commission or (3) the date at which the Offering is earlier terminated by CCHN in our sole discretion. We may undertake one or more closings on a rolling basis. After each closing, funds tendered by investors will be available to us. After the initial closing of this Offering, we expect to hold closings on at least a quarterly basis.

The Offering is being conducted on a “best efforts” basis, which means our directors and officers are using their commercially reasonable best efforts in an attempt to sell the Provider Shares. Such persons are not receiving any commission or any other remuneration based either directly or indirectly on sales of the Provider Shares. In offering the Provider Shares on our behalf, such persons are relying on the safe harbor from broker-dealer registration set forth in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended.

Purchase of the Provider Shares is limited to physicians, physician assistants and nurse practitioners licensed or approved to practice, as applicable, in North Carolina who participate in the Provider Network, reside in North Carolina, Georgia, South Carolina, Tennessee or Virginia and otherwise meet the eligibility criteria set forth herein (each, an “Eligible Investor”) (see “Offering Circular Summary—the Offering” and “Investor Suitability Requirements”). Each purchaser’s investment is limited to one, and only one, Provider Share. This Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sales of these securities, in any state in which such offer, solicitation or sale would be unlawful, prior to registration or qualification under the laws of any such state.

We are following the “Offering Circular” format of disclosure under Regulation A.

IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF CCHN AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THESE AUTHORITIES HAVE NOT PASSED UPON THE ACCURACY OR ADEQUACY OF THIS OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10 PERCENT OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

Offering price to the public | Underwriting discounts and commissions | Proceeds to issuer(1) | Proceeds to other persons | |||||||||||||

| Per Share: | $ | 750 | N/A | $ | 750 | (2 | ) | |||||||||

| Total: | $ | 15,000,000 | N/A | $ | 13,957,000 | (2 | ) | |||||||||

| (1) | We estimate all expenses of the Offering to be approximately $1,043,000. |

| (2) | See “Plan of Distribution—Technology & Closing Services” for information regarding the fees payable to Folio Investments, Inc. with respect to its online investment platform. |

THIS OFFERING CIRCULAR CONTAINS ALL OF THE REPRESENTATIONS BY CCHN CONCERNING THE OFFERING. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS OTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR, AND, IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATIONS MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY CCHN.

THE PROVIDER SHARES HAVE NOT BEEN QUALIFIED UNDER THE SECURITIES LAWS OF ANY STATE OR JURISDICTION. WE MAY QUALIFY THE OFFERING WITH THE NORTH CAROLINA SECURITIES REGULATORY BODY AND THE SECURITIES REGULATORY BODIES OF OTHER STATES AS WE MAY DETERMINE FROM TIME TO TIME.

This summary highlights information contained in this Offering Circular. This summary is not complete and does not contain all of the information that you should consider before investing in a Provider Share. You should carefully read the entire Offering Circular, especially concerning the risks associated with the investment in the securities covered by this Offering Circular discussed under the “Risk Factors” section beginning on page 6. Some of the statements in this Offering Circular are forward-looking statements. See the section entitled “Special Note Regarding Forward-Looking Statements” on page 14.

The relationship among CCHN and the other entities having a direct or indirect interest in Carolina Complete Health, as well as the expected ownership of CCHN following this Offering, are illustrated in the following diagram (in which the darker shaded box identifies our company and the lighter shaded box identifies Eligible Investors who purchase a Provider Share in this Offering):

Our Company

CCHN was incorporated in Delaware on May 19, 2016 as a wholly-owned subsidiary of the NCMS. CCHN’s primary purpose is to build and operate the Provider Network for the Health Plan. See “Business.” The Health Plan will be operated by Carolina Complete Health and created in connection with the Joint Venture depicted above to offer a patient-focused Medicaid health plan in response to the pending implementation of Medicaid reform in North Carolina.

During the interim period until the closing of the Joint Venture transactions (which is expected to occur after September 1, 2018), we expect our operations to consist of recruiting and retaining providers to participate in the Provider Network. Following the closing of the Joint Venture transactions, our fundamental business will be recruiting, building, developing, managing, educating, operating and maintaining the Provider Network for the purposes of providing services to the Health Plan. In consideration for providing such services for the Health Plan, we will, pursuant to the terms of the Network License and Management Services Agreement with Carolina Complete Health (the “CCHN Services Agreement”), receive a monthly fee equal to a predetermined percentage of the projected net revenues of the Health Plan during such month, which percentage in any given month will depend in part upon the number of individuals who are participating providers in the Provider Network. Although we will be engaged in the Joint Venture with Centene and its subsidiary, Centene Sub, CCHN is a standalone business whose success is not controlled or guaranteed by Centene, any of its affiliates, the NCMS, the NCCHCA (as defined below under “—The Joint Venture”) or any CHC (as defined below under “—The Joint Venture”).

We maintain principal executive offices at 222 N. Person Street, Suite 010, Raleigh, NC 27601. The phone number for these offices is 919-719-4161. Our website address is www.cch-network.com.

1

The Health Plan and Carolina Complete Health

The Health Plan is designed to be a patient-focused Medicaid health plan in North Carolina. Carolina Complete Health is a North Carolina corporation and a wholly-owned subsidiary of the Joint Venture Company. Carolina Complete Health will be licensed as an insurer by the State of North Carolina and will operate the Health Plan.

Carolina Complete Health will operate the Health Plan with the goals of maintaining profitability, offering competitive health insurance products and maximizing the use of value-driven systems of care. Value-driven systems of care are collaborative arrangements that integrate care coordination, access to data, evidence-based quality standards and payments systems to help achieve the goals enumerated below and, ultimately, provide high-quality, cost-effective care for patients. Value-driven systems of care simultaneously pursue three goals as defined and discussed by the Institute for Healthcare Improvement: controlling costs across a defined population, improving the health of the defined population and improving the experience of care. In North Carolina, there is a fourth goal of improving provider engagement and support, which focuses on collaboration within the medical community (including providers, beneficiaries and other stakeholders) in order to provide innovative solutions to improve care and patient outcomes in North Carolina.

CCHN has already commenced operations in order to support Carolina Complete Health’s submission of a bid to obtain a contract to provide managed care services for North Carolina’s Medicaid program, which follows the enactment of Medicaid reform legislation by the North Carolina General Assembly in 2015. This first round of contracting is expected to occur in 2018, with a “go live” date for the Health Plan in July 2019. See “Business.”

The Joint Venture

The NCMS, CCHN, Centene and Centene Sub are parties to an Amended and Restated Joint Venture Agreement dated August 25, 2017 (the “Joint Venture Agreement”) to facilitate the creation and successful operation of the Health Plan. The NCMS is a professional member organization and is seeking to promote access to quality health care for all citizens in North Carolina and championing initiatives that seek to improve quality of care and promote patient safety. Centene is a diversified, multi-national health care enterprise that provides a portfolio of services to government sponsored and commercial health care programs, focusing on under-insured and uninsured individuals. Centene’s common stock is listed on the New York Stock Exchange under the symbol “CNC.” The North Carolina Community Health Center Association (the “NCCHCA”), a private, non-profit membership association that represents federally-qualified health centers and aspiring health centers (“CHCs”) across North Carolina, will also participate in the activities of the Joint Venture.

The joint venture entity, Carolina Complete Health Holding Company Partnership (the “Joint Venture Company”), has been established as a Delaware general partnership authorized to issue 400 Class A Partnership Units (the “Class A Partnership Units”) and 3,600 Class B Partnership Units (the “Class B Partnership Units”). CCHN currently holds one Class A Partnership Unit, representing 20 percent of the partnership interests in the Joint Venture Company, and Centene Sub currently holds four Class B Partnership Units, representing 80 percent of the partnership interests in the Joint Venture Company. See “The Joint Venture.”

The Offering

CCHN is offering for sale one, but not more than one, share of its Class P Common Stock, at a per share subscription price of $750.00, to North Carolina health care providers who meet certain eligibility criteria. As described under “Investor Suitability Requirements,” an Eligible Investor is a physician, physician assistant or nurse practitioner who (1) if a physician or physician assistant, is licensed, and if a nurse practitioner, has approval to practice, pursuant to Article I, Chapter 90 of the North Carolina General Statutes, (2) is a resident of North Carolina, Georgia, South Carolina, Tennessee or Virginia and (3) has executed a participating provider agreement (a “Participating Provider Agreement”) with CCHN and Carolina Complete Health or is bound as a “Contracted Provider” (as defined therein) by an existing Participating Provider Agreement between CCHN, Carolina Complete Health and a “Provider” (as defined therein) by which he or she is employed or with which he or she has a contractual relationship. While ownership of our securities is not required to participate in the Provider Network, ideally each Eligible Investor would elect to purchase a Provider Share and become a stockholder of CCHN.

2

The total number of authorized shares of CCHN’s capital stock is 40,001 shares, of which one share is Class M Common Stock, $0.01 par value per share, and 40,000 shares are Class P Common Stock, $0.01 par value per share. As of April 26, 2018, the NCMS held the sole outstanding share of Class M Common Stock, and there were 1,505 outstanding shares of Class P Common Stock. The rights and privileges of holders of CCHN’s Class M Common Stock and Class P Common Stock are apportioned based upon the number of “Common Stock Equivalents” held as follows: each holder of Class P Common Stock shall hold a number of Common Stock Equivalents equal to the number of shares of Class P Common Stock then held by such holder, and each holder of Class M Common Stock shall hold a number of Common Stock Equivalents equal to the number of shares of Class M Stock held by such holder multiplied by a fraction (1) the numerator of which is the aggregate number of shares of Class P Common Stock then outstanding (less, solely for the purposes of calculating Common Stock Equivalents for purposes of voting rights, the number of shares of Class P Common Stock that are then suspended from voting pursuant to the stockholders’ agreement between CCHN and the holders of Class P Common Stock (the “Stockholders’ Agreement”)) and (2) the denominator of which is the aggregate number of shares of Class M Common Stock then outstanding. Accordingly, at all times, the holder or holders of Class M Common Stock will retain 50 percent of the aggregate voting power of CCHN’s common stock and will have an interest in CCHN equal to the aggregate of all holders of Class P Common Stock. See “Description of Capital Stock.”

On January 19, 2018, CCHN completed a private placement to certain CHCs in North Carolina and the NCCHCA of 1,505 shares of Class P Common Stock at a purchase price of $750.00 per share for aggregate proceeds of approximately $1.13 million (the “Private Placement”). The Provider Shares issued in this Offering represent a 46.5 percent equity interest in CCHN.

Currently, we do not intend to pay dividends on the Provider Shares for the foreseeable future. We intend to invest our future earnings, if any, to repay our indebtedness and fund our growth.

Principal Terms of the Offering

The following table highlights the principal terms of the Offering and the Provider Shares. Before deciding to invest, please carefully review the other disclosures in this Offering Circular, including “Description of Capital Stock” and the forms of Participating Provider Agreement, Subscription Agreement (the “Subscription Agreement”) and Stockholders’ Agreement to be executed by each Eligible Investor who subscribes to purchase a Provider Share in this Offering. See “Investment Documents.”

| Issuer: | Carolina Complete Health Network, Inc.

|

| Class of Stock: | Class P Common Stock, $0.01 par value per share

|

| Size of Offering: | Up to 20,000 Provider Shares for up to $15,000,000 |

| Eligible Investors: | Any physician, physician assistant or nurse practitioner, in each case who: |

| ● | if a physician or physician assistant, is licensed, and if a nurse practitioner, has approval to practice, pursuant to Article I, Chapter 90 of the North Carolina General Statutes; | |

| ● | is a resident of North Carolina, Georgia, South Carolina, Tennessee or Virginia; and | |

| ● | has executed a Participating Provider Agreement with CCHN and Carolina Complete Health or is bound as a “Contracted Provider” (as defined therein) by an existing Participating Provider Agreement between CCHN, Carolina Complete Health and a “Provider” (as defined therein) by which he or she is employed or with which he or she has a contractual relationship. |

| See “Investor Suitability Requirements.” |

3

| Price Per Share: | $750.00 (the “Class P Original Purchase Price”) |

| Investment Limitation: | One Provider Share per Eligible Investor |

| Dividends: | No dividends shall be paid on CCHN’s Class M Common Stock (which is held by the NCMS) unless dividends are concurrently declared and paid on the Class P Common Stock (including the Provider Shares) on an equal basis according to the number of Common Stock Equivalents deemed to be held; all dividends will be as and if declared by CCHN’s Board of Directors (the “CCHN Board”). |

| Redemption: | Provider Shares will be subject to redemption by CCHN in the event that the holder no longer qualifies as an Eligible Investor or in the event of the holder’s death, in each case for an amount equal to the fair market value of a share of Class P Common Stock based on the most recent valuation of CCHN, which valuations are to occur at least annually, as determined by the CCHN Board. Provider Shares will be redeemed in the event that CCHN becomes obligated to sell all of its partnership units in the Joint Venture Company for an amount equal to the drag-along premium CCHN receives pursuant to the terms of the Amended and Restated Partnership Agreement of the Joint Venture Company divided by the number of shares of Class P Common Stock then outstanding. See also “—Termination of the Joint Venture” below. |

| Transfer Restrictions: | Provider Shares (or any interest therein) may not be transferred, assigned, pledged or otherwise disposed of or encumbered. |

| Liquidation Preference: | Holders of Class P Common Stock (including Provider Shares) will be entitled to share ratably in CCHN’s assets in proportion to the number of Common Stock Equivalents deemed to be held by them that are remaining after payment or provision for payment of all of CCHN’s debts and obligations. |

| Voting Rights: | Holders of Class P Common Stock (including Provider Shares) will have one vote per share. While each holder of a Provider Share will be entitled to only one vote, CHCs and the NCCHCA were permitted to purchase more than one share in the Private Placement, which means that each of them will have the number of votes equal to the number of shares of Class P Common Stock that they hold. On all matters submitted to CCHN’s stockholders, except with respect to certain amendments to CCHN’s Amended and Restated Certificate of Incorporation that relate solely to the terms of Class M Common Stock or as otherwise required by applicable law, holders of Class P Common Stock, subject to their continued status as Eligible Investors and provided that their license or approval to practice is not suspended by the North Carolina Medical Board, will vote together as one class with the holder or holders of Class M Common Stock. See “Description of Capital Stock.” |

Special Governance Rights:

| Holders of Provider Shares who are physicians licensed under Article I, Chapter 90 of the North Carolina General Statutes will be eligible to be nominated (1) by the CCHN Board to serve on the CCHN Board and (2) by the Nominating Committee of the Joint Venture Company to serve as a director of Carolina Complete Health. See “Governance.” |

4

| Use of Proceeds: | Pursuant to the Joint Venture Agreement, CCHN is permitted to retain 55 percent of the Net Offering Proceeds from the Offering and the Private Placement (collectively, the “Net Offering Proceeds”) and is obligated to use 45 percent of the Net Offering Proceeds to help fund CCHN’s portion of the initial capitalization of the Joint Venture Company upon the closing of the Joint Venture transactions. We intend to use the retained portion of Net Offering Proceeds for general working capital purposes, but we may also use such proceeds for certain other limited purposes. See “Use of Proceeds” for further explanation of how we use the defined term “Net Offering Proceeds” in this Offering Circular and our intended use of such Net Offering Proceeds. |

| Risk Factors: | You should carefully read and consider the information set forth under the heading “Risk Factors” and all other information set forth in this Offering Circular before deciding to invest in a Provider Share. |

Benefits of Investing in the Offering

Given that CCHN does not intend to pay dividends in the foreseeable future and that Eligible Investors are limited to purchasing one and not more than one Provider Share for an investment of $750.00, it is unlikely that an investment in the Offering will produce meaningful economic benefits, even if the value of Provider Shares appreciates over time. As such, Eligible Investors should consider the following non-economic benefits as the primary benefits of an investment in the Offering.

Eligible Investors who purchase Provider Shares in the Offering will gain the opportunity to contribute to the direction and guidance of the operations of the Provider Network and the Health Plan and be involved in decisions that impact the care provided to patients. Holders of Provider Shares who are licensed physicians under North Carolina law will be eligible to be nominated to serve on the CCHN Board, the Board of Directors of Carolina Complete Health (the “Carolina Complete Health Board”) and the Medical Affairs Committee of the Carolina Complete Health Board (the “Medical Affairs Committee”). One member of the Medical Affairs Committee of the Carolina Complete Health Board will also serve on the Financial Matters Committee of the Carolina Complete Health Board. In addition, all holders of Provider Shares, regardless of whether they are licensed physicians, will be eligible to serve on advisory subcommittees of the Medical Affairs Committee, the size, composition and existence of such subcommittees to be determined from time to time by the Medical Affairs Committee. The purpose of the advisory subcommittees is to analyze and provide advice and recommendations on issues related to medical policy development. See “Governance” for additional information about the governance structure of the Joint Venture and the involvement of the holders of Provider Shares therein.

The Joint Venture Parties have committed to ensure that each holder of Provider Shares has the opportunity to be engaged with respect to the operation and management of Carolina Complete Health, the Health Plan and the Provider Network by agreeing to invite all such holders to attend meetings, which will be held at least annually, at which such holders will receive information with respect to the performance and activities of CCHN, Carolina Complete Health, the Health Plan and the Provider Network. The Joint Venture Parties have also agreed to cooperate with each other on an ongoing basis to develop and implement programs aimed at incentivizing and benefiting holders of Provider Shares in connection with their participation in the Provider Network. We expect that incentives offered to such holders will include providing (1) access to the Medical Affairs Committee, (2) professional development training and resources and (3) other incentives and benefits that may encourage widespread participation in the Provider Network.

Termination of the Joint Venture

The consummation of the transactions contemplated by the Joint Venture Agreement (the “Joint Venture Closing”) is subject to a number of conditions, many of which are beyond our control. See “The Joint Venture—Conditions to Closing.” If the Joint Venture Closing does not occur, we are contractually required by the Stockholders’ Agreement to redeem all Provider Shares sold in this Offering for $750.00 per share, in which case Eligible Investors who purchase Provider Shares will not realize any financial benefit from their investment.

5

Investing in the Provider Shares involves a high degree of risk. In deciding whether to purchase a Provider Share, you should carefully consider the following risk factors. Any of the following risks could have a material adverse effect on the value of the Provider Share you purchase and could cause you to lose all or part of your investment.

Risks Related to Investing in the Provider Shares

Investors will not be able to transfer their respective Provider Shares.

Pursuant to the Stockholders’ Agreement, an investor will not be able to transfer, assign, pledge or otherwise dispose of or encumber his or her Provider Share. As a result, you should be prepared to hold the Provider Share that you purchase indefinitely, subject to your continued status as an Eligible Investor.

The Provider Shares will not be listed on any securities exchange, and no liquid market for the Provider Shares is expected to develop.

The Provider Shares will not be listed on any securities exchange or any other traditional trading platform. There is currently no trading market for the Provider Shares, and we do not expect a trading market will ever develop. We do not currently have plans to apply for or otherwise seek trading or quotation of the Provider Shares on an over-the-counter market, and we do not expect to seek a listing on any securities exchange. Any investment in the Provider Shares will be highly illiquid, and Eligible Investors who purchase Provider Shares may not be able to sell or otherwise dispose of their respective Provider Shares on a timely basis or at all. If you cease to qualify as an Eligible Investor or in the event of your death, your Provider Share will be subject to redemption by CCHN pursuant to the terms of the Stockholders’ Agreement. You should be prepared to hold the Provider Share that you purchase indefinitely, subject to your continued status as an Eligible Investor.

Currently, we do not intend to pay dividends on the Provider Shares for the foreseeable future, and you are limited to purchasing one Provider Share; consequently, your ability to achieve a financial return on your investment will depend solely on appreciation in the value of your Provider Share.

Currently, we do not intend to pay dividends on the Provider Shares for the foreseeable future. We intend to invest our future earnings, if any, to repay our indebtedness and fund our growth. Therefore, you are not likely to receive any dividends on your Provider Share for the foreseeable future, and the financial success of an investment in a Provider Share will depend solely upon any future appreciation in value. There is no guarantee that your Provider Share will appreciate in value or even maintain the price at which you purchase your Provider Share. Furthermore, each Eligible Investor may only purchase one Provider Share. For the foreseeable future, the financial return on your investment will be limited to the appreciation in value of your single Provider Share, if any. As a result of our intention to invest our future earnings rather than pay dividends on the Provider Shares, it is unlikely that an investment in the Offering will produce meaningful economic benefits, even if the value of Provider Shares appreciates over time.

If the Joint Venture Closing does not occur, CCHN will redeem your Provider Share, in which case you will not realize any financial benefit from the investment transaction.

The Offering is being made on a continuous basis, and Eligible Investors who purchase Provider Shares will receive such shares before the Joint Venture Closing. However, most of the benefits of holding a Provider Share, as further described in “Offering Circular Summary—The Offering,” will not accrue to holders of Provider Shares unless and until the Joint Venture Closing occurs and the Health Plan begins enrolling members. The Joint Venture Closing is subject to a number of conditions including, among other conditions, (1) Carolina Complete Health must have submitted a bid for, been awarded and accepted a capitated Medicaid contract with the State of North Carolina (an “N.C. Medicaid Contract”); (2) the number of Eligible Investors who purchase Provider Shares and the number of investors attributable to CHCs that subscribed in the Private Placement must be at least 10,000 in the aggregate prior to the earlier of (a) the date that is 10 business days prior to the deadline for submitting proposals for the contract with the State of North Carolina and (b) March 12, 2019, the date that is 12 months after the Offering Statement on Form 1-A, of which this Offering Circular is a part, was qualified by the Commission; and (3) on or prior to 10 business days before the deadline for submitting proposals for the contract with the State of North Carolina, the Provider Network must have satisfied the provider participation requirements established by the State of North Carolina with respect to network adequacy. If the Joint Venture Closing does not occur, we are contractually required by the Stockholders’ Agreement to redeem all Provider Shares sold in this Offering for $750.00 per share, in which case you will not realize any financial benefit from your investment.

6

You will experience dilution of your ownership interest if we issue additional shares of our capital stock in the future.

Each Eligible Investor may purchase only one Provider Share. Accordingly, if we issue any additional shares of our capital stock, no matter the series, you will experience dilution of your ownership interest. The CCHN Board may at any time authorize the issuance of additional common stock without common stockholder approval, subject only to the total number of authorized common shares set forth in our Amended and Restated Certificate of Incorporation. The terms of equity securities issued by us in future transactions may be more favorable to new investors, and may include dividend and/or liquidation preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect. Furthermore, our Amended and Restated Certificate of Incorporation provides that each holder of Class M Common Stock will be deemed to hold a number of Common Stock Equivalents equal to the number of shares of Class M Common Stock held by such holder multiplied by a fraction (1) the numerator of which is the aggregate number of shares of Class P Common Stock then outstanding (less, solely for the purposes of calculating Common Stock Equivalents for purposes of voting rights, the number of shares of Class P Common Stock that are then suspended from voting pursuant to the Stockholders’ Agreement) and (2) the denominator of which is the aggregate number of shares of Class M Common Stock then outstanding. This provision ensures that the holder or holders of Class M Common Stock will retain 50 percent of the aggregate interest in CCHN, which will have a further dilutive effect on your ownership interest.

Risks Related to CCHN

We have a limited operating history in an evolving industry, which makes it difficult for you to evaluate our likely performance and this investment.

We were formed in May 2016 and have a limited operating history, which makes it difficult to accurately evaluate our capabilities and prospects. Our business is subject to the risks, expenses and difficulties frequently encountered by new ventures, including our reliance on other Joint Venture Parties, their key personnel and affiliates and outside consultants, among other factors. Our lack of history and the evolving nature of the market in which we operate make it likely that there are risks inherent in our business that are yet to be recognized by us or others, or not fully appreciated, and that could result in us earning less than we anticipate or even suffering further anticipated or unanticipated losses. Furthermore, our operations until the Joint Venture Closing will be primarily limited to recruiting and retaining providers to participate in the Provider Network. Since we will not gain significant experience or operating history until after the Joint Venture Closing occurs and the Health Plan begins enrolling members, the risks associated with our lack of experience and operations will not diminish until at least that time. It is possible that our inexperience will render us unable to efficiently and effectively perform services assigned to us pursuant to the Joint Venture Agreement. As a result of the foregoing, an investment in a Provider Share necessarily involves uncertainty about the stability of our earnings, cash flows and, ultimately, our ability to service and repay our debt and meet our other obligations.

We operate in an evolving industry that may not develop as expected. Assessing the future prospects of our business is challenging in light of both known and unknown risks and difficulties we may encounter. Growth prospects in our industry can be affected by a wide variety of factors, including, among others, competition from other companies, regulatory limitations on the services we can offer and the markets we can serve, changes in applicable laws and regulations and changes in underlying consumer behavior. We may not be able to successfully address these factors, which could negatively impact our growth and harm our business.

7

We have never generated revenue from operations, may never generate revenue from operations, are not currently profitable and may never become profitable.

We have incurred net losses since our formation. Although we are engaged in the Joint Venture, we operate and will continue to operate our own business, the results of which will not be controlled or guaranteed by any of the other participants in the Joint Venture. There are a number of events that must occur before we can generate revenue from operations, including the following: North Carolina’s application for Medicaid reform must receive federal approval; we must succeed in developing and maintaining the Provider Network; Carolina Complete Health must become licensed as an insurance company in North Carolina; and Carolina Complete Health must submit a bid for, be awarded and accept an N.C. Medicaid Contract. We cannot be certain that these events will occur, and even if they do, we may never generate revenue from operations that is significant enough to achieve profitability. We currently expect to begin generating revenue no earlier than mid-2019. Since we have no operating revenue, we expect to incur substantial losses and experience negative cash flow from operating activities until at least that time. In addition, there can be no assurance that we will be able to consummate our business strategy and plans or regarding whether financial, regulatory, market or other limitations may force us to modify, alter, significantly delay or significantly impede the implementation of such plans. Once we begin to generate revenue from operations, the payments we receive for our services to Carolina Complete Health will be the sole source of such revenue. If we cannot generate sufficient revenue based on our services to Carolina Complete Health, we may not achieve or maintain profitability. Furthermore, the amount of revenue that we generate from operations will directly correlate to the number of providers in the Provider Network and, as our service fees will be based on Carolina Complete Health’s revenues, will also depend on the number of members enrolled in the Health Plan and the per member per month fees set by the State of North Carolina. Accordingly, if we are unable to maintain a sufficiently sized Provider Network, or if there are a low number of members in the Health Plan or per member per month fees, it will negatively impact our revenue and may prevent us from having profitable operations. Our failure to achieve or maintain profitability would negatively impact the value of the Provider Shares and potentially require us to shut down our business, which would likely result in the loss of your investment.

We have substantial indebtedness and expect to incur additional substantial amounts of indebtedness in connection with the Joint Venture, which will affect our financial condition and may reduce the value of the Provider Shares.

Pursuant to the Second Amended and Restated Loan and Security Agreement dated August 25, 2017 between us and Centene (the “Centene Initial Loan Agreement”), Centene has funded our start-up costs with a multiple advance term loan in an amount up to $2.5 million, which amount may be increased in three increments of $500,000 up to an amount of $4.0 million upon the achievement of certain milestones related to this Offering (the “First Loan”). If Carolina Complete Health is awarded and accepts an N.C. Medicaid Contract, Centene has agreed to provide a secondary multiple advance term loan, which, based upon the amount of the Net Offering Proceeds, as well as our use of the Net Offering Proceeds, could provide us with up to an additional $3.0 million in funding, which amount may be increased up to $4.0 million if, in consultation with Centene and in Centene’s sole discretion, we have demonstrated good progress toward the establishment of the Provider Network (the “Second Loan” and, together with the First Loan, the “Initial Centene Loans”). We may use the Second Loan to fund our start-up costs, provided that the aggregate amount available under the Second Loan to fund our start-up costs will be reduced by an amount equal to 55 percent of the Net Offering Proceeds, less the amount of such proceeds applied by CCHN to capital calls for Carolina Complete Health or to repay principal borrowed from Centene under the Initial Centene Loans or the Loan and Security Agreement (as defined below). We may also use the Second Loan to repay amounts borrowed from Centene to fund a portion of our initial capital contribution to the Joint Venture Company at the Joint Venture Closing. Each of the First Loan and Second Loan bears interest at a rate of 6.75 percent and matures on the respective tenth anniversary of the first interest payment under such loan. All amounts drawn under the Initial Centene Loans are secured by all of our receivables from the CCHN Services Agreement and our partnership interest in the Joint Venture Company, and we are required under the Centene Initial Loan Agreement to remit 60 percent of our Excess Cash Flow (as defined in such agreement) to Centene in repayment of any amounts drawn.

8

Upon the Joint Venture Closing, we will enter into another Loan and Security Agreement with Centene (the “Loan and Security Agreement” and, together with the Centene Initial Loan Agreement, the “Loan Agreements”), pursuant to which Centene will provide us with multiple advance term loans in an aggregate amount of up to $40 million, $30 million of which will be incremental reserve funding that may be used by CCHN to (1) fund our portion of capital calls made for purposes of meeting Carolina Complete Health’s statutory reserve funding requirements, (2) fund a portion of our initial capital contribution to the Joint Venture Company at the Joint Venture Closing and (3) repay amounts borrowed from Centene to fund such portion of our initial capital contribution to the Joint Venture Company. The remaining $10 million will be a cushion loan in the event that we need assistance in funding our portion of capital calls made for purposes of (1) meeting Carolina Complete Health’s statutory reserve funding requirements; (2) satisfying operating losses incurred by Carolina Complete Health and/or (3) paying for any additional operating, capital or other expenses of Carolina Complete Health. Outstanding amounts under these facilities will bear interest at a rate of 5.00 percent over the three-month London Interbank Offered Rate and mature on the fifth anniversary of the date on which the initial term of the N.C. Medicaid Contract (excluding all renewals and extensions) expires or is terminated for any reason. We will not be permitted to use any borrowed funds to finance our own operations. The Loan and Security Agreement will contain an obligation to remit 60 percent of our Excess Cash Flows (as defined in such agreement) to Centene in repayment of any amounts drawn. Amounts drawn under the Loan and Security Agreement will be secured by all of our receivables from the CCHN Services Agreement and our partnership interest in the Joint Venture Company.

Our obligations under the Loan Agreements will reduce our available cash for re-investment, and therefore, may negatively impact our potential profitability until all drawn amounts are repaid. In addition, since the amounts drawn under the Loan Agreements are secured by our receivables from the CCHN Services Agreement and our partnership interest in the Joint Venture Company, if we default under either of them, you may lose the value of your investment. Our substantial indebtedness may also limit our ability to borrow additional funds or obtain additional financing in the future.

Upon the Joint Venture Closing, we will enter into an Amended and Restated Partnership Agreement with Centene Sub (the “Amended and Restated Partnership Agreement”), pursuant to which the parties have agreed that if the Joint Venture Company needs additional capital from CCHN in excess of the investment capital on-hand or available to CCHN, Centene will provide such additional capital that would otherwise be CCHN’s responsibility. If Centene were to provide such additional capital, it would dilute our partnership interest in the Joint Venture Company, and if necessary, Centene has the right to continue to provide such additional capital that can dilute our partnership interest in the Joint Venture Company from 20 percent down to a minimum partnership interest of 10 percent. Any dilution of our partnership interest in the Joint Venture Company may reduce the value of the Provider Shares. If we still require additional capital after our partnership interest in the Joint Venture Company has been reduced to 10 percent, any additional capital contribution from Centene may be reflected either as debt or preferred partnership units in the Joint Venture Company or Carolina Complete Health, which would further dilute our holdings and the value of the Provider Shares.

If we are required to raise capital through public or private financing or other arrangements, such financing may not be available on acceptable terms, or at all. Our failure to raise capital when needed could harm our business. If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of our stockholders could be significantly diluted, the newly-issued securities may have rights, preferences or privileges senior to those of existing stockholders and the value of the Provider Shares could be adversely affected. If we obtain additional debt financing, a substantial portion of our operating cash flow may be dedicated to the payment of principal and interest on such indebtedness, and the terms of the debt securities issued could impose significant restrictions on our operations.

9

Our ability to successfully build and operate the Provider Network and provide services to the Health Plan is substantially dependent upon our contractual arrangements with Centene, and any failure by Centene to perform its obligations under such contractual arrangements would have a material adverse effect on our business.

The success of our business is substantially dependent upon our contractual arrangements with Centene. In addition to providing us with necessary capital under the Loan Agreements, Centene has agreed to provide services necessary for operations in providing services to the Health Plan, including consulting services with respect to, among other things, the formation of our business and commencement of operations; recruitment and retention of health care providers to participate in the Provider Network; development of a business plan, financial plan and capitalization plan; and provision of access to data and analytics to facilitate implementation of value-based models of care on the broadest possible scale. Without the assistance to be provided by Centene, we would have to find a third party vendor to provide the necessary resources to build and operate the Provider Network effectively, which may or may not be available. Without such services, we would not be able to fulfill our obligations in the Joint Venture or continue our business. If Centene fails to perform its obligations under the contractual arrangements, we may have to incur substantial costs and expend additional resources to enforce such arrangements, and there can be no assurance that any such enforcement efforts would be effective.

We or Centene may also contract with various third parties to perform certain functions and services for us, including the provision of certain provider network services, information technology systems and other operational services and systems. Failure of any such third parties to perform their obligations could have a material adverse impact on our business.

Our success depends upon the participation in the Provider Network by health care providers serving North Carolina’s Medicaid beneficiaries.

We believe that the Health Plan will be one of the first physician-led Medicaid prepaid health plans (“PHPs”) offered in North Carolina. Our ability to build a sufficient Provider Network for the Health Plan and our ability to generate revenues will depend in part upon the willingness of North Carolina health care providers to participate in the Health Plan. Some physicians and other care providers have historically had negative opinions about managed care plans. We will need to undertake significant outreach and education efforts to sufficiently build the Provider Network. Even if North Carolina health care providers are willing to participate in a Medicaid health plan generally, there can be no assurance that they will view attributes of the Health Plan’s design favorably enough to join the Provider Network. Centene is not obligated to proceed with the Joint Venture and consummate the Joint Venture Closing if the Provider Network does not satisfy the applicable provider participation requirements established by the State of North Carolina with respect to network adequacy or if, by the applicable deadline, the number of Eligible Investors who purchase Provider Shares and the number of investors attributable to CHCs that subscribed in the Private Placement is not at least 10,000 in the aggregate. If the Joint Venture Closing does not occur, you will not realize any financial benefit from your investment. Furthermore, the revenues that we generate will depend in part upon the number of participating providers in the Provider Network; having fewer participating providers will decrease our revenues and negatively impact our financial condition.

There will be intense competition, both in the bid for an N.C. Medicaid Contract, without which the Joint Venture Closing will not occur, and also if Carolina Complete Health is awarded an N.C. Medicaid Contract, in the enrollment of members in the Health Plan.

In order to receive an N.C. Medicaid Contract, Carolina Complete Health must partake in a competitive bidding process. The State of North Carolina will offer three contracts for statewide PHPs, which may be awarded to either commercial plans or provider-led entities. Additionally, the State is authorized to award up to 12 regional PHP contracts, but only to provider-led entities. We anticipate that many companies will submit proposals in the bidding process for a statewide contract, one or more regional contracts, or both. If Carolina Complete Health is not awarded one of the available contracts, the Joint Venture Closing will not occur, and you will not realize any financial benefit from your investment.

If Carolina Complete Health is awarded an N.C. Medicaid Contract in the bidding process, there can be no guarantee that it will be one of the three statewide contracts. If Carolina Complete Health is awarded a regional N.C. Medicaid Contract, the scale of the Health Plan, and thus the scale of our operations, will be smaller, which may result in lower revenues and a longer timeframe until profitability. In addition, the Joint Venture Parties would face competition as they attempted to expand operations to serve other regions. Such competitive pressures in growing the scale of the Health Plan may impact our ability to successfully develop and operate the Provider Network. Regardless of which type of N.C. Medicaid Contract is awarded, if one is awarded, there will be competition for enrolling members in the Health Plan. Having too few members in the Health Plan would reduce Carolina Complete Health’s revenues, and in turn our revenues, perhaps below a profitable level.

10

Your ability to influence the outcome of matters submitted to our stockholders for a vote will be limited, and our influence over the actions of the Joint Venture Company will be limited.

Even though the CCHN Board ultimately will be composed of a majority of physicians, after the completion of the Offering, the NCMS will continue to hold 50 percent of the aggregate voting power of our securities. In addition, each Eligible Investor is limited to purchasing one Provider Share, whereas CHCs and the NCCHCA may have purchased more than one share of Class P Common Stock in the Private Placement. These circumstances will limit your ability to influence the outcome of matters submitted to our stockholders for a vote, including amendment of our Amended and Restated Certificate of Incorporation or our Amended and Restated Bylaws or the approval of any merger or other significant corporate transaction.

Additionally, the Offering will not impact the structure of the Joint Venture. CCHN and Centene Sub will own 20 percent and 80 percent of the partnership interests of the Joint Venture Company, respectively, which in turn, will continue to own 100 percent of Carolina Complete Health. In addition, although the Amended and Restated Partnership Agreement provides that only four of the 15 members of the Carolina Complete Health Board will be employees of Centene, eight of the 10 members of the management committee of the Joint Venture Company (the “Joint Venture Company Management Committee”) will be employees of Centene. Furthermore, under the Amended and Restated Partnership Agreement, our partnership units of the Joint Venture Company will be subject to certain “drag-along” rights in favor of Centene Sub. Accordingly, if Centene Sub elects to engage in a transaction with a third party purchaser that results in the sale of all of its partnership units of the Joint Venture Company or in the sale or other disposition of all or substantially all of the property and assets of the Joint Venture Company, Centene Sub may compel us to approve such transaction and, as applicable, sell our partnership units of the Joint Venture Company too. These governance and other provisions may restrict our ability to exert influence over and manage the business and operations of the Joint Venture Company.

We may pursue additional business opportunities that may not be successful.

Until such time as any and all amounts due and payable under any loan by Centene to CCHN, including the Initial Centene Loans, have been paid in full (the “Exclusivity Period”), CCHN is not permitted to provide network access and/or management services to any party other than Centene and Carolina Complete Health. Nonetheless, CCHN may explore and, prior to the expiration of the Exclusivity Period and with a waiver from Centene if needed, may enter into additional business opportunities with or without Centene and/or Carolina Complete Health, including, without limitation, providing services for the formation and operation of a health care plan or a network of health care providers, the provision of a Health Insurance Marketplace or Medicare Advantage product or other opportunities as they may arise.

Any opportunities that we may identify and pursue may involve risks, including the commitment of significant capital, the incurrence of additional indebtedness, the payment of advances, the acceleration of our proposed schedule of operations, the diversion of management’s attention and resources, litigation or other claims in connection with the endeavors, our lack of control over partnerships, joint ventures or other investment arrangements that facilitate the pursuit of those opportunities, the inability to successfully integrate any new businesses into our operations or even if successfully integrated, the risk of not achieving the intended results and the exposure to losses if the businesses are not successful. Additionally, pursuit of additional business opportunities may subject us to compliance with additional regulations depending on the nature of those businesses and our activities, which compliance may be burdensome and involve risks of liability and loss. If we do pursue new business opportunities, and those opportunities are not successful, we may not be able to offset their costs, which could have an adverse effect on our business, financial condition and operating results.

We may be unable to attract, retain or effectively manage the succession of key personnel.

We are highly dependent on our ability to attract and retain qualified personnel to operate our business. We currently have a very small management team, consisting of Jeffrey W. Runge, MD, an outside consultant serving as our President and Chief Executive Officer, Vincent T. Morgus, an employee of the NCMS serving as our Chief Operating Officer and Stephen W. Keene, an employee of the NCMS serving as our Secretary-Treasurer. We do not expect to hire employees until after the Joint Venture Closing. Until such time, we will rely exclusively on contracted assistance in connection with our preliminary activities related to building the Provider Network. If and when they are needed, our ability to find qualified individuals to serve as employees may be difficult and take an extended period of time because of the limited number of individuals in the managed care industry with the breadth of skills and experience required to operate and successfully expand a business such as ours. Competition to hire from this limited pool is intense, and we may be unable to hire, train, retain or motivate these personnel. In addition, the unique nature of our capital and governance structure will preclude us from compensating personnel with equity securities, and it may be difficult for us to offer competitive levels of cash compensation. If we are unable to attract and retain and effectively manage the succession plans for key personnel, executives and senior management, our business and financial position, results of operations or cash flows could be harmed.

We may be subject to liability as a general partner of the Joint Venture Company.

CCHN is a general partner in the Joint Venture Company. As a general partner, we are potentially liable for all of the liabilities of the partnership, despite holding only a minority of the partnership interests in the Joint Venture Company. Therefore, our liability could far exceed the amount or value of investment we will have made in the partnership even though the Amended and Restated Partnership Agreement will contain indemnification and contribution provisions that require the general partners to bear their respective percentage interests of losses incurred by any partner with respect to partnership liabilities. If we incur liability in connection with our interest in the Joint Venture Company, our financial condition, results of operations and business prospects could suffer.

11

A failure in or breach of our operational or security systems or infrastructure, or those of third parties with which we do business, including as a result of cyber attacks, could have an adverse effect on our business.

Information security risks have significantly increased in recent years in part because of the proliferation of new technologies, the use of the internet and telecommunications technologies to conduct our operations, and the increased sophistication and activities of organized crime, hackers, terrorists and other external parties, including foreign state agents. Our operations rely on the secure processing, transmission and storage of confidential, proprietary and other information in our computer systems and networks.

Security breaches may arise from external or internal threats. External breaches include hacking personal information for financial gain, attempting to cause harm to our operations, or intending to obtain competitive information. We plan to maintain a rigorous system of preventive and detective controls through our security programs; however, our prevention and detection controls may not prevent or identify all such attacks. Internal breaches may result from inappropriate security access to confidential information by rogue future employees, consultants or third party service providers. Any security breach involving the misappropriation, loss or other unauthorized disclosure or use of confidential member information, provider information, financial data, competitively sensitive information or other proprietary data, whether by us or a third party, could have a material adverse effect on our business.

Recent U.S. tax legislation may adversely affect our financial condition, results of operations and cash flows.

Recently enacted U.S. tax legislation has significantly changed the U.S. federal income taxation of U.S. corporations, including by reducing the U.S. corporate income tax rate, limiting interest deductions, permitting immediate expensing of certain capital expenditures, and revising the rules governing net operating losses. Many of these changes are effective immediately, without any transition periods or grandfathering for existing transactions. The legislation is unclear in many respects and could be subject to potential amendments and technical corrections, as well as interpretations and implementation regulations by the U.S. Department of the Treasury and Internal Revenue Service, any of which could materially affect the impacts of the legislation. In addition, it is unclear how these U.S. federal income tax changes will affect state and local taxation, which often uses federal taxable income as a starting point for computing state and local tax liabilities.

While some of the changes made by the tax legislation may adversely affect us in one or more reporting periods and prospectively, other changes may be beneficial on a going forward basis. We continue to work with our tax advisors to determine the full impact of this legislation on us. See Note 6, “Income Taxes,” in the notes to our financial statements appearing elsewhere in this Offering Circular for additional information about our deferred tax assets and our provisional analysis of the income tax effects of this new legislation.

Risks Related to Compliance and Regulation

The activities undertaken in the performance of the Joint Venture will be highly regulated, and new laws or regulations or changes in existing laws or regulations or their enforcement or application could force us to change how we operate and could harm our business.

The business activities that will be undertaken in the course of the Joint Venture, particularly the activities of Carolina Complete Health, will be extensively regulated by the North Carolina and federal governments. In addition, the managed care industry has received negative publicity that has led to increased legislation, regulation, review of industry practices and private litigation. The operations of certain of the Joint Venture Parties will be regulated by the relevant insurance and health and human services departments charged with overseeing the activities of the PHPs selected to provide or arrange for services to Medicaid beneficiaries. For example, Carolina Complete Health will need to comply with minimum statutory capital and other financial solvency requirements, such as deposit and surplus requirements.

The frequent enactment of, changes to, or interpretations of laws and regulations could, among other things, force us to restructure our relationships with providers within the Provider Network; require us to implement additional or different programs and systems; restrict revenue and enrollment growth; increase Carolina Complete Health’s medical and administrative costs; impose additional capital and surplus requirements on Carolina Complete Health; and increase or change Carolina Complete Health’s liability to members in the event of malpractice by our contracted providers. In addition, changes in political party or administrations at the state or federal level may change the attitude towards health care programs.

Additionally, the taxes and fees paid to federal, state and local governments may increase due to several factors, including enactment of, changes to, or interpretations of tax laws and regulations, and audits by governmental authorities.

If awarded, Carolina Complete Health’s N.C. Medicaid Contract will include a minimum medical loss ratio (“MLR”), which will require Carolina Complete Health to expend a percentage of the premiums it receives from the State on health care services for beneficiaries. Failure to maintain the minimum MLR could result in the assessment of financial penalties or other sanctions against Carolina Complete Health. The N.C. Medicaid Contract may also require Carolina Complete Health to return premium to the State if the Health Plan generates profits that exceed established levels. The N.C. Medicaid Contract may also require Carolina Complete Health to meet certain performance and quality metrics in order to maintain its contract or receive additional or full contractual revenue. For Carolina Complete Health to meet or achieve these various requirements, CCHN may need to contribute additional capital to the Joint Venture Company, which could have a material adverse effect on our business and financial position.

12

Although we strive to comply with all existing regulations and to meet performance standards applicable to the Joint Venture’s business, failure to do so could result in financial penalties or other sanctions. In addition, if other Joint Venture Parties fail to comply with existing regulations and performance standards applicable to their respective operations, it would have a negative impact on the Joint Venture as a whole and could negatively impact our operations. Also, even if Carolina Complete Health is awarded an N.C. Medicaid Contract, North Carolina may not allow it to continue to participate in the Medicaid program, or it may fail to win future procurements to participate in such program, which may end our business.

If any of the applicable Joint Venture Parties or Carolina Complete Health fails to comply with applicable privacy, security and data laws, regulations and standards, including with respect to third-party service providers that utilize sensitive personal information on our behalf, our business, reputation, results of operations, financial position and cash flows could be materially and adversely affected.

As part of their normal operations, certain of the Joint Venture Parties and Carolina Complete Health will collect, process and retain confidential member information. They will be subject to various federal and state laws and rules regarding the use and disclosure of confidential member information, including the Health Insurance Portability and Accountability Act (“HIPAA”) and the Health Information Technology for Economic and Clinical Health Act (“HITECH”) and the Gramm-Leach-Bliley Act, which require the protection of the privacy of medical records and the safeguarding of personal health information that is maintained and used. Despite our best attempts to maintain adherence to information privacy and security best practices as well as compliance with applicable laws and rules, our facilities and systems, and those of our third party service providers, may be vulnerable to privacy or security breaches, acts of vandalism or theft, malware, misplaced or lost data including paper or electronic media, programming and/or human errors or other similar events. Data breaches could require us to expend significant resources to remediate any damage, interrupt our operations and damage our reputation, subject us to state or federal agency review and could also result in enforcement actions, material fines and penalties, litigation or other actions which could have a material adverse effect on our business. Similar occurrences that may be experienced by other Joint Venture Parties required to comply with HIPAA and HITECH or Carolina Complete Health could have a material adverse effect on the operations of the Joint Venture and thus on our business.

In addition, HIPAA broadened the scope of fraud and abuse laws applicable to health care companies. HIPAA created civil penalties for, among other things, billing for medically unnecessary goods or services. HIPAA established new enforcement mechanisms to combat fraud and abuse, including civil and, in some instances, criminal penalties for failure to comply with specific standards relating to the privacy, security and electronic transmission of protected health information. The HITECH Act expanded the scope of these provisions by mandating individual notification in instances of breaches of protected health information, providing enhanced penalties for HIPAA violations, and granting enforcement authority to states’ Attorneys General in addition to the HHS Office for Civil Rights. It is possible that Congress may enact additional legislation in the future to increase penalties and to create a private right of action under HIPAA, which could entitle patients to seek monetary damages for violations of the privacy rules. In addition, HHS has announced that it will continue its audit program to assess HIPAA compliance efforts by covered entities with a focus on security risk assessments. An audit resulting in findings or allegations of noncompliance could have a material adverse effect on our business.

If any of the applicable Joint Venture Parties or Carolina Complete Health fails to comply with the extensive federal and state fraud and abuse laws, our business could be materially and adversely affected.

Detection and prevention of fraud, waste and abuse in Medicaid has been a major focus of federal and state government in recent years. Recent federal regulations have strengthened program integrity requirements to state Medicaid agencies and Medicaid managed care organizations, and carry risk of sanctions for noncompliance. Areas of emphasis include provider screening and enrollment, claims processing, data collection and sound compliance programs designed to detect and prevent fraud. Another applicable law is the federal False Claims Act, which prohibits the known filing of a false claim or the known use of false statements to obtain payment from the federal government. Many states have false claim act statutes that closely resemble the federal False Claims Act. Federal and state governments have made investigating and prosecuting health care fraud and abuse a priority. In the event any of the applicable Joint Venture Parties or Carolina Complete Health fails to comply with the extensive federal and state fraud and abuse laws, our business could be materially and adversely affected.

The requirements of complying on an ongoing basis with Regulation A of the Securities Act of 1933, as amended (the “Securities Act”) may strain our resources and divert management’s attention.

Because we are conducting an offering pursuant to Regulation A of the Securities Act, we are subject to certain ongoing reporting requirements. Compliance with these rules and regulations will require legal and financial compliance costs, which may impose strain on our operating budget and divert management’s time and attention from operational activities. The requirements of Regulation A may also make it significantly more expensive for us to maintain director and officer liability insurance. These factors could also make it difficult for us to attract and retain qualified officers or members of the CCHN Board. Moreover, as a result of the disclosure of information in this Offering Circular and in other public filings we make, our business operations, operating results and financial condition have become and will continue to be more visible, including to competitors and other third parties.

13

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Offering Circular contains forward-looking statements. In some cases, you can identify these statements by forward-looking words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect” or the negative or plural of these words or similar expressions. These forward-looking statements include, but are not limited to, statements concerning us, risk factors, plans and projections. You should not rely upon forward-looking statements as predictions of future events. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk Factors.” In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Offering Circular may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

Except as required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Offering Circular to conform these statements to actual results or to changes in our expectations.

You should read this Offering Circular, and the documents that we reference in this Offering Circular and have filed with the Commission as exhibits to the Offering Statement on Form 1-A of which this Offering Circular is a part with the understanding that our actual future results, performance and events and circumstances may be materially different from what we expect.

INVESTOR SUITABILITY REQUIREMENTS

We are only offering the Provider Shares to Eligible Investors. To purchase a Provider Share in the Offering, you must be a physician, physician assistant or nurse practitioner who:

| ● | if a physician or physician assistant, is licensed, and if a nurse practitioner, has approval to practice, pursuant to Article I, Chapter 90 of the North Carolina General Statutes; |

| ● | resides in North Carolina, Georgia, South Carolina, Tennessee or Virginia; and |

| ● | has executed a Participating Provider Agreement with CCHN and Carolina Complete Health or is bound as a “Contracted Provider” (as defined therein) by an existing Participating Provider Agreement between CCHN, Carolina Complete Health and a “Provider” (as defined therein) by which he or she is employed or with which he or she has a contractual relationship. |

In addition, in order to invest, applicable securities laws require that either (1) you are an “accredited investor” as such term is defined in Rule 501 promulgated under the Securities Act (“Rule 501”) or (2) the purchase price that you pay for the Provider Share ($750.00) is no more than 10 percent of the greater of your annual income or net worth (as determined under Rule 501).

14

Executing a Participating Provider Agreement with CCHN and Carolina Complete Health or being bound as a “Contracted Provider” under a Participating Provider Agreement (as defined therein) is required to be an Eligible Investor. While ownership of our securities is not required to participate in the Provider Network, ideally each Eligible Investor would elect to purchase a Provider Share and become a stockholder of CCHN. In order to purchase a Provider Share, Eligible Investors must also execute a Subscription Agreement and the Stockholders’ Agreement. Forms of each of these documents are filed as exhibits to the Offering Statement on Form 1-A of which this Offering Circular is a part. You should read these forms in their entirety before deciding whether to invest in a Provider Share.

| ● | Participating Provider Agreement: In order to invest in a Provider Share, you must either execute a Participating Provider Agreement or be a Contracted Provider under a Participating Provider Agreement (as defined therein). The Participating Provider Agreement obligates you to, subject to the approval of Carolina Complete Health and/or its affiliates, participate as a health care provider for Carolina Complete Health under the Health Plan and such other programs or health benefit arrangements identified in such agreement. It also requires you to comply with the requirements, policies, programs and procedures of Carolina Complete Health (and/or its affiliates) and any payor entity, including, but not limited to, credentialing criteria and requirements; notification requirements; medical management programs; claims and billing, quality assessment and improvement, utilization review and management, disease management, case management, on-site reviews, referral and prior authorization, and grievance and appeal procedures; coordination of benefits and third party liability policies; carve-out and third party vendor programs; and data reporting requirements. The Participating Provider Agreement has a three-year initial term and automatically renews for successive annual terms subject to the termination provisions therein. |

| ● | Subscription Agreement: To purchase a Provider Share, you must execute a Subscription Agreement. In the Subscription Agreement, you will be required to make certain representations and warranties regarding your status as an Eligible Investor. You also acknowledge and agree that the Subscription Agreement will be signed by electronic signature and that all communications with respect to your investment in a Provider Share will be delivered electronically. |

| ● | Stockholders’ Agreement: In order to become a holder of a Provider Share, you must also execute the Stockholders’ Agreement, which governs certain rights and obligations in connection with holding Class P Common Stock of CCHN. The Stockholders’ Agreement describes the circumstances under which and procedures by which CCHN may redeem your Provider Share. See “Description of Capital Stock—Description of the Class P Common Stock.” The Stockholders’ Agreement also provides that you may not transfer your Provider Share and that you will be suspended from voting during any time that you no longer qualify as an Eligible Investor or following the date on which you have experienced an event that would trigger a redemption right for CCHN. |

In addition to executing the investment documents described above, you generally are required to have a brokerage account with Folio Investments, Inc. (“Folio”), as Provider Shares may only be purchased through Folio’s online investment platform. For more information about Folio and the procedures for subscribing for a Provider Share, see “Plan of Distribution.”