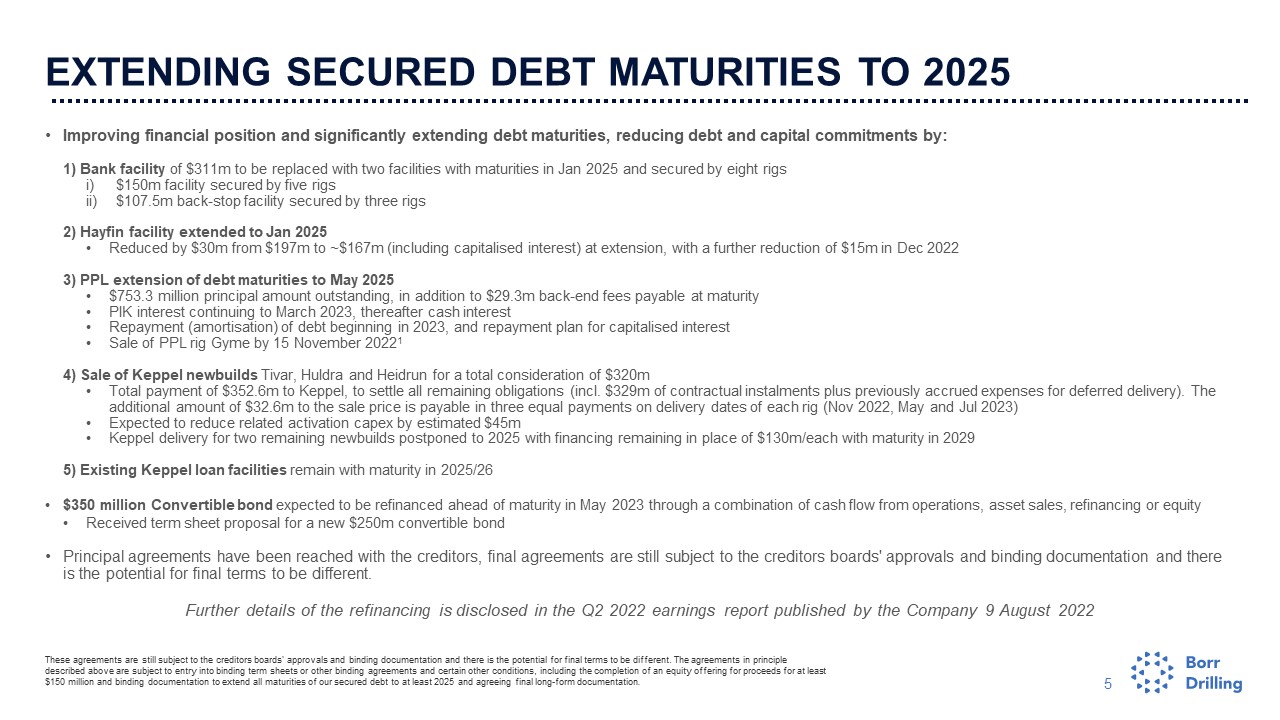

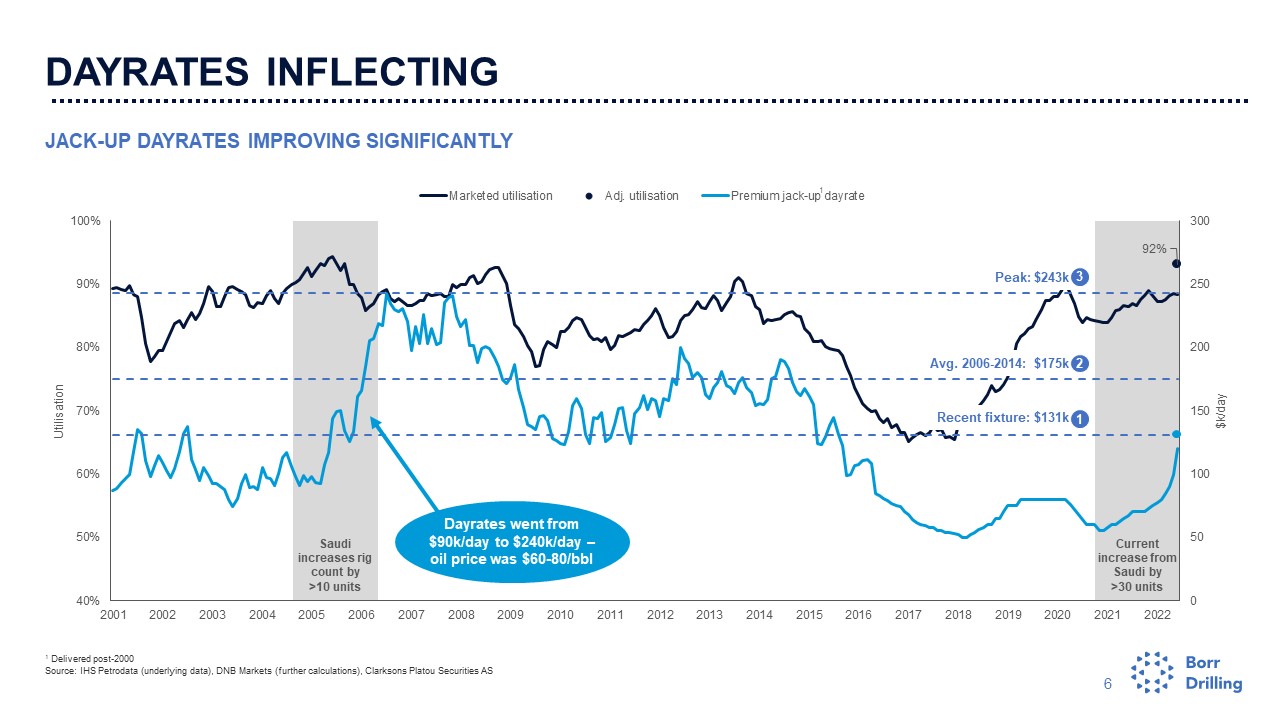

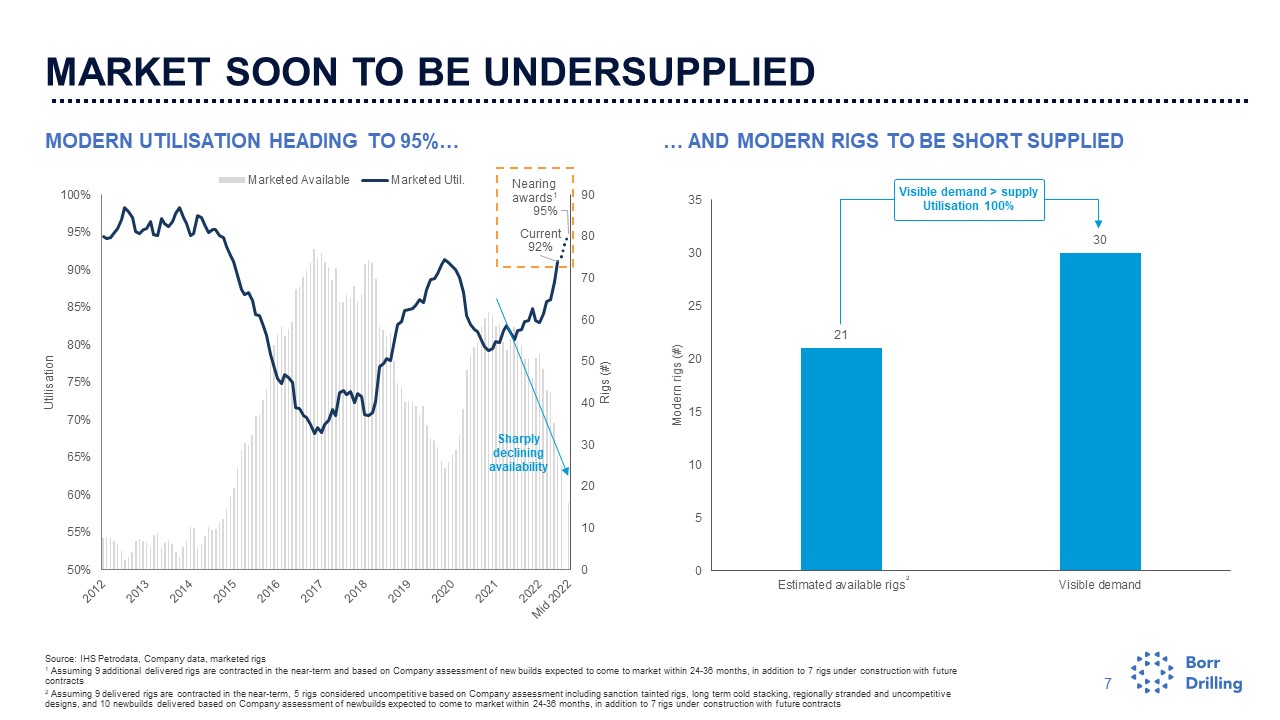

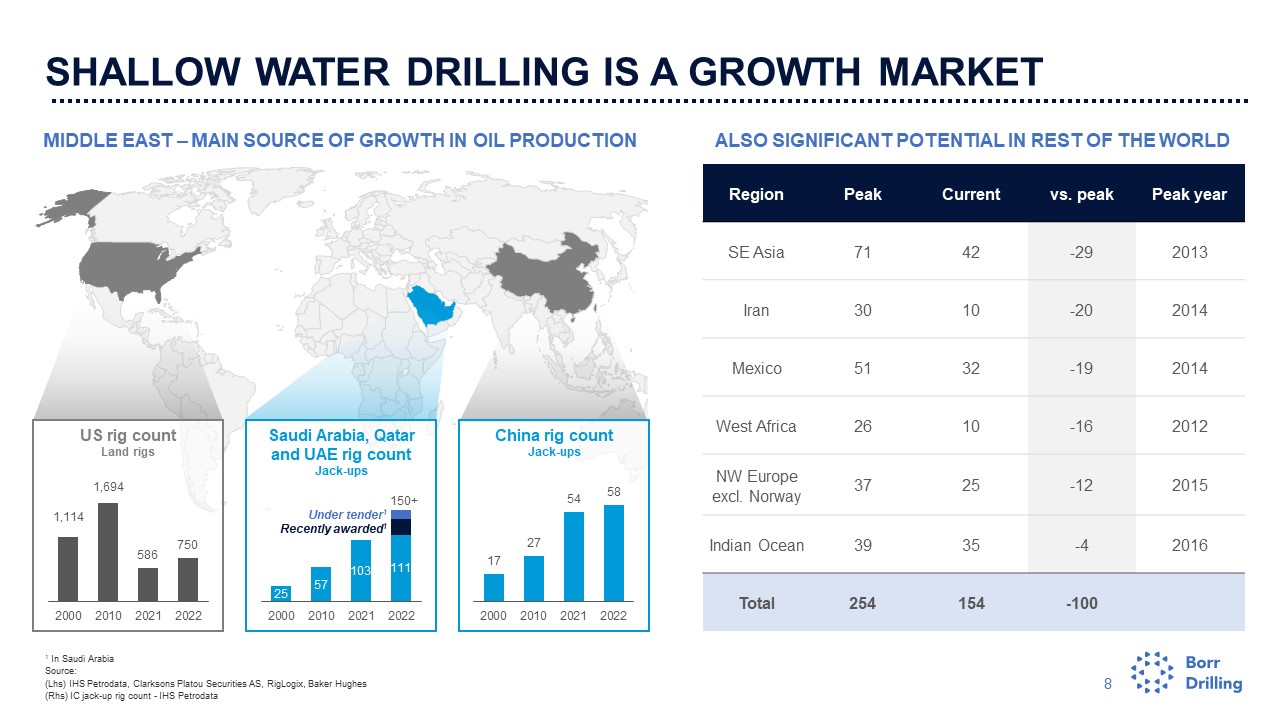

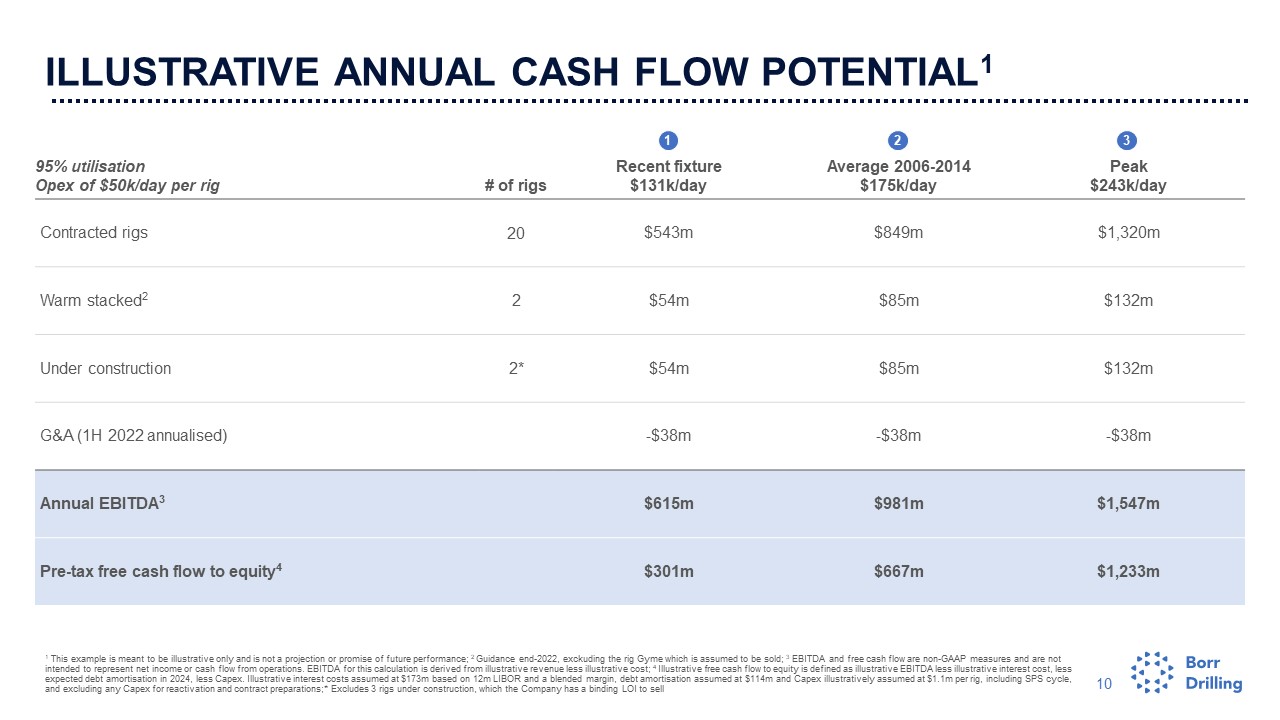

FORWARD LOOKING STATEMENTS/ This presentation and related discussions includes forward looking statements, which may be identified by words such as "continue", "estimate", "expect", "illustrative," "intends", "may", "project," "potential," "will" and similar expressions and include statements with respect to the proposed refinancing with certain of our lenders for which binding term sheets or other agreements are expected to be concluded during August 2022, expected payments to our lenders, the expected terms and expected benefits of the refinancing and the binding agreements we expect to enter into with lenders, including our expectation that the refinancing will contribute to a more solid financial position, and our plan to refinance our convertible bonds, including statements with respect to the high visibility on the refinancing of these bonds, expected financial results, expected industry trends, including expected incremental earnings, asset sale or new debt, statements with respect to the LOI to sell three of our rigs under construction, statements about substantially extended liquidity runway, statements with respect to the strong fundamentals drilling activity increase and quick paybacks, statements about the drilling market, including this market to be soon undersupplied, the shallow water drilling being a true growth market, statements about the high profitable drilling industry, including illustrative internal rate of returns (IRR), modern rig demand, market and dayrates growth in shallow water drilling market, illustrative annual cash flow potential, upside potential, statements in relation in connection with our fleet contract overview and other non-historical statements. These forward-looking statements are subject to risks, uncertainties, contingencies and other factors could cause actual events to differ materially from the expectations expressed or implied by the forward-looking statements included herein, including the risk that we may not be able to refinance our indebtedness as it falls due, the risk that we will not enter into binding term sheets or other agreements with all applicable lenders, including the risks that board approvals for the binding agreements or other agreements with our lenders are not obtained, the risk that we are unable to obtain necessary consents from other creditors, or reach final agreements and execute definitive documentation with our creditors for the binding agreements and risks relating to the final terms of such agreements, risks relating to meeting conditions to these agreements, including the payment requirements of these agreements, the risk that we will not consummate the proposed refinancing on expected terms or at all, risks relating to our liquidity including the risk that we may have insufficient liquidity to fund our operations, risks relating to our business and industry including industry conditions, the risk that actual results will be lower than those anticipated, risks relating to cash flows from operations, the risk that we may be unable to raise necessary funds through issuance of additional debt or equity or sale of assets and the risk that future equity issuances will dilute existing shareholders, risks relating to our debt instruments including risks relating to our ability to comply with covenants and obtain any necessary waivers and the risk of cross defaults, risks relating to our ability to meet our debt obligations and obligations under rig purchase contracts, risks relating to future performance including risks that upside potential and illustrative cash flow potential is not achieved, risks relating to industry supply and demand trends and rates and utilization, and other risks included in our filings with the Securities and Exchange Commission including those set forth under “Risk Factors” in our annual report on Form 20-F for the year ended December 31, 2021. 2