NASDAQ: TGAN Leading the GaN Revolution Fiscal Q2’23 Investor Update November 9th, 2022 l NASDAQ: TGAN

NASDAQ: TGAN Safe Harbor Statement • This presentation is made solely for informational purposes, and no representation or warranty, express or implied, is made by Transphorm, Inc. (“Transphorm”) or any of its representatives as to the information contained in these materials or disclosed during any related presentations or discussions. This presentation is intended solely for the purposes of familiarizing investors with Transphorm. This presentation is not an offer to sell nor does it seek an offer to buy any securities. • This presentation contains forward-looking statements. All statements other than statements of historical fact contained in this presentation, including statements regarding Transphorm’s business strategy, plans and objectives for future operations, expectations regarding its total addressable market, products, and competitive position, are forward- looking statements. The words “may,” “will,” “estimate,” “expect,” “plan,” “believe,” “potential,” “predict,” “target,” “should,” “would,” “could,” “continue,” “believe,” “project,” “intend” or similar terminology are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. • Transphorm may not actually achieve the plans, intentions, or expectations disclosed in these forward-looking statements, and you should not place undue reliance on these forward-looking statements. These statements are based upon • management’s current expectations, assumptions and estimates, and are not guarantees of future results or the timing thereof. Actual results may differ materially from those contemplated in these statements due to a variety of risks and uncertainties, including risks and uncertainties related to Transphorm’s business and financial performance and cash flows and its ability to reduce operating losses and achieve profitability, attract and retain customers, continue commercial production, continue to access funding sources to finance operations, continue having access to third party manufacturers, develop new products, enhance existing products, compete effectively, manage growth and costs, and execute on its business strategy. The following-looking statements contained in this presentation are also subject to other risks and uncertainties, including those more fully described in our filings with the Securities and Exchange Commission, including our Quarterly Report on Form 10-Q for the quarter ended June 30, 2022. • The information contained herein is provided only as of the date on which this presentation is made and is subject to change. Transphorm is not under any obligation, except as may be required by law, to update or otherwise revise the information after the date of this presentation. Transphorm has not independently verified the statistical and other industry data generated by independent parties and contained in this presentation and accordingly cannot guarantee their accuracy or completeness. 2

NASDAQ: TGAN Key Investment Highlights GaN Power Semiconductor Pioneer and Leader Ramping Commercially with Strong Manufacturing Base Technology and Product Development completed, Integrated Manufacturing, $24.1M FY-22 Revenues, Target >50% LT CAGR Best-In-Class Differentiated GaN Technology + Industry’s Strongest IP Position IP Portfolio Appraised in Excess of $200M3 Leader in Quality + Reliability, > 80 Billion Field hours, Silicon-like Reliability4 TGAN FET: Higher performance, easy interface, multiple packages Team Led by World-Renowned GaN Experts Proven Leadership, 18 PhDs and Over 300 Years of GaN Expertise, Recent expansion with Industry leaders Disruptive Technology GaN Enables Next Generation Power Conversion Solutions – 99% Efficiency1, 50% More Compact/Lightweight, Lower System Cost Large Market Opportunity Transphorm’s GaN Solutions will Enable the Future of Electric Vehicles and Fast-charging for 5G – Contributing to GaN TAM growing to $6B2 in 2026 1 Measured TGAN >99% efficient power stages, commercial implementations 2 See slide 10 on GaN TAM Analysis 3 3 2021 Analysis done for GaN portfolio using Intracom Group Intellectual Property Solutions’ patent valuation models based on 27 independent criteria, value consists of Transphorm’s owned or exclusively licensed patents (non-exclusive patents not included) 4 Based on field performance, low power and high power GaN, FIT (Failure in Time) < 0.2 per Billion hours Validation From Blue Chip Partners and Customers Including KKR, SAS, Nexperia, Yaskawa, Marelli, Microchip, Diodes and the U.S. DoD(Navy), DOE

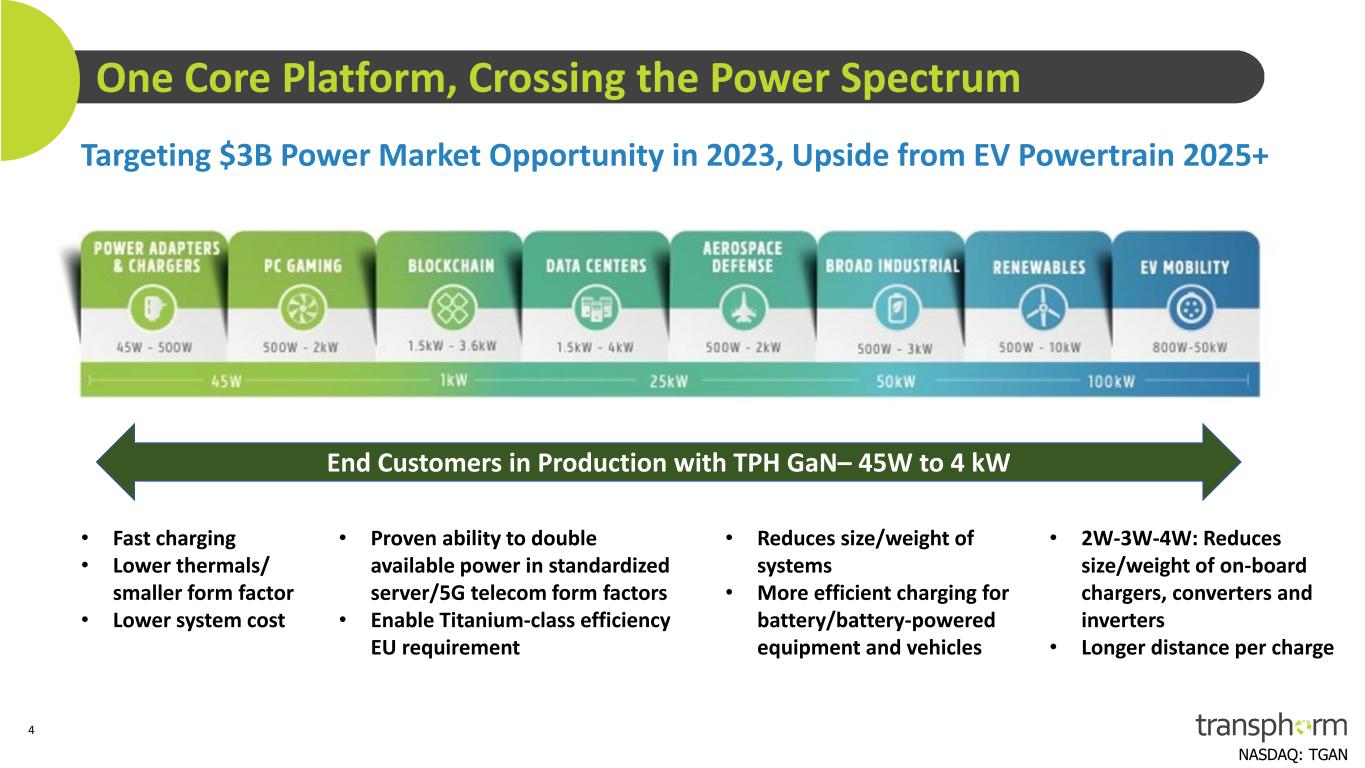

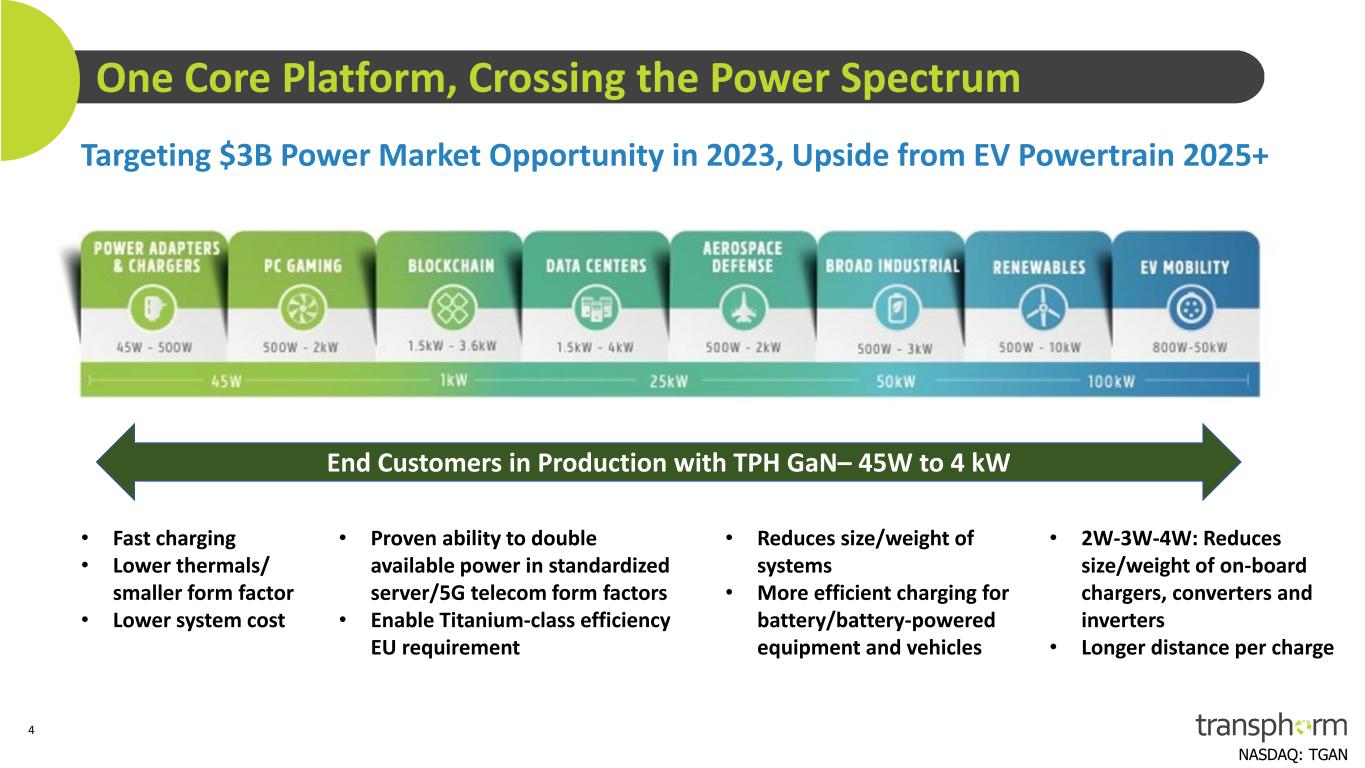

NASDAQ: TGAN One Core Platform, Crossing the Power Spectrum Targeting $3B Power Market Opportunity in 2023, Upside from EV Powertrain 2025+ • Fast charging • Lower thermals/ smaller form factor • Lower system cost • Proven ability to double available power in standardized server/5G telecom form factors • Enable Titanium-class efficiency EU requirement • Reduces size/weight of systems • More efficient charging for battery/battery-powered equipment and vehicles Near Term Long Term 4 • 2W-3W-4W: Reduces size/weight of on-board chargers, converters and inverters • Longer distance per charge End Customers in Production with TPH GaN– 45W to 4 kW

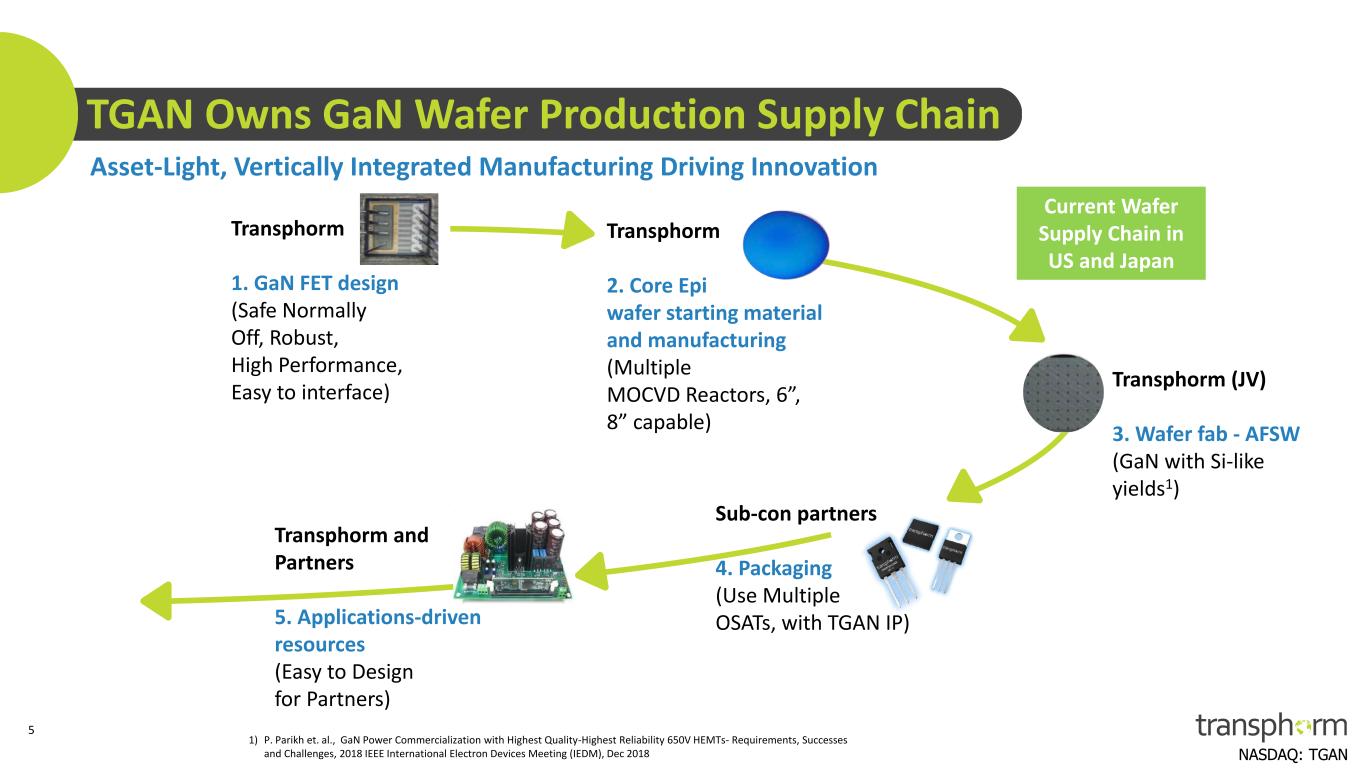

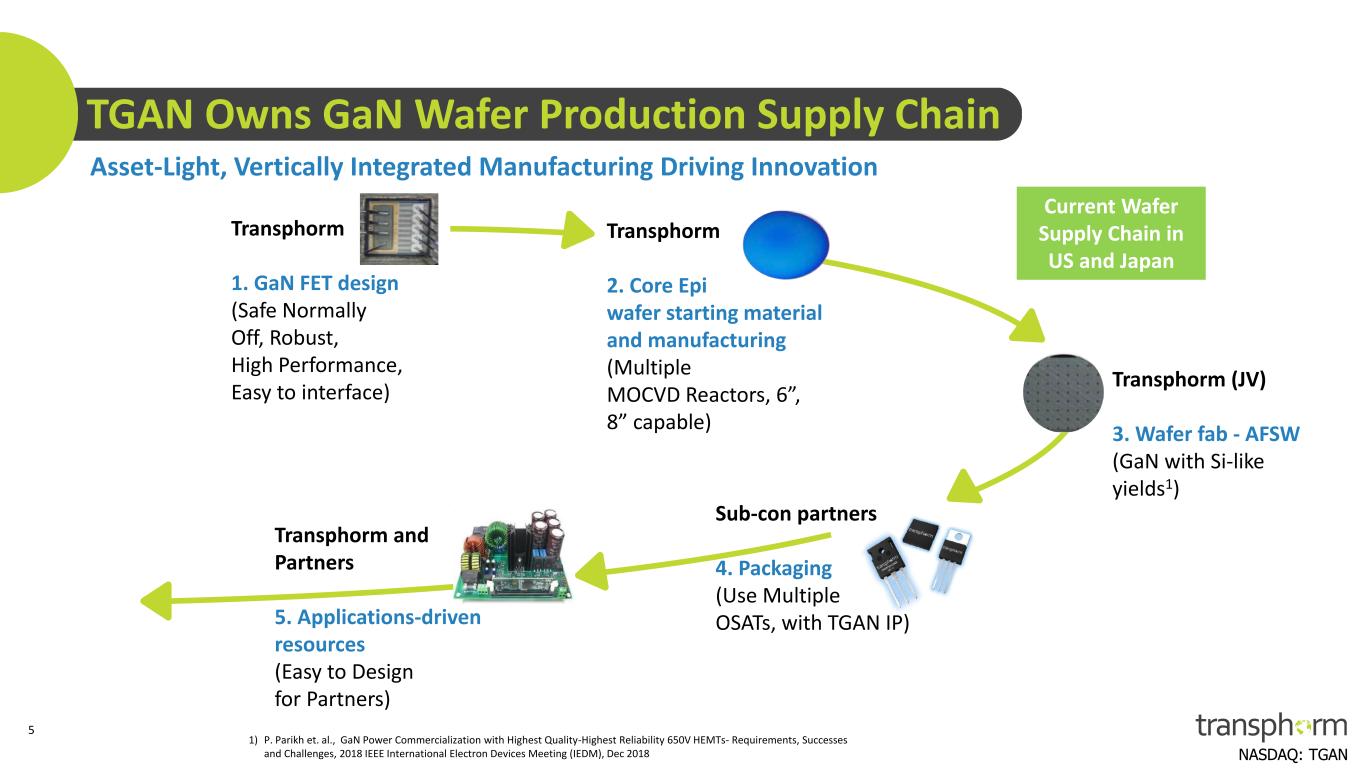

NASDAQ: TGAN TGAN Owns GaN Wafer Production Supply Chain Asset-Light, Vertically Integrated Manufacturing Driving Innovation Transphorm (JV) 3. Wafer fab - AFSW (GaN with Si-like yields1) Transphorm 1. GaN FET design (Safe Normally Off, Robust, High Performance, Easy to interface) Transphorm 2. Core Epi wafer starting material and manufacturing (Multiple MOCVD Reactors, 6”, 8” capable) Sub-con partners 4. Packaging (Use Multiple OSATs, with TGAN IP) Transphorm and Partners 5. Applications-driven resources (Easy to Design for Partners) 5 1) P. Parikh et. al., GaN Power Commercialization with Highest Quality-Highest Reliability 650V HEMTs- Requirements, Successes and Challenges, 2018 IEEE International Electron Devices Meeting (IEDM), Dec 2018 Current Wafer Supply Chain in US and Japan

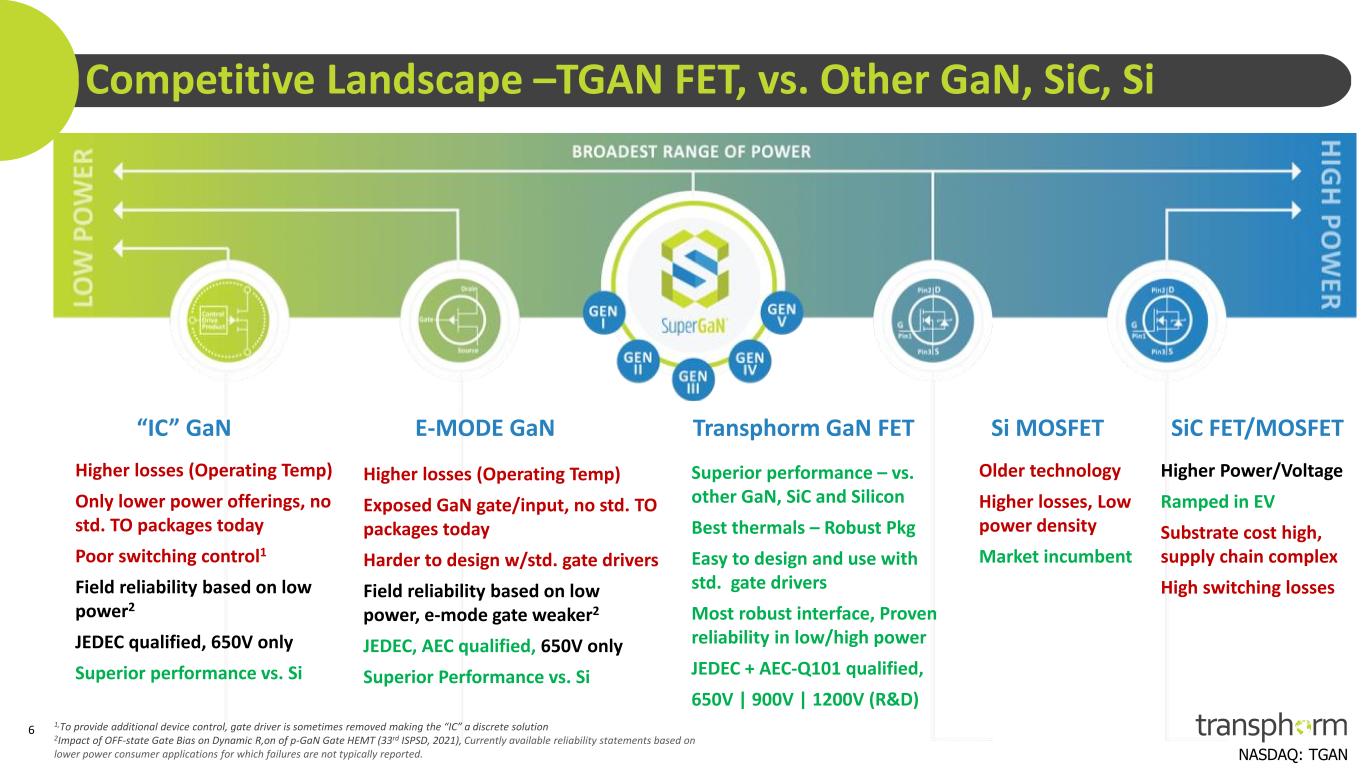

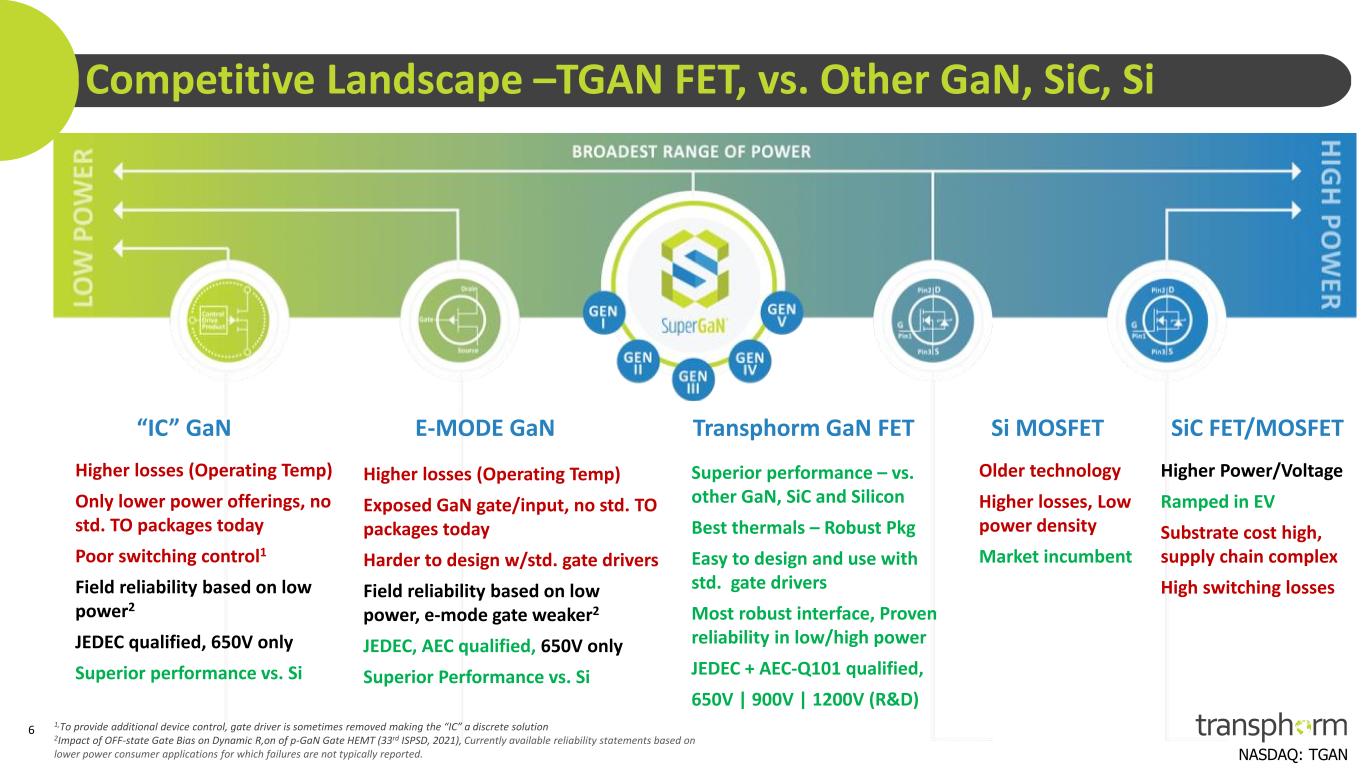

NASDAQ: TGAN Competitive Landscape –TGAN FET, vs. Other GaN, SiC, Si Higher losses (Operating Temp) Exposed GaN gate/input, no std. TO packages today Harder to design w/std. gate drivers Field reliability based on low power, e-mode gate weaker2 JEDEC, AEC qualified, 650V only Superior Performance vs. Si Higher losses (Operating Temp) Only lower power offerings, no std. TO packages today Poor switching control1 Field reliability based on low power2 JEDEC qualified, 650V only Superior performance vs. Si Older technology Higher losses, Low power density Market incumbent Higher Power/Voltage Ramped in EV Substrate cost high, supply chain complex High switching losses Superior performance – vs. other GaN, SiC and Silicon Best thermals – Robust Pkg Easy to design and use with std. gate drivers Most robust interface, Proven reliability in low/high power JEDEC + AEC-Q101 qualified, 650V | 900V | 1200V (R&D) 1,To provide additional device control, gate driver is sometimes removed making the “IC” a discrete solution 2Impact of OFF-state Gate Bias on Dynamic R,on of p-GaN Gate HEMT (33rd ISPSD, 2021), Currently available reliability statements based on lower power consumer applications for which failures are not typically reported. 6 “IC” GaN E-MODE GaN Transphorm GaN FET Si MOSFET SiC FET/MOSFET

NASDAQ: TGAN TGAN FET: Higher Range, Reliability & Performance Spanning Low to High Power 1. Based on our best knowledge of released products, press release and in volume production with customers’ systems 2. Based on existing rectifiers with 92% efficiency | Source: EPA estimated one kWh produces 1.52 pounds of carbon dioxide (excl. line-losses). 7 Markets GaN e-mode or “IC” GaN FET Power Range TGAN Wins Adapters 30-250W Datacenters 800-3200W Gaming (Desktop) 1600W Blockchain 1600-3600W Industrial, Renewable (≥ 500 W) 500-3000W Aerospace 420-1200W In Production1 Why Transphorm GaN FETs Win • Easy to use and drive (standard Si-like interface) • “e-mode” input interface is weaker – hard to operate in widely used TO Packages for higher power • 1 GaN FET = 2 e-mode GaN (mid-higher power) • Superior Dynamic performance => Efficiency • Higher performance, from smaller GaN die (vs. e-mode) • 30-50% effective on-resistance (loss) benefit at operating Temperatures • Proven reliability & manufacturing for scaled device • 45W – 10 kW capable single GaN device in production • AEC qualified • Higher power => higher energy and emissions impact, • Blockchain: 120 TWH, TGAN’s 1% efficiency gain => 1TWH + > 125 lbs of CO2 emissions / TGAN Device2

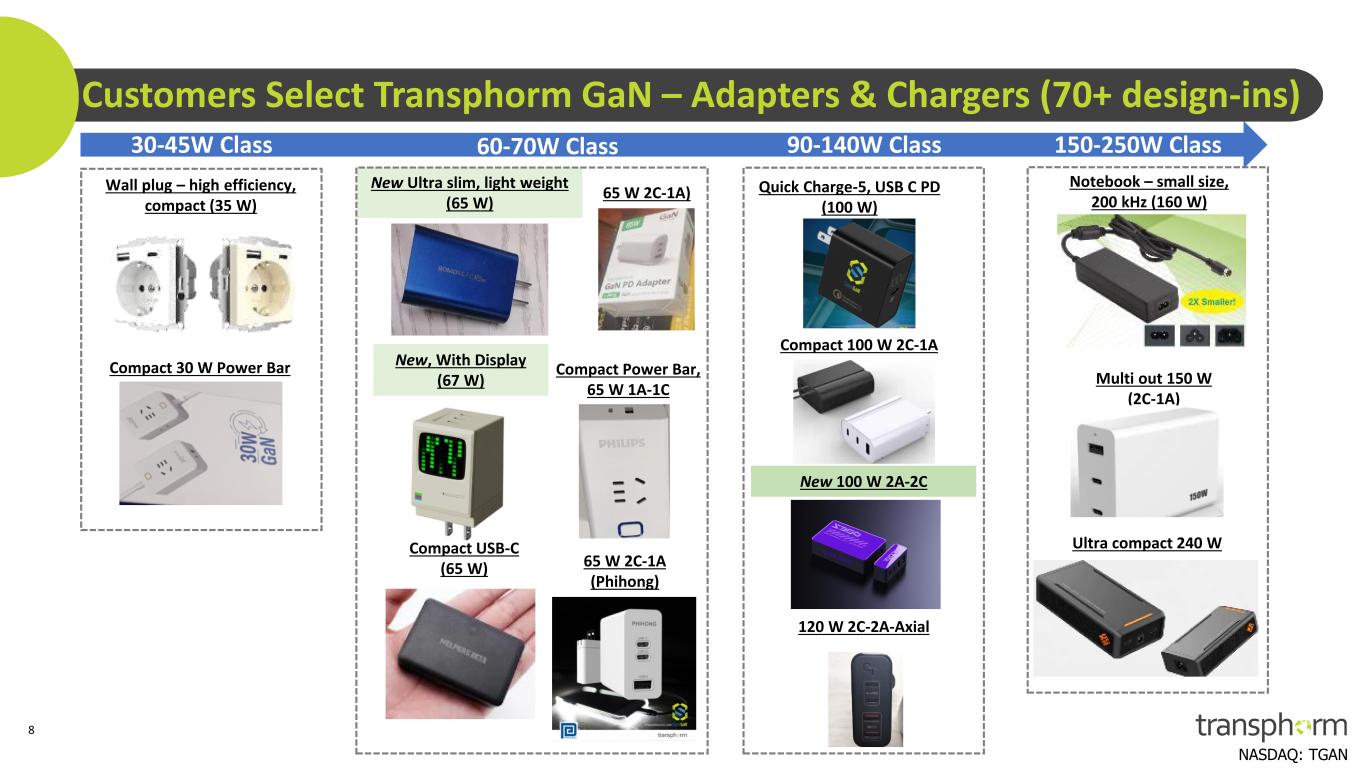

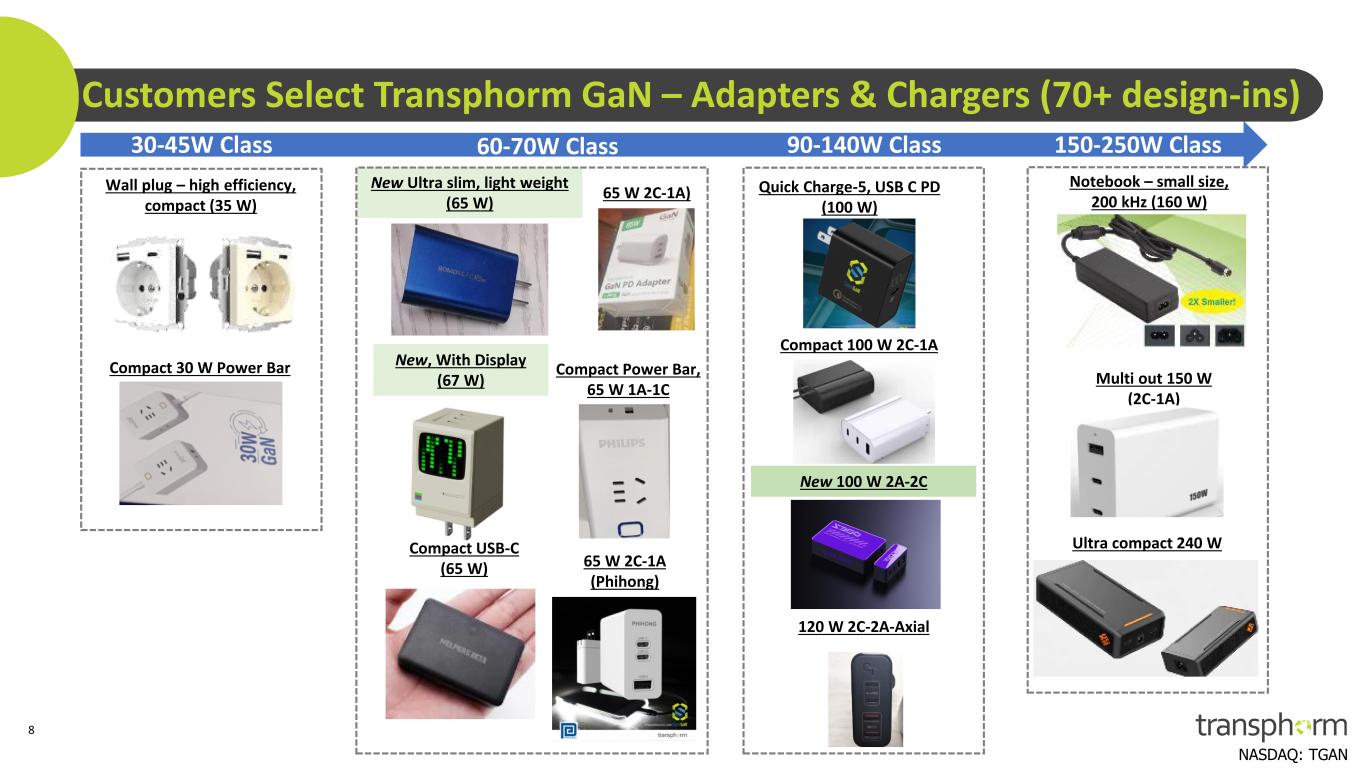

NASDAQ: TGAN Customers Select Transphorm GaN – Adapters & Chargers (70+ design-ins) Wall plug – high efficiency, compact (35 W) Ultra compact 240 W New Ultra slim, light weight (65 W) Quick Charge-5, USB C PD (100 W) Notebook – small size, 200 kHz (160 W) Compact Power Bar, 65 W 1A-1C Compact 30 W Power Bar Multi out 150 W (2C-1A) 120 W 2C-2A-Axial 65 W 2C-1A) New, With Display (67 W) 65 W 2C-1A (Phihong) Compact USB-C (65 W) Compact 100 W 2C-1A 30-45W Class 150-250W Class New 100 W 2A-2C 60-70W Class 90-140W Class 8

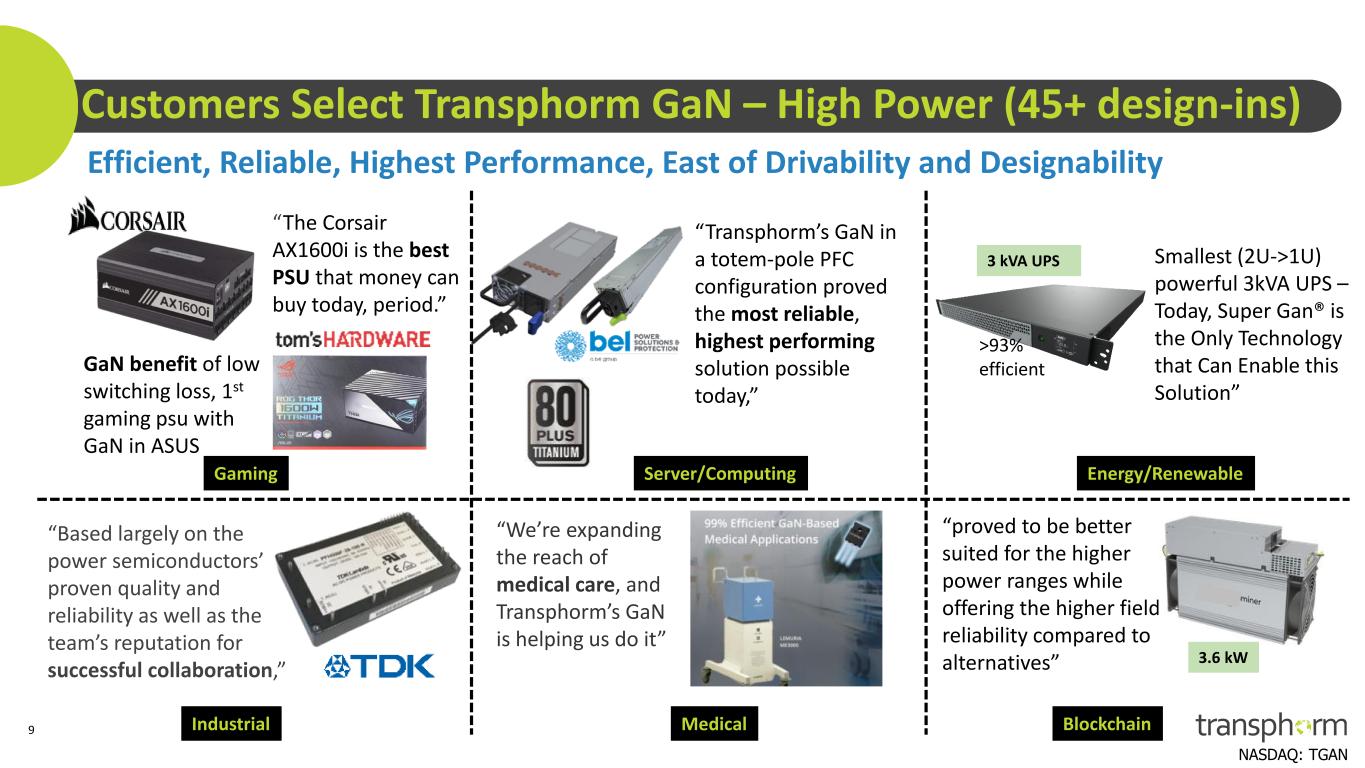

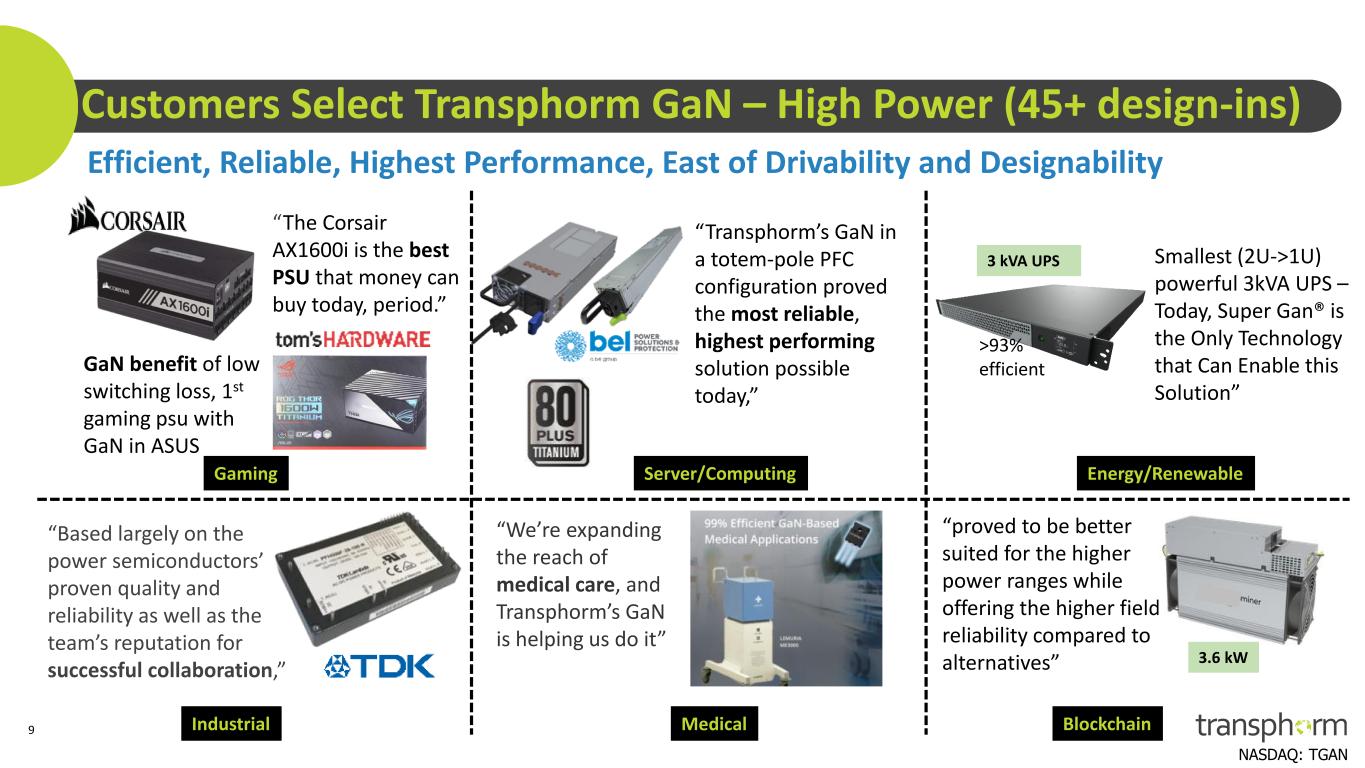

NASDAQ: TGAN “Transphorm’s GaN in a totem-pole PFC configuration proved the most reliable, highest performing solution possible today,” Customers Select Transphorm GaN – High Power (45+ design-ins) Efficient, Reliable, Highest Performance, East of Drivability and Designability “Based largely on the power semiconductors’ proven quality and reliability as well as the team’s reputation for successful collaboration,” “The Corsair AX1600i is the best PSU that money can buy today, period.” GaN benefit of low switching loss, 1st gaming psu with GaN in ASUS 9 “We’re expanding the reach of medical care, and Transphorm’s GaN is helping us do it” Smallest (2U->1U) powerful 3kVA UPS – Today, Super Gan® is the Only Technology that Can Enable this Solution” “proved to be better suited for the higher power ranges while offering the higher field reliability compared to alternatives” 3 kVA UPS >93% efficient 3.6 kW Energy/RenewableServer/ComputingGaming Industrial Medical Blockchain

NASDAQ: TGAN Limited Driving Distance ▪ Charger / Converter / Inverters for EVs ▪ Earlier penetration into 2W-3W EVs (CY2023) ▪ Staying ahead: R&D for 1200V 1 with GaN for higher battery voltage EVs (taking on SiC higher Voltage FETs) Limited Driving Distance Higher Cost & Power Demand GaN-enabled Power Solution Benefits1: 2x More Watts / Cubic Inch, Faster Charging Less Power Loss (~20%) Reduced Size (~50%) Increased Range Transphorm Gen IV 650V 35mΩ GaN FET • Automotive qualified (AEC) today EV challenges for existing Silicon-based solutions Lower Watts / Cubic Inch Power Loss Heat Constraints Limited Driving Distance Future of EV with GaN-based solutions GaN Enables Future of Next-Gen Electric Vehicles: 2W/3W/4W 10 Faster Charging & Increased Range w/ GaN 1) Program Management Update: January 2016, High efficiency high-density GaN-based 6.6kW bidirectional on-board charger for PEVs DOE Award number DE-EE0006834

NASDAQ: TGAN Accelerating Opportunity for GaN Enabled Power in EV 1. GaN Opportunities in EV, 4W DC-AC Aux Inverter On Board Charger (OBC) EV Powertrain 1. Addressable GaN $ Content/EV, 4W2 • Well-positioned for automotive opportunity with leading products, strategic partners • EV Adoption increasing to 32 million (44 million -hyper adoption) vehicles by 20301 Transphorm GaN AEC-Q101 (Auto) Qualified NOW 2022E 2025-26E ~$70 ~$200 1 IHS and Goldman Sachs Global Investment Research 2 Transphorm company internal estimates, 2022 includes OBC/DCBC, 2025 includes inverter (100kw) 3 30m E-bikes in China, 30m motorcycles in Asian market potential to be EVs (Motocycledata.com, Statista) 11 On Board Charger (OBC) Portable Chargers Battery Swapping Pole Chargers • TGAN FET already proven in battery-swapping • Potential to address 75 Million 2W/3W WW (Asia dominated)3, $8-10/vehicle 2. EV 2W, 3W Market2. GaN Opportunities in EV, 2W, 3W DC-DC Aux. Power Module

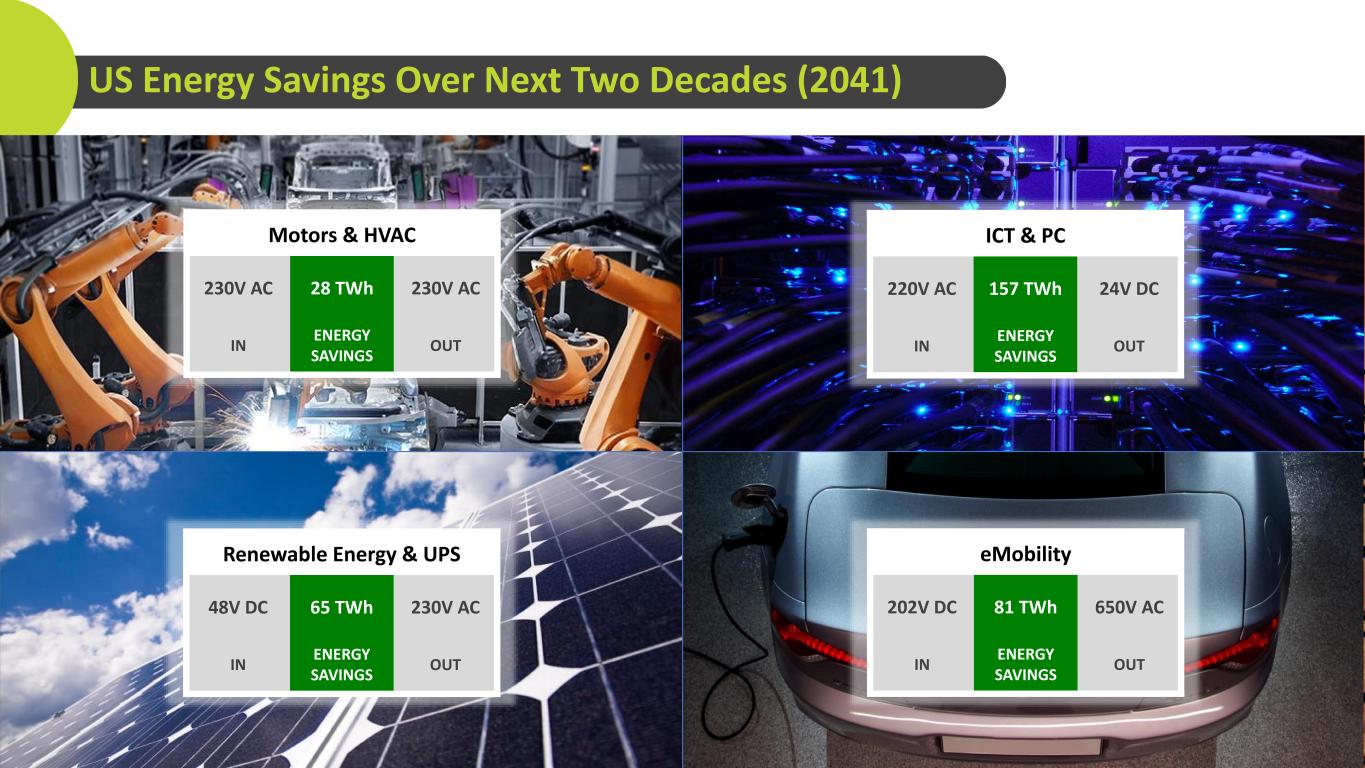

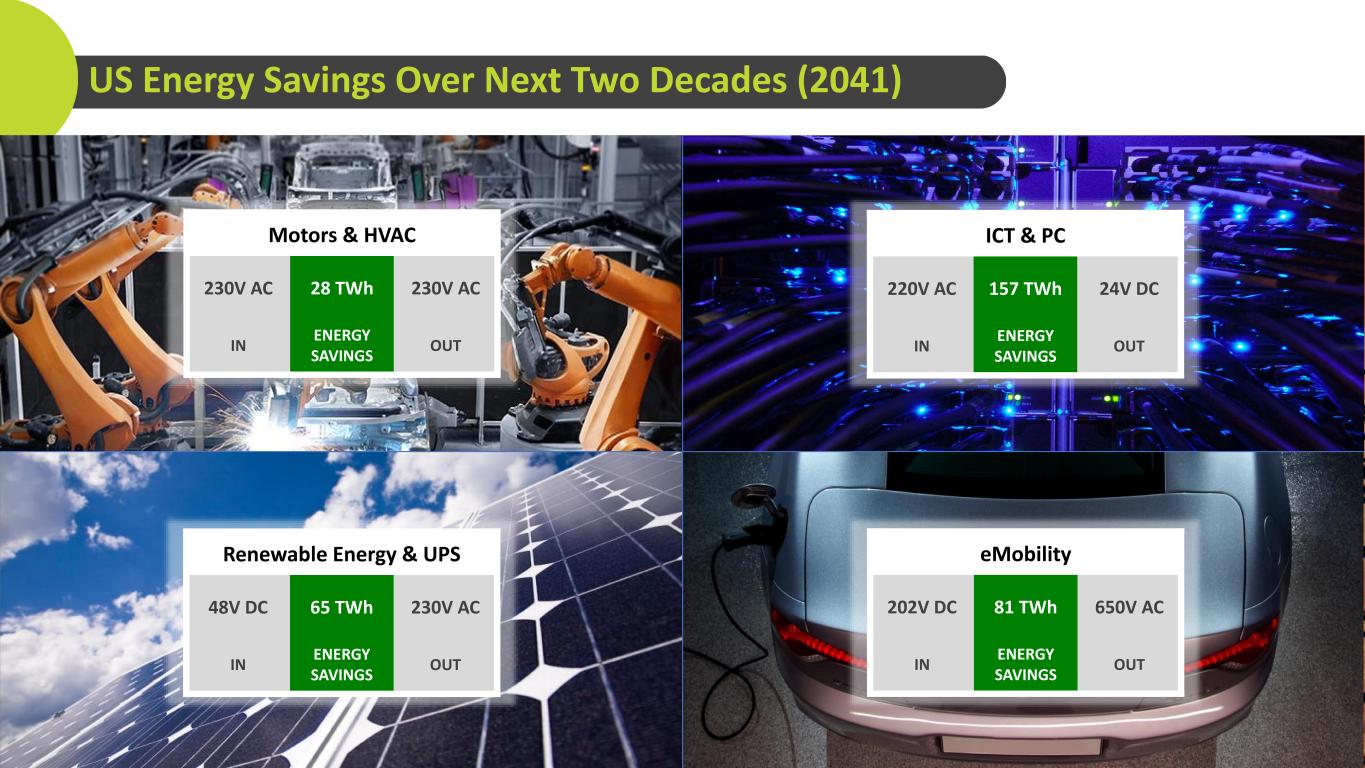

NASDAQ: TGAN US Energy Savings Over Next Two Decades (2041) 12 12 Motors & HVAC 230V AC 28 TWh 230V AC IN ENERGY SAVINGS OUT ICT & PC 220V AC 157 TWh 24V DC IN ENERGY SAVINGS OUT eMobility 202V DC 81 TWh 650V AC IN ENERGY SAVINGS OUT Renewable Energy & UPS 48V DC 65 TWh 230V AC IN ENERGY SAVINGS OUT

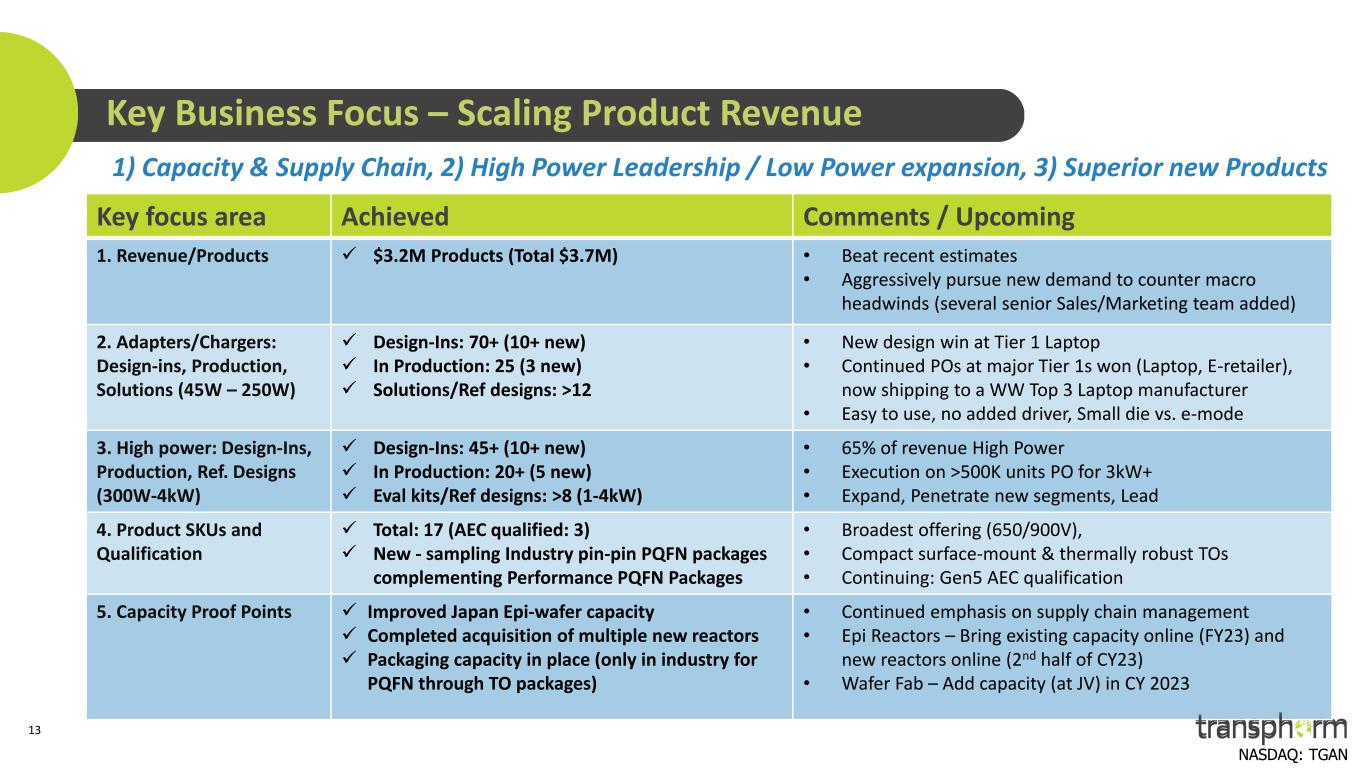

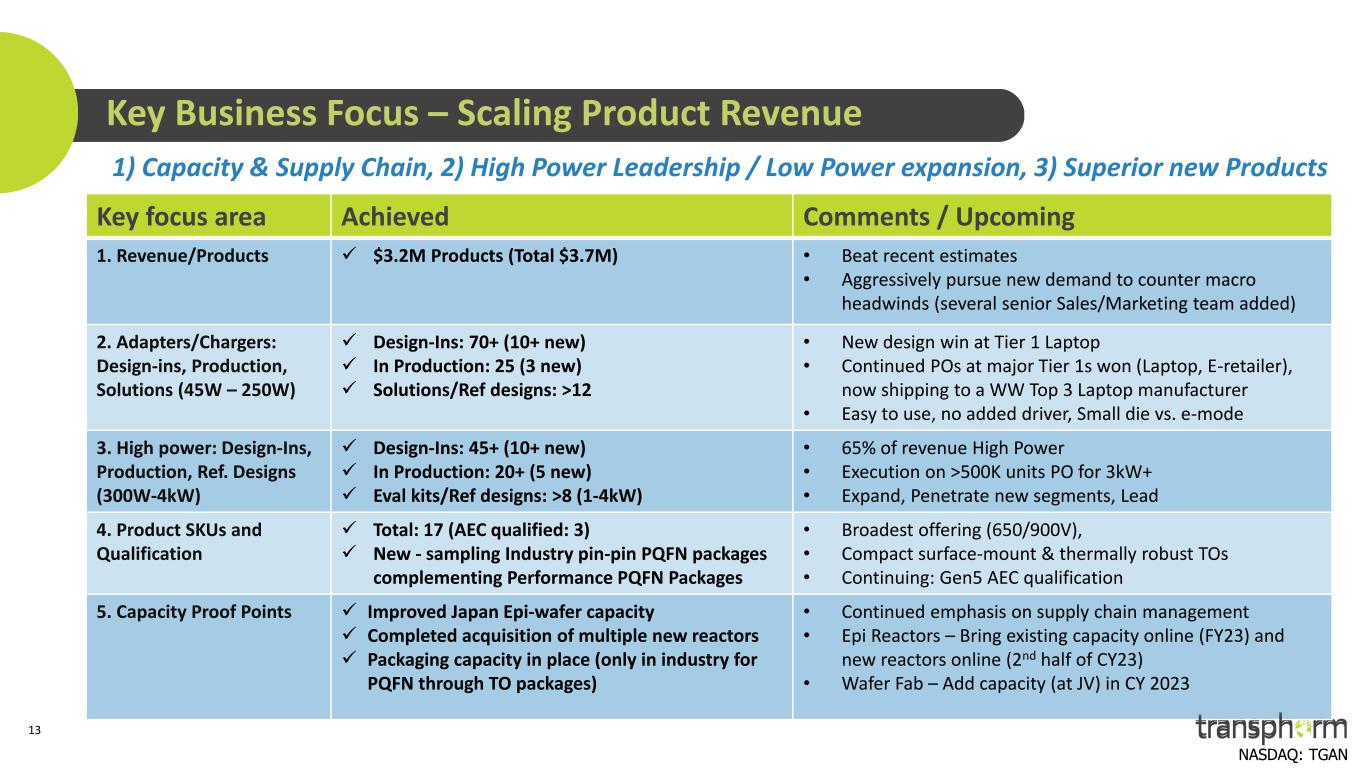

NASDAQ: TGAN Key Business Focus – Scaling Product Revenue 1) Capacity & Supply Chain, 2) High Power Leadership / Low Power expansion, 3) Superior new Products Key focus area Achieved Comments / Upcoming 1. Revenue/Products ✓ $3.2M Products (Total $3.7M) • Beat recent estimates • Aggressively pursue new demand to counter macro headwinds (several senior Sales/Marketing team added) 2. Adapters/Chargers: Design-ins, Production, Solutions (45W – 250W) ✓ Design-Ins: 70+ (10+ new) ✓ In Production: 25 (3 new) ✓ Solutions/Ref designs: >12 • New design win at Tier 1 Laptop • Continued POs at major Tier 1s won (Laptop, E-retailer), now shipping to a WW Top 3 Laptop manufacturer • Easy to use, no added driver, Small die vs. e-mode 3. High power: Design-Ins, Production, Ref. Designs (300W-4kW) ✓ Design-Ins: 45+ (10+ new) ✓ In Production: 20+ (5 new) ✓ Eval kits/Ref designs: >8 (1-4kW) • 65% of revenue High Power • Execution on >500K units PO for 3kW+ • Expand, Penetrate new segments, Lead 4. Product SKUs and Qualification ✓ Total: 17 (AEC qualified: 3) ✓ New - sampling Industry pin-pin PQFN packages complementing Performance PQFN Packages • Broadest offering (650/900V), • Compact surface-mount & thermally robust TOs • Continuing: Gen5 AEC qualification 5. Capacity Proof Points ✓ Improved Japan Epi-wafer capacity ✓ Completed acquisition of multiple new reactors ✓ Packaging capacity in place (only in industry for PQFN through TO packages) • Continued emphasis on supply chain management • Epi Reactors – Bring existing capacity online (FY23) and new reactors online (2nd half of CY23) • Wafer Fab – Add capacity (at JV) in CY 2023 13

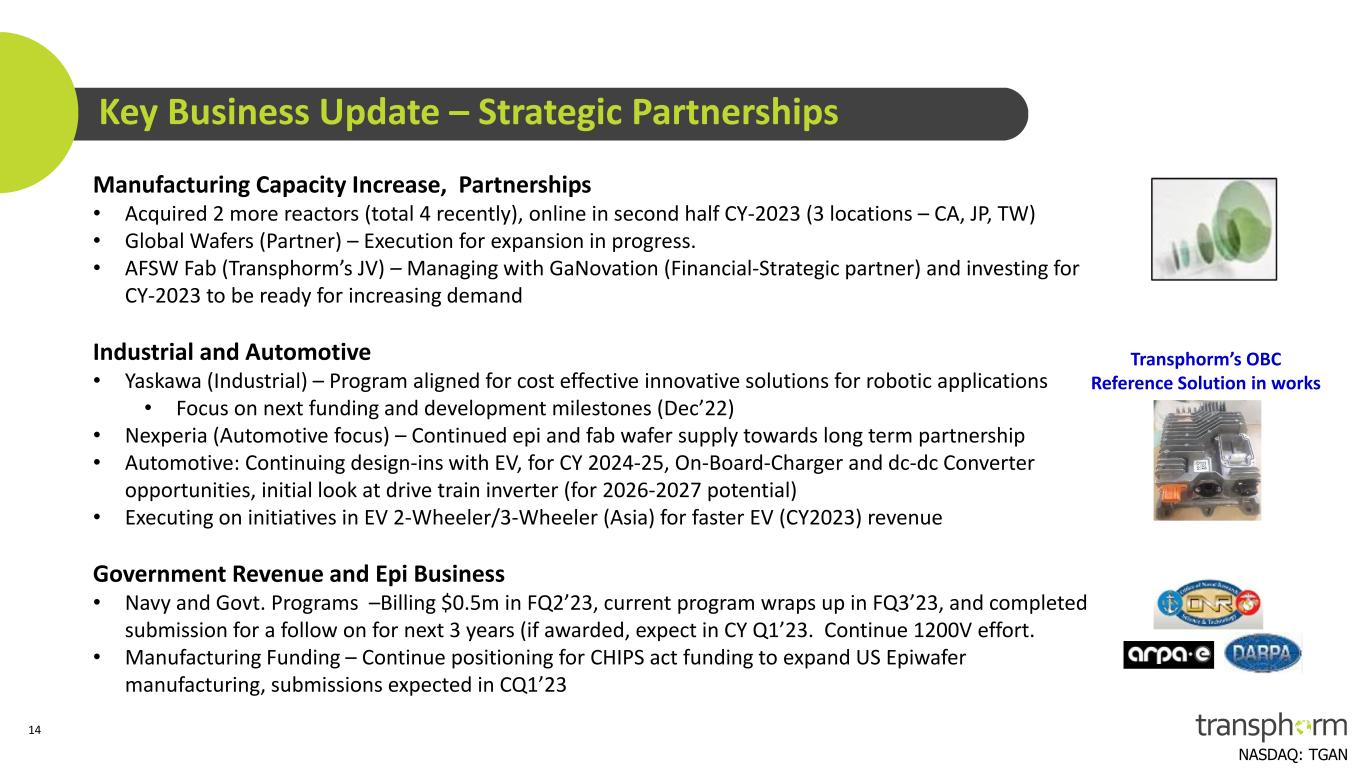

NASDAQ: TGAN Key Business Update – Strategic Partnerships Manufacturing Capacity Increase, Partnerships • Acquired 2 more reactors (total 4 recently), online in second half CY-2023 (3 locations – CA, JP, TW) • Global Wafers (Partner) – Execution for expansion in progress. • AFSW Fab (Transphorm’s JV) – Managing with GaNovation (Financial-Strategic partner) and investing for CY-2023 to be ready for increasing demand Industrial and Automotive • Yaskawa (Industrial) – Program aligned for cost effective innovative solutions for robotic applications • Focus on next funding and development milestones (Dec’22) • Nexperia (Automotive focus) – Continued epi and fab wafer supply towards long term partnership • Automotive: Continuing design-ins with EV, for CY 2024-25, On-Board-Charger and dc-dc Converter opportunities, initial look at drive train inverter (for 2026-2027 potential) • Executing on initiatives in EV 2-Wheeler/3-Wheeler (Asia) for faster EV (CY2023) revenue Government Revenue and Epi Business • Navy and Govt. Programs –Billing $0.5m in FQ2’23, current program wraps up in FQ3’23, and completed submission for a follow on for next 3 years (if awarded, expect in CY Q1’23. Continue 1200V effort. • Manufacturing Funding – Continue positioning for CHIPS act funding to expand US Epiwafer manufacturing, submissions expected in CQ1’23 14 Transphorm’s OBC Reference Solution in works

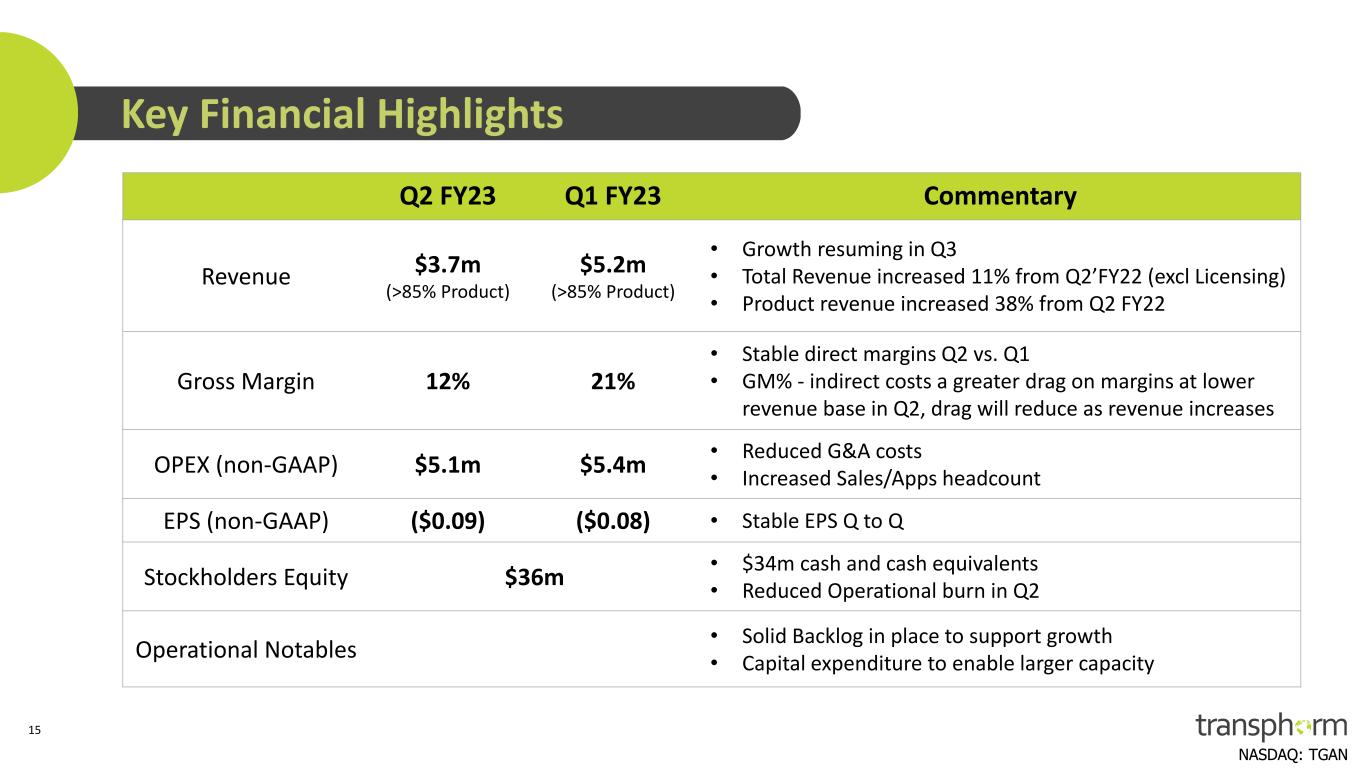

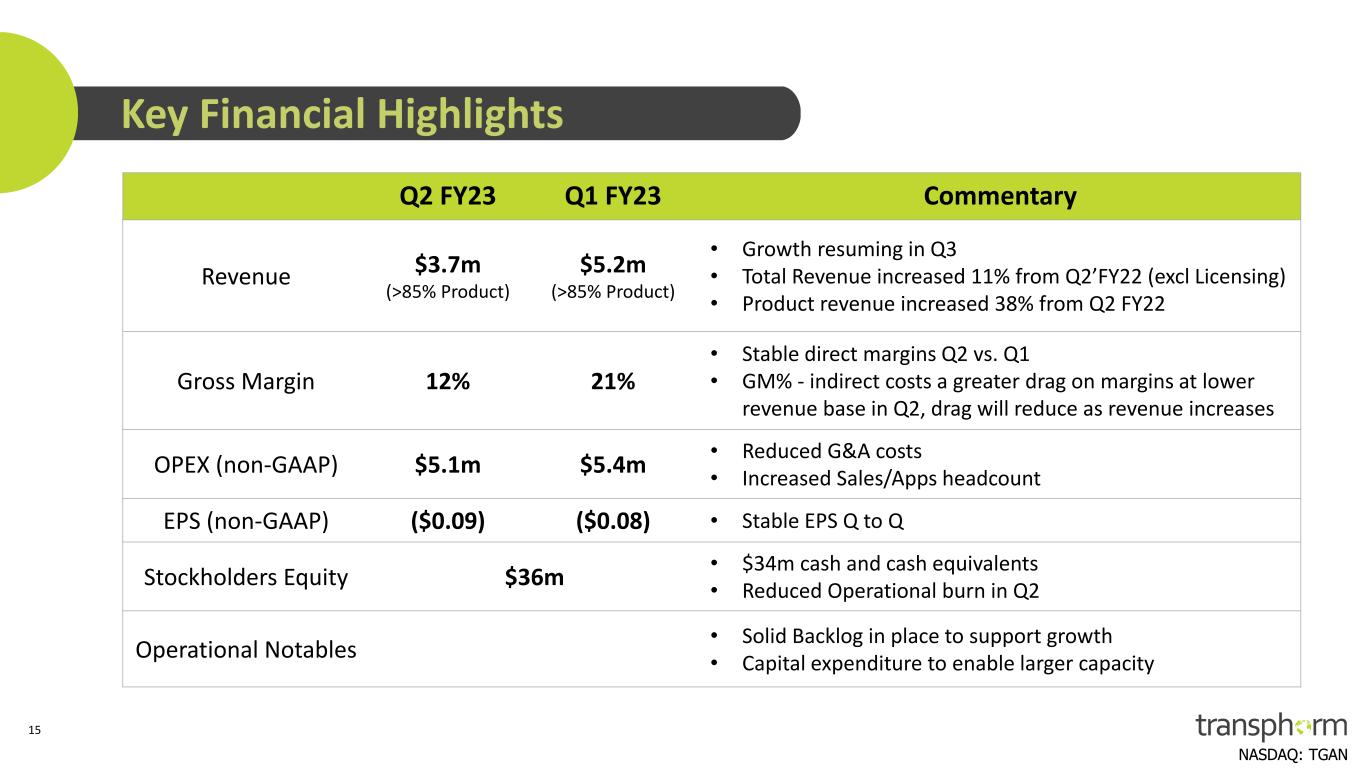

NASDAQ: TGAN Q2 FY23 Q1 FY23 Commentary Revenue $3.7m (>85% Product) $5.2m (>85% Product) • Growth resuming in Q3 • Total Revenue increased 11% from Q2’FY22 (excl Licensing) • Product revenue increased 38% from Q2 FY22 Gross Margin 12% 21% • Stable direct margins Q2 vs. Q1 • GM% - indirect costs a greater drag on margins at lower revenue base in Q2, drag will reduce as revenue increases OPEX (non-GAAP) $5.1m $5.4m • Reduced G&A costs • Increased Sales/Apps headcount EPS (non-GAAP) ($0.09) ($0.08) • Stable EPS Q to Q Stockholders Equity $36m • $34m cash and cash equivalents • Reduced Operational burn in Q2 Operational Notables • Solid Backlog in place to support growth • Capital expenditure to enable larger capacity Key Financial Highlights 15

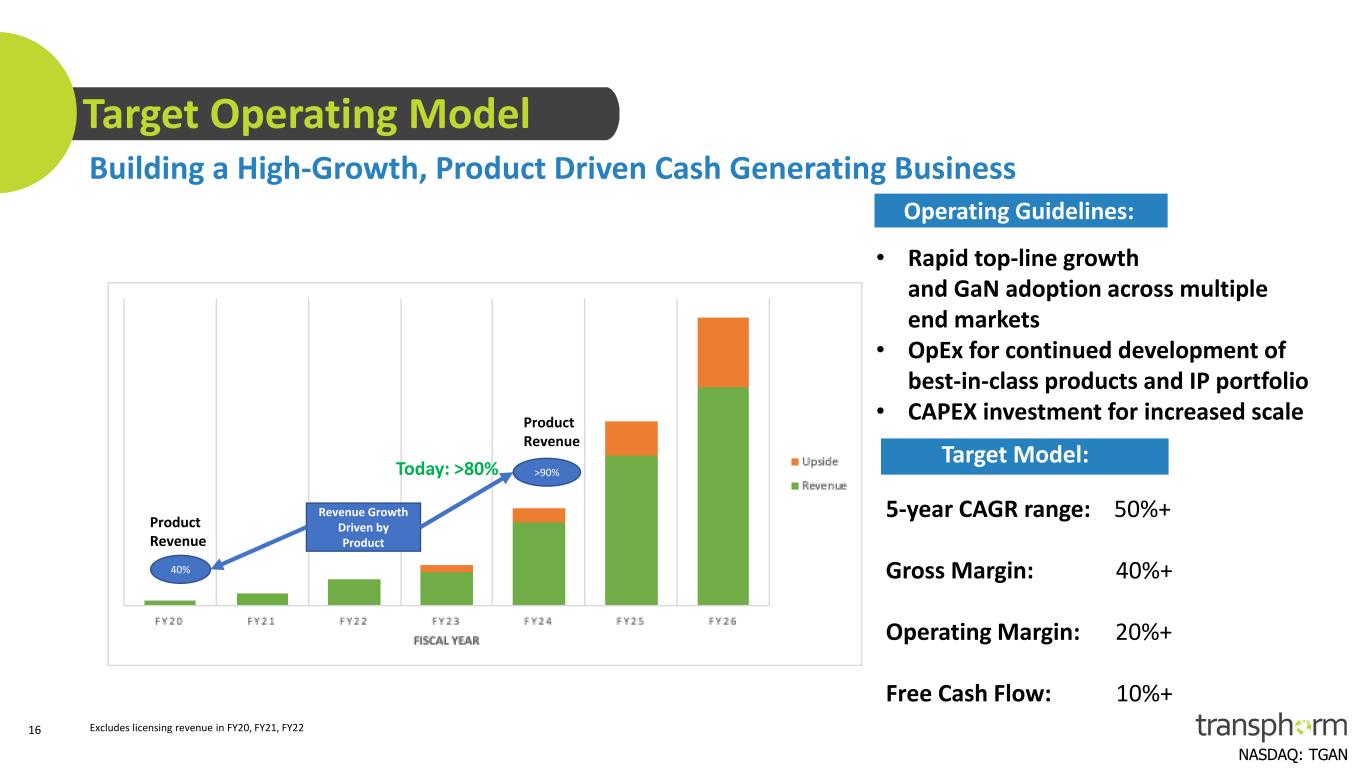

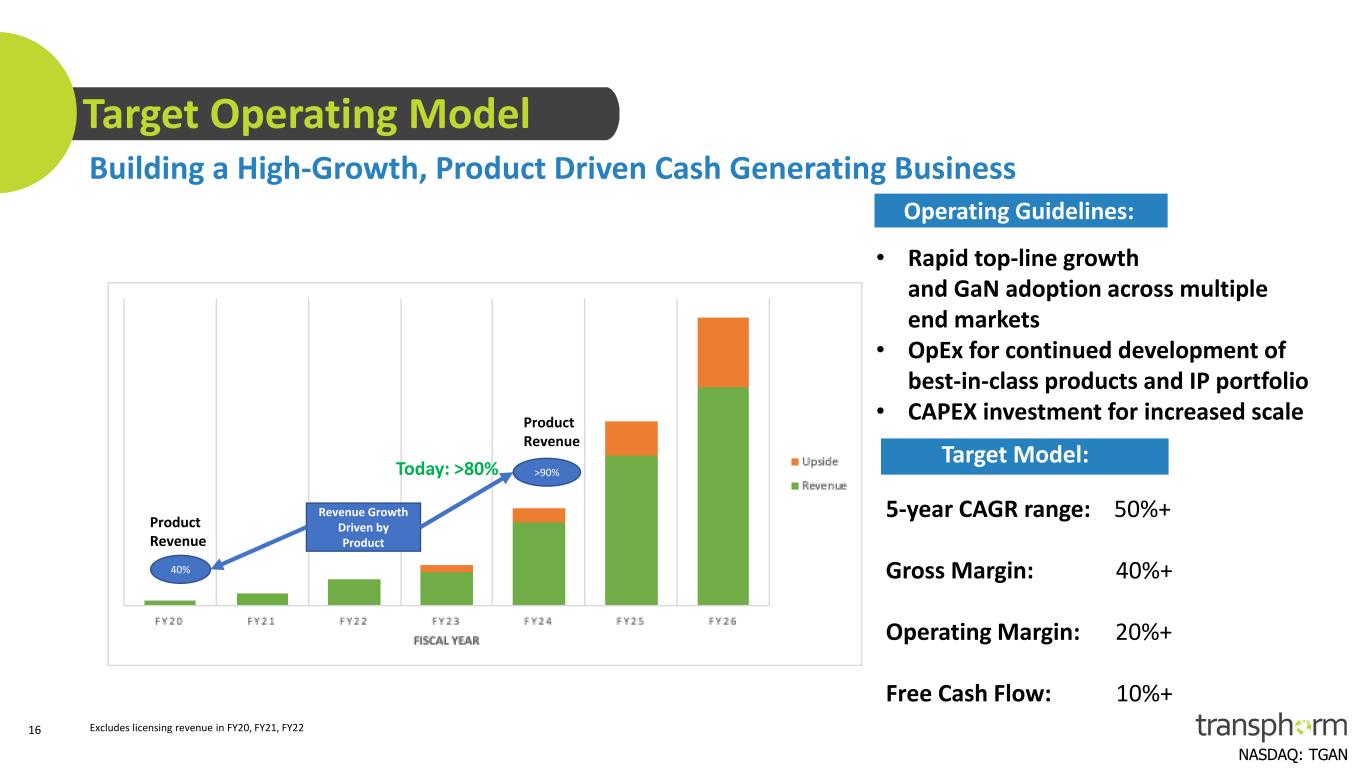

NASDAQ: TGAN Target Operating Model Building a High-Growth, Product Driven Cash Generating Business Product Revenue • Rapid top-line growth and GaN adoption across multiple end markets • OpEx for continued development of best-in-class products and IP portfolio • CAPEX investment for increased scale Target Model: 5-year CAGR range: 50%+ Gross Margin: 40%+ Operating Margin: 20%+ Free Cash Flow: 10%+ Operating Guidelines: 16 Today: >80% 40% >90% Revenue Growth Driven by Product Product Revenue Excludes licensing revenue in FY20, FY21, FY22

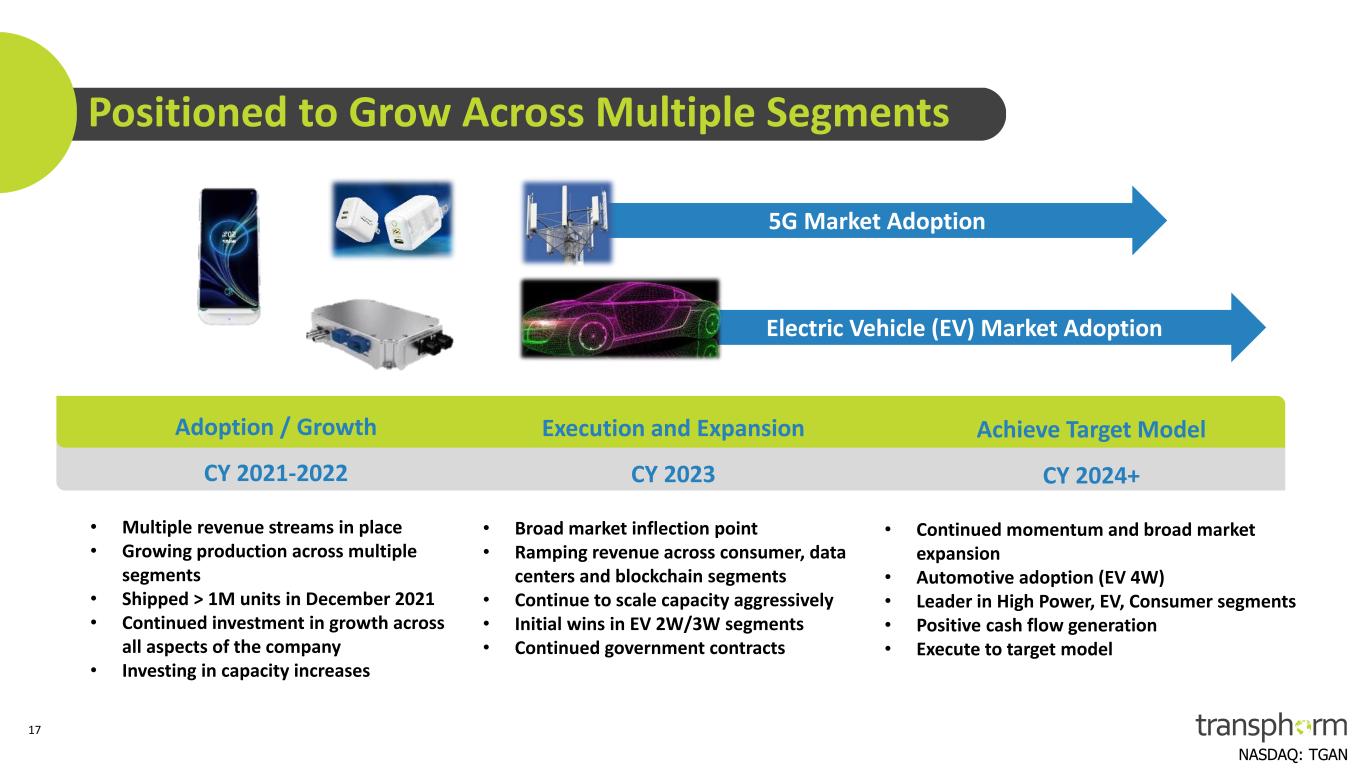

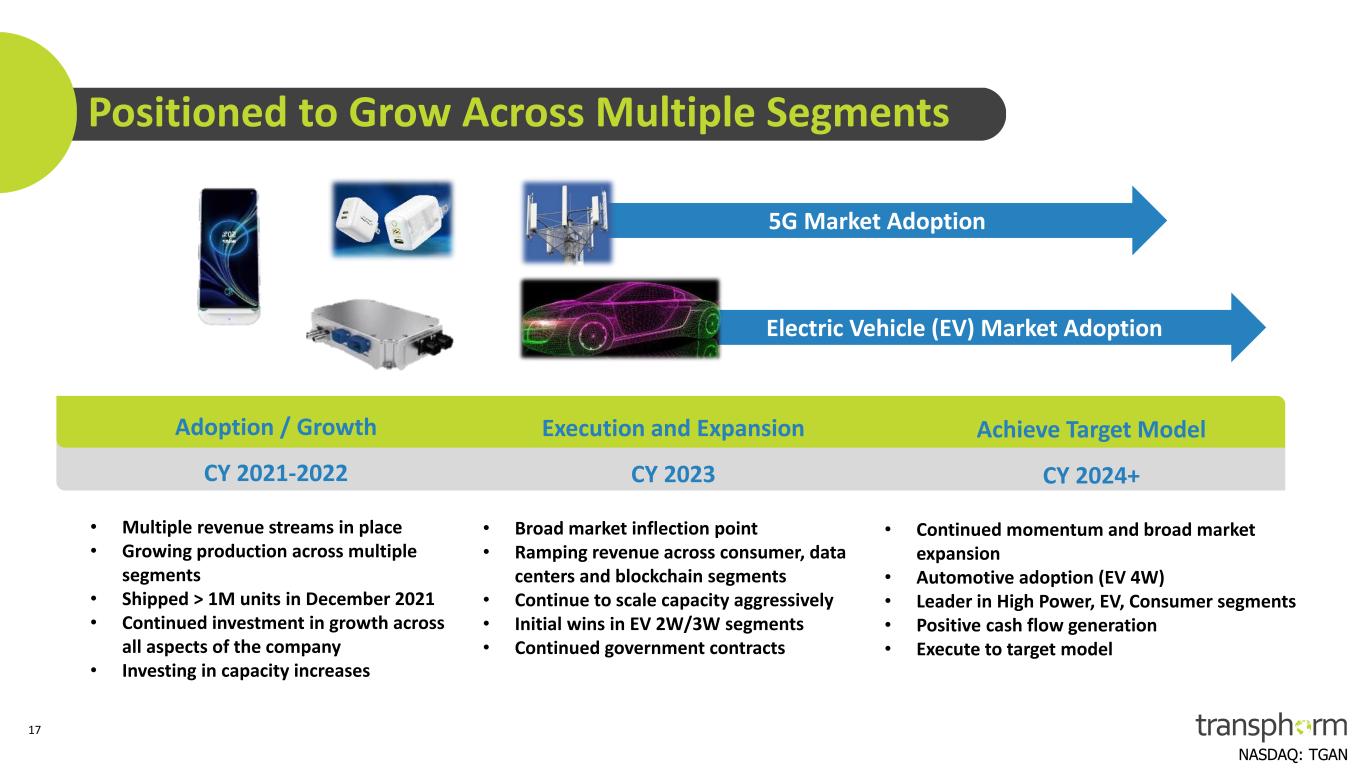

NASDAQ: TGAN Electric Vehicle (EV) Market Adoption 5G Market Adoption Positioned to Grow Across Multiple Segments Adoption / Growth CY 2021-2022 • Multiple revenue streams in place • Growing production across multiple segments • Shipped > 1M units in December 2021 • Continued investment in growth across all aspects of the company • Investing in capacity increases Execution and Expansion CY 2023 • Broad market inflection point • Ramping revenue across consumer, data centers and blockchain segments • Continue to scale capacity aggressively • Initial wins in EV 2W/3W segments • Continued government contracts Achieve Target Model CY 2024+ • Continued momentum and broad market expansion • Automotive adoption (EV 4W) • Leader in High Power, EV, Consumer segments • Positive cash flow generation • Execute to target model 17

NASDAQ: TGAN Key Investment Highlights GaN Power Semiconductor Pioneer and Leader Ramping Commercially with Strong Manufacturing Base Technology and Product Development completed, Integrated Manufacturing, $24.1M FY-22 Revenues, Target >50% LT CAGR Best-In-Class Differentiated GaN Technology + Industry’s Strongest IP Position IP Portfolio Appraised in Excess of $200M3 Leader in Quality + Reliability, > 80 Billion Field hours, Silicon-like Reliability4 TGAN FET: Higher performance, easy interface, multiple packages Team Led by World-Renowned GaN Experts Proven Leadership, 18 PhDs and Over 300 Years of GaN Expertise, Recent expansion with Industry leaders Disruptive Technology GaN Enables Next Generation Power Conversion Solutions – 99% Efficiency1, 50% More Compact/Lightweight, Lower System Cost Large Market Opportunity Transphorm’s GaN Solutions will Enable the Future of Electric Vehicles and Fast-charging for 5G – Contributing to GaN TAM growing to $6B2 in 2026 1 Measured TGAN >99% efficient power stages, commercial implementations 2 See slide 10 on GaN TAM Analysis 18 3 2021 Analysis done for GaN portfolio using Intracom Group Intellectual Property Solutions’ patent valuation models based on 27 independent criteria, value consists of Transphorm’s owned or exclusively licensed patents (non-exclusive patents not included) 4 Based on field performance, low power and high power GaN, FIT (Failure in Time) < 0.2 per Billion hours Validation From Blue Chip Partners and Customers Including KKR, SAS, Nexperia, Yaskawa, Marelli, Microchip, Diodes and the U.S. DoD(Navy), DOE

NASDAQ: TGAN Investor Relations Contact: David Hanover or Jack Perkins KCSA Strategic Communications transphorm@kcsa.com

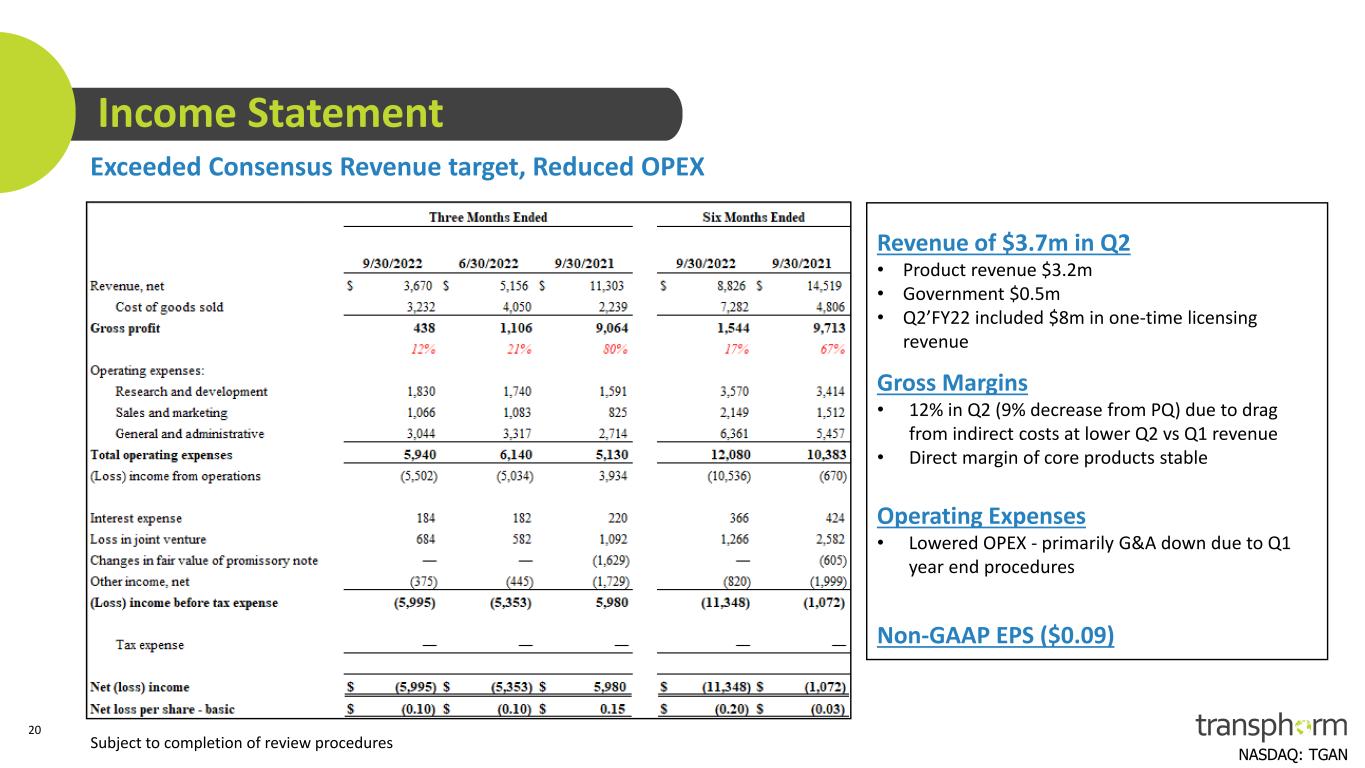

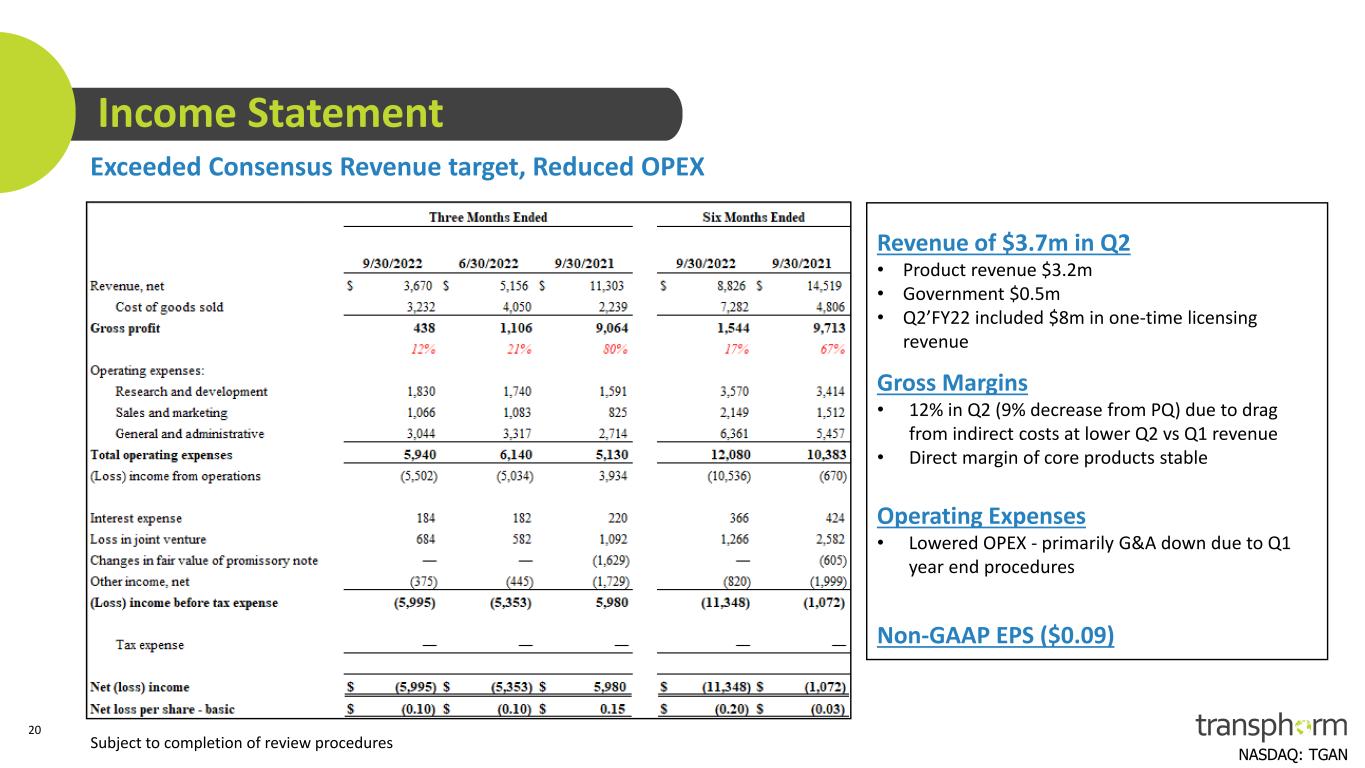

NASDAQ: TGAN Income Statement Exceeded Consensus Revenue target, Reduced OPEX 20 Subject to completion of review procedures Revenue of $3.7m in Q2 • Product revenue $3.2m • Government $0.5m • Q2’FY22 included $8m in one-time licensing revenue Gross Margins • 12% in Q2 (9% decrease from PQ) due to drag from indirect costs at lower Q2 vs Q1 revenue • Direct margin of core products stable Operating Expenses • Lowered OPEX - primarily G&A down due to Q1 year end procedures Non-GAAP EPS ($0.09)

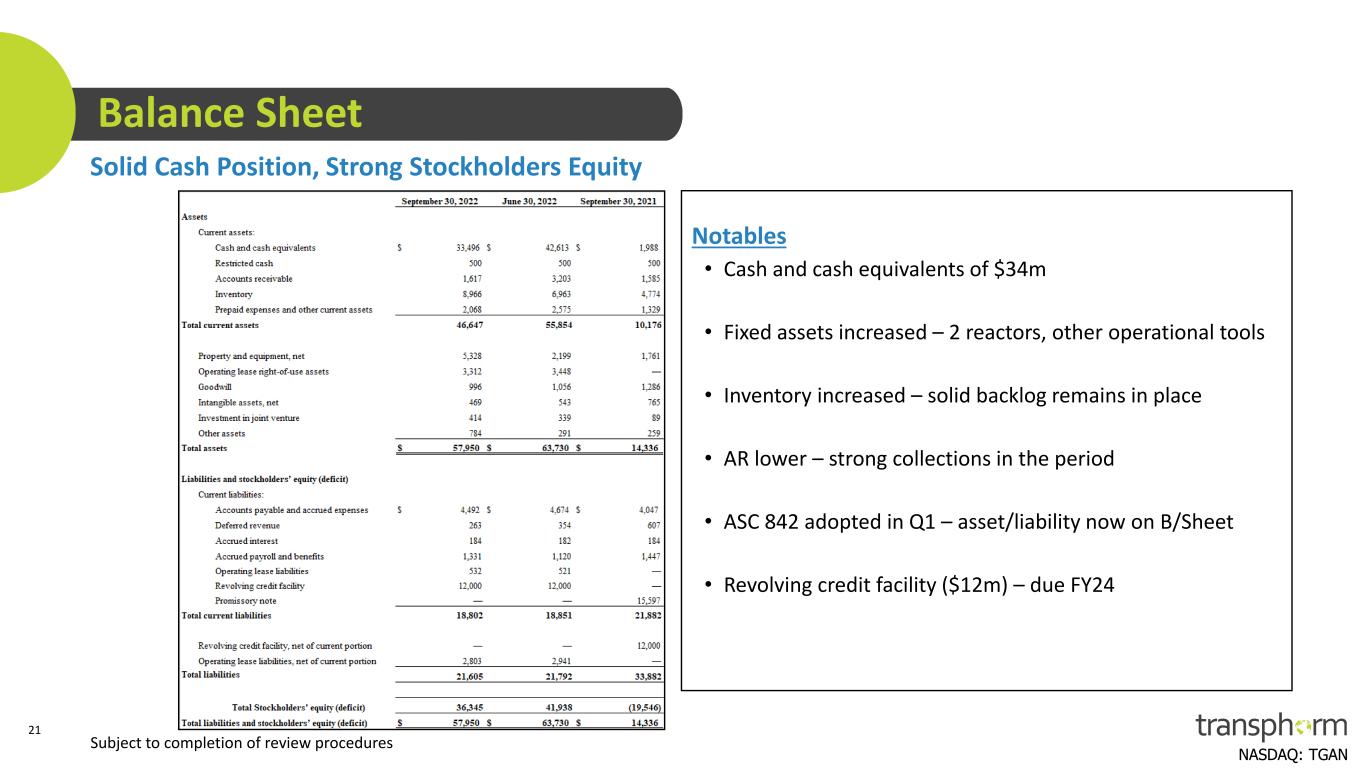

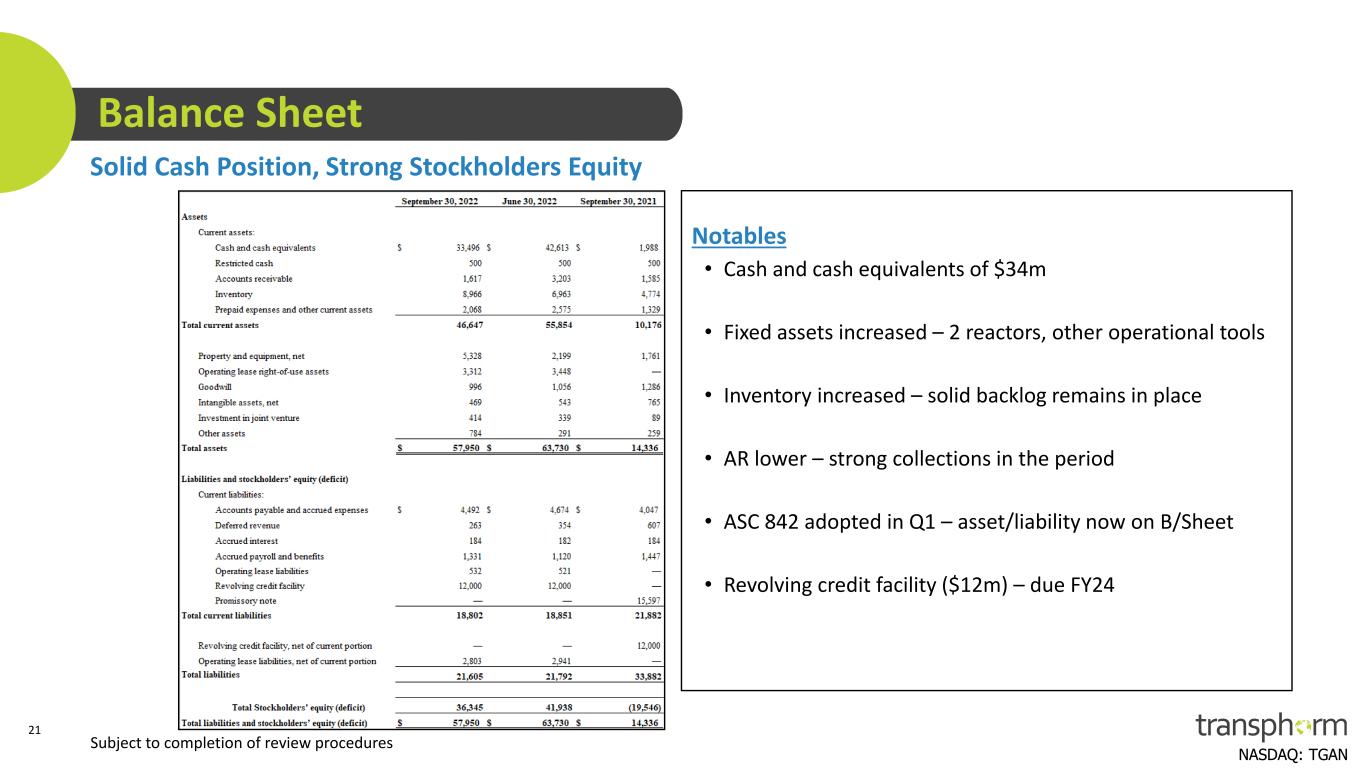

NASDAQ: TGAN Balance Sheet Solid Cash Position, Strong Stockholders Equity 21 Subject to completion of review procedures Notables • Cash and cash equivalents of $34m • Fixed assets increased – 2 reactors, other operational tools • Inventory increased – solid backlog remains in place • AR lower – strong collections in the period • ASC 842 adopted in Q1 – asset/liability now on B/Sheet • Revolving credit facility ($12m) – due FY24

NASDAQ: TGAN GAAP to NON-GAAP Reconciliation 22 Subject to completion of review procedures Non-GAAP OPEX lower in the quarter Government, G&A (legal/audit) SBC increased in quarter New options approved in Q2 Depreciation slightly higher Ongoing CAPEX investment Fair Value adjustments Prior converted note with Yaskawa – non- recurring

NASDAQ: TGAN 23 Glossary of Terms and Abbreviations AC – alternating current AEC-Q101 – Automotive Electronic Council’s electronic components stress qualification standard AFSW – Aizu Fujitsu Semiconductor Wafer Solution Limited, our joint venture wafer fabrication facility located in Aizu Wakamatsu, Japan BJT – bipolar junction transistor, a semiconductor device Bus voltage – voltage into, out of or within connections of a power electronic system CMOS – complementary MOS (metal oxide semiconductor), widely used semiconductor transistor architecture D2Pak – a surface mountable version of the TO220 package DC – direct current Die/Chip – an individual semiconductor device on the wafer, prior to packaging EAR – Export Administration Regulation Epi/Epiwafer/Epimaterials – GaN device layers grown on a substrate, from which active GaN- based devices are subsequently manufactured in a wafer fabrication facility Fab – fabrication, generally referring to a semiconductor wafer fabrication facility FET – field effect transistor, a type of switching transistor Figure of Merit - a quantity used to characterize the performance of a device, system or method, relative to its alternatives FIT – failure in time, referring to the expected number of device failures per billion hours of operation GaN – gallium nitride HEMT – high electron mobility transistor, a type of switching transistor with superior electronic properties IGBT – insulated-gate bipolar transistor, a three-terminal power semiconductor device primarily used as an electronic switch JEDEC – Joint Electron Device Engineering Council, an independent semiconductor engineering trade organization and standardization body that represents all areas of the electronics industry LIDAR – light detection and ranging, a remote sensing method that uses light in the form of a pulsed laser to measure distance Lossy – in the context of switching devices, subject to loss of power due to switching inefficiencies and other factors MOCVD – metal organic chemical vapor deposition, a technique for layering GaN layers onto substrates such as a silicon substrate and making the starting GaN semiconductor material (i.e., an epiwafer) Moore’s law – the observation that the number of transistors in a dense integrated circuit doubles about every two years MOSFET – metal-oxide-semiconductor field-effect transistor, a type of transistor Normally Off – default position is off Power converters / Inverters – electronic systems used to convert electricity from AC to DC (such as a charger), DC-AC (such as an inverter) or in some cases AC-AC or DC-DC within the systems converting from one voltage level to another PQFN – power quad flat no lead package, a compact surface mountable package used in power semiconductors RF – radio frequency SCR – silicon controlled rectifier, an early semiconductor switching device Si – silicon SiC – silicon carbide TO – transistor outline leaded packages commonly used in power semiconductors (such as TO220, TO247)