Table of Contents

|

| |

| Summary | |

| Earnings Press Release | |

| Fact Sheet | |

| | |

| Financial Information | |

| Condensed Consolidated Statements of Operations | |

| Funds from Operations | |

| Core Net Operating Income—Total Portfolio | |

| Same-Home Results—Quarterly and Year-to-Date Comparisons | |

| Same-Home Results—Sequential Quarterly Results | |

| Same-Home Results—Sequential Quarterly Metrics | |

| Same-Home Results—Operating Metrics by Market | |

| Condensed Consolidated Balance Sheets | |

| Debt Summary, Maturity Schedule and Interest Expense Reconciliation | |

| Capital Structure and Credit Metrics | |

| | |

| Property Information | |

| Top 20 Markets Summary | |

| Leasing Performance | |

| Scheduled Lease Expirations | |

| Top 20 Markets Home Price Appreciation Trends | |

| | |

| Other Information | |

| Disposition Summary | |

| Share Repurchase and ATM Share Issuance History | |

| 2018 Outlook | |

| Defined Terms and Non-GAAP Reconciliations | |

American Homes 4 Rent Reports Third Quarter 2018 Financial and Operating Results

AGOURA HILLS, Calif., Nov. 1, 2018—American Homes 4 Rent (NYSE: AMH) (the “Company”), a leading provider of high quality single-family homes for rent, today announced its financial and operating results for the quarter ended September 30, 2018.

Highlights

| |

| • | Total revenues increased 13.5% to $280.1 million for the third quarter of 2018 from $246.8 million for the third quarter of 2017. |

| |

| • | Net income attributable to common shareholders totaled $15.2 million, or $0.05 income per diluted share, for the third quarter of 2018, compared to net income attributable to common shareholders of $1.5 million, or a $0.00 loss per diluted share, for the third quarter of 2017. |

| |

| • | Core Funds from Operations attributable to common share and unit holders for the third quarter of 2018 was $94.6 million, or $0.27 per FFO share and unit, compared to $79.4 million, or $0.25 per FFO share and unit, for the same period in 2017, which represents an 8.0% increase on a per share and unit basis. |

| |

| • | Adjusted Funds from Operations attributable to common share and unit holders for the third quarter of 2018 was $79.4 million, or $0.23 per FFO share and unit, compared to $67.1 million, or $0.21 per FFO share and unit, for the same period in 2017. |

| |

| • | Core Net Operating Income ("Core NOI") margin on Same-Home properties was 63.4% for the third quarter of 2018, compared to 63.8% for the same period in 2017. |

| |

| • | Core NOI after capital expenditures from Same-Home properties increased by 3.4% year-over-year for the third quarter of 2018. |

| |

| • | Same-Home portfolio Average Occupied Days Percentage increased to 95.2% for the third quarter of 2018, compared to 94.1% for the third quarter of 2017, while achieving 3.4% growth in Average Monthly Realized Rent per property for the same comparable periods. |

| |

| • | Entered into a $156.3 million joint venture with a leading institutional investor to create a portfolio of newly constructed single-family rental homes, which will be developed and managed by the Company, providing additional scale and institutional endorsement of the Company's growing built-for-rental strategy. |

| |

| • | Issued 4,600,000 6.25% Series H perpetual preferred shares, raising gross proceeds of $115.0 million before offering costs (see "Capital Activities and Balance Sheet"). |

“Macro fundamentals of the single-family rental sector remain robust and our expectation is that they are likely to strengthen further as rising interest rates continue to pressure home affordability in the U.S.,” stated David Singelyn, American Homes 4 Rent’s Chief Executive Officer. “During the third quarter, we continued to experience record high volumes of prospective tenant traffic per available home that enabled us to drive a 110 basis point year-over-year increase in our Same-Home average occupied days percentage, while achieving strong blended leasing spreads of 4.1%. Looking forward, we believe that we still have significant runway ahead to continue optimizing our operations, while leveraging the scale of our platform to create long-term value for our shareholders.”

Third Quarter 2018 Financial Results

Net income attributable to common shareholders totaled $15.2 million, or $0.05 income per diluted share, for the third quarter of 2018, compared to net income attributable to common shareholders of $1.5 million, or a $0.00 loss per diluted share, for the third quarter of 2017. This increase was primarily attributable to higher revenues resulting from a larger number of leased properties and higher rental rates.

Earnings Press Release (continued)

Total revenues increased 13.5% to $280.1 million for the third quarter of 2018 from $246.8 million for the third quarter of 2017. Revenue growth was primarily driven by continued strong acquisition and leasing activity, as our average leased portfolio grew to 47,898 homes for the quarter ended September 30, 2018, compared to 46,058 homes for the quarter ended September 30, 2017, as well as higher rental rates.

Core NOI on our total portfolio increased 11.1% to $146.1 million for the third quarter of 2018, compared to $131.5 million for the third quarter of 2017. This increase was primarily due to growth in rental income resulting from a larger number of leased properties.

Core revenues from Same-Home properties increased 4.4% to $172.0 million for the third quarter of 2018, compared to $164.8 million for the third quarter of 2017. This growth was primarily driven by a 3.4% increase in Average Monthly Realized Rent and an increase in Average Occupied Days Percentage to 95.2% from 94.1%. Core property operating expenses from Same-Home properties increased 5.4% from $59.7 million for the third quarter of 2017 to $63.0 million for the third quarter of 2018, which was primarily attributable to property tax expense timing and higher repairs and maintenance costs, which included $0.3 million of costs to repair damages resulting from Hurricane Florence.

Core NOI from Same-Home properties increased 3.8% to $109.1 million for the third quarter of 2018, compared to $105.1 million for the third quarter of 2017. After capital expenditures, Core NOI from Same-Home properties increased 3.4% to $100.1 million for the third quarter of 2018, compared to $96.8 million for the third quarter of 2017. The increase in Core NOI from Same-Home properties was primarily attributable to an increase in rental revenue driven by higher Average Monthly Realized Rent and Average Occupied Days Percentage during the third quarter of 2018.The resulting increase in Core NOI after Capital Expenditures from Same-Home properties was offset, in part, by higher recurring capital expenditures primarily due to hotter summer temperatures, resulting in higher HVAC costs.

Core Funds from Operations attributable to common share and unit holders ("Core FFO attributable to common share and unit holders") was $94.6 million, or $0.27 per FFO share and unit, for the third quarter of 2018, compared to $79.4 million, or $0.25 per FFO share and unit, for the third quarter of 2017. Adjusted Funds from Operations attributable to common share and unit holders ("Adjusted FFO attributable to common share and unit holders") for the third quarter of 2018 was $79.4 million, or $0.23 per FFO share and unit, compared to $67.1 million, or $0.21 per FFO share and unit, for the third quarter of 2017. This improvement was primarily attributable to increases in rental revenue driven by a larger number of leased properties and higher rental rates.

Year-to-Date 2018 Financial Results

Net income attributable to common shareholders totaled $5.8 million, or $0.02 income per diluted share, for the nine-month period ended September 30, 2018, compared to a net loss attributable to common shareholders of $0.1 million, or a $0.00 loss per diluted share, for the nine-month period ended September 30, 2017. This increase was primarily attributable to higher revenues resulting from a larger number of leased properties and higher rental rates, partially offset by a noncash charge related to the redemption of the Series C participating preferred shares through a conversion into Class A common shares in April 2018.

Total revenues increased 11.8% to $802.5 million for the nine-month period ended September 30, 2018, from $717.6 million for the nine-month period ended September 30, 2017. Revenue growth was primarily driven by continued strong leasing activity, as our average leased portfolio grew to 47,617 homes for the nine months ended September 30, 2018, compared to 45,550 homes for the nine months ended September 30, 2017, as well as higher rental rates.

Earnings Press Release (continued)

Core NOI on our total portfolio increased 8.6% to $429.0 million for the nine-month period ended September 30, 2018, compared to $394.9 million for the nine-month period ended September 30, 2017. This increase was primarily due to growth in rental income resulting from a larger number of leased properties.

Core revenues from Same-Home properties increased 3.8% to $512.2 million for the nine-month period ended September 30, 2018, compared to $493.6 million for the nine-month period ended September 30, 2017. This growth was primarily driven by a 3.6% increase in Average Monthly Realized Rent. Core property operating expenses from Same-Home properties increased 6.5% from $173.3 million for the nine-month period ended September 30, 2017, to $184.6 million for the nine-month period ended September 30, 2018, which was primarily attributable to temporarily elevated turnover costs through April 2018, incurred as part of the Company's initiative to strengthen occupancy.

Core NOI from Same-Home properties increased 2.3% to $327.6 million for the nine months ended September 30, 2018, compared to $320.2 million for the nine months ended September 30, 2017. After capital expenditures, Core NOI from Same-Home properties increased 2.2% to $306.5 million for the nine-month period ended September 30, 2018, from $299.9 million for the nine-month period ended September 30, 2017. The increases in Core NOI from Same-Home properties and Core NOI After Capital Expenditures from Same-Home properties were primarily attributable to increases in rental revenue driven by higher rental rates during the nine-month period ended September 30, 2018, offset by higher R&M and turnover costs during the nine-month period ended September 30, 2018.

Core FFO attributable to common share and unit holders was $273.1 million, or $0.78 per FFO share and unit, for the nine-month period ended September 30, 2018, compared to $237.6 million, or $0.76 per FFO share and unit, for the nine-month period ended September 30, 2017. Adjusted FFO attributable to common share and unit holders for the nine-month period ended September 30, 2018, was $236.2 million, or $0.68 per FFO share and unit, compared to $207.2 million, or $0.66 per FFO share and unit, for the same period in 2017.

Portfolio

As of September 30, 2018, the Company had a total leased percentage of 95.2%, compared to 96.3% as of June 30, 2018. The leased percentage on Same-Home properties was 96.2% as of September 30, 2018, compared to 97.1% as of June 30, 2018.

Investments

As of September 30, 2018, the Company’s total portfolio consisted of 52,464 homes, including 2,266 properties to be disposed, compared to 52,049 homes as of June 30, 2018, including 2,209 properties to be disposed, an increase of 415 homes, which included 401 properties acquired through traditional acquisition channels, 168 newly constructed properties delivered through our AMH Development and National Builder Programs and 154 homes sold, rescinded or contributed to an unconsolidated joint venture.

Capital Activities and Balance Sheet

During the third quarter of 2018, the Company issued 4,600,000 6.25% Series H cumulative redeemable perpetual preferred shares in an underwritten public offering, raising gross proceeds of $115.0 million before offering costs of approximately $4.0 million, with a liquidation preference of $25.00 per share.

In August 2018, the Company entered into a $156.3 million joint venture with a leading institutional investor to develop, lease, and operate newly constructed single-family rental homes located in select submarkets in the Southeast. The Company holds a 20% unconsolidated interest in the joint venture and is entitled to its proportionate share of cash flows over the joint venture term of five years, along with opportunity for a promoted interest and fees for services the Company will provide to the joint

Earnings Press Release (continued)

venture.

As of September 30, 2018, the Company had cash and cash equivalents of $110.1 million and had total outstanding debt of $2.7 billion, excluding unamortized discounts, the value of exchangeable senior notes classified within equity and unamortized deferred financing costs, with a weighted-average interest rate of 4.21% and a weighted-average term to maturity of 14.0 years. The Company had no outstanding borrowings on our $800.0 million revolving credit facility and had $100.0 million of outstanding borrowings on our term loan facility at the end of the quarter.

2018 Outlook |

| | | | |

| | Full Year 2018 | |

| Same-Home | Previous Guidance | | Current Guidance | |

| Average Occupied Days Percentage | 95.0% - 95.5% | | 94.75% - 95.25% | (1) |

| Core revenues growth | 4.0% - 4.5% | | 3.75% - 4.25% | (2) |

| Property tax expense growth | 2.75% - 3.75% | | 2.75% - 3.75% | |

| Average R&M and turnover costs, net, plus Recurring Capital Expenditures per property | $2,050 - $2,150 | | $2,100 - $2,150 | |

| Core property operating expenses growth | 5.0% - 6.0% | | 5.5% - 6.0% | |

| | | | | |

| Core NOI margin | 64.0% - 65.0% | | 64.0% - 65.0% | |

| Core NOI After Capital Expenditures growth | 3.25% - 3.75% | | 2.5% - 3.0% | (2) |

| | | | | |

| Property Enhancing Capex | $8 - $12 million | | $8 - $12 million | |

| | | | | |

| General and administrative expense, excluding noncash share-based compensation | $34.5 - $35.5 million | | $34.5 - $35.5 million | |

| | | | | |

| Acquisition and development volume | $500 - $600 million | | $500 - $600 million | |

| |

| (1) | As previously communicated, we expected the full year Average Occupied Days Percentage to be below the midpoint of previous guidance range due to modest leasing disruption from Hurricane Florence. Additionally, as a result of recent field personnel turnover, we now expect occupancy softness in certain markets in the fourth quarter of 2018 and are therefore revising the guidance range to 94.75% to 95.25%. |

| |

| (2) | Revised as a result of lowered Average Occupied Days Percentage guidance. |

Note: The Company does not provide guidance for the most comparable GAAP financial measures of net income or loss, total revenues and property operating expenses, or a reconciliation of the above-listed forward-looking non-GAAP financial measures to the comparable GAAP financial measures because we are unable to reasonably predict certain items contained in the GAAP measures, including non-recurring and infrequent items that are not indicative of the Company's ongoing operations. Such items include, but are not limited to, net gain or loss on sales and impairment of single-family properties, casualty loss, Non-Same-Home revenues and Non-Same-Home property operating expenses. These items are uncertain, depend on various factors and could have a material impact on our GAAP results for the guidance period.

Additional Information

A copy of the Company’s Third Quarter 2018 Earnings Release and Supplemental Information Package and this press release are available on our website at www.americanhomes4rent.com. This information has also been furnished to the SEC in a current report on Form 8-K.

Conference Call

A conference call is scheduled on Friday, November 2, 2018, at 11:00 a.m. Eastern Time to discuss the Company’s financial results for the quarter ended September 30, 2018, and to provide an update on its business. The domestic dial-in number is (877) 451-6152 (for U.S. and Canada) and the international dial-in number is (201) 389-0879 (passcode not required). A simultaneous

Earnings Press Release (continued)

audio webcast may be accessed by using the link at www.americanhomes4rent.com, under “For Investors.” A replay of the conference call may be accessed through Friday, November 16, 2018, by calling (844) 512-2921 (U.S. and Canada) or (412) 317-6671 (international), replay passcode number 13683741#, or by using the link at www.americanhomes4rent.com, under “For Investors.”

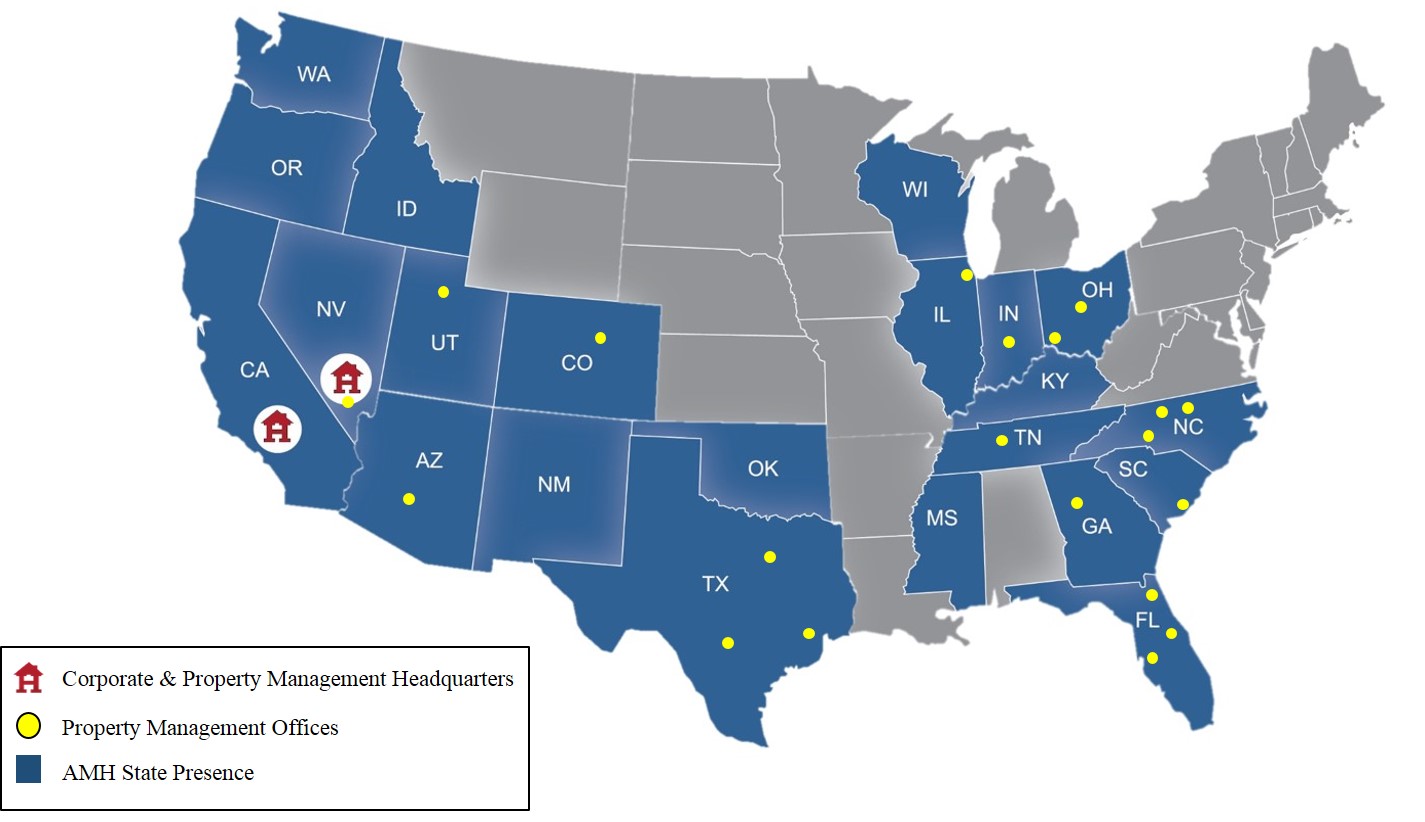

About American Homes 4 Rent

American Homes 4 Rent (NYSE: AMH) is a leader in the single-family home rental industry and “American Homes 4 Rent” is fast becoming a nationally recognized brand for rental homes, known for high quality, good value and tenant satisfaction. We are an internally managed Maryland real estate investment trust, or REIT, focused on acquiring, renovating, leasing, and operating attractive, single-family homes as rental properties. As of September 30, 2018, we owned 52,464 single-family properties in selected submarkets in 22 states.

Forward-Looking Statements

This press release contains “forward-looking statements.” These forward-looking statements relate to beliefs, expectations or intentions and similar statements concerning matters that are not of historical fact and are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “intend,” “potential,” “plan,” “goal,” "outlook" or other words that convey the uncertainty of future events or outcomes. Examples of forward-looking statements contained in this press release include, among others, our belief that we will continue to optimize operations to create long-term shareholder value. The Company has based these forward-looking statements on its current expectations and assumptions about future events. While the Company's management considers these expectations to be reasonable, they are inherently subject to risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond the Company’s control and could cause actual results to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to update any forward-looking statements to conform to actual results or changes in its expectations, unless required by applicable law. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of the Company in general, see the “Risk Factors” disclosed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017, and in the Company’s subsequent filings with the SEC.

Fact Sheet

(Amounts in thousands, except per share and property data)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| | For the Three Months Ended

Sep 30, | | For the Nine Months Ended

Sep 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

| Operating Data | | | | | | | |

| Net income (loss) attributable to common shareholders | $ | 15,177 |

| | $ | 1,535 |

| | $ | 5,840 |

| | $ | (141 | ) |

| Core revenues | $ | 231,286 |

| | $ | 208,034 |

| | $ | 678,491 |

| | $ | 616,240 |

|

| Core NOI | $ | 146,063 |

| | $ | 131,453 |

| | $ | 428,975 |

| | $ | 394,919 |

|

| Core NOI margin | 63.2 | % | | 63.2 | % | | 63.2 | % | | 64.1 | % |

| Platform Efficiency Percentage | 12.7 | % | | 12.2 | % | | 12.8 | % | | 12.5 | % |

| Adjusted EBITDAre after Capex and Leasing Costs | $ | 123,456 |

| | $ | 111,774 |

| | $ | 369,596 |

| | $ | 343,625 |

|

| Adjusted EBITDAre after Capex and Leasing Costs Margin | 52.3 | % | | 53.0 | % | | 53.6 | % | | 54.9 | % |

| Per FFO share and unit: | | | | | | | |

| FFO attributable to common share and unit holders | $ | 0.26 |

| | $ | 0.23 |

| | $ | 0.66 |

| | $ | 0.68 |

|

| Core FFO attributable to common share and unit holders | $ | 0.27 |

| | $ | 0.25 |

| | $ | 0.78 |

| | $ | 0.76 |

|

| Adjusted FFO attributable to common share and unit holders | $ | 0.23 |

| | $ | 0.21 |

| | $ | 0.68 |

| | $ | 0.66 |

|

|

| | | | | | | | | | | | | | | | | | | |

| | Sep 30,

2018 | | Jun 30,

2018 | | Mar 31,

2018 | | Dec 31,

2017 | | Sep 30,

2017 |

| Selected Balance Sheet Information - end of period | | | | | | | | | |

| Single-family properties, net | $ | 8,258,557 |

| | $ | 8,183,921 |

| | $ | 8,169,080 |

| | $ | 8,064,980 |

| | $ | 7,802,499 |

|

| Total assets | $ | 8,971,426 |

| | $ | 8,830,448 |

| | $ | 8,958,033 |

| | $ | 8,608,768 |

| | $ | 8,509,876 |

|

| Outstanding borrowings under credit facilities, net | $ | 99,176 |

| | $ | 99,120 |

| | $ | 198,132 |

| | $ | 338,023 |

| | $ | 197,913 |

|

| Total Debt | $ | 2,712,688 |

| | $ | 2,717,867 |

| | $ | 2,871,649 |

| | $ | 2,517,216 |

| | $ | 2,382,871 |

|

| Total Market Capitalization | $ | 11,299,123 |

| | $ | 11,279,968 |

| | $ | 10,693,963 |

| | $ | 10,975,663 |

| | $ | 10,799,923 |

|

| Total Debt to Total Market Capitalization | 24.0 | % | | 24.1 | % | | 26.9 | % | | 22.9 | % | | 22.1 | % |

| Net Debt to Adjusted EBITDAre | 4.7 x |

| | 5.0 x |

| | 5.1 x |

| | 4.8 x |

| | 4.2 x |

|

| NYSE AMH Class A common share closing price | $ | 21.89 |

| | $ | 22.18 |

| | $ | 20.08 |

| | $ | 21.84 |

| | $ | 21.71 |

|

|

| | | | | | | | | | | | | | |

| Portfolio Data - end of period | | | | | | | | | |

| Leased single-family properties | 47,776 |

| | 48,020 |

| | 47,677 |

| | 46,996 |

| | 46,026 |

|

| Occupied single-family properties | 47,551 |

| | 47,758 |

| | 47,095 |

| | 46,614 |

| | 45,660 |

|

| Single-family properties newly acquired and being renovated | 345 |

| | 223 |

| | 503 |

| | 980 |

| | 858 |

|

| Single-family properties being prepared for re-lease | 430 |

| | 332 |

| | 289 |

| | 372 |

| | 392 |

|

| Vacant single-family properties available for re-lease | 1,452 |

| | 1,116 |

| | 1,221 |

| | 1,902 |

| | 1,974 |

|

| Vacant single-family properties available for initial lease | 195 |

| | 149 |

| | 258 |

| | 679 |

| | 296 |

|

| Total single-family properties, excluding properties to be disposed | 50,198 |

| | 49,840 |

| | 49,948 |

| | 50,929 |

| | 49,546 |

|

| Single-family properties to be disposed (1) | 2,266 |

| | 2,209 |

| | 1,892 |

| | 310 |

| | 469 |

|

| Total single-family properties | 52,464 |

| | 52,049 |

| | 51,840 |

| | 51,239 |

| | 50,015 |

|

| Total leased percentage (2) | 95.2 | % | | 96.3 | % | | 95.5 | % | | 92.3 | % | | 92.9 | % |

| Total Average Occupied Days Percentage | 94.3 | % | | 94.8 | % | | 91.4 | % | | 90.8 | % | | 93.2 | % |

| Same-Home leased percentage (38,168 properties) | 96.2 | % | | 97.1 | % | | 97.2 | % | | 95.9 | % | | 95.2 | % |

| Same-Home Average Occupied Days Percentage (38,168 properties) | 95.2 | % | | 95.4 | % | | 94.7 | % | | 94.0 | % | | 94.1 | % |

|

| | | | | | | | | | | | | | | | | | | |

| Other Data | | | | | | | | | |

| Distributions declared per common share | $ | 0.05 |

| | $ | 0.05 |

| | $ | 0.05 |

| | $ | 0.05 |

| | $ | 0.05 |

|

| Distributions declared per Series D perpetual preferred share | $ | 0.41 |

| | $ | 0.41 |

| | $ | 0.41 |

| | $ | 0.41 |

| | $ | 0.41 |

|

| Distributions declared per Series E perpetual preferred share | $ | 0.40 |

| | $ | 0.40 |

| | $ | 0.40 |

| | $ | 0.40 |

| | $ | 0.40 |

|

| Distributions declared per Series F perpetual preferred share | $ | 0.37 |

| | $ | 0.37 |

| | $ | 0.37 |

| | $ | 0.37 |

| | $ | 0.37 |

|

| Distributions declared per Series G perpetual preferred share (3) | $ | 0.37 |

| | $ | 0.37 |

| | $ | 0.37 |

| | $ | 0.37 |

| | $ | 0.30 |

|

| Distributions declared per Series H perpetual preferred share (4) | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

| |

| (1) | As of September 30, 2018, represents 2,266 properties identified as part of our disposition program, comprised of 1,865 properties classified as held for sale and 401 properties identified for future sale. |

| |

| (2) | Leased percentage is calculated based on total single-family properties, excluding properties to be disposed. |

| |

| (3) | Series G perpetual preferred shares offering close date and initial dividend start date was July 17, 2017. |

| |

| (4) | Series H perpetual preferred shares offering close date and initial dividend start date was September 19, 2018, with an initial dividend declared in the fourth quarter of 2018. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 8

|

Condensed Consolidated Statements of Operations

(Amounts in thousands, except share and per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| | For the Three Months Ended

Sep 30, | | For the Nine Months Ended

Sep 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

| Revenues: | | | | | | | |

| Rents from single-family properties | $ | 231,324 |

| | $ | 207,490 |

| | $ | 676,558 |

| | $ | 613,245 |

|

| Fees from single-family properties | 2,711 |

| | 2,843 |

| | 8,298 |

| | 8,137 |

|

| Tenant charge-backs | 44,152 |

| | 36,094 |

| | 112,876 |

| | 91,849 |

|

| Other | 1,865 |

| | 409 |

| | 4,807 |

| | 4,367 |

|

| Total revenues | 280,052 |

| | 246,836 |

| | 802,539 |

| | 717,598 |

|

| | | | | | | | |

| Expenses: | | | | | | | |

| Property operating expenses | 113,600 |

| | 97,944 |

| | 313,430 |

| | 267,203 |

|

| Property management expenses | 18,865 |

| | 17,447 |

| | 56,468 |

| | 52,367 |

|

| General and administrative expense | 9,265 |

| | 8,525 |

| | 28,173 |

| | 26,746 |

|

| Interest expense | 30,930 |

| | 26,592 |

| | 92,209 |

| | 86,873 |

|

| Acquisition fees and costs expensed | 1,055 |

| | 1,306 |

| | 3,687 |

| | 3,814 |

|

| Depreciation and amortization | 79,940 |

| | 74,790 |

| | 237,562 |

| | 221,459 |

|

| Hurricane-related charges, net | — |

| | 10,136 |

| | — |

| | 10,136 |

|

| Other | 1,069 |

| | 1,285 |

| | 3,520 |

| | 4,202 |

|

| Total expenses | 254,724 |

| | 238,025 |

| | 735,049 |

| | 672,800 |

|

| | | | | | | | |

| Gain on sale of single-family properties and other, net | 4,953 |

| | 1,895 |

| | 10,449 |

| | 6,375 |

|

| Loss on early extinguishment of debt | — |

| | — |

| | (1,447 | ) | | (6,555 | ) |

| Remeasurement of participating preferred shares | — |

| | 8,391 |

| | 1,212 |

| | 1,341 |

|

| | | | | | | | |

| Net income | 30,281 |

| | 19,097 |

| | 77,704 |

| | 45,959 |

|

| | | | | | | | |

| Noncontrolling interest | 2,881 |

| | 309 |

| | 845 |

| | (22 | ) |

| Dividends on preferred shares | 12,223 |

| | 17,253 |

| | 38,804 |

| | 46,122 |

|

| Redemption of participating preferred shares | — |

| | — |

| | 32,215 |

| | — |

|

| | | | | | | | |

| Net income (loss) attributable to common shareholders | $ | 15,177 |

| | $ | 1,535 |

| | $ | 5,840 |

| | $ | (141 | ) |

| | | | | | | | |

| Weighted-average shares outstanding: | | | | | | | |

| Basic | 296,214,509 | | 266,767,313 | | 292,656,914 | | 256,768,343 |

| Diluted | 296,967,649 | | 289,153,060 | | 293,319,245 | | 256,768,343 |

| | | | | | | | |

| Net income (loss) attributable to common shareholders per share: | | | | | | | |

| Basic | $ | 0.05 |

| | $ | 0.01 |

| | $ | 0.02 |

| | $ | — |

|

| Diluted | $ | 0.05 |

| | $ | — |

| | $ | 0.02 |

| | $ | — |

|

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 9

|

Funds from Operations

(Amounts in thousands, except share and per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| | For the Three Months Ended

Sep 30, | | For the Nine Months Ended

Sep 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

| Net income (loss) attributable to common shareholders | $ | 15,177 |

| | $ | 1,535 |

| | $ | 5,840 |

| | $ | (141 | ) |

| Adjustments: | | | | | | | |

| Noncontrolling interests in the Operating Partnership | 2,881 |

| | 340 |

| | 1,104 |

| | (30 | ) |

| Net (gain) on sale / impairment of single-family properties and other | (4,393 | ) | | (596 | ) | | (7,653 | ) | | (2,589 | ) |

| Depreciation and amortization | 79,940 |

| | 74,790 |

| | 237,562 |

| | 221,459 |

|

| Less: depreciation and amortization of non-real estate assets | (1,845 | ) | | (1,753 | ) | | (5,462 | ) | | (6,050 | ) |

| FFO attributable to common share and unit holders | $ | 91,760 |

| | $ | 74,316 |

| | $ | 231,391 |

| | $ | 212,649 |

|

| Adjustments: | | | | | | | |

| Acquisition fees and costs expensed | 1,055 |

| | 1,306 |

| | 3,687 |

| | 3,814 |

|

| Noncash share-based compensation - general and administrative | 491 |

| | 699 |

| | 1,609 |

| | 1,917 |

|

| Noncash share-based compensation - property management | 341 |

| | 417 |

| | 1,141 |

| | 1,258 |

|

| Noncash interest expense related to acquired debt | 973 |

| | 910 |

| | 2,810 |

| | 2,624 |

|

| Hurricane-related charges, net | — |

| | 10,136 |

| | — |

| | 10,136 |

|

| Loss on early extinguishment of debt | — |

| | — |

| | 1,447 |

| | 6,555 |

|

| Remeasurement of participating preferred shares | — |

| | (8,391 | ) | | (1,212 | ) | | (1,341 | ) |

| Redemption of participating preferred shares | — |

| | — |

| | 32,215 |

| | — |

|

| Core FFO attributable to common share and unit holders | $ | 94,620 |

| | $ | 79,393 |

| | $ | 273,088 |

| | $ | 237,612 |

|

| Recurring capital expenditures (1) | (11,467 | ) | | (10,316 | ) | | (27,342 | ) | | (25,055 | ) |

| Leasing costs | (3,722 | ) | | (1,960 | ) | | (9,556 | ) | | (5,361 | ) |

| Adjusted FFO attributable to common share and unit holders | $ | 79,431 |

| | $ | 67,117 |

| | $ | 236,190 |

| | $ | 207,196 |

|

| | | | | | | | |

| Per FFO share and unit: | | | | | | | |

| FFO attributable to common share and unit holders | $ | 0.26 |

| | $ | 0.23 |

| | $ | 0.66 |

| | $ | 0.68 |

|

| Core FFO attributable to common share and unit holders | $ | 0.27 |

| | $ | 0.25 |

| | $ | 0.78 |

| | $ | 0.76 |

|

| Adjusted FFO attributable to common share and unit holders | $ | 0.23 |

| | $ | 0.21 |

| | $ | 0.68 |

| | $ | 0.66 |

|

| | | | | | | | |

| Weighted-average FFO shares and units: | | | | | | | |

| Common shares outstanding | 296,214,509 |

| | 266,767,313 |

| | 292,656,914 |

| | 256,768,343 |

|

| Share-based compensation plan (2) | 753,140 |

| | 736,456 |

| | 662,331 |

| | 746,643 |

|

| Operating partnership units | 55,350,153 |

| | 55,535,824 |

| | 55,350,153 |

| | 55,547,386 |

|

| Total weighted-average FFO shares and units | 352,317,802 |

| | 323,039,593 |

| | 348,669,398 |

| | 313,062,372 |

|

| |

| (1) | As a portion of our homes are recently acquired and / or renovated, we estimate recurring capital expenditures for our entire portfolio by multiplying (a) current period actual recurring capital expenditures per Same-Home Property by (b) our total number of properties, excluding non-stabilized properties and properties identified as part of our disposition program, comprised of properties classified as held for sale and properties identified for future sale. |

| |

| (2) | Reflects the effect of potentially dilutive securities issuable upon the assumed vesting / exercise of restricted stock units and stock options. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 10

|

Core Net Operating Income - Total Portfolio

(Amounts in thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| | For the Three Months Ended

Sep 30, | | For the Nine Months Ended

Sep 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

| Rents from single-family properties | $ | 231,324 |

| | $ | 207,490 |

| | $ | 676,558 |

| | $ | 613,245 |

|

| Fees from single-family properties | 2,711 |

| | 2,843 |

| | 8,298 |

| | 8,137 |

|

| Bad debt expense | (2,749 | ) | | (2,299 | ) | | (6,365 | ) | | (5,142 | ) |

| Core revenues | 231,286 |

| | 208,034 |

| | 678,491 |

| | 616,240 |

|

| | | | | | | | |

| Property tax expense | 40,607 |

| | 36,618 |

| | 119,708 |

| | 110,052 |

|

| HOA fees, net (1) | 5,298 |

| | 4,246 |

| | 14,620 |

| | 12,231 |

|

| R&M and turnover costs, net (1) | 19,931 |

| | 17,966 |

| | 57,382 |

| | 45,948 |

|

| Insurance | 2,173 |

| | 1,981 |

| | 6,166 |

| | 5,845 |

|

| Property management expenses, net (2) | 17,214 |

| | 15,770 |

| | 51,640 |

| | 47,245 |

|

| Core property operating expenses | 85,223 |

| | 76,581 |

| | 249,516 |

| | 221,321 |

|

| | | | | | | | |

| Core NOI | $ | 146,063 |

| | $ | 131,453 |

| | $ | 428,975 |

| | $ | 394,919 |

|

| Core NOI margin | 63.2 | % | | 63.2 | % | | 63.2 | % | | 64.1 | % |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended

Sep 30, 2018 |

| | Same-Home Properties | | Stabilized,

Non-Same-Home

Properties | | Non-Stabilized Former ARPI Properties | | Subtotal Same-Home, Stabilized and ARPI | | Other &

Held for Sale

Properties (3) | | Total

Single-Family

Properties |

| Property count | 38,168 |

| | 8,262 |

| | 2,573 |

| | 49,003 |

| | 3,461 |

| | 52,464 |

|

| | | | | | | | | | | | |

| Rents from single-family properties | $ | 171,991 |

| | $ | 38,157 |

| | $ | 10,796 |

| | $ | 220,944 |

| | $ | 10,380 |

| | $ | 231,324 |

|

| Fees from single-family properties | 2,013 |

| | 371 |

| | 150 |

| | 2,534 |

| | 177 |

| | 2,711 |

|

| Bad debt expense | (1,981 | ) | | (416 | ) | | (154 | ) | | (2,551 | ) | | (198 | ) | | (2,749 | ) |

| Core revenues | 172,023 |

| | 38,112 |

| | 10,792 |

| | 220,927 |

| | 10,359 |

| | 231,286 |

|

| | | | | | | | | | | | |

| Property tax expense | 30,047 |

| | 5,947 |

| | 1,891 |

| | 37,885 |

| | 2,722 |

| | 40,607 |

|

| HOA fees, net (1) | 3,742 |

| | 995 |

| | 277 |

| | 5,014 |

| | 284 |

| | 5,298 |

|

| R&M and turnover costs, net (1) | 14,957 |

| | 2,512 |

| | 828 |

| | 18,297 |

| | 1,634 |

| | 19,931 |

|

| Insurance | 1,561 |

| | 379 |

| | 103 |

| | 2,043 |

| | 130 |

| | 2,173 |

|

| Property management expenses, net (2) | 12,661 |

| | 2,741 |

| | 854 |

| | 16,256 |

| | 958 |

| | 17,214 |

|

| Core property operating expenses | 62,968 |

| | 12,574 |

| | 3,953 |

| | 79,495 |

| | 5,728 |

| | 85,223 |

|

| | | | | | | | | | | | |

| Core NOI | $ | 109,055 |

| | $ | 25,538 |

| | $ | 6,839 |

| | $ | 141,432 |

| | $ | 4,631 |

| | $ | 146,063 |

|

| Core NOI margin | 63.4 | % | | 67.0 | % | | 63.4 | % | | 64.0 | % | | 44.7 | % | | 63.2 | % |

| |

| (1) | Presented net of tenant charge-backs. |

| |

| (2) | Presented net of tenant charge-backs and excludes noncash share-based compensation expense related to centralized and field property management employees. |

| |

| (3) | Includes 1,195 non-stabilized properties and 2,266 properties identified as part of our disposition program, comprised of 1,865 properties classified as held for sale and 401 properties identified for future sale. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 11

|

Same-Home Results – Quarterly and Year-to-Date Comparisons

(Amounts in thousands, except property and per property data)

(Unaudited) |

| | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended

Sep 30, | | | | For the Nine Months Ended

Sep 30, | | |

| | 2018 | | 2017 | | Change | | 2018 | | 2017 | | Change |

| Number of Same-Home properties | 38,168 |

| | 38,168 |

| | | | 38,168 |

| | 38,168 |

| | |

| Leased percentage as of period end | 96.2 | % | | 95.2 | % | | 1.0 | % | | 96.2 | % | | 95.2 | % | | 1.0 | % |

| Occupancy percentage as of period end | 95.8 | % | | 94.4 | % | | 1.4 | % | | 95.8 | % | | 94.4 | % | | 1.4 | % |

| Average Occupied Days Percentage | 95.2 | % | | 94.1 | % | | 1.1 | % | | 95.1 | % | | 94.8 | % | | 0.3 | % |

| Average Monthly Realized Rent per property | $ | 1,578 |

| | $ | 1,526 |

| | 3.4 | % | | $ | 1,564 |

| | $ | 1,509 |

| | 3.6 | % |

| Turnover Rate | 10.8 | % | | 11.0 | % | | (0.2 | )% | | 29.9 | % | | 31.5 | % | | (1.6 | )% |

| Turnover Rate - TTM | 37.8 | % | | N/A |

| | | | 37.8 | % | | N/A |

| | |

| | | | | | | | | | | | |

| Core NOI: | | | | | | | | | | |

| Rents from single-family properties | $ | 171,991 |

| | $ | 164,466 |

| | 4.6 | % | | $ | 510,867 |

| | $ | 491,392 |

| | 4.0 | % |

| Fees from single-family properties | 2,013 |

| | 2,184 |

| | (7.8 | )% | | 5,961 |

| | 6,191 |

| | (3.7 | )% |

| Bad debt expense | (1,981 | ) | | (1,813 | ) | | 9.3 | % | | (4,637 | ) | | (4,029 | ) | | 15.1 | % |

| Core revenues | 172,023 |

| | 164,837 |

| | 4.4 | % | | 512,191 |

| | 493,554 |

| | 3.8 | % |

| | | | | | | | | | | | |

| Property tax expense | 30,047 |

| | 28,519 |

| | 5.4 | % | | 88,940 |

| | 86,029 |

| | 3.4 | % |

| HOA fees, net (1) | 3,742 |

| | 3,277 |

| | 14.2 | % | | 10,548 |

| | 9,523 |

| | 10.8 | % |

| R&M and turnover costs, net (1) (2) | 14,957 |

| | 14,052 |

| | 6.4 | % | | 42,120 |

| | 35,706 |

| | 18.0 | % |

| Insurance | 1,561 |

| | 1,532 |

| | 1.9 | % | | 4,577 |

| | 4,650 |

| | (1.6 | )% |

| Property management expenses, net (3) | 12,661 |

| | 12,368 |

| | 2.4 | % | | 38,400 |

| | 37,411 |

| | 2.6 | % |

| Core property operating expenses | 62,968 |

| | 59,748 |

| | 5.4 | % | | 184,585 |

| | 173,319 |

| | 6.5 | % |

| | | | | | | | | | | | |

| Core NOI | $ | 109,055 |

| | $ | 105,089 |

| | 3.8 | % | | $ | 327,606 |

| | $ | 320,235 |

| | 2.3 | % |

| Core NOI margin | 63.4 | % | | 63.8 | % | | | | 64.0 | % | | 64.9 | % | | |

| | | | | | | | | | | | |

| Recurring Capital Expenditures | 8,942 |

| | 8,258 |

| | 8.3 | % | | 21,090 |

| | 20,350 |

| | 3.6 | % |

| Core NOI After Capital Expenditures | $ | 100,113 |

| | $ | 96,831 |

| | 3.4 | % | | $ | 306,516 |

| | $ | 299,885 |

| | 2.2 | % |

| | | | | | | | | | | | |

| Property Enhancing Capex | | | | | | | | | | | |

| Resilient flooring program | $ | 3,173 |

| | $ | 988 |

| |

| | $ | 6,927 |

| | $ | 1,584 |

| |

|

| | | | | | | | | | | | |

| Per property: | | | | | | | | | | | |

| Average Recurring Capital Expenditures | $ | 234 |

| | $ | 216 |

| | 8.3 | % | | $ | 553 |

| | $ | 533 |

| | 3.6 | % |

| Average R&M and turnover costs, net, plus Recurring Capital Expenditures | $ | 627 |

| | $ | 585 |

| | 7.2 | % | | $ | 1,656 |

| | $ | 1,468 |

| | 12.8 | % |

| |

| (1) | Presented net of tenant charge-backs. |

| |

| (2) | Includes $0.3 million of repair costs related to Hurricane Florence in the third quarter of 2018. |

| |

| (3) | Presented net of tenant charge-backs and excludes noncash share-based compensation expense related to centralized and field property management employees. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 12

|

Same-Home Results – Sequential Quarterly Results

(Amounts in thousands, except per property data)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended |

| | Sep 30,

2018 | | Jun 30,

2018 | | Mar 31,

2018 | | Dec 31,

2017 | | Sep 30,

2017 |

| Core NOI: | | | | | | | | | |

| Rents from single-family properties | $ | 171,991 |

| | $ | 170,666 |

| | $ | 168,210 |

| | $ | 165,786 |

| | $ | 164,466 |

|

| Fees from single-family properties | 2,013 |

| | 1,989 |

| | 1,959 |

| | 1,943 |

| | 2,184 |

|

| Bad debt expense | (1,981 | ) | | (1,170 | ) | | (1,486 | ) | | (1,607 | ) | | (1,813 | ) |

| Core revenues | 172,023 |

| | 171,485 |

| | 168,683 |

| | 166,122 |

| | 164,837 |

|

| | | | | | | | | | |

| Property tax expense | 30,047 |

| | 29,647 |

| | 29,246 |

| | 28,948 |

| | 28,519 |

|

| HOA fees, net (1) | 3,742 |

| | 3,501 |

| | 3,305 |

| | 3,345 |

| | 3,277 |

|

| R&M and turnover costs, net (1) (2) | 14,957 |

| | 13,832 |

| | 13,331 |

| | 11,290 |

| | 14,052 |

|

| Insurance | 1,561 |

| | 1,512 |

| | 1,504 |

| | 1,557 |

| | 1,532 |

|

| Property management expenses, net (3) | 12,661 |

| | 12,592 |

| | 13,147 |

| | 12,112 |

| | 12,368 |

|

| Core property operating expenses | 62,968 |

| | 61,084 |

| | 60,533 |

| | 57,252 |

| | 59,748 |

|

| | | | | | | | | | |

| Core NOI | $ | 109,055 |

| | $ | 110,401 |

| | $ | 108,150 |

| | $ | 108,870 |

| | $ | 105,089 |

|

| Core NOI margin | 63.4 | % | | 64.4 | % | | 64.1 | % | | 65.5 | % | | 63.8 | % |

| | | | | | | | | | |

| Recurring Capital Expenditures | 8,942 |

| | 6,463 |

| | 5,685 |

| | 5,806 |

| | 8,258 |

|

| Core NOI After Capital Expenditures | $ | 100,113 |

| | $ | 103,938 |

| | $ | 102,465 |

| | $ | 103,064 |

| | $ | 96,831 |

|

| | | | | | | | | | |

| Property Enhancing Capex | | | | | | | | | |

| Resilient flooring program | $ | 3,173 |

| | $ | 2,444 |

| | $ | 1,310 |

| | $ | 1,504 |

| | $ | 988 |

|

| | | | | | | | | | |

| Per property: | | | | | | | | | |

| Average Recurring Capital Expenditures | $ | 234 |

| | $ | 170 |

| | $ | 149 |

| | $ | 152 |

| | $ | 216 |

|

| Average R&M and turnover costs, net, plus Recurring Capital Expenditures | $ | 627 |

| | $ | 531 |

| | $ | 498 |

| | $ | 447 |

| | $ | 585 |

|

| |

| (1) | Presented net of tenant charge-backs. |

| |

| (2) | Includes $0.3 million of repair costs related to Hurricane Florence in the third quarter of 2018. |

| |

| (3) | Presented net of tenant charge-backs and excludes noncash share-based compensation expense related to centralized and field property management employees. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 13

|

Same-Home Results – Sequential Quarterly Metrics

Average Occupied Days Percentage

|

| | | | | | | | | | | | | | |

| | For the Three Months Ended |

| | Sep 30,

2018 | | Jun 30,

2018 | | Mar 31,

2018 | | Dec 31,

2017 | | Sep 30,

2017 |

| Dallas-Fort Worth, TX | 94.0 | % | | 95.3 | % | | 94.5 | % | | 93.3 | % | | 92.9 | % |

| Atlanta, GA | 95.8 | % | | 96.1 | % | | 95.1 | % | | 95.7 | % | | 96.1 | % |

| Indianapolis, IN | 94.2 | % | | 94.9 | % | | 94.3 | % | | 94.2 | % | | 93.7 | % |

| Charlotte, NC | 95.0 | % | | 94.4 | % | | 93.5 | % | | 92.6 | % | | 94.0 | % |

| Houston, TX | 94.2 | % | | 95.1 | % | | 94.7 | % | | 93.6 | % | | 90.2 | % |

| Cincinnati, OH | 95.0 | % | | 95.0 | % | | 94.5 | % | | 94.0 | % | | 93.6 | % |

| Greater Chicago area, IL and IN | 96.1 | % | | 96.3 | % | | 96.6 | % | | 94.9 | % | | 94.8 | % |

| Phoenix, AZ | 96.2 | % | | 97.0 | % | | 96.5 | % | | 95.0 | % | | 95.6 | % |

| Nashville, TN | 94.7 | % | | 94.5 | % | | 92.9 | % | | 92.6 | % | | 92.3 | % |

| Tampa, FL | 94.6 | % | | 95.0 | % | | 94.8 | % | | 93.5 | % | | 94.2 | % |

| Raleigh, NC | 95.0 | % | | 93.9 | % | | 93.6 | % | | 93.8 | % | | 94.7 | % |

| Jacksonville, FL | 95.9 | % | | 96.7 | % | | 95.6 | % | | 95.4 | % | | 94.9 | % |

| Columbus, OH | 97.0 | % | | 96.0 | % | | 93.7 | % | | 92.5 | % | | 93.9 | % |

| Orlando, FL | 97.0 | % | | 96.3 | % | | 96.9 | % | | 96.7 | % | | 96.3 | % |

| Salt Lake City, UT | 94.9 | % | | 95.1 | % | | 95.2 | % | | 93.2 | % | | 94.2 | % |

| Las Vegas, NV | 97.2 | % | | 97.7 | % | | 96.6 | % | | 96.4 | % | | 96.9 | % |

| San Antonio, TX | 94.9 | % | | 95.0 | % | | 94.3 | % | | 92.8 | % | | 92.7 | % |

| Charleston, SC | 92.1 | % | | 90.8 | % | | 92.3 | % | | 93.7 | % | | 93.2 | % |

| Denver, CO | 93.7 | % | | 96.0 | % | | 97.0 | % | | 95.2 | % | | 95.4 | % |

| Greenville, SC | 94.1 | % | | 91.5 | % | | 90.6 | % | | 91.1 | % | | 90.4 | % |

| All Other (1) | 95.8 | % | | 95.9 | % | | 95.0 | % | | 94.0 | % | | 94.8 | % |

| Total / Average | 95.2 | % | | 95.4 | % | | 94.7 | % | | 94.0 | % | | 94.1 | % |

Average Monthly Realized Rent per property

|

| | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended |

| | Sep 30,

2018 | | Jun 30,

2018 | | Mar 31,

2018 | | Dec 31,

2017 | | Sep 30,

2017 |

| Dallas-Fort Worth, TX | $ | 1,709 |

| | $ | 1,690 |

| | $ | 1,677 |

| | $ | 1,666 |

| | $ | 1,659 |

|

| Atlanta, GA | 1,537 |

| | 1,525 |

| | 1,496 |

| | 1,481 |

| | 1,472 |

|

| Indianapolis, IN | 1,378 |

| | 1,377 |

| | 1,366 |

| | 1,358 |

| | 1,345 |

|

| Charlotte, NC | 1,535 |

| | 1,526 |

| | 1,522 |

| | 1,521 |

| | 1,508 |

|

| Houston, TX | 1,651 |

| | 1,621 |

| | 1,615 |

| | 1,622 |

| | 1,605 |

|

| Cincinnati, OH | 1,562 |

| | 1,547 |

| | 1,535 |

| | 1,517 |

| | 1,510 |

|

| Greater Chicago area, IL and IN | 1,824 |

| | 1,812 |

| | 1,788 |

| | 1,778 |

| | 1,765 |

|

| Phoenix, AZ | 1,347 |

| | 1,318 |

| | 1,299 |

| | 1,283 |

| | 1,259 |

|

| Nashville, TN | 1,708 |

| | 1,700 |

| | 1,702 |

| | 1,684 |

| | 1,686 |

|

| Tampa, FL | 1,714 |

| | 1,678 |

| | 1,671 |

| | 1,668 |

| | 1,646 |

|

| Raleigh, NC | 1,499 |

| | 1,493 |

| | 1,486 |

| | 1,478 |

| | 1,467 |

|

| Jacksonville, FL | 1,494 |

| | 1,475 |

| | 1,465 |

| | 1,447 |

| | 1,433 |

|

| Columbus, OH | 1,561 |

| | 1,544 |

| | 1,540 |

| | 1,526 |

| | 1,518 |

|

| Orlando, FL | 1,631 |

| | 1,604 |

| | 1,578 |

| | 1,579 |

| | 1,538 |

|

| Salt Lake City, UT | 1,683 |

| | 1,666 |

| | 1,643 |

| | 1,627 |

| | 1,608 |

|

| Las Vegas, NV | 1,499 |

| | 1,488 |

| | 1,467 |

| | 1,449 |

| | 1,438 |

|

| San Antonio, TX | 1,501 |

| | 1,491 |

| | 1,482 |

| | 1,481 |

| | 1,475 |

|

| Charleston, SC | 1,616 |

| | 1,607 |

| | 1,592 |

| | 1,609 |

| | 1,591 |

|

| Denver, CO | 2,159 |

| | 2,136 |

| | 2,112 |

| | 2,083 |

| | 2,071 |

|

| Greenville, SC | 1,518 |

| | 1,524 |

| | 1,528 |

| | 1,525 |

| | 1,518 |

|

| All Other (1) | 1,509 |

| | 1,493 |

| | 1,485 |

| | 1,468 |

| | 1,455 |

|

| Total / Average | $ | 1,578 |

| | $ | 1,563 |

| | $ | 1,551 |

| | $ | 1,540 |

| | $ | 1,526 |

|

| |

| (1) | Represents 15 markets in 15 states. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 14

|

Same-Home Results – Operating Metrics by Market

|

| | | | | | | | | | | | | | | | | | |

| | Number of Properties | | Gross Book Value per Property | | % of 3Q18 NOI | | Avg. Change in Rent for Renewals (1) | | Avg. Change in Rent for Re-Leases (1) | | Avg. Blended Change in Rent (1) |

| Dallas-Fort Worth, TX | 3,382 |

| | $ | 162,566 |

| | 7.3 | % | | 4.8 | % | | 3.7 | % | | 4.3 | % |

| Atlanta, GA | 3,049 |

| | 165,400 |

| | 8.3 | % | | 5.1 | % | | 6.9 | % | | 5.7 | % |

| Indianapolis, IN | 2,782 |

| | 153,579 |

| | 6.1 | % | | 3.2 | % | | 4.5 | % | | 3.7 | % |

| Charlotte, NC | 2,431 |

| | 175,719 |

| | 6.8 | % | | 3.1 | % | | 3.5 | % | | 3.2 | % |

| Houston, TX | 2,131 |

| | 170,659 |

| | 4.8 | % | | 3.7 | % | | 0.9 | % | | 2.8 | % |

| Cincinnati, OH | 1,878 |

| | 173,840 |

| | 5.0 | % | | 3.3 | % | | 3.3 | % | | 3.3 | % |

| Greater Chicago area, IL and IN | 1,758 |

| | 181,190 |

| | 4.7 | % | | 3.3 | % | | 1.8 | % | | 2.7 | % |

| Phoenix, AZ | 1,811 |

| | 164,303 |

| | 4.3 | % | | 6.6 | % | | 10.1 | % | | 7.8 | % |

| Nashville, TN | 1,717 |

| | 206,497 |

| | 5.9 | % | | 3.3 | % | | 2.4 | % | | 2.9 | % |

| Tampa, FL | 1,594 |

| | 188,566 |

| | 4.1 | % | | 3.9 | % | | 2.7 | % | | 3.4 | % |

| Raleigh, NC | 1,589 |

| | 180,118 |

| | 4.4 | % | | 2.9 | % | | 3.5 | % | | 3.1 | % |

| Jacksonville, FL | 1,586 |

| | 154,121 |

| | 3.8 | % | | 3.8 | % | | 4.8 | % | | 4.2 | % |

| Columbus, OH | 1,429 |

| | 155,950 |

| | 3.9 | % | | 3.6 | % | | 4.2 | % | | 3.9 | % |

| Orlando, FL | 1,244 |

| | 170,333 |

| | 3.2 | % | | 5.4 | % | | 6.9 | % | | 5.9 | % |

| Salt Lake City, UT | 1,047 |

| | 221,618 |

| | 3.6 | % | | 4.6 | % | | 7.1 | % | | 5.6 | % |

| Las Vegas, NV | 975 |

| | 176,529 |

| | 2.8 | % | | 5.0 | % | | 7.6 | % | | 5.7 | % |

| San Antonio, TX | 878 |

| | 155,930 |

| | 1.9 | % | | 3.6 | % | | 1.9 | % | | 3.0 | % |

| Charleston, SC | 667 |

| | 180,254 |

| | 1.7 | % | | 3.1 | % | | 1.8 | % | | 2.5 | % |

| Denver, CO | 653 |

| | 275,864 |

| | 2.7 | % | | 4.2 | % | | 4.2 | % | | 4.2 | % |

| Greenville, SC | 634 |

| | 172,738 |

| | 1.5 | % | | 3.1 | % | | 1.1 | % | | 2.2 | % |

| All Other (2) | 4,933 |

| | 170,809 |

| | 13.2 | % | | 4.1 | % | | 4.6 | % | | 4.3 | % |

| Total / Average | 38,168 |

| | $ | 173,675 |

| | 100.0 | % | | 4.1 | % | | 4.2 | % | | 4.1 | % |

|

| | | | | | | | | | | | | | | | | | | |

| | Average Occupied Days Percentage | | Average Monthly Realized Rent per property |

| | 3Q18 QTD | | 3Q17 QTD | | Change | | 3Q18 QTD | | 3Q17 QTD | | Change |

| Dallas-Fort Worth, TX | 94.0 | % | | 92.9 | % | | 1.1 | % | | $ | 1,709 |

| | $ | 1,659 |

| | 3.0 | % |

| Atlanta, GA | 95.8 | % | | 96.1 | % | | (0.3 | )% | | 1,537 |

| | 1,472 |

| | 4.4 | % |

| Indianapolis, IN | 94.2 | % | | 93.7 | % | | 0.5 | % | | 1,378 |

| | 1,345 |

| | 2.5 | % |

| Charlotte, NC | 95.0 | % | | 94.0 | % | | 1.0 | % | | 1,535 |

| | 1,508 |

| | 1.8 | % |

| Houston, TX | 94.2 | % | | 90.2 | % | | 4.0 | % | | 1,651 |

| | 1,605 |

| | 2.9 | % |

| Cincinnati, OH | 95.0 | % | | 93.6 | % | | 1.4 | % | | 1,562 |

| | 1,510 |

| | 3.4 | % |

| Greater Chicago area, IL and IN | 96.1 | % | | 94.8 | % | | 1.3 | % | | 1,824 |

| | 1,765 |

| | 3.3 | % |

| Phoenix, AZ | 96.2 | % | | 95.6 | % | | 0.6 | % | | 1,347 |

| | 1,259 |

| | 7.0 | % |

| Nashville, TN | 94.7 | % | | 92.3 | % | | 2.4 | % | | 1,708 |

| | 1,686 |

| | 1.3 | % |

| Tampa, FL | 94.6 | % | | 94.2 | % | | 0.4 | % | | 1,714 |

| | 1,646 |

| | 4.1 | % |

| Raleigh, NC | 95.0 | % | | 94.7 | % | | 0.3 | % | | 1,499 |

| | 1,467 |

| | 2.2 | % |

| Jacksonville, FL | 95.9 | % | | 94.9 | % | | 1.0 | % | | 1,494 |

| | 1,433 |

| | 4.3 | % |

| Columbus, OH | 97.0 | % | | 93.9 | % | | 3.1 | % | | 1,561 |

| | 1,518 |

| | 2.8 | % |

| Orlando, FL | 97.0 | % | | 96.3 | % | | 0.7 | % | | 1,631 |

| | 1,538 |

| | 6.0 | % |

| Salt Lake City, UT | 94.9 | % | | 94.2 | % | | 0.7 | % | | 1,683 |

| | 1,608 |

| | 4.7 | % |

| Las Vegas, NV | 97.2 | % | | 96.9 | % | | 0.3 | % | | 1,499 |

| | 1,438 |

| | 4.2 | % |

| San Antonio, TX | 94.9 | % | | 92.7 | % | | 2.2 | % | | 1,501 |

| | 1,475 |

| | 1.8 | % |

| Charleston, SC | 92.1 | % | | 93.2 | % | | (1.1 | )% | | 1,616 |

| | 1,591 |

| | 1.6 | % |

| Denver, CO | 93.7 | % | | 95.4 | % | | (1.7 | )% | | 2,159 |

| | 2,071 |

| | 4.2 | % |

| Greenville, SC | 94.1 | % | | 90.4 | % | | 3.7 | % | | 1,518 |

| | 1,518 |

| | — | % |

| All Other (2) | 95.8 | % | | 94.8 | % | | 1.0 | % | | 1,509 |

| | 1,455 |

| | 3.7 | % |

| Total / Average | 95.2 | % | | 94.1 | % | | 1.1 | % | | $ | 1,578 |

| | $ | 1,526 |

| | 3.4 | % |

| |

| (1) | Reflected for the three months ended September 30, 2018. |

| |

| (2) | Represents 15 markets in 15 states. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 15

|

Condensed Consolidated Balance Sheets

(Amounts in thousands)

|

| | | | | | | |

| | Sep 30, 2018 | | Dec 31, 2017 |

| | (Unaudited) | | |

| Assets | | | |

| Single-family properties: | | | |

| Land | $ | 1,689,207 |

| | $ | 1,665,631 |

|

| Buildings and improvements | 7,385,387 |

| | 7,303,270 |

|

| Single-family properties held for sale, net | 299,551 |

| | 35,803 |

|

| | 9,374,145 |

| | 9,004,704 |

|

| Less: accumulated depreciation | (1,115,588 | ) | | (939,724 | ) |

| Single-family properties, net | 8,258,557 |

| | 8,064,980 |

|

| Cash and cash equivalents | 110,138 |

| | 46,156 |

|

| Restricted cash | 156,026 |

| | 136,667 |

|

| Rent and other receivables, net | 36,078 |

| | 30,144 |

|

| Escrow deposits, prepaid expenses and other assets | 251,245 |

| | 171,851 |

|

| Deferred costs and other intangibles, net | 13,437 |

| | 13,025 |

|

| Asset-backed securitization certificates | 25,666 |

| | 25,666 |

|

| Goodwill | 120,279 |

| | 120,279 |

|

| Total assets | $ | 8,971,426 |

| | $ | 8,608,768 |

|

| | | | |

| Liabilities | | | |

| Revolving credit facility | $ | — |

| | $ | 140,000 |

|

| Term loan facility, net | 99,176 |

| | 198,023 |

|

| Asset-backed securitizations, net | 1,965,417 |

| | 1,977,308 |

|

| Unsecured senior notes, net | 492,603 |

| | — |

|

| Exchangeable senior notes, net | 114,507 |

| | 111,697 |

|

| Secured note payable | — |

| | 48,859 |

|

| Accounts payable and accrued expenses | 305,935 |

| | 222,867 |

|

| Amounts payable to affiliates | 4,784 |

| | 4,720 |

|

| Participating preferred shares derivative liability | — |

| | 29,470 |

|

| Total liabilities | 2,982,422 |

| | 2,732,944 |

|

| | | | |

| Commitments and contingencies | | | |

| | | | |

| Equity | | | |

| Shareholders’ equity: | | | |

| Class A common shares | 2,959 |

| | 2,861 |

|

| Class B common shares | 6 |

| | 6 |

|

| Preferred shares | 354 |

| | 384 |

|

| Additional paid-in capital | 5,750,309 |

| | 5,600,256 |

|

| Accumulated deficit | (493,995 | ) | | (453,953 | ) |

| Accumulated other comprehensive income | 9,026 |

| | 75 |

|

| Total shareholders’ equity | 5,268,659 |

| | 5,149,629 |

|

| Noncontrolling interest | 720,345 |

| | 726,195 |

|

| Total equity | 5,989,004 |

| | 5,875,824 |

|

| | | | |

| Total liabilities and equity | $ | 8,971,426 |

| | $ | 8,608,768 |

|

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 16

|

Debt Summary and Maturity Schedule as of September 30, 2018

(Amounts in thousands)

|

| | | | | | | | | | | | | | | | | | | |

| | Secured | | Unsecured | | Total Balance | | % of Total | | Interest

Rate (1) | | Years to Maturity (2) |

| Floating rate debt: | | | | | | | | | | | |

| Revolving credit facility (3) | $ | — |

| | $ | — |

| | $ | — |

| | — | % | | 3.46 | % | | 3.8 |

| Term loan facility (3) | — |

| | 100,000 |

| | 100,000 |

| | 3.7 | % | | 3.61 | % | | 3.8 |

| Total floating rate debt | — |

| | 100,000 |

| | 100,000 |

| | 3.7 | % | | 3.61 | % | | 3.8 |

| | | | | | | | | | | | |

| Fixed rate debt: | | | | | | | | | | | |

| AH4R 2014-SFR2 | 492,478 |

| | — |

| | 492,478 |

| | 18.2 | % | | 4.42 | % | | 6.0 |

| AH4R 2014-SFR3 | 508,080 |

| | — |

| | 508,080 |

| | 18.7 | % | | 4.40 | % | | 6.2 |

| AH4R 2015-SFR1 | 533,578 |

| | — |

| | 533,578 |

| | 19.7 | % | | 4.14 | % | | 26.5 |

| AH4R 2015-SFR2 | 463,552 |

| | — |

| | 463,552 |

| | 17.1 | % | | 4.36 | % | | 27.0 |

| Unsecured senior notes (4) | — |

| | 500,000 |

| | 500,000 |

| | 18.4 | % | | 4.08 | % | | 9.4 |

| Exchangeable senior notes | — |

| | 115,000 |

| | 115,000 |

| | 4.2 | % | | 3.25 | % | | 0.1 |

| Total fixed rate debt | 1,997,688 |

| | 615,000 |

| | 2,612,688 |

| | 96.3 | % | | 4.23 | % | | 14.4 |

| | | | | | | | | | | | |

| Total Debt | $ | 1,997,688 |

| | $ | 715,000 |

| | $ | 2,712,688 |

| | 100.0 | % | | 4.21 | % | | 14.0 |

| | | | | | | | | | | | |

| Unamortized discounts and loan costs | | | | | (40,985 | ) | | | | | | |

| Total debt per balance sheet | | | | | $ | 2,671,703 |

| | | | | | |

|

| | | | | | | | | | | | | | | |

| Year (2) | | Floating Rate | | Fixed Rate | | Total | | % of Total |

| Remaining 2018 | | $ | — |

| | $ | 120,179 |

| | $ | 120,179 |

| | 4.4 | % |

| 2019 | | — |

| | 20,714 |

| | 20,714 |

| | 0.8 | % |

| 2020 | | — |

| | 20,714 |

| | 20,714 |

| | 0.8 | % |

| 2021 | | — |

| | 20,714 |

| | 20,714 |

| | 0.8 | % |

| 2022 | | 100,000 |

| | 20,714 |

| | 120,714 |

| | 4.4 | % |

| 2023 | | — |

| | 20,714 |

| | 20,714 |

| | 0.8 | % |

| 2024 | | — |

| | 956,197 |

| | 956,197 |

| | 35.2 | % |

| 2025 | | — |

| | 10,302 |

| | 10,302 |

| | 0.4 | % |

| 2026 | | — |

| | 10,302 |

| | 10,302 |

| | 0.4 | % |

| 2027 | | — |

| | 10,302 |

| | 10,302 |

| | 0.4 | % |

| Thereafter | | — |

| | 1,401,836 |

| | 1,401,836 |

| | 51.6 | % |

| Total | | $ | 100,000 |

| | $ | 2,612,688 |

| | $ | 2,712,688 |

| | 100.0 | % |

(1) Interest rates on floating rate debt reflect stated rates as of period end.

| |

| (2) | Years to maturity and maturity schedule reflect all debt on a fully extended basis. |

| |

| (3) | The interest rates shown above reflect the Company's LIBOR-based borrowing rates, based on 1-month LIBOR and applicable margin as of period end. Balances reflect borrowings outstanding as of September 30, 2018. |

| |

| (4) | The stated interest rate on the unsecured senior notes is 4.25%, which was effectively hedged to yield an interest rate of 4.08%. |

Interest Expense Reconciliation

|

| | | | | | | | | | | | | | | |

| | For the Three Months Ended

Sep 30, | | For the Nine Months Ended

Sep 30, |

| (Amounts in thousands) | 2018 | | 2017 | | 2018 | | 2017 |

| Interest expense per income statement | $ | 30,930 |

| | $ | 26,592 |

| | $ | 92,209 |

| | $ | 86,873 |

|

| Less: noncash interest expense related to acquired debt | (973 | ) | | (910 | ) | | (2,810 | ) | | (2,624 | ) |

| Interest expense included in Core FFO attributable to common share and unit holders | 29,957 |

| | 25,682 |

| | 89,399 |

| | 84,249 |

|

| Less: amortization of discount, loan costs and cash flow hedge | (1,779 | ) | | (1,875 | ) | | (5,410 | ) | | (6,285 | ) |

| Add: capitalized interest | 1,414 |

| | 1,533 |

| | 5,213 |

| | 3,171 |

|

| Cash interest | $ | 29,592 |

| | $ | 25,340 |

| | $ | 89,202 |

| | $ | 81,135 |

|

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 17

|

Capital Structure and Credit Metrics as of September 30, 2018

(Amounts in thousands, except share and per share data)

Total Capitalization

|

| | | | | | | | | | | |

| Total Debt | | | | $ | 2,712,688 |

| | 24.0 | % |

| | | | | | | |

| Total preferred shares at liquidation value | | | | 883,750 |

| | 7.8 | % |

| | | | | | | |

| Common equity at market value: | | | | | | |

| Common shares outstanding | | 296,531,294 |

| | | | |

| Operating partnership units | | 55,350,153 |

| | | | |

| Total shares and units | | 351,881,447 |

| | | | |

| NYSE AMH Class A common share closing price at September 30, 2018 | | $ | 21.89 |

| | | | |

| Market value of common shares and operating partnership units | | | | 7,702,685 |

| | 68.2 | % |

| | | | | | | |

| Total Market Capitalization | | | | $ | 11,299,123 |

| | 100.0 | % |

Preferred Shares

|

| | | | | | | | | | | | | | | | | | | | | |

| | | Earliest Redemption Date | | Outstanding Shares | | Liquidation Value | | Annual Dividend

Per Share | | Annual Dividend

Amount |

| Series | | | | Per Share | | Total | | |

| 6.500% Series D Perpetual Preferred Shares | | 5/24/2021 | | 10,750,000 |

| | $ | 25.00 |

| | $ | 268,750 |

| | $ | 1.625 |

| | $ | 17,469 |

|

| 6.350% Series E Perpetual Preferred Shares | | 6/29/2021 | | 9,200,000 |

| | $ | 25.00 |

| | 230,000 |

| | $ | 1.588 |

| | 14,605 |

|

| 5.875% Series F Perpetual Preferred Shares | | 4/24/2022 | | 6,200,000 |

| | $ | 25.00 |

| | 155,000 |

| | $ | 1.469 |

| | 9,106 |

|

| 5.875% Series G Perpetual Preferred Shares | | 7/17/2022 | | 4,600,000 |

| | $ | 25.00 |

| | 115,000 |

| | $ | 1.469 |

| | 6,756 |

|

| 6.250% Series H Perpetual Preferred Shares | | 9/19/2023 | | 4,600,000 |

| | $ | 25.00 |

| | 115,000 |

| | $ | 1.563 |

| | 7,188 |

|

| Total preferred shares at liquidation value | | | | 35,350,000 |

| | | | $ | 883,750 |

| | | | $ | 55,124 |

|

|

| | | | | | | | |

| Credit Ratios | | | Credit Ratings | | | | |

| | | | | | | | |

| Net Debt to Adjusted EBITDAre | 4.7 x |

| | Rating Agency | | Rating | | Outlook |

| Debt and Preferred Shares to Adjusted EBITDAre | 6.7 x |

| | Moody's Investor Service | | Baa3 | | Stable |

| Fixed Charge Coverage | 3.2 x |

| | S&P Global Ratings | | BBB- | | Stable |

| Unencumbered Core NOI percentage | 65.6 | % | | | | | | |

|

| | | | | |

| Unsecured Senior Notes Covenant Ratios | | Requirement | | Actual |

| | | | | |

| Ratio of Indebtedness to Total Assets | | < 60.0% | | 27.4 | % |

| Ratio of Secured Debt to Total Assets | | < 40.0% | | 20.1 | % |

| Ratio of Unencumbered Assets to Unsecured Debt | | > 150.0% | | 962.2 | % |

| Ratio of Consolidated Income Available for Debt Service to Interest Expense | | > 1.50 x | | 4.65 x |

|

|

| | | | | |

| Unsecured Credit Facility Covenant Ratios | | Requirement | | Actual |

| | | | | |

| Ratio of Total Indebtedness to Total Asset Value | | < 60.0% | | 28.6 | % |

| Ratio of Secured Indebtedness to Total Asset Value | | < 40.0% | | 19.3 | % |

| Ratio of Unsecured Indebtedness to Unencumbered Asset Value | | < 60.0% | | 14.0 | % |

| Ratio of EBITDA to Fixed Charges | | > 1.75 x | | 2.86 x |

|

| Ratio of Unencumbered NOI to Unsecured Interest Expense | | > 1.75 x | | 15.62 x |

|

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 18

|

Top 20 Markets Summary as of September 30, 2018

Property Information (1)

|

| | | | | | | | | | | | | | |

| Market | | Number of

Properties | | Percentage

of Total

Properties | | Gross Book

Value per

Property | | Avg.

Sq. Ft. | | Avg. Age

(years) |

| Atlanta, GA | | 4,710 | | 9.4 | % | | $ | 173,714 |

| | 2,150 |

| | 16.8 |

| Dallas-Fort Worth, TX | | 4,320 | | 8.6 | % | | 163,595 |

| | 2,119 |

| | 14.8 |

| Charlotte, NC | | 3,538 | | 7.0 | % | | 188,153 |

| | 2,082 |

| | 15.0 |

| Houston, TX | | 3,100 | | 6.2 | % | | 161,015 |

| | 2,100 |

| | 12.8 |

| Phoenix, AZ | | 3,008 | | 6.0 | % | | 170,076 |

| | 1,832 |

| | 15.3 |

| Indianapolis, IN | | 2,889 | | 5.8 | % | | 152,169 |

| | 1,933 |

| | 16.0 |

| Nashville, TN | | 2,640 | | 5.3 | % | | 206,821 |

| | 2,116 |

| | 14.2 |

| Jacksonville, FL | | 2,105 | | 4.2 | % | | 169,570 |

| | 1,940 |

| | 14.0 |

| Tampa, FL | | 2,090 | | 4.2 | % | | 193,537 |

| | 1,949 |

| | 14.5 |

| Raleigh, NC | | 2,051 | | 4.1 | % | | 182,467 |

| | 1,874 |

| | 13.8 |

| Cincinnati, OH | | 1,987 | | 4.0 | % | | 173,742 |

| | 1,852 |

| | 16.2 |

| Columbus, OH | | 1,986 | | 4.0 | % | | 168,878 |

| | 1,867 |

| | 16.8 |

| Greater Chicago area, IL and IN | | 1,775 | | 3.5 | % | | 181,562 |

| | 1,871 |

| | 17.1 |

| Orlando, FL | | 1,680 | | 3.3 | % | | 176,225 |

| | 1,886 |

| | 17.3 |

| Salt Lake City, UT | | 1,294 | | 2.6 | % | | 237,152 |

| | 2,165 |

| | 17.3 |

| Las Vegas, NV | | 1,022 | | 2.0 | % | | 175,837 |

| | 1,840 |

| | 15.7 |

| San Antonio, TX | | 1,017 | | 2.0 | % | | 158,001 |

| | 2,015 |

| | 15.1 |

| Charleston, SC | | 1,008 | | 2.0 | % | | 191,351 |

| | 1,944 |

| | 12.2 |

| Savannah/Hilton Head, SC | | 828 | | 1.6 | % | | 176,367 |

| | 1,847 |

| | 11.9 |

| Winston Salem, NC | | 814 | | 1.6 | % | | 153,876 |

| | 1,748 |

| | 14.7 |

| All Other (4) | | 6,336 | | 12.6 | % | | 200,765 |

| | 1,916 |

| | 15.0 |

| Total / Average | | 50,198 | | 100.0 | % | | $ | 179,391 |

| | 1,982 |

| | 15.2 |

Leasing Information (1)

|

| | | | | | | | | | | | | | | | | | | |

| Market | | Leased

Percentage (2) | | Avg. Occupied Days

Percentage (3) | | Avg. Monthly Realized Rent

per property (3) | | Avg. Change in Rent for Renewals (3) | | Avg. Change in Rent for Re-Leases (3) | | Avg. Blended Change in

Rent (3) |

| Atlanta, GA | | 95.1 | % | | 94.9 | % | | $ | 1,539 |

| | 5.2 | % | | 7.0 | % | | 5.8 | % |

| Dallas-Fort Worth, TX | | 95.2 | % | | 93.5 | % | | 1,710 |

| | 4.7 | % | | 3.8 | % | | 4.3 | % |

| Charlotte, NC | | 95.3 | % | | 94.5 | % | | 1,544 |

| | 3.1 | % | | 3.6 | % | | 3.3 | % |

| Houston, TX | | 92.5 | % | | 91.2 | % | | 1,604 |

| | 3.7 | % | | 1.3 | % | | 2.9 | % |

| Phoenix, AZ | | 94.8 | % | | 94.5 | % | | 1,339 |

| | 6.5 | % | | 10.4 | % | | 7.8 | % |

| Indianapolis, IN | | 94.5 | % | | 94.0 | % | | 1,374 |

| | 3.3 | % | | 4.7 | % | | 3.8 | % |

| Nashville, TN | | 95.5 | % | | 94.9 | % | | 1,688 |

| | 3.4 | % | | 2.3 | % | | 3.0 | % |

| Jacksonville, FL | | 95.1 | % | | 94.6 | % | | 1,524 |

| | 3.8 | % | | 4.8 | % | | 4.2 | % |

| Tampa, FL | | 95.4 | % | | 94.0 | % | | 1,698 |

| | 3.8 | % | | 3.0 | % | | 3.4 | % |

| Raleigh, NC | | 95.9 | % | | 95.2 | % | | 1,493 |

| | 3.1 | % | | 3.9 | % | | 3.3 | % |

| Cincinnati, OH | | 97.0 | % | | 95.1 | % | | 1,562 |

| | 3.4 | % | | 3.4 | % | | 3.4 | % |

| Columbus, OH | | 97.7 | % | | 96.9 | % | | 1,574 |

| | 3.7 | % | | 4.0 | % | | 3.8 | % |

| Greater Chicago area, IL and IN | | 97.0 | % | | 95.9 | % | | 1,824 |

| | 3.3 | % | | 1.8 | % | | 2.7 | % |

| Orlando, FL | | 96.6 | % | | 96.3 | % | | 1,626 |

| | 5.5 | % | | 6.9 | % | | 5.9 | % |

| Salt Lake City, UT | | 95.0 | % | | 93.8 | % | | 1,698 |

| | 4.6 | % | | 7.1 | % | | 5.7 | % |

| Las Vegas, NV | | 97.9 | % | | 97.1 | % | | 1,490 |

| | 5.0 | % | | 7.6 | % | | 5.7 | % |

| San Antonio, TX | | 95.4 | % | | 94.6 | % | | 1,503 |

| | 3.6 | % | | 2.3 | % | | 3.2 | % |

| Charleston, SC | | 95.3 | % | | 93.1 | % | | 1,636 |

| | 3.1 | % | | 2.3 | % | | 2.7 | % |

| Savannah/Hilton Head, SC | | 96.7 | % | | 95.7 | % | | 1,508 |

| | 3.4 | % | | 4.0 | % | | 3.7 | % |

| Winston Salem, NC | | 95.2 | % | | 95.2 | % | | 1,304 |

| | 3.6 | % | | 5.2 | % | | 4.1 | % |

| All Other (4) | | 93.7 | % | | 92.9 | % | | 1,630 |

| | 4.2 | % | | 4.5 | % | | 4.3 | % |

| Total / Average | | 95.2 | % | | 94.3 | % | | $ | 1,575 |

| | 4.1 | % | | 4.3 | % | | 4.2 | % |

| |

| (1) | Property and leasing information excludes properties to be disposed. |

| |

| (2) | Reflected as of period end. |

| |

| (3) | Reflected for the three months ended September 30, 2018. |

| |

| (4) | Represents 16 markets in 14 states. |

|

| | |

| Refer to "Defined Terms and Non-GAAP Reconciliations" for definitions of metrics and reconciliations to GAAP. | | 19

|

Leasing Performance

|

| | | | | | | | | | | | | | | |

| | | 3Q18 | | 2Q18 | | 1Q18 | | 4Q17 | | 3Q17 |

| Average Change in Rent for Renewals | | 4.1 | % | | 3.9 | % | | 3.9 | % | | 4.2 | % | | 3.6 | % |

| Average Change in Rent for Re-leases | | 4.3 | % | | 6.3 | % | | 3.6 | % | | 1.6 | % | | 4.9 | % |

| Average Blended Change in Rent | | 4.2 | % | | 4.9 | % | | 3.7 | % | | 3.0 | % | | 4.1 | % |

Scheduled Lease Expirations

|

| | | | | | | | | | | | |

| | | MTM | | 4Q18 | | 1Q19 | | 2Q19 | | 3Q19 | | Thereafter |

| Lease expirations | | 1,983 | | 7,870 | | 11,571 | | 13,494 | | 12,233 | | 625 |

Top 20 Markets Home Price Appreciation Trends

The table below summarizes historic changes in the House Price Index of the Federal Housing Finance Agency (“FHFA”), known as the Quarterly Purchase-Only Index, specifically the non-seasonally adjusted “Purchase-Only Index” for the “100 Largest Metropolitan Statistical Areas.”

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | HPA Index (1) | | HPA Index Change |

| Market | | Dec 31,

2012 | | Dec 31,

2013 | | Dec 31,

2014 | | Dec 31,

2015 | | Dec 31,

2016 | | Dec 31,

2017 | | Mar 31,

2018 | | Jun 30,

2018 | |

| Atlanta, GA | | 100.0 |

| | 114.2 |

| | 122.3 |

| | 132.0 |

| | 143.0 |

| | 152.6 |

| | 156.4 |

| | 163.0 |

| | 63.0 | % |

| Dallas-Fort Worth, TX (2) | | 100.0 |

| | 108.4 |

| | 115.2 |

| | 127.6 |

| | 140.1 |

| | 153.7 |

| | 157.3 |

| | 160.8 |

| | 60.8 | % |

| Charlotte, NC | | 100.0 |

| | 113.4 |

| | 118.8 |

| | 126.8 |

| | 136.6 |

| | 148.2 |

| | 150.7 |

| | 155.5 |

| | 55.5 | % |

| Houston, TX | | 100.0 |

| | 110.8 |

| | 123.1 |

| | 130.1 |

| | 133.0 |

| | 137.0 |

| | 137.5 |

| | 141.3 |

| | 41.3 | % |

| Phoenix, AZ | | 100.0 |

| | 118.0 |

| | 123.3 |

| | 135.9 |

| | 146.1 |

| | 157.2 |

| | 160.9 |

| | 164.8 |

| | 64.8 | % |

| Indianapolis, IN | | 100.0 |

| | 106.4 |

| | 112.3 |

| | 117.8 |

| | 124.5 |

| | 134.2 |

| | 135.0 |

| | 142.3 |

| | 42.3 | % |

| Nashville, TN | | 100.0 |

| | 111.0 |

| | 117.4 |

| | 131.1 |

| | 141.1 |

| | 156.6 |

| | 157.0 |

| | 161.1 |

| | 61.1 | % |

| Jacksonville, FL | | 100.0 |

| | 114.2 |

| | 121.7 |

| | 127.7 |

| | 142.3 |

| | 150.6 |

| | 157.0 |

| | 163.7 |

| | 63.7 | % |

| Tampa, FL | | 100.0 |

| | 113.0 |

| | 121.1 |

| | 132.3 |

| | 149.1 |

| | 160.4 |

| | 165.3 |

| | 171.7 |

| | 71.7 | % |

| Raleigh, NC | | 100.0 |

| | 106.7 |

| | 111.6 |

| | 120.0 |

| | 130.8 |

| | 135.8 |

| | 140.1 |

| | 143.7 |

| | 43.7 | % |

| Cincinnati, OH | | 100.0 |

| | 104.9 |

| | 111.2 |

| | 115.7 |

| | 121.4 |

| | 128.3 |

| | 130.5 |

| | 133.4 |

| | 33.4 | % |

| Columbus, OH | | 100.0 |

| | 108.9 |