- HYZN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

POS AM Filing

Hyzon Motors (HYZN) POS AMProspectus update (post-effective amendment)

Filed: 6 Apr 22, 4:30pm

Delaware | 3620 | 82-2726724 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

| �� | iii | |||

| vi | ||||

| 1 | ||||

| 4 | ||||

| 8 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 51 | ||||

| 57 | ||||

| 86 | ||||

| 102 | ||||

| 112 | ||||

| 118 | ||||

| 128 | ||||

| 130 | ||||

| 146 | ||||

| 151 | ||||

| 157 | ||||

| 162 | ||||

| 162 | ||||

| 163 | ||||

F-1 |

| • | “2020 Plan” are to the Hyzon Motors Inc. 2020 Stock Incentive Plan; |

| • | “2021 Plan” are to the Hyzon Motors Inc. 2021 Equity Incentive Plan; |

| • | “Ardour” are to Ardour Capital Investments LLC; |

| • | “Ardour Subscription Agreement” are to that certain Subscription Agreement, dated February 8, 2021, by and among DCRB, ACP Mgmt Corp., a Delaware corporation, Ardour and Hyzon; |

| • | “Ardour Warrants” are to the redeemable warrants issued to Ardour on the Closing, entitling Ardour to purchase up to 230,048 shares of Class A Common Stock at an exercise price of $2.20 per share; |

| • | “ASC 815” are to Accounting Standards Codification 815-40, “Derivatives and Hedging — Contracts in Entity’s Own Equity”; |

| • | “Ascent Options” are to options to purchase outstanding shares of Legacy Hyzon Common Stock held by Ascent Funds Management LLC, which converted into 3,877,915 shares of Legacy Hyzon Common Stock immediately prior to the Effective Time, which converted into 6,871,667 shares of Class A Common Stock plus the contingent right to receive Earnout Shares in connection with the Closing; |

| • | “Board” are to the board of directors of Hyzon; |

| • | “Business Combination” are to the transactions contemplated by the Business Combination Agreement; |

| • | “Business Combination Agreement” are to that certain Business Combination Agreement and Plan of Reorganization, dated as of February 8, 2021, by and among DCRB, Merger Sub and Hyzon; |

| • | “Bylaws” are to Hyzon’s Amended and Restated Bylaws; |

| • | “Charter” are to Hyzon’s Amended and Restated Certificate of Incorporation; |

| • | “Class A Common Stock” are to Hyzon’s Class A Common Stock, par value $0.0001 per share; |

| • | “Closing” are to the closing of the Business Combination; |

| • | “Closing Date” are to July 16, 2021; |

| • | “DCRB” are to Decarbonization Plus Acquisition Corporation, a Delaware corporation; |

| • | “DCRB Class A Common Stock” are to DCRB’s Class A Common Stock, par value $0.0001 per share; |

| • | “DCRB Class B Common Stock” are to DCRB’s Class B Common Stock, par value $0.0001 per share; |

| • | “Earnout Period” are to the time period between the Closing Date and the five-year anniversary of the Closing Date; |

| • | “Earnout Shares” are to the 23,250,000 additional shares of Class A Common Stock that Hyzon may issue to Eligible Hyzon Equity holders during the Earnout Period, 5,293,958 of which are being registered pursuant to the registration statement of which this prospectus forms a part; |

| • | “Effective Time” are to the effective time of the merger; |

| • | “Eligible Hyzon Equity holder” are to a holder of (a) a share of Legacy Hyzon Common Stock, (b) an unexercised Legacy Hyzon Option or (c) an unexercised Legacy Hyzon Warrant, in each case immediately prior to the Effective Time; |

| • | “Exchange Act” are to the Securities Exchange Act of 1934, as amended; |

| • | “Founder Shares” are to the outstanding shares of DCRB’s Class B Common Stock; |

| • | “Horizon” are to Horizon Fuel Cell Technologies, a Singapore-based fuel cell company, which is the majority owner of Hymas Pte Ltd (“Hymas”), which is the majority owner of Hyzon; |

| • | “Hyzon”, “we”, “our”, “us” and the “Company” are to, prior to the Business Combination, Hyzon Motors Inc., a Delaware corporation, and following the Business Combination, Hyzon Motors Inc., a Delaware corporation, and its consolidated subsidiaries; |

| • | “Hyzon Europe” are to are to Hyzon Motors Europe B.V.; |

| • | “initial stockholders” are to the holders of DCRB’s Founder Shares, which includes DCRB’s Sponsor, DCRB’s independent directors and WRG; |

| • | “IRS” are to the Internal Revenue Service; |

| • | “JS Horizon” are to (a) Jiangsu Qingneng New Energy Technologies Co. Ltd. and (b) Shanghai Qingneng Horizon New Energy Ltd.; |

| • | “management” or our “management team” are to our officers and directors; |

| • | “merger” are to the merger of Merger Sub with and into Legacy Hyzon, with Legacy Hyzon surviving the merger as a wholly owned subsidiary of DCRB; |

| • | “Merger Sub” are to DCRB Merger Sub Inc., a Delaware corporation and a wholly-owned subsidiary of DCRB; |

| • | “Merger Sub Common Stock” are to Merger Sub’s common stock, par value $0.0001 per share; |

| • | “Nasdaq” are to the Nasdaq Capital Market; |

| • | “Hyzon” are to (a) prior to giving effect to the Business Combination, DCRB, and (b) after giving effect to the Business Combination, Hyzon Motors Inc., the new name of DCRB after giving effect to the Business Combination; |

| • | “Legacy Hyzon” are to, prior to the Business Combination, Hyzon Motors Inc., a Delaware corporation; |

| • | “Legacy Hyzon Common Stock” are to Legacy Hyzon’s common stock, par value $0.001 per share; |

| • | “Legacy Hyzon Convertible Notes” are to the convertible notes issued pursuant to the Convertible Notes Purchase Agreement, dated February 1, 2021, by and among Hyzon and the purchasers named therein, which converted into shares of Legacy Hyzon Common Stock at a price per share equal to 90% of the price per share paid by the PIPE Investors, and upon the Closing, converted into Class A Common Stock on a one-for-one |

| • | “Legacy Hyzon Historical Rollover Stockholders” are to the holders of shares of Class A Common Stock that were issued in exchange for all outstanding shares of Legacy Hyzon Common Stock in the Business Combination; |

| • | “Legacy Hyzon Options” are to all options to purchase shares of Legacy Hyzon Common Stock, whether or not exercisable and whether or not vested, outstanding immediately prior to the Effective Time under the Hyzon Motors Inc. 2020 Stock Incentive Plan or otherwise; |

| • | “Legacy Hyzon RSUs” are to all restricted stock units, whether or not vested, outstanding immediately prior to the Effective Time under the Hyzon Motors Inc. 2020 Stock Incentive Plan or otherwise; |

| • | “Legacy Hyzon Warrants” are to the warrants to purchase outstanding shares of Legacy Hyzon Common Stock held by Ardour; |

| • | “PIPE Financing” are to the private offering of securities of Hyzon to certain investors in connection with the Business Combination; |

| • | “PIPE Investors” are to investors in the PIPE Financing; |

| • | “PIPE Shares” are to the shares of Class A Common Stock that are issued in the PIPE Financing; |

| • | “private placement warrants” are to the warrants issued to DCRB’s Sponsor, certain of DCRB’s independent directors and WRG in a private placement simultaneously with the closing of DCRB’s initial public offering; |

| • | “public warrants” are to the warrants sold as part of DCRB’s units in DCRB’s initial public offering (whether they were purchased in DCRB’s initial public offering or thereafter in the open market); |

| • | “SEC” are to the U.S. Securities and Exchange Commission; |

| • | “Securities Act” are to the Securities Act of 1933, as amended; |

| • | “Selling Securityholders” are to the selling securityholders named in this prospectus; |

| • | “Sponsor” are to Decarbonization Plus Acquisition Sponsor, LLC, a Delaware limited liability company; |

| • | “Transactions” are to the Business Combination and the other transactions contemplated by the Business Combination Agreement; |

| • | “Trust Account” are to the trust account that holds the proceeds (including interest not previously released to DCRB to pay its franchise and income taxes) from DCRB’s initial public offering and the concurrent private placement of private placement warrants; and |

| • | “WRG” are to WRG DCRB Investors, LLC, an affiliate of Erik Anderson, who was DCRB’s Chief Executive Officer. |

| • | our ability to commercialize our products and strategic plans, including our ability to establish facilities to produce our vehicles or secure hydrogen supply in appropriate volumes, at competitive costs or with competitive emissions profiles; |

| • | our ability to effectively compete in the heavy-duty transportation sector, and withstand intense competition and competitive pressures from other companies worldwide in the industries in which we operate; |

| • | our ability to convert non-binding memoranda of understanding into binding orders or sales (including because of the current or prospective resources of our counterparties) and the abiltiy of our counterparties to make payments on orders; |

| • | our ability to invest in hydrogen production, distribution and refueling operations to supply our customers with hydrogen at competitive costs to operate their fuel cell electric vehicles; |

| • | disruptions in the global supply chain, including as a result of the COVID-19 pandemic and geopolitical events, and shortages of raw materials, and the related impacts on our third party suppliers and assemblers; |

| • | our ability to maintain the listing of our common stock on NASDAQ; |

| • | our ability to raise financing in the future; |

| • | our ability to retain or recruit, or changes required in, our officers, key employees or directors; |

| • | our ability to protect, defend or enforce intellectual property on which we depend; and |

| • | the impacts of legal proceedings, regulatory disputes and governmental inquiries. |

Issuer | Hyzon Motors Inc. (f/k/a Decarbonization Plus Acquisition Corporation) |

Shares of Class A Common Stock offered by us | 19,300,742 shares of Class A Common Stock, including 8,014,500 shares of Class A Common Stock issuable upon the exercise of the private placement warrants and 11,286,242 shares of Class A Common Stock issuable upon the exercise of the public warrants |

Shares of Class A Common Stock outstanding prior to exercise of private placement warrants and public warrants | 247,856,052 shares (as of March 11, 2022) |

Shares of Class A Common Stock outstanding assuming exercise of all private placement warrants and public warrants | 267,156,794 shares (based on the total shares outstanding as of March 11, 2022) |

Exercise price of warrants | $11.50 per share, subject to adjustments as described herein |

Use of proceeds | We will receive up to an aggregate of approximately $221.96 million from the exercise of the private placement warrants and the public warrants, assuming the exercise in full of all of such warrants for cash. We generally expect to use the net proceeds from the exercise of such warrants for general corporate purposes. See “ Use of Proceeds |

Shares of Class A Common Stock offered by the Selling Securityholders | 77,176,414 shares of Class A Common Stock (including up to 230,048 shares of Class A Common Stock that may be issued upon the exercise of the Ardour Warrants and up to 5,293,958 Earnout Shares) |

Warrants offered by the Selling Securityholders | 8,014,500 private placement warrants |

Use of proceeds | We will not receive any proceeds from the sale of shares of Class A Common Stock or the private placement warrants by the Selling Securityholders |

Lock-up Restrictions | Certain of our stockholders are subject to certain restrictions on transfer until the termination of applicable lock-up periods. See “Certain Relationships and Related Party Transactions—Lock-up Agreements |

Market for Class A Common Stock and warrants | Our Class A Common Stock and public warrants are currently traded on the Nasdaq Global Select Market under the symbols “HYZN” and “HYZNW,” respectively. |

| • | Our business model has yet to be tested and we may fail to commercialize our strategic plans. |

| • | We recently completed the Business Combination with Decarbonization Plus Acquisition Corporation (“DCRB”) in which we raised gross proceeds net of redemption and transaction costs totaling approximately $512.9 million. Nevertheless, we may need to raise additional funds, and these funds may not be available on terms favorable to us or our stockholders or at all when needed. |

| • | Increases in costs, disruption of supply or shortage of raw materials, could harm our business. |

| • | We qualify as an “emerging growth company’ as defined in Section 2(a)(19) of the Securities Act, as modified by the JOBS Act, and we take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including the auditor attestation requirements with respect to internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act. As a result, our shareholders may not have access to certain information they deem important. |

| • | We have identified a material weakness in our internal control over financial reporting which, if not corrected, could affect the reliability of our consolidated financial statements and have other adverse consequences. |

| • | Our Class A Common Stock commenced trading on the NASDAQ Global Select Market on July 19, 2021, and we have limited experience operating as a publicly traded company. We need to implement various policies, procedures and controls pertaining to our operations and governance as required by SEC and NASDAQ rules and regulations. |

| • | We have a limited number of current customers, and there is no assurance as to whether our sales pipeline will result in sales and revenues, or that we will be able to convert non-binding letters of intent or memoranda of understanding into orders or sales (including because of the current or prospective financial resources of the counterparties to ournon-binding memoranda of understanding and letters of intent, the liability accounting for our warrants or customer contractual demands), or that we will be able to identify additional potential customers and convert them to paying customers. |

| • | We also face and will continue to face significant competition in all aspects of our business and operations, and many of our current and future competitors have or will have significantly more resources than us, and may outcompete us for customers, employees, and suppliers. |

| • | We may not succeed in investing in hydrogen production, distribution and refueling operations critical to supplying our customers with hydrogen to operate our FCEVs either at all or in part, and/or at the cost required to achieve TCO for potential Hyzon FCEV customers to drive their purchases of our trucks. |

| • | There is no assurance that there will be, or that we will be able to supply, hydrogen at prices or with an emissions profile that allow our FCEVs to be competitive with commercial vehicles powered by other energy sources. |

| • | We may face legal challenges and other resistance attempting to sell our vehicles which could materially adversely affect our sales and costs. Additionally, unfavorable publicity, or a failure to respond effectively to adverse publicity, could harm our reputation and adversely affect our business. |

| • | If we engage in mergers or acquisitions, we may assume liabilities – both disclosed and undisclosed – by contract or under operation of law of the target or acquired company which could materially adversely affect our business and financial results. |

| • | To date, we have produced only technology validation or evaluation FCEVs and there is no assurance that we will be able to establish and operate facilities capable of producing our FCEVs in appropriate volumes and at competitive costs or at all. |

| • | We have limited experience servicing our FCEVs. If we are unable address the service requirements of our customers, our business will be materially and adversely affected. Additionally, insufficient warranty reserves to cover future warranty claims could materially adversely affect our business, prospects, financial condition, and operating results. |

| • | Threats to information technology, including unauthorized control of our vehicles or interruption of our systems, could adversely affect our business. |

| • | We may be unsuccessful in meeting various local, national and international safety and emissions rules and regulations for our products. |

| • | We depend on third parties, including Horizon, for supply of key inputs and components for our products. |

| • | We will depend on Horizon as a sole source supplier for our fuel cell systems, until such time we are able to commence manufacturing fuel cell systems inhouse. |

| • | the premium in the anticipated initial purchase prices of our commercial vehicles over those of comparable vehicles powered by ICE or other alternative energy sources, both including and excluding the effect of possible government and other subsidies and incentives designed to promote the purchase of vehicles powered by clean energy; |

| • | the total cost of ownership of the vehicle over its expected life, which includes the initial purchase price and ongoing operating costs, including hydrogen supply, price, and maintenance costs; |

| • | access to hydrogen supply and refueling stations locally and nationally, and related infrastructure costs; |

| • | the availability and terms of financing options for our customers to purchase or lease our vehicles; |

| • | the availability of tax and other governmental incentives to purchase and operate non-carbon emitting vehicles, and future regulations requiring increased use ofnon-carbon emitting vehicles; |

| • | government regulations and economic incentives promoting or mandating fuel efficiency and alternate forms of energy; |

| • | prices for hydrogen, diesel, natural gas, electricity and other sources of power for vehicles, and volatility in the cost of diesel or a prolonged period of low gasoline and natural gas costs that could decrease incentives to transition to vehicles powered by alternative energy sources; |

| • | the cost and availability of other alternatives to diesel or natural gas fueled vehicles, such as electric vehicles; |

| • | corporate sustainability initiatives and environmental, social and governance (“ESG”) policies; |

| • | perceptions about hydrogen, safety, design, performance, reliability and cost, especially if adverse events or accidents occur that are linked to the quality or safety of hydrogen-powered vehicles, or the safety of production, transportation or use of hydrogen generally; |

| • | the quality and availability of service for our commercial vehicles, including the availability of replacement parts; |

| • | the ability of our customers to purchase adequate insurance for our vehicles; and |

| • | macroeconomic factors. |

| • | cease development, sales or use of our products that incorporate or are covered by the asserted IP; |

| • | pay substantial damages, including through indemnification obligations; |

| • | obtain a license from the owner of the asserted IP, which license may not be available on reasonable terms or at all; or |

| • | redesign one or more aspects of our hydrogen-powered commercial vehicles or hydrogen fuel cell systems. |

| • | any patent applications we submit or currently have pending may not result in the issuance of patents; |

| • | the scope of our issued patents, including our patent claims, may not be broad enough to protect our proprietary rights; |

| • | our issued patents may be challenged or invalidated; |

| • | our employees, customers or business partners may breach their confidentiality, non-disclosure andnon-use obligations to us; |

| • | We fail or are determined by a court of competent jurisdiction to have failed to make reasonable efforts to protect our trade secrets; |

| • | third parties may independently develop technologies that are the same or similar to ours; |

| • | we may not be successful in enforcing our IP portfolio against third parties who are infringing or misappropriating such IP, for a number of reasons, including substantive and procedural legal impediments; |

| • | our trademarks may not be valid or enforceable, and our efforts to police unauthorized use of our trademarks may be deemed insufficient to satisfy legal requirements throughout the world; |

| • | the costs associated with enforcing patents, confidentiality and invention agreements or other IP may make enforcement impracticable; and |

| • | current and future competitors may circumvent or design around our IP. |

| • | actual or anticipated fluctuations in our quarterly financial results or the quarterly financial results of companies perceived to be similar to us; |

| • | changes in the market’s expectations about our operating results; |

| • | success of competitors; |

| • | our operating results failing to meet the expectation of securities analysts or investors in a particular period; |

| • | changes in financial estimates and recommendations by securities analysts concerning us or the market in general; |

| • | operating and stock price performance of other companies that investors deem comparable to us; |

| • | our ability to market new and enhanced products and technologies on a timely basis; |

| • | changes in laws and regulations affecting our business; |

| • | our ability to meet compliance requirements; |

| • | commencement of, or involvement in, litigation; |

| • | changes in our capital structure, such as future issuances of securities or the incurrence of additional debt; |

| • | the volume of shares of our Class A Common Stock available for public sale; |

| • | any major change in our Board or management; |

| • | investors engaged in short selling our Class A Common Stock; |

| • | sales of substantial amounts of Class A Common Stock by our directors, executive officers or significant stockholders or the perception that such sales could occur; and |

| • | general economic and political conditions such as recessions, interest rates, fuel prices, international currency fluctuations and acts of war or terrorism. |

| • | a limited availability of market quotations for our securities; |

| • | reduced liquidity for our securities; |

| • | a determination that our Class A Common Stock is a “penny stock” which will require brokers trading in our Class A Common Stock to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our securities; |

| • | a limited amount of news and analyst coverage; and |

| • | a decreased ability to issue additional securities or obtain additional financing in the future. |

| • | may significantly dilute the equity interests of our investors; |

| • | may subordinate the rights of holders of Class A Common Stock if preferred stock is issued with rights senior to those afforded our common stock; |

| • | could cause a change in control if a substantial number of shares of our Class A Common Stock are issued, which may affect, among other things, our ability to use our net operating loss carry forwards, if any, and could result in the resignation or removal of our present officers and directors; and |

| • | may adversely affect prevailing market prices for our units, Class A Common Stock and/or warrants. |

| • | our Board is divided into three classes with staggered terms; |

| • | the right of our Board to issue preferred stock without stockholder approval; |

| • | restrictions on the right of stockholders to remove directors without cause; and |

| • | restrictions on the right of stockholders to call special meetings of stockholders. |

| • | The former owners of Old Hyzon hold a majority in the post-combination company; |

| • | Hyzon and the former owners of Old Hyzon have the ability to appoint a majority of the board of directors of the post-combination company; |

| • | Old Hyzon’s management comprises the management of the post-combination company; |

| • | The operations of the post-combination company will represent the operations of Hyzon; and |

| • | The post-combination company assumed Hyzon’s name and headquarters. |

| • | each share of Old Hyzon Common Stock issued and outstanding immediately prior to the Effective Time (including shares of Old Hyzon Common Stock resulting from the conversion of the Ascent Options, but excluding any shares of Old Hyzon Common Stock resulting from the conversion of Old Hyzon Convertible Notes described above) was canceled and converted into the right to receive (a) the number of shares of Class A Common Stock equal to the Exchange Ratio and (b) the contingent right to receive the Earnout Shares, in each case without interest. Each share of Old Hyzon Common Stock |

issued and outstanding immediately prior to the Effective Time resulting from the conversion of Old Hyzon Convertible Notes was canceled and converted into the right to receive one share of Class A Common Stock and the contingent right to receive the Earnout Shares; |

| • | each share of Old Hyzon Common Stock held in the treasury of Hyzon was canceled without any conversion thereof and no payment or distribution was made with respect thereto; |

| • | each share of Merger Sub Common Stock issued and outstanding immediately prior to the Effective Time was converted into and exchanged for one validly issued, fully paid and nonassessable share of common stock, par value $0.001 per share, of the Company; |

| • | each Old Hyzon Warrant, to the extent then outstanding and unexercised, was automatically, without any action on the part of the holder thereof, converted into new warrants; |

| • | each Old Hyzon Option that was outstanding immediately prior to the Effective Time was converted into (A) an option to purchase a number of shares of Class A Common Stock equal to the product (rounded down to the nearest whole number) of (x) the number of shares of Old Hyzon Common Stock subject to such Old Hyzon Option immediately prior to the Effective Time and (y) the Exchange Ratio, at an exercise price per share (rounded up to the nearest whole cent) equal to (i) the exercise price per share of such Old Hyzon Option immediately prior to the Effective Time divided by (ii) the Exchange Ratio and (B) the contingent right to receive the Earnout Shares. Except as specifically provided in the Business Combination Agreement, following the Effective Time, each Exchanged Option (as defined below) will continue to be governed by the same terms and conditions (including vesting and exercisability terms) as were applicable to the corresponding former Old Hyzon Option immediately prior to the Effective Time; and |

| • | each Old Hyzon RSU, whether vested or not vested, outstanding immediately prior to the Effective Time was converted into (a) a restricted stock unit denominated in shares of Class A Common Stock equal to the product of (x) the number of shares of Old Hyzon Common Stock subject to such Hyzon RSU immediately prior to the Effective Time and (y) the Exchange Ratio and (b) the contingent right to receive Earnout Shares. |

(in thousands) | Purchase price | Shares Issued | ||||||

Share Consideration to Hyzon at Closing (a)(b)(c) | $ | 1,853,679 | 185,368 | |||||

| (a) | The value of common stock issued to Hyzon included in the consideration is reflected at $10.00 per share. The number of shares excludes 21,887,041 options, warrants and RSUs that do not represent legally outstanding shares of the post-combination company at Closing. |

| (b) | Amount excludes the issuance of 23,250,000 Earnout Shares to certain Eligible Hyzon Equityholders as a result of the post-combination company satisfying certain performance conditions described below within the Earnout Period. |

| (c) | Amount includes the Conversion Shares. |

in thousands | Shares | % | ||||||

DCRB Public Stockholders | 20,483 | 8.29 | % | |||||

DCRB Founders | 5,643 | 2.28 | % | |||||

Total DCRB | 26,126 | 10.57 | % | |||||

Old Hyzon (a) | 180,346 | 73.03 | % | |||||

Hyzon Convertible Note holders (b) | 5,022 | 2.03 | % | |||||

PIPE Shares (c) | 35,500 | 14.37 | % | |||||

Total Shares at Closing | 246,994 | 100.00 | % | |||||

| (a) | Amount excludes 21,877,041 options, warrants and RSUs, as well as 23,250,000 Earnout Shares that did not represent legally outstanding shares at Closing. |

| (b) | Represents shares issued to the holders of the Old Hyzon Convertible Notes upon close of the PIPE Financing, which triggered conversion of the Old Hyzon Convertible Notes. See adjustment (I). |

| (c) | Excludes the Conversion Shares. |

DCRB (Historical) (US GAAP) | Old Hyzon (Historical) (US GAAP) | Combined | Pro Forma Adjustments | As of 31-Mar-21 | ||||||||||||||||

Pro Forma Combined | ||||||||||||||||||||

ASSETS | ||||||||||||||||||||

Cash | $ | — | 47,773 | $ | 47,773 | $ | 204,837 | (A) | $ | 557,636 | ||||||||||

| | (7,900 (22,171 (14,200 355,000 (5,703 | ) (B) ) (B) ) (B)(C) (C) ) (B) | ||||||||||||||||||

Cash held in trust account | 225,731 | 225,731 | (204,837 | ) (A) | — | |||||||||||||||

| (20,894 | ) (A) | |||||||||||||||||||

Prepaid expenses and other current assets | 917 | 8,647 | 9,564 | 9,564 | ||||||||||||||||

Total current assets | $ | 226,648 | $ | 56,420 | $ | 283,068 | $ | 284,132 | $ | 567,199 | ||||||||||

Property and equipment—net | 4,313 | 4,313 | 4,313 | |||||||||||||||||

Right-Of-use | 1,507 | 1,507 | 1,507 | |||||||||||||||||

Deferred transaction costs | 3,465 | 3,465 | (3,465 | ) (B) | — | |||||||||||||||

Other assets | 736 | 736 | 736 | |||||||||||||||||

Total assets | $ | 226,648 | $ | 66,441 | $ | 293,089 | $ | 280,667 | $ | 573,755 | ||||||||||

LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||||||||||||||

Accounts payable | 591 | 591 | 591 | |||||||||||||||||

Accrued professional fees and other current liabilities | 3,544 | 3,622 | 7,166 | (3,544 | ) (B) | 3,622 | ||||||||||||||

Related party payables | 1,984 | 11,371 | 13,355 | (1,984 | ) (B) | 11,371 | ||||||||||||||

Current portion of operating lease liability | 434 | 434 | 434 | |||||||||||||||||

Accrued expenses and other current liabilities | 175 | 175 | (175 | ) (B) | — | |||||||||||||||

Deferred revenue | 2,905 | 2,905 | 2,905 | |||||||||||||||||

Total current liabilities | 5,703 | 18,923 | 24,626 | (5,703 | ) | 18,923 | ||||||||||||||

Lease liability, net of current portion | 1,257 | 1,257 | 1,257 | |||||||||||||||||

Deferred underwriting fee payable | 7,900 | 7,900 | (7,900 | ) (B) | — | |||||||||||||||

Convertible debt, net | 49,441 | 49,441 | 559 | (I) | — | |||||||||||||||

| (50,000 | ) (I) | — | ||||||||||||||||||

Earnout liability | 179,137 | (K) | 179,137 | |||||||||||||||||

Warrant liabilities | 33,939 | — | 33,939 | (21,105 | ) (H) | 12,834 | ||||||||||||||

Total liabilities | $ | 47,542 | $ | 69,621 | $ | 117,163 | $ | 94,987 | $ | 212,150 | ||||||||||

Commitments and Contingences | ||||||||||||||||||||

Common stock subject to possible redemption | 174,106 | 174,106 | (153,211 | ) (D) | — | |||||||||||||||

Stockholders’ Equity | (20,894 | ) (A) | ||||||||||||||||||

Common Stock | 94 | 94 | (94 | ) (E) | — | |||||||||||||||

Class A Common Stock | 1 | 1 | | 2 18 4 1 1 | (D) (E) (C) (I) (F) | 25 | ||||||||||||||

Class B Common Stock | 1 | 1 | (1 | ) (F) | (0 | ) | ||||||||||||||

Additional paid in capital | 27,953 | 19,522 | 47,475 | | 153,210 354,996 76 (22,954 (14,200 (3,465 (10,868 21,105 16,551 50,000 (179,247 | (D) (C) (E) ) (G) ) (B)(C) ) (B) ) (B) (H) (J) (I) ) (K) | 412,678 | |||||||||||||

Retained earnings (deficit) | (22,954 | ) | (22,418 | ) | (45,372 | ) | | (11,303 22,954 (16,551 (559 | ) (B) (G) ) (J) ) (I) | (50,830 | ) | |||||||||

Accumulated other comprehensive gain | (54 | ) | (54 | ) | (54 | ) | ||||||||||||||

Non-Controlling Interest | (324 | ) | (324 | ) | (324 | ) | ||||||||||||||

Total Stockholders’ Equity | $ | 5,000 | $ | (3,180 | ) | $ | 1,820 | $ | 185,569 | $ | 361,495 | |||||||||

Total Liabilities, Convertible Preferred Stock and Stockholders’ Equity | $ | 226,648 | $ | 66,441 | $ | 293,089 | $ | 280,667 | $ | 573,755 | ||||||||||

For the Period Ended December 31, 2020 | Pro Forma Adjustments | For the Period Ended 31-Dec-20 | ||||||||||||||||||

DCRB (Historical, As Restated) (US GAAP) | Old Hyzon (Historical) (US GAAP) | Combined | Pro Forma Combined | |||||||||||||||||

Revenue | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

Cost of sales | — | — | — | — | — | |||||||||||||||

Gross Margin | — | — | — | — | — | |||||||||||||||

Operating costs | — | — | — | — | — | |||||||||||||||

Research and development | — | 1,446 | 1,446 | 212 | (EE) | 1,658 | ||||||||||||||

Selling, general, and administrative | 5,480 | 12,785 | 18,265 | 11,303 | (CC) | 46,849 | ||||||||||||||

| (24 | ) (DD) | |||||||||||||||||||

| 17,306 | (EE) | |||||||||||||||||||

Total operating expenses | 5,480 | 14,231 | 19,711 | 28,797 | 48,508 | |||||||||||||||

Loss from operations | (5,480 | ) | (14,231 | ) | (19,711 | ) | (28,797 | ) | (48,508 | ) | ||||||||||

Expensed offering costs | (655 | ) | (655 | ) | (655 | ) | ||||||||||||||

Interest (expense) | — | (37 | ) | (37 | ) | (559 | ) (GG) | (596 | ) | |||||||||||

Loss on consolidation of variable interest entity | — | (100 | ) | (100 | ) | (100 | ) | |||||||||||||

Foreign currency loss, net | (8 | ) | (8 | ) | (8 | ) | ||||||||||||||

Interest Income | 3 | — | 3 | (3 | ) (BB) | — | ||||||||||||||

Change in fair value of warrant liabilities | (15,491 | ) | (15,491 | ) | 9,368 | (FF) | (6,123 | ) | ||||||||||||

Income (loss) before income taxes | (21,623 | ) | (14,376 | ) | (35,999 | ) | (19,991 | ) | (55,990 | ) | ||||||||||

Provision for income taxes | — | — | — | — | (AA) | — | ||||||||||||||

Net Income (loss) | $ | (21,623 | ) | $ | (14,376 | ) | $ | (35,999 | ) | $ | (19,991 | ) | $ | (55,990 | ) | |||||

Net Income (loss) attributable to noncontrolling interest | $ | (105 | ) | $ | (105 | ) | $ | — | $ | (105 | ) | |||||||||

Net Income (loss) attributable to Old Hyzon | $ | (14,271 | ) | $ | (35,894 | ) | $ | (19,991 | ) | $ | (55,990 | ) | ||||||||

Basic and diluted net loss per common share | $ | (4.22 | ) | $ | (0.17 | ) | $ | (0.23 | ) | |||||||||||

Weighted average shares outstanding, basic and diluted | 5,123,002 | 86,145,594 | — | 246,994,208 | ||||||||||||||||

DCRB (Historical) (US GAAP) | Old Hyzon (Historical) (US GAAP) | Combined | Pro Forma Adjustments | Pro Forma Combined | ||||||||||||||||

Revenue | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

Cost of sales | — | — | — | — | — | |||||||||||||||

Gross Margin | — | — | — | — | — | |||||||||||||||

Operating costs | — | — | — | |||||||||||||||||

Research and development | 627 | 627 | 3 | (EE) | 630 | |||||||||||||||

Selling, general, and administrative | 776 | 3,146 | 3,922 | (30 | ) (DD) | 4,109 | ||||||||||||||

| 217 | (EE) | |||||||||||||||||||

Total operating expenses | 776 | 3,773 | 4,549 | 190 | 4,739 | |||||||||||||||

Loss from operations | (776 | ) | (3,773 | ) | (4,549 | ) | (190 | ) | (4,739 | ) | ||||||||||

Interest (expense) | — | (4,590 | ) | (4,590 | ) | (4,590 | ) | |||||||||||||

Loss on consolidation of variable interest entity | — | — | — | |||||||||||||||||

Foreign currency loss, net | (28 | ) | (28 | ) | (28 | ) | ||||||||||||||

Change in fair value of warrant liabilities | (339 | ) | (339 | ) | 339 | (FF) | 0 | |||||||||||||

Interest Income | 3 | 2 | 5 | (5 | ) (BB) | — | ||||||||||||||

Income (loss) before income taxes | (1,111 | ) | (8,389 | ) | (9,500 | ) | 143 | (9,357 | ) | |||||||||||

Provision for income taxes | — | — | — | — | (AA) | — | ||||||||||||||

Net Income (loss) | $ | (1,111 | ) | $ | (8,389 | ) | $ | (9,500 | ) | $ | 143 | $ | (9,115 | ) | ||||||

Net Income (loss) attributable to noncontrolling interest | $ | (242 | ) | $ | (242 | ) | $ | — | $ | (242 | ) | |||||||||

Net Income (loss) attributable to Old Hyzon | $ | (8,147 | ) | $ | (9,258 | ) | $ | 144 | $ | (9,114 | ) | |||||||||

Basic and diluted net loss per common share | $ | (0.20 | ) | $ | (0.09 | ) | $ | (0.04 | ) | |||||||||||

Weighted average shares outstanding, basic and diluted | 5,643,125 | 93,793,115 | 246,994,208 | |||||||||||||||||

| • | DCRB’s unaudited condensed consolidated balance sheet as of March 31, 2021 and the related notes, included elsewhere in this prospectus; and |

| • | Old Hyzon’s unaudited condensed consolidated balance sheet as of March 31, 2021 and the related notes, included elsewhere in this prospectus. |

| • | DCRB’s unaudited condensed consolidated statement of operations for the three months ended March 31, 2021 and the related notes, included elsewhere in this prospectus; and |

| • | Old Hyzon’s unaudited condensed consolidated statement of operations for the three months ended March 31, 2021 and the related notes, included elsewhere in this prospectus. |

| • | DCRB’s audited consolidated statement of operations for the period ended December 31, 2020, as restated, and the related notes, included elsewhere in this prospectus; and |

| • | Old Hyzon’s audited consolidated statement of operations for the period from January 21, 2020 (inception) through December 31, 2020 and the related notes, included elsewhere in this prospectus. |

| (A) | Reflects the reclassification of $204.8 million of cash held in the Trust Account that becomes available at the Closing. Furthermore, $20.9 million in cash was paid to redeeming shareholders for the |

| 2,089,323 shares of DCRB Class A Common Stock that were redeemed at a per share redemption price of $10.00. |

| (B) | Reflects the settlement of $53.4 million of transaction costs at the Closing in connection with the Business Combination. Of the total, $22.1 million relates to advisory, bankers, legal and other fees incurred, $11.3 million of which is adjusted against retained earnings (see adjustment CC to the unaudited pro forma condensed combined statement of operations for the period from January 21, 2020 (inception) through December 31, 2020) while the remaining $10.8 million is considered direct and incremental to the Transactions and consequently adjusted against additional paid in capital; $7.9 million relates to deferred underwriting fees payable; $14.2 million relates to PIPE fees adjusted against additional paid in capital; and $5.7 million relates to existing DCRB accrued expenses and liabilities that were paid out of transaction proceeds. In addition, Old Hyzon reclassified $3.5 million of previously deferred transaction costs related to advisory and legal fees incurred prior to the Closing to additional paid in capital. |

| (C) | Reflects the proceeds of $355 million from the issuance of 35.5 million shares of Class A Common Stock pursuant to the PIPE Financing (excluding the Conversion Shares) based on commitments received which will be offset by the PIPE fee of 4% of gross proceeds or $14.2 million in adjustment (B). The net amount has been allocated to Class A Common Stock and additional paid-in capital using a par value of $0.0001 per share. |

| (D) | Reflects the reclassification of $153.2 million of Class A Common Stock subject to possible redemption that were ultimately not redeemed to permanent equity at $0.0001 par value. |

| (E) | Reflects the recapitalization of Hyzon’s equity and issuance of approximately 180.3 million shares of Class A Common Stock at $0.0001 par value as consideration for the reverse recapitalization. Note this amount excludes 5.0 million shares of Class A Common Stock issued upon conversion of the Old Hyzon Convertible Notes referenced in adjustment (I). |

| (F) | Reflects the reclassification of the Founder Shares from Class B Common Stock to Class A Common Stock at the Closing. |

| (G) | Reflects the reclassification of DCRB’s historical retained earnings to additional paid in capital as part of the reverse recapitalization. |

| (H) | Reflects the reclassification of the approximately 11.3 million public warrants from liability to equity upon the Closing. Hyzon has preliminarily evaluated the accounting for the public and private placement warrants for the post-combination company under ASC Topic 480 and ASC Topic 815. It currently expects the public warrants to qualify as equity instruments under both ASC Topic 480 and ASC Topic 815 after considering among other factors that the post-combination company will have a single-class equity structure. Separately, Hyzon expects the private placement warrants will continue to be accounted for as a liability under ASC Subtopic 815-40. |

| (I) | Reflects the conversion of Old Hyzon’s outstanding Old Hyzon Convertible Notes into shares of Class A Common Stock pursuant to such Old Hyzon Convertible Notes’ automatic conversion feature. The adjustment includes a charge to retained earnings of $0.6 million representing the final fair value adjustment on the bifurcated automatic conversion feature and write off of unamortized debt issuance costs (refer to adjustment (GG)). |

| (J) | Reflects the preliminary estimated fair value of the incremental compensation provided to holders of vested Old Hyzon Options and Old Hyzon RSUs (collectively, the “Vested Equity Awards”) who are granted the contingent right to receive approximately 1.9 million Earnout Shares pursuant to the Business Combination Agreement. There are no future service requirements related to such Earnout Shares; however, these Earnout Shares represent compensation under ASC Topic 718. Refer to Note 5—Earnout Shares for additional information. |

| (K) | Reflects recognition of the approximately 20.8 million Earnout Shares issuable to holders of Old Hyzon Common Stock which are not expected to be indexed to the post-combination company’s stock |

| pursuant to ASC Subtopic 815-40 as of the Closing. Therefore, such amount is classified as a liability in the unaudited pro forma condensed combined balance sheet and recognized at its preliminary estimated fair value. After the Closing, the earnout liability will be remeasured to its fair value at the end of each reporting period and subsequent changes in the fair value will be recognized in the post-combination company’s statement of operations within other income/expense. Refer to Note 5—Earnout Shares for additional information. |

| (AA) | Reflects the income tax effect of unaudited pro forma adjustments using the estimated effective tax rate of 0%. In its historical periods, Old Hyzon concluded that it is more likely than not that it will not recognize the benefits of federal and state net deferred tax assets and as a result established a valuation allowance. For pro forma purposes, it is assumed that this conclusion has continued after the Closing and as such, a 0% effective tax rate is reflected. |

| (BB) | Reflects the elimination of interest income and unrealized gain earned on the Trust Account. |

| (CC) | Reflects estimated transaction costs that are not considered direct and incremental to the Transactions (see adjustment (B) above). These costs are reflected as if incurred on January 21, 2020 (inception), the date the Transactions were completed for purposes of the unaudited pro forma condensed combined statements of operations. This is a non-recurring item. |

| (DD) | Reflects elimination of fees incurred by DCRB under an administrative support agreement with an affiliate of the Sponsor that will cease to be paid upon completion of the Business Combination. |

| (EE) | In addition to the 1.9 million Earnout Shares issuable to holders of Vested Equity Awards discussed in adjustment (J), approximately 0.5 million Earnout Shares are issuable to holders of unvested Old Hyzon Options and Hyzon RSUs (collectively, the “Unvested Equity Awards,” and together with the Vested Equity Awards the “Underlying Equity Awards”). Pursuant to the Business Combination Agreement, Earnout Shares received by holders of Unvested Equity Awards will be held back by the post-combination company and released within 30 days after vesting of the underlying Unvested Equity Award. Forfeiture of the underlying Unvested Equity Award results in forfeiture of the right to receive the associated Earnout Shares. Management determined the Earnout Shares issuable to holders of both Unvested Equity Awards and Vested Equity Awards represent stock compensation under ASC Topic 718 as they are issued in proportion to the Underlying Equity Awards, which themselves represent stock compensation under ASC Topic 718. In the case of Earnout Shares issuable to holders of Unvested Equity Awards, recipients are required to provide services to the post-combination company in order to vest in such Earnout Shares. Both the grant and service inception dates are assumed to be the date of the Closing, which for purposes of the unaudited pro forma condensed combined statements of operations is January 21, 2020 (inception). Additionally, the awards are assumed to be equity classified. The preliminary estimated fair value of the Earnout Shares issuable to holders of Vested Equity Awards is reflected as a one-time compensation charge at the Closing as such holders’ right to these Earnout Shares is not contingent upon provision of future service. Theone-time compensation charge associated with the Earnout Shares underlying the Vested Equity Awards is anon-recurring item. Due to the post-combination service required by holders of Unvested Equity Awards, the preliminary estimated fair value of the associated Earnout Shares is recognized assuming a weighted average service period of approximately five years. On a pro forma basis, as of December 31, 2020 and March 31, 2021, there was approximately $3.5 million and $3.3 million, respectively, of total unrecognized compensation cost related to the Earnout Shares associated with Unvested Equity Awards. The preliminary estimated fair value of the Earnout Shares issuable to holders of Vested Equity Awards was determined to be approximately $16.6 million. The |

| adjustment includes approximately $0.2 million and $0.9 million of amortization associated with Earnout Shares issuable to holders of Unvested Equity Awards for the three months ended March 31, 2021 and the period from January 21, 2020 (inception) through December 31, 2020, respectively. Refer to Note 5—Earnout Shares for additional information. |

| (FF) | Reflects the elimination of the change in fair value of the derivative warrant liability for the approximately 11.3 million public warrants due to the reclassification from liability to equity upon the Closing. Refer to adjustment (H). |

| (GG) | Reflects (1) the final fair value adjustment to the carrying amount of the bifurcated automatic conversion feature and (2) the write-off of remaining unamortized debt issuance costs, each in relation to conversion of the Old Hyzon Convertible Notes that occurred upon Closing assuming such conversion occurred on January 21, 2020 (inception), the date the Transactions were completed for purposes of the unaudited condensed combined statements of operations. This is anon-recurring item. |

| Three Months Ended March 31, 2021 | Period Ended December 31, 2020 | |||||||

(in thousands, except share and per share data) | ||||||||

Pro forma net loss | (9,115 | ) | (55,885 | ) | ||||

Pro forma weighted average shares outstanding—basic and diluted (1) | 246,994 | 246,994 | ||||||

Pro forma net loss per share—basic and diluted | (0.04 | ) | (0.23 | ) | ||||

Pro forma weighted average shares outstanding—basic and diluted | ||||||||

DCRB Public Stockholders | 20,483 | 20,483 | ||||||

DCRB Founders | 5,643 | 5,643 | ||||||

Total DCRB | 26,126 | 26,126 | ||||||

Old Hyzon (2) | 180,346 | 180,346 | ||||||

Hyzon Convertible Note holders (3) | 5,022 | 5,022 | ||||||

PIPE Shares (4) | 35,500 | 35,500 | ||||||

Pro forma weighted average shares outstanding—basic and diluted | 246,994 | 246,994 | ||||||

| (1) | For the purposes of applying the if converted method for calculating diluted earnings per share, it was assumed that all public warrants, private placement warrants, unvested Old Hyzon RSUs and Old Hyzon Options are exchanged for shares of Class A Common Stock. However, since this results in anti-dilution, the effect of such exchange was not included in the calculation of diluted loss per share. Shares underlying these instruments are as follows: (a) 19.3 million shares of Class A Common Stock underlying the public warrants, private placement warrants and warrants issued in connection with the conversion of certain loans that were made to DCRB prior to the Closing and (b) approximately 21.9 million shares of Class A Common Stock issued in exchange for unexercised Old Hyzon Options and Old Hyzon Warrants, and unvested Hyzon RSUs. |

| (2) | Excludes approximately 23.3 million Earnout Shares that were not legally outstanding at Closing. |

| (3) | Represents shares issued to holders of the Old Hyzon Convertible Notes upon close of the PIPE Financing, which triggered conversion of the Old Hyzon Convertible Notes. See adjustment (I). |

| (4) | Excludes the Conversion Shares. |

Earnout scenario | Total potential Statement of Operations Loss / (Gain) from change in Earnout fair value over the five-year Earnout Period | |||

None of the earnout tranches are triggered 1 | $ | (179.1) million | ||

Only the $18 earnout tranche is triggered 2 | $ | (34.2) million | ||

Both of the $18 and $20 earnout tranches are triggered 3 | $ | 126.9 million | ||

All of the $18, $20 and $35 earnout tranches are triggered | $ | (291.4) million | ||

| 1 | Assumes the reversal of the entire initial liability recorded associated with the Earnout Shares |

| 2 | Assumes the recognition of additional expense related to the increase in fair value related to the $18 earnout tranche, net of the reversal of the initial liability recorded associated with the $20 earnout tranche and the $35 earnout tranche |

| 3 | Assumes the recognition of additional expense related to the increase in fair value related to the $18 earnout tranche net of the $20 earnout tranche, and the reversal of the initial liability recorded associated with the $35 earnout tranche |

| • | Higher fuel efficiency: |

| • | Potentially lower cost of fuel non-renewable hydrocarbon resources, including diesel fuel. Because the cost to transport hydrogen can be significant,close-to-fleet |

| • | Improved performance FCEVs use high torque electric propulsion providing optimal performance in commercial mobility. As compared to ICEs, FCEVs provide smoother acceleration, even with vehicle mass exceeding Class 8 vehicle weight limits in the U.S. |

| • | Reduced noise |

operations in residential areas are often intended to reduce noise pollution, meaning that quieter hydrogen vehicles may enjoy more freedom to operate in some cases. |

| • | Zero GHG emissions Hydrogen fuel cell technology is a near-zero-emission powertrain, as there is no combustion occurring in hydrogen fuel cells. |

| • | Significant local area health benefits: |

| • | Reduced TCO |

| • | Seamless transition from ICE is possible |

| • | Increased driving range: 300-mile range depending on duty cycle. This range is greater than the distance advertised by many manufacturers for their heavy-duty BEVs. |

| • | Increased payloads: |

increased range and reduced refill times offered by hydrogen, this increased payload can generate better economics for our customers. Furthermore, additional weight allowances for zero-emission trucks benefit fuel cell electric trucks to the same extent as BEVs. |

| • | Faster refueling times: |

| • | Lower infrastructure hurdles: build-out is a challenge for both FCEV and BEV HD and MD commercial vehicles, but we believe hydrogen has the infrastructure advantage when considering the required cost and time tobuild-out the production, distribution and refueling infrastructure capacities to support each. Hydrogen fuel can be produced locally from a wide variety of resources and, when produced with low carbon intensity production methods and used to power fuel cells, results in zero direct GHG emissions. Clean hydrogen infrastructure can likely be built efficiently by building hydrogen production and dispensing in a modular fashion paired with and close to fleet deployments as the market develops from a breadth of locally available feedstocks, in most cases fully independent from major infrastructure constraints like the electricity grid. Comparatively, our analysis shows that any sizable HD and MD commercial truck BEV fleet deployment in many regions of the world will likely require significant electric charging infrastructure and electricity grid investment to bring substantial rapid charging to bear. For instance, charging just 100 Class 8 BEV trucks, each with battery capacity of 500kWh with megawatt chargers, would likely require at least 50 MW of power to support aback-to-base re-charging time. In addition to investing in last-mile charging infrastructure, significant investment would likely also need to be made in transmission and distribution infrastructure to deliver the power needed to charge high-capacity batteries in HD and MD commercial BEV fleets. In summary, we believe that the combination of availability, energy density, and local production will allow low carbon hydrogen to acquire substantial market share for powering HD and many MD commercial vehicles. |

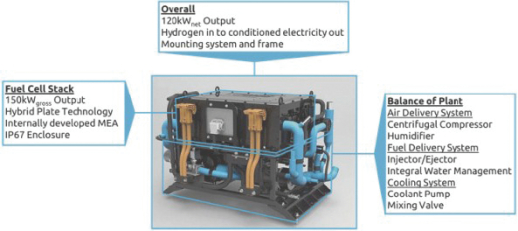

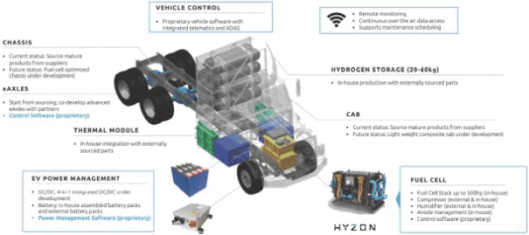

| • | Proven hydrogen fuel cell technology and vehicle electrification experience |

| • | Highly experienced and proven team. |

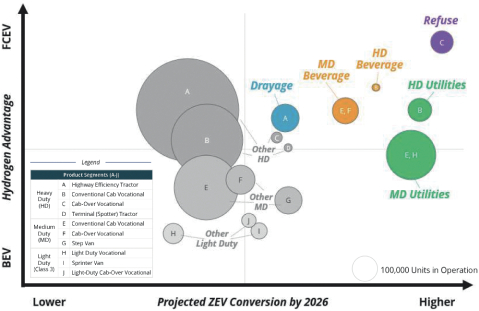

| • | Strong fit with the comme r cial vehicle market Market Opportunity ” and “ Competition |

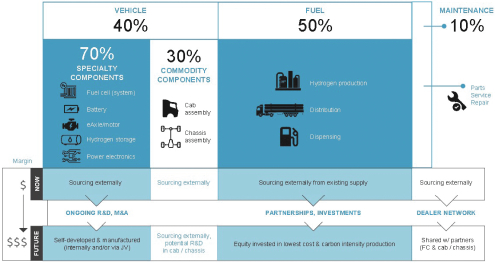

| • | Vertical integration in key FCEV components and targeted assembly capabilities. |

| • | Asset-light, first mover approach to vehicle assembly |

| • | Partnered approach to bringing competitive hydrogen fuel to market located close to fleet deployments low-to-negative |

| • | Upfit of commonly used vehicles – electrifying existing OEM vehicle platforms that our customers operate in their fleets today instead of introducing new cab and chassis designs increases the likelihood that drivers will be comfortable behind the wheel from day one. It further provides entry into international markets, as regional differences in vehicle designs are common, making upfit of existing platforms a faster pathway to putting familiar vehicles into customers’ hands. |

| • | Trial programs – before purchase, customers may participate in a paid trial to test our vehicles in daily operations. |

| • | Fuel access – during trial and after purchase, Hyzon aims to provide access to fueling infrastructure through a mobile refueler or local hydrogen production plant. |

| • | Existing carrier and service partners – thanks to a modular vehicle assembly approach, Hyzon can quickly train technical service providers to perform maintenance on the vehicle. |

| • | Leasing service – customers can participate in Hyzon’s leasing service, paying a stable and predictable monthly bundled rate for vehicle, fuel, and service. |

| • | the zero-emission vehicle; |

| • | scheduled preventative maintenance; and |

| • | hydrogen supply. |

| • | advanced materials for fuel cell stack, MEA and bipolar plate; |

| • | novel solid-state battery for optimizing FCEV performance; |

| • | high efficiency multi-motor drive systems with torque vectoring; |

| • | advanced driver assistance systems and autonomous driving technology; |

| • | purpose-built vehicle platforms with light-weight materials; |

| • | advanced production technologies in vehicle electrification components; |

| • | green hydrogen hubs with hydrogen and electricity produced from renewable resources; and |

| • | on-site energy storage with hydrogen and batteries. |

| • | Low Carbon Fuel Standard well-to-wheel |

| • | Grant and Subsidy Programs zero-emission vehicles and infrastructure technologies. Federal and state grant and subsidy programs are under evaluation for introduction and/or expansion, such as LCFS structures in Oregon and Washington, and the Federal IIJA which includes significant funding opportunities for hydrogen ecosystem enablement, including $8 billion for the establishment of at least four hydrogen hubs across the U.S. |

| • | EPA Smartway |

| • | The European Union currently maintains a key funding programme for research and innovation with a total budget of €95.5Bn, including €15.1Bn allocated for Climate, Energy and Mobility, including clean hydrogen and zero-emission road transport. The EU also has an Innovation Fund which provides €10Bn of support through 2030 for the commercial demonstration of innovativelow-carbon technologies. |

| • | The UK has introduced a Net Zero Hydrogen Fund (“NZHF”) of £240MM to support the commercial deployment of new low carbon hydrogen production projects. The UK additionally created the Department for Transport Zero Emission Road Freight Trials (“ZERFT”) £20MM to demonstrate zero-emission freight and stimulate transition through road freight trials. |

| • | Germany introduced various subsidies totaling approximately €3Bn up to 10 years to support the penetration of zero emission vehicles and green hydrogen production. These subsidies will contribute to the EU environmental objectives, in line with the European Green Deal. |

| • | China’s central government is initiating a four-year pilot program, and select cities will be elected to carry out research and development and application demonstrations of FCEVs. This pilot program seeks to encourage innovation and to stimulate the development of hydrogen and the FCEV industry in China. The Chinese central government will reward successful pilot cities and details of those benefits and programs are to be published by the government in a separate policy document. |

| • | Electronic Stability Control. loss-of-control. |

| • | Air Brake Systems. |

| • | Electric Vehicle Safety. |

| • | Flammability of Interior Materials. |

| • | Seat Belt Assemblies and Anchorages. |

| • | Tire Pressure Monitoring System. |

| • | Roof Crush Resistance. |

| • | Minimum Sound Requirements for Hybrid and Electric Vehicles. |

| • | Crash Tests for High-Voltage and Hydrogen Fuel System Integrity. |

| • | Step, Handhold and Deck Requirements. |

| • | Auxiliary Lamps. |

| • | Speedometer. |

| • | Electromagnetic Compatibility and Interference. |

| • | Lane Departure Warning System. |

| • | Electric Vehicle Safety. in-use and post-crash. |

| • | Hydrogen Fuel Cell Vehicle Safety. in-use and post-crash. |

| • | Our workforce COVID-19, we established protocols to help protect the health and safety of our workforce. We will continue to stayup-to-date |

| • | Operations and Supply Chain. zero-emission heavy commercial vehicles despite these challenges. In the future, we may experience supply chain disruptions from related or third-party suppliers and any such supply chain disruptions could cause delays in our development and delivery timelines. We continue to monitor the situation for any potential adverse impacts and execute appropriate countermeasures, where possible. To mitigate the impact of supply chain disruptions that we were experiencing in 2021, which disproportionately impacted our business in Europe, we focused on fulfilling orders for our vehicles in China where supply chain disruptions were not as significant. |

Year Ended December 31, | For the period January 21, 2020 (Inception) – December 31, | |||||||||||||||

2021 | 2020 | $ Change | % Change | |||||||||||||

Revenue | $ | 6,049 | $ | — | $ | 6,049 | NM | |||||||||

Operating expense: | ||||||||||||||||

Cost of Revenue | 21,191 | — | 21,191 | NM | ||||||||||||

Research and development | 16,443 | 1,446 | 14,997 | 1037 | % | |||||||||||

Selling, general and administrative | 69,792 | 12,785 | 57,007 | 446 | % | |||||||||||

Total operating expense | 107,426 | 14,231 | 93,195 | 655 | % | |||||||||||

Loss from operations | (101,377 | ) | (14,231 | ) | (87,146 | ) | 612 | % | ||||||||

Other income (expense): | ||||||||||||||||

Change in fair value of private placement warrant liability | 4,167 | — | 4,167 | NM | ||||||||||||

Change in fair value of earnout liability | 84,612 | — | 84,612 | NM | ||||||||||||

Foreign currency exchange loss and other expense | (1,452 | ) | (108 | ) | (1,344 | ) | 1244 | % | ||||||||

Interest expense, net | (5,235 | ) | (37 | ) | (5,198 | ) | 14049 | % | ||||||||

Total other income (expense) | 82,092 | (145 | ) | 82,237 | -56715 | % | ||||||||||

Net loss | $ | (19,285 | ) | $ | (14,376 | ) | $ | (4,909 | ) | 34 | % | |||||

Less: Net loss attributable to noncontrolling interest | (5,439 | ) | (105 | ) | (5,334 | ) | 5080 | % | ||||||||

Net loss attributable to Hyzon | $ | (13,846 | ) | $ | (14,271 | ) | $ | 425 | -3 | % | ||||||

Year Ended December 31, 2021 | For the period January 21, 2020 (Inception) – December 31, 2020 | |||||||

Net loss | $ | (19,285 | ) | $ | (14,376 | ) | ||

Plus: | ||||||||

Interest expense, net | 5,235 | 37 | ||||||

Income tax expense (benefit) | — | — | ||||||

Depreciation and amortization | 1,140 | 185 | ||||||

EBITDA | $ | (12,910 | ) | $ | (14,154 | ) | ||

Adjusted for: | ||||||||

Change in fair value of private placement warrant liability | (4,167 | ) | — | |||||

Change in fair value of earnout liability | (84,612 | ) | — | |||||

Stock-based compensation | 15,768 | 9,983 | ||||||

Executive transition charges (1) | 13,860 | — | ||||||

Business combination transaction expenses (2) | 6,533 | — | ||||||

Regulatory and legal matters (3) | 1,147 | — | ||||||

Acquisition-related expenses (4) | 591 | — | ||||||

Adjusted EBITDA | $ | (63,790 | ) | $ | (4,171) | |||

| (1) | Executive transition charges include stock-based compensation costs of $13.4 million and salary expense of $0.5 million related to former CTO’s retirement. |

| (2) | Transaction costs of $6.4 million attributable to the liability classified earnout shares and $0.1 million of write-off of debt issuance costs. |

| (3) | Regulatory and legal matters include legal, advisory, and other professional service fees incurred in connection with the short-seller analyst article from September 2021, and investigations and litigation related thereto. |

| (4) | Acquisition-related expenses incurred for potential and actual acquisitions that are unrelated to the current operations and neither are comparable to the prior period nor predictive of future results. |

Year Ended December 31, 2021 | For the period January 21, 2020 (Inception) - December 31, 2020 | |||||||

Net cash used in operating activities | $ | (95,191 | ) | $ | (1,182 | ) | ||

Net cash used in investing activities | (23,706 | ) | (553 | ) | ||||

Net cash provided by financing activities | 550,692 | 18,894 | ||||||

Total | 2022 | 2023 | 2024 | 2025 | 2026 and thereafter | |||||||||||||||||||

Horizon IP Agreement (1) | $ | 3,146 | $ | 3,146 | $ | — | $ | — | $ | — | $ | — | ||||||||||||

Finance Lease Obligation (2) | 688 | 448 | 240 | — | — | — | ||||||||||||||||||

Operating Lease Obligations (3) | 12,160 | 1,978 | 1,894 | 1,806 | 1,745 | 4,737 | ||||||||||||||||||

Purchase Obligations (4) | 33,969 | 29,069 | 4,900 | — | — | — | ||||||||||||||||||

$ | 49,963 | $ | 34,641 | $ | 7,034 | $ | 1,806 | $ | 1,745 | $ | 4,737 | |||||||||||||

| (1) | The final $3.1 million payment due to Jiangsu Horizon Powertrain, pursuant to the terms of the Horizon IP Agreement. Please see the section below entitled “ Material Transactions with Related Parties |

| (2) | The minimum lease payments for the finance lease obligation. |

| (3) | The minimum lease payments for operating lease obligations. The operating leases relate to real estate and vehicles. No asset is leased from any related party. |

| (4) | The Company enters into commitments under non-cancellable or partially cancellable purchase orders or vendor agreements in the ordinary course of business for FCEV components. |

| • | Fair Value of Common Stock. |

| • | Expected Term. |

| • | Expected Volatility. |

| • | Risk-Free Interest Rate. zero-coupon securities with maturities consistent with the estimated expected term. |

| • | Expected Dividend Yield. |

| • | Recent arms-length transactions involving the sale or transfer of our common stock; |

| • | Our historical financial results and future financial projections; |

| • | The market value of equity interests in substantially similar businesses, which equity interests can be valued through nondiscretionary, objective means; |

| • | The lack of marketability of our common stock; |

| • | The likelihood of achieving a liquidity event, such as the business combination, given prevailing market conditions; |

| • | Industry outlook; and |

| • | General economic outlook, including economic growth, inflation and unemployment, interest rate environment and global economic trends. |

Name | Age | Position | ||||

Executive Officers | ||||||

George Gu | 51 | Executive Chairman | ||||

Craig Knight | 53 | Director and Chief Executive Officer | ||||

Mark Gordon | 51 | Director and Chief Financial Officer | ||||

Shinichi Hirano | 62 | Chief Technology Officer | ||||

John Zavoli | 62 | General Counsel & Chief Legal Officer | ||||

Parker Meeks | 40 | Chief Strategy Officer | ||||

Pat Griffin | 57 | President of Vehicle Operations | ||||

Non-Employee Directors | ||||||

Erik Anderson (2) | 62 | Director | ||||

Ivy Brown (1) | 58 | Director | ||||

Dennis Edwards (2)(3) | 50 | Director | ||||

Viktor Meng (2)(3) | 46 | Director | ||||

Ki Deok Park (1) | 52 | Director | ||||

Elaine Wong (1)(3) | 46 | Director; Lead Independent Director | ||||

| (1) | Member of the audit committee. |

| (2) | Member of the compensation committee. |

| (3) | Member of the nominating and corporate governance committee. |

| • | the Board to have a majority of independent directors; |

| • | that Hyzon establish a compensation committee comprised entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and |

| • | that Hyzon have independent director oversight of Hyzon’s director nominations. |

| • | evaluating the performance, independence and qualifications of our independent auditors and determining their compensation and whether to retain our existing independent auditors or engage new independent auditors; |

| • | reviewing our financial reporting processes and disclosure controls; |

| • | reviewing and approving the engagement of our independent auditors to perform audit services and any permissible non-audit services; |

| • | reviewing with the independent auditors the annual audit plan, including the scope of audit activities and all critical accounting policies and estimates to be used by us; |

| • | obtaining and reviewing at least annually a report by our independent auditors describing the independent auditors’ internal quality control procedures and any material issues raised by the most recent internal quality-control review; |

| • | monitoring the rotation of partners of our independent auditors on our engagement team as required by law; |

| • | prior to engagement of any independent auditor, and at least annually thereafter, reviewing relationships that may reasonably be thought to bear on their independence, and assessing and otherwise taking the appropriate action to oversee the independence of our independent auditor; |

| • | preparing any report of the audit committee required by the rules and regulations of the SEC for inclusion in our annual proxy statement and reviewing our annual and quarterly financial statements and reports, including the disclosures contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and discussing the statements and reports with our independent auditors and management; |

| • | reviewing with our independent auditors and management significant issues that arise regarding accounting principles and financial statement presentation and matters concerning the scope, adequacy, and effectiveness of our financial controls and critical accounting policies and estimates; |

| • | reviewing with management and our auditors any earnings announcements and other public announcements regarding material developments; |

| • | establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and for the confidential, anonymous submission by our employees or any provider of accounting-related services of concerns regarding questionable accounting and auditing matters and review of submissions and the treatment of any such complaints; |

| • | reviewing and approving of any related party transactions that are required to be disclosed under SEC rules that require such approval under our related party transaction policy and reviewing and monitoring compliance with legal and regulatory responsibilities, including our code of ethics; |

| • | reviewing our major financial risk exposures, including the guidelines and policies to govern the process by which risk assessment and risk management is implemented; |

| • | conducting and reviewing with the Board an annual self-assessment of the performance of the audit committee, and reviewing and assessing the audit committee charter at least annually; and |

| • | reporting to the Board on a regular basis. |

| • | establishing our general compensation philosophy and, in consultation with management, overseeing the development and implementation of compensation programs; |

| • | reviewing and approving the corporate objectives that pertain to the determination of executive compensation; |

| • | determining and approving the compensation and other terms of employment of our executive officers; |

| • | reviewing and approving performance goals and objectives relevant to the compensation of our executive officers and assessing their performance against these goals and objectives; |

| • | making recommendations to the Board regarding the adoption or amendment of equity and cash incentive plans and approving such plans or amendments thereto to the extent authorized by the Board; |

| • | overseeing the activities of the committee or committees administering our retirement and benefit plans; |

| • | reviewing and making recommendations to the Board regarding the type and amount of compensation to be paid or awarded to non-employee board members; |

| • | reviewing and assessing the independence of compensation consultants, legal counsel and other advisors as required by Section 10C of the Exchange Act; |

| • | administering our equity incentive plans, to the extent such authority is delegated by the Board; |

| • | reviewing and approving the terms of any employment agreements, severance arrangements, change in control protections, indemnification agreements and any other material agreements for our executive officers; |

| • | reviewing with management our disclosures under the caption “Compensation Discussion and Analysis” in our periodic reports or proxy statements to be filed with the SEC, to the extent such caption is required to be included in any such report or proxy statement; |

| • | preparing an annual report on executive compensation, to the extent such report is required to be included in our annual proxy statement or Form 10-K; |

| • | reviewing and evaluating on an annual basis the performance of the compensation committee and recommending such changes as deemed necessary with the Board; and |

| • | in consultation with management, overseeing regulatory compliance with respect to compensation matters including overseeing our policies on structuring compensation programs to preserve tax deductibility. |

| • | identifying, reviewing and making recommendations of candidates to serve on the Board; |

| • | evaluating the performance of the Board, committees of the Board and individual directors and determining whether continued service on the Board is appropriate; |

| • | evaluating nominations by stockholders and management of candidates for election to the Board; |

| • | evaluating the current size, composition and organization of the Board and its committees and making recommendations to the Board for approvals; |

| • | evaluating the “independence” of directors and director nominees against the independence requirements under the NASDAQ Rules and regulations promulgated by the SEC and such other qualifications as may be established by the Board from time to time and make recommendations to the Board as to the independence of directors and nominees; |

| • | recommending to the Board directors to serve as members of each committee, as well as candidates to fill vacancies on any committee of the Board; |

| • | reviewing annually our corporate governance policies and principles and recommending to the Board any changes to such policies and principles; |

| • | advising and making recommendations to the Board on corporate governance matters; and |

| • | reviewing annually the nominating and corporate governance committee charter and recommending any proposed changes to the Board, including undertaking an annual review of its own performance. |

| • | for any transaction from which the director derives an improper personal benefit; |

| • | for any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

| • | for any unlawful payment of dividends or redemption of shares; or |

| • | for any breach of a director’s duty of loyalty to the corporation or its stockholders. |

| • | George Gu, Executive Chairman; |

| • | Craig Knight, Chief Executive Officer; |

| • | Parker Meeks, Chief Strategy Officer; and |

| • | Gary Robb, Former Chief Technology Officer |

Name and Position | Year | Salary ($) (A) | Bonus ($) | Option Awards ($) (B) | Stock Awards ($) (C) | All Other Compensation ($) (D) | Total ($) | |||||||||||||||||||||

George Gu Executive Chairman | | 2021 2020 | | | 410,577 211,591 | | | — — | | | — 6,140,625 | | | — — | | | 18,942 5,493 | | | 429,519 6,357,709 | | |||||||

Craig Knight Chief Executive Officer | | 2021 2020 | | | 378,658 148,090 | | | — — | | | — 4,492,188 | | | — — | | | 35,757 — | | | 414,415 4,640,278 | | |||||||

Parker Meeks Chief Strategy Officer (1) | 2021 | 250,961 | — | — | 2,603,997 | 11,133 | 2,866,091 | |||||||||||||||||||||

Gary Robb Former Chief Technology Officer | | 2021 2020 | | | 151,038 120,000 | | | — 7,500 | | | — 1,378,000 | | | 2,535,000 — | | | 111,530 6,494 | | | 2,797,568 1,511,994 | | |||||||

| (1) | Parker Meeks became a Named Executive Officer of Hyzon for the first time in 2021 |

(A) | Base Salary |

(B) | Option Awards |

(C) | Stock Awards |

(D) | All Other Compensation |

Option Awards | Stock Awards | |||||||||||||||||||||||||||||

Name | Award Type | Grant Date | Number of Securities Underlying Unexercised Options - Exercisable (#) | Number of Securities Underlying Unexercised Options - Unexercisable (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) (5) | ||||||||||||||||||||||

Craig Knight (1) | Options | 11/12/2020 | 5,537,500 | — | 1.13 | 1/4/2036 | — | — | ||||||||||||||||||||||

George Gu (2) | Options | 11/12/2020 | 5,537,500 | 5,537,500 | 1.41 | 1/3/2036 | — | — | ||||||||||||||||||||||

Parker Meeks (3) | RSUs | 6/9/2021 | — | — | — | — | 372,120 | 2,415,059 | ||||||||||||||||||||||

Gary Robb (4) | Options | 11/12/2020 | 590,666 | 1,181,334 | 1.13 | 11/11/2030 | — | — | ||||||||||||||||||||||

| RSUs | — | — | — | — | — | 125,000 | 811,250 | |||||||||||||||||||||||

| (1) | The option awards reported in these columns granted to Mr. Knight were fully vested on the grant date. |

| (2) | The option awards reported in this column granted to Mr. Gu vest as follows: 50% on the grant date and 50% on the occurrence of a Qualified HFCT Exit Event (as defined therein and described below under “Additional Narrative Disclosure—Potential Payments Upon a Termination or Change in Control”). |

| (3) | The RSUs granted to Mr. Meeks vest in four equal annual installments commencing upon the grant date, subject to continued employment. |