As filed with the Securities and Exchange Commission on February 23, 2018

Registration Statement No. 333-222678

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ESTRE AMBIENTAL, INC.

(Exact Name of Registrant as Specified in Its Charter)

Cayman Islands (Jurisdiction of Incorporation or Organization) | 4953 (Primary Standard Industrial Classification Code Number) | Not Applicable (I.R.S. Employer Identification Number) |

1830, Presidente Juscelino Kubitschek Avenue, Tower I, 3rd Floor

Itaim Bibi

São Paulo

04543-900 - SP

Brazil

+55 11 3709 2300

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, DE 19715

(302) 738-6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

J. Mathias von Bernuth, Esq.

Michael A. Civale, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

Avenida Brigadeiro Faria Lima, 3311, 7th Floor

São Paulo, Brazil 04538-133

Tel: 55-11-3708-1820

Fax: 55-11-3708-1845

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. o

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered(1) | Amount to be Registered | Proposed Maximum Offering Price per Share | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||

Ordinary shares, par value $0.0001 per ordinary share, issuable upon the exercise of the warrants | 24,501,399 | (2)(3) | $ | 11.50 | (4) | $ | 281,766,088.50 | (4) | $ | 35,079.88 | (5) | |

Ordinary shares, par value $0.0001 per ordinary share | 14,401,962 | (6) | $ | 9.20 | (7) | $ | 132,498,050.40 | (7) | $ | 16,496.01 | (8) | |

Ordinary shares, par value $0.0001 per ordinary share | 197,441 | (9) | $ | 9.20 | (7) | $ | 1,816,457.20 | (6) | $ | 226.15 | (8) | |

Total | 39,100,802 | — | $ | 416,080,596.10 | $ | 51,802.04 | (10) | |||||

| (1) | Pursuant to Rule 429 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement (this “Registration Statement”) contains a combined prospectus that covers (i) the offering of 24,501,399 ordinary shares, par value $0.0001 per ordinary share, of the registrant (“ordinary shares”) issuable upon the exercise of the warrants of the registrant (“warrants”) that was registered on the registrant's registration statement on Form F-4 (File No. 333-220428) and (ii) the resale of an aggregate of 14,599,403 ordinary shares that is being registered on this Registration Statement. |

| (2) | Pursuant to Rule 416 under the Securities Act, this Registration Statement also covers any additional ordinary shares that may be offered or issued in connection with any share split, share capitalization or similar transaction. |

| (3) | Consists of 24,501,399 ordinary shares issuable upon exercise of the warrants. As of the date of this Registration Statement, there are 24,501,399 warrants outstanding, which are exercisable on a one-for-one basis for ordinary shares. Each such warrant currently is exercisable for one ordinary share at a price of $11.50 per ordinary share. |

| (4) | Based on the exercise price of a warrant of $11.50 per warrant in accordance with Rule 457(g) under the Securities Act. |

| (5) | Previously paid by the registrant on September 12, 2017 in connection with the filing of the registrant's registration statement on Form F-4 (File No. 333-220428). |

| (6) | Consists of 14,401,962 ordinary shares held by certain unrelated institutional investors that purchased ordinary shares of the registrant in private placements in connection with consummation of the Transaction (as defined in the prospectus forming part of this Registration Statement) and that have, through to the date hereof, requested such ordinary shares to be included in this Registration Statement. |

| (7) | Estimated solely for purposes of calculating the registration fee according to Rule 457(c) under the Securities Act based on the average of the high and low prices of the registrant’s ordinary shares quoted on the NASDAQ Capital Market on January 18, 2018 (such date being within five business days of the date that this Registration Statement was first filed with the Securities and Exchange Commission). |

| (8) | Previously paid by the registrant on January 24, 2018 in connection with the filing of the registrant's registration statement on Form F-1 (File No. 333-222678). |

| (9) | Consists of 197,441 ordinary shares held by a former shareholder of Estre Ambiental S.A. who received ordinary shares in connection with the consummation of the Transaction and became a shareholder of the registrant, as described in this Registration Statement. |

| (10) | Previously paid, as described in notes (5) and (8) above. |

Pursuant to Rule 429(b) under the Securities Act, upon effectiveness, this Registration Statement shall constitute post-effective amendment no. 1 to the registration statement on Form F-4 (File No. 333-220428), which post-effective amendment shall hereafter become effective concurrently with the effectiveness of this Registration Statement in accordance with Section 8(c) of the Securities Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Combined Prospectus

This Registration Statement, which is a new registration statement, also constitutes post-effective amendment no.1 on Form F-1 to the Registration Statement on Form F-4 (File No. 333-220428) of Estre Ambiental, Inc. (the “Registrant”) and, in that regard, is being filed pursuant to the undertakings in Item 22 in such Form F-4 to file a post-effective amendment in relation thereto. Accordingly, this Registration Statement on Form F-1 (File No. 333-222678) of the Registrant contains a combined prospectus (the “Combined Prospectus”) pursuant to Rule 429 under the Securities Act of 1933, as amended (the “Securities Act”). The Combined Prospectus relates to the following registration statements:

| (1) | the Registration Statement on Form F-4 originally filed with the Securities and Exchange Commission (the “SEC”) on September 12, 2017 (File No. 333-220428), which was declared effective on December 8, 2017 (the “Prior Registration Statement”); and |

| (2) | this Registration Statement on From F-1 (File No. 333-222678) originally filed with the SEC on January 24, 2018 (File No. 333-222678), which is as amended by this Pre-Effective Amendment No. 1 thereto (this “Registration Statement”). |

The Prior Registration Statement registered the offering of 28,250,000 ordinary shares of the Registrant (the “ordinary shares”) issuable upon the exercise of the 28,250,000 warrants of the Registrant (the “warrants”) and the offering of such warrants in connection with the Transaction (as defined in the Combined Prospectus) was also registered on the Prior Registration Statement. Pursuant to this Regstration Statement, as described under “Deregistration of Securities from the Registration Statement on Form F-4 (File No. 333-220428)” below, the Registrant deregisters 3,748,601 ordinary shares that were registered on the Prior Registration Statement and the offering of the remaining 24,501,399 ordinary shares issuable upon exercise of the warrants is ongoing and remains registered pursuant to the Prior Registration Statement. Therefore, the Combined Prospectus covers such 24,501,399 ordinary shares issuable upon exercise of the warrants. Upon the exercise of the warrants, the ordinary shares issued in connection with such exercise will be freely tradable under the U.S. securities laws. Through the date hereof, none of the warrants have been exercised by the holders thereof. For the avoidance of doubt, neither the Prior Registration Statement nor this Registration Statement register the resale of the ordinary shares that are issued pursuant to the exercise of the warrants. Pursuant to Rule 416(a) of the Securities Act, the Prior Registration Statement also registered an indeterminable number of additional ordinary shares as may be issued to prevent dilution resulting from share splits, share capitalizations and similar transactions and accordingly the Combined Prospectus also covers any such additional ordinary shares. The Registrant is filing the Combined Prospectus in order to satisfy the requirements of the Securities Act and the rules and regulations thereunder for the offering registered on the Prior Registration Statement in order to maintain the effectiveness of the Prior Registration Statement to the extent that such Prior Registration Statement pertains to the ordinary shares issuable upon exercise of the warrants.

Pursuant to Rule 429(b) under the Securities Act, upon effectiveness, this Registration Statement shall constitute post-effective amendment no. 1 to the Prior Registration Statement, which post-effective amendment shall hereafter become effective concurrently with the effectiveness of this Registration Statement in accordance with Section 8(c) of the Securities Act.

This Registration Statement registers the resale of 14,599,403 ordinary shares by selling shareholders named in the Combined Prospectus.

The filing fee of $35,079.88 payable in connection with the registration of 24,501,399 ordinary shares issuable upon exercise of the warrants registered on the Prior Registration Statement was previously paid at the time of the initial filing of the Prior Registration Statement on December 8, 2017. The filing fee of $16,722.16 payable in connection with the registration of the resale of the 14,599,403 ordinary shares registered on this Registration Statement was previously paid at the time of the initial filing of this Registration Statement on January 24, 2018.

Deregistration of Securities from the Registration Statement on Form F-4 (File No. 333-220428)

In connection with the Transaction, the Prior Registration Statement registered up to a maximum number of securities specified in such Prior Registration Statement, not all of which were issued and sold in connection with the consummation of the Transaction on December 21, 2017. Accordingly, in accordance with the

undertakings made by the Registrant in the Prior Registrtaion Statement to remove from registration, by means of a post-effective amendment, any of the securities which remain unsold at the termination of the offering, the Registrant hereby deregisters the securities referred to below:

| (1) | In the Prior Registration Statement, the Registrant registered the issuance of 37,000,000 ordinary shares to be issued to holders of the public shares of Boulevard Acquisition Corp. II (“Boulevard”) (the “public shares”) in exchange for such public shares. As a result of the exercise of redemption rights in respect of 35,886,555 public shares in connection with the consummation of the Transaction, 1,113,445 ordinary shares were issued to the holders of public shares in connection with the consummation of the Transaction. Accordingly, the Registrant hereby deregisters 35,886,555 ordinary shares that were registered on the Prior Registration Statement and were not issued and sold in connection with the consummation of the Transaction. |

| (2) | In the Prior Registration Statement, the Registrant registered the issuance of 28,250,000 warrants to be issued to holders of the warrants of Boulevard Acquisition Corp II (the “warrants”) in exchange for such warrants of Boulevard. In connection with the consummation of the Transaction, the holders of 3,748,600 warrants of Boulevard forfeited such warrants. Accordingly, the Registrant hereby deregisters 3,748,600 warrants that were registered on the Prior Registration Statement and were not issued and sold in connection with the consummation of the Transaction. The offering and sale of the remaining 24,501,400 warrants was completed on December 21, 2017. |

| (3) | In the Prior Registration Statement, the Registrant registered the issuance of 28,250,000 ordinary shares issuable upon the exercise of the 28,250,000 warrants of the Registrant. As noted above, in connection with the consummation of the Transaction, the holders of 3,748,600 warrants of Boulevard forfeited such warrants. Furthermore, subsequent to consummation of the business combination, one warrant was cancelled. Accordingly, the Registrant hereby deregisters 3,748,601 ordinary shares that were registered on the Prior Registration Statement. The offering of the remaining 24,501,399 ordinary shares issuable upon exercise of the warrants is ongoing and remains registered pursuant to the Prior Registration Statement. |

The Prior Registration Statement is hereby amended, as appropriate, to reflect the deregistration of the securities referred to above.

The information in this preliminary prospectus is not complete and may be changed. The selling shareholders may not sell the securities described herein until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell the securities described herein and it is not soliciting an offer to buy the securities described herein in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated February 23, 2018.

PRELIMINARY PROSPECTUS

Este Ambiental, Inc.

(a Cayman Islands exempted company)

39,100,802 Ordinary Shares

This prospectus relates to two categories of our ordinary shares: (i) ordinary shares that are issuable upon exercise of our outstanding warrants, and (ii) ordinary shares which may be offered for sale from time to time by the selling shareholders identified in this prospectus.

Accordingly, this prospectus covers:

Ordinary shares issuable upon exercise of outstanding warrants:

| • | The offering of 24,501,399 ordinary shares that are issuable upon exercise of our outstanding warrants. The offering of such warrants and the ordinary shares issuable upon exercise of such warrants was registered on our registration statement on Form F-4 with File No. 333-220428. Each warrant is currently exercisable for one ordinary share at a price of US$11.50 per share, which exercise price is payable to us. |

Ordinary shares offered by selling shareholders:

| • | The resale of up to 14,599,403 of our ordinary shares which may be offered for sale from time to time by the selling shareholders named in this prospectus, comprising: |

| • | 14,401,962 ordinary shares held by certain institutional investors that purchased our ordinary shares in private placements and that have requested such ordinary shares to be included in the registration statement of which this prospectus forms part; and |

| • | 197,441 ordinary shares held by a shareholder of the Company (as defined below) who received ordinary shares in connection with the consummation of the Transaction (as defined below) and became a holder of our ordinary shares. |

We are registering the offer and sale by the selling shareholders named herein of the ordinary shares to satisfy certain registration rights we have granted in favor of such selling shareholders. We will not receive any proceeds from the sale of our ordinary shares by the selling shareholders.

Upon exercise of the warrants, the ordinary shares issued will be freely tradable under the U.S. securities laws. For the avoidance of doubt, this prospectus does not register the resale of the ordinary shares that are issuable upon the exercise of the warrants.

We do not know whether the holders of the warrants will exercise any of the warrants. If all of the warrants described in this prospectus are exercised in full, we will issue 24,501,399 ordinary shares and we will receive aggregate net proceeds of approximately US$281.8 million.

The selling shareholders may offer all or part of the shares for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. See “Plan of Distribution” beginning on page 196 of this prospectus for more information.

Our ordinary shares, par value US$0.0001 per share, are currently listed on the NASDAQ (as defined below) under the symbol “ESTR” and our warrants, exercisable for one ordinary share, are currently listed on the NASDAQ under the symbol “ESTRW.” On February 21, 2018, the closing price for the ordinary shares on the NASDAQ was US$10.10 per ordinary share and the closing price for the warrants on the NASDAQ was US$0.68 per warrant.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

We are an “emerging growth company” as that term is defined in the Jumpstart Our Business Startups Act of 2012 and, as such, are subject to reduced public company reporting requirements.

Investing in our ordinary shares involves risks. See “Risk Factors” beginning on page 42 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities described herein or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated , 2018.

You should rely only on the information contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by or on our behalf. Neither we, nor the selling shareholders, have authorized any other person to provide you with different or additional information. Neither we, nor the selling shareholders, take responsibility for, nor can we provide assurance as to the reliability of, any other information that others may provide. The information contained in this prospectus is accurate only as of the date of this prospectus or such other date stated in this prospectus, and our business, financial condition, results of operations and/or prospects may have changed since those dates.

The selling shareholders are not making an offer to sell the securities described herein in any jurisdiction where the offer or sale is not permitted. Except as otherwise set forth in this prospectus, neither we nor the selling shareholders have taken any action to permit a public offering of the securities described herein outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the securities described herein and the distribution of this prospectus outside the United States.

ii

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Important Information About IFRS and Non-IFRS Financial Measures

Presentation of Historical Financial Information

Unless otherwise indicated, the financial information contained in this prospectus is derived from the Company’s accounting records and its (1) audited financial statements as of and for the years ended December 31, 2014, 2015 and 2016 and (2) unaudited interim financial statements as of and for the six months ended June 30, 2017. These financial statements have been prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB.

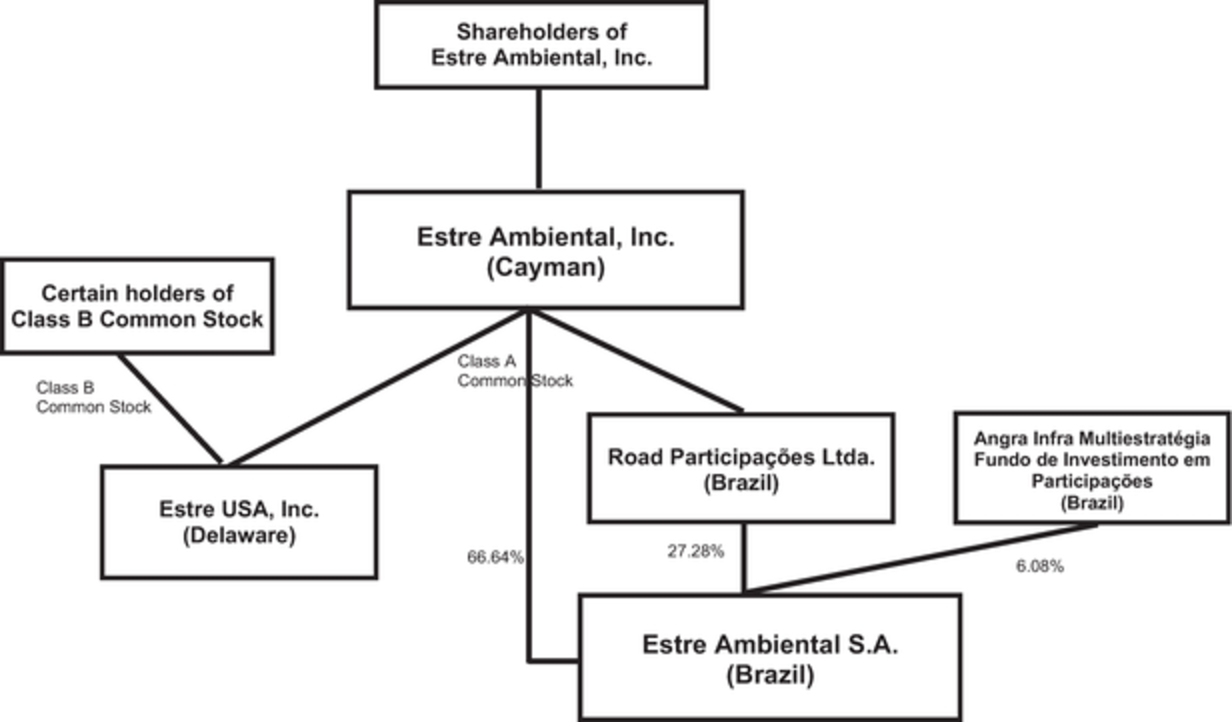

On December 21, 2017, we completed our (1) Pre-Closing Restructuring, pursuant to which the holders of the Company’s common shares contributed their Company common shares to us in exchange for an aggregate of 27,001,886 ordinary shares, and the Company as a result became our indirectly-owned subsidiary (in addition, 1,983,000 of our ordinary shares were issued to the Employee Compensation Entity immediately prior to the closing of the Merger), and (2) the Merger with Estre USA, pursuant to which Estre USA became our partially-owned subsidiary, which is referred to herein as the Merger. For additional information, see “Summary of the Prospectus—Recent Developments—Pre-Closing Restructuring and The Merger”).

Also on December 21, 2017, we issued 15,438,000 of our ordinary shares and 3,748,600 warrants to purchase ordinary shares at US$11.50 per share to certain institutional investors unaffiliated with us pursuant to a private investment in public equity, which we refer to as the PIPE Investment. For more information on the PIPE Investment, see “Summary of the Prospectus—Recent Developments— PIPE Investment” and “Description of Share Capital—PIPE Investment Registration Rights” and “Shares Eligible for Future Sale—PIPE Investment Registration Rights”.

As a result of the Merger and the PIPE Investment, we received a total US$139.9 million cash investment, (comprising US$11.2 million from existing shareholders of Estre USA that did not redeem their public shares in connection with the Merger, and US$128.7 million from the proceeds of the sale of our ordinary shares to PIPE Investors), out of which US$110.6 million was applied to reduce certain of our indebtedness pursuant to a simultaneous Debt Restructuring, coupled with a partial debt writedown and the refinancing of the balance of the debentures and related debt acknowledgment instrument through the amendment and restatement of the terms of such instruments with new terms. For more information, see “Summary of the Prospectus—Recent Developments— Debt Restructuring” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation—Indebtedness—Debentures—Debt Restructuring and Refinanced Debt”.

Prior to the Transaction, the Registrant had limited or no assets, operations or activities. The Registrant was incorporated to become the holding entity of the Company to effect the Transaction. The Transaction was accounted for as a reorganization and recapitalization transaction. Accordingly, the financial statements presented in this prospectus are those of the Company and its consolidated subsidiaries. The Registrant continues not to have any assets other than its indirect and direct equity interests in the Company and Estre USA.

Unless otherwise specifically indicated, the business, financial and other industry data set forth in this prospectus is presented as of and for the years ended December 31, 2014, 2015 and 2016 and as of and for the six months ended June 30, 2017 and, therefore, necessarily does not reflect the impact of the Merger, the PIPE Investment, the Debt Restructuring, the Pre-Closing Restructuring or any other events or expenses related thereto (which we collectively refer to as the “Transaction”) on our results of operations and financial position.

Non-IFRS Presentation

We refer in various places within this prospectus to the following non-IFRS measures: (i) revenues from services rendered (excluding revenues from divested operations), (ii) Adjusted EBITDA and (iii) Adjusted EBITDA Margin. The presentation of non-IFRS measures is not meant to be considered in isolation or as a substitute for the Company’s consolidated financial results prepared in accordance with IFRS. See “Selected Consolidated Historical Financial Data—Reconciliation of Non IFRS Financial Measures and Income Statement Data.”

We calculate adjusted EBITDA as net income (loss) for the period from continuing operations plus total finance expenses, net, depreciation, amortization and depletion, income tax and social contribution, as adjusted to

1

eliminate the effects of certain events that, in the opinion of our management, are isolated in nature and, therefore, hamper comparability across periods, including mainly (i) certain gains and losses incurred in the context of our comprehensive financial and organizational restructuring process occurring from 2014 to 2017, including gains and losses on the sale of certain assets sold to related parties in an effort to streamline our operations, severance expenses in connection with headcount reductions and extraordinary expenses relating to our restructuring incentive plan, and (ii) the non-cash effect of certain accounting adjustments consisting of (A) impairment expenses as a result of lower than expected returns on certain of our landfills, (B) write-offs of property, plant and equipment following a review of historical transactions with certain of our suppliers and (C) provisions established in connection with our participation in a tax amnesty program in 2017, and (iii) the effects of assets divested by us as part of our historial corporate restructuring efforts (including our contracts with Petrobras related to Estre O&G’s divested operations, sub-scale collections operations (Azaleia), and the Estrans landfill in Argentina). Our management believes that the presentation of Adjusted EBITDA provides investors with a more meaningful understanding of our operational results exclusive of items that our management believes otherwise distort comparability between periods, including by isolating the effects of our ongoing operations. Adjusted EBITDA does not have a standardized meaning and is not a recognized measure under GAAP or IFRS, and may not be comparable with measures with similar names presented by other companies. Adjusted EBITDA should not be considered by itself or as a substitute for net income, operating income or cash flow from operations or other measures of operating performance, liquidity or ability to pay dividends.

For a reconciliation from Adjusted EBITDA to our net income from continuing operations, see “Selected Consolidated Historical Financial Data—Reconciliation of Non-IFRS Financial Measures and Income Statement Data”.

We also present revenues from services rendered (excluding revenues from divested operations), which is defined as revenues from services rendered excluding the effects of revenues from assets divested by us as part of our historical corporate restructuring efforts. We believe the presentation of revenues from services rendered (excluding revenues from divested operations) provides investors with a more meaningful understanding of our revenues exclusive of items that we believe otherwise distort comparability between periods. Revenues from services rendered (excluding revenues from divested operations) does not have a standardized meaning and is not a recognized measure under GAAP or IFRS, and may not be comparable with measures with similar names presented by other companies. Revenues from services rendered (excluding revenues from divested operations) should not be considered by itself or as a substitute for revenues from services rendered or other measures of operating performance, liquidity or ability to pay dividends. For more information on our divested assets, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Factors Affecting Our Results of Operations—Divestments”.

For a reconciliation from our revenues from services rendered to revenues from services rendered (excluding revenues from divested operations), see “Selected Consolidated Historical Financial Data—Reconciliation of Non-IFRS Financial Measures and Income Statement Data”.

Unaudited Pro Forma Financial Information

In addition, we have also included in this prospectus unaudited pro forma financial information prepared based on the Company’s historical financial information, as adjusted to give pro forma effect to the Transaction as of certain dates and for certain periods as more fully described in the section titled “Unaudited Pro Forma Financial Information” beginning on page 167 of this prospectus.

Industry and Market Data

In this prospectus, we rely on and refer to information and statistics regarding the waste management services industry and our competitors from market research reports and other publicly available sources, including from ABRELPE, the International Solid Waste Association, Eurostat, Biocycle, the Central Bank and IBGE. We have supplemented such information where necessary with our own internal estimates and information obtained from discussions with our customers, taking into account publicly available information about other industry. Although we have no reason to believe that these sources are not reliable or that any of this information is not accurate or complete in all material respects, we have not independently verified any such information and, therefore, cannot guarantee its accuracy or completeness.

2

Frequently Used Terms

As used in this prospectus, unless the context otherwise requires or indicates, references to “we,” “us,” and “our” refer to Estre Ambiental, Inc., together with its consolidated subsidiaries.

In addition, this document, unless otherwise specified or the context otherwise requires:

“$,” “US$” and “U.S. dollar” each refer to the United States dollar.

“R$” and “reais” each refer to the Brazilian real.

“Angra” means Angra Infra Multiestratégia Fundo de Investimento em Participações.

“Central Bank” means the Banco Central do Brasil, or Brazilian Central Bank.

“Class B Shares” means the Class B shares, par value US$0.0001 per share, of the Registrant.

“Code” means the Internal Revenue Code of 1986, as amended.

“Companies Law” means the Companies Law of the Cayman Islands (2016 Revision).

“Company” refers to Estre Ambiental S.A., a sociedade anônima organized under the laws of Brazil;

“Debt Restructuring” means our debt restructuring carried out on December 26, 2017, pursuant to which we used an amount of US$110.6 million from the total cash investments received by us to partially prepay certain of our existing debentures and related debt acknowledgment instrument, each denominated in Brazilian reais, coupled with a partial debt writedown and the refinancing of the balance of our existing debentures and related debt acknowledgment instrument through the amendment and restatement of the terms of such debt instruments with new terms.

“Designated Stock Exchange” means any national securities exchange including NASDAQ Capital Market or NASDAQ.

“DGCL” means the Delaware General Corporation Law.

“Employee Compensation Entity” means Estre Ambiental Employee SPV, Inc., a Cayman Islands exempted company.

“Estre USA” refers to Estre USA Inc., a Delaware corporation, formerly known as Boulevard Acquisition Corp. II, which name was changed to Estre USA Inc. on December 21, 2017 in connection with the Transaction. References to Estre USA prior to December 21, 2017 shall be deemed references to its predecessor entity, Boulevard Acquisition Corp. II.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“IFRS” means International Financial Reporting Standards, as issued by the International Accounting Standards Board.

“Incentive Plan” means our 2017 Incentive Compensation Plan.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012, as amended.

“Memorandum and Articles” means the amended and restated memorandum and articles of association of the Registrant.

“Merger” means the merger of Merger Sub with and into Estre USA, with Estre USA surviving such merger as a partially-owned subsidiary of the Registrant.

“Merger Sub” means BII Merger Sub Corp., which entity was merged into Estre USA, with Estre USA surviving such merger as a partially-owned subsidiary of the Registrant.

“NASDAQ” means The NASDAQ Stock Market LLC.

“ordinary shares” means the ordinary shares, par value US$0.0001 per share, of the Registrant.

“PCAOB” means the Public Company Accounting Oversight Board.

3

“PIPE Investment” means the private investment in public equity pursuant to which we issued 15,438,000 of our ordinary shares and 3,748,600 warrants to purchase ordinary shares at US$11.50 per share to certain institutional investors unaffiliated with us.

“public warrants” means the warrants included in the units sold in Estre USA’s initial public offering, as converted in the Merger such that they represent the right to acquire ordinary shares of the Registrant, with each public warrant being exercisable for one of our ordinary shares, in accordance with its terms.

“Pre-Closing Restructuring” means the restructuring that the Company and the Registrant have completed immediately prior to effecting the Merger, pursuant to which, the holders of Company shares (other than Angra) contributed their shares of the Company to the Registrant in exchange for an aggregate of up to 27,001,886 ordinary shares, and the Company became a subsidiary of the Registrant. In addition, 1,983,000 of our ordinary shares were issued to the Employee Compensation Entity immediately prior to the closing of the Merger.

“private placement warrants” means the warrants to purchase Estre USA Class A Common Stock that were outstanding immediately prior to the closing of the Transaction that were purchased in a private placement in connection with Estre USA’s initial public offering, as converted in the Merger such that they represent the right to acquire ordinary shares of the Registrant, with each warrant being exercisable for one of the Registrant’s ordinary shares, in accordance with its terms.

“Registration Rights and Lock-Up Agreement” means the Registration Rights and Lock-Up Agreement to be entered into by and among the Registrant, the Sponsor and certain other persons and entities which will hold ordinary shares upon the Closing pursuant to the terms of the Transaction Agreement in connection with, and as a condition to the consummation of, the Transaction.

“Registrant” refers to Estre Ambiental, Inc., formerly known as Boulevard Acquisition Corp II Cayman Holding Company, a Cayman Islands exempted company, the only assets of which are its indirect and direct equity interests in the Company and Estre USA.

“Sponsor” means Boulevard Acquisition Sponsor II, LLC, a Delaware limited liability company.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Transaction” refers, collectively, to the Pre-Closing Restructuring, the Merger, the PIPE Investment and the Debt Restructuring, together with the other transactions ancillary thereto.

“warrants” means the public warrants, the private placement warrants and the warrants issued in a private placement to an investor that purchased ordinary shares in the PIPE Investment that have the same terms as the private placement warrants.

“U.S. GAAP” means United States generally accepted accounting principles.

4

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our ordinary shares. Before making an investment decision, you should read this entire prospectus carefully, especially “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Unaudited Pro Forma Financial Information” and the Company’s consolidated financial statements and notes thereto. Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements” for more information.

Overview

We are the largest waste management company in Latin America in terms of disposal capacity, collection volume and market share, providing collection, transfer, recycling and disposal services to more than 31 million people as of June 30, 2017. We provide municipal, commercial and industrial customers with a full range of waste management solutions, with a focus on leveraging our strategic disposal network to capture compelling growth opportunities in the Brazilian waste management industry. With the goal of creating and maintaining vertically integrated operations, we seek to serve the waste management needs of our customers from the point of collection to the point of disposal, a process we refer to as internalization. By internalizing the waste in the markets in which we operate, we are able to capture higher operating margins while simultaneously attaining a stable revenue stream, with the overall effect of creating significant barriers to entry for competitors.

As of June 30, 2017, we operated the largest landfill portfolio in Brazil, comprised of 13 landfills for non-hazardous residues (Class IIA and IIB) and three landfills also handling hazardous residues (Class I). In 2016, we handled over 16,000 daily tons of waste and, as of June 30, 2017, our landfills have a combined remaining licensed capacity of approximately 134 million cubic meters, with a robust pipeline of 24.2 million cubic meters of additional unlicensed capacity as of June 30, 2017. Our waste management infrastructure also includes three autoclaving facilities for the treatment and disposal of medical waste, five transfer stations, two units for blending hazardous waste, one refuse-derived fuel (RDF) facility, one electronic recycling plant (REEE), two landfill gas-to-energy facilities containing a total of 10 electricity generators with an aggregate 14 MW of installed capacity, one leachate treatment facility and a fleet of 983 vehicles supporting our collection business.

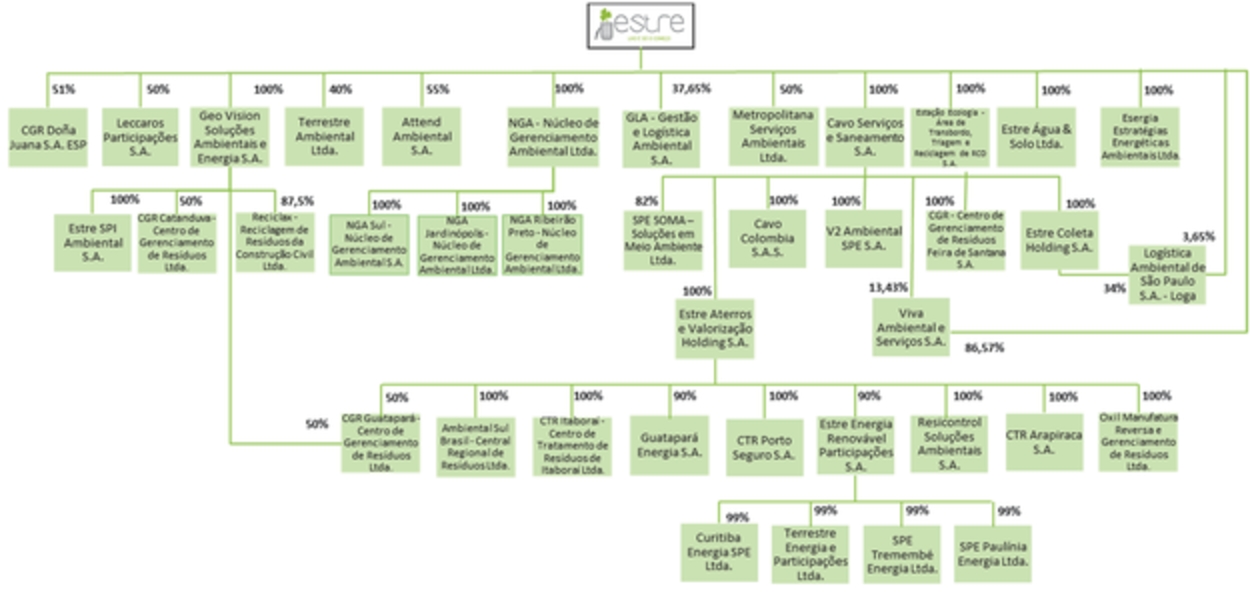

The graphic below highlights the main features of our fully-integrated waste management operations as of June 30, 2017:

Our geographic focus is on densely populated urban markets where we can capitalize on upstream and downstream opportunities for vertical integration through a strategically-planned and high-quality landfill-infrastructure. The states in which we operate represent approximately 50.0% of the population and 60.0% of the GDP of Brazil, according to the Governmental Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística), or IBGE.

5

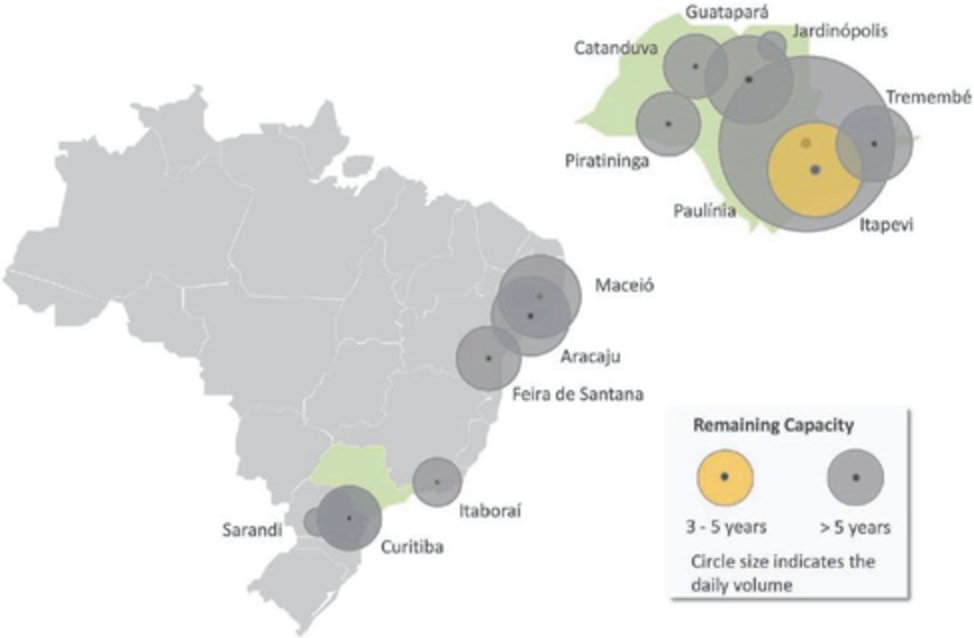

The map of Brazil below demonstrates our geographic footprint and our capabilities in the main markets in which we operate.

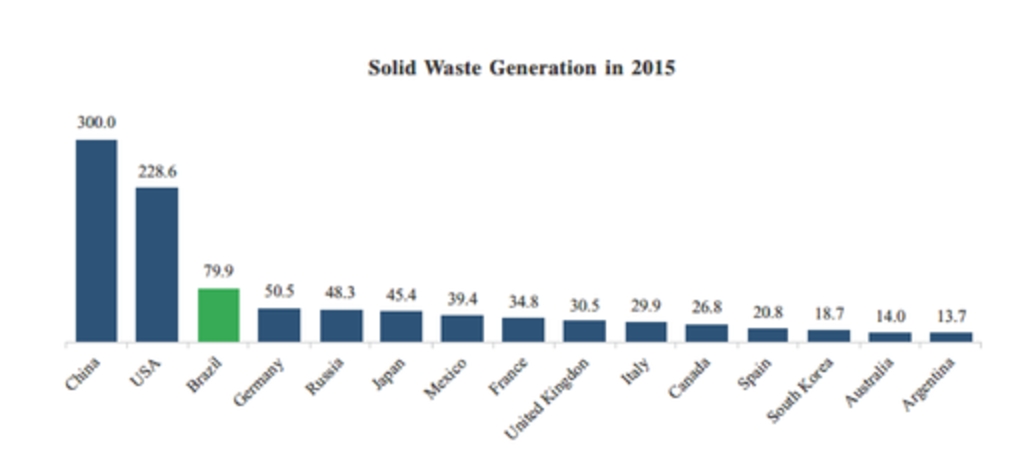

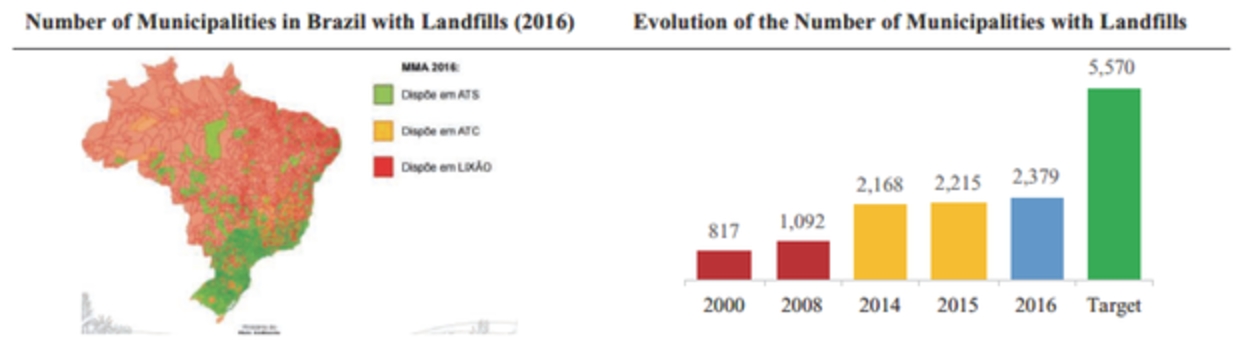

Brazil is geographically similar in size to the continental United States, and we believe the Brazilian waste management market exhibits many of the same characteristics as the U.S. market 30 years ago. There are 2,976 landfills in Brazil as of June 2017, according to the International Solid Waste Association, or ISWA, and the Brazilian Association of Public Cleaning and Waste Management (Associação Brasileira de Empresas de Limpeza Pública e Resíduos Especiais), or ABRELPE, of which approximately 25% are duly licensed and comply with regulatory and environmental standards and the remaining 75% are open dumps that are considered illegal. By contrast, there are 1,700 landfills in the United States today, as compared with 7,924 in 1988 when the enforcement of the Resource Conservation and Recovery Act and other environmental regulations had begun to solidify.

The Brazilian waste management industry demonstrates strong underlying volume growth with MSW having grown at a 4.0% compound annual growth rate from 2008 to 2015, according to ABRELPE. Considering such growth trends coupled with the fact that close to one half of all MSW in Brazil, or 37 million tons annually, is not properly disposed of according to ABRELPE, we believe we are uniquely poised to opportunistically expand our operations to meet this unmet demand, given our extensive know-how and specialized development and operational teams. We expect these efforts to be propelled by positive shifts in the regulatory framework as municipalities accelerate efforts to comply with the Brazilian 2010 Solid Waste National Policy elevating standards of MSW collection and disposal, with deadlines ranging from July 2018 to July 2021 depending on size of the city.

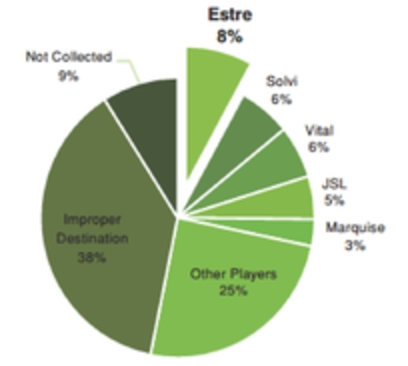

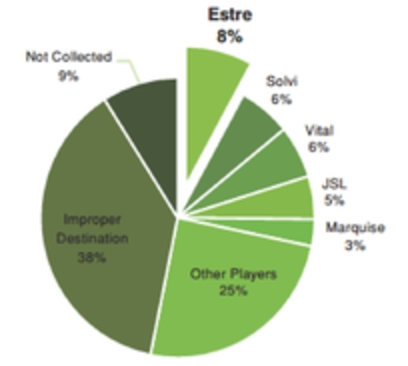

We are a market leader in a fragmented industry, where we enjoy an 8.0% market share, with the top five players capturing only 28.0% of the total market, according to our own analysis based on the most recent ABRELPE data available from 2016. We view the Brazilian market as ripe for consolidation, with a larger player like us as a natural consolidator, particularly given the additional financial resources obtained as a result of the Transaction.

6

The graph below demonstrates our market share relative to our main competitors as of 2016:

We have demonstrated consistent revenue generation across economic cycles, and we have been able to achieve stable revenue growth for the past three years despite challenging macroeconomic conditions in Brazil. Despite Brazilian gross domestic product, or GDP, contracting by 3.8% and 3.6% in 2015 and 2016, respectively, our revenues from services rendered grew by 3.5% and 4.0% in 2015 and 2016, respectively, and our revenues from services rendered (excluding revenues from divested operations) grew 6.9% and 8.1% in 2015 and 2016, respectively.

In spite of the recent economic downturn in Brazil and the consequent decrease in purchasing power among the general population, we believe our business has performed well and is generally less vulnerable to economic crises than companies operating in other sectors. We see the collection and disposal of municipal solid waste as an essential service exhibiting inelastic demand, which is largely insulated from economic downturn. Furthermore, in scenarios of high interest rates and credit constraints, we believe that our competitors, most of which are financially distressed companies that lack the scale, technology and skilled management that we possess, typically suffer the most, thus presenting opportunity in terms of market space for larger players like us.

As the Brazilian economy demonstrates signs of recovery, benefiting from lower inflation, ongoing rate easing, strengthening currency, and predicted return to GDP growth according to Brazilian Central Bank estimates, we believe that we are well-positioned to capitalize on future growth opportunities with a strengthened balance sheet as a result of the Transaction.

The table below shows our key performance metrics together with Brazilian macroeconomic data for the periods indicated (which does not reflect the impact of the Transaction on our results of operations and financial position).

For the six months ended June 30, | For the year ended December 31, | CAGR 2014 - 2016 | |||||||||||||||||||

2017 | 2017 | 2016 | 2016 | 2015 | 2014 | ||||||||||||||||

(in millions of US$, except percentages)(1) | (in millions of R$, except percentages) | (in millions of US$, except percentages)(1) | (in millions of R$, except percentages) | (%) | |||||||||||||||||

GDP growth (reduction)(%) | 1.2 | % | 1.2 | % | (3.6 | )% | (3.6 | )% | (3.8 | )% | 0.1 | % | N/A | ||||||||

Revenues from services rendered | 203.0 | 671.4 | 421.1 | 1,393.0 | 1,338.9 | 1,293.6 | 3.8 | % | |||||||||||||

Revenues from services rendered (excluding revenues from divested operations)(2)(3) | 203.0 | 671.4 | 421.1 | 1,393.0 | 1,289.1 | 1,205.8 | 7.5 | % | |||||||||||||

Profit/(loss) from continuing operations | 40.1 | 132.6 | (102.3 | ) | (338.5 | ) | (190.1 | ) | (98.0 | ) | N/A | ||||||||||

Adjusted EBITDA(4)(5) | 56.5 | 187.0 | 117.7 | 389.4 | 323.3 | 191.3 | 42.7 | % | |||||||||||||

Adjusted EBITDA Margin(6) | 27.9 | % | 27.9 | % | 28.0 | % | 28.0 | % | 25.1 | % | 15.9 | % | N/A | ||||||||

Volume growth(7) | (1.9 | )% | (1.9 | )% | 4.1 | % | 4.1 | % | (0.4 | )% | 3.6 | % | 1.8 | % | |||||||

Pricing growth(8) | 2.4 | % | 2.4 | % | 4.0 | % | 4.0 | % | 7.3 | % | 3.6 | % | 5.6 | % | |||||||

Total sales growth(9) | 0.5 | % | 0.5 | % | 8.1 | % | 8.1 | % | 6.9 | % | 7.2 | % | 7.4 | % | |||||||

| (1) | Solely for the convenience of the reader, the amounts in reais for the six months ended June 30, 2017 and for 2016 have been translated into U.S. dollars using the rate of R$3.3082 per U.S. dollar, which was the commercial selling rate for U.S. dollars as of |

7

June 30, 2017, as reported by the Central Bank. These translations should not be considered representations that any such amounts have been, could have been or could be converted into U.S. dollars at that or any other exchange rate. See “Exchange Rates” for further information about recent fluctuations in exchange rates.

| (2) | Revenues from services rendered (excluding revenues from divested operations) is defined as revenues from services rendered excluding the effects of revenues from assets divested by us as part of our corporate restructuring efforts. We believe that the presentation of revenues from services rendered (excluding revenues from divested operations) provides investors with a more meaningful understanding of our revenues exclusive of items that we believe would otherwise distort comparability between periods. Revenues from services rendered (excluding revenues from divested operations) does not have a standardized meaning and is not a recognized measure under GAAP or IFRS, and may not be comparable with measures with similar names presented by other companies. Revenues from services rendered (excluding revenues from divested operations) should not be considered by itself or as a substitute for revenues from services rendered or other measures of operating performance, liquidity or ability to pay dividends. For more information on our divested assets, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Factors Affecting Our Results of Operations—Divestments.” |

| (3) | For reconciliation from our revenues from services rendered to revenues from services rendered (excluding revenues from divested operations), see “Selected Consolidated Historical Financial Data—Reconciliation of Non-IFRS Financial Measures and Income Statement Data” below. |

| (4) | We calculate adjusted EBITDA as net income (loss) for the period from continuing operations plus total finance expenses, net, depreciation, amortization and depletion, income tax and social contribution, as adjusted to eliminate the effects of certain events that, in our opinion, are isolated in nature and, therefore, hamper comparability across periods, including mainly (i) certain gains and losses incurred in the context of our comprehensive financial and organizational restructuring process occurring from 2014 to 2017, including gains and losses on the sale of certain assets sold to related parties in an effort to streamline our operations, severance expenses in connection with headcount reductions and extraordinary expenses relating to our restructuring incentive plan, and (ii) the non cash effect of certain accounting adjustments consisting of (A) impairment expenses as a result of lower than expected returns on certain of our landfills, (B) write offs of property, plant and equipment following a review of historical transactions with certain of our suppliers and (C) provisions established in connection with our participation in a specific tax amnesty program in 2017 available for a potentially limited period of time, and (iii) the effects of assets divested by us as part of our corporate restructuring efforts (we contract with Petrobras related to Estre O&G’s divested operations, sub scale collections operations (Azaleia), and the Estrans landfill in Argentina). We believe that the presentation of Adjusted EBITDA provides investors with a more meaningful understanding of our operational results exclusive of items that we believe otherwise distort comparability between periods, including by isolating the effects of our ongoing operations. Adjusted EBITDA does not have a standardized meaning and is not a recognized measure under GAAP or IFRS, and may not be comparable with measures with similar names presented by other companies. Adjusted EBITDA should not be considered by itself or as a substitute for net income, operating income or cash flow from operations or other measures of operating performance, liquidity or ability to pay dividends. |

| (5) | For reconciliation from our net income (loss) from continuing operations to Adjusted EBITDA, see “Selected Consolidated Historical Financial Data—Reconciliation of Non-IFRS Financial Measures and Income Statement Data”. |

| (6) | Our Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by Revenues from services rendered (excluding revenues from divested operations). Adjusted EBITDA Margin does not have a standardized meaning and is not a recognized measure under GAAP or IFRS, and may not be comparable with measures with similar names presented by other companies. Adjusted EBITDA Margin should not be considered by itself or as a substitute for net income, operating income or cash flow from operations or other measures of operating performance, liquidity or ability to pay dividends. |

| (7) | Volume growth represents the rate of change in the total tons of waste handled by our operations over a given period. We use this metric to evaluate the size and scale of our operations. |

| (8) | Pricing growth is defined as the average change in prices applicable under our landfill and collection contracts over a given period. |

| (9) | Total sales growth is defined as pricing growth plus volume growth. We use this metric to evaluate the commercial performance and evolution of our operations. |

For information relating to the Registrant’s unaudited pro forma financial information as adjusted to give pro forma effect to the Transaction, see “Unaudited Pro Forma Financial Information”.

We have has been undergoing a comprehensive financial and corporate restructuring over the past several years pursuant to which we have reviewed and rationalized our cost structure, pricing, compliance and controls, planning processes, information technology and use of data. This restructuring effort has yielded several tangible benefits through focus on the following initiatives, among others; (i) the comprehensive redesign of our management information systems, including migration to SAP and implementation of CRM Oracle solutions and pricing systems, with the effect of improving efficiency of pricing and internal controls; (ii) the sale of certain assets that negatively impacted our margins and did not align with our strategic vision, (iii) collection of overdue accounts and successful implementation of price adjustments on certain large contracts with our municipal customers and (iv) the reorganization of our senior management team, including, through the implementation of our restructuring incentive plan in 2015 and the appointment of a new chief executive officer, Sergio Pedreiro, also in 2015, who launched efforts to instill a new results-oriented culture in us, including by replacing certain members of upper management, reducing corporate headcount by approximately 30%, and implementing an objective, results-based compensation system for our management.

Under Mr. Pedreiro’s guidance, we have implemented several concrete efforts with the goal of operating at a level of sophistication and efficiency similar to that of major U.S. waste management companies, which we believe distinguishes us from our Brazilian competitors. Among these initiatives, Mr. Pedreiro has leveraged his

8

international experience in finance and business administration, including his tenure as a member of the board of directors at Advanced Disposal Inc., to revamp our compliance infrastructure. Under Mr. Pedreiro’s leadership, we have demonstrated a focused commitment to strengthening our compliance policies and internal control system. Mr. Pedreiro appointed a seasoned compliance officer in 2015 and implemented a comprehensive new compliance program applicable to all employees and suppliers that is focused on transparency and ethical conduct, stipulating processes and procedures designed to detect and prevent improper conduct (for additional information regarding our compliance program, see “Business—Code of Ethics and Anti-Corruption Policy”). We view our compliance policies, and our focus on, and commitment to, compliance, as a material competitive advantage in seeking to ensure the sustainability of our business model.

In addition, Mr. Pedreiro redesigned our control framework, implementing SAP and CRM Oracle solutions with the effect of significantly improving efficiency and financial oversight by, among other benefits, reducing manual efforts and related errors by automating labor intensive tasks and, in so doing, improving productivity through data driven decision making. Prior to these initiatives spearheaded by Mr. Pedreiro, our pricing systems and contract management were largely operated manually and thus subject to a greater degree of human error. We believe that these efforts combined with the success of our corporate restructuring initiatives positions us to better capture the intended benefits of the Transaction, combining a more efficient cost structure with greater financial flexibility.

In order to propel future growth and fully realize the expected benefits from the Transaction, we are focused on executing a number of expansion-oriented initiatives for organic growth, including, among others: (i) the development of new landfills, with five landfills in the pipeline, (ii) the roll-out of new landfill gas-to-energy facilities, (iii) commercial efforts to attract new C&I customers to our existing landfills, (iv) the development of new transfer stations to expand the coverage area of our existing waste disposal infrastructure and (v) the attainment of new municipal contracts through competitive bidding processes.

We believe that our existing operations provide a scalable platform to drive profitable growth through strategic acquisitions. In 2011, our successful acquisition of Cavo Serviços e Saneamento S.A. solidified our leadership position in the Brazilian market and, since then, we have successfully executed seven other acquisitions of collection and disposal operations. Due to our scale relative to our competitors, we intend to pursue a tuck-in acquisition strategy, with the objective of increasing revenues and broadening our capabilities driven by acquisitions with a relatively small average transaction size. We anticipate that we will be better equipped with the financial resources to more actively pursue acquisition opportunities as a result of the Transaction. We are currently engaged in active discussions with several potential M&A targets that we believe could be completed at accretive adjusted EBITDA multiples and if such transactions are consummated, we further believe they could contribute to significant incremental revenues and adjusted EBITDA.

Our Business Segments

We offer our clients a full range of waste-related and environmental services that comprise every step of the waste management chain, from waste collection to disposal and, ultimately, value recovery. Our activities are divided into four separate and distinct business segments: (i) Collection & Cleaning Services; (ii) Landfills; (iii) Oil & Gas and (iv) Value Recovery, each as described below.

Collection & Cleaning Segment

Our Collection & Cleaning segment includes, primarily, household collection, pursuant to exclusive contracts with 12 municipalities across six Brazilian states, accounting for 91.4% of our revenues from this segment, and, to a lesser extent, commercial and industrial, or C&I, waste collection for private sector customers. Our collection services are supported by a fleet of 983 vehicles (801 for municipal services and 182 for C&I services) as of June 30, 2017 (of which 868 were owned by us, and 115 were leased), consisting mostly of collection and transfer trucks. According to census data compiled by the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística), or IBGE, we estimate that we currently serve approximately 31 million residential clients through our collection and cleaning and landfill activities and 580 private clients through our collection and cleaning activities.

We provide exclusive waste collection services in some of the largest and most densely-populated urban areas in Brazil. In the state of São Paulo, we provide collection services in the cities of São Paulo, Ribeirão Preto, Taboão da Serra, Araraquara, Jaú, Américo Brasiliense and Sertãozinho, and elsewhere in Brazil, in the

9

cities of Curitiba in the state of Paraná, Maceió in the state Alagoas, Aracaju in the state of Sergipe, Aparecida de Goiânia in the state of Goiás and Salvador in the state of Bahia. Through SPE Soma, we operate the largest urban cleaning operation in Brazil for the city of São Paulo.

Our residential collection services are typically performed pursuant to exclusive medium-term contracts with municipal entities ranging in term from three to five years in initial duration with subsequent renewal periods. our municipal contracts typically set forth a price per weight for the residue to be collected or, less commonly, a fixed monthly fee established as part of the competitive bidding process, and always stipulate annual price adjustments tied to inflation. Our experience is that a high percentage of our contracts with municipalities in the Collection & Cleaning segment are renewed or extended at the end of the scheduled term. Since January 1, 2015, only two collection and cleaning contracts that were scheduled to expire were not renewed or extended. Those contracts represented less than 2% of our revenues during that year, and the revenue loss was offset by winning new collection and cleaning contracts with other municipalities.

For the six months ended June 30, 2017, 52.6% of the waste collected from our municipal collections contracts by volume was disposed in our landfills, while in 2016, this figure stood at approximately 49.2%.

Our contracts with our C&I customers are typically from one to three years in initial duration with subsequent renewal periods with pricing based on estimated weight and time required to service the account. The pricing model for our C&I customers differs from the process for public clients in that it does not involve a public bidding process. Instead, contracts are negotiated privately between us and our prospective customers. Once an initial inquiry is made, our pricing team analyzes several factors based on the scope and type of services to be provided, as well as margin and other financial requirements, in order to arrive at the specific pricing terms to be negotiated with the prospective C&I client.

Landfills

We own and operates the largest portfolio of landfills in Brazil, with 13 landfills for the final disposal of both hazardous (Class I) and non-hazardous (Classes IIA and IIB) waste. In addition, we are currently developing five additional landfill sites, which we expect will become operational between 2018 and 2020. Our landfills received approximately 5.9 million tons of waste in 2016, with a remaining licensed disposal capacity of more than 134 million cubic meters of waste as of June 30, 2017. As of June 30, 2017, 16.4% of the total volume of waste disposed in our landfills was internalized from our municipal collection operations and transfer stations.

The table below sets forth key operating data with respect to each of our landfill sites, including their respective area, processing capacity and remaining licensed capacity.

# | Landfill Site | Area (m2) | Residues(1) | Tons per day (2017E) | Remaining licensed capacity (m3)(2) | Remaining life span (years) | Year Established | ||||||||||

1 | Paulínia | 1,962,307 | Class II | 4,985 | 15,145,303 | 20+ | 1999 | ||||||||||

2 | Curitiba | 2,703,643 | Class II | 2,547 | 3,341,966 | 20+ | 2010 | ||||||||||

3 | Maceió | 1,040,000 | Class II | 1,710 | 6,428,719 | 10 | 2010 | ||||||||||

4 | Aracaju | 1,305,143 | Class I and II | 1,358 | 14,033,588 | 25+ | 2012 | ||||||||||

5 | Guatapará | 1,000,000 | Class II | 1,418 | 5,668,422 | 15+ | 2007 | ||||||||||

6 | Itapevi | 215,832 | Class II | 1,336 | 594,451 | 5 | 2003 | ||||||||||

7 | Tremembé | 2,329,001 | Class I and II | 846 | 3,763,650 | 10 | 1996 | ||||||||||

8 | Itaborái | 4,200,000 | Class II | 633 | 66,924,474 | 20+ | 2010 | ||||||||||

9 | Piratininga | 759,297 | Class II | 528 | 4,732,660 | 25 | 2012 | ||||||||||

10 | Feira de Santana | 299,335 | Class II | 579 | 2,658,387 | 15+ | 2014 | ||||||||||

11 | Catanduva | 1,038,664 | Class II | 350 | 7,485,323 | 15+ | 2009 | ||||||||||

12 | Sarandi | 350,275 | Class II | 136 | 3,132,233 | 20+ | 2010 | ||||||||||

13 | Jardinópolis | 182,716 | Class I and II | 156 | 338,816 | 10+ | 2005 | ||||||||||

Total | 17,386,213 | — | 16,582 | 134,247,992 | — | — | |||||||||||

| (1) | Class I residues are considered to be hazardous and Class II residues are non-hazardous. |

| (2) | Data presented corresponds exclusively to remaining capacity for which we have already obtained a license for expansion from the relevant governmental authorities, and the figures presented do not consider disposal capacity beyond this licensed amount. In addition |

10

to these amounts, as of June 30, 2017, we had additional capacity of 24.2 million cubic meters for which licenses had not been obtained (13.3 million corresponding to unlicensed capacity at our Paulínia landfill, 9.6 million corresponding to unlicensed capacity at our Curitba landfill, 1.2 million correspond to unlicensed capacity at our Itapevi landfill and 76,000 corresponding to unlicensed capacity at our Jardinópolis landfill).

Landfills remain the cheapest waste disposal technology and the primary way of disposing of waste in Brazil, receiving approximately 53.0% of the urban solid waste collected in 2016, according to ABRELPE.

Our main customers in this segment are municipalities (accounting for 44.0% of our net revenues from this segment for the six months ended June 30, 2017) private and public collection companies (accounting for 28.4% of our net revenues from this segment for the six months ended June 30, 2017), and large C&I waste generators (accounting for 27.6% of our net revenues from this segment for the six months ended June 30, 2017). Our landfills generate revenue from disposal and tipping fees based on the type and weight or volume of waste being disposed, with price per ton established pursuant to short and medium term contracts typically with an initial duration of one to three years, subject to renewal, and built-in annual inflation adjustments.

Our landfill disposal services are a complement to our Collection & Cleaning segment, allowing for valuable cross-selling opportunities across our existing customer base. While we derive significant revenues in our Landfills segment from customers for whom we also provides collection and cleaning services, many of our customers in this segment are independent.

Our landfill operations are supported by a network of five transfer stations that serve to enhance the operational reach of our disposal network and increase the volume of revenue-generating disposal.

Oil & Gas

Our Oil & Gas segment provides on-site and off-site biological remediation of contaminated soil, primarily to one main client, Petrobras, that contracts us on a spot basis to clean sites that have been contaminated with oil and/or other pollutants.

Value Recovery

Through our Value Recovery segment, we opportunistically develop processes to convert and recycle collected waste into usable and efficient forms of energy, which, in many cases, can be sold to third parties. We also have the capabilities for traditional recycling activities, including with respect to complex electronic devices. Our activities in our Value Recovery segment can be divided into four sub-segments: (i) landfill gas-to-energy, (ii) co-processing & blending, (iii) reverse manufacturing and waste recycling and (iv) carbon credit.

As of June 30, 2017, we operated two landfill gas-to-energy generation facilities at our Curitiba and Guatapará landfills, with a total installed capacity of approximately 14MW and energy generation and sale of 36,290 MWh in the six months ended June 30, 2017 and 49,081 MWh, 38,811 MWh and 16,978 MWh in the years 2016, 2015 and 2014, respectively. In addition, we have received approval for the required permits to develop new gas-to-energy generation facilities at our Paulínia, Tremembé, Maceió, Piratininga and Aracaju landfills, which together comprise a total potential capacity of 46MW. We also have the potential for the expansion of our existing gas-to-energy generation facilities, as well as for the construction of new gas-to-energy generation projects, which expansion portfolio would comprise a total of 19MW in new energy generation capacity, potentially leading to a total aggregate capacity across all of our gas-to-energy generation facilities of 80MW over the coming years. Energy generated from landfill gas is considered a renewable resource and is therefore eligible for certain tax benefits. We sell approximately 80% of the energy generated from our biogas generation operations in the free market pursuant to power purchase agreements usually on three-year terms, with the remaining 20% sold on the spot market to benefit from the more volatile Brazilian energy market.

We also operate two co-processing facilities, one in Sorocaba, São Paulo and another in Balsa Nova, Paraná, where various types of industrial waste are treated and processed into a form of fuel used by cement plants in their industrial ovens. In addition, we operate one waste recycling facility at our Paulínia landfill with capacity to process approximately 40 thousand tons of waste per year, with contracted expansion plans to handle up to 500 tons of waste per day, as well as one facility for the reverse manufacturing of electronic devices and one mechanized recycling system for the processing of construction materials. Finally, we generate carbon credits by processing the methane naturally occurring from our landfill operations, and has been selling those carbon credits since 2006.

11

We are continuously looking to invest in businesses and technologies that offer ancillary or supplementary services or solutions to our current operations and have contracted the construction of a material recovery facility, or MRF, with capacity to handle 500 tons of MSW per day. This facility will operate in the Paulinia landfill and is expected to enter operation in the first half of 2018. We believe opportunities are abound in Brazil for the commercialization of landfill gas and recovered recyclable materials. In the future, we may also expand our landfill gas operations to include the distribution of landfill gas as a direct substitute for fossil fuels in industrial processes, or the processing of landfill gas into natural gas for sale as vehicle fuel or to natural gas suppliers.

Industry

We believe that the considerable size of the waste management market in Brazil, coupled with a favorable regulatory environment and the steadily increasing penetration rate of private waste collection and disposal services, present us with significant growth potential.

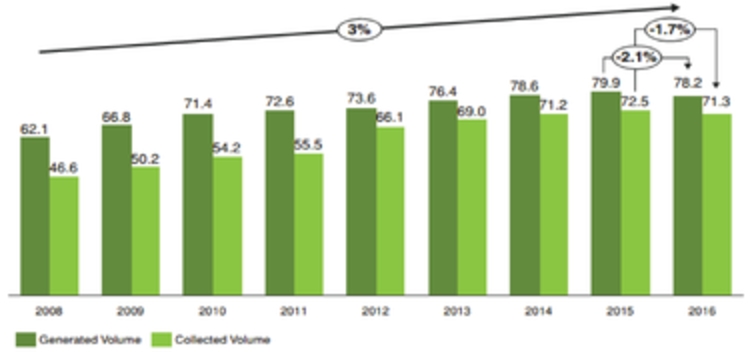

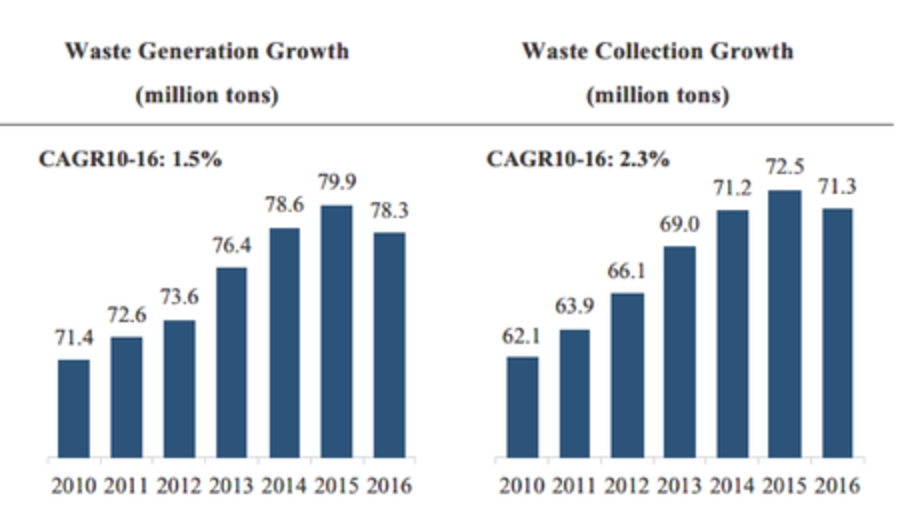

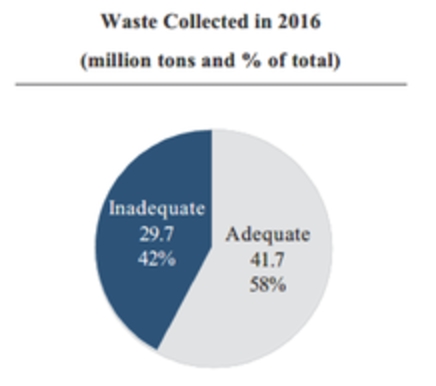

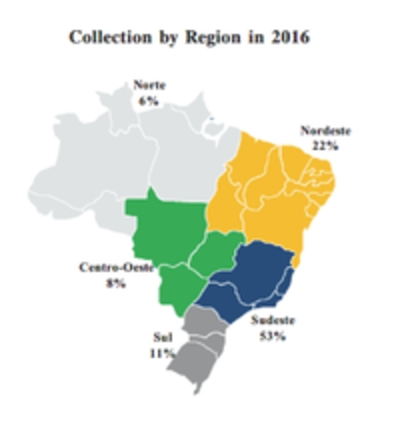

Brazil generated around 78.0 million tons of MSW in 2016, a 2.0% decrease as compared to 2015, according to ABRELPE data, while population growth during the same period was 0.8% according to IBGE. The majority (75.0%) of this waste originated from two main regions in Brazil: the Southeast and Northeast. In 2016, approximately R$24.5 billion was spent by municipal departments in Brazil on urban cleaning and MSW collection and disposal, according to ABRELPE data. In 2016, it is estimated that approximately 41.6% of MSW collected was not properly disposed, and approximately 7.0 million tons of waste volume remained uncollected according to ABRELPE data. The graphic below presents key metrics with respect the Brazilian waste management industry for the periods indicated:

Over the past decade, economic growth in Brazil has lifted millions out of poverty and into the middle class, boosting overall as well as per capita generation and collection volumes. While Brazil experienced decelerated GDP growth starting in 2014, prior to such stagnation and eventual recession, there was a strong correlation between growth in GDP and increases in waste generation and collection. For example, in 2010, when GDP growth was 7.5%, collection growth was 8.0% year-over-year compared to generation growth of 6.9% year-over-year. Even with negative GDP growth in 2015, MSW generation and collection grew on both absolute terms and on a per capita basis. However, in 2016, MSW generation and collection followed the negative GDP growth and, as a result, decreased in absolute terms and on a per capita basis. Therefore, as the Brazilian economy demonstrates signs of recovery and predicted return to GDP growth according to Brazilian Central Bank estimates, we believe there will be a corresponding increase in waste generation that we are well-positioned to capitalize on.

In 2016, approximately 70% of urban cleaning, collection and disposal services were performed by private companies, while 30% was performed by municipal departments, demonstrating the relevance of private companies in terms of the waste management chain in Brazil in recent years.

The significant increases in the penetration of waste collection services and proper methods of disposal in Brazil in the past several years have been in large part driven by Brazil’s recent commitment to more environmental sound waste management practices, as demonstrated by the enactment of Brazil’s National Solid Waste Policy legislation in 2010. The policy banned uncontrolled waste disposal practices nationwide, and since

12

its enactment has increased the overall volume of waste that was adequately disposed. As its implementation continues to gradually go into full effect through 2018-2021, Brazil’s National Solid Waste Policy is expected to continue to result in increased volumes of proper MSW handling and disposal as municipalities work towards compliance prior to the applicable deadline.

Despite significant strides, we believe Brazil’s waste management sector is still very much in its growth stages similar to the growth stages of the American waste management sector (corresponding roughly to the period from 1980 to 2013), where nominal growth in landfill tipping fees increased by a 2.8% compound annual growth rate from 1980 to 2013.

While the Brazilian waste management industry is highly fragmented, there are several prominent players that engage in all aspects of the value chain, with our company being the largest, according to our internal analysis based on ABRELPE data. Competition in the waste management industry is mainly driven by a few large companies, which are typically affiliates of large construction companies, and several smaller and regionally-based companies, which based on our assessment consist mainly of family-owned companies that lack the scale, technology and skilled management of the few larger players. We also compete with municipalities that maintain waste collection or disposal operations, which may have financial advantages due to the availability of tax revenue and tax-exempt financing, but which do not provide waste management services outside the borders of their own municipality.

We perceive significant downstream opportunities in the Brazilian waste management sector across the value chain, especially as this industry continues to advance and develop. Initiatives such as biogas-to-energy, co-processing, remediation services and recycling are mostly at an emerging stage in Brazil, and could be attractive ventures for Brazilian waste management companies as new technologies become available and political actors, environmental organizations and the general public continue to place emphasis on environmental issues. For example, as waste-to-energy technology becomes more efficient and cost effective in Brazil, new opportunities are being presented to Brazilian waste management players to enter into the power generation business, especially through the use of landfill gas.

Competitive Strengths

We believe that we are well-positioned as a leading provider of waste management solutions in Brazil, and believes our main competitive strengths include:

Leading player in Brazilian waste management industry

We are the largest waste management company in Latin America in terms of disposal capacity, collection volume and market share, providing collection, transfer, recycling and disposal services to more than 5,400 public and private customers as of June 30, 2017. The Brazilian waste management industry is highly fragmented, and we are the most significant player in terms of market share, with 8.0% of the market in 2016 and the top five largest players collectively accounting for only 28.0%, according to ABRELPE data in conjunction with our internal studies. We boast the largest portfolio of landfills in Brazil, which we view as key to further solidifying our market leadership. We operate 13 landfills strategically located throughout Brazil, and also owns the land on which we intend to develop five additional landfills, which could become operational as early as in 2018. The Brazilian waste management industry includes a total of approximately 226 companies, only five of which can be deemed large companies, and the remainder of which we believe are companies that lack the scale, technology and skilled management that we possess. Accordingly, we believe that most players in this industry would generally face difficulty in replicating our success, particularly in the landfill business due to the stringent licensing process to operate a landfill in Brazil (typically spanning three to five years) and substantial upfront capital requirements. Waste collection services and landfill operations are protected by high barriers to entry due in part to rigorous legislative, regulatory and licensing requirements, favoring large and experienced players like ourselves. As a result of our large scale and expertise, we believe that we are uniquely positioned to meet underserved needs and take advantage of attractive growth opportunities.

Vertically integrated operations

We offers a full range of waste management solutions to our customers and strive to serve as a single-source provider for our customers’ waste management needs, from the point of collection to the point of disposal, extracting value at every stage. For the six months ended June 30, 2017, 52.6% of the waste collected

13

from our municipal collections contracts by volume was disposed in our landfills. Our vertically integrated operations provide meaningful cost advantages, allowing us to capture the incremental disposal margins that otherwise would be paid to a third party in connection with our collection business. The disposal and tipping fees that we receive for use of our landfills from our collections customers as well as from other third-party collection service providers afford a predictable revenue stream, positively impacting cash flow generation and Adjusted EBITDA margins. By reducing costs and consolidating waste management operations in a single provider, We are able to more effectively compete for new business. This cost advantage is particularly valuable in relation to municipal contracts, as the outcome of the competitive bidding process is largely dictated by price. Our vertically integrated operations position us favorably to capitalize on inorganic growth opportunities, as our waste management infrastructure provides the flexibility to easily and efficiently integrate transfer stations or smaller-sized collections operations and quickly realize economies of scale and synergies therefrom.

Strategically located network of landfills