- VTAK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Catheter Precision (VTAK) DEF 14ADefinitive proxy

Filed: 19 Apr 19, 12:16pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☒Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a‑12 |

Ra Medical Systems, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☐ | Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

2070 Las Palmas Drive

Carlsbad, California 92011

(760) 804-1648

To our Stockholders:

We are pleased to invite you to attend the annual meeting of stockholders of Ra Medical Systems, Inc., to be held on Thursday, June 6, 2019 at 9:00 a.m. Pacific Time, at the offices of Ra Medical Systems, 1926 Kellogg Avenue, Carlsbad, California 92008.

At this year’s annual meeting, our stockholders will be asked to:

| • | elect as Class I directors the two nominees named in the accompanying proxy statement to serve until our 2022 annual meeting of stockholders or until their respective successors are duly elected and qualified. |

| • | ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019. |

| • | transact such other business that may properly come before the annual meeting. |

Details regarding how to attend the annual meeting and the business to be conducted at the annual meeting are more fully described in the accompanying notice of annual meeting of stockholders and proxy statement.

Your vote is important. Regardless of whether you plan to attend the annual meeting, it is important that your shares be represented and voted at the annual meeting, and we hope you will vote as soon as possible. You may vote by proxy via the Internet, by telephone, or by mail, according to the instructions on the enclosed proxy card or voting instruction card. Voting over the Internet or by telephone, by written proxy or voting instruction card will ensure your representation at the annual meeting regardless of whether you attend the annual meeting.

Thank you for your ongoing support of, and continued interest in, Ra Medical Systems, Inc.

Sincerely,

Dean Irwin

Chairman, Chief Executive Officer,

Co-President, and Chief Technology Officer

Carlsbad, California

April 19, 2019

The date of this proxy statement is April 19, 2019, and is being mailed to stockholders on or about April 23, 2019.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on June 6, 2019. Our Proxy Statement and Annual Report to Stockholders are available at www.proxydocs.com/RMED.

2070 Las Palmas Drive

Carlsbad, California 92011

(760) 804-1648

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Time and Date | 9:00 a.m. Pacific Time, on Thursday, June 6, 2019 |

Place | Ra Medical Systems, 1926 Kellogg Avenue, Carlsbad, California 92008 |

Items of Business | (1) To elect as Class I directors the two nominees named in the accompanying proxy statement to serve until our 2022 annual meeting of stockholders or until their respective successors are duly elected and qualified. (2) To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019. (3) To transact such other business that may properly come before the annual meeting. |

Adjournments and Postponements | Any action on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed. |

Record Date | April 10, 2019 Only stockholders of record of our common stock as of the close of business on Wednesday, April 10, 2019, are entitled to notice of and to vote at the annual meeting. |

Meeting Admission | You are invited to attend the annual meeting if you are a stockholder of record or a beneficial owner of shares of our common stock, in each case, as of April 10, 2019. If you are a stockholder of record, you must present valid government-issued photo identification (e.g., driver’s license or passport) for admission to the annual meeting. If you are a beneficial owner of shares of our common stock, you must provide proof of such ownership as of April 10, 2019 (e.g., your most recent account statement reflecting your stock ownership as of April 10, 2019) and you must present valid government-issued photo identification for admission to the annual meeting. |

Voting | Your vote is very important. You may vote by proxy via the Internet, by telephone, or by mail, according to the instructions on the enclosed proxy card or voting instruction card. For specific instructions on how to vote your shares, please refer to the section entitled Questions and Answers beginning on page 1 of the accompanying proxy statement. |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on June 6, 2019. The proxy statement, the accompanying materials and our 2018 annual report are being mailed on or about April 23, 2019 to all stockholders entitled to vote at the annual meeting. A copy of our proxy statement and our 2018 annual report are also posted on www.proxydocs.com/RMED and are available from the SEC on its website at www.sec.gov.

|

| By order of the Board of Directors, |

|

|

|

|

| Daniel Horwood |

|

| General Counsel and Corporate Secretary |

|

| Carlsbad, California |

|

|

|

April 19, 2019 |

|

|

| Page | |

|

| |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND ANNUAL MEETING | 1 | |

9 | ||

| 9 | |

| 9 | |

| 10 | |

| 10 | |

| 11 | |

| 12 | |

| 13 | |

| 13 | |

| 16 | |

| 16 | |

| Stockholder Recommendations for Nominations to Our Board of Directors | 17 |

| 18 | |

| Corporate Governance Principles and Code of Ethics and Conduct | 19 |

| 19 | |

| 21 | |

22 | ||

| 22 | |

| 22 | |

| 22 | |

PROPOSAL NUMBER 12 ‑ RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 23 | |

| Fees Paid to the Independent Registered Public Accounting Firm | 23 |

| 24 | |

| 24 | |

| 24 | |

| 24 | |

25 | ||

27 | ||

29 | ||

| 29 | |

| 30 | |

| 31 | |

| 32 | |

| 33 | |

| 34 | |

| 34 | |

| 35 | |

36 | ||

| 36 | |

| 36 | |

| 36 | |

| Policies and Procedures for Transactions with Related Persons | 36 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 37 | |

39 | ||

| 39 | |

| 39 | |

| 39 | |

| 39 | |

40 | ||

-i-

RA MEDICAL SYSTEMS, INC.

2070 Las Palmas Drive

Carlsbad, California 92011

PROXY STATEMENT

For the 2019 Annual Meeting of Stockholders

to be held on June 6, 2019

The information provided in the “Questions and Answers” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read the entire proxy statement carefully.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND ANNUAL MEETING

Why am I receiving these materials?

This proxy statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the 2019 annual meeting of stockholders of Ra Medical Systems, Inc., a Delaware corporation, and any postponements, adjournments, or continuations thereof, or the annual meeting. The annual meeting will be held on Thursday, June 6, 2019 at 9:00 a.m. Pacific Time, at the offices of Ra Medical Systems located at 1926 Kellogg Avenue, Carlsbad, California 92008.

Stockholders are invited to attend the annual meeting and are requested to vote on the items of business described in this proxy statement. This proxy statement, the accompanying materials and our 2018 annual report are being mailed on or about April 23, 2019, to all stockholders entitled to vote at the annual meeting. A copy of our proxy statement and our 2018 annual report are posted on www.proxydocs.com/RMED, and are also available from the SEC on its website at www.sec.gov.

What is a proxy?

A proxy is your legal designation of another person to vote the stock you own. The person you designate is your “proxy,” and you give the proxy authority to vote your shares by submitting the enclosed proxy card, or if available, voting by telephone or over the Internet. We have designated Dean S. Irwin, Andrew Jackson and Daniel Horwood to serve as proxies for the annual meeting.

What am I voting on?

You are being asked to vote on two proposals:

| • | the election of two (2) Class I directors from the nominees named in this proxy statement to hold office until our 2022 annual meeting of stockholders or until their respective successors are duly elected and qualified; and |

| • | the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2019. |

We will also transact any other business that properly comes before the annual meeting.

-1-

What if other matters are properly brought before the annual meeting?

As of the date of this proxy statement, we are not aware of any other matters that will be presented for consideration at the annual meeting. If any other matters are properly brought before the annual meeting, the persons named as proxies will be authorized to vote or otherwise act on those matters in accordance with their judgment. If for any reason a director nominee is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate as may be nominated by our board of directors.

How does the board of directors recommend that I vote?

Our board of directors recommends that you vote your shares:

| • | “FOR” the election of the directors nominated by our board of directors and named in this proxy statement as Class I directors; and |

| • | “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2019. |

Who may vote at the annual meeting?

Only stockholders of record as of the close of business on April 10, 2019, the record date for the annual meeting, or the record date, are entitled to vote at the annual meeting. As of the record date, there were 12,836,970 shares of our common stock issued and outstanding, held by 139 holders of record. We do not have cumulative voting rights for the election of directors.

Stockholder of Record: Shares Registered in Your Name. If, at the close of business on the record date for the annual meeting, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote in person at the annual meeting. You may also vote on the internet, mail, or by telephone as described below under the heading “How can I vote my shares?” and on your proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank, or Other Nominee. If, at the close of business on the record date for the annual meeting, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, or other nominee, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker, bank or other nominee regarding how to vote the shares in your account by following the voting instructions your broker, bank or other nominee provides. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the annual meeting unless you obtain a valid proxy from your broker, bank or other nominee.

-2-

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in one of the following ways:

| • | You may vote in person. If you plan to attend the annual meeting, you may vote by delivering your completed proxy card in person or by completing and submitting a ballot, which will be provided at the annual meeting. |

| • | You may vote by mail. Complete, sign and date the proxy card that accompanies this proxy statement and return it promptly in the postage-prepaid envelope provided (if you received printed proxy materials). Your completed, signed and dated proxy card must be received prior to the annual meeting. |

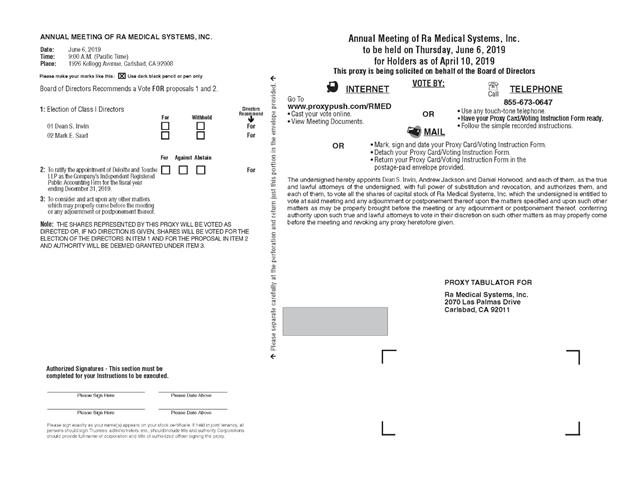

| • | You may vote by telephone. To vote over the telephone, dial toll-free (855) 673-0647and follow the recorded instructions. You will be asked to provide the company number and control number from your proxy card. Telephone voting is available 24 hours a day, 7 days a week, until 8:59 a.m. Pacific Time, on June 6, 2019. |

| • | You may vote via the Internet. To vote via the Internet, go to www.proxypush.com/RMED to complete an electronic proxy card (have your proxy card in hand when you visit the website). You will be asked to provide the company number and control number from your proxy card. Internet voting is available 24 hours a day, 7 days a week, until 8:59 a.m. Pacific Time, on June 6, 2019. |

Beneficial Owners: Shares Registered in the Name of a Broker, Bank or Other Nominee

If you are a beneficial owner of shares held of record by a broker, bank or other nominee, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to instruct your broker, bank or other nominee on how to vote your shares. Beneficial owners of shares should generally be able to vote by returning the voting instruction card, or by telephone or via the Internet. However, the availability of telephone or Internet voting will depend on the voting process of your broker, bank, or other nominee. As discussed above, if you are a beneficial owner, you may not vote your shares in person at the annual meeting unless you obtain a legal proxy from your broker, bank or other nominee that holds your shares giving you the right to vote the shares at the meeting.

Can I change my vote or revoke my proxy?

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record, you can change your vote or revoke your proxy at any time before the annual meeting by:

| • | entering a new vote by Internet or telephone (until the applicable deadline for each method as set forth above); |

| • | returning a later-dated proxy card (which automatically revokes the earlier proxy); |

| • | providing a written notice of revocation to our corporate secretary at Ra Medical Systems, Inc., 2070 Las Palmas Drive, Carlsbad, California 92011, Attention: Corporate Secretary; or |

| • | attending the annual meeting and voting in person. Attendance at the annual meeting will not cause your previously granted proxy to be revoked unless you specifically so request. |

-3-

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Nominee. If you are the beneficial owner of your shares, you must contact the broker, bank or other nominee holding your shares and follow their instructions to change your vote or revoke your proxy.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. The persons named in the proxy, Dean S. Irwin, our Chairman and Chief Executive Officer, Andrew Jackson, our Chief Financial Officer, and Daniel Horwood, our General Counsel and Corporate Secretary, have been designated as proxies for the annual meeting by our board of directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the annual meeting in accordance with the instruction of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors as described above and, if any other matters are properly brought before the annual meeting, the shares will be voted in accordance with the proxies’ judgment.

What shares can I vote?

Each share of our common stock issued and outstanding as of the close of business on April 10, 2019, the record date for the 2019 annual meeting of stockholders, is entitled to vote on all items being considered at the 2019 annual meeting. You may vote all shares owned by you as of the record date, including (i) shares held directly in your name as the stockholder of record and (ii) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee. On the record date, we had 12,836,970 shares of common stock issued and outstanding.

How many votes do I have?

On each matter to be voted upon at the annual meeting, each stockholder will be entitled to one vote for each share of our common stock held by them on the record date.

What is the quorum requirement for the annual meeting?

A quorum is the minimum number of shares required to be present or represented at the annual meeting for the meeting to be properly held under our bylaws and Delaware law. Holders of a majority of the voting power of our issued and outstanding common stock and entitled to vote at the annual meeting must be present in person or represented by proxy to hold and transact business at the annual meeting. On the record date, there were 12,836,970 shares outstanding and entitled to vote. Thus, the holders of at least 6,418,486 shares must be present in person or represented by proxy at the annual meeting to have a quorum.

Abstentions, “WITHHOLD” votes, and “broker non-votes” are counted as present and entitled to vote for purposes of determining a quorum. If there is no quorum, the chairman of the meeting or the holders of a majority of the voting power present in person or represented by proxy at the annual meeting and entitled to vote at the annual meeting may adjourn the meeting to another date.

What are broker non-votes?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker holding the shares as to how to vote on matters deemed “non-routine” and there is at least one “routine” matter to be voted upon at the meeting. Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker holding the

-4-

shares. If the beneficial owner does not provide voting instructions, the broker can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. In the event that a broker votes shares on the “routine” matters, but does not vote shares on the “non-routine” matters, those shares will be treated as broker non-votes with respect to the “non-routine” proposals. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

What matters are considered “routine” and “non-routine”?

The ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2019 (Proposal No. 2) is considered a “routine” matter. The election of directors (Proposal No. 1) is considered “non-routine”.

What are the effects of abstentions and broker non-votes?

An abstention represents a stockholder’s affirmative choice to decline to vote on a proposal. If a stockholder indicates on its proxy card that it wishes to abstain from voting its shares, or if a broker, bank or other nominee holding its customers’ shares of record causes abstentions to be recorded for shares, these shares will be considered present and entitled to vote at the annual meeting. As a result, abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against a proposal in cases where approval of the proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting (e.g., Proposal No. 2). However, because the outcome of Proposal No. 1 (election of directors) will be determined by a plurality vote, abstentions will have no impact on the outcome of such proposal as long as a quorum exists.

Broker non-votes will be counted for purposes of calculating whether a quorum is present at the annual meeting but will not be counted for purposes of determining the number of votes cast. Therefore, a broker non-vote will make a quorum more readily attainable but will not otherwise affect the outcome of the vote on any proposal.

What is the voting requirement to approve each of the proposals?

Proposal No. 1: Election of two nominees for Class I director named in this proxy statement to hold office until our 2022 annual meeting of stockholders or until their successors are duly elected and qualified.

The election of directors requires a plurality of the voting power of shares present in person or represented by proxy at the annual meeting and entitled to vote on the election of directors. This means that the two (2) nominees for Class I director receiving the highest number of “FOR” votes will be elected as Class I directors. You may vote (i) “FOR” each nominee, or (ii) “WITHHOLD” your vote as to each nominee. Any shares not voted “FOR” a particular nominee (whether as a result of voting withheld or a broker non-vote) will not be counted in such nominees’ favor and will have no effect on the outcome of the election. Because the outcome of this proposal will be determined by a plurality vote, shares voted “WITHHOLD” will have no impact on the outcome of this proposal, but will count towards the quorum requirement for the annual meeting.

-5-

Proposal No. 2: Ratification of Appointment of Deloitte & Touche LLP.

The ratification of the appointment of Deloitte & Touche LLP requires the affirmative vote of a majority of the shares of our common stock present in person or represented by proxy at the annual meeting and entitled to vote thereon to be approved. You may vote “FOR,” “AGAINST,” or “ABSTAIN” on this proposal. Abstentions will count towards the quorum requirement for the annual meeting and will have the same effect as a vote against the proposal. Broker non-votes are not included in the tabulation of voting results on this proposal, and will not affect the outcome of voting on this proposal. Notwithstanding the appointment of Deloitte & Touche LLP and even if our stockholders ratify the appointment, our audit committee, in its discretion, may appoint another independent registered public accounting firm at any time during our fiscal year if our audit committee believes that such a change would be in the best interests of our company and our stockholders.

Who will count the votes?

A representative of Mediant Communications, Inc. will tabulate the votes and act as inspector of elections.

What if I do not specify how my shares are to be voted or fail to provide timely directions to my broker, bank or other nominee?

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record and you submit a proxy but you do not provide voting instructions, your shares will be voted:

| • | “FOR” the election of each of the two (2) nominees for Class I director named in this proxy statement; and |

| • | “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2019. |

In addition, if any other matters are properly brought before the annual meeting, the persons named as proxies will be authorized to vote or otherwise act on those matters in accordance with their judgment.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Nominee. Brokers, banks and other nominees holding shares of common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker, bank or other nominee will have discretion to vote your shares on our sole “routine” matter – Proposal No. 2 to ratify the appointment of Deloitte & Touche LLP. Absent direction from you, however, your broker, bank or other nominee will not have the discretion to vote on Proposal No. 1 relating to the election of directors.

How can I contact Ra Medical Systems’ transfer agent?

You may contact our transfer agent by writing American Stock Transfer & Trust Company, LLC, 6201 15th Avenue, Brooklyn, New York 11219. You may also contact our transfer agent via email at help@astfinancial.com or by telephone at (800) 937-5449.

-6-

How can I attend the annual meeting?

Stockholder of Record: Shares Registered in Your Name. If you were a stockholder of record at the close of business on the record date, you must present valid government-issued photo identification (e.g., driver’s license or passport) for admission to the annual meeting.

Beneficial Owners: Shares Registered in the Name of a Broker, Bank or Other Nominee. If you were a beneficial owner at the close of business on the record date, you may not vote your shares in person at the annual meeting unless you obtain a “legal proxy” from your broker, bank or other nominee who is the stockholder of record with respect to your shares. You may still attend the annual meeting even if you do not have a legal proxy. For admission to the annual meeting, you must provide proof of beneficial ownership as of the record date (e.g., your most recent account statement reflecting your stock ownership as of the record date) and you must present valid government-issued photo identification.

Please note that no cameras, recording equipment, large bags, briefcases or packages will be permitted in the annual meeting.

Will the annual meeting be webcast?

We do not expect to webcast the annual meeting.

How are proxies solicited for the annual meeting and who is paying for such solicitation?

Our board of directors is soliciting proxies for use at the annual meeting by means of the proxy materials. We will bear the entire cost of proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the proxy materials. Copies of solicitation materials will also be made available upon request to brokers, banks and other nominees to forward to the beneficial owners of the shares held of record by such brokers, banks or other nominees. The original solicitation of proxies may be supplemented by solicitation by telephone, electronic communication, or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services, although we may reimburse such individuals for their reasonable out-of-pocket expenses in connection with such solicitation. We do not plan to retain a proxy solicitor to assist in the solicitation of proxies.

If you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur.

Where can I find the voting results of the annual meeting?

We will announce preliminary voting results at the annual meeting. We will also disclose voting results on a Current Report on Form 8-K filed with the SEC within four (4) business days after the annual meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four (4) business days after the annual meeting, we will file a Current Report on Form 8-K to publish preliminary results and, within four (4) business days after final results are known, file an additional Current Report on Form 8-K to publish the final results.

What does it mean if I receive more than one set of printed materials?

If you receive more than one set of printed materials, your shares may be registered in more than one name and/or are registered in different accounts. Please follow the voting instructions on each set of printed materials, as applicable, to ensure that all of your shares are voted.

-7-

I share an address with another stockholder, and we received only one printed copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted an SEC-approved procedure called “householding,” under which we can deliver a single copy of the proxy materials and annual report to multiple stockholders who share the same address unless we receive contrary instructions from one or more of the stockholders. This procedure reduces our printing and mailing costs. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will undertake to deliver promptly a separate copy of the proxy materials and annual report to any stockholder at a shared address to which we delivered a single copy of any of these documents. To receive a separate copy, or, if you are receiving multiple copies, to request that we only send a single copy of next year’s proxy materials and annual report, you may contact us as follows:

Ra Medical Systems, Inc.

Attention: Corporate Secretary

2070 Las Palmas Drive

Carlsbad, California 92011

(760)804-1648

Stockholders who hold shares in street name may contact their brokerage firm, bank, broker-dealer or other nominee to request information about householding.

Is there a list of stockholders entitled to vote at the annual meeting?

The names of stockholders of record entitled to vote at the annual meeting will be available at the annual meeting and from our corporate secretary for ten days prior to the meeting for any purpose germane to the meeting, between the hours of 9:00 a.m. and 4:30 p.m., Pacific Time, at our corporate headquarters located at 2070 Las Palmas Drive, Carlsbad, California 92011.

When are stockholder proposals due for next year’s annual meeting?

Please see the section entitled “Proposals of Stockholders for 2020 Annual Meeting” in this proxy statement for more information regarding the deadlines for the submission of stockholder proposals for our 2020 annual meeting.

What are the implications of being an “emerging growth company”?

We are an “emerging growth company” under applicable federal securities laws and therefore permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this proxy statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, including certain executive compensation disclosures required of a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We will remain an emerging growth company until the earliest to occur of: (a) January 1, 2024; (b) the last day of the fiscal year in which we have more than $1.07 billion in annual revenue; (c) the end of the fiscal year in which the market value of our common stock that is held by non-affiliates exceeds $700.0 million as of the end of the second quarter of that fiscal year; or (d) the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities.

-8-

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business and affairs are managed under the direction of our Board, which currently consists of six members, five of which are “independent” under New York Stock Exchange, or NYSE, listing standards. The Board is nominating two nominees for election. Our bylaws provide that the number of directors will be fixed from time to time by resolution of the Board. All directors hold office until their successors have been elected and qualified or until their earlier death, resignation, disqualification or removal. We have divided the terms of office of the directors into three classes with staggered three year terms: Class I, whose term expires at the 2019 Annual Meeting of Stockholders; Class II, whose term expires at the 2020 Annual Meeting of Stockholders; and Class III, whose term expires at the 2021 Annual Meeting of Stockholders.

There are two Class I directors whose current term of office expires at the Annual Meeting: Dean S. Irwin and Mark E. Saad. The Nominating and Corporate Governance Committee recommended, and the Board nominated, Dean S. Irwin and Mark E. Saad as nominees for re-election to the Board as Class I directors at the Annual Meeting. If elected, Messrs. Irwin and Saad will continue as directors and their terms will expire at the 2022 Annual Meeting of Stockholders.

Information about the Board of Directors

The following table sets forth the names, ages as of April 10, 2019, and certain other information regarding each member of the Board, including the nominees for election to the Board as Class I directors at the Annual Meeting, are set forth below. The following information has been furnished to us by the directors.

Name |

| Class |

| Age |

|

| Position |

| Director Since |

|

| Current Term Expires |

|

| Expiration of Term For Which Nominated |

| ||||

Nominees for Director |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dean Irwin |

| I |

|

| 56 |

|

| Chief Executive Officer, Co-President, Chief Technology Officer, and Chairman of the Board of Directors |

|

| 2002 |

|

|

| 2019 |

|

|

| 2022 |

|

Mark E. Saad(1)(2) |

| I |

|

| 49 |

|

| Director |

|

| 2018 |

|

|

| 2019 |

|

|

| 2022 |

|

Continuing Directors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Martin Colombatto (2)(3) |

| II |

|

| 60 |

|

| Lead Independent Director |

|

| 2017 |

|

|

| 2020 |

|

|

| — |

|

Maurice Buchbinder, M.D. (1) |

| II |

|

| 65 |

|

| Director |

|

| 2017 |

|

|

| 2020 |

|

|

| — |

|

Richard Mejia, Jr. (2)(3) |

| III |

|

| 71 |

|

| Director |

|

| 2018 |

|

|

| 2021 |

|

|

| — |

|

William R. Enquist, Jr. (1)(3) |

| III |

|

| 62 |

|

| Director |

|

| 2018 |

|

|

| 2021 |

|

|

| — |

|

(1) | Member of our nominating and corporate governance committee. |

(2) | Member of our audit committee. |

(3) | Member of our compensation committee. |

-9-

Nominees for Election at the Annual Meeting

Dean Irwin founded Ra Medical in 2002 and has served as Chief Executive Officer, Chief Technology Officer and Chairman of the Board since September 2002 and as Co-President since May 2018. Prior to forming Ra Medical, Mr. Irwin was Vice President of Research, Development, and Engineering at PhotoMedex, Inc., a manufacturer of excimer lasers, from February 1998 to August 2002. Prior to his tenure at PhotoMedex, Inc., Mr. Irwin provided scientific consulting for Intel Corporation from January of 1999 to August 1999 and was Vice President of Engineering and General Manager at SpatiaLight, Inc., a manufacturer and seller of high-resolution liquid crystal on silicon microdisplays, from June 1993 to February 1998. Mr. Irwin was also a founder and Chief Scientist at DIR Corp., a custom equipment development company, from May 1985 to January 1991. Mr. Irwin has held various engineering positions with Acculase, Inc., a laser development company, (acquired by PhotoMedex), General Atomics, a defense contractor, and Universal Voltronics Corp., a developer of high voltage power supplies. We believe that Mr. Irwin is qualified to serve as a member of our board of directors due to his senior management roles in multiple companies in the medical devices industry and his deep understanding of our business, operations, and strategy.

Mark E. Saad has served as a director of Ra Medical since July 2018. Mr. Saad currently serves as Partner and Chief Operating Officer of Alethea Capital Management, LLC, an asset management firm based in San Diego. From August 2014 to February 2017, Mr. Saad served as the Chief Financial Officer of Bird Rock Bio, Inc., a clinical stage biopharmaceutical company focused on developing innovative immuno-inflammatory regulators. Previously, Mr. Saad served as Chief Financial Officer of Cytori Therapeutics, a medical device developer and manufacturer, from 2004 to 2014, where he was responsible for finance and accounting, business development, and other operating functions. Prior to Cytori, he served as Executive Director of UBS Investment Bank, a multinational investment bank and financial services company, where he was the Chief Operating Officer of the Global Healthcare Group. Prior to UBS, Mr. Saad was part of the Health Care Investment Banking Group at Salomon Smith Barney, an investment bank. Mr. Saad has been a member of the board of directors of Axsome Therapeutics, Inc., a clinical-stage biopharmaceutical company, since December 2014. Mr. Saad holds a Bachelor of Arts from Villanova University. We believe that Mr. Saad is qualified to serve as a member of our board of directors due to his financial expertise and leadership experience.

Maurice Buchbinder has served as a director of Ra Medical since January 1, 2017. Dr. Buchbinder has served as Interventional Cardiologist for Maurice Buchbinder M.D., C.M., A Professional Corporation, from October 1994 to present. Dr. Buchbinder holds a Bachelor’s of Science degree from McGill University in Montreal, Canada, and a Doctor of Medicine, Master of Surgery, from McGill University. He completed his post-graduate education at Stanford University where he specialized in Cardiovascular Medicine. We believe that Dr. Buchbinder is qualified to serve as a member of our board of directors due to his extensive experience in the medical and medical device industries.

Martin Colombatto has served as a director of Ra Medical since January 2017. Mr. Colombatto has served as a Venture and Industry Partner of Seven Peaks Ventures LLP, a venture capital fund based in Bend, OR, since January 2016. From December 2013 to August 2014, Mr. Colombatto served as a director of PLX Technology, Inc., a technology company. Mr. Colombatto has also served as the Chief Executive Officer and President of Staccato Communications, Inc., an Ultra Wideband semiconductor company, from January 2006 to March 2009 and as Executive Chairman of Staccato Communications, Inc., from January 2006 to September 2010. Prior to joining Staccato, Mr. Colombatto served as Vice President and General Manager of the Networking Business unit of Broadcom Corp., a broadband communication semiconductor company, from July 1996 to July 2002. Mr. Colombatto was also previously employed by LSI Logic, an application specific semiconductor company, from August 1987 to July 1996. Mr. Colombatto also previously held engineering positions at Reliance Electric, a production

-10-

automation and control company, from August 1985 to June 1987 and Texas Instruments, an electronics company, from June 1982 to April 1985. Mr. Colombatto holds a Bachelor’s of Science Degree in Electronic Engineering Technology from California State Polytechnic University, Pomona. We believe that Mr. Colombatto is qualified to serve as a member of our board of directors due to his extensive management experience and familiarity with our business and strategy.

William R. Enquist, Jr. has served as a director of Ra Medical since July 2018. Mr. Enquist held various roles at Stryker Corporation, a medical device company, from 1986 to 2014, including Advisor from 2013 to 2014 and President, Global Endoscopy from 1998 to 2013. From 2015 to 2016, Mr. Enquist served as the chairman of the board of directors of EndoChoice Holdings, Inc., a publicly traded medical device company, until its acquisition by Boston Scientific in 2016. Mr. Enquist currently is chairman of the board of directors of Clinical Innovations and board director for SpineEx and Firefly Medical, all medical device companies. Mr. Enquist earned a BBA from the University of San Diego and completed Harvard University’s Program for Management Development. We believe that Mr. Enquist is qualified to serve as a member of our board of directors because of his extensive experience as a senior executive officer of other healthcare companies.

Richard Mejia, Jr. has served as a director of Ra Medical since July 2018. Mr. Mejia previously served as a partner in the San Diego office of Ernst & Young LLP, a public accounting firm, from 1988 up until his retirement in 2008, including that from 2001 through 2008 he led the Life Sciences practice. From 2014 to 2018 he served on the Board of Stemedica Cell Technologies, Inc., a life science company and from 2008 to 2015, Mr. Mejia served on the board of directors of Dot Hill Systems Corp., a public company which manufacturers software and hardware storage systems. From 2010 to 2012 he served on the board of directors of Sharp Health, a healthcare delivery system. Mr. Mejia holds a B.S. in Accounting from the University of Southern California. We believe that Mr. Mejia is qualified to serve as a director because of his extensive experience in public accounting, financial matters, industry knowledge and serving on boards of directors.

Our common stock is listed on the NYSE. Under the rules of the NYSE, independent directors must comprise a majority of a listed company’s board of directors within a specified period of the completion of such company’s initial public offering. In addition, the rules of the NYSE require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent. Under the rules of the NYSE, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

To be considered independent for purposes of Rule 10A-3 and under the rules of NYSE, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, board of directors, or any other board committee: (1) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or (2) be an affiliated person of the listed company or any of its subsidiaries.

Our board of directors undertook a review of the independence of our directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested from and provided by each director concerning his background, employment and affiliations, including family relationships, our board of directors has determined that each of Martin Colombatto, Maurice Buchbinder, Richard Mejia, Jr., Mark E. Saad, and William R. Enquist, Jr., representing five of our six directors, is “independent” as that term is defined under the rules of NYSE.

-11-

Our board of directors also determined that Richard Mejia, Jr. (Chairperson), Martin Colombatto, and Mark E. Saad, who currently comprise our audit committee, and Martin Colombatto (Chairperson), Richard Mejia, Jr., and William R. Enquist, who currently comprise our compensation committee, and Mark E. Saad (Chairperson), Maurice Buchbinder, M.D., and William R. Enquist, Jr., who currently comprise our nominating and corporate governance committee, satisfy the independence standards for those committees established by applicable Securities and Exchange Commission, or SEC, rules and the listing standards of the NYSE.

In making these determinations, our board of directors considered the relationships that each non-employee director has with us and all other facts and circumstances our board of directors deemed relevant in determining their independence, including consulting relationships, family relationships and the beneficial ownership of our capital stock by each non-employee director.

There are currently no family relationships among any of our directors or executive officers. For a description of the prior family relationships among our directors or executive officers, see the section entitled “Certain Relationships and Related Party Transactions: Certain Family Relationships.”

As described below, our board of directors is led by directors Dean Irwin and Martin Colombatto. Mr. Irwin founded Ra Medical and has served as our Chief Executive Officer, Chief Technology Officer and Chairman of the Board since September 2002 and as Co-President since May 2018. In addition, Mr. Colombatto, an independent director with substantial executive leadership experience, currently serves as our Lead Director.

Lead Director

Our corporate governance principles require that we designate one independent, non-employee director to serve as Lead Director at any time when our Chief Executive Officer serves as the Chairman of our board of directors or if the Chairman is not otherwise independent. Mr. Colombatto has served as our Lead Director since September 2018. The board chose Mr. Colombatto as our Lead Director because of his substantial executive experience in the technology industry. As Lead Director, Mr. Colombatto’s responsibilities include:

| • | coordinating and moderating executive sessions of our independent directors; |

| • | advising Mr. Irwin as to the quality, quantity, and timeliness of the flow of information from management that is necessary for the independent directors to effectively and responsibly perform their duties; |

| • | confirming the agenda with Mr. Irwin for meetings of our board of directors; |

| • | holding regular update sessions with Mr. Irwin; |

| • | acting as the principal liaison between the independent directors and Mr. Irwin on sensitive issues; and |

| • | performing such other duties as our board of directors may from time to time delegate to the Lead Director to assist our board of directors in the fulfillment of its responsibilities. |

Our board believes that these responsibilities of the Lead Director appropriately and effectively complement Ra Medical’s combined chairman and chief executive officer structure as described below.

-12-

Our corporate governance principles provide that the board will fill the chairman and chief executive officer positions based upon the board’s view of what is in our best interests at any point in time. Our board of directors believes that Mr. Irwin’s service as both chairman and chief executive officer, in combination with Mr. Colombatto’s service as Lead Director, is in the best interests of Ra Medical Systems and its stockholders.

Given his long tenure with and status within Ra Medical Systems, our board of directors believes Mr. Irwin possesses detailed and in-depth knowledge of the issues, opportunities, and challenges facing Ra Medical Systems, and we believe he is best positioned, in consultation with Mr. Colombatto, to develop agendas that ensure that the board’s time and attention are focused on the most critical matters. We also believe his combined role enables decisive leadership, ensures clear accountability, and enhances Ra Medical Systems’ ability to communicate its message and strategy clearly and consistently to its stockholders, employees, and customers.

In addition, we believe the working relationship between Mr. Irwin and Mr. Colombatto, on the one hand, and between Mr. Colombatto and the other independent directors, on the other, enhances and facilitates the flow of information between management and our board as well as the ability of our independent directors to evaluate and oversee management and its decision-making. Mr. Irwin and Mr. Colombatto speak regularly on strategic, operational, and management matters facing Ra Medical Systems. In addition, as discussed below, our board of directors holds executive sessions consisting only of non-employee directors in conjunction with each regular quarterly meeting of the board, and Mr. Colombatto and Mr. Irwin discuss board feedback to management following these executive sessions.

Role of Board in Risk Oversight Process

One of the key functions of our board of directors is informed oversight of our risk management process. Our board of directors does not have a standing risk management committee, but rather administers this oversight function directly through the board of directors as a whole, as well as through its standing committees that address risks inherent in their respective areas of oversight. In particular, our board of directors is responsible for monitoring and assessing strategic risk exposure. Our audit committee is responsible for reviewing and discussing our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies with respect to risk assessment and risk management. Our audit committee also monitors compliance with legal and regulatory requirements and reviews related party transactions, in addition to oversight of the performance of our external audit function. Our nominating and corporate governance committee assists our board of directors in fulfilling its oversight responsibilities with respect to the management of risk associated with board organization, membership and structure, and corporate governance. Our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. The board believes its leadership structure is consistent with and supports the administration of its risk oversight function.

During our fiscal year ended December 31, 2018, our board of directors held fifteen (15) meetings (including regularly scheduled and special meetings), and each director attended at least 75% of the aggregate of (i) the total number of meetings of our board of directors held during the period for which he has been a director and (ii) the total number of meetings held by all committees of our board of directors on which he served during the periods that he served.

It is the policy of our Board to regularly have separate meeting times for independent directors without management. Although we do not have a formal policy regarding attendance by members of our board of directors at annual meetings of stockholders, we encourage, but do not require, our directors to attend.

-13-

Our board of directors has an audit committee, a compensation committee and a nominating and corporate governance committee, each of which has the composition and the responsibilities described below. We believe that the composition of these committees meets the criteria for independence under, and the functioning of these committees comply with the requirements of, the Sarbanes-Oxley Act of 2002, the rules of the NYSE, and SEC rules and regulations.

Audit Committee

The members of our audit committee are Richard Mejia, Jr., Martin Colombatto and Mark E. Saad. Mr. Mejia serves as the chairperson of our audit committee. Our board of directors has determined that each of the members of our audit committee is an independent director under the NYSE listing rules, satisfies the additional independence criteria for audit committee members and satisfies the requirements for financial literacy under the NYSE listing rules and Rule 10A-3 of the Exchange Act, as applicable. Our board has also determined that Mr. Mejia qualifies as an audit committee financial expert within the meaning of the applicable rules and regulations of the SEC and satisfies the financial sophistication requirements of the NYSE listing rules.

Our audit committee oversees our corporate accounting and financial reporting process and assists our board of directors in monitoring our financial systems and our legal and regulatory compliance. Our audit committee responsibilities also include, among other things:

| • | selecting and hiring the independent registered public accounting firm to audit our financial statements; |

| • | overseeing the performance of the independent registered public accounting firm and taking those actions as it deems necessary to satisfy itself that the accountants are independent of management; |

| • | reviewing financial statements and discussing with management and the independent registered public accounting firm our annual audited and quarterly financial statements, the results of the independent audit and the quarterly reviews, and the reports and certifications regarding internal control over financial reporting and disclosure controls; |

| • | preparing the audit committee report that the SEC requires to be included in our annual proxy statement; |

| • | reviewing the adequacy and effectiveness of our internal controls and disclosure controls and procedures; |

| • | overseeing our policies on risk assessment and risk management; |

| • | reviewing related party transactions; and |

| • | approving or, as required, pre-approving, all audit and all permissible non-audit services and fees to be performed by the independent registered public accounting firm. |

Our audit committee operates under a written charter approved by our board of directors and that satisfies the applicable rules and regulations of the SEC and the listing requirements of NYSE. The charter is available on our website, www.ramed.com, under the Investor Relations tab under Governance. Our audit committee held two (2) meetings during 2018.

-14-

The members of our compensation committee are Martin Colombatto, William R. Enquist, Jr. and Richard Mejia, Jr. Mr. Colombatto serves as the chairperson of our compensation committee. Our board of directors has determined that each member of our compensation committee is an independent director under the current rules of NYSE, satisfies the additional independence criteria for compensation committee members under Rule 10C-1 and the NYSE listing rules and is a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act.

Our compensation committee oversees our corporate compensation programs. The compensation committee responsibilities also include, among other things:

| • | reviewing and approving or recommending to the board for approval compensation of our executive officers; |

| • | reviewing and recommending to the board for approval compensation of directors; |

| • | overseeing our overall compensation philosophy and compensation policies, plans and benefit programs for service providers, including our executive officers; |

| • | reviewing, approving and making recommendations to our board of directors regarding incentive compensation and equity plans; and |

| • | administering our equity compensation plans. |

Our compensation committee operates under a written charter approved by our board of directors and that satisfies the applicable rules and regulations of the SEC and the listing requirements of NYSE. The charter is available on our website, www.ramed.com, under the Investor Relations tab under Governance. Our compensation committee held two (2) meetings during 2018.

Nominating and Corporate Governance Committee

The members of our nominating and corporate governance committee are Mark E. Saad, Maurice Buchbinder and William R. Enquist, Jr. Mr. Saad serves as the chairperson of our nominating and corporate governance committee. All members of our nominating and corporate governance committee meet the requirements for independence under current NYSE listing standards and SEC rules and regulations. The nominating and corporate governance committee oversees our nominations for directors and corporate governance matters. The nominating and corporate governance committee responsibilities also include, among other things:

| • | identifying, evaluating and selecting, or making recommendations to our board of directors regarding, nominees for election to our board of directors and its committees; |

| • | evaluating the performance of our board of directors and of individual directors; |

| • | considering and making recommendations to our board of directors regarding the composition of our board of directors and its committees; and |

| • | developing and making recommendations to our board of directors regarding corporate governance guidelines and matters. |

-15-

Our nominating and corporate governance committee operates under a written charter approved by our board of directors and that satisfies the applicable rules and regulations of the SEC and the listing requirements of NYSE. The charter is available on our website, www.ramed.com, under the Investor Relations tab under Governance. Our nominating and corporate governance committee held one (1) meeting during 2018.

Compensation Committee Interlocks and Insider Participation

None of our executive officers currently serves, or in the past year has served, as a member of the compensation committee, or other board committee performing equivalent functions (or in the absence of any such committee, the entire board of directors) or director of any entity that has one or more executive officers serving on our compensation committee or our board of directors. None of the members of our compensation committee during the last fiscal year, which included Martin Colombatto, William R. Enquist, Jr. and Richard Mejia, Jr. is or has been an officer or employee of the Company.

Considerations in Evaluating Director Nominees

The nominating and corporate governance committee uses the following procedures to identify and evaluate any individual recommended or offered for nomination to the Board:

| • | The nominating and corporate governance committee will consider candidates recommended by stockholders in the same manner as candidates recommended to the nominating and corporate governance committee from other sources. |

| • | In its evaluation of director candidates, including the members of the Board eligible for re-election, the nominating and corporate governance committee will consider the following: |

| o | The current size and composition of the Board and the needs of the Board and the respective committees of the Board. |

| o | Such factors as character, integrity, judgment, diversity of background (including gender diversity) and experience, independence, area of expertise, corporate experience, length of service, potential conflicts of interest, other commitments and the like. The nominating and corporate governance committee evaluates these factors, among others, and does not assign any particular weighting or priority to any of these factors. |

| o | Other factors that the nominating and corporate governance committee may consider appropriate. |

The nominating and corporate governance committee evaluates all incumbent, replacement or additional nominees for election as directors, taking into account (i) all factors the committee considers appropriate, which may include career specialization, relevant technical skills or financial acumen, diversity of viewpoint and industry knowledge, and (ii) the following minimum qualifications:

| • | the highest personal and professional ethics and integrity; |

| • | proven achievement and competence in the nominee’s field and the ability to exercise sound business judgment; |

| • | skills that are complementary to those of the existing board; |

-16-

| • | the ability to assist and support management and make significant contributions to the Company’s success; and |

| • | an understanding of the fiduciary responsibilities required of a member of the board and the commitment of time and energy necessary to diligently carry out those responsibilities. |

The nominating and corporate governance committee also focuses on issues of diversity, such as diversity of gender, race, and national origin, education, professional experience and differences in viewpoints and skills. The nominating and corporate governance committee believes that it is essential that members of our board of directors represent diverse viewpoints.

If our nominating and corporate governance committee determines that an additional or replacement director is required, the nominating and corporate governance committee may take such measures as it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the nominating and corporate governance committee, board, or management.

The nominating and corporate governance committee may propose to the Board a candidate recommended or offered for nomination by a stockholder as a nominee for election to the Board.

Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors and our board of directors has the final authority in determining the selection of director candidates for nomination to our board. After completing its review and evaluation of director candidates, our board of directors, upon recommendation of our nominating and corporate governance committee, unanimously recommends Messrs. Irwin and Saad, the director nominees, for election as Class I directors to serve until our 2022 annual meeting of stockholders or until their respective successors are duly elected and qualified.

Stockholder Recommendations for Nominations to Our Board of Directors

It is the policy of our nominating and corporate governance committee to consider recommendations for candidates to our board of directors from our stockholders holding no less than one percent (1%) of the outstanding shares of the Company’s common stock continuously for at least twelve (12) months prior to the date of the submission of the recommendation or nomination. A stockholder that wishes to recommend a candidate for consideration by the committee as a potential candidate for director must direct the recommendation in writing to Ra Medical Systems, Inc., 2070 Las Palmas Drive, Carlsbad, California 92011, Attention: Corporate Secretary, and must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between us and the candidate and evidence of the recommending stockholder’s ownership of our stock. Such recommendation must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for board membership, including issues of character, integrity, judgment, and diversity of experience, independence, area of expertise, corporate experience, length of service, potential conflicts of interest, other commitments and the like and personal references. Our board of directors will consider the recommendation but will not be obligated to take any further action with respect to the recommendation.

-17-

A stockholder that instead desires to nominate a person directly for election to the Board at an annual meeting of the stockholders must meet the deadlines and other requirements set forth in Section 2.4 of the Company’s Bylaws and the rules and regulations of the Securities and Exchange Commission. Section 2.4 of the Company’s Bylaws requires that a stockholder who seeks to nominate a candidate for director must provide a written notice to the Secretary of the Company not later than the 45th day nor earlier than the 75th day before the one-year anniversary of the date on which the corporation first mailed its proxy materials or a notice of availability of proxy materials (whichever is earlier) for the preceding year’s annual meeting; provided, however, that in the event that no annual meeting was held in the previous year or if the date of the annual meeting is advanced by more than 30 days prior to or delayed by more than 60 days after the one-year anniversary of the date of the previous year’s annual meeting, then notice by the stockholder to be timely must be so received by the Secretary of the Company not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of (i) the 90th day prior to such annual meeting and (ii) the 10th day following the day on which Public Announcement (as defined below) of the date of such annual meeting is first made. That notice must state the information required by Section 2.4 of the Company’s Bylaws, and otherwise must comply with applicable federal and state law. The Secretary of the Company will provide a copy of the Bylaws upon request in writing from a stockholder. “Public Announcement” shall mean disclosure in a press release reported by the Dow Jones News Service, Associated Press or a comparable national news service or in a document publicly filed by the corporation with the Securities and Exchange Commission pursuant to Section 13, 14 or 15(d) of the Securities Exchange Act of 1934, as amended, or any successor thereto.

Communications with the Board of Directors

The Board believes that management speaks for the Company. Individual Board members may, from time to time, communicate with various constituencies that are involved with the Company, but it is expected that Board members would do this with knowledge of management and, in most instances, only at the request of management.

In cases where stockholders or other interested parties wish to communicate directly with our non-management directors, messages can be sent to Ra Medical Systems, Inc., 2070 Las Palmas Drive, Carlsbad, California 92011, Attention: Corporate Secretary. Our corporate secretary monitors these communications and will provide a summary of all received messages to the board at each regularly scheduled meeting. Our board typically meets on a quarterly basis. Where the nature of a communication warrants, our Secretary may determine, in his or her judgment, to obtain the more immediate attention of the appropriate committee of the board or non-management director, of independent advisors or of our management, as our Secretary considers appropriate.

Our Secretary may decide in the exercise of his or her judgment whether a response to any stockholder or interested party communication is necessary.

This procedure for stockholder and other interested party communications with the non-management directors is administered by our nominating and corporate governance committee. This procedure does not apply to (a) communications to non-management directors from our officers or directors who are stockholders, (b) stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act, or (c) communications to the audit committee pursuant to our procedures for complaints regarding accounting and auditing matters.

-18-

Corporate Governance Principles and Code of Ethics and Conduct

Our board of directors has adopted corporate governance principles. These principles address items such as the qualifications and responsibilities of our directors and director candidates and corporate governance policies and standards applicable to us in general. In addition, our board of directors has adopted a written code of ethics and conduct that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of our corporate governance principles and code of ethics and conduct are available on our website, www.ramed.com, under the Investor Relations tab under Governance, then Governance Documents. If we make any substantive amendments to, or grant any waivers from, the code of ethics and conduct for any officer or director, we will disclose the nature of such amendment or waiver on our website.

In connection with our initial public offering, our board of directors retained Compensia, a national compensation consultant, to provide our board of directors with an analysis of market data compiled from certain comparable public companies and assistance in determining compensation of directors. Our board of directors adopted our Outside Director Compensation Policy which provides that, following our initial public offering, each non-employee director is entitled to receive the following cash compensation for their services:

| • | $40,000 retainer per year for each non-employee director; |

| • | $40,000 retainer per year for service as non-employee chairman of the board of directors; |

| • | $30,000 retainer per year for service as lead non-employee director; |

| • | $20,000 retainer per year for the chairman of the audit committee or $10,000 retainer per year for each other member of the audit committee; |

| ��� | $15,000 retainer per year for the chairman of the compensation committee or $7,000 retainer per year for each other member of the compensation committee; and |

| • | $8,500 retainer per year for the chairman of the nominating and corporate governance committee or $4,500 retainer per year for each other member of the nominating and corporate governance committee. |

In addition to the cash compensation structure described above, our Outside Director Compensation Policy provides the following equity incentive compensation program for non-employee directors. Each non-employee director who first joins us (other than a director who becomes a non-employee director as a result of terminating employment with us) automatically is granted on the first trading date on or after his or her start date as a non-employee director a one-time, initial restricted stock unit award with a value of $140,000. Further, on the date of each of our annual stockholder meetings, each non-employee director who is continuing as a director following our annual stockholder meeting automatically will be granted an annual restricted stock unit award with a value of $100,000. Unless otherwise determined by our board of directors or our compensation committee, the number of restricted stock units subject to such awards will be determined based on the per share fair market value of our common stock on the applicable grant date. Each initial restricted stock unit award vests as to 1/3rd of the award on each of the first three anniversaries of the date the director’s service as a non-employee director started, subject to continued service through each relevant vesting date. Each annual restricted stock unit award will vest as to 100% of the underlying shares on the earlier of the one-year anniversary of the award’s grant date or the day before the date of our annual stockholder meeting next following the

-19-

award’s grant date, subject to continued service through such date. In the event of a change in control of our company, all equity awards granted to a non-employee director (including those granted pursuant to our Outside Director Compensation Policy) will fully vest and become immediately exercisable, subject to continued service through such date.

For compensation awarded following our initial public offering, in any fiscal year, a non-employee director may be paid, issued or granted cash compensation and equity awards with a total value of no greater than $500,000 (with the value of an equity award based on its grant date fair value for purposes of this limit), or the annual director limit. Equity awards or cash compensation granted to a non-employee director while he or she was an employee or consultant (other than a non-employee director) will not count toward the annual director limit.

Our Outside Director Compensation Policy also provides for the reimbursement of our non-employee directors for reasonable, customary and documented travel expenses to attend meetings of our board of directors and committees of our board of directors.

Compensation for our non-employee directors is not limited to the equity awards and payments set forth in our Outside Director Compensation Policy. Our non-employee directors remain eligible to receive equity awards and cash or other compensation outside of the Outside Director Compensation Policy, as may be provided from time to time at the discretion of our board of directors.

Outside Director Awards in Connection with Our Initial Public Offering

In addition to the equity awards received under our Outside Director Compensation Policy, our board of directors approved a grant to each non-employee director serving at the time of effectiveness of our initial registration statement on Form S-8 of an award of restricted stock units pursuant to the terms of our 2018 Equity Incentive Plan and form of restricted stock unit agreement thereunder. Each award was granted effective as of the effectiveness of our initial registration statement on Form S-8 and was for a number of restricted stock units determined by dividing $140,000 by our initial public offering price, or 8,235 RSUs. Each such RSU award vests as to 1/3 of the shares subject to each award on the first three anniversaries of October 4, 2018, subject to continued service through each relevant vesting date. In the event of a change of control of our company, such awards will fully vest and become immediately exercisable, subject to continued service through such date.

Our 2018 Equity Incentive Plan, or the 2018 Plan, provides that in the event of a merger or change in control, as defined in our 2018 Plan, each outstanding equity award granted under our 2018 Plan that is held by a non-employee director will fully vest, all restrictions on the shares subject to such award will lapse, and with respect to awards with performance-based vesting, all performance goals or other vesting criteria will be deemed achieved at 100% of target levels, and all of the shares subject to such award will become fully exercisable, if applicable.

-20-

2018 Director Compensation Table

The following table sets forth information regarding compensation earned or paid to our directors during the year ended December 31, 2018.

Name |

| Fees Earned or Paid in Cash ($) |

|

| Stock Awards ($) (1) |

|

| Option Awards ($) (1) |

|

| All Other Compensation ($) |

|

| Total ($) |

| |||||

Maurice Buchbinder (2) |

|

| 11,612 |

|

|

| 993,953 |

| (9) |

| 542,220 |

| (9) |

| — |

|

|

| 1,547,785 |

|

Martin Burstein (3) |

|

| — |

|

|

| 5,187,495 |

| (9) |

| 2,478,720 |

| (9) |

| — |

|

|

| 7,666,215 |

|

Martin Colombatto (4) |

|

| 24,791 |

|

|

| 993,953 |

| (9) |

| 542,220 |

| (9) |

| — |

|

|

| 1,560,964 |

|

William R. Enquist, Jr. (5) |

|

| 13,439 |

|

|

| 114,467 |

|

|

| — |

|

|

| — |

|

|

| 127,906 |

|