The average monthly notional value of the short futures contracts and long swap contracts during the year ended January 31, 2024, was ($99,207) and $1,538,462, respectively.

Balance Sheet Offsetting Information

During the ordinary course of business, the Fund may enter into transactions subject to enforceable netting agreements or other similar arrangements (“netting agreements”). Generally, the right to offset in netting agreements allows the Fund to offset any exposure to a specific counterparty with any collateral received or delivered to that counterparty based on the terms of the agreement. Generally, the Fund manages its cash collateral and securities collateral on a counterparty basis. As of January 31, 2024, the Fund was not subject to any netting agreements.

The following table provides a summary of offsetting financial liabilities and derivatives and the effect of derivative instruments on the Statement of Assets and Liabilities as of January 31, 2024.

| | | | | | | | | | | | |

| | | | | | | | | in Statement of Assets and Liabilities |

| | | Gross Amounts of

Recognized

Assets/Liabilities | | Gross Amounts Offset in

Statement of Assets | | Net Amounts of

Assets/Liabilities Presented in

Statement of | | | | | | |

| | | | | | | | | | | | |

| Futures Contracts | | $94 | | $– | | $94** | | $– | | $– | | $94 |

| | | | | | | | | | | | |

| Swaps | | $102,890 | | $– | | $102,890*** | | $– | | $102,890 | | $– |

| Reverse Repurchase Agreements | | $1,549,393 | | $– | | $1,549,393 | | $1,549,393 | | $– | | $– |

| * | The amount is limited to the net amounts of financial assets and liabilities and accordingly does not include excess collateral pledged. |

24

Angel Oak Strategic Credit Fund

Notes to the Financial Statements - (continued)

NOTE 4. DERIVATIVE TRANSACTIONS – (continued)

| ** Represents | the value of unrealized appreciation (depreciation) as presented in the Schedule of Open Futures Contracts, which is included in deposit at broker for futures on the Statement of Assets and Liabilities. |

| *** | Represents the value of unrealized appreciation (depreciation) as presented in the Schedule of Centrally Cleared Credit Default Swaps, which is included in deposit at broker for swaps on the Statement of Assets and Liabilities. |

NOTE 5. FEES AND OTHER RELATED PARTY TRANSACTIONS

Under the terms of the investment advisory agreement, on behalf of the Fund (the “Agreement”), the Adviser manages the Fund’s investments subject to oversight of the Trustees. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 1.25% of the average daily net assets of the Fund.

From April 1, 2020, through December 31, 2022, the Adviser contractually agreed to waive its fees and/or reimburse certain expenses (exclusive of any

front-end

sales loads, taxes, interest on borrowings, dividends on securities sold short, brokerage commissions,

12b-1

fees, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization and extraordinary expenses) to limit the Total Annual Fund Operating Expenses after fee waiver/expense reimbursement to 0.75% (“Expense Limit”) of the Fund’s average daily net assets. Effective January 1, 2023, the Expense Limit was terminated. Prior to January 1, 2023, the Expense Limit excluded certain expenses and consequently, the total annual fund operating expenses after fee waiver/expense reimbursement may have been higher than the Expense Limit.

The Adviser may recoup from the Fund any waived amount or reimbursed expenses with respect to the Fund pursuant to the prior agreement if such recoupment does not cause the Fund to exceed the Expense Limit in place at the time of the waiver and the recoupment is made within three years after the end of the month in which the Adviser incurred the expenses. During the year ended January 31, 2024, the Adviser had $487,007 of previously waived expenses expire. The amounts subject to repayment by the Fund, pursuant to the aforementioned conditions at January 31, 2024, are included in the table below.

| | | | |

| | | | |

| $972,655 | | $366,867 | | $605,788 |

Quasar Distributors, LLC, a wholly-owned subsidiary of Foreside Financial Group, LLC (doing business as ACA Group) (“the Distributor”), acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares.

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”), an indirect wholly-owned subsidiary of U.S. Bancorp, serves as the Fund’s Administrator (“Administrator”) and, in that capacity, performs various administrative and accounting services for the Fund. Fund Services also serves as the Fund’s fund accountant and transfer agent. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s custodian; coordinates the preparation and payment of the Fund’s expenses and reviews the Fund’s expense accruals. As compensation for its services, the Administrator is entitled to a monthly fee at an annual rate based upon the average daily net assets of the Fund. U.S. Bank, N.A. (the “Custodian”) serves as custodian to the Fund.

The Fund makes reimbursement payments to the Adviser for the salary associated with the office of the Chief Compliance Officer. The compliance fees expensed by the Fund during the year ended January 31, 2024, are included in the Statement of Operations.

Certain officers, Trustees and shareholders of the Fund are also owners or employees of the Adviser and may be compensated by the Fund.

NOTE 6. INVESTMENT TRANSACTIONS

For the year ended January 31, 2024, purchases and sales of investment securities, other than short-term investments and short- term U.S. Government securities, were as follows:

25

Angel Oak Strategic Credit Fund

Notes to the Financial Statements - (continued)

NOTE 6. INVESTMENT TRANSACTIONS – (continued)

For the year ended January 31, 2024, there were $2,977,969 of long-term purchases and $6,821,483 of long-term sales of U.S. Government securities for the Fund. These amounts are included in the aggregate purchases and sales of the investment securities displayed in the table above.

NOTE 7. REPURCHASE OFFERS

Shares repurchased during the year ended January 31, 2024, were as follows (See Note 1):

| | | | | | | | | | | | |

| | Repurchase

Request Deadline | | NAV on

Repurchase

Pricing Date | | Percentage of

Outstanding Shares the

Fund Offered to

Repurchase | | Number of

Shares the Fund

Offered to

Repurchase | | Percentage of

Shares Repurchased to | | Number of

Shares

Repurchased |

| February 24, 2023 | | March 17, 2023 | | $20.59 | | 5.0% | | 200,293 | | 0.4% | | 17,720 |

| May 26, 2023 | | June 16, 2023 | | $20.35 | | 5.0% | | 209,447 | | 0.3% | | 14,328 |

| August 25, 2023 | | September 15, 2023 | | $20.61 | | 5.0% | | 228,319 | | 0.5% | | 24,873 |

| November 24, 2023 | | December 15, 2023 | | $20.67 | | 5.0% | | 228,840 | | 0.2% | | 9,706 |

NOTE 8. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the 1940 Act. At January 31, 2024, Charles Schwab & Co., Inc. owned, as record shareholder, 75.87% of the outstanding shares of the Fund.

NOTE 9. FEDERAL TAX INFORMATION

The tax characterization of distributions paid for the year ended January 31, 2024, and January 31, 2023, were as follows:

| | | | | | | | |

| | | | | | | |

| | | | | | | | |

| Ordinary Income | | $ | 7,392,868 | | | $ | 5,189,444 | |

| Net Long-Term Capital Gain | | | – | | | | – | |

At January 31, 2024, the components of distributable earnings (accumulated deficit) on a tax basis were as follows:

| | | | |

| | | | |

| Tax Cost of Investments | | | $100,126,653 | |

| Unrealized Appreciation* | | | 2,907,648 | |

| Unrealized Depreciation* | | | (5,794,528) | |

Net Unrealized Appreciation (Depreciation )* | | | ($2,886,880) | |

| Undistributed Ordinary Income | | | 424,096 | |

| Undistributed Long-Term Gain (Loss) | | | – | |

| | | $424,096 | |

| Other Accumulated Gain (Loss) | | | (1,213,226) | |

Total Distributable Earnings (Accumulated Deficit) | | | ($3,676,010) | |

| * | Represents aggregated amounts of Fund’s investments, reverse repurchase agreements, futures, and swaps. |

The temporary differences between book basis and tax basis in the Fund are primarily attributable to dividends payable and future contract marked-to-market.

As of January 31, 2024, the Fund had available for federal tax purposes an unused capital loss carryforward of $812,853. For the year ended January 31, 2024, the Fund utilized $655,475 of capital loss carryforwards.

26

Angel Oak Strategic Credit Fund

Notes to the Financial Statements - (continued)

NOTE 9. FEDERAL TAX INFORMATION – (continued)

To the extent these carryforwards are used to offset futures gains, it is probable that the amount offset will not be distributed to shareholders. The carryforward expires as follows:

| | |

| | | |

| No expiration short-term | | $– |

| No expiration long-term | | $812,853 |

| | $812,853 |

Certain capital losses incurred after October 31 and within the current taxable year, are deemed to arise on the first business day of the Fund’s following taxable year. For the tax year ended January 31, 2024, the Fund did not defer any post-October losses.

NOTE 10. ACCOUNTING PRONOUNCEMENTS AND/OR REGULATORY UPDATES

In June 2022, the FASB issued Accounting Standards Update 2022-03, which amends

Fair Value Measurement (Topic 820): Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions

(“ASU 2022-03”). ASU 2022-03 clarifies guidance for fair value measurement of an equity security subject to a contractual sale restriction and establishes new disclosure requirements for such equity securities. ASU 2022-03 is effective for fiscal years beginning after December 15, 2023, and for interim periods within those fiscal years, with early adoption permitted. Management is currently evaluating the impact of these amendments on the financial statements for the fiscal year ending January 31, 2025.

In December 2022, the FASB issued an Accounting Standards Update, ASU 2022-06,

Reference Rate Reform (Topic 848) – Deferral of the Sunset Date of Topic 848

(“ASU 2022-06”). ASU 2022-06 is an amendment to ASU 2020-04,

which provided optional guidance to ease the potential accounting burden due to the discontinuation of the LIBOR and other

interbank-offered based reference rates and which was effective as of March 12, 2020, through December 31, 2022. ASU 2022-06

extends the effective period through December 31, 2024. Management is currently evaluating the impact, if any, of applying ASU

2022-06.

NOTE 11. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date these financial statements were issued. This evaluation did not result in any subsequent events that necessitated disclosures and/or adjustments other than the following:

Shares repurchased subsequent to January 31, 2024, were as follows (see Note 1):

| | | | | | | | | | | | |

| | Repurchase Request

Deadline | | NAV on

Repurchase

Pricing Date | | Percentage of

Outstanding Shares

the Fund Offered to

Repurchase | | Number of

Shares the Fund

Offered to

Repurchase | | Percentage of

Shares Repurchased to

Outstanding | | Number of

Shares

Repurchased |

| February 23, 2024 | | March 15, 2024 | | $20.93 | | 5.0% | | 232,428 | | 0.4% | | 17,198 |

27

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

Angel Oak Strategic Credit Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedules of investments, open futures contracts, open reverse repurchase agreements, and centrally cleared credit default swaps – buy protection, of Angel Oak Strategic Credit Fund (the “Fund”) as of January 31, 2024, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of January 31, 2024, the results its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of January 31, 2024, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more funds advised by Angel Oak Capital Advisors, LLC since 2011.

COHEN & COMPANY, LTD.

Milwaukee, Wisconsin

March 29, 2024

28

Additional Information (Unaudited)

1. Shareholder Notification of Federal Tax Status

For the taxable year ended January 31, 2024, certain dividends paid by the Fund may be subject to a maximum tax rate of 23.80% as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The Fund intends to designate the maximum amount allowable as taxed at a maximum rate of 23.80%.

For the taxable year ended January 31, 2024, the Fund paid qualified dividend income of 0.00%.

For the taxable year ended January 31, 2024, the percentage of ordinary income dividends paid by the Fund that qualifies for the dividends received deduction available to corporations was 0.00%.

For the taxable year ended January 31, 2024, the Fund did not pay any ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871(k)2(c).

For the taxable year ended January 31, 2024, the percentage of taxable ordinary income distributions that are designated as interest related dividends under Internal Revenue 871(k)1(c) was 68.47%.

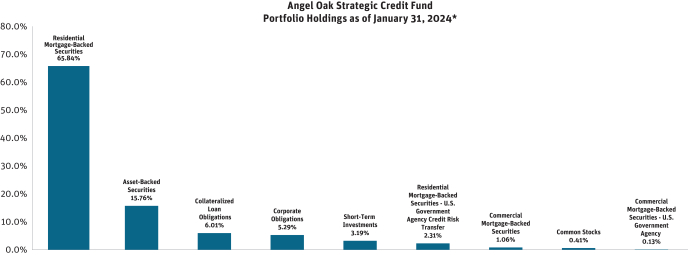

2. Disclosure of Portfolio Holdings

The Fund will file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Part F of Form

N-PORT.

The Fund’s Part F of Form

N-PORT

is available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling

(800) SEC-0230.

3. Proxy Voting Policies and Procedures

A description of the policies and procedures that the Fund uses to determine how to vote proxies related to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, is available without charge upon request by (1) calling the Fund at (855)

751-4324

and (2) from Trust documents filed with the SEC on the SEC’s website at www.sec.gov.

4. Statement Regarding the Basis for the Approval of the Continuance of Investment Advisory Agreement

Pursuant to Section 15(c) of the Investment Company Act of 1940, as amended (the “1940 Act”), at a telephonic meeting held on August 17, 2023, and an

in-person

meeting held on

September 27-28, 2023

(the “Meetings”), the Board of Trustees (the “Board”) of Angel Oak Strategic Credit Fund (the “Fund”) considered the renewal of the Investment Advisory Agreement (the “Investment Advisory Agreement” or the “Agreement”) between the Fund and Angel Oak Capital Advisors, LLC (the “Adviser” or “Angel Oak”) for

a one-year period.

The relevant provisions of the 1940 Act specifically provide that it is the duty of the Board to request and evaluate such information as the Board determines is necessary to allow it to properly consider the renewal of the Agreement, and it is the duty of the Adviser to furnish the Trustees with information that is responsive to their request. Accordingly, in determining whether to renew the Investment Advisory Agreement between the Adviser and the Fund, the Board requested, and the Adviser provided, information and data relevant to the Board’s consideration. This included materials prepared by the Adviser, the Fund’s administrator and an independent third-party data provider (the “Outside Data Provider”) that provided the Board with information regarding the fees and expenses of the Fund, as compared to other

similar closed-end funds.

Following their review and consideration, the Trustees determined that the Investment Advisory Agreement with respect to the Fund would enable shareholders of the Fund to obtain high quality services at a cost that is appropriate, reasonable, and in the best interests of the Fund and its shareholders. Accordingly, the Board, including those Trustees who are not considered to be “interested persons” of the Fund, as that term is defined in the 1940 Act (the “Independent Trustees”), unanimously approved the continuance of the Investment Advisory Agreement. In reaching their decision, the Trustees requested and obtained from the Adviser such information as they deemed reasonably necessary to evaluate the Investment Advisory Agreement. The Trustees also carefully considered the profitability data and comparative fee and expense information prepared by the Adviser. In considering the Investment Advisory Agreement with respect to the Fund, the Trustees evaluated a number of factors that they believed, in light of their reasonable business judgment, to be relevant. They based their decision on the following considerations, among others, although they did not identify any one specific consideration or any particular information that was controlling of their decision:

29

The nature, extent and quality of the advisory services to be provided.

The Trustees concluded that Angel Oak is capable of providing high quality services to the Fund, as indicated by the nature and quality of services provided in the past to the Fund and other registered investment companies advised by Angel Oak (the “Angel Oak Funds”), Angel Oak’s management capabilities demonstrated with respect to the Fund, the professional qualifications and experience of each of the portfolio managers of the Fund, Angel Oak’s investment and management oversight processes, and the competitive investment performance of the Fund. The Trustees also determined that Angel Oak proposed to provide investment advisory services that were of the same quality as services it provided to the Fund in the past, and that these services are appropriate in scope and extent in light of the Fund’s operations, the competitive landscape of the investment company business and investor needs. On the basis of the Trustees’ assessment of the nature, extent and quality of the advisory services provided by Angel Oak, the Trustees concluded that Angel Oak is capable of continuing to generate a level of long-term investment performance that is appropriate in light of the Fund’s investment objective, policies and strategies and competitive with many other comparable investment companies.

The investment performance of the Fund.

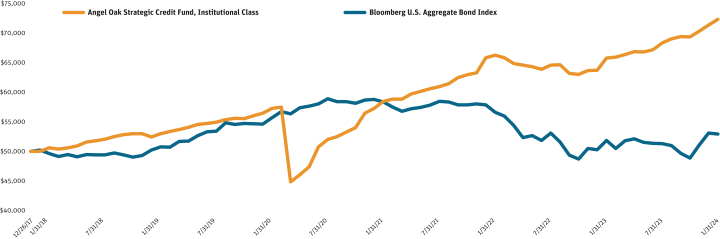

The Trustees concluded on the basis of information derived from independent third-party data that Angel Oak had achieved investment performance that was competitive relative to the Fund’s category, as established by the Outside Data Provider (the “Category”), and a smaller peer group of comparable funds (the “Peer Group”) over longer-term trailing periods, and the Trustees took into consideration the fact that Angel Oak focuses on long-term performance results with respect to its management of the Fund and that the Fund may have periods of underperformance when measured on a more short-term basis. In considering the performance of the Fund, the Trustees reviewed reports comparing the Fund’s performance to: (i) the Peer Group of comparable funds; (ii) the Fund’s Category; and (iii) the Fund’s benchmark index. In addition, the Trustees considered information they had requested comparing the performance of the Fund to that of other funds identified by the Adviser as direct competitors encountered by the Adviser in the context of marketing the Fund, as of June 30, 2023.

The Trustees observed that the Fund’s Institutional Class shares (which commenced operations in December 2017) had ranked in the first quartile of the Fund’s Peer Group over the three- and five-year periods ended June 30, 2023, and the period since the Fund’s inception, and in the fourth quartile of the Fund’s Peer Group over the

one-year

period ended June 30, 2023. The Trustees further noted that the Fund’s Institutional Class shares had outperformed the Fund’s benchmark index, the Bloomberg U.S. Aggregate Bond Index, over the

one-,

three-, and five-year periods ended June 30, 2023, and for the period since the Fund’s inception.

On the basis of the Trustees’ assessment of the nature, extent and quality of advisory services provided by Angel Oak, the Trustees concluded that Angel Oak is capable of generating a level of long-term investment performance that is appropriate in light of the Fund’s investment objectives, policies and strategies and competitive with many other investment companies.

The cost of advisory services provided and the level of profitability.

On the basis of comparative information derived from the expense data provided to the Board, the Trustees determined that the Fund’s management fee was lower than the median management fees of its peer interval funds and that its net expense ratio was lower than the median net expense ratio of its peer interval funds. The Board noted that the quality of services provided by Angel Oak and the past long-term performance of the Angel Oak Funds demonstrated that the advisory fee still offered an appropriate value for the Fund and its shareholders.

The Board also reviewed the fees that Angel Oak charges its other clients for discretionary portfolio management services, noting that the firm has a variety of account types with different fee arrangements,

including non-U.S. registered

funds (e.g., a UCITS fund)

and sub-advised funds

that have investment strategies similar to certain of the Angel Oak Funds. The Board considered the fee rates charged by Angel Oak to manage such funds and accounts. The Board took into account the unique management requirements involved in managing a registered investment company as opposed to other types of funds and accounts.

The Board also reviewed detailed profitability information and considered Angel Oak’s current level of profitability with respect to the Fund, and noted that Angel Oak’s profitability was acceptable and not excessive and consistent with applicable industry averages and that Angel Oak is committed to using its own resources to help improve the services it provides for the benefit of the Fund. The Trustees also noted that Angel Oak has provided information regarding its methodology for attributing profitability to the Fund, as opposed to its other lines of business. The Trustees also took into consideration the nature and extent of expenses that are borne directly by Angel Oak from its own financial resources to help to market and promote the Fund. Accordingly, on the basis of the Board’s review of the fees to be charged by Angel Oak for investment advisory services, the investment advisory and other services provided to the Fund by Angel Oak, and the estimated profitability of Angel Oak’s relationship with the Fund, the Board concluded that the level of investment advisory fees and Angel Oak’s profitability are appropriate in light of the investment advisory fees, overall expense ratios and investment performance of comparable

30

investment companies and the historical profitability of the relationship between the Fund and Angel Oak. The Trustees considered the profitability of Angel Oak both before and after the impact of the marketing-related expenses that Angel Oak incurs out of its own resources in connection with its management of the Fund.

The extent to which economies of scale may be realized as the Fund grows and whether the advisory fee reflects possible economies of scale.

While it was noted that the Fund’s investment advisory fee will not decrease as the Fund’s assets grow because the Fund is not subject to investment advisory fee breakpoints, the Trustees concluded that the Fund’s investment advisory fee was appropriate in light of the projected size of the Fund and appropriately reflects the current economic environment for Angel Oak and the competitive nature of

the closed-end interval

fund market. The Trustees then noted that they would have the opportunity to

periodically re-examine whether

the Fund had achieved economies of scale and the appropriateness of the investment advisory fee payable to Angel Oak with respect to the Fund, in the future, at which time the implementation of fee breakpoints on the Fund could be considered. Finally, the Trustees noted the continued improvements made to the Adviser’s infrastructure and services provided to the Fund, which had been funded by the advisory fees received by the Adviser.

Benefits to Angel Oak from its relationship with the Fund (and any corresponding benefits to the Fund).

The Trustees concluded that other benefits derived by Angel Oak from its relationship with the Fund are reasonable and fair and consistent with industry practice and the best interests of the Fund and its shareholders.

In approving the Investment Advisory Agreement, the Trustees determined that Angel Oak has made a substantial commitment to the recruitment and retention of high-quality personnel, and maintains the financial, compliance and operational resources reasonably necessary to manage the Fund in a professional manner that is consistent with the best interests of the Fund and its shareholders. The Trustees also concluded that Angel Oak has made a significant entrepreneurial commitment to the management and success of the Fund, which entails a substantial financial and professional commitment. The Board also considered matters with respect to the brokerage practices of Angel Oak, including its best-execution procedures, and noted that these were reasonable and consistent with standard industry practice.

Following further discussion and the consideration of questions raised by the Independent Trustees, the Trustees determined that they had received sufficient information relating to the Fund in order to consider the approval of the Investment Advisory Agreement. It was noted that, in making their determinations, the Trustees had considered and relied upon not only the materials provided to them for use at the Meetings with respect to the proposed contract renewal, but also the information about the Fund and Angel Oak that had been provided to them at the Meetings and throughout the past year in connection with their regular Board meetings. In reaching their conclusion with respect to the continuation of the Investment Advisory Agreement and the level of fees paid under the Investment Advisory Agreement, the Trustees did not identify any one single factor as being controlling, but, rather, the Board took note of a combination of factors that had influenced their decision-making process. They noted the level and quality of investment advisory services provided by the Adviser to the Fund, and they found that these services continued to benefit the Fund and its shareholders and also reflected management’s overall commitment to the continued growth and development of the Fund.

5. Compensation of Trustees

Each Trustee who is not an “interested person” (i.e., an “Independent Trustee”) of the Fund Complex (which includes affiliated registrants not discussed in this report) receives an annual retainer of $65,000

(pro-rated

for any periods less than one year) paid quarterly as well as $12,000 for attending each regularly scheduled meeting in connection with his or her service on the Board. In addition, each Committee Chair as well as the Chair of the Board receives additional annual compensation of $12,000

(pro-rated

for any periods less than one year). Independent Trustees are permitted for reimbursement of

expenses incurred in connection with attendance at meetings. The Fund’s Statement of Additional Information includes additional information about the Trustees and is available upon request by calling toll free (855)

751-4324.

The business of the Fund is managed under the oversight of the Board. The Board meets periodically to review the Fund’s performance, monitor investment activities and practices, and discuss other matters affecting the Fund. The Trustees are fiduciaries for the Fund’s shareholders and are governed by the laws of the State of Delaware in this regard. The names and addresses of the Trustees and officers of the Trust are listed below along with a description of their principal occupations over at least the last five years. The address of each Trustee and Officer of the Trust is c/o Angel Oak Capital Advisors, LLC, 3344 Peachtree Road NE, Suite 1725, Atlanta, GA 30326. The Fund’s Statement of Additional Information includes additional information about the Trustees and is available upon request by calling toll free (855)

751-4324.

31

| | | | | | | | | | |

Name and

Year of Birth | | Position with

the Trust | | Term of Office

and Length of

Time Served | | Principal

Occupation(s) During

Past 5 Years | | Number of

Portfolios

in Fund

Complex

Overseen

by Trustee

| | Other Directorships Held

During the Past 5 Years |

|

Ira P. Cohen 1959 | | Independent Trustee, Chair | | Trustee since 2017, Chair since 2017; indefinite term | | Executive Vice President, Recognos Financial (investment industry data analysis provider) (2015-2021); Independent financial services consultant (since 2005). | | 10 | | Trustee, Valued Advisers Trust (since 2010); Trustee, Apollo Diversified Real Estate Fund (formerly, Griffin Institutional Access Real Estate Fund) (since 2014); Trustee, Angel Oak Funds Trust (since 2014); Trustee, Angel Oak Financial Strategies Income Term Trust (since 2018); Trustee, U.S. Fixed Income Trust (since 2019); Trustee, Angel Oak Credit Opportunities Term Trust (since 2021); Trustee, Angel Oak Dynamic Financial Strategies Income Term Trust (2019-2022); Trustee, Apollo Credit Fund (formerly, Griffin Institutional Access Credit Fund) (2017-2022). |

Alvin R. Albe, Jr. 1953 | | Independent Trustee | | Since 2017; indefinite term | | Retired. | | 10 | | Trustee, Angel Oak Funds Trust (since 2014); Trustee, Angel Oak Financial Strategies Income Term Trust (since 2018); Trustee, Angel Oak Credit Opportunities Term Trust (since 2021); Trustee, Angel Oak Dynamic Financial Strategies Income Term Trust (2019-2022). |