As filed with the Securities and Exchange Commission on February 6, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23293

The Cushing Mutual Funds Trust

(Exact name of registrant as specified in charter)

600 N. Pearl Street, Suite 1205

Dallas, TX 75201

(Address of principal executive offices) (Zip code)

Mark Rhodes

600 N. Pearl Street, Suite 1205

Dallas, TX 75201

(Name and address of agent for service)

214-692-6334

Registrant's telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: November 30, 2022

Item 1. Reports to Stockholders.

Table of Contents

Shareholder Letters (Unaudited) | 1 |

Hypothetical Growth of a $10,000 Investment (Unaudited) | 6 |

Expense Examples (Unaudited) | 8 |

Allocation of Portfolio Assets (Unaudited) | 10 |

Schedules of Investments | 12 |

Statements of Assets & Liabilities | 18 |

Statements of Operations | 19 |

Statements of Changes in Net Assets | 20 |

Financial Highlights | 21 |

Notes to Financial Statements | 25 |

Report of Independent Registered Public Accounting Firm | 35 |

Trustees and Executive Officers (Unaudited) | 37 |

Additional Information (Unaudited) | 39 |

NXG NextGen Infrastructure Fund Shareholder Letter (Unaudited) |

Dear Fellow Shareholder,

For the twelve-month fiscal period ended November 30, 2022 (the “Period”), the NXG NextGen Infrastructure Fund (formerly known as Cushing® NextGen Infrastructure Fund), (Class I shares) (the “Fund”) delivered a -4.19% total return, versus total returns of 7.97% for the S&P Global Infrastructure Index, the Fund’s benchmark index, and -9.23% for the S&P 500 Index . During the period the Fund changed its name to reflect the rebranding of the asset manager.

Market and Strategy Overview

The Fund continues to invest among these themes:

| | ● | Clean & Sustainable Infrastructure – Renewable energy, sustainable and water |

| | ● | Communication & Technology Infrastructure – Data storage, information highway, and payments |

| | ● | Energy Infrastructure – Power and midstream energy |

| | ● | Industrial Infrastructure – Toll roads, freight transportation, ports and airports |

The Period saw a rotation out of high-growth Clean & Sustainable and Communication & Technology names and into more cyclical sectors, such as energy and commodities. The best performing theme for the fund was Energy Infrastructure which benefited from a rally in midstream oil & gas. Underlying oil & gas sector fundamentals remain positive. Key risks to the broader market – higher commodity prices, inflation, and interest rates – could all be relative benefits for midstream. Global demand for hydrocarbons remains resilient. The midstream sector was forced to deal with a “hard landing” in 2020 with the onset of the COVID-19 pandemic. Radical actions were taken, and the sector has reemerged with fortified balance sheets, the highest free cash flow generation in the sector’s history, and an acute focus on shareholder returns.

The quarter saw the passing of the landmark Inflation Reduction Act (IRA) in the US. The bill includes at least $370 billion in benefits to our Clean & Sustainable Infrastructure theme. According to the Energy Information Administration, 82% of new US power capacity additions will be renewables in 2022-241. This legislation will be an even bigger tailwind to this already economic, revolutionary technology. Solar and wind are already the lowest cost of new power generation, at ~$40/MWh unsubsidized2. These credits could reduce the cost up to another 65%, widening the gap to fossil fuel power generation.

Communication & Technology Infrastructure lagged during the period because of the macro trend of growth underperforming. We are firm believers that the secular trends of digitization and the continued development of cloud infrastructure. Global data is doubling every two to three years and 90% of the world’s data has been created since 20193.

Fund Performance & Positioning

The largest contributing sectors to performance were the midstream energy and residential solar equipment. The Fund’s top three biggest contributors were all midstream companies: Energy Transfer (ET), Cheniere Energy (LNG), and Targa Resources (TRGP), which benefitted from increase in strong recovery in demand and subsequent increase in commodity prices.

1 | US Energy Information Administration. “Electric Power Monthly” released 5/24/2022 |

2 | BNEF. “Levelized Cost of Electricity 1H 2022” 6/30/2022 |

3 | BofA. “To the Moon(shots)! – Future Tech Primer” 9/14/2021 |

1

The largest detracting sectors were energy metering & management and data centers. Individually, the Fund’s largest detractors were all Clean & Sustainable Infrastructure companies. Hydrogen company Plug Power (PLUG) was our largest detractor and traded down with other growth stocks and because of disappointing long-term guidance. Fluence Energy (FLNC), and Stem (STEM), both utility-scale battery system providers, underperformed because major cost inflation and US tariffs delaying some projects. We still have conviction in the long-term prospects of these companies and the Fund continues to hold all three names.

Outlook

We believe both that clean energy adoption is on a tremendous growth trajectory and that fossil fuels will be required for years to come. Overall demand for energy has grown consistently for decades and we expect that trend to continue, benefiting Energy Infrastructure and Clean & Sustainable Infrastructure. The digitization of the world is accelerating, and we believe Communication & Technology Infrastructure names are attractively priced.

We truly appreciate your support and look forward to continuing to help you achieve your investment goals.

Sincerely,

Mark Rhodes

Chief Executive Officer and President

The information provided herein represents the opinion of the Fund’s portfolio managers and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice. The opinions expressed are as of the date of this report and are subject to change. The information in this report is not a complete analysis of every aspect of any market, sector, industry, security or the Fund itself. Statements of fact are from sources considered reliable, but the Fund makes no representation or warranty as to their completeness or accuracy. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. Please refer to the Schedule of Investments for a complete list of Fund holdings.

Past performance does not guarantee future results. An investment in the Fund involves risks.

The Fund invests in infrastructure companies, which may be subject to a variety of factors that may adversely affect their business or operations, including high interest costs in connection with capital construction and improvement programs, high leverage, costs associated with environmental and other regulations, the effects of economic slowdown, surplus capacity, increased competition from other providers of services, uncertainties concerning the availability of fuel at reasonable prices, the effects of energy conservation policies and other factors. Sustainable infrastructure investments are subject to certain additional risks including high dependency upon on government policies that support renewable power generation and enhance the economic viability of owning renewable electric generation assets; adverse impacts from the reduction or discontinuation of tax benefits and other similar subsidies that benefit sustainable infrastructure companies; dependency on suitable weather condition and risk of damage to components used in the generation of renewable energy by severe weather; adverse changes and volatility in the wholesale market price for electricity in the markets served; the use of newly developed, less proven, technologies and the risk of failure of new technology to perform as anticipated; and dependence on a limited number of suppliers of system components and the occurrence of shortages, delays or component price changes. There is a risk that regulations that provide incentives for renewable energy could change or expire in a manner that adversely impacts the market for sustainable infrastructure companies generally. Technology and communications infrastructure investments are subject to certain additional risks including rapidly changing technologies and existing product obsolescence; short product life cycles; fierce competition; high research and development costs; aggressive pricing and reduced profit margins; the loss of patent, copyright and trademark protections; cyclical market patterns; evolving industry standards; frequent new product introductions and new market entrants; cyber security risks that include, among other things, theft, unauthorized monitoring, release, misuse, loss, destruction or corruption of confidential and highly restricted data, denial of service attacks, unauthorized access to relevant systems, compromises to networks or devices that the information infrastructure companies use, or operational disruption or failures in the physical infrastructure or operating systems, potentially resulting in, among other things, financial losses, violations of applicable privacy and other laws, regulatory fines, penalties, reputational damage, reimbursement or other compensation costs and/or additional compliance costs.

The Fund incurs operating expenses, including advisory fees. Investment returns for the Fund are shown net of fees and expenses.

2

The S&P 500 Index is an unmanaged index of common stocks that is frequently used as a general measure of stock market performance. The S&P Global Infrastructure Index is designed to track 75 companies from around the world chosen to represent the listed infrastructure industry while maintaining liquidity and tradability. To create diversified exposure, the index includes three distinct infrastructure clusters: energy, transportation, and utilities. Net total returns reflect the deduction of applicable withholding taxes. Indices include the reinvestment of dividends and do not include fees or expenses. It is not possible to invest directly in an index.

3

NXG Global Clean Equity Fund Shareholder Letter (Unaudited) |

Dear Fellow Shareholder,

For the twelve-month period ended November 30, 2022 (the “Period”), the Global Clean Equity Fund (Class I shares) (the “Fund”) delivered a total return of -29.61%, versus a -11.62% total return for the MSCI ACWI Net index, the Fund’s benchmark index. This compares to major clean indices of -23.25% for the NASDAQ Clean Edge Green Energy Index and 11.62% for S&P Global Clean Energy Index.

Market and Strategy Overview

The Period was an exceptionally tough period for growth stocks, including clean energy. The underperformance was not all about macro issues though. The Fund was hit with extreme cost inflation and the US names were materially impacted by tariffs. Despite these headwinds earnings estimates for our clean universe increased during the year. At the end of the period, we believe that these headwinds are abating.

The quarter saw the passing of the landmark Inflation Reduction Act (IRA) in the US. The bill includes at least $370 billion in benefits to our Clean & Sustainable Infrastructure theme. According to the Energy Information Administration, 82% of new US power capacity additions will be renewables in 2022-241. This legislation will be an even bigger tailwind to this already economic, revolutionary technology. Solar and wind are already the lowest cost of new power generation, at ~$40/MWh unsubsidized2. These credits could reduce the cost up to another 65%, widening the gap to fossil fuel power generation. The unsubsidized economic advantages of clean energy will drive adoption. We still see plentiful attractive opportunities in the future.

Fund Performance

Top contributing sectors during the period were solar module manufacturers and water metering & pumps. The largest contributor was Maxeon (MAXN), a solar panel manufacturer. Residential solar inverter manufacturers Enphase Energy (ENPH) and SMA Solar (S92 GR) were the second and third largest single name contributors.

The largest detractors were light EV manufacturers and diversified renewable generation. Individually, Indian renewable project developer Azure Power (AZRE) was the largest detractor following an internal investigation and departure of their CEO. The second and third worst performing stocks, Niu Technology (NIU) and NIO (NIO), are both Chinese EV manufacturers that lagged because of increased Chinese regulation and slowing economy. The Fund still owned all three names at the end of the period.

Outlook

We believe both that clean energy adoption is on a tremendous growth trajectory and that fossil fuels will be required for years to come. Overall demand for energy has grown consistently for decades and we expect that trend to continue. The energy crisis is being caused by rising demand, aging fossil fuel plants and supply disruptions. Solar and wind are the cheapest and quickest to market technologies for electricity production. The investment required to repower with low-cost renewables is massive. BNEF estimates that $4.1 trillion in annual spending will be required through 2050 to meet future demand3.

1 | US Energy Information Administration. “Electric Power Monthly” released 5/24/2022 |

2 | BNEF. “Levelized Cost of Electricity 1H 2022” 6/30/2022 |

3 | BNEF, “New Energy Outlook 2022” |

4

We believe that a broad approach to the clean investing will result in better performance. The Fund invests among these themes:

| | ● | Clean Energy – Renewable energy, sustainable and charging |

| | ● | Clean Infrastructure – Electrical transmission, smart cities, and waste |

| | ● | Clean Transportation – New energy vehicles, batteries, and future mobility |

| | ● | Clean Water – Treatment, management, and infrastructure |

We truly appreciate your support and look forward to continuing to help you achieve your investment goals.

Sincerely,

Mark Rhodes

Chief Executive Officer and President

The information provided herein represents the opinion of the Fund’s portfolio managers and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice. The opinions expressed are as of the date of this report and are subject to change. The information in this report is not a complete analysis of every aspect of any market, sector, industry, security or the Fund itself. Statements of fact are from sources considered reliable, but the Fund makes no representation or warranty as to their completeness or accuracy. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. Please refer to the Schedule of Investments for a complete list of Fund holdings.

Past performance does not guarantee future results. An investment in the Fund involves risks.

The Fund incurs operating expenses, including advisory fees. Investment returns for the Fund are shown net of fees and expenses.

Mutual fund investing involves risk. Principal loss is possible.

Small-cap and mid-cap companies frequently rely on narrower product lines and niche markets and may be more vulnerable to adverse business or market developments. Securities of these types of companies have limited market liquidity, and their prices may be more volatile. There is a risk that the securities issued by companies of a certain market capitalization may underperform the broader market at any given time.

The MSCI ACWI index is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 27 emerging markets. The NASDAQ Clean Edge Green Energy Index is a modified market capitalization-weighted index designed to track the performance of companies that are manufacturers, developers, distributors and/or installers of clean-energy technologies. The indices include reinvested dividends by do not include fees or expenses. It is not possible to invest directly in an index.

5

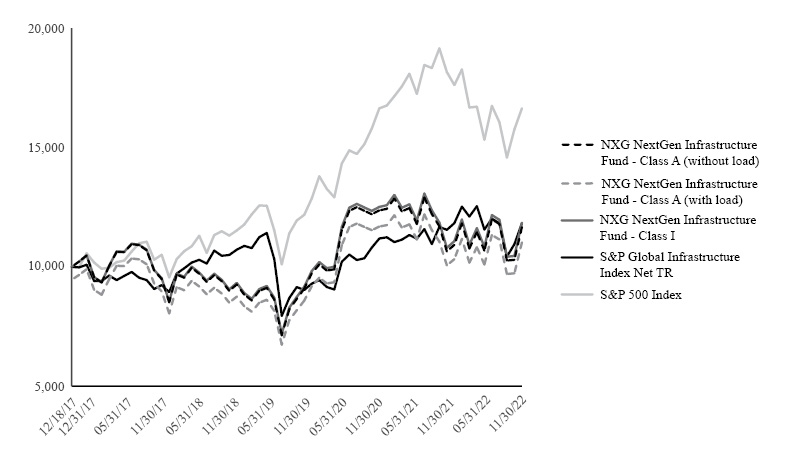

NXG NextGen Infrastructure Fund Hypothetical Growth of a $10,000 Investment (Unaudited) |

AVERAGE ANNUAL RETURNS |

November 30, 2022 | 1 Year | 5 Year | Since

Inception | Inception

Date |

Class A (without sales load) | -4.46% | n/a | 3.15% | 12/18/17 |

Class A (with sales load) | -9.72% | n/a | 1.99% | 12/18/17 |

| | | | | |

Class I(1) | -4.19% | 4.22% | 7.42% | 3/1/10 |

| | | | | |

S&P Global Infrastructure Index Net TR | 7.97% | 3.27% | 6.07% | 3/1/10 |

| | | | | |

S&P 500 Index | -9.21% | 10.98% | 12.91% | 3/1/10 |

(1) | Performance figures for Class I shares reflect the historical performance of the Predecessor Fund for periods prior to December 18, 2017. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 888-878-4080 or by visiting www.cushingfunds.com.

Class A (with sales load) performance reflects the maximum sales charge of 5.50%. Class I is not subject to a sales charge or maximum deferred sales charge.

The S&P Global Infrastructure Index Net TR is designed to track 75 companies from around the world chosen to represent the listed infrastructure industry while maintaining liquidity and tradability. You cannot invest directly in an index.

The S&P 500 Index is an unmanaged index of common stocks that is frequently used as a general measure of stock market performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares.

6

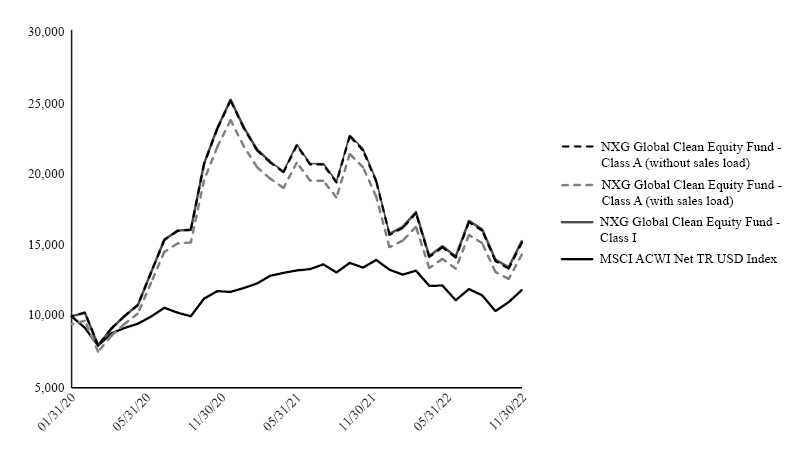

NXG Global Clean Equity Fund Hypothetical Growth of a $10,000 Investment (Unaudited) |

AVERAGE ANNUAL RETURNS |

November 30, 2022 | 1 Year | 5 Year | Since

Inception | Inception

Date |

Class A (without sales load) | -29.81% | n/a | 15.81% | 1/31/20 |

Class A (with sales load) | -33.68% | n/a | 13.53% | 1/31/20 |

| | | | | |

Class I(1) | -29.61% | n/a | 16.10% | 1/31/20 |

| | | | | |

MSCI ACWI Net TR USD Index | -11.62% | n/a | 6.15% | 1/31/20 |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 888-878-4080 or by visiting www.cushingfunds.com.

Class A (with sales load) performance reflects the maximum sales charge of 5.50%. Class I is not subject to a sales charge or maximum deferred sales charge.

The MSCI ACWI Index, MSCI’s flagship global equity index, is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 26 emerging markets. You cannot invest directly in an index.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares.

7

NXG NextGen Infrastructure Fund Expense Example (Unaudited) |

The example below is intended to describe the fees and expenses borne by shareholders during the period from June 1, 2022 through November 30, 2022, and the impact of those costs on your investment.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the fiscal year and held for the entire period from June 1, 2022 through November 30, 2022.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the period from June 1, 2022 through November 30, 2022. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Share Class | | Beginning

Account Value

06/01/22 | | | Ending

Account

Value (Based

on Actual

Returns and

Expenses)

11/30/22 | | | Expenses Paid

During Period1 | | | Ending

Account Value

(Based on

Hypothetical

5% Annualized

Return and

Actual

Expenses)

11/30/22 | | | Expenses Paid

During Period1 | | |

Net Expense

Ratio During

Period2

| |

Class A Shares | | $ | 1,000.00 | | | $ | 1,018.20 | | | $ | 7.59 | | | $ | 1,017.55 | | | $ | 7.59 | | | | 1.50 | % |

Class I Shares | | $ | 1,000.00 | | | $ | 1,019.60 | | | $ | 6.33 | | | $ | 1,018.80 | | | $ | 6.33 | | | | 1.25 | % |

1. | Expenses are equal to the Fund’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 365 and multiplied by 183 (to reflect the period). The table above represents the actual expenses incurred during the period. |

2 | . Expenses are equal to the Fund’s annualized expense ratio to reflect the period. |

8

NXG Global Clean Equity Fund Expense Example (Unaudited) |

The example below is intended to describe the fees and expenses borne by shareholders during the period from June 1, 2022 through November 30, 2022, and the impact of those costs on your investment.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the fiscal year and held for the entire period from June 1, 2022 through November 30, 2022.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the period from June 1, 2022 through November 30, 2022. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Share Class | | Beginning

Account Value

06/01/22 | | | Ending

Account

Value (Based

on Actual

Returns and

Expenses)

11/30/22 | | | Expenses Paid

During Period1 | | | Ending

Account Value

(Based on

Hypothetical

5% Annualized

Return and

Actual

Expenses)

11/30/22 | | | Expenses Paid

During Period1 | | |

Net Expense

Ratio During

Period2

| |

Class A Shares | | $ | 1,000.00 | | | $ | 1,022.60 | | | $ | 7.10 | | | $ | 1,018.05 | | | $ | 7.08 | | | | 1.40 | % |

Class I Shares | | $ | 1,000.00 | | | $ | 1,024.80 | | | $ | 5.84 | | | $ | 1,019.30 | | | $ | 5.82 | | | | 1.15 | % |

1. | Expenses are equal to the Fund’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 365 and multiplied by 183 (to reflect the period). The table above represents the actual expenses incurred during the period. |

2. | Expenses are equal to the Fund’s annualized expense ratio to reflect the period. |

9

NXG NextGen Infrastructure Fund Allocation of Portfolio Assets(1) (Unaudited) November 30, 2022

(Expressed as a Percentage of Total Investments) |

Solar Energy Equipment (2) | | | 10.0 | % |

Solar Equipment (2) | | | 8.8 | % |

Large Cap MLP (3) | | | 7.5 | % |

Solar Generation (2) | | | 5.8 | % |

Towers (2)(4) | | | 5.8 | % |

IT Services (2) | | | 5.5 | % |

LNG Midstream (2) | | | 5.2 | % |

Natural Gas Gathering & Processing (3) | | | 4.9 | % |

Solar Developer (2) | | | 4.4 | % |

Diversified Renewable Generation (2) | | | 3.9 | % |

YieldCo (2)(3) | | | 3.9 | % |

Large Cap Diversified C Corps (2)(3) | | | 3.7 | % |

Short-Term | | | 3.6 | % |

Wind Generation (2) | | | 3.5 | % |

Data Centers (2)(4) | | | 3.5 | % |

Industrials (2) | | | 3.4 | % |

Data Center Software (2) | | | 2.7 | % |

Engineering Metering & Management (2) | | | 2.2 | % |

Hydrogen Equipment (2) | | | 2.1 | % |

Electric Vehicle Charging (2) | | | 2.0 | % |

Battery Manufacturer (2) | | | 1.9 | % |

Energy Metering & Management (2) | | | 1.5 | % |

Wind Energy Equipment (2) | | | 1.2 | % |

Renewable Distribution (2) | | | 1.1 | % |

Communication Services (2) | | | 1.0 | % |

Natural Gas Transportation & Storage (2) | | | 0.9 | % |

| | | | 100.0 | % |

(1) | Fund holdings and sector allocations are subject to change and there is no assurance that the Fund will continue to hold any particular security. |

(3) | Master Limited Partnerships and Related Companies |

(4) | Real Estate Investment Trusts |

10

NXG Global Clean Equity Fund Allocation of Portfolio Assets(1) (Unaudited) November 30, 2022

(Expressed as a Percentage of Total Investments) |

Solar Energy Equipment (2) | | | 22.1 | % |

Solar Generation (2) | | | 9.3 | % |

YieldCo (2) | | | 7.8 | % |

Solar Developer (2) | | | 5.0 | % |

Fuel Cell Generation (2) | | | 4.8 | % |

New Energy Vehicle (2) | | | 4.4 | % |

Short-Term Investments | | | 4.3 | % |

Energy Metering & Management (2) | | | 4.2 | % |

Wind Generation (2) | | | 4.0 | % |

Electric Vehicle OEM (2) | | | 3.6 | % |

Diversified Renewable Generation (2) | | | 3.5 | % |

Industrials (2) | | | 3.4 | % |

Utilities (2) | | | 3.1 | % |

Hydrogen Equipment (2) | | | 3.0 | % |

Electric Vehicle Charging (2) | | | 2.5 | % |

Renewable Generation (2) | | | 2.5 | % |

Battery Manufacturer (2) | | | 2.2 | % |

Metering & Pumps (2) | | | 2.2 | % |

Smart Grid (2) | | | 2.2 | % |

Water Tech & Equipment (2) | | | 1.8 | % |

Wind Energy Equipment (2) | | | 1.4 | % |

Solar Materials (2) | | | 1.2 | % |

Solar Equipment (2) | | | 0.9 | % |

Semiconductor Manufacturing (2) | | | 0.6 | % |

| | | | 100.0 | % |

(1) | Fund holdings and sector allocations are subject to change and there is no assurance that the Fund will continue to hold any particular security. |

11

NXG NextGen Infrastructure Fund |

Schedule of Investments | November 30, 2022 |

| Common Stock — 72.5% | | Shares | | | Fair Value | |

| Battery Manufacturer — 1.9% | | | | | | | | |

Freyr Battery(1)(2) | | | 35,796 | | | $ | 488,615 | |

| | | | | | | | | |

| Communication Services — 1.0% | | | | | | | | |

Infrastrutture Wireless Italiane SpA(1) | | | 26,000 | | | | 259,319 | |

| | | | | | | | | |

| Data Centers — 1.1% | | | | | | | | |

Chindata Group Holdings Ltd.(1)(2) | | | 40,428 | | | | 289,465 | |

| | | | | | | | | |

| Data Center Software — 2.7% | | | | | | | | |

Megaport Ltd.(1)(2) | | | 150,000 | | | | 697,327 | |

| | | | | | | | | |

| Diversified Renewable Generation — 3.9% | | | | | | | | |

Renew Energy Global plc(1)(2) | | | 165,862 | | | | 1,006,782 | |

| | | | | | | | | |

| Electric Vehicle Charging — 2.0% | | | | | | | | |

Chargepoint Holdings, Inc.(2) | | | 17,000 | | | | 211,140 | |

Tritium DCFC Ltd.(1)(2) | | | 185,752 | | | | 297,203 | |

| | | | | | | | 508,343 | |

| Energy Metering & Management — 1.5% | | | | | | | | |

Ameresco, Inc.(2) | | | 5,964 | | | | 390,761 | |

| | | | | | | | | |

| Engineering Metering & Management — 2.2% | | | | | | | | |

Fluence Enercy, Inc.(2) | | | 17,698 | | | | 304,052 | |

STEM, Inc.(2) | | | 19,487 | | | | 254,695 | |

| | | | | | | | 558,747 | |

| Hydrogen Equipment — 2.1% | | | | | | | | |

Nel ASA(1)(2) | | | 338,468 | | | | 527,972 | |

| | | | | | | | | |

| Industrials — 3.3% | | | | | | | | |

Plug Power, Inc.(2) | | | 53,875 | | | | 859,845 | |

| | | | | | | | | |

| IT Services — 5.5% | | | | | | | | |

21Vianet Group, Inc.(1)(2) | | | 170,000 | | | | 851,700 | |

GDS Holdings Ltd.(1)(2) | | | 35,500 | | | | 564,450 | |

| | | | | | | | 1,416,150 | |

| Large Cap Diversified C Corps — 2.7% | | | | | | | | |

| Cheniere Energy, Inc. | | | 2,500 | | | | 438,400 | |

| Oneok, Inc. | | | 4,000 | | | | 267,680 | |

| | | | | | | | 706,080 | |

| LNG Midstream — 5.1% | | | | | | | | |

Nextdecade Corporation(2) | | | 25,000 | | | | 135,750 | |

| Targa Resources Corporation | | | 16,000 | | | | 1,190,240 | |

| | | | | | | | 1,325,990 | |

| Natural Gas Transportation & Storage — 0.9% | | | | | | | | |

| Equitrans Midstream Corporation | | | 28,000 | | | | 234,920 | |

| | | | | | | | | |

| Renewable Distribution — 1.1% | | | | | | | | |

Iberdola S.A.(1) | | | 25,375 | | | | 286,673 | |

See Accompanying Notes to the Financial Statements.

12

NXG NextGen Infrastructure Fund |

Schedule of Investments | November 30, 2022 — (Continued) |

| Common Stock — (Continued) | | Shares | | | Fair Value | |

| Solar Developer — 4.4% | | | | | | | | |

Azure Power Global Ltd.(1)(2) | | | 45,133 | | | $ | 257,709 | |

Sunnova Energy International, Inc.(2) | | | 38,122 | | | | 870,325 | |

| | | | | | | | 1,128,034 | |

| Solar Energy Equipment — 9.9% | | | | | | | | |

Enphase Energy, Inc.(2) | | | 1,200 | | | | 384,708 | |

SolarEdge Technologies, Inc.(2) | | | 3,250 | | | | 971,295 | |

Shoals Technologies Group, Inc. (2) | | | 13,422 | | | | 388,835 | |

Sunrun, Inc.(2) | | | 24,682 | | | | 804,140 | |

| | | | | | | | 2,548,978 | |

| Solar Equipment — 8.8% | | | | | | | | |

FTC Solar Inc.(2) | | | 101,995 | | | | 216,229 | |

Maxeon Solar Technologies Ltd.(1)(2) | | | 33,706 | | | | 775,912 | |

SMA Solar Technology AG(1)(2) | | | 18,825 | | | | 1,268,463 | |

| | | | | | | | 2,260,604 | |

| Solar Generation — 5.8% | | | | | | | | |

Altus Power, Inc.(2) | | | 74,104 | | | | 529,844 | |

Scatec ASA(1) | | | 23,032 | | | | 205,235 | |

Solaria Energia y Medio Ambiente, S.A.(1)(2) | | | 26,683 | | | | 481,847 | |

Sunpower Corporation(2) | | | 11,000 | | | | 266,750 | |

| | | | | | | | 1,483,676 | |

| Towers — 1.0% | | | | | | | | |

| SBA Communications Corporation | | | 896 | | | | 268,173 | |

| | | | | | | | | |

| Wind Energy Equipment — 1.2% | | | | | | | | |

Vestas Wind System(1) | | | 11,500 | | | | 298,796 | |

| | | | | | | | | |

| Wind Generation — 3.5% | | | | | | | | |

Orsted A/S(1)(3) | | | 10,242 | | | | 896,794 | |

| | | | | | | | | |

| YieldCo — 0.9% | | | | | | | | |

Atlantica Sustainable Infrastructure plc(1) | | | 8,000 | | | | 223,200 | |

| | | | | | | | | |

| Total Common Stock (Cost $17,153,943) | | | | | | $ | 18,665,244 | |

| | | | | | | | | |

See Accompanying Notes to the Financial Statements.

13

NXG NextGen Infrastructure Fund |

Schedule of Investments | November 30, 2022 — (Continued) |

| Master Limited Partnerships and Related Companies — 16.3% | | Units | | | Fair Value | |

| Large Cap Diversified C Corps — 1.0% | | | | | | | | |

| Plains All American Pipeline, L.P. | | | 20,000 | | | $ | 248,400 | |

| | | | | | | | | |

| Large Cap MLP — 7.4% | | | | | | | | |

| Energy Transfer, L.P. | | | 100,000 | | | | 1,254,000 | |

| MPLX, L.P. | | | 19,098 | | | | 649,141 | |

| | | | | | | | 1,903,141 | |

| Natural Gas Gathering & Processing — 4.9% | | | | | | | | |

| Crestwood Energy Partners, L.P. | | | 31,006 | | | | 918,398 | |

| Western Midstream Partners, L.P. | | | 12,000 | | | | 335,760 | |

| | | | | | | | 1,254,158 | |

| YieldCo — 3.0% | | | | | | | | |

| NextEra Energy Partners, L.P. | | | 9,700 | | | | 780,753 | |

| | | | | | | | | |

| Total Master Limited Partnerships (Cost $2,947,359) | | | | | | $ | 4,186,452 | |

| | | | | | | | | |

| Real Estate Investment Trusts — 7.0% | | | Shares | | | | | |

| Data Centers — 2.3% | | | | | | | | |

| Digital Reality Trust, Inc. | | | 3,600 | | | $ | 404,856 | |

Keppel DC REIT(1) | | | 144,558 | | | | 197,677 | |

| | | | | | | | 602,533 | |

| Towers — 4.7% | | | | | | | | |

| American Tower Corporation | | | 3,725 | | | | 824,156 | |

| Crown Castle International Corporation | | | 2,742 | | | | 387,801 | |

| | | | | | | | 1,211,957 | |

| Total Real Estate Investment Trusts (Cost $2,058,995) | | | | | | $ | 1,814,490 | |

| | | | | | | | | |

Short-Term Investments —

Investment Companies — 3.6% | | | | | | | | |

First American Government Obligations Fund - Class X, 3.67%(4) | | | 463,600 | | | $ | 463,600 | |

First American Treasury Obligations Fund - Class X, 3.75%(4) | | | 463,600 | | | | 463,600 | |

| Total Short-Term Investments (Cost $927,200) | | | | | | $ | 927,200 | |

| Total Investments — 99.4% (Cost $23,087,497) | | | | | | $ | 25,593,386 | |

| Other Assets in Excess of Liabilities — 0.6% | | | | | | | 154,981 | |

Total Net Assets Applicable to Unitholders — 100.0% | | | | | | $ | 25,748,367 | |

Percentages are stated as a percent of net assets.

(1) | Foreign issued security. Foreign concentration is as follows: Cayman Islands 6.62%, Germany 4.93%, and United Kingdom 4.78%. |

(2) | No distribution or dividend was made during the period ended November 30, 2022. As such, it is classified as a non-income producing security as of November 30, 2022. |

(3) | Securities purchased pursuant to Rule 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “qualified institutional buyers.” These securities have been deemed to be liquid by the Fund’s adviser under the supervision of the Board of Directors. As of November 30, 2022, the value of these investments was $896,794 or 3.48% of total net assets. |

(4) | Rate reported is the current yield as of November 30, 2022. |

See Accompanying Notes to the Financial Statements.

14

NXG Global Clean Equity Fund |

Schedule of Investments | November 30, 2022 |

| Common Stock — 94.2% | | Shares | | | Fair Value | |

| Battery Manufacturer — 2.2% | | | | | | | | |

Freyr Battery(1)(2) | | | 21,356 | | | $ | 291,509 | |

| | | | | | | | | |

| Diversified Renewable Generation — 3.4% | | | | | | | | |

Renew Energy Global plc(1)(2) | | | 74,469 | | | | 452,027 | |

| | | | | | | | | |

| Electric Vehicle Charging — 2.5% | | | | | | | | |

ChargePoint Holdings, Inc.(2) | | | 8,000 | | | | 99,360 | |

EVGO, Inc.(2) | | | 10,411 | | | | 66,631 | |

Tritium DCFC Ltd.(1)(2) | | | 101,372 | | | | 162,195 | |

| | | | | | | | 328,186 | |

| Electric Vehicle OEM — 3.6% | | | | | | | | |

Nio, Inc.(1)(2) | | | 13,076 | | | | 167,111 | |

Rivian Automotive, Inc.(2) | | | 5,051 | | | | 161,834 | |

Xpeng, Inc.(1)(2) | | | 13,161 | | | | 142,271 | |

| | | | | | | | 471,216 | |

| Energy Metering & Management — 4.1% | | | | | | | | |

Ameresco, Inc.(2) | | | 3,439 | | | | 225,323 | |

Fluence Energy, Inc.(2) | | | 8,500 | | | | 146,030 | |

Stem, Inc.(2) | | | 13,000 | | | | 169,910 | |

| | | | | | | | 541,263 | |

| Fuel Cell Generation — 4.7% | | | | | | | | |

SMA Solar Technology AG(1)(2) | | | 9,165 | | | | 617,554 | |

| | | | | | | | | |

| Hydrogen Equipment — 3.0% | | | | | | | | |

Nel ASA(1)(2) | | | 251,907 | | | | 392,947 | |

| | | | | | | | | |

| Industrials — 3.3% | | | | | | | | |

Plug Power, Inc.(2) | | | 27,416 | | | | 437,559 | |

| | | | | | | | | |

| Metering & Pumps — 2.1% | | | | | | | | |

| Xylem, Inc. | | | 2,500 | | | | 280,875 | |

| | | | | | | | | |

| New Energy Vehicle — 4.3% | | | | | | | | |

NIU Technologies(1)(2) | | | 62,183 | | | | 238,161 | |

Tesla, Inc.(2) | | | 1,700 | | | | 330,990 | |

| | | | | | | | 569,151 | |

| Renewable Distribution — 2.4% | | | | | | | | |

Iberdola S.A.(1) | | | 28,314 | | | | 319,877 | |

| | | | | | | | | |

| Semiconductor Manufacturing — 0.6% | | | | | | | | |

Wolfspeed, Inc.(2) | | | 900 | | | | 81,828 | |

| | | | | | | | | |

| Smart Grid — 2.1% | | | | | | | | |

Itron, Inc.(2) | | | 1,830 | | | | 97,319 | |

Landis & Gyr Group(1) | | | 2,628 | | | | 183,508 | |

| | | | | | | | 280,827 | |

See Accompanying Notes to the Financial Statements.

15

NXG Global Clean Equity Fund |

Schedule of Investments | November 30, 2022 — (Continued) |

| Common Stock — (Continued) | | Shares | | | Fair Value | |

| Solar Developer — 5.0% | | | | | | | | |

Azure Power Global Ltd.(1)(2) | | | 27,123 | | | $ | 154,872 | |

Sunnova Energy International, Inc.(2) | | | 21,760 | | | | 496,781 | |

| | | | | | | | 651,653 | |

| Solar Energy Equipment — 21.8% | | | | | | | | |

Array Technologies, Inc.(2) | | | 5,280 | | | | 110,563 | |

Enphase Energy, Inc.(2) | | | 1,550 | | | | 496,915 | |

First Solar, Inc.(2) | | | 1,040 | | | | 179,431 | |

Maxeon Solar Technologies Ltd.(1)(2) | | | 21,800 | | | | 501,836 | |

Shoals Technology Group, Inc.(2) | | | 8,000 | | | | 231,760 | |

SolarEdge Technologies, Inc.(2) | | | 2,090 | | | | 624,617 | |

Sunrun, Inc.(2) | | | 22,335 | | | | 727,674 | |

| | | | | | | | 2,872,796 | |

| Solar Equipment — 0.9% | | | | | | | | |

FTC Solar, Inc.(2) | | | 55,698 | | | | 118,080 | |

| | | | | | | | | |

| Solar Generation — 9.1% | | | | | | | | |

Altus Power, Inc.(2) | | | 41,128 | | | | 294,065 | |

Scatec ASA(1) | | | 12,015 | | | | 107,064 | |

Solaria Energia y Medio Ambiente, S.A.(1)(2) | | | 33,579 | | | | 606,377 | |

Sunpower Corporation(2) | | | 8,000 | | | | 194,000 | |

| | | | | | | | 1,201,506 | |

| Solar Materials — 1.2% | | | | | | | | |

JinkoSolar Holding Co., Ltd.(1)(2) | | | 3,000 | | | | 153,840 | |

| | | | | | | | | |

| Utilities — 3.1% | | | | | | | | |

Enel S.p.A.(1) | | | 37,809 | | | | 203,972 | |

RWE AG(1) | | | 4,598 | | | | 202,409 | |

| | | | | | | | 406,381 | |

| Water Tech & Equipment — 1.8% | | | | | | | | |

Energy Recovery, Inc.(2) | | | 5,000 | | | | 115,900 | |

Evoqua Water Technologies Corporation(2) | | | 2,748 | | | | 119,511 | |

| | | | | | | | 235,411 | |

| Wind Energy Equipment — 1.4% | | | | | | | | |

Vestas Wind System(1) | | | 7,000 | | | | 181,876 | |

| | | | | | | | | |

| Wind Generation — 3.9% | | | | | | | | |

Orsted A/S(1)(3) | | | 5,930 | | | | 519,233 | |

| | | | | | | | | |

| YieldCo — 7.7% | | | | | | | | |

Atlantica Sustainable Infrastructure plc(1) | | | 14,000 | | | | 390,600 | |

| Clearway Energy, Inc. | | | 3,344 | | | | 118,511 | |

Innergex Renewable Energy(1) | | | 11,719 | | | | 146,711 | |

| NextEra Energy Partners, L.P. | | | 4,435 | | | | 356,973 | |

| | | | | | | | 1,012,795 | |

| Total Common Stock (Cost $10,760,707) | | | | | | $ | 12,418,390 | |

See Accompanying Notes to the Financial Statements.

16

NXG Global Clean Equity Fund |

Schedule of Investments | November 30, 2022 — (Continued) |

Short-Term Investments —

Investment Companies — 4.3% | | Shares | | | Fair Value | |

First American Government Obligations Fund - Class X, 3.67%(4) | | | 279,846 | | | $ | 279,846 | |

First American Treasury Obligations Fund - Class X, 3.75%(4) | | | 279,846 | | | | 279,846 | |

| Total Short-Term Investments (Cost $559,692) | | | | | | $ | 559,692 | |

Total Investments — 98.5% (Cost $11,320,399) | | | | | | $ | 12,978,082 | |

| Other Assets in Excess of Liabilities — 1.5% | | | | | | | 191,050 | |

Total Net Assets Applicable to Unitholders — 100.0% | | | | | | $ | 13,169,132 | |

Percentages are stated as a percent of net assets.

(1) | Foreign issued security. Foreign concentration is as follows: Spain 7.03%, United Kingdom 6.40%, and Germany 6.23%. |

(2) | No distribution or dividend was made during the period ended November 30, 2022. As such, it is classified as a non-income producing security as of November 30, 2022. |

(3) | Securities purchased pursuant to Rule 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “qualified institutional buyers.” These securities have been deemed to be liquid by the Fund’s adviser under the supervision of the Board of Directors. As of November 30, 2022, the value of these investments was $519,233 or 3.94% of total net assets. |

(4) | Rate reported is the current yield as of November 30, 2022. |

See Accompanying Notes to the Financial Statements.

17

Cushing Mutual Funds Trust Statements of Assets & Liabilities November 30, 2022 |

| | | NXG NextGen

Infrastructure

Fund | | | NXG Global

Clean Equity

Fund | |

Assets | | | | | | | | |

Investments at fair value (1) | | $ | 25,593,386 | | | $ | 12,978,082 | |

Receivable from Adviser, net | | | 282 | | | | 1,776 | |

Receivable for investments sold | | | — | | | | 176,520 | |

Foreign currency at fair value(2) | | | 45,593 | | | | — | |

Receivable for shares sold | | | 133,250 | | | | 192,050 | |

Interest receivable | | | 751 | | | | 534 | |

Dividends receivable | | | 9,937 | | | | 8,208 | |

Prepaid expenses | | | 65,268 | | | | 15,987 | |

Total assets | | | 25,848,467 | | | | 13,373,157 | |

Liabilities | | | | | | | | |

Payable for investments purchased | | | — | | | | 82,625 | |

Payable for Fund shares redeemed | | | 3,528 | | | | 30,988 | |

Payable for 12b-1 distribution fee | | | 457 | | | | 1,530 | |

Accrued expenses and other liabilities | | | 96,115 | | | | 88,882 | |

Total liabilities | | | 100,100 | | | | 204,025 | |

Net assets | | $ | 25,748,367 | | | $ | 13,169,132 | |

Net Assets Consist of | | | | | | | | |

Additional paid-in capital | | $ | 27,993,317 | | | $ | 17,486,737 | |

Total distributable earnings/(deficits) | | | (2,244,950) | | | | (4,317,605) | |

Net assets | | $ | 25,748,367 | | | $ | 13,169,132 | |

Unlimited shares authorized, no par value | | Class A | | | Class A | |

Net assets | | $ | 558,998 | | | $ | 74,674 | |

Shares issued and outstanding | | | 31,579 | | | | 5,740 | |

Net asset value, redemption price and minimum offering price per share | | $ | 17.70 | | | $ | 13.01 | |

Maximum offering price per share (3) | | $ | 18.73 | | | $ | 13.77 | |

| | | | | | | | | |

| | | Class I | | | Class I | |

Net assets | | $ | 25,189,369 | | | $ | 13,094,458 | |

Shares issued and outstanding | | | 1,397,019 | | | | 998,996 | |

Net asset value, redemption price and minimum offering price per share | | $ | 18.03 | | | $ | 13.11 | |

| | | | | | | | | | | | | |

(1) Investments, at cost | | $ | 23,087,497 | | | $ | 11,320,399 | |

(2) | Foreign currency, at cost |

(3) | The offering price is calculated by dividing the net asset value by 1 minus the maximum sales charge of 5.50% for NextGen and 5.50% for Clean. |

See Accompanying Notes to the Financial Statements.

18

Cushing Mutual Funds Trust Statements of Operations Fiscal Year Ended November 30, 2022 |

| | | NXG NextGen

Infrastructure

Fund | | | NXG Global

Clean Equity

Fund | |

Investment Income | | | | | | | | |

Distributions and dividends | | $ | 634,688 | | | $ | 106,831 | |

Less: return of capital on distributions | | | (455,645) | | | | (78,433) | |

Less: foreign taxes withheld | | | (16,554) | | | | (6,831) | |

Distribution and dividend income | | | 162,489 | | | | 21,567 | |

Interest income | | | 2,877 | | | | 2,377 | |

Total Investment Income | | | 165,366 | | | | 23,944 | |

Expenses | | | | | | | | |

Advisory fees | | | 223,797 | | | | 121,047 | |

Accounting and Administrator fees | | | 121,875 | | | | 112,742 | |

Transfer agent expense | | | 66,352 | | | | 55,099 | |

Professional fees | | | 57,197 | | | | 47,562 | |

Blue sky expense | | | 44,842 | | | | 44,940 | |

Trustees’ fees | | | 42,458 | | | | 24,969 | |

Custodian fees and expenses | | | 21,590 | | | | 15,300 | |

Insurance expense | | | 13,619 | | | | 7,287 | |

Reports to shareholders | | | 11,253 | | | | 7,208 | |

Other expense | | | 4,005 | | | | 757 | |

Registration fees | | | 2,205 | | | | 1,912 | |

12b-1 distribution fee - Class A | | | 1,548 | | | | 247 | |

Total expenses | | | 610,741 | | | | 439,070 | |

Less: expense waived by Adviser | | | (276,074) | | | | (274,296) | |

Net expenses | | | 334,667 | | | | 164,774 | |

Net Investment Loss | | | (169,301) | | | | (140,830) | |

Realized and Unrealized Gain (Loss) on Investments | | | | | | | | |

Net realized loss on investments | | | (4,150,945) | | | | (5,678,416) | |

Net change in unrealized appreciation/(depreciation) on investments and foreign currency | | | 2,540,989 | | | | (613,886) | |

Net Realized and Unrealized Loss on Investments | | | (1,609,956) | | | | (6,292,302) | |

Net Decrease in Net Assets Applicable to Shareholders Resulting from Operations | | $ | (1,779,257) | | | $ | (6,433,132) | |

See Accompanying Notes to the Financial Statements.

19

Cushing Mutual Funds Trust Statements of Changes in Net Assets |

| | | NXG NextGen Infrastructure Fund | | | NXG Global Clean Equity Fund | |

| | | Fiscal Year

Ended

November 30,

2022 | | | Fiscal Year

Ended

November 30,

2021 | | | Fiscal Year

Ended

November 30,

2022 | | | Fiscal Year

Ended

November 30,

2021 | |

Operations | | | | | | | | | | | | | | | | |

Net investment loss | | $ | (169,301) | | | $ | (29,136) | | | $ | (140,830) | | | $ | (66,396) | |

Net realized gain (loss) on investments | | | (4,150,945) | | | | 3,609,853 | | | | (5,678,416) | | | | 2,583,836 | |

Net change in unrealized appreciation/(depreciation) on investments and foreign currency | | | 2,540,989 | | | | (3,551,180) | | | | (613,886) | | | | (2,340,154) | |

Net increase (decrease) in net assets applicable to shareholders resulting from operations | | | (1,779,257) | | | | 29,537 | | | | (6,433,132) | | | | 177,286 | |

Distributions to Class A Shareholders | | | | | | | | | | | | | | | | |

Distributions from distributable earnings | | | (35,446) | | | | (31,545) | | | | (18,284) | | | | (5,527) | |

Return of capital | | | (21,863) | | | | — | | | | (1,363) | | | | — | |

Distributions to Class I Shareholders | | | | | | | | | | | | | | | | |

Distributions from distributable earnings | | | (1,396,182) | | | | (926,454) | | | | (2,041,975) | | | | (310,023) | |

Return of capital | | | (861,180) | | | | — | | | | (152,232) | | | | — | |

Total dividends and distributions to Fund shareholders | | | (2,314,671) | | | | (957,999) | | | | (2,213,854) | | | | (315,550) | |

Capital Share Transactions | | | | | | | | | | | | | | | | |

Proceeds from shareholder subscriptions | | | 865,739 | | | | 25,691,473 | | | | 1,384,577 | | | | 17,751,215 | |

Dividend reinvestments | | | 1,300,543 | | | | 582,756 | | | | 1,071,465 | | | | 200,926 | |

Payments for redemptions | | | (6,871,804) | | | | (6,148,448) | | | | (3,450,188) | | | | (6,034,753) | |

Net increase (decrease) in net assets from capital share transactions | | | (4,705,522) | | | | 20,125,781 | | | | (994,146) | | | | 11,917,388 | |

Total increase (decrease) in net assets | | | (8,799,450) | | | | 19,197,319 | | | | (9,641,132) | | | | 11,779,124 | |

Net Assets | | | | | | | | | | | | | | | | |

Beginning of fiscal year | | | 34,547,817 | | | | 15,350,498 | | | | 22,810,264 | | | | 11,031,140 | |

End of fiscal year | | $ | 25,748,367 | | | $ | 34,547,817 | | | $ | 13,169,132 | | | $ | 22,810,264 | |

See Accompanying Notes to the Financial Statements.

20

NXG NextGen Infrastructure Fund Financial Highlights |

Class A Shares | | Fiscal Year

Ended

November 30,

2022 | | | Fiscal Year

Ended

November 30,

2021 | | | Fiscal Year

Ended

November 30,

2020 | | | Fiscal Year

Ended

November 30,

2019 | | | Period From

December 18,

2017(1)

through

November 30,

2018 | |

Per Common Share Data (2) | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, beginning of period | | $ | 20.08 | | | $ | 19.99 | | | $ | 15.33 | | | $ | 18.08 | | | $ | 20.00 | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (3) | | | (0.11 | ) | | | (0.08 | ) | | | 0.03 | | | | (0.19 | ) | | | 0.12 | |

Net realized and unrealized gain (loss) on investments | | | (0.81 | ) | | | 1.22 | | | | 5.14 | | | | (1.46 | ) | | | (1.07 | ) |

Net increase (decrease) from investment operations | | | (0.92 | ) | | | 1.14 | | | | 5.17 | | | | (1.65 | ) | | | (0.95 | ) |

Less Distributions to Common Stockholders: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.90 | ) | | | (1.05 | ) | | | (0.51 | ) | | | — | | | | (0.09 | ) |

Return of capital | | | (0.56 | ) | | | — | | | | — | | | | (1.10 | ) | | | (0.88 | ) |

Total distributions to common stockholders | | | (1.46 | ) | | | (1.05 | ) | | | (0.51 | ) | | | (1.10 | ) | | | (0.97 | ) |

Net Asset Value, end of period | | $ | 17.70 | | | $ | 20.08 | | | $ | 19.99 | | | $ | 15.33 | | | $ | 18.08 | |

Total Investment Return (5) | | | (4.46 | )% | | | 5.77 | % | | | 34.34 | % | | | (9.49 | )% | | | (5.06 | )%(4) |

Supplemental Data and Ratios | | | | | | | | | | | | | | | | | | | | |

Net assets applicable to common stockholders, end of period (000’s) | | $ | 559 | | | $ | 864 | | | $ | 436 | | | $ | 444 | | | $ | 252 | |

Ratio of expenses to average net assets before waiver | | | 2.55 | % | | | 2.65 | % | | | 4.02 | % | | | 2.82 | % | | | 2.20 | %(6) |

Ratio of expenses to average net assets after waiver | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.75 | % | | | 1.75 | %(6) |

Ratio of net investment income (loss) to average net assets after waiver | | | (0.64 | )% | | | (0.39 | )% | | | 0.21 | % | | | (1.09 | )% | | | 0.85 | %(6) |

Portfolio turnover rate (7) | | | 241.02 | % | | | 177.18 | % | | | 314.43 | % | | | 74.23 | % | | | 76.11 | %(4) |

(1) | Commencement of operations. |

(2) | Information presented relates to a Class A share outstanding for the entire period. |

(3) | Calculated using average shares outstanding method. |

(5) | Total investment return does not include the impact of the front-end sales load. |

(6) | Annualized for periods less than one full year. |

(7) | Portfolio turnover is calculated on the basis of the fund as a whole. |

See Accompanying Notes to the Financial Statements.

21

NXG NextGen Infrastructure Fund Financial Highlights |

Class I Shares | | Fiscal Year

Ended

November 30,

2022 | | | Fiscal

Year Ended

November 30,

2021 | | | Fiscal

Year Ended

November 30,

2020 | | | Fiscal

Year Ended

November 30,

2019 | | | Fiscal

Year Ended

November 30,

2018(1) | |

Per Common Share Data (2) | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, beginning of fiscal year | | $ | 20.37 | | | $ | 20.22 | | | $ | 15.46 | | | $ | 18.14 | | | $ | 19.51 | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (3) | | | (0.11 | ) | | | (0.03 | ) | | | 0.08 | | | | (0.15 | ) | | | 0.14 | |

Net realized and unrealized gain (loss) on investments | | | (0.77 | ) | | | 1.23 | | | | 5.19 | | | | (1.43 | ) | | | (0.31 | ) |

Net increase (decrease) from investment operations | | | (0.88 | ) | | | 1.20 | | | | 5.27 | | | | (1.58 | ) | | | (0.17 | ) |

Less Distributions to Common Stockholders: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.90 | ) | | | (1.05 | ) | | | (0.51 | ) | | | — | | | | (0.09 | ) |

Return of capital | | | (0.56 | ) | | | — | | | | — | | | | (1.10 | ) | | | (1.11 | ) |

Total distributions to common stockholders | | | (1.46 | ) | | | (1.05 | ) | | | (0.51 | ) | | | (1.10 | ) | | | (1.20 | ) |

Net Asset Value, end of fiscal year | | $ | 18.03 | | | $ | 20.37 | | | $ | 20.22 | | | $ | 15.46 | | | $ | 18.14 | |

Total Investment Return | | | (4.19 | )% | | | 5.95 | % | | | 34.77 | % | | | (9.07 | )% | | | (1.17 | )% |

Supplemental Data and Ratios | | | | | | | | | | | | | | | | | | | | |

Net assets applicable to common stockholders, end of fiscal year (000’s) | | $ | 25,189 | | | $ | 33,683 | | | $ | 14,915 | | | $ | 13,228 | | | $ | 61,119 | |

Ratio of expenses to average net assets before waiver | | | 2.30 | % | | | 2.39 | % | | | 3.77 | % | | | 2.57 | % | | | 1.91 | % |

Ratio of expenses to average net assets after waiver | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.50 | % | | | 1.50 | % |

Ratio of net investment income (loss) to average net assets after waiver | | | (0.64 | )% | | | (0.13 | )% | | | 0.46 | % | | | (0.84 | )% | | | 0.69 | % |

Portfolio turnover rate (4) | | | 241.02 | % | | | 177.18 | % | | | 314.43 | % | | | 74.23 | % | | | 76.11 | %(5) |

(1) | On December 18, 2017, The Cushing® MLP Infrastructure Fund I (the “Predecessor Fund”) was reorganized into The Cushing® MLP Infrastructure Fund. Information presented prior to December 18, 2017 is that of the Predecessor Fund. Per share amounts for the period prior to December 15, 2017 have been adjusted for a share conversion that occurred effective with the reorganization on December 15, 2017. The effect of the share conversion in connection with the reorganization was to multiply the number of outstanding shares of the Fund by the respective conversion factor of 35.809, with a corresponding decrease in the net asset value per share. This transaction did not change the net assets of the Fund or the value of a shareholder’s investment. |

(2) | Information presented relates to a Class I share outstanding for the entire fiscal year. |

(3) | Calculated using average shares outstanding method. |

(4) | Portfolio turnover is calculated on the basis of the fund as a whole without distinguishing between the classes of shares issued. |

(5) | Covers the period from December 18, 2017 through November 30, 2018, subsequent to the reorganization of the Predecessor Fund into the Fund. |

See Accompanying Notes to the Financial Statements.

22

NXG Global Clean Equity Fund Financial Highlights |

Class A Shares | | Fiscal

Year Ended

November 30,

2022 | | | Fiscal

Year Ended

November 30,

2021 | | | Period From

January 31,

2020(1)

through

November 30,

2020 | |

Per Common Share Data (2) | | | | | | | | | | | | |

Net Asset Value, beginning of period | | $ | 20.93 | | | $ | 20.52 | | | $ | 10.00 | |

Income from Investment Operations: | | | | | | | | | | | | |

Net investment loss (3) | | | (0.17 | ) | | | (0.17 | ) | | | (0.08 | ) |

Net realized and unrealized gain (loss) on investments | | | (5.67 | ) | | | 1.13 | | | | 10.69 | |

Net increase (decrease) from investment operations | | | (5.84 | ) | | | 0.96 | | | | 10.61 | |

Less Distributions to Common Stockholders: | | | | | | | | | | | | |

Net investment income | | | (1.94 | ) | | | (0.55 | ) | | | (0.09 | ) |

Return of capital | | | (0.14 | ) | | | — | | | | — | |

Total distributions to common stockholders | | | (2.08 | ) | | | (0.55 | ) | | | (0.09 | ) |

Net Asset Value, end of period | | $ | 13.01 | | | $ | 20.93 | | | $ | 20.52 | |

Total Investment Return (5) | | | (29.81 | )% | | | 4.65 | % | | | 106.34 | %(4) |

Supplemental Data and Ratios | | | | | | | | | | | | |

Net assets applicable to common stockholders, end of period (000’s) | | $ | 75 | | | $ | 205 | | | $ | 231 | |

Ratio of expenses to average net assets before waiver | | | 3.33 | % | | | 3.18 | % | | | 6.40 | %(6) |

Ratio of expenses to average net assets after waiver | | | 1.40 | % | | | 1.35 | % | | | 1.40 | %(6) |

Ratio of net investment loss to average net assets after waiver | | | (1.24 | )% | | | (0.78 | )% | | | (0.66 | )%(6) |

Portfolio turnover rate (7) | | | 118.40 | % | | | 88.38 | % | | | 39.68 | %(4) |

(1) | Commencement of operations. |

(2) | Information presented relates to a Class A share outstanding for the entire period. |

(3) | Calculated using average shares outstanding method. |

(5) | Total investment return does not include the impact of the front-end sales load. |

(6) | Annualized for periods less than one full year. |

(7) | Portfolio turnover is calculated on the basis of the fund as a whole. |

See Accompanying Notes to the Financial Statements.

23

NXG Global Clean Equity Fund Financial Highlights |

Class I Shares | | Fiscal

Year Ended

November 30,

2022 | | | Fiscal

Year Ended

November 30,

2021 | | | Period From

January 31,

2020(1)

through

November 30,

2020 | |

Per Common Share Data (2) | | | | | | | | | | | | |

Net Asset Value, beginning of period | | $ | 21.02 | | | $ | 20.56 | | | $ | 10.00 | |

Income from Investment Operations: | | | | | | | | | | | | |

Net investment loss (3) | | | (0.14 | ) | | | (0.11 | ) | | | (0.05 | ) |

Net realized and unrealized gain (loss) on investments | | | (5.69 | ) | | | 1.12 | | | | 10.70 | |

Net increase (decrease) from investment operations | | | (5.83 | ) | | | 1.01 | | | | 10.65 | |

Less Distributions to Common Stockholders: | | | | | | | | | | | | |

Net investment income | | | (1.94 | ) | | | (0.55 | ) | | | (0.09 | ) |

Return of capital | | | (0.14 | ) | | | — | | | | — | |

Total distributions to common stockholders | | | (2.08 | ) | | | (0.55 | ) | | | (0.09 | ) |

Net Asset Value, end of period | | $ | 13.11 | | | $ | 21.02 | | | $ | 20.56 | |

Total Investment Return | | | (29.61 | )% | | | 4.89 | % | | | 106.74 | %(4) |

Supplemental Data and Ratios | | | | | | | | | | | | |

Net assets applicable to common stockholders, end of period (000’s) | | $ | 13,094 | | | $ | 22,606 | | | $ | 10,800 | |

Ratio of expenses to average net assets before waiver | | | 3.08 | % | | | 2.93 | % | | | 6.15 | %(5) |

Ratio of expenses to average net assets after waiver | | | 1.15 | % | | | 1.10 | % | | | 1.15 | %(5) |

Ratio of net investment loss to average net assets after waiver | | | (0.99 | )% | | | (0.53 | )% | | | (0.41 | )%(5) |

Portfolio turnover rate (6) | | | 118.40 | % | | | 88.38 | % | | | 39.68 | %(4) |

(1) | Commencement of operations. |

(2) | Information presented relates to a Class I share outstanding for the entire period. |

(3) | Calculated using average shares outstanding method. |

(5) | Annualized for periods less than one full year. |

(6) | Portfolio turnover is calculated on the basis of the fund as a whole. |

See Accompanying Notes to the Financial Statements.

24

Cushing Mutual Funds Trust Notes to Financial Statements November 30, 2022 |

1. Organization

Cushing® Mutual Funds Trust (the “Trust”) was organized as a Delaware statutory trust on September 12, 2017 and is governed by a Declaration of Trust. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, and is comprised of two series (collectively referred to as the “Funds” and each individually, referred to as a “Fund”). These financial statements and notes relate to the NXG NextGen Infrastructure Fund (“NextGen”) and the NXG Global Clean Equity Fund (“Clean”), each series of the Trust. The Funds are managed by Cushing® Asset Management, LP, d/b/a NXG Investment Management (the “Adviser”).

NextGen’s investment objective is to seek current income and capital appreciation. NextGen commenced operations on December 18, 2017 following the completion of the reorganization of The Cushing MLP Infrastructure Fund I (the “Predecessor Fund”) with and into NextGen. The Predecessor Fund commenced operations on March 1, 2010. NextGen offers two classes of shares, Class A and Class I. Class A shares are subject to a maximum 5.50% front-end sales charge. Class I shares have no sales charge. The Fund pays distribution (12b-2) and/or service fees with respect to Class A shares at an annual rate of 0.25% of average daily net assets. The accounting and performance history of the Predecessor Fund were re-designated as that of the Class I Shares of NextGen.

Clean’s investment objective is to seek capital appreciation. Clean commenced operations on January 31, 2020. Clean offers two classes of shares, Class A and Class I. Class A shares are subject to a maximum 5.50% front-end sales charge. Class I shares have no sales charge. The Fund pays distribution (12b-2) and/or service fees with respect to Class A shares at an annual rate of 0.25% of average daily net assets.

2. Significant Accounting Policies

A. Basis of Presentation

The following is a summary of significant accounting policies, consistently followed by the Funds in preparation of the financial statements. Each Fund is considered an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standard Codification Topic 946, Financial Services - Investment Companies, which is part of U.S. Generally Accepted Accounting Principles (“U.S. GAAP”).

B. Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, recognition of distribution income and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

C. Investment Valuation

The Board of Trustees has designated the Adviser as the “valuation designee” for the Funds pursuant to Rule 2a-5 under the 1940 Act. The valuation designee is responsible for making fair value determinations pursuant to Valuation Policies and Procedures adopted by the Adviser and the Trust (the “Valuation Policy”). A committee of voting members comprised of senior personnel of the Adviser considers various pricing issues and establishes fair valuations of portfolio securities and other instruments held by the Funds in accordance with the Valuation Policy (the “Valuation Committee”). The Adviser as valuation designee is subject to monitoring and oversight by the Board of Trustees. As a general principle, the fair value of a portfolio instrument is the amount that an owner might reasonably expect to receive upon the instrument’s current sale. A range of factors and analysis may

25

be considered when determining fair value, including relevant market data, interest rates, credit considerations and/or issuer specific news. The Valuation Committee may consult with and receive input from third parties and will utilize a variety of market data including yields or prices of investments of comparable quality, type of issue, coupon, maturity, rating, indications of value from security dealers, evaluations of anticipated cash flows or collateral, spread over U.S. Treasury obligations, and other information and analysis. In addition, the Valuation Committee may consider valuations provided by valuation firms retained to assist in the valuation of certain of the Funds’ investments. Fair valuation involves subjective judgments. While the Funds’ use of fair valuation is intended to result in calculation of net asset value that fairly reflects values of the Funds’ portfolio securities as of the time of pricing, the Funds cannot guarantee that any fair valuation will, in fact, approximate the amount the Funds would actually realize upon the sale of the securities in question. It is possible that the fair value determined for a portfolio instrument may be materially different from the value that could be realized upon the sale of that instrument.

The valuation designee use the following valuation methods to determine value for investments for which market quotations are available, or if not available, the fair value, as determined in good faith pursuant to the Valuation Policy. The valuation of the portfolio securities of each Fund currently includes the following processes:

(i) The market value of each security listed or traded on any recognized securities exchange or automated quotation system will be the last reported sale price at the relevant valuation date on the composite tape or on the principal exchange on which such security is traded except those listed on the NASDAQ Global Market®, NASDAQ Global Select Market® and the NASDAQ Capital Market® exchanges (collectively, “NASDAQ”). Securities traded on NASDAQ will be valued at the NASDAQ Official Closing Price (“NOCP”). If no sale is reported on that date, the security will be valued at the last reported bid price. If the Valuation Committee (the “Committee”) determines that price is not representative of the actual market price, the Committee may determine the fair value of the security.

(ii) Securities not traded on a U.S. exchange or NASDAQ and foreign securities that are traded on foreign exchanges whose operations are similar to the U.S. over-the-counter market will be valued at prices supplied by a pricing service. If the Committee determines that price is not representative of the actual market price, the Committee may determine the fair value of the security.

(iii) Debt securities will be valued based on evaluated mean prices by an outside pricing service that employs a pricing model that takes into account bids, yield spreads, and/or other market data and specific security characteristics (e.g., credit quality, maturity and coupon rate). If a price cannot be obtained from pricing services, quotes from market makers or brokers may be used. When possible, more than one market maker or broker should be utilized and the mean of bid and ask prices should be used.

(iv) Private Placements in Public Entities (“PIPES”) will be valued using the price of the publicly traded common stock as a baseline, deducting the discount realized on the original purchase and amortizing the difference over the restricted period.

(v) Listed options on debt or equity securities are valued at the last sale price or, if there are no trades for the day, the mean of the closing bid price and ask price. Unlisted options on debt or equity securities are valued based upon their composite bid prices if held long, or their composite ask prices if held short. Futures are valued at the settlement price. Premiums for the sale of options written by an investment company registered under the 1940 Act (a “Registered Fund”) will be included in the assets of such Registered Fund, and the market value of such options will be included as a liability.

(vi) For valuation purposes, quotations of foreign portfolio securities, other assets and liabilities and forward contracts stated in foreign currency are as of the close of regular trading on the Exchange each day the Exchange is open for trading (or earlier as may be specified by the Registered Fund) and translated into U.S. dollar equivalents at the current prevailing market rates as quoted by a pricing service.

26

(vii) Foreign securities are valued using “fair value factors”. Fair value factors consider daily trade activity and price changes for depositary receipts, exchange-traded funds, index futures, foreign currency exchange activity, or other relevant market data.

(viii) Over-the-counter options on foreign securities and currencies are fair valued by obtaining the “last available bid” from a single dealer that is either the writer or purchaser of the option.

(ix) Swaps will be valued using market-based prices provided by pricing services or broker-dealer bid counterparty quotations.

(x) Whenever trading in a listed security held in a portfolio is temporarily suspended, halted or delisted from an exchange, the security may be priced using the last closing price for a period of up to 5 business days. The Committee will continue to monitor the security during this period and, if there is a belief that the last closing price does not reflect the fair value of such security, then the value of such security will be determined by the Committee based on factors the Committee deems relevant. Whenever any such valuation determination is made, the Committee will monitor the market and other sources of information available to it in order to ascertain whether any change in circumstance would suggest a change in the value so determined.

D. Security Transactions, Investment Income and Expenses

Security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are reported on a high cost basis. Interest income is recognized on an accrual basis, including amortization of premiums and accretion of discounts. Distributions and dividends (collectively, referred to as “Distributions”) are recorded on the ex-dividend date.

Distributions received from NextGen’s investments in master limited partnerships (“MLPs”) and real estate investment trusts (“REITs”) generally are comprised of ordinary income, capital gains and return of capital. For financial statement purposes, NextGen uses return of capital and income estimates to allocate the Distribution income received. Such estimates are based on historical information available from each MLP and REIT and other industry sources. These estimates may subsequently be revised based on information received from the MLPs and REITs after their tax reporting periods are concluded, as the actual character of these Distributions is not known until after NextGen’s fiscal year end.

The Funds estimate the allocation of investment income and return of capital for the Distributions received from its portfolio investments within the Statement of Operations. For the fiscal year ended November 30, 2022, NextGen has estimated approximately 73% of the Distributions from its portfolio investments to be return of capital. For the fiscal year ended November 30, 2022, Clean has estimated approximately 73% of the Distributions from its portfolio investments to be return of capital.

Expenses are recorded on an accrual basis. Each Fund offers multiple classes of shares which differ in their respective distribution fees. All shareholders bear the common expenses of each Fund. No class has preferential dividend rights; differences in per share dividend rates are generally due to differences in class-specific expenses. Income, non-class specific expenses, and realized and unrealized gains and losses are allocated daily to each class of shares based on the value of total shares outstanding of each class without distinction between share classes. Expenses attributable to a particular class of shares, such as distribution fees, are allocated directly to that class.

E. Distributions to Shareholders

Distributions to common shareholders are recorded on the ex-dividend date. The character of Distributions to common shareholders made during the period may differ from their ultimate characterization for federal income tax purposes.

27

For the fiscal year ended November 30, 2021, NextGen’s Distributions were 100%, or $957,999 ordinary income. For the fiscal year ended November 30, 2022, NextGen’s Distributions were expected to be 60%, or $1,395,345 ordinary income, 2%, or $36,280 long term capital gain, and 38%, or $883,043 return of capital.

For the fiscal year ended November 30, 2021, Clean’s Distributions were 100%, or $315,550 ordinary income. For the fiscal year ended November 30, 2022, Clean’s Distributions were expected to be 84%, or $1,857,807 ordinary income, 9%, or $202,452 long term capital gain, and 7%, or $153,595 return of capital.

For Federal income tax purposes, Distributions of short-term capital gains are treated as ordinary income distributions. In addition, on an annual basis, each Fund may distribute additional capital gains in the last calendar quarter, if necessary, to meet minimum distribution requirements and thus avoid being subject to excise taxes. The final character of Distributions paid for the fiscal year ended November 30, 2022 will be determined in early 2023.

Each shareholder will automatically be a participant under the Fund’s Dividend Reinvestment Plan (the “DRIP”) and have all income distributions and capital gains distributions automatically reinvested in shares, unless a shareholder otherwise elects to receive distributions in cash. Generally, for U.S. federal income tax purposes, shareholders receiving shares under the DRIP will be treated as having received a distribution equal to the amount of cash they would have received had the shareholder not participated in the DRIP.

F. Federal Income Taxation