UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

––––––––––––––––––

FORM N-CSR

––––––––––––––––––

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23299

––––––––––––––––––

OFS Credit Company, Inc.

(Exact name of registrant as specified in charter)

––––––––––––––––––

10 South Wacker Drive, Suite 2500

Chicago, IL 60606

(Address of principal executive offices)

Bilal Rashid

Chief Executive Officer

OFS Credit Company, Inc.

10 South Wacker Drive, Suite 2500

Chicago, IL 60606

(Name and address of agent for service)

––––––––––––––––––

Registrant’s telephone number, including area code: (847)734-2000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

Item 1. Report to Stockholders

The Company's Annual Report to stockholders for the year ended October 31, 2018 is filed herewith.

OFS CREDIT COMPANY, INC.

TABLE OF CONTENTS - ANNUAL REPORT

December 17, 2018

To Our Stockholders:

We are pleased to submit to you our first annual report for the year ended October 31, 2018.

We raised $50.0 million in an initial public offering ("IPO") in early October 2018 by offering 2.5 million shares of common stock at $20 per share; the fund operated for less than a full month in fiscal year 2018. Our investment adviser is OFS Capital Management, LLC, which we refer to as the “Advisor.” The Advisor is registered as an investment adviser under the Investment Advisers Act of 1940, as amended, and, as of September 30, 2018, had approximately $2.2 billion of committed assets under management for investment in collateralized loan obligation (“CLO”) securities and other investments. Since the Advisor paid all the fees associated with our IPO, we generated net proceeds of $50.0 million.

Shortly after the IPO we invested $43.6 million ($53.4 million principal amount) in 19 CLO equity vehicles, 17 of which have a reinvestment period ending in 2022 or beyond. Subsequently, we invested another $3.4 million in 2 additional CLO equity vehicles.

On October 15, 2018, our Board of Directors declared four cash distributions, including three monthly cash distributions of $0.167 per share for each of November, December and January of 2019 and a proportionate distribution of $0.0113 per share for the month of October (reflecting the number of days in the month after completion of our IPO).

Our primary investment objective is to generate current income, with a secondary objective to generate capital appreciation. Under normal market conditions, we will invest at least 80% of our assets, or net assets plus borrowings, in floating rate credit-based instruments and other structured credit investments - primarily through the purchase of equity tranches of CLOs.

The CLOs in which we invest are collateralized by portfolios consisting primarily of below investment grade U.S. senior secured loans with a large number of distinct underlying borrowers across various industry sectors. We believe that there are limited options for public investors to access the asset class. Our investors gain exposure to a diversified pool of senior floating rate corporate loans with varying vintages.

When we acquire securities at the inception of a CLO in an originated transaction (i.e., the primary CLO market), we intend to invest in CLO securities that we believe have the potential to generate attractive risk-adjusted returns and to outperform other similar CLO securities issued around the same time. When we acquire existing CLO securities, we intend to invest in CLO securities that we believe have the potential to generate attractive risk-adjusted returns. We believe the Advisor is uniquely positioned to manage the fund given its expertise in both investing in structured credit (CLO equity and subordinated debt tranches) and managing CLOs, which entails underwriting the underlying corporate loans. We are excited about the outlook for the fund.

Bilal Rashid

Chairman and Chief Executive Officer

This letter is intended to assist stockholders in understanding our performance during the period ended October 31, 2018. The views and opinions in this letter were current as of December 17, 2018. Statements other than those of historical facts included herein may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors. We undertake no duty to update any forward-looking statement made herein.

[Not Part of the Annual Report]

Important Information

This report is transmitted to the stockholders of OFS Credit Company, Inc. (“we”, “us”, “our” or the “Company”) and is furnished pursuant to certain regulatory requirements. This report and the information and views herein do not constitute investment advice, or a recommendation or an offer to enter into any transaction with the Company or any of its affiliates. This report is provided for informational purposes only, does not constitute an offer to sell securities of the Company and is not a prospectus. From time to time, the Company may have a registration statement relating to one or more of its securities on file with the U.S. Securities and Exchange Commission (“SEC”).

An investment in the Company is not appropriate for all investors. The investment program of the Company is speculative, entails substantial risk and includes investment techniques not employed by traditional mutual funds. An investment in the Company is not intended to be a complete investment program. Shares of closed-end investment companies, such as the Company, frequently trade at a discount from their net asset value (“NAV”), which may increase investors’ risk of loss. Past performance is not indicative of, or a guarantee of, future performance. The performance and certain other portfolio information quoted herein represents information as of October 31, 2018. Nothing herein should be relied upon as a representation as to the future performance or portfolio holdings of the Company. Investment return and principal value of an investment will fluctuate, and shares, when sold, may be worth more or less than their original cost. The Company’s performance is subject to change since the end of the period noted in this report and may be lower or higher than the performance data shown herein.

About OFS Credit Company, Inc.

The Company is a newly organized, non-diversified, externally managed closed-end management investment company that has registered as an investment company under the Investment Company Act of 1940, or the “1940 Act.” Our investment adviser is OFS Capital Management, LLC, which we refer to as “OFS Advisor” or the “Advisor.” Our primary investment objective is to generate current income, with a secondary objective to generate capital appreciation. Under normal market conditions, we will invest at least 80% of our assets, or net assets plus borrowings, in floating rate credit instruments and other structured credit investments, including: (i) collateralized loan obligation (“CLO”) debt and subordinated (i.e., residual or equity) securities; (ii) traditional corporate credit investments, including leveraged loans and high yield bonds; (iii) opportunistic credit investments, including stressed and distressed credit situations and long/short credit investments; and (iv) other credit-related instruments. The CLOs in which we intend to invest are collateralized by portfolios consisting primarily of below investment grade U.S. senior secured loans with a large number of distinct underlying borrowers across various industry sectors. As part of the 80%, we may also invest in other securities and instruments that are related to these investments or that OFS Advisor believes are consistent with our investment objectives, including senior debt tranches of CLOs, vehicles that provide access to leveraged loans, and loan accumulation facilities. Loan accumulation facilities are short- to medium-term facilities often provided by the bank that will serve as the placement agent or arranger on a CLO transaction. Loan accumulation facilities typically incur leverage between three and six times prior to a CLO’s pricing. The CLO securities in which we will primarily seek to invest are unrated or rated below investment grade and are considered speculative with respect to timely payment of interest and repayment of principal. Unrated and below investment grade securities are also sometimes referred to as “junk” securities. In addition, the CLO equity and subordinated debt securities in which we will invest are highly leveraged (with CLO equity securities typically being leveraged 9 to 13 times), which magnifies our risk of loss on such investments.

Forward-Looking Statements

This report may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical facts included in this report may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described in the Company’s filings with the SEC. The Company undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this report.

OFS Credit Company, Inc.

Summary of Certain Portfolio Characteristics (unaudited)

As of October 31, 2018

The information presented below is on a look–through basis to the portfolio of CLO investments held by the Company as of October 31, 2018 and reflects the aggregate underlying exposure of the Company based on the portfolios of those investments. The data is estimated and unaudited and is derived from third party sources as of October 31, 2018.

|

| | | | |

| The top ten industries of the underlying obligors on a look-through basis to the Company’s CLO investments and other unrated investments as of October 31, 2018 are provided below: | | The top ten underlying obligors on a look-through basis to the Company’s CLO investments and other unrated investments as of October 31, 2018 are provided below: |

| Top 10 Industries of Underlying Obligors | | Top 10 Underlying Obligors |

| Moody's Industry Name | % of Total | | Obligor | % of Total |

| High Tech Industries | 11.3% | | Altice SFRFP | 0.8% |

| Healthcare & Pharmaceuticals | 10.2% | | Dell International | 0.7% |

| Services: Business | 10.2% | | Asurion | 0.6% |

| Banking, Finance, Insurance & Real Estate | 7.1% | | TransDigm | 0.6% |

| Telecommunications | 4.9% | | Albertson's | 0.6% |

| Chemicals, Plastics & Rubber | 4.9% | | CenturyLink | 0.6% |

| Hotel, Gaming & Leisure | 4.7% | | SS&C | 0.5% |

| Retail | 4.4% | | First Data | 0.5% |

| Media: Broadcasting & Subscription | 4.4% | | BMC Software | 0.5% |

| Construction & Building | 3.7% | | Advantage Sales & Marketing | 0.5% |

| Total | 65.7% | | Total | 5.9% |

|

|

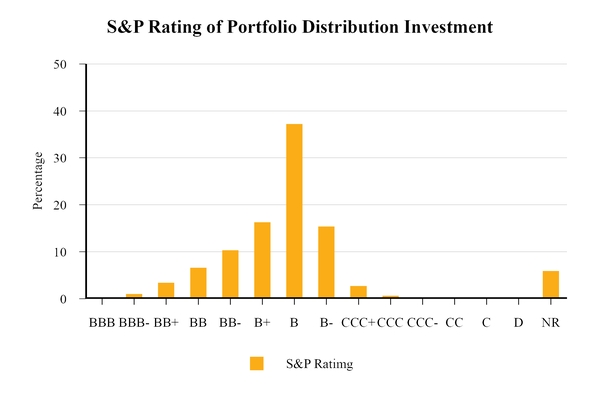

| The credit ratings distribution of the underlying obligors on a look-through basis to the Company’s CLO investments and other unrated investments as of October 31, 2018 is provided below: |

|

|

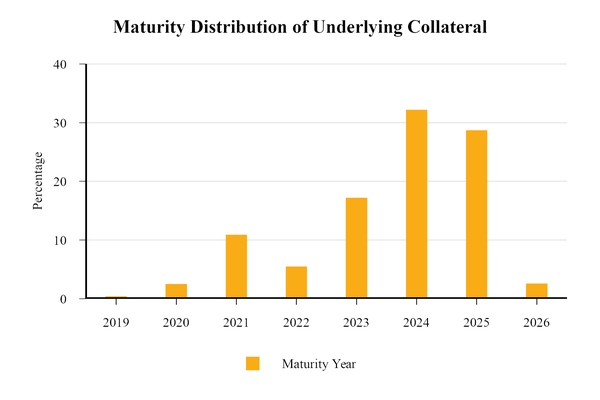

| The maturity distribution of the underlying obligors on a look-through basis to the Company’s CLO investments and other unrated investments as of October 31, 2018 is provided below: |

OFS Credit Company, Inc.

Statement of Assets and Liabilities

|

| | | | |

|

| October 31, 2018 |

| Assets: |

| |

|

| Investments at fair value (cost of $41,806,470) |

| $ | 41,875,940 |

|

| Cash |

| 9,056,303 |

|

| Investment distribution receivable |

| 155,443 |

|

| Prepaid expenses and other assets |

| 13,555 |

|

| Total assets |

| 51,101,241 |

|

|

|

|

|

| Liabilities: |

| |

|

| Administrative fee payable |

| 10,000 |

|

| Accrued professional fees |

| 96,946 |

|

| Payable for investment purchased |

| 590,000 |

|

| Other accrued expenses |

| 17,788 |

|

| Total liabilities |

| 714,734 |

|

|

|

|

|

| Commitments and contingencies (Note 5) |

|

|

|

|

|

|

|

| Net assets |

| $ | 50,386,507 |

|

|

|

|

|

| Net assets consists of: |

|

|

|

| Common stock, par value of $0.001 per share; 90,000,000 shares authorized and 2,505,000 shares issued and outstanding as of October 31, 2018 |

| 2,505 |

|

| Paid-in capital in excess of par |

| 49,963,923 |

|

| Total distributable earnings |

| 420,079 |

|

| Total net assets |

| 50,386,507 |

|

|

|

|

|

| Total liabilities and net assets |

| $ | 51,101,241 |

|

|

|

|

|

| Number of shares outstanding |

| 2,505,000 |

|

| Net asset value per share |

| $ | 20.11 |

|

See Notes to Financial Statements.

OFS Credit Company, Inc.

Statement of Operations

|

| | | | |

|

| Period from October 10 (commencement of operations) through October 31, 2018 |

| Investment income |

|

|

| Interest income |

| $ | 350,832 |

|

|

|

|

| Operating expenses |

|

|

| Management fees |

| 52,931 |

|

| Professional fees |

| 101,872 |

|

| Administrative fees |

| 10,000 |

|

| Board of directors fees |

| 10,645 |

|

| Other expenses |

| 11,278 |

|

| Total operating expenses |

| 186,726 |

|

| Less: Waiver of management fee (note 3) |

| (52,931 | ) |

| Net operating expenses |

| 133,795 |

|

|

|

|

|

| Net investment income |

| 217,037 |

|

|

|

|

|

| Realized and unrealized gain on investments |

|

|

|

| Net unrealized appreciation on investments |

| 69,470 |

|

| Net gain on investments |

| 69,470 |

|

|

|

|

|

| Net increase in net assets resulting from operations |

| $ | 286,507 |

|

|

|

|

See Notes to Financial Statements.

OFS Credit Company, Inc.

Statement of Changes in Net Assets

|

| | | |

| | Period from October 10 (commencement of operations) through October 31, 2018 |

| Increase in net assets resulting from operations: | |

| Net investment income | $ | 217,037 |

|

| Net unrealized appreciation on investments | 69,470 |

|

| Net increase in net assets resulting from operations | 286,507 |

|

| | |

| Capital share transactions: | |

| Proceeds from sale of shares | 50,000,000 |

|

| Net increase in net assets resulting from capital transactions | 50,000,000 |

|

| | |

| Net increase in net assets | 50,286,507 |

|

| | |

| Net assets at the beginning of the period | 100,000 |

|

| Net assets at the end of the period (including distributable earnings of $420,079) | $ | 50,386,507 |

|

| | |

| Capital share transactions: | |

| Shares at the beginning of the period | 5,000 |

|

| Initial public offering | 2,500,000 |

|

| Shares at the end of the period | 2,505,000 |

|

See Notes to Financial Statements.

OFS Credit Company, Inc.

Statement of Cash Flows

|

| | | | |

| | | Period from October 10 (commencement of operations) through October 31, 2018 |

| Cash flows from operating activities | | |

| Net increase in net assets resulting from operations | | $ | 286,507 |

|

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | |

| Net unrealized appreciation on investments | | (69,470 | ) |

| Accretion of interest income on structured-finance securities | | (350,609 | ) |

| Purchase of portfolio investments | | (43,615,625 | ) |

| Distributions from portfolio investments | | 2,159,764 |

|

| Changes in operating assets and liabilities: | | |

| Investment distribution receivable | | (155,443 | ) |

| Prepaid expenses and other assets | | (13,555 | ) |

| Administrative fee payable | | 10,000 |

|

| Accrued professional fees | | 96,946 |

|

| Payable for investment purchased | | 590,000 |

|

| Other accrued liabilities | | 17,788 |

|

| Net cash used in operating activities | | (41,043,697 | ) |

| | | |

| Cash flows from financing activities | | |

| Net proceeds from issuance of common stock | | 50,000,000 |

|

| Net cash provided by financing activities | | 50,000,000 |

|

| | | |

| Net increase in cash | | 8,956,303 |

|

| Cash at beginning of period | | 100,000 |

|

| Cash at end of period | | $ | 9,056,303 |

|

| | | |

See Notes to Financial Statements.

OFS Credit Company, Inc.

Schedule of Investments

October 31, 2018

|

| | | | | | | | | | | | | | | | | | | | | |

Company and Investment | | Effective Yield (3) | | Initial Acquisition Date | | Maturity (6) | | Principal Amount | | Amortized Cost (4) | | Fair Value (5) | | Percent of Net Assets |

Structured Finance (1)(2) | | | | | | | | | | | | | | |

| Anchorage Capital CLO 1-R Ltd. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Notes |

| 14.16% |

| 10/5/2018 |

| 4/13/2031 |

| $ | 2,100,000 |

|

| $ | 1,813,440 |

|

| $ | 1,953,000 |

|

| 3.9 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Atlas Senior Loan Fund X Ltd. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Notes |

| 15.22% |

| 10/5/2018 |

| 1/15/2031 |

| 5,000,000 |

|

| 3,278,574 |

|

| 3,250,000 |

|

| 6.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Atlas Senior Loan Fund IX Ltd. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Notes |

| 13.37% |

| 10/5/2018 |

| 4/20/2028 |

| 1,200,000 |

|

| 683,526 |

|

| 672,000 |

|

| 1.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Battalion CLO IX Ltd. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income Notes (7) |

| 15.78% |

| 10/10/2018 |

| 7/15/2031 |

| 1,079,022 |

|

| 735,292 |

|

| 712,155 |

|

| 1.4 |

|

| Subordinated Notes |

| 15.78% |

| 10/10/2018 |

| 7/15/2031 |

| 1,770,978 |

|

| 1,206,821 |

|

| 1,168,845 |

|

| 2.3 |

|

|

|

|

|

|

|

|

| 2,850,000 |

|

| 1,942,113 |

|

| 1,881,000 |

|

| 3.7 |

|

| Dryden 30 Senior Loan Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Notes |

| 14.10% |

| 10/5/2018 |

| 11/15/2028 |

| 1,000,000 |

|

| 595,084 |

|

| 550,000 |

|

| 1.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dryden 41 Senior Loan Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Notes |

| 13.72% |

| 10/5/2018 |

| 4/15/2031 |

| 2,600,000 |

|

| 1,966,062 |

|

| 2,028,000 |

|

| 4.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dryden 53 CLO, LTD., |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income Notes (7) |

| 12.84% |

| 10/5/2018 |

| 1/15/2031 |

| 2,400,000 |

|

| 2,078,399 |

|

| 2,016,000 |

|

| 4.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dryden 38 Senior Loan Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Notes |

| 13.63% |

| 10/5/2018 |

| 7/15/2030 |

| 2,600,000 |

|

| 1,879,412 |

|

| 1,924,000 |

|

| 3.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Elevation CLO 2017-7, Ltd. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Notes |

| 15.42% |

| 10/5/2018 |

| 7/15/2030 |

| 4,750,000 |

|

| 3,831,600 |

|

| 3,895,000 |

|

| 7.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Elevation CLO 2017-8, Ltd. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Notes |

| 15.06% |

| 10/5/2018 |

| 10/25/2030 |

| $ | 2,000,000 |

|

| $ | 1,700,728 |

|

| $ | 1,740,000 |

|

| 3.5 | % |

OFS Credit Company, Inc.

Schedule of Investments

October 31, 2018

|

| | | | | | | | | | | | | | | | | | | | | |

Company and Investment | | Effective Yield (3) | | Initial Acquisition Date | | Maturity (6) | | Principal Amount | | Amortized Cost (4) | | Fair Value (5) | | Percent of Net Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Flatiron CLO 18 Ltd. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Notes |

| 13.10% |

| 10/5/2018 |

| 4/17/2031 |

| 4,500,000 |

|

| 3,990,017 |

|

| 3,960,000 |

|

| 7.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Greenwood Park CLO, Ltd. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Notes |

| 13.10% |

| 10/5/2018 |

| 4/15/2031 |

| 4,000,000 |

|

| 3,694,103 |

|

| 3,680,000 |

|

| 7.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| HarbourView CLO VII-R, Ltd. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Notes |

| 17.53% |

| 10/5/2018 |

| 11/18/2026 |

| 3,100,000 |

|

| 2,091,207 |

|

| 2,139,000 |

|

| 4.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Madison Park Funding XXIII, Ltd., |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Notes |

| 8.86% |

| 10/5/2018 |

| 7/27/2047 |

| 2,200,000 |

|

| 2,129,581 |

|

| 2,112,000 |

|

| 4.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Marble Point CLO X Ltd. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Notes |

| 12.33% |

| 10/5/2018 |

| 10/15/2030 |

| 5,000,000 |

|

| 4,090,426 |

|

| 3,850,000 |

|

| 7.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Marble Point CLO XI Ltd. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income Notes (7) |

| 16.20% |

| 10/5/2018 |

| 12/18/2047 |

| 1,500,000 |

|

| 1,267,817 |

|

| 1,290,000 |

|

| 2.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Voya CLO 2017-4, Ltd. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Notes |

| 13.28% |

| 10/5/2018 |

| 10/15/2030 |

| 1,000,000 |

|

| 891,408 |

|

| 920,000 |

|

| 1.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| THL Credit Wind River 2014-3 CLO Ltd. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Notes |

| 16.29% |

| 10/10/2018 |

| 10/22/2031 |

| 2,778,000 |

|

| 2,046,604 |

|

| 2,027,940 |

|

| 4.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ZAIS CLO 3, Limited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income Notes (7) |

| 15.12% |

| 10/10/2018 |

| 7/15/2031 |

| 1,038,255 |

|

| 680,935 |

|

| 737,161 |

|

| 1.5 |

|

| Subordinated Notes |

| 15.12% |

| 10/10/2018 |

| 7/15/2031 |

| 1,761,745 |

|

| 1,155,434 |

|

| 1,250,839 |

|

| 2.5 |

|

|

|

|

|

|

|

|

| 2,800,000 |

|

| 1,836,369 |

|

| 1,988,000 |

|

| 4.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Structured Finance Notes |

|

|

|

|

|

|

| $ | 53,378,000 |

|

| $ | 41,806,470 |

|

| $ | 41,875,940 |

|

| 83.1 | % |

OFS Credit Company, Inc.

Schedule of Investments

October 31, 2018

(1) These investments are generally subject to certain limitations on resale, and may be deemed to be "restricted securities" under the Securities Act.

(2) Structured finance notes are considered CLO subordinated debt positions. CLO subordinated debt positions are entitled to recurring distributions which are generally equal to the remaining cash flow of payments made by underlying securities less contractual payments to debt holders and fund expenses.

(3) The effective yield is estimated based upon the current projection of the amount and timing of distributions in addition to the estimated amount of terminal principal payments. Effective yields for the Company's CLO subordinated debt positions are monitored and evaluated at each reporting date. The estimated yield and investment cost may ultimately not be realized. As of October 31, 2018, the Company's weighted-average effective yield on its aggregate CLO structured finance positions, based on current amortized cost, was 14.06%.

(4) Amortized cost reflects accretion of effective yield less any cash distributions received or entitled to be received from CLO structured finance investments.

(5) The fair value of all investments was determined using significant, unobservable inputs. See "Note 4. Fair Value of Financial Instruments".

(6) Maturity represents the contractual maturity date of the structured finance notes. Expected maturity and cash flows, not contractual maturity and cash flows, were utilized in deriving the effective yield of the investments.

(7) Security issued by an affiliate of named issuer.

See Notes to Financial Statements.

OFS Credit Company, Inc.

Notes to Financial Statements

Note 1. Organization

OFS Credit Company, Inc., (the “Company”) is a Delaware corporation formed on September 1, 2017. The Company’s operations commenced on October 10, 2018 upon completion of the sale and issuance of 2,500,000 shares of common stock at an aggregate purchase price of $50,000,000 (the "Offering"). Prior to October 10, 2018, there had been no activity other than the sale and issuance of 5,000 shares of common stock at an aggregate purchase price of $100,000 to OFS Funding I, LLC, a wholly owned subsidiary of Orchard First Source Asset Management, LLC (“OFSAM”).

The Company is a non-diversified, externally managed, closed-end management investment company that has registered as an investment company under the Investment Company Act of 1940, as amended ("1940 Act"); and intends to elect to be treated for federal income tax purposes, and to qualify annually thereafter, as a regulated investment company ("RIC") under the Internal Revenue Code of 1986, as amended (the "Code"). The Company's investment adviser is OFS Capital Management, LLC, which the Company refers to as “OFS Advisor”. The Company's primary investment objective is to generate current income, with a secondary objective to generate capital appreciation. The Company invests its assets in floating rate credit instruments and other structured credit investments, including: (i) collateralized loan obligation (“CLO”) debt and subordinated/residual tranche securities ("Structured Finance Notes"); (ii) traditional corporate credit investments, including leveraged loans and high yield bonds; (iii) opportunistic credit investments, including stressed and distressed credit situations and long/short credit investments; and (iv) other credit-related instruments. The CLOs in which the Company invests are collateralized by portfolios consisting primarily of below investment grade U.S. senior secured loans with a large number of distinct underlying borrowers across various industry sectors.

Note 2. Basis of Presentation and Summary of Significant Accounting Policies

Basis of presentation: The Company prepares its financial statements in accordance with accounting principles generally accepted in the United States of America ("GAAP"), including the provision ASC Topic 946, Financial Services — Investment Companies, and the reporting requirements of the 1940 Act and Article 6 of Regulation S-X. In the opinion of management, the financial statements include all adjustments, consisting only of normal and recurring accruals and adjustments, necessary for fair presentation in accordance with GAAP.

Use of estimates: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ significantly from those estimates.

Cash: The Company’s cash is maintained with a member bank of the FDIC and at times, such balances may be in excess of the FDIC insurance limits. Cash as of October 31, 2018, includes $9,056,303 held at US Bank National Association in a Money Market Deposit Account.

Investments: The Company applies fair value accounting in accordance with ASC Topic 820, which defines fair value, establishes a framework to measure fair value, and requires disclosures regarding fair value measurements. Fair value is defined as the price to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date. Fair value is determined through the use of models and other valuation techniques, valuation inputs, and assumptions market participants would use to value the investment. Highest priority is given to prices for identical assets quoted in active markets (Level 1) and the lowest priority is given to unobservable valuation inputs (Level 3). The availability of observable inputs can vary significantly and is affected by many factors, including the type of product, whether the product is new to the market, whether the product is traded on an active exchange or in the secondary market, and the current market conditions. To the extent that the valuation is based on less observable or unobservable inputs, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised by the Company in determining fair value is greatest for financial instruments classified as Level 3 (i.e., those instruments valued using non-observable inputs), which comprise the entirety of the Company’s investments.

Changes to the valuation policy are reviewed by management and the Company’s board of directors ("Board"). As the Company’s investments change, markets change, new products develop, and valuation inputs become more or less observable, the Company will continue to refine its valuation methodologies.

See Note 4 for additional disclosures of the Company’s fair value measurements of its financial instruments.

The Company may acquire Structured Finance Notes of CLO investment vehicles or invest in CLO loan accumulation facilities. In valuing such investments, the Company considers the indicative prices provided by a recognized industry pricing service as a primary source, and the implied yield of such prices, supplemented by actual trades executed in the market at or

around period-end, as well as the indicative prices provided by broker-dealers. The Company also considers the operating metrics of the CLO vehicle, including compliance with collateralization tests as well as defaults, restructuring activity and prepayment, and prepayments on the outstanding loans, if any. The Company engages a third-party valuation firm to provide assistance to the Company's Board in valuing our investments, which they will evaluate and consider in determining fair value.

Investment Income

Interest income: Interest income from investments in Structured Finance Notes is recognized on the basis of the estimated effective yield to expected redemptions utilizing assumed cash flows in accordance with ASC Sub-topic 325-40, Beneficial Interests in Securitized Financial Assets. The Company monitors the expected cash flows from its Structured Finance Notes, and the effective yield is determined and updated periodically.

Net realized and unrealized gain or loss on investments: Investment transactions are reported on a trade-date basis. Unsettled trades as of the balance sheet date are included in payables for investments purchased. Realized gains or losses on investments are measured by the difference between the net proceeds from the disposition and the amortized cost basis of the investment on a specific-identification basis. Investments are valued at fair value as determined in good faith by the Board. The Company reports changes in the fair value of investments as net changes in unrealized appreciation/depreciation on investments in the statement of operations.

Income taxes: The Company intends to elect to be treated as a RIC under Subchapter M of the Code as soon as practicable. Once qualified as a RIC, and so long as the Company maintains its status as a RIC, it generally will not pay corporate-level U.S. federal income taxes on the ordinary income or capital gains that it distributes at least annually to its stockholders as dividends. The Company is subject to corporate-level taxes under Subchapter C of the Code until it qualifies and elects to be treated as a RIC.

Distributions: Distributions to common stockholders are recorded on the record date. The timing of monthly distributions as well as the amount to be paid out as a distribution is determined by the Board each quarter. Distributions from net investment income and net realized gains are determined in accordance with the Code. Net realized capital gains, if any, are distributed at least annually, although the Company may decide to retain such capital gains for investment. Distributions paid in excess of taxable net investment income and net realized gains are considered returns of capital to stockholders.

Concentration of credit risk: Aside from its instruments in Structured Finance Notes and CLO loan accumulation facilities, financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash deposits at financial institutions. At various times during the year, the Company may exceed the federally insured limits. To mitigate this risk, the Company places cash deposits only with high credit quality institutions. Management believes the risk of loss related to our cash deposits is minimal. The amount of loss due to credit risk from investments in Structured Finance Notes, if underlying funds and managers fail to perform according to the terms of the indentures and collateral management agreements, and the collateral or other security for those instruments proved to be of no value to the Company is equal to the Company's recorded investment in Structured Finance Notes.

Note 3. Related Party Transactions

Investment Advisory and Management Agreement: OFS Advisor manages the day-to-day operations of, and provides investment advisory services to, the Company pursuant to an investment advisory and management agreement (the "Investment Advisory Agreement"). The Investment Advisory Agreement was approved by the Board on July 6, 2018 and became effective October 4, 2018. Under the terms of the Investment Advisory Agreement, OFS Advisor is responsible for: i) determining the composition of the portfolio, the nature and timing of the changes to the portfolio and the manner of implementing such changes; ii) identifying, evaluating and negotiating the structure of the investments made (including performing due diligence on prospective investments); iii) closing and monitoring the investments made and iv) providing other investment advisory, research and related services as required. OFS Advisor is a subsidiary of OFSAM and a registered investment advisor under the Investment Advisers Act of 1940, as amended (the "Advisers Act"). OFS Advisor’s services under the Investment Advisory Agreement are not exclusive, and both it and its members, officers and employees are free to furnish similar services to other persons and entities so long as its services to the Company are not impaired. OFS Advisor also serves as the investment adviser to CLO funds and other assets, including OFS Capital Corporation and Hancock Park Corporate Income, Inc.

OFS Advisor receives fees for providing services, consisting of two components: a base management fee ("Base Management Fee") and an incentive fee ("Incentive Fee"). The Base Management Fee is calculated and payable quarterly in arrears and equals an annual rate of 1.75% of the Company’s “Total Equity Base”, defined as the net asset value (“NAV”) of the Company’s shares of common stock and the paid-in capital of the Company’s preferred stock, if any. Base Management Fees are paid by the holders of our shares of common stock and are not paid by holders of preferred stock, if any, or the holders of any other types of securities that the Company may issue. Base Management Fees for any partial calendar quarter are prorated based on the number of days in such quarter. The Base Management Fee does not increase when the Company borrows funds, but will increase if the Company issues preferred stock.

For the period from October 10, 2018 (commencement of operations) through January 31, 2019, OFS Advisor has agreed to waive the Base Management Fee, without recourse against or reimbursement by the Company. For the period from October 10, 2018 (commencement of operations) through October 31, 2018, the waived base management fee was $52,931.

The Incentive Fee is calculated and payable quarterly in arrears and equals 20% of the Company’s “Pre-Incentive Fee Net Investment Income” for the immediately preceding quarter, subject to a preferred return, or “hurdle,” and a “catch up” feature. No incentive fees are payable to OFS Advisor in respect of any capital gains. For this purpose, “Pre-Incentive Fee Net Investment Income” means interest income, dividend income and any other income (including any other fees, such as commitment, origination, structuring, diligence and consulting fees or other fees that the Company receives from an investment) accrued during the calendar quarter, minus the Company’s operating expenses for the quarter (including the Base Management Fee, expenses payable under the administrative services agreement to OFS Capital Services, LLC, ("OFS Services") and any interest expense and dividends paid on any issued and outstanding preferred stock, but excluding the Incentive Fee). Pre-Incentive Fee Net Investment Income includes accrued income that the Company has not yet received in cash, as well as any such amounts received (or accrued) in kind. Pre-Incentive Fee Net Investment Income does not include any capital gains or losses, and no incentive fees are payable in respect of any capital gains and no incentive fees are reduced in respect of any capital losses.

In calculating the Incentive Fee for any given calendar quarter, Pre-Incentive Fee Net Investment Income, expressed as a rate of return on the value of the Company’s net assets at the end of the immediately preceding calendar quarter, is compared to a hurdle of 2.00% of the Company’s net asset value per quarter (8.00% annualized) (the "Hurdle Rate"). For such purposes, the Company’s quarterly rate of return is determined by dividing its Pre-Incentive Fee Net Investment Income by its reported net assets as of the prior period end. The Company’s net investment income used to calculate this part of the incentive fee is also included in the calculation of the Total Equity Base which is used to calculate the Base Management Fee. The Incentive Fee with respect to the Company’s Pre-Incentive Fee Net Investment Income in each calendar quarter as follows:

| |

| (A) | no Incentive Fee in any calendar quarter in which Pre-Incentive Fee Net Investment Income does not exceed the hurdle of 2.00% of NAV; |

| |

| (B) | 100% of Pre-Incentive Fee Net Investment Income with respect to that portion of such Pre-Incentive Fee Net Investment Income, if any, that exceeds the hurdle but is less than 2.50% of NAV in any calendar quarter (10.00% annualized). The Company refers to this portion of the Pre-Incentive Fee Net Investment Income (which exceeds the hurdle but is less than 2.50% of our NAV) as the “catch-up.” The “catch-up” is meant to provide OFS Advisor with 20% of Pre-Incentive Fee Net Investment Income as if a hurdle did not apply if this net investment income meets or exceeds 2.50% of NAV in any calendar quarter; and |

| |

| (C) | 20.0% of that portion of the Company’s pre-Incentive Fee net investment income, if any, with respect to which the Rate of Return exceeds 2.50% in such quarter (10.0% annualized) is payable to the Advisor (that is, once the hurdle is reached and the catch-up is achieved, 20% of all Pre-Incentive Fee Net Investment Income thereafter is paid to the Advisor). |

There shall be no accumulation of amounts on the Hurdle Rate from quarter to quarter, no claw back of amounts previously paid if the rate of return in any subsequent quarter is below the Hurdle Rate and no delay of payment if the Rate of Return in any prior quarters was below the Hurdle Rate. Incentive Fees shall be adjusted for any share issuances or repurchases during the calendar quarter, and Income-Based Fees for any partial quarter shall be prorated based on the number of days in such quarter.

For the period from October 10, 2018 (commencement of operations) through October 31, 2018, OFS Advisor has agreed to waive its incentive fee, without recourse against or reimbursement by the Company. For the period from October 10, 2018 (commencement of operations) through October 31, 2018, the waived incentive fee was $-0-.

Administration Agreement: OFS Services, an affiliate of OFS Advisor, provides the administrative services necessary for the Company to operate. OFS Services furnishes the Company with office facilities and equipment, necessary software licenses and subscriptions, and clerical, bookkeeping and record keeping services at such facilities pursuant to an administrative services agreement (the "Administration Agreement"). The Administration Agreement was approved by the Board on July 6, 2018 and became effective on October 4, 2018. Under the Administration Agreement, OFS Services performs, or oversees the performance of, the Company’s required administrative services, which include being responsible for the financial records that the Company is required to maintain and preparing reports to its stockholders and all other reports and materials required to be filed with the Securities and Exchange Commission or any other regulatory authority. In addition, OFS Services assists the Company in determining and publishing its net asset value, oversees the preparation and filing of its tax returns and the printing and dissemination of reports to its stockholders, and generally oversees the payment of the Company’s expenses and the performance of administrative and professional services rendered to the Company by others. Payment under the Administration Agreement is equal to an amount based upon the Company’s allocable portion (subject to the review and approval of the Board) of OFS Services’ overhead in performing its obligations under the Administration Agreement, including, but not limited

to, rent, information technology services and the Company’s allocable portion of the cost of its officers, including its chief executive officer, chief financial officer, chief compliance officer, chief accounting officer, corporate secretary and their respective staffs. To the extent that OFS Services outsources any of its functions, the Company will pay the fees associated with such functions on a direct basis without profit to OFS Services. The Administration Agreement may be renewed annually with the approval of the Board, including a majority of our directors who are not “interested persons.” The Administration Agreement may be terminated by either party without penalty upon 60 days’ written notice to the other party.

Administration fee expense was $10,000 for the period from October 10, 2018 (commencement of operations) October 31, 2018.

Note 4. Fair Value of Financial Instruments

The following table provides quantitative information about the Company’s Level 3 fair value measurements as of October 31, 2018. The weighted average calculations in the table below are based on the fair value within each respective valuation technique and methodology and asset category.

|

| | | | | | | | | |

| | Fair Value as of October 31, 2018 | | Valuation Techniques | | Unobservable Input | | Range(2) (Weighted average)(3) |

| Investments | | | | | | | |

| Structured Finance Notes | $ | 41,875,940 |

| | Market quotes | | NBIB (1) | | 55% - 96% (79.86%) |

(1) The Company generally uses non-binding indicative bid (“NBIB”) prices provided by an independent pricing service near the valuation date as the primary basis for the fair value determinations for Structured Finance Notes investments. These bid prices are non-binding, and an actual transaction price may differ. Each bid price is evaluated by the Board in conjunction with additional information compiled by OFS Advisor, including observed transactions at or near the valuation date, and performance and covenant compliance information as provided by the independent trustee.

(2) The range is comprised of the NBIB's provided by the independent pricing service.

(3) Weighted average is calculated based on fair value of investments.

The following tables present changes in the investment measured at fair value using Level 3 inputs for the period from October 10 (commencement of operations) through October 31, 2018.

|

| | | |

| | Structured Finance Notes |

| Level 3 assets, Beginning of period | $ | — |

|

| | |

Net unrealized appreciation on investments (1) | 69,470 |

|

| Accretion of interest income on structured-finance securities | 350,609 |

|

| Purchase of portfolio investments | 43,615,625 |

|

| Distributions from portfolio investments | (2,159,764 | ) |

| | |

| Level 3 assets, October 31, 2018 | $ | 41,875,940 |

|

(1) The change in net unrealized appreciation/(depreciation) during the period on level 3 assets held at the end of period is $69,470.

Other Financial Assets and Liabilities

GAAP requires disclosure of the fair value of financial instruments for which it is practical to estimate such value. The Company believes that the carrying amounts of its other financial instruments such as cash, receivables and payables approximate the fair value of such items due to the short maturity of such instruments.

The information presented should not be interpreted as an estimate of the fair value of the entire Company since fair value measurements are only required for a portion of the Company’s assets and liabilities. Due to the wide range of valuation techniques and the degree of subjectivity used in making the estimates, comparisons between the Company’s disclosures and those of other companies may not be meaningful.

Note 5. Commitments and Contingencies

In the normal course of business, the Company enters into contracts and agreements that contain a variety of representations and warranties that provide general indemnifications. The Company’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Company that have not occurred. The Company believes the risk of any material obligation under these indemnifications to be low.

Note 6. Federal Income Taxes

The Company intends to elect, and qualify annually thereafter, to be taxed as a RIC under Subchapter M of the Code. In order to maintain its status as a RIC, the Company will be required to distribute annually to its stockholders at least 90% of its investment company taxable income ("ICTI"), as defined by the Code. Additionally, to avoid a 4% excise tax on undistributed earnings the Company will be required to distribute each calendar year the sum of (i) 98% of its ordinary income for such calendar year (ii) 98.2% of its net capital gains for the period ending October 31 of that calendar year, and (iii) any income recognized, but not distributed, in preceding years and on which the Company paid no federal income tax. Maintenance of the Company's RIC status also requires adherence to certain source of income and asset diversification requirements.

The Company has met the source of income and asset diversification requirements as of October 31, 2018, and intends to continue meeting these requirements. The Company’s ICTI differs from the net increase in net assets resulting from operations primarily due to differences in income recognition for Structured Finance Notes for which GAAP requires recognition of an estimated constant yield whereas federal income tax rules require recognition of net investment income reported to the Company by the underlying CLO fund in the tax period reported, as well as differences in recognition of unrealized appreciation/depreciation of investments. The Company recognized no ICTI or realized capital gains during the period from through October 31, 2018. The Company recorded a reclassification to its capital accounts of $133,572 related to a net operating loss for tax purposes for the period ended October 31, 2018.

The tax-basis cost of investments and associated tax-basis gross unrealized appreciation (depreciation) inherent in the fair value of investments as of October 31, 2018, were as follows:

|

| | | | |

| Tax-basis amortized cost of investments | | $ | 41,455,861 |

|

| Tax-basis gross unrealized appreciation on investments | | 773,104 |

|

| Tax-basis gross unrealized depreciation on investments | | (353,025 | ) |

| Tax-basis net unrealized appreciation on investments | | 420,079 |

|

| Fair value of investments | | $ | 41,875,940 |

|

Note 7. Financial Highlights

The following is a schedule of financial highlights for the period ended October 31, 2018:

|

| | | |

| | Period from October 10 (commencement) through October 31, 2018 |

| Per share data: | |

| Net asset value per share at beginning of period | $ | 20.00 |

|

| Net investment income | 0.08 |

|

| Net unrealized appreciation | 0.03 |

|

| Net asset value per share at end of period | $ | 20.11 |

|

| Per share market value, end of period | 18.78 |

|

Total return based on market value (1) | (6.1 | )% |

Total return based on net asset value (2) | 0.6 | % |

| Ratio/Supplemental Data | |

| Net asset value at end of period | $ | 50,386,507 |

|

Ratio of total operating expenses to average net assets (4)(6) | 4.42 | % |

Ratio of net investment income to average net assets (5)(6) | 7.17 | % |

Portfolio turnover (3) | 5.10 | % |

| |

| (1) | Total return based on market value is calculated assuming shares of common stock were purchased at the market price at the beginning of the period, distributions were reinvested at a price obtained in the Company's dividend reinvestment plan, and shares were sold at the closing market price on the last day of the period. Total return is not annualized for a period of less than one year. |

| |

| (2) | Total return based on net asset value is calculated assuming shares of common stock were purchased at the net asset value at the beginning of the period, distributions were reinvested at a price obtained in the Company's dividend reinvestment plan, and shares were sold at the ending net asset value on the last day of the period. Total return is not annualized for a period of less than one year. |

| |

| (3) | Portfolio turnover rate is calculated using the lesser of period-to-date sales and principal payments or period-to-date purchases over the average of the invested assets at fair value. |

| |

| (4) | Ratio of total expenses before management fee waiver to average net assets was 6.17% for the period from October 10 through October 31, 2018. |

| |

| (5) | Ratio of net investment income before management fee waiver to average net assets was 5.42% for the period from October 10 through October 31, 2018. |

Note 8. Capital Transactions

Common Stock Transactions

On June 22, 2018, the Company sold and issued 5,000 shares of common stock at an aggregate purchase price of $100,000 to OFS Funding I, LLC, a wholly owned subsidiary of OFSAM.

On October 10, 2018, the Company completed the sale and issuance of 2,500,000 shares of common stock at an aggregate purchase price of $50,000,000 in the Offering. OFS Advisor paid commissions of $1,959,750 and organizational and offering costs of $575,018 relating to the Offering and such costs are not subject to recoupment from the Company. The Company used $43,025,625 of the proceeds to purchase its initial portfolio of investments.

Distributions

On October 15, 2018, the Board declared the following distributions on common shares.

|

| | |

| Record Date | Payable Date | Dividend Per Common Share |

| November 5, 2018 | November 16, 2018 | $0.113 |

| November 12, 2018 | November 30, 2018 | $0.167 |

| December 10, 2018 | December 31, 2018 | $0.167 |

| January 14, 2019 | January 31, 2019 | $0.167 |

Note 9. Subsequent Events

The Company evaluated events subsequent to October 31, 2018 to assess the need for disclosure. No subsequent events that require disclosure occurred through December 19, 2018.

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors

OFS Credit Company, Inc.:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of OFS Credit Company, Inc. (the “Company”), including the schedule of investments, as of October 31, 2018, the related statements of operations, changes in net assets, and cash flows for the period from October 10, 2018 (commencement of operations) through October 31, 2018 and the related notes (collectively, the “financial statements”) and the financial highlights for the period from October 10, 2018 through October 31, 2018. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Company as of October 31, 2018, the results of its operations, the changes in its net assets, its cash flows, and the financial highlights for the period from October 10, 2018 through October 31, 2018, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audit included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of October 31, 2018, by correspondence with custodians and brokers. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audit provides a reasonable basis for our opinion.

/s/ KPMG LLP

We have served as the Company’s auditor since 2018.

Chicago, Illinois

December 19, 2018

DISTRIBUTION REINVESTMENT PLAN

We have adopted a plan that provides for reinvestment of our distributions and other distributions on behalf of our stockholders (the “DRIP”), unless a stockholder elects to receive cash as provided below. As a result, if our Board authorizes, and we declare, a cash distribution, then our stockholders who have not “opted out” of our DRIP will have their cash distribution automatically reinvested in additional shares of common stock, rather than receiving the cash distribution.

No action is required on the part of a registered stockholder to have their cash distribution reinvested in our common stock. A registered stockholder may elect to receive an entire distribution in cash by notifying American Stock Transfer & Trust Company, LLC, the plan administrator and our transfer agent and registrar, in writing so that such notice is received by the plan administrator no later than 10 days prior to the record date for distributions to stockholders. The plan administrator will set up an account for shares acquired through the DRIP for each stockholder who has not elected to receive distributions in cash and hold such shares in non-certificated form. Upon request by a stockholder participating in the plan, received in writing not less than 10 days prior to the record date, the plan administrator will, instead of crediting shares to the participant’s account, issue a certificate registered in the participant’s name for the number of whole shares and a check for any fractional share.

Those stockholders whose shares are held by a broker or other financial intermediary may receive distributions in cash by notifying their broker or other financial intermediary of their election.

We will use primarily newly issued shares to implement the DRIP, whether our shares are trading at a premium or at a discount to net asset value. However, we reserve the right to direct the plan administrator to purchase shares in the open market in connection with our implementation of the plan. The number of shares to be issued to a stockholder is determined by dividing the total dollar amount of the distribution payable to such stockholder by the market price per share at the close of regular trading on the Nasdaq Capital Market on the valuation date for such distribution. Market price per share on that date will be the closing price for such shares on the Nasdaq Capital Market or, if no sale is reported for such day, at the average of their reported bid and asked prices. The number of shares to be outstanding after giving effect to payment of the distribution cannot be established until the value per share at which additional shares will be issued has been determined and elections of our stockholders have been tabulated.

There will be no brokerage charges or other charges to stockholders who participate in the DRIP. The plan administrator’s fees will be paid by us. If a participant elects by written notice to the plan administrator to have the plan administrator sell part or all of the shares held by the plan administrator in the participant’s account and remit the proceeds to the participant, the plan administrator is authorized to deduct a $15.00 transaction fee plus a $0.10 per share brokerage commission from the proceeds.

Stockholders who receive distributions in the form of stock are subject to the same U.S. federal tax consequences as are stockholders who elect to receive their distributions in cash; however, since their cash distributions will be reinvested, such stockholders will not receive cash with which to pay any applicable taxes on reinvested distributions. A stockholder’s basis for determining gain or loss upon the sale of stock received in a distribution from us will be equal to the total dollar amount of the distribution payable to the stockholder. Any stock received in a distribution will have a new holding period for tax purposes commencing on the day following the day on which the shares are credited to the U.S. stockholder’s account.

Participants may terminate their accounts under the DRIP by notifying the plan administrator via its website at www.amstock.com, by filling out the transaction request form located at the bottom of their statement and sending it to the plan administrator. Such termination will be effective immediately if the participant’s notice is received by the plan administrator not less than 10 days prior to any distribution record date; otherwise, such termination will be effective only with respect to any subsequent distribution. The DRIP may be terminated by us upon notice in writing mailed to each participant at least 30 days prior to any record date for the payment of any distribution by us. All correspondence concerning the DRIP should be directed to the plan administrator by mail American Stock Transfer & Trust Company, LLC, P.O. Box 922, Wall Street Station, New York, New York 10269, or by the plan administrator’s Interactive Voice Response System at (800) 937-5449.

If a stockholder withdraws or the plan is terminated, such stockholder will receive the number of whole shares in their account under the plan and a cash payment for any fraction of a share in their account.

If a stockholder holds shares with a brokerage firm that does not participate in the plan, such stockholder will not be able to participate in the plan and any distribution reinvestment may be effected on different terms than those described above. Consult your financial advisor for more information.

BOARD APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT

At an in-person organizational meeting of our Board held on July 6, 2018, our Board unanimously voted to approve the Investment Advisory Agreement. In reaching a decision to approve the Investment Advisory Agreement, the Board reviewed a significant amount of information and considered and concluded, among other things:

| |

| • | The nature, quality and extent of the advisory and other services to be provided to us by OFS Advisor, including the responses in a questionnaire regarding OFS Advisor’s investment process and OFS Advisor’s policies and guidelines currently in place to monitor and manage the risk and volatility associated with the Company’s portfolio, and the qualifications and abilities of the professional personnel of OFS Advisor and the compensation structure for such personnel, and concluded that such services are satisfactory; |

| |

| • | The investment performance of OFS Advisor; |

| |

| • | Comparative data with respect to advisory fees or similar expenses paid by other management investment companies with similar investment objectives, and concluded that the total advisory fees paid by the Company to OFS Advisor were reasonable; |

| |

| • | Our projected operating expenses and expense ratio compared to management investment companies with similar investment objectives, and concluded that our projected operating expenses were reasonable; |

| |

| • | Any existing and potential sources of indirect income to OFS Advisor from their relationship with the Company and the profitability of that relationship, and concluded that OFS Advisor’s profitability was not excessive with respect to us; |

| |

| • | The services to be performed and the personnel performing such services under the Investment Advisory Agreement, and concluded that the services to be performed and the personnel performing such services were satisfactory; |

| |

| • | The organizational capability and financial condition of OFS Advisor and its affiliates, and concluded that the organizational capability and financial condition of OFS Advisor were reasonable; and |

| |

| • | The possibility of obtaining similar services from other third-party service providers or through an internally managed structure, and concluded that our current externally managed structure with OFS Advisor as our investment advisor was satisfactory. |

Based on the information reviewed and the discussions detailed above, the Board, including all of the directors who are not “interested persons” as defined in the 1940 Act, concluded that the fees payable to OFS Advisor pursuant to the Investment Advisory Agreement were reasonable, and comparable to the fees paid by other management investment companies with similar investment objectives, in relation to the services to be provided. The Board did not assign relative weights to the above factors or the other factors considered by it. Individual members of the Board may have given different weights to different factors.

Additional Information

Management

Our Board is responsible for the overall management and supervision of our business and affairs, including the appointment of advisers and sub-advisers. Pursuant to the Investment Advisory Agreement, our Board has appointed OFS Advisor as our investment adviser. Our prospectus includes additional information about our directors and is available without charge, upon request by calling (847) 734-2000, or on the Securities and Exchange Commission website at http://www.sec.gov.

The investment committees of OFS Advisor (the "Adviser Investment Committees"), which includes the Structured Credit Investment Committee of OFS Advisor (the "Structured Credit Investment Committee"), are responsible for the overall asset allocation decisions and the evaluation and approval of investments of OFS Advisor’s advisory clients that invest in CLO securities.

The purpose of the Structured Credit Investment Committee is to evaluate and approve our prospective investments, subject at all times to the oversight of our Board. The Structured Credit Investment Committee, which is comprised of Richard Ressler (Chairman), Jeffrey Cerny, Bilal Rashid, Glen Ostrander and Kenneth A. Brown, is responsible for the evaluation and approval of all the investments made by us. The members of the senior investment team of OFS Adviser (the "Senior Investment Team") are our portfolio managers who are primarily responsible for the day-to-day management of the portfolio. The Senior Investment Team is supported by other investment professionals.

Information regarding the Structured Credit Investment Committee is as follows:

|

| | | | | |

Name (1) | | Age | | Position |

| Richard Ressler | | 60 | | Chairman of Structured Credit Investment Committee |

Bilal Rashid(2) | | 47 | | President and Senior Managing Director of OFSC and OFS Advisor |

Jeffrey A. Cerny(2) | | 55 | | Senior Managing Director of OFSC and OFS Advisor |

Glen Ostrander(2) | | 44 | | Managing Director of OFSC and OFS Advisor |

Kenneth A. Brown(2) | | 45 | | Managing Director of OFSC and OFS Advisor |

(1) The address for each member of the Structured Credit Investment Commitee is c/o OFS Capital Management, LLC, 10 S. Wacker Drive,

Suite 2500, Chicago, IL 60606.

(2) Member of the Senior Investment Team.

The Board of Directors

We have three classes of directors, currently consisting of one Class I director, two Class II directors and two Class III directors. At each annual meeting of stockholders, directors are elected for a full term of three years to succeed those whose terms are expiring. The terms of the three classes are staggered in a manner so that only one class is elected by stockholders annually.

The Board currently consists of five members, Messrs. Rashid and Cerny, Wolfgang Schubert, Kathleen M. Griggs and Romita Shetty. The term of one class expires each year commencing with the 2019 annual meeting. The term of Mr. Rashid expires at 2019 annual meeting; the terms of Ms. Shetty and Mr. Schubert expire at the 2020 annual meeting; and the terms of Ms. Griggs and Mr. Cerny expire at the 2021 annual meeting. Subsequently, each class of directors will stand for election at the conclusion of its respective term. Such classification may prevent replacement of a majority of the directors for up to a two-year period.

Information regarding our Board is as follows:

|

| | | | | | | | | | |

Name, Address(1)and Age | | Position(s) held with Company | | Term of Office and Length of Time Served | | Principal Occupation, Other Business Experience During the Past Five Years | | Number of Portfolios in Fund Complex Overseen by Director (2) | | Other Directorships Held by Director |

| Independent Directors | | | | | | | | |

Kathleen M. Griggs Age: 63

| | Director | | 2018 - Current | | Ms. Griggs has been a managing director of Griggs Consulting, LLC, a consulting and advisory firm, since 2014. Prior to that, Ms. Griggs served as the Chief Financial Officer of j2 Global, Inc. from 2007 to 2014. Ms. Griggs also previously served as a Director, Audit Committee Chair and Governance Committee member for Chad Therapeutics, Inc. from 2001 to 2009. Ms. Griggs received a Bachelor of Science degree in Business Administration from the University of Redlands and a Master of Business Administration degree from the University of Southern California in Los Angeles. From her experience as a Chief Financial Officer for over 25 years in public and private companies and as a financial expert for Chad Therapeutics, a public company, Ms. Griggs has developed extensive knowledge of accounting and finance, which we believe qualifies her for service on our Board. | | 1 | | None |

Wolfgang Schubert

Age: 48 | | Director | | 2018 - Current | | Mr. Schubert has served as a managing member of Werkstatt Capital, LLC, an investment management start-up that specializes in structured credit strategies, since July 2016. Prior to co-founding Werkstatt Capital, Mr. Schubert served as the chief risk officer of Strategic Value Partners from 2009 to 2015. Prior to joining Strategic Value Partners, Mr. Schubert held positions at Silver Point Capital, Merrill Lynch, JP Morgan and Goldman Sachs, where he worked in banking, structuring and financing functions. Mr. Schubert holds bachelor degrees from the University of Michigan, Ann Arbor and a master’s degree from Princeton University. He is also a CFA charterholder. We believe that Mr. Schubert’s wealth of experience in risk assessment and structured credit qualifies him for service on our Board.

| | 1

| | None |

|

| | | | | | | | | | |

Name, Address(1)and Age | | Position(s) held with Company | | Term of Office and Length of Time Served | | Principal Occupation, Other Business Experience During the Past Five Years | | Number of Portfolios in Fund Complex Overseen by Director (2) | | Other Directorships Held by Director |

| Independent Directors | | | | | | | | |

Romita Shetty

Age: 52

| | Director

| | 2018 - Current | | Ms. Shetty currently serves as a principal of DA Companies, parent of DA Capital LLC, a global investment manager specializing in credit and special situations. Ms. Shetty has 27 years of experience in fixed income and credit. At DA Capital she has focused on special situations, structured credit and private investments. She has also served in a management capacity as President of DA Capital Asia Pte Ltd. In 2007-2008 she ran the Global Special Opportunities group at Lehman Brothers which invested proprietary capital across the capital structure. Prior to that she co-ran North American structured equity and credit markets and the Global Alternative Investment product businesses at RBS from 2004 to 2006. Previously she worked at JP Morgan from 1997 to 2004 where she ran their Global Structured Credit Derivatives as well as Financial Institutions Solutions and CDO businesses. She started her career at Standard & Poor’s in 1990 where she worked on a wide variety of credit ratings including municipal bonds, financial institutions and asset-backed securities and managed a large part of their ABS ratings business. Ms. Shetty holds a BA (Honors) in History from St Stephens College, India and a Master of International Affairs from Columbia University. We believe that Ms. Shetty’s extensive experience in fixed income and credit management and expertise in the Company’s intended investments qualifies her for service on our Board. | | 1 | | None |

|

| | | | | | | | | | |

| Name, Address and Age | | Position(s) held with Company | | Term of Office and Length of Time Served | | Principal Occupation, Other Business Experience During the Past Five Years | | Number of Portfolios in Fund Complex Overseen by Director (1) | | Other Directorships Held by Director |

| Interested Directors | | | | | | | | |