different manufacturers. Some of the technologies are changing rapidly and we must continue to adapt to these changes in a timely and effective manner at an acceptable cost. There can be no assurance that we will be able to develop, acquire, enhance, deploy or integrate new technologies, including technologies needed to integrate genomics data into our Platform, that these new technologies will be effective and efficient, will meet our needs or achieve our expected goals or that we will be able to do so as quickly or cost effectively as our competitors.

If we cannot compete successfully with our competitors, we may be unable to increase or sustain our revenue or to achieve and then sustain profitability.

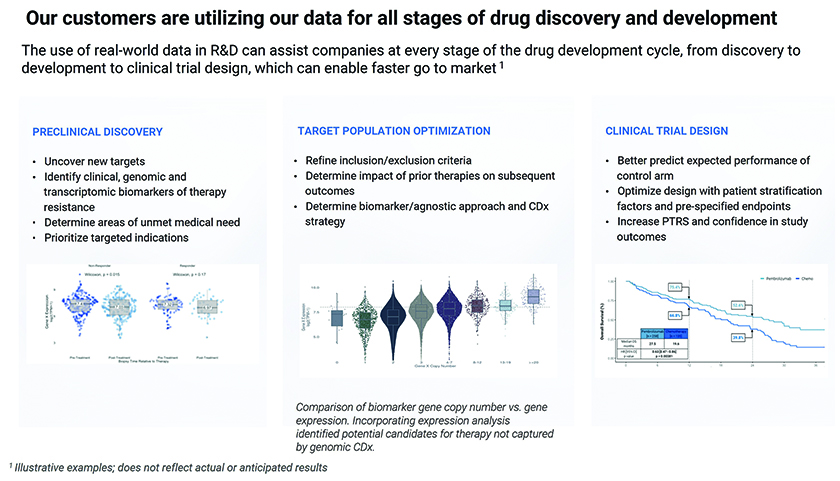

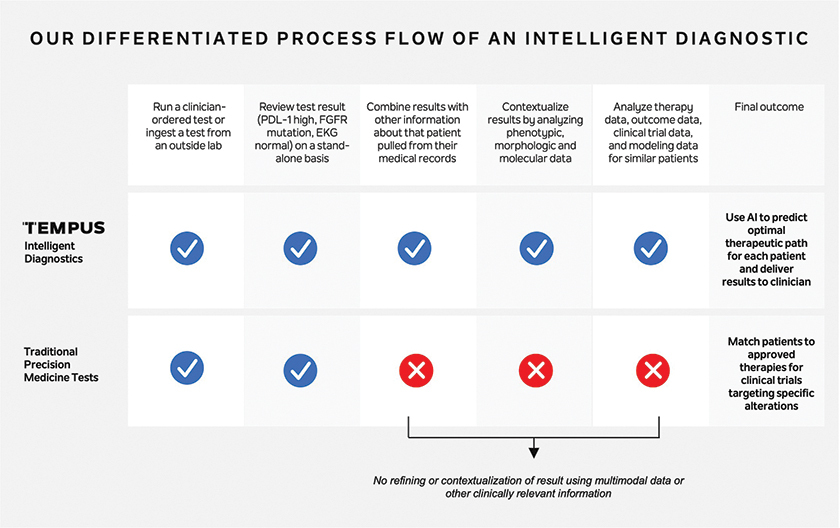

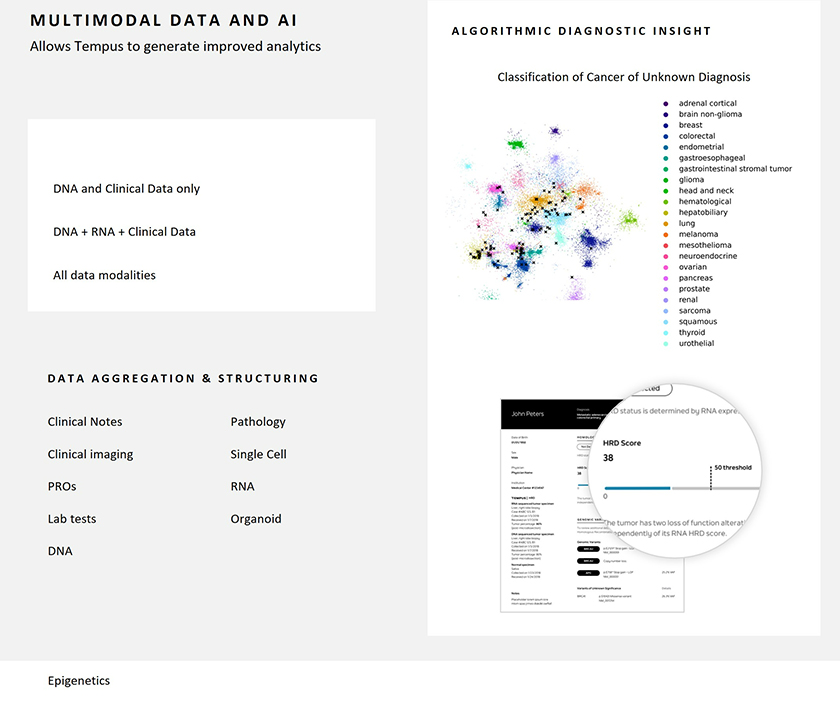

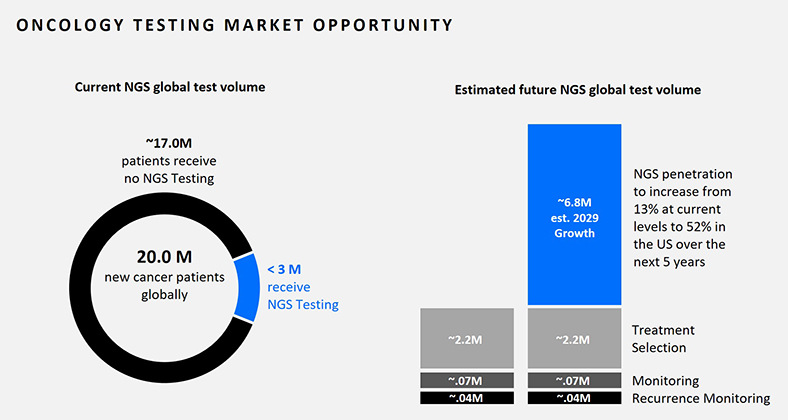

Growing understanding of the importance of biomarkers linked with therapy selection and response is leading to more companies offering products in genomic testing, including NGS diagnostics and PCR profiling. In addition, there are a number of healthcare technology companies providing data analysis products, including AI-driven data platforms and diagnostic products.

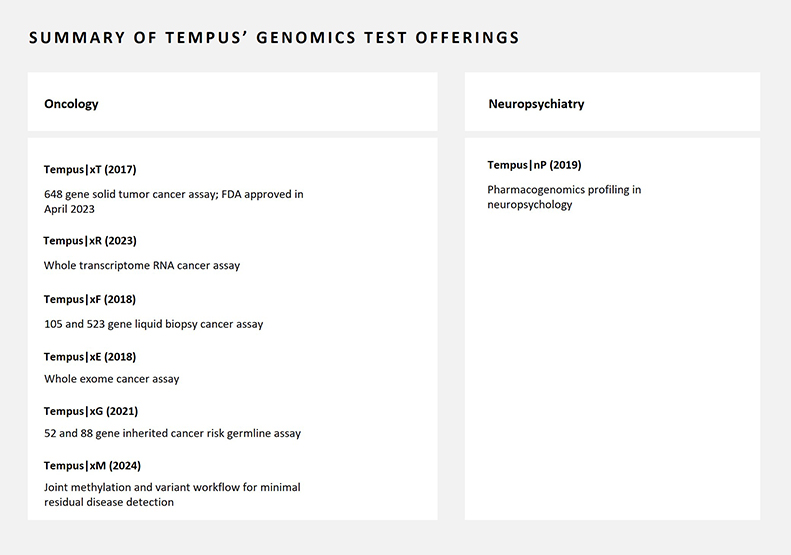

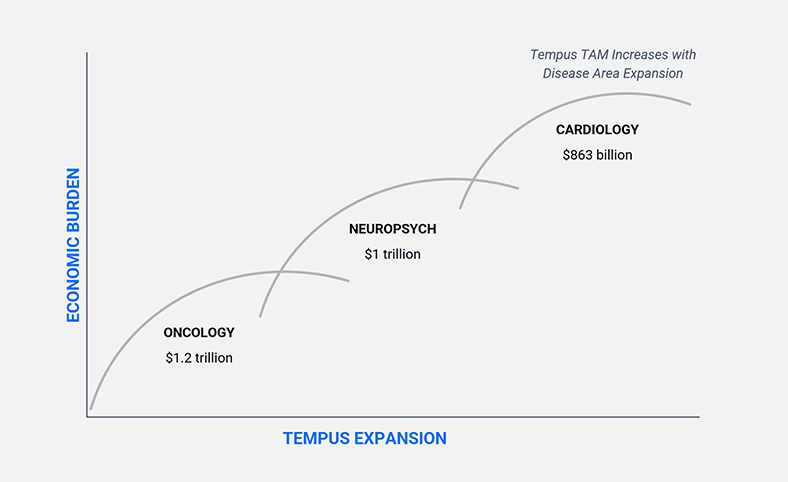

Our competitors with respect to our Genomics products include certain diagnostics companies, such as Foundation Medicine, Inc., which was acquired by Roche Holdings, Inc., Caris Life Sciences, Guardant Health, Inc., Neogenomics, and ResolutionBio, which was acquired by Agilent, among others, with respect to our currently marketed precision oncology tests, and legacy diagnostic laboratories, such as Quest and LabCorp. In addition, our competitors for our pharmacogenetic test in neuropsychology include Myriad Genetics, Inc. and Genomind, Inc.

Our competitors with respect to our Data and Services products include Flatiron Health, Inc., IQVIA Holdings Inc., and ConcertAI, among others. Furthermore, our Data and Services products also face competition from CROs, such as Fortrea, ICON, Syneos, PPD, and others, who provide data and clinical trial matching services to pharmaceutical and biotechnology companies.

Our competitors with respect to our AI Applications products include Roche Holdings, Inc., Caris Life Sciences, Guardant Health, Inc., Illumina, Inc., and others, with respect to our TO test, and Myriad Genetics, Inc., Caris Life Sciences, and others, with respect to our HRD test. We may also compete with companies developing or commercializing algorithm-based diagnostics using a variety of different data modalities, including digital pathology companies such as PathAI, Inc. and PaigeAI. In cardiology, we believe our competitors may include HeartFlow Inc., Anumana, Inc., and Eko Devices, Inc. In addition, we are aware that academic medical centers may be developing their own AI Applications and may decide to enter this market.

Some of our competitors and potential competitors may have longer operating histories; larger customer bases; greater brand recognition and market penetration; substantially greater financial, technological and research and development resources and selling and marketing capabilities; and more experience dealing with third-party payers. As a result, they may be able to respond more quickly to changes in customer requirements, devote greater resources to the development, promotion and sale of their products than we do or sell their products at prices designed to win significant levels of market share. We may not be able to compete effectively against these organizations. Increased competition and cost-saving initiatives on the part of governmental entities and other third-party payers are likely to result in pricing pressures, which could harm our sales or ability to gain market share. In addition, competitors may be acquired by, receive investments from or enter into other commercial relationships with larger, well-established and well-financed companies. Certain of our competitors may be able to secure key inputs from vendors on more favorable terms, devote greater resources to marketing and promotional campaigns, adopt more aggressive pricing policies and devote substantially more resources to product development than we can. In addition, companies or governments that control access to genetic testing through umbrella contracts or regional preferences could promote our competitors or prevent us from selling certain products. If we are unable to compete successfully against current and future competitors, we may be unable to increase market acceptance and sales of our tests, which could prevent us from increasing our revenue or achieving profitability and could cause our stock price to decline.

44