Industrial Logistics Properties Trust Exhibit 99.2 Fourth Quarter 2018 Supplemental Operating and Financial Data 16101 Queens Court, Upper Marlboro, MD Square Feet: 220,800 Tenant: La Z Boy Incorporated 1 All amounts in this report are unaudited.

TABLE OF CONTENTS PAGE/ EXHIBIT WARNING CONCERNING FORWARD LOOKING STATEMENTS 3 CORPORATE INFORMATION Company Profile 7 Investor Information 8 Research Coverage 9 FINANCIALS TABLE OF CONTENTS TABLE Key Financial Data 11 Consolidated Balance Sheets 12 Consolidated Statements of Income 13 Consolidated Statements of Cash Flows 14 Debt Summary 16 Debt Maturity Schedule 17 Leverage Ratios and Coverage Ratios 18 Capital Expenditures Summary 19 Property Acquisitions and Dispositions Information Since 1/1/18 20 Calculation and Reconciliation of Net Operating Income (NOI) and Cash Basis NOI 21 Reconciliation of NOI to Same Property NOI and Calculation of Same Property Cash Basis NOI 22 Calculation of EBITDA and Adjusted EBITDA 23 Calculation of Funds from Operations (FFO) and Normalized FFO 24 Definitions of Certain Non-GAAP Financial Measures 25 PORTFOLIO INFORMATION Portfolio Summary by Property Type 27 Same Property Results of Operations by Property Type 28 Leasing Summary 30 Occupancy and Leasing Analysis by Property Type 31 Tenant Credit Characteristics 32 Tenants Representing 1% or More Of Total Annualized Rental Revenues 33 Five Year Lease Expiration and Reset Schedule by Property Type 34 Portfolio Lease Expiration Schedule 35 EXHIBIT A Property Detail 37 Industrial Logistics Properties Trust 2 Supplemental Operating and Financial Data, December 31, 2018

WARNING CONCERNING FORWARD LOOKING STATEMENTS THIS PRESENTATION OF SUPPLEMENTAL OPERATING AND FINANCIAL DATA CONTAINS STATEMENTS THAT CONSTITUTE FORWARD LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER SECURITIES LAWS. ALSO, WHENEVER WE USE WORDS SUCH AS “BELIEVE”, “EXPECT”, “ANTICIPATE”, “INTEND”, “PLAN”, “ESTIMATE”, “WILL”, “MAY” AND NEGATIVES OR DERIVATIVES OF THESE OR SIMILAR EXPRESSIONS, WE ARE MAKING FORWARD LOOKING STATEMENTS. THESE FORWARD LOOKING STATEMENTS ARE BASED UPON OUR PRESENT INTENT, BELIEFS OR EXPECTATIONS, BUT FORWARD LOOKING STATEMENTS ARE NOT GUARANTEED TO OCCUR AND MAY NOT OCCUR. FORWARD LOOKING STATEMENTS IN THIS REPORT RELATE TO VARIOUS ASPECTS OF OUR BUSINESS, INCLUDING: • THE LIKELIHOOD THAT OUR TENANTS WILL PAY RENT OR BE NEGATIVELY AFFECTED BY CYCLICAL ECONOMIC CONDITIONS, • THE LIKELIHOOD THAT OUR TENANTS WILL RENEW OR EXTEND THEIR LEASES OR THAT WE WILL BE ABLE TO OBTAIN REPLACEMENT TENANTS, • OUR ACQUISITIONS OF PROPERTIES, • OUR ABILITY TO COMPETE FOR ACQUISITIONS AND TENANCIES EFFECTIVELY, • THE LIKELIHOOD THAT OUR RENTS WILL INCREASE WHEN WE RENEW OR EXTEND OUR LEASES, WHEN WE ENTER NEW LEASES, OR WHEN OUR RENTS RESET AT OUR HAWAII PROPERTIES, • OUR ABILITY TO PAY DISTRIBUTIONS TO OUR SHAREHOLDERS AND TO SUSTAIN THE AMOUNT OF SUCH DISTRIBUTIONS, • THE FUTURE AVAILABILITY OF BORROWINGS UNDER OUR REVOLVING CREDIT FACILITY, • OUR POLICIES AND PLANS REGARDING INVESTMENTS, FINANCINGS AND DISPOSITIONS, • OUR ABILITY TO RAISE DEBT OR EQUITY CAPITAL, • OUR ABILITY TO PAY INTEREST ON AND PRINCIPAL OF OUR DEBT, • OUR ABILITY TO APPROPRIATELY BALANCE OUR USE OF DEBT AND EQUITY CAPITAL, • CHANGES IN THE SECURITY OF CASH FLOWS FROM OUR PROPERTIES, • OUR TENANTS' ABILITY AND WILLINGNESS TO PAY THEIR RENT OBLIGATIONS TO US, • OUR ABILITY TO SUCCESSFULLY AND PROFITABLY COMPLETE EXPANSION AND RENOVATION PROJECTS AT OUR PROPERTIES AND TO REALIZE OUR EXPECTED RETURNS ON THOSE PROJECTS, • OUR EXPECTATION THAT WE BENEFIT FROM OUR RELATIONSHIPS WITH THE RMR GROUP INC., OR RMR INC., • OUR ABILITY TO QUALIFY AND MAINTAIN OUR QUALIFICATION FOR TAXATION AS A REAL ESTATE INVESTMENT TRUST, OR REIT, • CHANGES IN FEDERAL OR STATE TAX LAWS, • THE CREDIT QUALITIES OF OUR TENANTS, • CHANGES IN ENVIRONMENTAL LAWS OR IN THEIR INTERPRETATIONS OR ENFORCEMENT AS A RESULT OF CLIMATE CHANGE OR OTHERWISE, • OUR SALES OF PROPERTIES, AND • OTHER MATTERS. OUR ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR IMPLIED BY OUR FORWARD LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS. FACTORS THAT COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR FORWARD LOOKING STATEMENTS AND UPON OUR BUSINESS, RESULTS OF OPERATIONS, FINANCIAL CONDITION, FUNDS FROM OPERATIONS, OR FFO, NORMALIZED FFO, NET OPERATING INCOME, OR NOI, CASH BASIS NOI, EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION WARNING CONCERNING FORWARD LOOKING STATEMENTS CONCERNING FORWARD WARNING AND AMORTIZATION, OR EBITDA, EBITDA AS ADJUSTED, OR ADJUSTED EBITDA, CASH FLOWS, LIQUIDITY AND PROSPECTS INCLUDE, BUT ARE NOT LIMITED TO: Industrial Logistics Properties Trust 3 Supplemental Operating and Financial Data, December 31, 2018

WARNING CONCERNING FORWARD LOOKING STATEMENTS (CONTINUED) • THE IMPACT OF CONDITIONS IN THE ECONOMY AND THE CAPITAL MARKETS ON US AND OUR TENANTS, • COMPETITION WITHIN THE REAL ESTATE INDUSTRY, PARTICULARLY FOR INDUSTRIAL AND LOGISTICS PROPERTIES IN THOSE MARKETS IN WHICH OUR PROPERTIES ARE LOCATED, • COMPLIANCE WITH, AND CHANGES TO, FEDERAL, STATE AND LOCAL LAWS AND REGULATIONS, ACCOUNTING RULES, TAX LAWS AND SIMILAR MATTERS, • LIMITATIONS IMPOSED ON OUR BUSINESS AND OUR ABILITY TO SATISFY COMPLEX RULES IN ORDER FOR US TO QUALIFY FOR TAXATION AS A REIT FOR U.S. FEDERAL INCOME TAX PURPOSES, • ACTUAL AND POTENTIAL CONFLICTS OF INTEREST WITH OUR RELATED PARTIES, INCLUDING OUR MANAGING TRUSTEES, THE RMR GROUP LLC, OR RMR LLC, RMR INC., AFFILIATES INSURANCE COMPANY, OR AIC, AND OTHERS AFFILIATED WITH THEM, AND • ACTS OF TERRORISM, OUTBREAKS OF SO CALLED PANDEMICS OR OTHER MANMADE OR NATURAL DISASTERS BEYOND OUR CONTROL. FOR EXAMPLE: • OUR ABILITY TO MAKE FUTURE DISTRIBUTIONS TO OUR SHAREHOLDERS AND TO MAKE PAYMENTS OF PRINCIPAL AND INTEREST ON OUR INDEBTEDNESS DEPENDS UPON A NUMBER OF FACTORS, INCLUDING OUR FUTURE EARNINGS, THE CAPITAL COSTS WE INCUR TO LEASE OUR PROPERTIES AND OUR WORKING CAPITAL REQUIREMENTS. WE MAY BE UNABLE TO PAY OUR DEBT OBLIGATIONS OR TO MAINTAIN OUR CURRENT RATE OF DISTRIBUTIONS ON OUR COMMON SHARES AND FUTURE DISTRIBUTIONS MAY BE REDUCED OR ELIMINATED, • OUR ABILITY TO GROW OUR BUSINESS AND INCREASE OUR DISTRIBUTIONS DEPENDS IN LARGE PART UPON OUR ABILITY TO BUY PROPERTIES AND LEASE THEM FOR RENTS, LESS THEIR PROPERTY OPERATING COSTS, THAT EXCEED OUR CAPITAL COSTS. WE MAY BE UNABLE TO IDENTIFY PROPERTIES THAT WE WANT TO ACQUIRE AND WE MAY FAIL TO REACH AGREEMENT WITH THE SELLERS AND COMPLETE THE PURCHASES OF ANY PROPERTIES WE DO WANT TO ACQUIRE. IN ADDITION, ANY PROPERTIES WE MAY ACQUIRE MAY NOT PROVIDE US WITH RENTS LESS PROPERTY OPERATING COSTS THAT EXCEED OUR CAPITAL COSTS OR ACHIEVE OUR EXPECTED RETURNS, • CONTINGENCIES IN OUR ACQUISITION AND SALE AGREEMENTS MAY NOT BE SATISFIED AND ANY EXPECTED ACQUISITIONS AND SALES MAY NOT OCCUR, MAY BE DELAYED OR THE TERMS OF SUCH TRANSACTIONS MAY CHANGE, • RENTS THAT WE CAN CHARGE AT OUR PROPERTIES MAY DECLINE UPON RENT RESETS, LEASE RENEWALS OR LEASE EXPIRATIONS BECAUSE OF CHANGING MARKET CONDITIONS OR OTHERWISE, • LEASING FOR SOME OF OUR PROPERTIES DEPENDS ON A SINGLE TENANT AND WE MAY BE ADVERSELY AFFECTED BY THE BANKRUPTCY, INSOLVENCY, A DOWNTURN OF BUSINESS OR A LEASE TERMINATION OF A SINGLE TENANT, • CERTAIN OF OUR HAWAII PROPERTIES ARE LANDS LEASED FOR RENTS THAT PERIODICALLY RESET BASED ON THEN CURRENT FAIR MARKET VALUES. REVENUES FROM OUR PROPERTIES IN HAWAII HAVE GENERALLY INCREASED DURING OUR AND OUR PREDECESSORS' OWNERSHIP AS THE LEASES FOR THOSE PROPERTIES HAVE BEEN RESET, EXTENDED OR RENEWED. ALTHOUGH WE EXPECT THAT RENTS FOR OUR HAWAII PROPERTIES WILL INCREASE IN THE FUTURE, WE CANNOT BE SURE THEY WILL INCREASE. FUTURE RENTS FROM THESE PROPERTIES COULD DECREASE OR NOT INCREASE TO THE EXTENT THEY HAVE IN THE PAST OR BY THE AMOUNT WE EXPECT, • OUR POSSIBLE DEVELOPMENT OR REDEVELOPMENT OF CERTAIN OF OUR PROPERTIES MAY NOT BE REALIZED OR BE SUCCESSFUL, • OUR LEASING RELATED OBLIGATIONS MAY COST MORE AND MAY TAKE LONGER TO COMPLETE THAN WE EXPECT, AND OUR LEASING RELATED OBLIGATIONS MAY INCREASE IN THE FUTURE, • ECONOMIC CONDITIONS IN AREAS WHERE OUR PROPERTIES ARE LOCATED MAY DECLINE IN THE FUTURE. SUCH CIRCUMSTANCES OR OTHER CONDITIONS MAY REDUCE DEMAND FOR LEASING INDUSTRIAL SPACE. IF THE DEMAND FOR LEASING INDUSTRIAL SPACE IS REDUCED, WE MAY BE UNABLE TO RENEW LEASES WITH OUR TENANTS AS LEASES EXPIRE OR ENTER NEW LEASES AT RENTAL RATES AS HIGH AS EXPIRING RENTS AND OUR FINANCIAL RESULTS MAY DECLINE, • E-COMMERCE RETAIL SALES MAY NOT CONTINUE TO GROW AND INCREASE THE DEMAND FOR INDUSTRIAL AND LOGISTICS REAL ESTATE AS WE EXPECT, • INCREASING DEVELOPMENT OF INDUSTRIAL AND LOGISTICS PROPERTIES MAY REDUCE THE DEMAND FOR, AND RENTS FROM, OUR PROPERTIES, • OUR BELIEF THAT THERE IS A LIKELIHOOD THAT TENANTS MAY RENEW OR EXTEND OUR LEASES PRIOR TO THEIR EXPIRATIONS WHENEVER THEY HAVE MADE SIGNIFICANT WARNING CONCERNING FORWARD LOOKING STATEMENTS (CONTINUED) LOOKING STATEMENTS CONCERNING FORWARD WARNING INVESTMENTS IN THE LEASED PROPERTIES, OR BECAUSE THOSE PROPERTIES MAY BE OF STRATEGIC IMPORTANCE TO THEM, MAY NOT BE REALIZED, Industrial Logistics Properties Trust 4 Supplemental Operating and Financial Data, December 31, 2018

WARNING CONCERNING FORWARD LOOKING STATEMENTS (CONTINUED) • SOME OF OUR TENANTS MAY NOT RENEW EXPIRING LEASES, AND WE MAY BE UNABLE TO OBTAIN NEW TENANTS TO MAINTAIN OR INCREASE THE HISTORICAL OCCUPANCY RATES OF, OR RENTS FROM, OUR PROPERTIES, • THE COMPETITIVE ADVANTAGES WE BELIEVE WE HAVE MAY NOT IN FACT EXIST OR PROVIDE US WITH THE ADVANTAGES WE EXPECT. WE MAY FAIL TO MAINTAIN ANY OF THESE ADVANTAGES OR OUR COMPETITION MAY OBTAIN OR INCREASE THEIR COMPETITIVE ADVANTAGES RELATIVE TO US, • OUR INCREASED OPERATING EXPENSES AS A PUBLIC COMPANY MAY BE GREATER THAN WE EXPECT, • WE INTEND TO CONDUCT OUR BUSINESS ACTIVITIES IN A MANNER THAT WILL AFFORD US REASONABLE ACCESS TO CAPITAL FOR INVESTMENT AND FINANCING ACTIVITIES. HOWEVER, WE MAY NOT SUCCEED IN THIS REGARD AND WE MAY NOT HAVE REASONABLE ACCESS TO CAPITAL, • CONTINUED AVAILABILITY OF BORROWINGS UNDER OUR REVOLVING CREDIT FACILITY IS SUBJECT TO OUR SATISFYING CERTAIN FINANCIAL COVENANTS AND OTHER CREDIT FACILITY CONDITIONS THAT WE MAY BE UNABLE TO SATISFY, • ACTUAL COSTS UNDER OUR REVOLVING CREDIT FACILITY WILL BE HIGHER THAN LIBOR PLUS A PREMIUM BECAUSE OF FEES AND EXPENSES ASSOCIATED WITH SUCH DEBT, • WE MAY BE UNABLE TO REPAY OUR DEBT OBLIGATIONS WHEN THEY BECOME DUE, • THE MAXIMUM BORROWING AVAILABILITY UNDER OUR REVOLVING CREDIT FACILITY MAY BE INCREASED TO UP TO $1.5 BILLION IN CERTAIN CIRCUMSTANCES. HOWEVER, INCREASING THE MAXIMUM BORROWING AVAILABILITY UNDER OUR REVOLVING CREDIT FACILITY IS SUBJECT TO OUR OBTAINING ADDITIONAL COMMITMENTS FROM LENDERS, WHICH MAY NOT OCCUR, • WE HAVE THE OPTION TO EXTEND THE MATURITY DATE OF OUR REVOLVING CREDIT FACILITY UPON PAYMENT OF A FEE AND MEETING OTHER CONDITIONS. HOWEVER, THE APPLICABLE CONDITIONS MAY NOT BE MET, • THE PREMIUMS USED TO DETERMINE THE INTEREST RATE PAYABLE ON OUR REVOLVING CREDIT FACILITY AND THE UNUSED FEE PAYABLE ON OUR REVOLVING CREDIT FACILITY ARE BASED ON OUR LEVERAGE. CHANGES IN OUR LEVERAGE MAY CAUSE THE INTEREST AND FEES WE PAY TO INCREASE, • WE MAY SPEND MORE FOR CAPITAL EXPENDITURES THAN WE CURRENTLY EXPECT, • THE BUSINESS AND PROPERTY MANAGEMENT AGREEMENTS BETWEEN US AND RMR LLC HAVE CONTINUING 20 YEAR TERMS. HOWEVER, THOSE AGREEMENTS PERMIT EARLY TERMINATION IN CERTAIN CIRCUMSTANCES. ACCORDINGLY, WE CANNOT BE SURE THAT THESE AGREEMENTS WILL REMAIN IN EFFECT FOR CONTINUING 20 YEAR TERMS, • WE BELIEVE THAT OUR RELATIONSHIPS WITH OUR RELATED PARTIES, INCLUDING RMR LLC, RMR INC., AIC AND OTHERS AFFILIATED WITH THEM MAY BENEFIT US AND PROVIDE US WITH COMPETITIVE ADVANTAGES IN OPERATING AND GROWING OUR BUSINESS. HOWEVER, THE ADVANTAGES WE BELIEVE WE MAY REALIZE FROM THESE RELATIONSHIPS MAY NOT MATERIALIZE, AND • IT IS DIFFICULT TO ACCURATELY ESTIMATE DEVELOPMENT AND TENANT IMPROVEMENT COSTS. OUR DEVELOPMENT PROJECTS MAY COST MORE AND MAY TAKE LONGER TO COMPLETE THAN WE CURRENTLY EXPECT. CURRENTLY UNEXPECTED RESULTS COULD OCCUR DUE TO MANY DIFFERENT CIRCUMSTANCES, SOME OF WHICH ARE BEYOND OUR CONTROL, SUCH AS ACTS OF TERRORISM, NATURAL DISASTERS, CHANGES IN OUR TENANTS’ FINANCIAL CONDITIONS, THE MARKET DEMAND FOR LEASED SPACE OR CHANGES IN CAPITAL MARKETS OR THE ECONOMY GENERALLY. THE INFORMATION CONTAINED IN OUR FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION, OR SEC, INCLUDING UNDER THE CAPTION "RISK FACTORS" IN OUR PERIODIC REPORTS, OR INCORPORATED THEREIN, IDENTIFIES OTHER IMPORTANT FACTORS THAT COULD CAUSE DIFFERENCES FROM OUR FORWARD LOOKING STATEMENTS. OUR FILINGS WITH THE SEC ARE AVAILABLE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. YOU SHOULD NOT PLACE UNDUE RELIANCE UPON OUR FORWARD LOOKING STATEMENTS. EXCEPT AS REQUIRED BY LAW, WE DO NOT INTEND TO UPDATE OR CHANGE ANY FORWARD LOOKING STATEMENTS AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE. WARNING CONCERNING FORWARD LOOKING STATEMENTS (CONTINUED) LOOKING STATEMENTS CONCERNING FORWARD WARNING Industrial Logistics Properties Trust 5 Supplemental Operating and Financial Data, December 31, 2018

CORPORATE INFORMATION 10100 89th Avenue, Maple Grove, MN Square Feet: 319,062 Major Tenant: Bunzl Minneapolis, LLC 6

COMPANY PROFILE The Company: Industrial Logistics Properties Trust, or ILPT, we our or us, is a real estate investment trust, or REIT, formed in 2017 as a wholly owned subsidiary of Select Income REIT, or SIR, a former publicly traded REIT that merged with Office Properties Income Trust, or OPI, Corporate Headquarters: (formerly Government Properties Income Trust) on December 31, 2018. On January 17, 2018, we sold approximately 30.8% of our common shares in an initial public offering, or IPO, and became a separate public company. On December 27, 2018, SIR distributed Two Newton Place all 45,000,000 of our common shares that SIR previously owned to SIR's shareholders. For periods prior to January 17, 2018, our 255 Washington Street, Suite 300 historical results of operations and financial position relate to the 266 properties SIR contributed to us in connection with our formation Newton, MA 02458-1634 and have been derived from the financial statements of SIR. These historical results of operations and financial position include certain (t) (617) 219-1460 expenses that we did not directly incur but which were allocated to us when we were a wholly owned subsidiary of SIR and may not COMPANY PROFILE COMPANY reflect what our results of operations and financial position would have been if we had operated as a separate public company during those periods. Stock Exchange Listing: ILPT owns and leases industrial and logistics properties throughout the United States. As of December 31, 2018, we owned 270 Nasdaq properties with approximately 29.5 million rentable square feet located in 26 states, including 226 buildings, leasable land parcels and easements with approximately 16.8 million rentable square feet that are primarily industrial lands located in Hawaii. We are included Trading Symbol: in the Russell 2000® Index, the Russell 3000® Index, the MSCI U.S. REIT Index and the FTSE EPRA/NAREIT United States Index. Common Shares: ILPT Management: ILPT is managed by The RMR Group LLC, the operating subsidiary of The RMR Group Inc. (Nasdaq: RMR). RMR is an alternative asset management company that was founded in 1986 to manage real estate companies and related businesses. RMR primarily Key Data (as of and for the three provides management services to four publicly traded equity REITs and three real estate related operating businesses. In addition to managing ILPT, RMR manages Hospitality Properties Trust, a REIT that owns hotels and travel centers, Office Properties Income months ended December 31, 2018): Trust, a REIT that owns office buildings primarily leased to single tenants and those with high credit quality characteristics like (dollars and sq. ft. in 000s) government entities, and Senior Housing Properties Trust, a REIT that primarily owns healthcare, senior living and medical office buildings. RMR also provides management services to Five Star Senior Living Inc., a publicly traded operator of senior living Total properties 270 communities, Sonesta International Hotels Corporation, a privately owned operator and franchisor of hotels and cruise ships, and Total sq. ft. 29,535 TravelCenters of America LLC, a publicly traded operator and franchisor of travel centers along the U.S. Interstate Highway System and restaurants. RMR also advises the RMR Real Estate Income Fund, a publicly traded closed end fund that invests in publicly Percent leased 99.3% traded securities of real estate companies, and Tremont Mortgage Trust, a publicly traded mortgage REIT, through wholly owned SEC Q4 2018 total revenues $ 42,074 registered investment advisory subsidiaries, as well as manages the RMR Office Property Fund, a private, open end core plus fund Q4 2018 net income $ 18,288 focused on the acquisition, ownership and leasing of a diverse portfolio of multi-tenant office properties throughout the U.S. As of Q4 2018 Normalized FFO (1) $ 25,948 December 31, 2018, RMR had $29.7 billion of real estate assets under management and the combined RMR managed companies had approximately $12 billion of annual revenues, over 1,500 properties and over 50,000 employees. We believe that being managed by RMR is a competitive advantage for ILPT because of RMR’s depth of management and experience in the real estate industry. We also believe RMR provides management services to us at costs that are lower than we would have to pay for similar quality services. (1) See page 24 for the calculation of FFO and Normalized FFO and a reconciliation of net income determined in accordance with U.S. generally accepted accounting principles, or GAAP, to those amounts. Industrial Logistics Properties Trust 7 Supplemental Operating and Financial Data, December 31, 2018

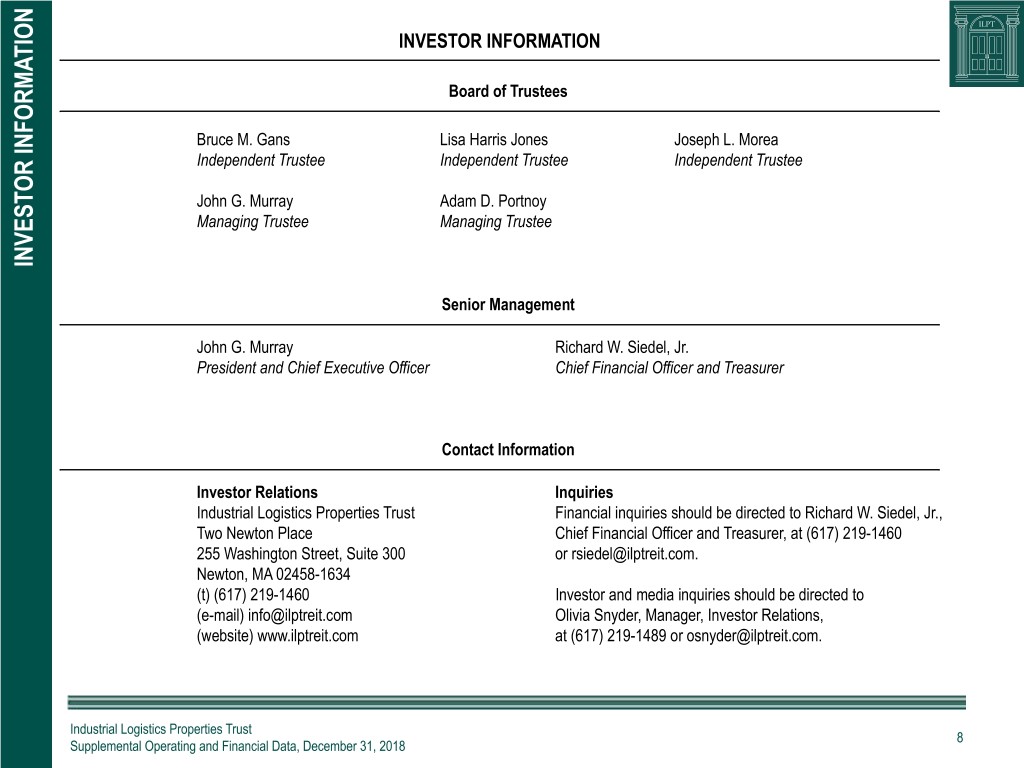

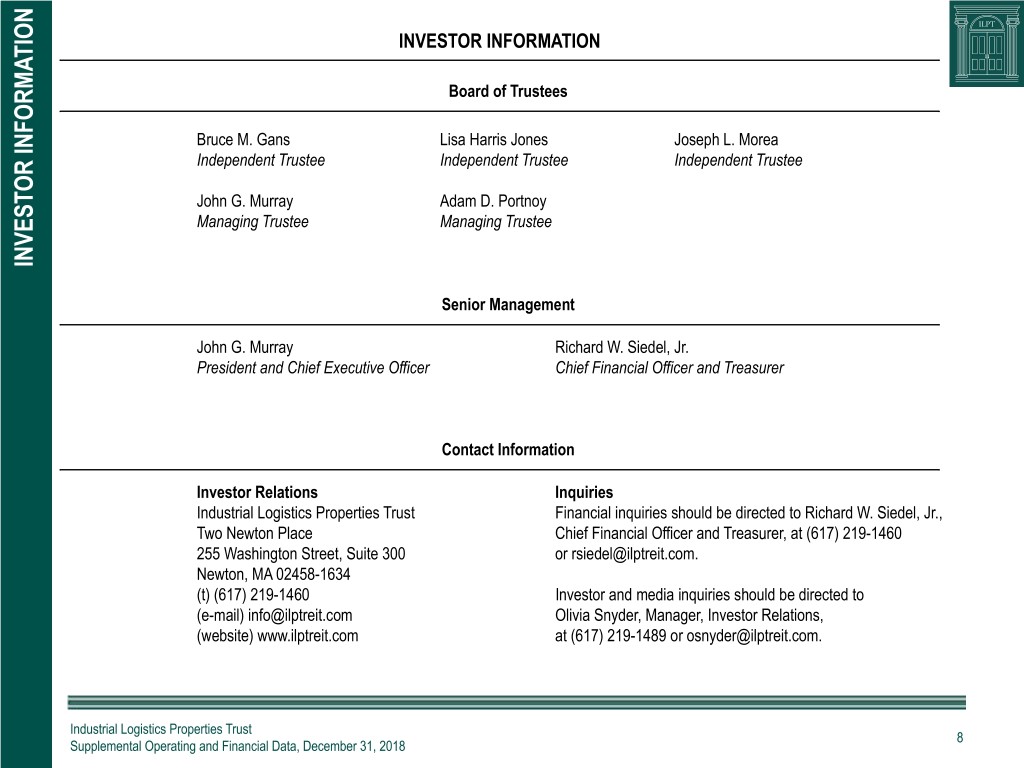

INVESTOR INFORMATION Board of Trustees Bruce M. Gans Lisa Harris Jones Joseph L. Morea Independent Trustee Independent Trustee Independent Trustee John G. Murray Adam D. Portnoy Managing Trustee Managing Trustee INVESTOR INFORMATION INVESTOR Senior Management John G. Murray Richard W. Siedel, Jr. President and Chief Executive Officer Chief Financial Officer and Treasurer Contact Information Investor Relations Inquiries Industrial Logistics Properties Trust Financial inquiries should be directed to Richard W. Siedel, Jr., Two Newton Place Chief Financial Officer and Treasurer, at (617) 219-1460 255 Washington Street, Suite 300 or rsiedel@ilptreit.com. Newton, MA 02458-1634 (t) (617) 219-1460 Investor and media inquiries should be directed to (e-mail) info@ilptreit.com Olivia Snyder, Manager, Investor Relations, (website) www.ilptreit.com at (617) 219-1489 or osnyder@ilptreit.com. Industrial Logistics Properties Trust 8 Supplemental Operating and Financial Data, December 31, 2018

RESEARCH COVERAGE Equity Research Coverage B. Riley FBR RBC Capital Markets Bryan Maher Michael Carroll (646) 885-5423 (440) 715-2649 RESEARCH COVERAGE bmaher@brileyfbr.com michael.carroll@rbccm.com Bank of America / Merrill Lynch UBS Equities James Feldman Frank Lee (646) 855-5808 (415) 352-5679 james.feldman@baml.com frank-a.lee@ubs.com JMP Securities Mitch Germain (212) 906-3546 mgermain@jmpsecurities.com ILPT is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding ILPT’s performance made by these analysts do not represent opinions, forecasts or predictions of ILPT or its management. ILPT does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts. Industrial Logistics Properties Trust 9 Supplemental Operating and Financial Data, December 31, 2018

FINANCIALS 5300 Centerpoint Parkway, Groveport, OH Square Feet: 581,342 Tenant: Avnet, Inc. 10

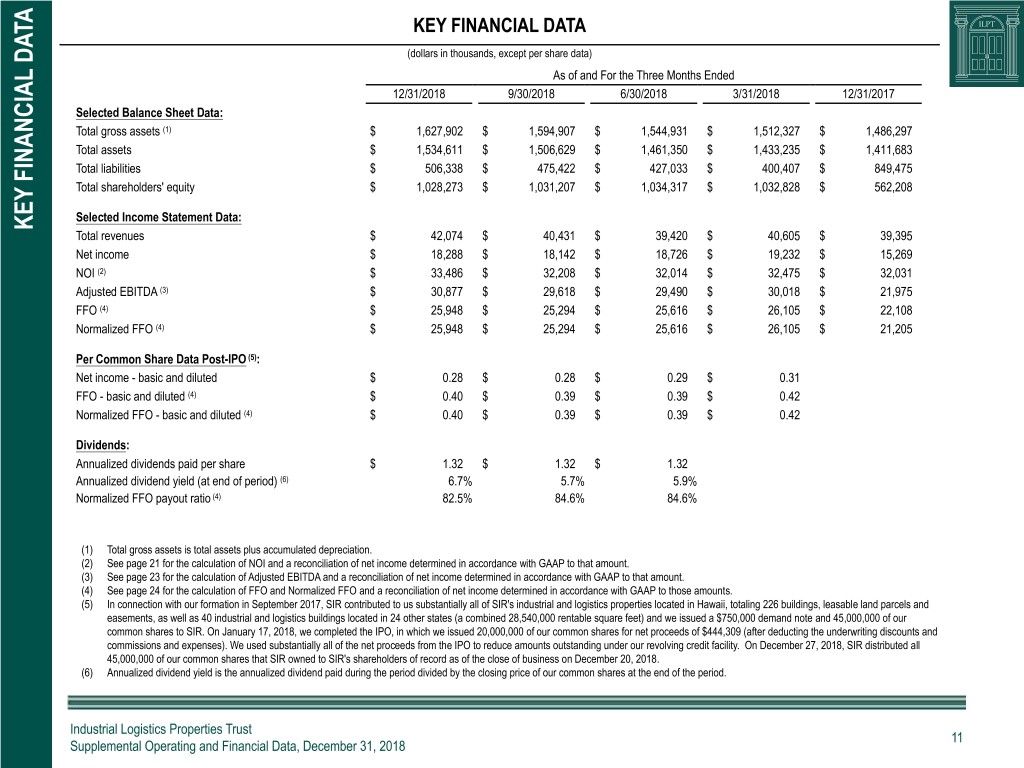

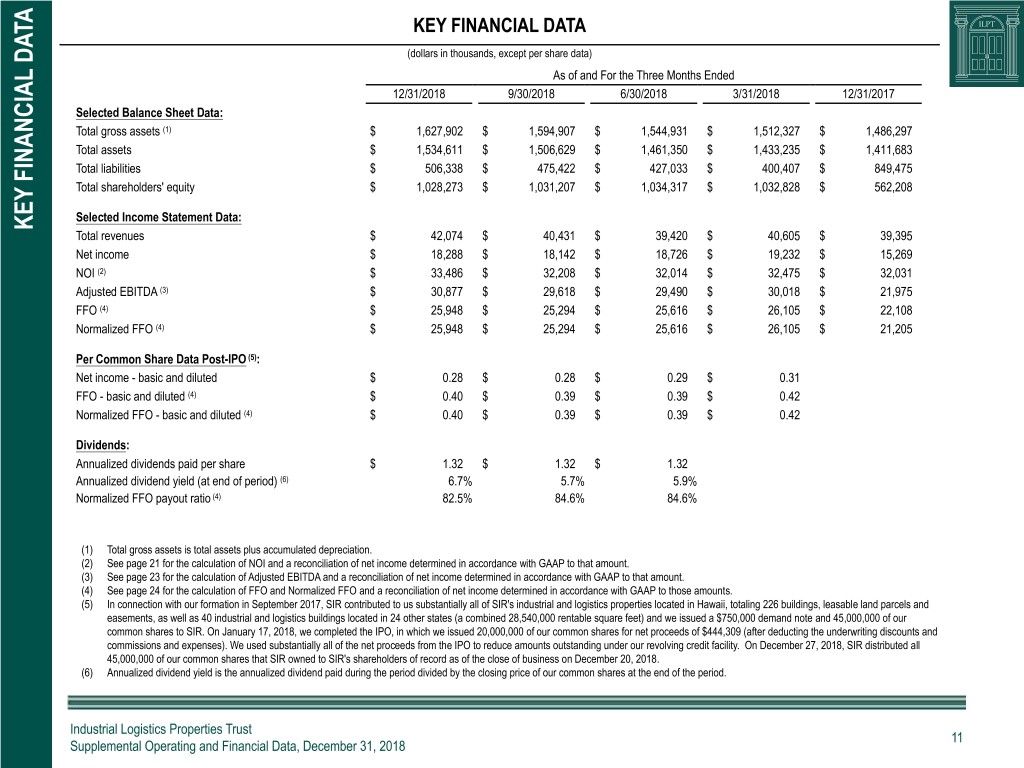

KEY FINANCIAL DATA (dollars in thousands, except per share data) As of and For the Three Months Ended 12/31/2018 9/30/2018 6/30/2018 3/31/2018 12/31/2017 Selected Balance Sheet Data: Total gross assets (1) $ 1,627,902 $ 1,594,907 $ 1,544,931 $ 1,512,327 $ 1,486,297 Total assets $ 1,534,611 $ 1,506,629 $ 1,461,350 $ 1,433,235 $ 1,411,683 Total liabilities $ 506,338 $ 475,422 $ 427,033 $ 400,407 $ 849,475 Total shareholders' equity $ 1,028,273 $ 1,031,207 $ 1,034,317 $ 1,032,828 $ 562,208 Selected Income Statement Data: KEY FINANCIAL DATA FINANCIAL KEY Total revenues $ 42,074 $ 40,431 $ 39,420 $ 40,605 $ 39,395 Net income $ 18,288 $ 18,142 $ 18,726 $ 19,232 $ 15,269 NOI (2) $ 33,486 $ 32,208 $ 32,014 $ 32,475 $ 32,031 Adjusted EBITDA (3) $ 30,877 $ 29,618 $ 29,490 $ 30,018 $ 21,975 FFO (4) $ 25,948 $ 25,294 $ 25,616 $ 26,105 $ 22,108 Normalized FFO (4) $ 25,948 $ 25,294 $ 25,616 $ 26,105 $ 21,205 Per Common Share Data Post-IPO (5): Net income - basic and diluted $ 0.28 $ 0.28 $ 0.29 $ 0.31 FFO - basic and diluted (4) $ 0.40 $ 0.39 $ 0.39 $ 0.42 Normalized FFO - basic and diluted (4) $ 0.40 $ 0.39 $ 0.39 $ 0.42 Dividends: Annualized dividends paid per share $ 1.32 $ 1.32 $ 1.32 Annualized dividend yield (at end of period) (6) 6.7% 5.7% 5.9% Normalized FFO payout ratio (4) 82.5% 84.6% 84.6% (1) Total gross assets is total assets plus accumulated depreciation. (2) See page 21 for the calculation of NOI and a reconciliation of net income determined in accordance with GAAP to that amount. (3) See page 23 for the calculation of Adjusted EBITDA and a reconciliation of net income determined in accordance with GAAP to that amount. (4) See page 24 for the calculation of FFO and Normalized FFO and a reconciliation of net income determined in accordance with GAAP to those amounts. (5) In connection with our formation in September 2017, SIR contributed to us substantially all of SIR's industrial and logistics properties located in Hawaii, totaling 226 buildings, leasable land parcels and easements, as well as 40 industrial and logistics buildings located in 24 other states (a combined 28,540,000 rentable square feet) and we issued a $750,000 demand note and 45,000,000 of our common shares to SIR. On January 17, 2018, we completed the IPO, in which we issued 20,000,000 of our common shares for net proceeds of $444,309 (after deducting the underwriting discounts and commissions and expenses). We used substantially all of the net proceeds from the IPO to reduce amounts outstanding under our revolving credit facility. On December 27, 2018, SIR distributed all 45,000,000 of our common shares that SIR owned to SIR's shareholders of record as of the close of business on December 20, 2018. (6) Annualized dividend yield is the annualized dividend paid during the period divided by the closing price of our common shares at the end of the period. Industrial Logistics Properties Trust 11 Supplemental Operating and Financial Data, December 31, 2018

CONSOLIDATED BALANCE SHEETS (dollars in thousands, except per share data) December 31, 2018 2017 ASSETS Real estate properties: Land $ 670,501 $ 642,706 Buildings and improvements 791,895 700,896 1,462,396 1,343,602 Accumulated depreciation (93,291) (74,614) 1,369,105 1,268,988 Acquired real estate leases, net 75,803 79,103 Cash and cash equivalents 9,608 — Rents receivable, including straight line rents of $54,916 and $50,177, respectively, net of allowance for doubtful accounts of $1,457 and $1,241, respectively 56,940 51,672 Debt issuance costs, net 4,430 1,724 Deferred leasing costs, net 6,157 5,254 Due from related persons 1,390 — Other assets, net 11,178 4,942 Total assets $ 1,534,611 $ 1,411,683 CONSOLIDATED BALANCE SHEETS CONSOLIDATED LIABILITIES AND SHAREHOLDERS' EQUITY Revolving credit facility $ 413,000 $ 750,000 Mortgage note payable, net 49,195 49,427 Assumed real estate lease obligations, net 18,316 20,384 Accounts payable and other liabilities 12,040 11,082 Rents collected in advance 6,004 5,794 Security deposits 6,130 5,674 Due to related persons 1,653 7,114 Total liabilities 506,338 849,475 Commitments and contingencies Shareholders' equity: Common shares of beneficial interest, $.01 par value: 100,000,000 shares authorized; 65,074,791 and 45,000,000 shares issued and outstanding, respectively 651 450 Additional paid in capital 998,447 546,489 Cumulative net income 89,657 15,269 Cumulative common distributions (60,482) — Total shareholders' equity 1,028,273 562,208 Total liabilities and shareholders' equity $ 1,534,611 $ 1,411,683 Industrial Logistics Properties Trust 12 Supplemental Operating and Financial Data, December 31, 2018

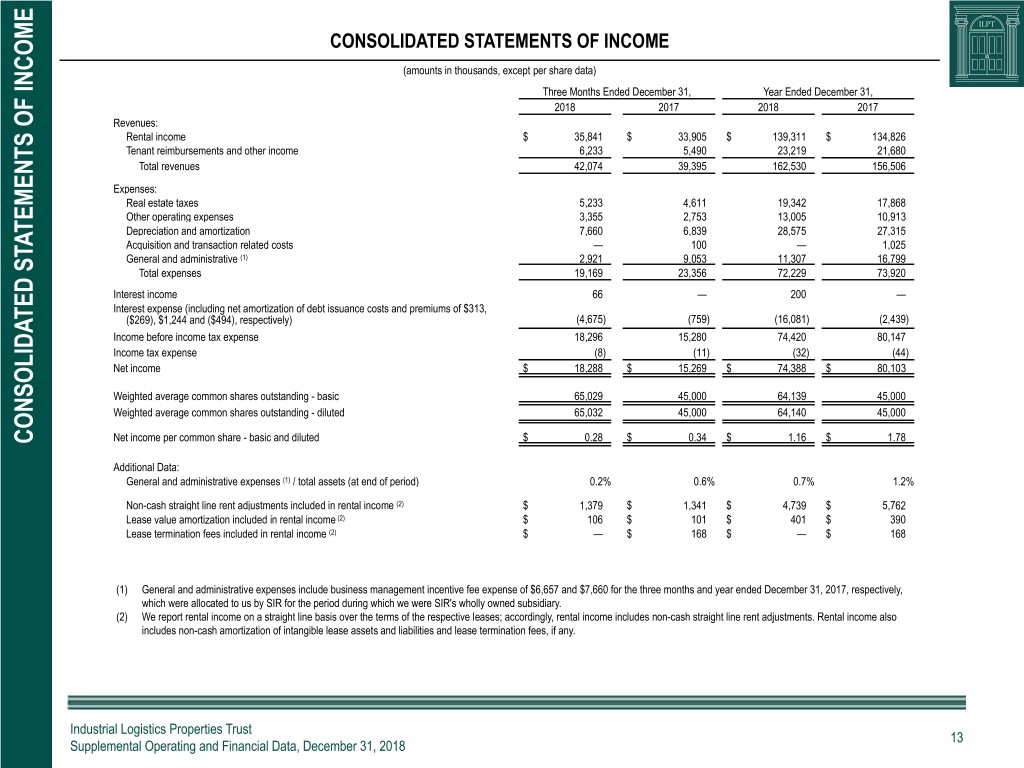

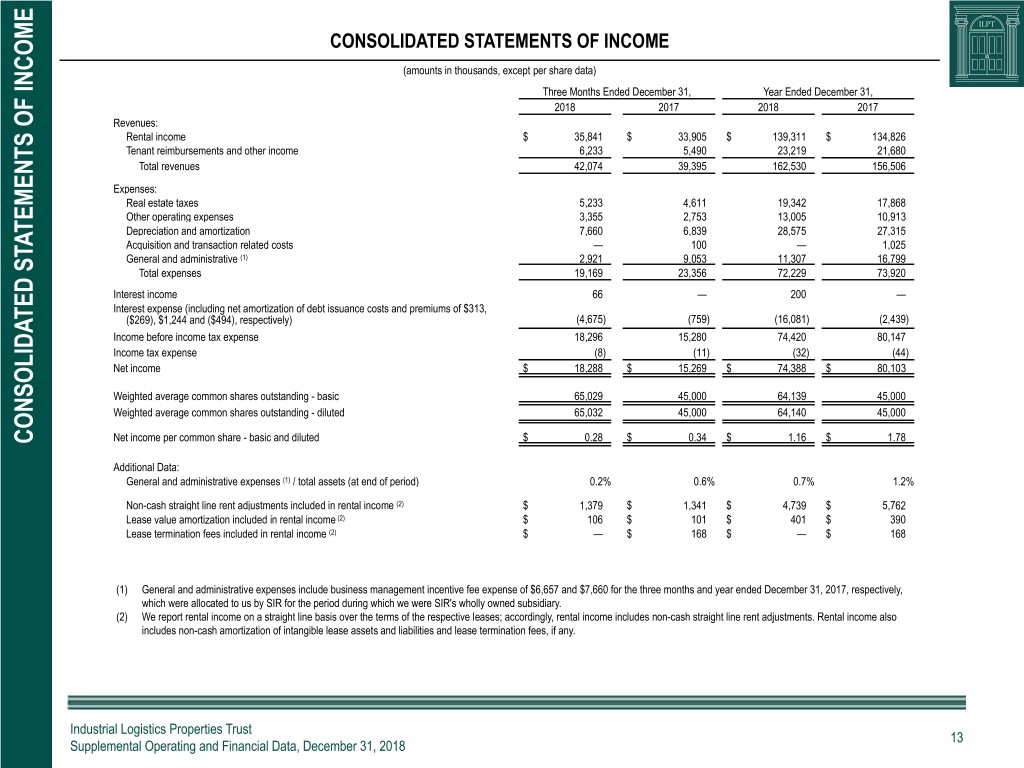

CONSOLIDATED STATEMENTS OF INCOME (amounts in thousands, except per share data) Three Months Ended December 31, Year Ended December 31, 2018 2017 2018 2017 Revenues: Rental income $ 35,841 $ 33,905 $ 139,311 $ 134,826 Tenant reimbursements and other income 6,233 5,490 23,219 21,680 Total revenues 42,074 39,395 162,530 156,506 Expenses: Real estate taxes 5,233 4,611 19,342 17,868 Other operating expenses 3,355 2,753 13,005 10,913 Depreciation and amortization 7,660 6,839 28,575 27,315 Acquisition and transaction related costs — 100 — 1,025 General and administrative (1) 2,921 9,053 11,307 16,799 Total expenses 19,169 23,356 72,229 73,920 Interest income 66 — 200 — Interest expense (including net amortization of debt issuance costs and premiums of $313, ($269), $1,244 and ($494), respectively) (4,675) (759) (16,081) (2,439) Income before income tax expense 18,296 15,280 74,420 80,147 Income tax expense (8) (11) (32) (44) Net income $ 18,288 $ 15,269 $ 74,388 $ 80,103 Weighted average common shares outstanding - basic 65,029 45,000 64,139 45,000 Weighted average common shares outstanding - diluted 65,032 45,000 64,140 45,000 Net income per common share - basic and diluted $ 0.28 $ 0.34 $ 1.16 $ 1.78 CONSOLIDATED STATEMENTS OF INCOME STATEMENTS CONSOLIDATED Additional Data: General and administrative expenses (1) / total assets (at end of period) 0.2% 0.6% 0.7% 1.2% Non-cash straight line rent adjustments included in rental income (2) $ 1,379 $ 1,341 $ 4,739 $ 5,762 Lease value amortization included in rental income (2) $ 106 $ 101 $ 401 $ 390 Lease termination fees included in rental income (2) $ — $ 168 $ — $ 168 (1) General and administrative expenses include business management incentive fee expense of $6,657 and $7,660 for the three months and year ended December 31, 2017, respectively, which were allocated to us by SIR for the period during which we were SIR's wholly owned subsidiary. (2) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes non-cash amortization of intangible lease assets and liabilities and lease termination fees, if any. Industrial Logistics Properties Trust 13 Supplemental Operating and Financial Data, December 31, 2018

CONSOLIDATED STATEMENTS OF CASH FLOWS (dollars in thousands) Year Ended December 31, 2018 2017 CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 74,388 $ 80,103 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 18,781 17,738 Net amortization of debt issuance costs and premiums 1,244 (494) Amortization of acquired real estate leases and assumed real estate lease obligations 8,592 8,434 Amortization of deferred leasing costs 820 771 Provision for losses on rents receivable 1,198 704 Straight line rental income (4,739) (5,762) Other non-cash expenses 927 — Change in assets and liabilities: Rents receivable (1,727) 436 Deferred leasing costs (1,745) (693) Due from related persons (1,390) — Other assets 3,591 (4,431) Accounts payable and other liabilities 1,618 245 Rents collected in advance 210 (743) CONSOLIDATED STATEMENTS OF CASH FLOWS STATEMENTS CONSOLIDATED Security deposits 456 33 Due to related persons (5,461) 7,114 Net cash provided by operating activities 96,763 103,455 CASH FLOWS FROM INVESTING ACTIVITIES: Real estate acquisitions (121,891) (281) Real estate improvements (5,004) (6,026) Investment in Affiliates Insurance Company (8,632) — Net cash used in investing activities (135,527) (6,307) Industrial Logistics Properties Trust 14 Supplemental Operating and Financial Data, December 31, 2018

CONSOLIDATED STATEMENTS OF CASH FLOWS (CONTINUED) (dollars in thousands) Year Ended December 31, 2018 2017 CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from issuance of common shares, net 444,309 — Borrowings under revolving credit facility 193,000 750,000 Repayments of revolving credit facility (530,000) — Repayment of mortgage notes payable — (14,344) Repayment of SIR note — (750,000) Payment of debt issuance costs (5,378) (1,724) Distributions to common shareholders (60,482) — Repurchase of common shares (52) — Contributions (1) 16,162 72,807 Distributions (1) (9,187) (153,887) Net cash provided by (used in) financing activities 48,372 (97,148) Increase in cash and cash equivalents 9,608 — Cash and cash equivalents at beginning of period — — Cash and cash equivalents at end of period $ 9,608 $ — SUPPLEMENTAL DISCLOSURES: Interest paid $ 14,749 $ 2,752 NON-CASH FINANCING ACTIVITIES: CONSOLIDATED STATEMENTS OF CASH FLOWS (CONTINUED) STATEMENTS CONSOLIDATED Distribution to SIR of ownership interest $ — $ (1,304,043) Issuance of SIR note $ — $ 750,000 Issuance of common shares $ — $ 554,043 (1) Relates to transactions that occurred prior to the IPO. Industrial Logistics Properties Trust 15 Supplemental Operating and Financial Data, December 31, 2018

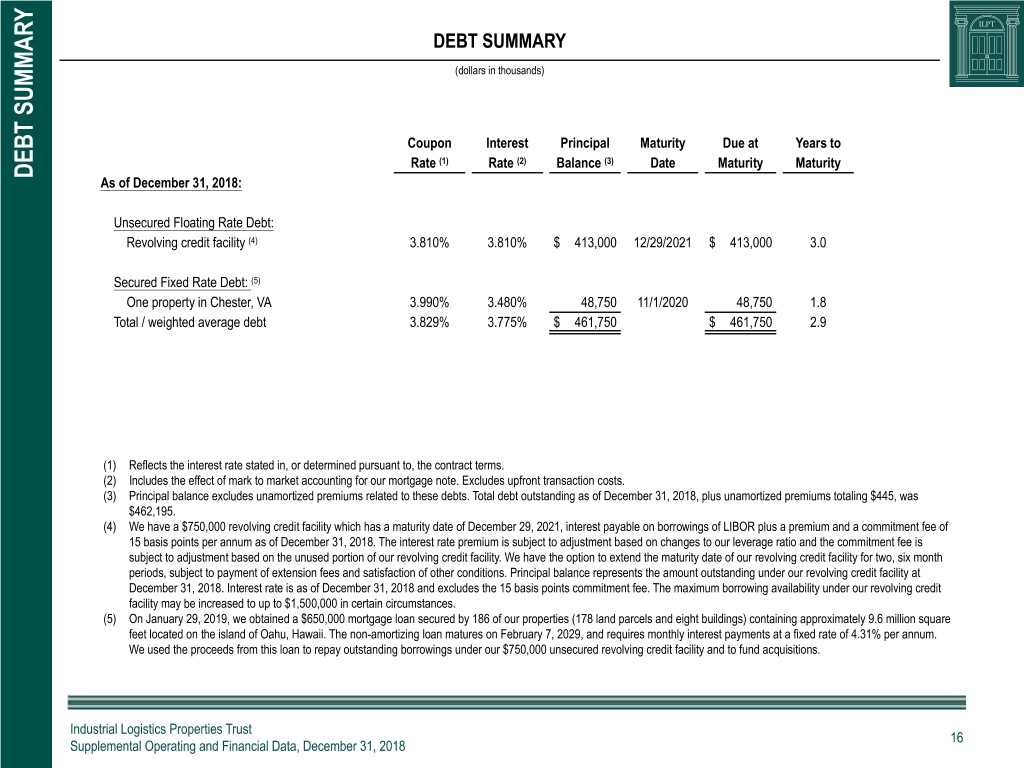

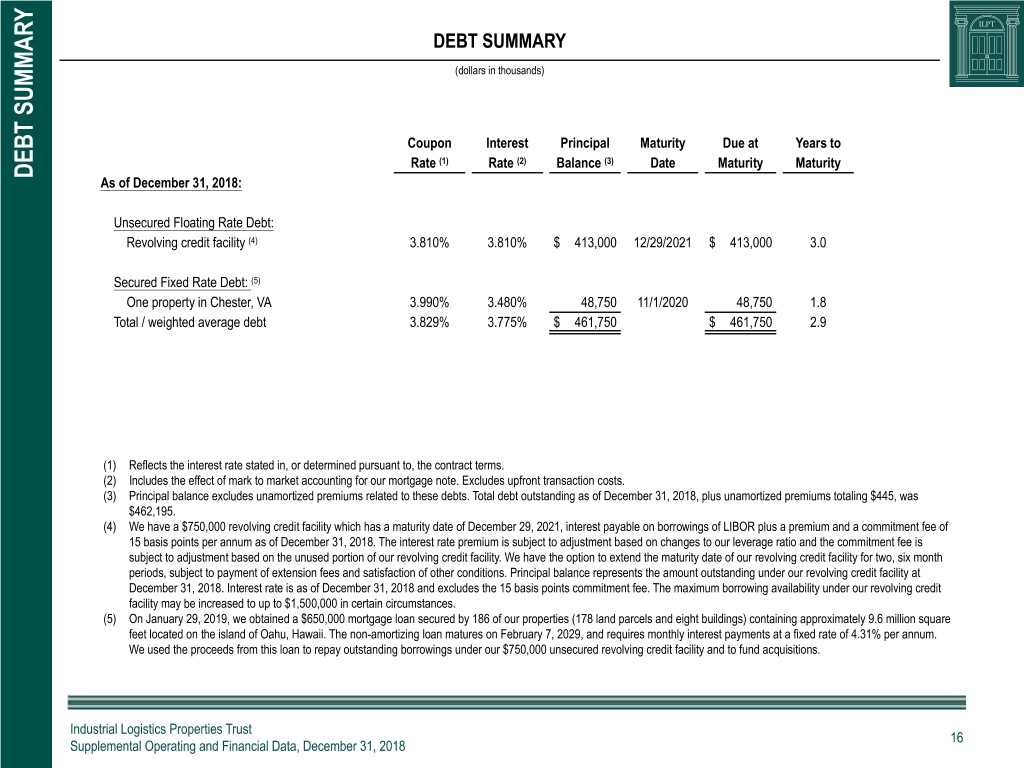

DEBT SUMMARY (dollars in thousands) Coupon Interest Principal Maturity Due at Years to Rate (1) Rate (2) Balance (3) Date Maturity Maturity DEBT SUMMARY As of December 31, 2018: Unsecured Floating Rate Debt: Revolving credit facility (4) 3.810% 3.810% $ 413,000 12/29/2021 $ 413,000 3.0 Secured Fixed Rate Debt: (5) One property in Chester, VA 3.990% 3.480% 48,750 11/1/2020 48,750 1.8 Total / weighted average debt 3.829% 3.775% $ 461,750 $ 461,750 2.9 (1) Reflects the interest rate stated in, or determined pursuant to, the contract terms. (2) Includes the effect of mark to market accounting for our mortgage note. Excludes upfront transaction costs. (3) Principal balance excludes unamortized premiums related to these debts. Total debt outstanding as of December 31, 2018, plus unamortized premiums totaling $445, was $462,195. (4) We have a $750,000 revolving credit facility which has a maturity date of December 29, 2021, interest payable on borrowings of LIBOR plus a premium and a commitment fee of 15 basis points per annum as of December 31, 2018. The interest rate premium is subject to adjustment based on changes to our leverage ratio and the commitment fee is subject to adjustment based on the unused portion of our revolving credit facility. We have the option to extend the maturity date of our revolving credit facility for two, six month periods, subject to payment of extension fees and satisfaction of other conditions. Principal balance represents the amount outstanding under our revolving credit facility at December 31, 2018. Interest rate is as of December 31, 2018 and excludes the 15 basis points commitment fee. The maximum borrowing availability under our revolving credit facility may be increased to up to $1,500,000 in certain circumstances. (5) On January 29, 2019, we obtained a $650,000 mortgage loan secured by 186 of our properties (178 land parcels and eight buildings) containing approximately 9.6 million square feet located on the island of Oahu, Hawaii. The non-amortizing loan matures on February 7, 2029, and requires monthly interest payments at a fixed rate of 4.31% per annum. We used the proceeds from this loan to repay outstanding borrowings under our $750,000 unsecured revolving credit facility and to fund acquisitions. Industrial Logistics Properties Trust 16 Supplemental Operating and Financial Data, December 31, 2018

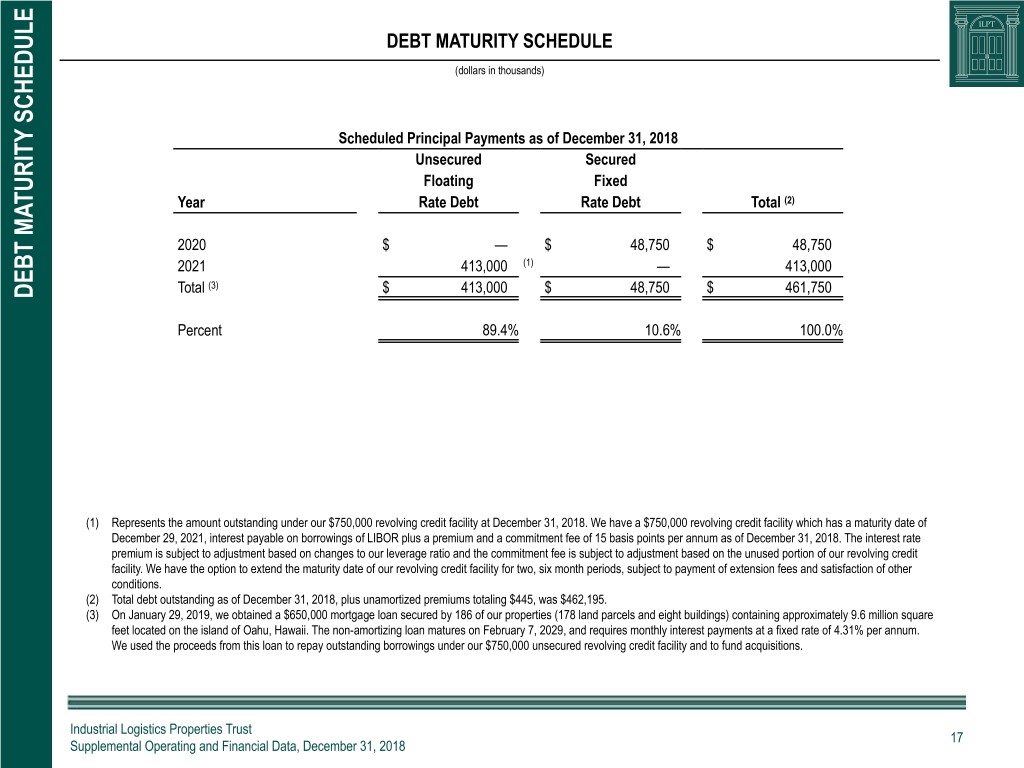

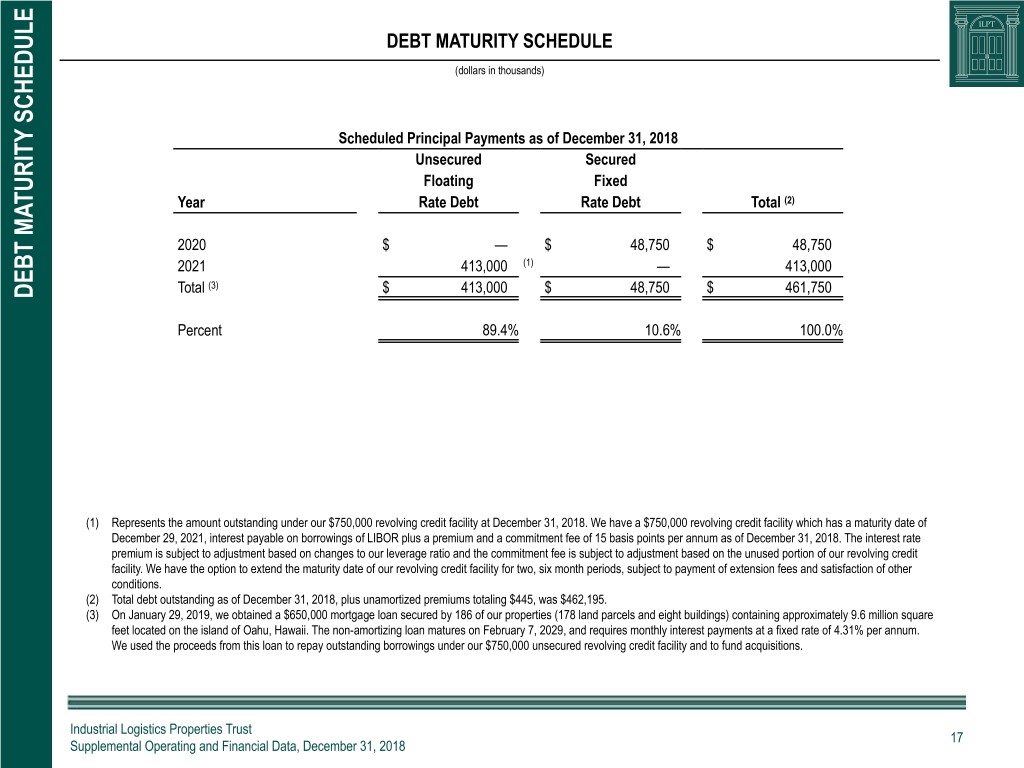

DEBT MATURITY SCHEDULE (dollars in thousands) Scheduled Principal Payments as of December 31, 2018 Unsecured Secured Floating Fixed Year Rate Debt Rate Debt Total (2) 2020 $ — $ 48,750 $ 48,750 2021 413,000 (1) — 413,000 Total (3) $ 413,000 $ 48,750 $ 461,750 DEBT MATURITY SCHEDULE DEBT MATURITY Percent 89.4% 10.6% 100.0% (1) Represents the amount outstanding under our $750,000 revolving credit facility at December 31, 2018. We have a $750,000 revolving credit facility which has a maturity date of December 29, 2021, interest payable on borrowings of LIBOR plus a premium and a commitment fee of 15 basis points per annum as of December 31, 2018. The interest rate premium is subject to adjustment based on changes to our leverage ratio and the commitment fee is subject to adjustment based on the unused portion of our revolving credit facility. We have the option to extend the maturity date of our revolving credit facility for two, six month periods, subject to payment of extension fees and satisfaction of other conditions. (2) Total debt outstanding as of December 31, 2018, plus unamortized premiums totaling $445, was $462,195. (3) On January 29, 2019, we obtained a $650,000 mortgage loan secured by 186 of our properties (178 land parcels and eight buildings) containing approximately 9.6 million square feet located on the island of Oahu, Hawaii. The non-amortizing loan matures on February 7, 2029, and requires monthly interest payments at a fixed rate of 4.31% per annum. We used the proceeds from this loan to repay outstanding borrowings under our $750,000 unsecured revolving credit facility and to fund acquisitions. Industrial Logistics Properties Trust 17 Supplemental Operating and Financial Data, December 31, 2018

(1) LEVERAGE RATIOS AND COVERAGE RATIOS (1) (dollars in thousands) As of and For the Three Months Ended 12/31/2018 9/30/2018 6/30/2018 3/31/2018 (2) Leverage Ratios Post-IPO: Total debt (3) / total gross assets (4) 28.4% 26.9% 24.8% 23.2% Total debt (3) / gross book value of real estate assets (5) 29.3% 27.7% 25.7% 24.2% Total debt (3) / total market capitalization (6) 26.5% 22.3% 20.9% 21.0% Secured debt (3) / total assets 3.2% 3.2% 3.3% 3.4% Variable rate debt (3) / total debt (3) 89.4% 88.6% 87.3% 86.1% Coverage Ratios Post-IPO: Total debt (3) / annualized Adjusted EBITDA (7) 3.7x 3.6x 3.3x 2.9x Adjusted EBITDA (7) / interest expense 6.6x 7.3x 8.3x 7.9x LEVERAGE RATIOS AND COVERAGE RATIOS AND COVERAGE RATIOS LEVERAGE RATIOS (1) On January 29, 2019, we obtained a $650,000 mortgage loan secured by 186 of our properties (178 land parcels and eight buildings) containing approximately 9.6 million square feet located on the island of Oahu, Hawaii. The ratios presented in the table are not adjusted for this mortgage loan that we obtained after December 31, 2018. (2) In connection with our formation in September 2017, SIR contributed to us substantially all of SIR's industrial and logistics properties located in Hawaii, totaling 226 buildings, leasable land parcels and easements, as well as 40 industrial and logistics buildings located in 24 other states (a combined 28,540,000 rentable square feet) and we issued a $750,000 demand note and 45,000,000 of our common shares to SIR. On January 17, 2018, we completed the IPO, in which we issued 20,000,000 of our common shares for net proceeds of $444,309 (after deducting the underwriting discounts and commissions and expenses). We used substantially all of the net proceeds from the IPO to reduce amounts outstanding under our revolving credit facility. On December 27, 2018, SIR distributed all 45,000,000 of our common shares that SIR owned to SIR's shareholders of record as of the close of business on December 20, 2018. (3) Debt amounts represent the principal balance as of the date reported. (4) Total gross assets is total assets plus accumulated depreciation. (5) Gross book value of real estate assets is real estate properties at cost, plus certain acquisition costs, if any, before depreciation and purchase price allocations, less impairment writedowns, if any. (6) Total market capitalization is total debt plus the market value of our common shares at the end of the period. (7) See page 23 for the calculation of Adjusted EBITDA and for a reconciliation of net income determined in accordance with GAAP to that amount. Industrial Logistics Properties Trust 18 Supplemental Operating and Financial Data, December 31, 2018

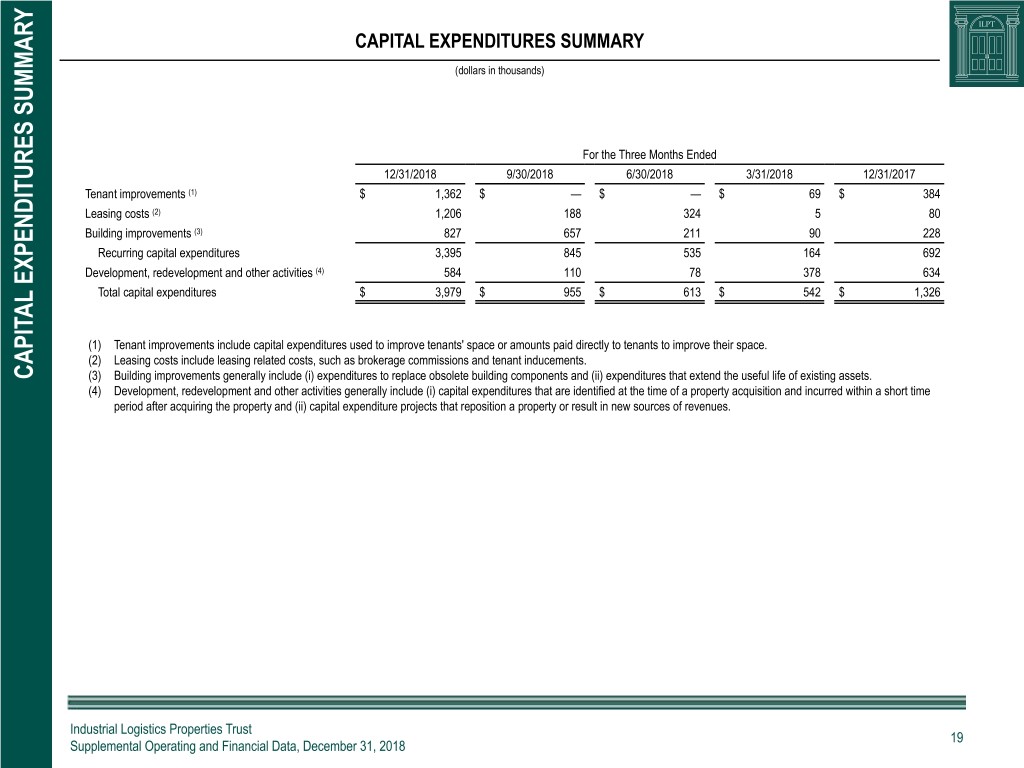

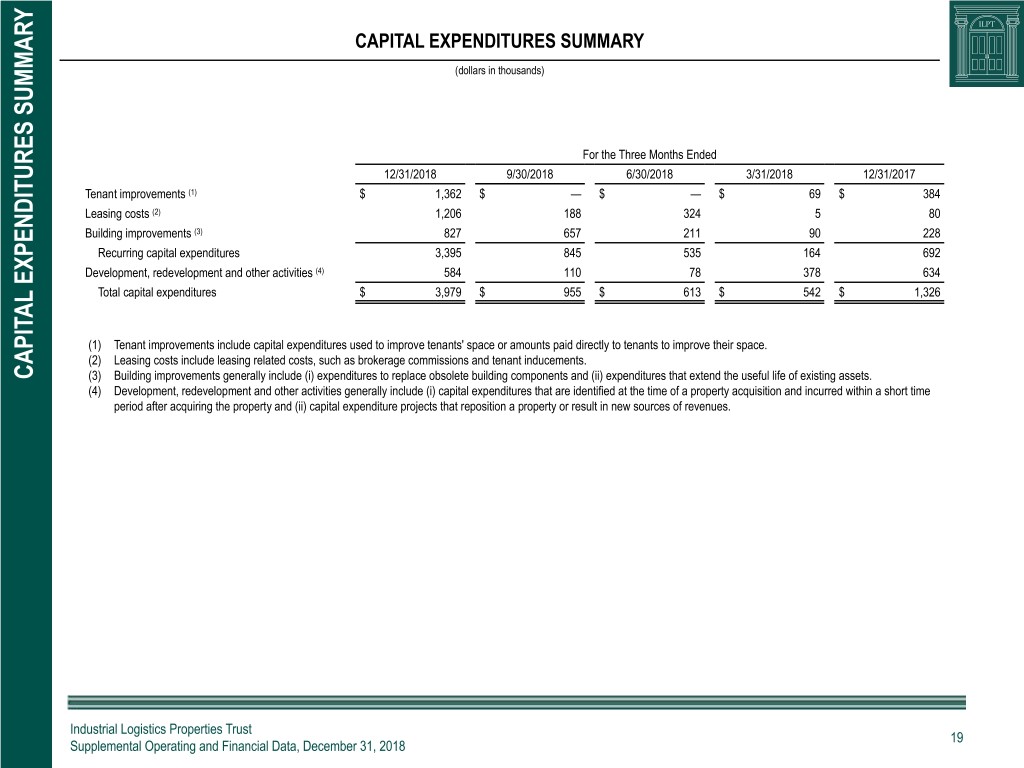

CAPITAL EXPENDITURES SUMMARY (dollars in thousands) For the Three Months Ended 12/31/2018 9/30/2018 6/30/2018 3/31/2018 12/31/2017 Tenant improvements (1) $ 1,362 $ — $ — $ 69 $ 384 Leasing costs (2) 1,206 188 324 5 80 Building improvements (3) 827 657 211 90 228 Recurring capital expenditures 3,395 845 535 164 692 Development, redevelopment and other activities (4) 584 110 78 378 634 Total capital expenditures $ 3,979 $ 955 $ 613 $ 542 $ 1,326 (1) Tenant improvements include capital expenditures used to improve tenants' space or amounts paid directly to tenants to improve their space. (2) Leasing costs include leasing related costs, such as brokerage commissions and tenant inducements. CAPITAL EXPENDITURES SUMMARY CAPITAL (3) Building improvements generally include (i) expenditures to replace obsolete building components and (ii) expenditures that extend the useful life of existing assets. (4) Development, redevelopment and other activities generally include (i) capital expenditures that are identified at the time of a property acquisition and incurred within a short time period after acquiring the property and (ii) capital expenditure projects that reposition a property or result in new sources of revenues. Industrial Logistics Properties Trust 19 Supplemental Operating and Financial Data, December 31, 2018

PROPERTY ACQUISITIONS AND DISPOSITIONS INFORMATION SINCE 1/1/18 (dollars and sq. ft. in thousands, except per sq. ft. data) Acquisitions (1): Weighted Average Purchase Remaining Date Number of Purchase Price (2) / Cap Lease Term Percent Acquired Location Properties Sq. Ft. Price (2) Sq. Ft. Rate (3) in Years (4) Leased (5) Major Tenant June 2018 Doral, FL 1 240 $ 43,075 $ 179 5.1% 10.0 100% Hellmann Worldwide Logistics, Inc. September 2018 Carlisle, PA 1 205 20,000 98 5.0% 6.5 100% TAP Worldwide, LLC September 2018 Upper Marlboro, MD 1 221 29,250 132 5.1% 12.3 100% LZB Manufacturing, Inc. October 2018 Maple Grove, MN 1 319 27,700 87 5.7% 6.3 100% Bunzl Minneapolis, LLC February 2019 2 states 7 3,708 249,500 67 6.1% 3.8 100% Various Total / Weighted Average 11 4,693 $ 369,525 $ 79 5.8% 5.3 100% (1) On October 10, 2018, we acquired a land parcel adjacent to a property we own located in Ankeny, IA for a purchase price of $450, excluding acquisition related costs. This land parcel will be used for a 194 square foot expansion for the existing tenant at such property. (2) Represents the gross purchase price, including assumed mortgage debt, if any, and excluding acquisition related costs and purchase price allocations. (3) Represents the ratio of (x) annual straight line rental income, excluding the impact of above and below market lease amortization, based on existing leases as of the date of acquisition, less estimated annual property operating expenses as of the date of acquisition, excluding depreciation and amortization expense, to (y) the acquisition purchase price, including the principal amount of any assumed debt and excluding acquisition related costs. (4) Average remaining lease term in years is weighted based on rental revenues as of the date acquired. (5) Percent leased is as of the date acquired. Dispositions: We have not disposed of any properties since January 1, 2018. PROPERTY ACQUISITIONS AND DISPOSITIONS INFORMATION SINCE 1/1/18 AND DISPOSITIONS INFORMATION ACQUISITIONS PROPERTY Industrial Logistics Properties Trust 20 Supplemental Operating and Financial Data, December 31, 2018

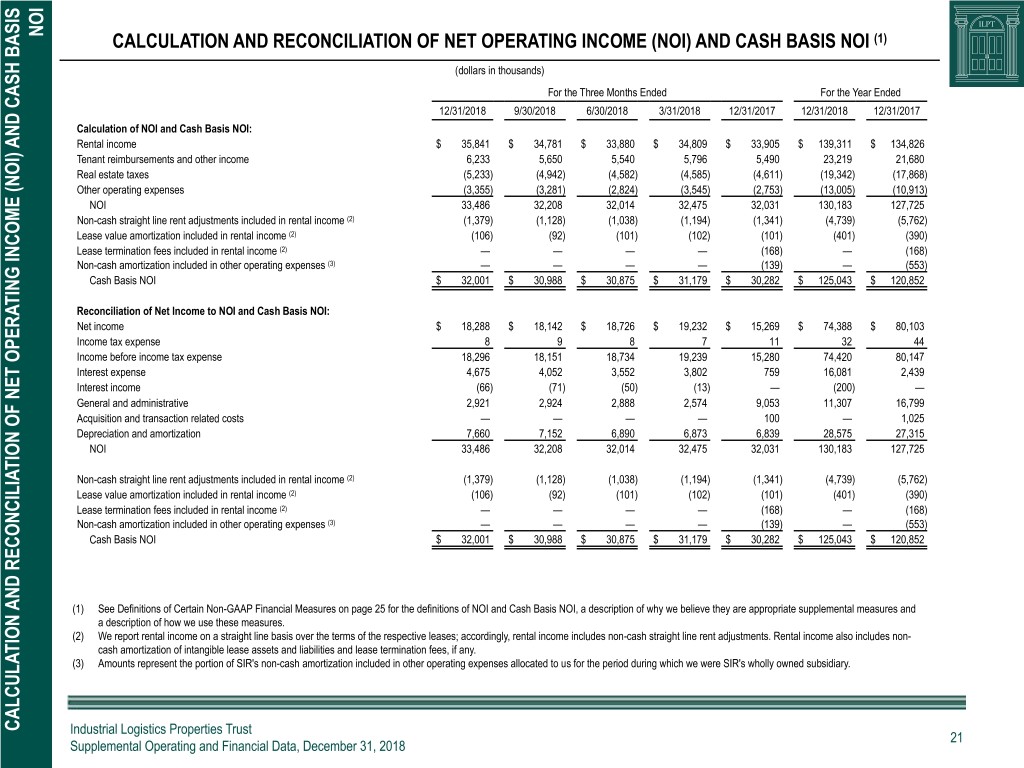

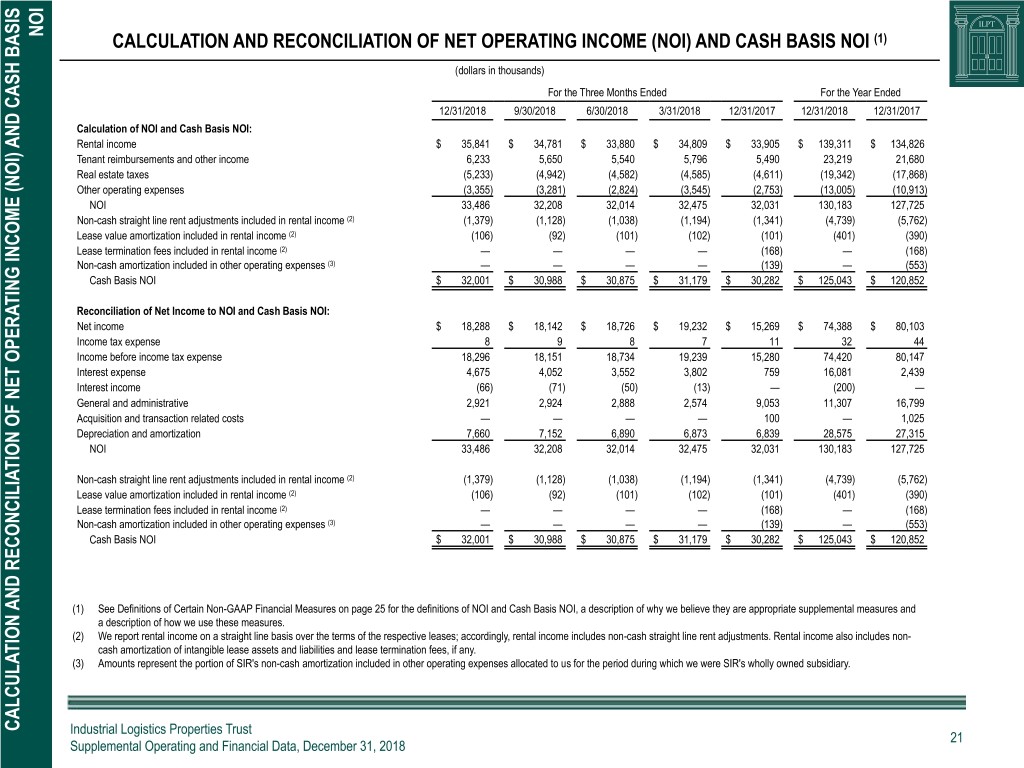

NOI CALCULATION AND RECONCILIATION OF NET OPERATING INCOME (NOI) AND CASH BASIS NOI (1) (dollars in thousands) For the Three Months Ended For the Year Ended 12/31/2018 9/30/2018 6/30/2018 3/31/2018 12/31/2017 12/31/2018 12/31/2017 Calculation of NOI and Cash Basis NOI: Rental income $ 35,841 $ 34,781 $ 33,880 $ 34,809 $ 33,905 $ 139,311 $ 134,826 Tenant reimbursements and other income 6,233 5,650 5,540 5,796 5,490 23,219 21,680 Real estate taxes (5,233) (4,942) (4,582) (4,585) (4,611) (19,342) (17,868) Other operating expenses (3,355) (3,281) (2,824) (3,545) (2,753) (13,005) (10,913) NOI 33,486 32,208 32,014 32,475 32,031 130,183 127,725 Non-cash straight line rent adjustments included in rental income (2) (1,379) (1,128) (1,038) (1,194) (1,341) (4,739) (5,762) Lease value amortization included in rental income (2) (106) (92) (101) (102) (101) (401) (390) Lease termination fees included in rental income (2) — — — — (168) — (168) Non-cash amortization included in other operating expenses (3) — — — — (139) — (553) Cash Basis NOI $ 32,001 $ 30,988 $ 30,875 $ 31,179 $ 30,282 $ 125,043 $ 120,852 Reconciliation of Net Income to NOI and Cash Basis NOI: Net income $ 18,288 $ 18,142 $ 18,726 $ 19,232 $ 15,269 $ 74,388 $ 80,103 Income tax expense 8 9 8 7 11 32 44 Income before income tax expense 18,296 18,151 18,734 19,239 15,280 74,420 80,147 Interest expense 4,675 4,052 3,552 3,802 759 16,081 2,439 Interest income (66) (71) (50) (13) — (200) — General and administrative 2,921 2,924 2,888 2,574 9,053 11,307 16,799 Acquisition and transaction related costs — — — — 100 — 1,025 Depreciation and amortization 7,660 7,152 6,890 6,873 6,839 28,575 27,315 NOI 33,486 32,208 32,014 32,475 32,031 130,183 127,725 Non-cash straight line rent adjustments included in rental income (2) (1,379) (1,128) (1,038) (1,194) (1,341) (4,739) (5,762) Lease value amortization included in rental income (2) (106) (92) (101) (102) (101) (401) (390) Lease termination fees included in rental income (2) — — — — (168) — (168) Non-cash amortization included in other operating expenses (3) — — — — (139) — (553) Cash Basis NOI $ 32,001 $ 30,988 $ 30,875 $ 31,179 $ 30,282 $ 125,043 $ 120,852 (1) See Definitions of Certain Non-GAAP Financial Measures on page 25 for the definitions of NOI and Cash Basis NOI, a description of why we believe they are appropriate supplemental measures and a description of how we use these measures. (2) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes non- cash amortization of intangible lease assets and liabilities and lease termination fees, if any. (3) Amounts represent the portion of SIR's non-cash amortization included in other operating expenses allocated to us for the period during which we were SIR's wholly owned subsidiary. CALCULATION AND RECONCILIATION OF NET OPERATING INCOME (NOI) AND CASH BASIS INCOME (NOI) OF NET OPERATING AND RECONCILIATION CALCULATION Industrial Logistics Properties Trust 21 Supplemental Operating and Financial Data, December 31, 2018

RECONCILIATION OF NOI TO SAME PROPERTY NOI AND CALCULATION OF SAME PROPERTY CASH BASIS NOI (1) (dollars in thousands) Three Months Ended December 31, Year Ended December 31, CASH BASIS NOI 2018 2017 2018 2017 Reconciliation of NOI to Same Property NOI (2)(3): Rental income $ 35,841 $ 33,905 $ 139,311 $ 134,826 Tenant reimbursements and other income 6,233 5,490 23,219 21,680 Real estate taxes (5,233) (4,611) (19,342) (17,868) Other operating expenses (3,355) (2,753) (13,005) (10,913) NOI 33,486 32,031 130,183 127,725 Less: NOI of properties not included in same property results (1,527) — (2,130) — Same property NOI $ 31,959 $ 32,031 $ 128,053 $ 127,725 Calculation of Same Property Cash Basis NOI (2)(3): Same property NOI $ 31,959 $ 32,031 $ 128,053 $ 127,725 Less: Non-cash straight line rent adjustments included in rental income (4) (1,196) (1,341) (4,477) (5,762) Lease value amortization included in rental income (4) (105) (101) (400) (390) Lease termination fees included in rental income (4) — (168) — (168) Non-cash amortization included in other operating expenses (5) — (139) — (553) Same property Cash Basis NOI $ 30,658 $ 30,282 $ 123,176 $ 120,852 (1) See Definitions of Certain Non-GAAP Financial Measures on page 25 for the definitions of NOI and Cash Basis NOI, a description of why we believe they are appropriate supplemental measures and a description of how we use these measures. (2) For the three months ended December 31, 2018, same property NOI and Cash Basis NOI are based on properties that we owned as of December 31, 2018 and that we owned (including for the period SIR owned our properties prior to the IPO) continuously since October 1, 2017. (3) For the year ended December 31, 2018, same property NOI and Cash Basis NOI are based on properties that we owned as of December 31, 2018 and that we owned (including for the period SIR owned our properties prior to the IPO) continuously since January 1, 2017. (4) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes non- cash amortization of intangible lease assets and liabilities and lease termination fees, if any. (5) The amounts for the three months and year ended December 31, 2017, respectively, represent the portion of SIR's non-cash amortization included in other operating expenses allocated to us for the period during which we were SIR's wholly owned subsidiary. Industrial Logistics Properties Trust 22 RECONCILIATION OF NOI TO SAME PROPERTY NOI AND CALCULATION OF SAME PROPERTY AND CALCULATION NOI SAME PROPERTY OF NOI TO RECONCILIATION Supplemental Operating and Financial Data, December 31, 2018

CALCULATION OF EBITDA AND ADJUSTED EBITDA (1) (dollars in thousands) For the Three Months Ended For the Year Ended 12/31/2018 9/30/2018 6/30/2018 3/31/2018 12/31/2017 12/31/2018 12/31/2017 Net income $ 18,288 $ 18,142 $ 18,726 $ 19,232 $ 15,269 $ 74,388 $ 80,103 Plus: interest expense 4,675 4,052 3,552 3,802 759 16,081 2,439 Plus: income tax expense 8 9 8 7 11 32 44 Plus: depreciation and amortization 7,660 7,152 6,890 6,873 6,839 28,575 27,315 EBITDA 30,631 29,355 29,176 29,914 22,878 119,076 109,901 Plus: acquisition and transaction related costs — — — — 100 — 1,025 Plus: general and administrative expense paid in common shares (2) 246 263 314 104 — 927 — Plus: estimated business management incentive fees (3) — — — — (1,003) — — Adjusted EBITDA (4) $ 30,877 $ 29,618 $ 29,490 $ 30,018 $ 21,975 $ 120,003 $ 110,926 (1) See Definitions of Certain Non-GAAP Financial Measures on page 25 for the definitions of EBITDA and Adjusted EBITDA and a description of why we believe they are appropriate supplemental measures. (2) Amounts represent equity based compensation to our trustees, our officers and certain other employees of RMR LLC. (3) Incentive fees under our and SIR's business management agreements with RMR LLC are payable after the end of each calendar year, are calculated based on common share total CALCULATION OF EBITDA AND ADJUSTED EBITDA AND OF EBITDA CALCULATION return, as defined in the respective agreements, and are included in general and administrative expense in our consolidated statements of income. In calculating net income in accordance with GAAP, we recognize estimated business management incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third quarters for purposes of calculating net income, we do not include such expense in the calculation of Adjusted EBITDA until the fourth quarter, when the amount of the business management incentive fee expense for the calendar year, if any, is determined. (4) Adjusted EBITDA for both the three months and year ended December 31, 2017 include $7,660, which represents the portion of SIR's business management incentive fee allocated to us, and was paid by SIR and not us. Excluding business management incentive fee expense, Adjusted EBITDA would have been $29,635 and $118,586 for the three months and year ended December 31, 2017, respectively. Industrial Logistics Properties Trust 23 Supplemental Operating and Financial Data, December 31, 2018

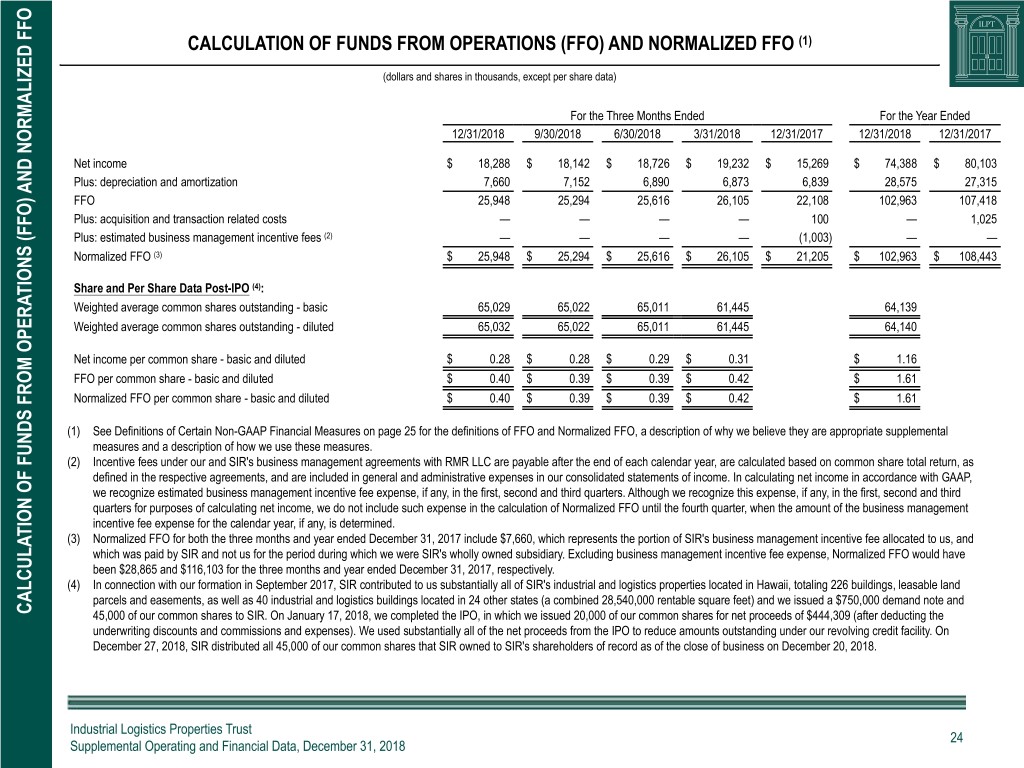

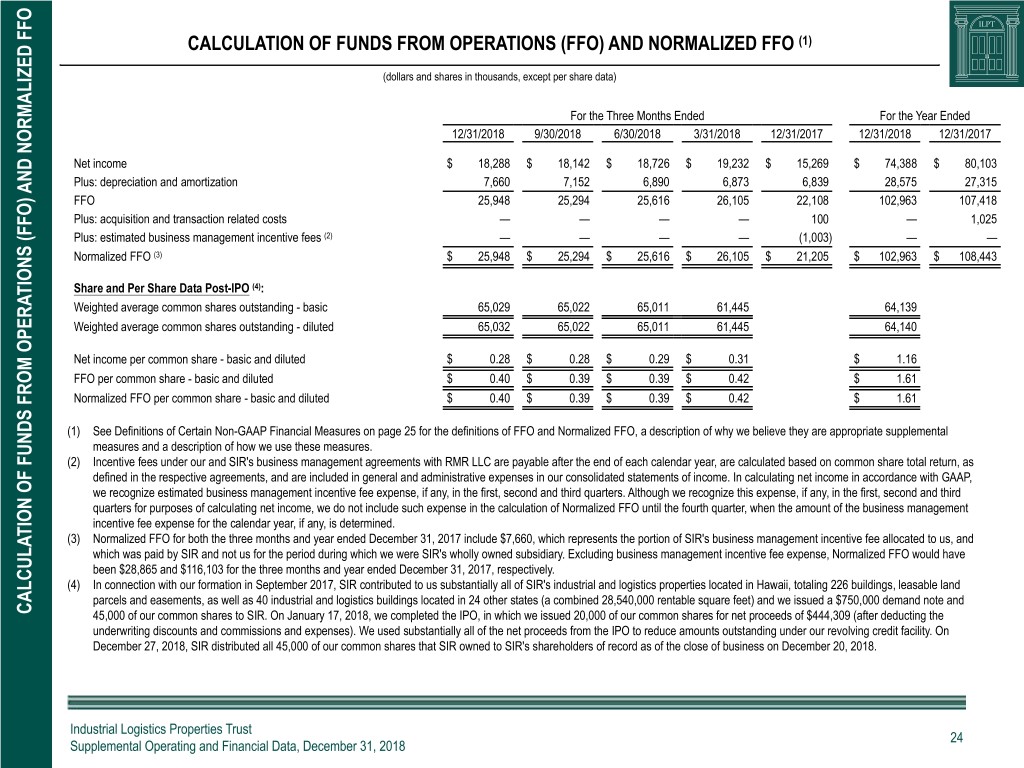

CALCULATION OF FUNDS FROM OPERATIONS (FFO) AND NORMALIZED FFO (1) (dollars and shares in thousands, except per share data) For the Three Months Ended For the Year Ended 12/31/2018 9/30/2018 6/30/2018 3/31/2018 12/31/2017 12/31/2018 12/31/2017 Net income $ 18,288 $ 18,142 $ 18,726 $ 19,232 $ 15,269 $ 74,388 $ 80,103 Plus: depreciation and amortization 7,660 7,152 6,890 6,873 6,839 28,575 27,315 FFO 25,948 25,294 25,616 26,105 22,108 102,963 107,418 Plus: acquisition and transaction related costs — — — — 100 — 1,025 Plus: estimated business management incentive fees (2) — — — — (1,003) — — Normalized FFO (3) $ 25,948 $ 25,294 $ 25,616 $ 26,105 $ 21,205 $ 102,963 $ 108,443 Share and Per Share Data Post-IPO (4): Weighted average common shares outstanding - basic 65,029 65,022 65,011 61,445 64,139 Weighted average common shares outstanding - diluted 65,032 65,022 65,011 61,445 64,140 Net income per common share - basic and diluted $ 0.28 $ 0.28 $ 0.29 $ 0.31 $ 1.16 FFO per common share - basic and diluted $ 0.40 $ 0.39 $ 0.39 $ 0.42 $ 1.61 Normalized FFO per common share - basic and diluted $ 0.40 $ 0.39 $ 0.39 $ 0.42 $ 1.61 (1) See Definitions of Certain Non-GAAP Financial Measures on page 25 for the definitions of FFO and Normalized FFO, a description of why we believe they are appropriate supplemental measures and a description of how we use these measures. (2) Incentive fees under our and SIR's business management agreements with RMR LLC are payable after the end of each calendar year, are calculated based on common share total return, as defined in the respective agreements, and are included in general and administrative expenses in our consolidated statements of income. In calculating net income in accordance with GAAP, we recognize estimated business management incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third quarters for purposes of calculating net income, we do not include such expense in the calculation of Normalized FFO until the fourth quarter, when the amount of the business management incentive fee expense for the calendar year, if any, is determined. (3) Normalized FFO for both the three months and year ended December 31, 2017 include $7,660, which represents the portion of SIR's business management incentive fee allocated to us, and which was paid by SIR and not us for the period during which we were SIR's wholly owned subsidiary. Excluding business management incentive fee expense, Normalized FFO would have been $28,865 and $116,103 for the three months and year ended December 31, 2017, respectively. (4) In connection with our formation in September 2017, SIR contributed to us substantially all of SIR's industrial and logistics properties located in Hawaii, totaling 226 buildings, leasable land parcels and easements, as well as 40 industrial and logistics buildings located in 24 other states (a combined 28,540,000 rentable square feet) and we issued a $750,000 demand note and CALCULATION OF FUNDS FROM OPERATIONS (FFO) AND NORMALIZED FFO (FFO) OF FUNDS FROM OPERATIONS CALCULATION 45,000 of our common shares to SIR. On January 17, 2018, we completed the IPO, in which we issued 20,000 of our common shares for net proceeds of $444,309 (after deducting the underwriting discounts and commissions and expenses). We used substantially all of the net proceeds from the IPO to reduce amounts outstanding under our revolving credit facility. On December 27, 2018, SIR distributed all 45,000 of our common shares that SIR owned to SIR's shareholders of record as of the close of business on December 20, 2018. Industrial Logistics Properties Trust 24 Supplemental Operating and Financial Data, December 31, 2018

DEFINITIONS OF CERTAIN NON-GAAP FINANCIAL MEASURES NOI and Cash Basis NOI: The calculations of NOI and Cash Basis NOI exclude certain components of net income in order to provide results that are more closely related to our property level results of operations. We calculate NOI and Cash Basis NOI as shown on pages 21 and 22. We define NOI as income from our rental of real estate less our property operating expenses. NOI excludes amortization of capitalized tenant improvement costs and leasing commissions that we record as depreciation and amortization. We define Cash Basis NOI as NOI excluding non-cash straight line rent adjustments, lease value amortization, lease termination fees, if any, and non-cash amortization included in other operating expenses. We consider NOI and Cash Basis NOI to be appropriate supplemental measures to net income because they may help both investors and management to understand the operations of our properties. We use NOI and Cash Basis NOI to evaluate individual and company wide property level performance, and we believe that NOI and Cash Basis NOI provide useful information to investors regarding our results of operations because they reflect only those income and expense items that are generated and incurred at the property level and may facilitate comparisons of our operating performance between periods and with other REITs. NOI and Cash Basis NOI do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income as indicators of our operating performance or as measures of our liquidity. These measures should be considered in conjunction with net income as presented in our consolidated statements of income. Other real estate companies and REITs may calculate NOI and Cash Basis NOI differently than we do. EBITDA and Adjusted EBITDA: We calculate EBITDA and Adjusted EBITDA as shown on page 23. We consider EBITDA and Adjusted EBITDA to be appropriate supplemental measures of our operating performance, along with net income. We believe that EBITDA and Adjusted EBITDA provide useful information to investors because by excluding the effects of certain historical amounts, such as interest, depreciation and amortization expense, EBITDA and Adjusted EBITDA may facilitate a comparison of current operating performance with our past operating performance. EBITDA and Adjusted EBITDA do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income as indicators of operating performance or as measures of our liquidity. These measures should be considered in conjunction with net income as presented in our consolidated statements of income. Other real estate companies and REITs may calculate EBITDA and Adjusted EBITDA differently than we do. FFO and Normalized FFO: We calculate FFO and Normalized FFO as shown on page 24. FFO is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or Nareit, which is net income, calculated in accordance with GAAP, plus real estate depreciation and amortization, as well as certain other adjustments currently not applicable to us. Our calculation of Normalized FFO differs from Nareit’s definition of FFO because we include business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of our core operating performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year, and we exclude acquisition and transaction related costs expensed under GAAP. We consider FFO and Normalized FFO to be appropriate supplemental measures of operating performance for a REIT, along with net income. We believe that FFO and Normalized FFO provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation expense, FFO and Normalized FFO may facilitate a comparison of our operating performance between periods and with other REITs. FFO and Normalized FFO are among the factors considered by our Board of Trustees when determining the amount of distributions to our shareholders. Other factors include, but are not limited to, requirements to qualify for taxation as a REIT, limitations in our credit agreement, the availability to us of debt and equity capital, our expectation of our future capital requirements and operating performance and our expected needs for and availability of cash to pay our obligations. FFO and Normalized FFO do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income as indicators of our operating performance or as measures of our liquidity. These measures should be considered in conjunction with net income as presented in our consolidated statements of income. Other real estate companies and REITs may calculate FFO and Normalized FFO differently than we do. DEFINITIONS OF CERTAIN NON-GAAP FINANCIAL MEASURES FINANCIAL NON-GAAP DEFINITIONS OF CERTAIN Industrial Logistics Properties Trust 25 Supplemental Operating and Financial Data, December 31, 2018

PORTFOLIO INFORMATION 5 Logistics Drive, Carlisle, PA Square Feet: 205,090 Tenant: TAP Worldwide, LLC 26

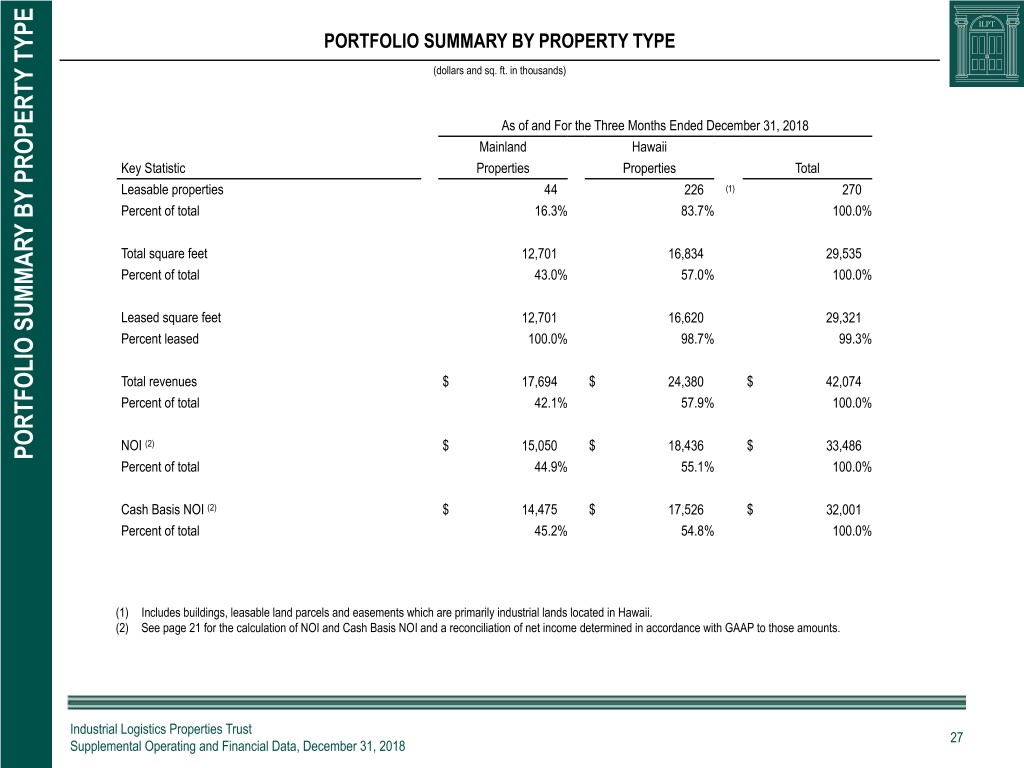

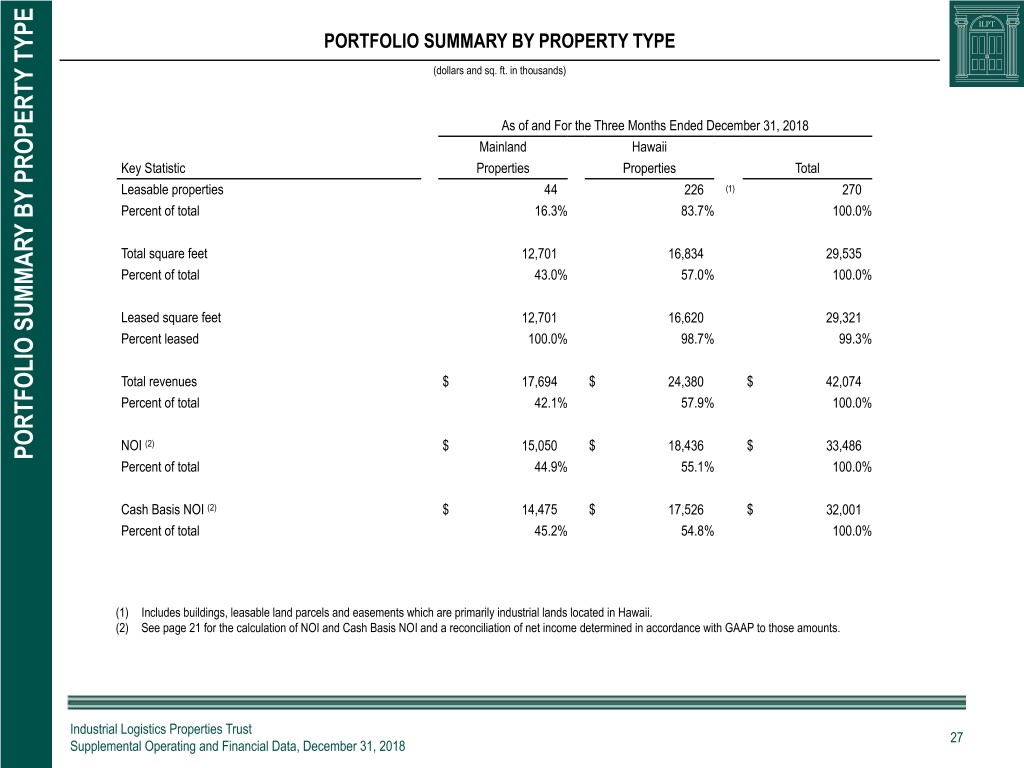

PORTFOLIO SUMMARY BY PROPERTY TYPE (dollars and sq. ft. in thousands) As of and For the Three Months Ended December 31, 2018 Mainland Hawaii Key Statistic Properties Properties Total Leasable properties 44 226 (1) 270 Percent of total 16.3% 83.7% 100.0% Total square feet 12,701 16,834 29,535 Percent of total 43.0% 57.0% 100.0% Leased square feet 12,701 16,620 29,321 Percent leased 100.0% 98.7% 99.3% Total revenues $ 17,694 $ 24,380 $ 42,074 Percent of total 42.1% 57.9% 100.0% NOI (2) $ 15,050 $ 18,436 $ 33,486 PORTFOLIO SUMMARY BY PROPERTY TYPE PROPERTY BY PORTFOLIO SUMMARY Percent of total 44.9% 55.1% 100.0% Cash Basis NOI (2) $ 14,475 $ 17,526 $ 32,001 Percent of total 45.2% 54.8% 100.0% (1) Includes buildings, leasable land parcels and easements which are primarily industrial lands located in Hawaii. (2) See page 21 for the calculation of NOI and Cash Basis NOI and a reconciliation of net income determined in accordance with GAAP to those amounts. Industrial Logistics Properties Trust 27 Supplemental Operating and Financial Data, December 31, 2018

SAME PROPERTY RESULTS OF OPERATIONS BY PROPERTY TYPE (dollars and sq. ft. in thousands) As of and For the Three Months Ended (1) As of and For the Year Ended (2) 12/31/2018 12/31/2017 12/31/2018 12/31/2017 Leasable Properties: Mainland Properties 40 40 40 40 Hawaii Properties 226 226 226 226 Total 266 266 266 266 Square Feet (3): Mainland Properties 11,716 11,706 11,716 11,706 Hawaii Properties 16,834 16,834 16,834 16,834 Total 28,550 28,540 28,550 28,540 Percent Leased (4): Mainland Properties 100.0 % 100.0% 100.0 % 100.0% Hawaii Properties 98.7 % 99.9% 98.7 % 99.9% Total 99.2 % 99.9% 99.2 % 99.9% Total Revenues: Mainland Properties $ 15,774 $ 15,589 $ 62,921 $ 62,334 Hawaii Properties 24,380 23,806 97,060 94,172 Total $ 40,154 $ 39,395 $ 159,981 $ 156,506 (1) Consists of properties that we owned (including for the period SIR owned our properties prior to the IPO) continuously since October 1, 2017. (2) Consists of properties that we owned (including for the period SIR owned our properties prior to the IPO) continuously since January 1, 2017. SAME PROPERTY RESULTS OF OPERATIONS BY PROPERTY TYPE PROPERTY BY OF OPERATIONS RESULTS SAME PROPERTY (3) Subject to modest adjustments when space is re-measured or re-configured for new tenants and when land leases are converted to building leases. (4) Includes (i) space being fitted out for occupancy pursuant to existing leases, if any, and (ii) space which is leased but is not occupied or is being offered for sublease by tenants, if any. Industrial Logistics Properties Trust 28 Supplemental Operating and Financial Data, December 31, 2018

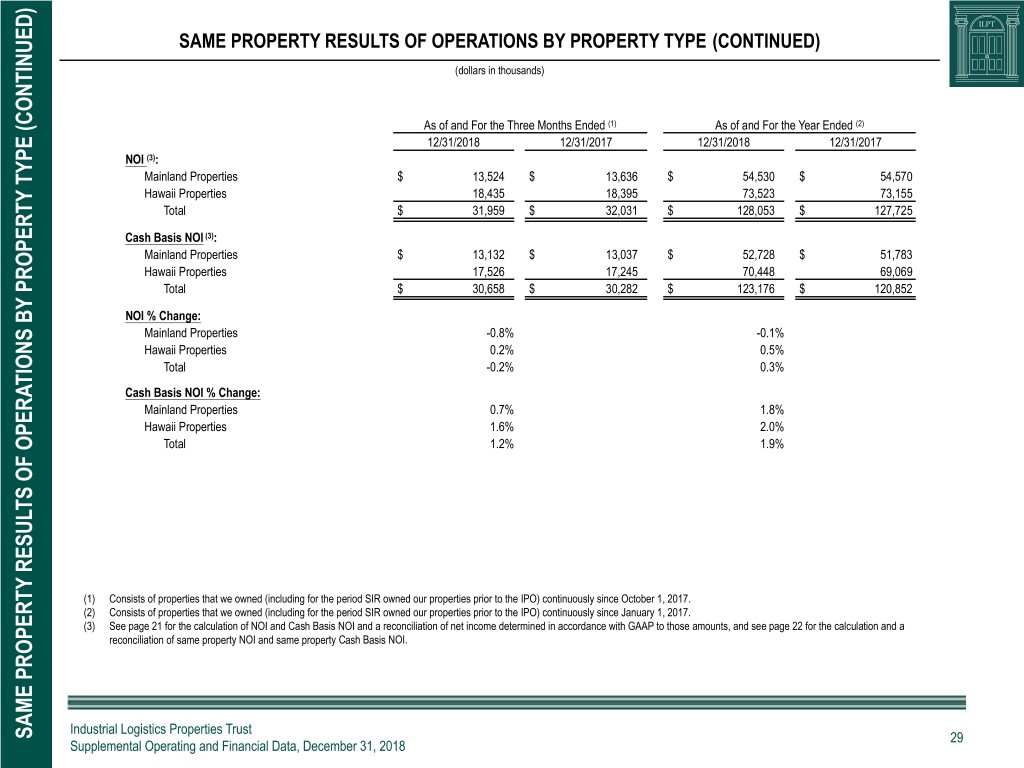

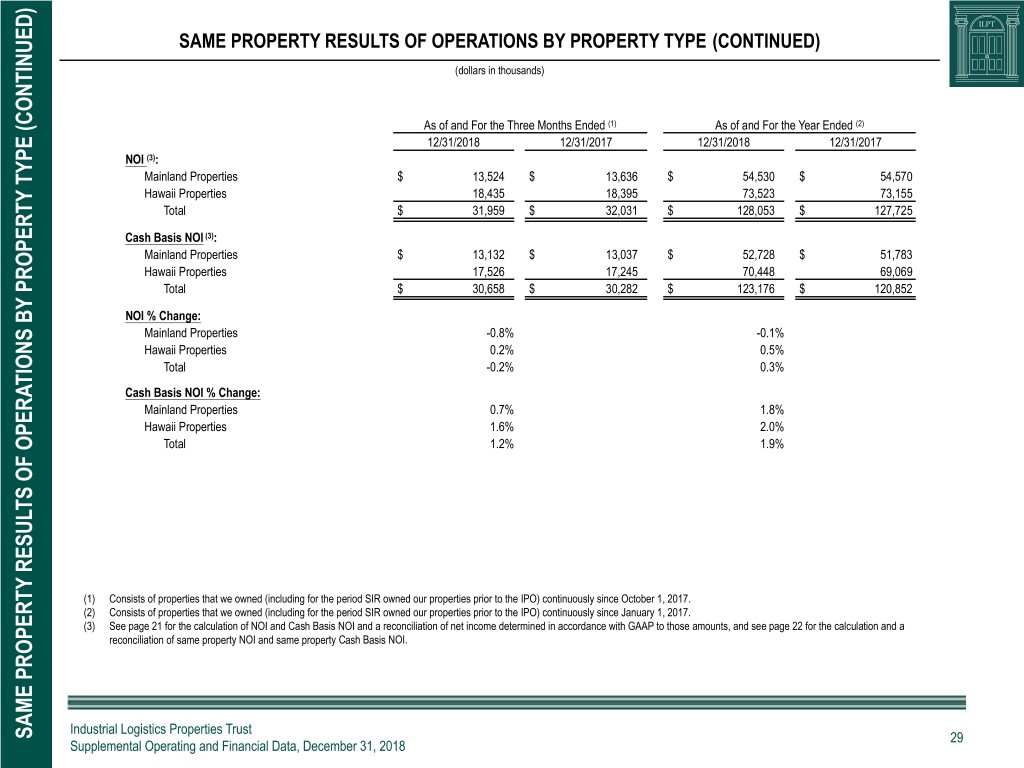

SAME PROPERTY RESULTS OF OPERATIONS BY PROPERTY TYPE (CONTINUED) (dollars in thousands) As of and For the Three Months Ended (1) As of and For the Year Ended (2) 12/31/2018 12/31/2017 12/31/2018 12/31/2017 NOI (3): Mainland Properties $ 13,524 $ 13,636 $ 54,530 $ 54,570 Hawaii Properties 18,435 18,395 73,523 73,155 Total $ 31,959 $ 32,031 $ 128,053 $ 127,725 Cash Basis NOI (3): Mainland Properties $ 13,132 $ 13,037 $ 52,728 $ 51,783 Hawaii Properties 17,526 17,245 70,448 69,069 Total $ 30,658 $ 30,282 $ 123,176 $ 120,852 NOI % Change: Mainland Properties -0.8% -0.1% Hawaii Properties 0.2% 0.5% Total -0.2% 0.3% Cash Basis NOI % Change: Mainland Properties 0.7% 1.8% Hawaii Properties 1.6% 2.0% Total 1.2% 1.9% (1) Consists of properties that we owned (including for the period SIR owned our properties prior to the IPO) continuously since October 1, 2017. (2) Consists of properties that we owned (including for the period SIR owned our properties prior to the IPO) continuously since January 1, 2017. (3) See page 21 for the calculation of NOI and Cash Basis NOI and a reconciliation of net income determined in accordance with GAAP to those amounts, and see page 22 for the calculation and a reconciliation of same property NOI and same property Cash Basis NOI. Industrial Logistics Properties Trust SAME PROPERTY RESULTS OF OPERATIONS BY PROPERTY TYPE (CONTINUED) PROPERTY BY OF OPERATIONS RESULTS SAME PROPERTY 29 Supplemental Operating and Financial Data, December 31, 2018

LEASING SUMMARY (dollars and sq. ft. in thousands, except per sq. ft. data) As of and For the Three Months Ended 12/31/2018 9/30/2018 6/30/2018 3/31/2018 12/31/2017 Leasable buildings (1) 270 269 267 266 266 Total sq. ft. (2) 29,535 29,216 28,780 28,540 28,540 Square feet leased 29,321 29,002 28,516 28,534 28,533 Percentage leased 99.3% 99.3% 99.1% 99.9% 99.9% Leasing Activity (Sq. Ft.): New leases 194 (3) 120 55 1 60 LEASING SUMMARY Renewals 1,598 204 163 295 108 Rent resets 80 516 34 — 200 Total 1,872 840 252 296 368 % Change in GAAP Rent (4): New leases 71.9% -15.3% 46.7% 19.6% 17.8% Renewals 17.8% 26.6% 25.5% 46.3% 8.9% Rent resets 18.2% 20.3% 18.0% —% 38.6% Weighted average (by square feet) 23.7% 17.7% 31.3% 45.9% 30.6% Leasing Costs and Concession Commitments (5): New leases $ 957 $ 321 $ 484 $ 33 $ 148 Renewals 651 77 56 35 8 Total $ 1,608 $ 398 $ 540 $ 68 $ 156 Leasing Costs and Concession Commitments per Sq. Ft. (6): New leases $ 4.93 $ 2.68 $ 8.80 $ 33.00 $ 2.47 Renewals $ 0.41 $ 0.38 $ 0.34 $ 0.12 $ 0.07 Total $ 0.90 $ 1.23 $ 2.48 $ 0.23 $ 0.93 Weighted Average Lease Term by Sq. Ft. (Years): New leases 15.0 4.4 21.1 7.0 3.6 Renewals 14.3 16.1 7.7 30.4 6.0 Total 14.4 11.8 11.1 30.3 5.1 Leasing Costs and Concession Commitments per Sq. Ft. per Year (5) (6): New leases $ 0.33 $ 0.61 $ 0.42 $ 4.71 $ 0.69 Renewals $ 0.03 $ 0.02 $ 0.04 $ 0.00 $ 0.01 Total $ 0.06 $ 0.10 $ 0.22 $ 0.01 $ 0.18 (1) Includes 226 buildings, leasable land parcels and easements with approximately 16,834 square feet which are primarily industrial lands located in Hawaii. (2) Subject to modest adjustments when space is re-measured or re-configured for new tenants and when land leases are converted to building leases. (3) Includes a 194 square foot expansion to be constructed prior to the commencement of the lease. (4) Percent change in prior rents charged for same space. Rents include estimated recurring expense reimbursements and exclude lease value amortization. References in this report to "same space" represent same land area and building area (with leasing rates for vacant space based upon the most recent rental rate for the same space). (5) Includes commitments made for leasing expenditures and concessions, such as tenant improvements, leasing commissions, tenant reimbursements and free rent. (6) Amounts are per square foot per year for the weighted average lease term by leased square feet. The above leasing summary is based on leases entered into during the periods indicated. Industrial Logistics Properties Trust 30 Supplemental Operating and Financial Data, December 31, 2018

OCCUPANCY AND LEASING ANALYSIS BY PROPERTY TYPE (sq. ft. in thousands) Total Sq. Ft. (1) Sq. Ft. Leases Executed During As of the Three Months Ended 12/31/2018 Property Type 12/31/2018 New (2) Renewals Total Mainland Properties 12,701 — 513 513 Hawaii Properties 16,834 — 1,085 1,085 Total 29,535 — 1,598 1,598 Sq. Ft. Leased As of 9/30/2018 Acquisitions / As of 12/31/2018 Property Type 9/30/2018 % Leased (3) (Sales) 12/31/2018 (2) % Leased Mainland Properties 12,382 100.0% 319 12,701 100.0% Hawaii Properties 16,620 98.7% — 16,620 98.7% Total 29,002 99.3% 319 29,321 99.3% OCCUPANCY AND LEASING ANALYSIS BY PROPERTY TYPE PROPERTY BY ANALYSIS AND LEASING OCCUPANCY (1) Subject to modest adjustments when space is re-measured or re-configured for new tenants and when land leases are converted to building leases. (2) Square footage excludes a 194 square foot expansion to be constructed prior to the commencement of the lease. (3) Excludes effects of space re-measurements during the period, if any. Percent leased includes (i) space being fitted out for occupancy, if any, and (ii) space which is leased but is not occupied or is being offered for sublease by tenants, if any. Industrial Logistics Properties Trust 31 Supplemental Operating and Financial Data, December 31, 2018

TENANT CREDIT CHARACTERISTICS As of December 31, 2018 % of Annualized Rental Revenues (1) Mainland Tenant Credit Characteristics Properties Consolidated Investment grade rated 39.7% 23.4% Subsidiaries of investment grade rated parent entities 8.9% 4.2% Other leased Hawaii lands —% 45.9% Subtotal investment grade rated, subsidiaries of 48.6% 73.5% investment grade rated parent entities and other leased Hawaii lands Other unrated or non-investment grade 51.4% 26.5% 100.0% 100.0% Mainland Properties Consolidated Properties TENANT CREDIT CHARACTERISTICS % of Annualized Rental Revenues (1) % of Annualized Rental Revenues (1) Investment grade rated Investment grade rated 23.4% 26.5% Subsidiaries of investment grade Subsidiaries of 39.7% rated parent investment grade entities 51.4% rated parent 4.2% entities Other leased Hawaii lands Other unrated or 8.9% non-investment grade Other unrated or 45.9% non-investment grade (1) We define annualized rental revenues as the annualized contractual rents, as of December 31, 2018, including straight line rent adjustments and excluding lease value amortization, adjusted for tenant concessions including free rent and amounts reimbursed to tenants, plus estimated recurring expense reimbursements from tenants. Industrial Logistics Properties Trust 32 Supplemental Operating and Financial Data, December 31, 2018

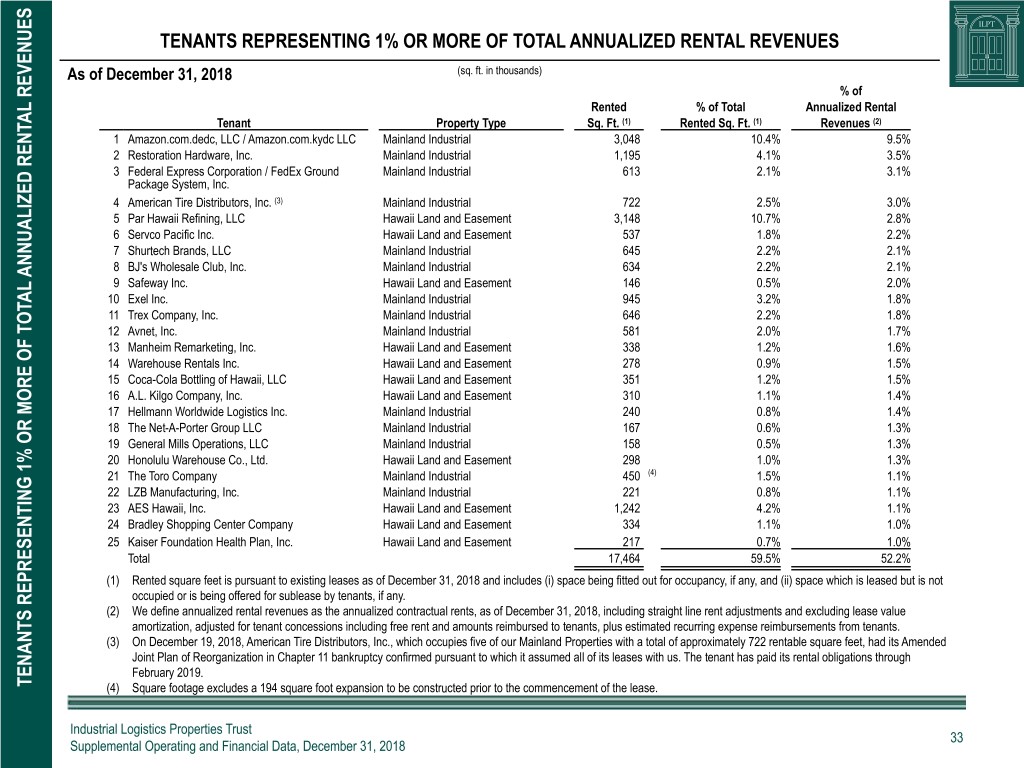

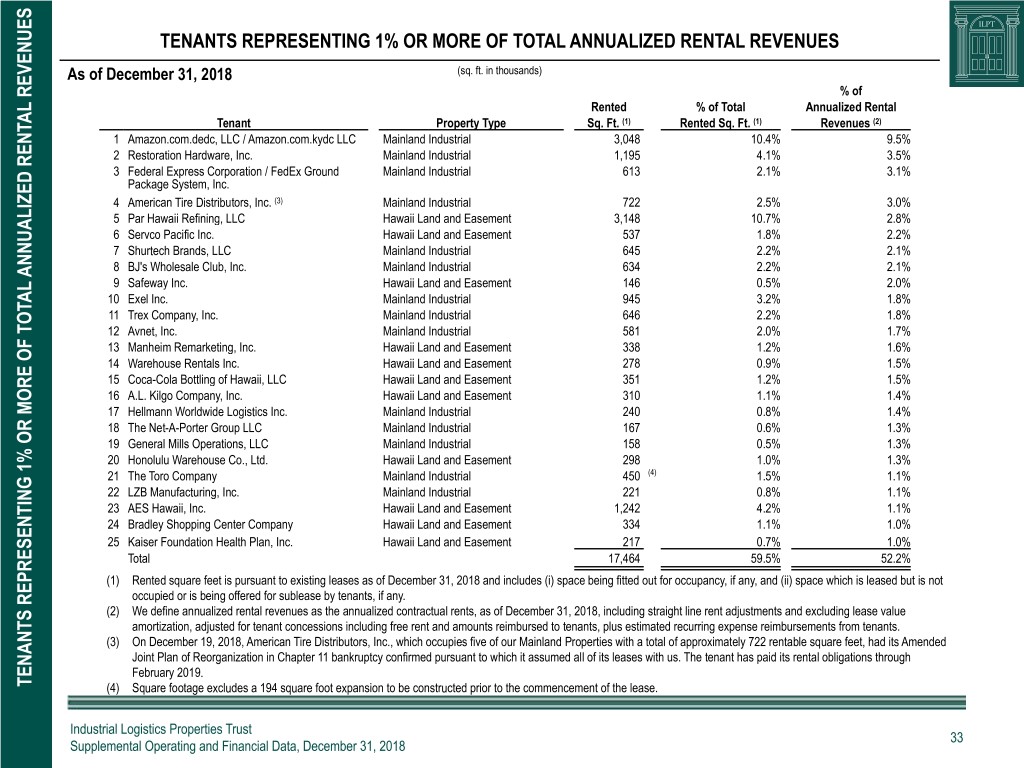

TENANTS REPRESENTING 1% OR MORE OF TOTAL ANNUALIZED RENTAL REVENUES As of December 31, 2018 (sq. ft. in thousands) % of Rented % of Total Annualized Rental Tenant Property Type Sq. Ft. (1) Rented Sq. Ft. (1) Revenues (2) 1 Amazon.com.dedc, LLC / Amazon.com.kydc LLC Mainland Industrial 3,048 10.4% 9.5% 2 Restoration Hardware, Inc. Mainland Industrial 1,195 4.1% 3.5% 3 Federal Express Corporation / FedEx Ground Mainland Industrial 613 2.1% 3.1% Package System, Inc. 4 American Tire Distributors, Inc. (3) Mainland Industrial 722 2.5% 3.0% 5 Par Hawaii Refining, LLC Hawaii Land and Easement 3,148 10.7% 2.8% 6 Servco Pacific Inc. Hawaii Land and Easement 537 1.8% 2.2% 7 Shurtech Brands, LLC Mainland Industrial 645 2.2% 2.1% 8 BJ's Wholesale Club, Inc. Mainland Industrial 634 2.2% 2.1% 9 Safeway Inc. Hawaii Land and Easement 146 0.5% 2.0% 10 Exel Inc. Mainland Industrial 945 3.2% 1.8% 11 Trex Company, Inc. Mainland Industrial 646 2.2% 1.8% 12 Avnet, Inc. Mainland Industrial 581 2.0% 1.7% 13 Manheim Remarketing, Inc. Hawaii Land and Easement 338 1.2% 1.6% 14 Warehouse Rentals Inc. Hawaii Land and Easement 278 0.9% 1.5% 15 Coca-Cola Bottling of Hawaii, LLC Hawaii Land and Easement 351 1.2% 1.5% 16 A.L. Kilgo Company, Inc. Hawaii Land and Easement 310 1.1% 1.4% 17 Hellmann Worldwide Logistics Inc. Mainland Industrial 240 0.8% 1.4% 18 The Net-A-Porter Group LLC Mainland Industrial 167 0.6% 1.3% 19 General Mills Operations, LLC Mainland Industrial 158 0.5% 1.3% 20 Honolulu Warehouse Co., Ltd. Hawaii Land and Easement 298 1.0% 1.3% 21 The Toro Company Mainland Industrial 450 (4) 1.5% 1.1% 22 LZB Manufacturing, Inc. Mainland Industrial 221 0.8% 1.1% 23 AES Hawaii, Inc. Hawaii Land and Easement 1,242 4.2% 1.1% 24 Bradley Shopping Center Company Hawaii Land and Easement 334 1.1% 1.0% 25 Kaiser Foundation Health Plan, Inc. Hawaii Land and Easement 217 0.7% 1.0% Total 17,464 59.5% 52.2% (1) Rented square feet is pursuant to existing leases as of December 31, 2018 and includes (i) space being fitted out for occupancy, if any, and (ii) space which is leased but is not occupied or is being offered for sublease by tenants, if any. (2) We define annualized rental revenues as the annualized contractual rents, as of December 31, 2018, including straight line rent adjustments and excluding lease value amortization, adjusted for tenant concessions including free rent and amounts reimbursed to tenants, plus estimated recurring expense reimbursements from tenants. (3) On December 19, 2018, American Tire Distributors, Inc., which occupies five of our Mainland Properties with a total of approximately 722 rentable square feet, had its Amended Joint Plan of Reorganization in Chapter 11 bankruptcy confirmed pursuant to which it assumed all of its leases with us. The tenant has paid its rental obligations through February 2019. TENANTS REPRESENTING 1% OR MORE OF TOTAL ANNUALIZED RENTAL REVENUES ANNUALIZED RENTAL TENANTS REPRESENTING 1% OR MORE OF TOTAL (4) Square footage excludes a 194 square foot expansion to be constructed prior to the commencement of the lease. Industrial Logistics Properties Trust 33 Supplemental Operating and Financial Data, December 31, 2018

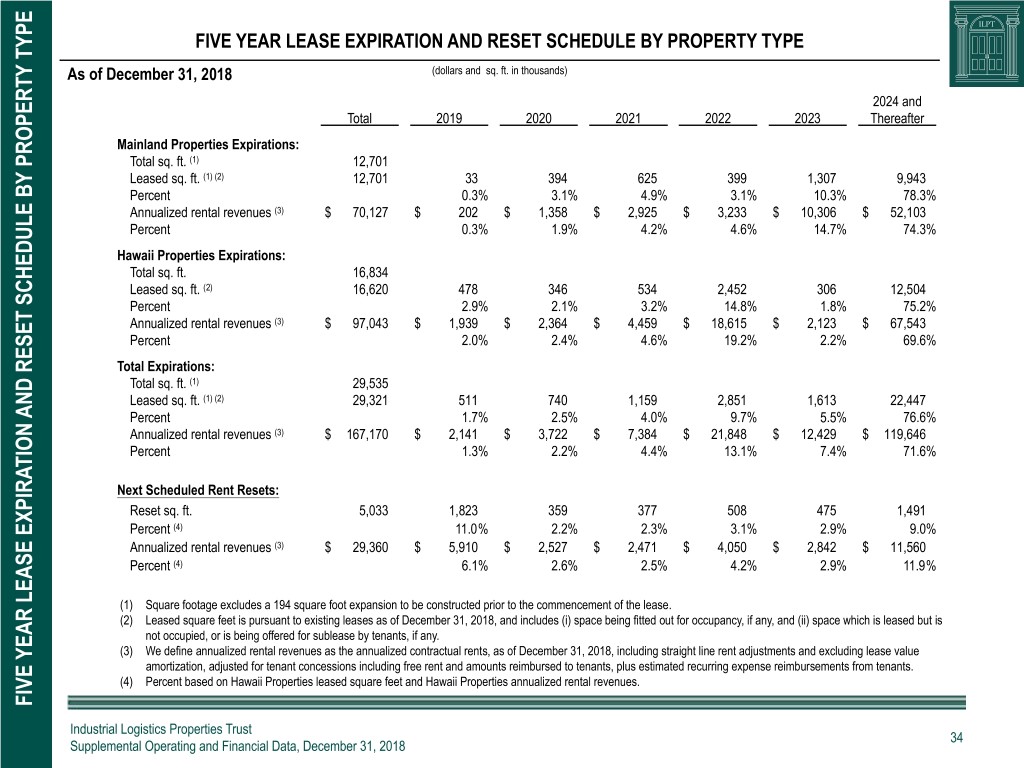

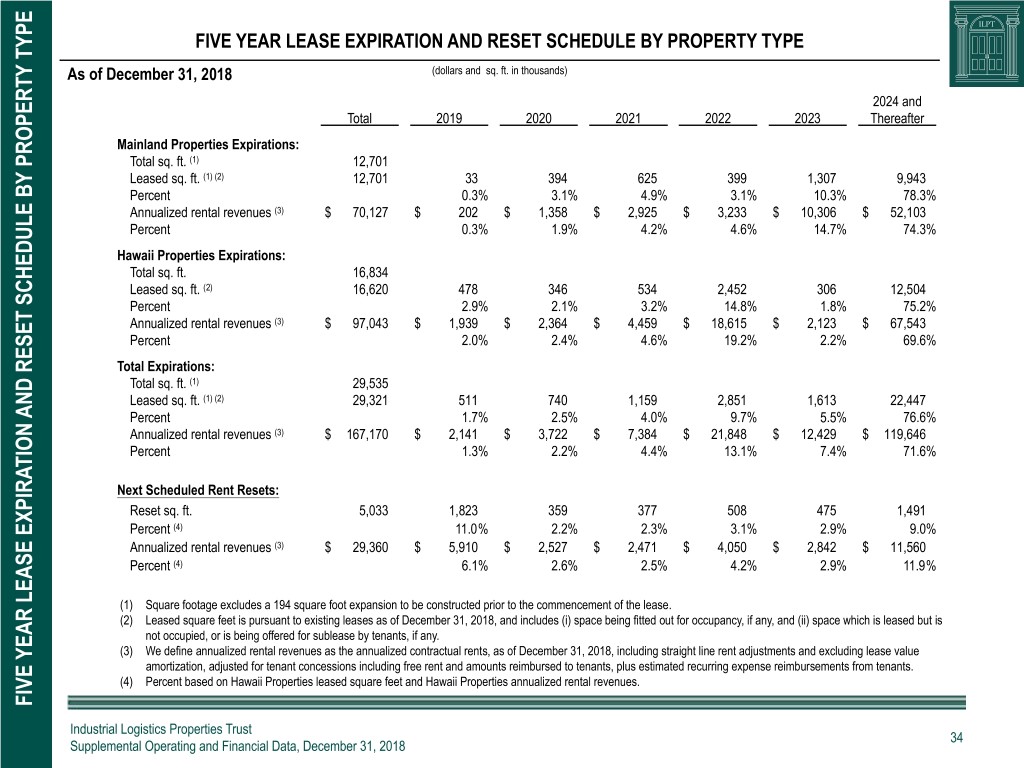

FIVE YEAR LEASE EXPIRATION AND RESET SCHEDULE BY PROPERTY TYPE As of December 31, 2018 (dollars and sq. ft. in thousands) 2024 and Total 2019 2020 2021 2022 2023 Thereafter Mainland Properties Expirations: Total sq. ft. (1) 12,701 Leased sq. ft. (1) (2) 12,701 33 394 625 399 1,307 9,943 Percent 0.3% 3.1% 4.9% 3.1% 10.3% 78.3% Annualized rental revenues (3) $ 70,127 $ 202 $ 1,358 $ 2,925 $ 3,233 $ 10,306 $ 52,103 Percent 0.3% 1.9% 4.2% 4.6% 14.7% 74.3% Hawaii Properties Expirations: Total sq. ft. 16,834 Leased sq. ft. (2) 16,620 478 346 534 2,452 306 12,504 Percent 2.9% 2.1% 3.2% 14.8% 1.8% 75.2% Annualized rental revenues (3) $ 97,043 $ 1,939 $ 2,364 $ 4,459 $ 18,615 $ 2,123 $ 67,543 Percent 2.0% 2.4% 4.6% 19.2% 2.2% 69.6% Total Expirations: Total sq. ft. (1) 29,535 Leased sq. ft. (1) (2) 29,321 511 740 1,159 2,851 1,613 22,447 Percent 1.7% 2.5% 4.0% 9.7% 5.5% 76.6% Annualized rental revenues (3) $ 167,170 $ 2,141 $ 3,722 $ 7,384 $ 21,848 $ 12,429 $ 119,646 Percent 1.3% 2.2% 4.4% 13.1% 7.4% 71.6% Next Scheduled Rent Resets: Reset sq. ft. 5,033 1,823 359 377 508 475 1,491 Percent (4) 11.0% 2.2% 2.3% 3.1% 2.9% 9.0% Annualized rental revenues (3) $ 29,360 $ 5,910 $ 2,527 $ 2,471 $ 4,050 $ 2,842 $ 11,560 Percent (4) 6.1% 2.6% 2.5% 4.2% 2.9% 11.9% (1) Square footage excludes a 194 square foot expansion to be constructed prior to the commencement of the lease. (2) Leased square feet is pursuant to existing leases as of December 31, 2018, and includes (i) space being fitted out for occupancy, if any, and (ii) space which is leased but is not occupied, or is being offered for sublease by tenants, if any. (3) We define annualized rental revenues as the annualized contractual rents, as of December 31, 2018, including straight line rent adjustments and excluding lease value amortization, adjusted for tenant concessions including free rent and amounts reimbursed to tenants, plus estimated recurring expense reimbursements from tenants. (4) Percent based on Hawaii Properties leased square feet and Hawaii Properties annualized rental revenues. FIVE YEAR LEASE EXPIRATION AND RESET SCHEDULE BY PROPERTY TYPE PROPERTY AND RESET SCHEDULE BY YEAR LEASE EXPIRATION FIVE Industrial Logistics Properties Trust 34 Supplemental Operating and Financial Data, December 31, 2018

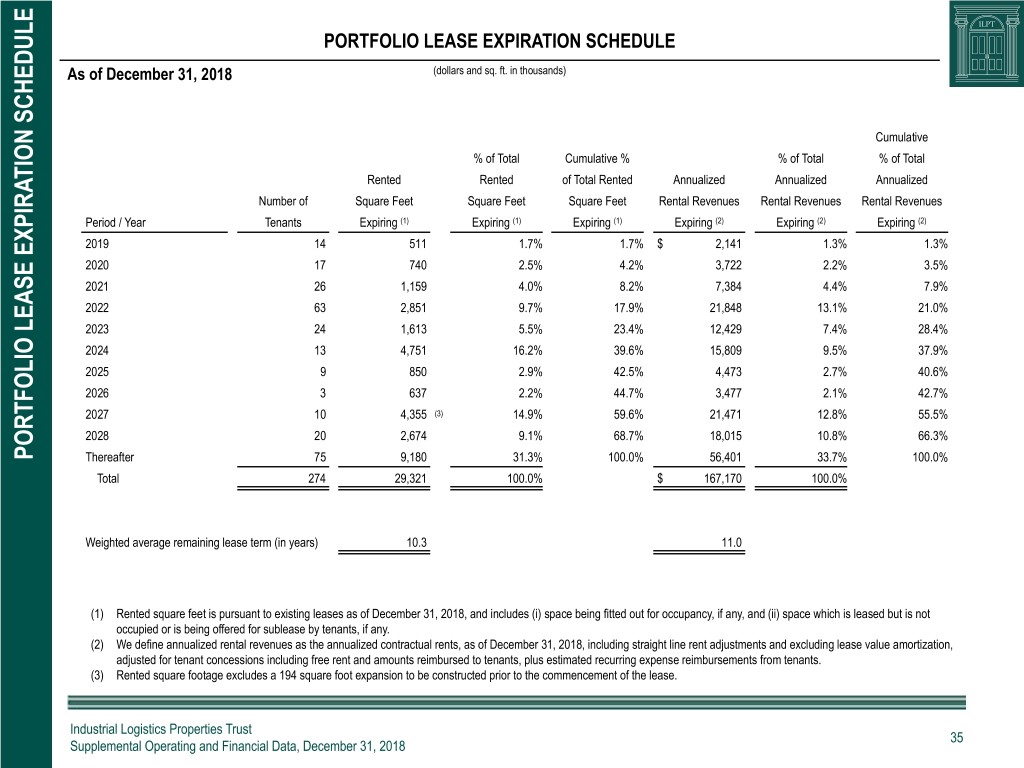

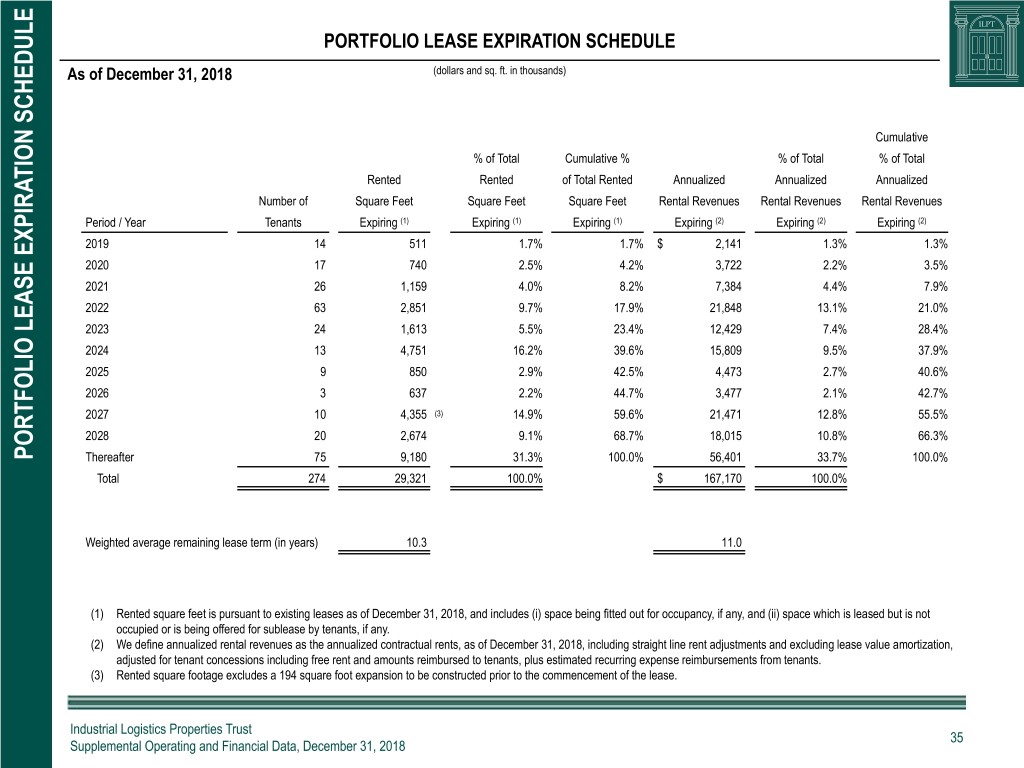

PORTFOLIO LEASE EXPIRATION SCHEDULE As of December 31, 2018 (dollars and sq. ft. in thousands) Cumulative % of Total Cumulative % % of Total % of Total Rented Rented of Total Rented Annualized Annualized Annualized Number of Square Feet Square Feet Square Feet Rental Revenues Rental Revenues Rental Revenues Period / Year Tenants Expiring (1) Expiring (1) Expiring (1) Expiring (2) Expiring (2) Expiring (2) 2019 14 511 1.7% 1.7% $ 2,141 1.3% 1.3% 2020 17 740 2.5% 4.2% 3,722 2.2% 3.5% 2021 26 1,159 4.0% 8.2% 7,384 4.4% 7.9% 2022 63 2,851 9.7% 17.9% 21,848 13.1% 21.0% 2023 24 1,613 5.5% 23.4% 12,429 7.4% 28.4% 2024 13 4,751 16.2% 39.6% 15,809 9.5% 37.9% 2025 9 850 2.9% 42.5% 4,473 2.7% 40.6% 2026 3 637 2.2% 44.7% 3,477 2.1% 42.7% 2027 10 4,355 (3) 14.9% 59.6% 21,471 12.8% 55.5% 2028 20 2,674 9.1% 68.7% 18,015 10.8% 66.3% PORTFOLIO LEASE EXPIRATION SCHEDULE PORTFOLIO LEASE EXPIRATION Thereafter 75 9,180 31.3% 100.0% 56,401 33.7% 100.0% Total 274 29,321 100.0% $ 167,170 100.0% Weighted average remaining lease term (in years) 10.3 11.0 (1) Rented square feet is pursuant to existing leases as of December 31, 2018, and includes (i) space being fitted out for occupancy, if any, and (ii) space which is leased but is not occupied or is being offered for sublease by tenants, if any. (2) We define annualized rental revenues as the annualized contractual rents, as of December 31, 2018, including straight line rent adjustments and excluding lease value amortization, adjusted for tenant concessions including free rent and amounts reimbursed to tenants, plus estimated recurring expense reimbursements from tenants. (3) Rented square footage excludes a 194 square foot expansion to be constructed prior to the commencement of the lease. Industrial Logistics Properties Trust 35 Supplemental Operating and Financial Data, December 31, 2018

EXHIBIT A Sand Island Industrial Land, Honolulu, HI 48 Buildings and Leasable Land Parcels Approximate Square Feet: 2,448,000 36

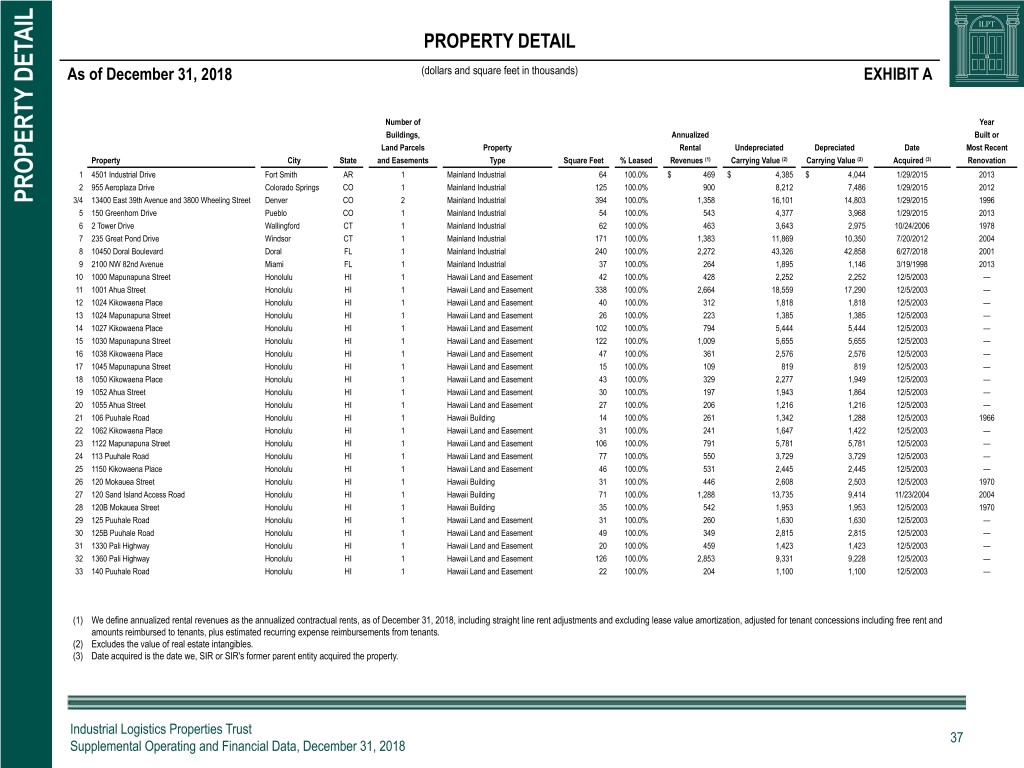

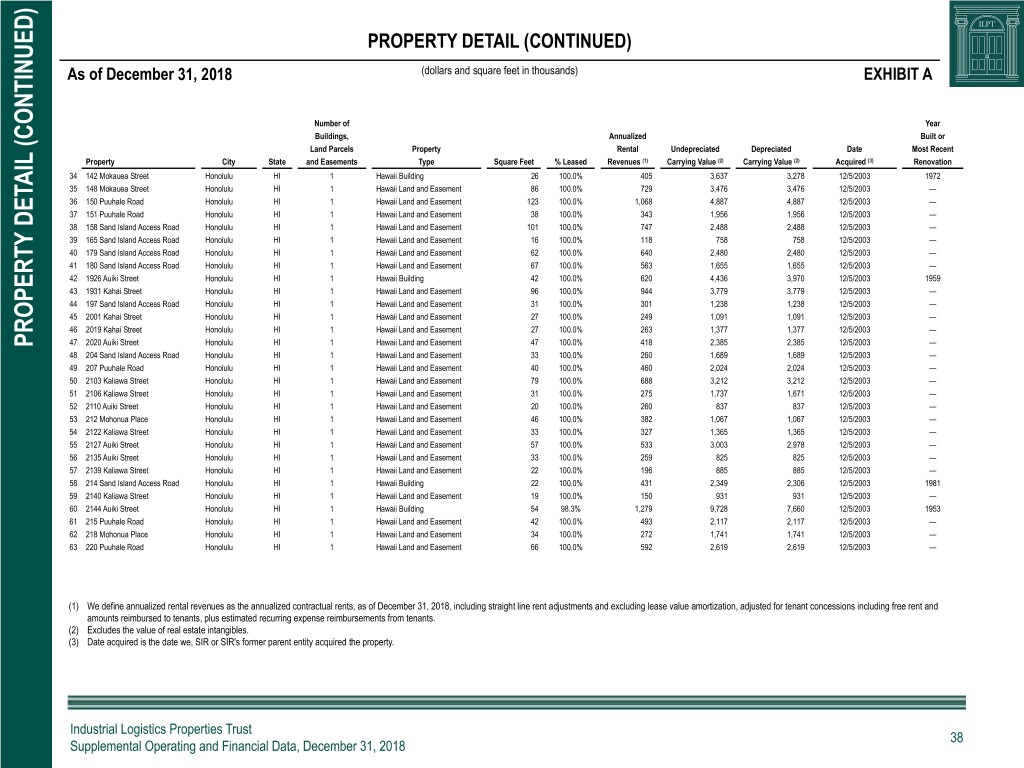

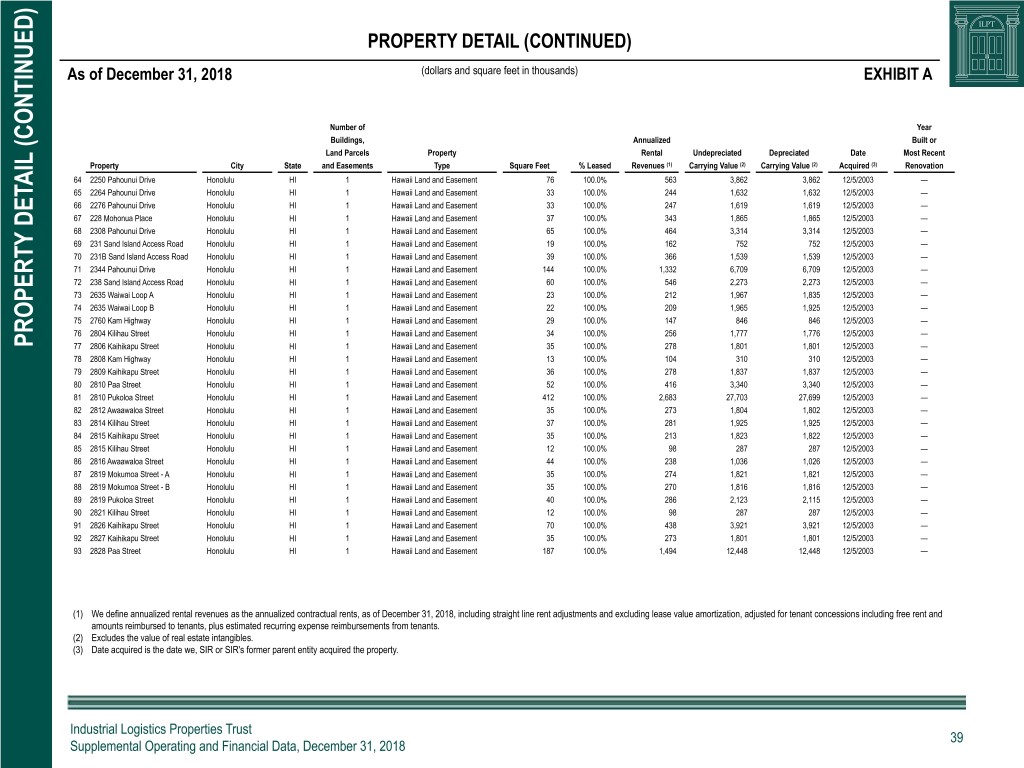

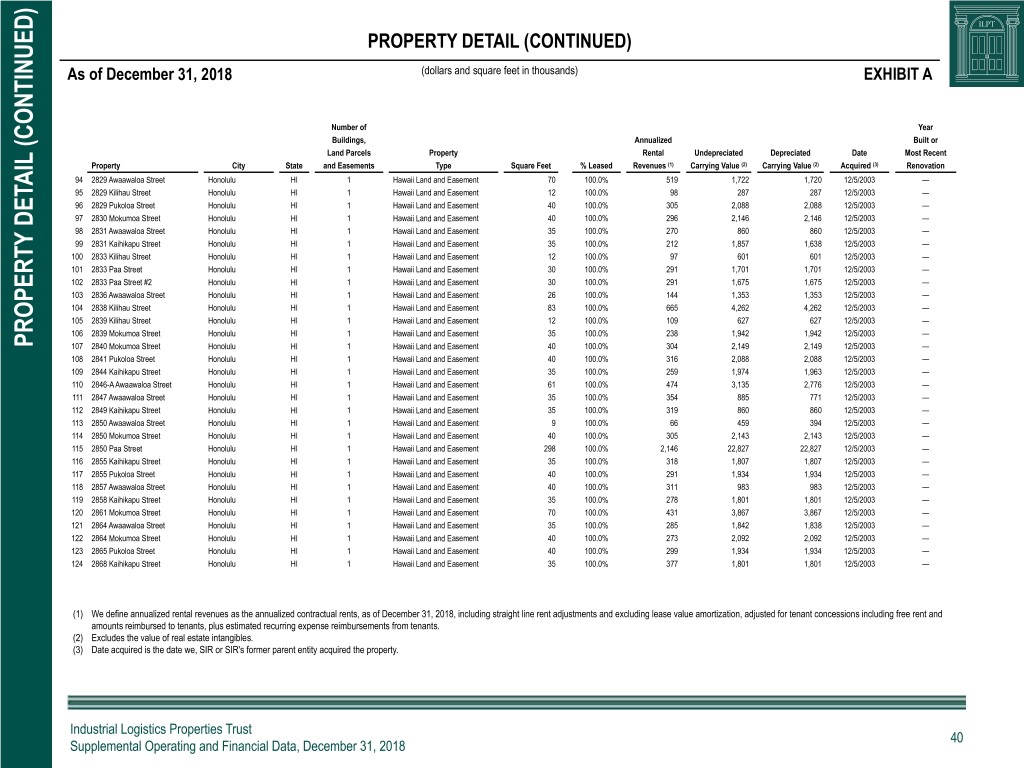

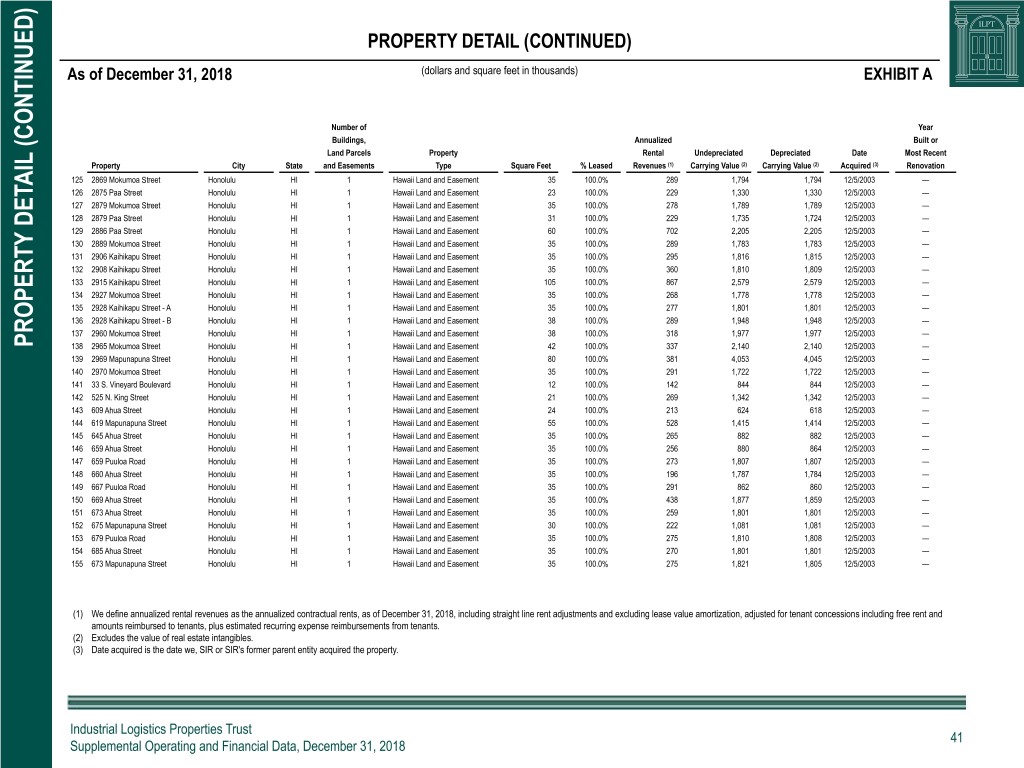

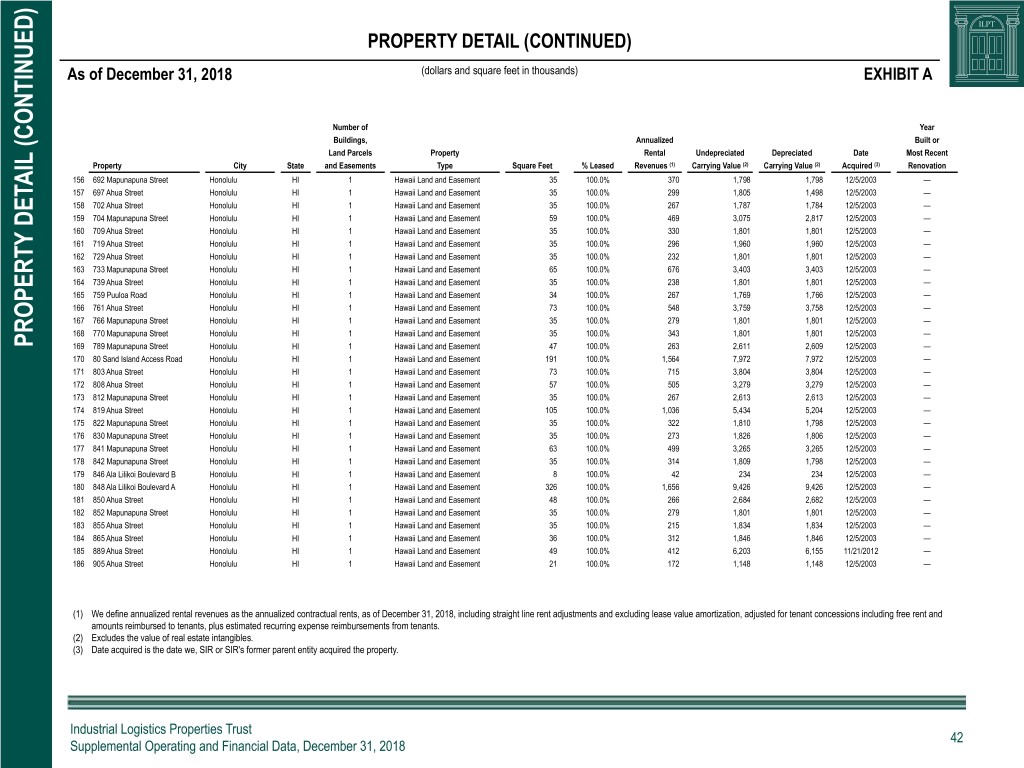

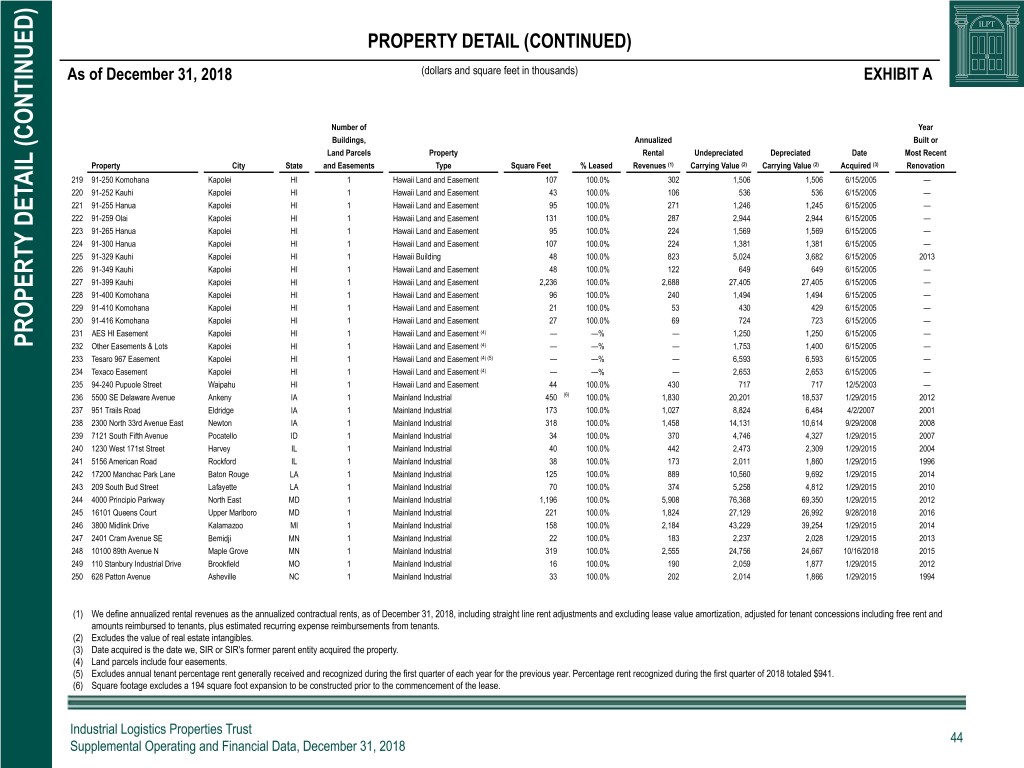

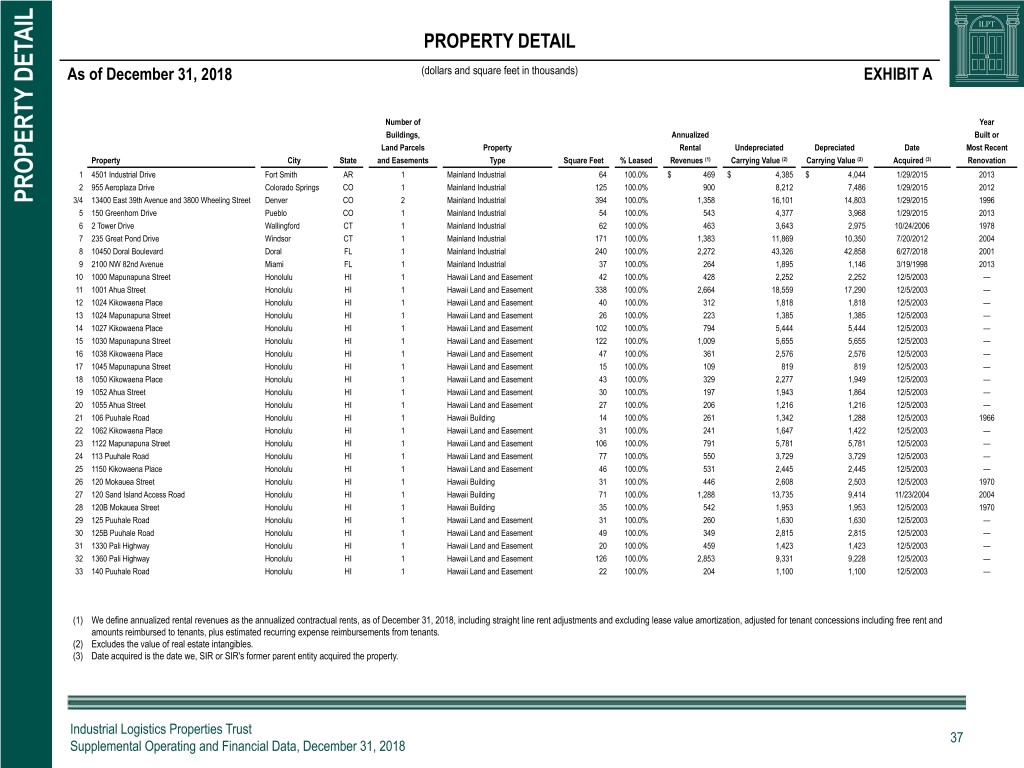

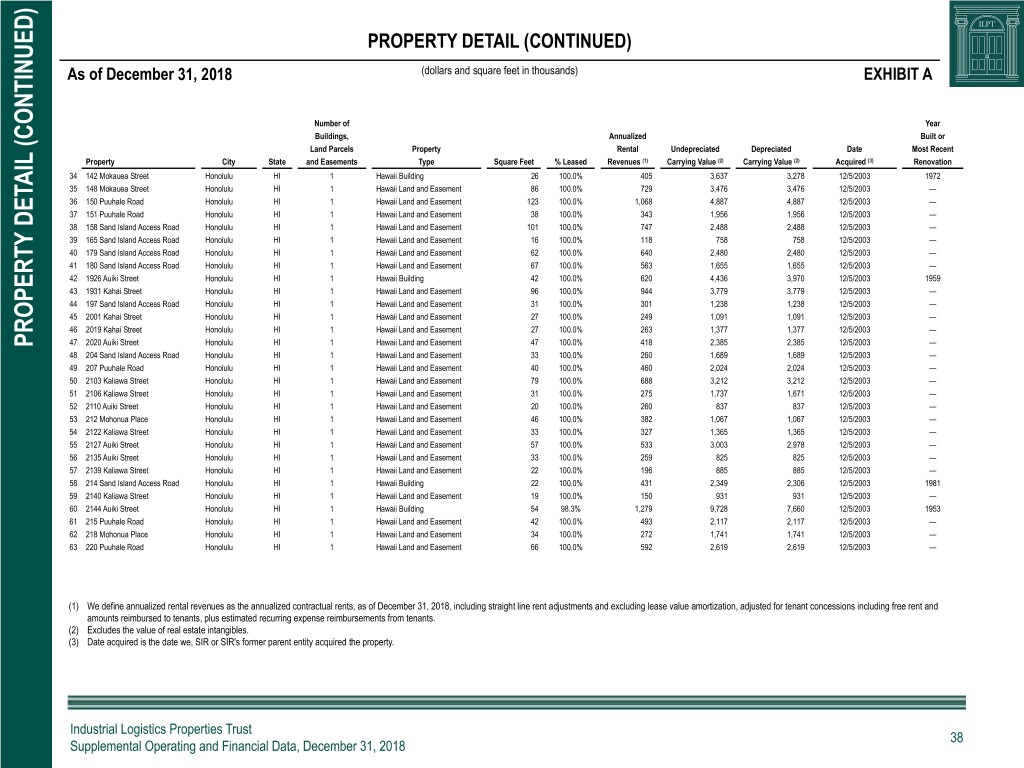

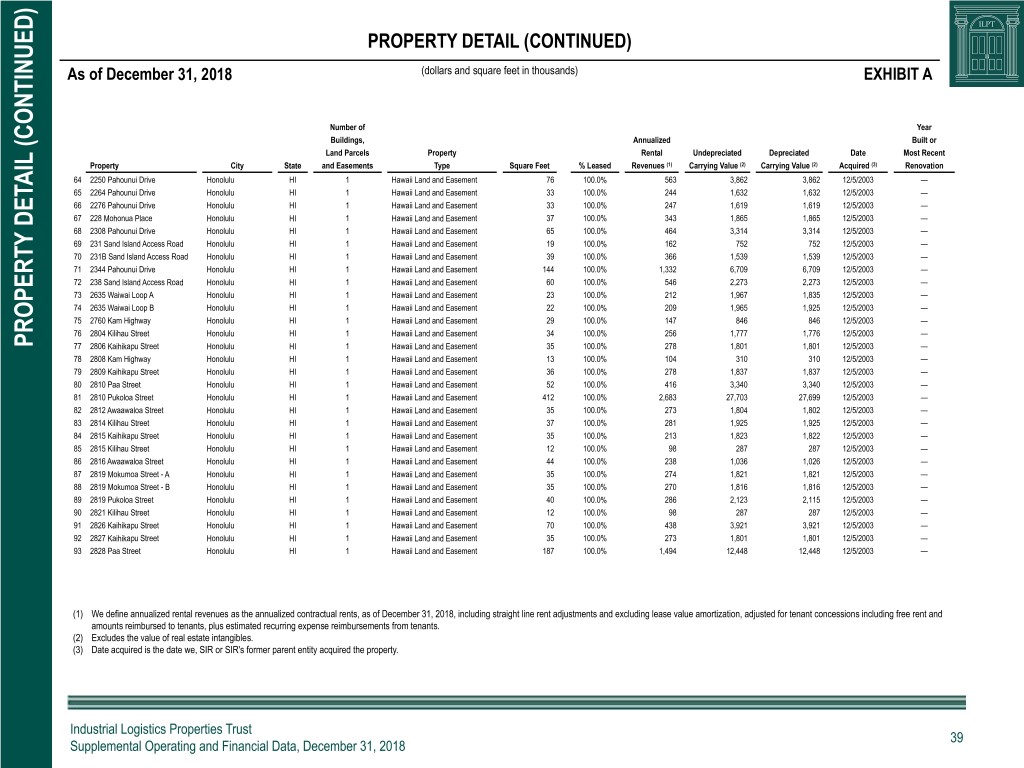

PROPERTY DETAIL As of December 31, 2018 (dollars and square feet in thousands) EXHIBIT A Number of Year Buildings, Annualized Built or Land Parcels Property Rental Undepreciated Depreciated Date Most Recent Property City State and Easements Type Square Feet % Leased Revenues (1) Carrying Value (2) Carrying Value (2) Acquired (3) Renovation 1 4501 Industrial Drive Fort Smith AR 1 Mainland Industrial 64 100.0% $ 469 $ 4,385 $ 4,044 1/29/2015 2013 2 955 Aeroplaza Drive Colorado Springs CO 1 Mainland Industrial 125 100.0% 900 8,212 7,486 1/29/2015 2012 PROPERTY DETAIL PROPERTY 3/4 13400 East 39th Avenue and 3800 Wheeling Street Denver CO 2 Mainland Industrial 394 100.0% 1,358 16,101 14,803 1/29/2015 1996 5 150 Greenhorn Drive Pueblo CO 1 Mainland Industrial 54 100.0% 543 4,377 3,968 1/29/2015 2013 6 2 Tower Drive Wallingford CT 1 Mainland Industrial 62 100.0% 463 3,643 2,975 10/24/2006 1978 7 235 Great Pond Drive Windsor CT 1 Mainland Industrial 171 100.0% 1,383 11,869 10,350 7/20/2012 2004 8 10450 Doral Boulevard Doral FL 1 Mainland Industrial 240 100.0% 2,272 43,326 42,858 6/27/2018 2001 9 2100 NW 82nd Avenue Miami FL 1 Mainland Industrial 37 100.0% 264 1,895 1,146 3/19/1998 2013 10 1000 Mapunapuna Street Honolulu HI 1 Hawaii Land and Easement 42 100.0% 428 2,252 2,252 12/5/2003 — 11 1001 Ahua Street Honolulu HI 1 Hawaii Land and Easement 338 100.0% 2,664 18,559 17,290 12/5/2003 — 12 1024 Kikowaena Place Honolulu HI 1 Hawaii Land and Easement 40 100.0% 312 1,818 1,818 12/5/2003 — 13 1024 Mapunapuna Street Honolulu HI 1 Hawaii Land and Easement 26 100.0% 223 1,385 1,385 12/5/2003 — 14 1027 Kikowaena Place Honolulu HI 1 Hawaii Land and Easement 102 100.0% 794 5,444 5,444 12/5/2003 — 15 1030 Mapunapuna Street Honolulu HI 1 Hawaii Land and Easement 122 100.0% 1,009 5,655 5,655 12/5/2003 — 16 1038 Kikowaena Place Honolulu HI 1 Hawaii Land and Easement 47 100.0% 361 2,576 2,576 12/5/2003 — 17 1045 Mapunapuna Street Honolulu HI 1 Hawaii Land and Easement 15 100.0% 109 819 819 12/5/2003 — 18 1050 Kikowaena Place Honolulu HI 1 Hawaii Land and Easement 43 100.0% 329 2,277 1,949 12/5/2003 — 19 1052 Ahua Street Honolulu HI 1 Hawaii Land and Easement 30 100.0% 197 1,943 1,864 12/5/2003 — 20 1055 Ahua Street Honolulu HI 1 Hawaii Land and Easement 27 100.0% 206 1,216 1,216 12/5/2003 — 21 106 Puuhale Road Honolulu HI 1 Hawaii Building 14 100.0% 261 1,342 1,288 12/5/2003 1966 22 1062 Kikowaena Place Honolulu HI 1 Hawaii Land and Easement 31 100.0% 241 1,647 1,422 12/5/2003 — 23 1122 Mapunapuna Street Honolulu HI 1 Hawaii Land and Easement 106 100.0% 791 5,781 5,781 12/5/2003 — 24 113 Puuhale Road Honolulu HI 1 Hawaii Land and Easement 77 100.0% 550 3,729 3,729 12/5/2003 — 25 1150 Kikowaena Place Honolulu HI 1 Hawaii Land and Easement 46 100.0% 531 2,445 2,445 12/5/2003 — 26 120 Mokauea Street Honolulu HI 1 Hawaii Building 31 100.0% 446 2,608 2,503 12/5/2003 1970 27 120 Sand Island Access Road Honolulu HI 1 Hawaii Building 71 100.0% 1,288 13,735 9,414 11/23/2004 2004 28 120B Mokauea Street Honolulu HI 1 Hawaii Building 35 100.0% 542 1,953 1,953 12/5/2003 1970 29 125 Puuhale Road Honolulu HI 1 Hawaii Land and Easement 31 100.0% 260 1,630 1,630 12/5/2003 — 30 125B Puuhale Road Honolulu HI 1 Hawaii Land and Easement 49 100.0% 349 2,815 2,815 12/5/2003 — 31 1330 Pali Highway Honolulu HI 1 Hawaii Land and Easement 20 100.0% 459 1,423 1,423 12/5/2003 — 32 1360 Pali Highway Honolulu HI 1 Hawaii Land and Easement 126 100.0% 2,853 9,331 9,228 12/5/2003 — 33 140 Puuhale Road Honolulu HI 1 Hawaii Land and Easement 22 100.0% 204 1,100 1,100 12/5/2003 — (1) We define annualized rental revenues as the annualized contractual rents, as of December 31, 2018, including straight line rent adjustments and excluding lease value amortization, adjusted for tenant concessions including free rent and amounts reimbursed to tenants, plus estimated recurring expense reimbursements from tenants. (2) Excludes the value of real estate intangibles. (3) Date acquired is the date we, SIR or SIR's former parent entity acquired the property. Industrial Logistics Properties Trust 37 Supplemental Operating and Financial Data, December 31, 2018