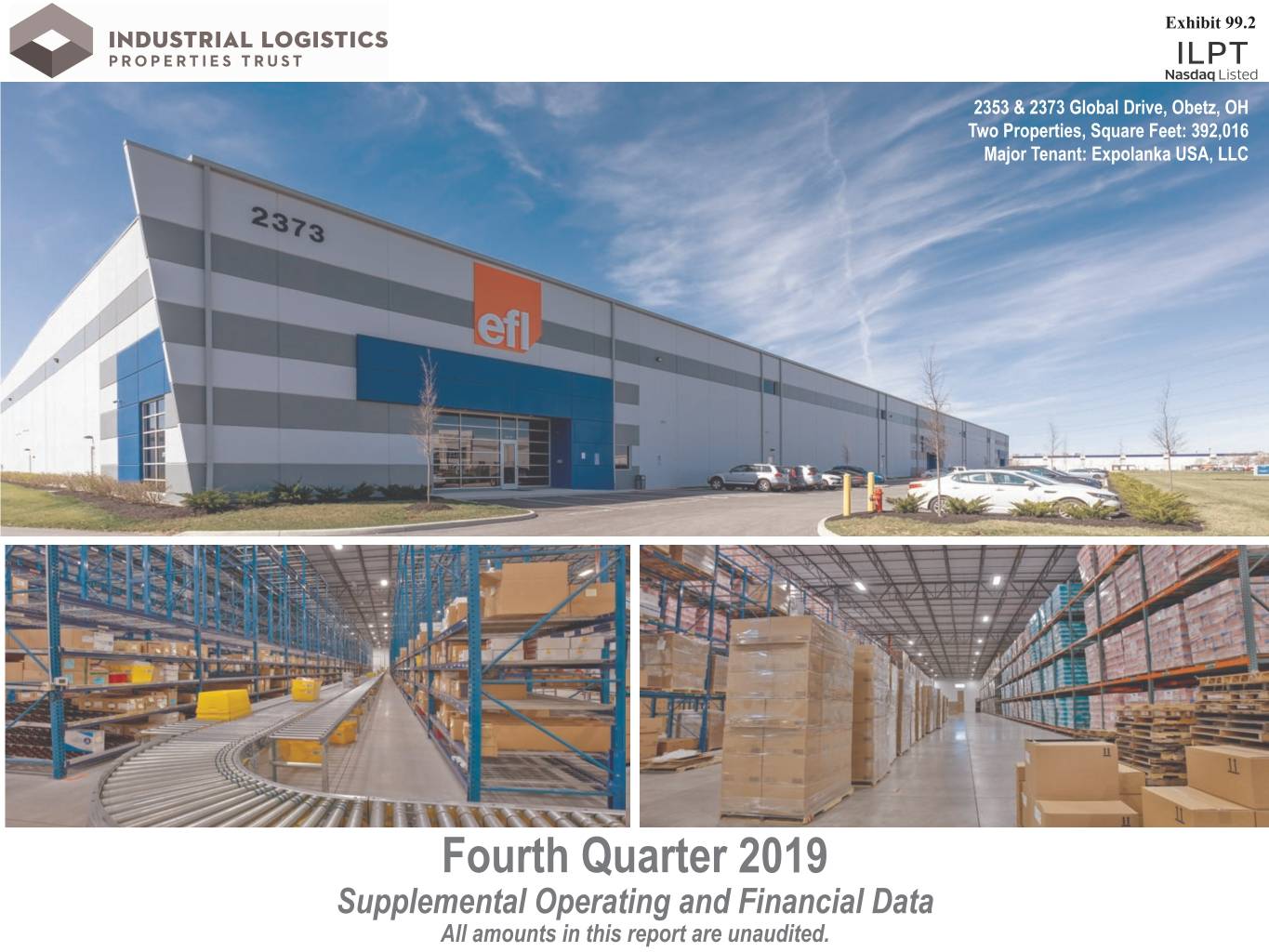

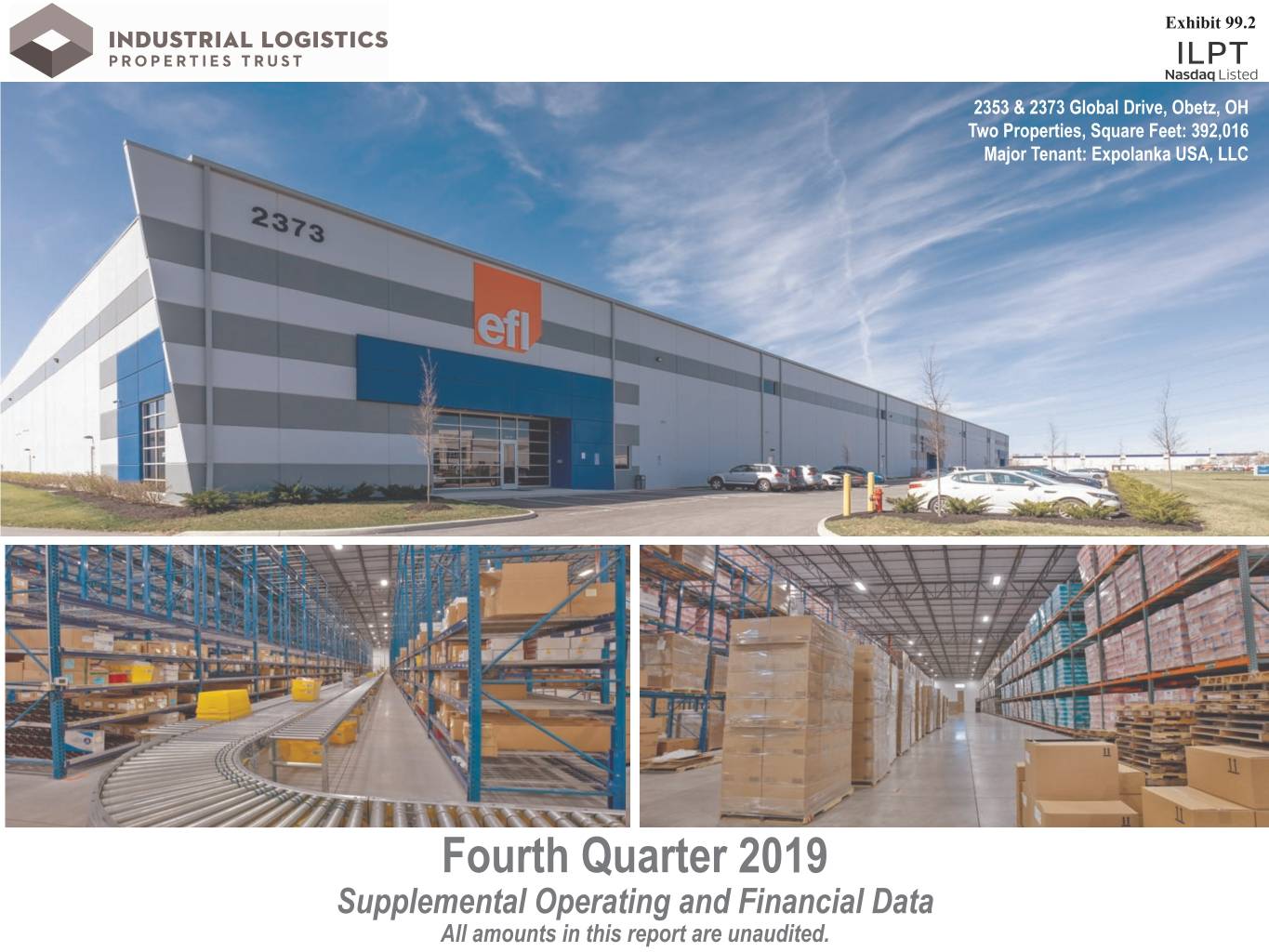

Exhibit 99.2 2353 & 2373 Global Drive, Obetz, OH Two Properties, Square Feet: 392,016 Major Tenant: Expolanka USA, LLC Fourth Quarter 2019 Supplemental Operating and Financial Data 1 All amounts in this report are unaudited.

TABLE OF CONTENTS PAGE/ EXHIBIT CORPORATE INFORMATION Company Profile..................................................................................................................................................................................................................................................... 4 Investor Information................................................................................................................................................................................................................................................ 5 Equity Research Coverage .................................................................................................................................................................................................................................... 6 FINANCIALS Key Financial Data ................................................................................................................................................................................................................................................. 8 Consolidated Balance Sheets ................................................................................................................................................................................................................................ 9 TABLE OF CONTENTS TABLE Consolidated Statements of Income ...................................................................................................................................................................................................................... 10 Consolidated Statements of Cash Flows ............................................................................................................................................................................................................... 11 Debt Summary ....................................................................................................................................................................................................................................................... 13 Debt Maturity Schedule.......................................................................................................................................................................................................................................... 14 Leverage Ratios and Coverage Ratios .................................................................................................................................................................................................................. 15 Capital Expenditures Summary.............................................................................................................................................................................................................................. 16 Property Acquisitions and Dispositions Information Since 1/1/19 .......................................................................................................................................................................... 17 Calculation and Reconciliation of NOI and Cash Basis NOI .................................................................................................................................................................................. 18 Reconciliation of NOI to Same Property NOI and Calculation of Same Property Cash Basis NOI........................................................................................................................ 19 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre .................................................................................................................................................................................. 20 Calculation of FFO and Normalized FFO............................................................................................................................................................................................................... 21 PORTFOLIO INFORMATION Portfolio Summary by Property Type...................................................................................................................................................................................................................... 23 Same Property Results of Operations by Property Type........................................................................................................................................................................................ 24 Leasing Summary .................................................................................................................................................................................................................................................. 26 Occupancy and Leasing Analysis by Property Type .............................................................................................................................................................................................. 27 Tenant Credit Characteristics ................................................................................................................................................................................................................................. 28 Tenants Representing 1% or More of Total Annualized Rental Revenues ............................................................................................................................................................. 29 Five Year Lease Expiration and Reset Schedule by Property Type ....................................................................................................................................................................... 30 Portfolio Lease Expiration Schedule ...................................................................................................................................................................................................................... 31 EXHIBIT A Property Detail........................................................................................................................................................................................................................................................ 33 NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS ...................................................................................................................................................................................................... 43 WARNING CONCERNING FORWARD-LOOKING STATEMENTS ........................................................................................................................................................................................................... 45 Please refer to the Non-GAAP Financial Measures and Certain Definitions for terms used throughout this document. 2

4237-4255 Anson Boulevard, Whitestown, IN Square Feet: 1,036,573 Tenant: Amazon.com Services, Inc. CORPORATE INFORMATION 3

COMPANY PROFILE The Company: Industrial Logistics Properties Trust, or ILPT, we, our or us, is a real estate investment trust, or REIT, that owns and leases industrial and logistics properties throughout the United States. On January 17, 2018, we completed our initial public offering, or the IPO. For Corporate Headquarters: the periods prior to January 17, 2018, our results of operations relate to 266 properties contributed to us by our former parent, Select Income REIT, or SIR, a former publicly traded REIT that merged with and into a wholly owned subsidiary of Office Properties Income Two Newton Place Trust, on December 31, 2018. As of December 31, 2019, we owned 300 properties with approximately 42.9 million rentable square 255 Washington Street, Suite 300 feet located in 30 states, including 226 buildings, leasable land parcels and easements with approximately 16.8 million rentable square Newton, MA 02458-1634 feet that are primarily industrial lands located in Hawaii. ILPT is a component of 52 market indices and it comprises more than 1% of (t) (617) 219-1460 the following indices as of December 31, 2019: Invesco KBW Premium Yield Equity REIT ETF INAV Index (KBWYIV), Hartford Risk- COMPANY PROFILE COMPANY Optimized Multifactor REIT TR Index (LROREX) and the Bloomberg Reit Industrial/Warehouse Index (BBREINDW). Stock Exchange Listing: Nasdaq Management: Trading Symbol: ILPT is managed by The RMR Group LLC, or RMR LLC, the operating subsidiary of The RMR Group Inc. (Nasdaq: RMR). RMR is an alternative asset management company that was founded in 1986 to manage real estate companies and related businesses. RMR Common Shares: ILPT primarily provides management services to four publicly traded equity REITs and three real estate related operating businesses. In addition to managing ILPT, RMR manages Service Properties Trust, a REIT that owns a diverse portfolio of hotels and net lease service and necessity-based retail properties, Office Properties Income Trust, a REIT that owns properties primarily leased to single tenants and those with high credit quality characteristics such as government entities, and Diversified Healthcare Trust (formerly Key Data (as of and for the three known as Senior Housing Properties Trust), a REIT that owns high-quality, private-pay healthcare properties like senior living communities, medical office and life science buildings and other healthcare related properties. RMR also provides management months ended December 31, 2019): services to Five Star Senior Living Inc., a publicly traded operator of senior living communities, Sonesta International Hotels Corporation, (dollars and sq. ft. in 000s) a privately owned operator and franchisor of hotels and cruise boats, and TravelCenters of America Inc., a publicly traded operator and franchisor of travel centers along the U.S. Interstate Highway System, standalone truck service facilities and restaurants. RMR Total properties 300 also advises the RMR Real Estate Income Fund, a publicly traded closed end fund that invests in publicly traded securities of real estate companies, and Tremont Mortgage Trust, a publicly traded mortgage REIT that focuses on originating and investing in floating Total sq. ft. 42,939 rate first mortgage whole loans, secured by middle market and transitional commercial real estate, through wholly owned Securities Percent leased 99.3% and Exchange Commission, or SEC, registered investment advisory subsidiaries, as well as manages the RMR Office Property Fund Q4 2019 Rental income $ 62,199 LP, a private, open end core plus fund focused on the acquisition, ownership and leasing of a diverse portfolio of multi-tenant office Q4 2019 Net income $ 11,674 properties throughout the U.S. As of December 31, 2019, RMR had $32.2 billion of real estate assets under management and the combined RMR managed companies had approximately $12 billion of annual revenues, over 2,100 properties and nearly 50,000 Q4 2019 Normalized FFO $ 29,713 employees. We believe that being managed by RMR is a competitive advantage for ILPT because of RMR’s depth of management and experience in the real estate industry. We also believe RMR provides management services to us at costs that are lower than we would have to pay for similar quality services if we were self managed. 4

INVESTOR INFORMATION Board of Trustees Bruce M. Gans Lisa Harris Jones Joseph L. Morea Lead Independent Trustee Independent Trustee Independent Trustee Kevin C. Phelan Laura A. Wilkin Independent Trustee Independent Trustee INVESTOR INFORMATION INVESTOR John G. Murray Adam D. Portnoy Managing Trustee Chair of the Board & Managing Trustee Senior Management John G. Murray Richard W. Siedel, Jr. Yael Duffy President and Chief Executive Officer Chief Financial Officer and Treasurer Vice President Contact Information Investor Relations Inquiries Industrial Logistics Properties Trust Investor and media inquiries should be directed to Two Newton Place Olivia Snyder, Manager, Investor Relations, 255 Washington Street, Suite 300 at (617) 219-1489 or osnyder@ilptreit.com. Newton, MA 02458-1634 (t) (617) 219-1460 Financial inquiries should be directed to Richard W. Siedel, Jr., (e-mail) info@ilptreit.com Chief Financial Officer and Treasurer, at (617) 219-1460 (website) www.ilptreit.com or rsiedel@ilptreit.com. 5

EQUITY RESEARCH COVERAGE B. Riley FBR JMP Securities Bryan Maher Aaron Hecht (646) 885-5423 (415) 835-3963 bmaher@brileyfbr.com ahecht@jmpsecurities.com BofA Securities RBC Capital Markets James Feldman Michael Carroll EQUITY RESEARCH COVERAGE EQUITY (646) 855-5808 (440) 715-2649 james.feldman@baml.com michael.carroll@rbccm.com ILPT is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding ILPT’s performance made by these analysts do not represent opinions, forecasts or predictions of ILPT or its management. ILPT does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts. 6

10450 Doral Blvd, Doral, FL Square Feet: 240,283 Tenant: Hellmann Worldwide Logistics, Inc. FINANCIALS 7

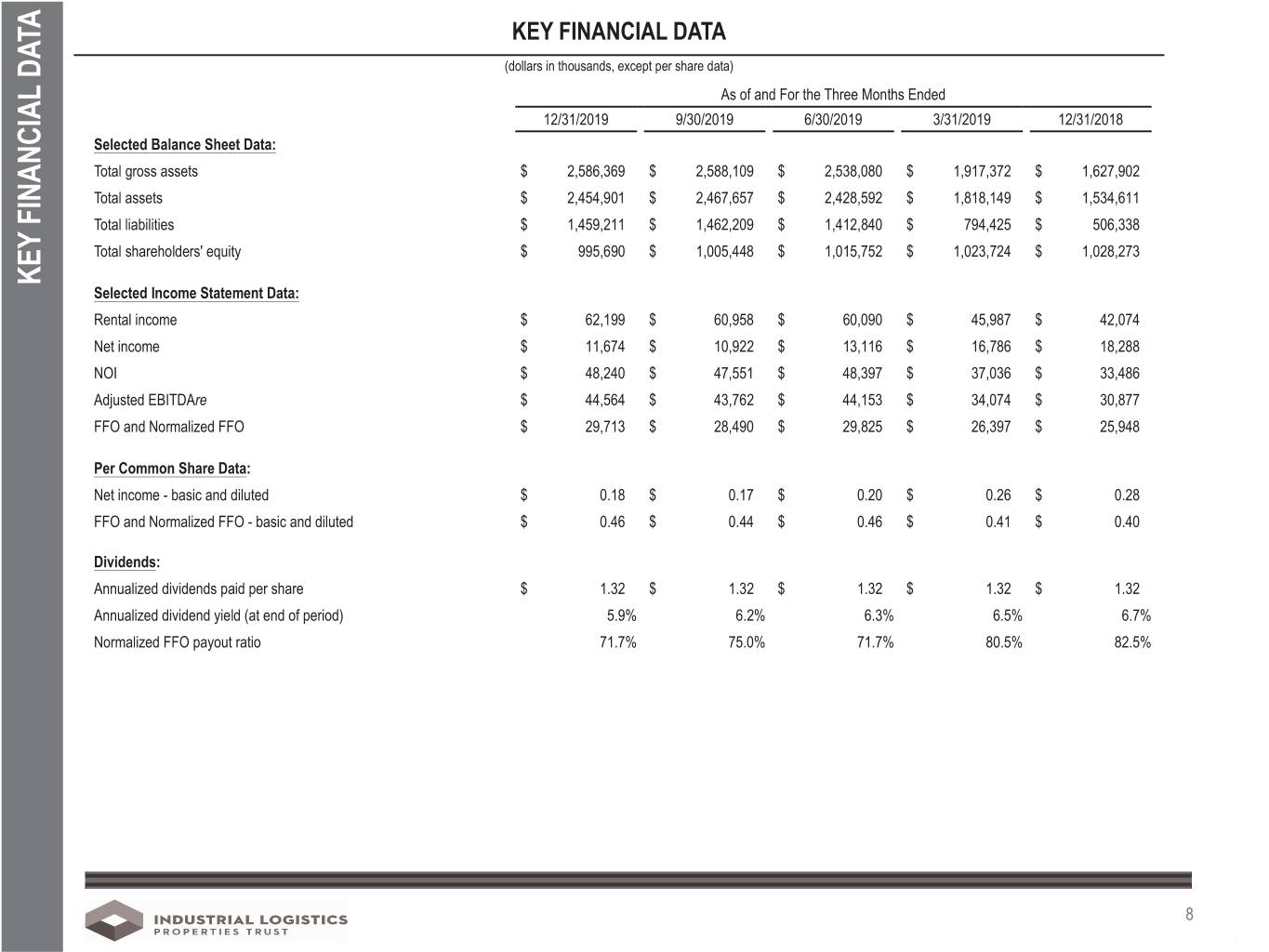

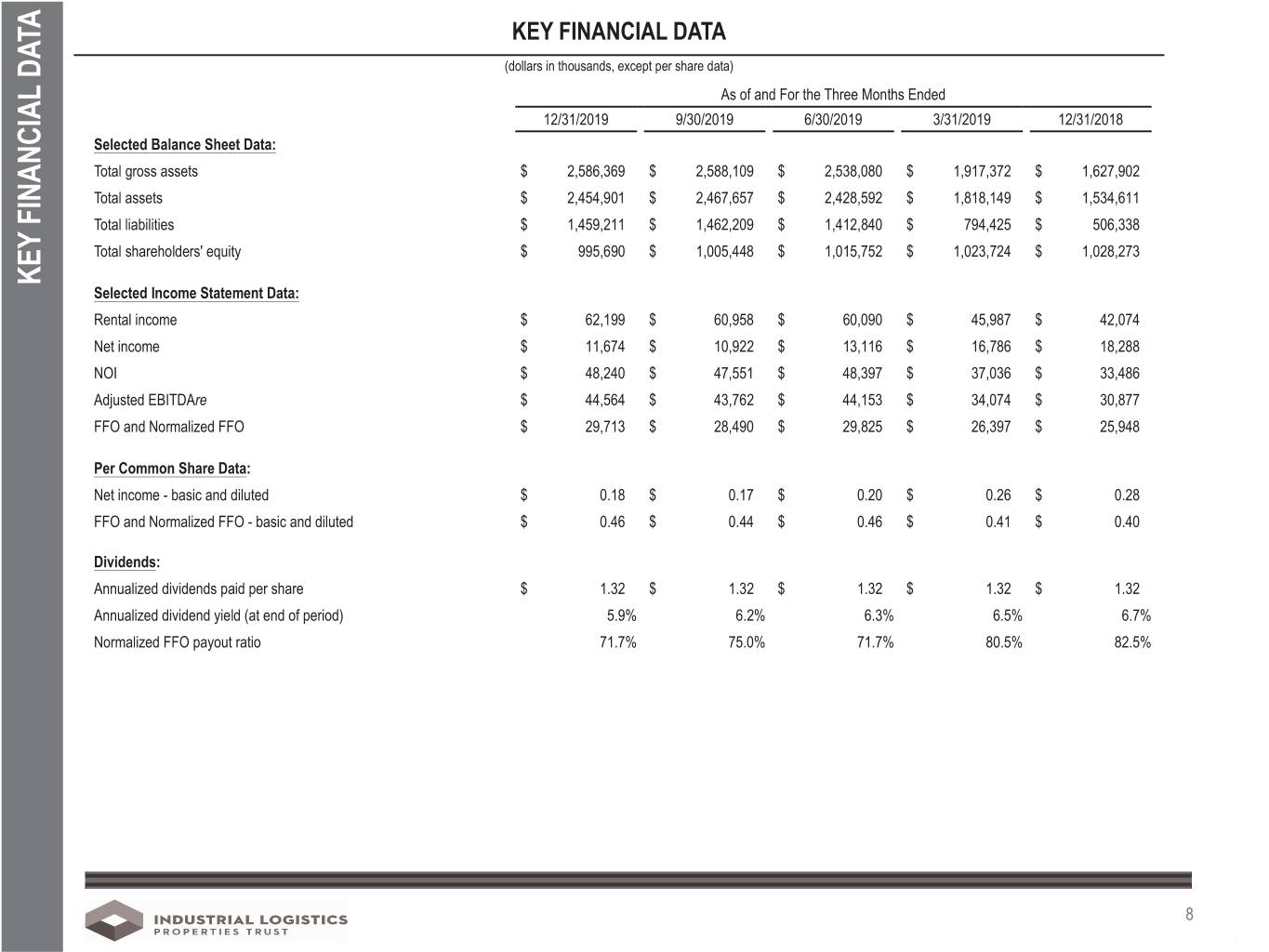

KEY FINANCIAL DATA (dollars in thousands, except per share data) As of and For the Three Months Ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Selected Balance Sheet Data: Total gross assets $ 2,586,369 $ 2,588,109 $ 2,538,080 $ 1,917,372 $ 1,627,902 Total assets $ 2,454,901 $ 2,467,657 $ 2,428,592 $ 1,818,149 $ 1,534,611 Total liabilities $ 1,459,211 $ 1,462,209 $ 1,412,840 $ 794,425 $ 506,338 Total shareholders' equity $ 995,690 $ 1,005,448 $ 1,015,752 $ 1,023,724 $ 1,028,273 KEY FINANCIAL DATA FINANCIAL KEY Selected Income Statement Data: Rental income $ 62,199 $ 60,958 $ 60,090 $ 45,987 $ 42,074 Net income $ 11,674 $ 10,922 $ 13,116 $ 16,786 $ 18,288 NOI $ 48,240 $ 47,551 $ 48,397 $ 37,036 $ 33,486 Adjusted EBITDAre $ 44,564 $ 43,762 $ 44,153 $ 34,074 $ 30,877 FFO and Normalized FFO $ 29,713 $ 28,490 $ 29,825 $ 26,397 $ 25,948 Per Common Share Data: Net income - basic and diluted $ 0.18 $ 0.17 $ 0.20 $ 0.26 $ 0.28 FFO and Normalized FFO - basic and diluted $ 0.46 $ 0.44 $ 0.46 $ 0.41 $ 0.40 Dividends: Annualized dividends paid per share $ 1.32 $ 1.32 $ 1.32 $ 1.32 $ 1.32 Annualized dividend yield (at end of period) 5.9% 6.2% 6.3% 6.5% 6.7% Normalized FFO payout ratio 71.7% 75.0% 71.7% 80.5% 82.5% 8

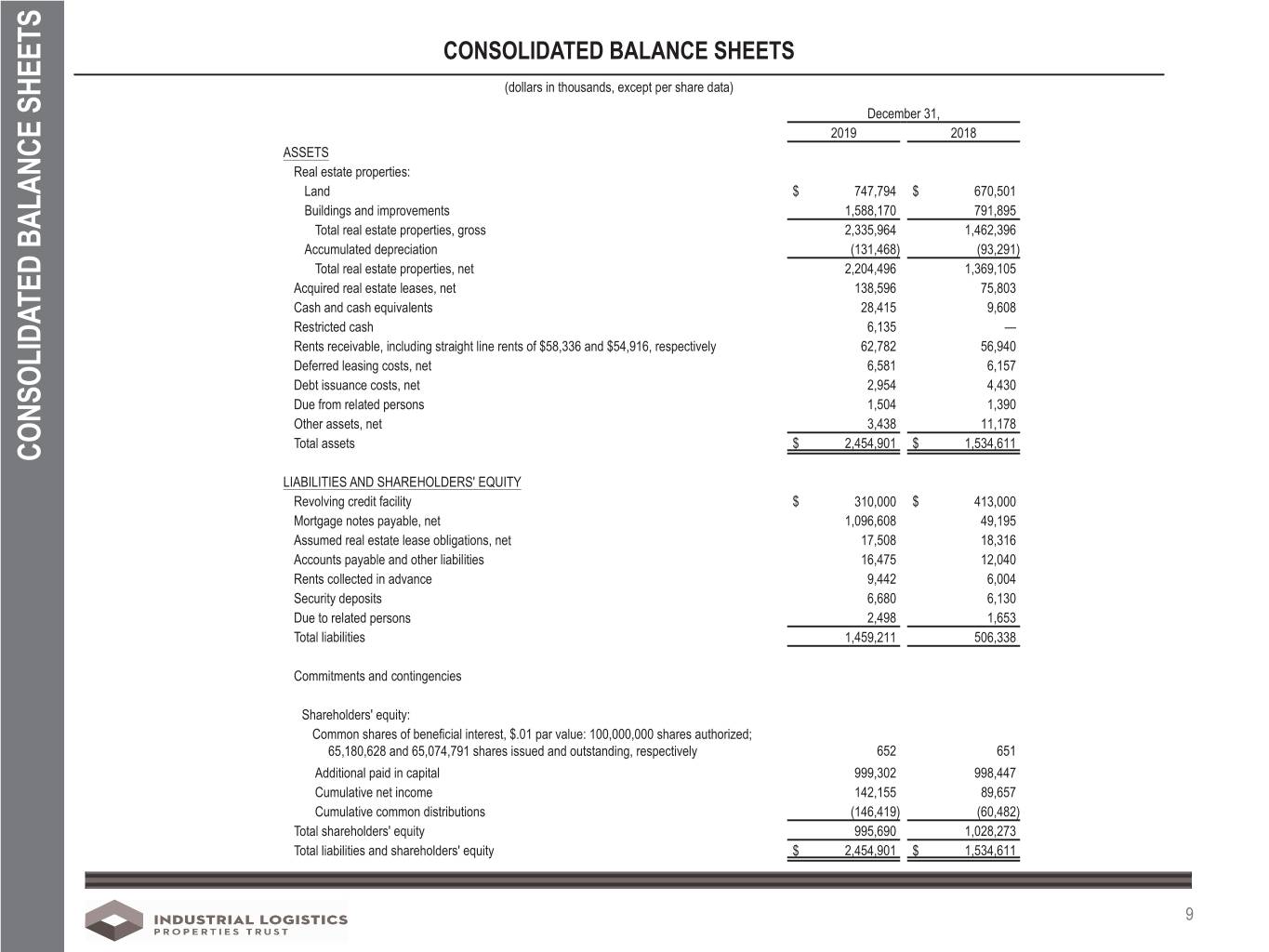

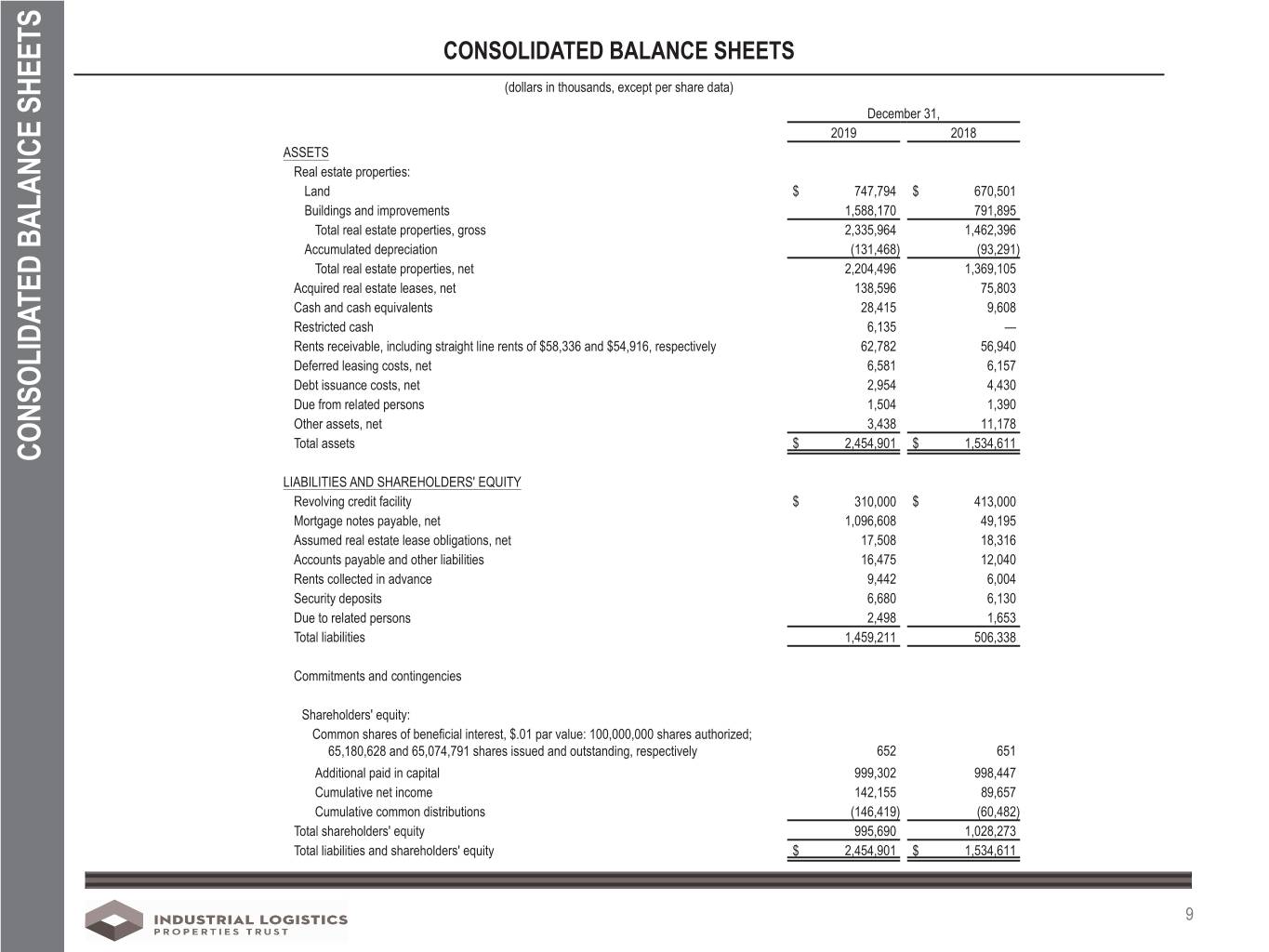

CONSOLIDATED BALANCE SHEETS (dollars in thousands, except per share data) December 31, 2019 2018 ASSETS Real estate properties: Land $ 747,794 $ 670,501 Buildings and improvements 1,588,170 791,895 Total real estate properties, gross 2,335,964 1,462,396 Accumulated depreciation (131,468) (93,291) Total real estate properties, net 2,204,496 1,369,105 Acquired real estate leases, net 138,596 75,803 Cash and cash equivalents 28,415 9,608 Restricted cash 6,135 — Rents receivable, including straight line rents of $58,336 and $54,916, respectively 62,782 56,940 Deferred leasing costs, net 6,581 6,157 Debt issuance costs, net 2,954 4,430 Due from related persons 1,504 1,390 Other assets, net 3,438 11,178 Total assets $ 2,454,901 $ 1,534,611 CONSOLIDATED BALANCE SHEETS CONSOLIDATED LIABILITIES AND SHAREHOLDERS' EQUITY Revolving credit facility $ 310,000 $ 413,000 Mortgage notes payable, net 1,096,608 49,195 Assumed real estate lease obligations, net 17,508 18,316 Accounts payable and other liabilities 16,475 12,040 Rents collected in advance 9,442 6,004 Security deposits 6,680 6,130 Due to related persons 2,498 1,653 Total liabilities 1,459,211 506,338 Commitments and contingencies Shareholders' equity: Common shares of beneficial interest, $.01 par value: 100,000,000 shares authorized; 65,180,628 and 65,074,791 shares issued and outstanding, respectively 652 651 Additional paid in capital 999,302 998,447 Cumulative net income 142,155 89,657 Cumulative common distributions (146,419) (60,482) Total shareholders' equity 995,690 1,028,273 Total liabilities and shareholders' equity $ 2,454,901 $ 1,534,611 9

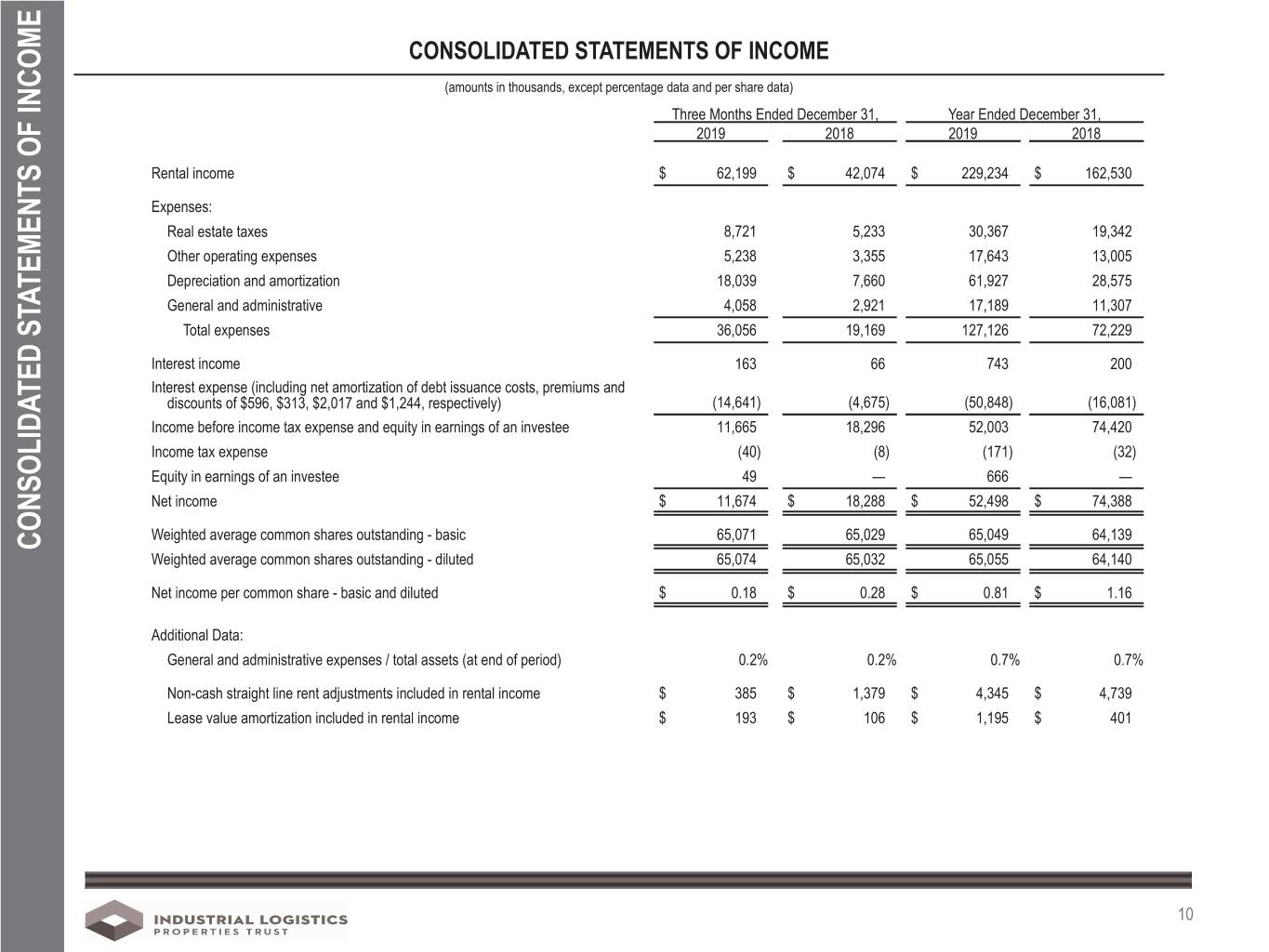

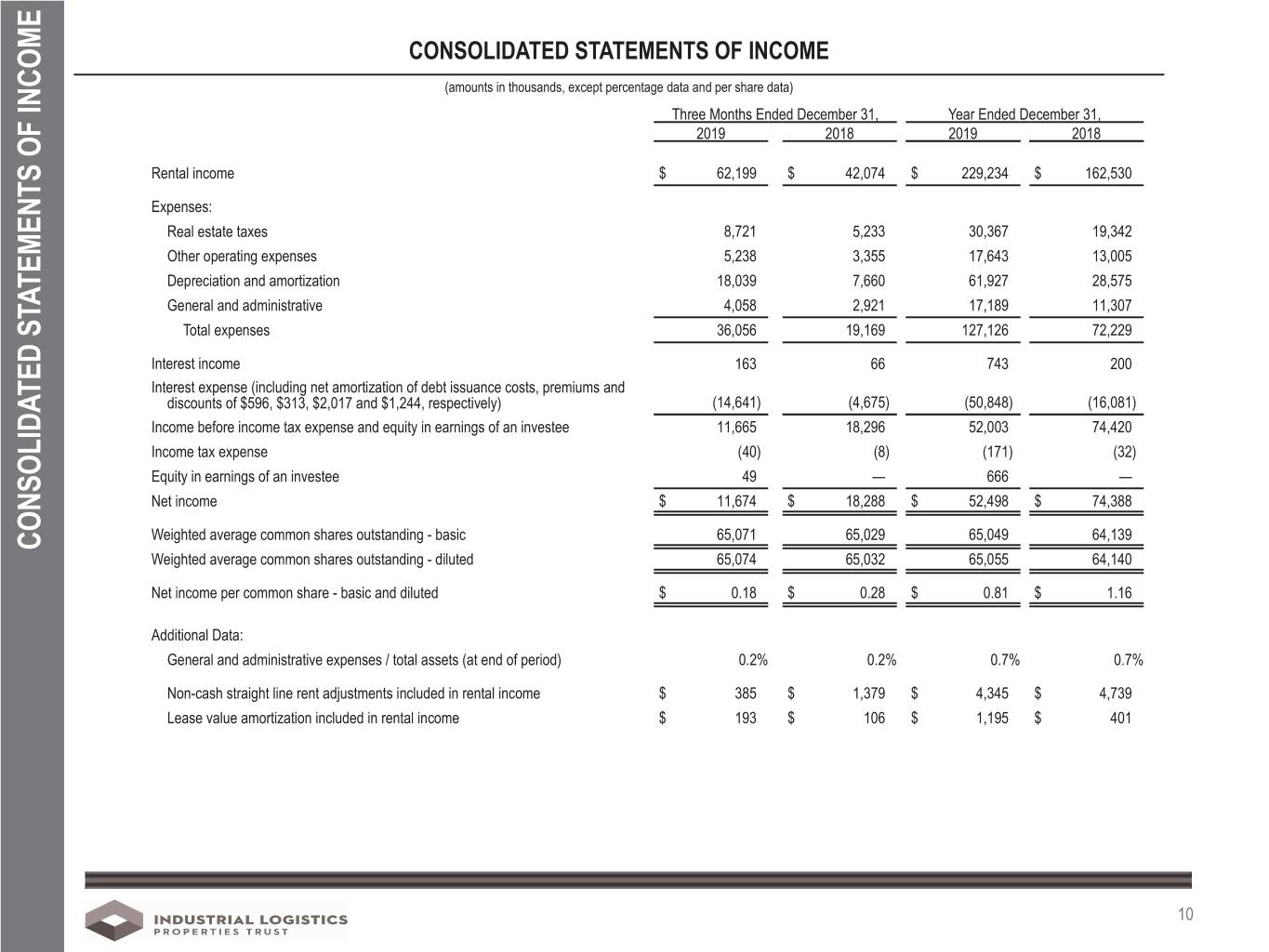

CONSOLIDATED STATEMENTS OF INCOME (amounts in thousands, except percentage data and per share data) Three Months Ended December 31, Year Ended December 31, 2019 2018 2019 2018 Rental income $ 62,199 $ 42,074 $ 229,234 $ 162,530 Expenses: Real estate taxes 8,721 5,233 30,367 19,342 Other operating expenses 5,238 3,355 17,643 13,005 Depreciation and amortization 18,039 7,660 61,927 28,575 General and administrative 4,058 2,921 17,189 11,307 Total expenses 36,056 19,169 127,126 72,229 Interest income 163 66 743 200 Interest expense (including net amortization of debt issuance costs, premiums and discounts of $596, $313, $2,017 and $1,244, respectively) (14,641) (4,675) (50,848) (16,081) Income before income tax expense and equity in earnings of an investee 11,665 18,296 52,003 74,420 Income tax expense (40) (8) (171) (32) Equity in earnings of an investee 49 — 666 — Net income $ 11,674 $ 18,288 $ 52,498 $ 74,388 Weighted average common shares outstanding - basic 65,071 65,029 65,049 64,139 CONSOLIDATED STATEMENTS OF INCOME STATEMENTS CONSOLIDATED Weighted average common shares outstanding - diluted 65,074 65,032 65,055 64,140 Net income per common share - basic and diluted $ 0.18 $ 0.28 $ 0.81 $ 1.16 Additional Data: General and administrative expenses / total assets (at end of period) 0.2% 0.2% 0.7% 0.7% Non-cash straight line rent adjustments included in rental income $ 385 $ 1,379 $ 4,345 $ 4,739 Lease value amortization included in rental income $ 193 $ 106 $ 1,195 $ 401 10

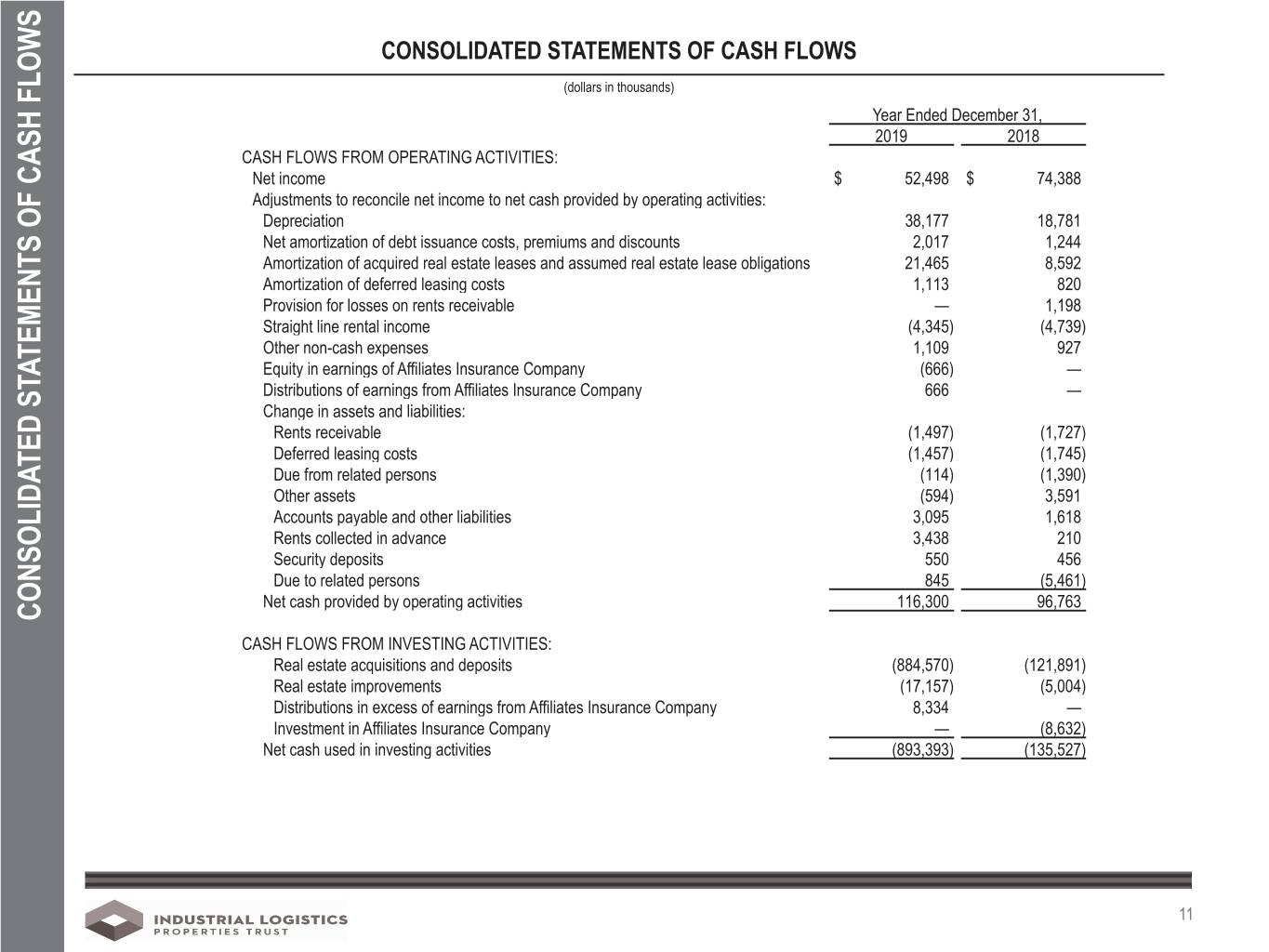

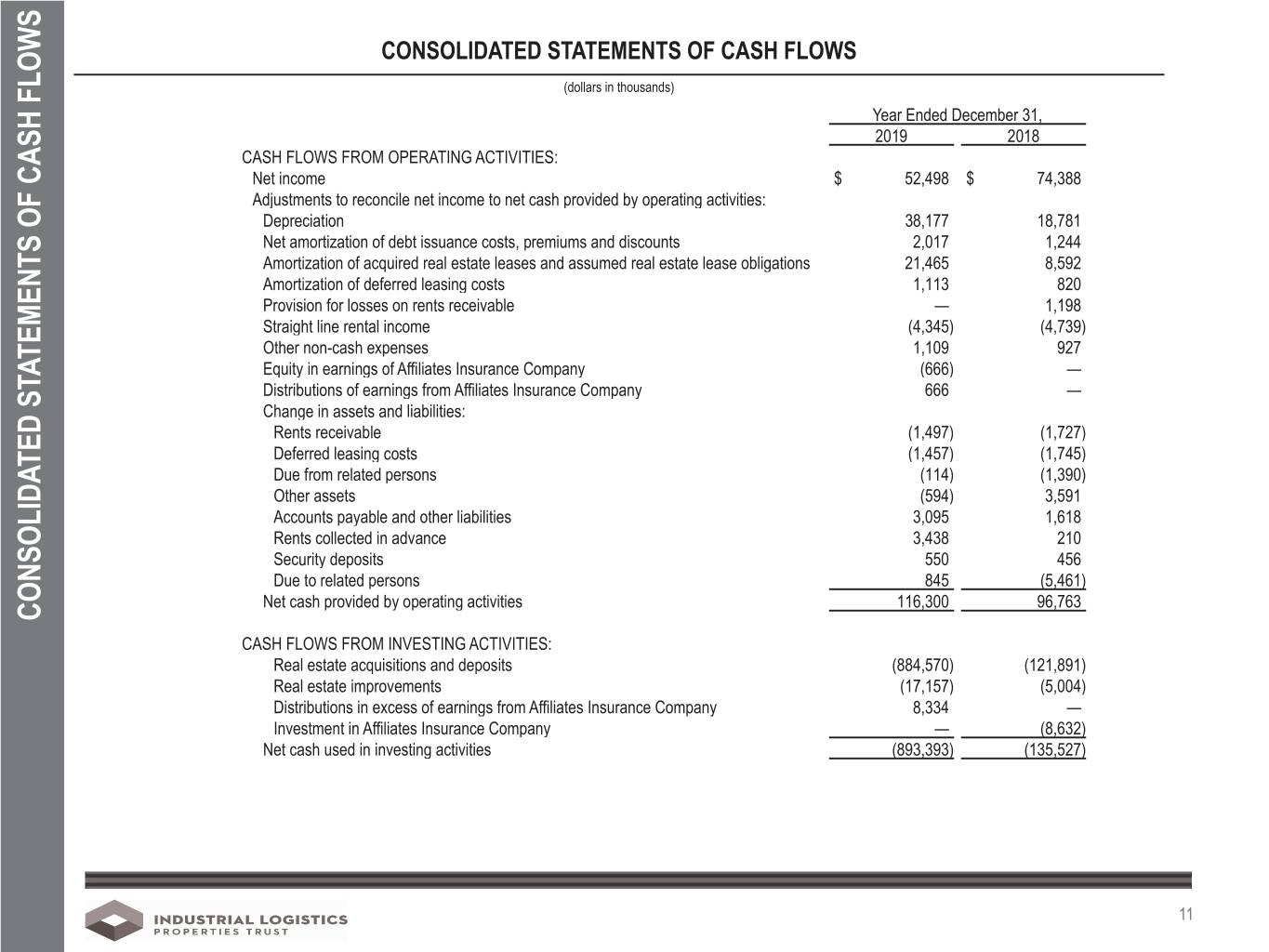

CONSOLIDATED STATEMENTS OF CASH FLOWS (dollars in thousands) Year Ended December 31, 2019 2018 CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 52,498 $ 74,388 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 38,177 18,781 Net amortization of debt issuance costs, premiums and discounts 2,017 1,244 Amortization of acquired real estate leases and assumed real estate lease obligations 21,465 8,592 Amortization of deferred leasing costs 1,113 820 Provision for losses on rents receivable — 1,198 Straight line rental income (4,345) (4,739) Other non-cash expenses 1,109 927 Equity in earnings of Affiliates Insurance Company (666) — Distributions of earnings from Affiliates Insurance Company 666 — Change in assets and liabilities: Rents receivable (1,497) (1,727) Deferred leasing costs (1,457) (1,745) Due from related persons (114) (1,390) Other assets (594) 3,591 Accounts payable and other liabilities 3,095 1,618 Rents collected in advance 3,438 210 Security deposits 550 456 Due to related persons 845 (5,461) Net cash provided by operating activities 116,300 96,763 CONSOLIDATED STATEMENTS OF CASH FLOWS STATEMENTS CONSOLIDATED CASH FLOWS FROM INVESTING ACTIVITIES: Real estate acquisitions and deposits (884,570) (121,891) Real estate improvements (17,157) (5,004) Distributions in excess of earnings from Affiliates Insurance Company 8,334 — Investment in Affiliates Insurance Company — (8,632) Net cash used in investing activities (893,393) (135,527) 11

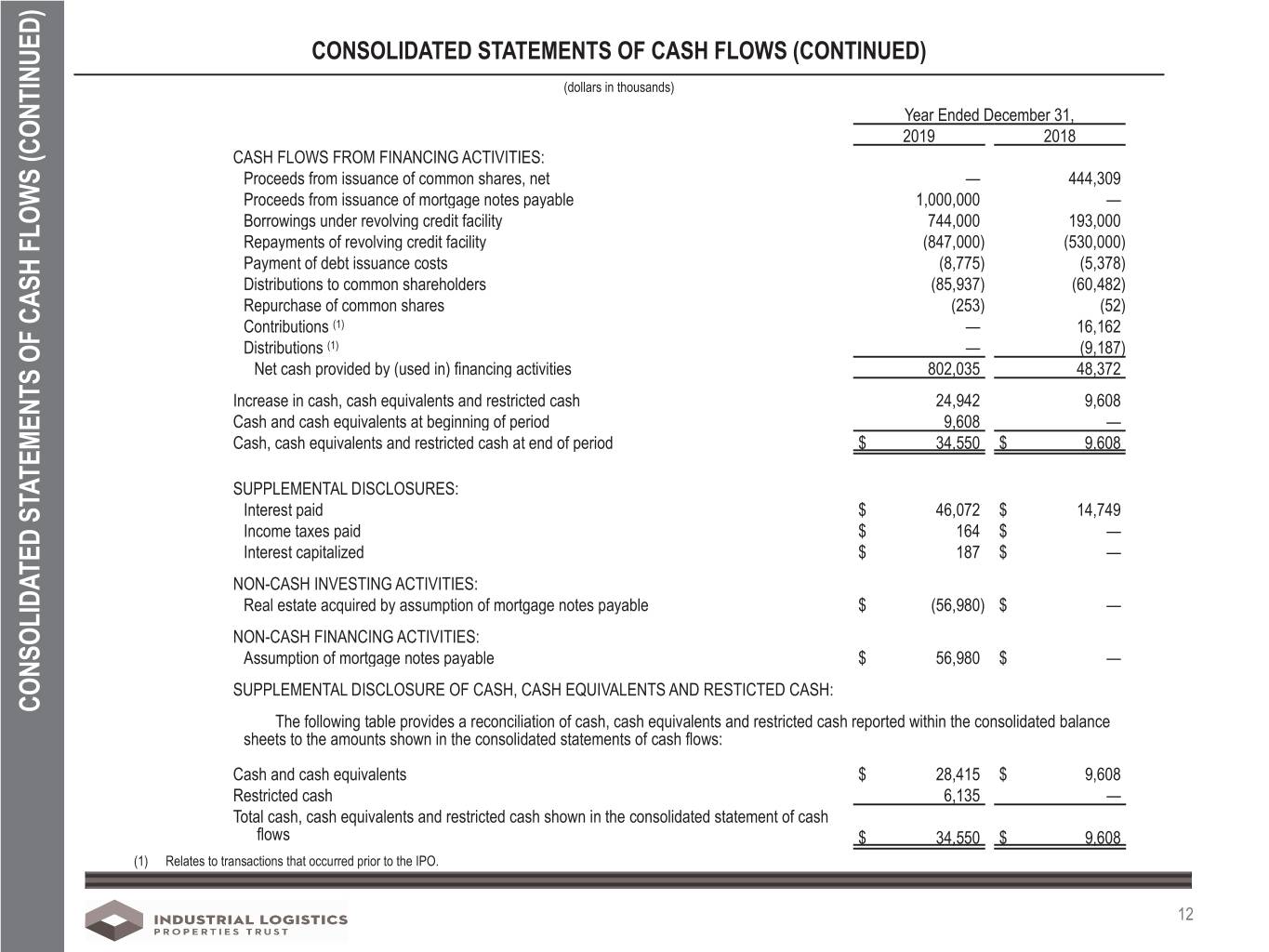

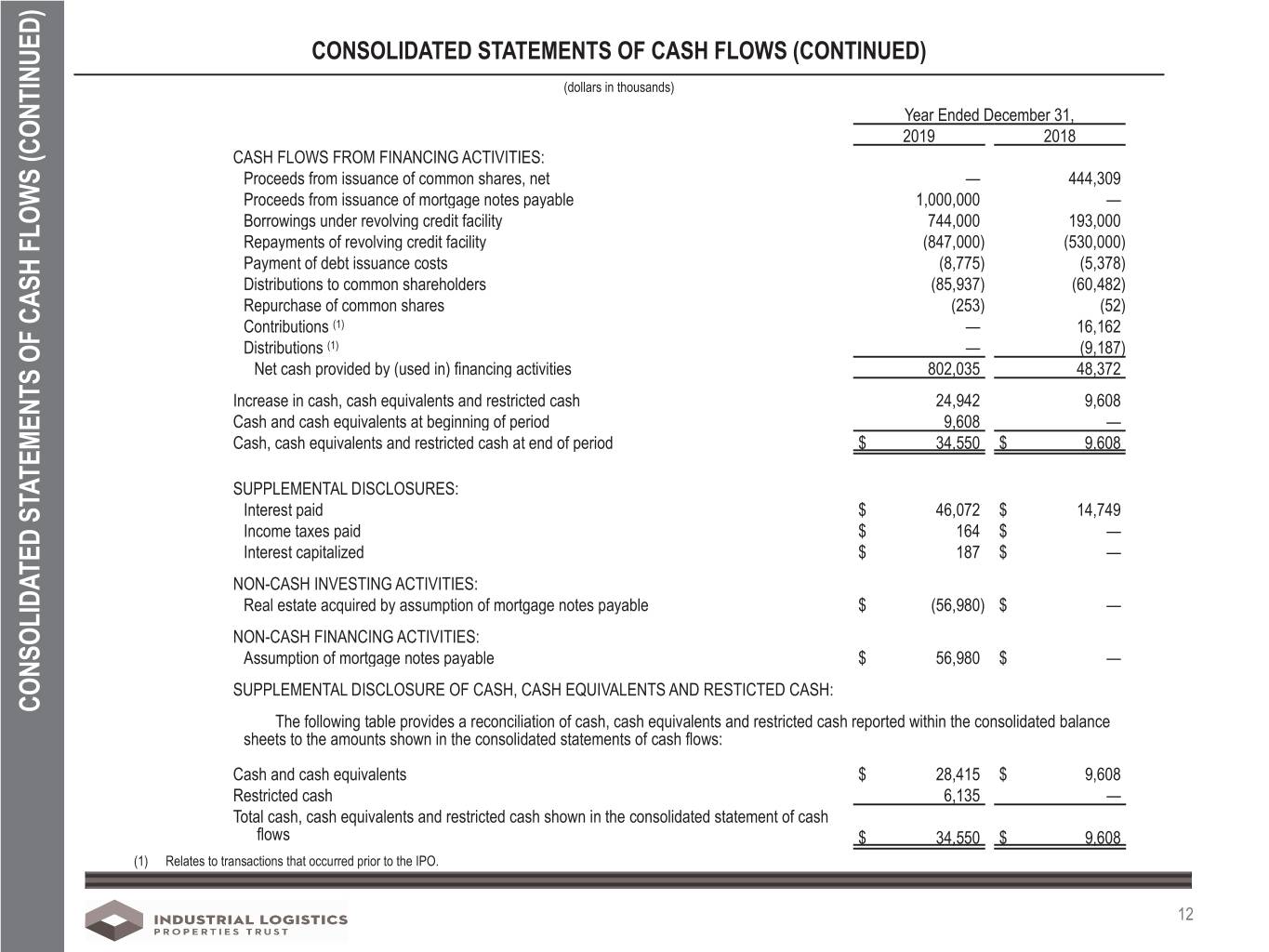

CONSOLIDATED STATEMENTS OF CASH FLOWS (CONTINUED) (dollars in thousands) Year Ended December 31, 2019 2018 CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from issuance of common shares, net — 444,309 Proceeds from issuance of mortgage notes payable 1,000,000 — Borrowings under revolving credit facility 744,000 193,000 Repayments of revolving credit facility (847,000) (530,000) Payment of debt issuance costs (8,775) (5,378) Distributions to common shareholders (85,937) (60,482) Repurchase of common shares (253) (52) Contributions (1) — 16,162 Distributions (1) — (9,187) Net cash provided by (used in) financing activities 802,035 48,372 Increase in cash, cash equivalents and restricted cash 24,942 9,608 Cash and cash equivalents at beginning of period 9,608 — Cash, cash equivalents and restricted cash at end of period $ 34,550 $ 9,608 SUPPLEMENTAL DISCLOSURES: Interest paid $ 46,072 $ 14,749 Income taxes paid $ 164 $ — Interest capitalized $ 187 $ — NON-CASH INVESTING ACTIVITIES: Real estate acquired by assumption of mortgage notes payable $ (56,980) $ — NON-CASH FINANCING ACTIVITIES: Assumption of mortgage notes payable $ 56,980 $ — SUPPLEMENTAL DISCLOSURE OF CASH, CASH EQUIVALENTS AND RESTICTED CASH: CONSOLIDATED STATEMENTS OF CASH FLOWS (CONTINUED) STATEMENTS CONSOLIDATED The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the consolidated balance sheets to the amounts shown in the consolidated statements of cash flows: Cash and cash equivalents $ 28,415 $ 9,608 Restricted cash 6,135 — Total cash, cash equivalents and restricted cash shown in the consolidated statement of cash flows $ 34,550 $ 9,608 (1) Relates to transactions that occurred prior to the IPO. 12

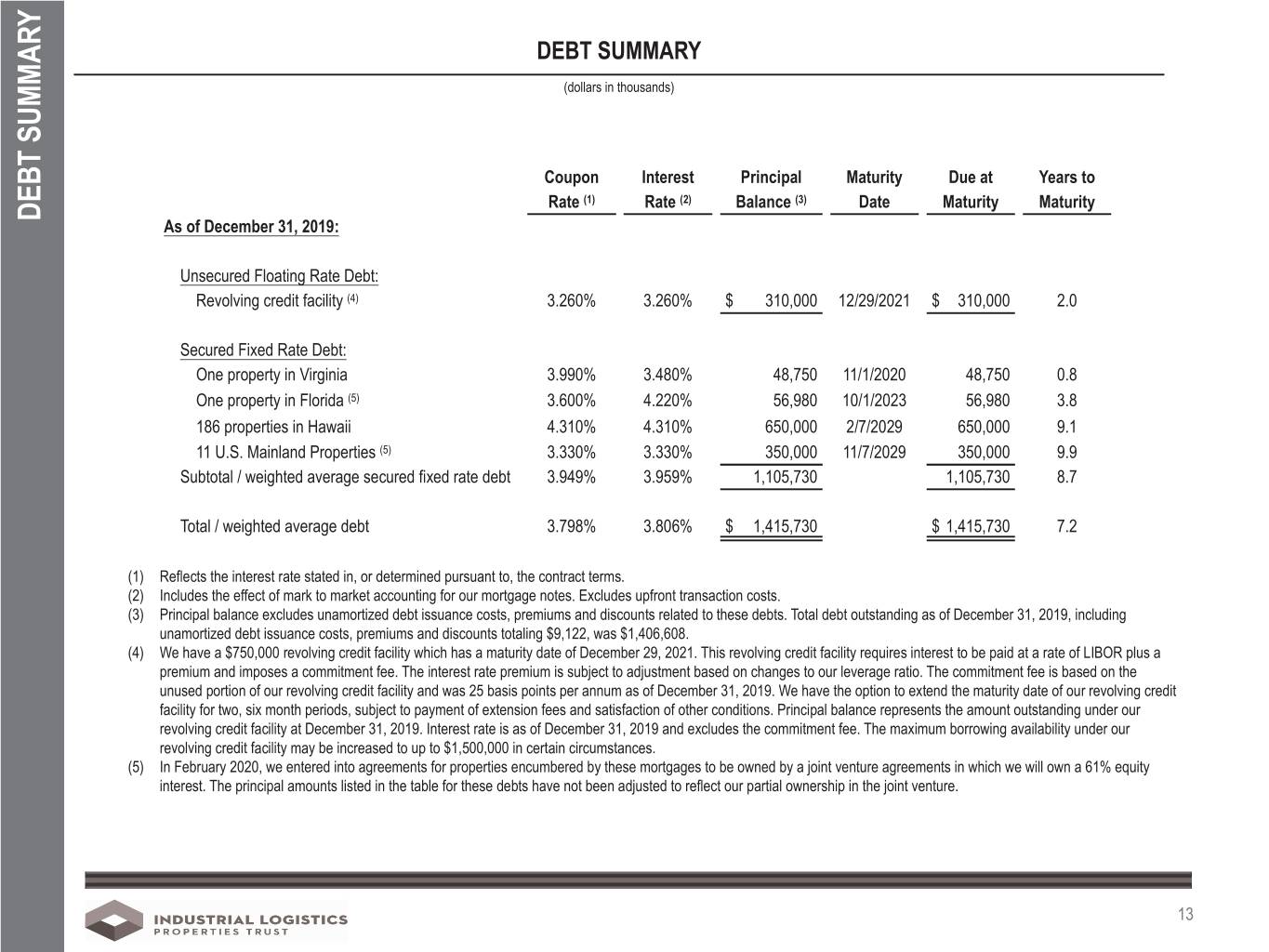

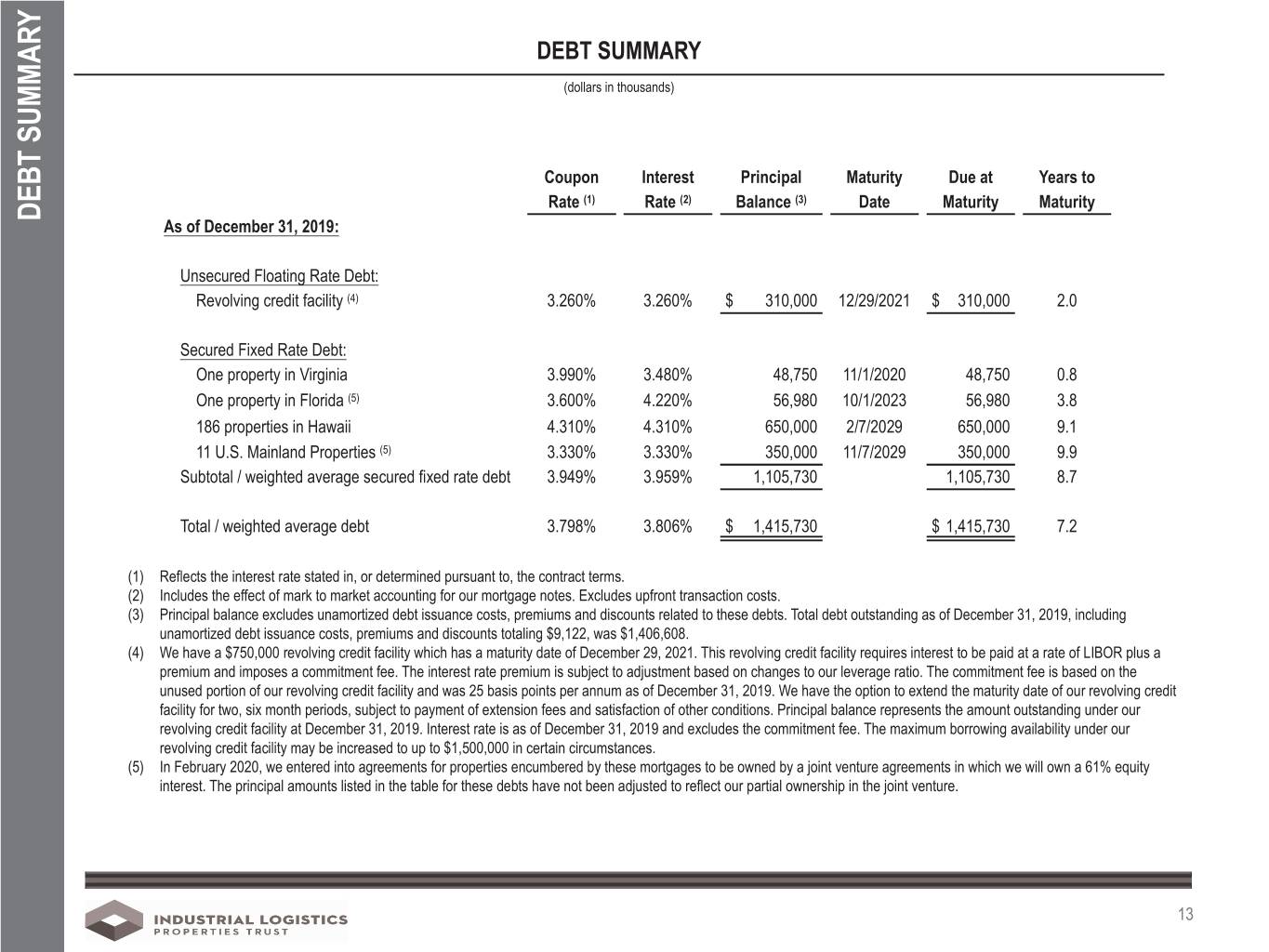

DEBT SUMMARY (dollars in thousands) Coupon Interest Principal Maturity Due at Years to Rate (1) Rate (2) Balance (3) Date Maturity Maturity DEBT SUMMARY As of December 31, 2019: Unsecured Floating Rate Debt: Revolving credit facility (4) 3.260% 3.260% $ 310,000 12/29/2021 $ 310,000 2.0 Secured Fixed Rate Debt: One property in Virginia 3.990% 3.480% 48,750 11/1/2020 48,750 0.8 One property in Florida (5) 3.600% 4.220% 56,980 10/1/2023 56,980 3.8 186 properties in Hawaii 4.310% 4.310% 650,000 2/7/2029 650,000 9.1 11 U.S. Mainland Properties (5) 3.330% 3.330% 350,000 11/7/2029 350,000 9.9 Subtotal / weighted average secured fixed rate debt 3.949% 3.959% 1,105,730 1,105,730 8.7 Total / weighted average debt 3.798% 3.806% $ 1,415,730 $ 1,415,730 7.2 (1) Reflects the interest rate stated in, or determined pursuant to, the contract terms. (2) Includes the effect of mark to market accounting for our mortgage notes. Excludes upfront transaction costs. (3) Principal balance excludes unamortized debt issuance costs, premiums and discounts related to these debts. Total debt outstanding as of December 31, 2019, including unamortized debt issuance costs, premiums and discounts totaling $9,122, was $1,406,608. (4) We have a $750,000 revolving credit facility which has a maturity date of December 29, 2021. This revolving credit facility requires interest to be paid at a rate of LIBOR plus a premium and imposes a commitment fee. The interest rate premium is subject to adjustment based on changes to our leverage ratio. The commitment fee is based on the unused portion of our revolving credit facility and was 25 basis points per annum as of December 31, 2019. We have the option to extend the maturity date of our revolving credit facility for two, six month periods, subject to payment of extension fees and satisfaction of other conditions. Principal balance represents the amount outstanding under our revolving credit facility at December 31, 2019. Interest rate is as of December 31, 2019 and excludes the commitment fee. The maximum borrowing availability under our revolving credit facility may be increased to up to $1,500,000 in certain circumstances. (5) In February 2020, we entered into agreements for properties encumbered by these mortgages to be owned by a joint venture agreements in which we will own a 61% equity interest. The principal amounts listed in the table for these debts have not been adjusted to reflect our partial ownership in the joint venture. 13

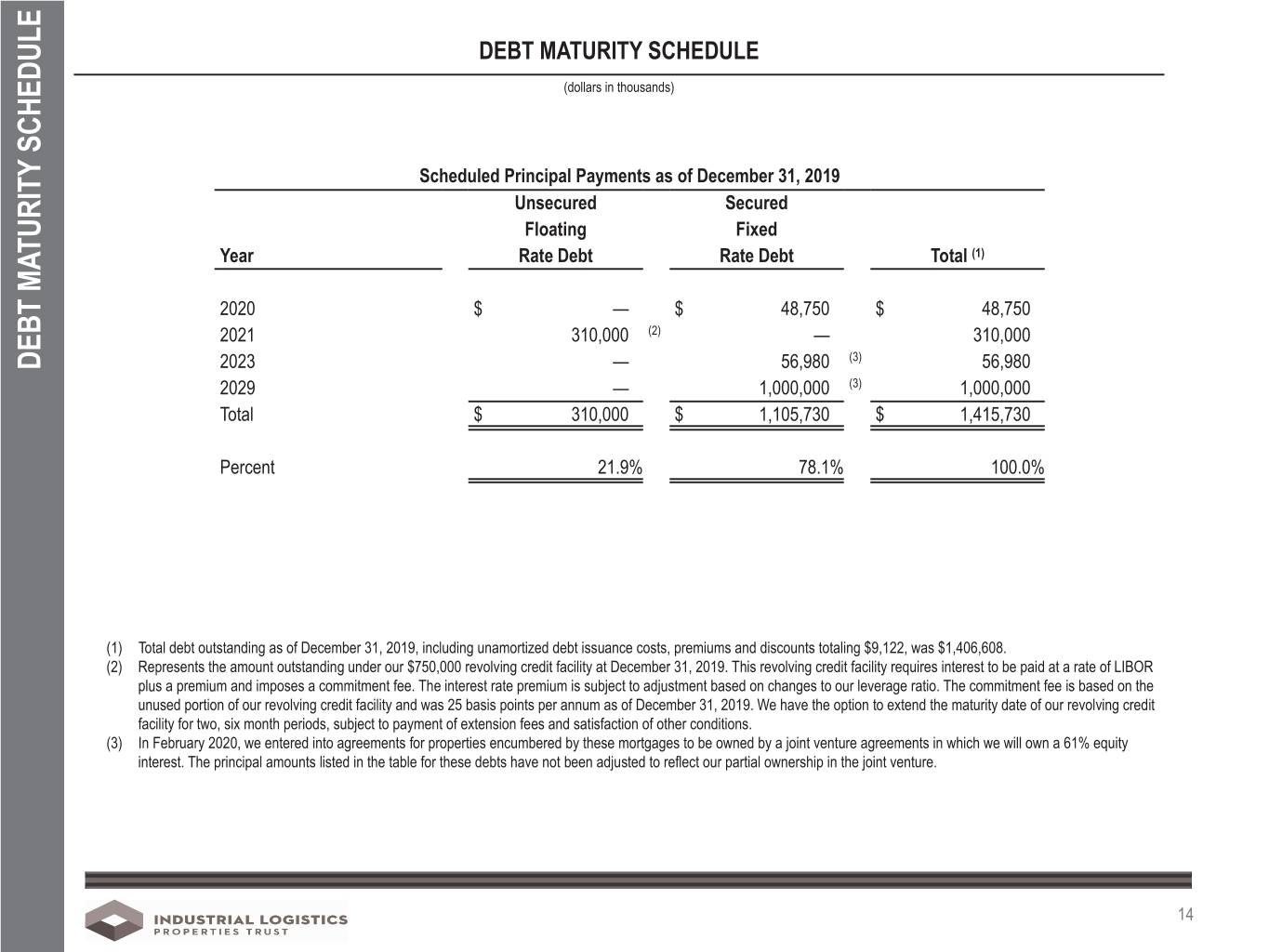

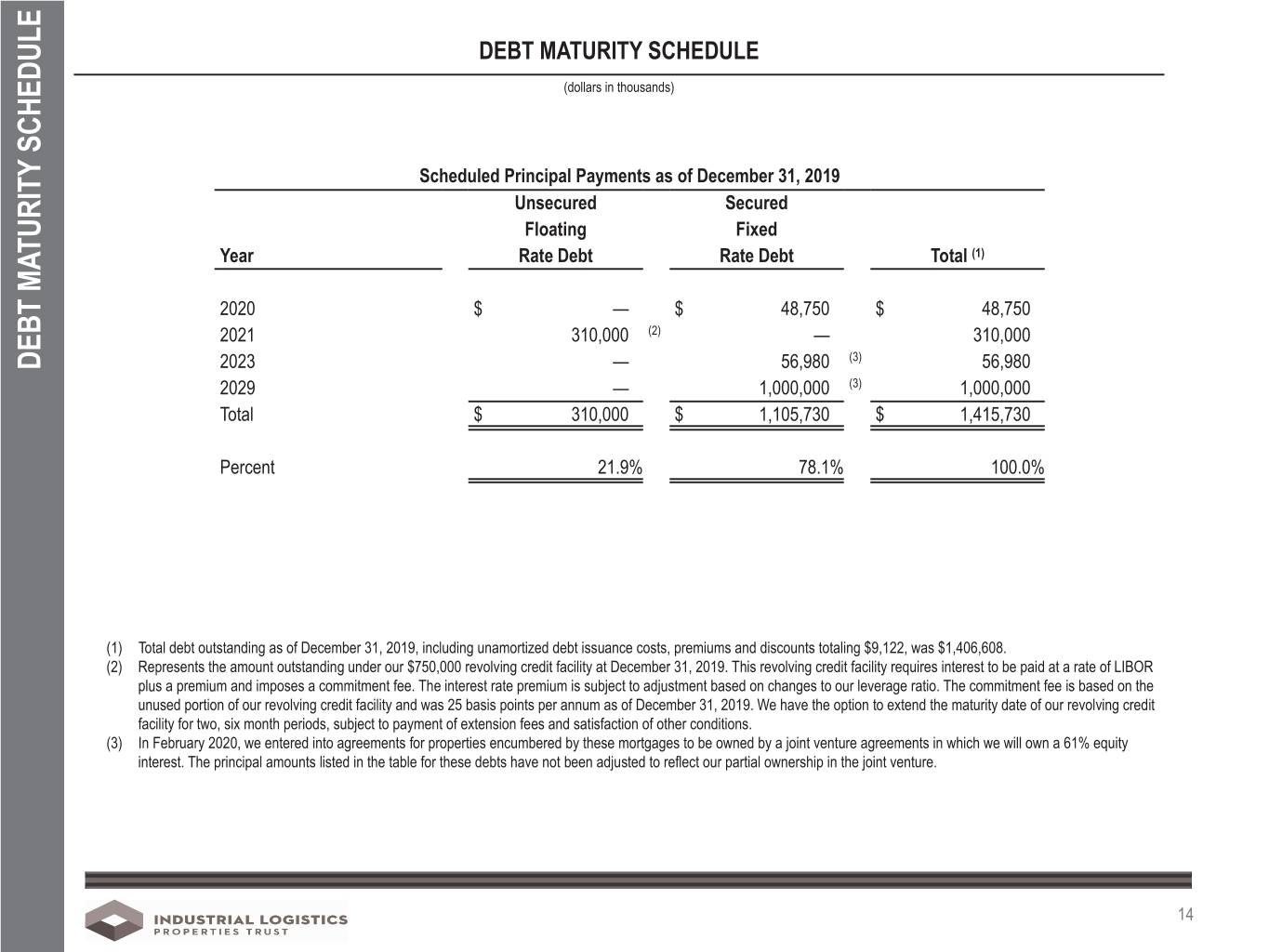

DEBT MATURITY SCHEDULE (dollars in thousands) Scheduled Principal Payments as of December 31, 2019 Unsecured Secured Floating Fixed Year Rate Debt Rate Debt Total (1) 2020 $ — $ 48,750 $ 48,750 2021 310,000 (2) — 310,000 (3) DEBT MATURITY SCHEDULE DEBT MATURITY 2023 — 56,980 56,980 2029 — 1,000,000 (3) 1,000,000 Total $ 310,000 $ 1,105,730 $ 1,415,730 Percent 21.9% 78.1% 100.0% (1) Total debt outstanding as of December 31, 2019, including unamortized debt issuance costs, premiums and discounts totaling $9,122, was $1,406,608. (2) Represents the amount outstanding under our $750,000 revolving credit facility at December 31, 2019. This revolving credit facility requires interest to be paid at a rate of LIBOR plus a premium and imposes a commitment fee. The interest rate premium is subject to adjustment based on changes to our leverage ratio. The commitment fee is based on the unused portion of our revolving credit facility and was 25 basis points per annum as of December 31, 2019. We have the option to extend the maturity date of our revolving credit facility for two, six month periods, subject to payment of extension fees and satisfaction of other conditions. (3) In February 2020, we entered into agreements for properties encumbered by these mortgages to be owned by a joint venture agreements in which we will own a 61% equity interest. The principal amounts listed in the table for these debts have not been adjusted to reflect our partial ownership in the joint venture. 14

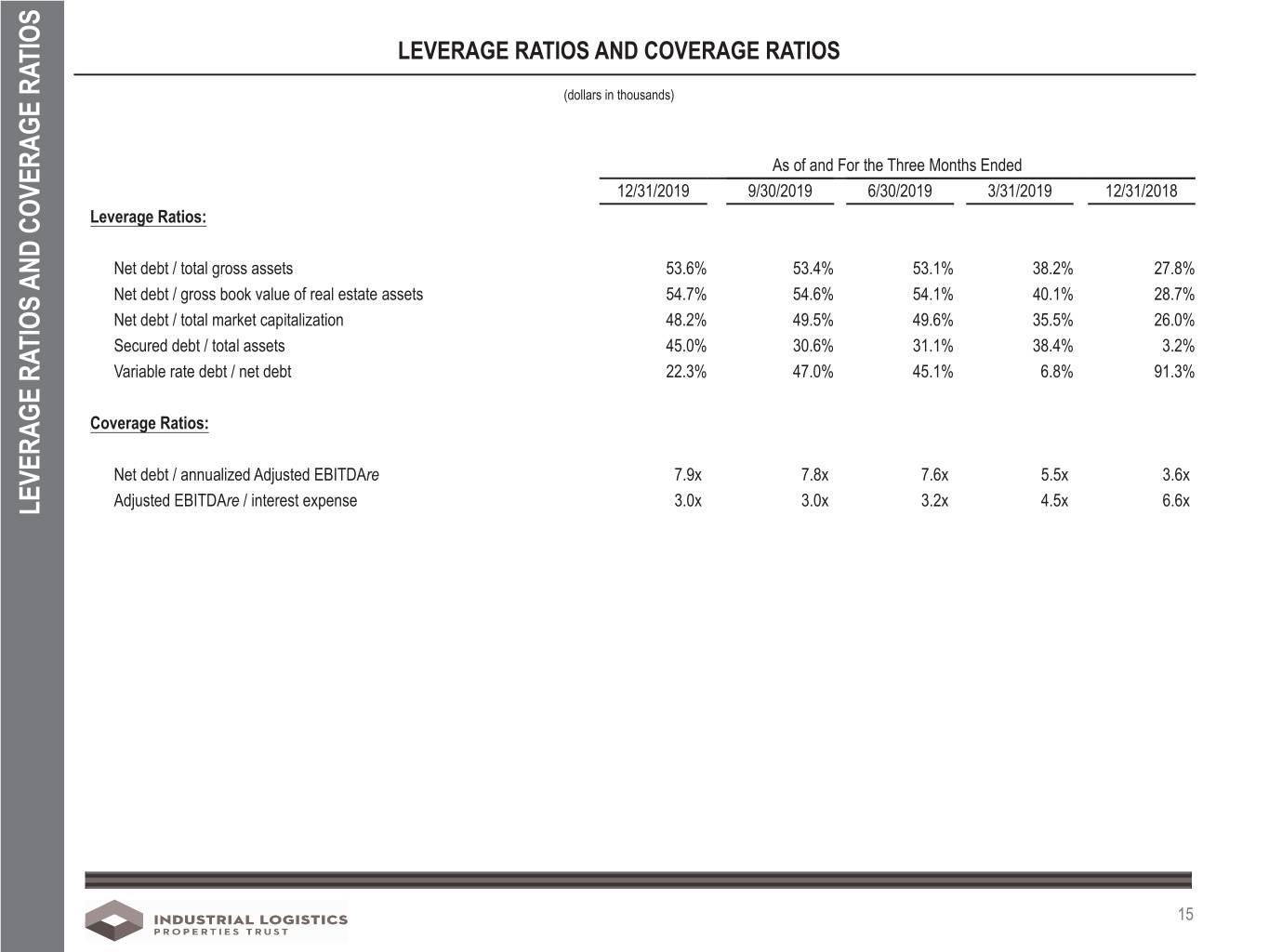

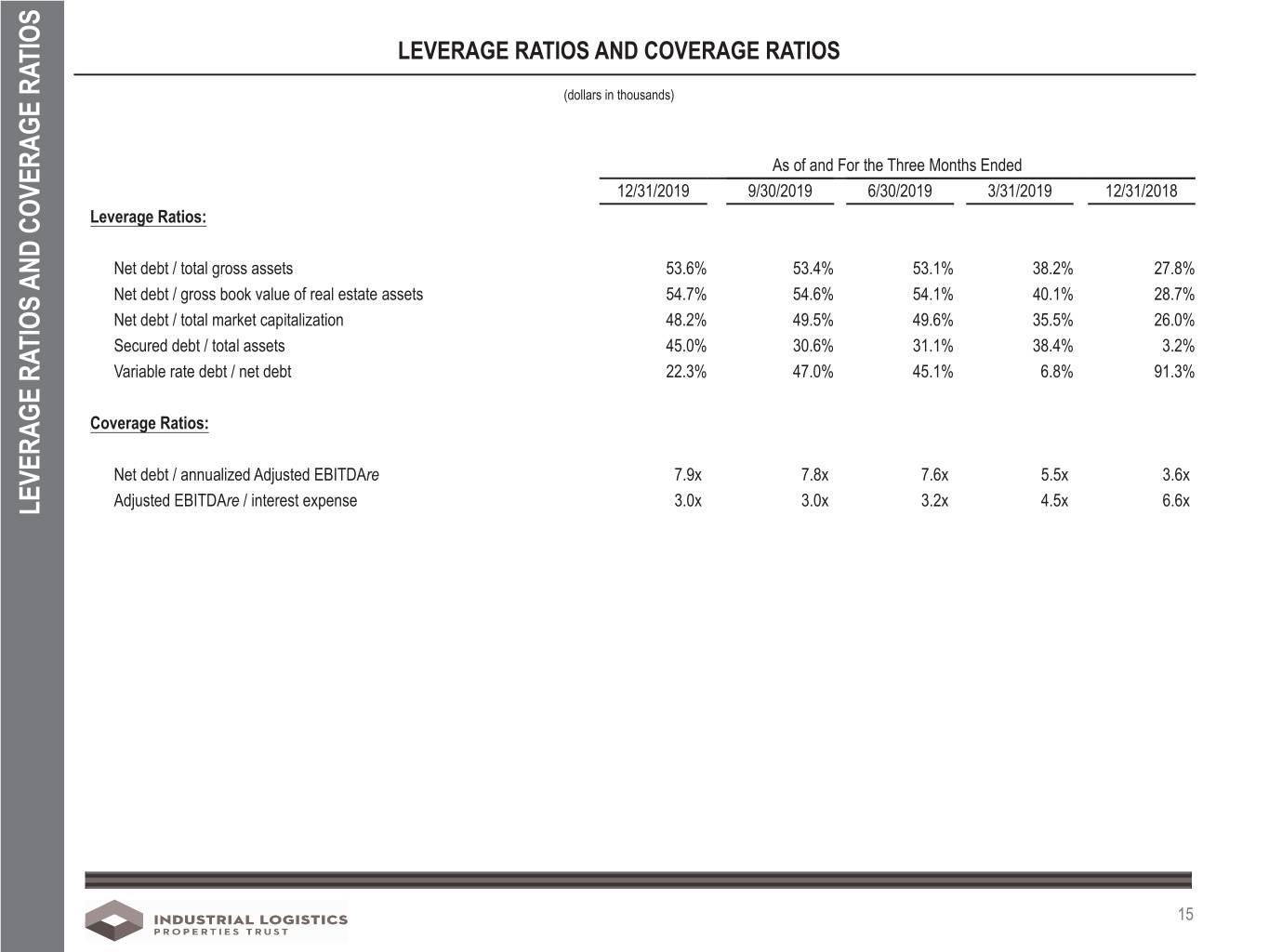

LEVERAGE RATIOS AND COVERAGE RATIOS (dollars in thousands) As of and For the Three Months Ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Leverage Ratios: Net debt / total gross assets 53.6% 53.4% 53.1% 38.2% 27.8% Net debt / gross book value of real estate assets 54.7% 54.6% 54.1% 40.1% 28.7% Net debt / total market capitalization 48.2% 49.5% 49.6% 35.5% 26.0% Secured debt / total assets 45.0% 30.6% 31.1% 38.4% 3.2% Variable rate debt / net debt 22.3% 47.0% 45.1% 6.8% 91.3% Coverage Ratios: Net debt / annualized Adjusted EBITDAre 7.9x 7.8x 7.6x 5.5x 3.6x Adjusted EBITDAre / interest expense 3.0x 3.0x 3.2x 4.5x 6.6x LEVERAGE RATIOS AND COVERAGE RATIOS AND COVERAGE RATIOS LEVERAGE RATIOS 15

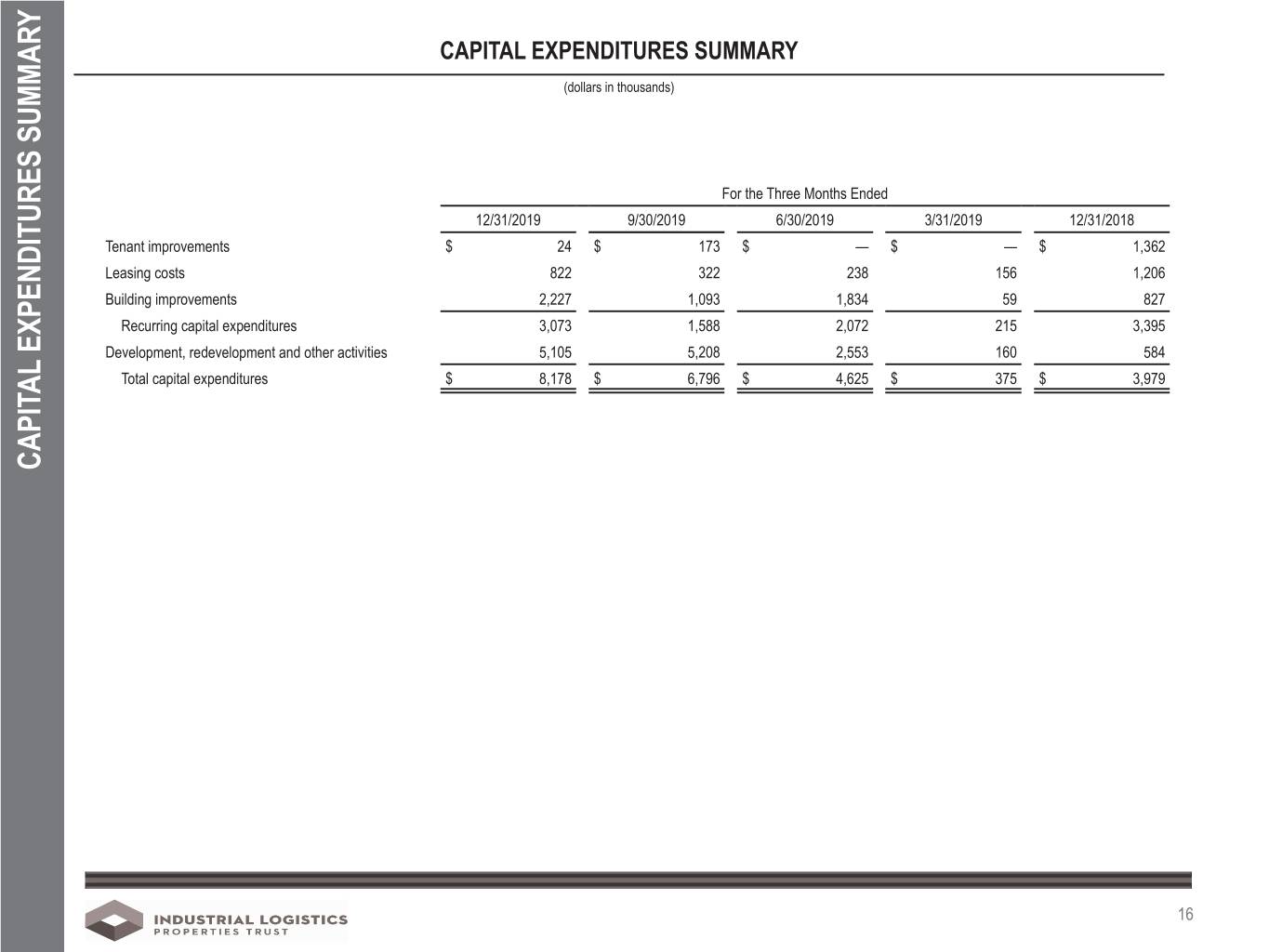

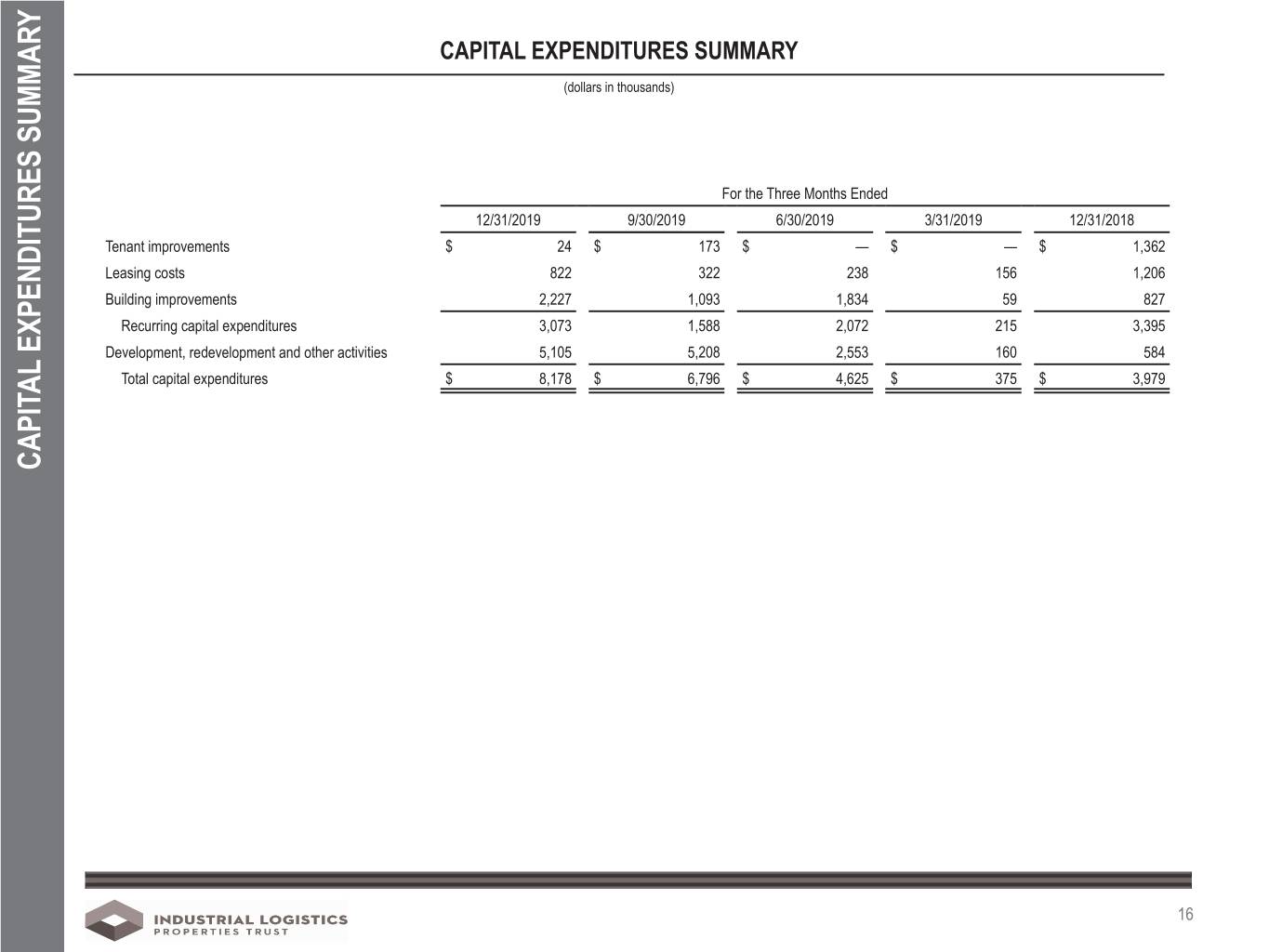

CAPITAL EXPENDITURES SUMMARY (dollars in thousands) For the Three Months Ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Tenant improvements $ 24 $ 173 $ — $ — $ 1,362 Leasing costs 822 322 238 156 1,206 Building improvements 2,227 1,093 1,834 59 827 Recurring capital expenditures 3,073 1,588 2,072 215 3,395 Development, redevelopment and other activities 5,105 5,208 2,553 160 584 Total capital expenditures $ 8,178 $ 6,796 $ 4,625 $ 375 $ 3,979 CAPITAL EXPENDITURES SUMMARY CAPITAL 16

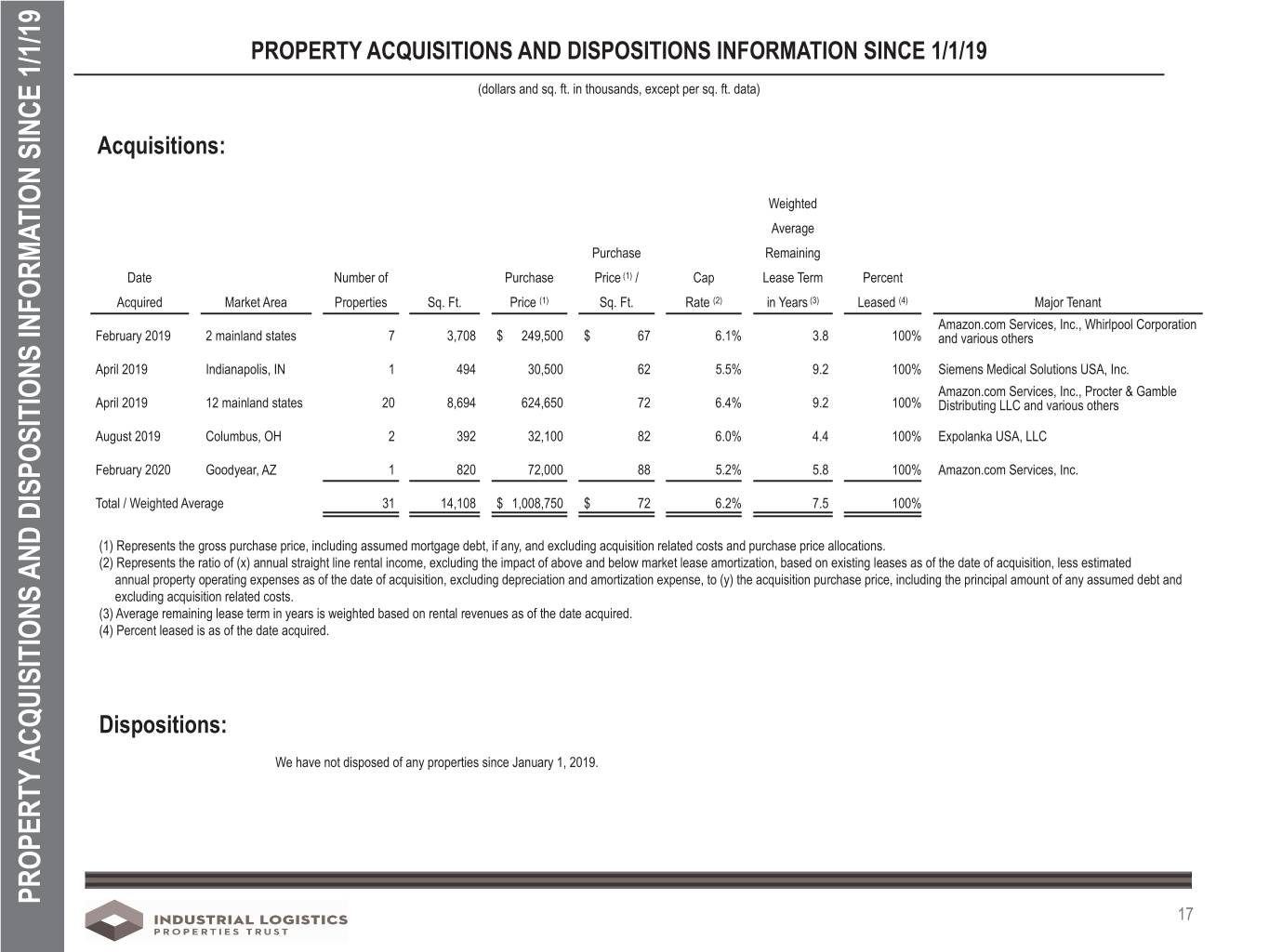

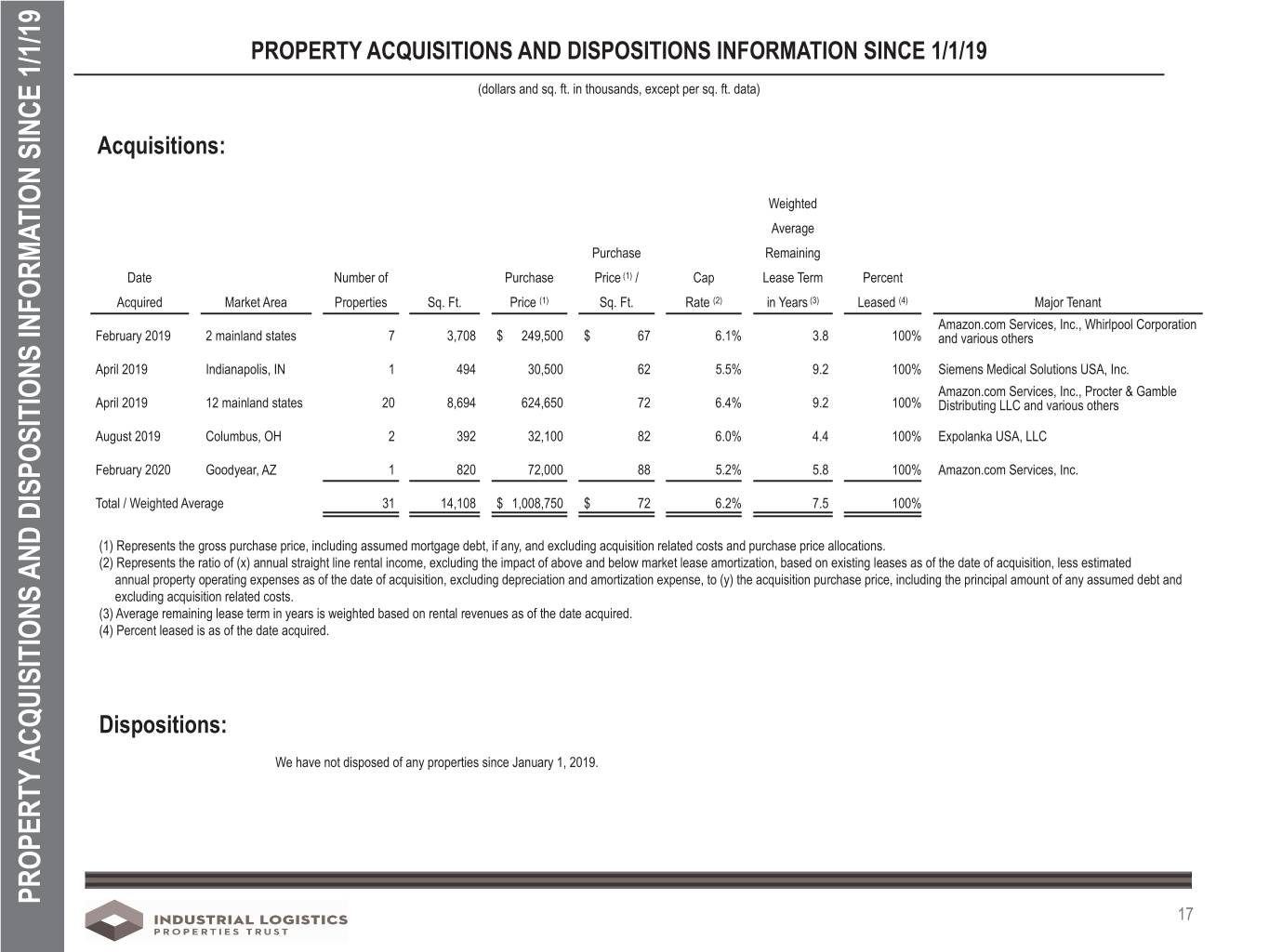

PROPERTY ACQUISITIONS AND DISPOSITIONS INFORMATION SINCE 1/1/19 (dollars and sq. ft. in thousands, except per sq. ft. data) Acquisitions: Weighted Average Purchase Remaining Date Number of Purchase Price (1) / Cap Lease Term Percent Acquired Market Area Properties Sq. Ft. Price (1) Sq. Ft. Rate (2) in Years (3) Leased (4) Major Tenant Amazon.com Services, Inc., Whirlpool Corporation February 2019 2 mainland states 7 3,708 $ 249,500 $ 67 6.1% 3.8 100% and various others April 2019 Indianapolis, IN 1 494 30,500 62 5.5% 9.2 100% Siemens Medical Solutions USA, Inc. Amazon.com Services, Inc., Procter & Gamble April 2019 12 mainland states 20 8,694 624,650 72 6.4% 9.2 100% Distributing LLC and various others August 2019 Columbus, OH 2 392 32,100 82 6.0% 4.4 100% Expolanka USA, LLC February 2020 Goodyear, AZ 1 820 72,000 88 5.2% 5.8 100% Amazon.com Services, Inc. Total / Weighted Average 31 14,108 $ 1,008,750 $ 72 6.2% 7.5 100% (1) Represents the gross purchase price, including assumed mortgage debt, if any, and excluding acquisition related costs and purchase price allocations. (2) Represents the ratio of (x) annual straight line rental income, excluding the impact of above and below market lease amortization, based on existing leases as of the date of acquisition, less estimated annual property operating expenses as of the date of acquisition, excluding depreciation and amortization expense, to (y) the acquisition purchase price, including the principal amount of any assumed debt and excluding acquisition related costs. (3) Average remaining lease term in years is weighted based on rental revenues as of the date acquired. (4) Percent leased is as of the date acquired. Dispositions: We have not disposed of any properties since January 1, 2019. PROPERTY ACQUISITIONS AND DISPOSITIONS INFORMATION SINCE 1/1/19 AND DISPOSITIONS INFORMATION ACQUISITIONS PROPERTY 17

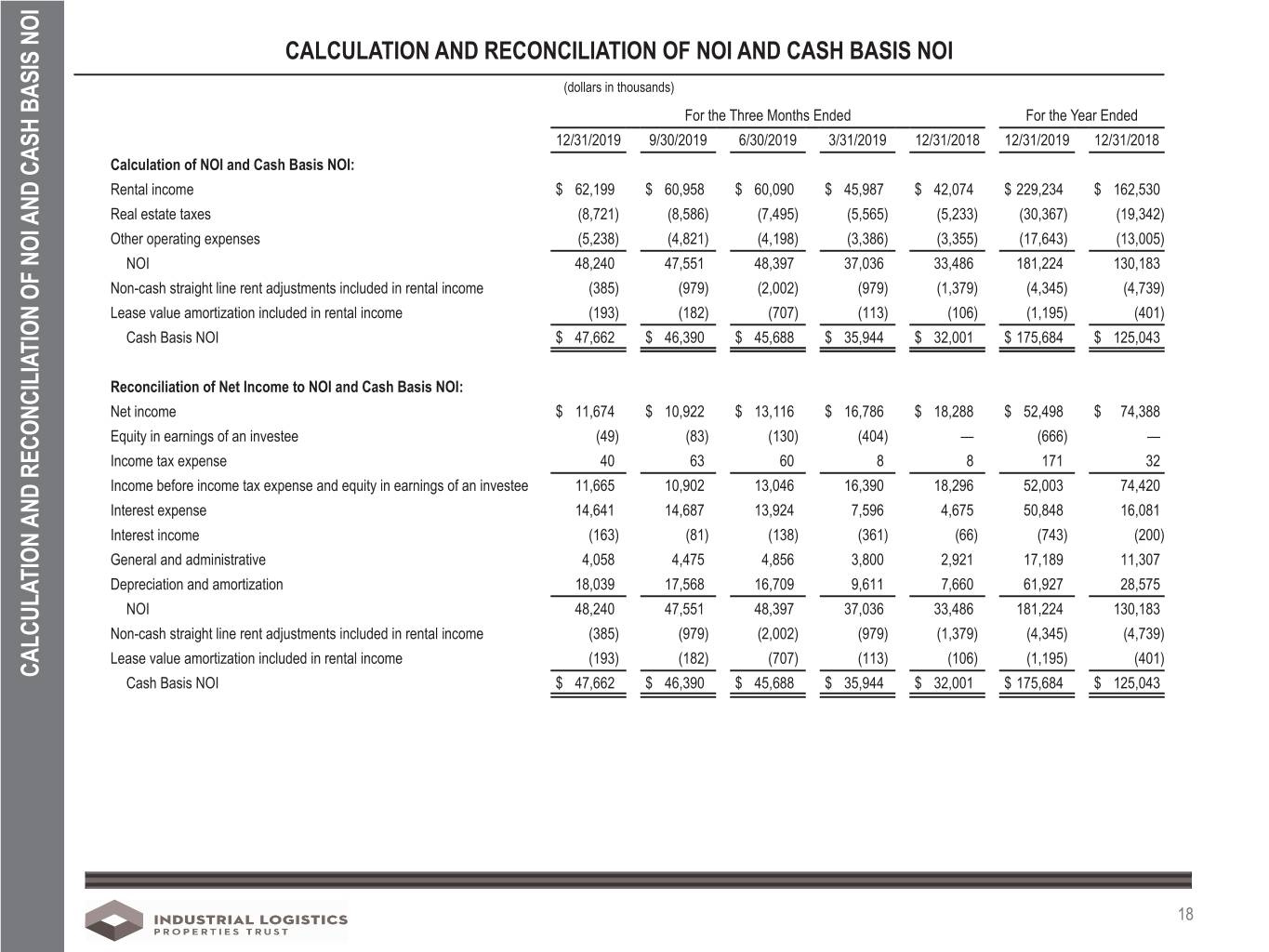

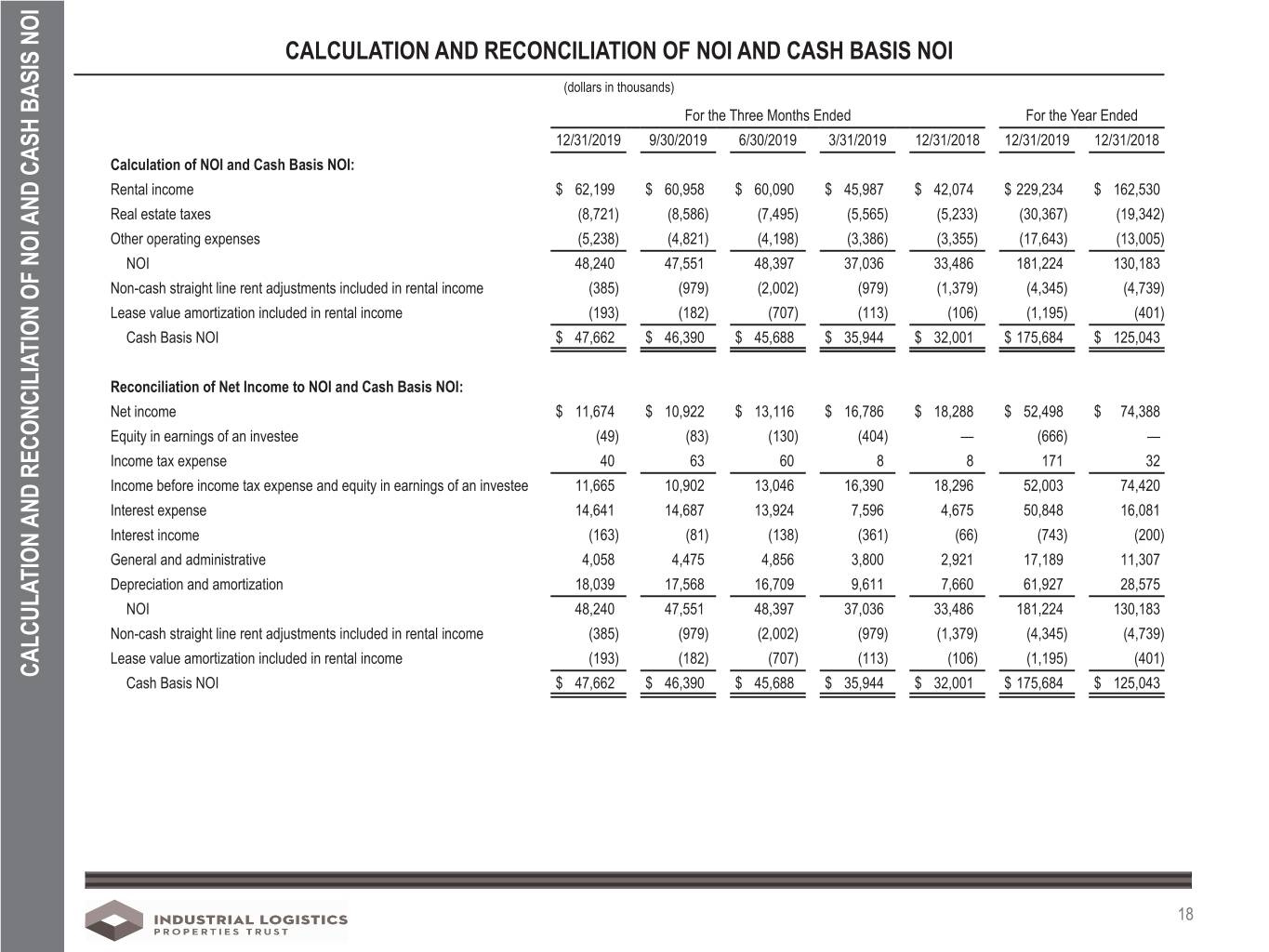

CALCULATION AND RECONCILIATION OF NOI AND CASH BASIS NOI (dollars in thousands) For the Three Months Ended For the Year Ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 12/31/2019 12/31/2018 Calculation of NOI and Cash Basis NOI: Rental income $ 62,199 $ 60,958 $ 60,090 $ 45,987 $ 42,074 $ 229,234 $ 162,530 Real estate taxes (8,721) (8,586) (7,495) (5,565) (5,233) (30,367) (19,342) Other operating expenses (5,238) (4,821) (4,198) (3,386) (3,355) (17,643) (13,005) NOI 48,240 47,551 48,397 37,036 33,486 181,224 130,183 Non-cash straight line rent adjustments included in rental income (385) (979) (2,002) (979) (1,379) (4,345) (4,739) Lease value amortization included in rental income (193) (182) (707) (113) (106) (1,195) (401) Cash Basis NOI $ 47,662 $ 46,390 $ 45,688 $ 35,944 $ 32,001 $ 175,684 $ 125,043 Reconciliation of Net Income to NOI and Cash Basis NOI: Net income $ 11,674 $ 10,922 $ 13,116 $ 16,786 $ 18,288 $ 52,498 $ 74,388 Equity in earnings of an investee (49) (83) (130) (404) — (666) — Income tax expense 40 63 60 8 8 171 32 Income before income tax expense and equity in earnings of an investee 11,665 10,902 13,046 16,390 18,296 52,003 74,420 Interest expense 14,641 14,687 13,924 7,596 4,675 50,848 16,081 Interest income (163) (81) (138) (361) (66) (743) (200) General and administrative 4,058 4,475 4,856 3,800 2,921 17,189 11,307 Depreciation and amortization 18,039 17,568 16,709 9,611 7,660 61,927 28,575 NOI 48,240 47,551 48,397 37,036 33,486 181,224 130,183 Non-cash straight line rent adjustments included in rental income (385) (979) (2,002) (979) (1,379) (4,345) (4,739) Lease value amortization included in rental income (193) (182) (707) (113) (106) (1,195) (401) CALCULATION AND RECONCILIATION OF NOI AND CASH BASIS NOI OF NOI AND RECONCILIATION CALCULATION Cash Basis NOI $ 47,662 $ 46,390 $ 45,688 $ 35,944 $ 32,001 $ 175,684 $ 125,043 18

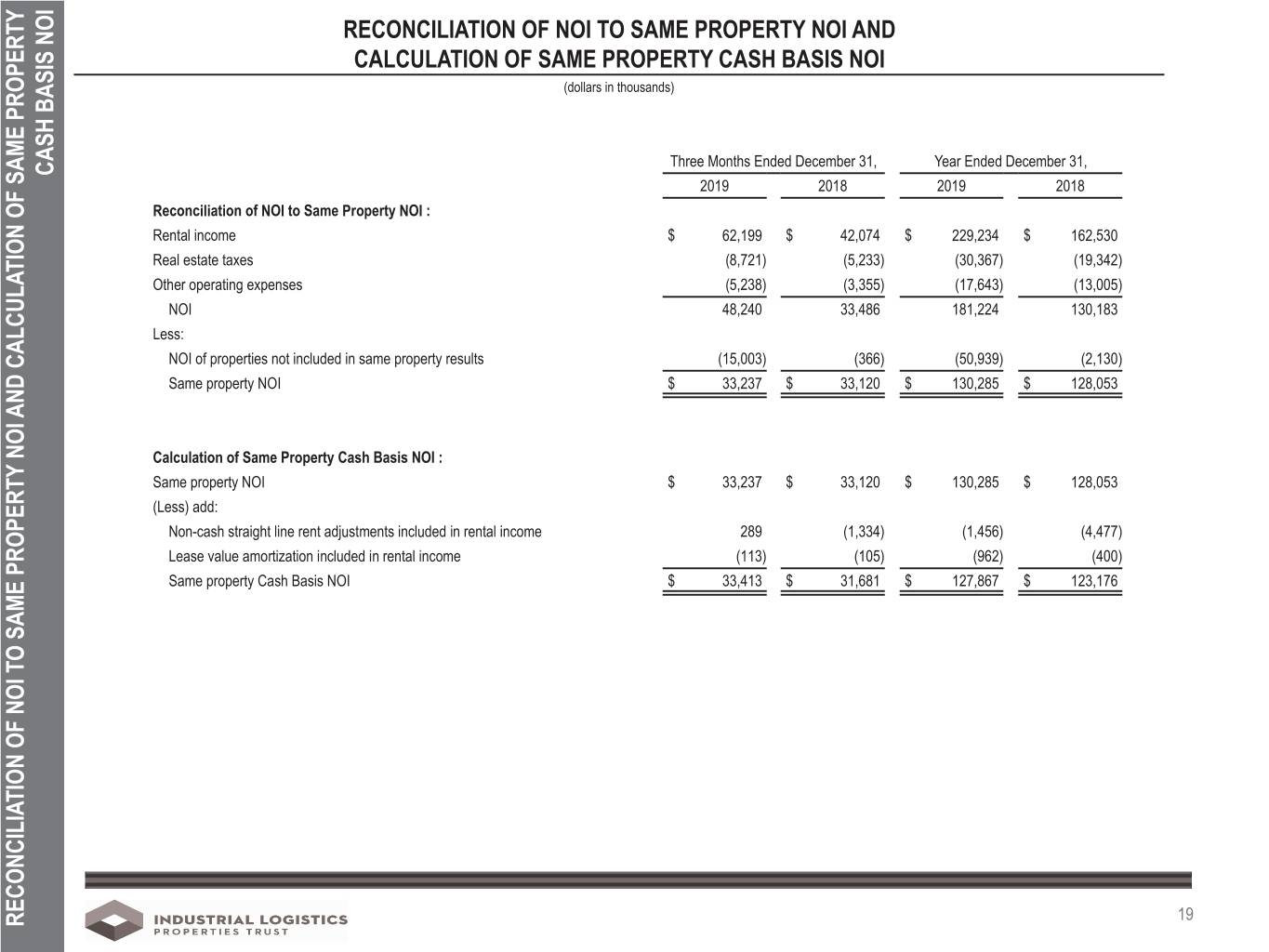

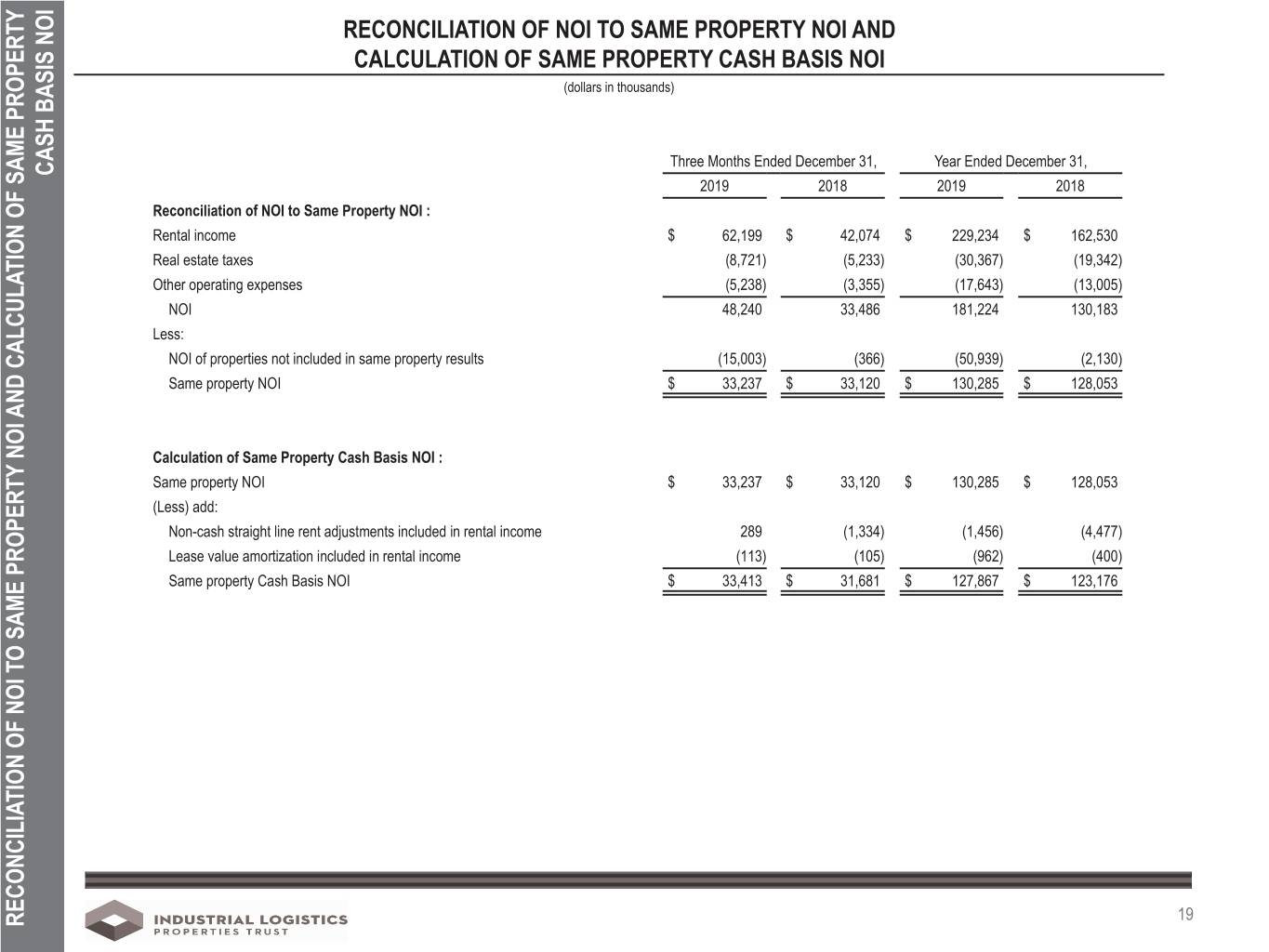

RECONCILIATION OF NOI TO SAME PROPERTY NOI AND CALCULATION OF SAME PROPERTY CASH BASIS NOI (dollars in thousands) Three Months Ended December 31, Year Ended December 31, CASH BASIS NOI 2019 2018 2019 2018 Reconciliation of NOI to Same Property NOI : Rental income $ 62,199 $ 42,074 $ 229,234 $ 162,530 Real estate taxes (8,721) (5,233) (30,367) (19,342) Other operating expenses (5,238) (3,355) (17,643) (13,005) NOI 48,240 33,486 181,224 130,183 Less: NOI of properties not included in same property results (15,003) (366) (50,939) (2,130) Same property NOI $ 33,237 $ 33,120 $ 130,285 $ 128,053 Calculation of Same Property Cash Basis NOI : Same property NOI $ 33,237 $ 33,120 $ 130,285 $ 128,053 (Less) add: Non-cash straight line rent adjustments included in rental income 289 (1,334) (1,456) (4,477) Lease value amortization included in rental income (113) (105) (962) (400) Same property Cash Basis NOI $ 33,413 $ 31,681 $ 127,867 $ 123,176 19 RECONCILIATION OF NOI TO SAME PROPERTY NOI AND CALCULATION OF SAME PROPERTY AND CALCULATION NOI SAME PROPERTY OF NOI TO RECONCILIATION

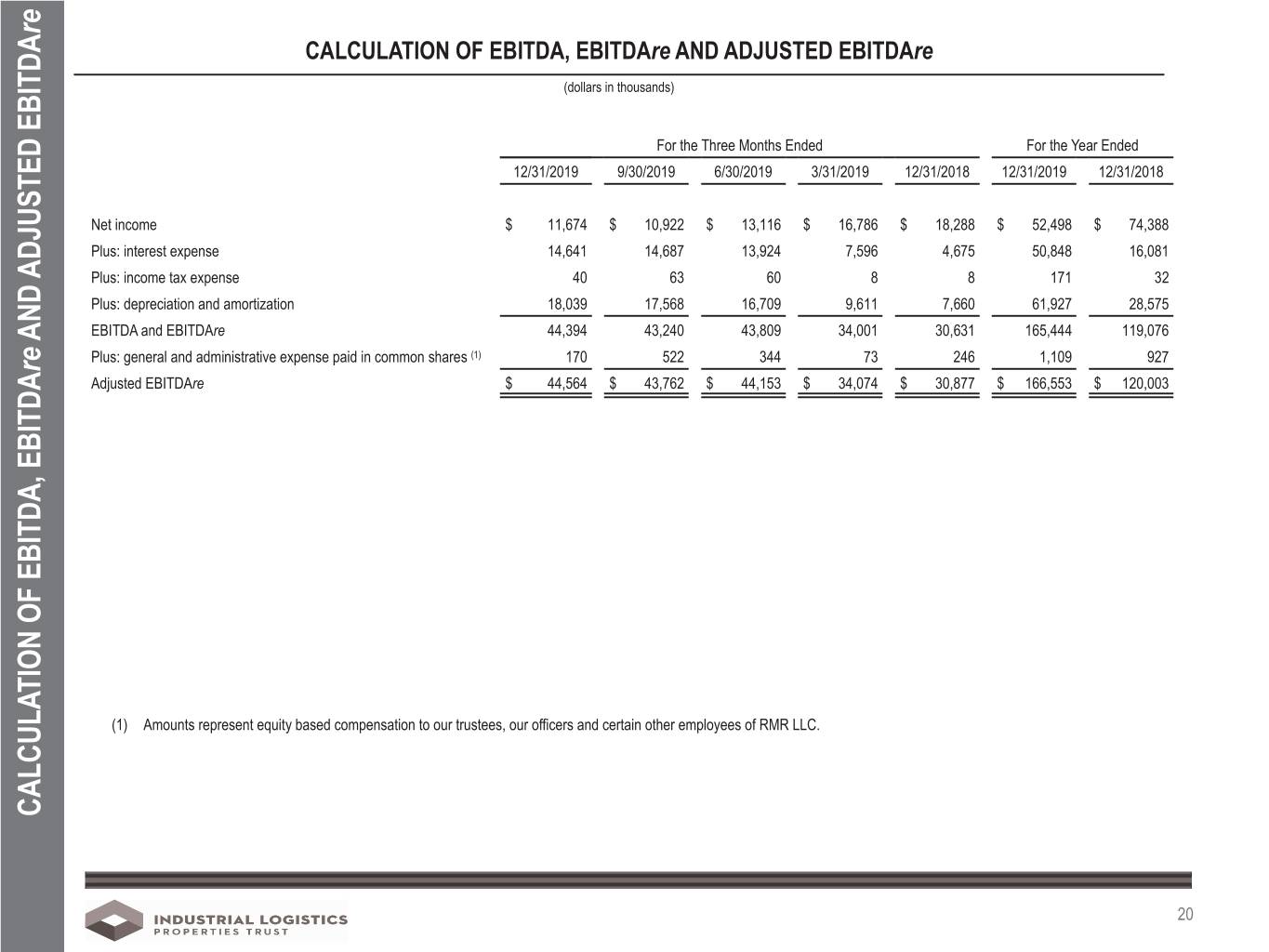

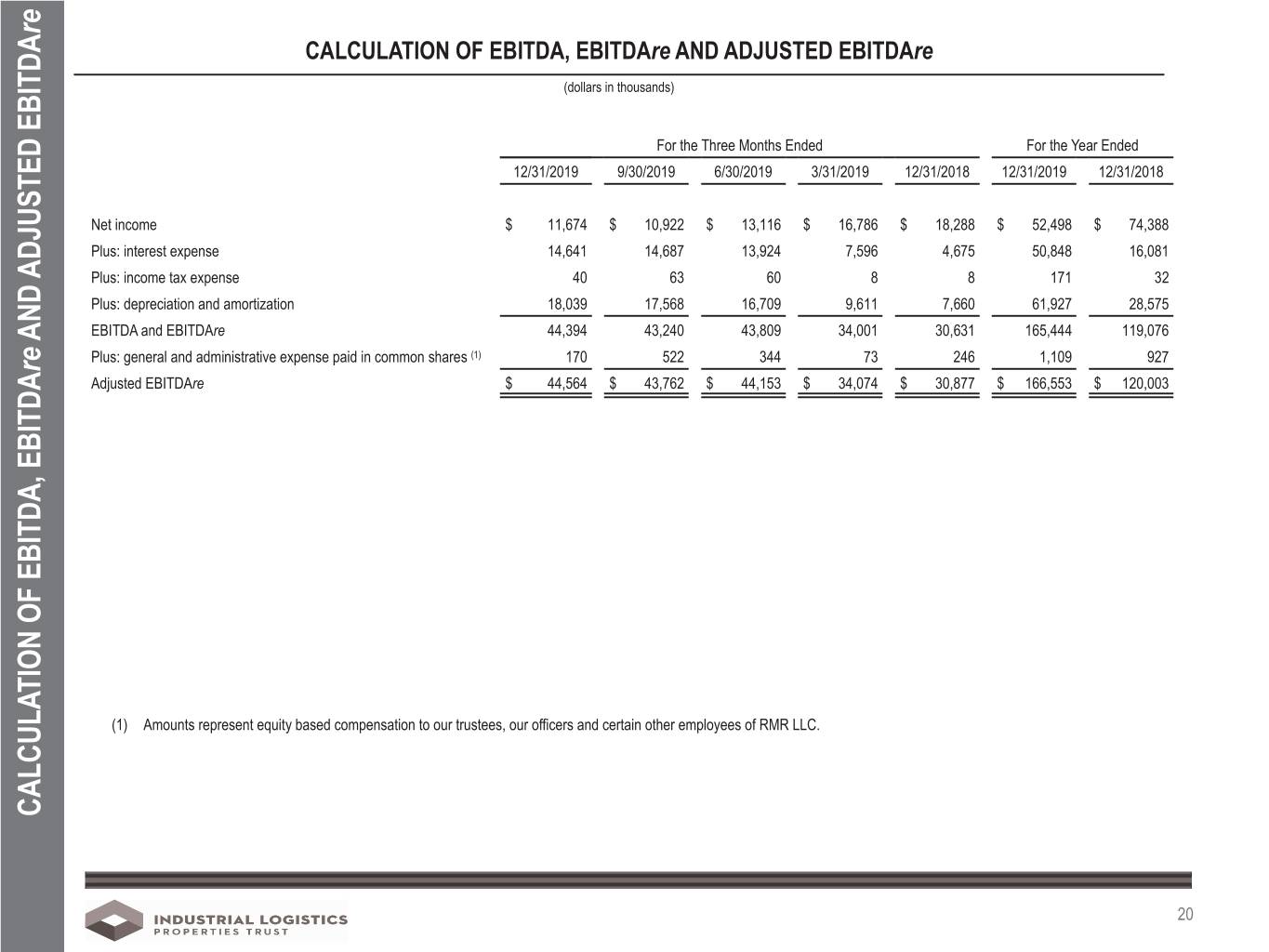

re CALCULATION OF EBITDA, EBITDAre AND ADJUSTED EBITDAre (dollars in thousands) For the Three Months Ended For the Year Ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 12/31/2019 12/31/2018 Net income $ 11,674 $ 10,922 $ 13,116 $ 16,786 $ 18,288 $ 52,498 $ 74,388 Plus: interest expense 14,641 14,687 13,924 7,596 4,675 50,848 16,081 Plus: income tax expense 40 63 60 8 8 171 32 Plus: depreciation and amortization 18,039 17,568 16,709 9,611 7,660 61,927 28,575 EBITDA and EBITDAre 44,394 43,240 43,809 34,001 30,631 165,444 119,076 AND ADJUSTED EBITDA AND Plus: general and administrative expense paid in common shares (1) 170 522 344 73 246 1,109 927 re Adjusted EBITDAre $ 44,564 $ 43,762 $ 44,153 $ 34,074 $ 30,877 $ 166,553 $ 120,003 (1) Amounts represent equity based compensation to our trustees, our officers and certain other employees of RMR LLC. CALCULATION OF EBITDA, EBITDA CALCULATION 20

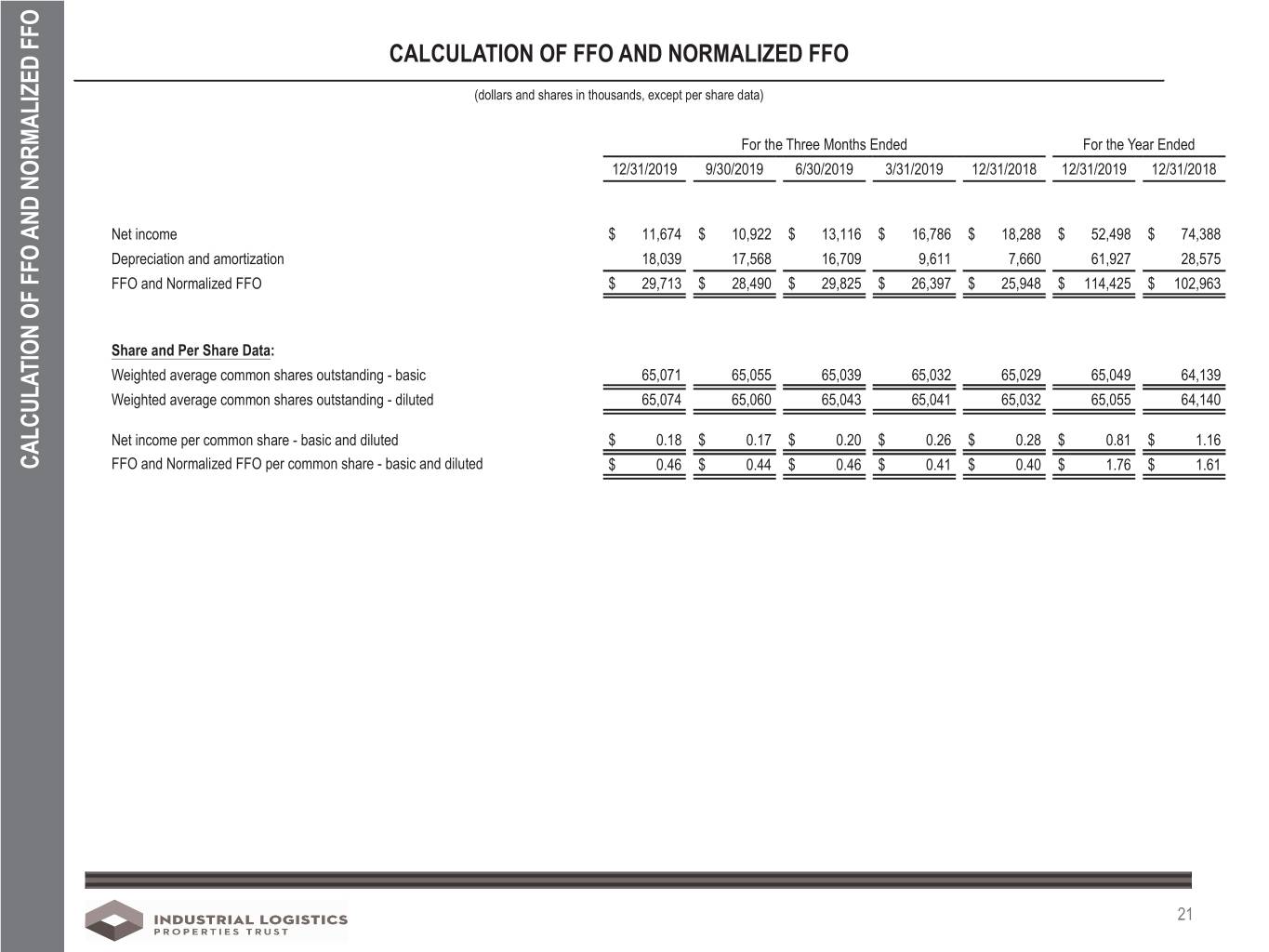

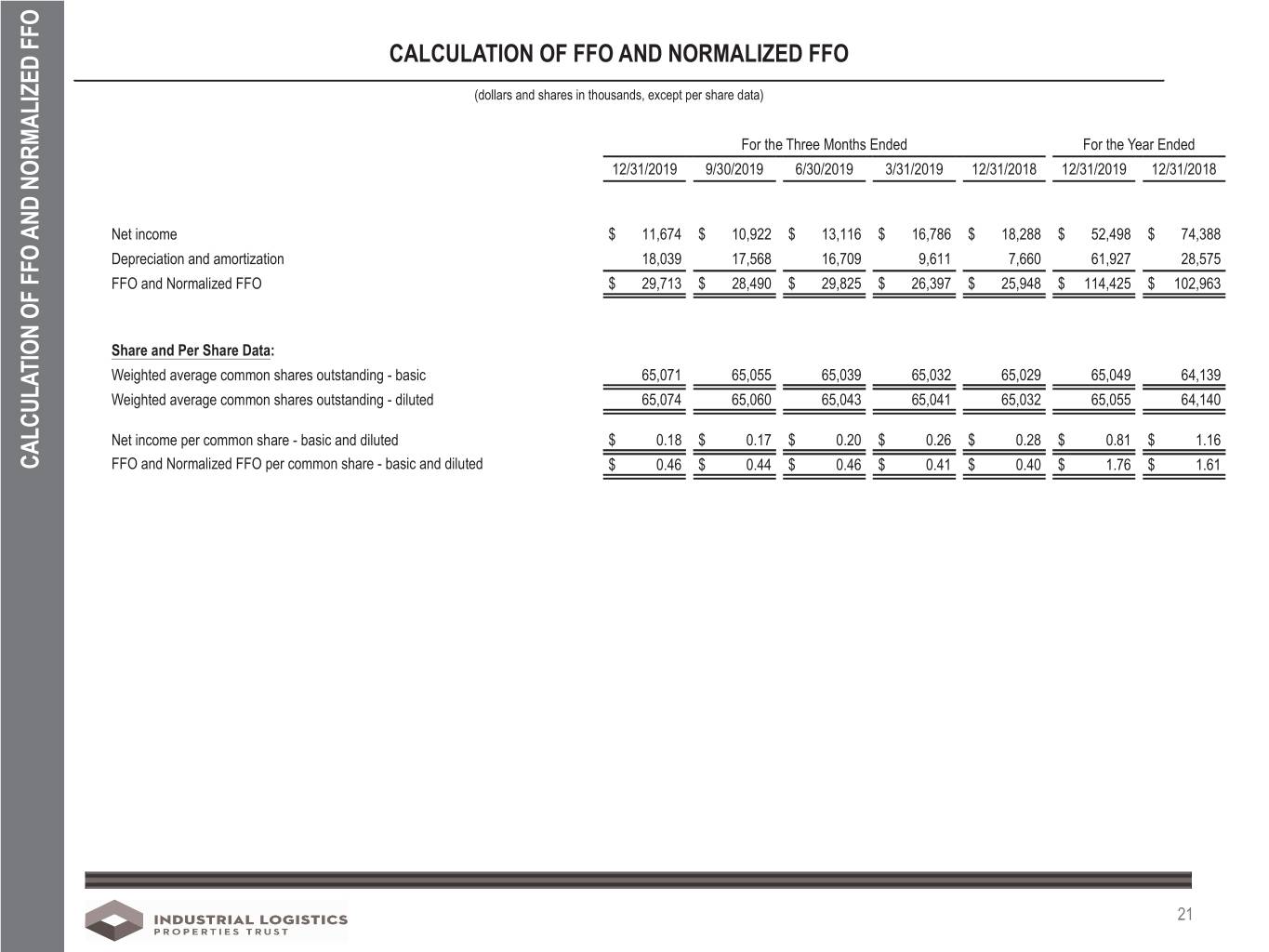

CALCULATION OF FFO AND NORMALIZED FFO (dollars and shares in thousands, except per share data) For the Three Months Ended For the Year Ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 12/31/2019 12/31/2018 Net income $ 11,674 $ 10,922 $ 13,116 $ 16,786 $ 18,288 $ 52,498 $ 74,388 Depreciation and amortization 18,039 17,568 16,709 9,611 7,660 61,927 28,575 FFO and Normalized FFO $ 29,713 $ 28,490 $ 29,825 $ 26,397 $ 25,948 $ 114,425 $ 102,963 Share and Per Share Data: Weighted average common shares outstanding - basic 65,071 65,055 65,039 65,032 65,029 65,049 64,139 Weighted average common shares outstanding - diluted 65,074 65,060 65,043 65,041 65,032 65,055 64,140 Net income per common share - basic and diluted $ 0.18 $ 0.17 $ 0.20 $ 0.26 $ 0.28 $ 0.81 $ 1.16 CALCULATION OF FFO AND NORMALIZED FFO OF FFO CALCULATION FFO and Normalized FFO per common share - basic and diluted $ 0.46 $ 0.44 $ 0.46 $ 0.41 $ 0.40 $ 1.76 $ 1.61 21

1985 International Way, Hebron, KY Square Feet: 189,400 Tenant: Verst Group Logistics, Inc. PORTFOLIO INFORMATION 22

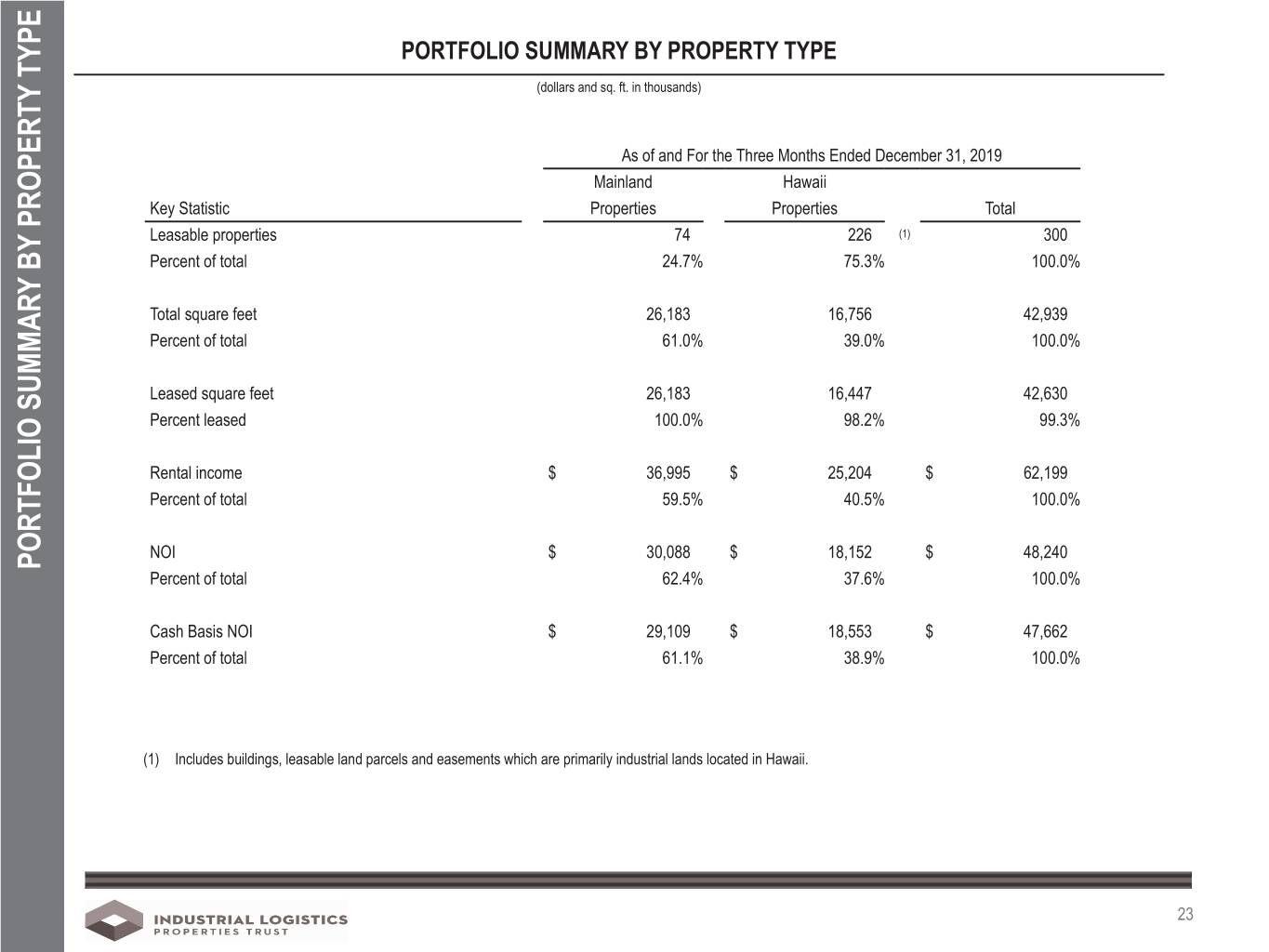

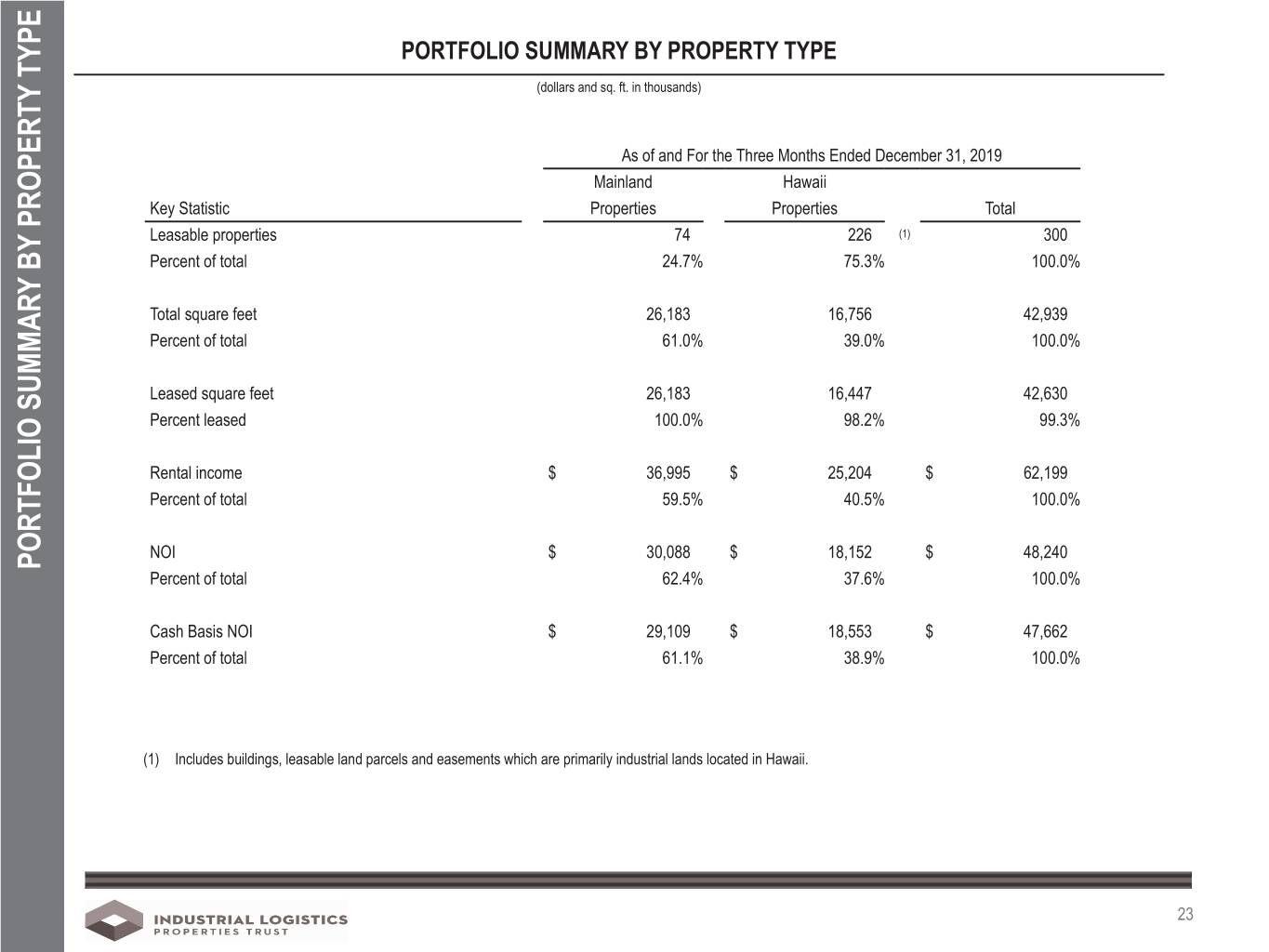

PORTFOLIO SUMMARY BY PROPERTY TYPE (dollars and sq. ft. in thousands) As of and For the Three Months Ended December 31, 2019 Mainland Hawaii Key Statistic Properties Properties Total Leasable properties 74 226 (1) 300 Percent of total 24.7% 75.3% 100.0% Total square feet 26,183 16,756 42,939 Percent of total 61.0% 39.0% 100.0% Leased square feet 26,183 16,447 42,630 Percent leased 100.0% 98.2% 99.3% Rental income $ 36,995 $ 25,204 $ 62,199 Percent of total 59.5% 40.5% 100.0% NOI $ 30,088 $ 18,152 $ 48,240 PORTFOLIO SUMMARY BY PROPERTY TYPE PROPERTY BY PORTFOLIO SUMMARY Percent of total 62.4% 37.6% 100.0% Cash Basis NOI $ 29,109 $ 18,553 $ 47,662 Percent of total 61.1% 38.9% 100.0% (1) Includes buildings, leasable land parcels and easements which are primarily industrial lands located in Hawaii. 23

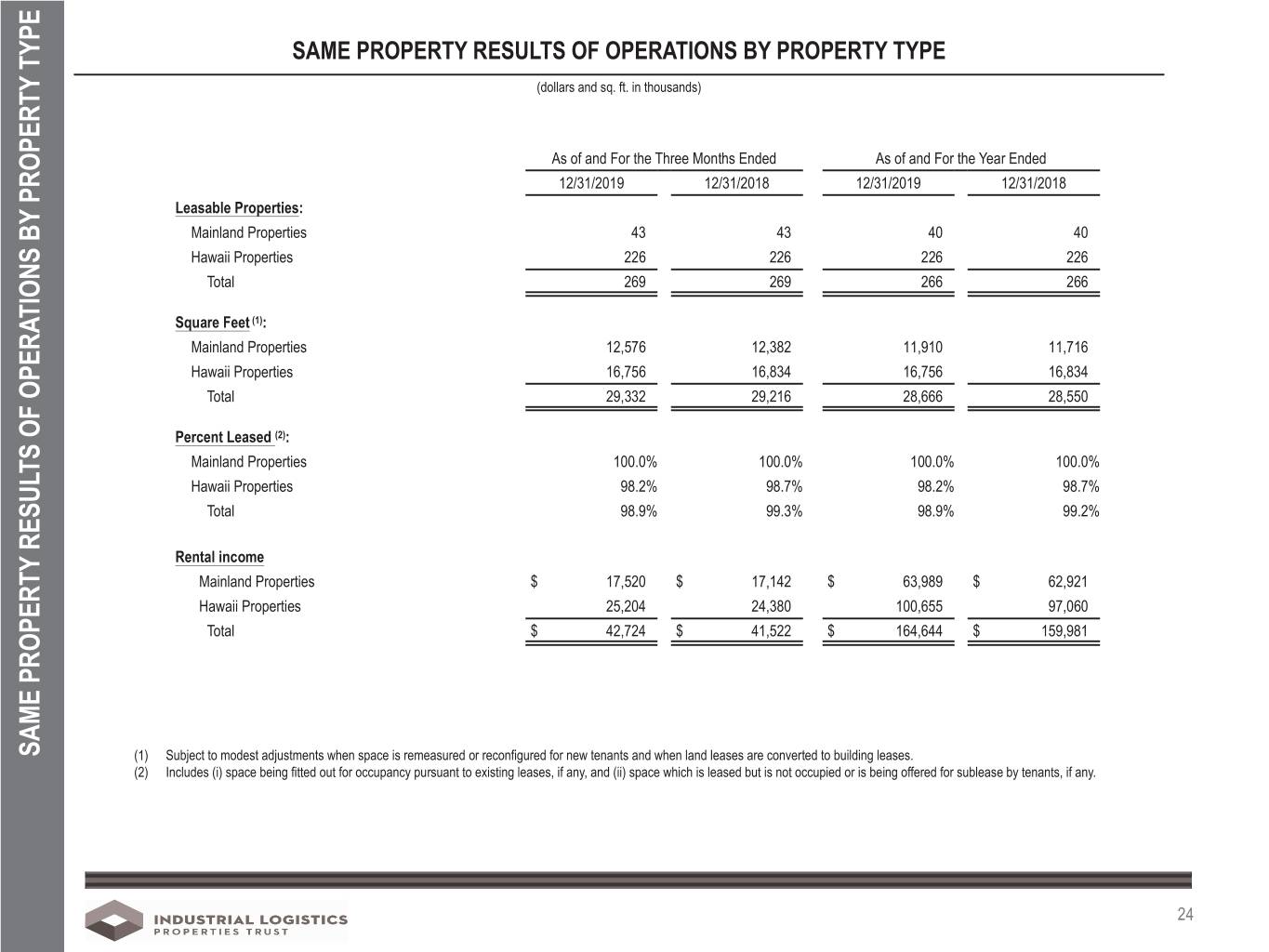

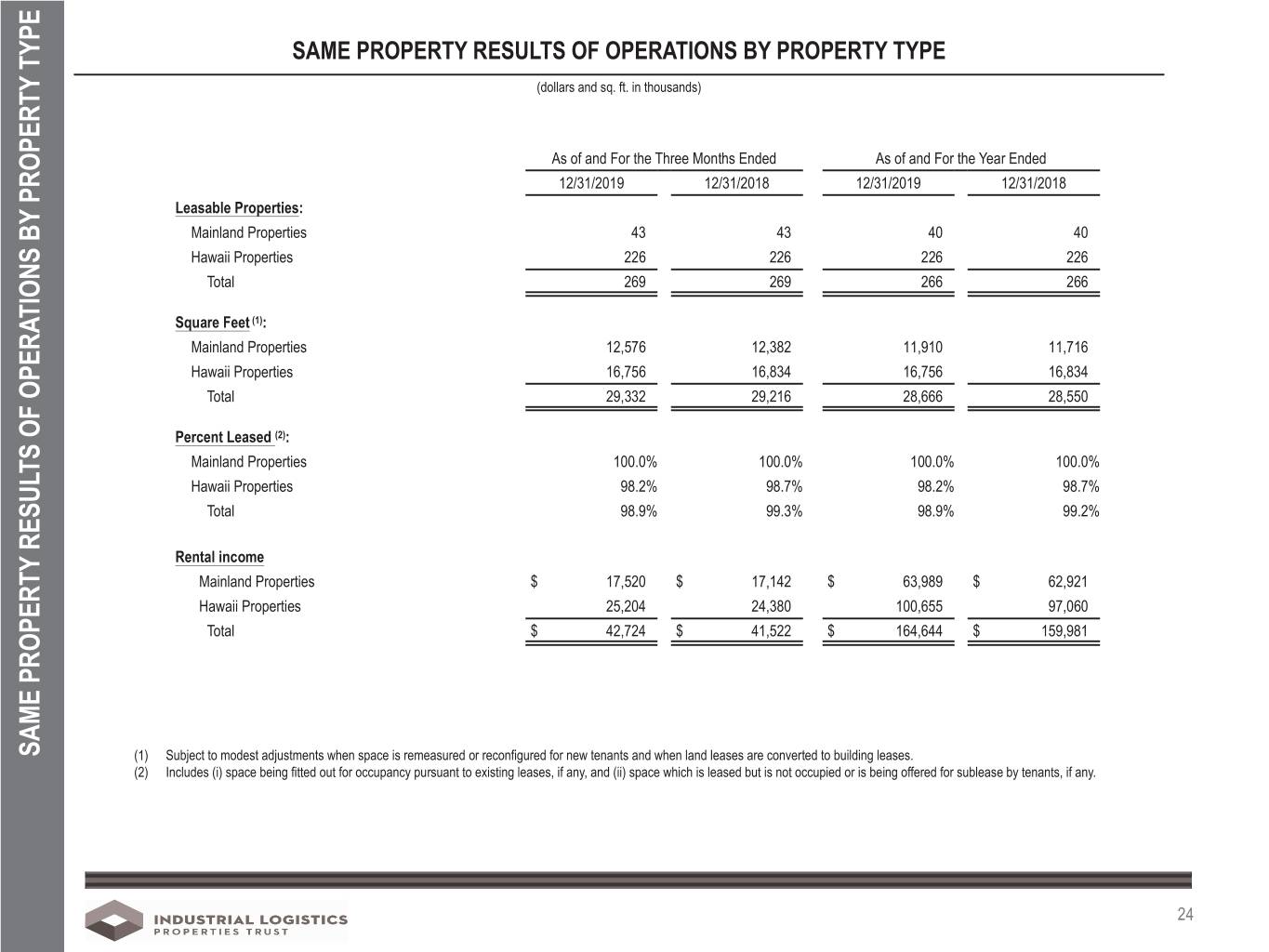

SAME PROPERTY RESULTS OF OPERATIONS BY PROPERTY TYPE (dollars and sq. ft. in thousands) As of and For the Three Months Ended As of and For the Year Ended 12/31/2019 12/31/2018 12/31/2019 12/31/2018 Leasable Properties: Mainland Properties 43 43 40 40 Hawaii Properties 226 226 226 226 Total 269 269 266 266 Square Feet (1): Mainland Properties 12,576 12,382 11,910 11,716 Hawaii Properties 16,756 16,834 16,756 16,834 Total 29,332 29,216 28,666 28,550 Percent Leased (2): Mainland Properties 100.0% 100.0% 100.0% 100.0% Hawaii Properties 98.2% 98.7% 98.2% 98.7% Total 98.9% 99.3% 98.9% 99.2% Rental income Mainland Properties $ 17,520 $ 17,142 $ 63,989 $ 62,921 Hawaii Properties 25,204 24,380 100,655 97,060 Total $ 42,724 $ 41,522 $ 164,644 $ 159,981 (1) Subject to modest adjustments when space is remeasured or reconfigured for new tenants and when land leases are converted to building leases. SAME PROPERTY RESULTS OF OPERATIONS BY PROPERTY TYPE PROPERTY BY OF OPERATIONS RESULTS SAME PROPERTY (2) Includes (i) space being fitted out for occupancy pursuant to existing leases, if any, and (ii) space which is leased but is not occupied or is being offered for sublease by tenants, if any. 24

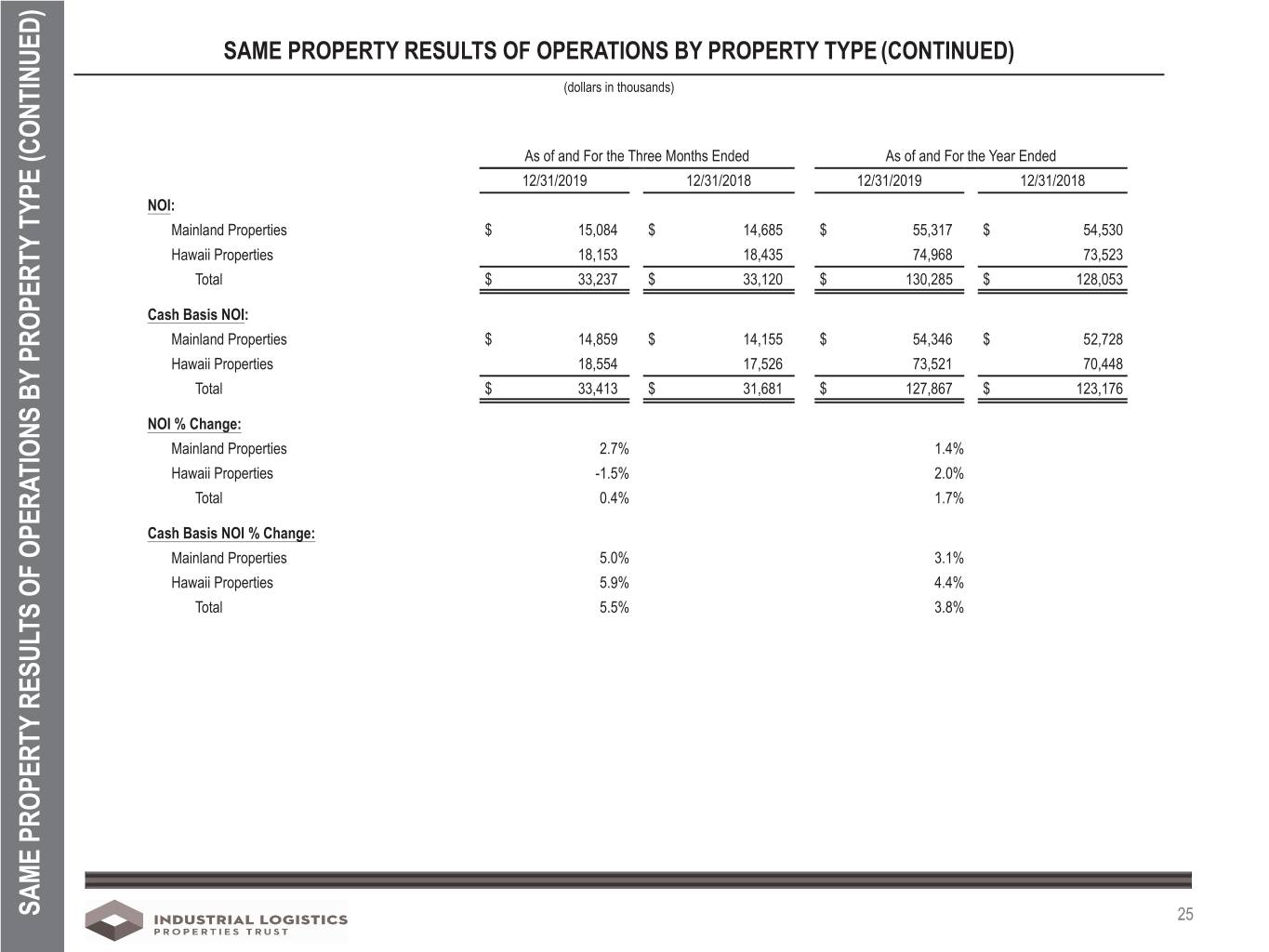

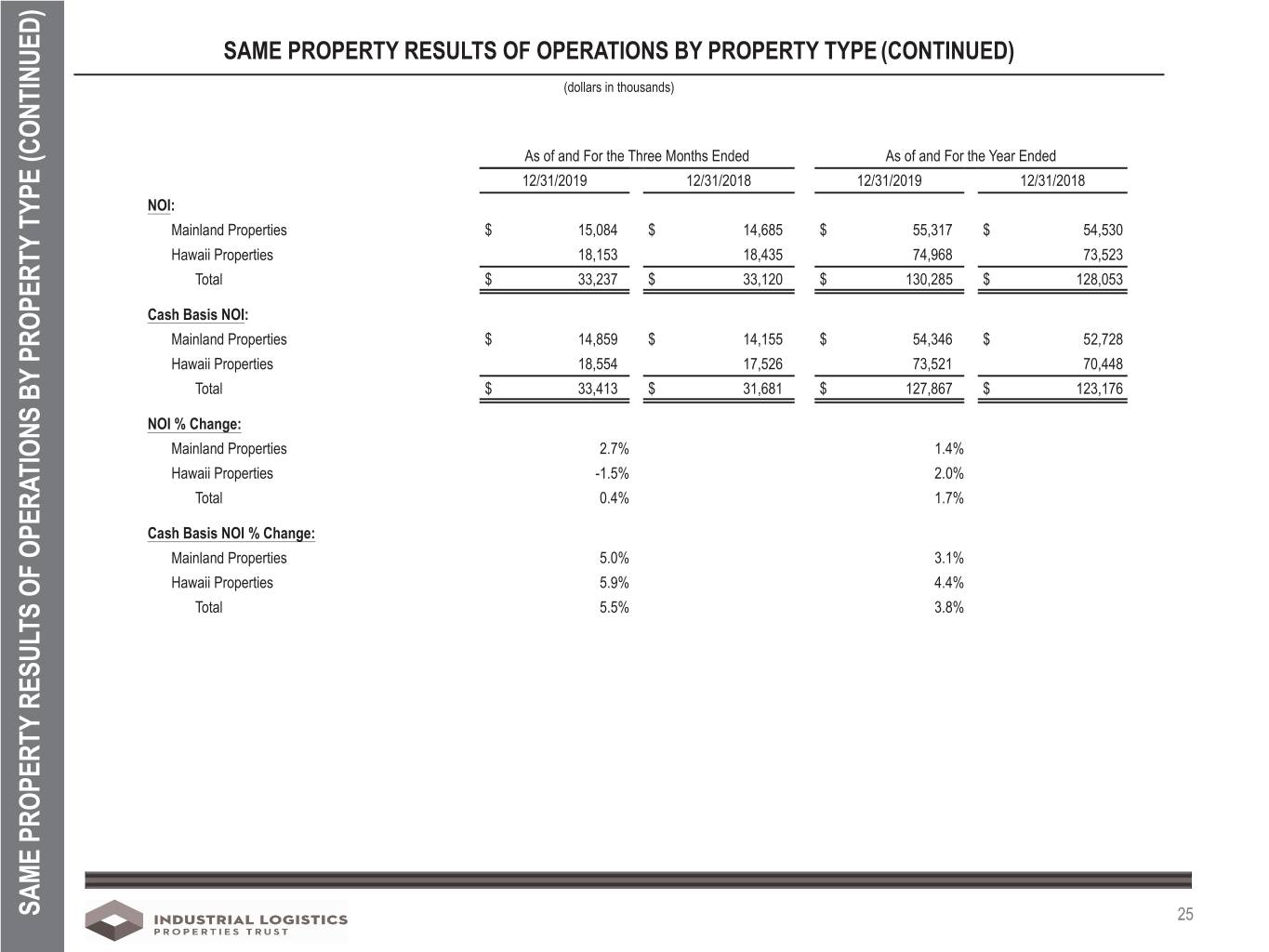

SAME PROPERTY RESULTS OF OPERATIONS BY PROPERTY TYPE (CONTINUED) (dollars in thousands) As of and For the Three Months Ended As of and For the Year Ended 12/31/2019 12/31/2018 12/31/2019 12/31/2018 NOI: Mainland Properties $ 15,084 $ 14,685 $ 55,317 $ 54,530 Hawaii Properties 18,153 18,435 74,968 73,523 Total $ 33,237 $ 33,120 $ 130,285 $ 128,053 Cash Basis NOI: Mainland Properties $ 14,859 $ 14,155 $ 54,346 $ 52,728 Hawaii Properties 18,554 17,526 73,521 70,448 Total $ 33,413 $ 31,681 $ 127,867 $ 123,176 NOI % Change: Mainland Properties 2.7% 1.4% Hawaii Properties -1.5% 2.0% Total 0.4% 1.7% Cash Basis NOI % Change: Mainland Properties 5.0% 3.1% Hawaii Properties 5.9% 4.4% Total 5.5% 3.8% SAME PROPERTY RESULTS OF OPERATIONS BY PROPERTY TYPE (CONTINUED) PROPERTY BY OF OPERATIONS RESULTS SAME PROPERTY 25

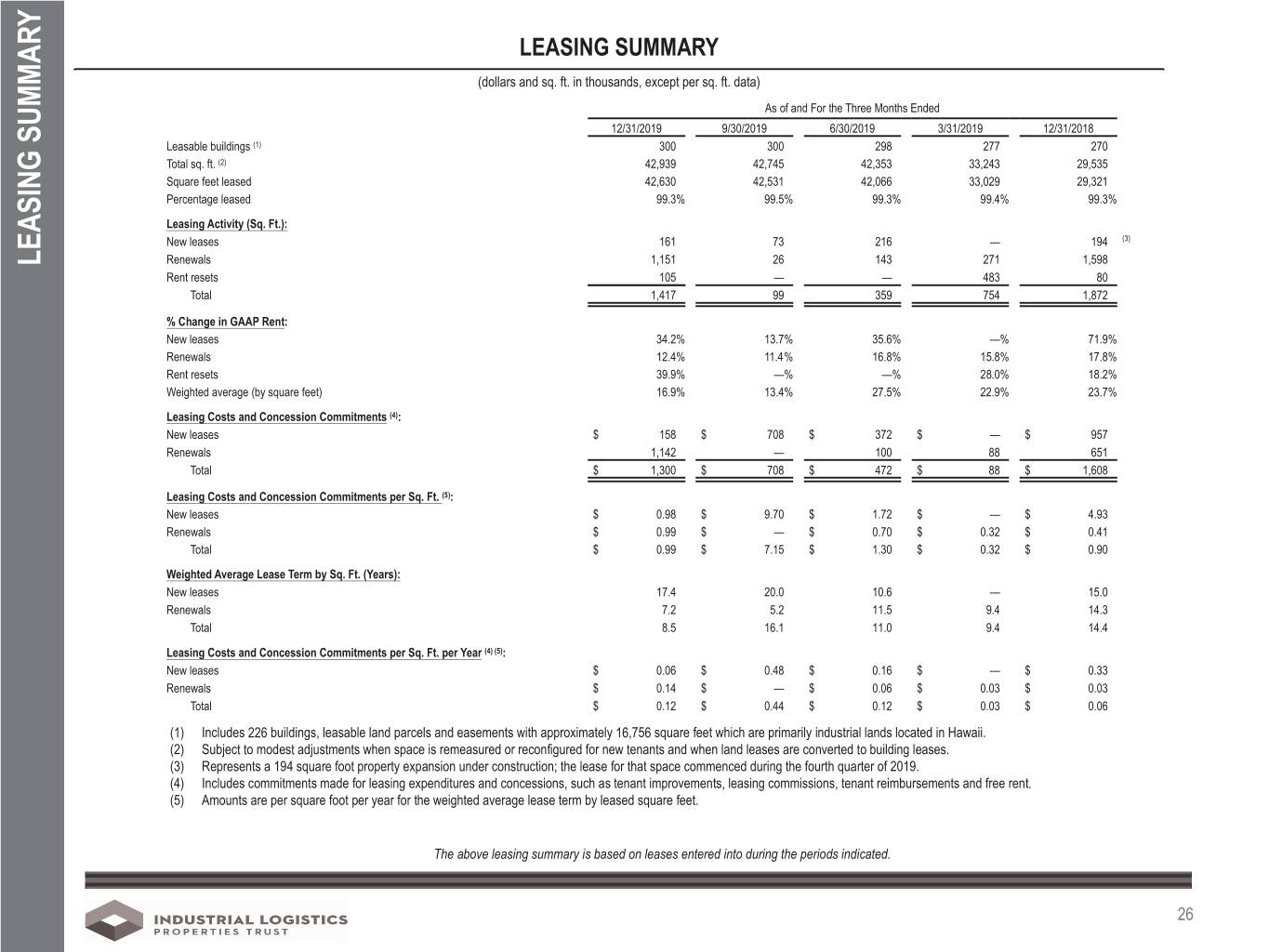

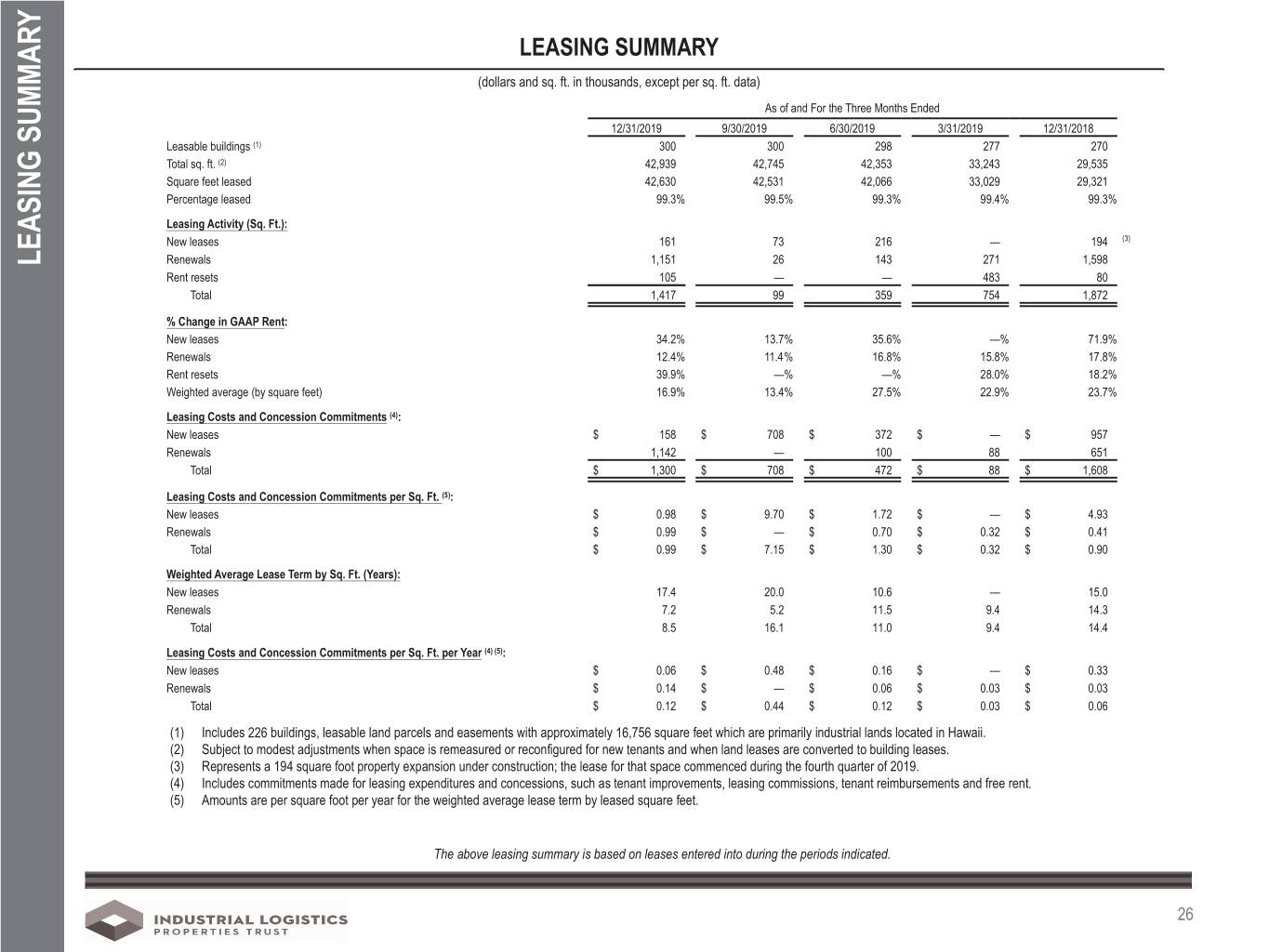

LEASING SUMMARY (dollars and sq. ft. in thousands, except per sq. ft. data) As of and For the Three Months Ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Leasable buildings (1) 300 300 298 277 270 Total sq. ft. (2) 42,939 42,745 42,353 33,243 29,535 Square feet leased 42,630 42,531 42,066 33,029 29,321 Percentage leased 99.3% 99.5% 99.3% 99.4% 99.3% Leasing Activity (Sq. Ft.): New leases 161 73 216 — 194 (3) LEASING SUMMARY Renewals 1,151 26 143 271 1,598 Rent resets 105 — — 483 80 Total 1,417 99 359 754 1,872 % Change in GAAP Rent: New leases 34.2% 13.7% 35.6% —% 71.9% Renewals 12.4% 11.4% 16.8% 15.8% 17.8% Rent resets 39.9% —% —% 28.0% 18.2% Weighted average (by square feet) 16.9% 13.4% 27.5% 22.9% 23.7% Leasing Costs and Concession Commitments (4): New leases $ 158 $ 708 $ 372 $ — $ 957 Renewals 1,142 — 100 88 651 Total $ 1,300 $ 708 $ 472 $ 88 $ 1,608 Leasing Costs and Concession Commitments per Sq. Ft. (5): New leases $ 0.98 $ 9.70 $ 1.72 $ — $ 4.93 Renewals $ 0.99 $ — $ 0.70 $ 0.32 $ 0.41 Total $ 0.99 $ 7.15 $ 1.30 $ 0.32 $ 0.90 Weighted Average Lease Term by Sq. Ft. (Years): New leases 17.4 20.0 10.6 — 15.0 Renewals 7.2 5.2 11.5 9.4 14.3 Total 8.5 16.1 11.0 9.4 14.4 Leasing Costs and Concession Commitments per Sq. Ft. per Year (4) (5): New leases $ 0.06 $ 0.48 $ 0.16 $ — $ 0.33 Renewals $ 0.14 $ — $ 0.06 $ 0.03 $ 0.03 Total $ 0.12 $ 0.44 $ 0.12 $ 0.03 $ 0.06 (1) Includes 226 buildings, leasable land parcels and easements with approximately 16,756 square feet which are primarily industrial lands located in Hawaii. (2) Subject to modest adjustments when space is remeasured or reconfigured for new tenants and when land leases are converted to building leases. (3) Represents a 194 square foot property expansion under construction; the lease for that space commenced during the fourth quarter of 2019. (4) Includes commitments made for leasing expenditures and concessions, such as tenant improvements, leasing commissions, tenant reimbursements and free rent. (5) Amounts are per square foot per year for the weighted average lease term by leased square feet. The above leasing summary is based on leases entered into during the periods indicated. 26

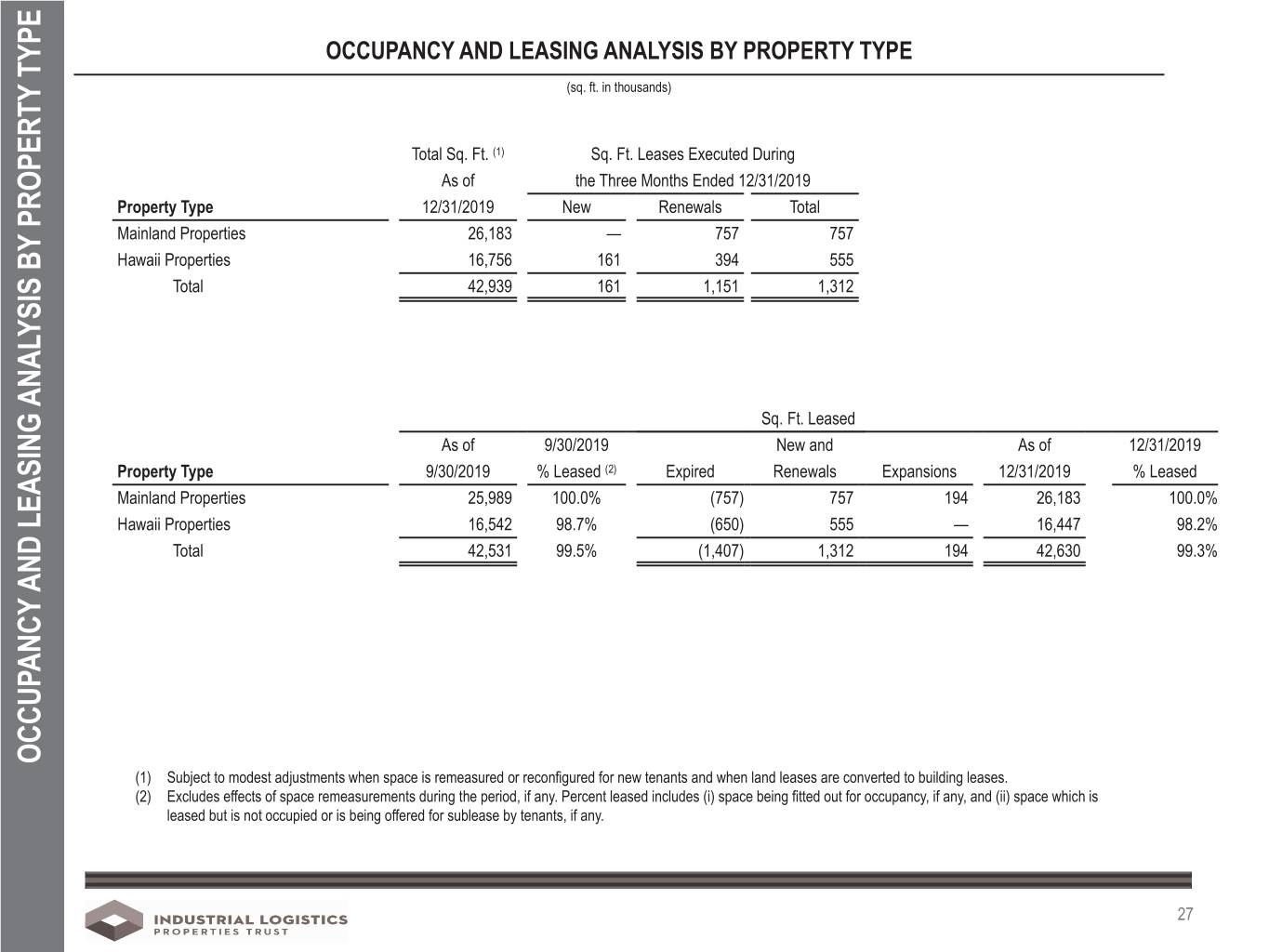

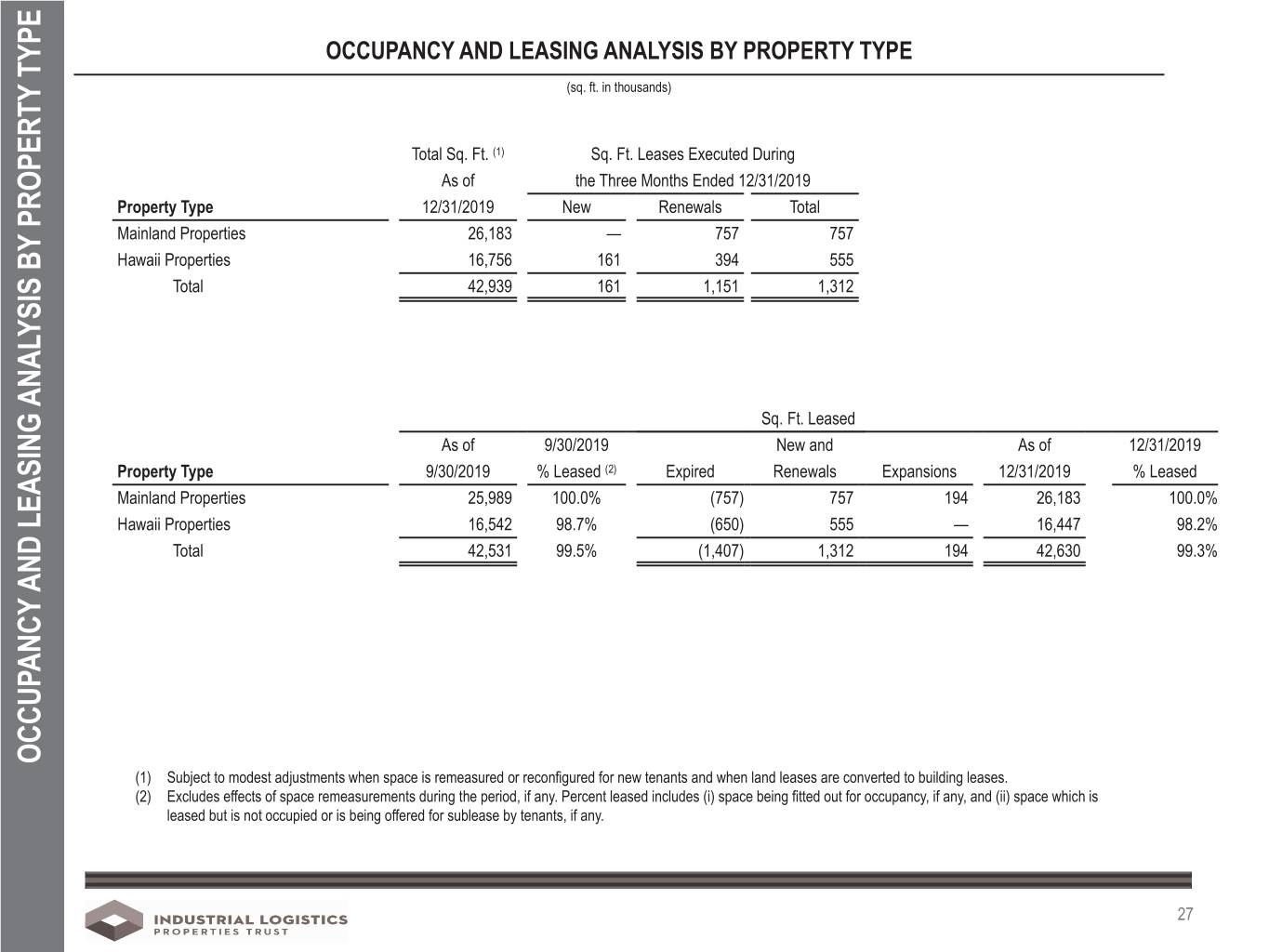

OCCUPANCY AND LEASING ANALYSIS BY PROPERTY TYPE (sq. ft. in thousands) Total Sq. Ft. (1) Sq. Ft. Leases Executed During As of the Three Months Ended 12/31/2019 Property Type 12/31/2019 New Renewals Total Mainland Properties 26,183 — 757 757 Hawaii Properties 16,756 161 394 555 Total 42,939 161 1,151 1,312 Sq. Ft. Leased As of 9/30/2019 New and As of 12/31/2019 Property Type 9/30/2019 % Leased (2) Expired Renewals Expansions 12/31/2019 % Leased Mainland Properties 25,989 100.0% (757) 757 194 26,183 100.0% Hawaii Properties 16,542 98.7% (650) 555 — 16,447 98.2% Total 42,531 99.5% (1,407) 1,312 194 42,630 99.3% OCCUPANCY AND LEASING ANALYSIS BY PROPERTY TYPE PROPERTY BY ANALYSIS AND LEASING OCCUPANCY (1) Subject to modest adjustments when space is remeasured or reconfigured for new tenants and when land leases are converted to building leases. (2) Excludes effects of space remeasurements during the period, if any. Percent leased includes (i) space being fitted out for occupancy, if any, and (ii) space which is leased but is not occupied or is being offered for sublease by tenants, if any. 27

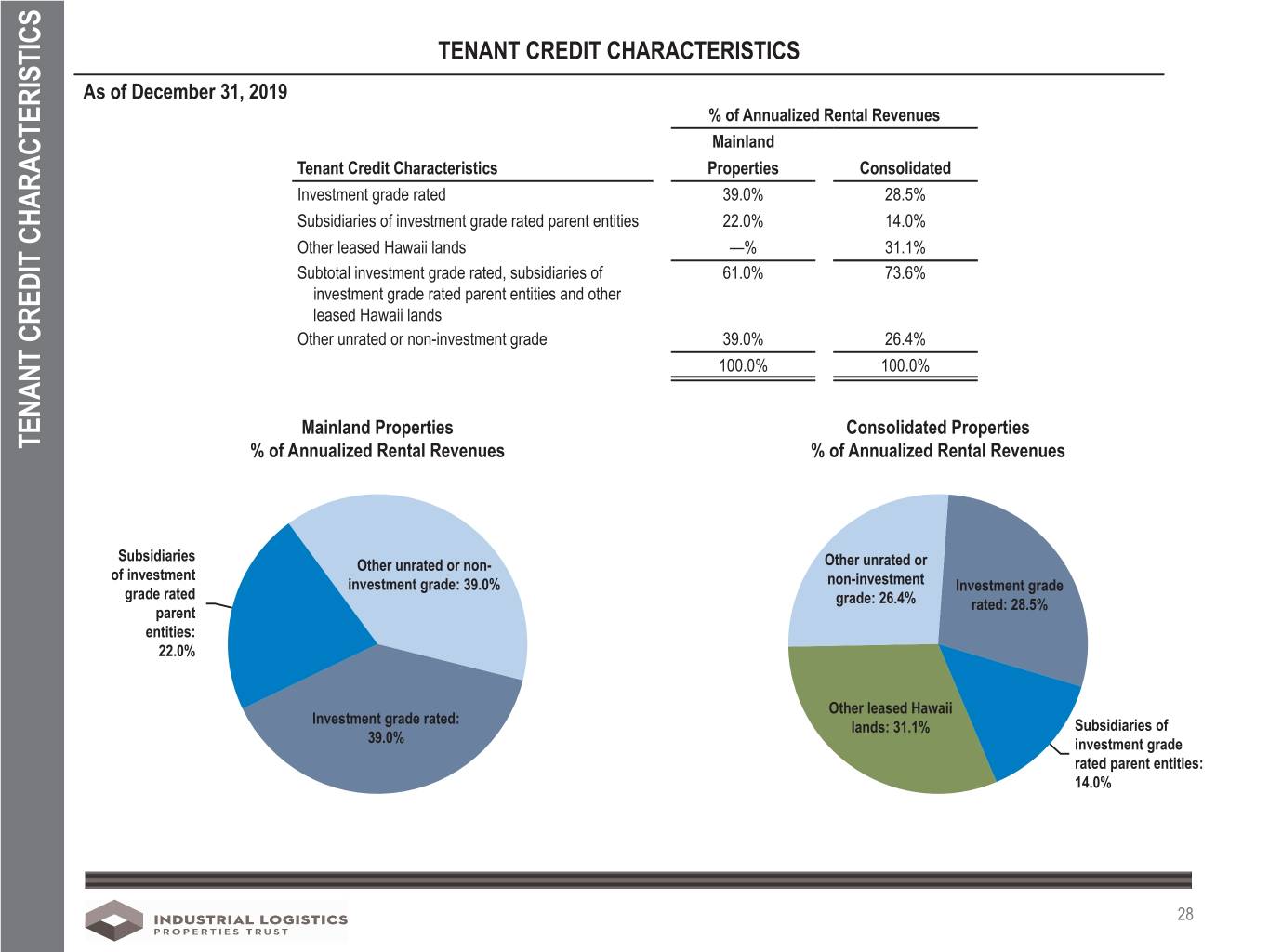

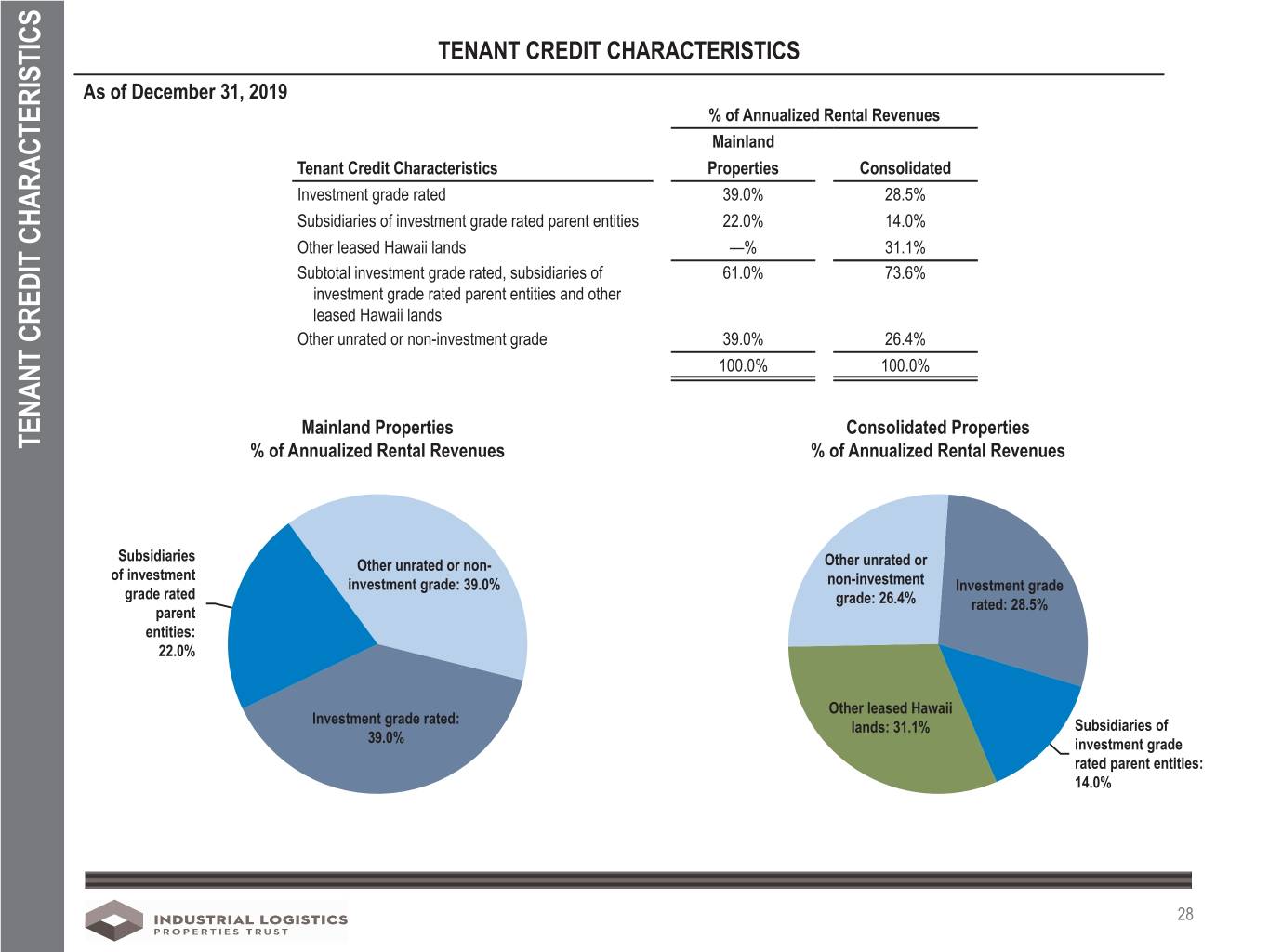

TENANT CREDIT CHARACTERISTICS As of December 31, 2019 % of Annualized Rental Revenues Mainland Tenant Credit Characteristics Properties Consolidated Investment grade rated 39.0% 28.5% Subsidiaries of investment grade rated parent entities 22.0% 14.0% Other leased Hawaii lands —% 31.1% Subtotal investment grade rated, subsidiaries of 61.0% 73.6% investment grade rated parent entities and other leased Hawaii lands Other unrated or non-investment grade 39.0% 26.4% 100.0% 100.0% Mainland Properties Consolidated Properties TENANT CREDIT CHARACTERISTICS % of Annualized Rental Revenues % of Annualized Rental Revenues Subsidiaries Other unrated or non- Other unrated or of investment investment grade: 39.0% non-investment Investment grade grade rated grade: 26.4% rated: 28.5% parent entities: 22.0% Other leased Hawaii Investment grade rated: lands: 31.1% Subsidiaries of 39.0% investment grade rated parent entities: 14.0% 28

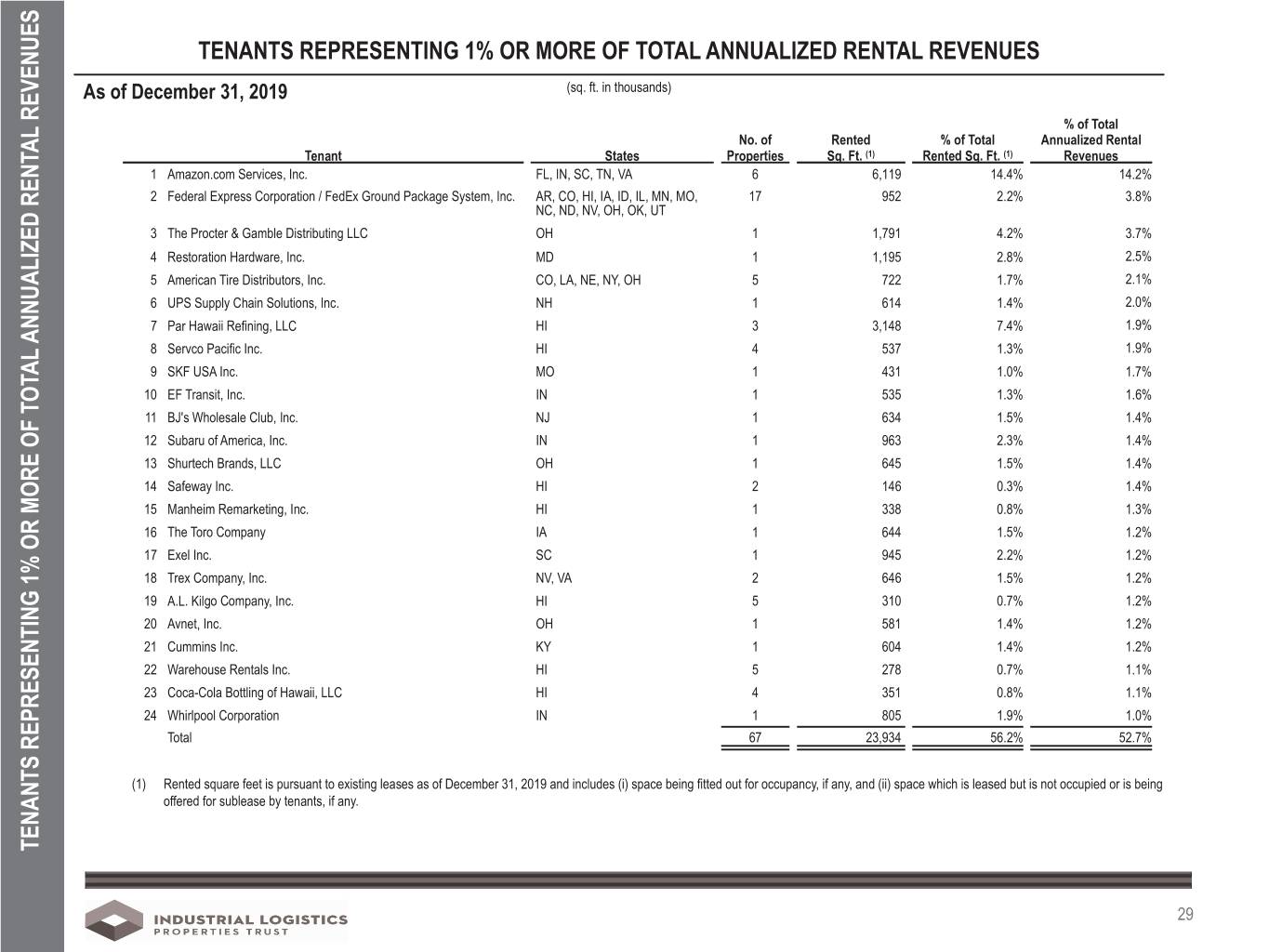

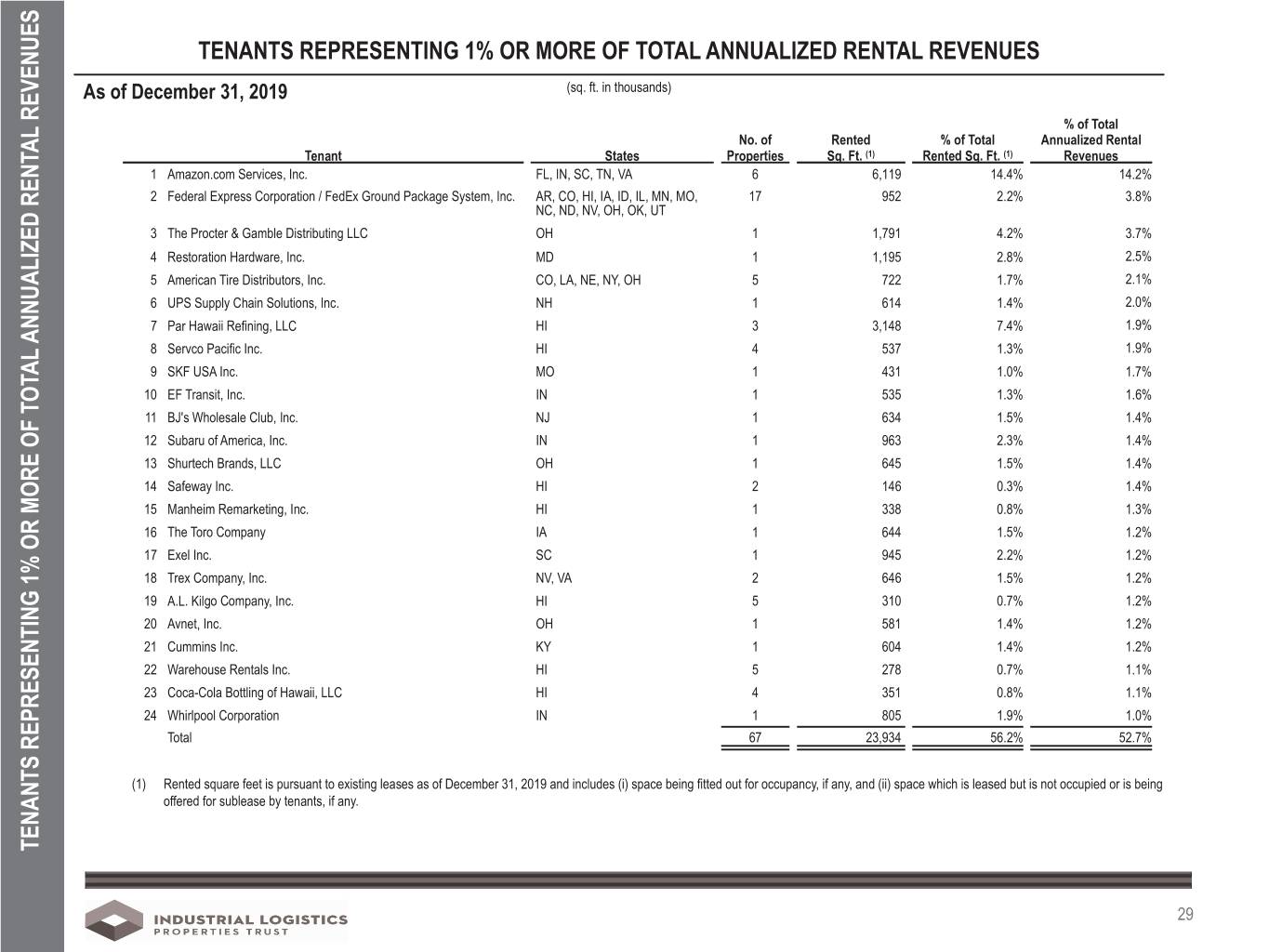

TENANTS REPRESENTING 1% OR MORE OF TOTAL ANNUALIZED RENTAL REVENUES As of December 31, 2019 (sq. ft. in thousands) % of Total No. of Rented % of Total Annualized Rental Tenant States Properties Sq. Ft. (1) Rented Sq. Ft. (1) Revenues 1 Amazon.com Services, Inc. FL, IN, SC, TN, VA 6 6,119 14.4% 14.2% 2 Federal Express Corporation / FedEx Ground Package System, Inc. AR, CO, HI, IA, ID, IL, MN, MO, 17 952 2.2% 3.8% NC, ND, NV, OH, OK, UT 3 The Procter & Gamble Distributing LLC OH 1 1,791 4.2% 3.7% 4 Restoration Hardware, Inc. MD 1 1,195 2.8% 2.5% 5 American Tire Distributors, Inc. CO, LA, NE, NY, OH 5 722 1.7% 2.1% 6 UPS Supply Chain Solutions, Inc. NH 1 614 1.4% 2.0% 7 Par Hawaii Refining, LLC HI 3 3,148 7.4% 1.9% 8 Servco Pacific Inc. HI 4 537 1.3% 1.9% 9 SKF USA Inc. MO 1 431 1.0% 1.7% 10 EF Transit, Inc. IN 1 535 1.3% 1.6% 11 BJ's Wholesale Club, Inc. NJ 1 634 1.5% 1.4% 12 Subaru of America, Inc. IN 1 963 2.3% 1.4% 13 Shurtech Brands, LLC OH 1 645 1.5% 1.4% 14 Safeway Inc. HI 2 146 0.3% 1.4% 15 Manheim Remarketing, Inc. HI 1 338 0.8% 1.3% 16 The Toro Company IA 1 644 1.5% 1.2% 17 Exel Inc. SC 1 945 2.2% 1.2% 18 Trex Company, Inc. NV, VA 2 646 1.5% 1.2% 19 A.L. Kilgo Company, Inc. HI 5 310 0.7% 1.2% 20 Avnet, Inc. OH 1 581 1.4% 1.2% 21 Cummins Inc. KY 1 604 1.4% 1.2% 22 Warehouse Rentals Inc. HI 5 278 0.7% 1.1% 23 Coca-Cola Bottling of Hawaii, LLC HI 4 351 0.8% 1.1% 24 Whirlpool Corporation IN 1 805 1.9% 1.0% Total 67 23,934 56.2% 52.7% (1) Rented square feet is pursuant to existing leases as of December 31, 2019 and includes (i) space being fitted out for occupancy, if any, and (ii) space which is leased but is not occupied or is being offered for sublease by tenants, if any. TENANTS REPRESENTING 1% OR MORE OF TOTAL ANNUALIZED RENTAL REVENUES ANNUALIZED RENTAL TENANTS REPRESENTING 1% OR MORE OF TOTAL 29

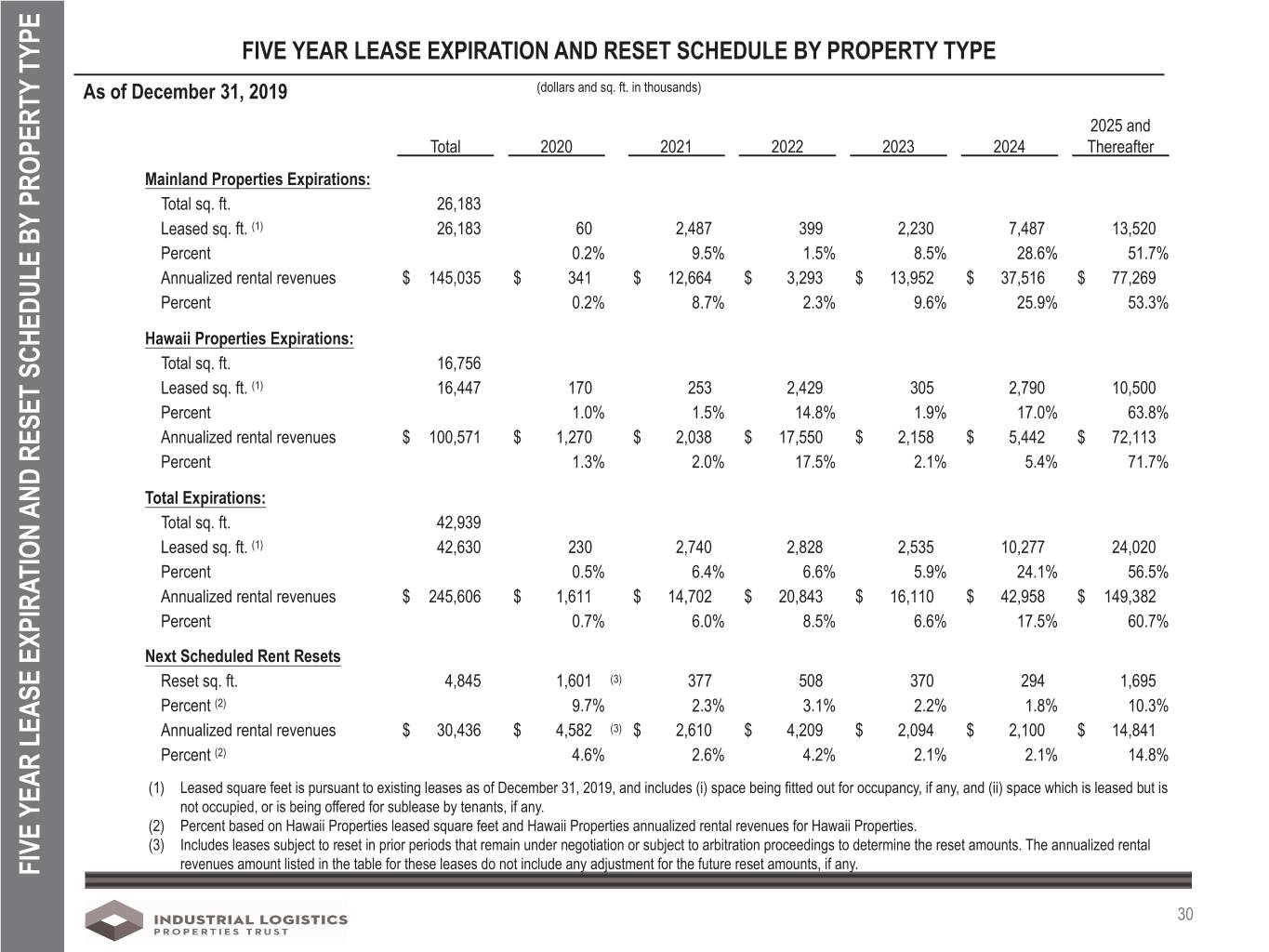

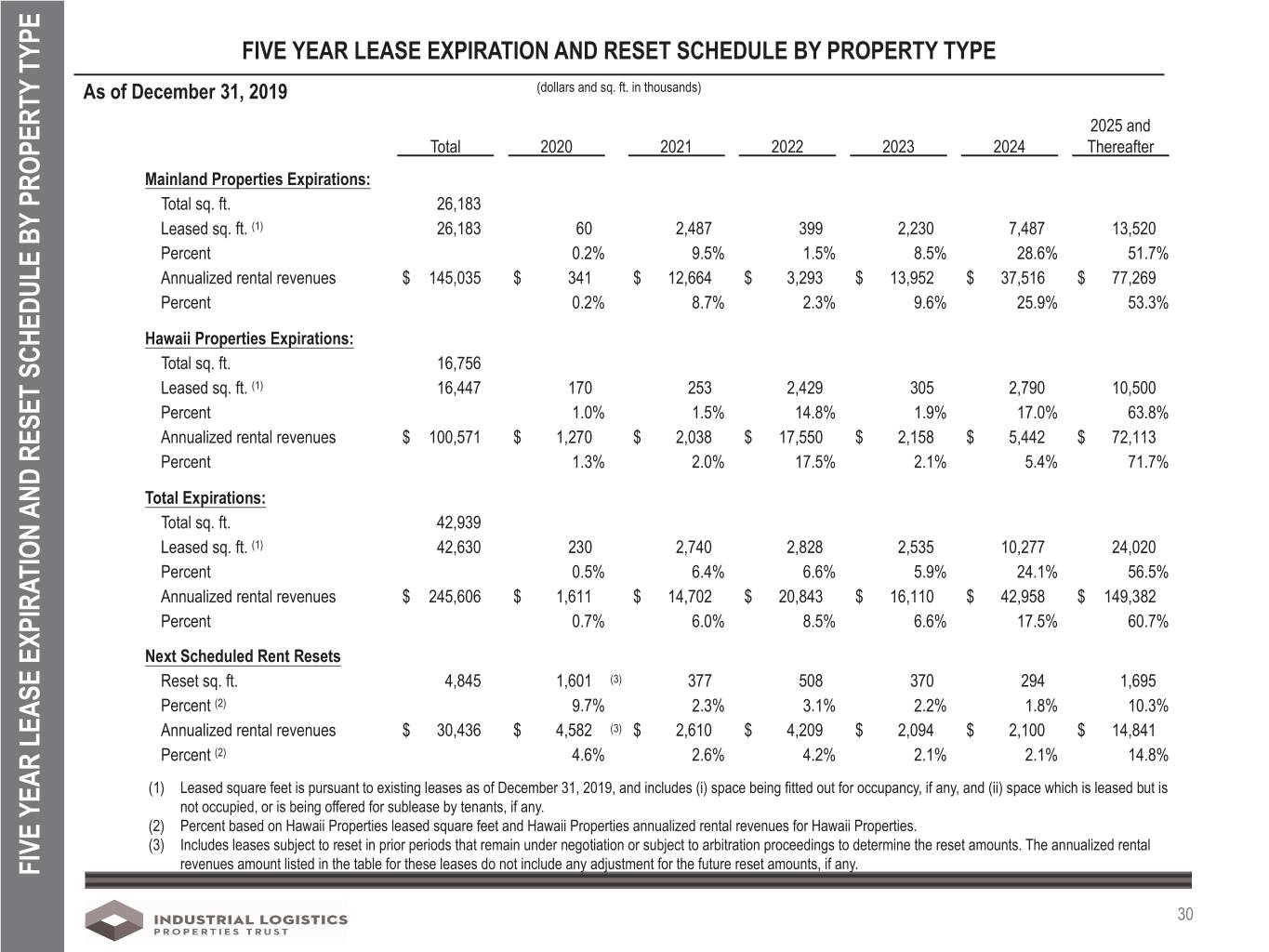

FIVE YEAR LEASE EXPIRATION AND RESET SCHEDULE BY PROPERTY TYPE As of December 31, 2019 (dollars and sq. ft. in thousands) 2025 and Total 2020 2021 2022 2023 2024 Thereafter Mainland Properties Expirations: Total sq. ft. 26,183 Leased sq. ft. (1) 26,183 60 2,487 399 2,230 7,487 13,520 Percent 0.2% 9.5% 1.5% 8.5% 28.6% 51.7% Annualized rental revenues $ 145,035 $ 341 $ 12,664 $ 3,293 $ 13,952 $ 37,516 $ 77,269 Percent 0.2% 8.7% 2.3% 9.6% 25.9% 53.3% Hawaii Properties Expirations: Total sq. ft. 16,756 Leased sq. ft. (1) 16,447 170 253 2,429 305 2,790 10,500 Percent 1.0% 1.5% 14.8% 1.9% 17.0% 63.8% Annualized rental revenues $ 100,571 $ 1,270 $ 2,038 $ 17,550 $ 2,158 $ 5,442 $ 72,113 Percent 1.3% 2.0% 17.5% 2.1% 5.4% 71.7% Total Expirations: Total sq. ft. 42,939 Leased sq. ft. (1) 42,630 230 2,740 2,828 2,535 10,277 24,020 Percent 0.5% 6.4% 6.6% 5.9% 24.1% 56.5% Annualized rental revenues $ 245,606 $ 1,611 $ 14,702 $ 20,843 $ 16,110 $ 42,958 $ 149,382 Percent 0.7% 6.0% 8.5% 6.6% 17.5% 60.7% Next Scheduled Rent Resets Reset sq. ft. 4,845 1,601 (3) 377 508 370 294 1,695 Percent (2) 9.7% 2.3% 3.1% 2.2% 1.8% 10.3% Annualized rental revenues $ 30,436 $ 4,582 (3) $ 2,610 $ 4,209 $ 2,094 $ 2,100 $ 14,841 Percent (2) 4.6% 2.6% 4.2% 2.1% 2.1% 14.8% (1) Leased square feet is pursuant to existing leases as of December 31, 2019, and includes (i) space being fitted out for occupancy, if any, and (ii) space which is leased but is not occupied, or is being offered for sublease by tenants, if any. (2) Percent based on Hawaii Properties leased square feet and Hawaii Properties annualized rental revenues for Hawaii Properties. (3) Includes leases subject to reset in prior periods that remain under negotiation or subject to arbitration proceedings to determine the reset amounts. The annualized rental revenues amount listed in the table for these leases do not include any adjustment for the future reset amounts, if any. FIVE YEAR LEASE EXPIRATION AND RESET SCHEDULE BY PROPERTY TYPE PROPERTY AND RESET SCHEDULE BY YEAR LEASE EXPIRATION FIVE 30

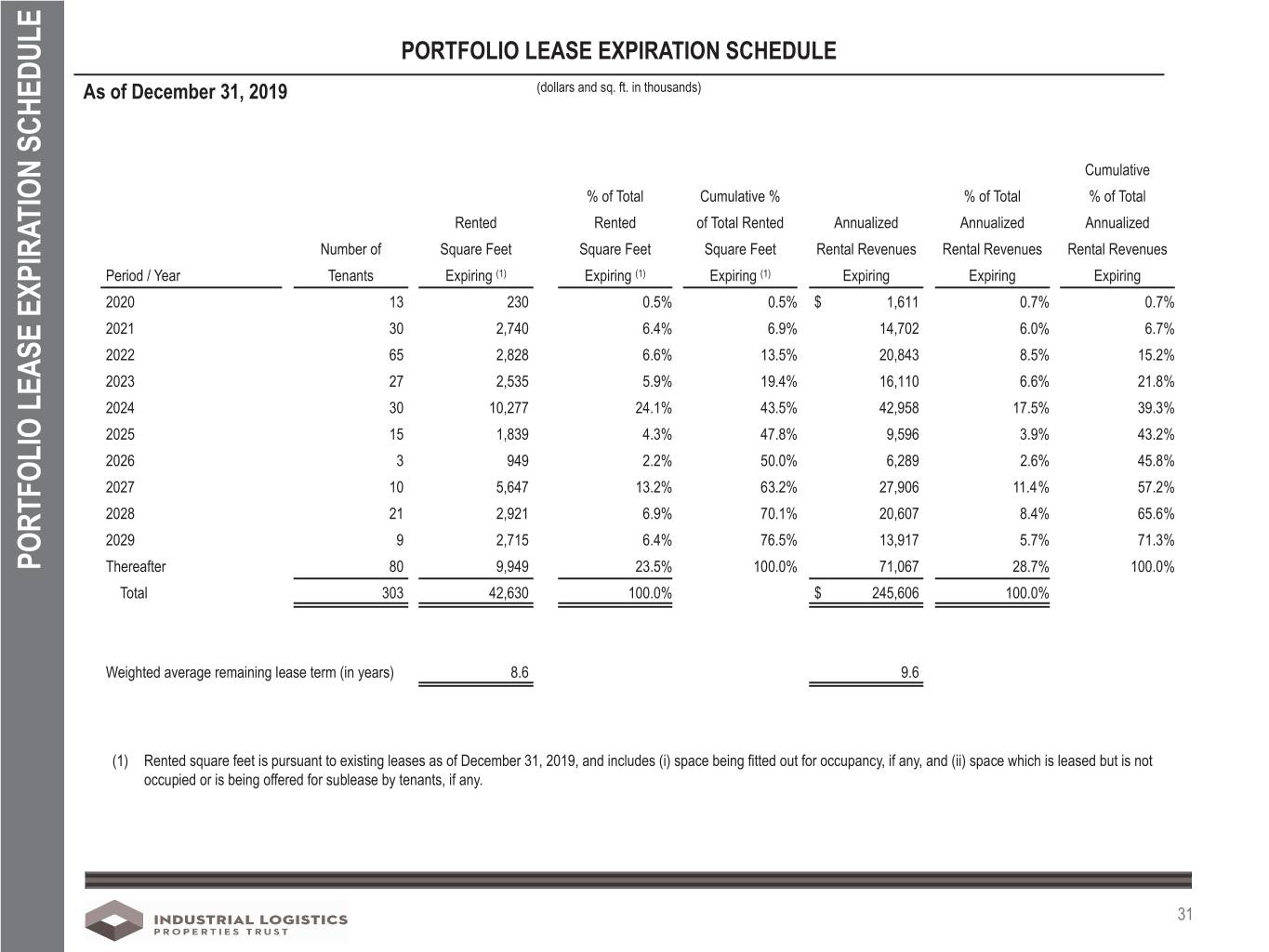

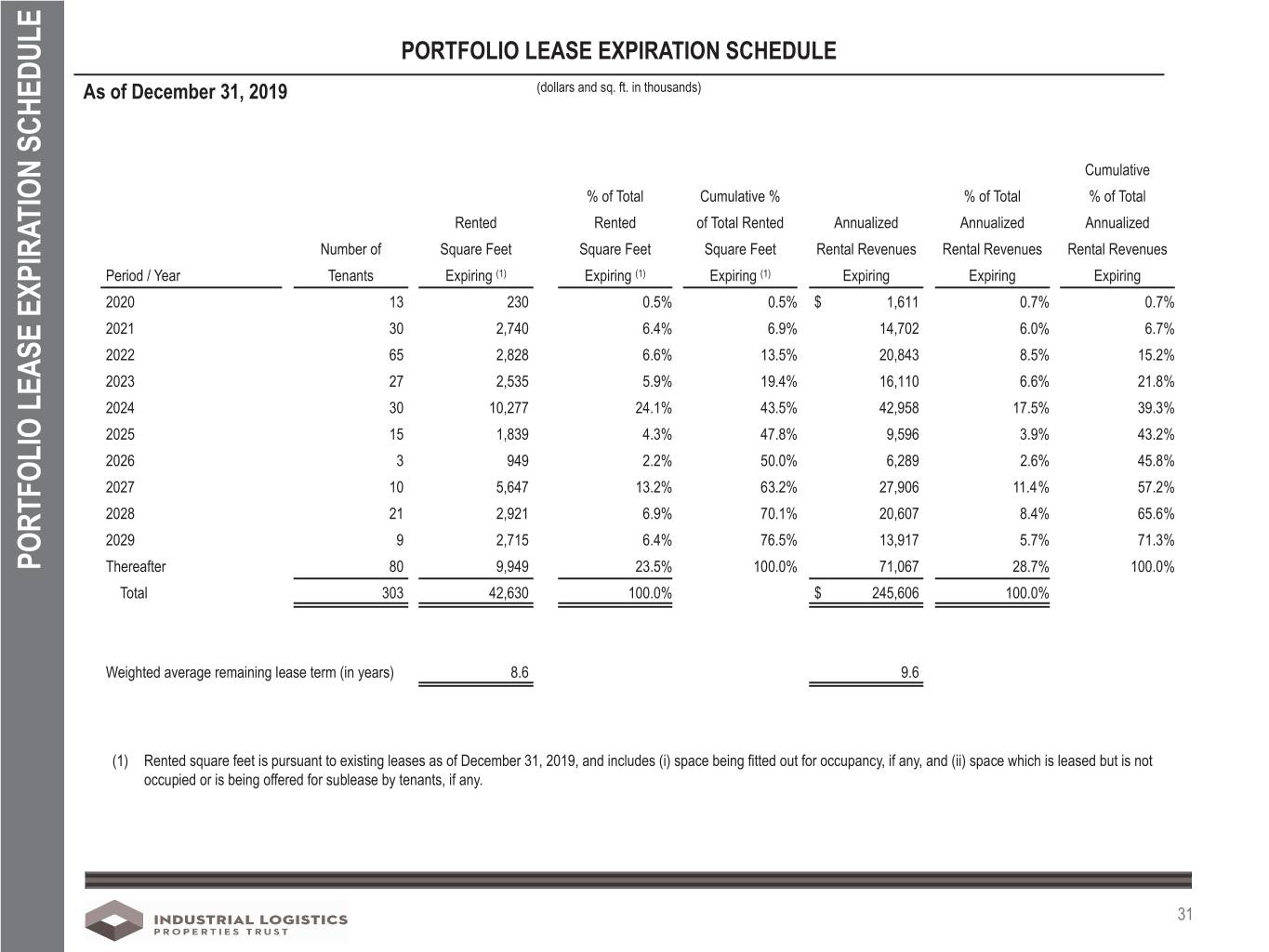

PORTFOLIO LEASE EXPIRATION SCHEDULE As of December 31, 2019 (dollars and sq. ft. in thousands) Cumulative % of Total Cumulative % % of Total % of Total Rented Rented of Total Rented Annualized Annualized Annualized Number of Square Feet Square Feet Square Feet Rental Revenues Rental Revenues Rental Revenues Period / Year Tenants Expiring (1) Expiring (1) Expiring (1) Expiring Expiring Expiring 2020 13 230 0.5% 0.5% $ 1,611 0.7% 0.7% 2021 30 2,740 6.4% 6.9% 14,702 6.0% 6.7% 2022 65 2,828 6.6% 13.5% 20,843 8.5% 15.2% 2023 27 2,535 5.9% 19.4% 16,110 6.6% 21.8% 2024 30 10,277 24.1% 43.5% 42,958 17.5% 39.3% 2025 15 1,839 4.3% 47.8% 9,596 3.9% 43.2% 2026 3 949 2.2% 50.0% 6,289 2.6% 45.8% 2027 10 5,647 13.2% 63.2% 27,906 11.4% 57.2% 2028 21 2,921 6.9% 70.1% 20,607 8.4% 65.6% 2029 9 2,715 6.4% 76.5% 13,917 5.7% 71.3% PORTFOLIO LEASE EXPIRATION SCHEDULE PORTFOLIO LEASE EXPIRATION Thereafter 80 9,949 23.5% 100.0% 71,067 28.7% 100.0% Total 303 42,630 100.0% $ 245,606 100.0% Weighted average remaining lease term (in years) 8.6 9.6 (1) Rented square feet is pursuant to existing leases as of December 31, 2019, and includes (i) space being fitted out for occupancy, if any, and (ii) space which is leased but is not occupied or is being offered for sublease by tenants, if any. 31

945 Monument Drive, Lebanon, IN Square Feet: 962,500 Tenant: Subaru of America, Inc. EXHIBIT A 32

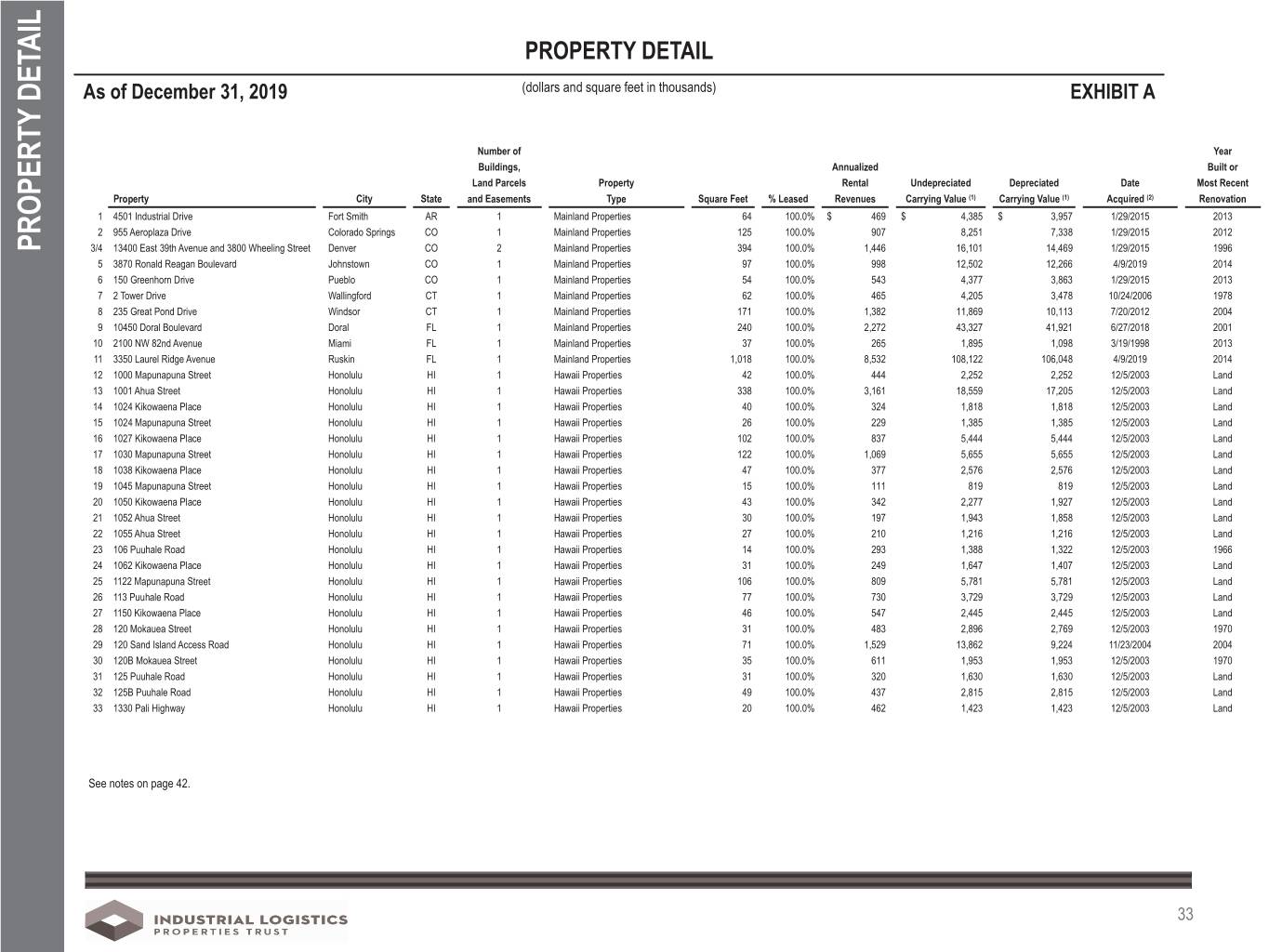

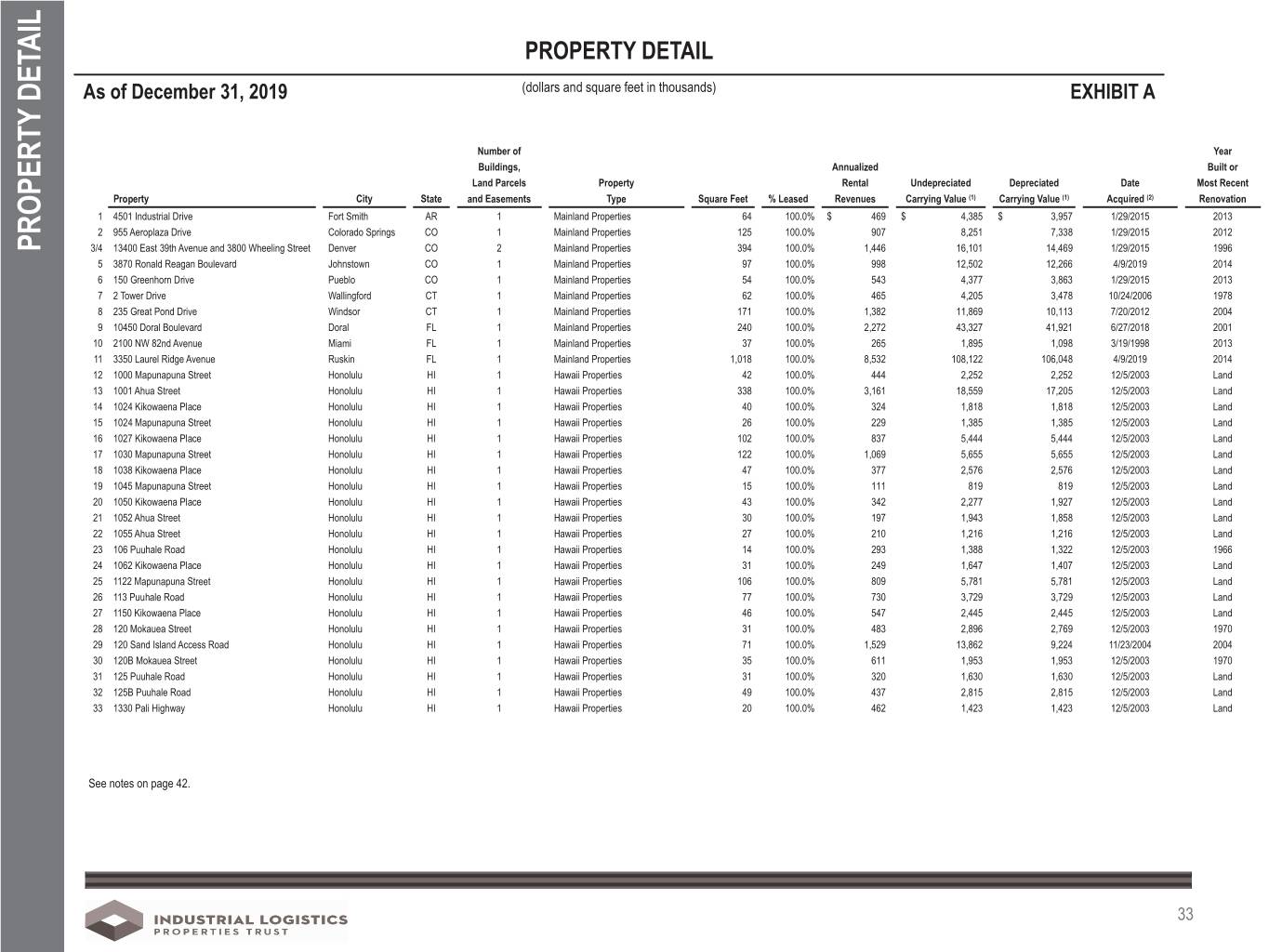

PROPERTY DETAIL As of December 31, 2019 (dollars and square feet in thousands) EXHIBIT A Number of Year Buildings, Annualized Built or Land Parcels Property Rental Undepreciated Depreciated Date Most Recent Property City State and Easements Type Square Feet % Leased Revenues Carrying Value (1) Carrying Value (1) Acquired (2) Renovation 1 4501 Industrial Drive Fort Smith AR 1 Mainland Properties 64 100.0% $ 469 $ 4,385 $ 3,957 1/29/2015 2013 2 955 Aeroplaza Drive Colorado Springs CO 1 Mainland Properties 125 100.0% 907 8,251 7,338 1/29/2015 2012 PROPERTY DETAIL PROPERTY 3/4 13400 East 39th Avenue and 3800 Wheeling Street Denver CO 2 Mainland Properties 394 100.0% 1,446 16,101 14,469 1/29/2015 1996 5 3870 Ronald Reagan Boulevard Johnstown CO 1 Mainland Properties 97 100.0% 998 12,502 12,266 4/9/2019 2014 6 150 Greenhorn Drive Pueblo CO 1 Mainland Properties 54 100.0% 543 4,377 3,863 1/29/2015 2013 7 2 Tower Drive Wallingford CT 1 Mainland Properties 62 100.0% 465 4,205 3,478 10/24/2006 1978 8 235 Great Pond Drive Windsor CT 1 Mainland Properties 171 100.0% 1,382 11,869 10,113 7/20/2012 2004 9 10450 Doral Boulevard Doral FL 1 Mainland Properties 240 100.0% 2,272 43,327 41,921 6/27/2018 2001 10 2100 NW 82nd Avenue Miami FL 1 Mainland Properties 37 100.0% 265 1,895 1,098 3/19/1998 2013 11 3350 Laurel Ridge Avenue Ruskin FL 1 Mainland Properties 1,018 100.0% 8,532 108,122 106,048 4/9/2019 2014 12 1000 Mapunapuna Street Honolulu HI 1 Hawaii Properties 42 100.0% 444 2,252 2,252 12/5/2003 Land 13 1001 Ahua Street Honolulu HI 1 Hawaii Properties 338 100.0% 3,161 18,559 17,205 12/5/2003 Land 14 1024 Kikowaena Place Honolulu HI 1 Hawaii Properties 40 100.0% 324 1,818 1,818 12/5/2003 Land 15 1024 Mapunapuna Street Honolulu HI 1 Hawaii Properties 26 100.0% 229 1,385 1,385 12/5/2003 Land 16 1027 Kikowaena Place Honolulu HI 1 Hawaii Properties 102 100.0% 837 5,444 5,444 12/5/2003 Land 17 1030 Mapunapuna Street Honolulu HI 1 Hawaii Properties 122 100.0% 1,069 5,655 5,655 12/5/2003 Land 18 1038 Kikowaena Place Honolulu HI 1 Hawaii Properties 47 100.0% 377 2,576 2,576 12/5/2003 Land 19 1045 Mapunapuna Street Honolulu HI 1 Hawaii Properties 15 100.0% 111 819 819 12/5/2003 Land 20 1050 Kikowaena Place Honolulu HI 1 Hawaii Properties 43 100.0% 342 2,277 1,927 12/5/2003 Land 21 1052 Ahua Street Honolulu HI 1 Hawaii Properties 30 100.0% 197 1,943 1,858 12/5/2003 Land 22 1055 Ahua Street Honolulu HI 1 Hawaii Properties 27 100.0% 210 1,216 1,216 12/5/2003 Land 23 106 Puuhale Road Honolulu HI 1 Hawaii Properties 14 100.0% 293 1,388 1,322 12/5/2003 1966 24 1062 Kikowaena Place Honolulu HI 1 Hawaii Properties 31 100.0% 249 1,647 1,407 12/5/2003 Land 25 1122 Mapunapuna Street Honolulu HI 1 Hawaii Properties 106 100.0% 809 5,781 5,781 12/5/2003 Land 26 113 Puuhale Road Honolulu HI 1 Hawaii Properties 77 100.0% 730 3,729 3,729 12/5/2003 Land 27 1150 Kikowaena Place Honolulu HI 1 Hawaii Properties 46 100.0% 547 2,445 2,445 12/5/2003 Land 28 120 Mokauea Street Honolulu HI 1 Hawaii Properties 31 100.0% 483 2,896 2,769 12/5/2003 1970 29 120 Sand Island Access Road Honolulu HI 1 Hawaii Properties 71 100.0% 1,529 13,862 9,224 11/23/2004 2004 30 120B Mokauea Street Honolulu HI 1 Hawaii Properties 35 100.0% 611 1,953 1,953 12/5/2003 1970 31 125 Puuhale Road Honolulu HI 1 Hawaii Properties 31 100.0% 320 1,630 1,630 12/5/2003 Land 32 125B Puuhale Road Honolulu HI 1 Hawaii Properties 49 100.0% 437 2,815 2,815 12/5/2003 Land 33 1330 Pali Highway Honolulu HI 1 Hawaii Properties 20 100.0% 462 1,423 1,423 12/5/2003 Land See notes on page 42. 33

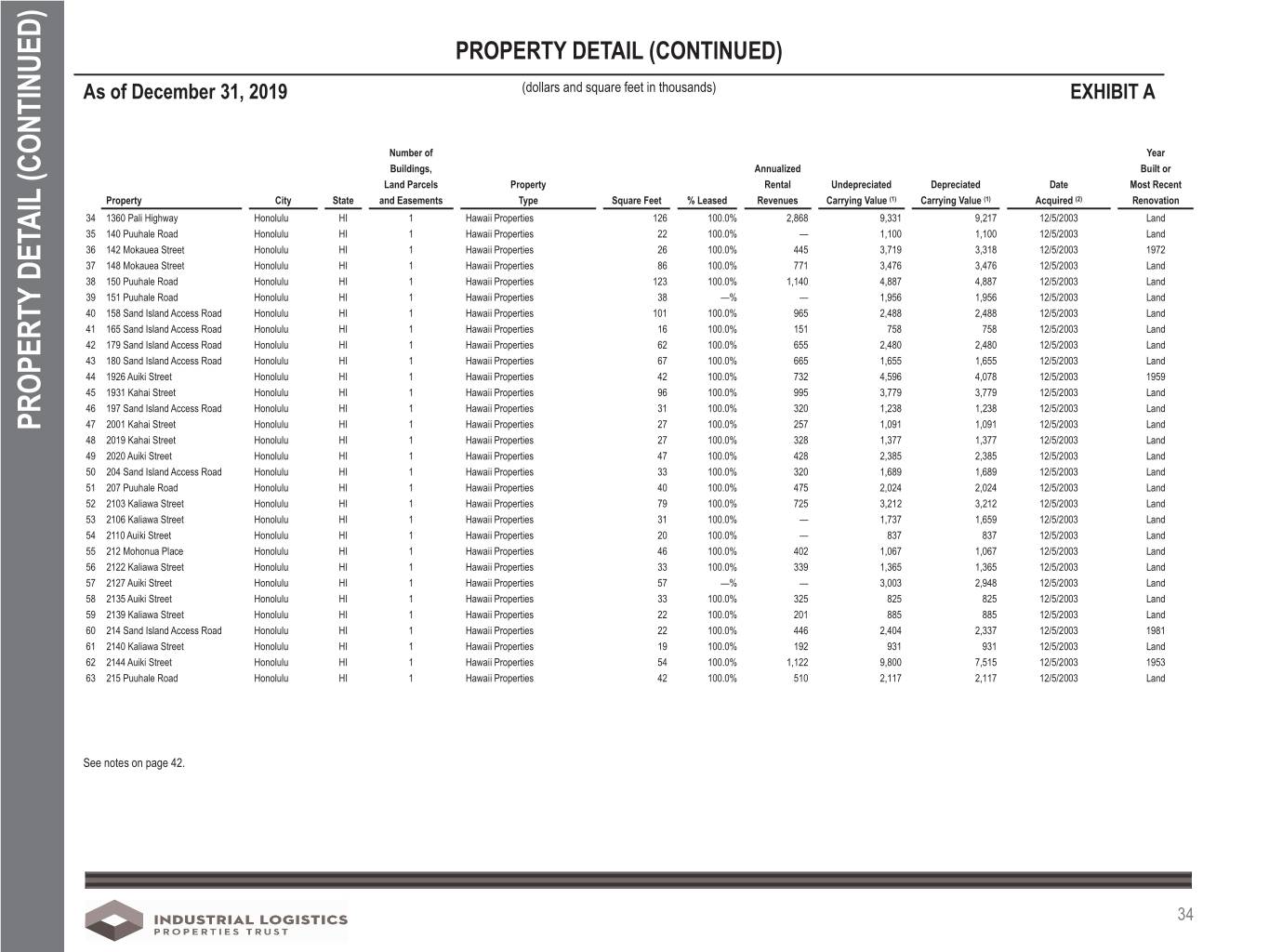

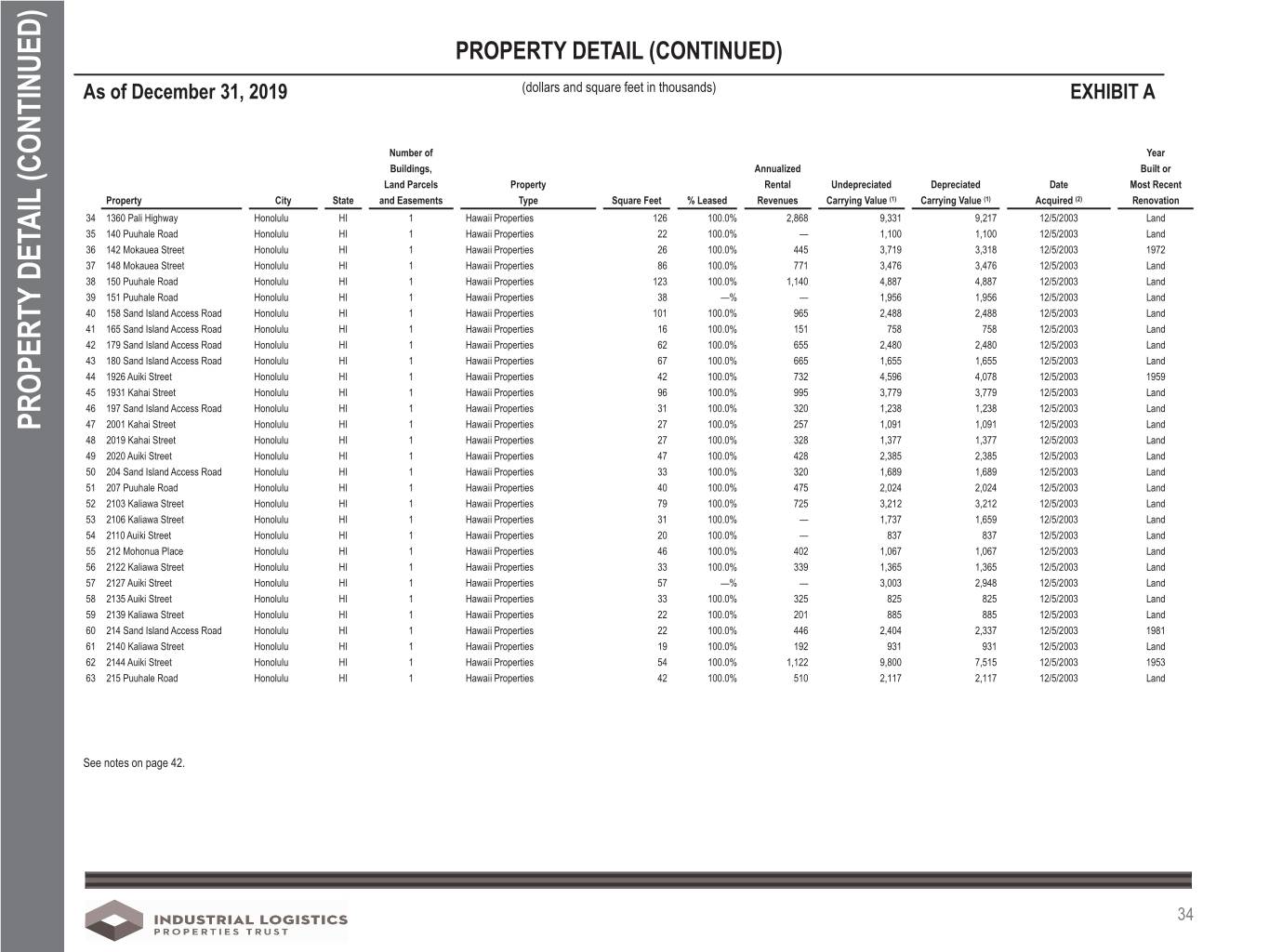

PROPERTY DETAIL (CONTINUED) As of December 31, 2019 (dollars and square feet in thousands) EXHIBIT A Number of Year Buildings, Annualized Built or Land Parcels Property Rental Undepreciated Depreciated Date Most Recent Property City State and Easements Type Square Feet % Leased Revenues Carrying Value (1) Carrying Value (1) Acquired (2) Renovation 34 1360 Pali Highway Honolulu HI 1 Hawaii Properties 126 100.0% 2,868 9,331 9,217 12/5/2003 Land 35 140 Puuhale Road Honolulu HI 1 Hawaii Properties 22 100.0% — 1,100 1,100 12/5/2003 Land 36 142 Mokauea Street Honolulu HI 1 Hawaii Properties 26 100.0% 445 3,719 3,318 12/5/2003 1972 37 148 Mokauea Street Honolulu HI 1 Hawaii Properties 86 100.0% 771 3,476 3,476 12/5/2003 Land 38 150 Puuhale Road Honolulu HI 1 Hawaii Properties 123 100.0% 1,140 4,887 4,887 12/5/2003 Land 39 151 Puuhale Road Honolulu HI 1 Hawaii Properties 38 —% — 1,956 1,956 12/5/2003 Land 40 158 Sand Island Access Road Honolulu HI 1 Hawaii Properties 101 100.0% 965 2,488 2,488 12/5/2003 Land 41 165 Sand Island Access Road Honolulu HI 1 Hawaii Properties 16 100.0% 151 758 758 12/5/2003 Land 42 179 Sand Island Access Road Honolulu HI 1 Hawaii Properties 62 100.0% 655 2,480 2,480 12/5/2003 Land 43 180 Sand Island Access Road Honolulu HI 1 Hawaii Properties 67 100.0% 665 1,655 1,655 12/5/2003 Land 44 1926 Auiki Street Honolulu HI 1 Hawaii Properties 42 100.0% 732 4,596 4,078 12/5/2003 1959 45 1931 Kahai Street Honolulu HI 1 Hawaii Properties 96 100.0% 995 3,779 3,779 12/5/2003 Land 46 197 Sand Island Access Road Honolulu HI 1 Hawaii Properties 31 100.0% 320 1,238 1,238 12/5/2003 Land PROPERTY DETAIL (CONTINUED) DETAIL PROPERTY 47 2001 Kahai Street Honolulu HI 1 Hawaii Properties 27 100.0% 257 1,091 1,091 12/5/2003 Land 48 2019 Kahai Street Honolulu HI 1 Hawaii Properties 27 100.0% 328 1,377 1,377 12/5/2003 Land 49 2020 Auiki Street Honolulu HI 1 Hawaii Properties 47 100.0% 428 2,385 2,385 12/5/2003 Land 50 204 Sand Island Access Road Honolulu HI 1 Hawaii Properties 33 100.0% 320 1,689 1,689 12/5/2003 Land 51 207 Puuhale Road Honolulu HI 1 Hawaii Properties 40 100.0% 475 2,024 2,024 12/5/2003 Land 52 2103 Kaliawa Street Honolulu HI 1 Hawaii Properties 79 100.0% 725 3,212 3,212 12/5/2003 Land 53 2106 Kaliawa Street Honolulu HI 1 Hawaii Properties 31 100.0% — 1,737 1,659 12/5/2003 Land 54 2110 Auiki Street Honolulu HI 1 Hawaii Properties 20 100.0% — 837 837 12/5/2003 Land 55 212 Mohonua Place Honolulu HI 1 Hawaii Properties 46 100.0% 402 1,067 1,067 12/5/2003 Land 56 2122 Kaliawa Street Honolulu HI 1 Hawaii Properties 33 100.0% 339 1,365 1,365 12/5/2003 Land 57 2127 Auiki Street Honolulu HI 1 Hawaii Properties 57 —% — 3,003 2,948 12/5/2003 Land 58 2135 Auiki Street Honolulu HI 1 Hawaii Properties 33 100.0% 325 825 825 12/5/2003 Land 59 2139 Kaliawa Street Honolulu HI 1 Hawaii Properties 22 100.0% 201 885 885 12/5/2003 Land 60 214 Sand Island Access Road Honolulu HI 1 Hawaii Properties 22 100.0% 446 2,404 2,337 12/5/2003 1981 61 2140 Kaliawa Street Honolulu HI 1 Hawaii Properties 19 100.0% 192 931 931 12/5/2003 Land 62 2144 Auiki Street Honolulu HI 1 Hawaii Properties 54 100.0% 1,122 9,800 7,515 12/5/2003 1953 63 215 Puuhale Road Honolulu HI 1 Hawaii Properties 42 100.0% 510 2,117 2,117 12/5/2003 Land See notes on page 42. 34

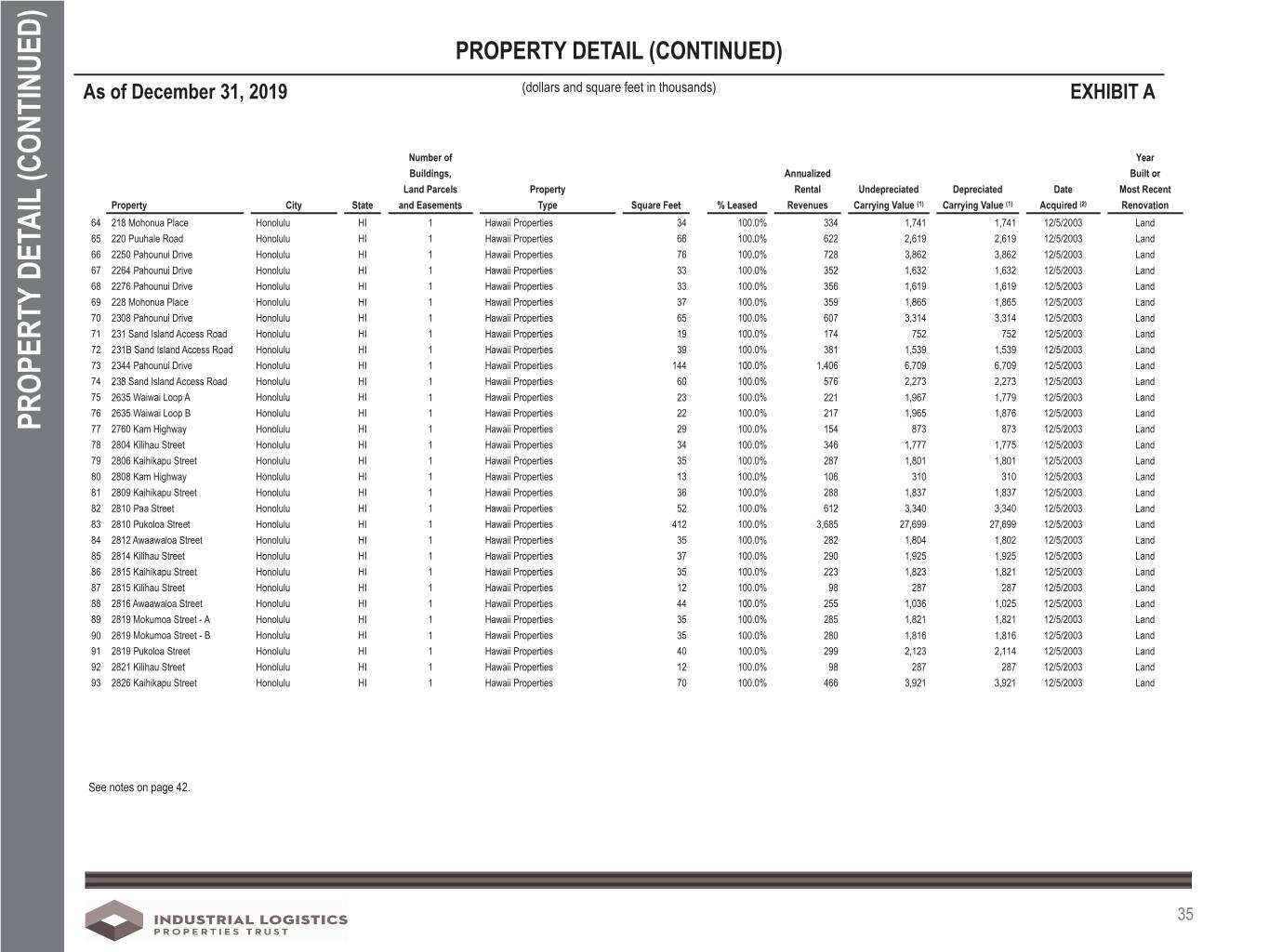

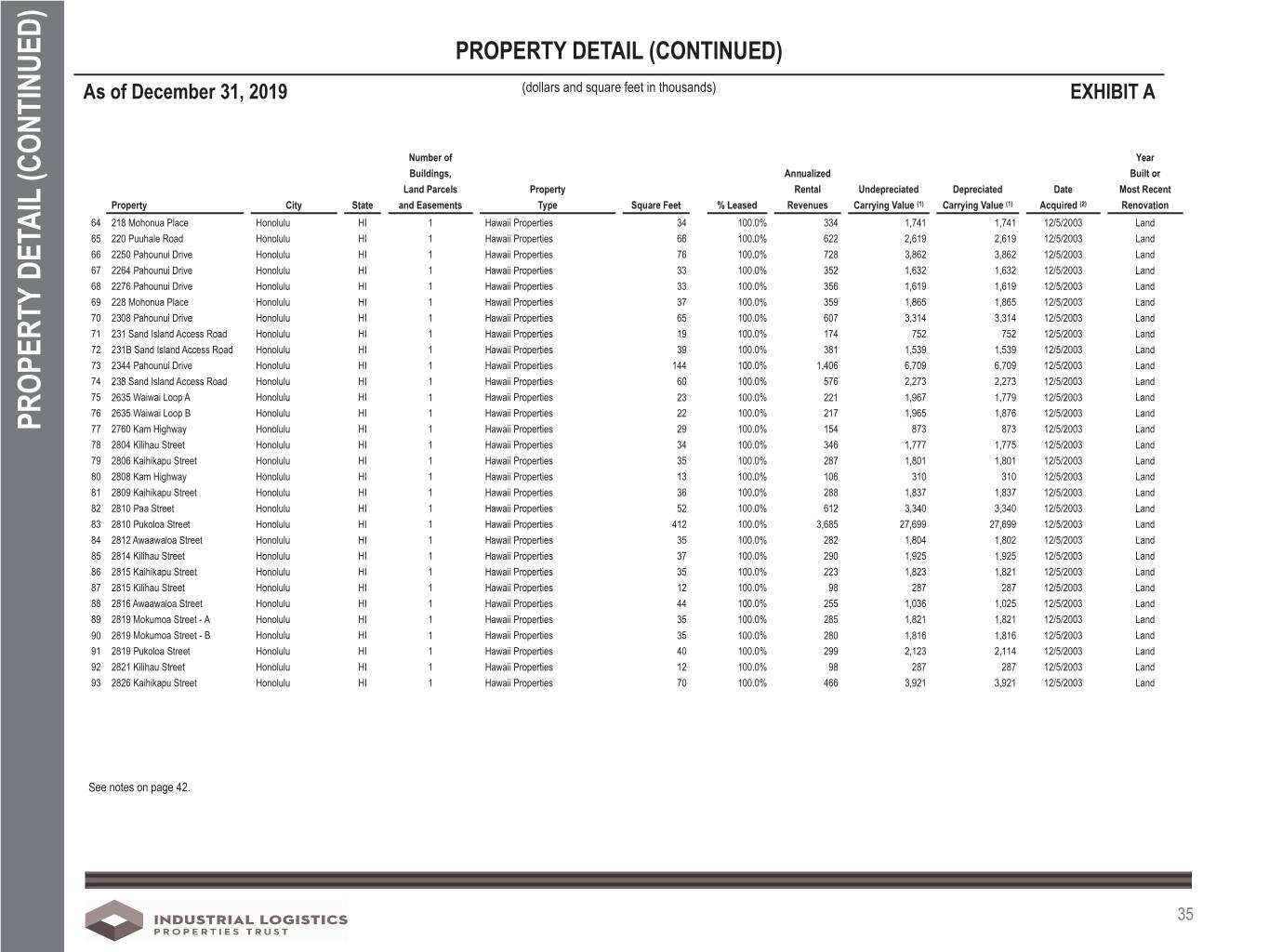

PROPERTY DETAIL (CONTINUED) As of December 31, 2019 (dollars and square feet in thousands) EXHIBIT A Number of Year Buildings, Annualized Built or Land Parcels Property Rental Undepreciated Depreciated Date Most Recent Property City State and Easements Type Square Feet % Leased Revenues Carrying Value (1) Carrying Value (1) Acquired (2) Renovation 64 218 Mohonua Place Honolulu HI 1 Hawaii Properties 34 100.0% 334 1,741 1,741 12/5/2003 Land 65 220 Puuhale Road Honolulu HI 1 Hawaii Properties 66 100.0% 622 2,619 2,619 12/5/2003 Land 66 2250 Pahounui Drive Honolulu HI 1 Hawaii Properties 76 100.0% 728 3,862 3,862 12/5/2003 Land 67 2264 Pahounui Drive Honolulu HI 1 Hawaii Properties 33 100.0% 352 1,632 1,632 12/5/2003 Land 68 2276 Pahounui Drive Honolulu HI 1 Hawaii Properties 33 100.0% 356 1,619 1,619 12/5/2003 Land 69 228 Mohonua Place Honolulu HI 1 Hawaii Properties 37 100.0% 359 1,865 1,865 12/5/2003 Land 70 2308 Pahounui Drive Honolulu HI 1 Hawaii Properties 65 100.0% 607 3,314 3,314 12/5/2003 Land 71 231 Sand Island Access Road Honolulu HI 1 Hawaii Properties 19 100.0% 174 752 752 12/5/2003 Land 72 231B Sand Island Access Road Honolulu HI 1 Hawaii Properties 39 100.0% 381 1,539 1,539 12/5/2003 Land 73 2344 Pahounui Drive Honolulu HI 1 Hawaii Properties 144 100.0% 1,406 6,709 6,709 12/5/2003 Land 74 238 Sand Island Access Road Honolulu HI 1 Hawaii Properties 60 100.0% 576 2,273 2,273 12/5/2003 Land 75 2635 Waiwai Loop A Honolulu HI 1 Hawaii Properties 23 100.0% 221 1,967 1,779 12/5/2003 Land 76 2635 Waiwai Loop B Honolulu HI 1 Hawaii Properties 22 100.0% 217 1,965 1,876 12/5/2003 Land PROPERTY DETAIL (CONTINUED) DETAIL PROPERTY 77 2760 Kam Highway Honolulu HI 1 Hawaii Properties 29 100.0% 154 873 873 12/5/2003 Land 78 2804 Kilihau Street Honolulu HI 1 Hawaii Properties 34 100.0% 346 1,777 1,775 12/5/2003 Land 79 2806 Kaihikapu Street Honolulu HI 1 Hawaii Properties 35 100.0% 287 1,801 1,801 12/5/2003 Land 80 2808 Kam Highway Honolulu HI 1 Hawaii Properties 13 100.0% 106 310 310 12/5/2003 Land 81 2809 Kaihikapu Street Honolulu HI 1 Hawaii Properties 36 100.0% 288 1,837 1,837 12/5/2003 Land 82 2810 Paa Street Honolulu HI 1 Hawaii Properties 52 100.0% 612 3,340 3,340 12/5/2003 Land 83 2810 Pukoloa Street Honolulu HI 1 Hawaii Properties 412 100.0% 3,685 27,699 27,699 12/5/2003 Land 84 2812 Awaawaloa Street Honolulu HI 1 Hawaii Properties 35 100.0% 282 1,804 1,802 12/5/2003 Land 85 2814 Kilihau Street Honolulu HI 1 Hawaii Properties 37 100.0% 290 1,925 1,925 12/5/2003 Land 86 2815 Kaihikapu Street Honolulu HI 1 Hawaii Properties 35 100.0% 223 1,823 1,821 12/5/2003 Land 87 2815 Kilihau Street Honolulu HI 1 Hawaii Properties 12 100.0% 98 287 287 12/5/2003 Land 88 2816 Awaawaloa Street Honolulu HI 1 Hawaii Properties 44 100.0% 255 1,036 1,025 12/5/2003 Land 89 2819 Mokumoa Street - A Honolulu HI 1 Hawaii Properties 35 100.0% 285 1,821 1,821 12/5/2003 Land 90 2819 Mokumoa Street - B Honolulu HI 1 Hawaii Properties 35 100.0% 280 1,816 1,816 12/5/2003 Land 91 2819 Pukoloa Street Honolulu HI 1 Hawaii Properties 40 100.0% 299 2,123 2,114 12/5/2003 Land 92 2821 Kilihau Street Honolulu HI 1 Hawaii Properties 12 100.0% 98 287 287 12/5/2003 Land 93 2826 Kaihikapu Street Honolulu HI 1 Hawaii Properties 70 100.0% 466 3,921 3,921 12/5/2003 Land See notes on page 42. 35

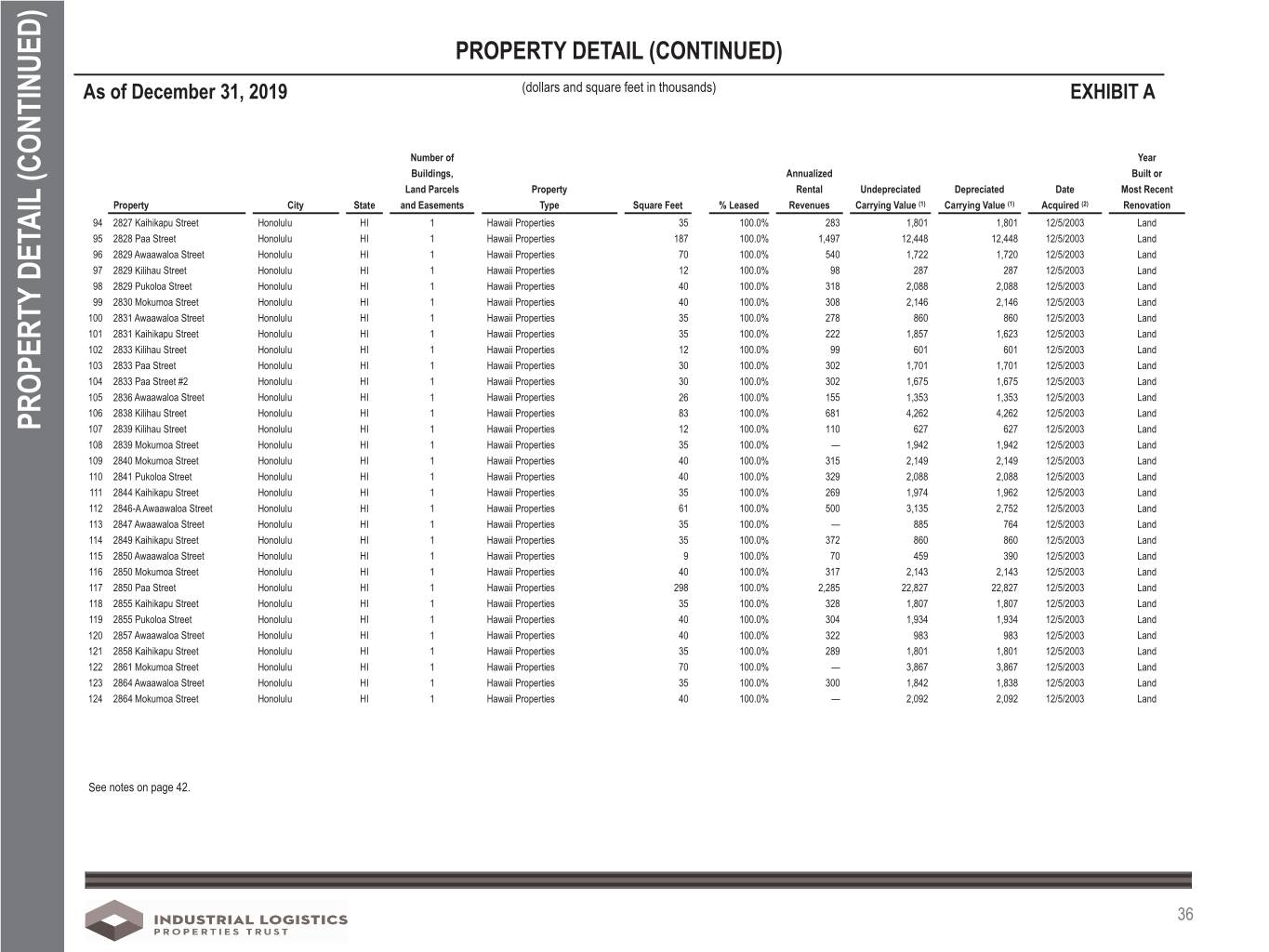

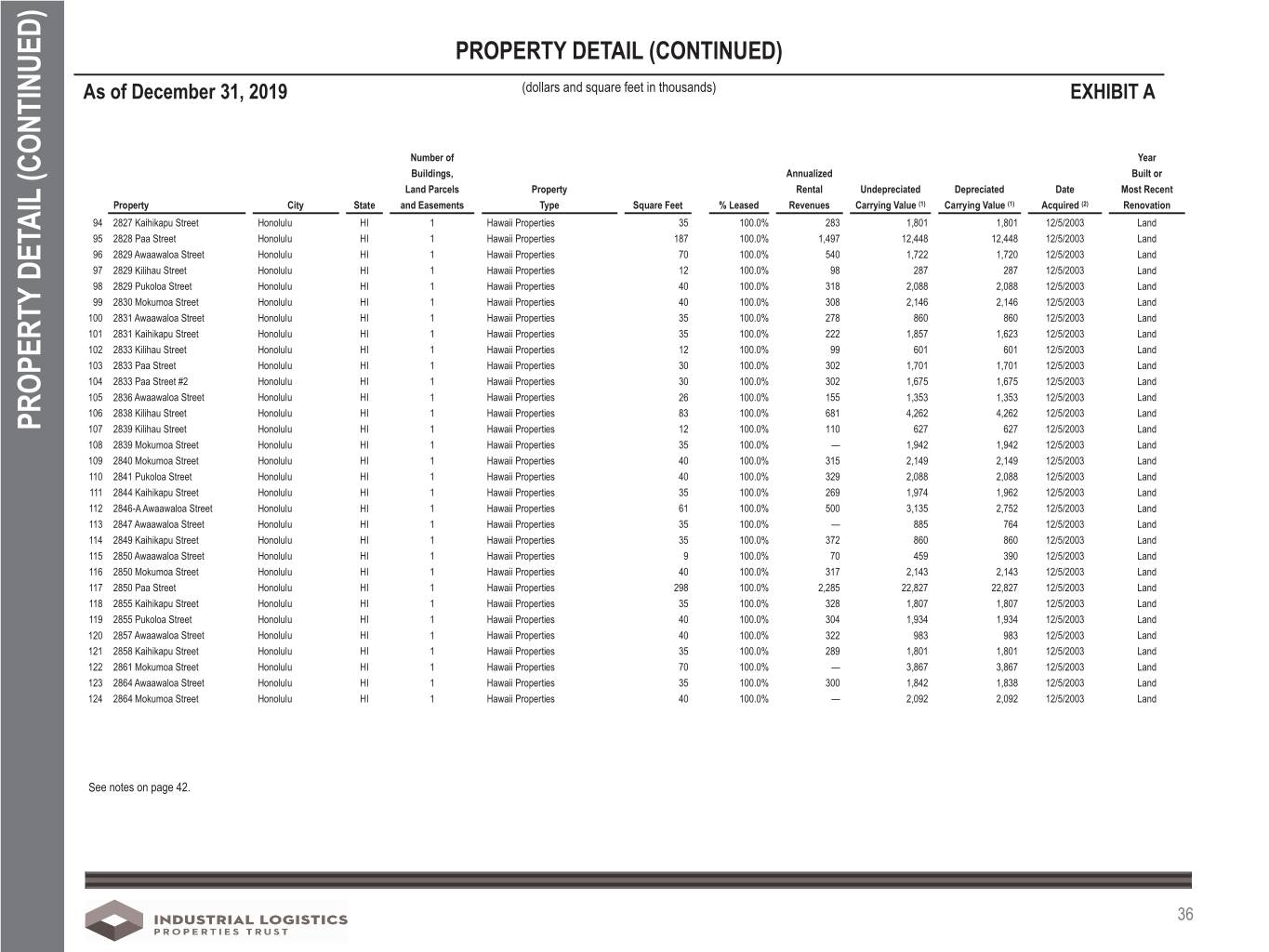

PROPERTY DETAIL (CONTINUED) As of December 31, 2019 (dollars and square feet in thousands) EXHIBIT A Number of Year Buildings, Annualized Built or Land Parcels Property Rental Undepreciated Depreciated Date Most Recent Property City State and Easements Type Square Feet % Leased Revenues Carrying Value (1) Carrying Value (1) Acquired (2) Renovation 94 2827 Kaihikapu Street Honolulu HI 1 Hawaii Properties 35 100.0% 283 1,801 1,801 12/5/2003 Land 95 2828 Paa Street Honolulu HI 1 Hawaii Properties 187 100.0% 1,497 12,448 12,448 12/5/2003 Land 96 2829 Awaawaloa Street Honolulu HI 1 Hawaii Properties 70 100.0% 540 1,722 1,720 12/5/2003 Land 97 2829 Kilihau Street Honolulu HI 1 Hawaii Properties 12 100.0% 98 287 287 12/5/2003 Land 98 2829 Pukoloa Street Honolulu HI 1 Hawaii Properties 40 100.0% 318 2,088 2,088 12/5/2003 Land 99 2830 Mokumoa Street Honolulu HI 1 Hawaii Properties 40 100.0% 308 2,146 2,146 12/5/2003 Land 100 2831 Awaawaloa Street Honolulu HI 1 Hawaii Properties 35 100.0% 278 860 860 12/5/2003 Land 101 2831 Kaihikapu Street Honolulu HI 1 Hawaii Properties 35 100.0% 222 1,857 1,623 12/5/2003 Land 102 2833 Kilihau Street Honolulu HI 1 Hawaii Properties 12 100.0% 99 601 601 12/5/2003 Land 103 2833 Paa Street Honolulu HI 1 Hawaii Properties 30 100.0% 302 1,701 1,701 12/5/2003 Land 104 2833 Paa Street #2 Honolulu HI 1 Hawaii Properties 30 100.0% 302 1,675 1,675 12/5/2003 Land 105 2836 Awaawaloa Street Honolulu HI 1 Hawaii Properties 26 100.0% 155 1,353 1,353 12/5/2003 Land 106 2838 Kilihau Street Honolulu HI 1 Hawaii Properties 83 100.0% 681 4,262 4,262 12/5/2003 Land PROPERTY DETAIL (CONTINUED) DETAIL PROPERTY 107 2839 Kilihau Street Honolulu HI 1 Hawaii Properties 12 100.0% 110 627 627 12/5/2003 Land 108 2839 Mokumoa Street Honolulu HI 1 Hawaii Properties 35 100.0% — 1,942 1,942 12/5/2003 Land 109 2840 Mokumoa Street Honolulu HI 1 Hawaii Properties 40 100.0% 315 2,149 2,149 12/5/2003 Land 110 2841 Pukoloa Street Honolulu HI 1 Hawaii Properties 40 100.0% 329 2,088 2,088 12/5/2003 Land 111 2844 Kaihikapu Street Honolulu HI 1 Hawaii Properties 35 100.0% 269 1,974 1,962 12/5/2003 Land 112 2846-A Awaawaloa Street Honolulu HI 1 Hawaii Properties 61 100.0% 500 3,135 2,752 12/5/2003 Land 113 2847 Awaawaloa Street Honolulu HI 1 Hawaii Properties 35 100.0% — 885 764 12/5/2003 Land 114 2849 Kaihikapu Street Honolulu HI 1 Hawaii Properties 35 100.0% 372 860 860 12/5/2003 Land 115 2850 Awaawaloa Street Honolulu HI 1 Hawaii Properties 9 100.0% 70 459 390 12/5/2003 Land 116 2850 Mokumoa Street Honolulu HI 1 Hawaii Properties 40 100.0% 317 2,143 2,143 12/5/2003 Land 117 2850 Paa Street Honolulu HI 1 Hawaii Properties 298 100.0% 2,285 22,827 22,827 12/5/2003 Land 118 2855 Kaihikapu Street Honolulu HI 1 Hawaii Properties 35 100.0% 328 1,807 1,807 12/5/2003 Land 119 2855 Pukoloa Street Honolulu HI 1 Hawaii Properties 40 100.0% 304 1,934 1,934 12/5/2003 Land 120 2857 Awaawaloa Street Honolulu HI 1 Hawaii Properties 40 100.0% 322 983 983 12/5/2003 Land 121 2858 Kaihikapu Street Honolulu HI 1 Hawaii Properties 35 100.0% 289 1,801 1,801 12/5/2003 Land 122 2861 Mokumoa Street Honolulu HI 1 Hawaii Properties 70 100.0% — 3,867 3,867 12/5/2003 Land 123 2864 Awaawaloa Street Honolulu HI 1 Hawaii Properties 35 100.0% 300 1,842 1,838 12/5/2003 Land 124 2864 Mokumoa Street Honolulu HI 1 Hawaii Properties 40 100.0% — 2,092 2,092 12/5/2003 Land See notes on page 42. 36

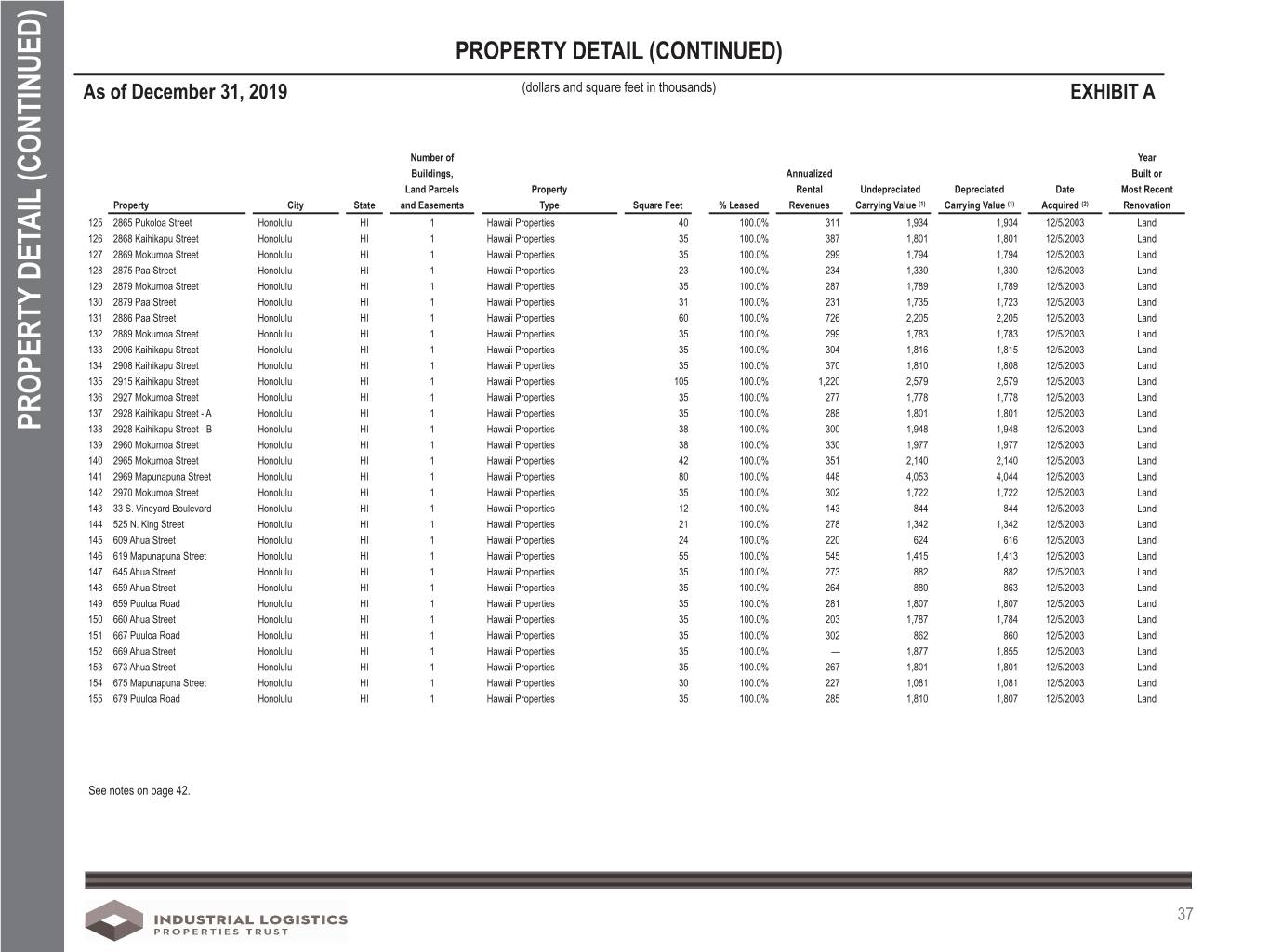

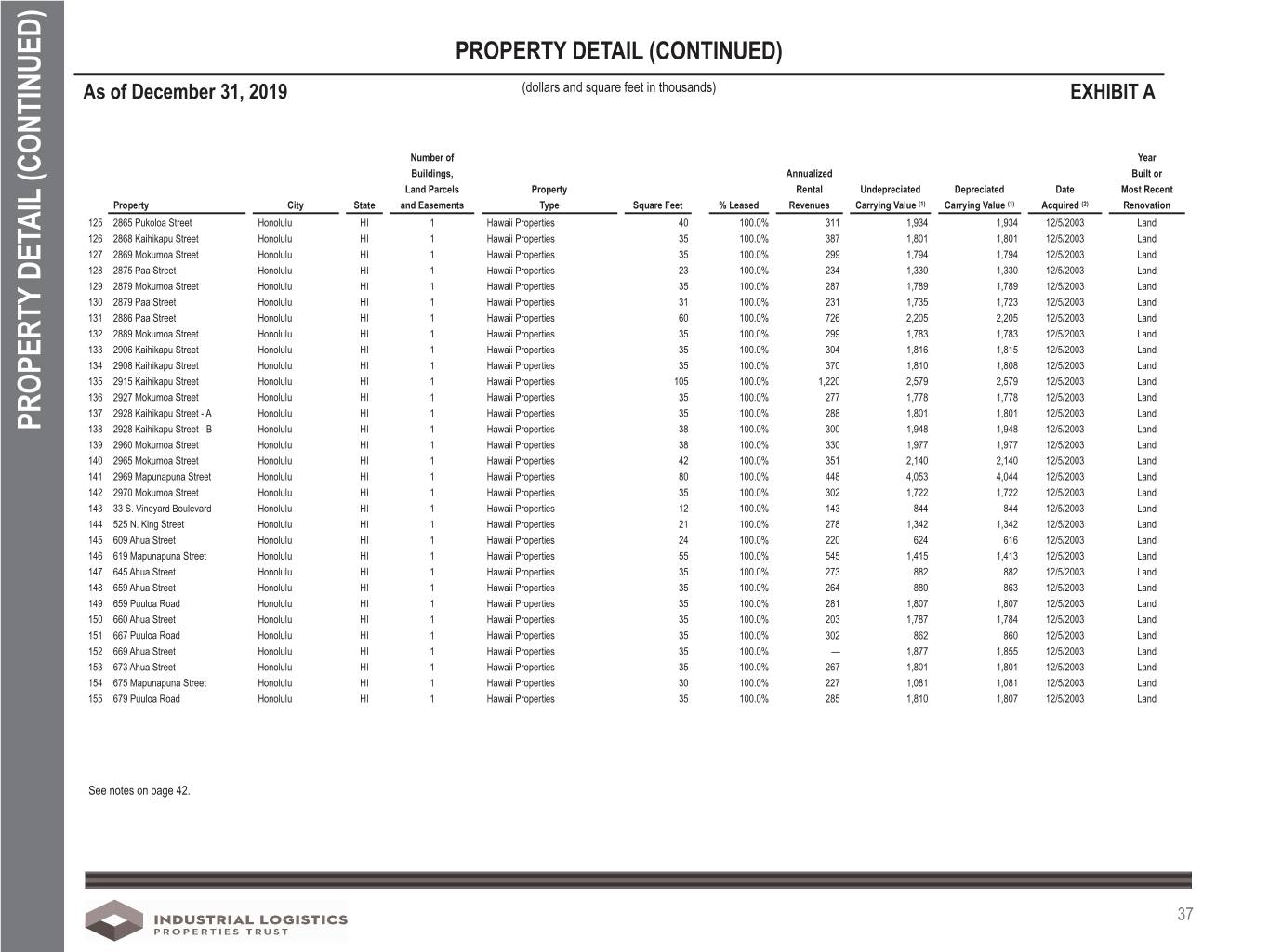

PROPERTY DETAIL (CONTINUED) As of December 31, 2019 (dollars and square feet in thousands) EXHIBIT A Number of Year Buildings, Annualized Built or Land Parcels Property Rental Undepreciated Depreciated Date Most Recent Property City State and Easements Type Square Feet % Leased Revenues Carrying Value (1) Carrying Value (1) Acquired (2) Renovation 125 2865 Pukoloa Street Honolulu HI 1 Hawaii Properties 40 100.0% 311 1,934 1,934 12/5/2003 Land 126 2868 Kaihikapu Street Honolulu HI 1 Hawaii Properties 35 100.0% 387 1,801 1,801 12/5/2003 Land 127 2869 Mokumoa Street Honolulu HI 1 Hawaii Properties 35 100.0% 299 1,794 1,794 12/5/2003 Land 128 2875 Paa Street Honolulu HI 1 Hawaii Properties 23 100.0% 234 1,330 1,330 12/5/2003 Land 129 2879 Mokumoa Street Honolulu HI 1 Hawaii Properties 35 100.0% 287 1,789 1,789 12/5/2003 Land 130 2879 Paa Street Honolulu HI 1 Hawaii Properties 31 100.0% 231 1,735 1,723 12/5/2003 Land 131 2886 Paa Street Honolulu HI 1 Hawaii Properties 60 100.0% 726 2,205 2,205 12/5/2003 Land 132 2889 Mokumoa Street Honolulu HI 1 Hawaii Properties 35 100.0% 299 1,783 1,783 12/5/2003 Land 133 2906 Kaihikapu Street Honolulu HI 1 Hawaii Properties 35 100.0% 304 1,816 1,815 12/5/2003 Land 134 2908 Kaihikapu Street Honolulu HI 1 Hawaii Properties 35 100.0% 370 1,810 1,808 12/5/2003 Land 135 2915 Kaihikapu Street Honolulu HI 1 Hawaii Properties 105 100.0% 1,220 2,579 2,579 12/5/2003 Land 136 2927 Mokumoa Street Honolulu HI 1 Hawaii Properties 35 100.0% 277 1,778 1,778 12/5/2003 Land 137 2928 Kaihikapu Street - A Honolulu HI 1 Hawaii Properties 35 100.0% 288 1,801 1,801 12/5/2003 Land PROPERTY DETAIL (CONTINUED) DETAIL PROPERTY 138 2928 Kaihikapu Street - B Honolulu HI 1 Hawaii Properties 38 100.0% 300 1,948 1,948 12/5/2003 Land 139 2960 Mokumoa Street Honolulu HI 1 Hawaii Properties 38 100.0% 330 1,977 1,977 12/5/2003 Land 140 2965 Mokumoa Street Honolulu HI 1 Hawaii Properties 42 100.0% 351 2,140 2,140 12/5/2003 Land 141 2969 Mapunapuna Street Honolulu HI 1 Hawaii Properties 80 100.0% 448 4,053 4,044 12/5/2003 Land 142 2970 Mokumoa Street Honolulu HI 1 Hawaii Properties 35 100.0% 302 1,722 1,722 12/5/2003 Land 143 33 S. Vineyard Boulevard Honolulu HI 1 Hawaii Properties 12 100.0% 143 844 844 12/5/2003 Land 144 525 N. King Street Honolulu HI 1 Hawaii Properties 21 100.0% 278 1,342 1,342 12/5/2003 Land 145 609 Ahua Street Honolulu HI 1 Hawaii Properties 24 100.0% 220 624 616 12/5/2003 Land 146 619 Mapunapuna Street Honolulu HI 1 Hawaii Properties 55 100.0% 545 1,415 1,413 12/5/2003 Land 147 645 Ahua Street Honolulu HI 1 Hawaii Properties 35 100.0% 273 882 882 12/5/2003 Land 148 659 Ahua Street Honolulu HI 1 Hawaii Properties 35 100.0% 264 880 863 12/5/2003 Land 149 659 Puuloa Road Honolulu HI 1 Hawaii Properties 35 100.0% 281 1,807 1,807 12/5/2003 Land 150 660 Ahua Street Honolulu HI 1 Hawaii Properties 35 100.0% 203 1,787 1,784 12/5/2003 Land 151 667 Puuloa Road Honolulu HI 1 Hawaii Properties 35 100.0% 302 862 860 12/5/2003 Land 152 669 Ahua Street Honolulu HI 1 Hawaii Properties 35 100.0% — 1,877 1,855 12/5/2003 Land 153 673 Ahua Street Honolulu HI 1 Hawaii Properties 35 100.0% 267 1,801 1,801 12/5/2003 Land 154 675 Mapunapuna Street Honolulu HI 1 Hawaii Properties 30 100.0% 227 1,081 1,081 12/5/2003 Land 155 679 Puuloa Road Honolulu HI 1 Hawaii Properties 35 100.0% 285 1,810 1,807 12/5/2003 Land See notes on page 42. 37

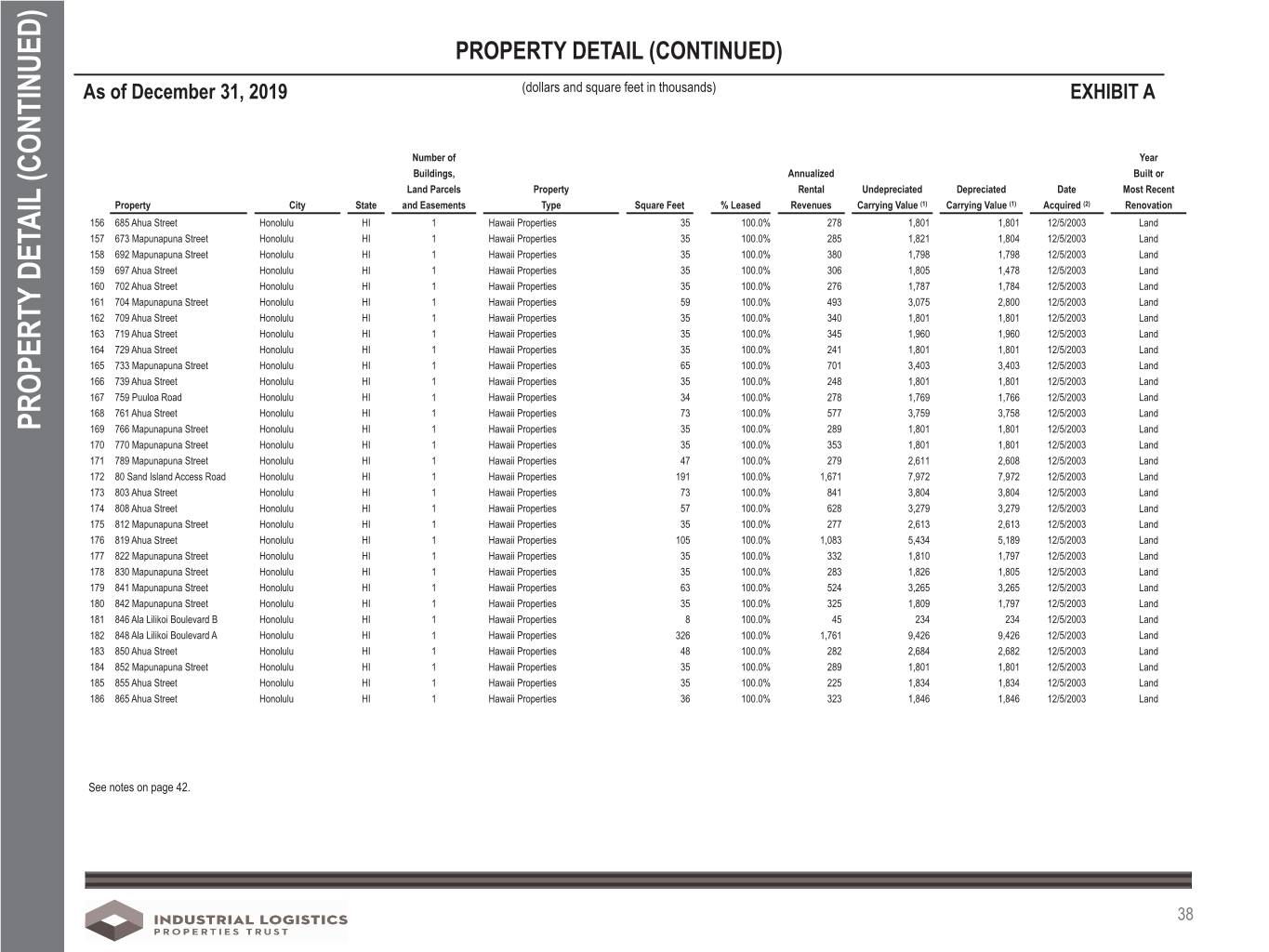

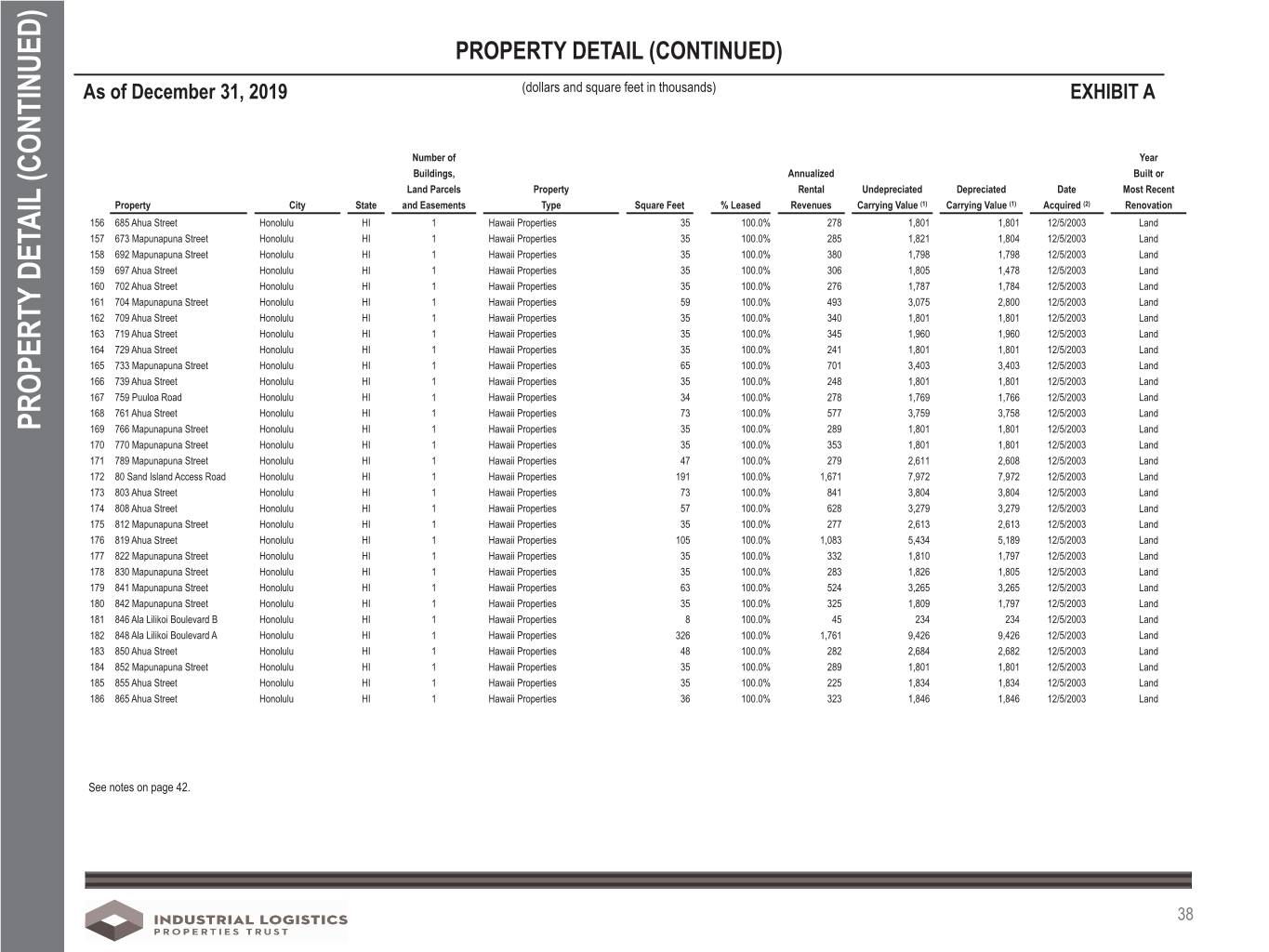

PROPERTY DETAIL (CONTINUED) As of December 31, 2019 (dollars and square feet in thousands) EXHIBIT A Number of Year Buildings, Annualized Built or Land Parcels Property Rental Undepreciated Depreciated Date Most Recent Property City State and Easements Type Square Feet % Leased Revenues Carrying Value (1) Carrying Value (1) Acquired (2) Renovation 156 685 Ahua Street Honolulu HI 1 Hawaii Properties 35 100.0% 278 1,801 1,801 12/5/2003 Land 157 673 Mapunapuna Street Honolulu HI 1 Hawaii Properties 35 100.0% 285 1,821 1,804 12/5/2003 Land 158 692 Mapunapuna Street Honolulu HI 1 Hawaii Properties 35 100.0% 380 1,798 1,798 12/5/2003 Land 159 697 Ahua Street Honolulu HI 1 Hawaii Properties 35 100.0% 306 1,805 1,478 12/5/2003 Land 160 702 Ahua Street Honolulu HI 1 Hawaii Properties 35 100.0% 276 1,787 1,784 12/5/2003 Land 161 704 Mapunapuna Street Honolulu HI 1 Hawaii Properties 59 100.0% 493 3,075 2,800 12/5/2003 Land 162 709 Ahua Street Honolulu HI 1 Hawaii Properties 35 100.0% 340 1,801 1,801 12/5/2003 Land 163 719 Ahua Street Honolulu HI 1 Hawaii Properties 35 100.0% 345 1,960 1,960 12/5/2003 Land 164 729 Ahua Street Honolulu HI 1 Hawaii Properties 35 100.0% 241 1,801 1,801 12/5/2003 Land 165 733 Mapunapuna Street Honolulu HI 1 Hawaii Properties 65 100.0% 701 3,403 3,403 12/5/2003 Land 166 739 Ahua Street Honolulu HI 1 Hawaii Properties 35 100.0% 248 1,801 1,801 12/5/2003 Land 167 759 Puuloa Road Honolulu HI 1 Hawaii Properties 34 100.0% 278 1,769 1,766 12/5/2003 Land 168 761 Ahua Street Honolulu HI 1 Hawaii Properties 73 100.0% 577 3,759 3,758 12/5/2003 Land PROPERTY DETAIL (CONTINUED) DETAIL PROPERTY 169 766 Mapunapuna Street Honolulu HI 1 Hawaii Properties 35 100.0% 289 1,801 1,801 12/5/2003 Land 170 770 Mapunapuna Street Honolulu HI 1 Hawaii Properties 35 100.0% 353 1,801 1,801 12/5/2003 Land 171 789 Mapunapuna Street Honolulu HI 1 Hawaii Properties 47 100.0% 279 2,611 2,608 12/5/2003 Land 172 80 Sand Island Access Road Honolulu HI 1 Hawaii Properties 191 100.0% 1,671 7,972 7,972 12/5/2003 Land 173 803 Ahua Street Honolulu HI 1 Hawaii Properties 73 100.0% 841 3,804 3,804 12/5/2003 Land 174 808 Ahua Street Honolulu HI 1 Hawaii Properties 57 100.0% 628 3,279 3,279 12/5/2003 Land 175 812 Mapunapuna Street Honolulu HI 1 Hawaii Properties 35 100.0% 277 2,613 2,613 12/5/2003 Land 176 819 Ahua Street Honolulu HI 1 Hawaii Properties 105 100.0% 1,083 5,434 5,189 12/5/2003 Land 177 822 Mapunapuna Street Honolulu HI 1 Hawaii Properties 35 100.0% 332 1,810 1,797 12/5/2003 Land 178 830 Mapunapuna Street Honolulu HI 1 Hawaii Properties 35 100.0% 283 1,826 1,805 12/5/2003 Land 179 841 Mapunapuna Street Honolulu HI 1 Hawaii Properties 63 100.0% 524 3,265 3,265 12/5/2003 Land 180 842 Mapunapuna Street Honolulu HI 1 Hawaii Properties 35 100.0% 325 1,809 1,797 12/5/2003 Land 181 846 Ala Lilikoi Boulevard B Honolulu HI 1 Hawaii Properties 8 100.0% 45 234 234 12/5/2003 Land 182 848 Ala Lilikoi Boulevard A Honolulu HI 1 Hawaii Properties 326 100.0% 1,761 9,426 9,426 12/5/2003 Land 183 850 Ahua Street Honolulu HI 1 Hawaii Properties 48 100.0% 282 2,684 2,682 12/5/2003 Land 184 852 Mapunapuna Street Honolulu HI 1 Hawaii Properties 35 100.0% 289 1,801 1,801 12/5/2003 Land 185 855 Ahua Street Honolulu HI 1 Hawaii Properties 35 100.0% 225 1,834 1,834 12/5/2003 Land 186 865 Ahua Street Honolulu HI 1 Hawaii Properties 36 100.0% 323 1,846 1,846 12/5/2003 Land See notes on page 42. 38

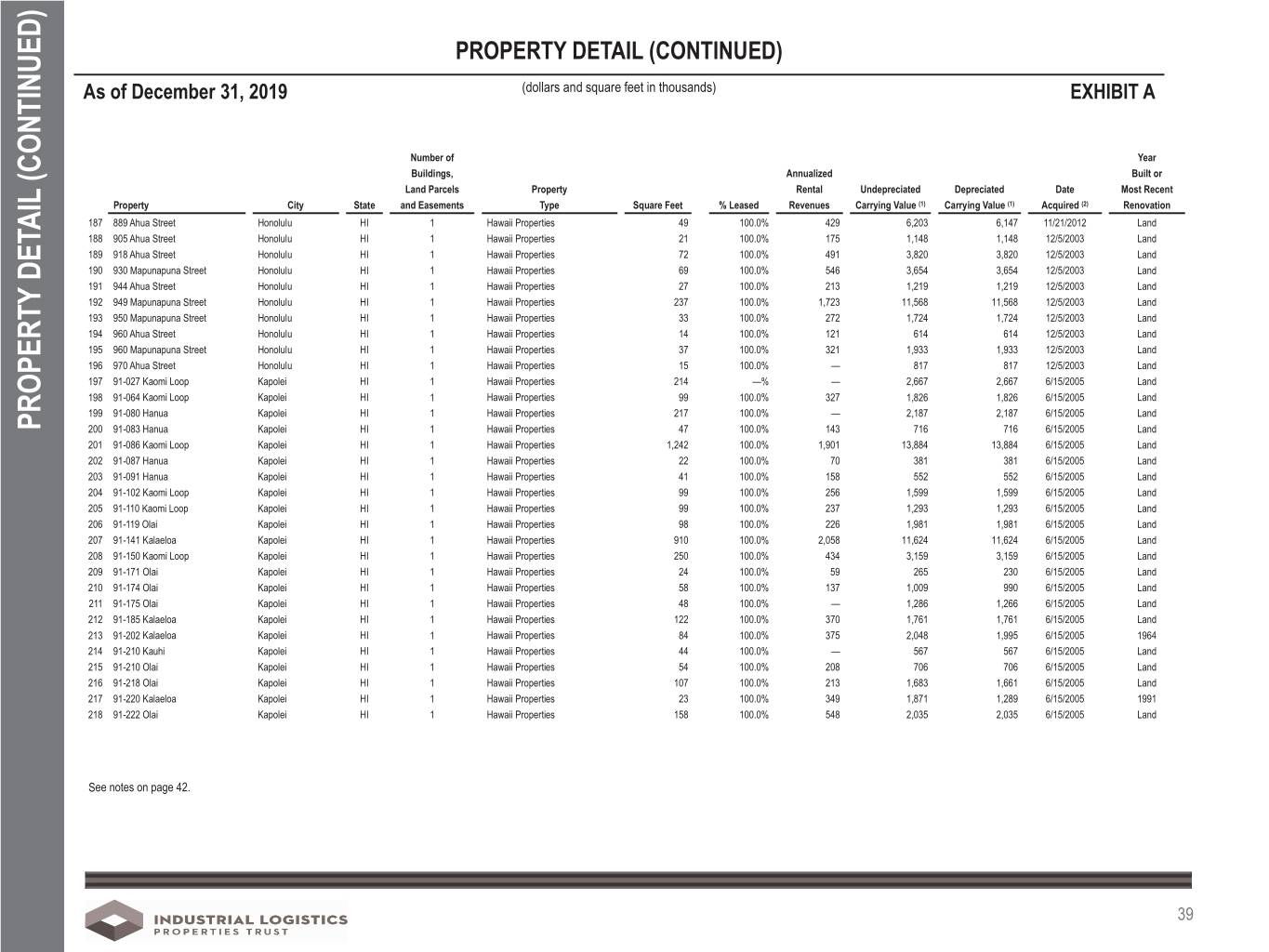

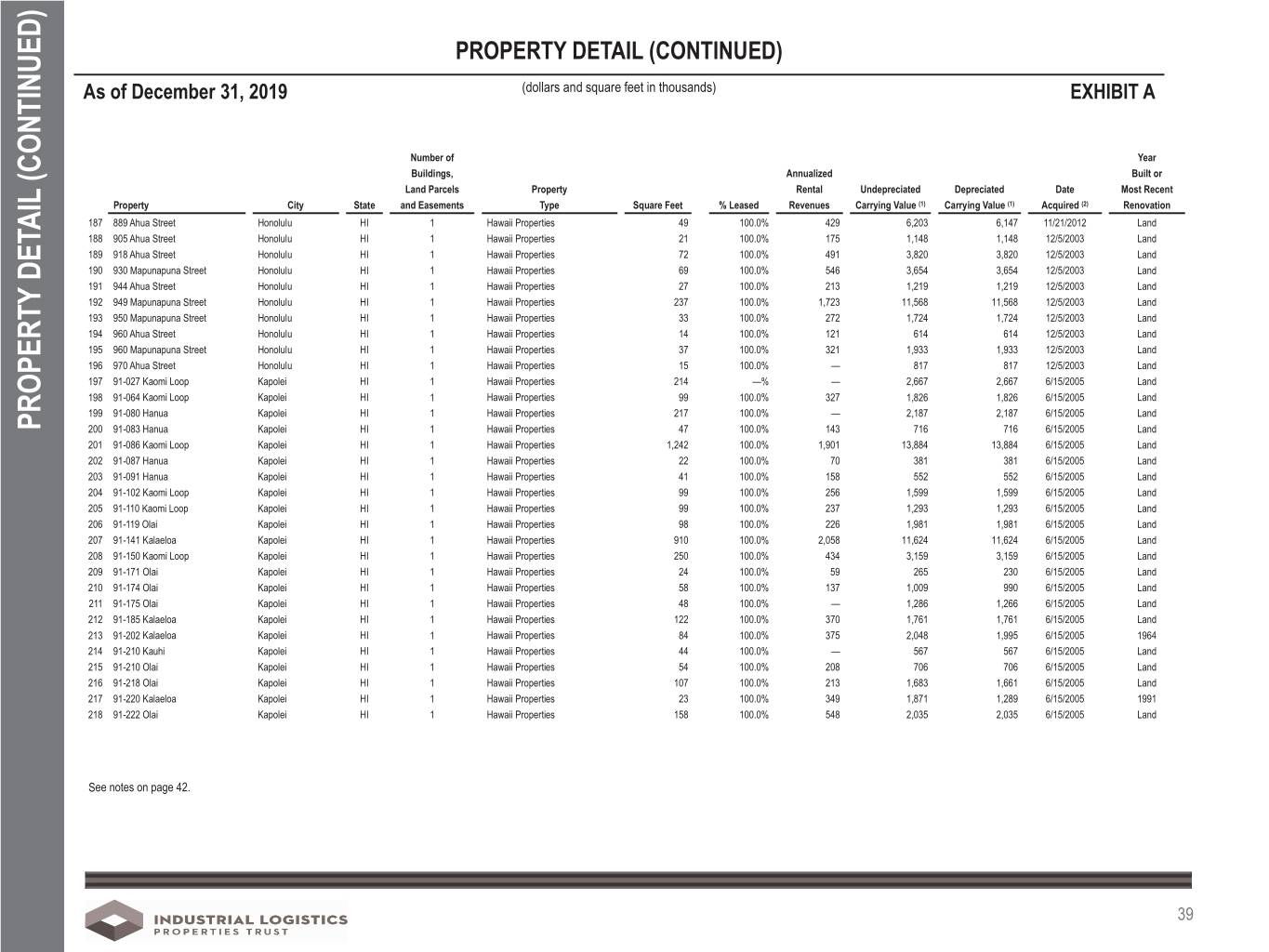

PROPERTY DETAIL (CONTINUED) As of December 31, 2019 (dollars and square feet in thousands) EXHIBIT A Number of Year Buildings, Annualized Built or Land Parcels Property Rental Undepreciated Depreciated Date Most Recent Property City State and Easements Type Square Feet % Leased Revenues Carrying Value (1) Carrying Value (1) Acquired (2) Renovation 187 889 Ahua Street Honolulu HI 1 Hawaii Properties 49 100.0% 429 6,203 6,147 11/21/2012 Land 188 905 Ahua Street Honolulu HI 1 Hawaii Properties 21 100.0% 175 1,148 1,148 12/5/2003 Land 189 918 Ahua Street Honolulu HI 1 Hawaii Properties 72 100.0% 491 3,820 3,820 12/5/2003 Land 190 930 Mapunapuna Street Honolulu HI 1 Hawaii Properties 69 100.0% 546 3,654 3,654 12/5/2003 Land 191 944 Ahua Street Honolulu HI 1 Hawaii Properties 27 100.0% 213 1,219 1,219 12/5/2003 Land 192 949 Mapunapuna Street Honolulu HI 1 Hawaii Properties 237 100.0% 1,723 11,568 11,568 12/5/2003 Land 193 950 Mapunapuna Street Honolulu HI 1 Hawaii Properties 33 100.0% 272 1,724 1,724 12/5/2003 Land 194 960 Ahua Street Honolulu HI 1 Hawaii Properties 14 100.0% 121 614 614 12/5/2003 Land 195 960 Mapunapuna Street Honolulu HI 1 Hawaii Properties 37 100.0% 321 1,933 1,933 12/5/2003 Land 196 970 Ahua Street Honolulu HI 1 Hawaii Properties 15 100.0% — 817 817 12/5/2003 Land 197 91-027 Kaomi Loop Kapolei HI 1 Hawaii Properties 214 —% — 2,667 2,667 6/15/2005 Land 198 91-064 Kaomi Loop Kapolei HI 1 Hawaii Properties 99 100.0% 327 1,826 1,826 6/15/2005 Land 199 91-080 Hanua Kapolei HI 1 Hawaii Properties 217 100.0% — 2,187 2,187 6/15/2005 Land PROPERTY DETAIL (CONTINUED) DETAIL PROPERTY 200 91-083 Hanua Kapolei HI 1 Hawaii Properties 47 100.0% 143 716 716 6/15/2005 Land 201 91-086 Kaomi Loop Kapolei HI 1 Hawaii Properties 1,242 100.0% 1,901 13,884 13,884 6/15/2005 Land 202 91-087 Hanua Kapolei HI 1 Hawaii Properties 22 100.0% 70 381 381 6/15/2005 Land 203 91-091 Hanua Kapolei HI 1 Hawaii Properties 41 100.0% 158 552 552 6/15/2005 Land 204 91-102 Kaomi Loop Kapolei HI 1 Hawaii Properties 99 100.0% 256 1,599 1,599 6/15/2005 Land 205 91-110 Kaomi Loop Kapolei HI 1 Hawaii Properties 99 100.0% 237 1,293 1,293 6/15/2005 Land 206 91-119 Olai Kapolei HI 1 Hawaii Properties 98 100.0% 226 1,981 1,981 6/15/2005 Land 207 91-141 Kalaeloa Kapolei HI 1 Hawaii Properties 910 100.0% 2,058 11,624 11,624 6/15/2005 Land 208 91-150 Kaomi Loop Kapolei HI 1 Hawaii Properties 250 100.0% 434 3,159 3,159 6/15/2005 Land 209 91-171 Olai Kapolei HI 1 Hawaii Properties 24 100.0% 59 265 230 6/15/2005 Land 210 91-174 Olai Kapolei HI 1 Hawaii Properties 58 100.0% 137 1,009 990 6/15/2005 Land 211 91-175 Olai Kapolei HI 1 Hawaii Properties 48 100.0% — 1,286 1,266 6/15/2005 Land 212 91-185 Kalaeloa Kapolei HI 1 Hawaii Properties 122 100.0% 370 1,761 1,761 6/15/2005 Land 213 91-202 Kalaeloa Kapolei HI 1 Hawaii Properties 84 100.0% 375 2,048 1,995 6/15/2005 1964 214 91-210 Kauhi Kapolei HI 1 Hawaii Properties 44 100.0% — 567 567 6/15/2005 Land 215 91-210 Olai Kapolei HI 1 Hawaii Properties 54 100.0% 208 706 706 6/15/2005 Land 216 91-218 Olai Kapolei HI 1 Hawaii Properties 107 100.0% 213 1,683 1,661 6/15/2005 Land 217 91-220 Kalaeloa Kapolei HI 1 Hawaii Properties 23 100.0% 349 1,871 1,289 6/15/2005 1991 218 91-222 Olai Kapolei HI 1 Hawaii Properties 158 100.0% 548 2,035 2,035 6/15/2005 Land See notes on page 42. 39

PROPERTY DETAIL (CONTINUED) As of December 31, 2019 (dollars and square feet in thousands) EXHIBIT A Number of Year Buildings, Annualized Built or Land Parcels Property Rental Undepreciated Depreciated Date Most Recent Property City State and Easements Type Square Feet % Leased Revenues Carrying Value (1) Carrying Value (1) Acquired (2) Renovation 219 91-238 Kauhi Kapolei HI 1 Hawaii Properties 85 100.0% 1,403 10,649 7,809 6/15/2005 1981 220 91-241 Kalaeloa Kapolei HI 1 Hawaii Properties 45 100.0% 703 5,295 3,588 6/15/2005 1990 221 91-250 Komohana Kapolei HI 1 Hawaii Properties 107 100.0% 306 1,506 1,506 6/15/2005 Land 222 91-252 Kauhi Kapolei HI 1 Hawaii Properties 43 100.0% 108 536 536 6/15/2005 Land 223 91-255 Hanua Kapolei HI 1 Hawaii Properties 95 100.0% 275 1,246 1,243 6/15/2005 Land 224 91-259 Olai Kapolei HI 1 Hawaii Properties 131 100.0% 294 2,944 2,944 6/15/2005 Land 225 91-265 Hanua Kapolei HI 1 Hawaii Properties 95 100.0% 235 1,569 1,569 6/15/2005 Land 226 91-300 Hanua Kapolei HI 1 Hawaii Properties 28 100.0% 445 1,381 1,381 6/15/2005 1994 227 91-329 Kauhi Kapolei HI 1 Hawaii Properties 48 100.0% 850 5,080 3,543 6/15/2005 2013 228 91-349 Kauhi Kapolei HI 1 Hawaii Properties 48 100.0% 124 649 649 6/15/2005 Land 229 91-399 Kauhi Kapolei HI 1 Hawaii Properties 2,236 100.0% 2,724 27,405 27,405 6/15/2005 Land 230 91-400 Komohana Kapolei HI 1 Hawaii Properties 96 100.0% 244 1,494 1,494 6/15/2005 Land 231 91-410 Komohana Kapolei HI 1 Hawaii Properties 21 100.0% 54 430 428 6/15/2005 Land PROPERTY DETAIL (CONTINUED) DETAIL PROPERTY 232 91-416 Komohana Kapolei HI 1 Hawaii Properties 27 100.0% 70 724 722 6/15/2005 Land 233 AES HI Easement Kapolei HI 1 Hawaii Properties — —% — 1,250 1,250 6/15/2005 Land 234 Other Easements & Lots Kapolei HI 1 Hawaii Properties (3) — —% — 1,753 1,318 6/15/2005 Land 235 Tesaro 967 Easement Kapolei HI 1 Hawaii Properties — —% — 6,593 6,593 6/15/2005 Land 236 Texaco Easement Kapolei HI 1 Hawaii Properties — —% — 2,653 2,653 6/15/2005 Land 237 94-240 Pupuole Street Waipahu HI 1 Hawaii Properties 44 100.0% 438 717 717 12/5/2003 Land 238 5500 SE Delaware Avenue Ankeny IA 1 Mainland Properties 644 100.0% 3,046 33,208 31,086 1/29/2015 2012 239 951 Trails Road Eldridge IA 1 Mainland Properties 173 100.0% 1,034 8,974 6,385 4/2/2007 2001 240 3425 Maple Drive Fort Dodge IA 1 Mainland Properties 25 100.0% 251 2,100 2,059 4/9/2019 2014 241 2300 North 33rd Avenue East Newton IA 1 Mainland Properties 318 100.0% 1,458 14,131 10,190 9/29/2008 2008 242 7121 South Fifth Avenue Pocatello ID 1 Mainland Properties 34 100.0% 400 5,023 4,495 1/29/2015 2012 243 1230 West 171st Street Harvey IL 1 Mainland Properties 40 100.0% 476 2,473 2,267 1/29/2015 2004 244 5156 American Road Rockford IL 1 Mainland Properties 38 100.0% 173 2,111 1,910 1/29/2015 1996 245 3201 Bearing Drive Franklin IN 1 Mainland Properties 424 100.0% 1,658 16,503 16,127 4/9/2019 2006 246 2482 Century Drive Goshen IN 1 Mainland Properties 250 100.0% 1,004 9,901 9,713 4/9/2019 2015 247 6825 West County Road 400 Greenfield IN 1 Mainland Properties 245 100.0% 1,660 15,386 15,025 2/14/2019 2008 248 900 Commerce Parkway West Greenwood IN 1 Mainland Properties 294 100.0% 1,458 17,736 17,327 2/14/2019 2007 249 9347 E Pendleton Pike Lawrence IN 1 Mainland Properties 535 100.0% 3,996 38,640 37,764 2/14/2019 2009 250 945 Monument Drive Lebanon IN 1 Mainland Properties 963 100.0% 3,516 47,005 46,115 4/9/2019 2014 See notes on page 42. 40

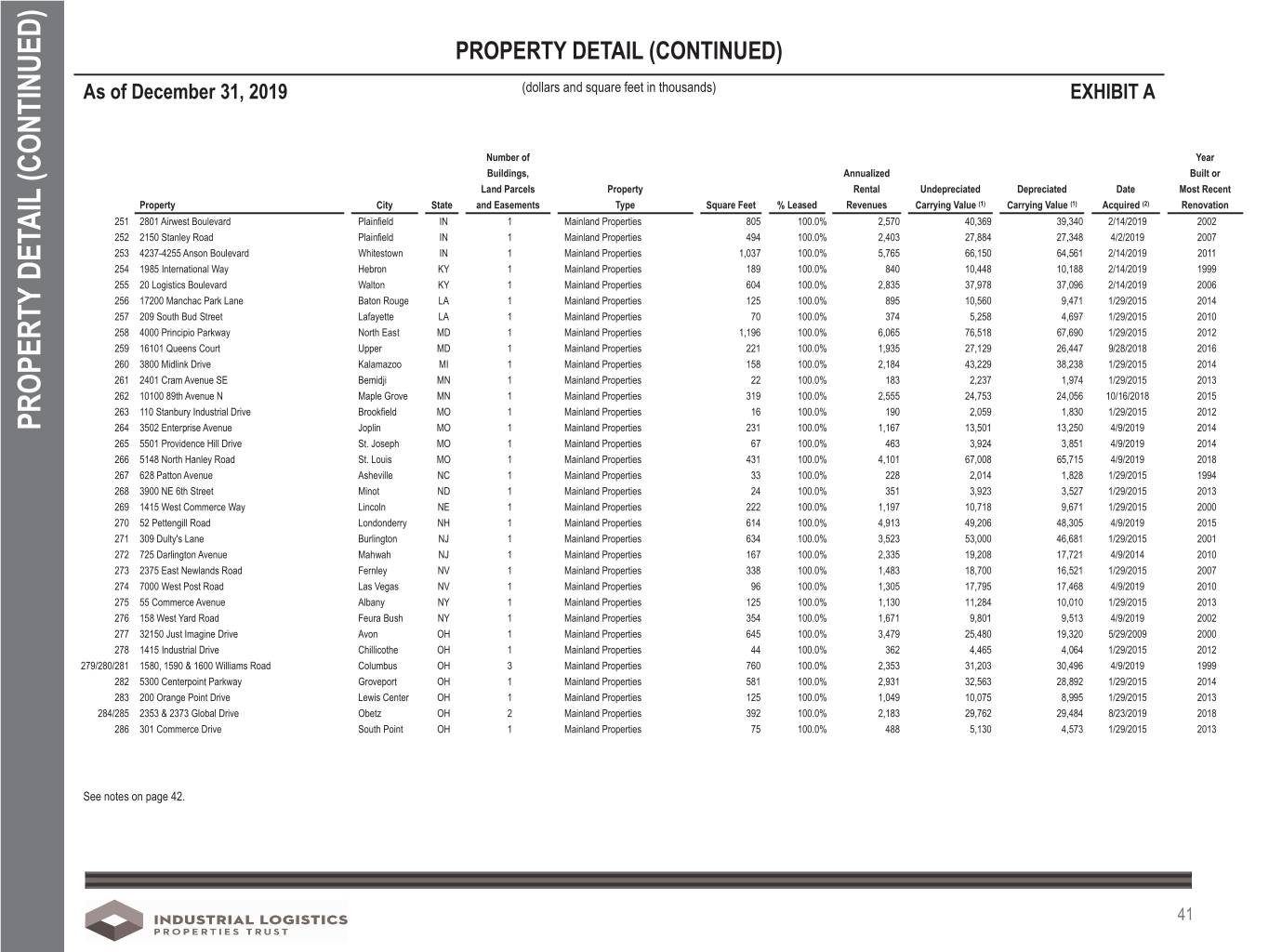

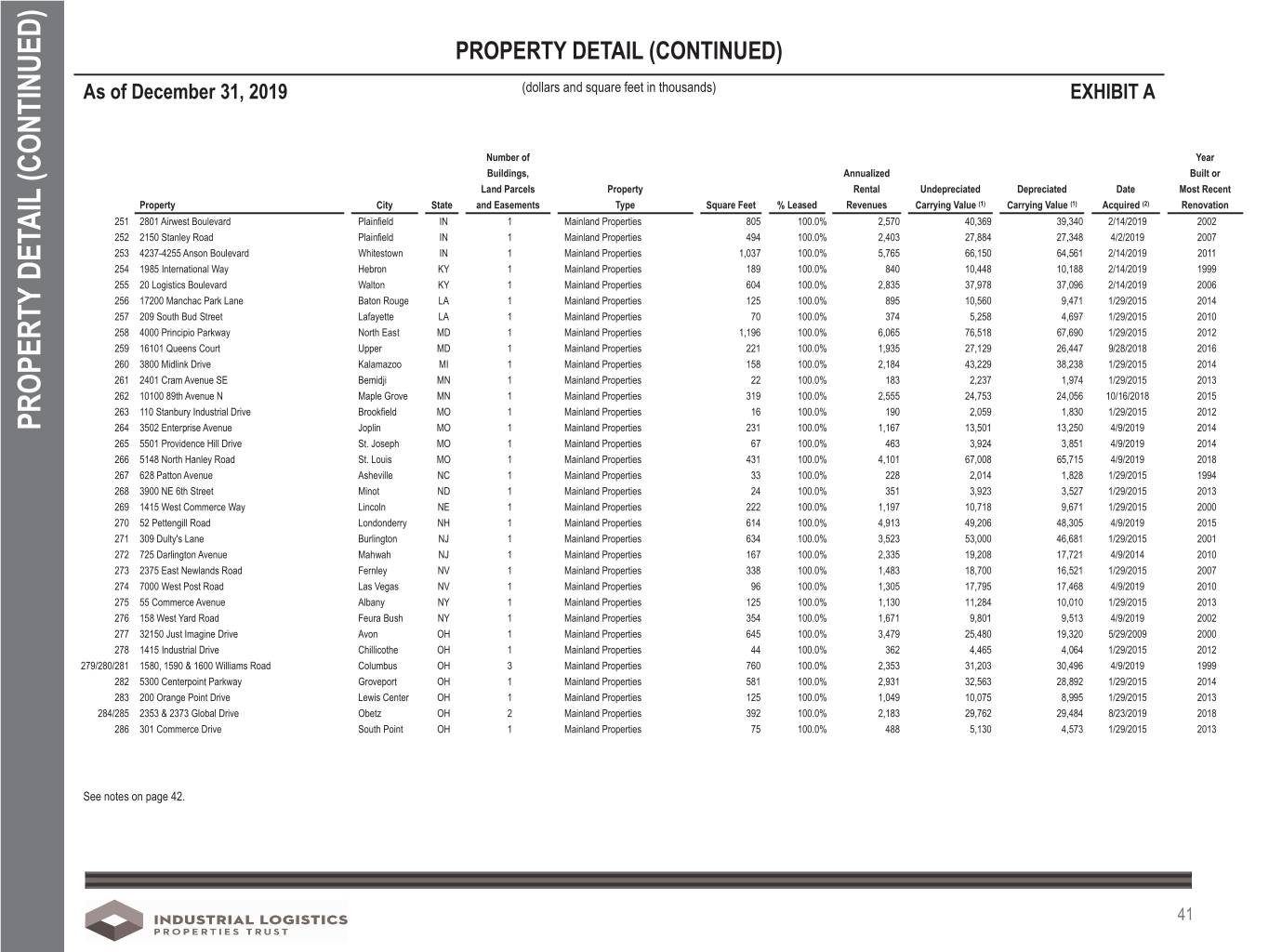

PROPERTY DETAIL (CONTINUED) As of December 31, 2019 (dollars and square feet in thousands) EXHIBIT A Number of Year Buildings, Annualized Built or Land Parcels Property Rental Undepreciated Depreciated Date Most Recent Property City State and Easements Type Square Feet % Leased Revenues Carrying Value (1) Carrying Value (1) Acquired (2) Renovation 251 2801 Airwest Boulevard Plainfield IN 1 Mainland Properties 805 100.0% 2,570 40,369 39,340 2/14/2019 2002 252 2150 Stanley Road Plainfield IN 1 Mainland Properties 494 100.0% 2,403 27,884 27,348 4/2/2019 2007 253 4237-4255 Anson Boulevard Whitestown IN 1 Mainland Properties 1,037 100.0% 5,765 66,150 64,561 2/14/2019 2011 254 1985 International Way Hebron KY 1 Mainland Properties 189 100.0% 840 10,448 10,188 2/14/2019 1999 255 20 Logistics Boulevard Walton KY 1 Mainland Properties 604 100.0% 2,835 37,978 37,096 2/14/2019 2006 256 17200 Manchac Park Lane Baton Rouge LA 1 Mainland Properties 125 100.0% 895 10,560 9,471 1/29/2015 2014 257 209 South Bud Street Lafayette LA 1 Mainland Properties 70 100.0% 374 5,258 4,697 1/29/2015 2010 258 4000 Principio Parkway North East MD 1 Mainland Properties 1,196 100.0% 6,065 76,518 67,690 1/29/2015 2012 259 16101 Queens Court Upper MD 1 Mainland Properties 221 100.0% 1,935 27,129 26,447 9/28/2018 2016 260 3800 Midlink Drive Kalamazoo MI 1 Mainland Properties 158 100.0% 2,184 43,229 38,238 1/29/2015 2014 261 2401 Cram Avenue SE Bemidji MN 1 Mainland Properties 22 100.0% 183 2,237 1,974 1/29/2015 2013 262 10100 89th Avenue N Maple Grove MN 1 Mainland Properties 319 100.0% 2,555 24,753 24,056 10/16/2018 2015 263 110 Stanbury Industrial Drive Brookfield MO 1 Mainland Properties 16 100.0% 190 2,059 1,830 1/29/2015 2012 PROPERTY DETAIL (CONTINUED) DETAIL PROPERTY 264 3502 Enterprise Avenue Joplin MO 1 Mainland Properties 231 100.0% 1,167 13,501 13,250 4/9/2019 2014 265 5501 Providence Hill Drive St. Joseph MO 1 Mainland Properties 67 100.0% 463 3,924 3,851 4/9/2019 2014 266 5148 North Hanley Road St. Louis MO 1 Mainland Properties 431 100.0% 4,101 67,008 65,715 4/9/2019 2018 267 628 Patton Avenue Asheville NC 1 Mainland Properties 33 100.0% 228 2,014 1,828 1/29/2015 1994 268 3900 NE 6th Street Minot ND 1 Mainland Properties 24 100.0% 351 3,923 3,527 1/29/2015 2013 269 1415 West Commerce Way Lincoln NE 1 Mainland Properties 222 100.0% 1,197 10,718 9,671 1/29/2015 2000 270 52 Pettengill Road Londonderry NH 1 Mainland Properties 614 100.0% 4,913 49,206 48,305 4/9/2019 2015 271 309 Dulty's Lane Burlington NJ 1 Mainland Properties 634 100.0% 3,523 53,000 46,681 1/29/2015 2001 272 725 Darlington Avenue Mahwah NJ 1 Mainland Properties 167 100.0% 2,335 19,208 17,721 4/9/2014 2010 273 2375 East Newlands Road Fernley NV 1 Mainland Properties 338 100.0% 1,483 18,700 16,521 1/29/2015 2007 274 7000 West Post Road Las Vegas NV 1 Mainland Properties 96 100.0% 1,305 17,795 17,468 4/9/2019 2010 275 55 Commerce Avenue Albany NY 1 Mainland Properties 125 100.0% 1,130 11,284 10,010 1/29/2015 2013 276 158 West Yard Road Feura Bush NY 1 Mainland Properties 354 100.0% 1,671 9,801 9,513 4/9/2019 2002 277 32150 Just Imagine Drive Avon OH 1 Mainland Properties 645 100.0% 3,479 25,480 19,320 5/29/2009 2000 278 1415 Industrial Drive Chillicothe OH 1 Mainland Properties 44 100.0% 362 4,465 4,064 1/29/2015 2012 279/280/281 1580, 1590 & 1600 Williams Road Columbus OH 3 Mainland Properties 760 100.0% 2,353 31,203 30,496 4/9/2019 1999 282 5300 Centerpoint Parkway Groveport OH 1 Mainland Properties 581 100.0% 2,931 32,563 28,892 1/29/2015 2014 283 200 Orange Point Drive Lewis Center OH 1 Mainland Properties 125 100.0% 1,049 10,075 8,995 1/29/2015 2013 284/285 2353 & 2373 Global Drive Obetz OH 2 Mainland Properties 392 100.0% 2,183 29,762 29,484 8/23/2019 2018 286 301 Commerce Drive South Point OH 1 Mainland Properties 75 100.0% 488 5,130 4,573 1/29/2015 2013 See notes on page 42. 41

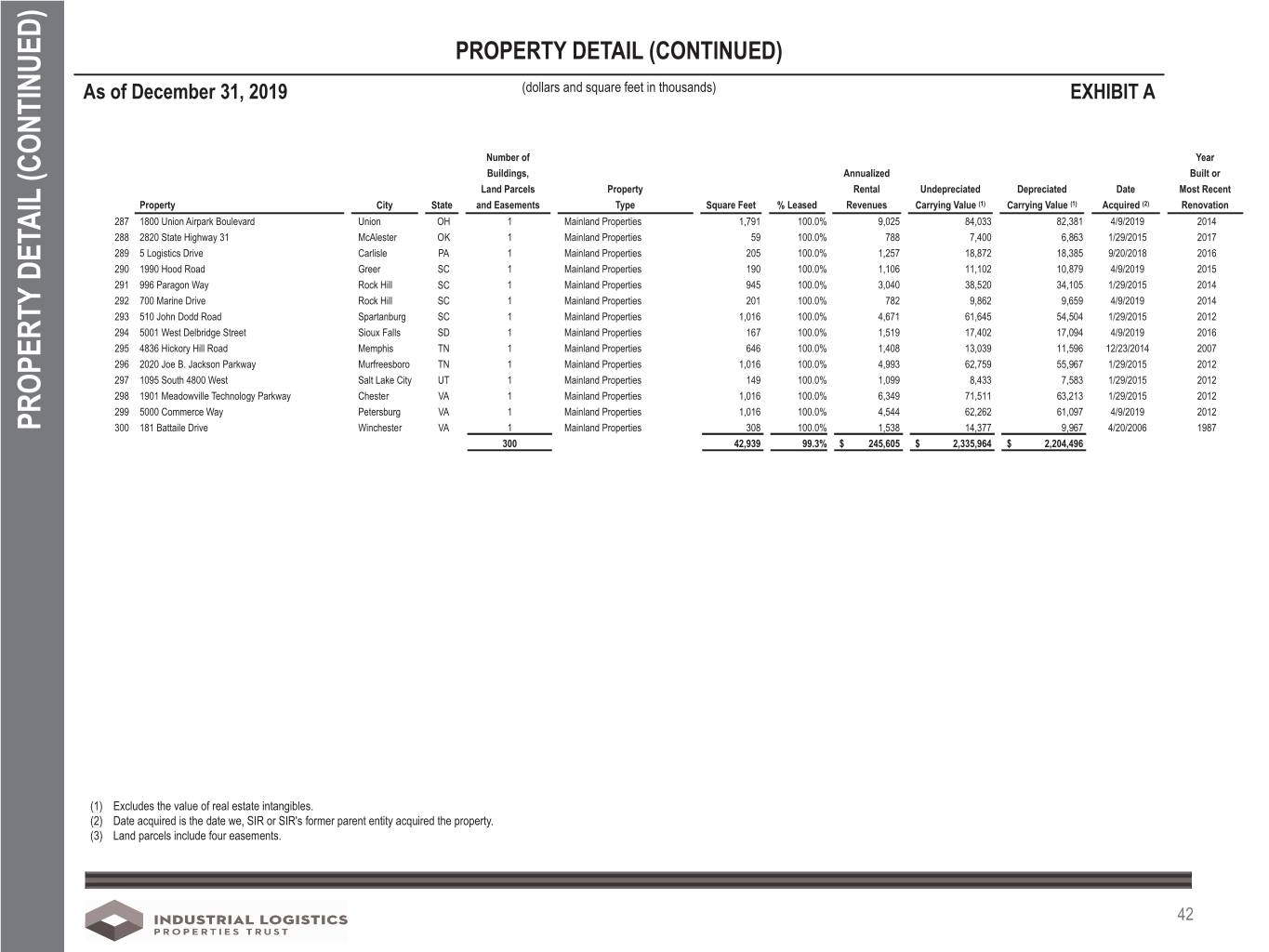

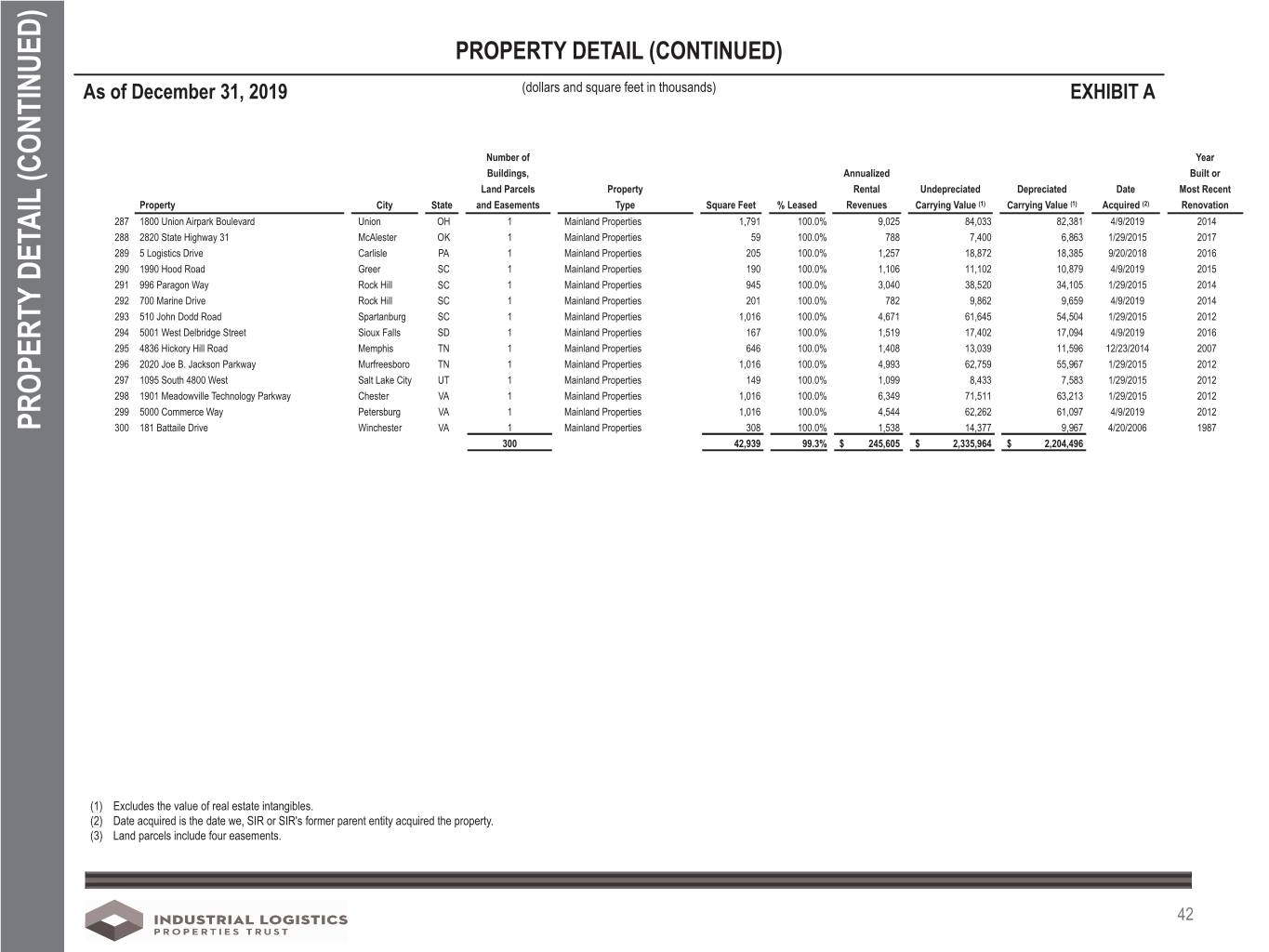

PROPERTY DETAIL (CONTINUED) As of December 31, 2019 (dollars and square feet in thousands) EXHIBIT A Number of Year Buildings, Annualized Built or Land Parcels Property Rental Undepreciated Depreciated Date Most Recent Property City State and Easements Type Square Feet % Leased Revenues Carrying Value (1) Carrying Value (1) Acquired (2) Renovation 287 1800 Union Airpark Boulevard Union OH 1 Mainland Properties 1,791 100.0% 9,025 84,033 82,381 4/9/2019 2014 288 2820 State Highway 31 McAlester OK 1 Mainland Properties 59 100.0% 788 7,400 6,863 1/29/2015 2017 289 5 Logistics Drive Carlisle PA 1 Mainland Properties 205 100.0% 1,257 18,872 18,385 9/20/2018 2016 290 1990 Hood Road Greer SC 1 Mainland Properties 190 100.0% 1,106 11,102 10,879 4/9/2019 2015 291 996 Paragon Way Rock Hill SC 1 Mainland Properties 945 100.0% 3,040 38,520 34,105 1/29/2015 2014 292 700 Marine Drive Rock Hill SC 1 Mainland Properties 201 100.0% 782 9,862 9,659 4/9/2019 2014 293 510 John Dodd Road Spartanburg SC 1 Mainland Properties 1,016 100.0% 4,671 61,645 54,504 1/29/2015 2012 294 5001 West Delbridge Street Sioux Falls SD 1 Mainland Properties 167 100.0% 1,519 17,402 17,094 4/9/2019 2016 295 4836 Hickory Hill Road Memphis TN 1 Mainland Properties 646 100.0% 1,408 13,039 11,596 12/23/2014 2007 296 2020 Joe B. Jackson Parkway Murfreesboro TN 1 Mainland Properties 1,016 100.0% 4,993 62,759 55,967 1/29/2015 2012 297 1095 South 4800 West Salt Lake City UT 1 Mainland Properties 149 100.0% 1,099 8,433 7,583 1/29/2015 2012 298 1901 Meadowville Technology Parkway Chester VA 1 Mainland Properties 1,016 100.0% 6,349 71,511 63,213 1/29/2015 2012 299 5000 Commerce Way Petersburg VA 1 Mainland Properties 1,016 100.0% 4,544 62,262 61,097 4/9/2019 2012 PROPERTY DETAIL (CONTINUED) DETAIL PROPERTY 300 181 Battaile Drive Winchester VA 1 Mainland Properties 308 100.0% 1,538 14,377 9,967 4/20/2006 1987 300 42,939 99.3% $ 245,605 $ 2,335,964 $ 2,204,496 (1) Excludes the value of real estate intangibles. (2) Date acquired is the date we, SIR or SIR's former parent entity acquired the property. (3) Land parcels include four easements. 42