Filed Pursuant to Rule 424(b)(5)

Registration Statement No. 333-233990

PROSPECTUS SUPPLEMENT

(To Prospectus dated October 18, 2019)

5,614,036 Shares

Odonate Therapeutics, Inc.

Common Stock

We are offering 5,614,036 shares of our common stock.

Our common stock is traded on the Nasdaq Global Select Market under the symbol “ODT.” On August 25, 2020, the last reported sale price per share of our common stock was $17.50.

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described under the heading “Risk Factors” on page S-8 of this prospectus supplement and in the accompanying prospectus, as well as those contained in the other documents that are incorporated by reference and any related free writing prospectus. You should carefully read this entire prospectus supplement and the accompanying prospectus, including any information incorporated by reference, before deciding whether to purchase shares of our common stock.

| | Per Share | | | Total | |

Public offering price | | $ | | 14.250 | | | $ | | 80,000,013 | |

Underwriting discounts and commissions(1)(2) | | $ | | 0.855 | | | $ | | 3,900,000 | |

Proceeds to Odonate Therapeutics, Inc., before expenses | | $ | | 13.395 | | | $ | | 76,100,013 | |

(1) See “Underwriting” beginning on page S-9 of this prospectus supplement for additional information regarding underwriting compensation.

(2) There will be no underwriting discount or commission paid with respect to the shares of common stock that Tang Capital Partners, LP purchases in this offering.

The underwriters may also exercise their option to purchase up to an additional 842,105 shares of common stock from us, at a price of $14.25 per share of common stock, for 30 days after the date of this prospectus supplement.

Existing stockholders affiliated with our directors have agreed to purchase approximately $35.0 million of shares of common stock in this offering at the public offering price. The underwriters will not receive any underwriting discounts or commissions with respect to purchases by Tang Capital Partners, LP.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The shares of common stock will be ready for delivery on or about September 1, 2020.

| | |

Book-Running Manager Jefferies | | Lead Manager LifeSci Capital |

Prospectus Supplement dated August 27, 2020.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

We are responsible for the information contained and incorporated by reference in this prospectus supplement, the accompanying prospectus and in any free writing prospectus that we have authorized for use in connection with this offering. We have not authorized anyone to give you any other information, and we take no responsibility for any other information that others may give you. We are not making offers to sell the securities in any jurisdiction in which an offer or solicitation is not authorized or permitted or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. The information contained and incorporated by reference in this prospectus supplement, the accompanying prospectus and any free writing prospectus that we have authorized for use in connection with this offering speaks only as of the date of this document, unless the information specifically indicates that another date applies. Neither the delivery of this prospectus supplement, the accompanying prospectus or any free writing prospectus that we have authorized for use in connection with this offering, nor any sale of securities made under these documents, will, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus supplement, the accompanying prospectus or any free writing prospectus that we have authorized for use in connection with this offering, nor that the information contained or incorporated by reference is correct as of any time subsequent to the date of such information. You should assume that the information contained and incorporated by reference in this prospectus supplement, the accompanying prospectus and in any free writing prospectus that we have authorized for use in connection with this offering is accurate only as of the date of the documents containing the information, unless the information specifically indicates that another date applies. Our business, financial condition, results of operations and prospects may have changed since those dates.

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus form part of a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. This document contains two parts. The first part consists of this prospectus supplement, which provides you with specific information about this offering. The second part consists of the accompanying prospectus, which provides more general information, some of which may not apply to this offering. Generally, when we refer only to the “prospectus,” we are referring to both parts combined. This prospectus supplement may add, update or change information contained in the accompanying prospectus. To the extent that any statement we make in this prospectus supplement is inconsistent with statements made in the accompanying prospectus, or any documents incorporated by reference, the statements made in this prospectus supplement will be deemed to modify or supersede those made in the accompanying prospectus, including the documents incorporated by reference therein. Information in any document we subsequently file that is incorporated by reference shall modify or supersede the information in this prospectus supplement, the accompanying prospectus and documents incorporated by reference prior to such subsequent filing.

Unless otherwise mentioned or unless the context requires otherwise, throughout this prospectus supplement, the words “Odonate,” “we,” “us,” “our” or the “Company” refer to Odonate Therapeutics, Inc., and the term “securities” refers to shares of our common stock.

S-1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement contains forward-looking statements within the meaning of the federal securities laws. We make such forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. You can identify forward-looking statements by the use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “will,” “should,” “may,” “plan,” “assume” and other expressions that predict or indicate future events and trends and that do not relate to historical matters. You should not unduly rely on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. These risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from the anticipated future results, performance or achievements expressed or implied by the forward-looking statements.

These forward-looking statements include, but are not limited to, statements regarding:

| • | whether results from CONTESSA will be sufficient to obtain regulatory approval to market tesetaxel; |

| • | our plans to develop and commercialize tesetaxel and any other product candidates; |

| • | our ongoing and planned clinical studies; |

| • | the relationship between preclinical study results and clinical study results; |

| • | the timing of and our ability to obtain regulatory approvals for tesetaxel and any other product candidates; |

| • | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

| • | our expected use of the net proceeds from this offering; |

| • | our ability to identify additional products or product candidates with significant commercial potential that are consistent with our commercial objectives; |

| • | the rate and degree of market acceptance and clinical utility of tesetaxel and any other product candidates, if approved; |

| • | our commercialization, marketing and manufacturing capabilities and strategy; |

| • | significant competition in our industry; |

| • | our intellectual property position; |

| • | our ability to retain key members of management; |

| • | our ability to execute our growth strategy; and |

| • | our ability to maintain effective internal controls. |

These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results to be materially different from the anticipated future results, performance or achievements expressed or implied by any forward-looking statements, including the factors described under the heading “Risk Factors” in this prospectus supplement and the accompanying prospectus, and the risk factors and cautionary statements described in other documents that we file from time to time with the SEC, specifically under the heading “Item 1A: Risk Factors” and elsewhere in our most recent Annual Report on Form 10-K for the year ended December 31, 2019 that was filed with the SEC on February 20, 2020, and any of our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. You should evaluate all forward-looking statements made in this prospectus supplement and the accompanying prospectus, including the documents we incorporate by reference, in the context of these risks, uncertainties and other factors.

S-2

We caution you that the risks, uncertainties and other factors referred to above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. All forward-looking statements in this prospectus supplement and the accompanying prospectus, including the documents we incorporate by reference, apply only as of the date made and are expressly qualified in their entirety by the cautionary statements included in this prospectus supplement and the accompanying prospectus. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

S-3

PROSPECTUS SUPPLEMENT SUMMARY

The following summary of our business highlights certain of the information contained elsewhere in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus. This summary does not contain all of the information that may be important to you. You should carefully read this entire prospectus supplement and the accompanying prospectus, including any information incorporated by reference, which are described under the headings “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference” herein and therein. In particular, you should carefully consider the risks and uncertainties described under the heading “Risk Factors” in this prospectus supplement and in the accompanying prospectus, as well as those contained in the other documents incorporated by reference and any related free writing prospectus.

Company Overview

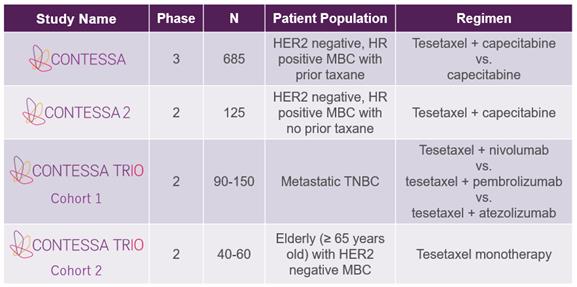

We are a pharmaceutical company dedicated to the development of best-in-class therapeutics that improve and extend the lives of patients with cancer. Our initial focus is on the development of tesetaxel, an investigational, orally administered chemotherapy agent that belongs to a class of drugs known as taxanes, which are widely used in the treatment of cancer. Tesetaxel has several pharmacologic properties that make it unique among taxanes, including: oral administration with a low pill burden; a long (~8-day) terminal plasma half-life in humans, enabling the maintenance of adequate drug levels with relatively infrequent dosing; no history of hypersensitivity (allergic) reactions; and significant activity against chemotherapy-resistant tumors. In patients with metastatic breast cancer (“MBC”), tesetaxel was shown to have significant, single-agent antitumor activity in two multicenter, Phase 2 studies. We are currently conducting three studies in breast cancer, as shown in the following table. We have announced positive top-line results from a multinational, multicenter, randomized, Phase 3 study of tesetaxel in MBC, known as CONTESSA. Our goal for tesetaxel is to develop an effective chemotherapy choice for patients that provides quality-of-life advantages over current alternatives. We plan to submit a New Drug Application (“NDA”) to the U.S. Food and Drug Administration (“FDA”) in mid-2021.

Ongoing Tesetaxel Clinical Studies

|

|

HER2=human epidermal growth factor receptor 2; HR=hormone receptor; MBC=metastatic breast cancer; TNBC=triple-negative breast cancer |

S-4

CONTESSA

CONTESSA is a multinational, multicenter, randomized, Phase 3 study of tesetaxel, an investigational, orally administered taxane, in patients with MBC. CONTESSA is comparing tesetaxel dosed orally at 27 mg/m2 on the first day of each 21 day cycle plus a reduced dose of capecitabine (1,650 mg/m2/day dosed orally for 14 days of each 21 day cycle) to the approved dose of capecitabine alone (2,500 mg/m2/day dosed orally for 14 days of each 21-day cycle) in 685 patients randomized 1:1 with human epidermal growth factor receptor 2 (“HER2”) negative, hormone receptor (“HR”) positive MBC previously treated with a taxane in the neoadjuvant or adjuvant setting. Capecitabine is an oral chemotherapy agent that is considered a standard of care treatment in MBC. Where indicated, patients must have received endocrine therapy with or without a cyclin dependent kinase (“CDK”) 4/6 inhibitor. The primary endpoint is progression-free survival (“PFS”) as assessed by an Independent Radiologic Review Committee (“IRC”). The secondary efficacy endpoints are overall survival (“OS”), objective response rate (“ORR”) as assessed by the IRC, and disease control rate (“DCR”) as assessed by the IRC.

In August 2020, we announced positive top-line results from CONTESSA. CONTESSA met the primary endpoint of improved PFS as assessed by the IRC. Median PFS was 9.8 months for tesetaxel plus a reduced dose of capecitabine versus 6.9 months for the approved dose of capecitabine alone, an improvement of 2.9 months. The risk of disease progression or death was reduced by 28.4% [hazard ratio=0.716 (95% confidence interval: 0.573-0.895); p=0.003] for patients who received tesetaxel plus a reduced dose of capecitabine versus patients who received the approved dose of capecitabine alone.

Tesetaxel plus capecitabine was associated with what we believe are manageable side effects consistent with findings from previous clinical studies. Grade ≥3 treatment-emergent adverse events (“TEAEs”) that occurred in ≥5% of patients were: neutropenia (71.2% for tesetaxel plus capecitabine vs. 8.3% for capecitabine alone); diarrhea (13.4% for tesetaxel plus capecitabine vs. 8.9% for capecitabine alone); hand foot syndrome (6.8% for tesetaxel plus capecitabine vs. 12.2% for capecitabine alone); febrile neutropenia (12.8% for tesetaxel plus capecitabine vs. 1.2% for capecitabine alone); fatigue (8.6% for tesetaxel plus capecitabine vs. 4.5% for capecitabine alone); hypokalemia (8.6% for tesetaxel plus capecitabine vs. 2.7% for capecitabine alone); leukopenia (10.1% for tesetaxel plus capecitabine vs. 0.9% for capecitabine alone); and anemia (8.0% for tesetaxel plus capecitabine vs. 2.1% for capecitabine alone).

Adverse events resulting in treatment discontinuation in ≥1% of patients were: neutropenia or febrile neutropenia (4.2% for tesetaxel plus capecitabine vs. 1.5% for capecitabine alone); neuropathy (3.6% for tesetaxel plus capecitabine vs. 0.3% for capecitabine alone); diarrhea (0.9% for tesetaxel plus capecitabine vs. 1.5% for capecitabine alone); and hand-foot syndrome (0.6% for tesetaxel plus capecitabine vs. 2.1% for capecitabine alone). Treatment discontinuation due to any adverse event occurred in 23.1% of patients treated with tesetaxel plus capecitabine versus 11.9% of patients treated with capecitabine alone.

Grade 2 alopecia (hair loss) occurred in 8.0% of patients treated with tesetaxel plus capecitabine versus 0.3% of patients treated with capecitabine alone. Grade ≥3 neuropathy occurred in 5.9% of patients treated with tesetaxel plus capecitabine versus 0.9% of patients treated with capecitabine alone.

While OS data are not mature, a recent interim analysis indicated the absence of an adverse effect on OS for tesetaxel plus a reduced dose of capecitabine. A final analysis of OS is expected to occur in 2022.

We plan to submit the results of CONTESSA for presentation at an upcoming medical meeting.

We plan to submit an NDA for tesetaxel to the FDA in mid-2021.

CONTESSA 2

CONTESSA 2 is a multinational, multicenter, Phase 2 study of tesetaxel, an investigational, orally administered taxane, in patients with MBC. CONTESSA 2 is investigating tesetaxel dosed orally at

S-5

27 mg/m2 on the first day of each 21-day cycle plus a reduced dose of capecitabine (1,650 mg/m2/day dosed orally for 14 days of each 21-day cycle) in approximately 125 patients with HER2 negative, HR positive MBC not previously treated with a taxane. Capecitabine is an oral chemotherapy agent that is considered a standard-of-care treatment in MBC. Where indicated, patients must have received endocrine therapy with or without a CDK 4/6 inhibitor. The primary endpoint is ORR as assessed by an IRC. The secondary efficacy endpoints are duration of response (“DoR”) as assessed by the IRC, PFS as assessed by the IRC, DCR as assessed by the IRC and OS.

CONTESSA TRIO

CONTESSA TRIO is a multi-cohort, multicenter, Phase 2 study of tesetaxel, an investigational, orally administered taxane, in patients with MBC.

| • | In Cohort 1, approximately 90 patients (with potential expansion to up to 150 patients) with locally advanced or metastatic triple-negative breast cancer (“TNBC”) who have not received prior chemotherapy for advanced disease will be randomized 1:1:1 to receive tesetaxel dosed orally at 27 mg/m2 on the first day of each 21-day cycle plus either: (1) nivolumab at 360 mg by intravenous infusion on the first day of each 21-day cycle; (2) pembrolizumab at 200 mg by intravenous infusion on the first day of each 21-day cycle; or (3) atezolizumab at 1,200 mg by intravenous infusion on the first day of each 21-day cycle. Nivolumab and pembrolizumab (PD-1 inhibitors) and atezolizumab (a PD-L1 inhibitor) are immuno-oncology (“IO”) agents approved for the treatment of multiple types of cancer. One of these agents, atezolizumab, in combination with the intravenously delivered taxane, nab-paclitaxel, was recently approved by the FDA as a first-line treatment for patients with metastatic TNBC. The dual primary endpoints for Cohort 1 are ORR and PFS. Secondary endpoints include DoR and OS. Efficacy results for each of the three PD-(L)1 inhibitor combinations will be assessed for correlation with the results of each of the three approved PD-L1 diagnostic assays. |

| • | In Cohort 2, approximately 40 elderly patients (with potential expansion to up to 60 patients) with HER2 negative MBC will receive tesetaxel monotherapy dosed orally at 27 mg/m2 on the first day of each 21-day cycle. The primary endpoint for Cohort 2 is ORR. Secondary endpoints include PFS, DoR and OS. |

Corporate Information

We are a Delaware corporation that was initially formed as a Delaware limited liability company in March 2013. On December 6, 2017, in anticipation of our initial public offering, we converted into a Delaware corporation.

Our principal executive offices are located at 4747 Executive Drive, Suite 210, San Diego, California 92121, and our telephone number is (858) 731-8180. Our corporate website address is www.odonate.com. Information contained on or accessible through our website is not a part of this prospectus supplement or the accompanying prospectus, and the inclusion of our website address in this prospectus supplement and the accompanying prospectus is an inactive textual reference only.

S-6

THE OFFERING

| |

Common stock offered by us pursuant to this prospectus supplement | 5,614,036 shares. |

Common stock to be outstanding immediately after this offering | 37,724,686 shares (or 38,566,791 shares of common stock if the underwriters’ option to purchase additional shares of common stock is exercised in full). |

Option to purchase additional shares of common stock | The underwriters have a 30-day option to purchase up to 842,105 additional shares of common stock. |

Use of proceeds | We intend to use the net proceeds from this offering for development, regulatory and commercial preparation activities relating to tesetaxel, as well as for working capital and general corporate purposes. See “Use of Proceeds” for additional information. |

Risk factors | You should read and consider the information set forth under the heading “Risk Factors” in this prospectus supplement and in the accompanying prospectus, together with the risk factors and cautionary statements described in our most recent Annual Report on Form 10-K, incorporated by reference herein, before deciding to invest in shares of our common stock. |

Nasdaq Global Select Market Symbol | “ODT” |

The number of shares of common stock shown above to be outstanding immediately after this offering is based on the 32,110,650 shares of common stock outstanding as of June 30, 2020, which includes 1,400,231 shares of common stock underlying outstanding employee incentive units with a weighted-average exercise price of $5.46 per share, and excludes:

| • | 4,438,877 shares of common stock subject to options outstanding as of June 30, 2020 with a weighted-average exercise price of $23.21 per share; |

| • | 1,663,402 shares of common stock reserved for future grant or issuance under the Odonate Therapeutics, Inc. 2017 Stock Option Plan as of June 30, 2020; and |

| • | 439,459 shares of common stock reserved for future issuance under the Odonate Therapeutics, Inc. 2017 Employee Stock Purchase Plan as of June 30, 2020. |

Except as otherwise noted, all information in this prospectus supplement assumes no exercise of the underwriters’ option to purchase additional shares of common stock.

S-7

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below and in the accompanying prospectus, as well as those contained in the other documents incorporated by reference and any free writing prospectus that we have authorized for use in connection with this offering, before deciding whether to purchase shares of our common stock. Our business, financial condition, results of operations, cash flow and prospects could be materially and adversely affected by any of these risks and uncertainties. In any such case, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Relating to this Offering

We have broad discretion as to the use of proceeds from this offering and may not use the proceeds effectively.

Our management will retain broad discretion as to the allocation of the proceeds and may spend these proceeds in ways in which you may not agree. The failure of our management to apply these funds effectively could result in unfavorable returns and uncertainty about our prospects, each of which could cause the price of our common stock to decline.

If you purchase shares of our common stock in this offering, you will incur immediate and substantial dilution.

If you purchase shares of our common stock in this offering, you will incur immediate and substantial dilution in the amount of $9.25 per share because the public offering price of $14.25 per share is substantially higher than the as-adjusted net tangible book value per share of our outstanding common stock. In addition, you may also experience additional dilution after this offering on any future equity issuances, including the issuance of common stock in connection with the Odonate Therapeutics, Inc. 2017 Stock Option Plan and the Odonate Therapeutics, Inc. 2017 Employee Stock Purchase Plan. To the extent we raise additional capital by issuing equity securities, our stockholders will experience substantial additional dilution. See “Dilution” for additional information.

USE OF PROCEEDS

We estimate that we will receive net proceeds from this offering of approximately $76.1 million (or approximately $87.4 million if the underwriters’ option to purchase up to 842,105 additional shares of common stock is exercised in full), based on the public offering price of $14.25 and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds from this offering for development, regulatory and commercial preparation activities relating to tesetaxel, as well as for working capital and general corporate purposes.

Pending the use of the net proceeds, we may invest the proceeds in interest-bearing, investment-grade securities, certificates of deposit or government securities.

DILUTION

Dilution represents the difference between the amount per share of common stock paid by purchasers of shares of common stock in this offering and the as-adjusted net tangible book value per share of our common stock immediately after this offering. The data in this section are derived from our balance sheet as of June 30, 2020. Net tangible book value per share of common stock is equal to our total tangible assets less the amount of our total liabilities, divided by the sum of the number of shares of common stock outstanding as of June 30, 2020, excluding shares of common stock underlying outstanding employee incentive units. Our net tangible book value as of June 30, 2020 was $105.5 million, or $3.44 per share of common stock.

S-8

After giving effect to our receipt of the estimated net proceeds from the sale of shares of our common stock in this offering, based on the public offering price of $14.25 per share of common stock and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us, our as-adjusted net tangible book value as of June 30, 2020 would have been $181.6 million, or $5.00 per share of common stock. This represents an immediate increase in net tangible book value to existing stockholders of $1.56 per share of common stock and immediate dilution in net tangible book value to purchasers of shares of common stock in this offering of $9.25 per share of common stock. The following table illustrates this dilution per share of common stock:

Public offering price per share of common stock | | | | | | | $ | | 14.25 | |

Net tangible book value per share of common stock as of June 30, 2020 | | $ | | 3.44 | | | | | | |

Increase in net tangible book value per share of common stock attributable to purchasers of shares of common stock in this offering | | $ | | 1.56 | | | | | | |

As-adjusted net tangible book value per share of common stock immediately after this offering | | | | | | | $ | | 5.00 | |

Dilution per share of common stock to purchasers of shares of common stock in this offering | | | | | | | $ | | 9.25 | |

If the underwriters fully exercise their option to purchase additional shares of common stock, as-adjusted net tangible book value after this offering would increase by approximately $0.19 per share of common stock, and there would be an immediate dilution of approximately $9.06 per share of common stock to purchasers of shares of common stock in this offering.

The foregoing excludes:

| • | 4,438,877 shares of common stock subject to options outstanding as of June 30, 2020 with a weighted-average exercise price of $23.21 per share; |

| • | 1,400,231 shares of common stock underlying outstanding employee incentive units as of June 30, 2020 with a weighted-average exercise price of $5.46 per share; |

| • | 1,663,402 shares of common stock reserved for future grant or issuance under the Odonate Therapeutics, Inc. 2017 Stock Option Plan as of June 30, 2020; and |

| • | 439,459 shares of common stock reserved for future issuance under the Odonate Therapeutics, Inc. 2017 Employee Stock Purchase Plan as of June 30, 2020. |

UNDERWRITING

Subject to the terms and conditions set forth in the underwriting agreement, dated August 27, 2020, between us and Jefferies LLC, as the representative of the underwriters named below, we have agreed to sell to the underwriters, and each of the underwriters has agreed, severally and not jointly, to purchase from us, the respective number of shares of common stock shown opposite its name below.

Underwriters | | Number of Shares | |

Jefferies LLC | | | 4,210,527 | |

LifeSci Capital | | | 1,403,509 | |

Total | | | 5,614,036 | |

The underwriting agreement provides that the obligations of the underwriters are subject to certain conditions precedent, such as the receipt by the underwriters of officers’ certificates, legal opinions and approval of certain legal matters by their counsel. The underwriting agreement provides that the underwriters will purchase all of the shares of common stock if any of them are purchased. If an underwriter defaults, the underwriting agreement provides that the purchase commitments of the non-defaulting underwriters may be increased or the underwriting agreement may be terminated.

S-9

We have agreed to indemnify the underwriters and certain of their controlling persons against certain liabilities, including liabilities under the Securities Act of 1933, as amended, and to contribute payments that the underwriters may be required to make in respect of those liabilities.

The underwriters are offering the shares of common stock, subject to prior sale, when, as and if issued to and accepted by them, subject to approval of legal matters by their counsel, including the validity of the shares of common stock and other conditions contained in the underwriting agreement such as the receipt by the underwriters of officer’s certificates and legal opinions. The underwriters reserve the right to withdraw, cancel or modify offers to the public and to reject orders in whole or in part.

Commissions and Expenses

The underwriters have advised us that they propose to offer the shares of common stock to the public at the public offering price set forth on the cover page of this prospectus supplement and to certain dealers, which may include the underwriters, at that price, less a concession not in excess of $0.513 per share of common stock. After the offering, the public offering price, concession and reallowance to dealers may be reduced by the representative. No such reduction will change the amount of proceeds to be received by us as set forth on the cover page of this prospectus supplement.

The following table shows the public offering price, the underwriting discounts and commissions that we are to pay the underwriters and the proceeds to us, before expenses, in connection with this offering. Such amounts are shown assuming both no exercise and full exercise by the underwriters of their option to purchase additional shares of common stock.

| | | | | | | Total | |

| | Per Share | | | Without Option to Purchase Additional Shares | | | With Option to Purchase Additional Shares | |

Public offering price | | $ | | 14.250 | | | $ | | 80,000,013 | | | $ | | 92,000,009 | |

Underwriting discounts and commissions | | $ | | 0.855 | | | $ | | 3,900,000 | | | $ | | 4,620,000 | |

Proceeds to us, before expenses | | $ | | 13.395 | | | $ | | 76,100,013 | | | $ | | 87,380,009 | |

We estimate expenses incurred by us in connection with this offering, other than the underwriting discounts and commissions, referred to above, will be approximately $150,000. We have also agreed to reimburse the underwriters for certain of their expenses up to $25,000. The underwriters have agreed to reimburse us for certain of our expenses in an aggregate amount equal to $150,000.

Existing stockholders affiliated with our directors have indicated an interest in purchasing approximately $35.0 million of shares of common stock in this offering at the public offering price. The underwriters will not receive any underwriting discounts or commissions with respect to purchases by Tang Capital Partners, LP.

Listing

Our common stock is traded on the Nasdaq Global Select Market under the symbol “ODT.”

Option to Purchase Additional Shares

We have granted to the underwriters an option, exercisable for 30 days from the date of this prospectus supplement, to purchase, from time to time, in whole or in part, up to an aggregate of 842,105 shares of common stock from us at the public offering price set forth on the cover page of this prospectus supplement, less underwriting discounts and commissions. If the underwriters exercise this option, each underwriter will be obligated, subject to specified conditions, to purchase a number of additional shares of

S-10

common stock proportionate to that underwriter’s initial purchase commitment as indicated in the table above.

No Sales of Similar Securities

We, our executive officers and directors and certain of our stockholders have agreed, subject to specified exceptions, not to directly or indirectly:

| • | sell, offer, contract or grant any option to sell (including any short sale), transfer, establish an open “put equivalent position” within the meaning of Rule 16a-l(h) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”); |

| • | otherwise dispose of any shares of common stock, options to acquire shares of common stock, or securities exchangeable or exercisable for or convertible into shares of common stock currently or hereafter owned either of record or beneficially; or |

| • | publicly announce an intention to do any of the foregoing for a period of 90 days after the date of this prospectus supplement without the prior written consent of Jefferies LLC. |

This restriction terminates after the close of trading of the common stock on and including the 90th day after the date of this prospectus supplement.

Jefferies LLC may, in its sole discretion and at any time or from time to time before the termination of the 90-day period, release all or any portion of the securities subject to lock-up agreements. Except for customary lock-up exceptions, there are no existing agreements between the underwriters and any of our stockholders who will execute a lock-up agreement that provide consent to the sale of shares of common stock prior to the expiration of the lock-up period.

Stabilization

The underwriters have advised us that they may engage in short sale transactions, stabilizing bids, syndicate covering transactions or the imposition of penalty bids in connection with this offering. These activities may have the effect of stabilizing or maintaining the market price of the common stock at a level above that which might otherwise prevail in the open market. Establishing short sales positions may involve either covered short sales or naked short sales.

Covered short sales are sales made in an amount not greater than the underwriters’ option to purchase additional shares of our common stock in this offering. The underwriters may close out any covered short position by either exercising their option to purchase additional shares of our common stock or purchasing shares of our common stock in the open market. In determining the source of shares of common stock to close out the covered short position, the underwriters will consider, among other things, the price of shares of common stock available for purchase in the open market as compared to the price at which they may purchase shares of our common stock through the option that we granted to them in connection with this offering.

Naked short sales are sales in excess of such option. The underwriters must close out any naked short position by purchasing shares of our common stock in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of shares of our common stock in the open market after pricing that could adversely affect investors who purchase in this offering.

A stabilizing bid is a bid for the purchase of shares of common stock on behalf of the underwriters for the purpose of fixing or maintaining the price of the common stock.

A syndicate covering transaction is the bid for or the purchase of shares of common stock on behalf of the underwriters to reduce a short position incurred by the underwriters in connection with the offering. Similar to other purchase transactions, the underwriters’ purchases to cover the syndicate short sales

S-11

may have the effect of raising or maintaining the market price of our common stock or preventing or retarding a decline in the market price of our common stock. As a result, the price of our common stock may be higher than the price that might otherwise exist in the open market.

A penalty bid is an arrangement permitting the underwriters to reclaim the selling concession otherwise accruing to a syndicate member in connection with the offering if the shares of common stock originally sold by such syndicate member are purchased in a syndicate covering transaction and, therefore, have not been effectively placed by such syndicate member.

Neither we nor any of the underwriters make any representation or prediction as to the direction or magnitude of any effect that the transactions described above may have on the price of shares of our common stock. The underwriters are not obligated to engage in these activities and, if commenced, any of the activities may be discontinued at any time.

The underwriters may also engage in passive market making transactions in our common stock on the Nasdaq Global Select Market in accordance with Rule 103 of Regulation M during a period before the commencement of offers or sales of shares of our common stock in this offering and extending through the completion of distribution. A passive market maker must display its bid at a price not in excess of the highest independent bid of that security. However, if all independent bids are lowered below the passive market maker’s bid, that bid must then be lowered when specified purchase limits are exceeded.

Electronic Distribution

A prospectus supplement and accompanying prospectus in electronic format may be made available by e-mail or on the web sites or through online services maintained by one or more of the underwriters or their affiliates. In those cases, prospective investors may view offering terms online and may be allowed to place orders online. The underwriters may agree with us to allocate a specific number of shares of common stock for sale to online brokerage account holders. Any such allocation for online distributions will be made by the underwriters on the same basis as other allocations. Other than this prospectus supplement and the accompanying prospectus in electronic format, the information on the underwriters’ web sites and any information contained in any other web site maintained by any of the underwriters is not part of this prospectus supplement and the accompanying prospectus, has not been approved and/or endorsed by us or the underwriters and should not be relied on by investors.

Other Activities and Relationships

The underwriters and certain of their respective affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory services, investment management, investment research, principal investment, hedging, financing and brokerage activities. The underwriters and certain of their respective affiliates have performed, and may in the future perform, various commercial and investment banking and financial advisory services for us and our affiliates, for which they received or will receive customary fees and expenses.

In the ordinary course of their various business activities, the underwriters and certain of their affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers, and such investment and securities activities may involve securities and/or instruments issued by us and our affiliates. The underwriters and certain of their respective affiliates may also communicate independent investment recommendations, market color or trading ideas and/or publish or express independent research views in respect of such securities or instruments and may at any time hold or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

S-12

Notice to Prospective Investors in the European Economic Area

In relation to each member state of the European Economic Area, that has implemented the Prospectus Directive (each, a “Relevant Member State”), an offer to the public of any shares of common stock that are the subject of the offering contemplated by this prospectus supplement and the accompanying prospectus may not be made in that Relevant Member State, except that an offer to the public in that Relevant Member State of any common shares may be made at any time under the following exemptions under the Prospectus Directive, if they have been implemented in that Relevant Member State:

| • | to any legal entity which is a “qualified investor” as defined in the Prospectus Directive; |

| • | to fewer than 100 or, if the Relevant Member State has implemented the relevant provision of the 2010 PD Amending Directive, 150, natural or legal persons (other than qualified investors as defined in the Prospectus Directive), as permitted under the Prospectus Directive, subject to obtaining the prior consent of the underwriters or the underwriters nominated by us for any such offer; or |

| • | in any other circumstances falling within Article 3(2) of the Prospectus Directive; provided that no such offer of shares of common stock shall require us or any of the underwriters to publish a prospectus pursuant to Article 3 of the Prospectus Directive, or supplement a prospectus pursuant to Article 16 of the Prospectus Directive. |

For the purposes of this provision, the expression to “offer of shares of common stock to the public” in relation to the common stock in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the shares of common stock to be offered so as to enable an investor to decide to purchase or subscribe to the shares of common stock, as the same may be varied in that Relevant Member State by any measure implementing the Prospectus Directive in that Relevant Member State, and the expression “Prospectus Directive” means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and includes any relevant implementing measure in the Relevant Member State, and the expression “2010 PD Amending Directive” means Directive 2010/73/EU.

Notice to Prospective Investors in the United Kingdom

This prospectus supplement and the accompanying prospectus are only being distributed to, and are only directed at, persons in the United Kingdom that are qualified investors within the meaning of Article 2(1)(e) of the Prospectus Directive that are also: (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”); and/or (ii) high net worth entities falling within Article 49(2)(a) to (d) of the Order and other persons to whom it may lawfully be communicated (each such person being referred to as a “relevant person”).

This prospectus supplement and the accompanying prospectus should not be distributed, published or reproduced (in whole or in part) or disclosed by recipients to any other persons in the United Kingdom. Any person, in the United Kingdom that is not a relevant person should not act or rely on this document or any of its contents.

Notice to Prospective Investors in Hong Kong

No securities have been offered or sold, and no securities may be offered or sold, in Hong Kong, by means of any document, other than: (i) to persons whose ordinary business is to buy or sell shares or debentures, whether as principal or agent; or (ii) to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong (the “SFO”) and any rules made under that Ordinance; or in other circumstances which do not result in the document being a “prospectus” as defined in the Companies Ordinance (Cap. 32) of Hong Kong (the “CO”) or which do not constitute an offer or invitation to the public for the purpose of the CO or the SFO. No document, invitation or advertisement relating to the securities has been issued or may be issued or may be in the possession of any person for the

S-13

purpose of issue (in each case whether in Hong Kong or elsewhere), that is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except if permitted under the securities laws of Hong Kong) other than with respect to securities that are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” as defined in the SFO and any rules made under that Ordinance.

This prospectus supplement and the accompanying prospectus have not been registered with the Registrar of Companies in Hong Kong. Accordingly, this prospectus supplement and the accompanying prospectus may not be issued, circulated or distributed in Hong Kong, and the securities may not be offered for subscription to members of the public in Hong Kong. Each person acquiring the securities will be required, and is deemed by the acquisition of the securities, to confirm that he is aware of the restriction on offers of the securities described in this prospectus supplement and accompanying prospectus and that he is not acquiring, and has not been offered, any securities in circumstances that contravene any such restrictions.

Notice to Prospective Investors in Japan

The offering has not been and will not be registered under the Financial Instruments and Exchange Law of Japan (Law No. 25 of 1948 of Japan, as amended, the “FIEL”) and the underwriters will not offer or sell any securities, directly or indirectly, in Japan or to, or for the benefit of, any resident of Japan (the term as used herein means any person resident in Japan, including any corporation or other entity organized under the laws of Japan), or to others for re-offering or resale, directly or indirectly, in Japan or to, or for the benefit of, any resident of Japan, except pursuant to an exemption from the registration requirements of, and otherwise in compliance with the FIEL and any other applicable laws, regulations and ministerial guidelines of Japan.

Notice to Prospective Investors in Singapore

This prospectus supplement and the accompanying prospectus have not been and will not be lodged or registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this prospectus supplement and the accompanying prospectus and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the shares of common stock offered hereby may not be circulated or distributed, nor may the shares of common stock be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than: (i) to an institutional investor under Section 274 of the Securities and Futures Act, Chapter 289 of Singapore (the “SFA”); (ii) to a relevant person pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275, of the SFA; or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the shares of common stock are subscribed or purchased under Section 275 of the SFA by a relevant person that is:

| • | a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)), the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or |

| • | a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities (as defined in Section 239(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the shares of common stock pursuant to an offer made under Section 275 of the SFA except: |

| • | to an institutional investor or to a relevant person defined in Section 275(2) of the SFA, or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(i)(B) of the SFA; |

| • | where no consideration is or will be given for the transfer; |

S-14

| • | where the transfer is by operation of law; |

| • | as specified in Section 276(7) of the SFA; or |

| • | as specified in Regulation 32 of the Securities and Futures (Offers of Investments) (Shares and Debentures) Regulations 2005 of Singapore. |

Notice to Prospective Investors in Canada

Resale Restrictions

The offering of the shares of common stock in Canada is being made only in the provinces of Ontario, Quebec, Alberta and British Columbia on a private placement basis exempt from the requirement that the we prepare and file a prospectus with the securities regulatory authorities in each province where trades of these securities are made. Any resale of the shares of common stock in Canada must be made under applicable securities laws which may vary depending on the relevant jurisdiction and which may require resales to be made under available statutory exemptions or under a discretionary exemption granted by the applicable Canadian securities regulatory authority. Purchasers are advised to seek legal advice prior to any resale of the securities.

Representations of Canadian Purchasers

By purchasing shares of common stock in Canada and accepting delivery of a purchase confirmation, a purchaser is representing to us and the dealer from whom the purchase confirmation is received that:

| • | the purchaser is entitled under applicable provincial securities laws to purchase the shares of common stock without the benefit of a prospectus qualified under those securities laws, as it is an “accredited investor” as defined under National Instrument 45-106 – Prospectus Exemptions; |

| • | the purchaser is a “permitted client” as defined under National Instrument 31-103 – Registration Requirements, Exemptions and Ongoing Registrant Obligations; |

| • | where required by law, the purchaser is purchasing as principal and not as agent; and |

| • | the purchaser has reviewed the text above under “Resale Restrictions.” |

Conflicts of Interest

Canadian purchasers are hereby notified that the underwriters relying on the exemption set out in section 3A.3 or 3A.4, if applicable, of National Instrument 33-105 – Underwriting Conflicts, to not provide certain conflict of interest disclosures in this document.

Statutory Rights of Action

Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if the offering memorandum (including any amendment thereto) such as this document contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the purchaser’s province or territory. The purchaser of these securities in Canada should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights or consult with a legal advisor.

Enforcement of Legal Rights

All of our directors and officers as well as the experts named herein may be located outside of Canada, and, as a result, it may not be possible for Canadian purchasers to effect service of process within Canada upon us or those persons. All or a substantial portion of our assets, and the assets of those persons may be located outside of Canada, and, as a result, it may not be possible to satisfy a

S-15

judgment against us or those persons in Canada or to enforce a judgment obtained in Canadian courts against us or those persons outside of Canada.

Taxation and Eligibility for Investment

Canadian purchasers of the shares of common stock should consult their own legal and tax advisors with respect to the tax consequences of an investment in the shares of common stock in their particular circumstances and about the eligibility of the shares of common stock for investment by the purchaser under relevant Canadian legislation.

Notice to Prospective Investors in Australia

This prospectus supplement and the accompanying prospectus is not a disclosure document for the purposes of Australia’s Corporations Act 2001 (Cth) of Australia (the “Corporations Act”), has not been lodged with the Australian Securities and Investments Commission and is only directed to the categories of exempt persons set out below. Accordingly, if you receive this prospectus supplement and the accompanying prospectus in Australia, you confirm and warrant that you are either:

| • | a “sophisticated investor” under Section 708(8)(a) or (b) of the Corporations Act; |

| • | a “sophisticated investor” under Section 708(8)(c) or (d) of the Corporations Act and that you have provided an accountant’s certificate to the Company that complies with the requirements of Section 708(8)(c)(i) or (ii) of the Corporations Act and related regulations before the offer has been made; |

| • | a person associated with the Company under Section 708(12) of the Corporations Act; or |

| • | a “professional investor” under Section 708(11)(a) or (b) of the Corporations Act. |

To the extent that you are unable to confirm or warrant that you are an exempt sophisticated investor, associated person or professional investor under the Corporations Act, any offer made to you under this prospectus supplement and the accompanying prospectus is void and incapable of acceptance.

Further, you warrant and agree that you will not offer any of the securities issued to you pursuant to this prospectus supplement and the accompanying prospectus for resale in Australia within 12 months of those securities being issued unless any such resale offer is exempt from the requirement to issue a disclosure document under Section 708 of the Corporations Act.

Notice to Prospective Investors in Israel

This document does not constitute a prospectus under the Israeli Securities Law, 5728-1968 (the “Israeli Securities Law”), and has not been filed with or approved by the Israel Securities Authority. In Israel, this prospectus supplement and the accompanying prospectus is being distributed only to, and is directed only at, and any offer of the shares of common stock offered hereby is directed only at: (i) a limited number of persons in accordance with the Israeli Securities Law; and (ii) investors listed in the first addendum to the Israeli Securities Law, as it may be amended from time to time (the “Addendum”), consisting primarily of joint investment in trust funds, provident funds, insurance companies, banks, portfolio managers, investment advisors, members of the Tel Aviv Stock Exchange, underwriters, venture capital funds, entities with equity in excess of NIS 50 million and “qualified individuals,” each as defined in the Addendum, collectively referred to as qualified investors (in each case, purchasing for their own account or, where permitted under the Addendum, for the accounts of their clients who are investors listed in the Addendum). Qualified investors are required to submit written confirmation that they fall within the scope of the Addendum, are aware of the meaning of the Addendum and agree to it.

S-16

Notice to Prospective Investors in Switzerland

The shares of common stock may not be publicly offered in Switzerland and will not be listed on the SIX Swiss Exchange (“SIX”) or on any other stock exchange or regulated trading facility in Switzerland. This prospectus supplement and the accompanying prospectus has been prepared without regard to the disclosure standards for issuance prospectuses under art. 652a or art. 1156 of the Swiss Code of Obligations or the disclosure standards for listing prospectuses under art. 27 ff. of the SIX Listing Rules or the listing rules of any other stock exchange or regulated trading facility in Switzerland. Neither this prospectus supplement and the accompanying prospectus, nor any other offering or marketing material relating to the shares of common stock or the offering, may be publicly distributed or otherwise made publicly available in Switzerland.

Neither this prospectus supplement and the accompanying prospectus, nor any other offering or marketing material relating to the offering, the Company or the shares of common stock offered hereby, have been or will be filed with or approved by any Swiss regulatory authority. In particular, this prospectus supplement and the accompanying prospectus will not be filed with, and the offer of securities will not be supervised by, the Swiss Financial Market Supervisory Authority FINMA, and the offer of securities has not been and will not be authorized under the Swiss Federal Act on Collective Investment Schemes (the “CISA”). The investor protection afforded to acquirers of interests in collective investment schemes under the CISA does not extend to acquirers of shares of common stock offered hereby.

EXPERTS

The financial statements of Odonate Therapeutics, Inc. as of December 31, 2019 and 2018 and for each of the years in the two-year period ended December 31, 2019 are incorporated in this prospectus supplement by reference from the Odonate Therapeutics, Inc. Annual Report on Form 10-K for the year ended December 31, 2019 and have been audited by Squar Milner LLP, an independent registered public accounting firm, as stated in their report thereon, incorporated herein by reference, and have been incorporated by reference in this prospectus supplement and registration statement in reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

LEGAL MATTERS

The validity of the common stock being offered in this prospectus supplement will be passed on by Gibson, Dunn & Crutcher LLP of San Francisco, California. Latham & Watkins LLP of Menlo Park, California is counsel to the underwriters in connection with this offering.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

Odonate is subject to the informational requirements of the Exchange Act, and in accordance therewith, files annual, quarterly and special reports, proxy statements and other information with the SEC. The SEC maintains an Internet website that contains reports, proxy statements and other information about registrants, like us, that file electronically with the SEC. The address of that site is www.sec.gov. Statements contained in this prospectus supplement as to the contents of any contract or other document are not necessarily complete, and in each instance, we refer you to the copy of the contract or document filed as an exhibit to the registration statement, each such statement being qualified in all respects by such reference.

S-17

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to incorporate by reference the information and reports we file with it, which means that we can disclose important information to you by referring you to these documents. The information incorporated by reference is an important part of this prospectus supplement, and information that we file after the date hereof with the SEC will automatically update and supersede the information already incorporated by reference. We are incorporating by reference the documents listed below:

| • | Annual Report on Form 10-K for the year ended December 31, 2019 filed with the SEC on February 20, 2020; |

| • | Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020 and June 30, 2020 filed with the SEC on April 28, 2020 and July 30, 2020, respectively; |

| • | Definitive Proxy Statement on Schedule 14A filed with the SEC on May 15, 2020; and |

| • | The description of our common stock contained in our registration statement on Form 8-A filed with the SEC on December 5, 2017, as updated by Exhibit 4.1 to our Annual Report on Form 10-K for the year ended December 31, 2019 filed with the SEC on February 20, 2020, together with any amendment or report filed for the purpose of updating such description. |

All documents we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act shall be deemed incorporated by reference in this prospectus supplement and to be a part of this prospectus supplement from the date of filing of those documents, with the exception of any portion of any report or document that is not deemed “filed” under such provisions on or after the date of this prospectus supplement, until the earlier of the date on which: (1) all of the securities registered hereunder have been sold; or (2) the registration statement of which this prospectus supplement is a part has been withdrawn.

Nothing in this prospectus supplement shall be deemed to incorporate information furnished but not filed with the SEC pursuant to Item 2.02 or 7.01 of Form 8-K.

Upon written or oral request, we will provide without charge to each person to whom a copy of the prospectus supplement is delivered a copy of the documents incorporated by reference herein (other than exhibits to such documents unless such exhibits are specifically incorporated by reference herein). You may request a copy of these filings, at no cost, by writing, calling or emailing us at the contact information set forth below. We have authorized no one to provide you with any information that differs from that contained in this prospectus supplement. Accordingly, we take no responsibility for any other information that others may give you. You should not assume that the information in this prospectus supplement is accurate as of any date other than the date of the front cover of this prospectus supplement.

Odonate Therapeutics, Inc.

4747 Executive Drive, Suite 210

San Diego, California 92121

Attn: Investor Relations

(858) 731-8180

ir@odonate.com

S-18

PROSPECTUS

$200,000,000

Odonate Therapeutics, Inc.

Common Stock

We may offer and sell up to an aggregate of $200,000,000 of common stock from time to time in one or more offerings.

This prospectus provides a general description of the common stock we may offer. Each time we offer common stock, we will provide specific terms of the common stock offered in a supplement to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. A prospectus supplement and any related free writing prospectus may also add, update or change information contained in this prospectus. You should carefully read this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as any documents incorporated by reference, before you invest in any of the common stock being offered.

This prospectus may not be used to sell our common stock unless accompanied by a prospectus supplement.

Our common stock is traded on the Nasdaq Global Select Market under the symbol “ODT.” On September 26, 2019, the last reported sale price per share of our common stock was $26.26.

We may offer and sell our common stock to or through one or more agents, underwriters, dealers or other third parties or directly to one or more purchasers on a continuous or delayed basis. If agents, underwriters or dealers are used to sell our common stock, we will name them and describe their compensation in a prospectus supplement. The price to the public of our common stock and the net proceeds we expect to receive from the sale of such common stock will also be set forth in a prospectus supplement.

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties referenced under the heading “Risk Factors” on page 5 of this prospectus, as well as those contained in the applicable prospectus supplement and any related free writing prospectus, and in the other documents that are incorporated by reference into this prospectus or the applicable prospectus supplement.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 18, 2019.

TABLE OF CONTENTS

We are responsible for the information contained and incorporated by reference in this prospectus, in any accompanying prospectus supplement and in any related free writing prospectus we prepare or authorize. We have not authorized anyone to give you any other information, and we take no responsibility for any other information that others may give you. We are not making offers to sell the securities in any jurisdiction in which an offer or solicitation is not authorized or permitted or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. The information contained or incorporated by reference in this document or such documents incorporated by reference, as applicable, speaks only as of the date of this document, unless the information specifically indicates that another date applies. Neither the delivery of this prospectus or any accompanying prospectus supplement, nor any sale of securities made under these documents, will, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus, any accompanying prospectus supplement or any free writing prospectus we may provide you in connection with an offering or that the information contained or incorporated by reference is correct as of any time subsequent to the date of such information. You should assume that the information contained or incorporated by reference in this prospectus or any accompanying prospectus supplement is accurate only as of the date of the documents containing the information, unless the information specifically indicates that another date applies. Our business, financial condition, results of operations and prospects may have changed since those dates.

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, we may offer common stock from time to time in one or more offerings for an aggregate offering price of up to $200,000,000. This prospectus provides you with a general description of our common stock being offered.

Each time we offer shares of common stock under this prospectus, we will provide a prospectus supplement that will contain more specific information about the terms of the offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. This prospectus may not be used to sell our common stock unless accompanied by a prospectus supplement. Each such prospectus supplement and any free writing prospectus that we may authorize to be provided to you may also add, update or change information contained in this prospectus or in documents incorporated by reference into this prospectus. We urge you to carefully read this prospectus, any applicable prospectus supplement and any related free writing prospectus, together with the information incorporated herein by reference as described under the headings “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference” before you invest in our common stock.

We have not authorized anyone to provide you with information in addition to or different from that contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. We take no responsibility for, and can provide no assurances as to the reliability of, any information not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. This prospectus is an offer to sell the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate only as of the date on the front of the document and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement or any related free writing prospectus, or any sale of a security.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described under the heading “Where You Can Find Additional Information.”

Unless otherwise mentioned or unless the context requires otherwise, throughout this prospectus, any applicable prospectus supplement and any related free writing prospectus, the words “Odonate,” “the Company,” “we,” “us,” “our” or similar references refer to Odonate Therapeutics, Inc., and the term “securities” refers to shares of our common stock.

1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents that we incorporate by reference, contains forward-looking statements within the meaning of the federal securities laws. We make such forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. You can identify forward-looking statements by the use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “will,” “should,” “may,” “plan,” “assume” and other expressions that predict or indicate future events and trends and that do not relate to historical matters. You should not unduly rely on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. These risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from the anticipated future results, performance or achievements expressed or implied by the forward-looking statements.

These forward-looking statements include, but are not limited to, statements regarding:

| • | our plans to develop and commercialize tesetaxel and any other product candidates; |

| • | our ongoing and planned clinical studies; |

| • | the relationship between preclinical study results and clinical study results; |

| • | the timing of and our ability to obtain regulatory approvals for tesetaxel and any other product candidates; |

| • | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

| • | our ability to identify additional products or product candidates with significant commercial potential that are consistent with our commercial objectives; |

| • | the rate and degree of market acceptance and clinical utility of tesetaxel and any other product candidates, if approved; |

| • | our commercialization, marketing and manufacturing capabilities and strategy; |

| • | significant competition in our industry; |

| • | our intellectual property position; |

| • | our ability to retain key members of management; |

| • | our ability to execute our growth strategy; and |

| • | our ability to maintain effective internal controls. |

These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results to differ materially from the anticipated future results, performance or achievements expressed or implied by any forward-looking statements, including the factors described under the heading “Risk Factors” in this prospectus and the risk factors and cautionary statements described in other documents that we file from time to time with the SEC, specifically under the heading “Item 1A: Risk Factors” and elsewhere in our most recent Annual Report on Form 10-K for the year ended December 31, 2018 that was filed with the SEC on February 22, 2019 and any of our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. You should evaluate all forward-looking statements made in this prospectus, including the documents that we incorporate by reference, in the context of these risks, uncertainties and other factors.

We caution you that the risks, uncertainties and other factors referred to above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. All forward-looking statements in this prospectus, including the documents we incorporate by reference,

2

apply only as of the date made and are expressly qualified in their entirety by the cautionary statements included in this prospectus. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

ABOUT THE COMPANY

Our Company

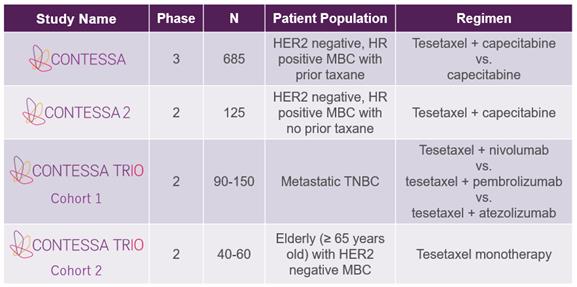

We are a pharmaceutical company dedicated to the development of best-in-class therapeutics that improve and extend the lives of patients with cancer. Our initial focus is on the development of tesetaxel, an investigational, orally administered chemotherapy agent that belongs to a class of drugs known as taxanes, which are widely used in the treatment of cancer. Tesetaxel has several pharmacologic properties that make it unique among taxanes, including: oral administration with a low pill burden; a long (~8-day) terminal plasma half-life in humans, enabling the maintenance of adequate drug levels with relatively infrequent dosing; no history of hypersensitivity (allergic) reactions; and significant activity against chemotherapy-resistant tumors. In patients with metastatic breast cancer, tesetaxel was shown to have significant, single-agent antitumor activity in two multicenter, Phase 2 studies. We are currently conducting three studies in breast cancer, as shown in the following table, including a multinational, multicenter, randomized, Phase 3 study in patients with human epidermal growth factor receptor 2 (“HER2”) negative, hormone receptor (“HR”) positive metastatic breast cancer (“MBC”), known as CONTESSA. We expect to complete enrollment of CONTESSA in the second half of 2019 and report top-line results from CONTESSA in 2020. Our goal for tesetaxel is to develop an effective chemotherapy choice for patients that provides quality-of-life advantages over current alternatives.

Ongoing Tesetaxel Clinical Studies

|

|

HER2= human epidermal growth factor receptor 2; HR=hormone receptor; MBC=metastatic breast cancer; TNBC=triple-negative breast cancer |

CONTESSA

CONTESSA is a multinational, multicenter, randomized, Phase 3 study of tesetaxel, an investigational, orally administered taxane, in patients with MBC. CONTESSA is comparing tesetaxel dosed orally at 27 mg/m2 on the first day of each 21-day cycle plus a reduced dose of capecitabine (1,650 mg/m2/day dosed orally for 14 days of each 21-day cycle) to the approved dose of capecitabine alone (2,500 mg/m2/day dosed orally for 14 days of each 21-day cycle) in approximately 600 patients randomized 1:1 with HER2 negative, HR positive MBC previously treated with a taxane in the neoadjuvant or adjuvant setting. Capecitabine is an oral chemotherapy agent that is considered a standard-of-care treatment in MBC.

3