INVESTOR PRESENTATION November 5, 2020 Exhibit 99.3

Cautionary Statement Regarding Forward-looking Statements This presentation may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond our control, and may cause actual results to differ significantly from those expressed in any forward-looking statement. Among others, the following uncertainties and other factors could cause actual results to differ from those set forth in the forward-looking statements: operating costs and business disruption may be greater than expected; uncertainties regarding the ongoing impact of the novel coronavirus (COVID-19), the severity of the disease, the duration of the COVID-19 outbreak, actions that may be taken by governmental authorities to contain the COVID-19 outbreak or to treat its impact, the potential negative impacts of COVID-19 on the global economy and its adverse impact on the real estate market, the economy and the Company’s investments (including, but not limited to, the Los Angeles mixed-use development loan and other hospitality loans), financial condition and business operation; defaults by borrowers in paying debt service on outstanding indebtedness and borrowers’ abilities to manage and stabilize properties; deterioration in the performance of the properties securing our investments (including depletion of interest and other reserves or payment-in-kind concessions in lieu of current interest payment obligations) that may cause deterioration in the performance of our investments and, potentially, principal losses to us; the Company's operating results may differ materially from the information presented in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as well as in Colony Credit Real Estate’s other filings with the Securities and Exchange Commission; the fair value of the Company's investments may be subject to uncertainties; the Company's use of leverage could hinder its ability to make distributions and may significantly impact its liquidity position; given the Company's dependence on its external manager, an affiliate of Colony Capital, Inc., any adverse changes in the financial health or otherwise of its manager or Colony Capital, Inc. could hinder the Company's operating performance and return on stockholder's investment; the ability to realize substantial efficiencies as well as anticipated strategic and financial benefits, including, but not limited to expected returns on equity and/or yields on investments; adverse impacts on the Company's corporate revolver, including covenant compliance and borrowing base capacity; adverse impacts on the Company's liquidity, including margin calls on master repurchase facilities, debt service or lease payment defaults or deferrals, demands for protective advances and capital expenditures, or its ability to continue to generate liquidity from sales of Legacy, Non-Strategic assets; the Company’s ability to liquidate its Legacy, Non-Strategic assets within the projected timeframe or at the projected values; the timing of and ability to deploy available capital; the Company’s ability to pay, maintain or grow the dividend at all in the future; the timing of and ability to complete repurchases of the Company’s stock; the ability of the Company to refinance certain mortgage debt on similar terms to those currently existing or at all; whether Colony Capital will continue to serve as our external manager or whether we will pursue another strategic transaction; and the impact of legislative, regulatory and competitive changes, and the actions of government authorities, including the current U.S. presidential administration, and in particular those affecting the commercial real estate finance and mortgage industry or our business. The foregoing list of factors is not exhaustive. Additional information about these and other factors can be found in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 and Part II, Item 1A of the Company’s Form 10-Q for the quarter ended June 30, 2020, as well as in Colony Credit Real Estate’s other filings with the Securities and Exchange Commission. Moreover, each of the factors referenced above are likely to also be impacted directly or indirectly by the ongoing impact of COVID-19 and investors are cautioned to interpret substantially all of such statements and risks as being heightened as a result of the ongoing impact of the COVID-19. We caution investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this presentation. Colony Credit Real Estate is under no duty to update any of these forward-looking statements after the date of this presentation, nor to conform prior statements to actual results or revised expectations, and Colony Credit Real Estate does not intend to do so. We caution investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this presentation. Colony Credit Real Estate is under no duty to update any of these forward-looking statements after the date of this presentation, nor to conform prior statements to actual results or revised expectations, and Colony Credit Real Estate does not intend to do so.

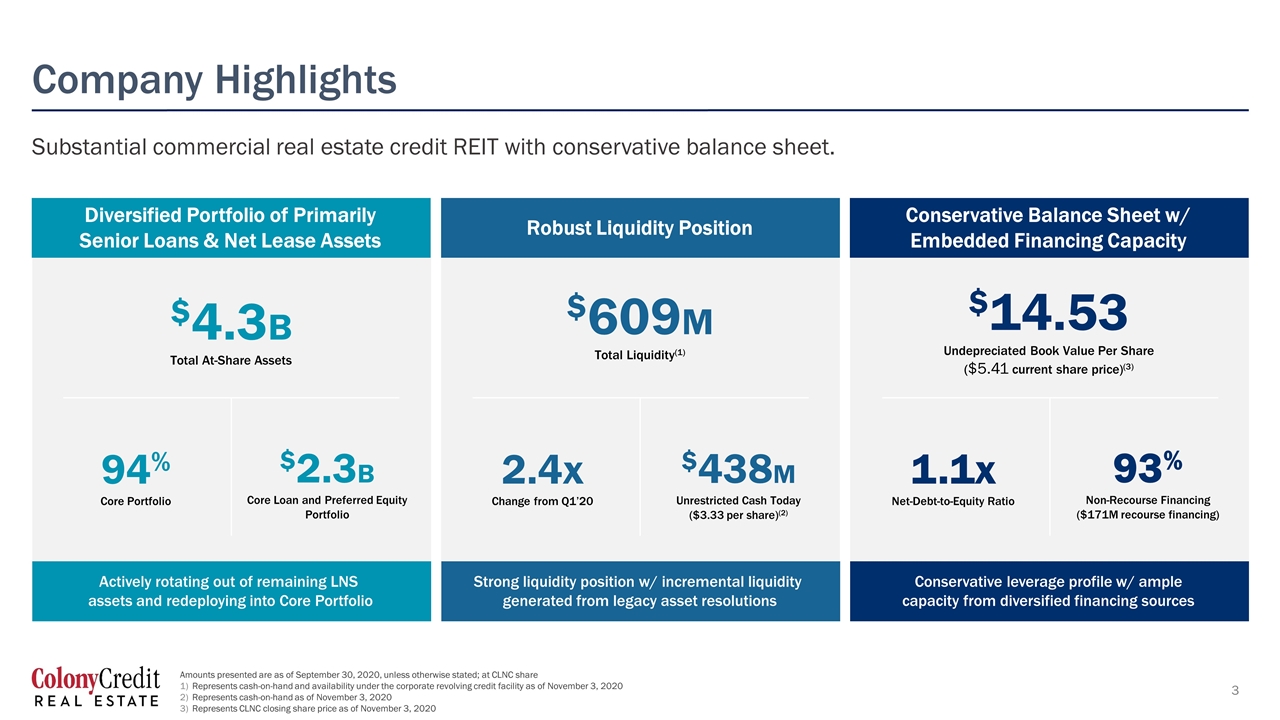

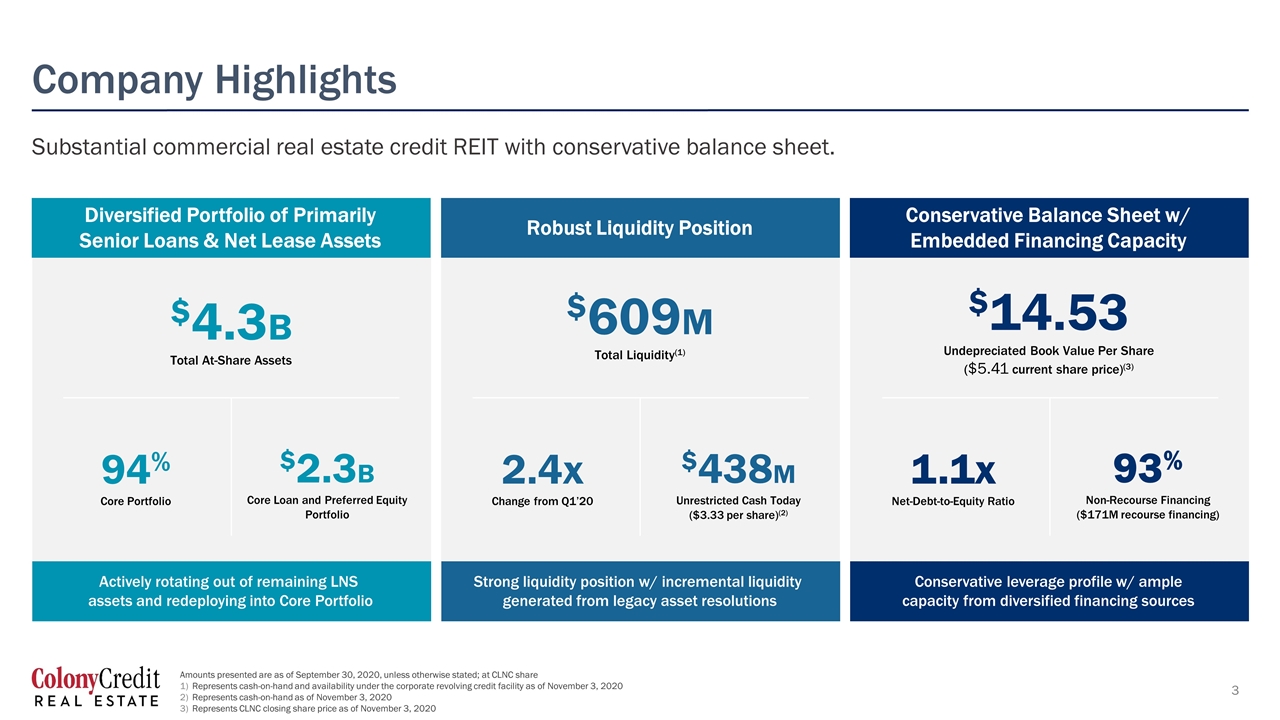

Company Highlights Substantial commercial real estate credit REIT with conservative balance sheet. Diversified Portfolio of Primarily Senior Loans & Net Lease Assets Robust Liquidity Position Conservative Balance Sheet w/ Embedded Financing Capacity $609M Total Liquidity(1) 2.4x Change from Q1’20 $4.3B Total At-Share Assets 94% Core Portfolio $14.53 Undepreciated Book Value Per Share ($5.41 current share price)(3) 93% Non-Recourse Financing ($171M recourse financing) Actively rotating out of remaining LNS assets and redeploying into Core Portfolio Strong liquidity position w/ incremental liquidity generated from legacy asset resolutions Conservative leverage profile w/ ample capacity from diversified financing sources $2.3B Core Loan and Preferred Equity Portfolio $438M Unrestricted Cash Today ($3.33 per share)(2) 1.1x Net-Debt-to-Equity Ratio Amounts presented are as of September 30, 2020, unless otherwise stated; at CLNC share Represents cash-on-hand and availability under the corporate revolving credit facility as of November 3, 2020 Represents cash-on-hand as of November 3, 2020 Represents CLNC closing share price as of November 3, 2020

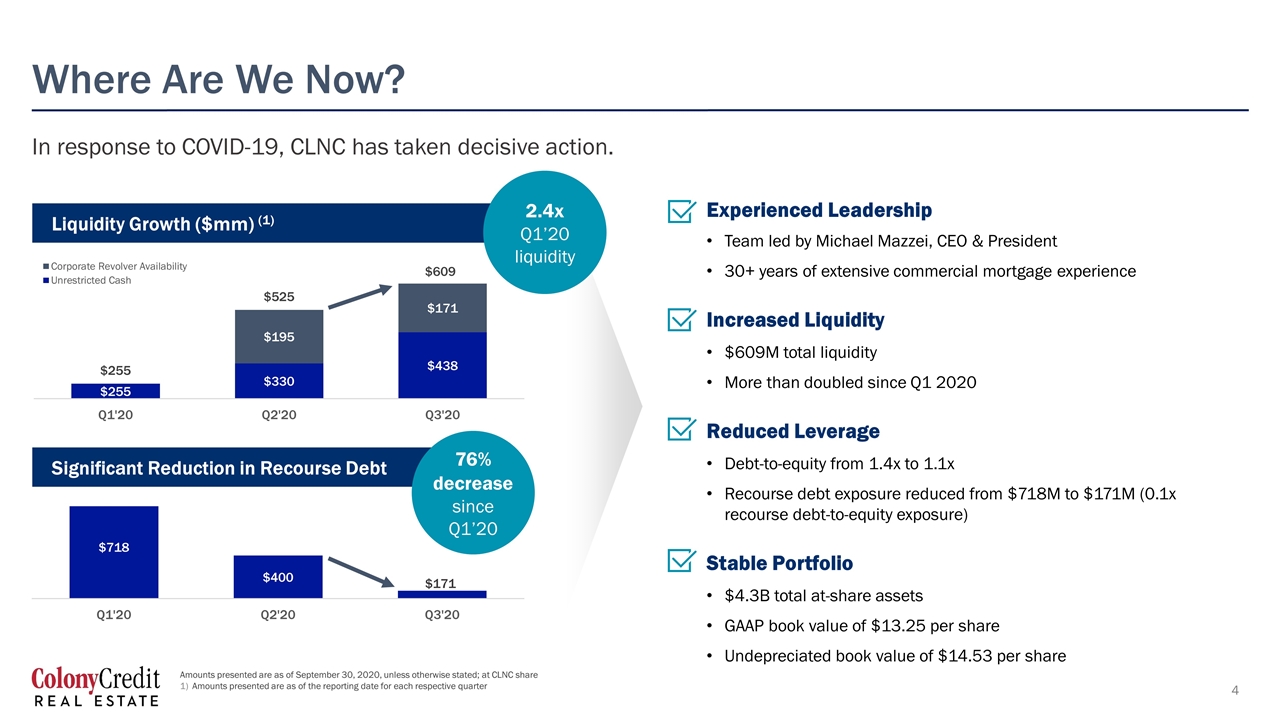

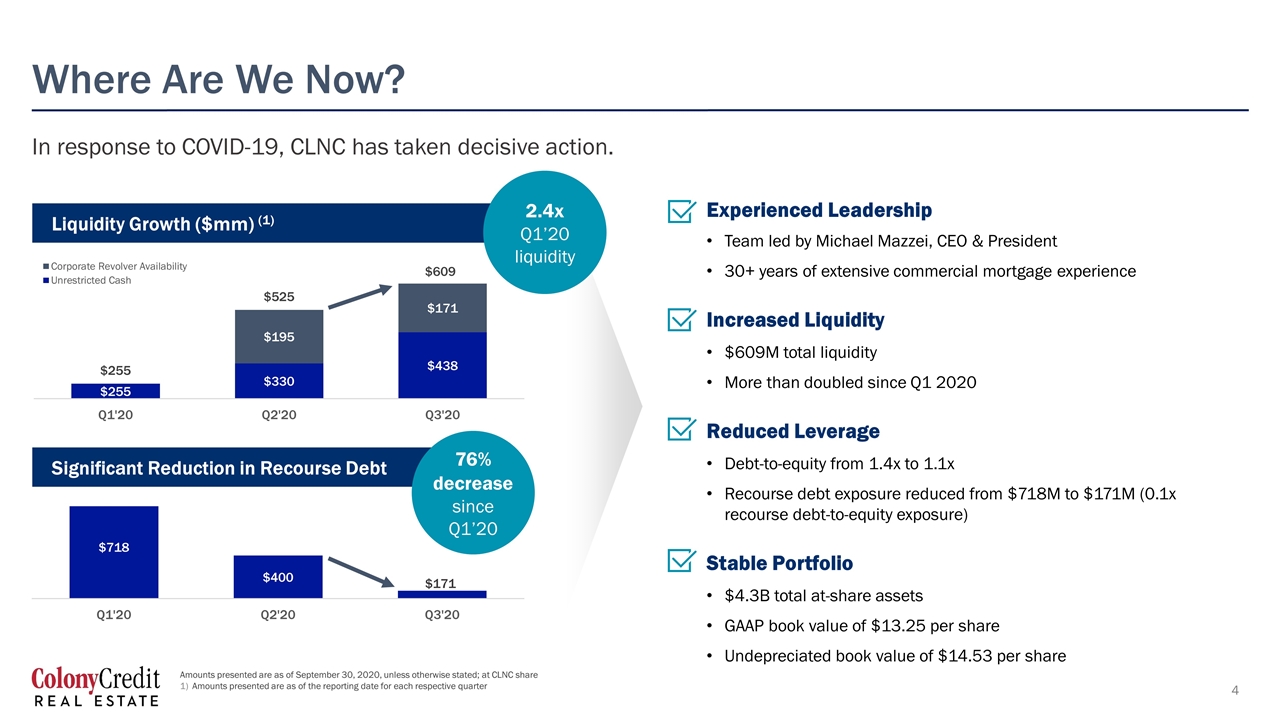

Where Are We Now? In response to COVID-19, CLNC has taken decisive action. Experienced Leadership Team led by Michael Mazzei, CEO & President 30+ years of extensive commercial mortgage experience Increased Liquidity $609M total liquidity More than doubled since Q1 2020 Reduced Leverage Debt-to-equity from 1.4x to 1.1x Recourse debt exposure reduced from $718M to $171M (0.1x recourse debt-to-equity exposure) Stable Portfolio $4.3B total at-share assets GAAP book value of $13.25 per share Undepreciated book value of $14.53 per share Liquidity Growth ($mm) (1) Significant Reduction in Recourse Debt 2.4x Q1’20 liquidity 76% decrease since Q1’20 Amounts presented are as of September 30, 2020, unless otherwise stated; at CLNC share Amounts presented are as of the reporting date for each respective quarter

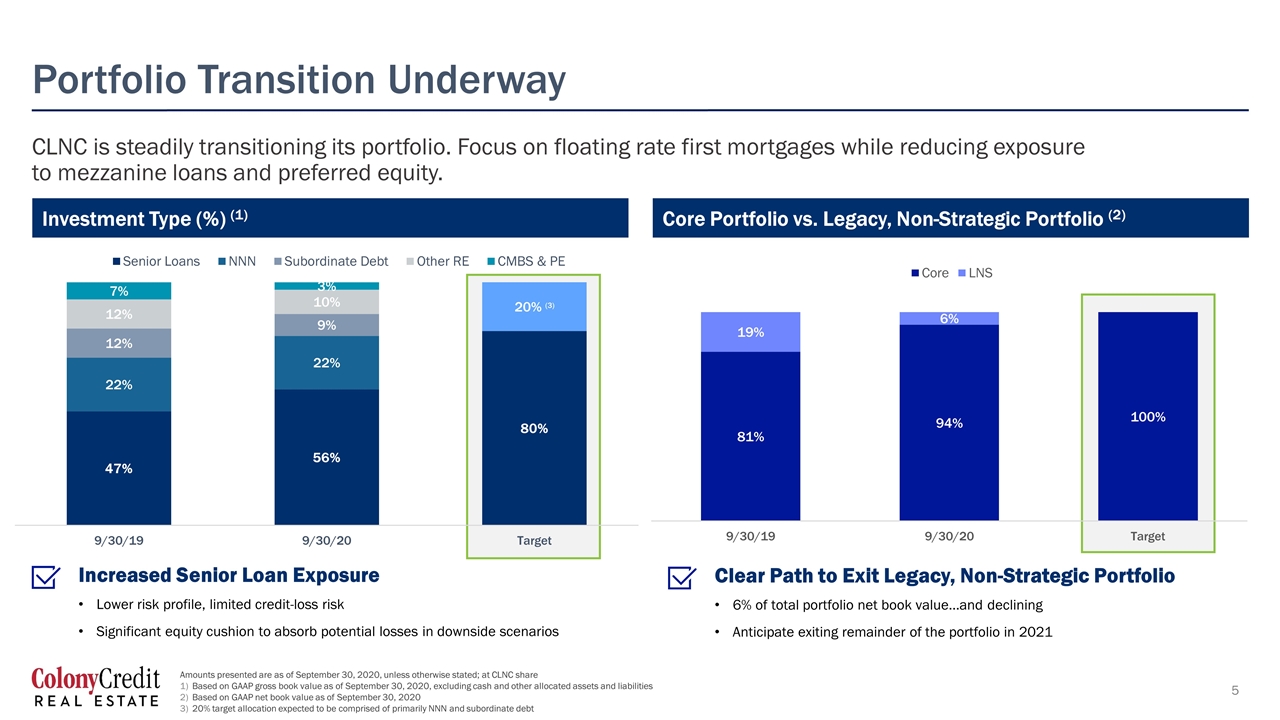

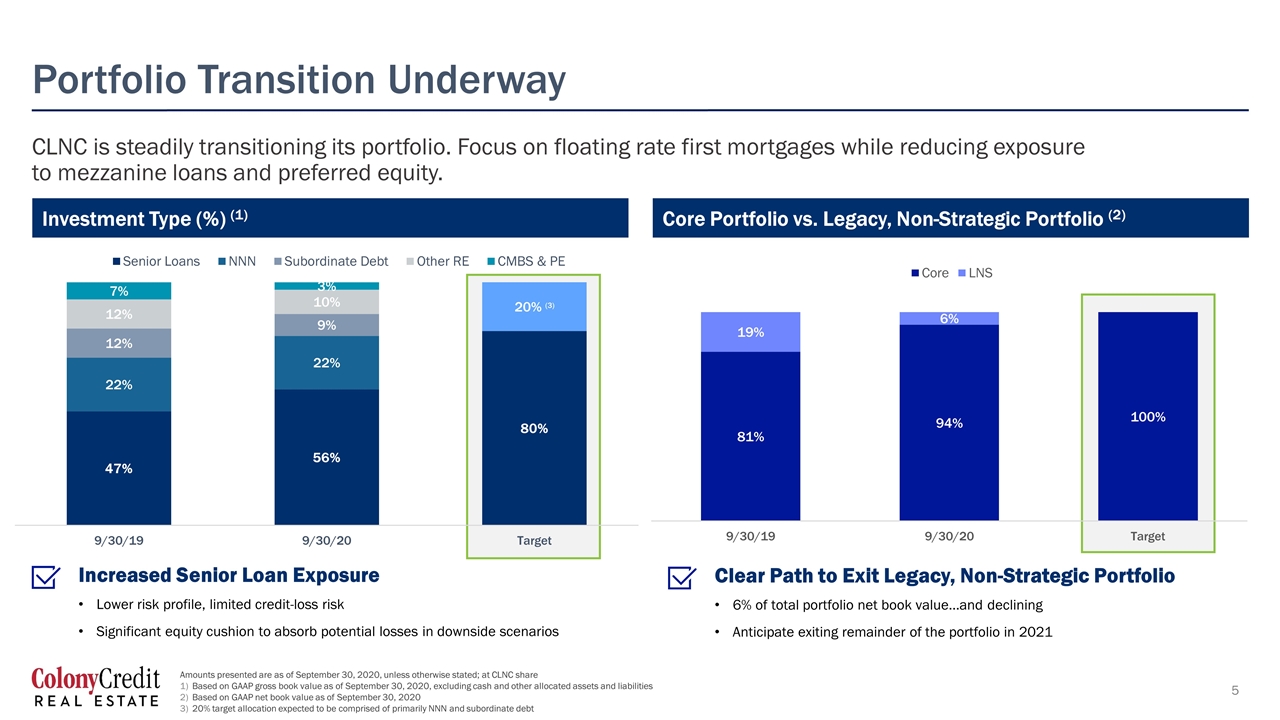

Portfolio Transition Underway CLNC is steadily transitioning its portfolio. Focus on floating rate first mortgages while reducing exposure to mezzanine loans and preferred equity. Increased Senior Loan Exposure Lower risk profile, limited credit-loss risk Significant equity cushion to absorb potential losses in downside scenarios Clear Path to Exit Legacy, Non-Strategic Portfolio 6% of total portfolio net book value…and declining Anticipate exiting remainder of the portfolio in 2021 Amounts presented are as of September 30, 2020, unless otherwise stated; at CLNC share Based on GAAP gross book value as of September 30, 2020, excluding cash and other allocated assets and liabilities Based on GAAP net book value as of September 30, 2020 20% target allocation expected to be comprised of primarily NNN and subordinate debt Investment Type (%) (1) Core Portfolio vs. Legacy, Non-Strategic Portfolio (2)

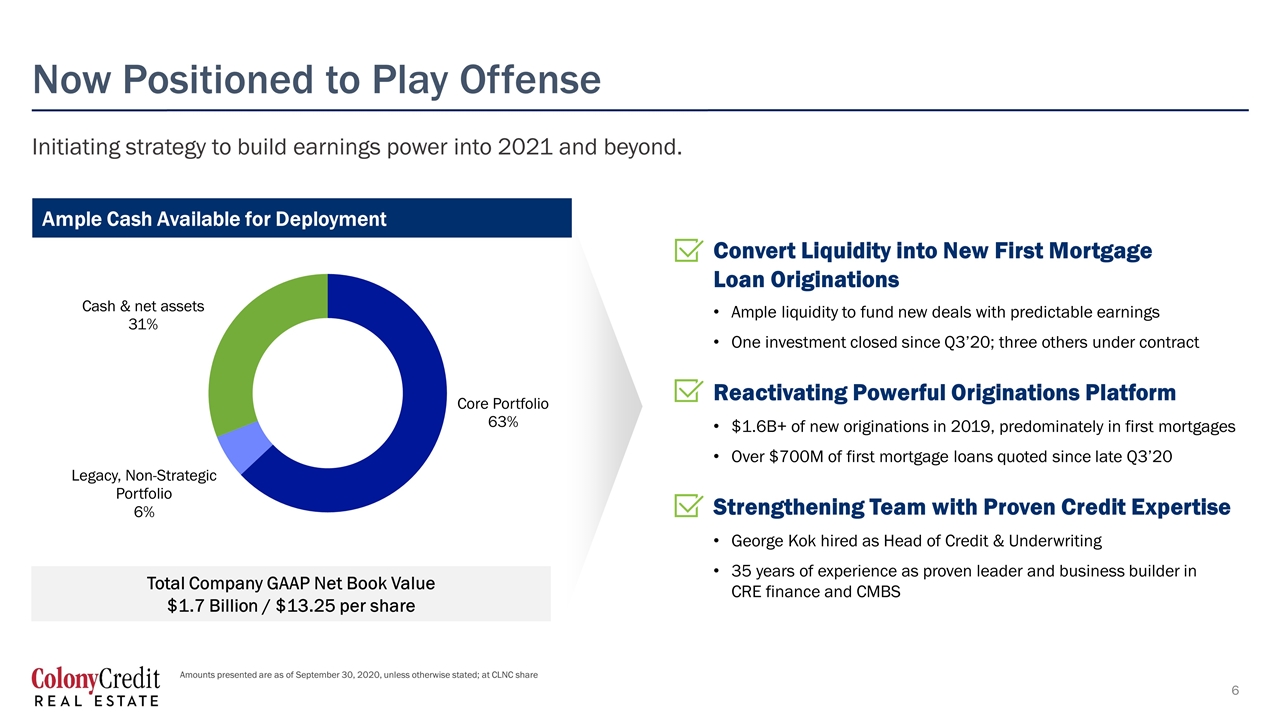

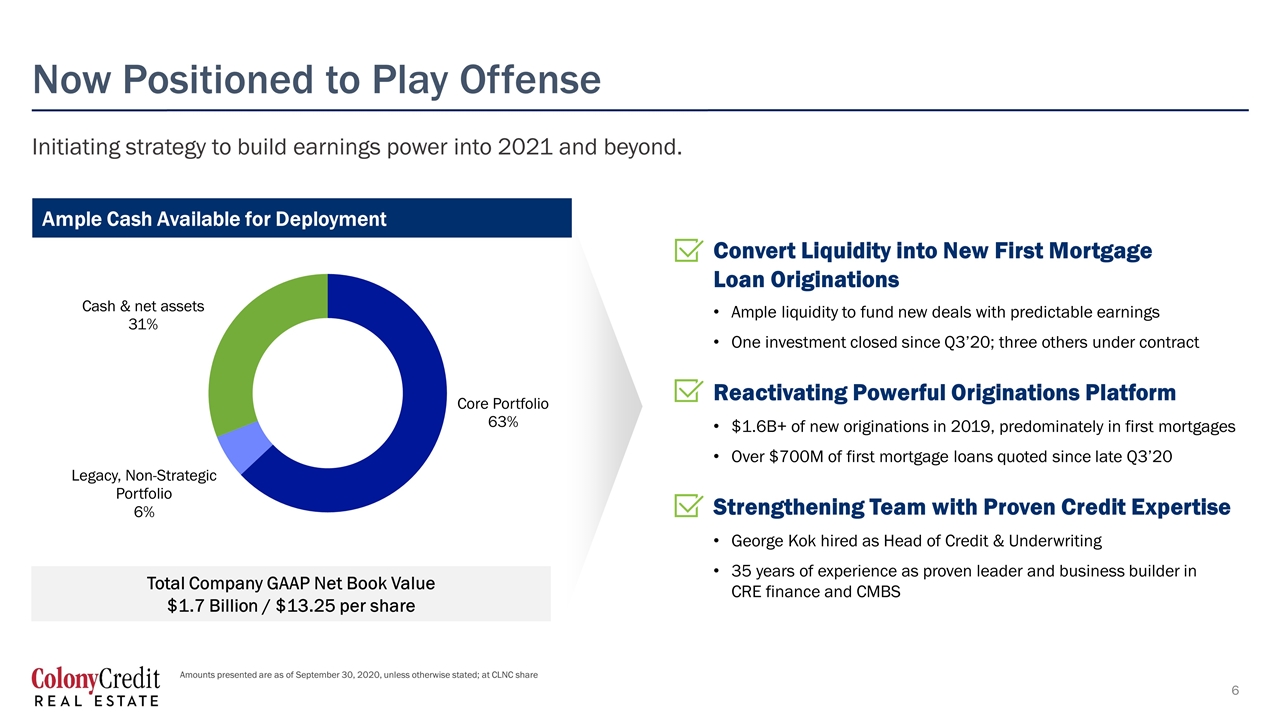

Now Positioned to Play Offense Initiating strategy to build earnings power into 2021 and beyond. Convert Liquidity into New First Mortgage Loan Originations Ample liquidity to fund new deals with predictable earnings One investment closed since Q3’20; three others under contract Reactivating Powerful Originations Platform $1.6B+ of new originations in 2019, predominately in first mortgages Over $700M of first mortgage loans quoted since late Q3’20 Strengthening Team with Proven Credit Expertise George Kok hired as Head of Credit & Underwriting 35 years of experience as proven leader and business builder in CRE finance and CMBS Ample Cash Available for Deployment Total Company GAAP Net Book Value $1.7 Billion / $13.25 per share Amounts presented are as of September 30, 2020, unless otherwise stated; at CLNC share

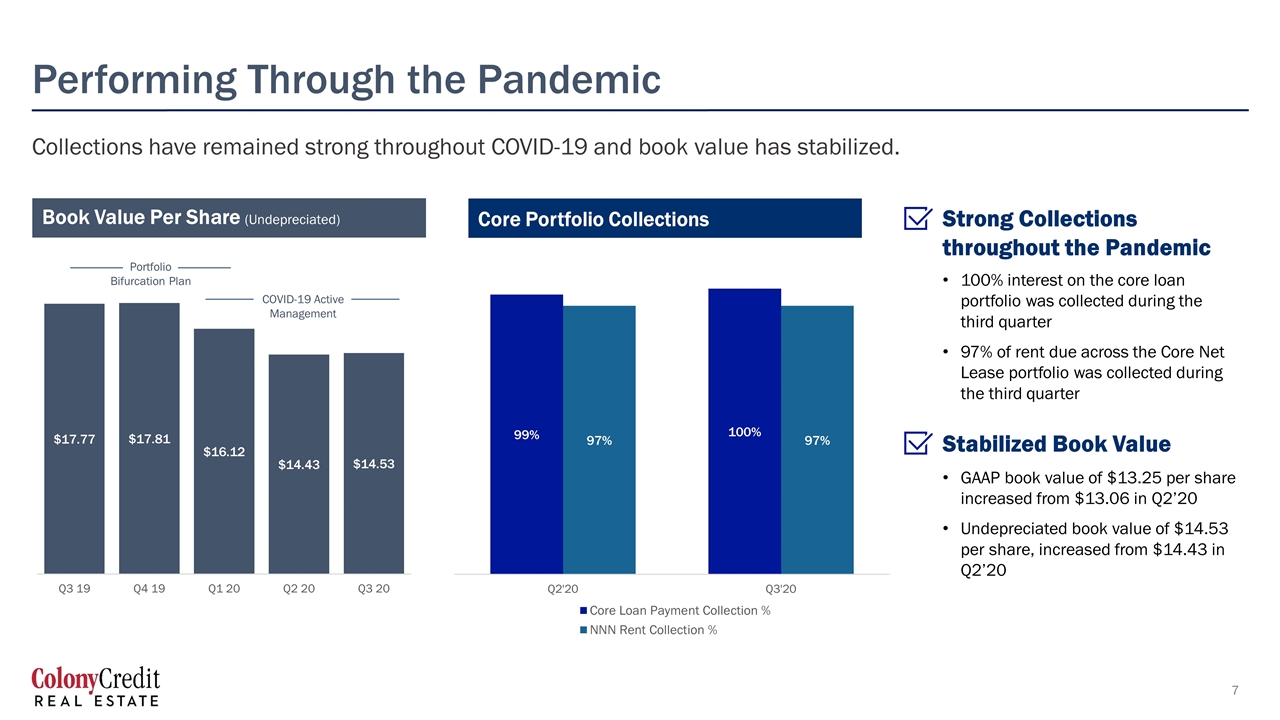

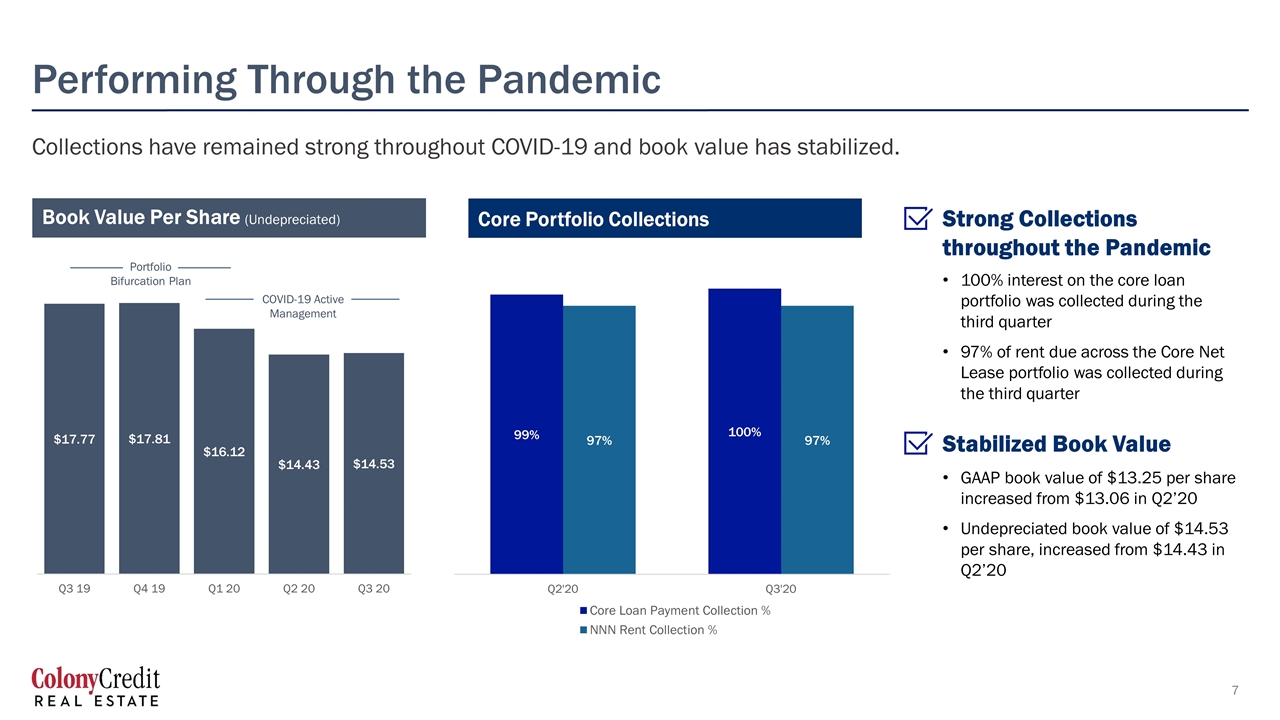

Performing Through the Pandemic Collections have remained strong throughout COVID-19 and book value has stabilized. Strong Collections throughout the Pandemic 100% interest on the core loan portfolio was collected during the third quarter 97% of rent due across the Core Net Lease portfolio was collected during the third quarter Stabilized Book Value GAAP book value of $13.25 per share increased from $13.06 in Q2’20 Undepreciated book value of $14.53 per share, increased from $14.43 in Q2’20 Book Value Per Share (Undepreciated) Core Portfolio Collections Portfolio Bifurcation Plan COVID-19 Active Management

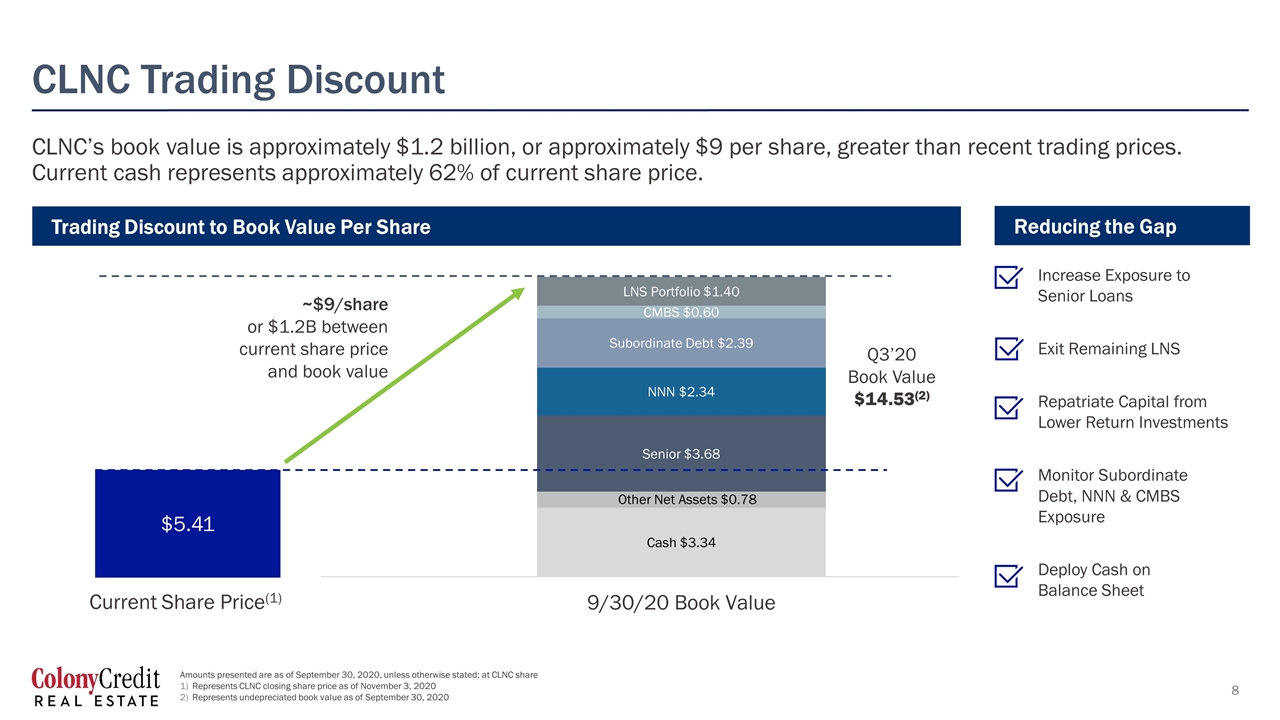

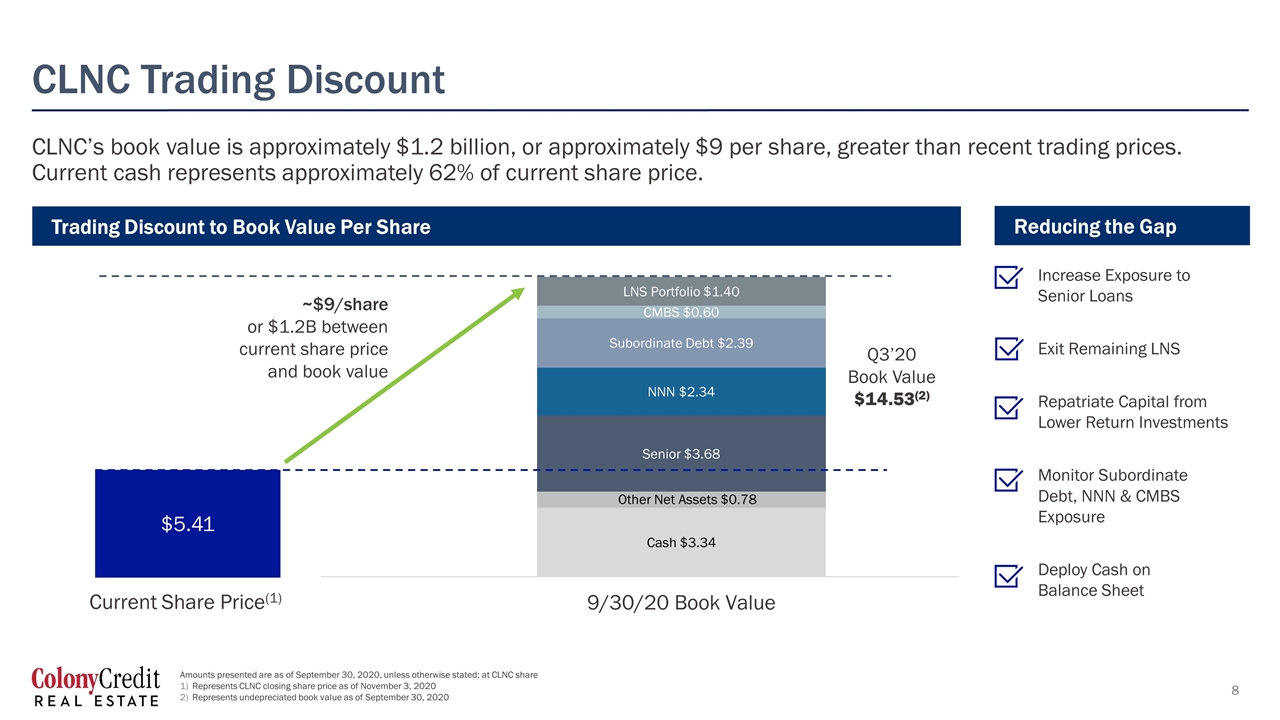

CLNC Trading Discount CLNC’s book value is approximately $1.2 billion, or approximately $9 per share, greater than recent trading prices. Current cash represents approximately 62% of current share price. Trading Discount to Book Value Per Share Current Share Price(1) Q3’20 Book Value $14.53(2) ~$9/share or $1.2B between current share price and book value $5.41 Increase Exposure to Senior Loans Exit Remaining LNS Repatriate Capital from Lower Return Investments Monitor Subordinate Debt, NNN & CMBS Exposure Deploy Cash on Balance Sheet Reducing the Gap Amounts presented are as of September 30, 2020, unless otherwise stated; at CLNC share Represents CLNC closing share price as of November 3, 2020 Represents undepreciated book value as of September 30, 2020

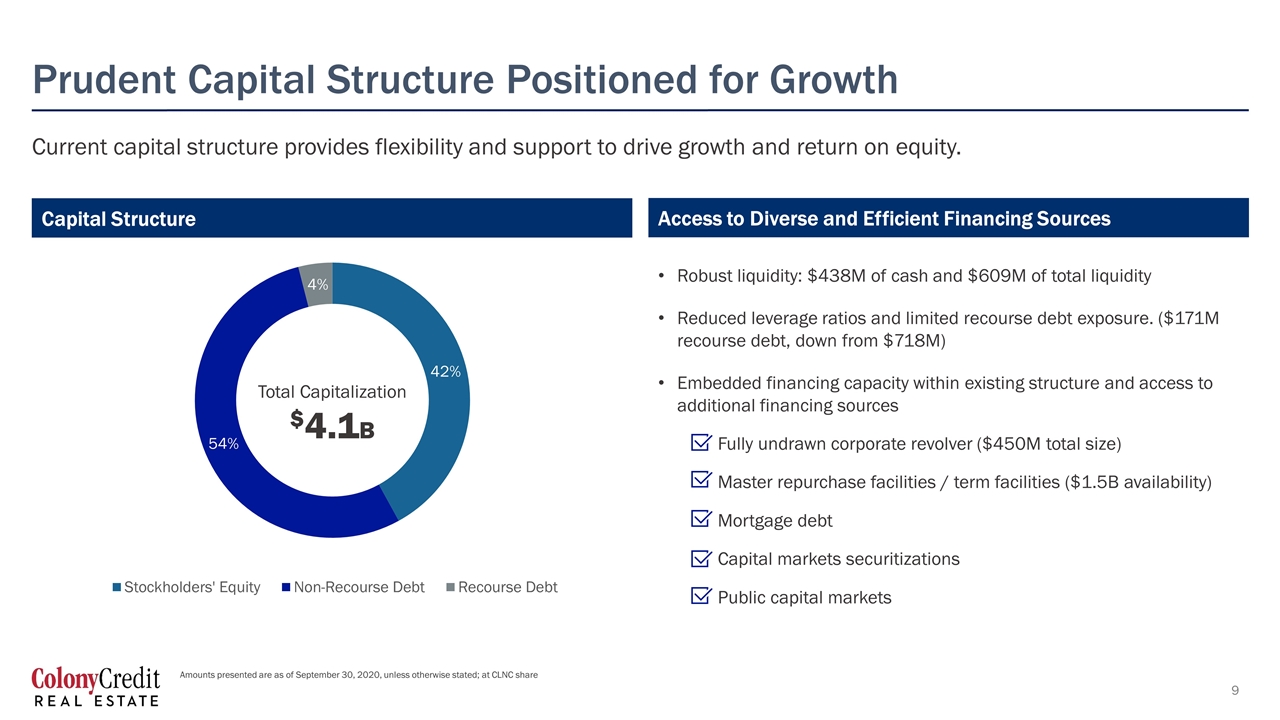

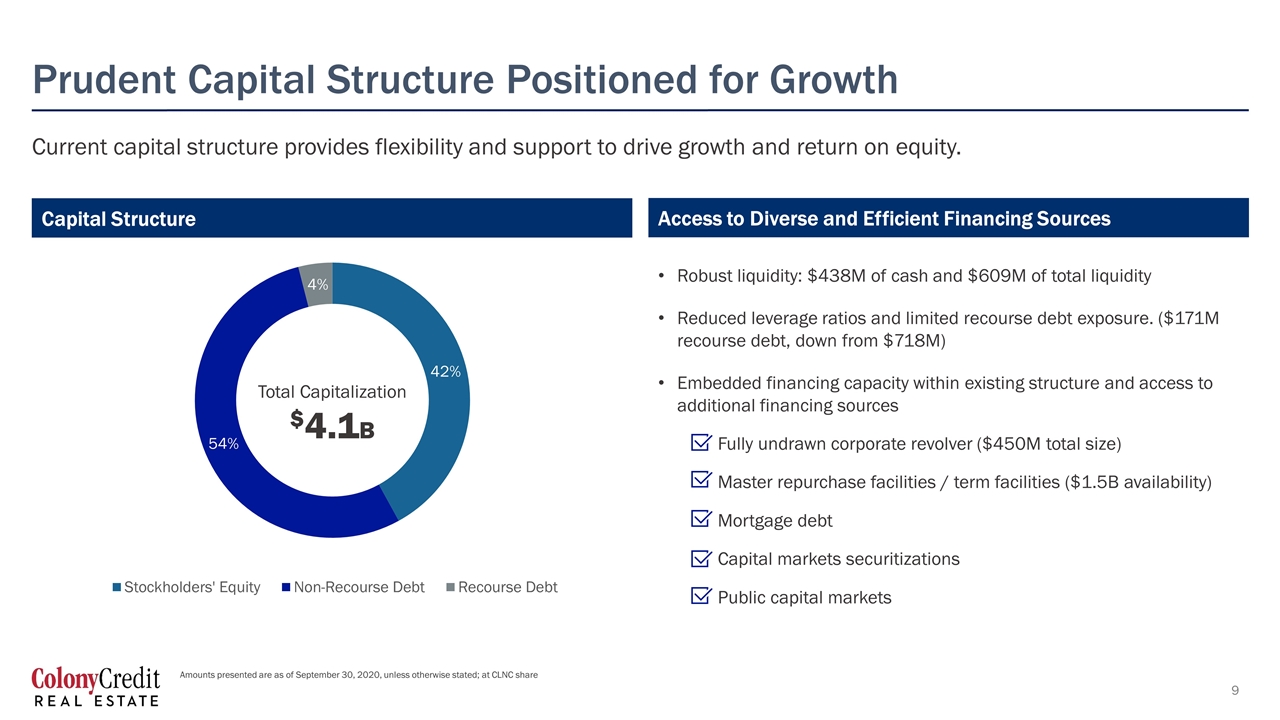

Prudent Capital Structure Positioned for Growth Current capital structure provides flexibility and support to drive growth and return on equity. Total Capitalization $4.1B Robust liquidity: $438M of cash and $609M of total liquidity Reduced leverage ratios and limited recourse debt exposure. ($171M recourse debt, down from $718M) Embedded financing capacity within existing structure and access to additional financing sources Fully undrawn corporate revolver ($450M total size) Master repurchase facilities / term facilities ($1.5B availability) Mortgage debt Capital markets securitizations Public capital markets Capital Structure Access to Diverse and Efficient Financing Sources Amounts presented are as of September 30, 2020, unless otherwise stated; at CLNC share

CLNC Investment Opportunity CLNC’s strong balance sheet positions the firm on a path towards substantial earnings growth and shareholder value creation. Positioned for Growth A Simple Game Plan Stable and Recurring Earnings Robust liquidity position Embedded financing capacity Team in-place to capitalize on growth opportunities Deploy cash on balance sheet in senior loans Repatriate proceeds from lower yielding asset and redeploy the capital Build earnings and reinstate a dividend Valuation discount between current share price and underlying book value Path to build earnings Ultimately CLNC will trade to an earnings yield

Company Information Colony Credit Real Estate (NYSE: CLNC) is one of the largest publicly traded commercial real estate (CRE) credit REITs, focused on originating, acquiring, financing and managing a diversified portfolio consisting primarily of CRE debt investments and net leased properties predominantly in the United States. CRE debt investments primarily consist of first mortgage loans, which we expect to be the primary investment strategy. Colony Credit Real Estate is externally managed by a subsidiary of leading global real estate and investment management firm, Colony Capital, Inc. Colony Credit Real Estate is organized as a Maryland corporation and taxed as a REIT for U.S. federal income tax purposes. For additional information regarding the Company and its management and business, please refer to www.clncredit.com. Analyst Coverage: Raymond James Stephen Laws 901-579-4868 B. Riley FBR Randy Binner 703-312-1890 Investor Relations: ADDO Investor Relations Lasse Glassen 310-829-5400 lglassen@addoir.com Headquarters: Los Angeles 515 South Flower Street 44th Floor Los Angeles, CA 90071 310-282-8220 Stock & Transfer Agent: American Stock & Transfer Trust Company (AST) 866-751-6317 help@astfinancial.com Company Website: www.clncredit.com Press & Media: Owen Blicksilver P.R., Inc. Caroline Luz 203-656-2829 caroline@blicksilverpr.com NYSE Ticker: CLNC Shareholder information

Important Note Regarding Non-GAAP Financial Measures and Definitions We present Core Earnings/Legacy, Non-Strategic (“LNS”) Earnings, which are non-GAAP supplemental financial measures of our performance. Our Core Earnings are generated by the Core Portfolio and Legacy, Non-Strategic Earnings are generated by the Legacy, Non-Strategic Portfolio. We believe that Core Earnings/Legacy, Non-Strategic Earnings provides meaningful information to consider in addition to our net income and cash flow from operating activities determined in accordance with accounting principles generally accepted in the United States (“U.S. GAAP” or “GAAP”). These supplemental financial measures help us to evaluate our performance excluding the effects of certain transactions and U.S. GAAP adjustments that we believe are not necessarily indicative of our current portfolio and operations. For information on the fees we pay our Manager, see Note 10, “Related Party Arrangements” to our consolidated financial statements included in Form 10-Q to be filed with the U.S. Securities and Exchange Commission (“SEC”). In addition, we believe that our investors also use Core Earnings/Legacy, Non-Strategic Earnings or a comparable supplemental performance measure to evaluate and compare the performance of us and our peers, and as such, we believe that the disclosure of Core Earnings/Legacy, Non-Strategic Earnings is useful to our investors. We define Core Earnings/Legacy, Non-Strategic Earnings as U.S. GAAP net income (loss) attributable to our common stockholders (or, without duplication, the owners of the common equity of our direct subsidiaries, such as our operating partnership or “OP”) and excluding (i) non-cash equity compensation expense, (ii) the expenses incurred in connection with our formation or other strategic transactions, (iii) the incentive fee, (iv) acquisition costs from successful acquisitions, (v) gains or losses from sales of real estate property and impairment write-downs of depreciable real estate, including unconsolidated joint ventures and preferred equity investments, (vi) CECL reserves determined by probability of default / loss given default (or “PD/LGD”) model, (vii) depreciation and amortization, (viii) any unrealized gains or losses or other similar non-cash items that are included in net income for the current quarter, regardless of whether such items are included in other comprehensive income or loss, or in net income, (ix) one-time events pursuant to changes in U.S. GAAP and (x) certain material non-cash income or expense items that in the judgment of management should not be included in Core Earnings/Legacy, Non-Strategic Earnings. For clauses (ix) and (x), such exclusions shall only be applied after discussions between our Manager and our independent directors and after approval by a majority of our independent directors. U.S. GAAP net income (loss) attributable to our common stockholders and Core Earnings/Legacy, Non-Strategic Earnings include provision for loan losses. Prior to the third quarter of 2019, Core Earnings reflected adjustments to U.S. GAAP net income to exclude impairment of real estate and provision for loan losses. During the third quarter of 2019, we revised our definition of Core Earnings to include the provision for loan losses while excluding realized losses of sales of real estate property and impairment write-downs of preferred equity investments. This was approved by a majority of our independent directors. Core Earnings/Legacy, Non-Strategic Earnings does not represent net income or cash generated from operating activities and should not be considered as an alternative to U.S. GAAP net income or an indication of our cash flows from operating activities determined in accordance with U.S. GAAP, a measure of our liquidity, or an indication of funds available to fund our cash needs, including our ability to make cash distributions. In addition, our methodology for calculating Core Earnings/Legacy, Non-Strategic Earnings may differ from methodologies employed by other companies to calculate the same or similar non-GAAP supplemental financial measures, and accordingly, our reported Core Earnings/Legacy, Non-Strategic Earnings may not be comparable to the Core Earnings/Legacy, Non-Strategic Earnings reported by other companies. The Company calculates Core Earnings/Legacy, Non-Strategic Earnings per share, which are non-GAAP supplemental financial measures, based on a weighted average number of common shares and operating partnership units (held by members other than the Company or its subsidiaries). The Company presents pro rata (“at share” or “at CLNC share”) financial information, which is not, and is not intended to be, a presentation in accordance with GAAP. The Company computes pro rata financial information by applying its economic interest to each financial statement line item on an investment-by-investment basis. Similarly, noncontrolling interests’ (“NCI”) share of assets, liabilities, profits and losses was computed by applying noncontrolling interests’ economic interest to each financial statement line item. The Company provides pro rata financial information because it may assist investors and analysts in estimating the Company’s economic interest in its investments. However, pro rata financial information as an analytical tool has limitations. Other companies may not calculate their pro rata information in the same methodology, and accordingly, the Company’s pro rata information may not be comparable to other companies pro rata information. As such, the pro rata financial information should not be considered in isolation or as a substitute for our financial statements as reported under GAAP, but may be used as a supplement to financial information as reported under GAAP.