Exhibit 99.3 INVESTOR PRESENTATION February 24, 2021Exhibit 99.3 INVESTOR PRESENTATION February 24, 2021

Cautionary Statement Regarding Forward-looking Statements This presentation may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond our control, and may cause actual results to differ significantly from those expressed in any forward-looking statement. Among others, the following uncertainties and other factors could cause actual results to differ from those set forth in the forward-looking statements: operating costs and business disruption may be greater than expected; uncertainties regarding the ongoing impact of the novel coronavirus (COVID-19), the severity of the disease, the duration of the COVID-19 outbreak, actions that may be taken by governmental authorities to contain the COVID-19 outbreak or to treat its impact, the potential negative impacts of COVID-19 on the global economy and its adverse impact on the real estate market, the economy and the Company’s investments (including, but not limited to, the Los Angeles mixed-use development loan, other hospitality loans and Dublin development financings), financial condition and business operation; defaults by borrowers in paying debt service on outstanding indebtedness and borrowers’ abilities to manage and stabilize properties; deterioration in the performance of the properties securing our investments (including depletion of interest and other reserves or payment-in-kind concessions in lieu of current interest payment obligations) that may cause deterioration in the performance of our investments and, potentially, principal losses to us; the Company's operating results may differ materially from the information presented in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, as well as in Colony Credit Real Estate’s other filings with the Securities and Exchange Commission; the fair value of the Company's investments may be subject to uncertainties; the Company's use of leverage could hinder its ability to make distributions and may significantly impact its liquidity position; given the Company's dependence on its external manager, an affiliate of Colony Capital, Inc., any adverse changes in the financial health or otherwise of its manager or Colony Capital, Inc. could hinder the Company's operating performance and returnonstockholder's investment; the ability to realize substantial efficiencies as well as anticipated strategic and financial benefits, including, but not limited to expected returns on equity and/or yields on investments; adverse impacts on the Company's corporate revolver, including covenant compliance and borrowing base capacity; adverse impacts on the Company's liquidity, including margin calls on master repurchase facilities, debt service or lease payment defaults or deferrals, demands for protective advances and capital expenditures, or its ability to continue to generate liquidity from sales of Legacy, Non-Strategic assets; the Company’s ability to liquidate its Legacy, Non-Strategic assets within the projected timeframe or at the projected values; the timing of and ability to deploy available capital; whether the Company will achieve its anticipated 2021 Distributable Earnings per share (as adjusted), or maintain or produce higher Distributable Earnings per share (as adjusted) in the near term or ever; the Company’s ability to maintain or grow the dividend at all in the future, including the Company maintaining its common stock dividend at $0.10 per share for each quarter during calendar year 2021; the timing of and ability to complete repurchases of the Company’s stock; the ability of the Company to refinance certain mortgage debt on similar terms to those currently existing or at all; whether Colony Capital will continue to serve as our external manager or whether we will pursue another strategic transaction; and the impact of legislative, regulatory and competitive changes, and the actions of government authorities, and in particular those affecting the commercial real estate finance and mortgage industry or our business. The foregoing list of factors is not exhaustive. Additional information about these and other factors can be found in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and Part II, Item 1A of the Company’s Form 10-Q for the quarter ended September 30, 2020, as well as in Colony Credit Real Estate’s other filings with the Securities and Exchange Commission. Moreover, each of the factors referenced above are likely to also be impacted directly or indirectly by the ongoing impact of COVID-19 and investors are cautioned to interpret substantially all of such statements and risks as being heightened as a result of the ongoing impact of the COVID-19. We caution investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this presentation. Colony Credit Real Estate is under no duty to update any of these forward-looking statements after the date of this presentation, nor to conform prior statements to actual results or revised expectations, and Colony Credit Real Estate does not intend to do so. We caution investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this presentation. Colony Credit Real Estate is under no duty to update any of these forward-looking statements after the date of this presentation, nor to conform prior statements to actual results or revised expectations, and Colony Credit Real Estate does not intend to do so. 2Cautionary Statement Regarding Forward-looking Statements This presentation may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond our control, and may cause actual results to differ significantly from those expressed in any forward-looking statement. Among others, the following uncertainties and other factors could cause actual results to differ from those set forth in the forward-looking statements: operating costs and business disruption may be greater than expected; uncertainties regarding the ongoing impact of the novel coronavirus (COVID-19), the severity of the disease, the duration of the COVID-19 outbreak, actions that may be taken by governmental authorities to contain the COVID-19 outbreak or to treat its impact, the potential negative impacts of COVID-19 on the global economy and its adverse impact on the real estate market, the economy and the Company’s investments (including, but not limited to, the Los Angeles mixed-use development loan, other hospitality loans and Dublin development financings), financial condition and business operation; defaults by borrowers in paying debt service on outstanding indebtedness and borrowers’ abilities to manage and stabilize properties; deterioration in the performance of the properties securing our investments (including depletion of interest and other reserves or payment-in-kind concessions in lieu of current interest payment obligations) that may cause deterioration in the performance of our investments and, potentially, principal losses to us; the Company's operating results may differ materially from the information presented in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, as well as in Colony Credit Real Estate’s other filings with the Securities and Exchange Commission; the fair value of the Company's investments may be subject to uncertainties; the Company's use of leverage could hinder its ability to make distributions and may significantly impact its liquidity position; given the Company's dependence on its external manager, an affiliate of Colony Capital, Inc., any adverse changes in the financial health or otherwise of its manager or Colony Capital, Inc. could hinder the Company's operating performance and returnonstockholder's investment; the ability to realize substantial efficiencies as well as anticipated strategic and financial benefits, including, but not limited to expected returns on equity and/or yields on investments; adverse impacts on the Company's corporate revolver, including covenant compliance and borrowing base capacity; adverse impacts on the Company's liquidity, including margin calls on master repurchase facilities, debt service or lease payment defaults or deferrals, demands for protective advances and capital expenditures, or its ability to continue to generate liquidity from sales of Legacy, Non-Strategic assets; the Company’s ability to liquidate its Legacy, Non-Strategic assets within the projected timeframe or at the projected values; the timing of and ability to deploy available capital; whether the Company will achieve its anticipated 2021 Distributable Earnings per share (as adjusted), or maintain or produce higher Distributable Earnings per share (as adjusted) in the near term or ever; the Company’s ability to maintain or grow the dividend at all in the future, including the Company maintaining its common stock dividend at $0.10 per share for each quarter during calendar year 2021; the timing of and ability to complete repurchases of the Company’s stock; the ability of the Company to refinance certain mortgage debt on similar terms to those currently existing or at all; whether Colony Capital will continue to serve as our external manager or whether we will pursue another strategic transaction; and the impact of legislative, regulatory and competitive changes, and the actions of government authorities, and in particular those affecting the commercial real estate finance and mortgage industry or our business. The foregoing list of factors is not exhaustive. Additional information about these and other factors can be found in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and Part II, Item 1A of the Company’s Form 10-Q for the quarter ended September 30, 2020, as well as in Colony Credit Real Estate’s other filings with the Securities and Exchange Commission. Moreover, each of the factors referenced above are likely to also be impacted directly or indirectly by the ongoing impact of COVID-19 and investors are cautioned to interpret substantially all of such statements and risks as being heightened as a result of the ongoing impact of the COVID-19. We caution investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this presentation. Colony Credit Real Estate is under no duty to update any of these forward-looking statements after the date of this presentation, nor to conform prior statements to actual results or revised expectations, and Colony Credit Real Estate does not intend to do so. We caution investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this presentation. Colony Credit Real Estate is under no duty to update any of these forward-looking statements after the date of this presentation, nor to conform prior statements to actual results or revised expectations, and Colony Credit Real Estate does not intend to do so. 2

2020 Accomplishments & 2021 Priorities CLNC accomplished several key initiatives during 2020 and is well-positioned for growth in 2021 Successfully Navigated 2020 2021 Priorities New Management Team Reinstate Quarterly Dividend for Q1’21 Protected Balance Sheet & Exited LNS Portfolio Manage Portfolio and Deploy Cash on Balance Sheet Reduced Leverage and Recourse Financing Exposure Increase Earnings Primarily Through First Mortgages Resumed New Originations Grow Dividend 32020 Accomplishments & 2021 Priorities CLNC accomplished several key initiatives during 2020 and is well-positioned for growth in 2021 Successfully Navigated 2020 2021 Priorities New Management Team Reinstate Quarterly Dividend for Q1’21 Protected Balance Sheet & Exited LNS Portfolio Manage Portfolio and Deploy Cash on Balance Sheet Reduced Leverage and Recourse Financing Exposure Increase Earnings Primarily Through First Mortgages Resumed New Originations Grow Dividend 3

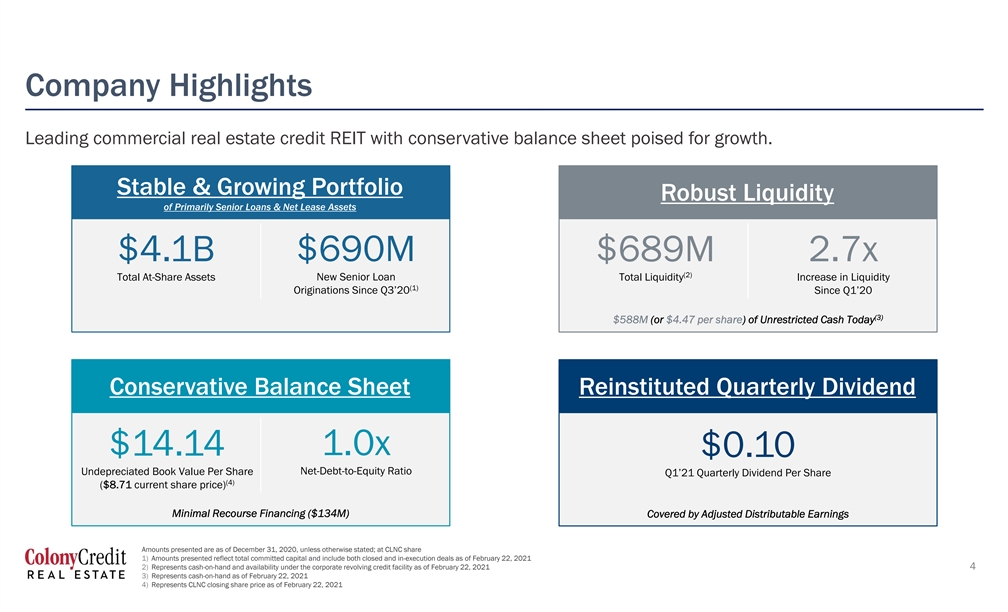

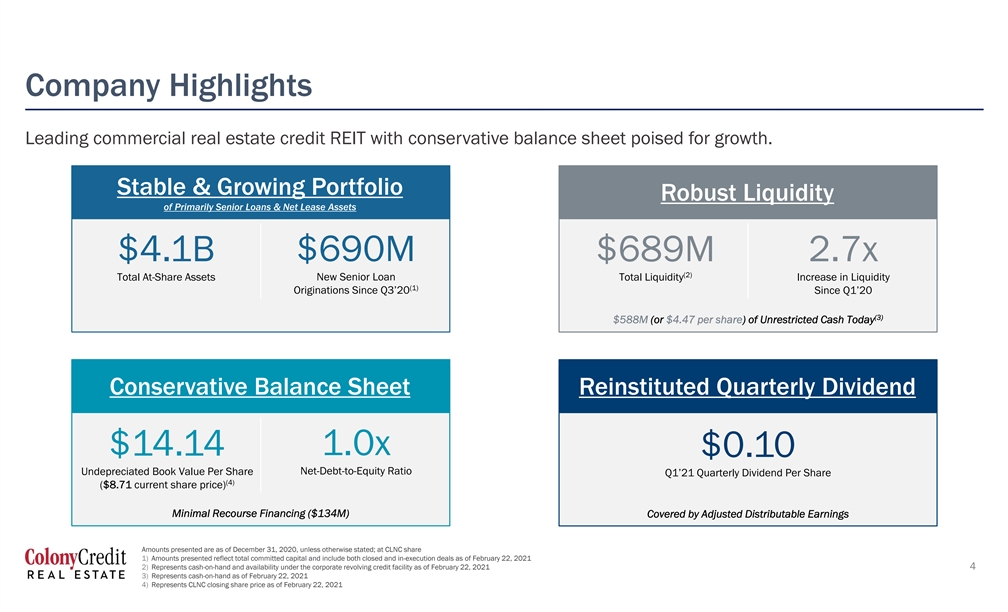

Company Highlights Leading commercial real estate credit REIT with conservative balance sheet poised for growth. Stable & Growing Portfolio Robust Liquidity of Primarily Senior Loans & Net Lease Assets $4.1B $690M $689M 2.7x (2) Total At-Share Assets New Senior Loan Total Liquidity Increase in Liquidity (1) Originations Since Q3’20 Since Q1’20 (3) $588M (or $4.47 per share) of Unrestricted Cash Today Conservative Balance Sheet Reinstituted Quarterly Dividend 1.0x $14.14 $0.10 Undepreciated Book Value Per Share Net-Debt-to-Equity Ratio Q1’21 Quarterly Dividend Per Share (4) ($8.71 current share price) Minimal Recourse Financing ($134M) Covered by Adjusted Distributable Earnings Amounts presented are as of December 31, 2020, unless otherwise stated; at CLNC share 1) Amounts presented reflect total committed capital and include both closed and in-execution deals as of February 22, 2021 2) Represents cash-on-hand and availability under the corporate revolving credit facility as of February 22, 2021 4 3) Represents cash-on-hand as of February 22, 2021 4) Represents CLNC closing share price as of February 22, 2021Company Highlights Leading commercial real estate credit REIT with conservative balance sheet poised for growth. Stable & Growing Portfolio Robust Liquidity of Primarily Senior Loans & Net Lease Assets $4.1B $690M $689M 2.7x (2) Total At-Share Assets New Senior Loan Total Liquidity Increase in Liquidity (1) Originations Since Q3’20 Since Q1’20 (3) $588M (or $4.47 per share) of Unrestricted Cash Today Conservative Balance Sheet Reinstituted Quarterly Dividend 1.0x $14.14 $0.10 Undepreciated Book Value Per Share Net-Debt-to-Equity Ratio Q1’21 Quarterly Dividend Per Share (4) ($8.71 current share price) Minimal Recourse Financing ($134M) Covered by Adjusted Distributable Earnings Amounts presented are as of December 31, 2020, unless otherwise stated; at CLNC share 1) Amounts presented reflect total committed capital and include both closed and in-execution deals as of February 22, 2021 2) Represents cash-on-hand and availability under the corporate revolving credit facility as of February 22, 2021 4 3) Represents cash-on-hand as of February 22, 2021 4) Represents CLNC closing share price as of February 22, 2021

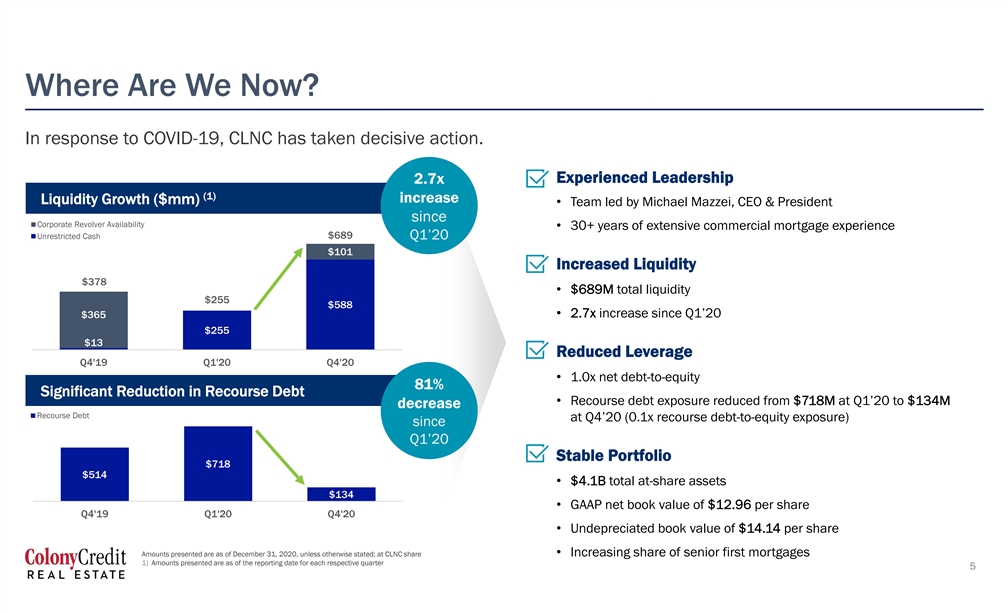

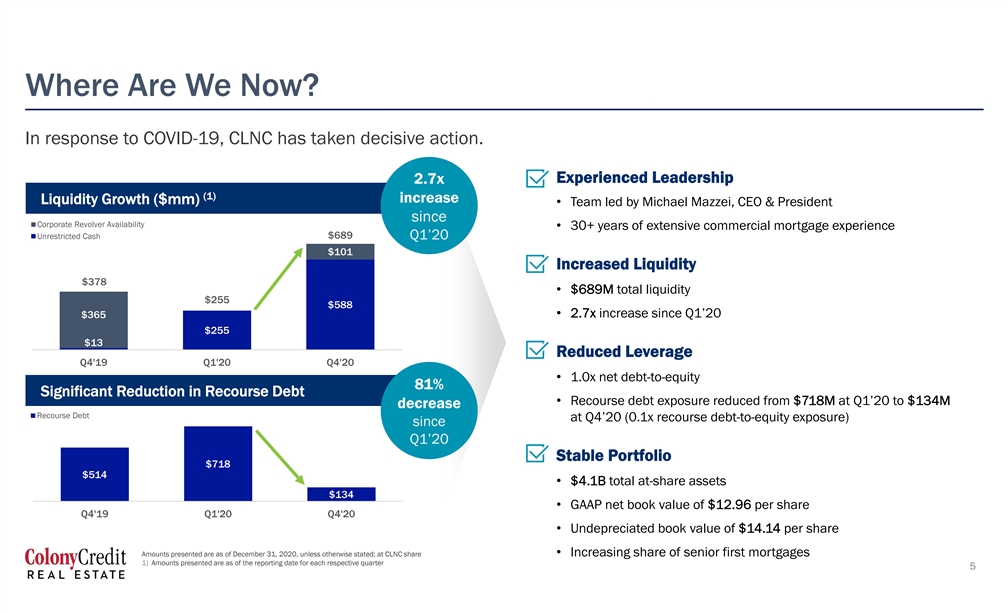

Where Are We Now? In response to COVID-19, CLNC has taken decisive action. Experienced Leadership 2.7x (1) increase Liquidity Growth ($mm) • Team led by Michael Mazzei, CEO & President since Corporate Revolver Availability • 30+ years of extensive commercial mortgage experience Unrestricted Cash $689 Q1’20 $101 Increased Liquidity $378 • $689M total liquidity $255 $588 $365 • 2.7x increase since Q1’20 $255 $13 Reduced Leverage Q4'19 Q1'20 Q4'20 • 1.0x net debt-to-equity 81% Significant Reduction in Recourse Debt • Recourse debt exposure reduced from $718M at Q1’20 to $134M decrease Recourse Debt at Q4’20 (0.1x recourse debt-to-equity exposure) since Q1’20 Stable Portfolio $718 $514 • $4.1B total at-share assets $134 • GAAP net book value of $12.96 per share Q4'19 Q1'20 Q4'20 • Undepreciated book value of $14.14 per share Amounts presented are as of December 31, 2020, unless otherwise stated; at CLNC share • Increasing share of senior first mortgages 1) Amounts presented are as of the reporting date for each respective quarter 5Where Are We Now? In response to COVID-19, CLNC has taken decisive action. Experienced Leadership 2.7x (1) increase Liquidity Growth ($mm) • Team led by Michael Mazzei, CEO & President since Corporate Revolver Availability • 30+ years of extensive commercial mortgage experience Unrestricted Cash $689 Q1’20 $101 Increased Liquidity $378 • $689M total liquidity $255 $588 $365 • 2.7x increase since Q1’20 $255 $13 Reduced Leverage Q4'19 Q1'20 Q4'20 • 1.0x net debt-to-equity 81% Significant Reduction in Recourse Debt • Recourse debt exposure reduced from $718M at Q1’20 to $134M decrease Recourse Debt at Q4’20 (0.1x recourse debt-to-equity exposure) since Q1’20 Stable Portfolio $718 $514 • $4.1B total at-share assets $134 • GAAP net book value of $12.96 per share Q4'19 Q1'20 Q4'20 • Undepreciated book value of $14.14 per share Amounts presented are as of December 31, 2020, unless otherwise stated; at CLNC share • Increasing share of senior first mortgages 1) Amounts presented are as of the reporting date for each respective quarter 5

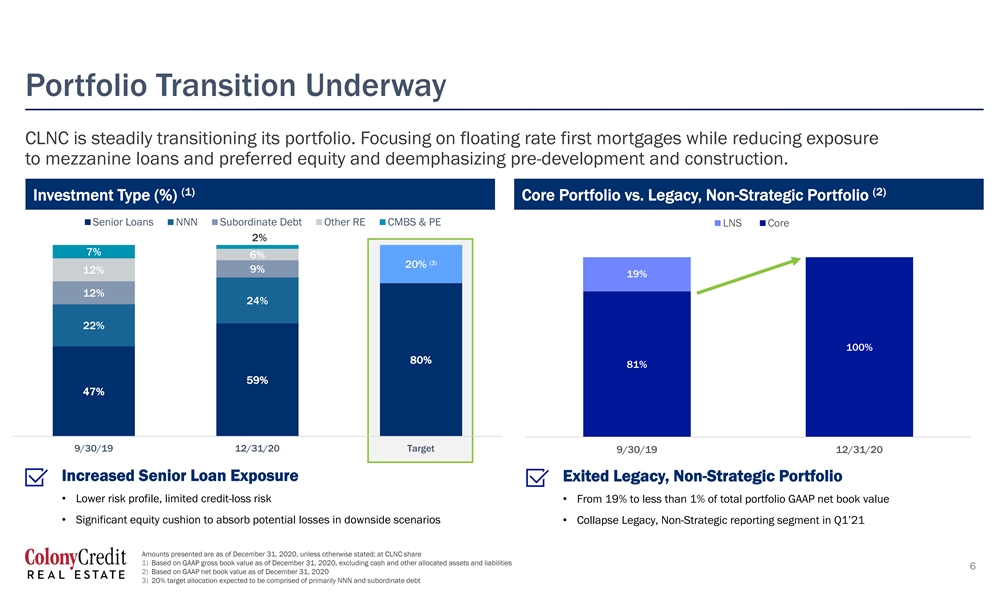

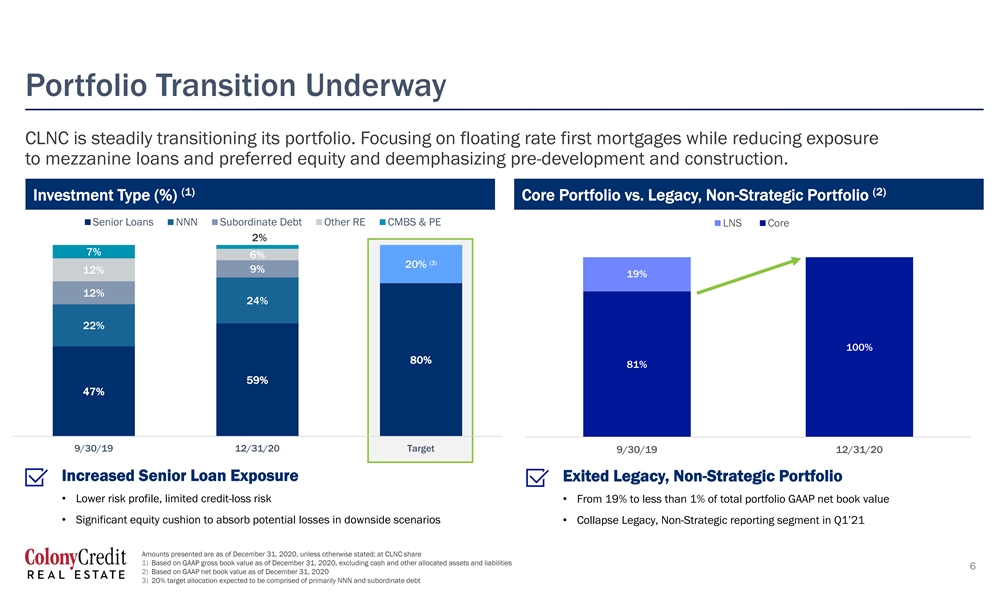

Portfolio Transition Underway CLNC is steadily transitioning its portfolio. Focusing on floating rate first mortgages while reducing exposure to mezzanine loans and preferred equity and deemphasizing pre-development and construction. (1) (2) Investment Type (%) Core Portfolio vs. Legacy, Non-Strategic Portfolio Senior Loans NNN Subordinate Debt Other RE CMBS & PE LNS Core 2% 0% 7% 6% (3) 20% 9% 12% 19% 12% 24% 22% 100% 80% 81% 59% 47% 9/30/19 12/31/20 Target 9/30/19 12/31/20 Increased Senior Loan Exposure Exited Legacy, Non-Strategic Portfolio • Lower risk profile, limited credit-loss risk • From 19% to less than 1% of total portfolio GAAP net book value • Significant equity cushion to absorb potential losses in downside scenarios • Collapse Legacy, Non-Strategic reporting segment in Q1’21 Amounts presented are as of December 31, 2020, unless otherwise stated; at CLNC share 1) Based on GAAP gross book value as of December 31, 2020, excluding cash and other allocated assets and liabilities 6 2) Based on GAAP net book value as of December 31, 2020 3) 20% target allocation expected to be comprised of primarily NNN and subordinate debtPortfolio Transition Underway CLNC is steadily transitioning its portfolio. Focusing on floating rate first mortgages while reducing exposure to mezzanine loans and preferred equity and deemphasizing pre-development and construction. (1) (2) Investment Type (%) Core Portfolio vs. Legacy, Non-Strategic Portfolio Senior Loans NNN Subordinate Debt Other RE CMBS & PE LNS Core 2% 0% 7% 6% (3) 20% 9% 12% 19% 12% 24% 22% 100% 80% 81% 59% 47% 9/30/19 12/31/20 Target 9/30/19 12/31/20 Increased Senior Loan Exposure Exited Legacy, Non-Strategic Portfolio • Lower risk profile, limited credit-loss risk • From 19% to less than 1% of total portfolio GAAP net book value • Significant equity cushion to absorb potential losses in downside scenarios • Collapse Legacy, Non-Strategic reporting segment in Q1’21 Amounts presented are as of December 31, 2020, unless otherwise stated; at CLNC share 1) Based on GAAP gross book value as of December 31, 2020, excluding cash and other allocated assets and liabilities 6 2) Based on GAAP net book value as of December 31, 2020 3) 20% target allocation expected to be comprised of primarily NNN and subordinate debt

Building Earnings Build earnings through deployment of cash into first mortgages with a focus on multifamily and office in growing markets. Collateral Diversification Convert Liquidity into New First Mortgage Loan Originations Office 20% • $588M cash on hand to fund new deals with predictable earnings • Nine investments closed since Q3’20 for $334M of committed capital; 13 others under contract for $356M of committed capital Multifamily 80% Powerful Originations Platform Producing Results • $690M of new originations closed or under contract since Q3’20 (1) New Originations with Predictable and Quality Earnings • Emphasis on lowering concentration risks; reduced average and maximum loan sizes Number of Loans 22 Total Committed Capital / Initial Funding $690M / $625M Strengthening Team with Proven Credit Expertise • George Kok hired as Chief Credit Officer Average Loan Size (Committed Capital) $31M • 35 years of experience as proven leader and business builder in CRE finance and CMBS W.A. Initial Term / Extended Term 3 Years / 5 Years % Floating Rate 100% 7 Amounts presented are as of February 22, 2021, unless otherwise stated; at CLNC share 1) Amounts presented include both closed and in-execution deals as of February 22, 2021Building Earnings Build earnings through deployment of cash into first mortgages with a focus on multifamily and office in growing markets. Collateral Diversification Convert Liquidity into New First Mortgage Loan Originations Office 20% • $588M cash on hand to fund new deals with predictable earnings • Nine investments closed since Q3’20 for $334M of committed capital; 13 others under contract for $356M of committed capital Multifamily 80% Powerful Originations Platform Producing Results • $690M of new originations closed or under contract since Q3’20 (1) New Originations with Predictable and Quality Earnings • Emphasis on lowering concentration risks; reduced average and maximum loan sizes Number of Loans 22 Total Committed Capital / Initial Funding $690M / $625M Strengthening Team with Proven Credit Expertise • George Kok hired as Chief Credit Officer Average Loan Size (Committed Capital) $31M • 35 years of experience as proven leader and business builder in CRE finance and CMBS W.A. Initial Term / Extended Term 3 Years / 5 Years % Floating Rate 100% 7 Amounts presented are as of February 22, 2021, unless otherwise stated; at CLNC share 1) Amounts presented include both closed and in-execution deals as of February 22, 2021

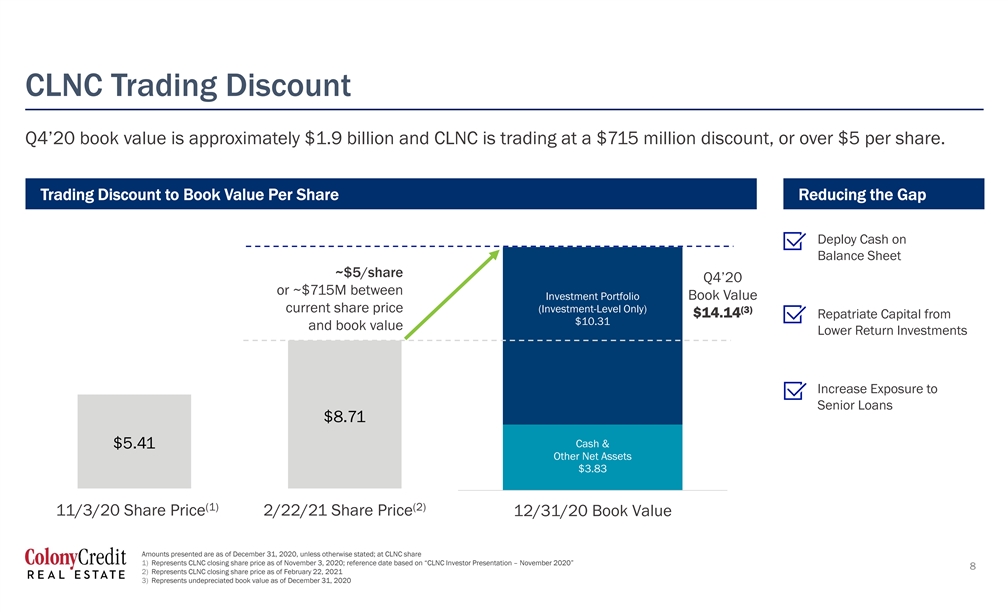

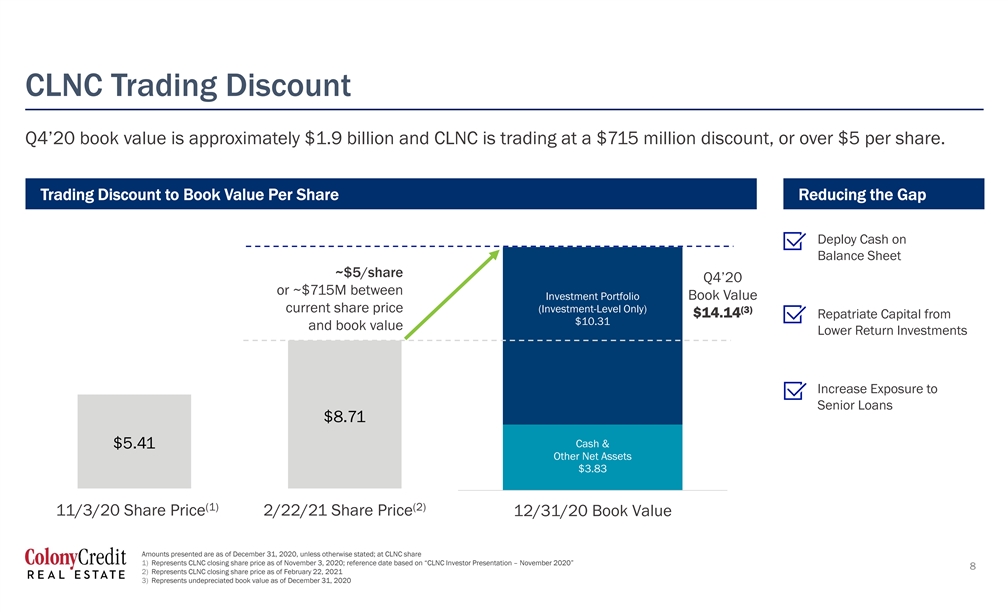

CLNC Trading Discount Q4’20 book value is approximately $1.9 billion and CLNC is trading at a $715 million discount, or over $5 per share. Trading Discount to Book Value Per Share Reducing the Gap Deploy Cash on Balance Sheet ~$5/share Q4’20 or ~$715M between Investment Portfolio Book Value current share price (Investment-Level Only) (3) $14.14 Repatriate Capital from $10.31 and book value Lower Return Investments Increase Exposure to Senior Loans $8.71 Cash & $5.41 Other Net Assets $3.83 (1) (2) 11/3/20 Share Price 2/22/21 Share Price 12/31/20 Book Value Amounts presented are as of December 31, 2020, unless otherwise stated; at CLNC share 1) Represents CLNC closing share price as of November 3, 2020; reference date based on “CLNC Investor Presentation – November 2020” 8 2) Represents CLNC closing share price as of February 22, 2021 3) Represents undepreciated book value as of December 31, 2020CLNC Trading Discount Q4’20 book value is approximately $1.9 billion and CLNC is trading at a $715 million discount, or over $5 per share. Trading Discount to Book Value Per Share Reducing the Gap Deploy Cash on Balance Sheet ~$5/share Q4’20 or ~$715M between Investment Portfolio Book Value current share price (Investment-Level Only) (3) $14.14 Repatriate Capital from $10.31 and book value Lower Return Investments Increase Exposure to Senior Loans $8.71 Cash & $5.41 Other Net Assets $3.83 (1) (2) 11/3/20 Share Price 2/22/21 Share Price 12/31/20 Book Value Amounts presented are as of December 31, 2020, unless otherwise stated; at CLNC share 1) Represents CLNC closing share price as of November 3, 2020; reference date based on “CLNC Investor Presentation – November 2020” 8 2) Represents CLNC closing share price as of February 22, 2021 3) Represents undepreciated book value as of December 31, 2020

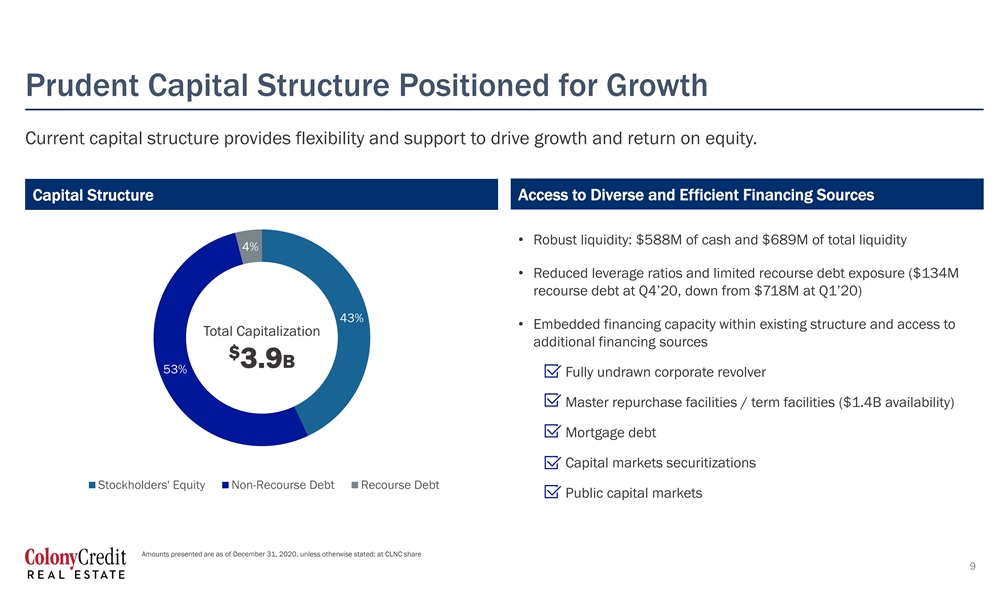

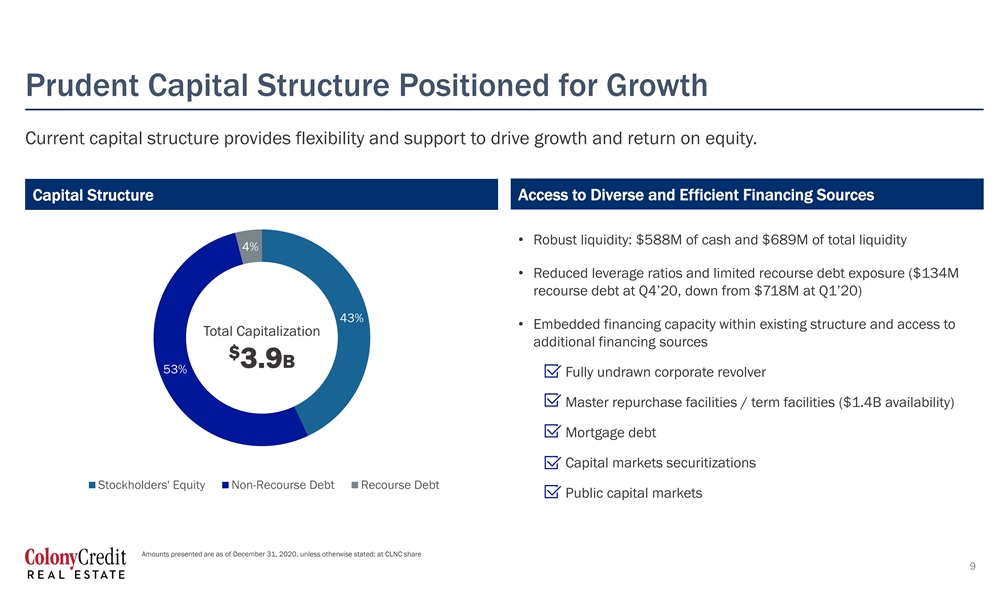

Prudent Capital Structure Positioned for Growth Current capital structure provides flexibility and support to drive growth and return on equity. Access to Diverse and Efficient Financing Sources Capital Structure • Robust liquidity: $588M of cash and $689M of total liquidity 4% • Reduced leverage ratios and limited recourse debt exposure ($134M recourse debt at Q4’20, down from $718M at Q1’20) 43% • Embedded financing capacity within existing structure and access to Total Capitalization additional financing sources $ 3.9B 53% ü Fully undrawn corporate revolver ü Master repurchase facilities / term facilities ($1.4B availability) ü Mortgage debt ü Capital markets securitizations Stockholders' Equity Non-Recourse Debt Recourse Debt ü Public capital markets Amounts presented are as of December 31, 2020, unless otherwise stated; at CLNC share 9Prudent Capital Structure Positioned for Growth Current capital structure provides flexibility and support to drive growth and return on equity. Access to Diverse and Efficient Financing Sources Capital Structure • Robust liquidity: $588M of cash and $689M of total liquidity 4% • Reduced leverage ratios and limited recourse debt exposure ($134M recourse debt at Q4’20, down from $718M at Q1’20) 43% • Embedded financing capacity within existing structure and access to Total Capitalization additional financing sources $ 3.9B 53% ü Fully undrawn corporate revolver ü Master repurchase facilities / term facilities ($1.4B availability) ü Mortgage debt ü Capital markets securitizations Stockholders' Equity Non-Recourse Debt Recourse Debt ü Public capital markets Amounts presented are as of December 31, 2020, unless otherwise stated; at CLNC share 9

CLNC Investment Opportunity CLNC’s strong balance sheet positions the firm on a path towards substantial earnings growth and shareholder value creation. Positioned for Growth A Simple Game Plan Stable and Recurring Earnings • Clear path to build earnings • Liquidity position of $689 million • Deploy cash on balance sheet into new senior loans • Embedded financing capacity • Grow dividend • Repatriate proceeds from lower yielding • Experienced team in-place to capitalize on • Close valuation discount between current assets and redeploy the capital growth opportunities share price and underlying book value • Build earnings and reinstated dividend for Q1’21 • $690M of new originations closed or under contract since Q3’20 10CLNC Investment Opportunity CLNC’s strong balance sheet positions the firm on a path towards substantial earnings growth and shareholder value creation. Positioned for Growth A Simple Game Plan Stable and Recurring Earnings • Clear path to build earnings • Liquidity position of $689 million • Deploy cash on balance sheet into new senior loans • Embedded financing capacity • Grow dividend • Repatriate proceeds from lower yielding • Experienced team in-place to capitalize on • Close valuation discount between current assets and redeploy the capital growth opportunities share price and underlying book value • Build earnings and reinstated dividend for Q1’21 • $690M of new originations closed or under contract since Q3’20 10

Company Information Colony Credit Real Estate (NYSE: CLNC) is one of the largest publicly traded commercial real estate (CRE) credit REITs, focused on originating, acquiring, financing and managing a diversified portfolio consisting primarily of CRE debt investments and net leased properties predominantly in the United States. CRE debt investments primarily consist of first mortgage loans, which we expect to be the primary investment strategy. Colony Credit Real Estate is externally managed by a subsidiary of leading global real estate and investment management firm, Colony Capital, Inc. Colony Credit Real Estate is organized as a Maryland corporation and taxed as a REIT for U.S. federal income tax purposes. For additional information regarding the Company and its management and business, please refer to www.clncredit.com. Shareholder information Principal Offices: Company Website: Investor Relations: Analyst Coverage: Los Angeles New York www.clncredit.com ADDO Investor Relations Raymond James 515 South Flower Street 590 Madison Avenue Lasse Glassen Stephen Laws th th 44 Floor 34 Floor 310-829-5400 901-579-4868 NYSE Ticker: Los Angeles, CA 90071 New York, NY 10022 lglassen@addoir.com CLNC 310-282-8220 212-547-2600 B. Riley FBR Randy Binner Stock & Transfer Agent: Press & Media: 703-312-1890 American Stock & Transfer Owen Blicksilver P.R., Inc. Trust Company (AST) Caroline Luz BTIG 866-751-6317 203-656-2829 Timothy Hayes help@astfinancial.com caroline@blicksilverpr.com 212-738-6199 11Company Information Colony Credit Real Estate (NYSE: CLNC) is one of the largest publicly traded commercial real estate (CRE) credit REITs, focused on originating, acquiring, financing and managing a diversified portfolio consisting primarily of CRE debt investments and net leased properties predominantly in the United States. CRE debt investments primarily consist of first mortgage loans, which we expect to be the primary investment strategy. Colony Credit Real Estate is externally managed by a subsidiary of leading global real estate and investment management firm, Colony Capital, Inc. Colony Credit Real Estate is organized as a Maryland corporation and taxed as a REIT for U.S. federal income tax purposes. For additional information regarding the Company and its management and business, please refer to www.clncredit.com. Shareholder information Principal Offices: Company Website: Investor Relations: Analyst Coverage: Los Angeles New York www.clncredit.com ADDO Investor Relations Raymond James 515 South Flower Street 590 Madison Avenue Lasse Glassen Stephen Laws th th 44 Floor 34 Floor 310-829-5400 901-579-4868 NYSE Ticker: Los Angeles, CA 90071 New York, NY 10022 lglassen@addoir.com CLNC 310-282-8220 212-547-2600 B. Riley FBR Randy Binner Stock & Transfer Agent: Press & Media: 703-312-1890 American Stock & Transfer Owen Blicksilver P.R., Inc. Trust Company (AST) Caroline Luz BTIG 866-751-6317 203-656-2829 Timothy Hayes help@astfinancial.com caroline@blicksilverpr.com 212-738-6199 11

Important Note Regarding Non-GAAP Financial Measures and Definitions We present Distributable Earnings/Legacy, Non-Strategic Distributable Earnings, which is a non-GAAP supplemental financial measure of our performance. Our Distributable Earnings are generated by the Core Portfolio and Legacy, Non- Strategic Distributable Earnings are generated by the Legacy, Non-Strategic Portfolio. We believe that Distributable Earnings/Legacy, Non-Strategic Distributable Earnings provides meaningful information to consider in addition to our net income and cash flow from operating activities determined in accordance with U.S. GAAP, and this metric is a useful indicator for investors in evaluating and comparing our operating performance to our peers and our ability to pay dividends. We elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended, beginning with our taxable year ended December 31, 2018. As a REIT, we are required to distribute substantially all of our taxable income and we believe that dividends are one of the principal reasons investors invest in credit or commercial mortgage REITs such as our company. Over time, Distributable Earnings has been a useful indicator of our dividends per share and we consider that measure in determining the dividend, if any, to be paid. This supplemental financial measure also helps us to evaluate our performance excluding the effects of certain transactions and U.S. GAAP adjustments that we believe are not necessarily indicative of our current portfolio and operations. For information on the fees we pay our Manager, see Note 10, “Related Party Arrangements” to our consolidated financial statements included in Form 10-K to be filed with the U.S. Securities and Exchange Commission (“SEC”). We define Distributable Earnings/Legacy, Non-Strategic Distributable Earnings as U.S. GAAP net income (loss) attributable to our common stockholders (or, without duplication, the owners of the common equity of our direct subsidiaries, such as our operating partnership or “OP”) and excluding (i) non-cash equity compensation expense, (ii) the expenses incurred in connection with our formation or other strategic transactions, (iii) the incentive fee, (iv) acquisition costs from successful acquisitions, (v) gains or losses from sales of real estate property and impairment write-downs of depreciable real estate, including unconsolidated joint ventures and preferred equity investments, (vi) CECL reserves determined by probability of default / loss given default (or “PD/LGD”) model, (vii) depreciation and amortization, (viii) any unrealized gains or losses or other similar non-cash items that are included in net income for the current quarter, regardless of whether such items are included in other comprehensive income or loss, or in net income, (ix) one-time events pursuant to changes in U.S. GAAP and (x) certain material non-cash income or expense items that in the judgment of management should not be included in Distributable Earnings/Legacy, Non-Strategic Distributable Earnings. For clauses (ix) and (x), such exclusions shall only be applied after discussions between our Manager and our independent directors and after approval by a majority of our independent directors. Distributable Earnings/Legacy, Non-Strategic Distributable Earnings include provision for loan losses when realized. Loan losses are realized when such amounts are deemed nonrecoverable at the time the loan is repaid, or if the underlying asset is sold following foreclosure, or if we determine that it is probable that all amounts due will not be collected; realized loan losses to be included in Distributable Earnings is the difference between the cash received, or expected to be received, and the book value of the asset. Distributable Earnings/Legacy, Non-Strategic Distributable Earnings does not represent net income or cash generated from operating activities and should not be considered as an alternative to U.S. GAAP net income or an indication of our cash flows from operating activities determined in accordance with U.S. GAAP, a measure of our liquidity, or an indication of funds available to fund our cash needs. In addition, our methodology for calculating Distributable Earnings/Legacy, Non-Strategic Distributable Earnings may differ from methodologies employed by other companies to calculate the same or similar non-GAAP supplemental financial measures, and accordingly, our reported Distributable Earnings may not be comparable to the Distributable Earnings reported by other companies. The Company calculates Distributable Earnings/Legacy, Non-Strategic Distributable Earnings per share, which are non-GAAP supplemental financial measures, based on a weighted average number of common shares and operating partnership units (held by members other than the Company or its subsidiaries). The Company presents pro rata (“at share” or “at CLNC share”) financial information, which is not, and is not intended to be, a presentation in accordance with GAAP. The Company computes pro rata financial information by applying its economic interest to each financial statement line item on an investment-by-investment basis. Similarly, noncontrolling interests’ (“NCI”) share of assets, liabilities, profits and losses was computed by applying noncontrolling interests’ economic interest to each financial statement line item. The Company provides pro rata financial information because it may assist investors and analysts in estimating the Company’s economic interest in its investments. However, pro rata financial information as an analytical tool has limitations. Other companies may not calculate their pro rata information in the same methodology, and accordingly, the Company’s pro rata information may not be comparable to other companies pro rata information. As such, the pro rata financial information should not be considered in isolation or as a substitute for our financial statements as reported under GAAP, but may be used as a supplement to financial information as reported under GAAP. 12Important Note Regarding Non-GAAP Financial Measures and Definitions We present Distributable Earnings/Legacy, Non-Strategic Distributable Earnings, which is a non-GAAP supplemental financial measure of our performance. Our Distributable Earnings are generated by the Core Portfolio and Legacy, Non- Strategic Distributable Earnings are generated by the Legacy, Non-Strategic Portfolio. We believe that Distributable Earnings/Legacy, Non-Strategic Distributable Earnings provides meaningful information to consider in addition to our net income and cash flow from operating activities determined in accordance with U.S. GAAP, and this metric is a useful indicator for investors in evaluating and comparing our operating performance to our peers and our ability to pay dividends. We elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended, beginning with our taxable year ended December 31, 2018. As a REIT, we are required to distribute substantially all of our taxable income and we believe that dividends are one of the principal reasons investors invest in credit or commercial mortgage REITs such as our company. Over time, Distributable Earnings has been a useful indicator of our dividends per share and we consider that measure in determining the dividend, if any, to be paid. This supplemental financial measure also helps us to evaluate our performance excluding the effects of certain transactions and U.S. GAAP adjustments that we believe are not necessarily indicative of our current portfolio and operations. For information on the fees we pay our Manager, see Note 10, “Related Party Arrangements” to our consolidated financial statements included in Form 10-K to be filed with the U.S. Securities and Exchange Commission (“SEC”). We define Distributable Earnings/Legacy, Non-Strategic Distributable Earnings as U.S. GAAP net income (loss) attributable to our common stockholders (or, without duplication, the owners of the common equity of our direct subsidiaries, such as our operating partnership or “OP”) and excluding (i) non-cash equity compensation expense, (ii) the expenses incurred in connection with our formation or other strategic transactions, (iii) the incentive fee, (iv) acquisition costs from successful acquisitions, (v) gains or losses from sales of real estate property and impairment write-downs of depreciable real estate, including unconsolidated joint ventures and preferred equity investments, (vi) CECL reserves determined by probability of default / loss given default (or “PD/LGD”) model, (vii) depreciation and amortization, (viii) any unrealized gains or losses or other similar non-cash items that are included in net income for the current quarter, regardless of whether such items are included in other comprehensive income or loss, or in net income, (ix) one-time events pursuant to changes in U.S. GAAP and (x) certain material non-cash income or expense items that in the judgment of management should not be included in Distributable Earnings/Legacy, Non-Strategic Distributable Earnings. For clauses (ix) and (x), such exclusions shall only be applied after discussions between our Manager and our independent directors and after approval by a majority of our independent directors. Distributable Earnings/Legacy, Non-Strategic Distributable Earnings include provision for loan losses when realized. Loan losses are realized when such amounts are deemed nonrecoverable at the time the loan is repaid, or if the underlying asset is sold following foreclosure, or if we determine that it is probable that all amounts due will not be collected; realized loan losses to be included in Distributable Earnings is the difference between the cash received, or expected to be received, and the book value of the asset. Distributable Earnings/Legacy, Non-Strategic Distributable Earnings does not represent net income or cash generated from operating activities and should not be considered as an alternative to U.S. GAAP net income or an indication of our cash flows from operating activities determined in accordance with U.S. GAAP, a measure of our liquidity, or an indication of funds available to fund our cash needs. In addition, our methodology for calculating Distributable Earnings/Legacy, Non-Strategic Distributable Earnings may differ from methodologies employed by other companies to calculate the same or similar non-GAAP supplemental financial measures, and accordingly, our reported Distributable Earnings may not be comparable to the Distributable Earnings reported by other companies. The Company calculates Distributable Earnings/Legacy, Non-Strategic Distributable Earnings per share, which are non-GAAP supplemental financial measures, based on a weighted average number of common shares and operating partnership units (held by members other than the Company or its subsidiaries). The Company presents pro rata (“at share” or “at CLNC share”) financial information, which is not, and is not intended to be, a presentation in accordance with GAAP. The Company computes pro rata financial information by applying its economic interest to each financial statement line item on an investment-by-investment basis. Similarly, noncontrolling interests’ (“NCI”) share of assets, liabilities, profits and losses was computed by applying noncontrolling interests’ economic interest to each financial statement line item. The Company provides pro rata financial information because it may assist investors and analysts in estimating the Company’s economic interest in its investments. However, pro rata financial information as an analytical tool has limitations. Other companies may not calculate their pro rata information in the same methodology, and accordingly, the Company’s pro rata information may not be comparable to other companies pro rata information. As such, the pro rata financial information should not be considered in isolation or as a substitute for our financial statements as reported under GAAP, but may be used as a supplement to financial information as reported under GAAP. 12

1313