UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

| |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2020

OR

|

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-38377

|

| | | | |

| | COLONY CREDIT REAL ESTATE, INC. | |

| | (Exact Name of Registrant as Specified in Its Charter) | |

| | | | | |

| | Maryland | | 38-4046290 | |

| | (State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) | |

515 S. Flower Street, 44th Floor

Los Angeles, CA 90071

(Address of Principal Executive Offices, Including Zip Code)

(310) 282-8820

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, par value $0.01 per share | CLNC | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one): |

| | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | | | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☐

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

As of May 7, 2020, Colony Credit Real Estate, Inc. had 128,488,858 shares of Class A common stock, par value $0.01 per share, outstanding

EXPLANATORY NOTE

This Quarterly Report on Form 10-Q of Colony Credit Real Estate, Inc., a Maryland corporation (the “Company”), includes the financial statements and other financial information of (i) the Company and (ii) the Company’s accounting predecessor, which are investment entities in which Colony Capital Operating Company, LLC (“CLNY OP”) or its subsidiaries owned interests ranging from approximately 38% to 100% and that were contributed to the Company on January 31, 2018 in connection with the closing of the Combination (as defined below) and certain intercompany balances between those entities and CLNY OP or its subsidiaries (the “CLNY Investment Entities”).

On January 31, 2018, the Company completed the transactions contemplated by that certain Master Combination Agreement, dated as of August 25, 2017, as amended and restated on November 20, 2017 (the “Combination Agreement”), by and among (i) the Company, (ii) Credit RE Operating Company, LLC, a Delaware limited liability company and wholly-owned subsidiary of the Company (the “OP”), (iii) CLNY OP, a Delaware limited liability company and the operating company of Colony Capital, Inc., formerly Colony NorthStar, Inc. (“Colony Capital”), a Maryland corporation, (iv) NRF RED REIT Corp., a Maryland corporation and indirect subsidiary of CLNY OP (“RED REIT”), (v) NorthStar Real Estate Income Trust, Inc., a Maryland corporation (“NorthStar I”), (vi) NorthStar Real Estate Income Trust Operating Partnership, LP, a Delaware limited partnership and the operating partnership of NorthStar I (“NorthStar I OP”), (vii) NorthStar Real Estate Income II, Inc., a Maryland corporation (“NorthStar II”), and (viii) NorthStar Real Estate Income Operating Partnership II, LP, a Delaware limited partnership and the operating partnership of NorthStar II (“NorthStar II OP”).

Pursuant to the Combination Agreement, (i) CLNY OP contributed and conveyed to the Company a select portfolio of assets and liabilities (the “CLNY Contributed Portfolio”) of CLNY OP (the “CLNY OP Contribution”), (ii) RED REIT contributed and conveyed to the OP a select portfolio of assets and liabilities of RED REIT (the “RED REIT Contribution” and, together with the CLNY OP Contribution, the “CLNY Contributions”), (iii) NorthStar I merged with and into the Company, with the Company surviving the merger (the “NorthStar I Merger”), (iv) NorthStar II merged with and into the Company, with the Company surviving the merger (the “NorthStar II Merger” and, together with the NorthStar I Merger, the “Mergers”), and (v) immediately following the Mergers, the Company contributed and conveyed to the OP the CLNY Contributed Portfolio and the equity interests of each of NorthStar I OP and NorthStar II OP then-owned by the Company in exchange for units of membership interest in the OP (the “Company Contribution” and, collectively with the Mergers and the CLNY Contributions, the “Combination”). To satisfy the condition to completion of the Combination that the Company’s Class A common stock, par value $0.01 per share (the “Class A common stock”), be approved for listing on a national securities exchange in connection with either an initial public offering or a listing, the Class A common stock was approved for listing by the New York Stock Exchange and began trading under the ticker “CLNC” on February 1, 2018.

The CLNY Contributions were accounted for as a reorganization of entities under common control, since both the Company and CLNY Investment Entities were under common control of Colony Capital at the time the contributions were made. Accordingly, the Company’s financial statements for prior periods were recast to reflect the consolidation of the CLNY Investment Entities as if the contribution had occurred on the date of the earliest period presented.

As used throughout this document, the terms the “Company,” “we,” “our” and “us” mean:

| |

| • | Colony Credit Real Estate, Inc. and the consolidated CLNY Investment Entities for periods on or prior to the closing of the Combination on January 31, 2018; and |

| |

| • | The combined operations of Colony Credit Real Estate, Inc., NorthStar I and NorthStar II beginning February 1, 2018, following the closing of the Combination. |

Accordingly, comparisons of the period to period financial information of the Company as set forth herein may not be meaningful because the CLNY Investment Entities represents only a portion of the assets and liabilities Colony Credit Real Estate, Inc. acquired in the Combination and does not reflect any potential benefits that may result from realization of future cost savings from operating efficiencies, or other incremental synergies expected to result from the Combination.

In addition to the financial statements contained herein, you should read and consider the audited financial statements and accompanying notes thereto of the Company for the year ended December 31, 2019 included in our Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 28, 2020.

COLONY CREDIT REAL ESTATE, INC.

FORM 10-Q

TABLE OF CONTENTS

Special Note Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond our control, and may cause actual results to differ significantly from those expressed in any forward-looking statement.

Currently, one of the most significant factors that could cause actual outcomes to differ materially from our forward-looking statements is the potential adverse effect of the current pandemic of the novel coronavirus, or COVID-19, on the financial condition, results of operations, cash flows and performance of the Company, its borrowers and tenants, the real estate market and the global economy and financial markets. The extent to which COVID-19 pandemic impacts us, our borrowers and our tenants will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures, among others. Moreover, investors are cautioned to interpret many of the risks identified under the section titled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019 as being heightened as a result of the ongoing and numerous adverse impacts of the COVID-19 pandemic.

Among others, the following uncertainties and other factors could cause actual results to differ from those set forth in the forward-looking statements.

| |

| • | operating costs and business disruption may be greater than expected; |

| |

| • | uncertainties regarding the ongoing impact of COVID-19, the severity of the disease, the duration of the COVID-19 outbreak, actions that may be taken by governmental authorities to contain the COVID-19 outbreak or to treat its impact, the potential negative impacts of COVID-19 on the global economy and its adverse impact on the real estate market, the economy and our investments, financial condition and business operations; |

| |

| • | defaults by borrowers in paying debt service on outstanding indebtedness and borrowers’ abilities to manage and stabilize properties; |

| |

| • | deterioration in the performance of the properties securing our investments (including depletion of interest and other reserves or payment-in-kind concessions in lieu of current interest payment obligations) that may cause deterioration in the performance of our investments and, potentially, principal losses to us; |

| |

| • | the fair value of our investments may be subject to uncertainties; |

| |

| • | our use of leverage could hinder our ability to make distributions and may significantly impact our liquidity position; |

| |

| • | given our dependence on our external manager, an affiliate of Colony Capital, Inc., any adverse changes in the financial health or otherwise of our manager or Colony Capital, Inc. could hinder our operating performance and return on stockholder’s investment; |

| |

| • | the ability to realize substantial efficiencies as well as anticipated strategic and financial benefits, including, but not limited to expected returns on equity and/or yields on investments; |

| |

| • | adverse impacts on our corporate revolver, including covenant compliance and borrowing base capacity; |

| |

| • | adverse impacts on our liquidity, including margin calls on master repurchase facilities, debt service or lease payment defaults or deferrals, demands for protective advances and capital expenditures, or our ability to continue to generate liquidity from sales of legacy, non-strategic assets; |

| |

| • | our ability to liquidate our legacy, non-strategic assets within the projected timeframe or at the projected values; |

| |

| • | the timing of and ability to deploy available capital; |

| |

| • | our ability to pay, maintain or grow the dividend in the future; |

| |

| • | the timing of and ability to complete repurchases of our stock; |

| |

| • | our ability to refinance certain mortgage debt on similar terms to those currently existing or at all; |

| |

| • | whether Colony Capital will continue to serve as our external manager or whether we will pursue a strategic transaction related thereto; and the impact of legislative, regulatory and competitive changes |

| |

| • | and the actions of governmental authorities, including the current U.S. presidential administration, and in particular those affecting the commercial real estate finance and mortgage industry or our business. |

The foregoing list of factors is not exhaustive. We urge you to carefully review the disclosures we make concerning risks in the sections entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, the section entitled “Risk Factors” in this Form 10-Q for the quarter ended March 31, 2020 and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” herein.

We caution investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this Quarterly Report on Form 10-Q. The Company is under no duty to update any of these forward-looking statements after the date of this Quarterly Report on Form 10-Q, nor to conform prior statements to actual results or revised expectations, and the Company does not intend to do so.

PART I

Item 1. Financial Statements

COLONY CREDIT REAL ESTATE, INC.

CONSOLIDATED BALANCE SHEETS

(in Thousands, Except Share and Per Share Data)

|

| | | | | | | |

| | March 31, 2020 (Unaudited) | | December 31, 2019 |

| Assets | | | |

| Cash and cash equivalents | $ | 393,845 |

| | $ | 69,619 |

|

| Restricted cash | 159,521 |

| | 126,065 |

|

Loans and preferred equity held for investment, net(1) | 2,351,278 |

| | 2,576,332 |

|

| Real estate securities, available for sale, at fair value | 179,572 |

| | 252,824 |

|

| Real estate, net | 1,226,988 |

| | 1,484,796 |

|

| Investments in unconsolidated ventures ($8,764 and $10,283 at fair value, respectively) | 585,994 |

| | 595,305 |

|

| Receivables, net | 41,569 |

| | 46,456 |

|

| Deferred leasing costs and intangible assets, net | 98,507 |

| | 112,762 |

|

| Assets held for sale | 270,680 |

| | 189,470 |

|

| Other assets | 62,643 |

| | 87,707 |

|

| Mortgage loans held in securitization trusts, at fair value | 1,822,991 |

| | 1,872,970 |

|

| Total assets | $ | 7,193,588 |

| | $ | 7,414,306 |

|

| Liabilities | | | |

| Securitization bonds payable, net | $ | 833,671 |

| | $ | 833,153 |

|

| Mortgage and other notes payable, net | 1,152,851 |

| | 1,256,112 |

|

| Credit facilities | 1,260,419 |

| | 1,099,233 |

|

| Due to related party (Note 10) | 10,766 |

| | 11,016 |

|

| Accrued and other liabilities | 145,956 |

| | 140,424 |

|

| Intangible liabilities, net | 10,548 |

| | 22,149 |

|

| Liabilities related to assets held for sale | 10,842 |

| | 294 |

|

| Escrow deposits payable | 49,499 |

| | 74,497 |

|

| Dividends payable | 13,147 |

| | 13,164 |

|

| Mortgage obligations issued by securitization trusts, at fair value | 1,732,388 |

| | 1,762,914 |

|

| Total liabilities | 5,220,087 |

| | 5,212,956 |

|

| Commitments and contingencies (Note 16) |

| |

|

| Equity | | | |

| Stockholders’ equity | | | |

| Preferred stock, $0.01 par value, 50,000,000 shares authorized, no shares issued and outstanding as of March 31, 2020 and 2019 | — |

| | — |

|

| Common stock, $0.01 par value per share | | | |

| Class A, 950,000,000 shares authorized, 128,366,427 and 128,538,703 shares issued and outstanding as of March 31, 2020 and December 31, 2019, respectively | 1,284 |

| | 1,285 |

|

| Additional paid-in capital | 2,907,796 |

| | 2,909,181 |

|

| Accumulated deficit | (959,695 | ) | | (819,738 | ) |

| Accumulated other comprehensive income (loss) | (42,705 | ) | | 28,294 |

|

| Total stockholders’ equity | 1,906,680 |

| | 2,119,022 |

|

| Noncontrolling interests in investment entities | 21,141 |

| | 31,631 |

|

| Noncontrolling interests in the Operating Partnership | 45,680 |

| | 50,697 |

|

| Total equity | 1,973,501 |

| | 2,201,350 |

|

| Total liabilities and equity | $ | 7,193,588 |

| | $ | 7,414,306 |

|

_________________________________________

| |

| (1) | Net of $52.2 million and $272.6 million of allowance for loan losses at March 31, 2020 and December 31, 2019, respectively. See Note 3, “Loans and Preferred Equity Held for Investments, net and Loans Held for Sale” for further details. |

The accompanying notes are an integral part of these consolidated financial statements.

COLONY CREDIT REAL ESTATE, INC.

CONSOLIDATED BALANCE SHEETS

(in Thousands)

The following table presents assets and liabilities of securitization trusts and certain real estate properties that have noncontrolling interests as variable interest entities for which the Company is determined to be the primary beneficiary.

|

| | | | | | | |

| | March 31, 2020 (Unaudited) | | December 31, 2019 |

| Assets | | | |

| Cash and cash equivalents | $ | 11,965 |

| | $ | 14,109 |

|

| Restricted cash | 15,737 |

| | 25,646 |

|

| Loans and preferred equity held for investment, net | 994,306 |

| | 1,016,781 |

|

| Real estate, net | 178,123 |

| | 381,608 |

|

| Receivables, net | 20,668 |

| | 26,044 |

|

| Deferred leasing costs and intangible assets, net | 26,638 |

| | 36,323 |

|

| Assets held for sale | 210,434 |

| | 102,397 |

|

| Other assets | 24,867 |

| | 26,463 |

|

| Mortgage loans held in securitization trusts, at fair value | 1,822,991 |

| | 1,872,970 |

|

| Total assets | $ | 3,305,729 |

| | $ | 3,502,341 |

|

| Liabilities | | | |

| Securitization bonds payable, net | $ | 833,671 |

| | $ | 833,153 |

|

| Mortgage and other notes payable, net | 297,286 |

| | 341,480 |

|

| Credit facilities | 24,847 |

| | 23,882 |

|

| Accrued and other liabilities | 100,764 |

| | 124,969 |

|

| Intangible liabilities, net | 8,751 |

| | 20,230 |

|

| Liabilities related to assets held for sale | 10,842 |

| | 251 |

|

| Escrow deposits payable | 4,128 |

| | 10,485 |

|

| Mortgage obligations issued by securitization trusts, at fair value | 1,732,388 |

| | 1,762,914 |

|

| Total liabilities | $ | 3,012,677 |

| | $ | 3,117,364 |

|

The accompanying notes are an integral part of these consolidated financial statements.

COLONY CREDIT REAL ESTATE, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in Thousands, Except Per Share Data)

(Unaudited)

|

| | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2020 | | 2019 |

| Net interest income | | | | |

| Interest income | | $ | 46,104 |

| | $ | 38,409 |

|

| Interest expense | | (20,744 | ) | | (19,292 | ) |

| Interest income on mortgage loans held in securitization trusts | | 20,555 |

| | 38,476 |

|

| Interest expense on mortgage obligations issued by securitization trusts | | (18,059 | ) | | (35,635 | ) |

| Net interest income | | 27,856 |

| | 21,958 |

|

| | | | | |

| Property and other income | | | | |

| Property operating income | | 52,513 |

| | 63,134 |

|

| Other income | | 9,409 |

| | 177 |

|

| Total property and other income | | 61,922 |

| | 63,311 |

|

| | | | | |

| Expenses | | | | |

| Management fee expense | | 7,946 |

| | 11,358 |

|

| Property operating expense | | 22,531 |

| | 28,180 |

|

| Transaction, investment and servicing expense | | 3,134 |

| | 529 |

|

| Interest expense on real estate | | 13,078 |

| | 13,607 |

|

| Depreciation and amortization | | 17,976 |

| | 27,662 |

|

| Provision for loan losses | | 69,932 |

| | — |

|

| Impairment of operating real estate | | 4,126 |

| | — |

|

| Administrative expense (including $342 and $1,843 of equity-based compensation expense, respectively) | | 7,038 |

| | 6,653 |

|

| Total expenses | | 145,761 |

| | 87,989 |

|

| | | | | |

| Other income (loss) | | | | |

| Unrealized gain (loss) on mortgage loans and obligations held in securitization trusts, net | | (19,452 | ) | | 1,029 |

|

| Realized gain on mortgage loans and obligations held in securitization trusts, net | | — |

| | 48 |

|

| Other loss, net | | (20,162 | ) | | (5,079 | ) |

| Loss before equity in earnings of unconsolidated ventures and income taxes | | (95,597 | ) | | (6,722 | ) |

| Equity in earnings of unconsolidated ventures | | 17,167 |

| | 21,310 |

|

| Income tax benefit (expense) | | (1,711 | ) | | 369 |

|

| Net income (loss) | | (80,141 | ) | | 14,957 |

|

| Net (income) loss attributable to noncontrolling interests: | | | | |

| Investment entities | | (523 | ) | | 298 |

|

| Operating Partnership | | 1,892 |

| | (347 | ) |

| Net income (loss) attributable to Colony Credit Real Estate, Inc. common stockholders | | $ | (78,772 | ) | | $ | 14,908 |

|

| | | | | |

Net income (loss) per common share - basic and diluted (Note 18) | | $ | (0.62 | ) | | $ | 0.11 |

|

| | | | | |

Weighted average shares of common stock outstanding - basic and diluted (Note 18) | | 128,487 |

| | 127,943 |

|

The accompanying notes are an integral part of these consolidated financial statements.

COLONY CREDIT REAL ESTATE, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in Thousands)

(Unaudited)

|

| | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2020 | | 2019 |

| Net income (loss) | | $ | (80,141 | ) | | $ | 14,957 |

|

| Other comprehensive income (loss) | |

|

| | |

| Unrealized gain (loss) on real estate securities, available for sale | | (75,029 | ) | | 9,758 |

|

| Change in fair value of net investment hedges | | 21,764 |

| | 7,395 |

|

| Foreign currency translation loss | | (19,436 | ) | | (3,310 | ) |

| Total other comprehensive income (loss) | | (72,701 | ) | | 13,843 |

|

| Comprehensive income (loss) | | (152,842 | ) | | 28,800 |

|

| Comprehensive (income) loss attributable to noncontrolling interests: | | | | |

| Investment entities | | (523 | ) | | 298 |

|

| Operating Partnership | | 3,594 |

| | (671 | ) |

| Comprehensive income (loss) attributable to common stockholders | | $ | (149,771 | ) | | $ | 28,427 |

|

The accompanying notes are an integral part of these consolidated financial statements.

COLONY CREDIT REAL ESTATE, INC.

CONSOLIDATED STATEMENTS OF EQUITY

(in Thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional

Paid-in

Capital | | Retained

Earnings

(Accumulated

Deficit) | | Accumulated

Other

Comprehensive

Income | | Total

Stockholders’

Equity | | | Noncontrolling Interests in Investment Entities | | Noncontrolling Interests in the Operating Partnership | | Total

Equity | |

| | Class A | | Class B-3 | |

| | Shares | | Amount | | Shares | | Amount | |

| Balance as of December 31, 2018 | 83,410 |

| | $ | 834 |

| | 44,399 |

| | $ | 444 |

| | $ | 2,899,353 |

| | $ | (193,327 | ) | | $ | (399 | ) | | $ | 2,706,905 |

| | | $ | 72,683 |

| | $ | 65,614 |

| | $ | 2,845,202 |

| |

| Contributions | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | | 24 |

| | — |

| | 24 |

| |

| Distributions | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | | (394 | ) | | — |

| | (394 | ) | |

| Adjustments related to the Combination | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | | — |

| | — |

| | — |

| |

| Conversion of Class B-3 common stock to Class A common stock | 44,399 |

| | 444 |

| | (44,399 | ) | | (444 | ) | | — |

| | — |

| | — |

| | — |

| | | — |

| | — |

| | — |

| |

| Issuance and amortization of equity-based compensation | 800 |

| | 8 |

| | — |

| | — |

| | 1,835 |

| | — |

| | — |

| | 1,843 |

| | | — |

| | — |

| | 1,843 |

| |

| Other comprehensive loss | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 13,519 |

| | 13,519 |

| | | — |

| | 324 |

| | 13,843 |

| |

| Dividends and distributions declared ($0.44 per Class A share and $0.15 per Class B-3 share) | — |

| | — |

| | — |

| | — |

| | — |

| | (55,726 | ) | | — |

| | (55,726 | ) | | | — |

| | (1,340 | ) | | (57,066 | ) | |

| Shares canceled for tax withholding on vested stock awards | (96 | ) | | (1 | ) | | — |

| | — |

| | (1,496 | ) | | — |

| | — |

| | (1,497 | ) | | | — |

| | — |

| | (1,497 | ) | |

| Reallocation of equity | — |

| | — |

| | — |

| | — |

| | (23 | ) | | — |

| | — |

| | (23 | ) | | | — |

| | 23 |

| | — |

| |

| Net income (loss) | — |

| | — |

| | — |

| | — |

| | — |

| | 14,908 |

| | — |

| | 14,908 |

| | | (298 | ) | | 347 |

| | 14,957 |

| |

| Balance as of March 31, 2019 | 128,513 |

| | $ | 1,285 |

| | — |

| | $ | — |

| | $ | 2,899,669 |

| | $ | (234,145 | ) | | $ | 13,120 |

| | $ | 2,679,929 |

| | | $ | 72,015 |

| | $ | 64,968 |

| | $ | 2,816,912 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2019 | 128,539 |

| | $ | 1,285 |

| | — |

| | $ | — |

| | $ | 2,909,181 |

| | $ | (819,738 | ) | | $ | 28,294 |

| | $ | 2,119,022 |

| | | $ | 31,631 |

| | $ | 50,697 |

| | $ | 2,201,350 |

| |

| Contributions | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | | — |

| | — |

| | — |

| |

| Distributions | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | | (11,013 | ) | | — |

| | (11,013 | ) | |

| Conversion of Class B-3 common stock to Class A common stock | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | | — |

| | — |

| | — |

| |

| Issuance and amortization of equity-based compensation | — |

| | — |

| | — |

| | — |

| | 342 |

| | — |

| | — |

| | 342 |

| | | — |

| | — |

| | 342 |

| |

| Other comprehensive income | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (70,999 | ) | | (70,999 | ) | | | — |

| | (1,702 | ) | | (72,701 | ) | |

| Dividends and distributions declared ($0.30 per share) | — |

| | — |

| | — |

| | — |

| | — |

| | (38,541 | ) | | — |

| | (38,541 | ) | | | — |

| | (922 | ) | | (39,463 | ) | |

| Shares canceled for tax withholding on vested stock awards | (173 | ) | | (1 | ) | | — |

| | — |

| | (1,686 | ) | | — |

| | — |

| | (1,687 | ) | | | — |

| | — |

| | (1,687 | ) | |

| Reallocation of equity | — |

| | — |

| | — |

| | — |

| | (41 | ) | | — |

| | — |

| | (41 | ) | | | — |

| | 41 |

| | — |

| |

| Effect of CECL adoption (see Note 2) | — |

| | — |

| | — |

| | — |

| | — |

| | (22,644 | ) | | — |

| | (22,644 | ) | | | — |

| | (542 | ) | | (23,186 | ) | |

| Net income (loss) | — |

| | — |

| | — |

| | — |

| | — |

| | (78,772 | ) | | — |

| | (78,772 | ) | | | 523 |

| | (1,892 | ) | | (80,141 | ) | |

| Balance as of March 31, 2020 | 128,366 |

| | $ | 1,284 |

| | — |

| | $ | — |

| | $ | 2,907,796 |

| | $ | (959,695 | ) | | $ | (42,705 | ) | | $ | 1,906,680 |

| | | $ | 21,141 |

| | $ | 45,680 |

| | $ | 1,973,501 |

| |

The accompanying notes are an integral part of these consolidated financial statements.

COLONY CREDIT REAL ESTATE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in Thousands)

(Unaudited)

|

| | | | | | | |

| | Three Months Ended March 31, |

| | 2020 | | 2019 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | (80,141 | ) | | $ | 14,957 |

|

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Equity in earnings of unconsolidated ventures | (17,167 | ) | | (21,310 | ) |

| Depreciation and amortization | 17,976 |

| | 27,662 |

|

| Straight-line rental income | (1,426 | ) | | (1,732 | ) |

| Amortization of above/below market lease values, net | (404 | ) | | (612 | ) |

| Amortization of premium/accretion of discount and fees on investments and borrowings, net | (3,992 | ) | | (2,582 | ) |

| Amortization of deferred financing costs | 3,582 |

| | 2,029 |

|

| Amortization of right-of-use lease assets and operating lease liabilities | 24 |

| | 25 |

|

| Paid-in-kind interest added to loan principal, net of interest received | (3,171 | ) | | (3,258 | ) |

| Distributions of cumulative earnings from unconsolidated ventures | 9,326 |

| | 18,492 |

|

| Unrealized gain on mortgage loans and obligations held in securitization trusts, net | 19,452 |

| | (1,029 | ) |

| Realized (gain) loss on mortgage loans and obligations held in securitization trusts, net | — |

| | (48 | ) |

| Provision for loan losses | 69,932 |

| | — |

|

| Impairment of operating real estate | 4,126 |

| | — |

|

| Amortization of equity-based compensation | 342 |

| | 1,843 |

|

| Mortgage notes above/below market value amortization | (255 | ) | | 87 |

|

| Deferred income tax (benefit) expense | (788 | ) | | (2,693 | ) |

| Other loss | 20,452 |

| | — |

|

| Changes in assets and liabilities: | | | |

| Receivables, net | 6,511 |

| | (4,200 | ) |

| Deferred costs and other assets | 16,680 |

| | 4,778 |

|

| Due to related party | (250 | ) | | (1,169 | ) |

| Other liabilities | (3,605 | ) | | 6,438 |

|

| Net cash provided by operating activities | 57,204 |

| | 37,678 |

|

| Cash flows from investing activities: | | | |

| Acquisition, origination and funding of loans and preferred equity held for investment, net | (37,452 | ) | | (241,693 | ) |

| Repayment on loans and preferred equity held for investment | 160,069 |

| | 172,686 |

|

| Repayment on loans held for sale | 450 |

| | — |

|

| Proceeds from sale of real estate | 160,830 |

| | — |

|

| Acquisition of and additions to real estate, related intangibles and leasing commissions | (11,325 | ) | | (6,242 | ) |

| Investments in unconsolidated ventures | (16,748 | ) | | (5,182 | ) |

| Proceeds from sale of investments in unconsolidated ventures | 1,795 |

| | 34,475 |

|

| Distributions in excess of cumulative earnings from unconsolidated ventures | 16,528 |

| | 65,836 |

|

| Repayment of principal in mortgage loans held in securitization trusts | 6,577 |

| | — |

|

| Net receipts on settlement of derivative instruments | 19,637 |

| | 1,638 |

|

| Deposit on investments | — |

| | (352 | ) |

| Change in escrow deposits | (24,998 | ) | | (2,322 | ) |

| Net cash provided by investing activities | 275,363 |

| | 18,844 |

|

| Cash flows from financing activities: | | | |

| Distributions paid on common stock | (38,558 | ) | | (55,629 | ) |

| Distributions paid on common stock to noncontrolling interests | (922 | ) | | (1,340 | ) |

| Shares canceled for tax withholding on vested stock awards | (1,688 | ) | | — |

|

| Borrowings from mortgage notes | 2,280 |

| | 22,174 |

|

| Repayment of mortgage notes | (76,585 | ) | | (1,509 | ) |

| Borrowings from credit facilities | 249,991 |

| | 714,615 |

|

| Repayment of credit facilities | (88,804 | ) | | (695,260 | ) |

| Repayment of securitization bonds | — |

| | (27,709 | ) |

| Repayment of mortgage obligations issued by securitization trusts | (6,577 | ) | | — |

|

| Payment of deferred financing costs | (1,600 | ) | | (1,593 | ) |

| Contributions from noncontrolling interests | — |

| | 24 |

|

| Distributions to noncontrolling interests | (11,013 | ) | | (394 | ) |

| Net cash provided by (used in) financing activities | 26,524 |

| | (46,621 | ) |

| Effect of exchange rates on cash, cash equivalents and restricted cash | (1,409 | ) | | (7 | ) |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 357,682 |

| | 9,894 |

|

| Cash, cash equivalents and restricted cash - beginning of period | 195,684 |

| | 187,463 |

|

| Cash, cash equivalents and restricted cash - end of period | $ | 553,366 |

| | $ | 197,357 |

|

The accompanying notes are an integral part of these consolidated financial statements.

COLONY CREDIT REAL ESTATE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

(in Thousands)

|

| | | | | | | |

| | Three Months Ended March 31, |

| | 2020 | | 2019 |

| Reconciliation of cash, cash equivalents, and restricted cash to consolidated balance sheets | | | |

| Beginning of the period | | | |

| Cash and cash equivalents | $ | 69,619 |

| | $ | 77,317 |

|

| Restricted cash | 126,065 |

| | 110,146 |

|

| Total cash, cash equivalents and restricted cash, beginning of period | $ | 195,684 |

| | $ | 187,463 |

|

| | | | |

| End of the period | | | |

| Cash and cash equivalents | $ | 393,845 |

| | $ | 89,916 |

|

| Restricted cash | 159,521 |

| | 107,441 |

|

| Total cash, cash equivalents and restricted cash, end of period | $ | 553,366 |

| | $ | 197,357 |

|

|

| | | | | |

| | Three Months Ended March 31, |

| | 2020 | | 2019 |

| Supplemental disclosure of non-cash investing and financing activities: | | | |

| Consolidation of securitization trust (VIE asset/liability additions) | — |

| | 24,393 |

|

| Accrual of distribution payable | (17 | ) | | 19,083 |

|

| Foreclosure of loans held for investment, net of provision for loan losses | — |

| | 105,437 |

|

| Right-of-use lease assets and operating lease liabilities | (730 | ) | | 16,959 |

|

| PE Investments sale proceeds receivable | — |

| | 14,453 |

|

| Conversion of Class B-3 common stock to Class A common stock | — |

| | 444 |

|

| Due to Manager for share repurchases | — |

| | 1,497 |

|

The accompanying notes are an integral part of these consolidated financial statements.

COLONY CREDIT REAL ESTATE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| |

| 1. | Business and Organization |

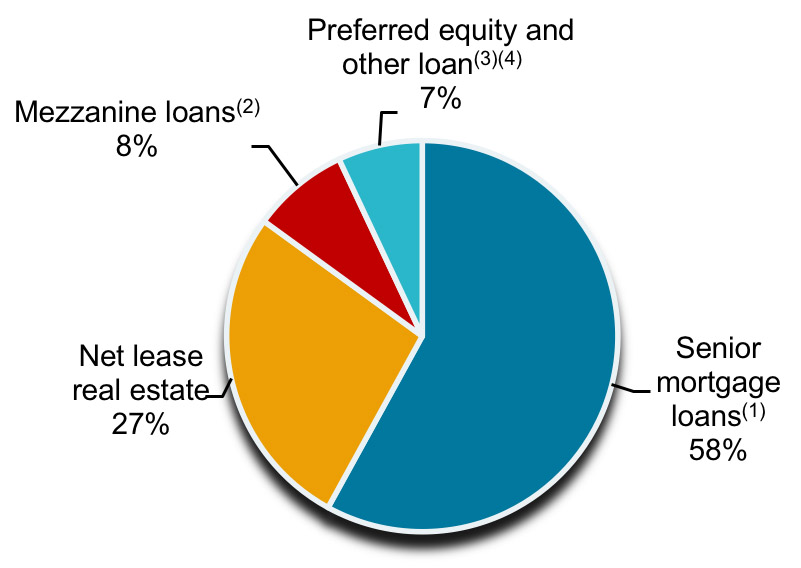

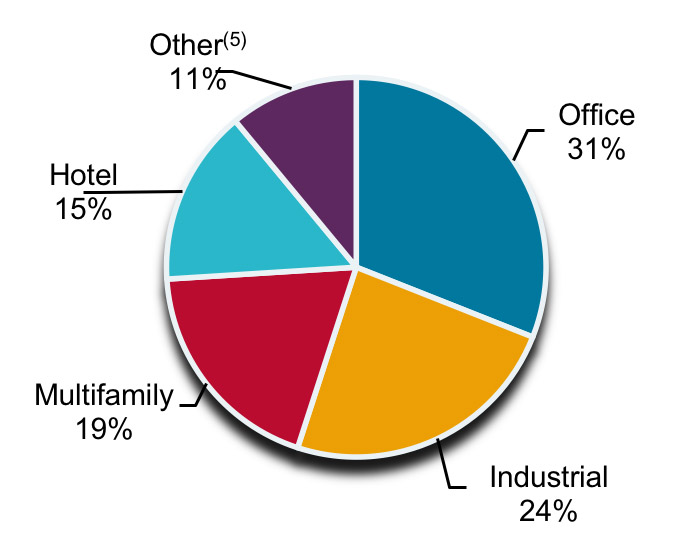

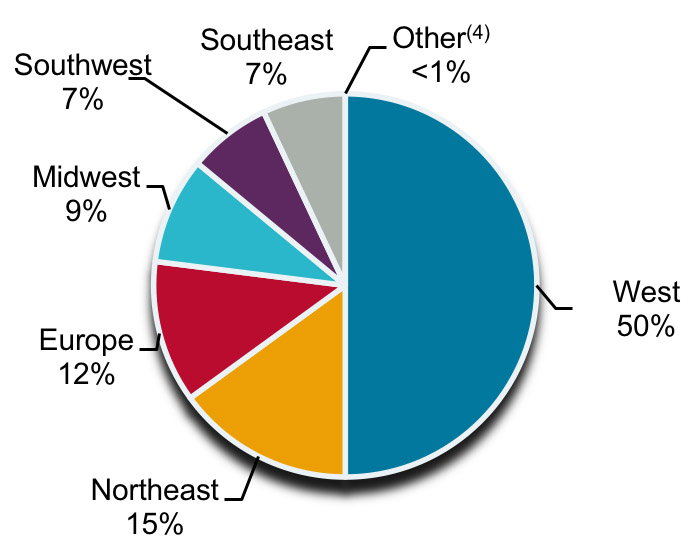

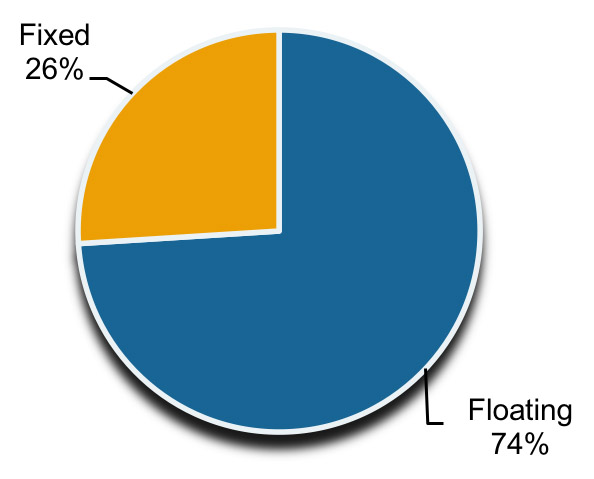

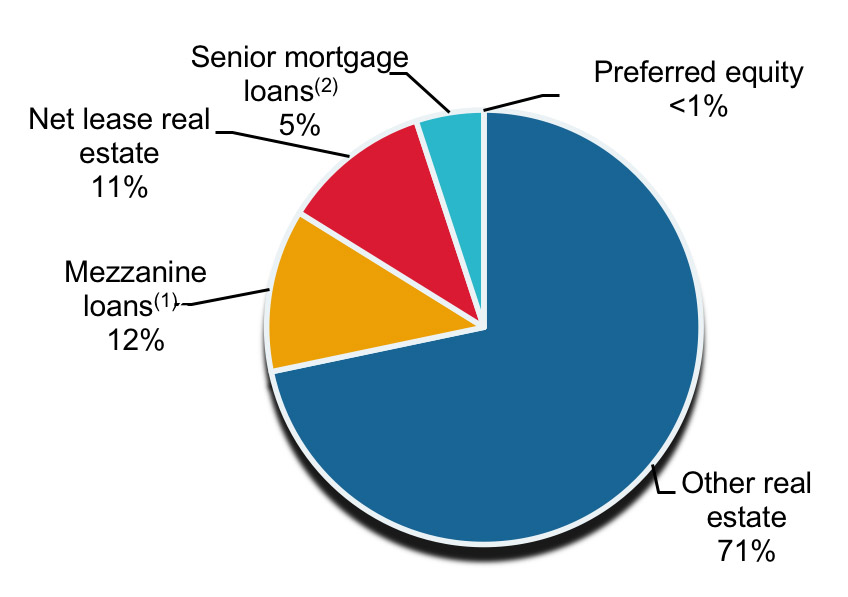

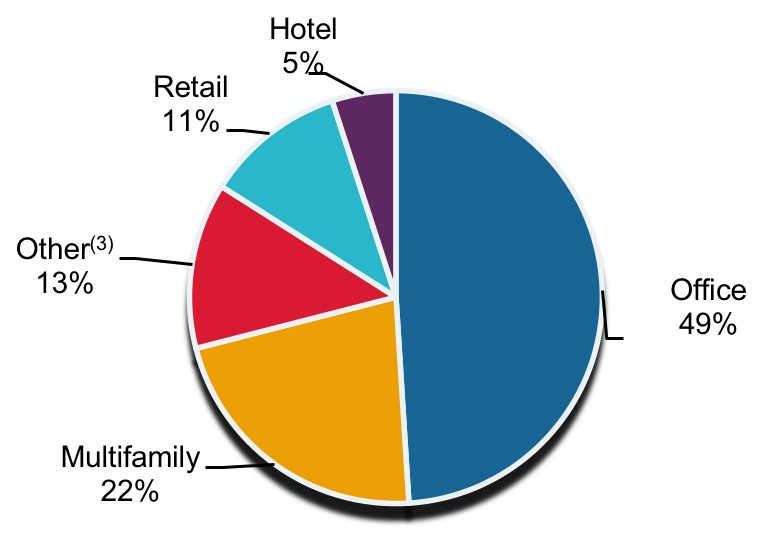

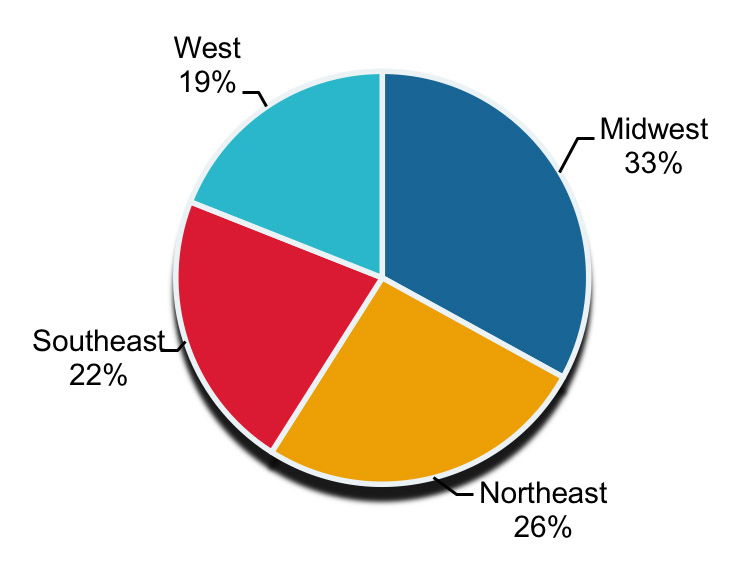

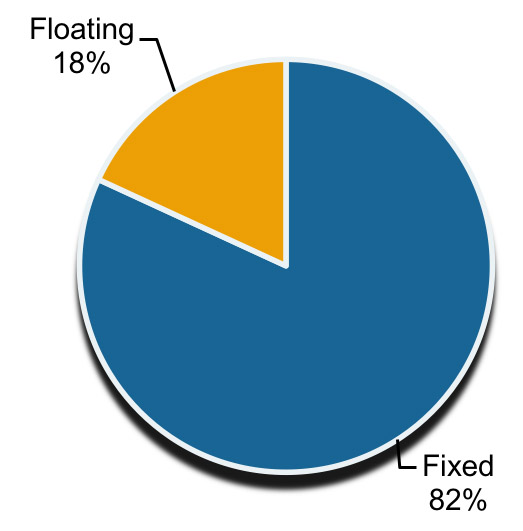

Colony Credit Real Estate, Inc. (together with its consolidated subsidiaries, the “Company”) is a commercial real estate (“CRE”) credit real estate investment trust (“REIT”) focused on originating, acquiring, financing and managing a diversified portfolio consisting primarily of CRE senior mortgage loans, mezzanine loans, preferred equity, debt securities and net leased properties predominantly in the United States. CRE debt investments include senior mortgage loans, mezzanine loans, preferred equity, and participations in such loans and preferred equity interests. CRE debt securities primarily consist of commercial mortgage-backed securities (“CMBS”) (including “B-pieces” of a CMBS securitization pool) or CRE collateralized loan obligations (“CLOs”) (including the junior tranches thereof, collateralized by pools of CRE debt investments). Net leased properties consist of CRE properties with long-term leases to tenants on a net-lease basis, where such tenants generally will be responsible for property operating expenses such as insurance, utilities, maintenance capital expenditures and real estate taxes.

The Company was organized in the state of Maryland on August 23, 2017. On January 31, 2018, the Company completed the transactions contemplated by that certain Master Combination Agreement, dated as of August 25, 2017, as amended and restated on November 20, 2017 (the “Combination Agreement,” as further discussed below). The Company elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended (the “Code”), beginning with its taxable year ended December 31, 2018. Effective June 25, 2018, the Company changed its name from Colony NorthStar Credit Real Estate, Inc. to Colony Credit Real Estate, Inc. Also on June 25, 2018, Colony NorthStar, Inc. changed its name to Colony Capital, Inc. The Company conducts all of its activities and holds substantially all of its assets and liabilities through its operating subsidiary, Credit RE Operating Company, LLC (the “Operating Partnership” or “OP”). At March 31, 2020, the Company owned 97.7% of the OP, as its sole managing member. The remaining 2.3% is owned by an affiliate of the Company as noncontrolling interests.

The Company is externally managed and has 0 employees. The Company is managed by CLNC Manager, LLC (the “Manager”), a Delaware limited liability company and a wholly-owned and indirect subsidiary of Colony Capital Operating Company, LLC (“CLNY OP”), a Delaware limited liability company and the operating company of Colony Capital. Colony Capital manages capital on behalf of its stockholders, as well as institutional and retail investors in private funds, non-traded and traded REITs and registered investment companies.

The Combination

Pursuant to the Combination Agreement, (i) CLNY OP contributed and conveyed to the Company a select portfolio of assets and liabilities (the “CLNY OP Contributed Portfolio”) of CLNY OP (the “CLNY OP Contribution”), (ii) NRF RED REIT Corp., a Maryland corporation and indirect subsidiary of CLNY OP (“RED REIT”) contributed and conveyed to the OP a select portfolio of assets and liabilities (the “RED REIT Contributed Portfolio” and, together with the CLNY OP Contributed Portfolio, the “CLNY Contributed Portfolio”) of RED REIT (the “RED REIT Contribution” and, together with the CLNY OP Contribution, the “CLNY Contributions”), (iii) NorthStar Real Estate Income Trust, Inc. (“NorthStar I”), a publicly registered non-traded REIT sponsored and managed by a subsidiary of Colony Capital, merged with and into the Company, with the Company surviving the merger (the “NorthStar I Merger”), (iv) NorthStar Real Estate Income II, Inc. (“NorthStar II”), a publicly registered non-traded REIT sponsored and managed by a subsidiary of Colony Capital, merged with and into the Company, with the Company surviving the merger (the “NorthStar II Merger” and, together with the NorthStar I Merger, the “Mergers”), and (v) immediately following the Mergers, the Company contributed and conveyed to the OP the CLNY OP Contributed Portfolio and the equity interests of each of NorthStar Real Estate Income Trust Operating Partnership, LP, a Delaware limited partnership and the operating partnership of NorthStar I, and NorthStar Real Estate Income Operating Partnership II, LP, a Delaware limited partnership and the operating partnership of NorthStar II, then-owned by the Company in exchange for units of membership interest in the OP (the “Company Contribution” and, collectively with the Mergers and the CLNY Contributions, the “Combination”).

On January 18, 2018, the Combination was approved by the stockholders of NorthStar I and NorthStar II. The Combination closed on January 31, 2018 (the “Closing Date”) and the Company’s Class A common stock, par value $0.01 per share (the “Class A common stock”), began trading on the New York Stock Exchange (“NYSE”) on February 1, 2018 under the symbol “CLNC.”

The Combination is accounted for under the acquisition method for business combinations pursuant to Accounting Standards Codification (“ASC”) Topic 805, Business Combinations, with the Company as the accounting acquirer.

COLONY CREDIT REAL ESTATE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Segment Realignment

During the third quarter of 2019, the Company realigned the business and reportable segment information to reflect how the Chief Operating Decision Makers (“CODM”) regularly review and manage the business. Refer to Note 17, “Segment Reporting” for further detail.

Impact of COVID-19

At the time of preparation of the first quarter 2020 financial statements, the world is facing a global pandemic, the coronavirus disease 2019, or COVID-19. Efforts to address the pandemic, such as social distancing, closures or reduced capacity of retail and service outlets, hotels, factories and public venues, often mandated by governments, are having a significant impact on the global economy and financial markets across major industries, including many sectors of real estate. Specifically, the Company's loans and preferred equity held for investment and real estate investments in the hospitality and retail sectors have experienced or anticipate a myriad of challenges, including, but not limited to: significant declines in operating cash flows at the Company’s retail and hospitality properties which in turn affect their ability to meet debt service and covenant requirements on investment-level debt (non-recourse to the Company); flexible lease payment terms sought by tenants; potential payment defaults on the Company's loans and preferred equity held for investment; and a distressed market affecting real estate values in general. As the timing of many of the closures and ensuing economic turmoil did not occur until late in the first quarter of 2020, the effects of COVID-19 on the Company's business were not material and adverse in the first quarter of 2020.

However, the Company anticipates more pronounced and material effects on the Company’s financial condition and results of operations in future periods, beginning with the second quarter of 2020.

The sharp decline and volatility in equity and debt markets, and the challenges faced by the Company as a result of the economic fallout from COVID-19 have affected valuation of the Company’s financial assets, carried at fair value, and also represent indicators of potential impairment on certain loans and preferred equity held for investment and held for sale at the end of the first quarter of 2020. The Company’s consideration and assessment of impairment is discussed further in Note 3, “Loans and Preferred Equity Held for Investment, net and Loans Held for Sale” and Note 14, “Fair Value”.

If a general economic downturn resulting from efforts to contain COVID-19 persists, it could have a prolonged material and negative impact on the Company’s financial condition and results of operations. At this time, as the extent and duration of the increasingly broad effects of COVID-19 on the global economy remain unclear, it is difficult for the Company to assess and estimate the impact on the Company's results of operations with any meaningful precision. Accordingly, any estimates of the effects of COVID-19 as reflected and/or discussed in these financial statements are based upon the Company's best estimates using information known to the Company at this time, and such estimates may change in the near term, the effects of which could be material.

| |

| 2. | Summary of Significant Accounting Policies |

The significant accounting policies of the Company are described below. The accounting policies of the Company’s unconsolidated ventures are substantially similar to those of the Company.

Basis of Presentation

The accompanying unaudited interim financial statements have been prepared in accordance with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all information and footnotes required by accounting principles generally accepted in the United States of America (“U.S. GAAP”) for complete financial statements. These statements reflect all normal and recurring adjustments which, in the opinion of management, are necessary to present fairly the financial position, results of operations and cash flows of the Company for the interim periods presented. However, the results of operations for the interim period presented are not necessarily indicative of the results that may be expected for the year ending December 31, 2020, or for any other future period. These interim financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in, or presented as exhibits to, the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019.

The Combination

The Combination is accounted for under the acquisition method for business combinations pursuant to ASC Topic 805, Business Combinations. In the Combination, the Company was considered to be the accounting acquirer so all of its assets and liabilities immediately prior to the closing of the Combination are reflected at their historical carrying values. The consideration transferred by the Company established a new accounting basis for the assets acquired, liabilities assumed and noncontrolling interests of NorthStar I and NorthStar II, which were measured at their respective fair values on the Closing Date.

COLONY CREDIT REAL ESTATE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates and assumptions.

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of the Company and its controlled subsidiaries. The portions of the equity, net income and other comprehensive income of consolidated subsidiaries that are not attributable to the parent are presented separately as amounts attributable to noncontrolling interests in the consolidated financial statements.

The Company consolidates entities in which it has a controlling financial interest by first considering if an entity meets the definition of a variable interest entity (“VIE”) for which the Company is deemed to be the primary beneficiary, or if the Company has the power to control an entity through a majority of voting interest or through other arrangements.

Variable Interest Entities

Variable Interest Entities—A VIE is an entity that either (i) lacks sufficient equity to finance its activities without additional subordinated financial support from other parties; (ii) whose equity holders lack the characteristics of a controlling financial interest; or (iii) is established with non-substantive voting rights. A VIE is consolidated by its primary beneficiary, which is defined as the party who has a controlling financial interest in the VIE through (a) power to direct the activities of the VIE that most significantly affect the VIE’s economic performance, and (b) obligation to absorb losses or right to receive benefits of the VIE that could be significant to the VIE. The Company also considers interests held by its related parties, including de facto agents. The Company assesses whether it is a member of a related party group that collectively meets the power and benefits criteria and, if so, whether the Company is most closely associated with the VIE. In performing the related party analysis, the Company considers both qualitative and quantitative factors, including, but not limited to: the amount and characteristics of its investment relative to the related party; the Company’s and the related party’s ability to control or significantly influence key decisions of the VIE including consideration of involvement by de facto agents; the obligation or likelihood for the Company or the related party to fund operating losses of the VIE; and the similarity and significance of the VIE’s business activities to those of the Company and the related party. The determination of whether an entity is a VIE, and whether the Company is the primary beneficiary, may involve significant judgment, including the determination of which activities most significantly affect the entities’ performance, and estimates about the current and future fair values and performance of assets held by the VIE.

Voting Interest Entities—Unlike VIEs, voting interest entities have sufficient equity to finance their activities and equity investors exhibit the characteristics of a controlling financial interest through their voting rights. The Company consolidates such entities when it has the power to control these entities through ownership of a majority of the entities’ voting interests or through other arrangements.

At each reporting period, the Company reassesses whether changes in facts and circumstances cause a change in the status of an entity as a VIE or voting interest entity, and/or a change in the Company’s consolidation assessment.

Changes in consolidation status are applied prospectively. An entity may be consolidated as a result of this reassessment, in which case, the assets, liabilities and noncontrolling interest in the entity are recorded at fair value upon initial consolidation. Any existing equity interest held by the Company in the entity prior to the Company obtaining control will be remeasured at fair value, which may result in a gain or loss recognized upon initial consolidation. However, if the consolidation represents an asset acquisition of a voting interest entity, the Company’s existing interest in the acquired assets, if any, is not remeasured to fair value but continues to be carried at historical cost. The Company may also deconsolidate a subsidiary as a result of this reassessment, which may result in a gain or loss recognized upon deconsolidation depending on the carrying values of deconsolidated assets and liabilities compared to the fair value of any interests retained.

As of March 31, 2020, the Company has identified certain consolidated and unconsolidated VIEs. Assets of each of the VIEs, other than the OP, may only be used to settle obligations of the respective VIE. Creditors of each of the VIEs have no recourse to the general credit of the Company.

Consolidated VIEs

The Company’s operating subsidiary, the OP, is a limited liability company that has governing provisions that are the functional equivalent of a limited partnership. The Company holds the majority of membership interest in the OP, is the managing member of the OP and exercises full responsibility, discretion and control over the day-to-day management of the OP. The noncontrolling

COLONY CREDIT REAL ESTATE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

interests in the OP do not have substantive liquidation rights, substantive kick-out rights without cause, or substantive participating rights that could be exercised by a simple majority of noncontrolling interest members (including by such a member unilaterally). The absence of such rights, which represent voting rights in a limited partnership equivalent structure, would render the OP to be a VIE. The Company, as managing member, has the power to direct the core activities of the OP that most significantly affect the OP’s performance, and through its majority interest in the OP, has both the right to receive benefits from and the obligation to absorb losses of the OP. Accordingly, the Company is the primary beneficiary of the OP and consolidates the OP. As the Company conducts its business and holds its assets and liabilities through the OP, the total assets and liabilities of the OP represent substantially all of the total consolidated assets and liabilities of the Company.

Other consolidated VIEs include the Investing VIEs (as defined and discussed below) and certain operating real estate properties that have noncontrolling interests. The noncontrolling interests in the operating real estate properties represent third party joint venture partners with ownership ranging from 3.5% to 20.0%. These noncontrolling interests do not have substantive kick-out nor participating rights.

Investing VIEs

The Company’s investments in securitization financing entities (“Investing VIEs”) include subordinate first-loss tranches of securitization trusts, which represent interests in such VIEs. Investing VIEs are structured as pass through entities that receive principal and interest payments from the underlying debt collateral assets and distribute those payments to the securitization trust’s certificate holders, including the most subordinate tranches of the securitization trust. Generally, a securitization trust designates the most junior subordinate tranche outstanding as the controlling class, which entitles the holder of the controlling class to unilaterally appoint and remove the special servicer for the trust, and as such may qualify as the primary beneficiary of the trust.

If it is determined that the Company is the primary beneficiary of an Investing VIE as a result of acquiring the subordinate first-loss tranches of the securitization trust, the Company would consolidate the assets, liabilities, income and expenses of the entire Investing VIE. The assets held by an Investing VIE are restricted and can only be used to fulfill its own obligations. The obligations of an Investing VIE have neither any recourse to the general credit of the Company as the consolidating parent entity of an Investing VIE, nor to any of the Company’s other consolidated entities.

As of March 31, 2020, the Company held subordinate tranches of securitization trusts in 2 Investing VIEs for which the Company has determined it is the primary beneficiary because it has the power to direct the activities that most significantly impact the economic performance of the securitization trusts. The Company’s subordinate tranches of the securitization trusts, which represent the retained interest and related interest income, are eliminated in consolidation. As a result, all of the assets, liabilities (obligations to the certificate holders of the securitization trusts, less the Company’s retained interest from the subordinate tranches of the securitization trusts), income and expenses of the Investing VIEs are presented in the consolidated financial statements of the Company although the Company legally owns the subordinate tranches of the securitization trusts only. Regardless of the presentation, the Company’s consolidated financial statements of operations ultimately reflect the net income attributable to its retained interest in the subordinate tranches of the securitization trusts. Refer to Note 5, “Real Estate Securities, Available for Sale” for further discussion.

The Company elected the fair value option for the initial recognition of the assets and liabilities of its consolidated Investing VIEs. Interest income and interest expense associated with the Investing VIEs are presented separately on the consolidated statements of operations, and the assets and liabilities of the Investing VIEs are separately presented as “Mortgage loans held in securitization trusts, at fair value” and “Mortgage obligations issued by securitization trusts, at fair value,” respectively, on the consolidated balance sheets. Refer to Note 14, “Fair Value” for further discussion.

The Company has adopted guidance issued by the Financial Accounting Standards Board (“FASB”), allowing the Company to measure both the financial assets and liabilities of a qualifying collateralized financing entity (“CFE”), such as its Investing VIEs, using the fair value of either the CFE’s financial assets or financial liabilities, whichever is more observable. A CFE is a VIE that holds financial assets, issues beneficial interests in those assets and has no more than nominal equity, and the beneficial interests have contractual recourse only to the related assets of the CFE. As the liabilities of the Company’s Investing VIEs are marketable securities with observable trade data, their fair value is more observable and is referenced to determine fair value of the assets of its Investing VIEs. Refer to Note 14, “Fair Value” for further discussion.

Unconsolidated VIEs

As of March 31, 2020, the Company identified unconsolidated VIEs related to its securities investments, indirect interests in real estate through real estate private equity funds (“PE Investments”) and CRE debt investments. Based on management’s analysis,

COLONY CREDIT REAL ESTATE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

the Company determined that it is not the primary beneficiary of the above VIEs. Accordingly, the VIEs are not consolidated in the Company’s financial statements as of March 31, 2020.

Assets of each of the VIEs may only be used to settle obligations of the respective VIE. Creditors of each of the VIEs have no recourse to the general credit of the Company.

The following table presents the Company’s classification, carrying value and maximum exposure of unconsolidated VIEs as of March 31, 2020 (dollars in thousands):

|

| | | | | | | | |

| | | Carrying Value | | Maximum Exposure to Loss |

| Real estate securities, available for sale | | $ | 179,572 |

| | $ | 238,080 |

|

| Investments in unconsolidated ventures | | 499,549 |

| | 531,730 |

|

| Loans and preferred equity held for investment, net | | 17,587 |

| | 17,587 |

|

| Total assets | | $ | 696,708 |

| | $ | 787,397 |

|

The Company did not provide financial support to the unconsolidated VIEs during the three months ended March 31, 2020. As of March 31, 2020, there were no explicit arrangements or implicit variable interests that could require the Company to provide financial support to the unconsolidated VIEs. The maximum exposure to loss of real estate securities, available for sale was determined as the amortized cost, which represents the purchase price of the investments adjusted by any unamortized premiums or discounts as of March 31, 2020. The maximum exposure to loss of investments in unconsolidated ventures and loans and preferred equity held for investment, net was determined as the carrying value plus any future funding commitments. Refer to Note 3, “Loans and Preferred Equity Held for Investment, net and Loans Held for Sale” and Note 16, “Commitments and Contingencies” for further discussion.

Noncontrolling Interests

Noncontrolling Interests in Investment Entities—This represents interests in consolidated investment entities held by third party joint venture partners and prior to the closing of the Combination, such interests held by private funds managed by Colony Capital. Allocation of net income or loss is generally based upon relative ownership interests held by equity owners in each investment entity, or based upon contractual arrangements that may provide for disproportionate allocation of economic returns among equity interests, including using a hypothetical liquidation at book value basis, where applicable and substantive.

Noncontrolling Interests in the Operating Partnership—This represents membership interests in the OP held by RED REIT. Noncontrolling interests in the OP are allocated a share of net income or loss in the OP based on their weighted average ownership interest in the OP during the period. Noncontrolling interests in the OP have the right to require the OP to redeem part or all of the membership units in the OP for cash based on the market value of an equivalent number of shares of Class A common stock at the time of redemption, or at the Company’s election as managing member of the OP, through the issuance of shares of Class A common stock on a 1-for-one basis. At the end of each reporting period, noncontrolling interests in the OP is adjusted to reflect their ownership percentage in the OP at the end of the period, through a reallocation between controlling and noncontrolling interests in the OP, as applicable.

Comprehensive Income (Loss)

The Company reports consolidated comprehensive income (loss) in separate statements following the consolidated statements of operations. Comprehensive income (loss) is defined as the change in equity resulting from net income (loss) and other comprehensive income (“OCI”). The components of OCI include unrealized gain (loss) on CRE debt securities available for sale for which the fair value option was not elected, gain (loss) on derivative instruments used in the Company’s risk management activities used for economic hedging purposes (“designated hedges”), and gain (loss) on foreign currency translation.

Fair Value Measurement

Fair value is based on an exit price, defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. Where appropriate, the Company makes adjustments to estimated fair values to appropriately reflect counterparty credit risk as well as the Company’s own credit-worthiness.

The estimated fair value of financial assets and financial liabilities are categorized into a three-tier hierarchy, prioritized based on the level of transparency in inputs used in the valuation techniques, as follows:

Level 1—Quoted prices (unadjusted) in active markets for identical assets or liabilities.

COLONY CREDIT REAL ESTATE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Level 2—Observable inputs other than Level 1 prices, such as quoted prices for similar assets or liabilities, quoted prices in non-active markets, or valuation techniques utilizing inputs that are derived principally from or corroborated by observable data directly or indirectly for substantially the full term of the financial instrument.

Level 3—At least one assumption or input is unobservable and it is significant to the fair value measurement, requiring significant management judgment or estimate.

Where the inputs used to measure the fair value of a financial instrument fall into different levels of the fair value hierarchy, the financial instrument is categorized within the hierarchy based on the lowest level of input that is significant to its fair value measurement.

Fair Value Option

The fair value option provides an option to elect fair value as an alternative measurement for selected financial instruments. Gains and losses on items for which the fair value option has been elected are reported in earnings. The fair value option may be elected only upon the occurrence of certain specified events, including when the Company enters into an eligible firm commitment, at initial recognition of the financial instrument, as well as upon a business combination or consolidation of a subsidiary. The election is irrevocable unless a new election event occurs.

The Company has elected the fair value option for PE Investments. The Company has also elected the fair value option to account for the eligible financial assets and liabilities of its consolidated Investing VIEs in order to mitigate potential accounting mismatches between the carrying value of the instruments and the related assets and liabilities to be consolidated. The Company has adopted the measurement alternative allowing the Company to measure both the financial assets and financial liabilities of a qualifying CFE it consolidates using the fair value of either the CFE’s financial assets or financial liabilities, whichever is more observable.

Business Combinations

Definition of a Business—The Company evaluates each purchase transaction to determine whether the acquired assets meet the definition of a business. If substantially all of the fair value of gross assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets, then the set of transferred assets and activities is not a business. If not, for an acquisition to be considered a business, it would have to include an input and a substantive process that together significantly contribute to the ability to create outputs (i.e., there is a continuation of revenue before and after the transaction). A substantive process is not ancillary or minor, cannot be replaced without significant costs, effort or delay or is otherwise considered unique or scarce. To qualify as a business without outputs, the acquired assets would require an organized workforce with the necessary skills, knowledge and experience that performs a substantive process.

Asset Acquisitions—For acquisitions that are not deemed to be businesses, the assets acquired are recognized based on their cost to the Company as the acquirer and no gain or loss is recognized. The cost of assets acquired in a group is allocated to individual assets within the group based on their relative fair values and does not give rise to goodwill. Transaction costs related to the acquisition of assets are included in the cost basis of the assets acquired.

Business Combinations—The Company accounts for acquisitions that qualify as business combinations by applying the acquisition method. Transaction costs related to the acquisition of a business are expensed as incurred and excluded from the fair value of consideration transferred. The identifiable assets acquired, liabilities assumed and noncontrolling interests in an acquired entity are recognized and measured at their estimated fair values. The excess of the fair value of consideration transferred over the fair values of identifiable assets acquired, liabilities assumed and noncontrolling interests in an acquired entity, net of fair value of any previously held interest in the acquired entity, is recorded as goodwill. Such valuations require management to make significant estimates and assumptions.

Cash and Cash Equivalents

Short-term, highly liquid investments with original maturities of three months or less are considered to be cash equivalents. The Company did not have any cash equivalents at March 31, 2020 or December 31, 2019. The Company’s cash is held with major financial institutions and may at times exceed federally insured limits.

Restricted Cash

Restricted cash consists primarily of borrower escrow deposits, tenant escrow deposits and real estate capital expenditure reserves.

COLONY CREDIT REAL ESTATE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Loans and Preferred Equity Held for Investment

The Company originates and purchases loans and preferred equity held for investment. The accounting framework for loans and preferred equity held for investment depends on the Company’s strategy whether to hold or sell the loan, whether the loan was credit-impaired at the time of acquisition, or if the lending arrangement is an acquisition, development and construction loan.

Loans and Preferred Equity Held for Investment

Loans and preferred equity that the Company has the intent and ability to hold for the foreseeable future are classified as held for investment. Originated loans and preferred equity are recorded at amortized cost, or outstanding unpaid principal balance plus exit fees less net deferred loan fees. Net deferred loan fees include unamortized origination and other fees charged to the borrower less direct incremental loan origination costs incurred by the Company. Purchased loans and preferred equity are recorded at amortized cost, or unpaid principal balance plus purchase premium or less unamortized discount. Costs to purchase loans and preferred equity are expensed as incurred.

Interest Income—Interest income is recognized based upon contractual interest rate and unpaid principal balance of the loans and preferred equity investments. Net deferred loan fees on originated loans and preferred equity investments are deferred and amortized as adjustments to interest income over the expected life of the loans and preferred equity investments using the effective yield method. Premium or discount on purchased loans and preferred equity investments are amortized as adjustments to interest income over the expected life of the loans and preferred equity investments using the effective yield method. When a loan or preferred equity investment is prepaid, prepayment fees and any excess of proceeds over the carrying amount of the loan or preferred equity investment is recognized as additional interest income.

The Company has debt investments in its portfolio that contain a payment-in-kind (“PIK”) provision. Contractual PIK interest, which represents contractually deferred interest added to the loan balance that is due at the end of the loan term, is generally recorded on an accrual basis to the extent such amounts are expected to be collected. The Company will generally cease accruing PIK interest if there is insufficient value to support the accrual or management does not expect the borrower to be able to pay all principal and interest due.

Nonaccrual—Accrual of interest income is suspended on nonaccrual loans and preferred equity investments. Loans and preferred equity investments that are past due 90 days or more as to principal or interest, or where reasonable doubt exists as to timely collection, are generally considered nonperforming and placed on nonaccrual. Interest receivable is reversed against interest income when loans and preferred equity investments are placed on nonaccrual status. Interest collected is recognized on a cash basis by crediting income when received; or if ultimate collectability of loan and preferred equity principal is uncertain, interest collected is recognized using a cost recovery method by applying interest collected as a reduction to loan and preferred equity carrying value. Loans and preferred equity investments may be restored to accrual status when all principal and interest are current and full repayment of the remaining contractual principal and interest are reasonably assured.

Loans Held for Sale

Loans that the Company intends to sell or liquidate in the foreseeable future are classified as held for sale. Loans held for sale are carried at the lower of amortized cost or fair value less disposal cost, with valuation changes recognized as impairment loss. Loans held for sale are not subject to allowance for loan losses. Net deferred loan origination fees and loan purchase premiums or discounts are deferred and capitalized as part of the carrying value of the held for sale loan until the loan is sold, therefore included in the periodic valuation adjustments based on lower of cost or fair value less disposal cost.

At March 31, 2020, the Company classified 7 loans in its Legacy, Non-Strategic Portfolio as held for sale. See Note 3, “Loans and Preferred Equity Held for Investment, net and Loans Held for Sale” for further detail.

Acquisition, Development and Construction (“ADC”) Arrangements

The Company provides loans to third party developers for the acquisition, development and construction of real estate. Under an ADC arrangement, the Company participates in the expected residual profits of the project through the sale, refinancing or other use of the property. The Company evaluates the characteristics of each ADC arrangement, including its risks and rewards, to determine whether they are more similar to those associated with a loan or an investment in real estate. ADC arrangements with characteristics implying loan classification are presented as loans held for investment and result in the recognition of interest income. ADC arrangements with characteristics implying real estate joint ventures are presented as investments in unconsolidated joint ventures and are accounted for using the equity method. The classification of each ADC arrangement as either loan receivable or real estate joint venture involves significant judgment and relies on various factors, including market conditions, amount and timing of expected residual profits, credit enhancements in the form of guaranties, estimated fair value of the collateral, and

COLONY CREDIT REAL ESTATE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

significance of borrower equity in the project, among others. The classification of ADC arrangements is performed at inception, and periodically reassessed when significant changes occur in the circumstances or conditions described above.

Operating Real Estate

Real Estate Acquisitions—Real estate acquired in acquisitions that are deemed to be business combinations is recorded at the fair values of the acquired components at the time of acquisition, allocated among land, buildings, improvements, equipment and lease-related tangible and identifiable intangible assets and liabilities, including forgone leasing costs, in-place lease values and above- or below-market lease values. Real estate acquired in acquisitions that are deemed to be asset acquisitions is recorded at the total value of consideration transferred, including transaction costs, and allocated to the acquired components based upon relative fair value. The estimated fair value of acquired land is derived from recent comparable sales of land and listings within the same local region based on available market data. The estimated fair value of acquired buildings and building improvements is derived from comparable sales, discounted cash flow analysis using market-based assumptions, or replacement cost, as appropriate. The fair value of site and tenant improvements is estimated based upon current market replacement costs and other relevant market rate information.

Real Estate Held for Investment

Real estate held for investment is carried at cost less accumulated depreciation.

Costs Capitalized or Expensed—Expenditures for ordinary repairs and maintenance are expensed as incurred, while expenditures for significant renovations that improve or extend the useful life of the asset are capitalized and depreciated over their estimated useful lives.

Depreciation—Real estate held for investment, other than land, is depreciated on a straight-line basis over the estimated useful lives of the assets, as follows:

|

| | |

| Real Estate Assets | | Term |

| Building (fee interest) | | 7 to 48 years |

| Building leasehold interests | | Lesser of remaining term of the lease or remaining life of the building |

| Building improvements | | Lesser of the useful life or remaining life of the building |

| Land improvements | | 1 to 15 years |

| Tenant improvements | | Lesser of the useful life or remaining term of the lease |

| Furniture, fixtures and equipment | | 2 to 8 years |