UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number: 811-23298

WEISS STRATEGIC INTERVAL FUND

(Exact name of Registrant as specified in charter)

320 PARK AVENUE, 20TH FLOOR

NEW YORK, NEW YORK 10022

(Address of Principal Executive Offices)

Jeffrey Dillabough, Esq.

Secretary

Weiss Strategic Interval Fund

320 Park Avenue, 20th Floor

New York, New York 10022

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (212) 415-4500

Date of fiscal year end: December 31st

Date of reporting period: December 31, 2021

Item 1. Reports to Stockholders.

Weiss Strategic Interval Fund

Annual Report

December 31, 2021

Table of Contents

Dear Shareholder:

The Weiss Strategic Interval Fund (the “Fund”) investment objective is to provide returns with moderate volatility and reduced correlation to the overall performance of the equity market. The Fund will pursue its investment objective by establishing long and short positions in a diversified portfolio of equity securities. The equity securities in which the Fund will take long and short positions include primarily domestically traded large and mid-capitalization equity securities, including master limited partnerships or other entities that offer economic exposure to master limited partnerships (collectively, “MLPs”) and shares of real estate investment trusts (“REITs”). The Fund may also invest in securities of other investment companies, including exchange-traded funds (“ETFs”), and depositary receipts, including American Depositary Receipts (“ADRs”).

In 2022, we expect inflation to remain stubbornly high. Consequently, the Fed is expected to start a tightening cycle. Bond volatility is likely to remain high and stocks have been driven higher by growth in the M2 money supply from ~$15 trillion pre-COVID-19 to ~$21 trillion at year end 2021. With all of these factors, it is not surprising that many of our investors are searching for solutions to navigate a unique market environment and the pressure on fixed income portfolios is becoming a central theme.

Weiss Strategic Interval Fund finished December up 0.74%. The equity investment style was positive for the month despite dramatic factor shifts. The most important move was seen in growth vs value. Pure Growth vs Pure Value had its second worst month in the last 20 years as the market continued to discount the likelihood that inflation would not be transitory leaving the Fed behind the curve. The extreme shock of this, combined with gridlock in Washington regarding stimulus, made it a challenging month for putting on risk. As things settle in Q1-2022, we believe the long-awaited opportunity for dispersion will surge again after nine months of fears around vaccines and COVID-19. We expect 2022 to be a good year for diversified funds.

| | | | |

| One State Street, 20th Floor | | WEISS MULTI-STRATEGY ADVISERS LLC | | 320 Park Avenue, 20th Floor |

| Hartford, CT 06103 | | gweiss.com | | New York, NY 10022 |

| +1 860 240 8900 | | | | +1 212 415 4500 |

ADVISORY SERVICES ARE OFFERED THROUGH WEISS MULTI-STRATEGY ADVISERS LLC, AN SEC REGISTERED INVESTMENT ADVISER.

SECURITIES ARE OFFERED THROUGH AN AFFILIATED BROKER-DEALER, WEISS MULTI-STRATEGY FUNDS LLC, MEMBER FINRA/SIPC.

WWW.FINRA.ORG WWW.SIPC.ORG

1

Diversification does not assure a profit nor protect against loss in a declining market.

Mutual fund investing involves risk. Principal loss is possible. Derivatives involve special risks including correlation, counterparty, liquidity, operational, accounting and tax risks. These risks, in certain cases, may be greater than the risks presented by more traditional investments. The Fund may also use options and future contracts, which have the risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of securities prices, interest rates and currency exchange rates. The investment in options is not suitable for all investors. The Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater in emerging markets. Investment by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. The Fund may use leverage which may exaggerate the effect of any increase or decrease in the value of portfolio securities or the Net Asset Value of the Fund, and money borrowed will be subject to interest costs. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities.

Small- and Medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Investing in ETFs are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Fund’s ability to sell its shares. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested.

Must be preceded or accompanied by a prospectus.

| | | | |

| One State Street, 20th Floor | | WEISS MULTI-STRATEGY ADVISERS LLC | | 320 Park Avenue, 20th Floor |

| Hartford, CT 06103 | | gweiss.com | | New York, NY 10022 |

| +1 860 240 8900 | | | | +1 212 415 4500 |

ADVISORY SERVICES ARE OFFERED THROUGH WEISS MULTI-STRATEGY ADVISERS LLC, AN SEC REGISTERED INVESTMENT ADVISER.

SECURITIES ARE OFFERED THROUGH AN AFFILIATED BROKER-DEALER, WEISS MULTI-STRATEGY FUNDS LLC, MEMBER FINRA/SIPC.

WWW.FINRA.ORG WWW.SIPC.ORG

2

Management Discussion of Fund Performance

Weiss Strategic Interval Fund

December 31, 2021 (unaudited)

Performance

| | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | Since Inception1 | |

Fund NAV Returns2 | | | 10.85% | | | | 17.46% | | | | 16.98% | |

HFRI RV: Multi-Strategy Index | | | 7.03% | | | | 6.33% | | | | 4.45% | |

S & P 500 (Total Return) | | | 28.71% | | | | 26.07% | | | | 16.40% | |

| |

| 1 | Inception date of the Fund was February 1, 2018. |

| 2 | Returns represent non-GAAP total returns of the Fund that provides useful information to Somerset and the Board of Trustees. The non-GAAP total returns include amounts loaned to Somerset. |

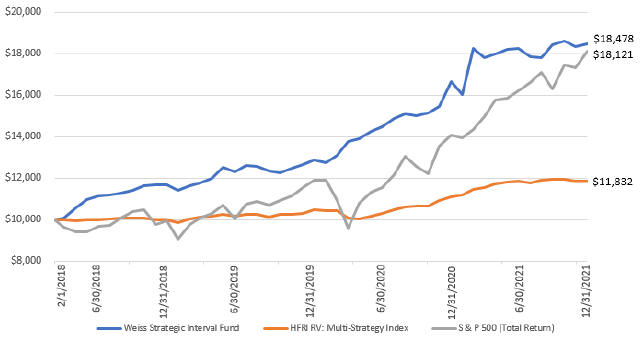

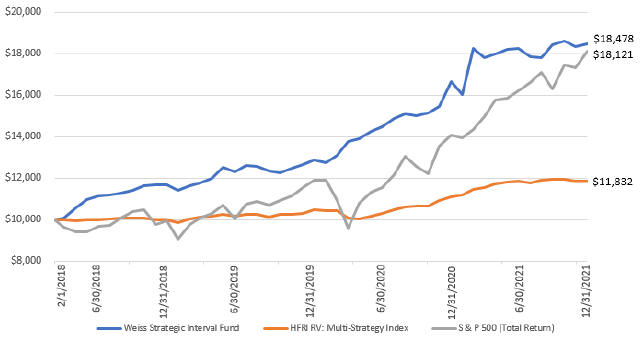

Growth of $10,000 Investment (Since Inception 2/1/2018)

Benchmark Definitions

The S&P 500 Index (Total Return) is a capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries and includes reinvested dividends.

The HFRI RV Multi-Strategy Index provides performance data with respect to a select universe of relative value multi-strategy hedge fund strategies (for purposes of this report the preliminary HFRI RV Multi-Strategy Index value is utilized). The HFRI RV Multi-Strategy Index is being used under license from Hedge Fund Research, Inc., which does not approve of or endorse any of the products discussed in this presentation. Source for HFRI data: Hedge Fund Research, Inc. www.hedgefundresearch.com.

Neither index reflects the same fees or expenses than those of the Fund, and the Fund may and will invest in different securities and trading strategies than those reflected in the indices. Sector, industry, stock and country exposures, volatility and risk characteristics of the Fund’s portfolio will also differ from the indices. Index data is provided for reference purposes only and is not meant to imply that the Fund will achieve performance similar to or better than that of an index. One cannot invest directly in an index.

Past performance is not indicative of future results. Commodity interest trading involves substantial risk of loss.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

3

Investments Composition

Weiss Strategic Interval Fund

December 31, 2021 (unaudited)

Top Ten Holdings as of December 31, 2021*

| | | | |

| Description | | % of Net Assets | |

First Industrial Realty Trust, Inc. | | | 12.5 | % |

Americold Realty Trust | | | 12.4 | % |

Equity Residential | | | 11.1 | % |

NETSTREIT Corp. | | | 9.3 | % |

Terreno Realty Corp. | | | 8.5 | % |

Agree Realty Corp. | | | 8.2 | % |

QUALCOMM, Inc. | | | 8.1 | % |

Mid-America Apartment Communities, Inc. | | | 7.0 | % |

Federal Realty Investment Trust | | | 6.8 | % |

Acadia Realty Trust | | | 6.3 | % |

TOTAL | | | 90.2 | % |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company. |

| | | | | | | | |

| Country | | Securities Held Long % of Net Assets | | | Securities Sold Short % of Net Assets | |

United States | | | 445.3 | % | | | (403.1)% | |

Britain | | | 8.0 | % | | | (2.2)% | |

Bermuda | | | 7.8 | % | | | (1.7)% | |

Luxembourg | | | 6.1 | % | | | —% | |

Canada | | | 5.0 | % | | | (1.8)% | |

Netherlands | | | 5.1 | % | | | (1.0)% | |

Israel | | | 4.5 | % | | | (0.4)% | |

Ireland | | | 3.1 | % | | | (2.9)% | |

Puerto Rico | | | 2.6 | % | | | —% | |

British Virgin | | | 1.8 | % | | | —% | |

France | | | 1.2 | % | | | (0.5)% | |

Cayman Islands | | | 1.0 | % | | | (0.1)% | |

India | | | 1.0 | % | | | —% | |

Switzerland | | | 1.0 | % | | | (0.7)% | |

Brazil | | | 0.4 | % | | | —% | |

Panama | | | 0.4 | % | | | (0.3)% | |

Jersey | | | 0.3 | % | | | (0.2)% | |

Mauritius | | | 0.2 | % | | | —% | |

Denmark | | | 0.1 | % | | | —% | |

Mexico | | | 0.1 | % | | | —% | |

Liberia | | | — | % | | | (0.2)% | |

Australia | | | — | % | | | (0.2)% | |

Taiwan | | | — | % | | | (0.2)% | |

Belgium | | | — | % | | | (0.1)% | |

TOTAL | | | 495.0 | % | | | (415.6)% | |

| | |

| Industry | | Securities Held Long % of Net Assets | | | Securities Sold Short % of Net Assets | |

Real Estate Investment Trusts | | | 153.6 | % | | | (112.6)% | |

Software | | | 41.3 | % | | | (5.9)% | |

Semiconductors & Semiconductor Equipment | | | 33.9 | % | | | (9.9)% | |

Banks | | | 33.2 | % | | | (34.2)% | |

Food Products | | | 16.7 | % | | | (12.4)% | |

Beverages | | | 13.2 | % | | | (9.0)% | |

IT Services | | | 12.9 | % | | | (5.0)% | |

Diversified Financial Services | | | 11.0 | % | | | —% | |

Hotels, Restaurants & Leisure | | | 10.6 | % | | | (6.2)% | |

Communications Equipment | | | 10.4 | % | | | (0.5)% | |

Oil, Gas & Consumable Fuels | | | 10.3 | % | | | (8.2)% | |

Media | | | 7.7 | % | | | (2.6)% | |

Biotechnology | | | 7.3 | % | | | (1.0)% | |

Containers & Packaging | | | 7.3 | % | | | (1.1)% | |

Technology Hardware, Storage & Peripherals | | | 6.8 | % | | | (2.4)% | |

Interactive Media & Services | | | 6.5 | % | | | (1.3)% | |

Electrical Equipment | | | 6.4 | % | | | (2.1)% | |

Exchange-Traded Funds | | | 6.4 | % | | | (123.4)% | |

4

Investments Composition

Weiss Strategic Interval Fund

December 31, 2021 (unaudited)

| | | | | | | | |

Machinery | | | 6.2 | % | | | (7.7)% | |

Electronic Equipment, Instruments & Components | | | 6.1 | % | | | (1.6)% | |

Road & Rail | | | 5.9 | % | | | (3.6)% | |

Chemicals | | | 5.2 | % | | | (2.8)% | |

Capital Markets | | | 4.6 | % | | | (6.2)% | |

Thrifts & Mortgage Finance | | | 4.3 | % | | | (1.9)% | |

Household Products | | | 4.2 | % | | | (3.0)% | |

Pharmaceuticals | | | 4.2 | % | | | (0.7)% | |

Life Sciences Tools & Services | | | 4.1 | % | | | (0.8)% | |

Trading Companies & Distributors | | | 3.9 | % | | | (1.4)% | |

Professional Services | | | 3.8 | % | | | (1.0)% | |

Health Care Equipment & Supplies | | | 3.7 | % | | | (1.3)% | |

Consumer Finance | | | 3.4 | % | | | (5.1)% | |

Personal Products | | | 3.3 | % | | | (0.4)% | |

Aerospace & Defense | | | 3.2 | % | | | (1.7)% | |

Specialty Retail | | | 3.1 | % | | | (1.8)% | |

Health Care Technology | | | 2.8 | % | | | —% | |

Building Products | | | 2.8 | % | | | (3.0)% | |

Airlines | | | 2.5 | % | | | (1.0)% | |

Household Durables | | | 2.1 | % | | | (2.5)% | |

Entertainment | | | 1.9 | % | | | (3.0)% | |

Metals & Mining | | | 2.0 | % | | | (1.5)% | |

Food & Staples Retailing | | | 1.5 | % | | | (2.7)% | |

Commercial Services & Supplies | | | 1.3 | % | | | —% | |

Electric Utilities | | | 1.3 | % | | | (0.3)% | |

Health Care Providers & Services | | | 1.3 | % | | | (2.0)% | |

Air Freight & Logistics | | | 1.3 | % | | | (1.3)% | |

Diversified Consumer Services | | | 1.2 | % | | | (0.1)% | |

Construction & Engineering | | | 1.2 | % | | | (0.0)%* | |

Mortgage Real Estate Investment | | | 1.1 | % | | | (3.6)% | |

Paper & Forest Products | | | 1.0 | % | | | —% | |

Insurance | | | 0.9 | % | | | —% | |

Automobiles | | | 0.9 | % | | | (0.8)% | |

Internet & Direct Marketing Retail | | | 0.8 | % | | | (3.8)% | |

Auto Components | | | 0.7 | % | | | (1.6)% | |

Wireless Telecommunication Services | | | 0.4 | % | | | —% | |

Energy Equipment & Services | | | 0.3 | % | | | (0.4)% | |

Construction Materials | | | 0.3 | % | | | (0.2)% | |

Textiles, Apparel & Luxury Goods | | | 0.2 | % | | | (0.4)% | |

Leisure Products | | | 0.2 | % | | | (0.5)% | |

Multiline Retail | | | 0.1 | % | | | (0.6)% | |

Distributors | | | 0.1 | % | | | —% | |

Industrial Conglomerates | | | 0.1 | % | | | (5.4)% | |

Marine | | | 0.0 | %* | | | —% | |

Diversified Telecommunication Services | | | — | % | | | (1.7)% | |

Real Estate Management & Development | | | — | % | | | (0.4)% | |

TOTAL | | | 495.0 | % | | | (415.6)% | |

* Rounds to 0.0%.

5

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Long Investments 495.0% | | | | | | | | |

Common Stocks 488.2% | | | | | | | | |

Aerospace & Defense 3.2% | | | | | | | | |

Curtiss-Wright Corp.(1),(2) | | | 9,082 | | | $ | 1,259,401 | |

General Dynamics Corp.(2) | | | 2,461 | | | | 513,045 | |

Howmet Aerospace, Inc. | | | 36,662 | | | | 1,166,951 | |

PAE, Inc.(2),(3) | | | 26,220 | | | | 260,365 | |

Spirit AeroSystems Holdings, Inc., Class A(1),(2) | | | 11,822 | | | | 509,410 | |

TransDigm Group, Inc.(2),(3) | | | 5,274 | | | | 3,355,741 | |

Triumph Group, Inc.(2),(3) | | | 13,108 | | | | 242,891 | |

| | | | | |

| | | | | | | 7,307,804 | |

| | | | | | | | |

Air Freight & Logistics 1.3% | | | | | | | | |

Expeditors International of Washington, Inc.(2) | | | 2,027 | | | | 272,206 | |

FedEx Corp.(2) | | | 8,944 | | | | 2,313,276 | |

GXO Logistics, Inc.(2),(3) | | | 3,169 | | | | 287,840 | |

| | | | | | | | |

| | | | | | | 2,873,322 | |

| | | | | | | | |

Airlines 2.5% | | | | | | | | |

Alaska Air Group, Inc.(2),(3) | | | 57,402 | | | | 2,990,644 | |

Copa Holdings S.A., Class A(2),(3),(4) | | | 11,896 | | | | 983,323 | |

Ryanair Holdings PLC, ADR(1),(2),(3),(4) | | | 16,571 | | | | 1,695,711 | |

| | | | | | | | |

| | | | | | | 5,669,678 | |

| | | | | | | | |

Auto Components 0.7% | | | | | | | | |

Autoliv, Inc.(2) | | | 14,443 | | | | 1,493,551 | |

Visteon Corp.(2),(3) | | | 1,629 | | | | 181,047 | |

| | | | | | | | |

| | | | | | | 1,674,598 | |

| | | | | | | | |

Automobiles 0.9% | | | | | | | | |

Ford Motor Co.(1),(2) | | | 1,757 | | | | 36,493 | |

General Motors Co.(2),(3) | | | 5,382 | | | | 315,546 | |

Tesla, Inc.(2),(3) | | | 1,537 | | | | 1,624,271 | |

| | | | | | | | |

| | | | | | | 1,976,310 | |

| | | | | | | | |

Banks 33.2% | | | | | | | | |

Banner Corp.(2) | | | 44,848 | | | | 2,720,928 | |

BOK Financial Corp.(1),(2) | | | 5,324 | | | | 561,629 | |

Cadence Bank(1),(2) | | | 176,285 | | | | 5,251,530 | |

Citizens Financial Group, Inc.(1),(2) | | | 125,609 | | | | 5,935,025 | |

First BanCorp(2),(4) | | | 128,424 | | | | 1,769,683 | |

Huntington Bancshares, Inc.(1),(2) | | | 450,854 | | | | 6,952,169 | |

M&T Bank Corp.(1),(2) | | | 33,961 | | | | 5,215,730 | |

PacWest Bancorp(2) | | | 98,369 | | | | 4,443,328 | |

Popular, Inc.(2),(4) | | | 50,237 | | | | 4,121,444 | |

Signature Bank(1),(2) | | | 8,893 | | | | 2,876,619 | |

SVB Financial Group(1),(2),(3) | | | 6,716 | | | | 4,555,060 | |

Synovus Financial Corp.(2) | | | 91,167 | | | | 4,364,164 | |

Umpqua Holdings Corp.(2) | | | 11,256 | | | | 216,565 | |

US Bancorp(1),(2) | | | 32,072 | | | | 1,801,484 | |

Webster Financial Corp.(1),(2) | | | 92,988 | | | | 5,192,450 | |

Wells Fargo & Co.(2) | | | 288,033 | | | | 13,819,823 | |

Western Alliance Bancorp(2) | | | 33,611 | | | | 3,618,224 | |

Wintrust Financial Corp.(2) | | | 10,013 | | | | 909,381 | |

Zions Bancorp NA(1),(2) | | | 30,837 | | | | 1,947,665 | |

| | | | | |

| | | | | | | 76,272,901 | |

| | | | | | | | |

Beverages 13.2% | | | | | | | | |

Boston Beer Co., Inc. (The), Class A(2),(3) | | | 1,787 | | | | 902,614 | |

Celsius Holdings, Inc.(1),(2),(3) | | | 21,864 | | | | 1,630,398 | |

Coca-Cola Co. (The)(2) | | | 101,411 | | | | 6,004,545 | |

Coca-Cola Europacific Partners PLC(1),(2),(4) | | | 197,883 | | | | 11,067,596 | |

Monster Beverage Corp.(2),(3) | | | 59,979 | | | | 5,760,383 | |

The accompanying notes are an integral part of the financial statements.

6

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Common Stocks | | | | | | | | |

Beverages | | | | | | | | |

Vintage Wine Estates, Inc.(2),(3) | | | 426,569 | | | | 5,042,046 | |

| | | | | | | | |

| | | | 30,407,582 | |

| | | | | | | | |

Biotechnology 7.3% | | | | | | | | |

AbbVie, Inc.(1),(2) | | | 10,851 | | | | 1,469,225 | |

ACADIA Pharmaceuticals, Inc.(2),(3) | | | 9,409 | | | | 219,606 | |

Albireo Pharma, Inc.(2),(3) | | | 700 | | | | 16,303 | |

Alder Biopharmaceuticals, Inc.(1),(3) | | | 6,157 | | | | 10,467 | |

Aldeyra Therapeutics, Inc.(1),(3) | | | 44,485 | | | | 177,940 | |

Applied Genetic Technologies Corp.(1),(2),(3) | | | 1,337 | | | | 2,540 | |

Arena Pharmaceuticals, Inc.(2),(3) | | | 3,885 | | | | 361,072 | |

Argenx SE, ADR(2),(3),(4) | | | 330 | | | | 115,563 | |

Arrowhead Pharmaceuticals, Inc.(1),(3) | | | 2,151 | | | | 142,611 | |

Ascendis Pharma A/S, ADR(2),(3),(4) | | | 1,689 | | | | 227,221 | |

Aurinia Pharmaceuticals, Inc.(2),(3),(4) | | | 11,735 | | | | 268,380 | |

Autolus Therapeutics PLC(1),(2),(3),(4) | | | 1,872 | | | | 9,716 | |

AVEO Pharmaceuticals, Inc.(1),(2),(3) | | | 23,375 | | | | 109,629 | |

BELLUS Health, Inc.(1),(2),(3),(4) | | | 1,657 | | | | 13,339 | |

Biohaven Pharmaceutical Holding Co., Ltd.(1),(2),(3),(4) | | | 25,639 | | | | 3,533,311 | |

BioMarin Pharmaceutical, Inc.(2),(3) | | | 729 | | | | 64,407 | |

Bioxcel Therapeutics, Inc.(1),(2),(3) | | | 8,073 | | | | 164,124 | |

Dynavax Technologies Corp.(1),(2),(3) | | | 7,252 | | | | 102,036 | |

Eiger BioPharmaceuticals, Inc.(1),(2),(3) | | | 33,884 | | | | 175,858 | |

Elevation Oncology, Inc.(2),(3) | | | 5,031 | | | | 30,287 | |

Epizyme, Inc.(1),(2),(3) | | | 2,176 | | | | 5,440 | |

Exelixis, Inc.(2),(3) | | | 15,518 | | | | 283,669 | |

Fate Therapeutics, Inc.(1),(2),(3) | | | 3,098 | | | | 181,264 | |

FibroGen, Inc.(2),(3) | | | 1,012 | | | | 14,269 | |

Global Blood Therapeutics, Inc.(1),(2),(3) | | | 8,915 | | | | 260,942 | |

Heron Therapeutics, Inc.(1),(2),(3) | | | 8,925 | | | | 81,485 | |

Horizon Therapeutics PLC(2),(3),(4) | | | 8,430 | | | | 908,417 | |

Incyte Corp.(2),(3) | | | 973 | | | | 71,418 | |

Insmed, Inc.(1),(2),(3) | | | 14,803 | | | | 403,234 | |

Ionis Pharmaceuticals, Inc.(1),(2),(3) | | | 1,810 | | | | 55,078 | |

Iovance Biotherapeutics, Inc.(1),(3) | | | 24,493 | | | | 467,571 | |

Karyopharm Therapeutics, Inc.(1),(2),(3) | | | 8,124 | | | | 52,237 | |

Merus N.V.(2),(3),(4) | | | 912 | | | | 29,002 | |

Mirati Therapeutics, Inc.(1),(2),(3) | | | 7,043 | | | | 1,033,138 | |

Molecular Templates, Inc.(1),(2),(3) | | | 15,786 | | | | 61,881 | |

Natera, Inc.(2),(3) | | | 7,707 | | | | 719,757 | |

Neurocrine Biosciences, Inc.(2),(3) | | | 3,295 | | | | 280,635 | |

Regeneron Pharmaceuticals, Inc.(2),(3) | | | 1,054 | | | | 665,622 | |

Rigel Pharmaceuticals, Inc.(1),(2),(3) | | | 26,998 | | | | 71,545 | |

Rocket Pharmaceuticals, Inc.(1),(3) | | | 5,286 | | | | 115,393 | |

Sage Therapeutics, Inc.(2),(3) | | | 886 | | | | 37,690 | |

Seagen, Inc.(2),(3) | | | 2,190 | | | | 338,574 | |

TG Therapeutics, Inc.(1),(2),(3) | | | 4,443 | | | | 84,417 | |

Turning Point Therapeutics, Inc.(2),(3) | | | 4,554 | | | | 217,226 | |

United Therapeutics Corp.(2),(3) | | | 6,336 | | | | 1,369,083 | |

Vertex Pharmaceuticals, Inc.(2),(3) | | | 8,002 | | | | 1,757,239 | |

Zymeworks, Inc.(2),(3),(4) | | | 211 | | | | 3,458 | |

| | | | | | | | |

| | | | | | | 16,783,319 | |

| | | | | | | | |

Building Products 2.8% | | | | | | | | |

Builders FirstSource, Inc.(1),(2),(3) | | | 26,307 | | | | 2,254,773 | |

Carrier Global Corp.(2) | | | 21,501 | | | | 1,166,214 | |

Fortune Brands Home & Security, Inc.(2) | | | 2,807 | | | | 300,069 | |

Johnson Controls International PLC(2),(4) | | | 11,800 | | | | 959,458 | |

The accompanying notes are an integral part of the financial statements.

7

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Common Stocks | | | | | | | | |

Building Products | | | | | | | | |

Masco Corp.(1),(2) | | | 24,401 | | | | 1,713,438 | |

| | | | | | | | |

| | | | | | | 6,393,952 | |

| | | | | | | | |

Capital Markets 4.6% | | | | | | | | |

Blucora, Inc.(2),(3) | | | 87,258 | | | | 1,511,309 | |

FactSet Research Systems, Inc.(2) | | | 704 | | | | 342,151 | |

Goldman Sachs Group, Inc. (The)(1) | | | 6,590 | | | | 2,521,004 | |

State Street Corp.(2) | | | 65,951 | | | | 6,133,443 | |

| | | | | | | | |

| | | | | | | 10,507,907 | |

| | | | | | | | |

Chemicals 5.2% | | | | | | | | |

Atotech Ltd.(2),(3),(4) | | | 9,072 | | | | 231,517 | |

Axalta Coating Systems Ltd.(2),(3),(4) | | | 56,482 | | | | 1,870,684 | |

CF Industries Holdings, Inc.(2) | | | 3,018 | | | | 213,614 | |

DuPont de Nemours, Inc.(2) | | | 49,937 | | | | 4,033,911 | |

GCP Applied Technologies, Inc.(2),(3) | | | 7,498 | | | | 237,387 | |

Huntsman Corp.(2) | | | 127,419 | | | | 4,444,375 | |

PPG Industries, Inc.(1) | | | 3,280 | | | | 565,603 | |

Tronox Holdings PLC, Class A(2),(4) | | | 10,248 | | | | 246,260 | |

Westlake Chemical Corp.(2) | | | 2,110 | | | | 204,944 | |

| | | | | | | | |

| | | | | | | 12,048,295 | |

| | | | | | | | |

Commercial Services & Supplies 1.3% | | | | | | | | |

ACV Auctions, Inc., Class A(2),(3) | | | 39,594 | | | | 745,951 | |

Clean Harbors, Inc.(1),(2),(3) | | | 11,943 | | | | 1,191,553 | |

Republic Services, Inc.(1),(2) | | | 780 | | | | 108,771 | |

Waste Connections, Inc.(2),(4) | | | 7,006 | | | | 954,708 | |

| | | | | | | | |

| | | | | | | 3,000,983 | |

| | | | | | | | |

Communications Equipment 10.4% | | | | | | | | |

ADTRAN, Inc.(1),(2) | | | 175,600 | | | | 4,008,948 | |

Arista Networks, Inc.(1),(2),(3) | | | 21,126 | | | | 3,036,863 | |

Ciena Corp.(1),(2),(3) | | | 26,470 | | | | 2,037,396 | |

CommScope Holding Co., Inc.(1),(2),(3) | | | 1,074,521 | | | | 11,862,712 | |

F5, Inc.(1),(2),(3) | | | 3,788 | | | | 926,961 | |

Radware Ltd.(2),(3),(4) | | | 45,786 | | | | 1,906,529 | |

| | | | | | | | |

| | | | | | | 23,779,409 | |

| | | | | | | | |

Construction & Engineering 1.2% | | | | | | | | |

Ameresco, Inc., Class A(3) | | | 3,207 | | | | 261,178 | |

WillScot Mobile Mini Holdings Corp.(2),(3) | | | 61,733 | | | | 2,521,176 | |

| | | | | | | | |

| | | | | | | 2,782,354 | |

| | | | | | | | |

Construction Materials 0.3% | | | | | | | | |

Cemex S.A.B. de C.V., ADR(3),(4) | | | 47,970 | | | | 325,236 | |

Martin Marietta Materials, Inc.(1),(2) | | | 767 | | | | 337,879 | |

| | | | | | | | |

| | | | | | | 663,115 | |

| | | | | | | | |

Consumer Finance 3.4% | | | | | | | | |

Ally Financial, Inc.(2) | | | 90,170 | | | | 4,292,994 | |

Curo Group Holdings Corp.(2) | | | 1,647 | | | | 26,368 | |

Synchrony Financial(1),(2) | | | 77,323 | | | | 3,587,014 | |

| | | | | | | | |

| | | | | | | 7,906,376 | |

| | | | | | | | |

Containers & Packaging 7.3% | | | | | | | | |

Ardagh Metal Packaging S.A.(2),(3),(4) | | | 1,538,176 | | | | 13,889,729 | |

Berry Global Group, Inc.(1),(2),(3) | | | 22,600 | | | | 1,667,428 | |

Crown Holdings, Inc.(2) | | | 1,731 | | | | 191,483 | |

The accompanying notes are an integral part of the financial statements.

8

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Common Stocks | | | | | | | | |

Containers & Packaging | | | | | | | | |

Sealed Air Corp.(1),(2) | | | 15,676 | | | | 1,057,660 | |

| | | | | | | | |

| | | | | | | 16,806,300 | |

| | | | | | | | |

Distributors 0.1% | | | | | | | | |

Pool Corp.(2) | | | 478 | | | | 270,548 | |

| | | | | | | | |

Diversified Consumer Services 1.2% | | | | | | | | |

Chegg, Inc.(1),(2),(3) | | | 12,358 | | | | 379,391 | |

Coursera, Inc.(2),(3) | | | 11,739 | | | | 286,901 | |

European Wax Center, Inc., Class A(2),(3) | | | 38,225 | | | | 1,160,129 | |

Nerdy, Inc.(2),(3) | | | 27,638 | | | | 124,371 | |

Terminix Global Holdings, Inc.(2),(3) | | | 19,457 | | | | 880,040 | |

| | | | | | | | |

| | | | | | | 2,830,832 | |

| | | | | | | | |

Diversified Financial Services 10.9% | | | | | | | | |

Aequi Acquisition Corp.(2),(3) | | | 55,839 | | | | 559,507 | |

Aequi Acquisition Corp., Class A(2),(3) | | | 26,623 | | | | 260,639 | |

Anzu Special Acquisition Corp. I, Class A(2),(3) | | | 11,398 | | | | 111,017 | |

Apollo Strategic Growth Capital, Class A(2),(3),(4) | | | 28,019 | | | | 276,548 | |

Apollo Strategic Growth Capital II(2),(3),(4) | | | 1,043 | | | | 10,388 | |

Argus Capital Corp., Class A(2),(3) | | | 100,333 | | | | 993,297 | |

Atlas Crest Investment Corp. II(2),(3) | | | 9,270 | | | | 92,051 | |

Aurora Acquisition Corp., Class A(2),(3),(4) | | | 21,157 | | | | 209,454 | |

Beard Energy Transition Acquisition Corp.(2),(3) | | | 11,996 | | | | 121,879 | |

Broadscale Acquisition Corp., Class A(2),(3) | | | 22,768 | | | | 226,314 | |

Capstar Special Purpose Acquisition Corp., Class A(2),(3) | | | 12,414 | | | | 123,643 | |

Carney Technology Acquisition Corp. II(2),(3) | | | 9,695 | | | | 96,950 | |

CENAQ Energy Corp.(2),(3) | | | 13,736 | | | | 139,832 | |

Churchill Capital Corp. VI(2),(3) | | | 10,205 | | | | 101,642 | |

Churchill Capital Corp. VII(2),(3) | | | 17,791 | | | | 178,284 | |

Cohn Robbins Holdings Corp., Class A(2),(3),(4) | | | 10,689 | | | | 105,073 | |

Conyers Park III Acquisition Corp.(2),(3) | | | 416,606 | | | | 4,203,555 | |

Direct Selling Acquisition Corp.(2),(3) | | | 8,360 | | | | 84,938 | |

ECP Environmental Growth Opportunities Corp., Class A(2),(3) | | | 21,700 | | | | 213,962 | |

Edify Acquisition Corp.(2),(3) | | | 1,794 | | | | 17,922 | |

Everest Consolidator Acquisition Corp.(2),(3) | | | 16,822 | | | | 169,061 | |

Financial Strategies Acquisition Corp.(2),(3) | | | 40,406 | | | | 418,202 | |

Fortress Capital Acquisition Corp.(2),(3),(4) | | | 4,669 | | | | 46,176 | |

Fortress Value Acquisition Corp. IV(2),(3) | | | 4,666 | | | | 46,567 | |

Frazier Lifesciences Acquisition Corp.(2),(3),(4) | | | 4,797 | | | | 47,586 | |

GigCapital5, Inc.(2),(3) | | | 12,536 | | | | 130,124 | |

Global Partner Acquisition Corp. II(2),(3),(4) | | | 4,148 | | | | 40,858 | |

GO Acquisition Corp.(2),(3) | | | 4,185 | | | | 43,545 | |

Golden Falcon Acquisition Corp.(2),(3) | | | 5,530 | | | | 55,576 | |

Gores Holdings VII, Inc.(2),(3) | | | 7,971 | | | | 79,232 | |

Gores Technology Partners II, Inc., Class A(2),(3) | | | 15,960 | | | | 158,004 | |

Gores Technology Partners, Inc.(2),(3) | | | 11,400 | | | | 114,684 | |

Hudson Executive Investment Corp. II(2),(3) | | | 4,362 | | | | 43,184 | |

Hudson Executive Investment Corp. III(2),(3) | | | 10,361 | | | | 101,540 | |

HumanCo Acquisition Corp., Class A(2),(3) | | | 278,581 | | | | 2,724,522 | |

Lazard Growth Acquisition Corp. I(2),(3),(4) | | | 5,700 | | | | 56,430 | |

Longview Acquisition Corp. II(2),(3) | | | 11,188 | | | | 111,992 | |

M3-Brigade Acquisition II Corp., Class A(2),(3) | | | 14,731 | | | | 145,984 | |

Magnum Opus Acquisition Ltd., Class A(2),(3),(4) | | | 5,407 | | | | 53,637 | |

MDH Acquisition Corp., Class A(2),(3) | | | 21,005 | | | | 205,849 | |

North Mountain Merger Corp., Class A(2),(3) | | | 14,010 | | | | 138,139 | |

Northern Star Investment Corp. III(2),(3) | | | 11,398 | | | | 113,125 | |

Omnichannel Acquisition Corp., Class A(2),(3) | | | 4,485 | | | | 44,626 | |

Pine Technology Acquisition Corp., Class A(2),(3) | | | 21,014 | | | | 206,988 | |

The accompanying notes are an integral part of the financial statements.

9

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Common Stocks | | | | | | | | |

Diversified Financial Services | | | | | | | | |

Pontem Corp.(2),(3),(4) | | | 4,781 | | | | 48,192 | |

Primavera Capital Acquisition Corp.(2),(3),(4) | | | 2,312 | | | | 23,212 | |

Priveterra Acquisition Corp.(2),(3) | | | 5,669 | | | | 56,123 | |

PropTech Investment Corp. II(2),(3) | | | 7,044 | | | | 70,299 | |

Queen’s Gambit Growth Capital, Class A(2),(3),(4) | | | 13,661 | | | | 135,244 | |

Revolution Healthcare Acquisition Corp.(2),(3) | | | 5,698 | | | | 56,410 | |

RMG Acquisition Corp. III(2),(3),(4) | | | 4,165 | | | | 41,442 | |

Schultze Special Purpose Acquisition Corp. II(2),(3) | | | 22,559 | | | | 229,876 | |

ScION Tech Growth I(2),(3),(4) | | | 6,940 | | | | 68,845 | |

ScION Tech Growth II(2),(3),(4) | | | 7,587 | | | | 75,111 | |

Senior Connect Acquisition Corp. I, Class A(2),(3) | | | 7,744 | | | | 75,427 | |

Simon Property Group Acquisition Holdings, Inc.(2),(3) | | | 641,299 | | | | 6,345,654 | |

Simon Property Group Acquisition Holdings, Inc., Class A(2),(3) | | | 218,580 | | | | 2,128,969 | |

SVF Investment Corp. 3, Class A(2),(3),(4) | | | 2,280 | | | | 22,800 | |

Tishman Speyer Innovation Corp. II(2),(3) | | | 118,319 | | | | 1,165,442 | |

Tishman Speyer Innovation Corp. II, Class A(2),(3) | | | 29,639 | | | | 288,980 | |

TLG Acquisition One Corp.(2),(3) | | | 4,852 | | | | 48,035 | |

Turmeric Acquisition Corp.(2),(3),(4) | | | 6,073 | | | | 60,730 | |

Vector Acquisition Corp. II, Class A(2),(3),(4) | | | 10,946 | | | | 106,942 | |

Velocity Acquisition Corp., Class A(2),(3) | | | 14,633 | | | | 142,306 | |

Virgin Group Acquisition Corp. II, Class A(2),(3),(4) | | | 28,019 | | | | 276,548 | |

Warburg Pincus Capital Corp. I-A(2),(3),(4) | | | 11,400 | | | | 114,000 | |

Williams Rowland Acquisition Corp.(2),(3) | | | 13,602 | | | | 137,516 | |

| | | | | | | | |

| | | | | | | 25,140,629 | |

| | | | | | | | |

Electric Utilities 1.3% | | | | | | | | |

NextEra Energy, Inc.(1) | | | 12,777 | | | | 1,192,861 | |

PNM Resources, Inc.(2) | | | 38,236 | | | | 1,743,944 | |

| | | | | | | | |

| | | | | | | 2,936,805 | |

| | | | | | | | |

Electrical Equipment 6.4% | | | | | | | | |

AMETEK, Inc.(2) | | | 24,937 | | | | 3,666,736 | |

Generac Holdings, Inc.(2),(3) | | | 1,718 | | | | 604,599 | |

nVent Electric PLC(2),(4) | | | 37,111 | | | | 1,410,218 | |

Regal Rexnord Corp.(1),(2) | | | 39,833 | | | | 6,778,780 | |

Sensata Technologies Holding PLC(2),(3),(4) | | | 14,397 | | | | 888,151 | |

Vicor Corp.(2),(3) | | | 10,576 | | | | 1,342,940 | |

| | | | | | | | |

| | | | | | | 14,691,424 | |

| | | | | | | | |

Electronic Equipment, Instruments & Components 6.1% | | | | | | | | |

908 Devices, Inc.(1),(2),(3) | | | 6,392 | | | | 165,361 | |

Coherent, Inc.(2),(3) | | | 10,258 | | | | 2,734,167 | |

II-VI, Inc.(1),(3) | | | 78,985 | | | | 5,397,045 | |

Mirion Technologies, Inc.(2),(3) | | | 82,356 | | | | 862,267 | |

Rogers Corp.(2),(3) | | | 7,993 | | | | 2,182,089 | |

TE Connectivity Ltd.(2),(4) | | | 13,649 | | | | 2,202,130 | |

Zebra Technologies Corp., Class A(2),(3) | | | 853 | | | | 507,706 | |

| | | | | | | | |

| | | | | | | 14,050,765 | |

| | | | | | | | |

Energy Equipment & Services 0.3% | | | | | | | | |

Halliburton Co.(1),(2) | | | 33,285 | | | | 761,228 | |

| | | | | | | | |

Entertainment 1.9% | | | | | | | | |

Activision Blizzard, Inc.(2) | | | 7,399 | | | | 492,255 | |

Netflix, Inc.(2),(3) | | | 1,751 | | | | 1,054,872 | |

ROBLOX Corp., Class A(1),(2),(3) | | | 3,343 | | | | 344,864 | |

Sciplay Corp., Class A(2),(3) | | | 79,875 | | | | 1,100,678 | |

Spotify Technology S.A.(2),(3),(4) | | | 762 | | | | 178,331 | |

Take-Two Interactive Software, Inc.(2),(3) | | | 1,760 | | | | 312,787 | |

The accompanying notes are an integral part of the financial statements.

10

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Common Stocks | | | | | | | | |

Entertainment | | | | | | | | |

Zynga, Inc., Class A(2),(3) | | | 135,355 | | | | 866,272 | |

| | | | | | | | |

| | | | | | | 4,350,059 | |

| | | | | | | | |

Food & Staples Retailing 1.5% | | | | | | | | |

Performance Food Group Co.(2),(3) | | | 70,317 | | | | 3,226,847 | |

Walmart, Inc. | | | 855 | | | | 123,710 | |

| | | | | | | | |

| | | | | | | 3,350,557 | |

| | | | | | | | |

Food Products 16.7% | | | | | | | | |

Bunge Ltd.(2),(4) | | | 39,667 | | | | 3,703,311 | |

Conagra Brands, Inc.(1),(2) | | | 52,710 | | | | 1,800,046 | |

Darling Ingredients, Inc.(2),(3) | | | 19,876 | | | | 1,377,208 | |

Hershey Co. (The)(1),(2) | | | 35,532 | | | | 6,874,376 | |

Hostess Brands, Inc.(2),(3) | | | 268,283 | | | | 5,478,339 | |

JM Smucker Co. (The)(2) | | | 19,027 | | | | 2,584,247 | |

Kraft Heinz Co. (The)(1),(2) | | | 96,554 | | | | 3,466,289 | |

Pilgrim’s Pride Corp.(2),(3) | | | 173,703 | | | | 4,898,425 | |

Simply Good Foods Co. (The)(2),(3) | | | 121,628 | | | | 5,056,076 | |

Sovos Brands, Inc.(2),(3) | | | 210,046 | | | | 3,161,192 | |

| | | | | | | | |

| | | | | | | 38,399,509 | |

| | | | | | | | |

Health Care Equipment & Supplies 3.7% | | | | | | | | |

Abbott Laboratories(1),(2) | | | 3,624 | | | | 510,042 | |

ABIOMED, Inc.(1),(2),(3) | | | 1,450 | | | | 520,796 | |

Boston Scientific Corp.(2),(3) | | | 10,850 | | | | 460,908 | |

Cardiovascular Systems, Inc.(2),(3) | | | 330 | | | | 6,197 | |

CVRX, Inc.(2),(3) | | | 18,168 | | | | 222,195 | |

DexCom, Inc.(1),(2),(3) | | | 3,414 | | | | 1,833,147 | |

Edwards Lifesciences Corp.(1),(2),(3) | | | 12,076 | | | | 1,564,446 | |

Haemonetics Corp.(1),(2),(3) | | | 6,290 | | | | 333,622 | |

Inari Medical, Inc.(2),(3) | | | 4,469 | | | | 407,886 | |

Intersect ENT, Inc.(2),(3) | | | 15,830 | | | | 432,317 | |

NeuroPace, Inc.(2),(3) | | | 1,077 | | | | 10,856 | |

Outset Medical, Inc.(2),(3) | | | 3,494 | | | | 161,038 | |

Penumbra, Inc.(1),(2),(3) | | | 697 | | | | 200,262 | |

Pulmonx Corp.(2),(3) | | | 341 | | | | 10,936 | |

Quidel Corp.(2),(3) | | | 878 | | | | 118,521 | |

Silk Road Medical, Inc.(1),(2),(3) | | | 3,018 | | | | 128,597 | |

STAAR Surgical Co.(1),(3) | | | 2,826 | | | | 258,014 | |

Stryker Corp.(1),(2) | | | 2,472 | | | | 661,062 | |

Tandem Diabetes Care, Inc.(1),(2),(3) | | | 2,709 | | | | 407,759 | |

Teleflex, Inc.(2) | | | 910 | | | | 298,917 | |

Zimmer Biomet Holdings, Inc.(2) | | | 370 | | | | 47,005 | |

| | | | | | | | |

| | | | | | | 8,594,523 | |

| | | | | | | | |

Health Care Providers & Services 1.3% | | | | | | | | |

Centene Corp.(2),(3) | | | 5,957 | | | | 490,857 | |

CVS Health Corp.(2) | | | 3,003 | | | | 309,789 | |

Guardant Health, Inc.(1),(2),(3) | | | 548 | | | | 54,811 | |

Humana, Inc.(2) | | | 3,515 | | | | 1,630,468 | |

Oak Street Health, Inc.(1),(3) | | | 1,761 | | | | 58,360 | |

Option Care Health, Inc.(1),(2),(3) | | | 11,671 | | | | 331,923 | |

Pennant Group, Inc. (The)(1),(2),(3) | | | 1,748 | | | | 40,344 | |

| | | | | | | | |

| | | | | | | 2,916,552 | |

| | | | | | | | |

Health Care Technology 2.7% | | | | | | | | |

Cerner Corp.(2) | | | 35,430 | | | | 3,290,384 | |

Change Healthcare, Inc.(2),(3) | | | 6,769 | | | | 144,721 | |

Convey Health Solutions Holdings, Inc.(2),(3) | | | 16,128 | | | | 134,830 | |

Inspire Medical Systems, Inc.(2),(3) | | | 1,768 | | | | 406,746 | |

The accompanying notes are an integral part of the financial statements.

11

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Common Stocks | | | | | | | | |

Health Care Technology | | | | | | | | |

Sema4 Holdings Corp.(2),(3) | | | 482,626 | | | | 2,152,512 | |

| | | | | | | | |

| | | | | | | 6,129,193 | |

| | | | | | | | |

Hotels, Restaurants & Leisure 10.6% | | | | | | | | |

Bloomin’ Brands, Inc.(1),(2),(3) | | | 35,210 | | | | 738,706 | |

Booking Holdings, Inc.(2),(3) | | | 635 | | | | 1,523,511 | |

Boyd Gaming Corp.(2),(3) | | | 56,712 | | | | 3,718,606 | |

Caesars Entertainment, Inc.(2),(3) | | | 2,342 | | | | 219,047 | |

Chipotle Mexican Grill, Inc.(2),(3) | | | 669 | | | | 1,169,579 | |

Darden Restaurants, Inc.(1),(2) | | | 7,707 | | | | 1,160,983 | |

Expedia Group, Inc.(1),(3) | | | 9,744 | | | | 1,760,936 | |

Hilton Worldwide Holdings, Inc.(1),(2),(3) | | | 7,755 | | | | 1,209,702 | |

MakeMyTrip Ltd.(2),(3),(4) | | | 12,980 | | | | 359,676 | |

Marriott International, Inc., Class A(2),(3) | | | 11,005 | | | | 1,818,466 | |

Marriott Vacations Worldwide Corp.(2) | | | 5,359 | | | | 905,564 | |

MGM Resorts International(2) | | | 60,905 | | | | 2,733,416 | |

Penn National Gaming, Inc. | | | 7,098 | | | | 368,011 | |

Sweetgreen, Inc., Class A(2),(3) | | | 4,258 | | | | 136,256 | |

Texas Roadhouse, Inc., Class A(2) | | | 15,507 | | | | 1,384,465 | |

Vail Resorts, Inc.(1),(2) | | | 6,457 | | | | 2,117,250 | |

Wendy’s Co. (The)(2) | | | 125,100 | | | | 2,983,635 | |

| | | | | | | | |

| | | | | | | 24,307,809 | |

| | | | | | | | |

Household Durables 2.1% | | | | | | | | |

DR Horton, Inc.(2) | | | 6,351 | | | | 688,766 | |

KB Home(2) | | | 3,070 | | | | 137,321 | |

Lennar Corp., Class A(1),(2) | | | 5,732 | | | | 665,829 | |

Meritage Homes Corp.(2),(3) | | | 7,217 | | | | 880,907 | |

TopBuild Corp.(1),(2),(3) | | | 3,592 | | | | 991,069 | |

Tri Pointe Homes, Inc.(2),(3) | | | 5,620 | | | | 156,742 | |

Vizio Holding Corp., Class A(2),(3) | | | 29,160 | | | | 566,579 | |

Whirlpool Corp.(2) | | | 3,002 | | | | 704,449 | |

| | | | | | | | |

| | | | | | | 4,791,662 | |

| | | | | | | | |

Household Products 4.2% | | | | | | | | |

Colgate-Palmolive Co.(2) | | | 41,289 | | | | 3,523,603 | |

Procter & Gamble Co. (The)(1),(2) | | | 20,184 | | | | 3,301,699 | |

Spectrum Brands Holdings, Inc.(1),(2) | | | 28,843 | | | | 2,933,910 | |

| | | | | | | | |

| | | | | | | 9,759,212 | |

| | | | | | | | |

Industrial Conglomerates 0.1% | | | | | | | | |

Roper Technologies, Inc.(2) | | | 384 | | | | 188,874 | |

| | | | | | | | |

Insurance 0.9% | | | | | | | | |

American National Group, Inc.(2) | | | 2,489 | | | | 470,023 | |

Arthur J Gallagher & Co.(1),(2) | | | 1,144 | | | | 194,102 | |

Athene Holding Ltd., Class A(2),(3),(4) | | | 17,598 | | | | 1,466,441 | |

Syncora Holdings Ltd.(2),(3),(4) | | | 56,504 | | | | 9,606 | |

| | | | | | | | |

| | | | | | | 2,140,172 | |

| | | | | | | | |

Interactive Media & Services 6.5% | | | | | | | | |

Alphabet, Inc., Class C(2),(3) | | | 1 | | | | 2,893 | |

Alphabet, Inc., Class A(2),(3) | | | 2,698 | | | | 7,816,214 | |

Meta Platforms, Inc., Class A(2),(3) | | | 16,380 | | | | 5,509,413 | |

QuinStreet, Inc.(1),(2),(3) | | | 59,568 | | | | 1,083,542 | |

Vimeo, Inc.(1),(2),(3) | | | 17,645 | | | | 316,904 | |

ZoomInfo Technologies, Inc., Class A(2),(3) | | | 3,994 | | | | 256,415 | |

| | | | | | | | |

| | | | | | | 14,985,381 | |

| | | | | | | | |

Internet & Direct Marketing Retail 0.8% | | | | | | | | |

Altaba, Inc.(3) | | | 148,076 | | | | 878,091 | |

Global-e Online Ltd.(2),(3),(4) | | | 8,788 | | | | 557,071 | |

The accompanying notes are an integral part of the financial statements.

12

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Common Stocks | | | | | | | | |

Internet & Direct Marketing Retail | | | | | | | | |

MercadoLibre, Inc.(2),(3) | | | 369 | | | | 497,560 | |

| | | | | | | | |

| | | | | | | 1,932,722 | |

| | | | | | | | |

IT Services 12.9% | | | | | | | | |

Accenture PLC, Class A(2),(4) | | | 5,252 | | | | 2,177,217 | |

Akamai Technologies, Inc.(1),(3) | | | 7,936 | | | | 928,829 | |

Concentrix Corp.(2) | | | 41,348 | | | | 7,385,580 | |

DXC Technology Co.(1),(2),(3) | | | 132,059 | | | | 4,250,979 | |

Fastly, Inc., Class A(2),(3) | | | 5,284 | | | | 187,318 | |

Fidelity National Information Services, Inc.(2) | | | 3,504 | | | | 382,462 | |

GoDaddy, Inc., Class A(3) | | | 2,109 | | | | 178,970 | |

I3 Verticals, Inc., Class A(1),(2),(3) | | | 77,567 | | | | 1,767,752 | |

Infosys Ltd., ADR(1),(2),(4) | | | 92,846 | | | | 2,349,932 | |

Kyndryl Holdings, Inc.(1),(2),(3) | | | 50,644 | | | | 916,664 | |

LiveRamp Holdings, Inc.(1),(2),(3) | | | 70,460 | | | | 3,378,557 | |

Marqeta, Inc., Class A(2),(3) | | | 52,196 | | | | 896,205 | |

MongoDB, Inc.(1),(3) | | | 1,766 | | | | 934,832 | |

Nuvei Corp.(2),(3),(4) | | | 3,521 | | | | 228,795 | |

Okta, Inc.(1),(3) | | | 4,854 | | | | 1,088,121 | |

Sabre Corp.(1),(2),(3) | | | 38,262 | | | | 328,670 | |

Shopify, Inc., Class A(2),(3),(4) | | | 529 | | | | 728,639 | |

Snowflake, Inc., Class A(1),(3) | | | 2,996 | | | | 1,014,895 | |

Twilio, Inc., Class A(1),(2),(3) | | | 1,194 | | | | 314,428 | |

Wix.com Ltd.(2),(3),(4) | | | 525 | | | | 82,840 | |

| | | | | | | | |

| | | | | | | 29,521,685 | |

| | | | | | | | |

Leisure Products 0.2% | | | | | | | | |

Hayward Holdings, Inc.(2),(3) | | | 16,082 | | | | 421,831 | |

| | | | | | | | |

Life Sciences Tools & Services 3.9% | | | | | | | | |

Avantor, Inc.(2),(3) | | | 14,292 | | | | 602,265 | |

Berkeley Lights, Inc.(1),(2),(3) | | | 8,035 | | | | 146,076 | |

Danaher Corp.(2) | | | 1,813 | | | | 596,495 | |

Fluidigm Corp.(1),(2),(3) | | | 400 | | | | 1,568 | |

NanoString Technologies, Inc.(1),(2),(3) | | | 5,550 | | | | 234,377 | |

Pacific Biosciences of California, Inc.(1),(2),(3) | | | 9,112 | | | | 186,432 | |

Repligen Corp.(1),(3) | | | 4,904 | | | | 1,298,775 | |

SomaLogic, Inc.(2),(3) | | | 501,097 | | | | 5,832,769 | |

| | | | | | | | |

| | | | | | | 8,898,757 | |

| | | | | | | | |

Machinery 6.2% | | | | | | | | |

CNH Industrial N.V.(2),(4) | | | 110,239 | | | | 2,141,944 | |

Deere & Co.(2) | | | 4,403 | | | | 1,509,745 | |

Dover Corp.(2) | | | 6,433 | | | | 1,168,233 | |

Evoqua Water Technologies Corp.(1),(2),(3) | | | 12,598 | | | | 588,956 | |

Ingersoll Rand, Inc.(1),(2) | | | 27,673 | | | | 1,712,128 | |

Middleby Corp. (The)(1),(2),(3) | | | 2,643 | | | | 520,037 | |

Otis Worldwide Corp.(2) | | | 26,385 | | | | 2,297,342 | |

PACCAR, Inc.(2) | | | 10,430 | | | | 920,552 | |

Parker-Hannifin Corp.(1),(2) | | | 3,643 | | | | 1,158,911 | |

SPX FLOW, Inc.(2) | | | 4,118 | | | | 356,125 | |

Welbilt, Inc.(2),(3) | | | 76,102 | | | | 1,808,944 | |

| | | | | | | | |

| | | | | | | 14,182,917 | |

| | | | | | | | |

Marine 0.0% | | | | | | | | |

Kirby Corp.(2),(3) | | | 1,056 | | | | 62,748 | |

| | | | | | | | |

Media 7.7% | | | | | | | | |

Altice USA, Inc., Class A(1),(2),(3) | | | 24,976 | | | | 404,112 | |

comScore, Inc.(1),(2),(3) | | | 2,247,335 | | | | 7,506,099 | |

Criteo S.A., ADR(2),(3),(4) | | | 71,857 | | | | 2,793,082 | |

The accompanying notes are an integral part of the financial statements.

13

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Common Stocks | |

Media | |

Fox Corp., Class A(2) | | | 8,237 | | | | 303,945 | |

Gray Television, Inc.(2) | | | 44,175 | | | | 890,568 | |

iHeartMedia, Inc., Class A(2),(3) | | | 29,843 | | | | 627,897 | |

Liberty Broadband Corp., Class C(2),(3) | | | 3,791 | | | | 610,730 | |

Liberty Media Corp-Liberty SiriusXM, Class A(1),(2),(3) | | | 5,585 | | | | 283,997 | |

Nexstar Media Group, Inc., Class A(1),(2) | | | 7,062 | | | | 1,066,221 | |

Shaw Communications, Inc., Class B(2),(4) | | | 8,812 | | | | 267,356 | |

Sinclair Broadcast Group, Inc., Class A(1),(2) | | | 25,614 | | | | 676,978 | |

TEGNA, Inc.(2) | | | 13,034 | | | | 241,911 | |

ViacomCBS, Inc., Class B(2) | | | 65,456 | | | | 1,975,462 | |

| | | | | | | | |

| | | | 17,648,358 | |

| | | | | | | | |

Metals & Mining 2.0% | | | | | | | | |

Alpha Metallurgical Resources, Inc.(3) | | | 3,521 | | | | 214,957 | |

BHP Group PLC, ADR(2),(4) | | | 40,201 | | | | 2,402,814 | |

Freeport-McMoRan, Inc.(2) | | | 13,515 | | | | 563,981 | |

Hudbay Minerals, Inc.(2),(4) | | | 71,161 | | | | 515,917 | |

Vale S.A., ADR(2),(4) | | | 61,617 | | | | 863,870 | |

Warrior Met Coal, Inc. | | | 5,281 | | | | 135,775 | |

| | | | | | | | |

| | | | 4,697,314 | |

| | | | | | | | |

Mortgage Real Estate Investment 1.1% | | | | | | | | |

AFC Gamma, Inc.(2) | | | 106,251 | | | | 2,418,273 | |

| | | | | | | | |

Multiline Retail 0.1% | | | | | | | | |

Ollie’s Bargain Outlet Holdings, Inc.(1),(3) | | | 5,458 | | | | 279,395 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels 10.3% | | | | | | | | |

Antero Resources Corp.(2),(3) | | | 97,751 | | | | 1,710,643 | |

Arch Resources, Inc.(2) | | | 8,071 | | | | 737,044 | |

ConocoPhillips(2) | | | 26,634 | | | | 1,922,442 | |

Coterra Energy, Inc.(1),(2) | | | 98,521 | | | | 1,871,899 | |

Devon Energy Corp.(1),(2) | | | 51,919 | | | | 2,287,032 | |

Diamondback Energy, Inc.(1),(2) | | | 15,851 | | | | 1,709,530 | |

Marathon Oil Corp.(1) | | | 112,030 | | | | 1,839,533 | |

Marathon Petroleum Corp.(1) | | | 12,572 | | | | 804,482 | |

Matador Resources Co.(1),(2) | | | 40,830 | | | | 1,507,444 | |

Northern Oil and Gas, Inc.(2) | | | 87,585 | | | | 1,802,499 | |

Ovintiv, Inc.(2) | | | 54,171 | | | | 1,825,563 | |

PDC Energy, Inc.(1) | | | 35,387 | | | | 1,726,178 | |

Pioneer Natural Resources Co.(2) | | | 10,996 | | | | 1,999,952 | |

Range Resources Corp.(1),(2),(3) | | | 74,868 | | | | 1,334,896 | |

Royal Dutch Shell PLC, Class A, ADR(2),(4) | | | 13,439 | | | | 583,253 | |

| | | | | | | | |

| | | | 23,662,390 | |

| | | | | | | | |

Paper & Forest Products 1.0% | | | | | | | | |

Louisiana-Pacific Corp.(2) | | | 13,535 | | | | 1,060,467 | |

West Fraser Timber Co., Ltd.(2),(4) | | | 11,831 | | | | 1,128,204 | |

| | | | | | | | |

| | | | 2,188,671 | |

| | | | | | | | |

Personal Products 3.3% | | | | | | | | |

BellRing Brands, Inc., Class A(1),(3) | | | 15,253 | | | | 435,168 | |

Coty, Inc., Class A(1),(2),(3) | | | 207,443 | | | | 2,178,151 | |

elf Beauty, Inc.(1),(2),(3) | | | 150,280 | | | | 4,990,799 | |

| | | | | | | | |

| | | | 7,604,118 | |

| | | | | | | | |

Pharmaceuticals 4.2% | | | | | | | | |

Aerie Pharmaceuticals, Inc.(2),(3) | | | 297 | | | | 2,085 | |

AstraZeneca PLC, ADR(1),(2),(4) | | | 29,515 | | | | 1,719,249 | |

Axsome Therapeutics, Inc.(1),(2),(3) | | | 4,978 | | | | 188,069 | |

Bausch Health Cos., Inc.(2),(3),(4) | | | 7,859 | | | | 216,987 | |

The accompanying notes are an integral part of the financial statements.

14

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Common Stocks | |

Pharmaceuticals | |

Bristol-Myers Squibb Co.(1),(2) | | | 36,904 | | | | 2,300,964 | |

Catalent, Inc.(2),(3) | | | 3,439 | | | | 440,295 | |

Eli Lilly & Co.(2) | | | 11,381 | | | | 3,143,660 | |

Green Thumb Industries, Inc.(2),(3),(4) | | | 58,039 | | | | 1,286,173 | |

Intra-Cellular Therapies, Inc.(1),(2),(3) | | | 901 | | | | 47,158 | |

Merck & Co., Inc.(2) | | | 3,870 | | | | 296,597 | |

Relmada Therapeutics, Inc.(2),(3) | | | 1,768 | | | | 39,833 | |

TherapeuticsMD, Inc.(2),(3) | | | 15,551 | | | | 5,528 | |

Zogenix, Inc.(1),(2),(3) | | | 1,595 | | | | 25,919 | |

| | | | | | | | |

| | | | 9,712,517 | |

| | | | | | | | |

Professional Services 3.8% | | | | | | | | |

IHS Markit Ltd.(2),(4) | | | 62,747 | | | | 8,340,331 | |

KBR, Inc.(1) | | | 8,314 | | | | 395,913 | |

| | | | | | | | |

| | | | 8,736,244 | |

| | | | | | | | |

Real Estate Investment Trusts 153.6% | | | | | | | | |

Acadia Realty Trust(2) | | | 663,133 | | | | 14,476,193 | |

Agree Realty Corp.(2) | | | 264,810 | | | | 18,896,842 | |

Alexandria Real Estate Equities, Inc.(2) | | | 42,405 | | | | 9,454,619 | |

American Campus Communities, Inc.(1),(2) | | | 159,106 | | | | 9,115,183 | |

American Homes 4 Rent, Class A(1),(2) | | | 63,932 | | | | 2,788,075 | |

Americold Realty Trust(1),(2) | | | 871,090 | | | | 28,563,041 | |

AvalonBay Communities, Inc.(1),(2) | | | 21,773 | | | | 5,499,642 | |

CareTrust REIT, Inc.(2) | | | 31,425 | | | | 717,433 | |

CyrusOne, Inc.(2) | | | 85,128 | | | | 7,637,684 | |

Duke Realty Corp. | | | 1,096 | | | | 71,941 | |

Equity Residential(1),(2) | | | 281,953 | | | | 25,516,747 | |

Federal Realty Investment Trust(1),(2) | | | 115,291 | | | | 15,716,469 | |

First Industrial Realty Trust, Inc.(2) | | | 433,292 | | | | 28,683,930 | |

Healthcare Trust of America, Inc., Class A(2) | | | 292,355 | | | | 9,761,733 | |

Highwoods Properties, Inc.(1),(2) | | | 101,049 | | | | 4,505,775 | |

Host Hotels & Resorts, Inc.(1),(3) | | | 14,084 | | | | 244,921 | |

Hudson Pacific Properties, Inc.(1),(2) | | | 72,207 | | | | 1,784,235 | |

InvenTrust Properties Corp.(2) | | | 12,471 | | | | 339,959 | |

Kilroy Realty Corp.(2) | | | 61,115 | | | | 4,061,703 | |

Kimco Realty Corp.(1),(2) | | | 157,035 | | | | 3,870,913 | |

Kite Realty Group Trust(2) | | | 435,933 | | | | 9,494,621 | |

Medical Properties Trust, Inc.(1),(2) | | | 176,279 | | | | 4,165,473 | |

MGM Growth Properties LLC, Class A(2) | | | 12,919 | | | | 527,741 | |

Mid-America Apartment Communities, Inc.(1),(2) | | | 69,650 | | | | 15,980,496 | |

Monmouth Real Estate Investment Corp.(2) | | | 11,629 | | | | 244,325 | |

National Storage Affiliates Trust(2) | | | 188,287 | | | | 13,029,460 | |

NETSTREIT Corp.(2) | | | 930,423 | | | | 21,306,687 | |

Newlake Capital Partners, Inc.(2) | | | 32,894 | | | | 943,400 | |

Omega Healthcare Investors, Inc.(2) | | | 82,382 | | | | 2,437,683 | |

Paramount Group, Inc.(2) | | | 894,295 | | | | 7,458,420 | |

Piedmont Office Realty Trust, Inc., Class A(2) | | | 786,790 | | | | 14,461,200 | |

Plymouth Industrial REIT, Inc.(2) | | | 219,170 | | | | 7,013,440 | |

Postal Realty Trust, Inc., Class A(2) | | | 102,330 | | | | 2,026,134 | |

Sabra Health Care REIT, Inc.(1),(2) | | | 79,310 | | | | 1,073,857 | |

Simon Property Group, Inc.(1),(2) | | | 2,676 | | | | 427,545 | |

Spirit Realty Capital, Inc.(2) | | | 84,162 | | | | 4,055,767 | |

Sun Communities, Inc.(2) | | | 44,179 | | | | 9,276,265 | |

Terreno Realty Corp.(2) | | | 227,840 | | | | 19,432,474 | |

Ventas, Inc.(1),(2) | | | 276,179 | | | | 14,118,270 | |

VICI Properties, Inc.(1),(2) | | | 69,518 | | | | 2,093,187 | |

The accompanying notes are an integral part of the financial statements.

15

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Common Stocks | |

Real Estate Investment Trusts | |

WP Carey, Inc.(1),(2) | | | 142,809 | | | | 11,717,478 | |

| | | | | | | | |

| | | | 352,990,961 | |

| | | | | | | | |

Road & Rail 5.9% | | | | | | | | |

ArcBest Corp.(2) | | | 704 | | | | 84,374 | |

Avis Budget Group, Inc.(3) | | | 415 | | | | 86,059 | |

Canadian Pacific Railway Ltd.(2),(4) | | | 79,266 | | | | 5,702,396 | |

CSX Corp.(1),(2) | | | 73,847 | | | | 2,776,647 | |

Heartland Express, Inc. | | | 1,714 | | | | 28,830 | |

Hertz Global Holdings, Inc.(2),(3) | | | 4,106 | | | | 102,609 | |

Norfolk Southern Corp.(2) | | | 1,515 | | | | 451,031 | |

Saia, Inc.(2),(3) | | | 4,214 | | | | 1,420,244 | |

Uber Technologies, Inc.(2),(3) | | | 47,437 | | | | 1,989,033 | |

XPO Logistics, Inc.(2),(3) | | | 12,342 | | | | 955,641 | |

| | | | | | | | |

| | | | 13,596,864 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment 33.9% | | | | | | | | |

Ambarella, Inc.(2),(3),(4) | | | 2,081 | | | | 422,214 | |

Applied Materials, Inc.(1),(2) | | | 30,330 | | | | 4,772,729 | |

ASML Holding N.V.(2),(4) | | | 8,636 | | | | 6,875,465 | |

Azenta, Inc.(1),(2) | | | 22,660 | | | | 2,336,473 | |

Broadcom, Inc.(1),(2) | | | 2,955 | | | | 1,966,287 | |

CMC Materials, Inc.(2) | | | 2,283 | | | | 437,628 | |

KLA Corp.(2) | | | 1,748 | | | | 751,832 | |

Kulicke & Soffa Industries, Inc.(1) | | | 8,823 | | | | 534,144 | |

Lam Research Corp.(1),(2) | | | 2,297 | | | | 1,651,888 | |

Marvell Technology, Inc.(1),(2) | | | 145,329 | | | | 12,714,834 | |

Micron Technology, Inc.(2) | | | 97,722 | | | | 9,102,804 | |

MKS Instruments, Inc.(1),(2) | | | 8,617 | | | | 1,500,823 | |

NeoPhotonics Corp.(2),(3) | | | 8,394 | | | | 129,016 | |

NVIDIA Corp.(1),(2) | | | 12,597 | | | | 3,704,904 | |

NXP Semiconductors N.V.(2),(4) | | | 4,230 | | | | 963,509 | |

ON Semiconductor Corp.(2),(3) | | | 24,531 | | | | 1,666,145 | |

QUALCOMM, Inc.(2) | | | 101,303 | | | | 18,525,280 | |

Ultra Clean Holdings, Inc.(2),(3) | | | 19,254 | | | | 1,104,409 | |

Wolfspeed, Inc.(1),(3) | | | 1,765 | | | | 197,274 | |

Xilinx, Inc.(2) | | | 39,867 | | | | 8,453,000 | |

| | | | | | | | |

| | | | 77,810,658 | |

| | | | | | | | |

Software 41.3% | | | | | | | | |

Adobe, Inc.(1),(2),(3) | | | 3,337 | | | | 1,892,279 | |

Alteryx, Inc., Class A(1),(2),(3) | | | 15,578 | | | | 942,469 | |

Anaplan, Inc.(2),(3) | | | 11,251 | | | | 515,858 | |

Asana, Inc., Class A(1),(3) | | | 7,004 | | | | 522,148 | |

Atlassian Corp. PLC, Class A(2),(3),(4) | | | 3,877 | | | | 1,478,261 | |

Autodesk, Inc.(2),(3) | | | 1,275 | | | | 358,517 | |

Avalara, Inc.(1),(3) | | | 1,406 | | | | 181,529 | |

Avaya Holdings Corp.(2),(3) | | | 9,263 | | | | 183,407 | |

Bill.com Holdings, Inc.(1),(3) | | | 3,502 | | | | 872,523 | |

Bottomline Technologies DE, Inc.(2),(3) | | | 22,224 | | | | 1,254,989 | |

Braze, Inc., Class A(2),(3) | | | 9,507 | | | | 733,560 | |

Cadence Design Systems, Inc.(2),(3) | | | 7,032 | | | | 1,310,413 | |

Cipher Mining, Inc.(2),(3) | | | 315,500 | | | | 1,460,765 | |

Cognyte Software Ltd.(2),(3),(4) | | | 75,720 | | | | 1,186,532 | |

CommVault Systems, Inc.(2),(3) | | | 6,982 | | | | 481,199 | |

Confluent, Inc., Class A(1),(2),(3) | | | 16,190 | | | | 1,234,326 | |

Crowdstrike Holdings, Inc., Class A(2),(3) | | | 2,294 | | | | 469,697 | |

CyberArk Software Ltd.(1),(2),(3),(4) | | | 8,472 | | | | 1,468,028 | |

Datadog, Inc., Class A(1),(2),(3) | | | 7,566 | | | | 1,347,580 | |

The accompanying notes are an integral part of the financial statements.

16

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Common Stocks | |

Software | |

Descartes Systems Group, Inc. (The)(2),(3),(4) | | | 2,817 | | | | 232,910 | |

DocuSign, Inc.(2),(3) | | | 881 | | | | 134,185 | |

Domo, Inc., Class B(1),(2),(3) | | | 79,513 | | | | 3,943,845 | |

Dynatrace, Inc.(2),(3) | | | 17,575 | | | | 1,060,651 | |

Elastic N.V.(2),(3),(4) | | | 7,419 | | | | 913,205 | |

EngageSmart, Inc.(2),(3) | | | 95,908 | | | | 2,313,301 | |

Everbridge, Inc.(1),(2),(3) | | | 4,696 | | | | 316,182 | |

Five9, Inc.(1),(2),(3) | | | 6,268 | | | | 860,722 | |

Fortinet, Inc.(1),(3) | | | 6,162 | | | | 2,214,623 | |

HubSpot, Inc.(2),(3) | | | 1,164 | | | | 767,251 | |

Intuit, Inc.(2) | | | 8,075 | | | | 5,194,001 | |

ironSource Ltd., Class A(2),(3),(4) | | | 263,591 | | | | 2,040,194 | |

Mandiant, Inc.(1),(3) | | | 20,946 | | | | 367,393 | |

Manhattan Associates, Inc.(2),(3) | | | 23,044 | | | | 3,583,112 | |

McAfee Corp., Class A(2) | | | 57,616 | | | | 1,485,917 | |

Microsoft Corp.(2) | | | 35,715 | | | | 12,011,669 | |

Mimecast Ltd.(2),(3),(4) | | | 5,626 | | | | 447,661 | |

Momentive Global, Inc.(2),(3) | | | 92,710 | | | | 1,960,817 | |

Nice Ltd., ADR(1),(2),(3),(4) | | | 1,054 | | | | 319,994 | |

Nuance Communications, Inc.(2),(3) | | | 89,873 | | | | 4,971,774 | |

Nutanix, Inc., Class A(2),(3) | | | 31,756 | | | | 1,011,746 | |

Palo Alto Networks, Inc.(1),(2),(3) | | | 7,050 | | | | 3,925,158 | |

RingCentral, Inc., Class A(1),(2),(3) | | | 3,183 | | | | 596,335 | |

Riskified Ltd., Class A(2),(3),(4) | | | 84,456 | | | | 663,824 | |

Sailpoint Technologies Holdings, Inc.(1),(2),(3) | | | 16,884 | | | | 816,173 | |

Samsara, Inc., Class A(2),(3) | | | 6,942 | | | | 195,140 | |

SentinelOne, Inc., Class A(2),(3) | | | 10,453 | | | | 527,772 | |

ServiceNow, Inc.(1),(2),(3) | | | 4,015 | | | | 2,606,177 | |

Smartsheet, Inc., Class A(1),(2),(3) | | | 19,925 | | | | 1,543,191 | |

Splunk, Inc.(1),(2),(3) | | | 10,575 | | | | 1,223,739 | |

Sumo Logic, Inc.(2),(3) | | | 56,336 | | | | 763,916 | |

Synchronoss Technologies, Inc.(1),(2),(3) | | | 77,136 | | | | 188,212 | |

Synopsys, Inc.(2),(3) | | | 5,386 | | | | 1,984,741 | |

Tenable Holdings, Inc.(2),(3) | | | 64,806 | | | | 3,568,866 | |

Tufin Software Technologies Ltd.(2),(3),(4) | | | 191,881 | | | | 2,024,345 | |

Unity Software, Inc.(3) | | | 2,455 | | | | 351,040 | |

Varonis Systems, Inc.(1),(2),(3) | | | 17,591 | | | | 858,089 | |

Verint Systems, Inc.(1),(2),(3) | | | 38,332 | | | | 2,012,813 | |

Vonage Holdings Corp.(2),(3) | | | 83,617 | | | | 1,738,397 | |

Workday, Inc., Class A(2),(3) | | | 6,592 | | | | 1,800,803 | |

Zendesk, Inc.(1),(2),(3) | | | 4,747 | | | | 495,065 | |

Zeta Global Holdings Corp., Class A(2),(3) | | | 65,425 | | | | 550,879 | |

Zscaler, Inc.(1),(2),(3) | | | 7,785 | | | | 2,501,554 | |

| | | | | | | | |

| | | | 94,981,462 | |

| | | | | | | | |

Specialty Retail 3.1% | | | | | | | | |

Bath & Body Works, Inc.(2) | | | 2,197 | | | | 153,329 | |

Brilliant Earth Group, Inc., Class A(2),(3) | | | 47,564 | | | | 859,006 | |

Citi Trends, Inc.(2),(3) | | | 16,197 | | | | 1,534,666 | |

Five Below, Inc.(2),(3) | | | 5,300 | | | | 1,096,517 | |

Home Depot, Inc. (The)(2) | | | 772 | | | | 320,388 | |

Lithia Motors, Inc., Class A(2) | | | 3,191 | | | | 947,567 | |

Lowe’s Cos., Inc.(2) | | | 5,824 | | | | 1,505,387 | |

Tractor Supply Co.(2) | | | 3,169 | | | | 756,123 | |

| | | | | | | | |

| | | | 7,172,983 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals 6.8% | | | | | | | | |

Apple, Inc.(2) | | | 41,829 | | | | 7,427,575 | |

The accompanying notes are an integral part of the financial statements.

17

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Common Stocks | |

Technology Hardware, Storage & Peripherals | |

NetApp, Inc.(1),(2) | | | 33,626 | | | | 3,093,256 | |

Pure Storage, Inc., Class A(2),(3) | | | 154,683 | | | | 5,034,932 | |

| | | | | | | | |

| | | | 15,555,763 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods 0.2% | |

Capri Holdings Ltd.(1),(2),(3),(4) | | | 8,392 | | | | 544,725 | |

| | | | | | | | |

Thrifts & Mortgage Finance 4.3% | |

Mr. Cooper Group, Inc.(2),(3) | | | 66,762 | | | | 2,777,967 | |

New York Community Bancorp, Inc.(1),(2) | | | 379,710 | | | | 4,636,259 | |

PennyMac Financial Services, Inc.(1),(2) | | | 23,447 | | | | 1,636,131 | |

UWM Holdings Corp.(1),(2) | | | 136,491 | | | | 808,027 | |

| | | | | | | | |

| | | | 9,858,384 | |

| | | | | | | | |

Trading Companies & Distributors 3.9% | |

AerCap Holdings N.V.(2),(3),(4) | | | 10,723 | | | | 701,499 | |

Air Lease Corp.(1),(2) | | | 3,509 | | | | 155,203 | |

Fortress Transportation and Infrastructure Investors LLC(2) | | | 11,755 | | | | 339,955 | |

Triton International Ltd.(2),(4) | | | 43,788 | | | | 2,637,351 | |

United Rentals, Inc.(2),(3) | | | 4,940 | | | | 1,641,512 | |

Watsco, Inc.(2) | | | 2,121 | | | | 663,618 | |

WESCO International, Inc.(1),(2),(3) | | | 17,647 | | | | 2,322,169 | |

WW Grainger, Inc.(1),(2) | | | 899 | | | | 465,898 | |

| | | | | | | | |

| | | | 8,927,205 | |

| | | | | | | | |

Wireless Telecommunication Services 0.4% | |

NII Holdings, Inc.(3) | | | 174,048 | | | | 60,917 | |

T-Mobile U.S., Inc.(1),(2),(3) | | | 8,134 | | | | 943,381 | |

| | | | | | | | |

| | | | 1,004,298 | |

| | | | | | | | |

Total Common Stocks (Cost $1,075,112,805) | | | | | | | 1,121,861,182 | |

| | | | | | | | |

Exchange-Traded Funds 6.4% | |

ARK Innovation ETF | | | 11,271 | | | | 1,066,124 | |

Energy Select Sector SPDR Fund(2) | | | 355 | | | | 19,703 | |

Financial Select Sector SPDR Fund | | | 16,967 | | | | 662,561 | |

Invesco S&P 500 Equal Weight ETF(2) | | | 38,792 | | | | 6,313,398 | |

Invesco S&P 500 Low Volatility ETF(2) | | | 38,403 | | | | 2,635,598 | |

iShares Russell 2000 ETF | | | 5,333 | | | | 1,186,326 | |

ProShares UltraShort 20+ Year Treasury ETF | | | 7,136 | | | | 120,527 | |

ProShares VIX Short-Term Futures ETF(2),(3) | | | 77,263 | | | | 1,172,080 | |

SPDR S&P 500 ETF Trust | | | 765 | | | | 363,344 | |

SPDR S&P Oil & Gas Exploration & Production ETF(1),(2) | | | 8,886 | | | | 851,901 | |

United States Oil Fund L.P.(2),(3) | | | 5,001 | | | | 271,854 | |

| | | | | | | | |

Total Exchange-Traded Funds (Cost $14,574,022) | | | | | | | 14,663,416 | |

| | | | | | | | |

Warrants 0.4% | |

Biotechnology 0.0% | |

EQRx, Inc.(2),(3) | | | 33,681 | | | | 35,877 | |

| | | | | | | | |

Diversified Financial Services 0.1% | |

Aequi Acquisition Corp., Class A(2),(3) | | | 8,874 | | | | 4,855 | |

Argus Capital Corp., Class A(2),(3) | | | 50,166 | | | | 27,090 | |

Gores Technology Partners II, Inc.(2),(3) | | | 3,126 | | | | 4,330 | |

HumanCo Acquisition Corp., Class A(2),(3) | | | 150,043 | | | | 108,038 | |

| | | | | | | | |

| | | | 144,313 | |

| | | | | | | | |

Health Care Technology 0.1% | |

Multiplan Corp.(2),(3) | | | 4,362 | | | | 5,561 | |

The accompanying notes are an integral part of the financial statements.

18

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Warrants | |

Health Care Technology | |

Sema4 Holdings Corp.(2),(3) | | | 304,201 | | | | 296,596 | |

| | | | | | | | |

| | | | 302,157 | |

| | | | | | | | |

Life Sciences Tools & Services 0.2% | |

SomaLogic, Inc.(2),(3) | | | 120,844 | | | | 412,078 | |

| | | | | | | | |

Total Warrants (Cost $1,386,517) | | | | | | | 894,425 | |

| | | | | | | | |

Total Long Investments (Cost $1,091,073,344) | | | | | | | 1,137,419,023 | |

| | | | | | | | |

Securities Sold Short (5)(415.6)% | |

Common Stocks (292.2)% | |

Aerospace & Defense (1.7)% | |

Aerojet Rocketdyne Holdings, Inc. | | | 51,372 | | | | (2,402,155 | ) |

Boeing Co. (The) | | | 5,647 | | | | (1,136,854 | ) |

Northrop Grumman Corp. | | | 744 | | | | (287,980 | ) |

Virgin Galactic Holdings, Inc. | | | 8,718 | | | | (116,647 | ) |

| | | | | | | | |

| | | | (3,943,636 | ) |

| | | | | | | | |

Air Freight & Logistics (1.3)% | |

United Parcel Service, Inc., Class B | | | 13,456 | | | | (2,884,159 | ) |

| | | | | | | | |

Airlines (1.0)% | |

American Airlines Group, Inc. | | | 33,434 | | | | (600,475 | ) |

United Airlines Holdings, Inc. | | | 38,723 | | | | (1,695,293 | ) |

| | | | | | | | |

| | | | (2,295,768 | ) |

| | | | | | | | |

Auto Components (1.6)% | |

American Axle & Manufacturing Holdings, Inc. | | | 21,062 | | | | (196,509 | ) |

Lear Corp. | | | 4,559 | | | | (834,069 | ) |

Veoneer, Inc. | | | 71,440 | | | | (2,534,691 | ) |

| | | | | | | | |

| | | | (3,565,269 | ) |

| | | | | | | | |

Automobiles (0.8)% | |

Fisker, Inc. | | | 17,530 | | | | (275,747 | ) |

Stellantis N.V.(4) | | | 77,466 | | | | (1,453,262 | ) |

| | | | | | | | |

| | | | (1,729,009 | ) |

| | | | | | | | |

Banks (34.2)% | |

Ameris Bancorp | | | 43,851 | | | | (2,178,518 | ) |

Associated Banc-Corp | | | 41,791 | | | | (944,059 | ) |

Bank of America Corp. | | | 284,535 | | | | (12,658,962 | ) |

BankUnited, Inc. | | | 61,192 | | | | (2,589,033 | ) |

Citigroup, Inc. | | | 42,045 | | | | (2,539,098 | ) |

Columbia Banking System, Inc. | | | 6,657 | | | | (217,817 | ) |

Cullen/Frost Bankers, Inc. | | | 30,514 | | | | (3,846,900 | ) |

East West Bancorp, Inc. | | | 54,739 | | | | (4,306,864 | ) |

Fifth Third Bancorp | | | 202,556 | | | | (8,821,314 | ) |

First Horizon Corp. | | | 317,088 | | | | (5,178,047 | ) |

First Republic Bank | | | 13,820 | | | | (2,853,968 | ) |

FNB Corp. | | | 186,626 | | | | (2,263,773 | ) |

Great Western Bancorp, Inc. | | | 26,890 | | | | (913,184 | ) |

Hancock Whitney Corp. | | | 47,459 | | | | (2,373,899 | ) |

Hilltop Holdings, Inc. | | | 49,243 | | | | (1,730,399 | ) |

PNC Financial Services Group, Inc. (The) | | | 34,871 | | | | (6,992,333 | ) |

Regions Financial Corp. | | | 321,551 | | | | (7,009,812 | ) |

Renasant Corp. | | | 45,727 | | | | (1,735,340 | ) |

Simmons First National Corp., Class A | | | 49,638 | | | | (1,468,292 | ) |

Texas Capital Bancshares, Inc. | | | 43,592 | | | | (2,626,418 | ) |

Truist Financial Corp. | | | 90,512 | | | | (5,299,478 | ) |

| | | | | | | | |

| | | | (78,547,508 | ) |

| | | | | | | | |

Beverages (9.0)% | |

Anheuser-Busch InBev S.A., ADR(4) | | | 2,096 | | | | (126,913 | ) |

The accompanying notes are an integral part of the financial statements.

19

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Common Stocks | |

Beverages | |

Keurig Dr Pepper, Inc. | | | 116,905 | | | | (4,309,118) | |

Molson Coors Beverage Co., Class B | | | 68,043 | | | | (3,153,793) | |

National Beverage Corp. | | | 67,083 | | | | (3,040,873) | |

PepsiCo, Inc. | | | 57,562 | | | | (9,999,095) | |

| | | | | | | | |

| | | | (20,629,792) | |

| | | | | | | | |

Biotechnology (1.0)% | | | | | | | | |

Cerevel Therapeutics Holdings, Inc. | | | 355 | | | | (11,509) | |

Exact Sciences Corp. | | | 3,378 | | | | (262,910) | |

Invitae Corp. | | | 38,651 | | | | (590,201) | |

Kodiak Sciences, Inc. | | | 1,091 | | | | (92,495) | |

Moderna, Inc. | | | 1,382 | | | | (351,000) | |

Novavax, Inc. | | | 883 | | | | (126,331) | |

Twist Bioscience Corp. | | | 12,171 | | | | (941,913) | |

| | | | | | | | |

| | | | (2,376,359) | |

| | | | | | | | |

Building Products (3.0)% | | | | | | | | |

Allegion PLC(4) | | | 11,842 | | | | (1,568,354) | |

American Woodmark Corp. | | | 6,947 | | | | (452,944) | |

AO Smith Corp. | | | 11,846 | | | | (1,016,979) | |

Armstrong World Industries, Inc. | | | 2,733 | | | | (317,356) | |

AZEK Co., Inc. (The) | | | 2,119 | | | | (97,983) | |

Lennox International, Inc. | | | 4,928 | | | | (1,598,446) | |

Owens Corning | | | 1,887 | | | | (170,774) | |

Trane Technologies PLC(4) | | | 7,459 | | | | (1,506,942) | |

Zurn Water Solutions Corp. | | | 3,515 | | | | (127,946) | |

| | | | | | | | |

| | | | (6,857,724) | |

| | | | | | | | |

Capital Markets (6.2)% | | | | | | | | |

Apollo Global Management, Inc. | | | 20,573 | | | | (1,490,102) | |

Bank of New York Mellon Corp. (The) | | | 62,275 | | | | (3,616,932) | |

Charles Schwab Corp. (The) | | | 13,834 | | | | (1,163,440) | |

S&P Global, Inc. | | | 16,880 | | | | (7,966,178) | |

| | | | | | | | |

| | | | (14,236,652) | |

| | | | | | | | |

Chemicals (2.8)% | | | | | | | | |

Ashland Global Holdings, Inc. | | | 1,757 | | | | (189,159) | |

Celanese Corp. | | | 1,054 | | | | (177,135) | |

Danimer Scientific, Inc. | | | 13,866 | | | | (118,138) | |

Dow, Inc. | | | 18,961 | | | | (1,075,468) | |

Ecolab, Inc. | | | 1,216 | | | | (285,261) | |

International Flavors & Fragrances, Inc. | | | 4,929 | | | | (742,554) | |

LyondellBasell Industries N.V., Class A(4) | | | 8,672 | | | | (799,819) | |

Olin Corp. | | | 11,279 | | | | (648,768) | |

PureCycle Technologies, Inc. | | | 17,757 | | | | (169,935) | |

RPM International, Inc. | | | 3,758 | | | | (379,558) | |

Sherwin-Williams Co. (The) | | | 5,140 | | | | (1,810,102) | |

| | | | | | | | |

| | | | (6,395,897) | |

| | | | | | | | |

Communications Equipment (0.5)% | | | | | | | | |

Cisco Systems, Inc. | | | 3,034 | | | | (192,265) | |

The accompanying notes are an integral part of the financial statements.

20

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Common Stocks | |

Communications Equipment | |

Viasat, Inc. | | | 20,514 | | | | (913,693) | |

| | | | | | | | |

| | | | (1,105,958) | |

| | | | | | | | |

Construction & Engineering (0.0)% | | | | | | | | |

Quanta Services, Inc. | | | 175 | | | | (20,066) | |

| | | | | | | | |

Construction Materials (0.2)% | | | | | | | | |

Vulcan Materials Co. | | | 1,985 | | | | (412,046) | |

| | | | | | | | |

Consumer Finance (5.1)% | | | | | | | | |

American Express Co. | | | 26,246 | | | | (4,293,846) | |

Capital One Financial Corp. | | | 12,323 | | | | (1,787,944) | |

Credit Acceptance Corp. | | | 176 | | | | (121,032) | |

Discover Financial Services | | | 45,409 | | | | (5,247,464) | |

SoFi Technologies, Inc. | | | 15,960 | | | | (252,327) | |

| | | | | | | | |

| | | | (11,702,613) | |

| | | | | | | | |

Containers & Packaging (1.1)% | | | | | | | | |

Amcor PLC(4) | | | 42,180 | | | | (506,582) | |

Ball Corp. | | | 21,981 | | | | (2,116,111) | |

| | | | | | | | |

| | | | (2,622,693) | |

| | | | | | | | |

Diversified Consumer Services (0.1)% | | | | | | | | |

Udemy, Inc. | | | 15,867 | | | | (310,041) | |

| | | | | | | | |

Diversified Telecommunication Services (1.7)% | | | | | | | | |

Verizon Communications, Inc. | | | 75,091 | | | | (3,901,728) | |

| | | | | | | | |

Electric Utilities (0.3)% | | | | | | | | |

Avangrid, Inc. | | | 15,226 | | | | (759,473) | |

| | | | | | | | |

Electrical Equipment (2.1)% | | | | | | | | |

Bloom Energy Corp., Class A | | | 17,560 | | | | (385,091) | |

Eaton Corp. PLC(4) | | | 4,830 | | | | (834,721) | |

Emerson Electric Co. | | | 10,726 | | | | (997,196) | |

Hubbell, Inc. | | | 3,697 | | | | (769,974) | |

Rockwell Automation, Inc. | | | 3,744 | | | | (1,306,095) | |

Shoals Technologies Group, Inc., Class A | | | 9,891 | | | | (240,351) | |

Vertiv Holdings Co. | | | 14,295 | | | | (356,946) | |

| | | | | | | | |

| | | | (4,890,374) | |

| | | | | | | | |

Electronic Equipment, Instruments & Components (1.6)% | | | | | | | | |

Amphenol Corp., Class A | | | 13,999 | | | | (1,224,352) | |

TD SYNNEX Corp. | | | 21,121 | | | | (2,415,398) | |

| | | | | | | | |

| | | | (3,639,750) | |

| | | | | | | | |

Energy Equipment & Services (0.4)% | | | | | | | | |

Baker Hughes Co. | | | 41,581 | | | | (1,000,439) | |

ProPetro Holding Corp. | | | 3,600 | | | | (29,160) | |

| | | | | | | | |

| | | | (1,029,599) | |

| | | | | | | | |

Entertainment (3.0)% | | | | | | | | |

Electronic Arts, Inc. | | | 21,246 | | | | (2,802,347) | |

Endeavor Group Holdings, Inc., Class A | | | 41,029 | | | | (1,431,502) | |

Roku, Inc. | | | 4,283 | | | | (977,380) | |

Walt Disney Co. (The) | | | 10,267 | | | | (1,590,256) | |

| | | | | | | | |

| | | | (6,801,485) | |

| | | | | | | | |

Food & Staples Retailing (2.7)% | | | | | | | | |

Costco Wholesale Corp. | | | 3,954 | | | | (2,244,686) | |

Sysco Corp. | | | 50,321 | | | | (3,952,715) | |

The accompanying notes are an integral part of the financial statements.

21

Schedule of Investments

Weiss Strategic Interval Fund

December 31, 2021

| | | | | | | | |

| Investments | | Shares | | | Value |

Common Stocks | |

Food & Staples Retailing | |

Walmart, Inc. | | | 305 | | | | (44,130) | |

| | | | | | | | |

| | | | (6,241,531) | |

| | | | | | | | |

Food Products (12.4)% | | | | | | | | |

Archer-Daniels-Midland Co. | | | 60,776 | | | | (4,107,850) | |

B&G Foods, Inc. | | | 70,870 | | | | (2,177,835) | |

Campbell Soup Co. | | | 59,211 | | | | (2,573,310) | |

Flowers Foods, Inc. | | | 182,195 | | | | (5,004,897) | |

General Mills, Inc. | | | 4,919 | | | | (331,442) | |

Kellogg Co. | | | 45,877 | | | | (2,955,396) | |