CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Other than the compensation agreements and other arrangements described under “Executive Compensation” and “Director Compensation” in this prospectus and the transactions described below, since April 29, 2014 (date of inception), there has not been and there is not currently proposed, any transaction or series of similar transactions to which we were, or will be, a party in which the amount involved exceeded, or will exceed, $120,000 and in which any director, executive officer, holder of five percent or more of any class of our capital stock or any member of the immediate family of, or entities affiliated with, any of the foregoing persons, had, or will have, a direct or indirect material interest.

We believe the terms obtained or consideration that we paid or received, as applicable, in connection with the transactions described below were comparable to terms available or the amounts that we would pay or receive, as applicable, inarm’s-length transactions.

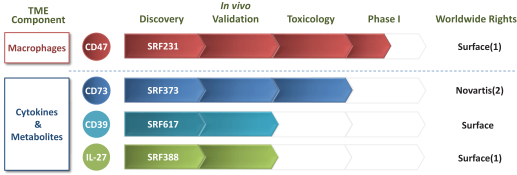

Collaboration With Novartis

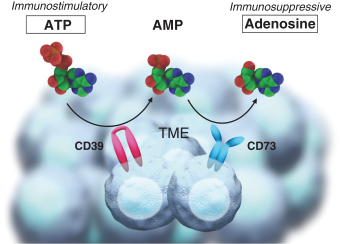

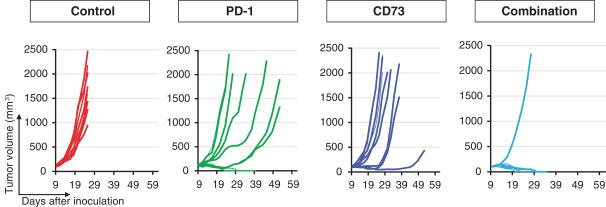

In January 2016, we entered into a strategic collaboration agreement, or the Collaboration Agreement, with Novartis Institutes for Biomedical Research, Inc., or Novartis, to develop next-generation cancer therapies. The Collaboration Agreement was subsequently amended in May 2016, July 2017 and September 2017. Pursuant to the Collaboration Agreement, we granted Novartis an exclusive license to research, develop, manufacture and commercialize antibodies that target CD73, along with the right to purchase exclusive option rights to up to four specified targets to obtain certain development, manufacturing and commercialization rights. Novartis may exercise up to three purchased options. We received an upfront payment of $70.0 million from Novartis upon entering into the agreement. Under the Collaboration Agreement, we are entitled to potential option purchase, option exercise and milestone payments upon the achievement of specified development and sales milestones, which could amount to $1.39 billion, as well as tiered royalties on annual net sales by Novartis on licensed products ranging from high single-digit to mid-teens percentages. In addition, we are required to pay Novartis tiered royalties on annual net sales by us of licensed products in the United States ranging from high single-digit to mid-teens percentages. Through December 31, 2017, we had received an aggregate of $35.0 million in option purchase and milestone payments from Novartis. In February 2018, we received an additional milestone payment of $45.0 million from Novartis. See “Business—Strategic Collaboration with Novartis” for further information regarding the Collaboration Agreement. In January 2016, we also received a $13.5 million equity investment from Novartis.

Participation Agreement

In connection with entering into the Collaboration Agreement, we entered into a participation agreement, or the Participation Agreement, with Novartis. The Participation Agreement gives us the right, in our sole discretion, to require Novartis to participate in any (i) private placement of our preferred or common stock or (ii) our initial public offering, up to an aggregate of $11.5 million, subject to certain conditions. The rights granted under the Participation Agreement will terminate upon the completion of this offering, if not exercised by us.

Sublease with CoStim (a Subsidiary of Novartis)

In November 2014, we entered into a sublease with CoStim Pharmaceuticals, Inc., or CoStim, a subsidiary of Novartis, to provide for the lease of 6,815 square feet of office and laboratory space in a building in Cambridge, Massachusetts. Pursuant to this sublease, we are to pay CoStim an aggregate of $1.5 million of base rent, payable in monthly installments of approximately $30,000, in addition to assuming all of CoStim’s additional rent obligations under its prime lease. Effective as of April 1, 2017, we entered into a sublease of the space to VL42, Inc. For the years ended December 31, 2014, 2015, 2016 and 2017, we paid CoStim an aggregate of $0, $0.6 million, $0.6 million and $0.6 million, respectively. The term of the sublease will terminate on March 31, 2018.

147