| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-207132-15 | ||

October 16, 2017

Free Writing Prospectus

Structural and Collateral Term Sheet

$977,059,894

(Approximate Initial Mortgage Pool Balance)

$842,714,000

(Offered Certificates)

Citigroup Commercial Mortgage Trust 2017-C4

As Issuing Entity

Citigroup Commercial Mortgage Securities Inc.

As Depositor

Commercial Mortgage Pass-Through Certificates, Series 2017-C4

Citi Real Estate Funding Inc.

Cantor Commercial Real Estate Lending, L.P.

Ladder Capital Finance LLC

German American Capital Corporation

Rialto Mortgage Finance, LLC

As Sponsors and Mortgage Loan Sellers

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc., Cantor Fitzgerald & Co., Academy Securities, Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation being made that these materials are accurate or complete and that these materials may not be updated or (3) these materials possibly being confidential, are, in each case, not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| Citigroup | Cantor Fitzgerald & Co. | Deutsche Bank Securities |

| Co-Lead Managers and Joint Bookrunners | |

| Academy Securities | |

| Co-Manager | |

| CERTIFICATE SUMMARY |

The securities offered by this structural and collateral term sheet (this “Term Sheet”) are described in greater detail in the preliminary prospectus, dated on or about October 16, 2017, included as part of our registration statement (SEC File No. 333-207132) (the “Preliminary Prospectus”). The Preliminary Prospectus contains material information that is not contained in this Term Sheet (including, without limitation, a detailed discussion of risks associated with an investment in the offered securities under the heading“Risk Factors” in the Preliminary Prospectus). The Preliminary Prospectus is available upon request from Citigroup Global Markets Inc., Deutsche Bank Securities Inc., Cantor Fitzgerald & Co. or Academy Securities, Inc. This Term Sheet is subject to change.

For information regarding certain risks associated with an investment in this transaction, refer to “Risk Factors” in the Preliminary Prospectus. Capitalized terms used but not otherwise defined in this Term Sheet have the respective meanings assigned to those terms in the Preliminary Prospectus.

The Securities May Not Be a Suitable Investment for You

The securities offered by this Term Sheet are not suitable investments for all investors. In particular, you should not purchase any class of securities unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with that class of securities. For those reasons and for the reasons set forth under the heading “Risk Factors” in the Preliminary Prospectus, the yield to maturity of, the aggregate amount and timing of distributions on and the market value of the offered securities are subject to material variability from period to period and give rise to the potential for significant loss over the life of those securities. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered securities involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the securities. Potential investors are advised and encouraged to review the Preliminary Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered securities described in this Term Sheet.

The securities offered by these materials are being offered when, as and if issued. This Term Sheet is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this Term Sheet may not pertain to any securities that will actually be sold. The information contained in this Term Sheet may be based on assumptions regarding market conditions and other matters as reflected in this Term Sheet. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this Term Sheet should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this Term Sheet may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this Term Sheet or derivatives thereof (including options). Information contained in this Term Sheet is current as of the date appearing on this Term Sheet only. Information in this Term Sheet regarding the securities and the mortgage loans backing any securities discussed in this Term Sheet supersedes all prior information regarding such securities and mortgage loans. None ofCitigroup Global Markets Inc., Deutsche Bank Securities Inc., Cantor Fitzgerald & Co. or Academy Securities, Inc.provides accounting, tax or legal advice.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

2

The issuing entity will be relying on an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity and Other Aspects of the Offered Certificates” in the Preliminary Prospectus). See also “Legal Investment” in the Preliminary Prospectus.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

3

| CERTIFICATE SUMMARY |

| OFFERED CERTIFICATES | |||||||||||||||

| Offered Classes | Expected Ratings (Moody’s / Fitch / KBRA)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Initial Pass- Through Rate(4) | Pass-Through Rate Description | Expected Wtd. Avg. Life (Yrs)(5) | Expected Principal Window(5) | ||||||||

| Class A-1 | Aaa(sf) / AAAsf / AAA(sf) | $27,750,000 | 30.000% | % | (6) | 2.69 | 11/17 - 8/22 | ||||||||

| Class A-2 | Aaa(sf) / AAAsf / AAA(sf) | $103,900,000 | 30.000% | % | (6) | 4.93 | 8/22 - 10/22 | ||||||||

| Class A-3 | Aaa(sf) / AAAsf / AAA(sf) | $240,000,000 | 30.000% | % | (6) | 9.67 | 3/27 - 8/27 | ||||||||

| Class A-4 | Aaa(sf) / AAAsf / AAA(sf) | $271,691,000 | 30.000% | % | (6) | 9.85 | 8/27 - 9/27 | ||||||||

| Class A-AB | Aaa(sf) / AAAsf / AAA(sf) | $40,600,000 | 30.000% | % | (6) | 7.41 | 10/22 - 6/27 | ||||||||

| Class X-A | Aa1(sf) / AAAsf / AAA(sf) | $757,221,000 | (7) | N/A | % | Variable IO(8) | N/A | N/A | |||||||

| Class X-B | NR / A-sf / AAA(sf) | $85,493,000 | (7) | N/A | % | Variable IO(8) | N/A | N/A | |||||||

| Class A-S | Aa3(sf) / AAAsf / AAA(sf) | $73,280,000 | 22.500% | % | (6) | 9.87 | 9/27 - 9/27 | ||||||||

| Class B | NR / AA-sf / AA(sf) | $45,189,000 | 17.875% | % | (6) | 9.87 | 9/27 - 10/27 | ||||||||

| Class C | NR / A-sf / A-(sf) | $40,304,000 | 13.750% | % | (6) | 9.95 | 10/27 - 10/27 | ||||||||

| NON-OFFERED CERTIFICATES | |||||||||||||||

| Non-Offered Classes | Expected Ratings (Moody’s / Fitch / KBRA)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Initial Pass- Through Rate(4) | Pass-Through Rate Description | Expected Wtd. Avg. Life (Yrs)(5) | Expected Principal Window(5) | ||||||||

| Class X-D | NR / BBB-sf / BBB(sf) | $31,754,000 | (7) | N/A | % | Variable IO(8) | N/A | N/A | |||||||

| Class D | NR / BBB-sf / BBB(sf) | $31,754,000 | (9) | 10.500% | % | (6) | 9.95 | 10/27 - 10/27 | |||||||

| Class E-RR(10) | NR / BBB-sf / BBB-(sf) | $19,541,000 | (9) | 8.500% | % | (6) | 9.95 | 10/27 - 10/27 | |||||||

| Class F-RR(10) | NR / BB+sf / BBB-(sf) | $12,214,000 | 7.250% | % | (6) | 9.95 | 10/27 - 10/27 | ||||||||

| Class G-RR(10) | NR / BB-sf / BB(sf) | $12,213,000 | 6.000% | % | (6) | 9.95 | 10/27 - 10/27 | ||||||||

| Class H-RR(10) | NR / B-sf /B+(sf) | $9,770,000 | 5.000% | % | (6) | 9.96 | 10/27 - 11/27 | ||||||||

| Class J-RR(10) | NR / NR / NR | $48,853,893 | 0.000% | % | (6) | 10.03 | 11/27 - 11/27 | ||||||||

| Class S(11) | N/A | N/A | N/A | N/A | N/A | N/A | N/A | ||||||||

| Class R(11) | N/A | N/A | N/A | N/A | N/A | N/A | N/A | ||||||||

| (1) | It is a condition of issuance that the offered certificates and certain classes of non-offered certificates receive the ratings set forth above. The anticipated ratings shown are those of Moody’s Investors Service, Inc. (“Moody’s”), Fitch Ratings, Inc. (“Fitch”) and Kroll Bond Rating Agency, Inc. (“KBRA”). Subject to the discussion under “Ratings” in the Preliminary Prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders of all payments of interest to which they are entitled on each distribution date and, except in the case of the interest only certificates, the ultimate receipt by holders of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the Preliminary Prospectus. Moody’s, Fitch and KBRA have informed us that the “sf” designation in the ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related rating agency’s website. The depositor and the underwriters have not verified, do not adopt and do not accept responsibility for any statements made by the rating agencies on those websites. Credit ratings referenced throughout this Term Sheet are forward-looking opinions about credit risk and express a rating agency’s opinion about the willingness and ability of an issuer of securities to meet its financial obligations in full and on time. Ratings are not indications of investment merit and are not buy, sell or hold recommendations, a measure of asset value or an indication of the suitability of an investment. |

| (2) | Approximate, subject to a variance of plus or minus 5% and any variation in the certificate balances of the Class D certificates and the RR Certificates (as defined in footnote (10) below), including as described in footnote (9) below, following calculation of the actual fair value of all of the “ABS interests” (as such term is defined in Regulation RR) issued by the issuing entity, as described under “Credit Risk Retention” in the Preliminary Prospectus. In addition, the notional amounts of the Class X-A, Class X-B and Class X-D certificates may vary depending upon the final pricing of the classes of Principal Balance Certificates (as defined in footnote (6) below) whose certificate balances comprise such notional amounts, and, if as a result of such pricing the pass-through rate of any class of the Class X-A, Class X-B or Class X-D certificates, as applicable, would be equal to zero at all times, such class of certificates will not be issued on the closing date of this securitization. |

| (3) | The approximate initial credit support percentages set forth for the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates are represented in the aggregate. |

| (4) | Approximateper annum rate as of the Closing Date. |

| (5) | Determined assuming no prepayments prior to the maturity date or any anticipated repayment date, as applicable, for anymortgageloan and based on the modeling assumptions describedunder “Yield, Prepayment and Maturity Considerations” in the Preliminary Prospectus. |

| (6) | For any distribution date, the pass-through rate for each class of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB, Class A-S, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR and Class J-RR certificates (collectively, the “Principal Balance Certificates”) will generally be equal to one of (i) a fixedper annum rate, (ii) the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as in effect from time to time, (iii) a rate equal to the lesser of a specifiedper annum rate and the weighted average rate described in clause (ii), or (iv) the weighted average rate described in clause (ii) less a specified percentage, but no less than 0.000%, as describedunder“Description of the Certificates—Distributions—Pass-Through Rates” in the Preliminary Prospectus. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

4

| (7) | The Class X-A, Class X-B and Class X-D certificates (collectively, the “Class X Certificates”) will not have certificate balances and will not be entitled to receive distributions of principal. Interest will accrue on each class of Class X Certificates at the related pass-through rate based upon the related notional amount. The notional amount of each class of the Class X Certificates will be equal to the certificate balance or the aggregate of the certificate balances, as applicable, from time to time of the class or classes of the Principal Balance Certificates identified in the same row as such class of Class X Certificates in the chart below (as to such class of Class X Certificates, the “Corresponding Principal Balance Certificates”): |

| Class of Class X Certificates | Class(es) of Corresponding Principal Balance Certificates |

| Class X-A | Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB and Class A-S |

| Class X-B | Class B and Class C |

| Class X-D | Class D |

| (8) | The pass-through rate for each class of Class X Certificates will generally be aper annumrate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as in effect from time to time, over (ii) the pass-through rate (or, if applicable, the weighted average of the pass-through rates) of the class or classes of Corresponding Principal Balance Certificates as in effect from time to time, as described in the Preliminary Prospectus. |

| (9) | The approximate initial certificate balances of the Class D and Class E-RR certificates are estimated based in part on the estimated ranges of certificate balances and estimated fair values described in “Credit Risk Retention” in the Preliminary Prospectus. The initial certificate balance of the Class D certificates is expected to fall within a range of $27,455,000 and $31,754,000, and the initial certificate balance of the Class E-RR certificates is expected to fall within a range of $19,541,000 and $23,840,000, with the ultimate initial certificate balances of the Class D and Class E-RR certificates determined such that, upon initial issuance, the aggregate fair value of the RR Certificates will equal at least 5% of the estimated fair value of all ABS interests issued by the issuing entity. |

| (10) | In satisfaction of the risk retention obligations of Citi Real Estate Funding Inc. (as retaining sponsor) with respect to this transaction, all of the Class E-RR, Class F-RR, Class G-RR, Class H-RR and Class J-RR certificates (collectively, the “RR Certificates”), in the aggregate initial certificate balance of approximately $102,591,893, and with a fair value expected to represent at least 5.0% of the fair value, as of the closing date for this transaction, of all ABS interests issued by the issuing entity, will constitute an “eligible horizontal residual interest” (as such term is defined in Regulation RR) that is to be purchased and retained by KKR Real Estate Credit Opportunity Partners Aggregator I L.P. in accordance with the credit risk retention rules applicable to this securitization transaction. See “Credit Risk Retention” in the Preliminary Prospectus. |

| (11) | Neither the Class S certificates nor the Class R certificates will have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date.Excess interest accruing after the related anticipated repayment date on any mortgage loan with an anticipated repayment date will, to the extent collected, be allocated to the Class S certificates as set forth in “Description of the Certificates—Distributions—Excess Interest” in the Preliminary Prospectus.The Class R certificates will represent the residual interests in each of two separate REMICs, as further described in the Preliminary Prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

5

| MORTGAGE POOL CHARACTERISTICS |

| Mortgage Pool Characteristics(1) | |

| Initial Pool Balance(2) | $977,059,894 |

| Number of Mortgage Loans | 57 |

| Number of Mortgaged Properties | 95 |

| Average Cut-off Date Balance | $17,141,402 |

| Weighted Average Mortgage Rate | 4.46836% |

| Weighted Average Remaining Term to Maturity/ARD (months)(3) | 112 |

| Weighted Average Remaining Amortization Term (months)(4) | 353 |

| Weighted Average Cut-off Date LTV Ratio(5) | 59.1% |

| Weighted Average Maturity Date/ARD LTV Ratio(3)(5) | 54.4% |

| Weighted Average UW NCF DSCR(6) | 1.89x |

| Weighted Average Debt Yield on Underwritten NOI(7) | 10.9% |

| % of Initial Pool Balance of Mortgage Loans that are Amortizing Balloon | 25.9% |

| % of Initial Pool Balance of Mortgage Loans that are Interest Only then Amortizing Balloon | 32.2% |

| % of Initial Pool Balance of Mortgage Loans that are Interest Only | 41.9% |

| % of Initial Pool Balance of Mortgaged Properties with Single Tenants | 16.3% |

| % of Initial Pool Balance of Mortgage Loans with Mezzanine Debt | 10.2% |

| % of Initial Pool Balance of Mortgage Loans with Subordinate Debt | 4.9% |

| (1) | The Cut-off Date LTV Ratio, Maturity Date/ARD LTV Ratio, UW NCF DSCR, Debt Yield on Underwritten NOI and Cut-off Date Balance Per SF / Rooms information for each mortgage loan is presented in this Term Sheet (i) if such mortgage loan is part of a loan combination (as defined under “Collateral Overview—Loan Combination Summary” below), based on both that mortgage loan and any related pari passu companion loan(s) but, unless otherwise specifically indicated, without regard to any related subordinate companion loan(s), and (ii) unless otherwise specifically indicated, without regard to any other indebtedness (whether or not secured by the related mortgaged property, ownership interests in the related borrower or otherwise) that currently exists or that may be incurred by the related borrower or its owners in the future. |

| (2) | Subject to a permitted variance of plus or minus 5%. |

| (3) | Unless otherwise indicated, mortgage loans with anticipated repayment dates are presented as if they were to mature on the anticipated repayment date. |

| (4) | Excludes mortgage loans that are interest-only for the entire term. |

| (5) | The Cut-off Date LTV Ratios and Maturity Date/ARD LTV Ratios presented in this Term Sheet are generally based on the “as-is” appraised values of the related mortgaged properties (as set forth on Annex A to the Preliminary Prospectus), provided that such LTV ratios may be calculated (i) based on “as-stabilized” or similar values in certain cases where the completion of certain hypothetical conditions or other events at the property are assumed and/or where reserves have been established at origination to satisfy the applicable condition or event that is expected to occur or (ii) based on an “as-is portfolio value”, which represents the appraised value for a portfolio of mortgaged properties as a whole and not the sum of the appraised values for each of the individual mortgaged properties, in each case as further described in the definitions of “Appraised Value”, “Cut-off Date LTV Ratio” and “Maturity Date/ARD LTV Ratio” under “Certain Definitions” in this Term Sheet and under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus. |

| (6) | The UW NCF DSCR for each mortgage loan is generally calculated by dividing the UW NCF for the related mortgaged property or mortgaged properties by the annual debt service for such mortgage loan, as adjusted in the case of mortgage loans with a partial interest only period by using the first 12 amortizing payments due instead of the actual interest only payment due. |

| (7) | The Debt Yield on Underwritten NOI for each mortgage loan is generally calculated as the related mortgaged property’s Underwritten NOI divided by the Cut-off Date Balance of such mortgage loan, and the Debt Yield on Underwritten NCF for each mortgage loan is generally calculated as the related mortgaged property’s Underwritten NCF divided by the Cut-off Date Balance of such mortgage loan. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

6

| KEY FEATURES OF THE CERTIFICATES |

| Co-Lead Managers and Joint Bookrunners: | Citigroup Global Markets Inc. Deutsche Bank Securities Inc. Cantor Fitzgerald & Co. | |

| Co-Manager: | Academy Securities, Inc. | |

| Depositor: | Citigroup Commercial Mortgage Securities Inc. | |

| Initial Pool Balance: | $977,059,894 | |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association | |

| Special Servicer: | Midland Loan Services, a Division of PNC Bank, National Association | |

| Certificate Administrator: | Citibank, N.A. | |

Trustee: | Wilmington Trust, National Association | |

| Operating Advisor: | Park Bridge Lender Services LLC | |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC | |

| Credit Risk Retention: | For a discussion on the manner in which the U.S. credit risk retention requirements are being satisfied by Citi Real Estate Funding Inc., as retaining sponsor, see “Credit Risk Retention” in the Preliminary Prospectus. Note that this securitization transaction is not structured to satisfy the EU risk retention and due diligence requirements. | |

| Closing Date: | On or about October 31, 2017 | |

| Cut-off Date: | With respect to each mortgage loan, the due date in October 2017 for that mortgage loan (or, in the case of any mortgage loan that has its first due date subsequent to October 2017, the date that would have been its due date in October 2017 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month) | |

| Determination Date: | The 8th day of each month or next business day, commencing in November 2017 | |

| Distribution Date: | The 4th business day after the Determination Date, commencing in November 2017 | |

| Interest Accrual: | Preceding calendar month | |

| ERISA Eligible: | The offered certificates are expected to be ERISA eligible, subject to the exemption conditions described in the Preliminary Prospectus | |

| SMMEA Eligible: | No | |

| Payment Structure: | Sequential Pay | |

| Day Count: | 30/360 | |

| Tax Structure: | REMIC | |

| Rated Final Distribution Date: | October 2050 | |

| Cleanup Call: | 1.0% | |

| Minimum Denominations: | $10,000 minimum for the offered certificates (other than the Class X-A and Class X-B certificates); $1,000,000 minimum for the Class X-A and Class X-B certificates; and integral multiples of $1 thereafter for all the offered certificates | |

| Delivery: | Book-entry through DTC | |

| Bond Information: | Cash flows are expected to be modeled by TREPP, INTEX and BLOOMBERG |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

7

| TRANSACTION HIGHLIGHTS |

| ■ | $977,059,894 (Approximate) New-Issue Multi-Borrower CMBS: |

| — | Overview:The mortgage pool consists of 57 fixed-rate commercial mortgage loans that have an aggregate Cut-off Date Balance of $977,059,894 (the “Initial Pool Balance”), have an average mortgage loan Cut-off Date Balance of $17,141,402 and are secured by 95 mortgaged properties located throughout 30 states and the District of Columbia. |

| — | LTV:59.1% weighted average Cut-off Date LTV Ratio |

| — | DSCR:1.89x weighted average Underwritten Debt Service Coverage Ratio |

| — | Debt Yield: 10.9% weighted average Debt Yield on Underwritten NOI |

| — | Credit Support: 30.000% credit support to Class A-1 / A-2 / A-3 / A-4 / A-AB |

| ■ | Loan Structural Features: |

| — | Amortization:58.1% of the mortgage loans by Initial Pool Balance have scheduled amortization: |

| – | 25.9% of the mortgage loans by Initial Pool Balance have amortization for the entire term with a balloon payment due at maturity |

| – | 32.2% of the mortgage loans by Initial Pool Balance have scheduled amortization following a partial interest only period with a balloon payment due at maturity |

| — | Hard Lockboxes: 71.0% of the mortgage loans by Initial Pool Balance have a Hard Lockbox in place |

| — | Cash Traps: 97.3% of the mortgage loans by Initial Pool Balance have cash traps triggered by certain declines in cash flow, all at levels equal to or greater than a 1.05x coverage, that fund an excess cash flow reserve |

| — | Reserves:The mortgage loans require amounts to be escrowed for reserves as follows: |

| – | Real Estate Taxes: 46 mortgage loans representing 69.9% of the Initial Pool Balance |

| – | Insurance: 38 mortgage loans representing 49.8% of the Initial Pool Balance |

| – | Replacement Reserves (Including FF&E Reserves): 44 mortgage loans representing 71.6% of the Initial Pool Balance |

| – | Tenant Improvements / Leasing Commissions: 26 mortgage loans representing 64.0% of the portion of the Initial Pool Balance that is secured by office, retail, mixed use and industrial properties as well as one hospitality property and one multifamily property each with commercial tenants |

| — | Predominantly Defeasance Mortgage Loans: 79.2% of the mortgage loans by Initial Pool Balance permit defeasance only after an initial lockout period |

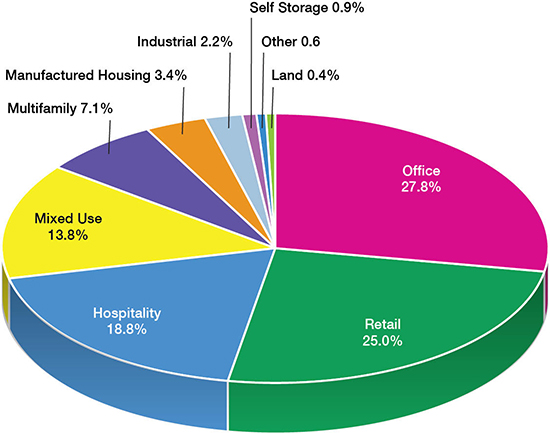

| ■ | Multiple-Asset Types > 5.0% of the Initial Pool Balance: |

| — | Office:27.8% of the mortgaged properties by allocated Initial Pool Balance are office properties |

| — | Retail:25.0% of the mortgaged properties by allocated Initial Pool Balance are retail properties (19.1% are anchored retail properties) |

| — | Hospitality:18.8% of the mortgaged properties by allocated Initial Pool Balance are hospitality properties |

| — | Mixed Use: 13.8% of the mortgaged properties by allocated Initial Pool Balance are mixed use properties |

| — | Multifamily:7.1% of the mortgaged properties by allocated Initial Pool Balance are multifamily properties |

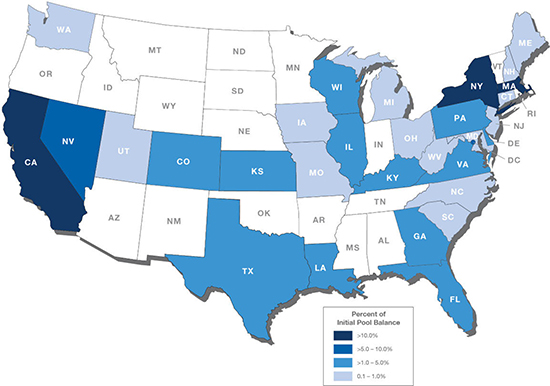

| ■ | Geographic Diversity: The 95 mortgaged properties are located throughout 30 states and the District of Columbia, with only three states having greater than 10.0% of the allocated Initial Pool Balance: California (20.6%), New York (11.3%) and Massachusetts (10.2%) |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

8

| COLLATERAL OVERVIEW |

Mortgage Loans by Loan Seller

Mortgage Loan Seller | Mortgage Loans | Mortgaged Properties | Aggregate Cut-off Date Balance | % of Initial Pool Balance | ||||||||

| Citi Real Estate Funding Inc. | 11 | 28 | $333,258,262 | 34.1 | % | |||||||

| Cantor Commercial Real Estate Lending, L.P. | 18 | 30 | 246,280,124 | 25.2 | ||||||||

| Ladder Capital Finance LLC | 14 | 15 | 173,669,500 | 17.8 | ||||||||

| German American Capital Corporation | 7 | 14 | 152,187,982 | 15.6 | ||||||||

| Rialto Mortgage Finance, LLC | 7 | 8 | 71,664,025 | 7.3 | ||||||||

| Total | 57 | 95 | $977,059,894 | 100.0 | % | |||||||

Ten Largest Mortgage Loans(1)(2)

# | Mortgage Loan Name | Cut-off Date | % of | Property Type | Property | Cut-off Date | UW NCF | UW | Cut-off | ||||||||||||||||

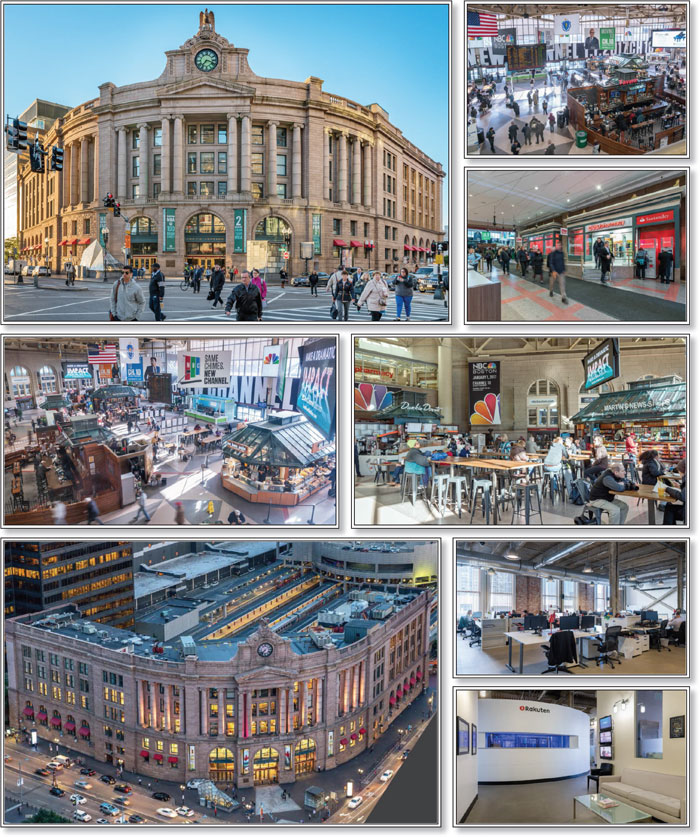

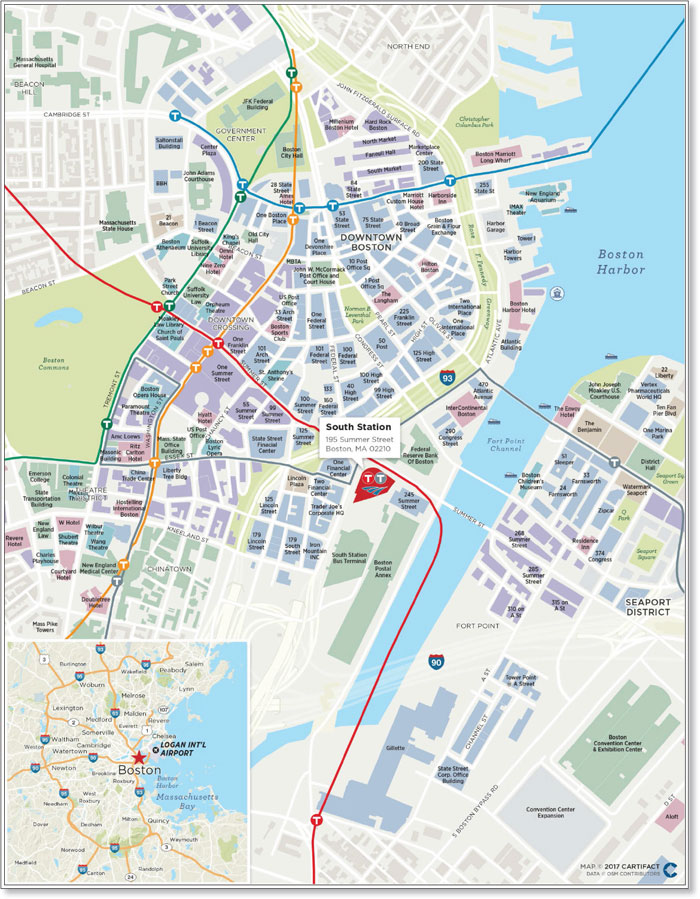

| 1 | South Station | $75,000,000 | 7.7 | % | Mixed Use | 200,775 | $374 | 1.72 | x | 8.5 | % | 58.8 | % | ||||||||||||

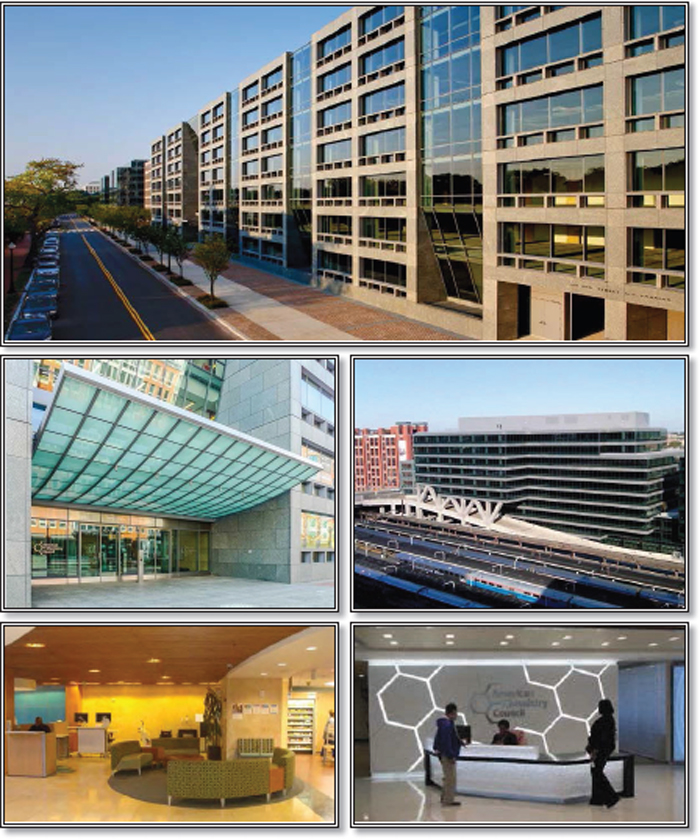

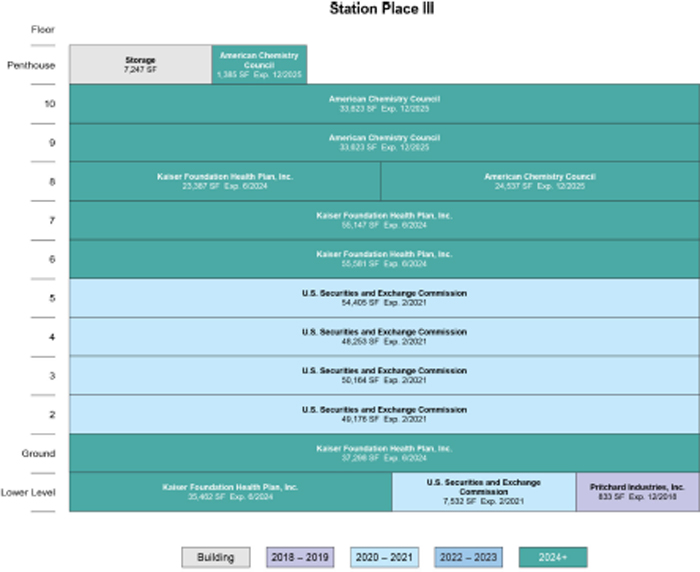

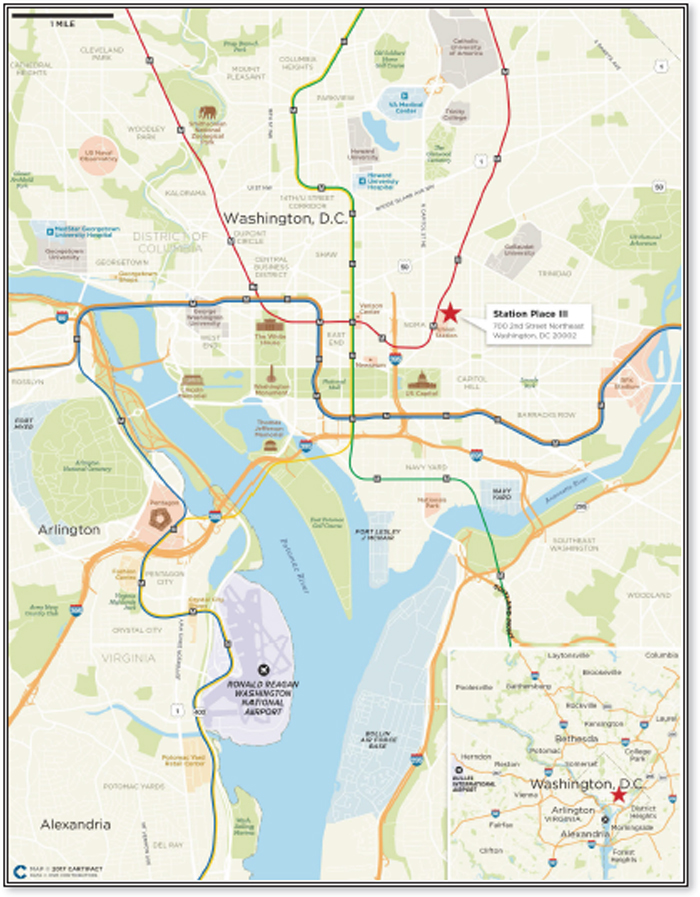

| 2 | Station Place III | 50,000,000 | 5.1 | Office | 517,653 | $367 | 3.00 | x | 11.9 | % | 47.6 | % | |||||||||||||

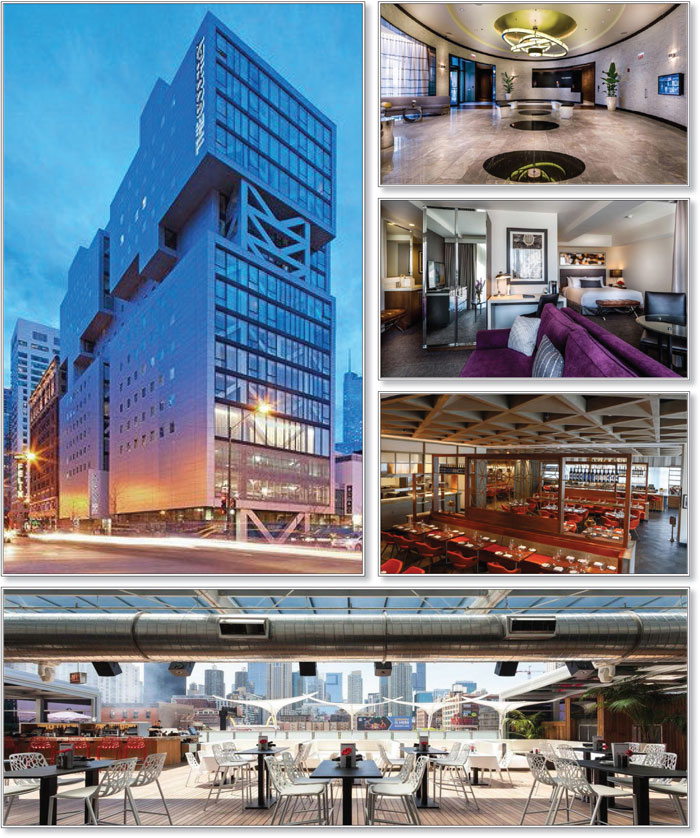

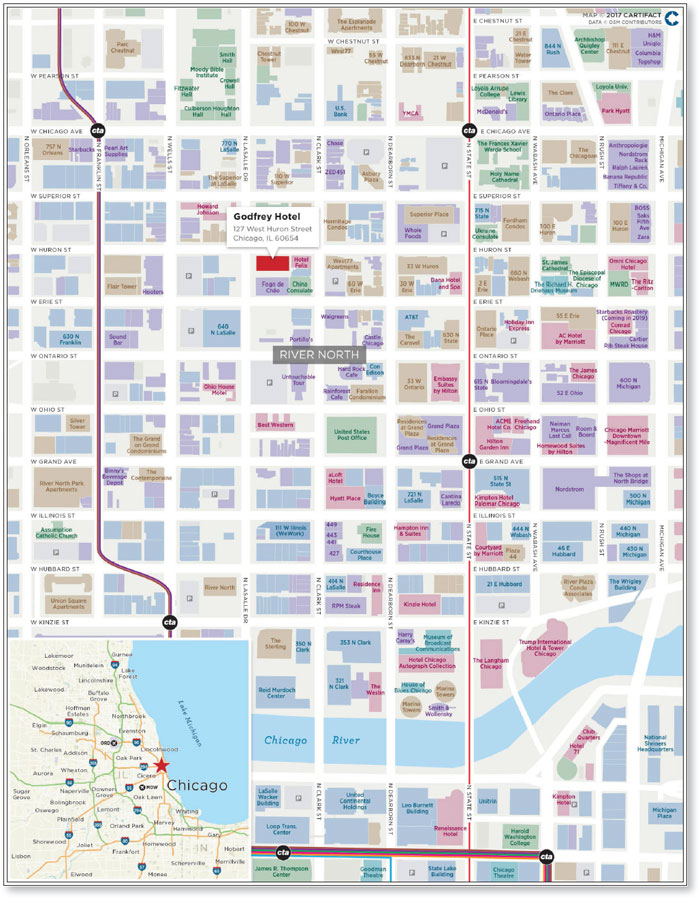

| 3 | Godfrey Hotel | 47,500,000 | 4.9 | Hospitality | 221 | $214,932 | 2.11 | x | 15.5 | % | 46.8 | % | |||||||||||||

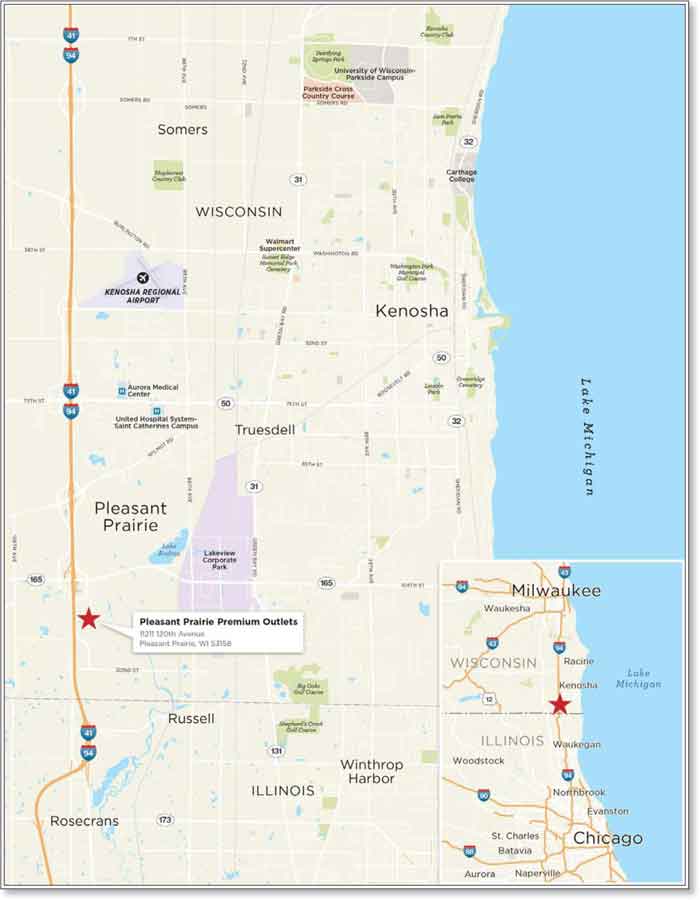

| 4 | Pleasant Prairie Premium Outlets | 41,000,000 | 4.2 | Retail | 402,615 | $360 | 2.66 | x | 11.2 | % | 50.0 | % | |||||||||||||

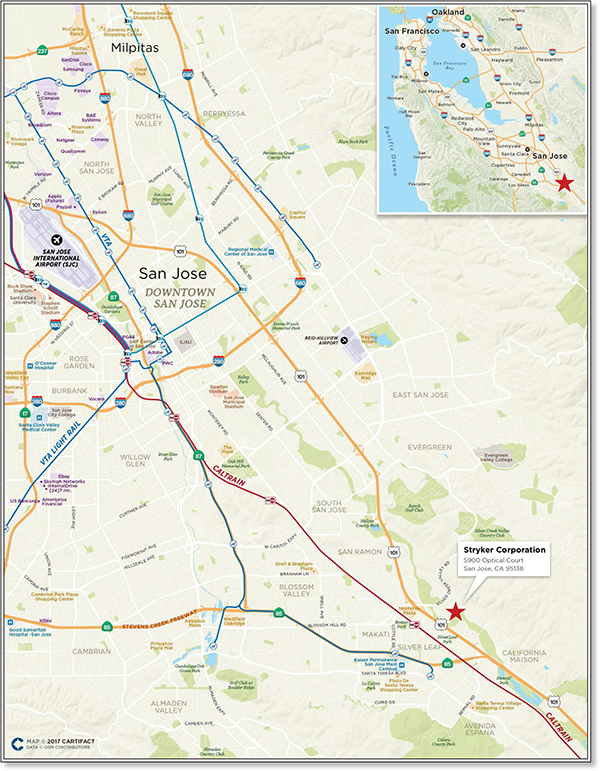

| 5 | Stryker Corporation | 39,900,000 | 4.1 | Office | 191,276 | $209 | 1.99 | x | 11.6 | % | 65.4 | % | |||||||||||||

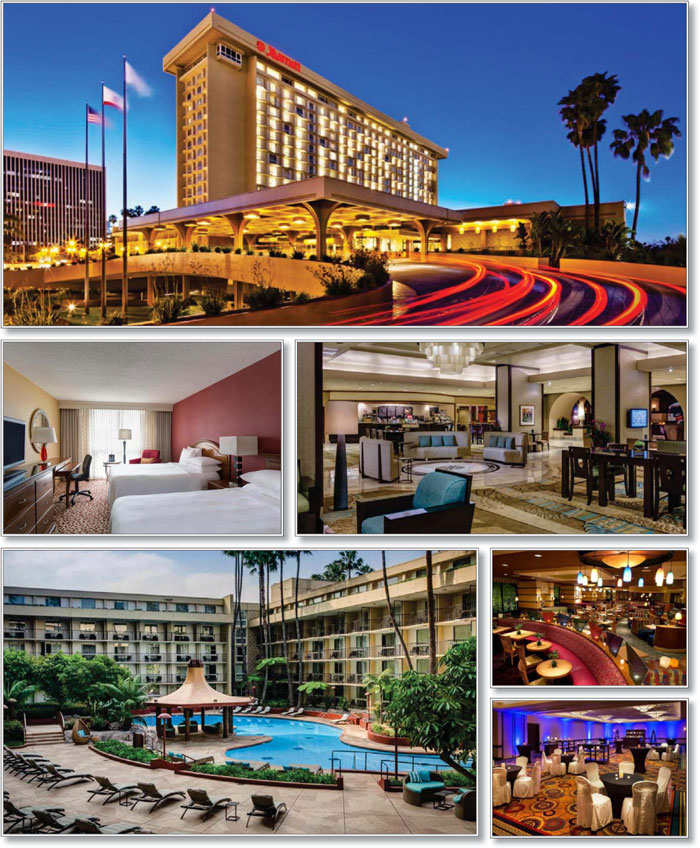

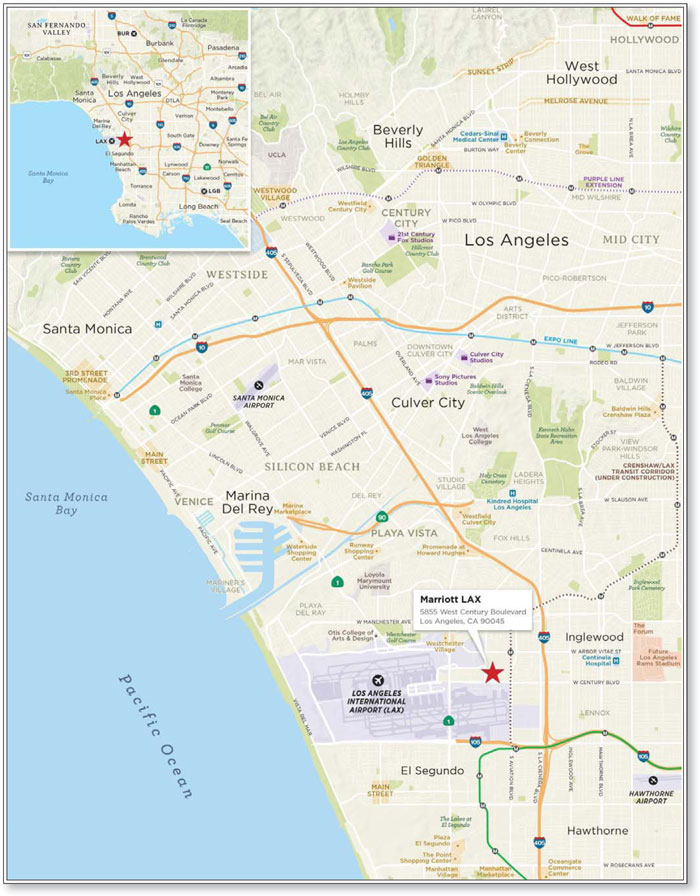

| 6 | Marriott LAX | 39,689,333 | 4.1 | Hospitality | 1,004 | $144,734 | 1.72 | x | 13.8 | % | 48.3 | % | |||||||||||||

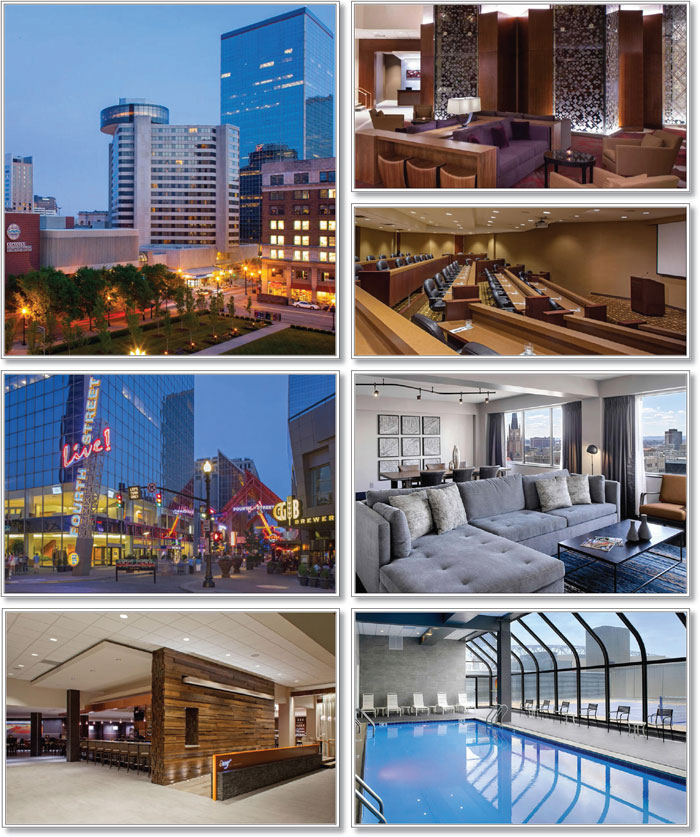

| 7 | Hyatt Regency Louisville | 38,540,000 | 3.9 | Hospitality | 393 | $98,066 | 2.14 | x | 15.2 | % | 54.7 | % | |||||||||||||

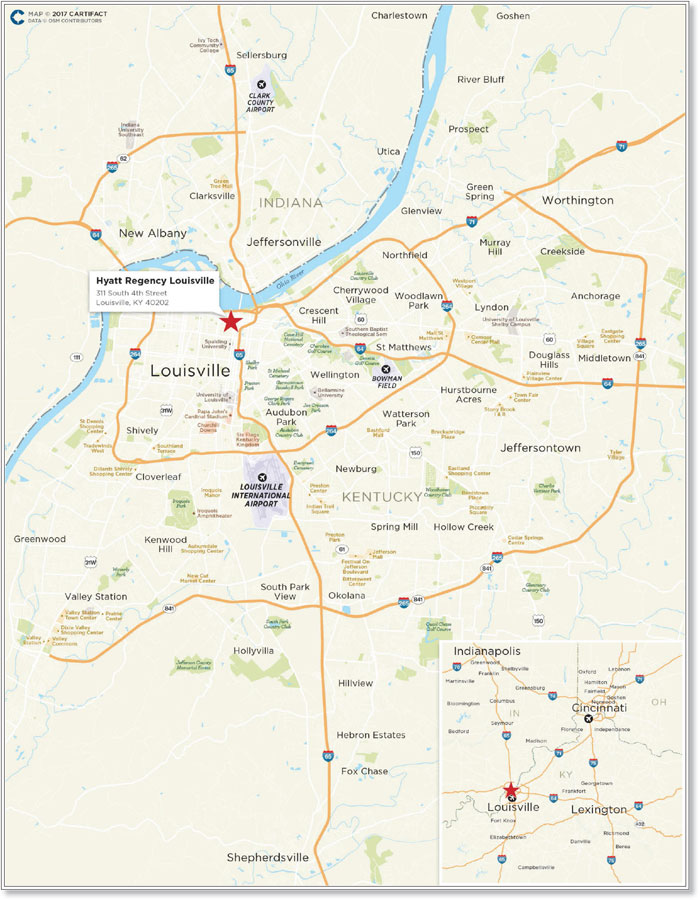

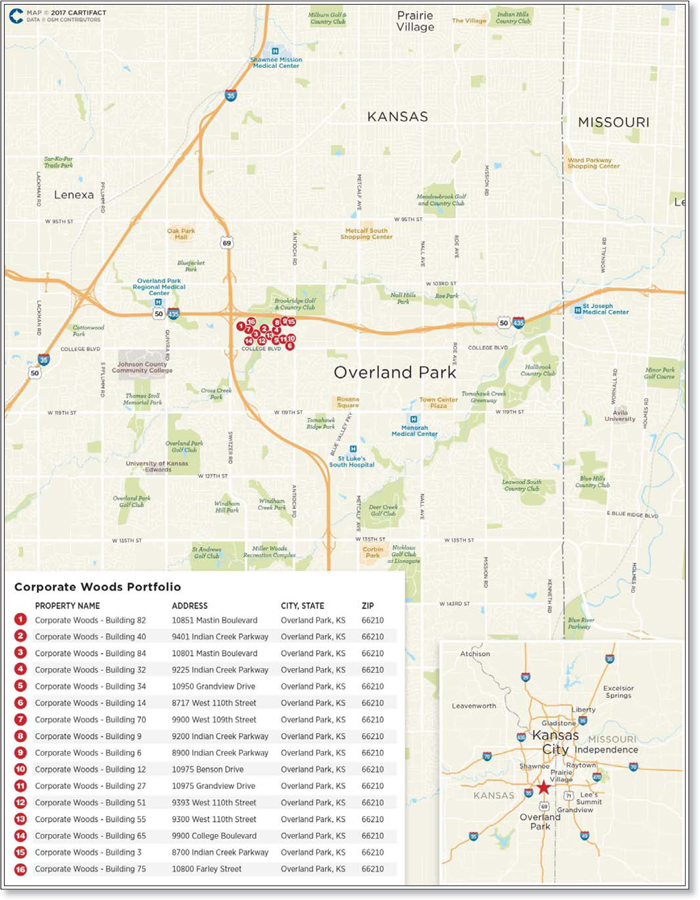

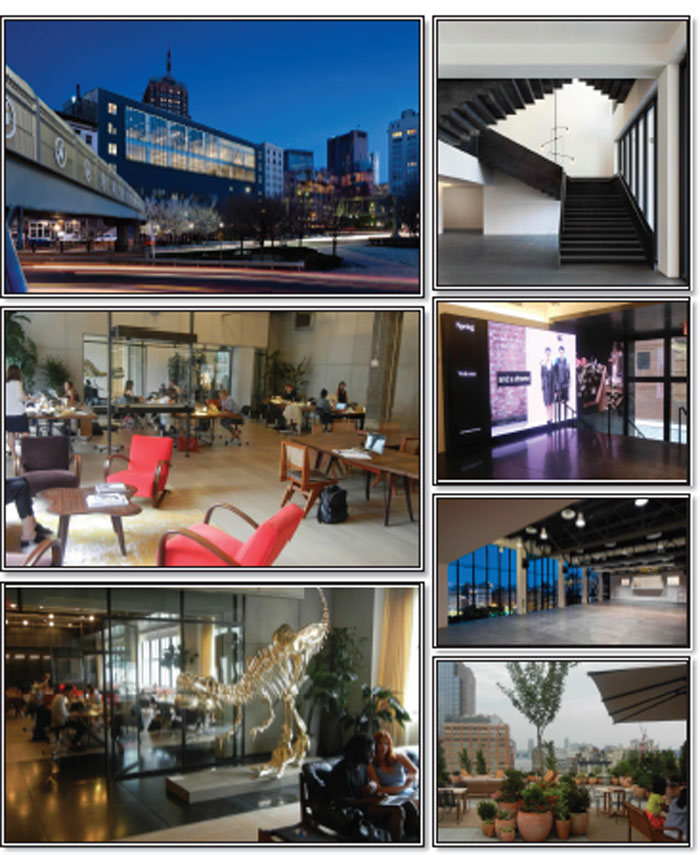

| 8 | Corporate Woods Portfolio | 35,577,660 | 3.6 | Office/Retail | 2,033,179 | $109 | 1.48 | x | 10.2 | % | 73.9 | % | |||||||||||||

| 9 | 50 Varick Street | 35,000,000 | 3.6 | Office | 158,574 | $491 | 2.01 | x | 8.7 | % | 55.6 | % | |||||||||||||

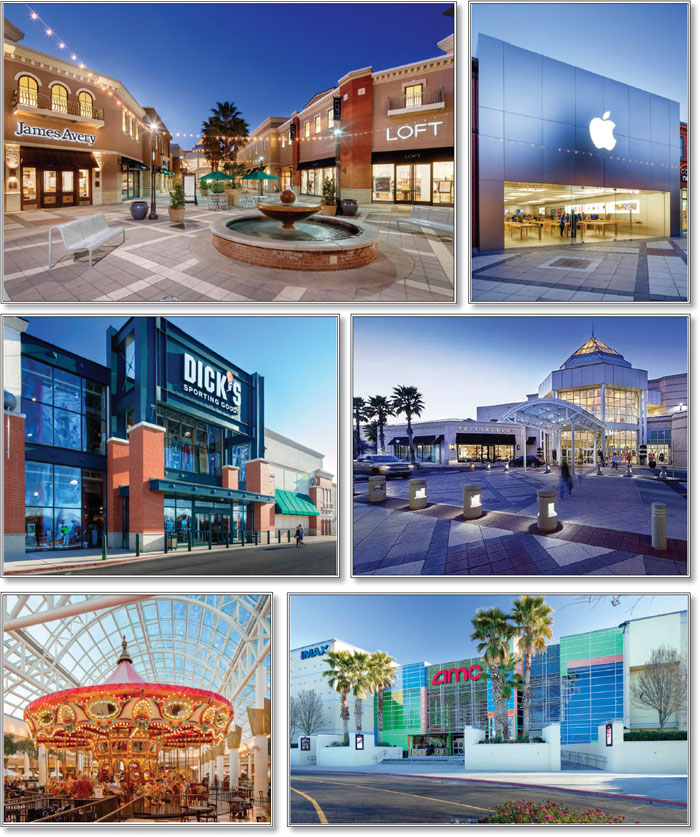

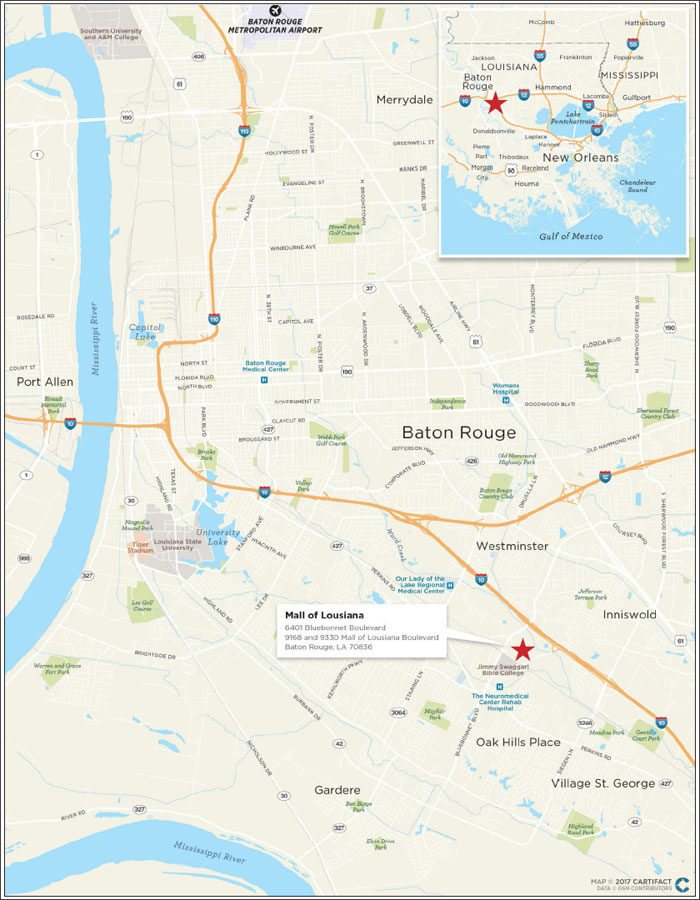

| 10 | Mall of Louisiana | 28,000,000 | 2.9 | Retail | 776,789 | $418 | 1.85 | x | 11.1 | % | 57.0 | % | |||||||||||||

| Top 10 Total / Wtd. Avg. | $430,206,992 | 44.0 | % | 2.08 | x | 11.6 | % | 55.5 | % | ||||||||||||||||

| Remaining Total / Wtd. Avg. | 546,852,902 | 56.0 | 1.75 | x | 10.3 | % | 61.9 | % | |||||||||||||||||

| Total / Wtd. Avg. | $977,059,894 | 100.0 | % | 1.89 | x | 10.9 | % | 59.1 | % | ||||||||||||||||

| (1) | See footnotes to table entitled“Mortgage Pool Characteristics” above. |

| (2) | With respect to each mortgage loan that is part of a loan combination (as identified under “Collateral Overview—Loan Combination Summary” below), the UW NCF DSCR, UW NOI Debt Yield and Cut-off Date LTV Ratio are calculated based on both that mortgage loan and any related pari passu companion loan(s), but without regard to any related subordinate companion loan(s) or other indebtedness. |

| (3) | With respect to certain of the mortgage loans identified above, the Cut-off Date LTV Ratios have been calculated using “as-stabilized”, “portfolio premium” or similar hypothetical values. Such mortgage loans are identified under the definition of “Appraised Value” set forth under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

9

| COLLATERAL OVERVIEW (continued) |

Loan Combination Summary

Mortgaged Property Name(1) | Mortgage Loan Cut-off Date Balance | Mortgage Loan as Approx. % of Initial Pool Balance | Aggregate Pari Passu Companion Loan Cut-off Date Balance | Loan Combination Cut-off Date Balance | Controlling Pooling/Trust and Servicing Agreement (“Controlling PSA”)(2) | Master Servicer / Outside Servicer | Special Servicer / Outside Special Servicer | |||||||||

| Station Place III | $50,000,000 | 5.1% | $140,000,000 | $190,000,000 | JPMDB 2017-C7(3) | Midland(3) | Midland(3) | |||||||||

| Pleasant Prairie Premium Outlets | $41,000,000 | 4.2% | $104,000,000 | $145,000,000 | CGCMT 2017-P8 | Wells Fargo | KeyBank | |||||||||

| Marriott LAX | $39,689,333 | 4.1% | $105,623,236 | $145,312,569 | CGCMT 2017-C4 | Midland | Midland | |||||||||

| Corporate Woods Portfolio | $35,577,660 | 3.6% | $185,378,331 | $220,955,991 | CGCMT 2017-P8 | Wells Fargo | KeyBank | |||||||||

| 50 Varick Street | $35,000,000 | 3.6% | $42,890,000 | $77,890,000 | UBS 2017-C4(4) | Wells Fargo(4) | Rialto(4) | |||||||||

| Mall of Louisiana | $28,000,000 | 2.9% | $297,000,000 | $325,000,000 | BANK 2017-BNK7 | Wells Fargo | Rialto | |||||||||

| IGT Reno | $25,000,000 | 2.6% | $55,000,000 | $80,000,000 | CD 2017-CD5 | Wells Fargo | Rialto | |||||||||

| Chelsea Multifamily Portfolio | $25,000,000 | 2.6% | $50,000,000 | $75,000,000 | CGCMT 2017-C4(5)(6) | Midland(5) | Midland(5) | |||||||||

| Westin Crystal City | $24,000,000 | 2.5% | $24,000,000 | $48,000,000 | CGCMT 2017-C4(5)(6) | Midland(5) | Midland(5) | |||||||||

| Capital Centers II & III | $21,443,357 | 2.2% | $26,928,867 | $48,372,224 | JPMDB 2017-C7(3) | Midland(3) | Midland(3) | |||||||||

| Walgreens Witkoff Portfolio | $16,150,000 | 1.7% | $32,000,000 | $48,150,000 | JPMDB 2017-C7(3) | Midland(3) | Midland(3) | |||||||||

| Bank of America Office Campus Building 600 | $9,935,000 | 1.0% | $20,000,000 | $29,935,000 | UBS 2017-C4(7) | Wells Fargo(6) | Rialto(6) | |||||||||

| (1) | Each of the mortgage loans included in the issuing entity that is secured by a mortgaged property or portfolio of mortgaged properties identified in the table above, together with the related companion loan(s) (none of which is included in the issuing entity), is referred to in this Term Sheet as a “loan combination”. See “Description of the Mortgage Pool—The Loan Combinations” in the Preliminary Prospectus. |

| (2) | Each loan combination will be serviced under the related Controlling PSA, and the controlling class representative (or an equivalent entity), if any, under the related Controlling PSA (or such other party as is designated under the related Controlling PSA) will be entitled to exercise the rights of controlling note holder for the subject loan combination, except as otherwise discussed in footnotes (4) and (5) below. |

| (3) | Each of the Station Place III controlling pari passu companion loan (currently held by JP Morgan Chase Bank, National Association), the Capital Centers II & III controlling pari passu companion loan (currently held by Deutsche Bank AG, acting through its New York Branch) and the Walgreens Witkoff Portfolio controlling pari passu companion loan (currently held by Deutsche Bank AG, acting through its New York Branch) is expected to be contributed to the JPMDB 2017-C7 securitization transaction. Although the JPMDB 2017-C7 securitization transaction has not yet closed, the Station Place III loan combination, the Capital Centers II & III loan combination and the Walgreens Witkoff Portfolio loan combination are presented throughout this Term Sheet as outside serviced loan combinations (given that, based on a publicly available preliminary prospectus for the JPMDB 2017-C7 securitization transaction, the anticipated closing date for the JPMDB 2017-C7 securitization transaction is the same as the anticipated closing date for this securitization transaction). Accordingly, each of the Station Place III loan combination, the Capital Center II & III loan combination and the Walgreens Witkoff Portfolio loan combination is expected to be (and information presented in the foregoing table is based on the assumption that each such loan combination will be) serviced and administered pursuant to the JPMDB 2017-C7 pooling and servicing agreement. |

| (4) | The 50 Varick Street loan combination is expected to initially be serviced pursuant to the UBS 2017-C4 pooling and servicing agreement (which will be the initial Controlling PSA for such loan combination), by the outside servicer and outside special servicer set forth in the table above. The information in the preceding sentence and the foregoing table for the 50 Varick Street loan combination is, in part, based on a publicly available preliminary prospectus for the UBS 2017-C4 securitization transaction. Notwithstanding the foregoing, upon the inclusion of the related controlling pari passu companion loan, which is currently held by Ladder Capital Finance LLC or an affiliate, in a future securitization transaction, such loan combination will be serviced under the pooling and servicing agreement entered into in connection with that future securitization, which will then be the applicable Controlling PSA for such loan combination. Although the UBS 2017-C4 pooling and servicing agreement will initially be the Controlling PSA for the 50 Varick Street loan combination, the holder of the related controlling pari passu companion loan for such loan combination will be the directing holder for such loan combination while it is serviced under the UBS 2017-C4 pooling and servicing agreement and, solely as to such loan combination, will exercise all rights normally exercised by the UBS 2017-C4 directing certificateholder with respect to most other mortgage loans serviced under the UBS 2017-C4 pooling and servicing agreement. |

| (5) | Each of the Chelsea Multifamily Portfolio loan combination and the Westin Crystal City loan combination will initially be serviced by the master servicer and the special servicer pursuant to the CGCMT 2017-C4 pooling and servicing agreement. In the case of each such loan combination, upon the inclusion of the related controlling pari passu companion loan in a future securitization transaction, the subject loan combination will be serviced under the pooling and servicing agreement entered into in connection with that future securitization, which will then be the applicable Controlling PSA for such loan combination. Although the CGCMT 2017-C4 pooling and servicing agreement will initially be the Controlling PSA for each of the Chelsea Multifamily Portfolio loan combination and the Westin Crystal City loan combination, the holder of the related controlling companion loan for each such loan combination will be the Directing Holder of the subject loan combination while it is serviced under the CGCMT 2017-C4 pooling and servicing agreement and, solely as to the subject loan combination, will exercise all rights normally exercised by the CGCMT 2017-C4 controlling class representative with respect to other loan combinations for which the CGCMT 2017-C4 pooling and servicing agreement is the Controlling PSA. |

| (6) | The Bank of America Office Campus Building 600 controlling pari passu companion loan is currently held by Ladder Capital Finance LLC or an affiliate, but is expected to be contributed to the UBS 2017-C4 securitization transaction. Although the UBS 2017-C4 securitization transaction has not yet closed, the Bank of America Office Campus Building 600 loan combination is presented throughout this Term Sheet as an outside serviced loan combination (given that, based on a publicly available preliminary prospectus for the UBS 2017-C4 securitization transaction, the anticipated closing date for the UBS 2017-C4 securitization transaction is prior to the anticipated closing date for this securitization transaction). Accordingly, the Bank of America Office Campus Building 600 loan combination is expected to be (and information presented in the foregoing table is based on the assumption that such loan combination will be) serviced and administered pursuant to the UBS 2017-C4 pooling and servicing agreement. |

Mortgage Loans with Existing Mezzanine Debt or Subordinate Debt(1)

Mortgaged Property Name | Mortgage Loan Cut-off Date Balance | Aggregate Pari Passu Companion Loan Cut-off Date Balance | Mezzanine Debt Cut-off Date Balance | Other Subordinate Debt Cut-off Date Balance | Cut-off Date Total Debt Balance(2) | Wtd. Avg Cut-off Date Total Debt Interest Rate(2) | Cut-off Date Mortgage Loan LTV(3) | Cut-off Date Total Debt LTV(2) | Cut-off Date Mortgage Loan UW NCF DSCR(3) | Cut-off Date Total Debt UW NCF DSCR(2) | ||||||||||

| South Station | $75,000,000 | — | $20,000,000 | — | $95,000,000 | 4.96997% | 58.8% | 74.5% | 1.72x | 1.23x | ||||||||||

| Godfrey Hotel(4) | $47,500,000 | — | — | $25,000,000 | (4) | (4) | 46.8% | (4) | 2.11x | (4) | ||||||||||

| IGT Reno | $25,000,000 | $55,000,000 | $17,500,000 | — | $97,500,000 | 5.11000% | 50.9% | 62.0% | 2.05x | 1.53x |

| (1) | See footnotes to table entitled “Mortgage Pool Characteristics” above. |

| (2) | All “Total Debt” calculations set forth in the table above include any related pari passu companion loan(s), any related subordinate companion loan(s) and any related mezzanine debt. |

| (3) | “Cut-off Date Mortgage Loan LTV” and “Cut-off Date Mortgage Loan UW NCF DSCR” calculations include any related pari passu companion loan(s). |

| (4) | The related borrower’s subordinate debt is comprised of (1) a loan with an outstanding balance of $24,875,000 secured by a junior mortgage on the related mortgaged property and (2) an unsecured bridge loan with an outstanding balance of $125,000. See “—Permitted Unsecured Debt and Other Debt” in the Preliminary Prospectus. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

10

| COLLATERAL OVERVIEW (continued) |

Loan Combination Controlling Notes and Non-Controlling Notes

Mortgaged Property Name / | Controlling Note(1)(2) | Current Holder of | Current or Anticipated Holder of Securitized Note(4) | Aggregate Cut-off Date Balance | ||||||||

| Station Place III | ||||||||||||

| Note A-1 | Yes | JPMorgan Chase Bank, National Association | JPMDB 2017-C7(5) | $64,000,000 | ||||||||

| Notes A-2 and A-3 | No | JPMorgan Chase Bank, National Association | Not Identified | $50,000,000 | ||||||||

| Note A-4 | No | CREFI | CGCMT 2017-C4 | $50,000,000 | ||||||||

| Note A-5 | No | CREFI | Not Identified | $26,000,000 | ||||||||

| Pleasant Prairie Premium Outlets | ||||||||||||

| Note A-1 | Yes | — | CGCMT 2017-P8 | $34,000,000 | ||||||||

| Note A-2 | No | CREFI | CGCMT 2017-C4 | $41,000,000 | ||||||||

| Note A-3 | No | Wells Fargo Bank, National Association | Not Identified | $45,000,000 | ||||||||

| Note A-4 | No | Wells Fargo Bank, National Association | WFCM 2017-C40(6) | $25,000,000 | ||||||||

| Marriott LAX | ||||||||||||

| Note A-1-A | Yes | LCF or an affiliate | CGCMT 2017-C4 | $39,689,333 | ||||||||

| Note A-2 | No | — | LCCM 2017-LC26 | $61,518,465 | ||||||||

| Note A-3-A | No | LCF or an affiliate | Not Identified | $44,104,771 | ||||||||

| Corporate Woods Portfolio | ||||||||||||

| Notes A-1-A and A-3 | Yes (Note A-1-A) | — | CGCMT 2017-P8 | $49,933,557 | ||||||||

| Note A-1-B | No | CREFI | Not Identified | $24,966,779 | ||||||||

| Note A-2 | No | CREFI | CGCMT 2017-C4 | $35,577,660 | ||||||||

| Note A-4 | No | — | BANK 2017-BNK7 | $70,531,150 | ||||||||

| Note A-5 | No | Morgan Stanley Bank, N.A. | MSBAM 2017-C34(7) | $39,946,846 | ||||||||

| 50 Varick Street | ||||||||||||

| Note A-1 | No | LCF or an affiliate | CGCMT 2017-C4 | $35,000,000 | ||||||||

| Note A-2-A | No | LCF or an affiliate | UBS 2017-C4(8) | $25,500,000 | ||||||||

| Note A-3-A | Yes | LCF or an affiliate | Not Identified | $17,390,000 | ||||||||

| Mall of Louisiana | ||||||||||||

| Note A-1 | Yes | — | BANK 2017-BNK7 | $65,000,000 | ||||||||

| Note A-2 | No | Bank of America, National Association | MSBAM 2017-C34(7) | $44,000,000 | ||||||||

| Notes A-3-1 and A-5-2 | No | — | CGCMT 2017-P8 | $47,000,000 | ||||||||

| Note A-3-2 | No | CREFI | CGCMT 2017-C4 | $28,000,000 | ||||||||

| Note A-4 | No | — | COMM 2017-COR2 | $50,000,000 | ||||||||

| Note A-5-1 | No | Barclays Bank PLC | Not Identified | $41,000,000 | ||||||||

| Notes A-6 and A-7 | No | Barclays Bank PLC | WFCM 2017-C40(6) | $50,000,000 | ||||||||

| IGT Reno | ||||||||||||

| Note A-1-A | Yes | — | CD 2017-CD5 | $30,000,000 | ||||||||

| Note A-1-B | No | — | CGCMT 2017-B1 | $10,000,000 | ||||||||

| Note A-2-A | No | CCRE Lending | CGCMT 2017-C4 | $25,000,000 | ||||||||

| Note A-2-B | No | CCRE Lending | Not Identified | $15,000,000 | ||||||||

| Chelsea Multifamily Portfolio | ||||||||||||

| Note A-1 | Yes | CCRE Lending | Not Identified | $50,000,000 | ||||||||

| Note A-2 | No | CCRE Lending | CGCMT 2017-C4 | $25,000,000 | ||||||||

| Westin Crystal City | ||||||||||||

| Note A-1 | Yes | CCRE Lending | Not Identified | $24,000,000 | ||||||||

| Note A-2 | No | CCRE Lending | CGCMT 2017-C4 | $24,000,000 | ||||||||

| Capital Centers II & III | ||||||||||||

| Note A-1 | Yes | DBNY | JPMDB 2017-C7(5) | $26,928,867 | ||||||||

| Note A-2 | No | DBNY | CGCMT 2017-C4 | $21,443,357 | ||||||||

| Walgreens Witkoff Portfolio | ||||||||||||

| Note A-1 | Yes | DBNY | JPMDB 2017-C7(5) | $32,000,000 | ||||||||

| Note A-2 | No | DBNY | CGCMT 2017-C4 | $16,150,000 | ||||||||

| Bank of America Office Campus Building 600 | ||||||||||||

| Note A-1 | Yes | LCF or an affiliate | UBS 2017-C4(8) | $20,000,000 | ||||||||

| Note A-2 | No | LCF or an affiliate | CGCMT 2017-C4 | $9,935,000 | ||||||||

| (1) | The holder(s) of one or more specified controlling notes (collectively, the “Controlling Note”) will be the “controlling note holder(s)” entitled (directly or through a representative) to (a) approve or, in some cases, direct material servicing decisions involving the related loan combination (while the remaining such holder(s) generally are only entitled to non-binding consultation rights in such regard), and (b) in some cases, replace the applicable special servicer with respect to such loan combination with or without cause. See “Description of the Mortgage Pool—The Loan Combinations” and “The Pooling and Servicing Agreement—Directing Holder” in the Preliminary Prospectus. |

| (2) | The holder(s) of the note(s) other than the Controlling Note (each, a “Non-Controlling Note”) will be the “non-controlling note holder(s)” generally entitled (directly or through a representative) to certain non-binding consultation rights with respect to any decisions as to which the holder of the Controlling Note has consent rights involving the related loan combination, subject to certain exceptions, including that in certain cases where the related Controlling Note is a B-note such consultation rights will not be afforded to the holder(s) of the Non-Controlling Notes until after a control trigger event has occurred with respect to either such Controlling Note or certain certificates backed thereby, in each case as set forth in the related co-lender agreement. See “Description of the Mortgage Pool—The Loan Combinations” in the Preliminary Prospectus. |

| (3) | Unless otherwise specified, with respect to each loan combination, any related unsecuritized Controlling Note and/or Non-Controlling Note may be further split, modified, combined and/or reissued (prior to its inclusion in a securitization transaction) as one or multiple Controlling Notes or Non-Controlling Notes, as the case may be, subject to the terms of the related co-lender agreement (including that the aggregate principal balance, weighted average interest rate and certain other material terms cannot be changed). In connection with the foregoing, any such split, modified or combined Controlling Note or Non-Controlling Note, as the case may be, may be transferred to one or multiple parties (not identified in the table above) prior to its inclusion in a future commercial mortgage securitization transaction. |

| (4) | Unless otherwise specified, with respect to each loan combination, each related unsecuritized pari passu companion loan (both controlling and non-controlling) is expected to be contributed to one or more future commercial mortgage securitization transactions. Under the column “Current or Anticipated Holder of Securitized Note”, (i) the identification of a securitization trust means we have identified an outside securitization that has closed or as to which a preliminary prospectus or final prospectus has printed that has included or is expected to include the subject Controlling Note or Non-Controlling Note, as the case may be, (ii) “Not Identified” means no preliminary prospectus or final prospectus has printed that identifies the future outside securitization that is expected to include the subject Controlling Note or Non-Controlling Note, and (iii) “Not Applicable” means the subject Controlling Note or Non-Controlling Note is not intended to be contributed to a future commercial mortgage securitization transaction. Under the column “Current Holder of Unsecuritized Note”, “—” means the subjectControlling Note or Non-Controlling Note is not an unsecuritized note and is currently held by the securitization trust referenced under the “Current or Anticipated Holder of Securitized Note” column. |

| (5) | The JPMDB 2017-C7 securitization transaction is scheduled to close on or about October 31, 2017. |

| (6) | The WFCM 2017-C40 securitization transaction is scheduled to close on or about October 17, 2017. |

| (7) | The MSBAM 2017-C34 securitization transaction is scheduled to close on or about October 19, 2017. |

| (8) | The UBS 2017-C4 securitization transaction is scheduled to close on or about October 18, 2017. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

11

| COLLATERAL OVERVIEW (continued) |

Previously Securitized Mortgaged Properties(1)

Mortgaged Property Name | Mortgage Loan Seller | City | State | Property Type | Cut-off Date Balance / Allocated Cut-off Date Balance | % of Initial Pool Balance | Previous Securitization | ||||||||

| Station Place III | CREFI | Washington | District of Columbia | Office | $50,000,000 | 5.1% | MSC 2011-C1 | ||||||||

| Pleasant Prairie Premium Outlets | CREFI | Pleasant Prairie | Wisconsin | Retail | $41,000,000 | 4.2% | Various(2) | ||||||||

| Corporate Woods Portfolio(3) | CREFI | Overland Park | Kansas | Various | $35,577,660 | 3.6% | CGCC 2014-FL1 | ||||||||

| Mall of Louisiana | CREFI | Baton Rouge | Louisiana | Retail | $28,000,000 | 2.9% | MLMT 2006-C1 | ||||||||

| Torrey Executive Centre | CCRE | San Diego | California | Office | $25,200,000 | 2.6% | WBCMT 2007-C33 | ||||||||

| 2100 West Loop | GACC | Houston | Texas | Office | $22,400,000 | 2.3% | MSC 2007-IQ14 | ||||||||

| Capital Center II | GACC | Rancho Cordova | California | Office | $12,114,392 | 1.2% | BSCMS 2006-PW13 | ||||||||

| Capital Center III | GACC | Rancho Cordova | California | Office | $9,328,966 | 1.0% | BSCMS 2006-PW13 | ||||||||

| Worcester | GACC | Worcester | Massachusetts | Retail | $2,980,529 | 0.3% | LBUBS 2008-C1 | ||||||||

| New Bedford | GACC | New Bedford | Massachusetts | Retail | $2,455,325 | 0.3% | LBUBS 2008-C1 | ||||||||

| Staten Island | GACC | Staten Island | New York | Retail | $2,389,675 | 0.2% | LBUBS 2008-C1 | ||||||||

| Windham | GACC | Windham | Maine | Retail | $2,205,854 | 0.2% | LBUBS 2008-C1 | ||||||||

| Yarmouth | GACC | South Yarmouth | Massachusetts | Retail | $2,166,463 | 0.2% | LBUBS 2008-C1 | ||||||||

| Hampstead | GACC | East Hampstead | New Hampshire | Retail | $1,982,642 | 0.2% | LBUBS 2008-C1 | ||||||||

| Woodbury | GACC | Woodbury | New Jersey | Retail | $1,969,512 | 0.2% | LBUBS 2008-C1 | ||||||||

| Old Orchard Center | CCRE | Valencia | California | Retail | $14,383,072 | 1.5% | COMM 2012-CR4 | ||||||||

| Mills Pointe Shopping Center | CCRE | Carrollton | Texas | Retail | $9,700,000 | 1.0% | GCCFC 2005-GG3 | ||||||||

| Hickory Village | CREFI | Fort Collins | Colorado | Manufactured Housing | $8,139,268 | 0.8% | MSC 2007-IQ16 | ||||||||

| Carolina Center Business Park | CREFI | West Columbia | South Carolina | Industrial | $6,741,335 | 0.7% | BACM 2008-1 | ||||||||

| West End Commons | CCRE | Cartersville | Georgia | Mixed Use | $5,224,813 | 0.5% | LBCMT 2007-C3 | ||||||||

| Vail Ranch Towne Square | CCRE | Temecula | California | Mixed Use | $5,000,000 | 0.5% | CGCMT 2007-C6 | ||||||||

| (1) | The table above includes mortgaged properties securing mortgage loans for which the most recent prior financing of all or a significant portion of such mortgaged properties was included in a securitization. Information under “Previous Securitization” represents the most recent such securitization with respect to each of those mortgaged properties. The information in the above table is based solely on information provided by the related borrower or obtained through searches of a third-party database, and has not otherwise been confirmed by the mortgage loan sellers. |

| (2) | The Pleasant Prairie Premium Outlets mortgaged property was previously securitized in the JPMCC 2007-CB18, WBCMT 2006-C25 and WBCMT 2006-C23 transactions. |

| (3) | All 16 of the Corporate Woods Portfolio mortgaged properties were previously securitized in the CGCC 2014-FL1 transaction. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

12

(THIS PAGE INTENTIONALLY LEFT BLANK)

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

13

| COLLATERAL OVERVIEW (continued) |

Property Types

| Property Type / Detail | Number of Mortgaged Properties | Aggregate Cut-off Date Balance(1) | % of Initial Pool Balance(1) | Wtd. Avg. Underwritten NCF DSCR(2)(3) | Wtd. Avg. Cut-off Date LTV Ratio(2)(3) | Wtd. Avg. Debt Yield on Underwritten NOI(2)(3) | ||||||||||||

| Office | 26 | $271,586,389 | 27.8 | % | 1.98 | x | 62.3 | % | 10.6 | % | ||||||||

| Suburban | 23 | 170,986,389 | 17.5 | 1.72 | x | 67.0 | % | 10.7 | % | |||||||||

| CBD | 3 | 100,600,000 | 10.3 | 2.43 | x | 54.4 | % | 10.6 | % | |||||||||

| Retail | 26 | $244,628,644 | 25.0 | % | 1.77 | x | 61.8 | % | 9.8 | % | ||||||||

| Anchored | 9 | 117,529,697 | 12.0 | 1.54 | x | 66.0 | % | 9.7 | % | |||||||||

| Outlet Center | 1 | 41,000,000 | 4.2 | 2.66 | x | 50.0 | % | 11.2 | % | |||||||||

| Single Tenant Retail | 8 | 37,674,146 | 3.9 | 1.65 | x | 62.0 | % | 7.8 | % | |||||||||

| Super Regional Mall | 1 | 28,000,000 | 2.9 | 1.85 | x | 57.0 | % | 11.1 | % | |||||||||

| Unanchored | 5 | 14,174,800 | 1.5 | 1.38 | x | 70.1 | % | 9.6 | % | |||||||||

| Shadow Anchored | 2 | 6,250,000 | 0.6 | 1.52 | x | 63.0 | % | 10.4 | % | |||||||||

| Hospitality | 8 | $183,232,278 | 18.8 | % | 2.06 | x | 52.2 | % | 14.7 | % | ||||||||

| Full Service | 5 | 161,943,253 | 16.6 | 2.06 | x | 51.4 | % | 14.6 | % | |||||||||

| Limited Service | 2 | 11,750,000 | 1.2 | 2.02 | x | 58.3 | % | 15.9 | % | |||||||||

| Select Service | 1 | 9,539,025 | 1.0 | 2.12 | x | 58.2 | % | 15.5 | % | |||||||||

| Mixed Use | 5 | $135,224,813 | 13.8 | % | 1.96 | x | 55.2 | % | 9.7 | % | ||||||||

| Office/Retail | 3 | 85,224,813 | 8.7 | 1.71 | x | 59.1 | % | 8.9 | % | |||||||||

| Office/Industrial | 1 | 25,000,000 | 2.6 | 2.05 | x | 50.9 | % | 13.3 | % | |||||||||

| Retail/Office/Parking | 1 | 25,000,000 | 2.6 | 2.71 | x | 46.3 | % | 9.0 | % | |||||||||

| Multifamily | 17 | $69,359,887 | 7.1 | % | 1.54 | x | 59.3 | % | 7.8 | % | ||||||||

| Mid Rise | 14 | 44,500,000 | 4.6 | 1.48 | x | 57.6 | % | 7.1 | % | |||||||||

| Garden | 3 | 24,859,887 | 2.5 | 1.65 | x | 62.4 | % | 9.1 | % | |||||||||

| Manufactured Housing | 6 | $33,156,872 | 3.4 | % | 1.57 | x | 61.9 | % | 10.1 | % | ||||||||

| Industrial | 3 | $21,041,335 | 2.2 | % | 2.20 | x | 62.5 | % | 12.8 | % | ||||||||

| Flex | 2 | 14,300,000 | 1.5 | 2.57 | x | 60.6 | % | 14.0 | % | |||||||||

| Flex/Warehouse | 1 | 6,741,335 | 0.7 | 1.43 | x | 66.7 | % | 10.3 | % | |||||||||

| Self Storage | 2 | $9,204,677 | 0.9 | % | 1.39 | x | 70.9 | % | 9.0 | % | ||||||||

| Other | 1 | $6,000,000 | 0.6 | % | 1.96 | x | 47.5 | % | 10.6 | % | ||||||||

| Land | 1 | $3,625,000 | 0.4 | % | 1.97 | x | 58.0 | % | 8.3 | % | ||||||||

| Total | 95 | $977,059,894 | 100.0 | % | 1.89 | x | 59.1 | % | 10.9 | % | ||||||||

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Weighted average based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (3) | See footnotes to the table entitled “Mortgage Pool Characteristics” above. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

14

| COLLATERAL OVERVIEW (continued) |

Geographic Distribution

Property Location | Number of Mortgaged Properties | Aggregate Cut-off Date Balance(1) | % of Initial Pool Balance(1) | Aggregate Appraised Value(2) | % of Total Appraised Value | Underwritten | % of Total Underwritten NOI | ||||||||||||||

| California | 12 | $201,754,682 | 20.6 | % | $605,120,000 | 16.8 | % | $41,130,291 | 18.2 | % | |||||||||||

| New York | 17 | 110,139,675 | 11.3 | 375,900,000 | 10.4 | 15,993,659 | 7.1 | ||||||||||||||

| Massachusetts | 5 | 100,077,317 | 10.2 | 184,400,000 | 5.1 | 9,510,207 | 4.2 | ||||||||||||||

| Nevada | 4 | 52,000,000 | 5.3 | 195,980,000 | 5.4 | 13,298,635 | 5.9 | ||||||||||||||

| District of Columbia | 1 | 50,000,000 | 5.1 | 399,000,000 | 11.1 | 22,529,370 | 10.0 | ||||||||||||||

| Illinois | 1 | 47,500,000 | 4.9 | 101,400,000 | 2.8 | 7,383,517 | 3.3 | ||||||||||||||

| Georgia | 9 | 47,128,838 | 4.8 | 75,760,000 | 2.1 | 5,740,676 | 2.5 | ||||||||||||||

| Wisconsin | 1 | 41,000,000 | 4.2 | 290,000,000 | 8.1 | 16,273,310 | 7.2 | ||||||||||||||

| Kentucky | 1 | 38,540,000 | 3.9 | 70,500,000 | 2.0 | 5,840,507 | 2.6 | ||||||||||||||

| Kansas | 16 | 35,577,660 | 3.6 | 295,500,000 | 8.2 | 22,612,063 | 10.0 | ||||||||||||||

| Florida | 3 | 34,147,000 | 3.5 | 77,300,000 | 2.1 | 4,732,214 | 2.1 | ||||||||||||||

| Pennsylvania | 2 | 32,990,015 | 3.4 | 53,360,000 | 1.5 | 2,991,080 | 1.3 | ||||||||||||||

| Texas | 2 | 32,100,000 | 3.3 | 46,080,000 | 1.3 | 3,499,230 | 1.5 | ||||||||||||||

| Louisiana | 1 | 28,000,000 | 2.9 | 570,000,000 | 15.8 | 36,062,923 | 16.0 | ||||||||||||||

| Colorado | 4 | 24,956,872 | 2.6 | 41,510,000 | 1.2 | 2,579,578 | 1.1 | ||||||||||||||

| Virginia | 1 | 24,000,000 | 2.5 | 84,500,000 | 2.3 | 6,414,594 | 2.8 | ||||||||||||||

| Delaware | 1 | 15,600,000 | 1.6 | 21,300,000 | 0.6 | 1,666,353 | 0.7 | ||||||||||||||

| North Carolina | 1 | 9,620,000 | 1.0 | 13,200,000 | 0.4 | 1,031,892 | 0.5 | ||||||||||||||

| Washington | 1 | 8,000,000 | 0.8 | 13,000,000 | 0.4 | 1,134,392 | 0.5 | ||||||||||||||

| South Carolina | 1 | 6,741,335 | 0.7 | 10,100,000 | 0.3 | 694,016 | 0.3 | ||||||||||||||

| Missouri | 1 | 6,000,000 | 0.6 | 12,620,000 | 0.4 | 635,650 | 0.3 | ||||||||||||||

| Utah | 1 | 5,992,677 | 0.6 | 8,600,000 | 0.2 | 562,109 | 0.2 | ||||||||||||||

| West Virginia | 1 | 5,239,625 | 0.5 | 9,975,000 | 0.3 | 871,918 | 0.4 | ||||||||||||||

| Michigan | 1 | 3,650,000 | 0.4 | 5,600,000 | 0.2 | 331,402 | 0.1 | ||||||||||||||

| Maryland | 1 | 3,625,000 | 0.4 | 6,250,000 | 0.2 | 300,006 | 1.3 | ||||||||||||||

| Ohio | 1 | 3,146,319 | 0.3 | 4,450,000 | 0.1 | 308,537 | 0.1 | ||||||||||||||

| Connecticut | 1 | 2,394,872 | 0.2 | 4,120,000 | 0.1 | 301,714 | 0.1 | ||||||||||||||

| Maine | 1 | 2,205,854 | 0.2 | 8,400,000 | 0.2 | 468,251 | 0.2 | ||||||||||||||

| New Hampshire | 1 | 1,982,642 | 0.2 | 7,550,000 | 0.2 | 420,868 | 0.2 | ||||||||||||||

| New Jersey | 1 | 1,969,512 | 0.2 | 7,500,000 | 0.2 | 418,081 | 0.2 | ||||||||||||||

| Iowa | 1 | 980,000 | 0.1 | 1,400,000 | 0.0 | 88,060 | 0.0 | ||||||||||||||

| Total | 95 | $977,059,894 | 100.0 | % | $3,600,375,000 | 100.0 | % | $225,825,101 | 100.0 | % | |||||||||||

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Aggregate Appraised Values and Underwritten NOI reflect the aggregate values without any reduction for the pari passu companion loan(s). |

| (3) | The Capital Centers II & III and Walgreens Witkoff Portfolio mortgage loans are mortgage loans secured by multiple properties, however these mortgage loans were underwritten as a portfolio as a whole. With respect to states containing mortgaged properties secured by these mortgage loans, the information in the above table allocates Underwritten NOI based upon each respective mortgaged property’s allocated loan amount as set forth on Annex A. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

15

COLLATERAL OVERVIEW (continued)

| Distribution of Cut-off Date Balances | |||||||||||

| Range of Cut-off Date Balances ($) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance | ||||||||

| 980,000- 4,999,999 | 11 | $33,690,810 | 3.4 | % | |||||||

| 5,000,000 - 9,999,999 | 17 | 125,646,743 | 12.9 | ||||||||

| 10,000,000 - 19,999,999 | 8 | 120,721,992 | 12.4 | ||||||||

| 20,000,000 - 29,999,999 | 12 | 294,793,357 | 30.2 | ||||||||

| 30,000,000 - 39,999,999 | 5 | 188,706,992 | 19.3 | ||||||||

| 40,000,000 - 49,999,999 | 2 | 88,500,000 | 9.1 | ||||||||

| 50,000,000 - 59,999,999 | 1 | 50,000,000 | 5.1 | ||||||||

| 60,000,000 - 75,000,000 | 1 | 75,000,000 | 7.7 | ||||||||

| Total | 57 | $977,059,894 | 100.0 | % | |||||||

| Distribution of UW NCF DSCRs(1) | |||||||||||

| Range of UW DSCR (x) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance | ||||||||

| 1.10 - 1.20 | 1 | $16,150,000 | 1.7 | % | |||||||

| 1.21 - 1.50 | 15 | 208,932,345 | 21.4 | ||||||||

| 1.51 – 2.00 | 26 | 414,468,898 | 42.4 | ||||||||

| 2.01 – 2.50 | 10 | 190,408,651 | 19.5 | ||||||||

| 2.51 – 3.00 | 4 | 140,000,000 | 14.3 | ||||||||

| 3.01 – 3.45 | 1 | 7,100,000 | 0.7 | ||||||||

| Total | 57 | $977,059,894 | 100.0 | % | |||||||

| (1) See footnotes (1) and (6) to the table entitled “Mortgage Pool Characteristics” above. | |||||||||||

| Distribution of Amortization Types(1) | |||||||||||

| Amortization Type | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance | ||||||||

| Interest Only | 17 | $398,290,000 | 40.8 | % | |||||||

| Interest Only, Then Amortizing(2) | 18 | 298,897,000 | 30.6 | ||||||||

| Amortizing (30 Years) | 15 | 223,604,349 | 22.9 | ||||||||

| Amortizing (25 Years) | 4 | 29,203,545 | 3.0 | ||||||||

| Interest Only, Then Amortizing – ARD(2) | 1 | 16,150,000 | 1.7 | ||||||||

| Interest Only – ARD | 2 | 10,915,000 | 1.1 | ||||||||

| Total | 57 | $977,059,894 | 100.0 | % | |||||||

| (1) All of the mortgage loans will have balloon payments at maturity date or have an anticipated repayment date, as applicable. | |||||||||||

| (2) Original partial interest only periods range from 12 to 84 months. | |||||||||||

| Distribution of Lockboxes | |||||||||||

| Lockbox Type | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance | ||||||||

| Hard | 29 | $693,709,614 | 71.0 | % | |||||||

| Springing | 27 | 258,350,280 | 26.4 | ||||||||

| Soft | 1 | 25,000,000 | 2.6 | ||||||||

| Total | 57 | $977,059,894 | 100.0 | % | |||||||

| Distribution of Cut-off Date LTV Ratios(1) | |||||||||||

| Range of Cut-off Date LTV (%) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance | ||||||||

| 39.7 - 50.0 | 7 | $214,689,333 | 22.0 | % | |||||||

| 50.1 - 60.0 | 21 | 371,752,443 | 38.0 | ||||||||

| 60.1 - 70.0 | 23 | 307,312,140 | 31.5 | ||||||||

| 70.1 - 75.0 | 5 | 67,155,978 | 6.9 | ||||||||

| 75.1 - 78.3 | 1 | 16,150,000 | 1.7 | ||||||||

| Total | 57 | $977,059,894 | 100.0 | % | |||||||

| (1) See footnotes (1) and (5) to the table entitled “Mortgage Pool Characteristics” above. | |||||||||||

| Distribution of Maturity Date/ARD LTV Ratios(1) | |||||||||||

| Range of Maturity Date/ARD LTV (%) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance | ||||||||

| 37.7 - 49.9 | 14 | $267,826,775 | 27.4 | % | |||||||

| 50.0 - 54.9 | 14 | 194,838,019 | 19.9 | ||||||||

| 55.0 - 59.9 | 17 | 372,608,099 | 38.1 | ||||||||

| 60.0 - 64.9 | 4 | 49,895,000 | 5.1 | ||||||||

| 65.0 - 69.9 | 6 | 74,762,000 | 7.7 | ||||||||

| 70.0 - 73.6 | 2 | 17,130,000 | 1.8 | ||||||||

| Total | 57 | $977,059,894 | 100.0 | % | |||||||

| (1) See footnotes (1), (3) and (5) to the table entitled “Mortgage Pool Characteristics” above. | |||||||||||

| Distribution of Loan Purpose | |||||||||||

| Loan Purpose | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance | ||||||||

| Refinance | 28 | $415,285,362 | 42.5 | % | |||||||

| Acquisition | 23 | 392,674,531 | 40.2 | ||||||||

| Recapitalization | 4 | 133,900,000 | 13.7 | ||||||||

| Acquisition/Refinance | 2 | 35,200,000 | 3.6 | ||||||||

| Total | 57 | $977,059,894 | 100.0 | % | |||||||

| Distribution of Mortgage Rates | |||||||||||

| Range of Mortgage Rates (%) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance | ||||||||

| 3.250 - 4.000 | 5 | $149,239,625 | 15.3 | % | |||||||

| 4.001 - 4.500 | 15 | 390,990,284 | 40.0 | ||||||||

| 4.501 - 5.000 | 22 | 287,758,428 | 29.5 | ||||||||

| 5.001 - 5.500 | 13 | 131,867,621 | 13.5 | ||||||||

| 5.501 - 5.600 | 2 | 17,203,935 | 1.8 | ||||||||

| Total | 57 | $977,059,894 | 100.0 | % | |||||||

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Deutsche Bank Securities Inc. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

16

COLLATERAL OVERVIEW (continued)

| Distribution of Debt Yield on Underwritten NOI(1) | |||||||||||

| Range of Debt Yields on Underwritten NOI (%) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance | ||||||||

| 6.2 - 7.9 | 3 | $62,150,000 | 6.4 | % | |||||||

| 8.0 - 8.9 | 9 | 209,901,268 | 21.5 | ||||||||

| 9.0 - 9.9 | 12 | 139,792,083 | 14.3 | ||||||||