Exhibit 5.2

May 3, 2019

CyrusOne Inc., CyrusOne LP and CyrusOne Finance Corp.

Registration Statement on Form S-3

Ladies and Gentlemen:

We have acted as counsel for CyrusOne Inc., a Maryland corporation (the “Parent Issuer”), CyrusOne LP, a Maryland limited partnership (“CyrusOne LP”), and CyrusOne Finance Corp., a Maryland corporation (“FinCo” and, together with CyrusOne LP, the “Subsidiary Issuers”) in connection with the preparation and filing with the U.S. Securities and Exchange Commission (the “Commission”) of a registration statement on Form S-3 (the “Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”), relating to the registration under the Securities Act and the proposed issuance and sale from time to time pursuant to Rule 415 under the Securities Act of (a) debt securities of the Parent Issuer in one or more series (the “Parent Debt Securities”) to be issued under an indenture (the “Parent Debt Indenture”), to be entered into among the Parent Issuer, any guarantors of the Parent Debt Securities and a trustee (the “Parent Debt Trustee”), (b) full and unconditional guarantees (the “Parent Debt Guarantees”) by the Subsidiary Issuers and the guarantors listed on Annex A hereto (the “Subsidiary Guarantors” and, together with the Subsidiary Issuers, the “Parent Debt Guarantors”) of the Parent Debt Securities, (c) debt securities of the Subsidiary Issuers in one or more series (the “Subsidiary Debt Securities” and, together with the Parent Debt Securities, the “Debt Securities”) to be issued under an indenture (the “Subsidiary Debt Indenture” and, together with the Parent Debt Indenture, the “Indentures”), to be entered into among the Subsidiary Issuers, any guarantors of the Subsidiary Debt Securities and a trustee (the “ Subsidiary Debt Trustee”), (d) full and unconditional guarantees (the “Subsidiary Debt Guarantees” and, together with the Parent Debt Guarantees, the “Guarantees”) by the Parent Issuer and the Subsidiary Guarantors (collectively, the “Subsidiary Debt Guarantors”) of the Subsidiary Debt Securities, (e) common stock, par value $0.01 per share, of the Parent Issuer (the “Common Stock”), (f) preferred stock, par value $0.01 per share, of the Parent Issuer (the “Preferred Stock”), (g) warrants to purchase Common Stock, Preferred Stock or Parent Debt Securities (the “Warrants”) in one or more series under a warrant agreement (the “Warrant Agreement”) to be entered

into by the Parent Issuer and a warrant agent (the “Warrant Agent”), (h) rights to purchase Common Stock, Preferred Stock or Parent Debt Securities (the “Rights”) in one or more series under a rights agreement (the “Rights Agreement”) to be entered into by the Parent Issuer and a rights agent (the “Rights Agent”) and (i) units consisting of two or more of Common Stock, Preferred Stock, Parent Debt Securities, Subsidiary Debt Securities, Warrants or Rights (the “Units” and, together with the securities specified in clauses (a) through (h) above, the “Securities”) in one or more series under a unit agreement (the “Unit Agreement”) to be entered into by the Parent Issuer and a unit agent (the “Unit Agent”). The Parent Issuer, the Subsidiary Issuers and the Subsidiary Guarantors are collectively referred to herein as the “Registrants”.

In that connection, we have examined originals, or copies certified or otherwise identified to our satisfaction, of such documents, corporate records, certificates of corporate officers and government officials and such other documents as we have deemed necessary or appropriate for the purposes of this opinion.

As to various questions of fact material to this opinion, we have relied upon representations of officers or directors of the Registrants and documents furnished to us by the Registrants without independent verification of their accuracy. We have also assumed the genuineness of all signatures, the legal capacity and competency of all natural persons, the authenticity of all documents submitted to us as originals and the conformity to authentic original documents of all documents submitted to us as copies.

Based upon and subject to the foregoing, and assuming that: (i) the Registration Statement and any supplements and amendments thereto (including post-effective amendments) will have become effective and will comply with all applicable laws; (ii) the Registration Statement and any supplements and amendments thereto (including post-effective amendments) will be effective and will comply with all applicable laws at the time the Securities are offered or issued as contemplated by the Registration Statement; (iii) a prospectus supplement will have been prepared and filed with the Commission describing the Securities offered thereby and will comply with all applicable laws; (iv) all Securities will be issued and sold in compliance with all applicable Federal and state securities laws and in the manner stated in the Registration Statement and the appropriate prospectus supplement; (v) none of the terms of any Security to be established subsequent to the date hereof, nor the issuance and delivery of such Security, nor the compliance by the Registrants with the terms of such Security will violate any applicable law or will result in a violation of any provision of any instrument or agreement then binding upon the Registrants or any restriction imposed by any court or governmental body having jurisdiction over the Registrants; (vi) a definitive purchase, underwriting or similar agreement and any other necessary agreement with respect to any Securities offered or issued will have been duly authorized and validly executed and delivered by the Registrants and the other parties thereto; (vii) any Warrant Agreement, Rights Agreement and Unit Agreement will be governed by the laws of the State of New York; and (viii) any Securities issuable upon conversion, exchange or exercise of any Security being offered or issued will be duly authorized, created and, if appropriate, reserved for issuance upon such conversion, exchange or exercise, we are of opinion that:

1. With respect to the Parent Debt Securities and the Parent Debt Guarantees to be issued under the Parent Debt Indenture, when (A) the Parent Debt Trustee is qualified to act as trustee under the Parent Debt Indenture, (B) the Parent Debt Trustee has duly executed and delivered the Parent Debt Indenture and any supplemental indenture thereunder, (C) the Parent Debt Indenture and any supplemental indenture thereunder has been duly authorized and validly executed and delivered by the Parent Issuer and any Parent Debt Guarantors to the Parent Debt Trustee, (D) the Parent Debt Indenture has been duly qualified under the Trust Indenture Act of 1939, as amended, (E) the boards of directors or members, as applicable (the “Boards”), of the Parent Issuer and any Parent Debt Guarantors have taken all necessary corporate, limited liability company, limited partnership or statutory trust, as applicable, action to approve the issuance and terms of a particular series of the Parent Debt Securities and the Parent Debt Guarantees, if any, the terms of the offering thereof and related matters and (F) such Parent Debt Securities and Parent Debt Guarantees have been duly executed, authenticated, issued and delivered in accordance with the provisions of the Parent Debt Indenture, any supplemental indenture and the applicable definitive purchase, underwriting or similar agreement approved by the applicable Boards upon payment of the consideration therefor provided for therein, such Parent Debt Securities and Parent Debt Guarantees will be validly issued and will constitute valid and binding obligations of the Parent Issuer and such Parent Debt Guarantors, enforceable against them in accordance with their terms (subject to applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer and other similar laws affecting creditors’ rights generally from time to time in effect and to general principles of equity, including, without limitation, concepts of materiality, reasonableness, good faith and fair dealing, regardless of whether such enforceability is considered in a proceeding in equity or at law).

2. With respect to the Subsidiary Debt Securities and the Subsidiary Debt Guarantees to be issued under the Subsidiary Debt Indenture, when (A) the Subsidiary Debt Trustee is qualified to act as trustee under the Subsidiary Debt Indenture, (B) the Subsidiary Debt Trustee has duly executed and delivered the Subsidiary Debt Indenture and any supplemental indenture thereunder, (C) the Subsidiary Debt Indenture and any supplemental indenture thereunder has been duly authorized and validly executed and delivered by the Subsidiary Issuers and any Subsidiary Debt Guarantors to the Subsidiary Debt Trustee, (D) the Subsidiary Debt Indenture has been duly qualified under the Trust Indenture Act of 1939, as amended, (E) the Boards of the Subsidiary Issuers and any Subsidiary Debt Guarantors have taken all necessary corporate, limited liability company, limited partnership or statutory trust, as applicable, action to approve the issuance and terms of a particular series of the Subsidiary Debt Securities and the Subsidiary Debt Guarantees, if any, the terms of the offering thereof and related matters and (F) such Subsidiary Debt Securities and Subsidiary Debt Guarantees have been duly executed, authenticated, issued and delivered in accordance with the provisions of the Subsidiary Debt Indenture, any supplemental indenture and the applicable

definitive purchase, underwriting or similar agreement approved by the applicable Boards upon payment of the consideration therefor provided for therein, such Subsidiary Debt Securities and Subsidiary Debt Guarantees will be validly issued and will constitute valid and binding obligations of the Subsidiary Issuers and such Subsidiary Debt Guarantors, enforceable against them in accordance with their terms (subject to applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer and other similar laws affecting creditors’ rights generally from time to time in effect and to general principles of equity, including, without limitation, concepts of materiality, reasonableness, good faith and fair dealing, regardless of whether such enforceability is considered in a proceeding in equity or at law).

3. With respect to the Warrants, when (a) the Warrant Agent has duly executed and delivered the Warrant Agreement, (b) the Warrant Agreement has been duly authorized and validly executed and delivered by the Parent Issuer to the Warrant Agent, (c) the Board of the Parent Issuer has taken all necessary corporate action to approve the due and valid issuance and terms of a particular series of Warrants, the terms of the offering thereof and related matters and (d) such Warrants have been duly executed, countersigned, registered and delivered in accordance with the provisions of the Warrant Agreement and the applicable definitive purchase, underwriting or similar agreement approved by the Board of the Parent Issuer, upon payment of the consideration therefor provided for therein, such Warrants will constitute valid and binding obligations of the Parent Issuer, enforceable against the Parent Issuer in accordance with their terms (subject to applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer and other similar laws affecting creditors’ rights generally from time to time in effect and to general principles of equity, including, without limitation, concepts of materiality, reasonableness, good faith and fair dealing, regardless of whether such enforceability is considered in a proceeding in equity or at law).

4. With respect to the Rights, when (a) the Rights Agent has duly executed and delivered the Rights Agreement, (b) the Rights Agreement has been duly authorized and validly executed and delivered by the Parent Issuer to the Rights Agent, (c) the Board of the Parent Issuer has taken all necessary corporate action to approve the due and valid issuance and terms of a particular series of Rights, the terms of the offering thereof and related matters and (d) such Rights have been duly executed and delivered in accordance with the provisions of the Rights Agreement and the applicable definitive purchase, underwriting or similar agreement approved by the Board of the Parent Issuer, upon payment of the consideration therefor provided for therein, such Rights will constitute valid and binding obligations of the Parent Issuer, enforceable against the Parent Issuer in accordance with their terms (subject to applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer and other similar laws affecting creditors’ rights generally from time to time in effect and to general principles of equity, including, without limitation, concepts of materiality, reasonableness, good faith and fair dealing, regardless

of whether such enforceability is considered in a proceeding in equity or at law).

5. With respect to the Units, when (a) the Unit Agent has duly executed and delivered the Unit Agreement, (b) the Unit Agreement has been duly authorized and validly executed and delivered by the Parent Issuer to the Unit Agent, (c) the Board of the Parent Issuer has taken all necessary corporate action to approve the due and valid issuance and terms of a particular series of Units, the terms of the offering thereof and related matters and (d) such Units have been duly executed and delivered in accordance with the provisions of the Unit Agreement and the applicable definitive purchase, underwriting or similar agreement approved by the Board of the Parent Issuer, upon payment of the consideration therefor provided for therein, such Units will constitute valid and binding obligations of the Parent Issuer, enforceable against the Parent Issuer in accordance with their terms (subject to applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer and other similar laws affecting creditors’ rights generally from time to time in effect and to general principles of equity, including, without limitation, concepts of materiality, reasonableness, good faith and fair dealing, regardless of whether such enforceability is considered in a proceeding in equity or at law).

We express no opinion herein as to any provision of the Indentures, the Warrant Agreement, the Rights Agreement or the Unit Agreement or the Debt Securities, the Guarantees, the Warrants, the Rights or the Units that (a) relates to the subject matter jurisdiction of any Federal court of the United States of America, or any Federal appellate court, to adjudicate any controversy related thereto, (b) contains a waiver of an inconvenient forum, (c) relates to the waiver of rights to jury trial or (d) provides for indemnification, contribution or limitations on liability. We also express no opinion as to (i) the enforceability of the provisions of the Indentures, the Warrant Agreement, the Rights Agreement or the Unit Agreement or the Debt Securities, the Guarantees, the Warrants, the Rights or the Units to the extent that such provisions constitute a waiver of illegality as a defense to performance of contract obligations or any other defense to performance which cannot, as a matter of law, be effectively waived or (ii) whether a state court outside the State of New York or a Federal court of the United States would give effect to the choice of New York law provided for therein.

Courts in the United States have not customarily rendered judgments for money damages denominated in any currency other than United States dollars. Section 27(b) of the Judiciary Law of the State of New York provides, however, that a judgment or decree in an action based upon an obligation denominated in a currency other than United States dollars shall be rendered in the foreign currency of the underlying obligation and converted into United States dollars at the rate of exchange prevailing on the date of the entry of the judgment or decree. We express no opinion as to whether a Federal court would render a judgment other than in United States dollars.

We are admitted to practice only in the State of New York and express no opinion as to matters governed by any laws other than the laws of the State of New York,

the General Corporation Law of the State of Delaware, the Limited Liability Company Act of the State of Delaware and the Federal laws of the United States of America. In particular, we do not purport to pass on any matter governed by the laws of the State of Maryland.

We understand that we may be referred to as counsel who has passed upon the validity of the Debt Securities, the Guarantees, the Warrants, the Rights or the Units of the Registrants in the prospectus and in a supplement to the prospectus forming a part of the Registration Statement, and we hereby consent to such use of our name in said Registration Statement and to the use of this opinion for filing with said Registration Statement as Exhibit 5.2 thereto. In giving this consent, we do not hereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the Rules and Regulations of the Commission promulgated thereunder.

In rendering this opinion, we have assumed, without independent investigation, the correctness of, and take no responsibility for, (i) the opinion dated May 3, 2019, of Venable LLP, Maryland counsel to the Registrants, a copy of which shall be filed with the Registration Statement as Exhibit 5.1 thereto, as to all matters of law covered therein relating to the laws of Maryland; and (ii) the opinion dated May 3, 2019, of Skadden, Arps, Meagher and Flom LLP, special tax counsel to the Registrants, a copy of which shall be filed with the Registration Statement as Exhibit 8.1 thereto, as to all matters of law covered therein.

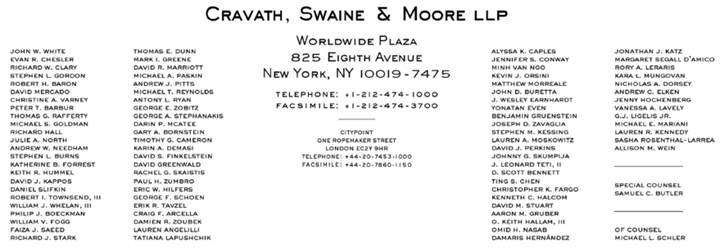

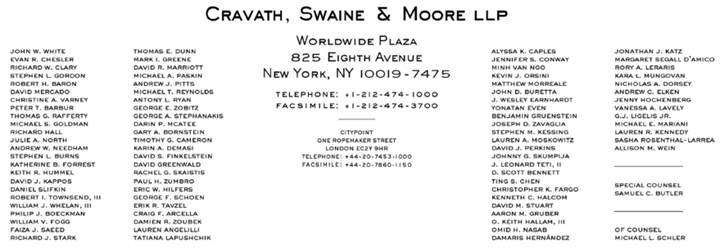

| Very truly yours, |

| |

| /s/ CRAVATH, SWAINE & MOORE LLP |

| |

| Cravath, Swaine & Moore LLP |

|

CyrusOne Inc., CyrusOne LP and CyrusOne Finance Corp.

2101 Cedar Springs Road, Suite 900

Dallas, TX 75201

Annex A

Guarantors

| | State or Other Jurisdiction |

Guarantors | | of Incorporation or Organization |

| | |

CyrusOne GP | | Maryland |

| | |

CyrusOne Foreign Holdings LLC | | Delaware |

| | |

CyrusOne LLC | | Delaware |

| | |

CyrusOne TRS Inc. | | Delaware |

| | |

Cervalis Holdings LLC | | Delaware |

| | |

Cervalis LLC | | Delaware |

| | |

CyrusOne-NC LLC | | Delaware |

| | |

CyrusOne-NJ LLC | | Delaware |

| | |

C1-Allen LLC | | Delaware |

| | |

C1-ATL LLC | | Delaware |

| | |

C1-Mesa LLC | | Delaware |

| | |

C1-Sterling VIII LLC | | Delaware |

| | |

C1-Santa Clara LLC | | Delaware |

| | |

Warhol TRS LLC | | Delaware |

| | |

Warhol Partnership LLC | | Delaware |

| | |

Warhol REIT LLC | | Delaware |