As filed with the United States Securities and Exchange Commission on September 17, 2018.

Registration Statement No. 333-225121

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________

Post-Effective Amendment No. 2

to

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

______________________________________________

Realm Therapeutics plc

(Exact name of registrant as specified in its charter)

______________________________________________

|

| | | | |

| England and Wales | | 2834 | | Not applicable |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

______________________________________________

267 Great Valley Parkway

Malvern, PA 19355

United States of America

Tel: +1 484 321 2700

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

______________________________________________

Realm Therapeutics, Inc.

267 Great Valley Parkway

Malvern, PA 19355

United States of America

Tel: +1 484 321 2700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

______________________________________________

Copies to:

|

| | |

Joshua A. Kaufman Jeffrey P. Libson Divakar Gupta Cooley LLP 1114 Avenue of the Americas New York, New York 10036 +1 212 479 6000 | | Ed Lukins Ed Dyson Cooley (UK) LLP Dashwood 69 Old Broad Street London EC2M 1QS United Kingdom +44 20 7785 9355 |

______________________________________________

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC:

As soon as practicable after this registration statement is declared effective.

______________________________________________

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act. Emerging growth company þ

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. þ

| |

| † | The term “new or revised financial accounting standards” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

DATED September 17, 2018

FINAL PROSPECTUS

126,857,901 Ordinary Shares

Represented by Approximately 5,074,316 American Depositary Shares

American Depositary Shares, or ADSs, each representing 25 ordinary shares of Realm Therapeutics plc, are listed on the Nasdaq Stock Market, or Nasdaq, under the symbol “RLM”. Our ordinary shares are currently traded on AIM, a market operated by the London Stock Exchange, under the ticker symbol “RLM”. The closing price of our ordinary shares on AIM on September 7, 2018 was £0.106 per share, which is equivalent to $0.14 per share based on the noon buying rate of the Federal Reserve Bank of New York on September 4, 2018, or $3.50 per ADS, after giving effect to the 25:1 ordinary share: ADS ratio. We have appointed Citibank, N.A. to act as the depositary for the ADSs representing our ordinary shares, including the Registered Shares, as defined below. Holders of ordinary shares registered hereby are able to deposit such shares with the depositary in exchange for ADSs representing such shares at the ratio referred to in the first sentence of this paragraph. ADSs representing the ordinary shares registered hereby became freely tradeable in the United States on the effective date of the registration statement of which this prospectus forms a part.

We have filed the registration statement of which this prospectus forms a part in part in respect of its obligations under a Registration Rights Agreement, dated September 21, 2017, concerning an aggregate of 66,396,485 ordinary shares (of which the registrant is hereby registering 66,254,529 of such ordinary shares) that we privately placed with investors on October 12, 2017 and an aggregate of 26,558,600 ordinary shares issuable upon the exercise of warrants issued on the same date to such investors. We also registered pursuant to the registration statement of which this prospectus forms a part an aggregate of 34,044,772 ordinary shares held by other shareholders identified herein. All such shareholders are identified in this prospectus and referred to as the Registered Holders. We refer to the aggregate 126,857,901 ordinary shares registered hereby as the Registered Shares. Any Registered Shares offered and sold in the United States by the Registered Holders will be in the form of ADSs. The Registered Holders are also permitted to sell ordinary shares not represented by ADSs in private transactions, including on AIM, a market operated by the London Stock Exchange, which resales are not covered by this prospectus. Unlike an initial public offering, any disposition by the Registered Holders of the Registered Shares represented by ADSs is not being underwritten by any investment bank. The Registered Holders may, or may not, elect to dispose of Registered Shares represented by ADSs as and to the extent that they may individually determine. Such dispositions, if any, will be made through brokerage transactions on Nasdaq or other securities exchanges in the United States at prevailing market prices. See the section entitled “Plan of Distribution.” We will not receive proceeds from any disposition of Registered Shares in the form of ADSs by Registered Holders.

We are an “emerging growth company” as defined under the federal securities laws and, as such, will be subject to reduced public company reporting requirements. See the section entitled “Prospectus Summary — Implications of Being an Emerging Growth Company and a Foreign Private Issuer” for additional information.

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Investing in ADSs representing our ordinary shares involves a high degree of risk. Before buying any ADSs representing our ordinary shares you should carefully read the discussion of material risks of investing in such securities in “Risk Factors” beginning on page 8 of this prospectus.

TABLE OF CONTENTS

We are responsible for the information contained in this prospectus and any free writing prospectus that we may prepare or authorize. We have not authorized anyone to provide you with different or additional information, and we do not take any responsibility for any other information that others may give you. We are not making an offer to sell ADSs representing our ordinary shares in any jurisdiction where the offer or sale thereof is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or the sale of any ADSs representing our ordinary shares.

For investors outside the United States: Neither we nor the Registered Holders have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction other than the United States where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the ADSs and the distribution of this prospectus outside the United States.

We are incorporated under the laws of England and Wales. Under the rules of the U.S. Securities and Exchange Commission, we are currently eligible for treatment as a “foreign private issuer.” As a foreign private issuer, we are not required to file periodic reports and financial statements with the U.S. Securities and Exchange Commission as frequently or as promptly as domestic registrants whose securities are registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

MARKET, INDUSTRY AND OTHER DATA

This prospectus contains estimates, projections and other information concerning our industry and our business. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from our own internal estimates and research as well as from reports, research surveys, studies and similar data prepared by market research firms and other third parties such as investment banking analysts, industry, medical and general publications, government data and similar sources. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See the section entitled “Special Note Regarding Forward-Looking Statements.”

ABOUT THIS PROSPECTUS

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to the terms “Realm,” “Realm Therapeutics,” “Realm Therapeutics plc,” “the company,” “we,” “us” and “our” refer to Realm Therapeutics plc together with its subsidiaries.

We own various trademark registrations and applications, and unregistered trademarks. All other trade names, trademarks and service marks of other companies appearing in this prospectus are the property of their respective holders. Solely for convenience, the trademarks and trade names in this prospectus may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend to use or display other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

PRESENTATION OF FINANCIAL INFORMATION

Our reporting currency is the U.S. dollar given the majority of our operations are located in the United States and transactions are denominated in U.S. dollars. The functional currency of Realm Therapeutics plc, the registrant, is pounds sterling, and its assets and liabilities are translated at the rate of exchange at year-end, while the statements of operations are translated at the average exchange rates in effect during the year. The net effect of these translation adjustments is shown as a component of accumulated other comprehensive income (loss). In this prospectus, we present our consolidated financial statements in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, as issued by the Financial Accounting Standards Board, or FASB.

We are a public limited company incorporated and domiciled in the United Kingdom, and registered in England and Wales, with our shares publicly traded on the Alternative Investment Market of the London Stock Exchange, or AIM as well as on the Nasdaq Capital Market. As required by AIM, we also prepare and issue annual and interim financial statements in accordance with International Financial Reporting Standards, or IFRS, as adopted by the European Union. Readers of this prospectus should note that there may be certain differences between the presentation of our financial position, results of operations and cash flows under IFRS and U.S. GAAP accounting standards.

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in ADSs representing our ordinary shares. You should read the entire prospectus carefully, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and the related notes included in this prospectus before making an investment decision.

Overview

We are a biopharmaceutical company with a proprietary technology platform of high concentration hypochlorous acid, or HOCl. HOCl is known as an anti-microbial molecule that is produced naturally in the body as part of the oxidative burst process, an innate immune response to infectious microbial agents. Our proprietary technology includes a specialized method for manufacturing high purity HOCl, which yields high concentration formulations that are stabilized for certain periods of time within specific pH ranges. We possess patents granted to us in the United States for composition of matter for the stabilized formulation of HOCl, methods of use and methods of manufacturing, as well as international patent protection and in-licensed HOCl technology related to our manufacturing process.

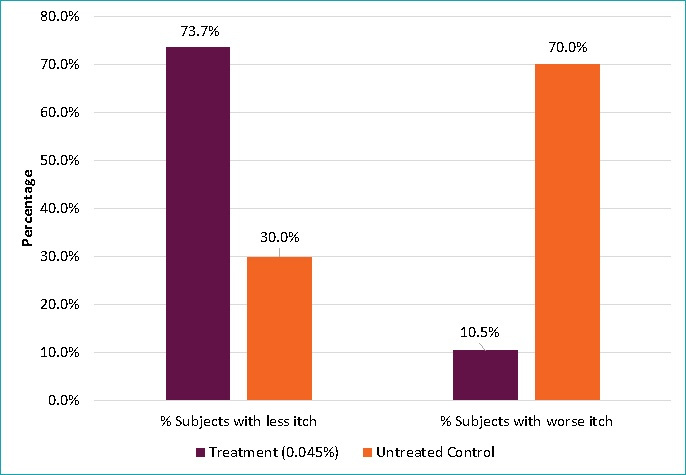

On August 14, 2018, we announced top-line results from a Phase 2 clinical trial evaluating our product candidate, PR022, a non-alcohol based topical gel containing the active ingredient HOCl, in patients with Atopic Dermatitis, or AD. This trial began in December 2017 and enrollment was completed in May 2018. Preliminary top-line results from the study demonstrated that PR022 showed no difference from vehicle in the primary endpoint of percent change in Eczema Area Severity Index, or EASI, versus baseline. On September 17, 2018, we announced that a full analysis of the AD study results showed a statistically significant efficacy signal in a subpopulation treated with the higher dose formulation. However, the results did not meet our threshold for continued investment and, as such, we have decided to discontinue further development of PR022 and all of our drug development programs, which are all based on the Company’s proprietary HOCl technology.

In March 2018, we announced that in a Phase 2 clinical trial for Allergic Conjunctivitis, or AC, an ophthalmic disease, PR013, our former product candidate designed as a topical solution containing HOCl as its active ingredient, did not demonstrate efficacy. As a result, we determined not to pursue the clinical development of PR013.

We have engaged MTS Health Partners to act as an advisor to assist us in exploring potential strategic alternatives, which may include the potential sale of the Company, as we seek to maximize the value of our assets, including the growing Vashe® wound care royalty stream and our FDA 510(k)-cleared anti-itch hydrogel, which was marketed as Aurstat™ before we terminated the out-licensing agreement so that we could purse a drug development pathway. Previously we successfully developed and sold businesses focused on supermarket retail and endoscope decontamination, both of which were based our proprietary HOCl technology. We may look to in-license or acquire further assets or undertake a broader corporate transaction.

We have a highly experienced and well-regarded management team that has gained significant industry know-how through experience at leading biopharmaceutical companies, including GSK, Johnson & Johnson, Novartis and Intercept. Additionally, our Chief Medical Officer is an immunologist with significant experience in studying immune-mediating diseases in various therapeutic areas (including oncology and hematological diseases) and has advanced several drug candidates from pre-clinical development through approval and commercialization.

Corporate Information

We were initially formed as a private limited company under the laws of England and Wales in April 2006 under the name PuriCore plc. In December 2016, we changed our name to Realm Therapeutics plc

to more accurately reflect our strategic focus and direction. Our ordinary shares were initially listed on the main market of the London Stock Exchange in June 2006. The listing was transferred to AIM, a market operated by the London Stock Exchange, in December 2014 and the ordinary shares currently trade thereon under the symbol “RLM”. ADSs representing our ordinary shares are now also listed on the Nasdaq Capital Market.

Our corporate headquarters are located at 267 Great Valley Parkway, Malvern, PA 19355, United States of America, where the telephone number is +1 484 321 2700. Our registered office is located at c/o CMS Cameron McKenna Nabarro Olswang LLP, Cannon Place, 78 Cannon Street London EC4N 6AF, United Kingdom, where the telephone number is +44.207.367.3000. Our website address is www.realmtx.com. The information contained on, or that can be accessed from, our website does not form part of this prospectus. Our agent for service of process in the United States is Realm Therapeutics, Inc., 267 Great Valley Parkway, Malvern, PA 19355, United States of America.

On October 12, 2017, we announced that we completed a private placement of £19.3 million, comprising 66,396,485 ordinary shares and warrants to purchase an aggregate of 26,558,600 shares with U.S. and U.K. healthcare specialist funds including OrbiMed, BVF Partners, RA Capital Management, Abingworth BioEquities and Polar Capital, as well as certain existing investors. The placement included a registration rights agreement requiring us to register the resale of the shares representing the ordinary shares acquired in the private placement as well as the shares issuable upon exercise of warrants sold in conjunction therewith following the initial listing of our ordinary shares (in the form of ADSs) on a U.S. securities exchange. The registration statement of which this prospectus forms a part has been filed in part pursuant to such registration rights agreement.

In July 2018, the SEC declared effective the registration statement of which this prospectus forms a part as well as a registration statement registering ADSs representing our ordinary shares as a class of securities under the Securities Exchange Act of 1934, the ADSs were listed for trading on the Nasdaq Capital Market. The registration statements were filed in part to facilitate the creation of a trading market in the United States for such ADSs and in satisfaction of our obligations under a registration rights agreement that we entered into with investors who participated in the October 2017 private placement. We did not register any new issuance of securities at such time.

Risks Associated with Our Business

Our business is subject to a number of risks of which you should be aware before making an investment decision. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth in the section titled “Risk Factors” before deciding whether to invest in ADSs representing our ordinary shares. These important risks include, but are not limited to, the following:

| |

| • | Following our announcement of top-line results from our Phase 2 clinical trial of PR022 for the treatment of AD, we have discontinued the further development of all of our drug development programs and are exploring strategic alternatives, including the potential sale of the Company, which represents material changes in business strategy, which we may not be able to execute effectively, on our intended timeline or at all, and our failure to do so may impact the price and volatility of the Company’s ordinary shares and ADSs representing our ordinary shares. |

| |

| • | We may not be able to obtain any value from our assets including the Vashe® wound care royalty stream and our FDA 510(k)-cleared anti-itch hydrogel, which was marketed as Aurstat™ or such realization of value may be lower than it otherwise would have been because of our negotiating position. |

| |

| • | While we previously successfully developed and sold businesses focused on supermarket retail and endoscope decontamination both of which were based our proprietary HOCl technology, we may not be successful in doing so in the future with our current assets. |

| |

| • | We may not be successful in potential attempts to in-license or acquire further assets or to undertake a broader corporate transaction to deliver value to shareholders. |

| |

| • | We have incurred significant losses and negative cash flow since our inception. We expect to continue to incur losses and may never achieve or maintain profitability. |

| |

| • | If we are unable to obtain or protect our intellectual property rights, we may not be able to compete effectively in our markets. |

| |

| • | The price of ADSs representing our ordinary shares or our ordinary shares may be volatile and may fluctuate due to factors beyond our control. |

| |

| • | To date, there has historically been no public market for ADSs representing our ordinary shares, and an active market may not develop in which investors can resell such ADSs. |

| |

| • | We currently qualify as a foreign private issuer and an emerging growth company. As a result, we will not be subject to the same level of reporting and corporate governance obligations applicable a U.S. domestic public company that is not an emerging growth company. We may lose our foreign private issuer status, which would then require us to comply with the Exchange Act’s domestic reporting regime and Nasdaq’s corporate governance requirements applicable to a domestic issuer, and cause us to incur significant incremental legal, accounting and other expenses. |

| |

| • | If securities or industry analysts do not publish research, or publish inaccurate or unfavorable research, about our business, the price of ADSs representing our ordinary shares or our ordinary shares and the trading volume thereof could decline. |

| |

| • | We believe that we will likely be classified as a passive foreign investment company, or PFIC, for U.S. federal income tax purposes for the taxable year ended December 31, 2017, and we expect to continue to be a PFIC for our current taxable year resulting in potential adverse consequences to U.S. holders of ADSs representing our ordinary shares or our ordinary shares. |

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As such, we may take advantage of certain exemptions from various reporting requirements that are applicable to other publicly traded entities that are not emerging growth companies. These exemptions include:

| |

| • | the option to present only two years of audited financial statements and related discussion in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus; |

| |

| • | not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002; |

| |

| • | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the |

auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

| |

| • | not being required to submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,” “say-on-frequency,” and “say-on-golden parachutes;” and |

| |

| • | not being required to disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 13(a) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, for complying with new or revised accounting standards. As a result, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to irrevocably opt out of this extended transition period and will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Under federal securities laws, our decision to opt out of the extended transition period is irrevocable.

We will remain an emerging growth company until the earliest of: (1) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion; (2) the last day of 2023; (3) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur on the last day of any fiscal year that the aggregate worldwide market value of our common equity held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter; or (iv) the date on which we have issued more than $1.0 billion in non-convertible debt securities during any three year period.

Foreign Private Issuer

We report under the Exchange Act as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act we are exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| |

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| |

| • | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| |

| • | the rules under the Exchange Act requiring the filing with the U.S. Securities and Exchange Commission, or the SEC, of quarterly reports on Form 10-Q containing unaudited financial and other specific information, and current reports on Form 8-K upon the occurrence of specified significant events. |

Foreign private issuers are also are exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company, but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither an emerging growth company nor a foreign private issuer.

THE REGISTERED SHARES

|

| | |

| Nasdaq Stock Market listing | | ADSs representing our ordinary shares have been approved for listing on the Nasdaq Stock Market under the symbol “RLM”. |

| | | |

| AIM trading symbol for our ordinary shares | | “RLM”. |

| | | |

| Registered Shares being registered on behalf of the Registered Holders | | 126,857,901 ordinary shares, represented by an aggregate of approximately 5,074,316 ADSs. |

| | | |

| Ordinary shares issued and outstanding immediately before and after the effectiveness of the registration statement of which this prospectus forms a part | | 116,561,917 ordinary shares. |

| | | |

| American Depositary Shares | | Each ADS represents 25 ordinary shares, nominal value £0.10 per share. Holders of ADSs have the rights of an ADS holder or beneficial owner (as applicable) as provided in the deposit agreement amongst us, the depositary and holders and beneficial owners of ADSs from time to time. To better understand the terms of ADSs representing our ordinary shares, see the section entitled “Description of American Depositary Shares.” We also encourage you to read the deposit agreement, the form of which is filed as an exhibit to the registration statement of which this prospectus forms a part. |

| | | |

| Depositary | | Citibank, N.A. |

| | | |

| Use of proceeds | | We will not receive proceeds from the disposition, if any, of Registered Shares in the form of ADSs by the Registered Holders. |

| | | |

| Risk factors | | See the section entitled “Risk Factors” and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in ADSs representing our ordinary shares. |

Unless otherwise stated in this prospectus, the number of our ordinary shares set forth herein is as of June 30, 2018 and is based on 116,561,917 ordinary shares issued and outstanding but excludes: 26,917,173 ordinary shares reserved for issuance pursuant to the terms of outstanding warrants, and 11,263,655 ordinary shares reserved for issuance upon the exercise of outstanding options under our Equity Incentive Plan.

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables set forth, for the periods and as of the dates indicated, our summary consolidated financial data. The consolidated statements of operations data for the years ended December 31, 2016 and 2017 is derived from our audited consolidated financial statements appearing elsewhere in this prospectus. Our audited consolidated financial statements included in this prospectus have been prepared in accordance with U.S. GAAP as issued by the Financial Accounting Standards Board, or FASB. The statement of operations data for the six months ended June 30, 2017 and 2018 and the balance sheet data as of June 30, 2018 have been derived from our unaudited interim financial statements included elsewhere in this prospectus and have been prepared on the same basis as the audited financial statements. You should read this data together with our consolidated financial statements and related notes included elsewhere in this prospectus and the information under the captions “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results are not necessarily indicative of our future results, and our results for any interim period are not necessarily indicative of the results to be expected for a full fiscal year.

|

| | | | | | | | | | | | | | | |

| | Years Ended December 31, | | Six Months Ended June 30, |

| (in thousands except share and per share data) | 2016 | | 2017 | | 2017 | | 2018 |

| Consolidated statement of operations data: | | | | | | | |

| Revenues | $ | 867 |

| | $ | 1,121 |

| | $ | 619 |

| | $ | — |

|

| Cost of revenues | 121 |

| | — |

| | — |

| | — |

|

| | 746 |

| | 1,121 |

| | 619 |

| | — |

|

| Operating expenses: | | | | | | | |

| Research and development | 4,805 |

| | 8,189 |

| | 2,968 |

| | 7,376 |

|

| General and administrative | 3,248 |

| | 3,622 |

| | 1,602 |

| | 3,518 |

|

| | 8,053 |

| | 11,811 |

| | 4,570 |

| | 10,894 |

|

| Loss from operations | (7,307 | ) | | (10,690 | ) | | (3,951 | ) | | (10,894 | ) |

| Interest income | 3 |

| | 58 |

| | 18 |

| | 248 |

|

| Loss from continuing operations before income taxes | (7,304 | ) | | (10,632 | ) | | (3,933 | ) | | (10,646 | ) |

| Income tax benefit | 2,230 |

| | 108 |

| | — |

| | — |

|

| Net loss from continuing operations | (5,074 | ) | | (10,524 | ) | | (3,933 | ) | | (10,646 | ) |

| Net income from discontinued operations, net of tax expense | 5,156 |

| | — |

| | — |

| | — |

|

| Net income (loss) | $ | 82 |

| | $ | (10,524 | ) | | $ | (3,933 | ) | | $ | (10,646 | ) |

| | | | | | | | |

| Net income (loss) per ordinary share - basic and diluted: | | | | | | | |

| Loss from continuing operations | $ | (0.10 | ) | | $ | (0.16 | ) | | $ | (0.08 | ) | | $ | (0.09 | ) |

| Income from discontinued operations | 0.10 |

| | — |

| | — |

| | — |

|

| Net income (loss) per ordinary share | $ | 0.00 |

| | $ | (0.16 | ) | | $ | (0.08 | ) | | $ | (0.09 | ) |

| | | | | | | | |

| Weighted average ordinary shares - basic and diluted | 50,139,121 |

| | 65,081,903 |

| | 50,165,432 |

| | 116,561,917 |

|

|

| | | |

| | As of June 30, 2018 |

| (in thousands) | |

| Consolidated balance sheet data: | |

| Cash, cash equivalents and marketable securities | $ | 23,669 |

|

| Working capital | $ | 22,180 |

|

| Total liabilities | $ | 2,449 |

|

| Total shareholders’ equity | $ | 24,282 |

|

RISK FACTORS

Investing in ADSs representing our ordinary shares involves a high degree of risk. Before deciding whether to invest, you should carefully consider the risks described below, and all other information contained in this prospectus, including our consolidated financial statements and the related notes included elsewhere in this prospectus. The occurrence of any of the events or developments described below could harm our business, financial condition, results of operations and growth prospects. In such an event, the market price of ADSs representing our ordinary shares or our ordinary shares could decline and you may lose all or part of your investment.

Risks Relating to Our Business

Following our announcement of top-line results from our Phase 2 clinical trial of PR022 for the treatment of Atopic Dermatitis (AD), we have discontinued the further development of all of our drug development programs and have begun a review of potential strategic alternatives, including the potential sale of the Company.

On September 17, 2018, we announced that our results of our Phase 2 clinical trial of PR022 in AD showed a statistically significant efficacy signal in a subpopulation treated with the higher dose formulation. However, the results did not meet our threshold for continued investment and, as such, we decided to discontinue further development of all of our drug development programs, which are all based on our proprietary HOCl technology. We have engaged MTS Health Partners to act as our advisor to assist in exploring potential strategic alternatives, which may include the potential sale of the Company, as we seek to maximize the value of our assets including the growing Vashe® wound care royalty stream and our FDA approved anti-itch hydrogel, which had been marketed as Aurstat™. Our discontinuation of the development of all of our drug development programs and our exploration of strategic alternatives, including the potential sale of the Company, represent material changes in our business strategy, which we may not be able to execute effectively, on our intended timeline or at all. These changes in business strategy and any failure to so execute it may impact the price and volatility of our publicly traded ordinary shares and ADRs representing such shares.

We may not be successful in obtaining value from our current assets or potential future assets.

We are exploring potential strategic alternatives to maximize the value of our assets. However, while we previously successfully developed and sold businesses focused on supermarket retail and endoscope decontamination based on our HOCl technology, we may not be successful in doing so in the future with our current assets. Specifically, we may not be able to obtain any value from our assets including the Vashe wound care royalty stream and our FDA 510(k)-cleared anti-itch hydrogel, which was marketed as Aurstat or such realization of value may be lower than it otherwise would have been because of our negotiating position. Additionally, we may not be successful in potential attempts to in-license or acquire assets or to undertake a broader corporate transaction to deliver value to shareholders in connection therewith. If we are not successful in obtaining value from our current assets or potential future assets, the value of our Company and your investment in our ordinary shares will suffer.

We have incurred significant losses and negative cash flow since our inception. We expect to continue to incur losses and may never achieve or maintain profitability.

Since inception, we have incurred significant net losses and negative cash flows from operations. We incurred net losses from continuing operations of $5.1 million, $10.5 million and $10.6 million, and negative cash flows from continuing operations of $6.7 million, $9.5 and $10.1 million for the years ended December 31, 2016 and 2017 and the six months ended June 30, 2018 respectively. As of June 30, 2018, we had an accumulated deficit of $198.0 million. We have no pharmaceutical products in clinical development or approved for commercialization.

We may never be able generate revenue that is significant enough to achieve profitability. Our failure to become and remain profitable would depress the value of our company and could impair our ability to raise capital, expand our business and / or continue our operations. A decline in the value of our Company could also cause you to lose all or part of your investment in our ordinary shares and / or your ADSs representing our ordinary shares.

We may not be successful in potential attempts to in-license or acquire further assets or to undertake a broader corporate transaction to deliver value to shareholders.

We may seek to in-license or acquire additional product candidates potentially for dermatological and other indications. We may not be able to develop or identify product candidates that are safe, tolerable and effective. Even if we are successful in our product candidate acquisition efforts, the potential product candidates that we identify, in-license or acquire may not be suitable for clinical development, including as a result of being shown to have harmful side effects or other characteristics that indicate that they are unlikely to be products that will receive marketing approval and achieve market acceptance. Additionally, the failures of our recent Phase 2 trials may negatively impact our Company’s reputation or negotiating position in in-licensing or acquiring assets under competitive circumstances.

HOCl is inherently unstable.

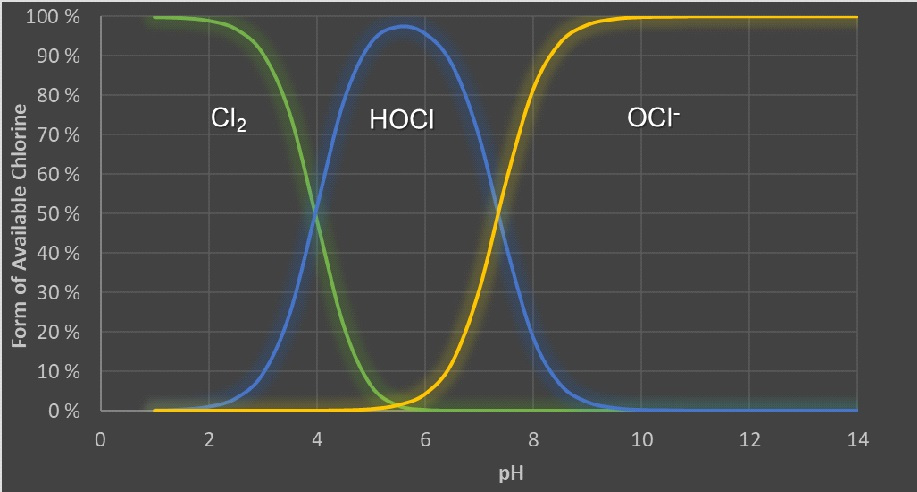

HOCl is formed from the dissolution of chlorine in water. The form of chlorine changes from Cl2 to HOCl to OCL- depending on the pH of its environment. HOCl is the form in which chlorine predominantly exists at a pH range of 4.0 to 6.5. This presents a challenge to the stability, and therefore the marketability, of our product containing HOCl. While we have been granted patents regarding the stabilization of HOCl, there can be no assurance that we will be able to develop and manufacture one or more formulations of HOCl that provide a sufficient shelf-life sufficient for commercial purposes based on such technology. To achieve a commercially viable shelf-life for such products containing HOCl may require a significant investment of money and resources, as well as time to develop, test and potentially patent, new formulations and packaging designs. Cold-chain maintenance may also be required to be instituted in the supply chain in order to maintain the necessary shelf life.

We rely on a small team of key management.

We rely on small management and research and development teams. In particular, we rely on the efforts of our Chief Executive Officer, Alex Martin, our Chief Financial Officer and Chief Operating Officer, Marella Thorell, and our Chief Medical Officer, Dr. Christian Peters. While we have entered into employment agreements with certain executive officers, each of these employees may terminate their employment with us at any time. We do not maintain “key person” insurance for either of these executive officers. We have reduced our workforce, including those in research and development, in order conserve cash resources while undertaking our strategic review. The loss of key members of our management team, including as a result of the recently announced strategic review of our business, could result in a delay of our strategic plans or require us to incur additional costs to recruit and / or train replacements, either of which could have a material adverse effect on our business or the outcome of the strategic review.

We may become subject to claims in connection with past asset dispositions.

We sold our Supermarket Retail business in October 2016. In connection with this transaction, we

provided customary representations, warranties and covenants and related indemnities to counterparties. Although we are not aware of any outstanding matters that would reasonably form a basis for a claim related to this transaction, circumstances may arise that could result in a claim against us by counterparties pursuant to our indemnification obligations thereunder and the underlying representations, warranties and covenants. If we become subject to liability based upon such contractual obligations or otherwise and we are required to indemnify the counterparties, it could have a material adverse effect on our business and financial position.

Product liability lawsuits against us could cause us to incur substantial liabilities and to limit commercialization of any products that we may develop.

We face an inherent risk of product liability exposure if we commercially sell any products. If we cannot successfully defend ourselves against claims that our products caused injuries, we will incur substantial liabilities. Regardless of merit or eventual outcome, liability claims may result in:

| |

| • | decreased demand for any products that we may develop; |

| |

| • | injury to our reputation and significant negative media attention; |

| |

| • | withdrawal of clinical trial participants; |

| |

| • | significant costs to defend the related litigation; |

| |

| • | substantial monetary awards paid to trial participants or patients; |

| |

| • | reduced resources of our management to pursue our business strategy; and |

| |

| • | the inability to commercialize any products that we may develop. |

We currently hold $10 million in product liability insurance coverage in the aggregate, with a per incident limit of $10 million, which may not be adequate to cover all liabilities that we may incur. Insurance coverage is increasingly expensive. We may not be able to maintain insurance coverage at a reasonable cost or in an amount adequate to satisfy any liability that may arise.

Our business and operations would suffer in the event of computer system failures, cyberattacks or a deficiency in our cybersecurity.

Despite the implementation of security measures, our internal computer systems, and those of third parties on which we rely, are vulnerable to damage from computer viruses, malware, natural disasters, terrorism, war, telecommunication and electrical failures, cyberattacks or cyber intrusions over the Internet, attachments to emails, persons inside our organization, or persons with access to systems inside our organization. The risk of a security breach or disruption, particularly through cyberattacks or cyber intrusion, including by computer hackers, foreign governments, and cyber terrorists, has generally increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. To the extent that any disruption or security breach was to result in a loss of or damage to our data or applications, or inappropriate disclosure of confidential or proprietary information, we could incur material legal claims and liability and damage to our reputation.

Risks Relating to Intellectual Property Matters

If we are unable to obtain or protect our intellectual property rights, we may not be able to compete effectively in our markets.

We rely upon a combination of patents, trade secret protection, and confidentiality agreements to protect our intellectual property. The issuance, scope, validity, enforceability, strength and commercial

value of patents in the pharmaceutical field involves complex legal and scientific questions and can be uncertain. Some patent applications that we own may fail to result in issued patents with claims that cover products in the U.S. or in foreign jurisdictions. If this were to occur, early generic competition could be expected against any product candidates in development. There may be relevant prior art relating to our current or future patents and patent applications which could invalidate a patent or prevent a patent from issuing based on a pending patent application.

We have in-licensed certain intellectual property, including patents, from Dr. Vitold Bakhir relating to electrochemical cell devices for production of HOCl. While our licenses are exclusive at least within our field and require cooperation from the licensor to enforce the licensed patents, there is no guarantee that these patents will be successfully enforced against competitors, or that the licensor will fully comply with the terms of the license, including obligations relating to patent enforcement and defense of the patents. Further, we have sublicensed certain intellectual property licensed from Dr. Bakhir to Chemstar Corp. for certain unrelated fields, including rights to enforce this intellectual property in these fields. Enforcement of the intellectual property in the sublicensed fields could compromise or result in invalidation of some or all of the intellectual property sublicensed to Chemstar Corp.

The patent prosecution process is expensive and time consuming. We may not be able to prepare, file, and prosecute all necessary or desirable patent applications for a commercially reasonable cost or in a timely manner or in all jurisdictions. It is also possible that we may fail to identify patentable aspects of inventions made in the course of development and commercialization activities before it is too late to obtain patent protection on them. Further, there are other companies pursuing HOCl related technologies. These third parties may file patent applications or disclose concepts relevant to our technology before we are able to file our patent applications, and thus these third party patents and disclosures may constitute prior art against our patents and applications. Moreover, depending on the terms of any future in licenses to which we may become a party, we may not have the right to control the preparation, filing, and prosecution of patent applications, or to maintain or enforce the patents, covering technology in licensed from third parties. Therefore, these patents and patent applications may not be prosecuted and enforced in a manner consistent with the best interests of our business.

In addition to the protection afforded by patents, we rely on trade secret protection and confidentiality agreements to protect proprietary know-how, information, or technology that is not patentable or is difficult to patent, including processes and information relating to our manufacturing programs for which patents are difficult to enforce or would not provide a competitive advantage. Although we generally require all of our employees to assign their inventions to us, and all of our employees, consultants, advisors, and any third parties who have access to our proprietary know-how, information, or technology to enter into confidentiality agreements, we cannot provide any assurances that all such agreements have been duly executed, or that our trade secrets and other confidential proprietary information will not be disclosed, or that competitors will not otherwise gain access to our trade secrets or independently develop substantially equivalent information and techniques. We also seek to preserve the integrity and confidentiality of our data and trade secrets by maintaining physical security of our premises and physical and electronic security of our information technology systems. While we have confidence in these individuals, organizations and systems, agreements, or security measures may be breached, and we may not have adequate remedies for any breach. Also, if the steps taken to maintain our trade secrets are deemed inadequate, we may have insufficient recourse against third parties for misappropriating the trade secret. In addition, others may independently discover our trade secrets and proprietary information. For example, the FDA is considering whether to make additional information publicly available on a routine basis, including information that we may consider to be trade secrets or other proprietary information, and it is not clear at the present time how the FDA’s disclosure policies may change in the future. Furthermore, we have sold certain of our businesses over the past few years, pursuant to which licenses were granted to the acquirers of such businesses to utilize certain of our intellectual property rights, including rights to produce and market HOCl for particular purposes. We have also out-licensed our intellectual property to certain third parties. If the licensees do not respect the terms of such agreements, including limitations as to the field of use, then we could be adversely affected due to the loss of potential

business opportunities outside the scope of those granted to the licensees, or we could be subject to non-contractual disclosure of such information. If we are unable to prevent material disclosure of the non-patented intellectual property related to our technologies to third parties, and there is no guarantee that we will have any such enforceable trade secret protection, we may not be able to establish or maintain a competitive advantage in our market, which could materially adversely affect our business, results of operations and financial condition.

We may enjoy only limited geographical protection with respect to certain patents and we may not be able to protect our intellectual property rights throughout the world.

Filing and prosecuting patent applications and defending patents covering our HOCl technology in all countries throughout the world would be prohibitively expensive. While we have filed patent applications in jurisdictions that we believe are important to our business, our patent position in these jurisdiction may not be the same as our position in the U.S. Competitors may use our technologies in jurisdictions where we have not obtained patent protection to develop their own products and, further, may export otherwise infringing products to territories where we have patent protection, but enforcement rights are not as strong as those in the U.S. or Europe.

In addition, we may decide to abandon national and regional patent applications before grant. The examination of each national or regional patent application is an independent proceeding. As a result, patent applications in the same family may issue as patents in some jurisdictions, such as in the U.S., but may issue as patents with claims of different scope or may even be refused in other jurisdictions. It is also quite common that depending on the country, the scope of patent protection may vary for the same product candidate or technology.

While we intend to protect our intellectual property rights in our expected significant markets, we cannot ensure that we will be able to initiate or maintain similar efforts in all jurisdictions in which we may wish to market products using our HOCl technology. Accordingly, our efforts to protect our intellectual property rights in such countries may be inadequate, which may have an adverse effect on our ability to successfully commercialize any products using our HOCl technology in all of our expected significant foreign markets. If we encounter difficulties in protecting, or are otherwise precluded from effectively protecting, the intellectual property rights important for our business in such jurisdictions, the value of these rights may be diminished, and we may face additional competition from others in those jurisdictions.

The laws of some jurisdictions do not protect intellectual property rights to the same extent as the laws or rules and regulations in the U.S. and Europe, and many companies have encountered significant difficulties in protecting and defending such rights in such jurisdictions. The legal systems of certain countries, particularly certain developing countries, do not favor the enforcement of patents, trade secrets, and other intellectual property rights, which could make it difficult for us to stop the infringement of our future patents or marketing of competing products in violation of our proprietary rights generally. Proceedings to enforce our patent rights in other jurisdictions, whether or not successful, could result in substantial costs and divert our efforts and attention from other aspects of our business, could put our future patents at risk of being invalidated or interpreted narrowly and our patent applications at risk of not issuing as patents, and could provoke third parties to assert claims against us. We may not prevail in any lawsuits that we initiate and the damages or other remedies awarded, if any, may not be commercially meaningful. Accordingly, our efforts to enforce our intellectual property rights around the world may be inadequate to obtain a significant commercial advantage from the intellectual property that we develop or license.

Some countries also have compulsory licensing laws under which a patent owner may be compelled to grant licenses to third parties. In addition, some countries limit the enforceability of patents against government agencies or government contractors. In those countries, the patent owner may have limited remedies, which could materially diminish the value of such patents. If we are forced to grant a license to third parties with respect to any patents relevant to our business, our competitive position may be impaired.

Patent reform legislation could increase the uncertainties and costs surrounding the prosecution of our patent applications and the enforcement or defense of our future patents.

Our ability to obtain patents is highly uncertain because, to date, some legal principles remain unresolved, there has not been a consistent policy regarding the breadth or interpretation of claims allowed in patents in the U.S. and the specific content of patents and patent applications that are necessary to support and interpret patent claims is highly uncertain due to the complex nature of the relevant legal, scientific, and factual issues. Changes in either patent laws or interpretations of patent laws in the U.S. and other jurisdictions or countries may diminish the value of our intellectual property or narrow the scope of our patent protection.

Depending on actions by the U.S. Congress, the federal courts, and the USPTO, the laws and regulations governing patents could change in unpredictable ways that would weaken our ability to obtain new patents or to enforce patents that we have owned or licensed or that we might obtain in the future. An inability to obtain, enforce, and defend patents covering our proprietary technologies would materially and adversely affect our business prospects and financial condition.

Similarly, changes in patent laws and regulations in other countries or jurisdictions or changes in the governmental bodies that enforce them or changes in how the relevant governmental authority enforces patent laws or regulations may weaken our ability to obtain new patents or to enforce patents that we may obtain in the future. Further, the laws of some foreign countries do not protect proprietary rights to the same extent or in the same manner as the laws of the U.S. As a result, we may encounter significant problems in protecting and defending our intellectual property both in the U.S. and abroad. For example, if the issuance to us, in a given country, of a patent covering an invention is not followed by the issuance, in other countries, of patents covering the same invention, or if any judicial interpretation of the validity, enforceability, or scope of the claims, or the written description or enablement, in a patent issued in one country is not similar to the interpretation given to the corresponding patent issued in another country, our ability to protect our intellectual property in those countries may be limited. Changes in either patent laws or in interpretations of patent laws in the U.S. and other jurisdictions or countries may materially diminish the value of our intellectual property or narrow the scope of our patent protection.

Obtaining and maintaining our patent protection depends on compliance with various procedural, document submission, fee payment and other requirements imposed by government patent agencies, and our patent protection could be reduced or eliminated for non-compliance with these requirements.

Periodic maintenance fees, renewal fees, annuity fees, and various other government fees on patents and / or applications, including certain in-licensed patents, will be due to be paid to the USPTO and various government patent agencies outside of the U.S. over the lifetime of our patents and / or applications and patent rights we may obtain or apply for in the future. We rely on our outside counsel to coordinate payment of these fees. The USPTO and various non-U.S. government patent agencies require compliance with several procedural, documentary, fee payment, and other similar provisions during the patent application process. We employ reputable law firms and other professionals to help us comply with procedural and formal requirements relating to our patents. In many cases, an inadvertent lapse can be cured by payment of a late fee or by other means in accordance with the applicable rules. There are situations, however, in which non-compliance can result in abandonment or lapse of the patents or patent applications, resulting in partial or complete loss of patent rights in the relevant jurisdiction. In such an event, potential competitors might be able to enter the market, and this circumstance could harm our business.

We may be involved in lawsuits to protect or enforce our patents, which could be expensive, time consuming and unsuccessful.

Competitors may infringe our patents. To counter infringement or unauthorized use, we may be required to file infringement claims, which can be expensive and time-consuming. If we initiate legal proceedings against a third party to enforce a patent covering our technology or any product candidates,

the defendant could counterclaim that the patent covering such technology or product candidate is invalid and / or unenforceable. In patent litigation in the U.S., defendant counterclaims alleging invalidity and / or unenforceability are common, and there are numerous grounds upon which a third party can assert invalidity or unenforceability of a patent. In an infringement proceeding, a court may decide that a patent of ours is not valid or is unenforceable, or may refuse to stop the other party from using the technology at issue on the grounds that our patents do not cover the technology in question. Third parties may also raise similar claims before administrative bodies in the U.S. or abroad, even outside the context of litigation. Such mechanisms include re-examination, post grant review, inter partes review, or IPR, and equivalent proceedings in foreign jurisdictions (e.g., opposition proceedings). Such proceedings could be more expeditious or cost-effective for plaintiffs than a standard court proceeding, and could result in revocation of or amendment to our patents in such a way that they no longer cover our technology and any product candidates or similar products of our competitors. The outcome following legal assertions of invalidity and unenforceability is unpredictable. With respect to the validity question, for example, we cannot be certain that there is no invalidating prior art, of which we, our patent counsel, and the patent examiner were unaware during prosecution. If a defendant were to prevail on a legal assertion of invalidity and / or unenforceability, we would lose at least part, and perhaps all, of the patent protection on our product candidates. An adverse result in any litigation or defense proceedings could put one or more of our patents at risk of being invalidated or interpreted narrowly, could put our patent applications at risk of not issuing and could have a material adverse effect on our business.

Interference or derivation proceedings provoked by third parties or brought by us may be necessary to determine the priority of inventions with respect to our patent applications. Our business could be harmed if the prevailing party does not offer us a license on commercially reasonable terms. Our defense of litigation or interference or derivation proceedings may fail and, even if successful, may result in substantial costs and distract our management and other employees. We may not be able to prevent misappropriation of our intellectual property rights, particularly in countries where the laws may not protect those rights as fully as in the U.S.

Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, there is a risk that some of our confidential information could be compromised by disclosure during this type of litigation. There could also be public announcements of the results of hearings, motions, or other interim proceedings or developments. If securities analysts or investors perceive these results to be negative, it could have a material adverse effect on the price of our ordinary shares and ADSs representing our ordinary shares.

Third parties may initiate legal proceedings alleging that we are infringing their intellectual property rights, the outcome of which could have a material adverse effect on our business.

As any future product candidates progress toward commercialization, the possibility of a patent infringement claim against us increases. There can be no assurance that any future product candidates do not infringe other parties’ patents or other proprietary rights, and competitors or other parties may assert that we infringe their proprietary rights in any event. For instance, we are aware of a significant patent estate around HOCl. We may become party to, or threatened with, adversarial proceedings or litigation regarding intellectual property rights with respect to any future product candidates, including interference or derivation proceedings before the USPTO. Third parties may assert infringement claims against us based on existing patents or patents that may be granted in the future. There are third parties that hold significant patent estates relating to HOCl. While we do not believe these third party patent estates cover any of our technology, if we are found to infringe a third party’s intellectual property rights, we could be required to obtain a license from such third party to continue commercializing any future product candidates. However, we may not be able to obtain any required license on commercially reasonable terms or at all. Even if a license can be obtained on acceptable terms, the rights may be non-exclusive, which could give our competitors access to the same technology or intellectual property rights licensed to us. If we fail to obtain a required license, we may be unable to effectively market product candidates based on our technology, which could limit our ability to generate revenue or achieve profitability and possibly prevent us from generating revenue sufficient to sustain our operations.

Alternatively, we may need to redesign our infringing products, which may be impossible or require substantial time and monetary expenditure. Under certain circumstances, we could be forced, including by court orders, to cease commercializing any such product candidates. In addition, in any such proceeding or litigation, we could be found liable for substantial monetary damages, potentially including treble damages and attorneys’ fees, if we are found to have willfully infringed. A finding of infringement could prevent us from commercializing any such product candidates or force us to cease some of our business operations, which could harm our business. Any claims by third parties that we have misappropriated their confidential information or trade secrets could have a similar negative impact on our business.

The cost to us in defending or initiating any litigation or other proceeding relating to patent or other proprietary rights, even if resolved in our favor, could be substantial, and litigation would divert our management’s attention. Some of our competitors may be able to sustain the costs of complex patent litigation more effectively than we can because they have substantially greater resources. Uncertainties resulting from the initiation and continuation of patent litigation or other proceedings could delay our research and development efforts and limit our ability to continue our operations.

We may be subject to claims challenging the inventorship or ownership of our future patents and other intellectual property.

We may also be subject to claims that former employees, collaborators, or other third parties have an ownership interest in our patent applications, our future patents or other intellectual property. We may be subject to ownership disputes in the future arising, for example, from conflicting obligations of consultants or others who are involved in developing our HOCl technology. Litigation may be necessary to defend against these and other claims challenging inventorship or ownership. If we fail in defending any such claims, in addition to paying monetary damages, we may lose valuable intellectual property rights, such as exclusive ownership of, or right to use, valuable intellectual property. Such an outcome could have a material adverse effect on our business. Even if we are successful in defending against such claims, litigation could result in substantial costs and be a distraction to management and other employees.

Risks Relating to our Ordinary Shares and our ADSs Representing Ordinary Shares

The price of ADSs representing our ordinary shares or our ordinary shares may be volatile and may fluctuate due to factors beyond our control.

The trading market for publicly traded clinical stage drug development companies has been highly volatile and is likely to remain highly volatile in the future. The market price of ADSs representing our ordinary shares or our ordinary shares may fluctuate significantly due to a variety of factors, including:

| |

| • | announcements or developments in connection with the strategic review of our business; |

| |

| • | technological innovations or commercial product introductions by us or competitors; |

| |

| • | changes in U.S. and international government regulations; |

| |

| • | developments concerning proprietary rights, including patents and litigation matters; |

| |

| • | financing events, or our inability to obtain financing, or other corporate transactions; |

| |

| • | publication of research reports or comments by securities or industry analysts; |

| |

| • | general market conditions in the biopharmaceutical and pharmaceutical industries or in the economy as a whole; or |

| |

| • | other events and factors, many of which are beyond our control. |

In addition, we cannot assure investors that our ordinary shares will continue to be traded on AIM. If such trading were to cease, certain investors may decide to sell their ordinary shares, which could have an adverse impact on the price of the ordinary shares and the ADSs representing our ordinary shares. For so long as our ordinary shares are traded on AIM and Nasdaq, it is possible that relatively small trades on AIM or Nasdaq could disproportionately affect the trading price of our ordinary shares on AIM and of ADSs representing our ordinary shares on Nasdaq due to the current limited trading volume of our ordinary shares on AIM and Nasdaq.

These and other market and industry factors may cause the market price and demand for ADSs representing our ordinary shares or our ordinary shares to fluctuate substantially, regardless of our actual operating performance, which may limit or prevent investors from readily selling their ADSs representing our ordinary shares or ordinary shares and may otherwise negatively affect the liquidity of ADSs representing our ordinary shares or our ordinary shares. In addition, the U.S. and UK stock markets in general, and the equities of emerging companies in particular, have experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of these companies. In the past in the U.S., when the market price of a security has been volatile, holders of that security have sometimes instituted securities class action litigation against the issuer. If any of the holders of ADSs representing our ordinary shares or our ordinary shares were to bring such a lawsuit against us, we could incur substantial costs defending the lawsuit and the attention of our senior management would be diverted from the operation of our business. Any adverse determination in litigation could also subject us to significant liabilities.

We are are incurring increased costs as a result of operating as a company with securities listed in the U.S. in addition to the UK, and our senior management is required to devote substantial time to new compliance initiatives and corporate governance practices.

As a company with securities listed in the U.S. in addition to the UK, and particularly after we no longer qualify as an emerging growth company, we will incur significant legal, accounting, insurance and other expenses that we did not incur previously. The Sarbanes-Oxley Act of 2002, the Dodd-Frank Wall Street Reform and Consumer Protection Act, the listing requirements of Nasdaq and other applicable securities rules and regulations impose various requirements on non-U.S. reporting public companies, including the establishment and maintenance of effective disclosure and financial controls and corporate governance practices. Our senior management and other personnel will need to devote a substantial amount of time to these compliance initiatives. Moreover, these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, or Section 404, we will be required to furnish a report by our senior management on our internal control over financial reporting beginning with our second annual report to be filed with the U.S. Securities and Exchange Commission, or SEC. However, while we remain an emerging growth company, we will not be required to include an attestation report on internal control over financial reporting issued by our independent registered public accounting firm. To prepare for eventual compliance with Section 404, we will need to continue to dedicate internal resources, potentially engage outside consultants and adopt a detailed work plan to assess and document the adequacy of internal control over financial reporting, continue steps to improve control processes as appropriate, validate through testing that controls are functioning as documented, and implement a continuous reporting and improvement process for internal control over financial reporting. We anticipate that the process to document and evaluate our internal control over financial reporting will be both costly and challenging.

To date, there has been limited public market for ADSs representing our ordinary shares, and an active market may not develop in which investors can resell such ADSs.

Although the ADSs are listed for trading on the Nasdaq Global market, to date there has been limited public market for ADSs representing our ordinary shares although our ordinary shares have traded on AIM since 2014 and prior to that on the main market of the London Stock Exchange since 2006. We

cannot predict the extent to which an active market for ADSs representing our ordinary shares will develop or be sustained or how the development of such a market might affect the market price for our ordinary shares on AIM.

Fluctuations in the exchange rate between the U.S. dollar and the pound sterling may increase the risk of holding the ADSs.

Our share price is quoted on AIM in pounds sterling, while the ADSs will trade on Nasdaq in U.S. dollars. Fluctuations in the exchange rate between the U.S. dollar and the pound sterling may result in temporary differences between the value of the ADSs representing our ordinary shares and the value of our ordinary shares, which may result in heavy trading by investors seeking to exploit such differences. In addition, as a result of fluctuations in the exchange rate between the U.S. dollar and the pound sterling, the U.S. dollar equivalent of the proceeds that a holder of the ADSs representing our ordinary shares would receive upon the sale in the UK of any shares withdrawn from the depositary receipts facility, and the U.S. dollar equivalent of any cash dividends paid, if any, in pounds sterling on our ordinary shares represented by the ADSs, could also decline.

Future sales, or the possibility of future sales, of a substantial number of ADSs representing our ordinary shares or our ordinary shares could adversely affect the price of such securities.

Future sales of a substantial number of ADSs representing our ordinary shares or our ordinary shares, or the perception that such sales will occur, could cause a decline in the market price of ADSs representing our ordinary shares and our ordinary shares. As of September 14, 2018, we had 116,561,917 ordinary shares issued and outstanding and 1,668,764 ADSs representing our ordinary shares outstanding. All of our ordinary shares are freely tradeable on AIM. Holders of all of our ordinary shares are able to deposit such ordinary shares with the depositary in exchange for ADSs representing such shares at the ratio of 25 ordinary shares to 1 ADS, which ADSs are freely tradeable.

If holders sell substantial amounts of ADSs representing our ordinary shares or ordinary shares in the respective public markets therefor, or if the market perceives that such sales may occur, the market price of ADSs representing our ordinary shares and our ordinary shares and our ability to raise capital through an issue of equity securities in the future could be adversely affected.

Because we do not anticipate paying any cash dividends on our ordinary shares which underlie our ADSs in the foreseeable future, capital appreciation, if any, will be the sole source of gains on such securities and you may never receive a return on your investment.

Under the laws of England and Wales, a company’s accumulated realized profits must exceed its accumulated realized losses on a non-consolidated basis before dividends can be paid. Therefore, we must have distributable profits before issuing a dividend. We have not paid dividends in the past on our ordinary shares. We intend to retain earnings, if any, for use in our business and do not anticipate paying any cash dividends in the foreseeable future. As a result, capital appreciation, if any, on ADSs representing our ordinary shares or our ordinary shares are expected to be the sole source of gains on such securities for the foreseeable future.

Securities traded on AIM may carry a higher risk than securities traded on certain other exchanges, which may impact the value of your investment.

Our ordinary shares are currently traded on AIM. Investment in equities traded on AIM is sometimes perceived to carry a higher risk than an investment in equities quoted on exchanges with more stringent listing requirements, such as the main market for listed securities of the London Stock Exchange. This is because AIM imposes less stringent corporate governance and ongoing reporting requirements than these other exchanges. In addition, AIM requires only half-yearly financial reporting, rather than the quarterly financial reporting required for U.S.-listed companies that are domestic registrants. You should be aware that the value of our ordinary shares may be influenced by many factors, some of which may be specific to us and some of which may affect AIM-quoted companies generally, including the depth and liquidity of the market, our performance, a large or small volume of trading in our ordinary shares,