- IDAI Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

T Stamp (IDAI) S-1IPO registration

Filed: 27 Jan 25, 5:11pm

As filed with the U.S. Securities and Exchange Commission on January 27, 2025

Registration No. 333-________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

T STAMP INC.

(Exact name of registrant as specified in its charter)

Delaware |

| 7372 |

| 20-2222203 |

(State or other jurisdiction of |

| (Primary Standard Industrial |

| (I.R.S. Employer |

3017 Bolling Way NE, Floor 2,

Atlanta, Georgia, 30305, USA

(404) 806-9906

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Gareth Genner

c/o T Stamp Inc.

3017 Bolling Way NE, Floor 2,

Atlanta, Georgia, 30305, USA

(404) 806-9906

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a Copy to:

CrowdCheck Law LLP

700 12th Street NW, Suite 700

Washington, DC 20005

Approximate date of commencement of proposed sale to the public: Promptly after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

|

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

EXPLANATORY NOTE

Pursuant to Rule 429 under the Securities Act of 1933, as amended (the “Securities Act”), the prospectus included in this Registration Statement on Form S-1 (this “Registration Statement”) is a combined prospectus relating to:

| ● | The resale of up to 621,303 shares of Class A Common Stock, par value $0.01 per share (“Class A Common Stock”) issuable upon the exercise of certain warrants issued to Armistice Capital Master Fund Ltd. (“Armistice” or the “Selling Stockholder”) comprised of: (i) up to 414,202 shares of Class A Common Stock issuable upon the exercise of certain warrants (the “2025 Series A Warrants”) at an exercise price of $8.45 per share; and up to 207,101 shares of Class A Common Stock issuable upon the exercise of certain warrants at an exercise price of $8.45 per share (the “ 2025 Series B Warrants”, and collectively with the Series A Warrants, the “2025 Private Placement Warrants”) issued to Armistice in private placement offering consummated on January 8, 2025; |

| ● | The resale of up to 648,148 shares of our Class A Common Stock comprised of shares issuable upon the exercise of common stock purchase warrants consisting of Series A common warrants exercisable for up to 370,370 shares of Class A Common Stock at an exercise price of $8.10 per share (the “December 2024 Series A Warrants”), and Series B common warrants exercisable for up to 277,778 shares of Class A Common Stock at an exercise price of $8.10 per share (the “December 2024 Series B Warrants”, and collectively, the “December 2024 Private Placement Warrants”) which were sold to the Selling Stockholder in a private placement offering consummated on December 6, 2024. |

| ● | The resale of up to 827,391 shares of our Class A Common Stock comprised of (i) 190,987 shares issuable upon the exercise of certain common stock purchase warrants (the “September 2024 Private Placement Warrants”) at an exercise price of $4.8345 per share; and (ii) 636,404 shares issuable upon the exercise of certain common stock purchase warrants (the “September 2024 New Warrants”) at an exercise price of $4.8345 per share, each of which were sold to the Selling Stockholder in a private placement offering consummated on September 3, 2024 and which were registered on a registration statement on Form S-3 (File No. 333-282310) that was initially declared effective by the SEC on December 6, 2024. |

This Registration Statement, which is a new registration statement, also constitutes Post-Effective Amendment No. 1 to Registration Statement No. 333-282310 and Post-Effective Amendment No. 1 to Registration Statement No. 333-277151 and such post-effective amendments shall hereafter become effective concurrently with the effectiveness of this Registration Statement and in accordance with Section 8(c) of the Securities Act.

On January 6, 2025, the Company effected a reverse stock split of its outstanding Common Stock at a ratio of one (1) share of Common Stock for every fifteen (15) shares of Common Stock (the “Reverse Stock Split”). Unless stated otherwise, all discussion of the Company’s Class A Common Stock in this Registration Statement, including securities exercisable or convertible into our Class A Common Stock, has been adjusted to reflect Reverse Stock Split. The Company has also included in this Registration Statement adjusted versions of the financial statements previously filed with its Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 to give effect to the Reverse Stock Split.

2

SUBJECT TO COMPLETION | PRELIMINARY PROSPECTUS DATED JANUARY 27, 2025 |

T Stamp Inc.

Up to 2,096,842 Shares of Class A Common Stock

This prospectus relates to the resale by the Selling Stockholder from time to time of up to an aggregate of 2,096,842 shares of our Class A Common Stock, par value $0.01 per share (the “Class A Common Stock”) consisting of:

| ● | 621,303 shares of Class A Common Stock issuable upon the exercise of certain warrants issued to the Selling Stockholder comprised of (i) up to 414,202 shares of Class A Common Stock issuable upon the exercise of the 2025 Series A Warrants and up to 207,101 shares of Class A Common Stock issuable upon the exercise of the 2025 Series B Warrants sold to the Selling Stockholder in private placement offering consummated on January 8, 2025; |

| ● | 648,148 shares of our Class A Common Stock issuable upon the exercise of common stock purchase warrants comprised of (i) up to 370,370 shares of Class A Common Stock issuable upon the exercise of December 2024 Series A Warrants, and (ii) up to 277,778 shares of Class A Common Stock issuable upon the December 2024 Series B Warrants sold to the Selling Stockholder in a private placement offering consummated on December 6, 2024. |

| ● | 827,391 shares of our Class A Common Stock comprised of (i) 190,987 shares issuable upon the exercise of the “September 2024 Private Placement Warrants” and (ii) 636,404 shares issuable upon the exercise of the September 2024 New Warrants, each of which were sold to the Selling Stockholder in a private placement offering consummated on September 3, 2024 and which were registered on a registration statement on Form S-3 (File No. 333-282310) that was initially declared effective by the SEC on December 6, 2024. |

We refer to all of the warrants referenced above collectively as the “Warrants”.

The Selling Stockholder may offer and sell its shares in public or private transactions, or both. These sales may occur at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market price, or at negotiated prices.

As provided by Rule 416 of the Securities Act of 1933, as amended, this prospectus also covers any additional shares of Class A Common Stock that may become issuable upon any anti-dilution adjustment pursuant to the terms of the Warrants issued to the Selling Stockholders by reason of stock splits, stock dividends, and other events described therein.

The Selling Stockholder may sell all or a portion of shares through underwriters, broker dealers or agents, who may receive compensation in the form of discounts, concessions or commissions from the Selling Stockholder, the purchasers of the shares, or both. See “Plan of Distribution” for a more complete description of the ways in which the shares may be sold. We will not receive any of the proceeds from the sale of any of the 2,096,842 shares by the Selling Stockholder. However, upon exercise of the Warrants for cash, the Selling Stockholder would pay us an exercise price of between $4.8345 and $8.45 per share of Class A Common Stock, subject to any adjustment pursuant to the terms of the Warrants, or an aggregate of approximately $14,500,031 if the Warrants are exercised in full for cash. The Warrants are also exercisable on a cashless basis under certain circumstances, and if the Warrants are exercised on a cashless basis, we would not receive any cash payment from the Selling Stockholder upon any such exercise of the Warrants. We have agreed to bear the expenses (other than underwriting discounts, commissions or agent’s commissions and legal expenses of the Selling Stockholder) in connection with the registration of the Class A Common Stock being offered under this prospectus by the Selling Stockholder.

We will pay the expenses of registering these shares, but all selling and other expenses incurred by the Selling Stockholder will be paid by the Selling Stockholder. See “Plan of Distribution.”

3

We are an “emerging growth company” and a “smaller reporting company” as such terms are defined under federal securities laws, and, as such have elected to take advantage of certain reduced public company reporting requirements for this prospectus and may elect to do so in future filings.

Our Class A Common Stock is quoted on The NASDAQ Capital Market under the symbol “IDAI.” On January 24, 2025, the last reported sale price of our Class A Common Stock on The NASDAQ Capital Market was $4.72 per share.

Unless stated otherwise, all discussion of the Company’s Class A Common Stock, including securities exercisable or convertible into our Class A Common Stock, has been adjusted to reflect the 15-for-1 reverse stock split, which became effective on January 6, 2025.

You should read this prospectus carefully before you invest in any of our securities.

Investing in securities involves a high degree of risk. See “Risk Factors” beginning on page 17 of this prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the securities offered hereby or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is January 27, 2025

4

TABLE OF CONTENTS

| Page |

6 | |

6 | |

7 | |

14 | |

14 | |

15 | |

16 | |

23 | |

23 | |

25 | |

27 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 29 |

44 | |

59 | |

62 | |

62 | |

62 | |

68 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 70 |

70 | |

71 | |

71 | |

71 | |

72 | |

F-1 | |

77 |

5

ABOUT THIS PROSPECTUS

The registration statement on Form S-1, of which this prospectus forms a part and that we have filed with the Securities and Exchange Commission (the “SEC”), includes exhibits that provide more detail of the matters discussed in this prospectus.

Additionally, we incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions under the section of this prospectus entitled “Where You Can Find More Information.” You should read this prospectus and the related exhibits filed with the SEC, together with the additional information described under the heading “Where You Can Find More Information.”

You should rely only on the information contained in this prospectus and in any free writing prospectus prepared by or on behalf of us. We have not, and the Selling Stockholder has not, authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or any related free writing prospectus. This prospectus is an offer to sell only the securities offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date. Our business, financial condition, results of operations and prospects may have changed since that date.

Neither we nor the Selling Stockholder are offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted. Neither we nor the Selling Stockholder have done anything that would permit this Offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the jurisdiction of the United States who come into possession of this prospectus and any free writing prospectus related to this Offering are required to inform themselves about and to observe any restrictions relating to this Offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

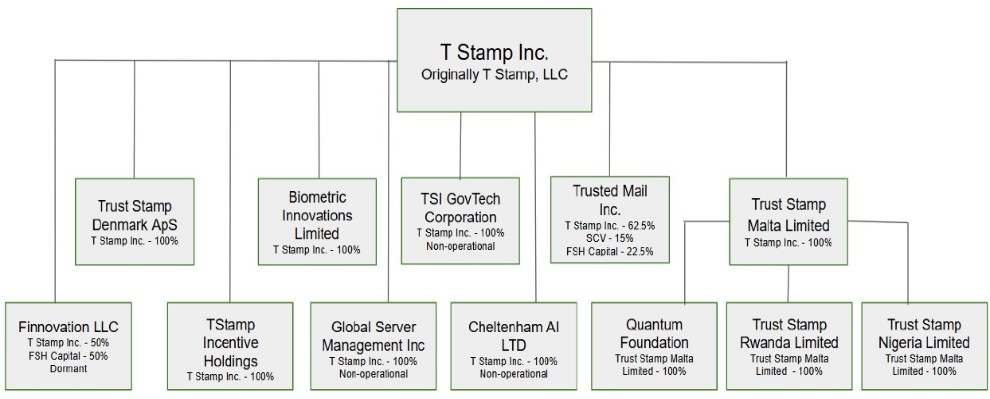

Unless the context otherwise requires, the terms “T Stamp,” “Trust Stamp”, the “Company,” “we,” “us” and “our” refer to T Stamp Inc. and its subsidiaries on a collective basis.

This prospectus includes industry and market data and other information, which we have obtained from, or is based upon, market research, independent industry publications or other publicly available information. Although we believe each such source to have been reliable as of its respective date, we have not independently verified the information contained in such sources. Any such data and other information is subject to change based on various factors, including those described below under the heading “Risk Factors” and elsewhere in this prospectus.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

THIS PROSPECTUS MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE”, “PROJECT”, “BELIEVE”, “ANTICIPATE”, “INTEND”, “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

6

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements and the related notes appearing elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in our Class A Common Stock discussed under “Risk Factors”, “The Company’s Business”, and information contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” before deciding whether to buy our Class A Common Stock

Overview

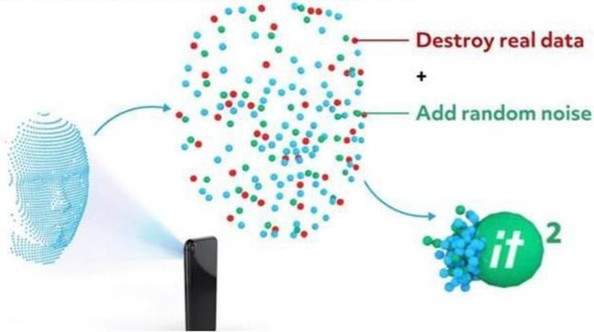

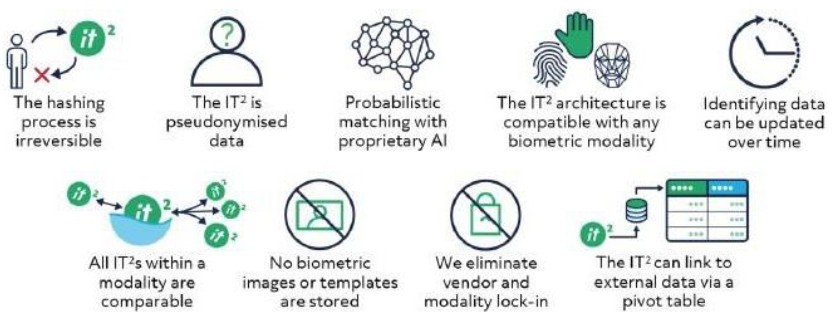

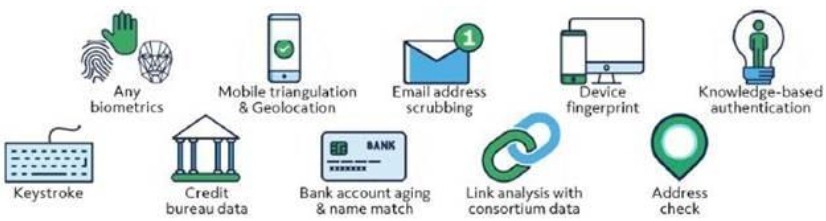

Trust Stamp primarily develops proprietary artificial intelligence-powered solutions, researching and leveraging machine learning artificial intelligence, including computer vision, cryptography, and data mining, to process and protect data and deliver insightful outputs that identify and defend against fraud, protect sensitive user information, facilitate automated processes, and extend the reach of digital services through global accessibility. We utilize the power and agility of technologies such as GPU processing, edge computing, neural networks, and large language models to process and protect data faster and more effectively than historically possible to deliver results at a disruptively low cost for usage across multiple industries.

Our team has substantial expertise in the creation and development of AI-enabled software products. We license our technology and expertise in numerous fields, with an increasing emphasis on addressing diverse markets through established partners who will integrate our technology into field-specific applications.

Over the last 6-months, the Company has undertaken a multi-pronged process to position itself better to leverage the growing opportunities offered by the expanded use and acceptance of AI technologies. This process has included:

| 1) | Reducing the size of the non-production-focused executive and consulting teams to reduce overhead for the 2025 calendar year. |

| 2) | Releasing sales staff that did not meet their targets. |

| 3) | Negotiating the sale of certain assets that have resulted in continuous operating losses to raise operating capital and eliminate the cash flow deficits associated with the assets. This will allow a sharpened focus on and investment in products with the best promise for profitable revenue generation. The negotiations are very advanced, and an announcement will be made when appropriate. |

| 4) | Negotiating a services contract to offset the cost of the technical team members while maintaining significant R&D and product development capabilities. |

| 5) | Refocusing go-to-market strategies on joint ventures with proven industry partners with access to target markets |

Markets

Trust Stamp has evaluated the market potential for its services in part by reviewing the following reports, articles, and data sources, none of which were commissioned by the Company, and none of which are to be incorporated by reference:

Data Security and Fraud

| ● | According to the “2021 Year End Report: Data Breach QuickView” published by Flashpoint, 4,145 publicly disclosed breaches exposed over 22 billion records in 2022. |

| ● | The cumulative merchant losses to online payment fraud between 2023 and 2027 will exceed $343 billion globally according to a 2022 report titled “Fighting Online Payment Fraud in 2022 & Beyond” published by Juniper Research. |

Financial and Societal Inclusion

| ● | According to the “Global Findex Database 2021,” published by the World Bank, 1.4 billion people were unbanked as of 2021. |

7

| ● | 131 million small and medium-sized enterprises in emerging markets lack access to finance, limiting their ability to grow and thrive (UNSGSA Financial Inclusion Webpage, Accessed March 2023). |

| ● | The global market for Microfinance is estimated at $157 Billion in the year 2020, and is projected to reach $342 billion by 2026 according to the 2022 report titled “Microfinance - Global Market Trajectory & Analytics” published by Global Industry Analysts, Inc. |

Trust Stamp’s biometric authentication, liveness detection, and information tokenization enable individuals to verify and establish their identities using data derived from biometrics. While individuals in this market lack traditional means of identity verification, Trust Stamp provides a means to authenticate identity that preserves an individual’s privacy and control over that identity.

Alternatives to Detention (“ATD”)

| ● | The ATD market includes Federal, State, and Municipal agencies for both criminal justice and immigration purposes. Trust Stamp addresses the ATD market with applications built on Trust Stamp’s privacy-preserving solutions allowing individuals to comply with ATD requirements using ethical and humane technology methodologies. Trust Stamp has developed innovative patented technologies for use in the ATD market encompassing biometrics, geolocation, and tokenization as well as a proprietary, tamper-resistant, battery-free “Tap-In-Band” that can complement or replace biometric check-in requirements and provide a lower-cost and more humane alternative to traditional “ankle bracelet” technology. |

Other Markets

The Company is developing products and working with partners and industry organizations in other sectors that offer significant market opportunities and has entered into go-to-market or licensing agreements, including global data location services, healthcare, IoT, automotive dealer services, and computer vision for UAV operations. We anticipate licensing our technology in numerous fields, typically through established partners who will integrate our technology into field-specific applications.

Principal Products and Services

We adhere to the best practices outlined in the National Institute of Standards and Technology (“NIST”) and International Organization for Standardization (“ISO”) frameworks, and our policies and procedures in managing personally identifiable information (“PII”) comply with General Data Protection Regulation (“GDPR”) requirements wherever such requirements are applicable.

Key Customers

The Company’s initial business consisted of developing proprietary privacy-first identity solutions and implementing them through custom applications built and maintained for a few key customers. In 2022, the Company added to its product offerings a modular and highly scalable SaaS model with low-code or no implementation (“the Orchestration Layer”).

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” and accordingly may provide less public disclosure than larger public companies, including the inclusion of only two years of audited financial statements, and unaudited interim financial statements for the three and nine months ended September 30, 2024. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined under the Securities Act of 1933, as amended (the “Securities Act”). As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of such audited financial statements; |

8

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (or the Sarbanes-Oxley Act); |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

In addition, an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. We have elected to avail ourselves of this extended transition period. We will remain an emerging growth company until the earliest to occur of: (i) our reporting $1.07 billion or more in annual gross revenues; (ii) the end of fiscal year 2026; (iii) our issuance, in a three year period of more than $1 billion in non-convertible debt; and (iv) the end of the fiscal year in which the market value of our common stock held by non-affiliates exceeded $700 million on the last business day of our second fiscal quarter.

We have elected to take advantage of certain of the reduced disclosure obligations and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than the information you might receive from other public reporting companies in which you hold equity interests.

To the extent that we continue to qualify as a “smaller reporting company,” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, after we cease to qualify as an “emerging growth company,” certain of the exemptions available to us as an “emerging growth company” may continue to be available to us as a smaller reporting company, including: (1) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act; (2) scaled executive compensation disclosures; and (3) the ability to provide only two years of audited financial statements, instead of three years.

Going Concern

Our independent registered public accounting firm, in its audit report to the consolidated financial statements for the years ended December 31, 2023 and 2022, included a note expressing substantial doubt about the Company’s ability to continue as a going concern. Our audited consolidated financial statements do not include any adjustments that may result from the outcome of this uncertainty.

Additionally, the unaudited condensed consolidated financial statements for the three and nine months ended September 30, 2024 and 2023 included elsewhere in this prospectus also have been prepared on a going concern basis, expressing substantial doubt about our ability to continue as an ongoing business for the next twelve months. Our unaudited condensed consolidated financial statements do not include any adjustments that may result from the outcome of this uncertainty.

If we cannot secure the financing needed to continue as a viable business, our shareholders may lose some or all of their investment in us.

Recent Developments

Appointment of New Chief Financial Officer

On January 17, 2025, the Board of Directors of the Company appointed Lance Wilson as the Company’s new Chief Financial Officer, to fill the vacancy in the position left after Alex Valdes’s resignation as Chief Financial Officer effective January 2, 2025.

Lance Wilson, a licensed Certified Public Accountant in Georgia, first joined the Company in 2021, serving in various financial capacities, most recently as the Senior Vice President of Accounting & Finance at Trust Stamp from July 2024 until being appointed to his role as CFO. Lance leads all external financial reporting, including SEC filings and technical accounting research and implementation. Lance has played a key role in multiple initiatives, including a successful public fundraising campaign that resulted in Trust Stamp’s NASDAQ listing in January 2022.

Prior to joining Trust Stamp, Lance served as the Financial Reporting Manager at Cousins Properties (NYSE: CUZ) from July 2020 to July 2021, where he managed all SEC filings, technical accounting projects, and audit engagements. Prior to that, he severed in various

9

accounting roles at The North Highland Company, Change Healthcare (formerly McKesson Technology Solutions), and BDO-USA, LLC. Lance holds a Master of Accountancy degree and a Bachelor of Science in Commerce and Business Administration from The University of Alabama.

Lance Wilson has no family relationships with any other director, executive officer, or person nominated or chosen by the Company to become a director or executive officer.

Lance Wilson and the Company entered into an Executive Employment Agreement (the “Agreement”), with an effective date of January 1, 2025, for his role as Chief Financial Officer (CFO) of the Company. The Agreement outlines Mr. Wilson’s ongoing responsibilities, including oversight of the Company’s financial integrity, regulatory compliance, and multicurrency financial reporting. It also details his leadership in investor relations and compliance with applicable SEC, Nasdaq, and Sarbanes-Oxley requirements.

Under the Agreement, Mr. Wilson will receive an annual base salary of $182,250, subject to periodic review, and will be eligible for an annual equity bonus of at least 10% of his base salary in the form of restricted stock units. The Agreement also includes provisions for reimbursement of business expenses, participation in Company benefit plans, and relocation assistance if applicable.

The Agreement has an open-ended term, continuing until either party provides 120 days’ written notice of termination. It also specifies termination provisions, including compensation and benefits in the event of termination by the Company without cause or by Mr. Wilson for good reason, such as severance equal to up to 36 months of base salary and accelerated vesting of equity awards in certain circumstances, including a change in control. Termination for cause or voluntary resignation without good reason would result in payment of only accrued compensation and benefits through the termination date.

The Agreement contains customary confidentiality and non-disclosure provisions related to the Company’s trade secrets and other sensitive information.

The foregoing description of the Agreement is intended to be a summary, and is qualified in its entirety by reference to the Agreement itself, a copy of included as Exhibit 10.13 to the registration statement of which this prospectus forms a part.

Securities Purchase Agreement dated January 6, 2025

On January 6, 2025, the Company entered into a securities purchase agreement (the “January 2025 SPA”) with an institutional investor (the “Selling Stockholder”), pursuant to which the Company agreed to issue and sell to the Selling Stockholder (i) in a registered direct offering, (a) 175,000 shares of Class A Common Stock (the “January 2025 Shares”); and (b) Pre-Funded Warrants (the "January 2025 Pre-Funded Warrants") to purchase 239,202 shares of the Company’s Class A Common Stock at an exercise price of $0.001 per share and (ii) in a concurrent private placement, common stock purchase warrants consisting of Series A common warrants exercisable for up to 414,202 shares of Class A Common Stock at an exercise price of $8.45 per share of Class A Common Stock (the “January 2025 Series A Warrants”), and Series B common warrants exercisable for up to 207,101 shares of Class A Common Stock at an exercise price of $8.45 per share (the “January 2025 Series B Warrants”, and collectively with the January 2025 Series A Warrants, the “January 2025 Private Placement Warrants”). The offering price per January 2025 Share and respective January 2025 Private Placement Warrants was $8.45, and the offering price per Pre-Funded Warrant was $8.449.

The securities to be issued in the registered direct offering were offered pursuant to the Company’s shelf registration statement on Form S-3 (File 333-271091) (the “Shelf Registration Statement”), initially filed by the Company with the SEC under the Securities Act on April 3, 2023 and declared effective on April 12, 2023. The January 2025 Pre-Funded Warrants are immediately exercisable upon issuance and will remain exercisable until all of the January 2025 Pre-Funded Warrants are exercised in full.

The January 2025 Private Placement Warrants (and the shares of Class A Common Stock issuable upon the exercise of the January 2025 Private Placement Warrants) were not registered under the Securities Act, and were offered pursuant to an exemption from the registration requirements of the Securities Act provided under Section 4(a)(2) of the Securities Act and/or Rule 506 of Regulation D promulgated under the Securities Act.

The terms of the Series A and January 2025 Series B Warrants that comprise the January 2025 Private Placement Warrants are identical, except that the January 2025 Series A Warrants provide for additional protections for the Selling Stockholder in the event of a “Fundamental Transaction” while the January 2025 Series A Warrants are outstanding (which includes, but is not limited to, merger transactions or a sale of substantially all of the Company’s assets). In such an event, then if holders of the Company’s Common Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Selling Stockholder will

10

be given the same choice as to the consideration it receives upon any exercise of either the Series A or January 2025 Series B Warrants following such Fundamental Transaction. Notwithstanding anything to the contrary, for the January 2025 Series A Warrants, in the event of a Fundamental Transaction, the Selling Stockholder may require the Company or its successor to repurchase the January 2025 Series A Warrants for its Black-Scholes Value (as defined in the Series A Warrant) in cash. This right can be exercised concurrently with, or within 30 days following, the consummation or public announcement of the transaction. If the Fundamental Transaction occurs outside the Company’s control, such as in a hostile takeover or an unapproved transaction, the holder is entitled to receive consideration equivalent in type and proportion to that offered to common stockholders, also calculated based on the Black-Scholes model. Additionally, if no consideration is offered to the Company’s stockholders in the transaction, the holder is deemed to receive common stock of the successor entity, preserving the January 2025 Series A Warrants’ value.

The January 2025 Private Placement Warrants are immediately exercisable upon issuance, and will expire five years thereafter, and in certain circumstances may be exercised on a cashless basis. If we fail for any reason to deliver shares of Class A Common Stock upon the valid exercise of the January 2025 Private Placement Warrants, subject to our receipt of a valid exercise notice and the aggregate exercise price, by the time period set forth in the January 2025 Private Placement Warrants, we are required to pay the applicable holder, in cash, as liquidated damages as set forth in the January 2025 Private Placement Warrants. The January 2025 Pre-Funded Warrants and January 2025 Private Placement Warrants also include customary buy-in rights in the event we fail to deliver shares of common stock upon exercise thereof within the time periods set forth in the January 2025 Pre-Funded Warrants and January 2025 Private Placement Warrants.

On January 8, 2025, the Company closed the registered direct offering and the private placement offering (collectively, the “January 2025 Offering”), raising gross proceeds of approximately $3.5 million before deducting placement agent fees and other offering expenses payable by the Company. In the event that all January 2025 Private Placement Warrants are exercised for cash, the Company will receive additional gross proceeds of approximately $5,250,010. The Company’s primary use of the net proceeds will be for working capital, capital expenditures and other general corporate purposes.

Pursuant to the terms of the January 2025 SPA, the Company is required within 30 days of January 6, 2025 to file a registration statement on Form S-1 or other appropriate form if the Company is not then S-1 eligible registering the resale of the shares of Class A Common Stock issued and issuable upon the exercise of the January 2025 Private Placement Warrants. The Company is required to use commercially reasonable efforts to cause such registration to become effective within 91 days of the closing of the

January 2025 Offering, and to keep the registration statement effective at all times until no investor owns any January 2025 Private Placement Warrants or shares issuable upon exercise thereof.

Pursuant to the terms of the January 2025 SPA, from January 6, 2025 until 30 days after closing, subject to certain exceptions, we may not issue, enter into any agreement to issue or announce the issuance or proposed issuance of any shares of common stock or common stock equivalents, or file any registration statement or any amendment or supplement thereto, other than a prospectus supplement for the Shelf Registration Statement. In addition, from January 6, 2025 until 45 days after closing, we are prohibited from effecting or entering into an agreement to effect any issuance of common stock or common stock equivalents involving a variable rate transaction (as defined in the January 2025 SPA).

The foregoing description of the January 2025 SPA, January 2025 Pre-Funded Warrants, January 2025 Series A Warrants, and January 2025 Series B Warrants is intended to be a summary, and is qualified by reference to the full text of each of these documents, included as Exhibits 10.35, 4.19, 4.20, and 4.21, respectively, to the registration statement of which this prospectus forms a part.

Securities Purchase Agreement dated December 5, 2024

On December 5, 2024, the Company entered into a securities purchase agreement (the “December 2024 SPA”) with an investor, pursuant to which the Company agreed to issue and sell to the Selling Stockholder (i) in a registered direct offering, (a) 139,000 shares of Class A Common Stock (the “December 2024 Shares”); and (b) Pre-Funded Warrants (the "December 2024 Pre-Funded Warrants") to purchase 231,370 shares of the Company’s Class A Common Stock at an exercise price of $0.015 per share and (ii) in a concurrent private placement, common stock purchase warrants consisting of Series A common warrants exercisable for up to 370,370 shares of Class A Common Stock at an exercise price of $8.10 per share of Class A Common Stock (the “December 2024 Series A Warrants”), and Series B common warrants exercisable for up to 277,778 shares of Class A Common Stock at an exercise price of $8.10 per share (the “December 2024 Series B Warrants”, and collectively with the December 2024 Series A Warrants, the “December 2024 Private Placement Warrants”). The offering price per December 2024 Share and respective December 2024 Private Placement Warrants was $8.10 and the offering price per December 2024 Pre-Funded Warrant was $8.09.

11

Pursuant to the December 2024 SPA, the Company agreed to hold an annual or special meeting of its stockholders within sixty (60) days following the closing date of the December 2024 SPA for the purpose of obtaining shareholder approval of (i) an increase in the number of authorized shares of the Company; and (ii) the December 2024 SPA and transactions contemplated thereunder (including, but not limited to, the issuance of the December 2024 Private Placement Warrants, and shares issuable upon the exercise of the December 2024 Private Placement Warrants) as may be required by the applicable rules and regulations of the Nasdaq Stock Market (“Shareholder Approval”). If the Company does not obtain Shareholder Approval at the first meeting, the Company must call a meeting every ninety (90) days thereafter to seek Shareholder Approval until the earlier of the date on which Shareholder Approval is obtained or the warrants are no longer outstanding.

The terms of the December 2024 Series A and Series B Warrants that comprise the December 2024 Private Placement Warrants are identical, except that the December 2024 Series A Warrants provide for additional protections for the Selling Stockholder in the event of a “Fundamental Transaction” while the December 2024 Series A Warrants are outstanding (which includes, but is not limited to, merger transactions or a sale of substantially all of the Company’s assets). In such an event, then if holders of the Company’s Common Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Selling Stockholder will be given the same choice as to the consideration it receives upon any exercise of either the December 2024 Series A or Series B Warrants following such Fundamental Transaction. Notwithstanding anything to the contrary, for the December 2024 Series A Warrants, in the event of a Fundamental Transaction, the Selling Stockholder may require the Company or its successor to repurchase the December 2024 Series A Warrants for its Black-Scholes Value (as defined in the Series A Warrant) in cash. This right can be exercised concurrently with, or within 30 days following, the consummation or public announcement of the transaction. If the Fundamental Transaction occurs outside the Company’s control, such as in a hostile takeover or an unapproved transaction, the holder is entitled to receive consideration equivalent in type and proportion to that offered to common stockholders, also calculated based on the Black-Scholes model. Additionally, if no consideration is offered to the Company’s stockholders in the transaction, the holder is deemed to receive common stock of the successor entity, preserving the December 2024 Series A Warrants’ value.

The December 2024 Private Placement Warrants are immediately exercisable upon the date December 2024 Shareholder Approval is received, and will expire five years thereafter, and in certain circumstances may be exercised on a cashless basis. If we fail for any reason to deliver shares of Class A Common Stock upon the valid exercise of the December 2024 Private Placement Warrants, subject to our receipt of a valid exercise notice and the aggregate exercise price, by the time period set forth in the December 2024 Private Placement Warrants, we are required to pay the applicable holder, in cash, as liquidated damages as set forth in the December 2024 Private Placement Warrants. The December 2024 Pre-Funded Warrants and December 2024 Private Placement Warrants also include customary buy-in rights in the event we fail to deliver shares of common stock upon exercise thereof within the time periods set forth in the December 2024 Pre-Funded Warrants and December 2024 Private Placement Warrants.

The foregoing description of the December 2024 SPA, December 2024 Pre-Funded Warrants, December 2024 Series A Warrants, and December 2024 Series B Warrants is intended to be a summary, and is qualified by reference to the full text of each of these documents, included as Exhibits 10.31, 4.16, 4.17, and 4.18, respectively, to the registration statement of which this prospectus forms a part.

Amendment to Third Amended and Restated Certificate of Incorporation of the Company (Reverse Stock Split)

On December 30, 2024, the Company filed a Certificate of Amendment to the Company’s Third Amended and Restated Certificate of Incorporation, which was previously approved by the Company’s stockholders at the special meeting held on November 18, 2024 and described in the Company’s definitive proxy statement filed with the SEC on September 30, 2024, to effectuate a reverse stock split at a ratio of one (1) share of Common Stock for every fifteen (15) shares of Common Stock (the “Reverse Stock Split”) which became effective as of the opening of business on January 6, 2024 (the “Effective Time”).

As a result, at the Effective Time, each fifteen (15) pre-split shares of Common Stock outstanding automatically combined into one (1) new share of Common Stock, and the number of outstanding shares of Common Stock were reduced from 28,984,426 to 1,933,990. Proportional adjustments have also been made to the number of shares of Common Stock issuable upon exercise or conversion of the Company’s outstanding equity awards, stock options, and warrants in existence as of the Effective Time, as well as the applicable exercise price(s) of such instruments.

The number of authorized shares of Common Stock and the par value of each share of Common Stock remain unchanged. No fractional shares were issued as a result of the Reverse Stock Split, and any fractional shares that would otherwise have resulted from the Reverse Stock Split were rounded up.

For more information regarding the Reverse Stock Split, see the definitive proxy statement filed by the Company with the Securities and Exchange Commission on September 30, 2024 and Form 8-K filed on November 21, 2024 announcing the result of the stockholder vote, the relevant portions of which are incorporated herein by reference. The description of the Certificate of Amendment and the

12

Reverse Stock Split is qualified in its entirety by reference to the full text of the Certificate of Amendment, a copy of which is included as Exhibit 3.2 to the registration statement of which this prospectus forms a part.

Results of Stockholder Special Meeting

On November 18, 2024, the Company held a Special Meeting of Stockholders (the “Special Meeting”) to consider and vote upon:

| ● | Proposal 1: Ratification of the approval of that certain Securities Purchase Agreement dated July 13, 2024 between our Company and DQI Holdings, Inc. (the “July DQI SPA”) and all transactions contemplated thereunder, including, but not limited to, the sale of 306,514 shares of our Class A Common Stock, par value $0.01 per share to DQI as required by and in accordance with Nasdaq Listing Rule 5635(d)); and |

| ● | Proposal 2: Ratification of the approval of the issuance of certain warrants issued to the Selling Stockholder pursuant to a securities purchase agreement dated September 3, 2024 as required by and in accordance with Nasdaq Listing Rule 5635(d)); |

| ● | Proposal 3: Approval of the issuance of certain warrants issued to the Selling Stockholder pursuant to a warrant exercise agreement also dated September 3, 2024 as required by and in accordance with Nasdaq Listing Rule 5635(d)); and |

| ● | Proposal 4: Approval a reverse stock split of our Common Stock at a ratio of not less than 1-for-5 and not more than 1-for-50, with such ratio to be determined by the Board of Directors on or prior to December 31, 2024, in its sole discretion, and which would be effected by filing a Certificate of Amendment to the Company’s Third Amended and Restated Certificate of Incorporation with the State of Delaware |

At the Special Meeting, 44% of our Common Stock entitled to vote at the Special Meeting were represented in person or by proxy at the Special Meeting. Based on the results of the vote, the stockholders voted to approve Proposals 1, 2, 3 and 4. The number of votes cast for or withheld from the approval is also set forth below. The voting results disclosed below are final.

Proposal |

| Number |

| Number |

| Number |

| Percentage |

|

Ratify, by a vote of all the stockholders, the approval of the July DQI SPA and all transactions contemplated thereunder, including, but not limited to, the sale of 4,597,701 shares of our Class A Common Stock to DQI as required by and in accordance with Nasdaq Listing Rule 5635(d)) (“Proposal 1”) | | 536,368 | | 14,867 | | 1,036 | | 97 | % |

Ratify, by a vote of all the stockholders, the issuance of certain warrants and the issuance of up to 2,864,798 shares from the exercise of the those warrants issued as part of the securities purchase agreement entered into with the Selling Stockholder on September 3, 2024, in accordance with Nasdaq Listing Rule 5635(d)) (“Proposal 2”); | | 532,312 | | 19,679 | | 281 | | 96 | % |

Approve the issuance of the certain warrants and the issuance of up to 9,546,060 shares of our Common Stock upon the exercise of those warrants issued to the Selling Stockholder pursuant to a warrant exercise agreement also dated September 3, 2024 as required by and in accordance with Nasdaq Listing Rule 5635(d)) (“Proposal 3”) | | 532,161 | | 19,864 | | 246 | | 96 | % |

Approve a reverse stock split of our Common Stock at a ratio of not less than 1-for-5 and not more than 1-for-50, with such ratio to be determined by the Board of Directors on or prior to December 31, 2024, in its sole discretion (“Proposal 4”) | | 528,665 | | 22,983 | | 624 | | 96 | % |

Election of New Board Member

On November 2, 2024, the Board of Directors of the Company elected Andrew Scott Francis, the current Chief Technology Officer of the Company, to the Board of Directors, effective immediately, to fill a vacancy on the Board of Directors left from the resignation of Joshua Allen from the Company’s Board of Directors on September 26, 2024. Andrew Scott Francis will be a member of the “Class III” directors of the Company.

Corporate Information

Our principal executive office is located at 3017 Bolling Way NE, Floor 2, Atlanta, Georgia, 30305, United States of America, which serves as our headquarters. Our telephone number is (404) 806-9906. Our website address is www.truststamp.ai. Information contained on our website that can be accessed through our website is not incorporated by reference in this prospectus.

13

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act. In accordance with the Exchange Act, we file reports, proxy statements and other information with the SEC. Such reports, proxy statements and other information filed by us are available to the public free of charge at www.sec.gov. Copies of certain information filed by us with the SEC are also available in the investors section of our website at www.truststamp.ai. You may also read and copy any document we file with the SEC at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the public reference facilities by calling the SEC at 1-800-SEC-0330.

This prospectus omits some information contained in the registration statement of which this prospectus forms a part in accordance with SEC rules and regulations. You should review the information and exhibits in the registration statement for further information about us and the securities we are offering. Statements in this prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to these filings. You should review the complete document to evaluate these statements.

THE OFFERING

This prospectus relates to the resale from time to time by the Selling Stockholder identified herein of up to 2,096,842 shares of our Class A Common Stock. We are not directly offering any shares for sale under the registration statement of which this prospectus is a part.

Class A Common Stock outstanding prior to this prospectus (as of January 24, 2025): |

| 2,200,046 |

|

|

|

Class A Common Stock offered by the Selling Stockholder hereunder: |

| 2,096,842 (2) |

|

|

|

Class A Common Stock to be outstanding after this prospectus: |

| 4,296,888 (1) |

|

|

|

Use of Proceeds: |

| We will not receive any proceeds from the sale of our Class A Common Stock offered by the Selling Stockholder under this prospectus. However, in the case of all of the Warrants being exercised by the Selling Stockholder for cash, the Selling Stockholder would pay us an aggregate of approximately $14,500,031 if the Warrants are exercised in full for cash. The Warrants are also exercisable on a cashless basis, and if the Warrants are exercised on a cashless basis, we would not receive any cash payment from the Selling Stockholder upon any such exercise of the Warrants. |

|

|

|

Offering Price: |

| The Selling Stockholder may sell all or a portion of their shares through public or private transactions at prevailing market prices or at privately negotiated prices. |

|

|

|

Risk Factors: |

| Investing in our securities involves a high degree of risk and purchasers may lose their entire investment. See the disclosure under the heading “Risk Factors” beginning on page 17 of this prospectus. |

|

|

|

NASDAQ Trading Symbol: |

| IDAI |

| (1) | The above discussion is based on 2,200,046 shares of Class A Common Stock outstanding as of January 24, 2025, but excludes shares issuable pursuant the following outstanding instruments (calculated as of January 24, 2025): |

| ● | Restricted Stock Units (“RSUs”) (112,409 shares), |

| ● | stock options (27,522 shares), and |

14

| ● | warrants (760,733 shares), and |

| ● | stock grants (8,731 shares). |

| (2) | Assumes all 2,096,842 shares of Class A Common Stock underlying the Warrants are sold by the Selling Stockholder. |

SUMMARY CONSOLIDATED FINANCIAL DATA

You should read the following summary consolidated financial data together with our audited consolidated financial statements and the related notes appearing elsewhere in this prospectus and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this prospectus. We have derived the statements of operations data for the nine months ended September 30, 2024 and 2023 and balance sheet data as of September 30, 2024 from our unaudited condensed consolidated financial statements appearing elsewhere in this prospectus, and we have derived the consolidated statements of operations data for the years ended December 31, 2023 and 2022 from our audited consolidated financial statements appearing elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future, and our results for any interim period are not necessarily indicative of results that may be expected for any full year.

Statements of Operations Data:

| | | | | |||||||||

|

| For the years ended | | For the nine months ended |

| ||||||||

| | | | | | | | (Unaudited) | | (Unaudited) | | ||

|

| 2023 |

| 2022 |

| 2024 |

| 2023 | | ||||

Net revenue | | $ | 4,560,275 | | $ | 5,385,077 | | $ | 1,585,153 | | $ | 3,985,242 | |

Operating expenses | | | 12,450,077 | | | 17,464,000 | | | 9,736,472 | | | 8,968,985 | |

Operating loss | | | (7,889,802) | | | (12,078,923) | | | (8,151,319) | | | (4,983,743) | |

Total other income (expense), net | | | 238,675 | | | 8,459 | | | 3,557,913 | | | 230,763 | |

Net loss before taxes | | | (7,651,127) | | | (12,070,464) | | | (4,593,406) | | | (4,752,980) | |

Income tax expense | | | 13,485 | | | (21,076) | | | — | | | — | |

Deemed dividend | | | — | | | — | | | (1,939,439) | | | — | |

Net loss before noncontrolling interest | | | (7,637,642) | | | (12,091,540) | | | (6,532,845) | | | (4,752,980) | |

Net loss attributable to noncontrolling interest | | | — | | | — | | | — | | | — | |

Net loss attributable to T Stamp Inc. (2) | | $ | (7,637,642) | | $ | (12,091,540) | | $ | (6,532,845) | | $ | (4,752,980) | |

Basic and diluted net loss per share attributable to T Stamp Inc. (1) | | $ | (16.07) | | $ | (38.32) | | $ | (7.33) | | $ | (10.71) | |

| (1) | See Note 1 to our audited consolidated financial statements for the years ended December 31, 2023 and 2022 and Note 1 to our unaudited condensed consolidated financial statements three and nine months September 30, 2024 and 2023 included elsewhere in this prospectus for an explanation of the method used to compute basic and diluted net loss per share. |

| (2) | We have provided the reconciliations between the net losses and Adjusted EBITDA under the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this prospectus. |

Consolidated Balance Sheet Data:

| | | | | |||||||||

|

| As of December 31, | | As of September 30, |

| ||||||||

| | | | | | (Unaudited) | | (Unaudited) | | ||||

|

| 2023 |

| 2022 |

| 2024 |

| 2023 | | ||||

Cash and cash equivalents | | $ | 3,140,747 | | $ | 1,254,494 | | $ | 598,031 | | $ | 3,182,503 | |

Total Assets | | $ | 7,893,314 | | $ | 6,411,918 | | $ | 10,559,627 | | $ | 7,472,874 | |

Total Liabilities | | $ | 3,978,434 | | $ | 5,786,774 | | $ | 4,990,886 | | $ | 3,243,445 | |

Total Stockholders’ Equity | | $ | 3,914,880 | | $ | 625,144 | | $ | 5,568,741 | | $ | 4,229,429 | |

15

RISK FACTORS

An investment in our Class A Common Stock involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks described below, together with all of the other information set forth in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be materially and adversely affected, which could cause the trading price of our Class A Common Stock to decline, resulting in a loss of all or part of your investment. The risks described below and in the documents referenced above are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business. You should only consider investing in our securities if you can bear the risk of loss of your entire investment.

The SEC requires the Company to identify risks that are specific to its business and its financial condition. The Company is still subject to all the same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events, and technological developments (such as cyber-attacks and the ability to prevent such attacks). Additionally, early-stage companies are inherently riskier than more developed companies, and the risk of business failure and complete loss of your investment capital is present. You should consider general risks as well as specific risks when deciding whether to invest.

Below is a summary of material risks, uncertainties and other factors that could have a material effect on the Company and its operations:

| ● | We are a comparatively early-stage company that has incurred operating losses in the past, expect to incur operating losses in the future, and may never achieve or maintain profitability. |

| ● | Our technology continues to be developed, and there is no guarantee that we will ever successfully develop the technology that is essential to our business to a point at which no further development is needed. |

| ● | We may be subject to numerous data protection requirements and regulations. |

| ● | We operate in a highly competitive industry that is dominated by a number of exceptionally large, well-capitalized market leaders and the size and resources of some of our competitors may allow them to compete more effectively than we can. |

| ● | We rely on third parties to provide services essential to the success of our business. |

| ● | We currently have three customers that account for substantially all of our revenues. |

| ● | We expect to raise additional capital through equity and/or debt offerings to support our working capital requirements and operating losses. |

| ● | Our independent registered public accounting firm, in its audit report to the audited consolidated financial statements, included a note expressing substantial doubt about the Company’s ability to continue as a going concern. Additionally, the accompanying unaudited condensed consolidated financial statements for the three and nine months ended September 30, 2024 included with this prospectus have been prepared on a going concern basis. Neither of these consolidated financial statements include any adjustments that may result from the outcome of this uncertainty. |

| ● | As the vast majority of our revenue is US Dollar denominated and a significant percentage of our expenses are incurred in other currencies, we are subject to risks relating to foreign currency fluctuations. |

Risks Related to Our Company

We have a limited operating history upon which you can evaluate our performance and have not yet generated profits. Accordingly, our prospects must be considered in light of the risks that any new company encounters. Our Company was incorporated under the laws of the State of Delaware on April 11, 2016, and we have not yet generated profits. The likelihood of our creation of a viable business must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the growth of a business, operation in a competitive industry, and the continued development of our technology and products. We anticipate that our operating expenses will increase for the near future, and there is no assurance that we will be profitable

16

in the near future. You should consider our business, operations, and prospects in light of the risks, expenses and challenges faced as an emerging growth company.

We have historically operated at a loss, which has resulted in an accumulated deficit. For the fiscal year ended December 31, 2023, we incurred a net loss of $7.64 million, compared to a net loss of $12.09 million for the fiscal year ended December 31, 2022. For the nine months ended September 30, 2024, we incurred a net loss of $6.53 million. There can be no assurance that we will ever achieve profitability. Even if we do, there can be no assurance that we will be able to maintain or increase profitability on a quarterly or annual basis. Failure to do so would continue to have a material adverse effect on our accumulated deficit, would affect our cash flows, would affect our efforts to raise capital and is likely to result in a decline in our Class A Common Stock price.

Our consolidated financial statements for the fiscal years ended December 31, 2023 and 2022 have been prepared on a going concern basis. We have not yet generated profits and have an accumulated deficit of $50.85 million as of December 31, 2023, and $55.45 million as of September 30, 2024. Our independent registered public accounting firm, in its audit report to the audited consolidated financial statements for the year ended December 31, 2023, included a note expressing substantial doubt about the Company’s ability to continue as a going concern. Additionally, the unaudited condensed consolidated financial statements for the three and nine months ended September 30, 2024 have been prepared on a going concern basis. Neither of these financial statements include any adjustments that may result from the outcome of this uncertainty. We may not have enough funds to sustain the business until it becomes profitable. Even if we raise additional funding through future financing efforts, we may not accurately anticipate how quickly we may use such funds and whether such funds would be sufficient to bring the business to profitability. The Company’s ability to continue as a going concern in the next twelve months following the date of the unaudited condensed consolidated financial statements is dependent upon its ability to produce revenues and/or obtain financing sufficient to meet current and future obligations and deploy such to produce profitable operating results.

Our cash could be adversely affected if the financial institutions in which we hold our cash fail. The Company maintains domestic cash deposits in Federal Deposit Insurance Corporation (“FDIC”) insured banks. The domestic bank deposit balances may exceed the FDIC insurance limits. In addition, given the foreign markets we serve, we maintain cash deposits in foreign banks, some of which are not insured or partially insured by the FDIC or other similar agency. These balances could be impacted if one or more of the financial institutions in which we deposit monies fails or is subject to other adverse conditions in the financial or credit markets.

Our technology continues to be developed, and it is unlikely that we will ever develop our technology to a point at which no further development is required. Trust Stamp is developing complex technology that requires significant technical and regulatory expertise to develop, commercialize and update to meet evolving market and regulatory requirements. While we constantly monitor and adapt our products and technology as criminal methods of breaching cybersecurity advance, there is no guarantee we will consistently be able to develop technology that can effectively counteract such criminal efforts. If we are unable to successfully develop and commercialize our technology and products, it will significantly affect our viability as a company.

If our security measures are breached or unauthorized access to individually identifiable biometric or other personally identifiable information is otherwise obtained, our reputation may be harmed, and we may incur significant liabilities. In the ordinary course of our business, we may collect and store sensitive data, including protected health information (“PHI”), personally identifiable information (“PII”), owned or controlled by ourselves or our customers, and other parties. We communicate sensitive data, including patient data, electronically, and through relationships with multiple third-party vendors and their subcontractors. These applications and data encompass a wide variety of business-critical information, including research and development information, patient data, commercial information, and business and financial information. We face a number of risks relative to protecting this critical information, including loss of access risk, inappropriate use or disclosure, inappropriate modification, and the risk of our being unable to adequately monitor, audit, and modify our controls over our critical information. This risk extends to the third-party vendors and subcontractors we use to manage this sensitive data. As a custodian of this data, Trust Stamp therefore inherits responsibilities related to this data, exposing itself to potential threats. Data breaches occur at all levels of corporate sophistication (including at companies with significantly greater resources and security measures than our own) and the resulting fallout stemming from these breaches can be costly, time-consuming, and damaging to a company’s reputation. Further, data breaches need not occur from malicious attack or phishing only. Often, employee carelessness can result in sharing PII with a much wider audience than intended. Consequences of such data breaches could result in fines, litigation expenses, costs of implementing better systems, and the damage of negative publicity, all of which could have a material adverse effect on our business operations and financial condition.

17

We are subject to substantial governmental regulation relating to our technology and will continue to be for the lifetime of our Company. By virtue of handling sensitive PII and biometric data, we are subject to numerous statutes related to data privacy and additional legislation and regulation should be anticipated in every jurisdiction in which we operate. Examples of federal (US) and European statutes we could be subject to are:

| ● | Health Insurance Portability and Accountability Act (HIPAA) |

| ● | Health Information Technology for Economic and Clinical Health Act (HITECH) |

Any such access, breach, or other loss of information could result in legal claims or proceedings, liability under federal or state laws that protect the privacy of personal information under HIPAA and/or “HITECH”. Notice of breaches must be made to affected individuals, the Secretary of the Department of Health and Human Services (“HHS”), and for extensive breaches, notice may need to be made to the media or state attorneys general. Penalties for violations of these laws vary. For instance, penalties for failure to comply with a requirement of HIPAA and HITECH vary significantly, and include significant civil monetary penalties and, in certain circumstances, criminal penalties with fines up to $250,000 per violation and/or imprisonment. A person who knowingly obtains or discloses individually identifiable health information in violation of HIPAA may face a criminal penalty of up to $50,000 and up to one-year imprisonment. The criminal penalties increase if the wrongful conduct involves false pretenses or the intent to sell, transfer or use identifiable health information for commercial advantage, personal gain, or malicious harm.

Further, various states, such as California, have implemented similar privacy laws and regulations, such as the California Confidentiality of Medical Information Act, that impose restrictive requirements regulating the use and disclosure of health information and other personally identifiable information. Where state laws are more protective, we have to comply with the stricter provisions. In addition to fines and penalties imposed upon violators, some of these state laws also afford private rights of action to individuals who believe their personal information has been misused. California’s patient privacy laws, for example, provide for penalties of up to $250,000 and permit injured parties to sue for damages. The interplay of federal and state laws may be subject to varying interpretations by courts and government agencies, creating complex compliance issues for us and data we receive, use and share, potentially exposing us to additional expense, adverse publicity, and liability. Further, as regulatory focus on privacy issues continues to increase and laws and regulations concerning the protection of personal information expand and become more complex, these potential risks to our business could intensify. Changes in laws or regulations associated with the enhanced protection of certain types of sensitive data, such as PII or PHI, along with increased customer demands for enhanced data security infrastructure, could greatly increase our cost of providing our services, decrease demand for our services, reduce our revenues and/or subject us to additional liabilities.

Compliance with U.S. and international data protection laws and regulations could cause us to incur substantial costs or require us to change our business practices and compliance procedures in a manner adverse to our business. Moreover, complying with these various laws could require us to take on more onerous obligations in our contracts, restrict our ability to collect, use and disclose data, or in some cases, impact our ability to operate in certain jurisdictions. We rely on our customers to obtain valid and appropriate consents from data subjects whose biometric samples and data we process on such customers’ behalf. Given that we do not obtain direct consent from such data subjects and we do not audit our customers to ensure that they have obtained the necessary consents required by law, the failure of our customers to obtain consents that are in compliance with applicable law could result in our own non-compliance with privacy laws. Such failure to comply with U.S. and international data protection laws and regulations could result in government enforcement actions (which could include civil or criminal penalties), private litigation and/or adverse publicity and could negatively affect our operating results and business. Claims that we have violated individuals’ privacy rights, failed to comply with data protection laws, or breached our contractual obligations, even if we are not found liable, could be expensive and time consuming to defend, could result in adverse publicity and could have a material adverse effect on our business, financial condition and results of operations.

We anticipate sustaining operating losses for the foreseeable future. It is anticipated that we will sustain operating losses into 2025 as we continue with research and development, and strive to gain new customers for our technology and market share in our industry. Our ability to become profitable depends on our ability to expand our customer base, consisting of companies willing to license our technology. There can be no assurance that this will occur. Unanticipated problems and expenses are often encountered in offering new products which may impact whether the Company is successful. Furthermore, we may encounter substantial delays and unexpected expenses related to development, technological changes, marketing, regulatory requirements and changes to such requirements or other unforeseen difficulties. There can be no assurance that we will ever become profitable. If the Company sustains losses over an extended period of time, it may be unable to continue in business.

18

If our products do not achieve broad acceptance both domestically and internationally, we will not be able to achieve our anticipated level of growth. Our revenues are derived from licensing our identity authentication solutions. We cannot accurately predict the future growth rate or the size of the market for our technology. The expansion of the market for our solutions depends on a number of factors, such as

| ● | the cost, performance and reliability of our solutions and the products and services offered by our competitors; |

| ● | customers’ perceptions regarding the benefits of biometrics and other authentication solutions; |

| ● | public perceptions regarding the intrusiveness of these solutions and the manner in which organizations use biometric and other identity information collected; |

| ● | public perceptions regarding the confidentiality of private information; |

| ● | proposed or enacted legislation related to privacy of information |

| ● | customers’ satisfaction with biometrics solutions; and |

| ● | marketing efforts and publicity regarding biometrics solutions. |

Even if our technology gains wide market acceptance, our solutions may not adequately address market requirements and may not continue to gain market acceptance. If authentication solutions generally or our solutions specifically do not gain wide market acceptance, we may not be able to achieve our anticipated level of growth and our revenues and results of operations would suffer.

We operate in a highly competitive industry that is dominated by multiple very large, well-capitalized market leaders and is constantly evolving. New entrants to the market, existing competitor actions, or other changes in market dynamics could adversely impact us. The level of competition in the identity authentication industry is high, with multiple exceptionally large, well-capitalized competitors holding a majority share of the market. Currently, we are not aware of any direct competitors of the Company able to offer our main technological offering. Nonetheless, many of the companies in the identity authentication market have longer operating histories, larger customer bases, significantly greater financial, technological, sales, marketing, and other resources than we do. At any point, these companies may decide to devote their resources to creating a competing technology solution which will impact our ability to maintain or gain market share in this industry. Further, such companies will be able to respond more quickly than we can to new or changing opportunities, technologies, standards, or client requirements, more quickly develop new products or devote greater resources to the promotion and sale of their products and services than we can. Likewise, their greater capabilities in these areas may enable them to better withstand periodic downturns in the identity management solutions industry and compete more effectively on the basis of price and production. In addition, new companies may enter the markets in which we compete, further increasing competition in the identity management solutions industry.

We believe that our ability to compete successfully depends on a number of factors, including the type and quality of our products and the strength of our brand names, as well as many factors beyond our control. We may not be able to compete successfully against current or future competitors, and increased competition may result in price reductions, reduced profit margins, loss of market share and an inability to generate cash flows that are sufficient to maintain or expand the development and marketing of new products, any of which would adversely impact our results of operations and financial condition.