The 2017 Mandatory Exchangeable Trust ("Trust") was established on October 10, 2017 and is registered as a non-diversified, closed-end investment company under the Investment Company Act of 1940, as amended (the "Act"). The Trust commenced operations on December 15, 2017. In December 2017, the Trust offered and sold 2017 Mandatory Exchangeable Trust Securities (“Trust Securities") to qualified institutional buyers (“QIBs”) in reliance on the non-public offering exemption from registration under the Securities Act of 1933, as amended (the “Securities Act”) afforded by Section 4(a)(2) of this Act, and has relied on Rule 144A under the Securities Act for transactions involving the resale of Trust Securities. The Trust received an in kind contribution of U.S. Treasury securities and the Forward Agreements (the “Contracts”) for the purchase of shares of Class A common stock of the New York Times Company (the "Company") in return for the issuance of Trust Securities. The counterparties to the Contracts are certain existing shareholders of the Company (the “Sellers”). Under the terms of the Contracts, the Trust will exchange each Trust Security for between 4.6948 and 5.6338 shares of the Company’s common stock (with the ultimate amount of shares determined by reference to the future trading price of the Company shares in relation to certain prescribed amounts) on December 1, 2020 (the “Exchange Date”). The Trust will thereafter terminate.

The Trust has entered into an Administration Agreement with U.S. Bank National Association (the "Administrator") to provide administrative services to the Trust.

| 2. | Significant Accounting Policies |

A. Basis of Accounting

The accompanying financial statements of the Trust have been prepared on an accrual basis in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”). The Trust is an investment company and follows the accounting and reporting guidance of FASB ASC Topic 946.

B. Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, recognition of income and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

C. Investment Valuation

Investments made by the Trust are carried at fair value. The Trust uses the following valuation methods to determine the fair value of its investments:

| (i) | the U.S. Treasury Securities held by the Trust are valued at the mean between the last current bid and asked prices or, if quotations are not readily available, as determined in good faith by the Board of Trustees of the Trust (the “Board of Trustees”) pursuant to policies and procedures that have been adopted and approved by the Board of Trustees from time to time; |

| (ii) | subject to review and approval by the Managing Trustee and a good faith determination by the Board of Trustees, the Contracts are valued by an independent valuation firm with expertise in valuing these types of Contracts, using an income approach (in the form of a discounted cash flow analysis), in conjunction with a Monte Carlo model that simulates potential future payouts under the Contracts. |

D. Investment Transactions and Investment Income

Investment transactions of the Trust are accounted for as of the date the securities are purchased or sold by the Trust (the “trade date”). Interest income is recorded as earned and includes accrual of discounts, using the effective yield method. Amortized cost represents original cost, adjusted for a proportional increase or decrease in cost due to the discount or premium until maturity.

2017 Mandatory Exchangeable Trust

NOTES TO FINANCIAL STATEMENTS

As of and for the six month period ended June 30, 2019

(Unaudited)

E. Organizational Costs

Organizational costs of the Trust consist of costs incurred to establish the Trust and enable it legally to conduct business. Organizational costs are expensed as incurred. During the six month period ended June 30, 2019, the Trust incurred $0 of organizational costs.

On December 15, 2017, the Trust entered into the Contracts, which are derivative instruments, with the Sellers for which the Sellers received $239,912,754 in connection therewith. Pursuant to these Contracts, each of which has similar terms, the Sellers are obligated to deliver to the Trust a specified number of Company shares on the Exchange Date so as to permit the holders of Trust Securities to exchange on the Exchange Date the Trust Securities they hold for the specified number of shares of the Company.

At June 30, 2019, the Contracts had the following value:

Forward Agreements | Trade Date | Net Cost of Contracts | Fair Value of Contracts | Unrealized Appreciation |

| Counterparties – Sellers | 12/1/2020 | $239,912,754 | $369,849,502 | $129,936,748 |

The fair value of the Contracts is included in investments in the Statement of Assets and Liabilities. The net change in unrealized depreciation is included in the Statement of Operations.

The primary risk of investing in the Contracts is the failure of the Sellers to deliver the shares of the Company on the Exchange Date, as provided under the terms and conditions of the Contracts. The Trust has received collateral in the form of Company shares, which mitigates the potential risk to investors. The Sellers’ obligation under the Contracts is collateralized by the Company shares that are held in the custody of the Trust’s Custodian, U.S. Bank National Association. At June 30, 2019 the Custodian held 16,197,175 shares of the Company with an aggregate fair value of $528,351,849.

The Trustees, on behalf of the Trust, have entered into various agreements fundamental to the operation of the Trust that contain indemnification provisions designed for the protection of the Trust. The Trust’s maximum exposure under these agreements is unknown. However, the Trust has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

The Sellers have agreed to pay all fees and expenses relating to the offering and operation of the Trust including, but not limited to, organizational costs, offering costs, trustee fees, and administration fees. The Trust is not responsible for any fees associated with the Trust’s ongoing operations. In connection with its agreement, the Sellers contributed $1,139,000 in cash to an account held by the Administrator to cover all existing and future fees and expenses of the Trust. As of June 30, 2019, $317,360 remained in the account.

Holders of Trust Securities are entitled to receive distributions from the maturity of U.S. Treasury Securities of $1.2969 per quarter (except for the first distribution on March 1, 2018 of $1.0951), payable quarterly, which commenced on March 1, 2018. Distributions to the Trusts holders for the period ended June 30, 2019 were $7,457,175.

2017 Mandatory Exchangeable Trust

NOTES TO FINANCIAL STATEMENTS

As of and for the six month period ended June 30, 2019

(Unaudited)

Dividends from net investment income and distributions from realized gains from investment transactions have been determined in accordance with Federal income tax regulations and may differ from net investment income and realized gains recorded by the Fund for financial reporting purposes. These differences, which could be temporary or permanent in nature may result in reclassification of distributions; however, net investment income, net realized gains and losses, and net assets are not affected.

The Trust is not an association taxable as a corporation for Federal or State income tax purposes; accordingly, no provision is required for such taxes. Specifically, the Trust is a grantor trust under the U.S. federal and State income tax laws and, as such, holders of Trust Securities are treated as if each holder owns directly its proportionate share of the assets held by the Trust.

The Trust complies with the authoritative guidance for uncertainty in income taxes. This guidance requires the Trust to determine whether a tax position of the Trust is more likely than not to be sustained upon examination by the applicable taxing authority, including the resolution of any related appeals or litigation processes, based on the technical merits of the position. The Trust reviewed and evaluated tax positions in its major jurisdictions and determined whether or not there are uncertain tax positions that require financial statement recognition. The Trust has determined that no reserves for uncertain tax positions are required to be recorded for any of the Trust’s open tax years. The Trust is additionally not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months. As a result, no income tax liability or expense has been recorded in the accompanying financial statements.

As of June 30, 2019, gross unrealized appreciation and depreciation of investments, based on cost for Federal income tax purposes, equaled $129,936,748 and $10,029, respectively. The aggregate cost of investments for Federal income tax purposes was $261,982,835 at June 30, 2019.

The tax character of the total distributable earnings as of December 31, 2018, was as follows:

| Ordinary Income | | Unrealized Appreciation | | Total Distributable Earnings |

| $542,075 | | $26,518,256 | | $27,060,331 |

| 8. | Fair Value Measurements |

Under generally accepted accounting principles for fair value measurements, a three-tier hierarchy to prioritize the assumptions, referred to as inputs, is used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is summarized in the three broad levels listed below.

Level 1: Quoted prices (unadjusted) in active markets that are accessible at the measurement date for identical assets or liabilities.

Level 2: Valuations that are based on other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment spreads, credit risk, etc.)

Level 3: Valuations based on significant unobservable inputs that are not corroborated by market data.

In cases where the inputs used to measure fair value fall in different levels of the fair value hierarchy, the level disclosed is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

2017 Mandatory Exchangeable Trust

NOTES TO FINANCIAL STATEMENTS

As of and for the six month period ended June 30, 2019

(Unaudited)

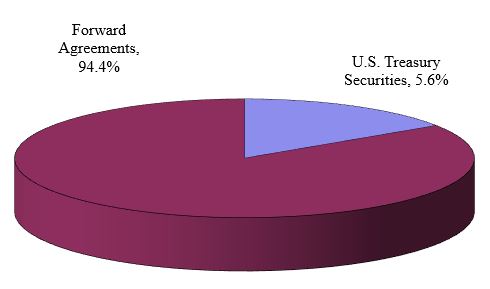

The following is a summary of the inputs used to value the Trust’s investments as of June 30, 2019:

| | | | | | Fair Value Measurements at June 30, 2019 Using | |

| | | | | | Quoted Prices in | | | | | | Significant | |

| | | | | | Active Markets for | | | Significant Other | | | Unobservable | |

| | | Fair Value at | | | Identical Assets | | | Observable Inputs | | | Inputs | |

Description | | June 30, 2019 | | | (Level 1) | | | (Level 2) | | | (Level 3) | |

Other | | | | | | | | | | | | |

| U.S. Treasury Securities | | $ | 22,060,052 | | | $ | 22,060,052 | | | $ | - | | | $ | - | |

Total Other | | | 22,060,052 | | | | 22,060,052 | | | | - | | | | - | |

Derivative Instruments | | | | | | | | | | | | | | | | |

| Forward Agreements | | | 369,849,502 | | | | - | | | | - | | | | 369,849,502 | |

Total Derivative Instruments | | | 369,849,502 | | | | - | | | | - | | | | 369,849,502 | |

Total | | $ | 391,909,554 | | | $ | 22,060,052 | | | $ | - | | | $ | 369,849,502 | |

| | | | | | | | | | | | | | | | | |

During the six month period ended June 30, 2019, there were no transfers between Level 1, Level 2 and Level 3.

| | Fair Value Measurements Using Significant Unobservable Inputs (Level 3) for Investments for the period ended June 30, 2019 |

Fair Value Beginning Balance | $ 266,639,035 |

| Net unrealized appreciation | 103,210,467 |

| Investments contributed in kind | |

Transfers Out of Level 3 | - |

Fair Value Ending Balance | $ 369,849,502 |

The change in unrealized gains/(losses) for Level 3 investments held at period end was $103,210,467.

The following table is a summary of quantitative information about significant unobservable valuation inputs for Level 3 fair value measurement for investments held as of June 30, 2019.

| Type of Asset | Fair Value as of June 30, 2019 | Valuation Technique | Unobservable Input |

| Forward Agreements | $369,849,502 | Income Approach Pricing Model Technique | Daily volatility of stock price of underlying Assets – 1.10%. Risk Free rate of return – 2.91%. Equity risk premium – 6.04%. Size premium – 0.00%. |

2017 Mandatory Exchangeable Trust

NOTES TO FINANCIAL STATEMENTS

As of and for the six month period ended June 30, 2019

(Unaudited)

| 9. | Investment Transactions |

For the six month period ended June 30, 2019, $7,458,000 in U.S. Treasury Securities matured. The proceeds were used by the Trust to make distributions to the Trust Security Holders. The Trust did not sell any securities during the period ended June 30, 2019.

| 10. | Capital Share Transactions |

For the six month period ended June 30, 2019, the Trust did not sell any Trust Securities to qualified institutional buyers in reliance on Rule 144A under the Securities Act. As of June 30, 2019, there were 2,875,001 Trust Securities issued and outstanding. During 2018 the Sellers contributed $410,413 to the Trust for the purpose of funding distributions to the Trust Security Holders. This contribution is not subject to any reimbursement conditions to the Sellers.

The Trust has performed an evaluation of subsequent events through the date the financial statements were available to be issued. No subsequent events or transactions had occurred that would have materially impacted the financial statements as presented.

2017 Mandatory Exchangeable Trust

NOTES TO FINANCIAL STATEMENTS

ADDITIONAL INFORMATION

June 30, 2019

(Unaudited)

Trustee Compensation

The Trust does not compensate any of its trustees who are interested persons. For the six month period ended June 30, 2019, no compensation was paid to the Trustees, including special compensation. The Trust’s Statement of Additional Information includes additional information about the trustees and is available on the SEC’s Web site at www.sec.gov.

Form N-Q

The Trust will file its complete schedule of portfolio holdings for the first and third quarters of each fiscal year with the SEC on Form N-Q. The Trust’s Form N-Q and Form N-2 will be available on or before their respective filing dates without charge by visiting the SEC’s Web site at www.sec.gov. In addition, you may review and copy the Trust’s Form N-Q at the SEC’s Public Reference Room in Washington D.C. You may obtain information on the operation of the Public Reference Room by calling (800) SEC-0330.