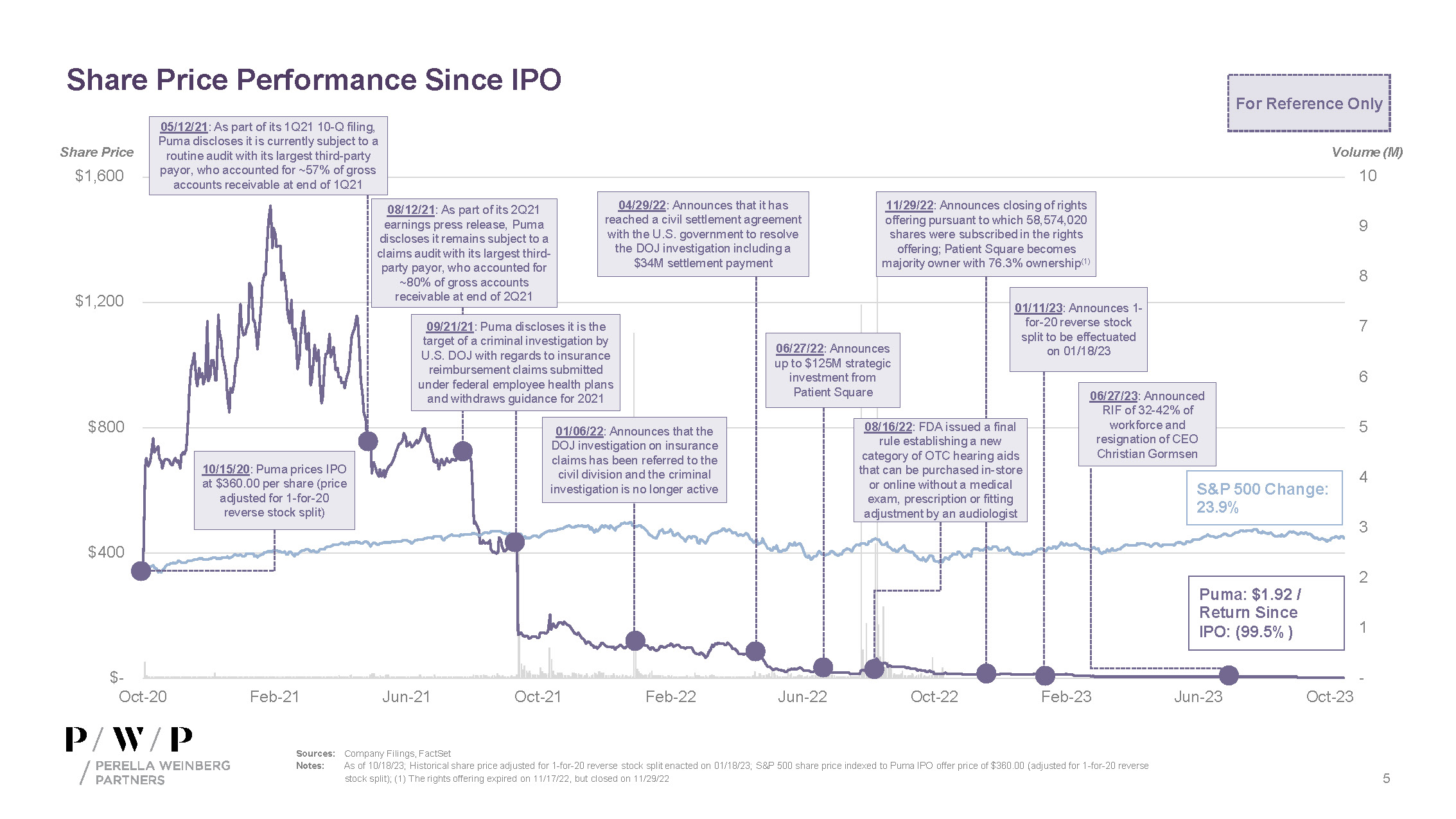

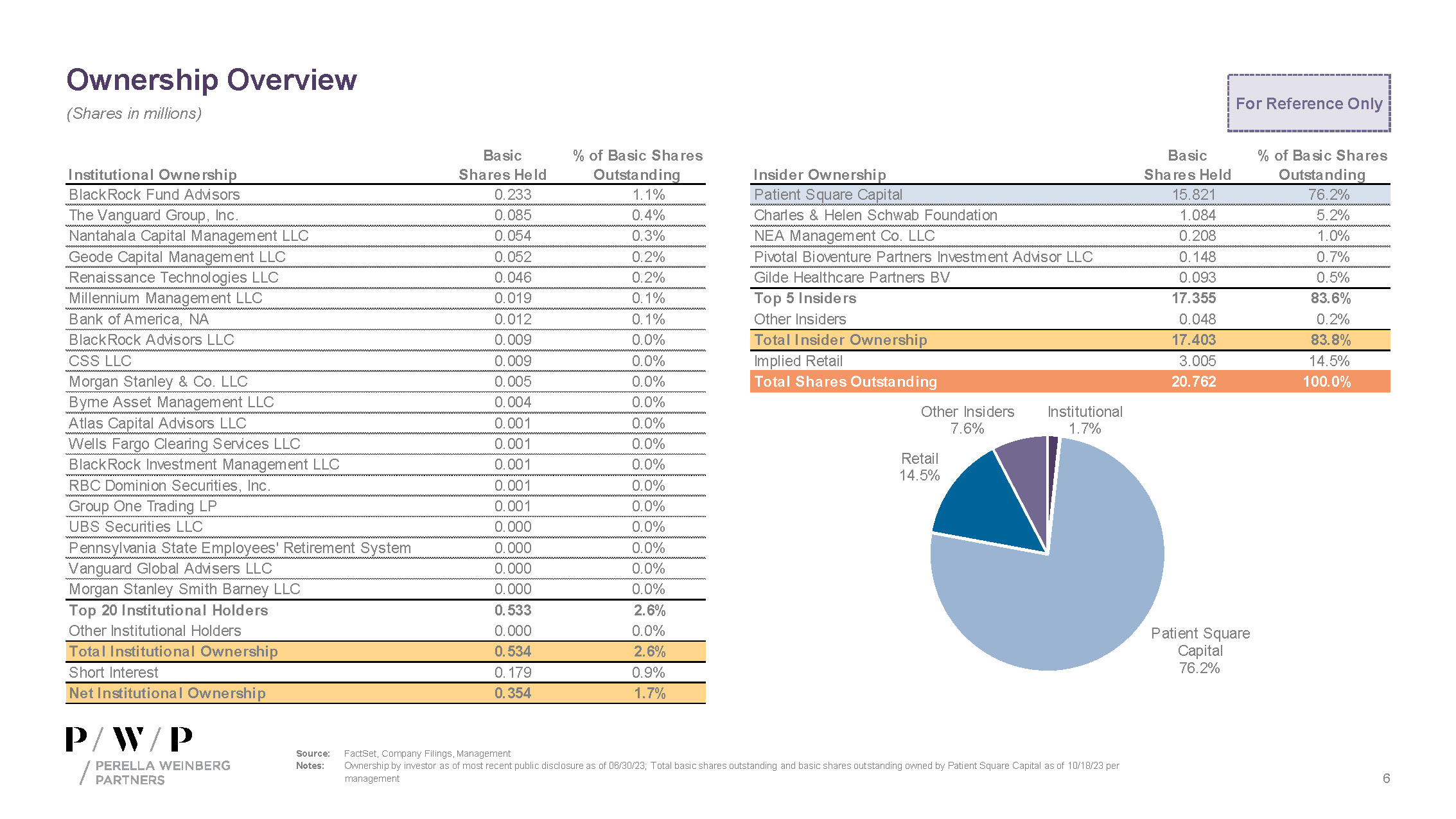

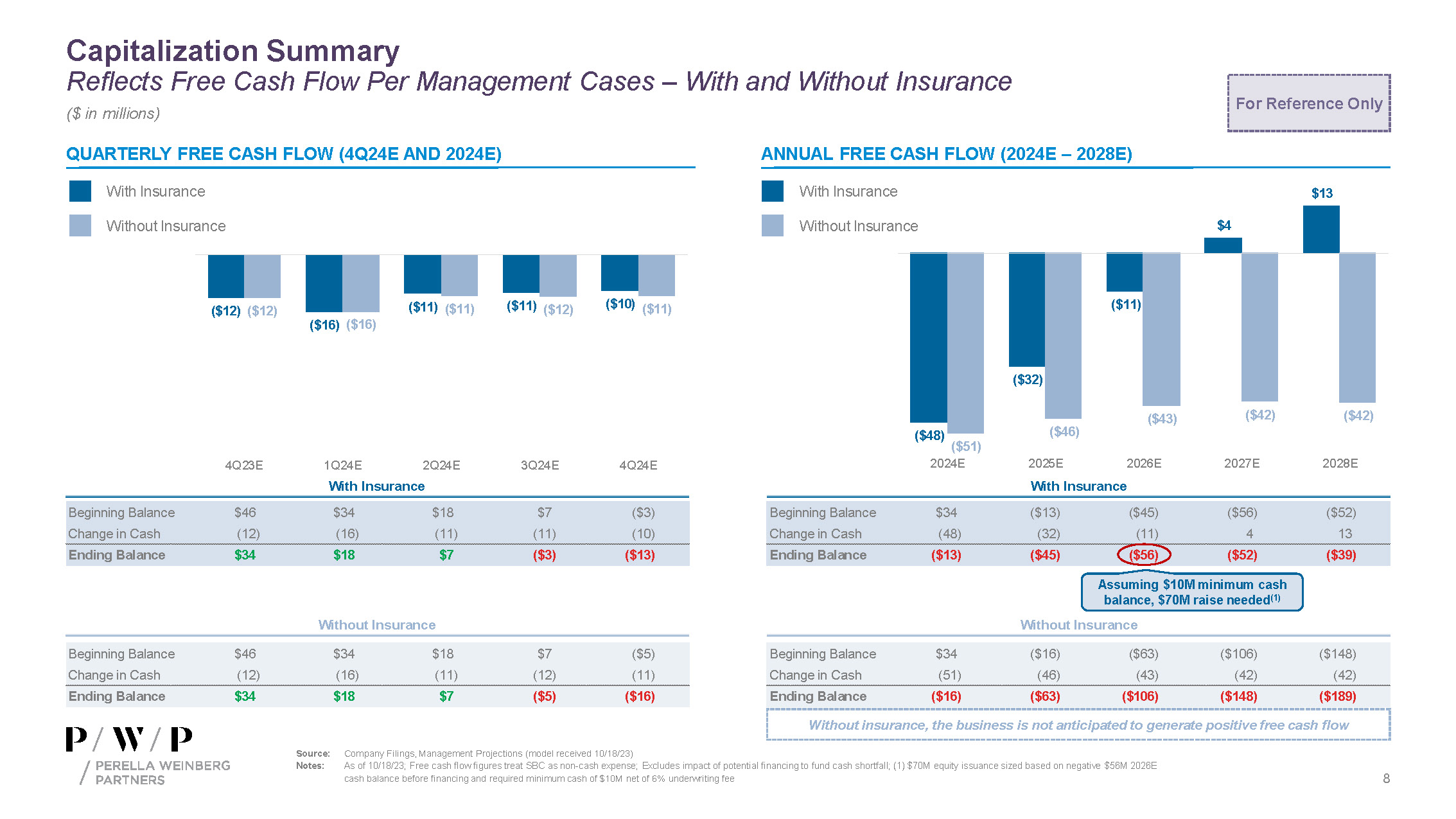

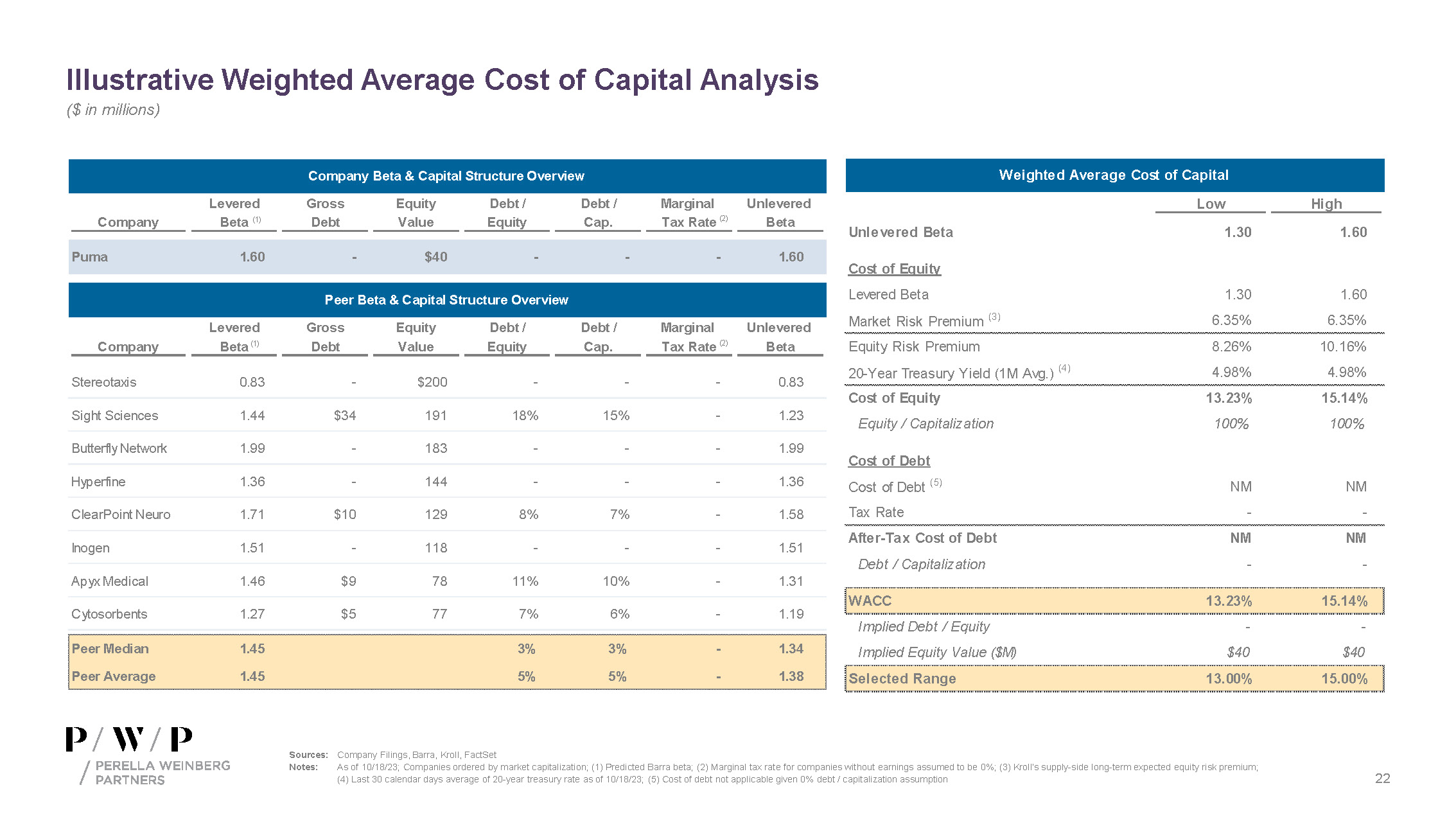

4 Situation Overview In May 2021, Puma disclosed a claims audit by an insurance company that was its largest third-party payor In September 2021, Puma disclosed that it was the target of a DOJ investigation related to reimbursement claims the company submitted on behalf of its customers covered by federal employee health plans As a consequence of the investigation, Puma withdrew from the insurance market, which represented ~48% of the units shipped in the three months ended September 30, 2021, announced it was unable to file its quarterly reports with the SEC, and fell out of compliance with Nasdaq listing requirements Puma also began to assess strategic alternatives, including a financing, potential sale, or liquidation As a part of that assessment, Puma and its representatives contacted more than ten strategic buyers and more than twenty potential financing partners, with only Patient Square Capital (“PSC”) submitting a proposal On April 29, 2022, Puma entered into a civil settlement with the DOJ including a $34M payment, announced its intent to regain insurance coverage, and announced the need to raise capital to cover ~$20M to $25M of quarterly cash burn through 2022 On June 27, 2022, Puma announced an investment of up to $125M from PSC to backstop a rights offering to shareholders to finance the company – Had all of Puma’s existing shareholders exercised their subscription rights in full, PSC would not own any equity stake in the Company On November 17, 2022, the rights offering expired with PSC becoming majority owner with 76.3%(1) ownership of the Company; only 16% of the rights offering was subscribed(2) Today, Puma has a $40M market cap, and expects its cash balance to drop below $10M in late Q2 2024 Sources: Company Filings Notes: As of 10/18/23; (1) 76.2% ownership today due to share issuance related to share based compensation; (2) Only 58.6M shares of the 375M shares were subscribed