- NRXP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

NRx Pharmaceuticals (NRXP) DEF 14ADefinitive proxy

Filed: 5 Sep 24, 4:18pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the SEC Only (As Permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to § 240.14a-12 |

NRX PHARMACEUTICALS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

NRx Pharmaceuticals, Inc.

1201 Orange Street, Suite 600

Wilmington, DE 19801

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON OCTOBER 8, 2024

September 5, 2024

Dear Stockholder,

You are cordially invited to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of NRx Pharmaceuticals, Inc., a Delaware corporation (the “Company”) to be held on October 8, 2024, at 11:00 a.m., Eastern Time, in virtual-only format at https://www.cstproxy.com/nrxpharma/2024.

The attached Notice of Annual Meeting of Stockholders and the accompanying proxy statement (the “Proxy Statement”) describe the business we will conduct at the Annual Meeting and provide information about us that you should consider when you vote your shares.

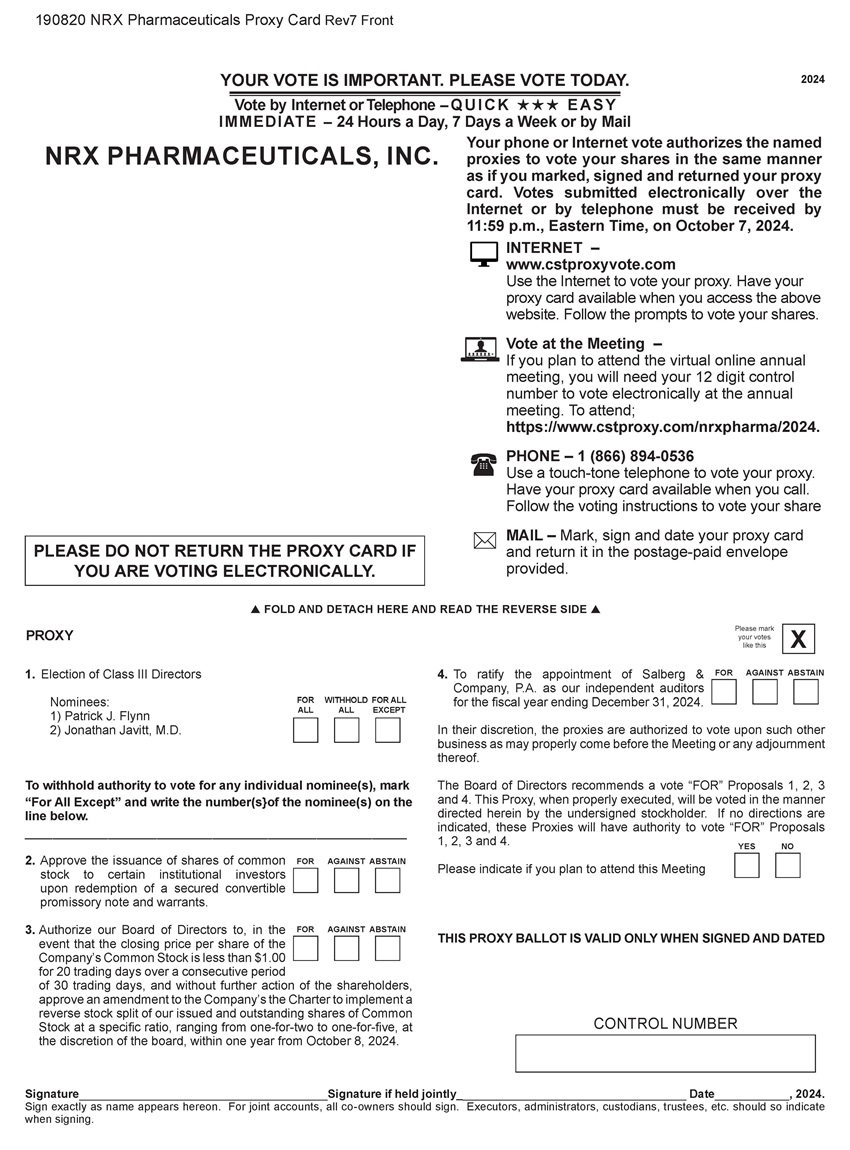

At the Annual Meeting, we will ask stockholders to:

(1) | elect Patrick J. Flynn and Jonathan Javitt, M.D., M.P.H. as Class III members of the Company’s Board of Directors (the “Board”), to serve until the 2027 annual meeting of stockholders or until the appointment, election, and qualification of their successors; |

(2) | approve the issuance of shares of our common stock, par value $0.001 per share (“Common Stock”), to certain institutional investors (the “Investors”) in accordance with Nasdaq Listing Rule 5635(d) upon conversion or redemption of a secured convertible promissory note (the “Note”) and warrants (the “Warrants”) pursuant to a Securities Purchase Agreement, dated August 12, 2024 (the “Purchase Agreement”) by and between the Company and the Investors (the “Share Issuance Proposal” or, “Proposal 2”); |

(3) | authorize our Board of Directors to, in the event that the closing price per share of the Company’s Common Stock on the principal market on the trading day is less than $1.00 for twenty (20) trading days over a consecutive thirty (30) trading days period, without any further action or vote necessary by the Company’s stockholders, approve an amendment to Company’s Second Amended and Restated Certificate of Incorporation to implement a reverse stock split of our issued and outstanding shares of Common Stock at a specific ratio, ranging from one-for-two (1:2) to one-for-five (1:5), such ratio to be determined in the Board of Director’s discretion, within one year from October 8, 2024; |

(4) | ratify the selection of Salberg & Company, P.A. as the Company’s independent auditors for the fiscal year ending December 31, 2024; and |

(5) | transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

Our Board of Directors unanimously recommends a vote of “For” the matters considered at the Annual Meeting.

We hope you will be able to attend the Annual Meeting. When you have finished reading the Proxy Statement, you are urged to vote in accordance with the instructions set forth in the Proxy Statement. You may change or revoke your proxy at any time before it is voted at the Annual Meeting. Whether you plan to attend the Annual Meeting or not, we urge you to vote and submit your proxy by the Internet, telephone or mail to ensure that your shares will be represented and voted at the Annual Meeting and the presence of a quorum.

Thank you for your ongoing support. We look forward to seeing you at our Annual Meeting.

Sincerely,

/s/ Jonathan Javitt

Jonathan Javitt, Chairman of the Board of Directors

NRx Pharmaceuticals, Inc.

1201 Orange Street, Suite 600

Wilmington, DE 19801

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

ANNUAL MEETING DATE: OCTOBER 8, 2024

To the Stockholders:

The 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of NRx Pharmaceuticals, Inc., a Delaware corporation (the “Company”), will be held on October 8, 2024, at 11:00 a.m., Eastern Time, in virtual-only format at https://www.cstproxy.com/nrxpharma/2024 for the following purposes:

(1) | to elect Patrick J. Flynn and Jonathan Javitt, M.D., M.P.H. as Class III members of the Company’s Board of Directors (the “Board”), to serve until the 2027 annual meeting of stockholders or until the appointment, election, and qualification of their successors; |

(2) | to approve the issuance of shares of our common stock, par value $0.001 per share (“Common Stock”), to certain institutional investors (the “Investors”) in accordance with Nasdaq Listing Rule 5635(d) upon conversion or redemption of a secured convertible promissory note (the “Note”) and warrants (the “Warrants”) pursuant to a Securities Purchase Agreement, dated August 12, 2024 (the “Purchase Agreement”) by and between the Company and the Investors (the “Share Issuance Proposal” or, “Proposal 2”); |

(3) | authorize our Board of Directors to, in the event that the closing price per share of the Company’s Common Stock on the principal market on the trading day is less than $1.00 for twenty (20) trading days over a consecutive thirty (30) trading days period, without any further action or vote necessary by the Company’s stockholders, approve an amendment to Company’s Second Amended and Restated Certificate of Incorporation (the “Charter”) to implement a reverse stock split of our issued and outstanding shares of Common Stock at a specific ratio, ranging from one-for-two (1:2) to one-for-five (1:5), such ratio to be determined in the Board of Director’s discretion, within one year from October 8, 2024 (the “Potential Reverse Split”) (“Proposal 3”); and |

(4) | to ratify the selection of Salberg & Company, P.A. as the Company’s independent auditors for the fiscal year ending December 31, 2024; and |

(5) | to transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

The foregoing items are more fully described in the accompanying Proxy Statement, which forms a part of this Notice of Annual Meeting of Stockholders. As of the date of the Proxy Statement, we do not know of any other matters to be raised at the Annual Meeting other than those described in the Proxy Statement.

The Annual Meeting will be conducted in a virtual-only format. The Board believes that a virtual meeting will enable increased stockholder accessibility while allowing for meeting efficiency and reduced costs. You will be able to attend the Annual Meeting virtually, vote your shares, and submit your questions during the meeting by visiting https://www.cstproxy.com/nrxpharma/2024. Details regarding how to attend the Annual Meeting online are more fully described in the accompanying Proxy Statement.

Stockholders entitled to notice of and to vote at the Annual Meeting shall be determined as of the close of business on August 21, 2024, the record date fixed by our Board for such purpose. A list of stockholders of record will be available at the Annual Meeting and during the ten days prior to the Annual Meeting at the office of the Secretary at the above address. All stockholders are cordially invited to attend the Annual Meeting. You may change or revoke your proxy at any time before it is voted at the Annual Meeting. Whether you plan to attend the Annual Meeting or not, we urge you to vote and submit your proxy by the Internet, telephone or mail to ensure that your shares will be represented and voted at the Annual Meeting and the presence of a quorum.

Thank you for your continued support of NRx Pharmaceuticals, Inc. We look forward to seeing you at the Annual Meeting.

By Order of the Board,

/s/ Jonathan Javitt

Jonathan Javitt, Chairman of the

Board of Directors,

Wilmington, Delaware

September 5, 2024

TABLE OF CONTENTS

| Page |

Proxy Statement | 1 |

Important Notice Regarding the Availability of Proxy Materials | 1 |

Questions and Answers About the Annual Meeting | 1 |

Corporate Governance | 7 |

Directors and Executive Officers | 12 |

Executive Compensation | 15 |

Director Compensation | 23 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 24 |

Proposal 1: Election of Class III Directors | 25 |

Proposal 2: Share Issuance Proposal | 26 |

| Proposal 3: Reverse Split Proposal | 28 |

Proposal 4: Ratification of Selection of Auditors | 31 |

Certain Relationships and Related Person Transactions | 33 |

Stockholder Proposals | 34 |

Householding of Proxy Materials | 35 |

Other Matters | 35 |

NRx Pharmaceuticals, Inc.

1201 Orange Street, Suite 600

Wilmington, DE 19801

(484) 254-6134

September 5, 2024

PROXY STATEMENT

This proxy statement (the “Proxy Statement”), the attached Notice of Annual Meeting of Stockholders (the “Notice”) and the enclosed proxy card are being mailed to stockholders of record on or about August 21, 2024 and are furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of NRx Pharmaceuticals, Inc. (the “Company,” “we,” or “us”) for use at our 2024 Annual Meeting of Stockholders (the “Annual Meeting”), to be held on October 8, 2024, at 11:00 a.m., Eastern Time, in virtual-only format at https://www.cstproxy.com/nrxpharma/2024, and at any adjournments or postponements thereof. Although not part of this Proxy Statement, we are also sending along with this Proxy Statement, our Annual Report on Form 10-K, which includes our financial statements and related notes thereto for the fiscal year ended December 31, 2023 (as amended on Form 10-K/A, the “2023 Annual Report”).

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON OCTOBER 11, 2024.

This Proxy Statement and our 2023 Annual Report are available for viewing, printing and downloading at www.nrxpharma.com.

Additionally, you can find a copy of our 2023 Annual Report on the website of the Securities and Exchange Commission (the “SEC”) at https://www.sec.gov, or in the “Financial Information” section of the “Investor Relations” section of our website at https://www.nrxpharma.com. You may also obtain a printed copy of our 2023 Annual Report, free of charge, from us by sending a written request to: Attention: Secretary, NRx Pharmaceuticals, Inc., 1201 North Market Street, Suite 111, Wilmington, DE 19801. Exhibits to the 2023 Annual Report will be provided upon written request and payment of an appropriate processing fee.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

What is a proxy?

A proxy is a person you appoint to vote on your behalf. By using the methods discussed below, you will be appointing Jonathan Javitt as your proxy. The proxy will vote on your behalf, and will have the authority to appoint a substitute to act as proxy. If you are unable to attend the Annual Meeting, please vote by proxy so that your shares may be voted.

What is a proxy statement?

A proxy statement is a document that regulations of the SEC require that we give to you when we ask you to sign a proxy card to vote your shares at the Annual Meeting.

What am I voting on?

At the Annual Meeting, you will be asked to act upon the matters outlined in the Notice, which include the following:

(1) | the election of Patrick J. Flynn and Jonathan Javitt, M.D., M.P.H. as Class III members of our Board, to serve until the 2027 annual meeting of stockholders or until the appointment, election, and qualification of their successors (“Proposal 1”); |

(2) | the approval of the issuance of shares of our Common Stock to certain institutional investors (the “Investors”) in accordance with Nasdaq Listing Rule 5635(d) upon conversion or redemption of a secured convertible promissory note (the “Note”) and warrants (the “Warrants”) pursuant to a Securities Purchase Agreement, dated August 12, 2024 (the “Purchase Agreement”) by and between the Company and the Investors (“Proposal 2”); |

(3) | authorize our Board of Directors to, in the event that the closing price per share of the Company’s Common Stock on the principal market on the trading day is less than $1.00 for twenty (20) trading days over a consecutive thirty (30) trading days period, without any further action or vote necessary by the Company’s stockholders, approve an amendment to Company’s Second Amended and Restated Certificate of Incorporation (the “Charter”) to implement a reverse stock split of our issued and outstanding shares of Common Stock at a specific ratio, ranging from one-for-two (1:2) to one-for-five (1:5), such ratio to be determined in the Board of Director’s discretion, within one year from October 8, 2024 (the “Potential Reverse Split”) (“Proposal 3”); |

(4) | the ratification the selection of Salberg & Company, P.A. as our independent auditors for the fiscal year ending December 31, 2024 (“Proposal 4”); and |

(5) | the transaction of such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

What happens if additional matters are presented at the Annual Meeting?

The Board knows of no other matters to be presented at the Annual Meeting. If any other matter should be presented at the Annual Meeting upon which a vote may be properly taken, shares represented by all proxies received by the Board will be voted with respect thereto in accordance with the judgment of the persons named as proxies in the proxy.

Who is entitled to vote at the Annual Meeting, and how many votes do they have?

Only common stockholders of record as of the close of business on August 21, 2024 (the “Record Date”) will be entitled to vote at the Annual Meeting and any adjournments or postponements thereof. As of the Record Date, 10,749,518 shares of our Common Stock were issued and outstanding. Each share of Common Stock outstanding as of the Record Date will be entitled to one vote, and stockholders may vote such shares by voting online at the Annual Meeting or by proxy.

How can I access the virtual Annual Meeting?

We are committed to ensuring that stockholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend the meeting virtually, vote your shares electronically and submit questions during the meeting by visiting https://www.cstproxy.com/nrxpharma/2024. We will try to answer as many stockholder-submitted questions as time permits that comply with the meeting rules of conduct. However, we reserve the right to edit inappropriate language or to exclude questions that are not pertinent to meeting matters or that are otherwise inappropriate. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

Instructions on how to participate in and attend the Annual Meeting virtually via the Internet, including instructions on how to demonstrate proof of ownership, will be posted at https://www.cstproxy.com/nrxpharma/2024.

What constitutes a quorum?

The holders of not less than one-third (1/3) of our Common Stock issued and outstanding and entitled to vote, present in person, or by remote communication, or represented by proxy, is necessary to constitute a quorum for the transaction of business at the Annual Meeting. A quorum is necessary in order to conduct the Annual Meeting. If you choose to have your shares represented by proxy at the Annual Meeting, you will be considered part of the quorum. Abstentions, withheld votes and “broker non-votes,” if any, will be included in the calculation of the number of shares considered to be present at the Annual Meeting to determine whether a quorum has been established.

Regardless of whether a quorum is present at the Annual Meeting, the vote of a majority of the shares entitled to vote at the Annual Meeting, represented in person virtually or by proxy, may adjourn the Annual Meeting to a later date or dates, without notice other than announcement at the Annual Meeting. If an adjournment is for more than 30 days, or if after the adjournment a new record date is fixed for the adjourned Annual Meeting, we will provide notice of the adjourned meeting to each stockholder of record entitled to vote at the Annual Meeting.

How do I vote?

The proxy is solicited by the Board and is revocable by you any time before it is voted. Execution of a proxy will not in any way affect a stockholder’s right to attend the Annual Meeting and vote online at the Annual Meeting, although the presence (without further action) of a stockholder at the Annual Meeting will not constitute revocation of a previously given proxy. Any stockholder delivering a proxy has the right to revoke it by either (1) filing a written revocation with our Secretary at NRx Pharmaceuticals, Inc., 1201 North Market Street, Suite 111, Wilmington, DE 19801, (2) submitting a new proxy by telephone, Internet, or proxy card after the date of the previously submitted proxy, or (3) voting online at the Annual Meeting and voting by ballot. Your most current vote, whether by telephone, Internet or proxy card is the one that will be counted.

Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. If you vote by proxy, the individuals named on the proxy card, or your “proxies,” will vote your shares in the manner you indicate. You may specify whether your shares should be voted for or withheld with respect to Proposal 1, and voted for, against, or abstain with respect to Proposals 2, 3 and 4. Voting by proxy will not affect your right to attend the Annual Meeting. If your shares are registered directly in your name through our transfer agent, Continental Stock Transfer & Trust Company (“Continental”), or you have stock certificates registered in your name, you may vote:

● | By mail. Complete and mail the enclosed proxy card in the enclosed postage prepaid envelope. Your proxy will be voted in accordance with your instructions. If you sign the proxy card but do not specify how you want your shares voted, they will be voted as recommended by our Board. |

● | By Internet or by telephone. Follow the instructions attached to the proxy card to vote by Internet or telephone. |

● | During the Annual Meeting. Instructions on how to vote while participating in the Annual Meeting live via the Internet are posted at https://www.cstproxy.com/nrxpharma/2024. |

Telephone and Internet voting facilities for stockholders of record will be available 24-hours a day and will close at 11:59 p.m. Eastern Time on October 7, 2024.

What if I change my mind after I return my proxy card?

Any stockholder delivering a proxy has the right to revoke it by either (1) filing a written revocation with our Secretary at NRx Pharmaceuticals, Inc., 1201 North Market Street, Suite 111, Wilmington, DE 19801, (2) submitting a new proxy by telephone, Internet, or proxy card after the date of the previously submitted proxy, or (3) voting online at the Annual Meeting and voting by ballot. Your most current vote, whether by telephone, Internet or proxy card is the one that will be counted.

What is the difference between a stockholder of record and a “street name” holder?

If your shares are registered directly in your name with Continental, our transfer agent, you are considered the stockholder of record with respect to those shares. The Notice has been sent directly to you by us.

If your shares are held in a stock brokerage account or by a bank or other nominee, the nominee is considered the record holder of those shares. You are considered the beneficial owner of these shares, and your shares are held in “street name.” A notice or Proxy Statement and voting instruction card have been forwarded to you by your nominee. As the beneficial owner of your shares, you must provide the bank, broker, or other holder of record with instructions on how to vote your shares, and can do so as follows:

● | By mail. Follow the instructions you receive from your broker or other nominee explaining how to vote your shares. |

● | By Internet or by telephone. Follow the instructions you receive from your broker or other nominee to vote by Internet or telephone. |

● | During the Annual Meeting. Instructions on how to vote while participating in the Annual Meeting live via the Internet are posted at https://www.cstproxy.com/nrxpharma/2024. |

What is a broker non-vote?

Broker non-votes occur when shares are held indirectly through a broker, bank or other intermediary on behalf of a beneficial owner (referred to as held in “street name”) and the broker submits a proxy but does not vote for a matter because the broker has not received voting instructions from the beneficial owner and (i) the broker does not have discretionary voting authority on the matter, or (ii) the broker chooses not to vote on a matter for which it has discretionary voting authority. Under the rules that govern how brokers may vote shares for which they have not received voting instructions from the beneficial owner, brokers are permitted to exercise discretionary voting authority only on “routine” matters when voting instructions have not been timely received from a beneficial owner. The ratification of independent registered public accountants, for example, is a “routine proposal.” Brokers and other nominees may not vote on “non-routine” proposals, such as the election of directors, the Share Issuance Proposal, and the Potential Reverse Split. Therefore, if you hold your shares in street name and you do not instruct your bank, broker or other nominee how to vote on Proposal 1, Proposal 2, or Proposal 3, no votes will be cast on such proposals on your behalf. If you hold your shares in street name, it is critical that you cast your vote if you want your vote to be counted for any proposal.

If I am a beneficial owner of shares, can my brokerage firm vote my shares?

If you are a beneficial owner and do not vote via the Internet or telephone or by returning a signed voting instruction card to your broker, your shares may be voted only with respect to so-called “routine” matters where your broker has discretionary voting authority over your shares. Subject to the rules applicable to broker nominees concerning transmission of proxy materials to beneficial owners, only the ratification of independent registered public accountants is considered a “routine matter.” Accordingly, except for Proposal 4, brokers will not have such discretionary authority to vote your unvoted shares on any proposal at the Annual Meeting without receiving instructions from you. If you hold your shares in street name, it is critical that you cast your vote if you want your vote to be counted for Proposal 1, Proposal 2, and Proposal 3.

How are abstentions and broker non-votes treated for purposes of the Annual Meeting?

The holders of not less than one-third (1/3) of the stock issued and outstanding and entitled to vote, present in person, or by remote communication, or represented by proxy, is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker “non-votes” are counted as present or represented for purposes of determining the presence or absence of a quorum for the Annual Meeting. A “non-vote” occurs when a nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because, in respect of such other proposal, the nominee does not have discretionary voting power and has not received voting instructions from the beneficial owner. An automated system administered by our transfer agent tabulates the votes. The vote on each matter submitted to stockholders is tabulated separately.

All properly executed proxies returned in time to be cast at the Annual Meeting will be voted. If your shares are registered in your name, they will not be counted if you do not vote as described above. If your shares are held in street name and you do not provide voting instructions to the bank, broker or other holder of record that holds your shares, the bank, broker or other holder of record will not have the authority to vote your unvoted shares on any proposal described in this Proxy Statement if it does not receive instructions from you. Accordingly, we encourage you to provide voting instructions. This ensures your shares will be voted at the Annual Meeting in the manner you desire.

What vote is required to approve each proposal?

The following sets forth the vote required to approve the proposals and how votes are counted:

Proposal 1: Election of Class III Directors | | The affirmative vote of a plurality of the votes cast is required to elect Patrick J. Flynn and Jonathan Javitt, M.D., M.P.H., the director nominees, as Class III members of our Board for a term ending at the 2027 annual meeting of stockholders or the appointment, election, and qualification of their successors. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for Proposal 1. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. You may also choose to withhold your vote. |

Proposal 2: Share Issuance Proposal | | The affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) on this proposal is required for the approval of the Share Issuance Proposal. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for this Proposal 2. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. You may also choose to withhold your vote. |

| Proposal 3: Authorization of the Board of Directors to Implement a Reverse Stock Split | The affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) on this proposal is required to authorize our Board of Directors to, in the event that the closing price per share of the Company’s Common Stock on the principal market on the trading day is less than $1.00 for twenty (20) trading days over a consecutive thirty (30) trading days period, without any further action or vote necessary by the Company’s stockholders, approve an amendment to Company’s Second Amended and Restated Certificate of Incorporation (the “Charter”) to implement a reverse stock split of our issued and outstanding shares of Common Stock at a specific ratio, ranging from one-for-two (1:2) to one-for-five (1:5), such ratio to be determined in the Board of Director’s discretion, within one year from October 8, 2024 (the “Potential Reverse Split”) (“Proposal 3”); | |

Proposal 4: Ratification of Selection of Independent Registered Public Accounting Firm | | The affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) on this proposal is required to ratify the selection of our independent registered public accounting firm. Abstentions will have no effect on the results of this vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name for Proposal 4. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our stockholders to select our independent registered public accounting firm. However, if our stockholders do not ratify the selection of Salberg & Company, P.A. as our independent registered public accounting firm for the year ending December 31, 2024, the audit committee of our Board will reconsider its selection. |

If you hold your shares in street name, it is critical that you cast your vote for Proposal 1, Proposal 2, and Proposal 3. Your bank, broker, or other holder of record only has discretionary authority to vote any uninstructed shares on Proposal 4.

What happens if a director nominee is unable to stand for election?

Our Board of Directors may select a substitute nominee. If you have completed, signed and returned your proxy card, the proxy can vote your shares for the substitute nominee.

Is my vote kept confidential?

Proxies, ballots and voting tabulations identifying stockholders are kept confidential and will not be disclosed to third parties except as may be necessary to meet legal requirements.

Who is being nominated for director?

The Class III director candidates nominated for election at the Annual Meeting are Patrick J. Flynn and Jonathan Javitt, M.D., M.P.H.

Who is our independent registered public accounting firm and will they be represented at the Annual Meeting?

Salberg & Company, P.A. served as our independent registered public accounting firm auditing and reporting on our financial statements for the year ended December 31, 2023, and is expected to serve as our independent registered public accounting firm auditing and reporting on our financial statements for the year ended December 31, 2024. We do not expect that representatives of Salberg & Company, P.A. will be present at the Annual Meeting.

Are there any other matters to be acted upon at the Annual Meeting?

Management does not intend to present any business at the Annual Meeting for a vote other than the matters set forth in the Notice and has no information that others will do so. If other matters requiring a vote of the stockholders properly come before the Annual Meeting, it is the intention of the persons named in the form of proxy to vote the shares represented by the proxies held by them in accordance with applicable law and their judgment on such matters.

Where can I find the voting results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting, and we will publish preliminary results, or final results if available, in a Current Report on Form 8-K within four business days following the date of the Annual Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amendment to the initial Form 8-K to disclose the final voting results within four business days after such final voting results are known.

Do I have any dissenters’ or appraisal rights or cumulative voting rights with respect to any of the matters to be voted on at the Annual Meeting?

No. None of our stockholders have any dissenters’ or appraisal rights or cumulative voting rights with respect to the matter to be voted on at the Annual Meeting.

Who is soliciting proxies, how are they being solicited, and who pays the cost?

Our Board is making this solicitation of proxies for the Annual Meeting. We will bear all costs of such solicitation, including the cost of preparing and distributing this Proxy Statement and the enclosed form of proxy, and the cost of hosting the virtual Annual Meeting. After the initial distribution of this Proxy Statement, proxies may be solicited by mail, telephone, or personally by our directors, officers, employees or agents. Brokerage houses and other custodians, nominees and fiduciaries will be requested to forward soliciting materials to beneficial owners of shares held by them for the accounts of beneficial owners, and we will pay their reasonable out-of-pocket expenses.

We have engaged Continental, our transfer agent, to host the virtual Annual Meeting and manage the production and distribution of this Proxy Statement. We expect to pay Continental approximately $20,000 for their services.

What is “householding” and how does it affect me?

With respect to eligible stockholders who share a single address, we may send only one copy of the proxy materials to that address unless we receive instructions to the contrary from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, if a stockholder of record residing at such address wishes to receive separate proxy materials in the future, he or she may contact us by sending a request to our Secretary at NRx Pharmaceuticals, Inc., 1201 North Market Street, Suite 111, Wilmington, Delaware 19801. Eligible stockholders of record receiving multiple copies of our proxy materials can request householding by contacting us in the same manner. Stockholders who own shares through a bank, broker or other intermediary can request householding by contacting the intermediary or by contacting us at the above address or phone number.

We hereby undertake to deliver promptly, upon written or oral request, a copy of the proxy materials to a stockholder at a shared address to which a single copy of the document was delivered. Requests should be directed to the address or phone number set forth above.

May I access and receive proxy materials electronically?

Most stockholders can elect to view or receive copies of future proxy materials over the Internet instead of receiving paper copies in the mail.

If you are a stockholder of record, you can choose this option and save us the cost of producing and mailing these documents by visiting https://www.cstproxy.com/nrxpharma/2024, accessing your account information and following the instructions provided.

Who can help answer my questions?

The information provided above in this “Question and Answer” format is for your convenience only and is merely a summary of the information contained in this Proxy Statement. We urge you to carefully read this entire Proxy Statement, including the documents we refer to in this Proxy Statement. If you have further questions, or need additional materials, please feel free to contact our Secretary at NRx Pharmaceuticals, Inc., 1201 North Market Street, Suite 111, Wilmington, Delaware 19801.

CORPORATE GOVERNANCE

Our Board manages or directs the business and affairs of the Company, as provided by the Delaware General Corporation Law (the “DGCL”) and conducts its business through meetings of the Board and three standing committees: the audit committee (the “Audit Committee”), the compensation committee (the “Compensation Committee”) and the nominating and corporate governance committee (the “Nominating and Corporate Governance Committee”).

Our Board evaluates our corporate governance policies on an ongoing basis with a view towards maintaining the best corporate governance practices in the context of our current business environment and aligning our governance practices closely with the interest of our stockholders. Our Board and management value the perspective of our stockholders and encourage stockholders to communicate with the Board as described under the heading “Communications with the Board” below.

Classified Board of Directors

In accordance with our Second Amended and Restated Certificate of Incorporation (the “Charter”) and our Second Amended and Restated Bylaws (the “Bylaws”), our Board is divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire are elected to serve from the time of election and qualification until the third annual meeting of stockholders following election. Our directors are divided among the three classes as follows:

● | the Class I director is Chaim Hurvitz, and his term expires at our 2025 annual meeting of stockholders; |

● | the Class II directors are Janet Rehnquist and Dennis McBride, Ph.D., and their terms will expire at the 2026 annual meeting of stockholders; and |

● | the Class III directors are Stephen H. Willard, Patrick J. Flynn and Jonathan Javitt, M.D., M.P.H., and their terms will expire at the Annual Meeting. |

Our Certificate of Incorporation provides that the authorized number of directors may be changed only by resolution of the Board. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of the Company. Subject to the special rights of the holders of one or more outstanding series of preferred stock to elect directors, our directors may be removed only for cause by the affirmative vote of the holders of at least 75% of our outstanding voting stock entitled to vote in the election of directors.

Director Independence

Our Board has determined that Messrs. Flynn, Hurvitz, McBride and Ms. Rehnquist are “independent directors” as defined in the Nasdaq Stock Market (“Nasdaq”) listing standards and applicable SEC rules.

Committees of the Board of Directors

Our Board directs the management of our business and affairs, as provided by Delaware law, and conducts its business through meetings of the Board and standing committees. Our Board has established the following three standing committees: Audit Committee, Nominating and Corporate Governance Committee and Compensation Committee. In addition, from time to time, special committees may be established under the direction of the Board when necessary to address specific issues. Our Board has adopted written charters for each of these committees, copies of which are available under the Corporate Governance section of our corporate website at www.nrxpharma.com. The information contained in, or accessible through, our website does not constitute a part of this Proxy Statement. We have included our website address in this Proxy Statement solely as an inactive textual reference.

The chart below reflects the standing committees of our Board and the composition of each committee as of the date of this Proxy Statement:

Committees | ||||||

Director Name | Audit | Compensation | Nominating and | |||

Stephen H. Willard | ||||||

Jonathan Javitt, M.D., M.P.H. | ||||||

Patrick J. Flynn | CC | CC | X | |||

Chaim Hurvitz | X | X | X | |||

Dennis McBride Ph.D. | X | X | X | |||

Janet Rehnquist | X | X | CC | |||

CC – Committee Chair |

X – Member |

Audit Committee

Our Audit Committee consists of Messrs. Flynn, Hurvitz, and McBride, and Ms. Rehnquist, with Mr. Flynn serving as chair. Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Nasdaq rules require that our Audit Committee be composed entirely of independent members. Our Board has affirmatively determined that Messrs. Flynn, Hurvitz, and McBride, and Ms. Rehnquist each meet the definition of “independent director” for purposes of serving on the Audit Committee under Rule 10A-3 of the Exchange Act and the Nasdaq rules. Each member of our Audit Committee also meets the financial literacy requirements of Nasdaq listing standards. In addition, our Board has determined that each of Messrs. Flynn, Hurvitz, and McBride, and Ms. Rehnquist qualifies as an “Audit Committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K. The Audit Committee met four times during the year ended December 31, 2023. Our Board has adopted a written charter for the Audit Committee. The complete text of the Audit Committee’s current charter is available on our website at www.nrxpharma.com.

Pursuant to its charter, the Audit Committee is primarily responsible for, among other things:

● | appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm; |

● | discussing with our independent registered public accounting firm their independence from management; |

● | reviewing, with our independent registered public accounting firm, the scope and results of their audit; |

● | approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm; |

● | overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the quarterly and annual financial statements that we file with the SEC; |

● | overseeing our financial and accounting controls and compliance with legal and regulatory requirements; |

● | reviewing our policies on risk assessment and risk management; |

● | reviewing related person transactions; and |

● | establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters. |

Compensation Committee

Our Compensation Committee consists of Messrs. Flynn, Hurvitz, and McBride, and Ms. Rehnquist, with Mr. Flynn serving as chair. Our Board has affirmatively determined that Messrs. Flynn and Hurvitz, and Ms. Rehnquist each meet the definition of “independent director” for purposes of serving on the Compensation Committee under the Nasdaq rules, including the heightened independence standards for members of a Compensation Committee, and are “non-employee directors” as defined in Rule 16b-3 of the Exchange Act. The Compensation Committee did not meet during the year ended December 31, 2023. Our Board has adopted a written charter for the Compensation Committee. The complete text of the Compensation Committee’s current charter is available on our website at www.nrxpharma.com.

Pursuant to its charter, the Compensation Committee is primarily responsible for, among other things:

● | reviewing and approving the corporate goals and objectives, evaluating the performance of and reviewing and approving, (either alone or, if directed by our Board, in conjunction with a majority of the independent members of the Board) the compensation of our Chief Executive Officer; |

● | overseeing an evaluation of the performance of and reviewing and setting or making recommendations to our Board regarding the compensation of our other executive officers; |

● | reviewing and approving or making recommendations to our Board regarding our incentive compensation and equity-based plans, policies and programs; |

● | reviewing and approving all employment agreement and severance arrangements for our executive officers; |

● | making recommendations to our Board regarding the compensation of our directors; and |

● | retaining and overseeing any compensation consultants. |

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Mr. Hurvitz and Ms. Rehnquist, with Ms. Rehnquist serving as chair. Our Board has affirmatively determined that Mr. Hurvitz and Ms. Rehnquist each meet the definition of “independent director” under the Nasdaq rules. The Nominating and Corporate Governance Committee met once during the year ended December 31, 2023. Our Board has adopted a written charter for the Nominating and Corporate Governance Committee. The complete text of the Nominating and Corporate Governance Committee’s current charter is available on our website at www.nrxpharma.com.

Pursuant to its charter, the Nominating and Corporate Governance Committee is primarily responsible for, among other things:

● | identifying individuals qualified to become members of our Board, consistent with criteria approved by our Board; |

● | overseeing succession planning for our Chief Executive Officer and other executive officers; |

● | periodically reviewing our Board’s leadership structure and recommending any proposed changes to our Board; |

● | overseeing an annual evaluation of the effectiveness of our Board and its committees; and |

● | developing and recommending to our Board a set of corporate governance guidelines. |

Risk Oversight

Our Board is responsible for overseeing our risk management process. Our Board focuses on our general risk management strategy, the most significant risks facing us, and oversees the implementation of risk mitigation strategies by management. Our Audit Committee is also responsible for discussing our policies with respect to risk assessment and risk management. Our Board believes its administration of its risk oversight function has not negatively affected our Board’s leadership structure.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serve as a member of the Board or Compensation Committee (or other committee performing equivalent functions) of any entity that has one or more executive officers serving on our Board or Compensation Committee.

Code of Business Conduct and Ethics

We adopted a written code of business conduct and ethics, our Business Code of Conduct and Anti-Corruption Policy (the “Code of Conduct”), that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The complete text of the Code of Conduct is available on our website at www.nrxpharma.com. In addition, we intend to post on our website all disclosures that are required by law or the Nasdaq listing standards concerning any amendments to, or waivers from, any provision of the Code of Conduct.

Director Attendance at Meetings

The Company encourages and expects all of its directors to attend the meetings of the Board. During the fiscal year ended December 31, 2023, the Board met eight times. Each member of our Board attended at least 75% of the aggregate of (i) the total number of meetings of the Board (held during the period for which he or she was a director), and (ii) the total number of meetings held by all committees of the Board on which such director served (held during the period that such director served).

Board Leadership Structure

The Company does not have a formal policy regarding whether to separate the Chairman and Principal Executive Officer positions. Our Board believes that the decision to combine or separate the Chairman and Principal Executive Officer positions depends on the facts and circumstances facing the Company at a given time and could change over time. Currently, Mr. Willard serves as our current Chief Executive Officer and Principal Executive Officer (the “PEO”) of the Company. The current acting Chairman of our Board is Dr. Javitt.

As the Company evolves, the Board will regularly evaluate the Board leadership structure to ensure it continues to meet the needs of the Company, and to ensure that it provides strong, independent oversight for our stockholders. In particular, as part of this evaluation, the Board will take under consideration the outcomes of the Board and committee self-evaluation process as well as other factors, including the current state of the Company’s strategy and operations, recent performance, market and industry factors and peer company practices.

Policies Governing Director Nominations

Securityholder Recommendations

Our Bylaws provide that nominations of any person for election to the Board at an annual meeting may be made at such meeting by a stockholder present in person virtually (A) who was a record owner of shares of the Company both at the time of giving the notice provided for in the Bylaws and at the time of the Annual Meeting, (B) is entitled to vote at the Annual Meeting, and (C) has complied with the Bylaws as to such notice and nomination.

All stockholder recommendations for director candidates must be submitted to our Secretary at NRx Pharmaceuticals, Inc., 1201 North Market Street, Suite 111, Wilmington, Delaware 19801, who will forward all recommendations to the Nominating and Corporate Governance Committee. All stockholder recommendations for director candidates for the Annual Meeting must be submitted to our Secretary on or before August 23, 2024, and must include the following information:

● | the name and address of the stockholder (including, if applicable, the name and address that appear on the Company’s books and records); |

● | the class or series and number of shares of the Company that are, directly or indirectly, owned of record or beneficially owned by the stockholder; |

● | the full notional amount of any securities that, directly or indirectly, underlie any “derivative security” that constitutes a “call equivalent position” and that is, directly or indirectly, held or maintained by such Proposing Person with respect to any shares of any class or series of shares of the Company; |

● | the name and address of the proposed director candidate (including, if applicable, the name and address that appear on the Company’s books and records); |

● | the class or series and number of shares of the Company that are, directly or indirectly, owned of record or beneficially owned by the proposed director candidate, if applicable; |

● | all information relating to such proposed director candidate that is required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors in a contested election pursuant to Section 14(a) under the Exchange Act (including such candidate’s written consent to being named in the Proxy Statement as a nominee and to serving as a director if elected); |

● | a description of any direct or indirect material interest in any material contract or agreement between or among the stockholder, on the one hand, and each proposed director candidate for nomination or his or her respective associates or any other participants in such solicitation, on the other hand; and |

● | a completed and signed questionnaire, representation and agreement, as specified in the Bylaws. |

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and persons who own more than 10% of the Company’s Common Stock to file reports of ownership and changes of ownership of such securities with the SEC.

Based solely on a review of the reports received by the SEC, the Company believes that, during the fiscal year ended December 31, 2023, the Company’s officers, directors and greater than 10% owners timely filed all reports they were required to file under Section 16(a), except as set forth below:

Name | Number of | Number of | ||||||

Chaim Hurvitz | 1 | 1 | ||||||

Aaron Gorovitz | 1 | 1 | ||||||

Communications with the Board

If you wish to communicate with any of our directors or the Board as a group, you may do so by writing to them at Name(s) of Director(s)/Board of Directors of NRx, Pharmaceuticals, Inc., c/o Secretary, NRx Pharmaceuticals, Inc., 1201 North Market Street, Suite 111, Wilmington, Delaware 19801.

We recommend that all correspondence be sent via certified U.S. Mail, return receipt requested. All correspondence received by the Secretary will be forwarded by the Secretary promptly to the addressee(s).

DIRECTORS AND EXECUTIVE OFFICERS

We have two (2) Class III directors with terms expiring at the Annual Meeting: Patrick J. Flynn and Jonathan Javitt, M.D., M.P.H. Stephen H. Willard is not standing for reelection at the Annual Meeting. Our Board has nominated Patrick J. Flynn and Jonathan Javitt, M.D., M.P.H. to serve as Class III members of our Board until the 2027 annual meeting of stockholders or until the appointment, election, and qualification of their successors.

Information Regarding the Directors and Executive Officers

The following table sets forth, as of the date of this Proxy Statement, certain information regarding our current executive officers and directors who are responsible for overseeing the management of our business.

Name | Age | Position | ||

Jonathan Javitt, M.D., M.P.H. | 67 | Chairman and Chief Scientist | ||

Stephen H. Willard | 63 | Chief Executive Officer and Director | ||

Riccardo Panicucci | 64 | Chief Manufacturing and Technology Officer | ||

Matthew Duffy | 62 | Chief Business Officer | ||

Richard Narido | 46 | Chief Financial Officer and Treasurer | ||

Patrick J. Flynn | 75 | Director, Audit Committee Chair | ||

Chaim Hurvitz | 64 | Director | ||

Dennis McBride | 70 | Director | ||

Janet Rehnquist | 67 | Director, Compliance Committee Chair |

Executive Officer and Director Biographies

Jonathan Javitt, M.D., M.P.H. Dr. Javitt, founder of the Company, serves as our Chairman and as Chief Scientist and was re-elected Chairman in December 2023. Dr. Javitt additionally served as the Company’s CEO from May 2021 until March 2022. He was the Co-founder, Chairman, and CEO of NeuroRx, Inc., which merged with the Company in May 2021. He participated in leading drug and medical device development and commercialization projects for Allergan, Alcon, Eyetech, Merck, Novartis, Pfizer, and Pharmacia and has led the Company’s regulatory and clinical development efforts from their inception. He has played leadership roles in seven successful healthcare IT and biopharma start-up companies. He was appointed to healthcare leadership roles under President Ronald Reagan, George H.W. Bush, Clinton and George W. Bush. During the Reagan and Bush ‘41 administrations, he was designated as an Expert Consultant to the Department of Health and Human Services. President Clinton designated him as a Special Government Employee of the White House Executive Office of the President to serve on the 1993 Health Reform Task Force. Under President George W. Bush, he was commissioned to lead the Healthcare Committee of the President’s Information Technology Advisory Committee and to serve as a Special Employee of the Undersecretary of Defense. Dr. Javitt has published more than 200 scientific works in the areas of health outcomes and pharmacoeconomics that have been cited more than 31,000 times. Dr. Javitt holds an A.B. with Honors from Princeton University, an M.D. from Cornell University and a Masters of Public Health from the Harvard Chan School of Public Health which designated him an Alumnus of Merit in. He continues to serve as an adjunct Professor of Ophthalmology at the Johns Hopkins School of Medicine and as a Senior Fellow of the Potomac Institute for Policy Studies.

We re-elected Dr. Javitt to serve as Chairman, based on his substantial practical experience and expertise in drug development and his prior leadership in multiple private and public sector organizations.

Stephen H. Willard, Esq. Mr. Willard serves as our Chief Executive Officer and as a member of the Board since July 2022. He has more than 20 years of experience as the CEO of pharma and biotech companies. From 2012 to March 2021, Mr. Willard served, and since July 2022 has served, as a Director of Nozin, Inc., an infection prevention company and pioneer in nasal decolonization. From November 2013 to March 2021, Mr. Willard served as CEO of Cellphire Inc., (“Cellphire”) a leading company in platelet and cell stabilization, between, during which period he aided in the expansion of Cellphire, managed all aspects of its dynamic growth and oversaw all its operations. Prior to joining Cellphire, from 2000 to 2013, Mr. Willard served in executive roles at Flamel Technologies S.A (FLML), a drug delivery company. From 2000 to 2005, Mr. Willard served as CFO of Flamel and subsequently, from 2006 to 2013, served as CEO of Flamel. From 2000 to 2014, Mr. Willard was also a member of the board of directors for E*TRADE Financial or its bank, a subsidiary of Morgan Stanley, which offers an electronic trading platform to trade financial assets. Mr. Willard has more than 20 years of experience as the CEO of pharma and biotech companies. Since 2018, Mr. Willard has served as a Presidentially-commissioned member of the National Science Board, which governs the National Science Foundation. He received a B.A. from Williams College in 1982 and a J.D. from Yale Law School in 1985, where he edited the Yale Law Journal.

We selected Mr. Willard to serve on our Board not only because he is the Company’s Chief Executive Officer but also due to his substantial practical experience and expertise in senior leadership roles with multiple private and public biotechnology companies, his extensive experience as a practicing securities attorney, his mergers and acquisitions experience, and his connections to the biotechnology community as a member of the National Science Board. As previously announced, at Mr. Willard’s recommendation the Company has instituted a search for a successor Chief Executive Officer who has prior experience in the launch of a drug approved by the United States Food and Drug Administration. Mr. Willard will not be standing for re-election at the Annual Meeting.

Riccardo Panicucci, PhD. Dr. Panicucci has served as our Chief Technology and Manufacturing Officer since January 2021 and has served in this role since March 2018. Dr. Panicucci previously served as VP of Pharmaceutical Development Services at WuXi STA from February 2015 to March 2018, where he provided scientific leadership in formulation development and GMP manufacturing. In that capacity, he developed the original formulation for NRX-101. From 2004 to 2015, Dr. Panicucci served as Global Head of Chemical and Pharmaceutical Profiling (CPP) at Novartis. Dr. Panicucci has also led R&D groups at Vertex Pharmaceuticals, Symbollon Pharmaceuticals, Biogen, and Bausch & Lomb. He earned a Ph.D. in Chemistry from the University of Toronto and did a Post-Doctoral Fellowship at the University of California, Santa Barbara.

Matthew Duffy. Mr. Duffy has forty years’ experience as a pharmaceutical executive and licensed Capital Markets professional. He has extensive drug development-to-market experience, including in CNS, beginning at Pfizer, Inc. in Sales Management and Marketing. He subsequently led drug commercialization activities at Medimmune (Synagis) as head of Marketing and Lev Pharmaceuticals (Cinryze) as head of Commercial Operations. Matt has more than 20 years’ experience as a FINRA-licensed investment banker, buy-side and sell-side equity research analyst and Investor Relations professional. He has served as Managing Director at Roberts Mitani, LLC, at LifeSci Partners, LLC, at Laidlaw LTD (current), and co-founded Black Diamond Research, LLC, a sell-side equity research firm specializing in healthcare/biotechnology. He served on the Board of CorMedix, Inc. (Nasdaq:CRMD) and currently serves on the boards and/or management of Algorithm Sciences, Inc, Lucius Partners, LLC, Voltron Therapeutics, Inc, PD Theranostics, Inc and AerWave Medical, Inc. Matt received his undergraduate degree in Economics from Duke University. He holds Series 7, 63 and 65 securities licenses.

Richard Narido, MS. Mr. Narido has served as our Interim Chief Financial Officer since September 2023. Prior to his appointment as our Interim Chief Financial Officer, Mr. Narido served as the Chief Financial Officer of Lucira Health (“Lucira”) until Pfizer Inc.’s acquisition of Lucira in April 2023. From July 2018 to March 2021, Mr. Narido served in various roles at Assembly Biosciences, Inc., including most recently as Executive Director, Finance, Controllership and Treasury. From June 2014 to June 2018, Mr. Narido served in various roles at Bio-Rad Laboratories, Inc., including as Americas Head of Finance, Global Commercial Operations. Prior to June 2014, Mr. Narido held various finance roles, including Global Head Finance Reporting and Accounting for Novartis Vaccines and Diagnostics and several industry-related positions, including Business Unit Controller for McKesson Corporation. Mr. Narido started his career with PricewaterhouseCoopers’s Financial Audit and Assurance practice. Mr. Narido holds a Bachelor of Science degree from the University of San Francisco and a Master of Science in Business Management and Leadership degree from the Pepperdine Graziadio Business School.

Patrick J. Flynn. Mr. Flynn has served as a member of our Board and Chair of our Audit Committee since May 2021 and previously served on the board of NeuroRx, Inc. Mr. Flynn is an entrepreneur with more than 35 years of senior executive experience. He has provided leadership to numerous successful organizations including start-ups and growth-stage companies and has served in a variety of roles, including Executive Chairman, board member, CEO, COO, CFO and advisor. Additionally, Mr. Flynn currently serves as an advisor to Good Measures where he was previously COO and responsible for the day-to-day operations of the company’s innovative approach to healthcare and nutrition services. Prior to joining Good Measures, Mr. Flynn was the co-founder of Predilytics, Inc. and served as Executive Chairman. Before joining Predilytics, Mr. Flynn contributed his expertise as COO and then as CEO to Health Dialog, where he helped build the business from an early-stage healthcare services organization and led its successful exit to BUPA, a global insurance company. Prior to this role, Flynn was a co-founder of Symmetrix, a management consulting firm specializing in healthcare and financial services. Mr. Flynn began his career with Bank of America where he held several positions over the course of 15 years, including Vice President of World Banking and Vice President of Risk Management. Mr. Flynn earned his B.S. in Finance from the Wharton School at the University of Pennsylvania.

We selected Mr. Flynn to serve on our Board because he brings to the Company over 30 years of audit compliance, entrepreneurship, business, and board experience.

Chaim Hurvitz. Mr. Hurvitz has served as a member of our Board since May 2021. Mr. Hurvitz served as a member of the NeuroRx, Inc., the predecessor to our company, board of directors from May 2015. Mr. Hurvitz has served as the Chief Executive Officer of CH Health, a private venture capital firm, since May 2011. Mr. Hurvitz previously served as a member of the board of directors of Teva Pharmaceuticals Industries Ltd. from October 2010 to July 2014. Previously, he was a member of the senior management of Teva Pharmaceuticals Industries Ltd., serving as the President of Teva International Group from 2002 until 2010, as President and Chief Executive Officer of Teva Pharmaceuticals Europe from 1992 to 1999 and as Vice President — Israeli Pharmaceutical Sales from 1999 until 2002. Mr. Hurvitz is a founding investor and a director of Galmed Pharmaceuticals Ltd. Mr. Hurvitz presently serves as a member of the management of the Manufacturers Association of Israel and head of its pharmaceutical branch. Mr. Hurvitz holds a B.A. from Tel Aviv University.

We selected Mr. Hurvitz to serve as a director because he brings decades of pharmaceutical experience to the Board. In addition, Mr. Hurvitz brings international relationships to the Company that have, and will continue to add value to the execution of the Company’s business plan.

Dennis McBride, Ph.D. Dennis McBride, Ph.D., age 70, serves as a research professor at Virginia Tech since May 2021, and has led numerous national and international initiatives in neuroscience and its interface with information technology, national security, and medical technology/drug development within the federal government, three of which are now multi-billion dollar enterprises. Dr. McBride also served as Director of the Acquisition and Innovation Research Center for the Department of Defense from February 2022 to February 2024, and as Vice President of Strategy and Innovation at Source America from December 2015 - December 2020. Dr. McBride began his career as a medical scientist in Naval Aviation and ergonomics and served in eight nationally prominent laboratories, including the Defense Advanced Research Projects Agency (DARPA), Naval Aerospace Medical Research Lab, Naval Research Lab, the Office of Naval Research, and the Naval Medical Research Institute. Upon retiring as a highly decorated senior officer (O-6), he assumed leadership of the Potomac Institute for Policy Studies, where he continues to serve as President Emeritus. Following his ten-year term, he was recruited back to the National Defense University to lead the Center for Technology and National Security Policy, culminating his government career as a Senior Executive-4 (Civilian equivalent to Rear Admiral/Vice Admiral). Dr. McBride has served as an adviser to Cabinet Secretaries, US Congressional Committees, and to corporate C-Suite executives. His educational background includes formal enrollment at the University of Georgia, Naval Aerospace Medical Institute (flight surgeon school), the University of Southern California, the London School of Economics, and Harvard Business School, earning a Ph.D. in experimental psychology, four master’s degrees, and an additional postdoctoral education in aviation medicine, systems engineering science, and strategic disruption. He has published widely and was elected by faculty in 1999 to full professor. Dr. McBride has served at multiple universities in colleges of Arts & Sciences, Engineering, Public Policy, and Medicine. For the past 12 years, Dr. McBride has served as an adjunct Professor at Georgetown University School of Medicine and co-Director of Georgetown’s Regulatory Science Program.

We selected Mr. McBride to serve as a director because he brings decades of high-level science experience to the Board. In addition, Mr. McBride brings important new relationships to the Company that have, and will continue to add value to the execution of the Company’s business plan.

Janet Rehnquist, Esq. Ms. Rehnquist has served as a member of our Board since December 2023. Ms. Rehnquist is an attorney with more than 25 years of experience in highly regulated industries, particularly healthcare. Ms. Rehnquist founded RehnquistLaw PLLC in 2006, where her primary responsibilities include advising clients on regulatory and compliance matters as well as governmental investigations. Notably, Ms. Rehnquist served as an Assistant United States Attorney for the Eastern District of Virginia and served as the Inspector General at the Department of Health and Human Services from 2001-2003. Additionally, she has served as Counsel to the U.S. Senate Permanent Subcommittee on Investigations. Ms. Rehnquist earned a BA with honors from the University of Virginia (1979) and a JD from the University of Virginia School of Law (1985), where she was an editor of the Journal of Law and Politics.

We selected Ms. Rehnquist to serve as a director because she brings over 25 years of legal, governmental, and regulatory compliance expertise and experience to the Board.

Board Diversity Matrix

Pursuant to Rule 5606(f) of the Nasdaq Listing Rules, set forth below is certain information on each director’s voluntary self-identified characteristics, as of August 21, 2024.

Total Number of Directors | | 6 | |||||||

| | Female | | Male | | Non-Binary | | Did Not Disclose Gender | |

Part I: Gender Identity | | | | | | | | | |

Directors | | 1 | | 5 | | | | ||

Part II: Demographic Background | | | | | | | | | |

African American or Black | | | | | | | | | |

Alaskan Native or Native American | | | | | | | | | |

Asian | | | | | | | | | |

Hispanic or Latinx | | | | | | | | | |

Native Hawaiian or Pacific Islander | | | | | | | | | |

White | | 1 | | 5 | | | | | |

Two or More Races or Ethnicities | | | | | | | | | |

LGBTQ+ | | | | | | | | | |

Did Not Disclose Demographic Background | | | | | | | | | |

EXECUTIVE COMPENSATION

Summary Compensation Table

The following summary compensation table and narrative disclosure sets forth information regarding all compensation awarded to, earned by, or paid to our Named Executive Officers, which consist of (a) any persons who served as our principal executive officer during any part of the year ended December 31, 2023; (b) each of our two most highly compensated executive officers other than our principal executive officer who served as executive officers at the end of the year ended December 31, 2023; and (c) up to two additional individuals for whom disclosure would have been provided under clause (b) but for the fact that the person was not serving as an executive officer at the end of the year ended December 31, 2023 (collectively, the “Named Executive Officers”).

Our “Named Executive Officers” for the year ended December 31, 2023 were (i) Stephen H. Willard, our Chief Executive Officer; (ii) Jonathan Javitt, M.D., M.P.H., our Chief Scientist and Chairman; and (iii) Richard Narido, our Chief Financial Officer.

On April 1, 2024, the Company completed a stockholder approved 1-for-10 reverse stock split of the Company’s Common Stock. All references in this Proxy Statement to number of common shares, price per share and weighted average number of shares outstanding have been adjusted to reflect the 1-for-10 reverse stock split on a retroactive basis.

2023 Summary Compensation Table

The following table presents information regarding the total compensation of our Named Executive Officers for the years ended December 31, 2023 and 2022.

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($)(1) | Option Awards ($)(2) | All Other Compensation ($) | Total ($) | |||||||||||||||||||

Stephen Willard(3) | 2023 | 500,000 | 500,000 | |||||||||||||||||||||||

Chief Executive Officer | 2022 | 233,871 | — | 566,000 | — | — | 799,871 | |||||||||||||||||||

Jonathan Javitt(4)(5)(6) | 2023 | 602,755 | (6) | — | — | — | 27,443 | 630,198 | ||||||||||||||||||

Chairman and Chief Scientist | 2022 | 867,446 | (7) | — | — | — | 6,250 | 873,696 | ||||||||||||||||||

Richard Narido(8) | 2023 | 255,015 | — | — | 43,000 | — | 298,015 | |||||||||||||||||||

Chief Financial Officer | 2022 | — | — | — | — | — | — | |||||||||||||||||||

(1) | Amount reflects the grant date fair value of restricted stock granted as an employment inducement award during fiscal year 2023 or fiscal year 2022 as calculated in accordance with ASC Topic 718, See Note 10 to the consolidated financial statements contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 for information regarding the assumptions used in calculating this amount. | |

(2) | Amount reflects the grant date fair value of stock options granted during fiscal year 2023 or fiscal year 2022 as calculated in accordance with ASC Topic 718,. See Note 10 to the consolidated financial statements contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 for information regarding the assumptions used in calculating these amounts. | |

(3) | Mr. Willard was appointed Chief Executive Officer on July 12, 2022. | |

(4) | For 2023, All Other Compensation reflects reimbursement for legal fees incurred. For 2022, the All Other Compensation column reflects: (i) for Dr. Javitt, $6,250 for his service as Chairman of the Board during the first quarter of 2022. | |

(5) | Dr. Javitt served as Chief Executive Officer of the Company until his retirement on March 8, 2022, at which time he assumed the role of Chief Scientist and remained as a member of the Board of Directors. Dr. Javitt was appointed as Chairman of the Board on December 19, 2023. | |

(6) | Amount reported reflects (i) $0 in base salary, and (ii) $602,755 in consulting fees, and (iii) $27,443 in reimbursement for legal expenses. | |

(7) | Amount reported reflects (i) $51,008 in base salary, and (ii) $816,438 in consulting fees, which included approximately $300,000 in deferred compensation from 2021. | |

(8) | Mr. Narido was appointed as Interim Chief Financial Officer in September 2023 through a consulting agreement with LifeSci Advisors. Amount reflected above accounts for total payment to LifeSci Advisors inclusive of their mark up. |

Narrative to Summary Compensation Table

Base Salaries and Compensation

Our Named Executive Officers receive an annual base salary or annual rate of compensation to compensate them for services rendered. The base salary or annual rate of compensation payable to each Named Executive Officer is intended to provide a fixed component of compensation reflecting the executive’s skill set, experience, role and responsibilities. For the year ended December 31, 2023: (i) Mr. Willard’s annual base salary was set at $500,000; (ii) Dr. Javitt’s was compensated through an annual consulting agreement that was set at $575,000 and eligible for an annual performance-based bonus with a minimum target of $250,000; and (iii) Mr. Narido’s compensation for 2023 was via a consulting agreement with LifeSci Advisors, LLC.

Cash Bonus Compensation

Pursuant to his employment agreement, Mr. Willard is eligible to receive a discretionary annual performance-based cash bonus with a target equal to 50% of base salary. Pursuant to his employment agreement, Dr. Javitt was eligible to receive a discretionary annual performance-based cash bonus with a target equal to $275,000.

Equity Compensation

We typically grant stock options pursuant to the NRx Pharmaceuticals, Inc. 2021 Omnibus Incentive Plan (the “Omnibus Plan”) as the long-term incentive component of our compensation program. Stock options allow employees, including our Named Executive Officers, to purchase shares of Common Stock at a price equal to the fair market value of Common Stock on the date of grant. Our stock options have vesting schedules that are designed to encourage continued employment and typically vest in substantially equal installments on each of the first three anniversaries of the applicable vesting commencement date, subject to the recipient’s continued service through each applicable vesting date. From time to time, our Board may also construct alternate vesting schedules as it determines appropriate to motivate particular employees, as further described below.

Option Awards

In 2023, Richard Narido was granted options to purchase 10,000 shares of Common Stock.

Refer to the “Outstanding Equity Awards at 2023 Fiscal Year End” table below for additional information regarding these options.

Willard Restricted Stock Award

As an inducement to join the Company, Mr. Willard received a grant of 100,000 shares of restricted stock. Such grant of restricted stock was designed to comply with the Nasdaq inducement exemption and was granted outside of the Company’s existing equity compensation plans. However, the restricted stock award is governed in all respects as if issued under the Omnibus Plan. The shares of restricted stock will vest in substantially equal installments on each of the first three anniversaries of the date of grant, subject to Mr. Willard’s continued employment with, appointment as a director of, or engagement to provide services to, the Company through the applicable vesting date.

Mr. Willard’s shares of restricted stock are subject to clawback if Mr. Willard engages in conduct that is in conflict with or adverse to the Company’s interests while employed by the Company, including violating non-competition, non-solicitation, and non-disparagement covenants.

Refer to the “Outstanding Equity Awards at 2023 Fiscal Year End” table below for additional information regarding these shares of restricted stock.

Executive Officer Employment Arrangements

Willard Employment Agreement

In connection with his commencement of employment with us in July 2022, we entered into an employment agreement with Mr. Willard (the “Willard Employment Agreement”) pursuant to which he serves as our Chief Executive Officer and as a director on our Board. The Willard Employment Agreement provides for an initial two-year term and extends automatically for additional one-year periods unless either party provides notice of termination. The Willard Employment Agreement provides for an annual base salary of $500,000, a performance-based bonus with a minimum target of 50% of base salary, and an inducement grant of 100,000 shares of restricted stock that vests over a three-year period.

The Willard Employment Agreement includes (i) a confidentiality covenant that applies during the term of employment and for three years following termination, (ii) assignment of intellectual property, (iii) a non-competition covenant that applies during the term of employment and for 12 months following termination, and (iv) non-solicitation of employees and customers covenants that apply during the term of employment and for 12 months following termination.

Javitt Employment Agreement and Javitt Consulting Agreement

In connection with his commencement of employment with us in May 2015, we entered into an employment agreement with Dr. Javitt (the “Javitt Employment Agreement”) pursuant to which he served as our Chief Executive Officer and President. The Javitt Employment Agreement provided for an initial five-year term and extended automatically for additional one-year periods unless either party provided notice of termination. The Javitt Employment Agreement provided for a base salary of $275,000, subject to periodic increase by the Board. The Javitt Employment Agreement was terminated on March 8, 2022 when Dr. Javitt retired and became a consultant to the Company. Upon entering into the Javitt Consulting Agreement (as defined below), Dr. Javitt waived his rights to the bonus, severance and certain other provisions under the Javitt Employment Agreement.