Exhibit 99.2 Trusted Communication Platform I nvestor s Pr esentation Febr uar y 2023 Copyright © Kaleyra, Inc. 2023

DISCLAIMER FORWARD LOOKING STATEMENTS This pres entation c ontains forward- looking s tatem ents within the m eaning of U.S . federal s ec urities laws . S uc h forward- looking s tatem ents inc lude, but are not lim ited to, s tatem ents regarding the expec tations , beliefs , intentions , plans , pros pec ts or s trategies regarding the future business plans of K aleyra, Inc . (“K aleyra” or the “C om pany”) and the C om pany’s fi nanc ial results, as well as future s ize and growth of addres s able m arkets . Any s tatem ents c ontained herein that are not s tatem ents of his toric al fac t m ay be deem ed to be forward- looking s tatem ents . In addition, any s tatem ents that ref er to projec tions , forec as ts or other c harac terizations of future events or circum s tances , inc luding any underlying as sum ptions, are forward- looking s tatem ents . The words antic ipate, believe, c ontinue, c ould, es tim ate, expec t, intends , m ay, m ight,” plan, pos s ible, potential, predic t, projec t, s hould, would and s im ilar expres s ions m ay identify forward- looking s tatem ents , but the abs enc e of thes e words does not m ean that a s tatem ent is not forward- looking. The forward- looking s tatem ents c ontained in this pres entation are bas ed on c ertain as s um ptions of K aleyra in light of its experienc e and perc eption of his toric al trends , c urrent c onditions , and expec ted future developm ents and their potential effec ts on K aleyra as well as other fac tors that K aleyra believes are appropriate in the circum s tances . There c an be no as s uranc e that future developm ents affec ting K aleyra will be thos e antic ipated. Thes e forward- looking s tatem ents involve a num ber of ris ks , unc ertainties (s om e of whic h are beyond the c ontrol of K aleyra), or other as s um ptions that m ay c aus e ac tual res ults or perform anc e to be m aterially diff erent from thos e expres s ed or im plied by thes e forward- looking s tatem ents . S hould one or m ore of thes e ris ks or unc ertainties m aterialize, or s hould any of the as s um ptions being m ade prove inc orrec t, ac tual res ults m ay vary in m aterial res pec ts from thos e projec ted in thes e forward- looking s tatem ents . K aleyra undertakes no obligation to update or revis e any forward- looking s tatem ents , whether as a res ult of new inform ation, future events , or otherwis e, exc ept as m ay be required under applic able s ec urities laws . C ertain indus try, m arket and c om petitive pos ition data inc luded in this pres entation is bas ed on res earc h, s urveys and other data obtained from third party s ourc es and the C om pany’s own internal es tim ates and res earc h. W hile K aleyra believes thes e third party s ourc es to be reliable, it has not independently verified, and m akes no repres entation as to the accuracy or c om pletenes s of any inform ation obtained from third party s ourc es . In addition, c ertain of this data involves a num ber of assum ptions and lim itations , and there c an be no guarantee as to the accuracy or reliability of s uc h assum ptions . NON- GAAP FINANCIAL MEASURE AND RELATED INFORMATION This pres entation inc ludes referenc es to Adjus ted Gros s Margin, Adjus ted E BITDA and Adjus ted E arnings Per S hare (E PS ), i.e. fi nanc ial m eas ures that are not prepared in accordance with U.S . generally ac c epted accounting princ iples (“GAAP”). Adjus ted Gros s Margin is defi ned as of any date of c alc ulation, the c ons olidated revenues of K aleyra and its subsidiaries, net of the c os t of goods s old c alc ulated from the unaudited c ons olidated fi nanc ial s tatem ents of s uc h party and its subsidiaries, plus the am ortization of ac quired intangible as s ets running through c os t of goods s old, divided by the c ons olidated revenues . Adjus ted E BITDA is defi ned as of any date of c alc ulation, the c ons olidated earnings or los s of K aleyra and its subsidiaries, before fi nanc e inc om e and fi nanc e c os t (inc luding bank c harges ), tax, deprec iation and am ortization c alc ulated from the unaudited c ons olidated fi nanc ial s tatem ents of s uc h party and its subsidiaries, plus (i) trans ac tion and one- off expens es , (ii) without duplic ation of c laus e (i), s everanc e or c hange of c ontrol paym ents , (iii) any expens es related to c om pany res truc turing, (iv) any c om pens ation expens es relating to s toc k options , res tric ted s toc k units , res tric ted s toc k or s im ilar equity interes ts as m ay be is s ued by Kaleyra or any of its s ubs idiaries to its or their em ployees and (v) any provis ion for the write down of as s ets . Adjus ted E PS is c alc ulated by dividing the adjus ted net inc om e (loss) by the weighted num ber of s hares outs tanding. Adjus ted net inc om e (loss) is defi ned as of any date of c alc ulation, the net inc om e (loss) of K aleyra and its subsidiaries, plus : (i) trans ac tion and one- off expens es , (ii) without duplic ation of c laus e (i), s everanc e or c hange of c ontrol paym ents , (iii) any expens es related to c om pany res truc turing, (iv) any c om pens ation expens es relating to s toc k options , res tric ted s toc k units , res tric ted s toc k or s im ilar equity interes ts as m ay be issued by K aleyra or any of its s ubs idiaries to its or their em ployees , (v) any provis ion for the write down of as s ets , (vi) the am ortization of ac quired intangible as s ets and (vii) the am ortization of debt dis c ount and is s uanc e c os ts of c onvertible fi nanc ial ins trum ents . K aleyra’s m anagem ent believes that thes e non- GAAP m eas ures of K aleyra’s fi nanc ial res ults will provide us eful inform ation to inves tors regarding c ertain fi nanc ial and bus ines s trends relating to Kaleyra’s antic ipated fi nanc ial c ondition and res ults of operations . Internally, m anagem ent us es thes e Non- GAAP financ ial m eas ures in ass ess ing the C om pany's operating res ults and in planning and forec as ting. Inves tors s hould not rely on any s ingle fi nanc ial m eas ure to evaluate K aleyra’s bus ines s . C ertain of the fi nanc ial m etric s in this pres entation c an be found in K aleyra’s F orm 10 - K for the year ended Dec em ber 31, 20 22, that we expec t to file with the “S E C ” on or about Marc h 6, 20 23, and the rec onc iliation of Adjus ted Gros s Margin, Adjus ted E BITDA and Adjus ted E PS can be found on s lide 21- 23 of this pres entation. This pres entation als o inc ludes referenc e to the non- GAAP operating m etric Dollar- B as ed Net E xpans ion R ate, whos e defi nition c an be found on s lide 24 of this pres entation. TRADEMARKS AND INTELLECTUAL PROPERTY All trademarks, service marks, and trade names of Kaleyra and its subsidiaries or affiliates used herein are trademarks, servic e marks, or registered trademarks of Kaleyra as noted herein. Any other product, company names, or logos mentioned herein are the trademarks and/or intellectual property of their respective owners. 2 Copyright © Kaleyra, Inc. 2023

T he T r usted Communication Platfor m as a Ser vice (CPaaS) Kaleyra’s omnichannel platform helps businesses around the world connect with customers on their preferred channels 3 Copyright © Kaleyra, Inc. 2023

Over view 4

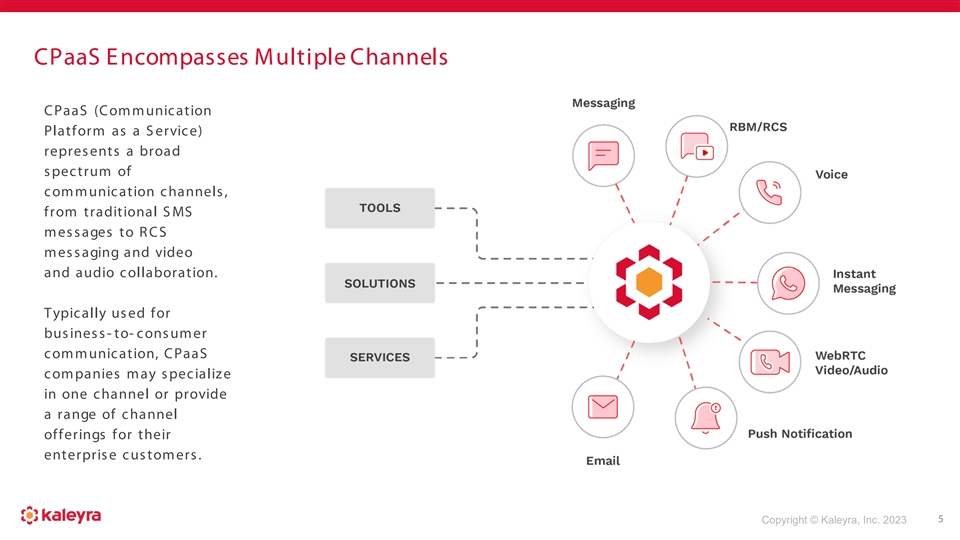

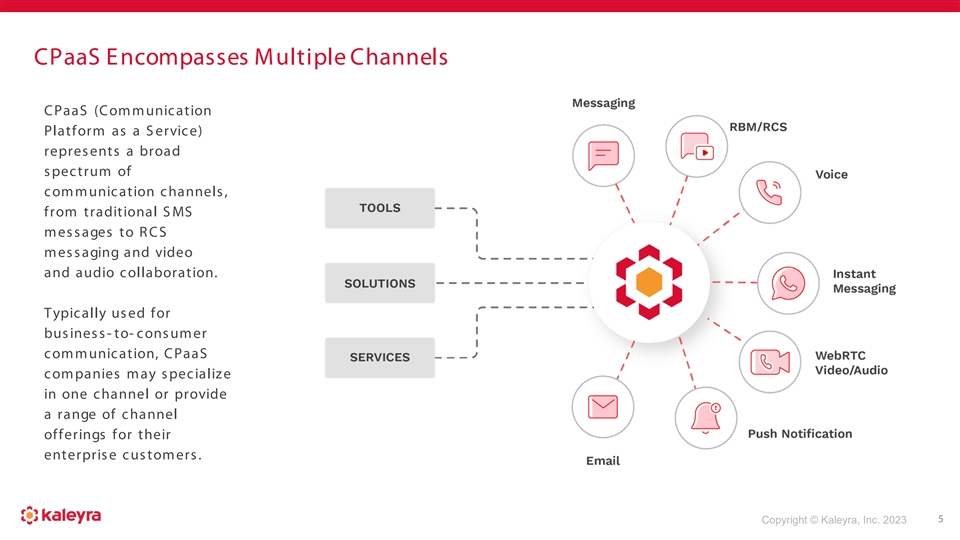

CPaaS E ncompasses M ultiple Channels CPaaS (Communication Platform as a Service) represents a broad spectrum of communication channels, from traditional SMS messages to RCS messaging and video and audio collaboration. Typically used for business - to- c ons um er communication, CPaaS companies may specialize in one channel or provide a range of channel offerings for their enterprise customers. 5 Copyright © Kaleyra, Inc. 2023

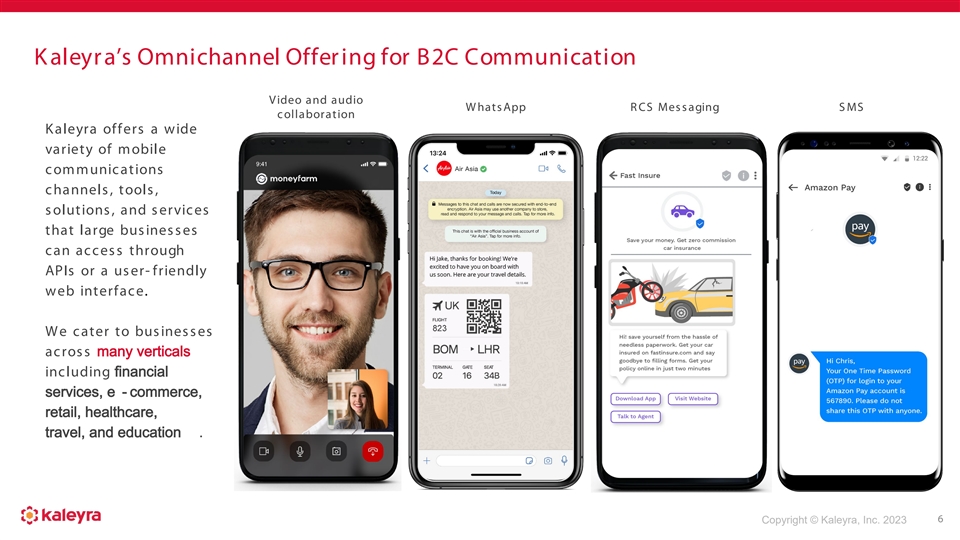

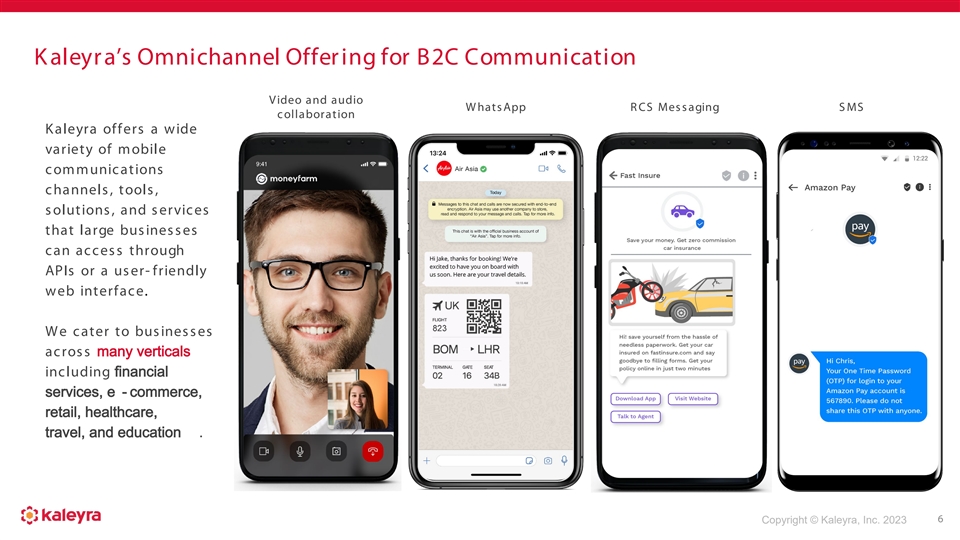

K aleyr a’s Omnichannel Offer ing for B2C Communication Video and audio W hats App RCS Messaging S MS c ollaboration Kaleyra offers a wide variety of m obile c om m unic ations channels, tools, solutions, and services that large businesses can access through APIs or a user- friendly web interface. We cater to businesses ac ross many verticals inc luding financial services, e - commerce, retail, healthcare, travel, and education . 6 Copyright © Kaleyra, Inc. 2023

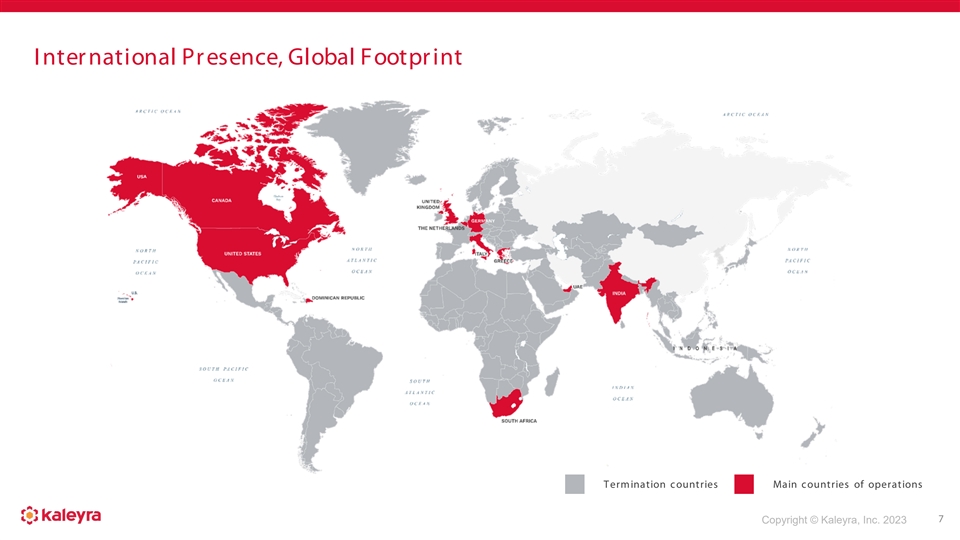

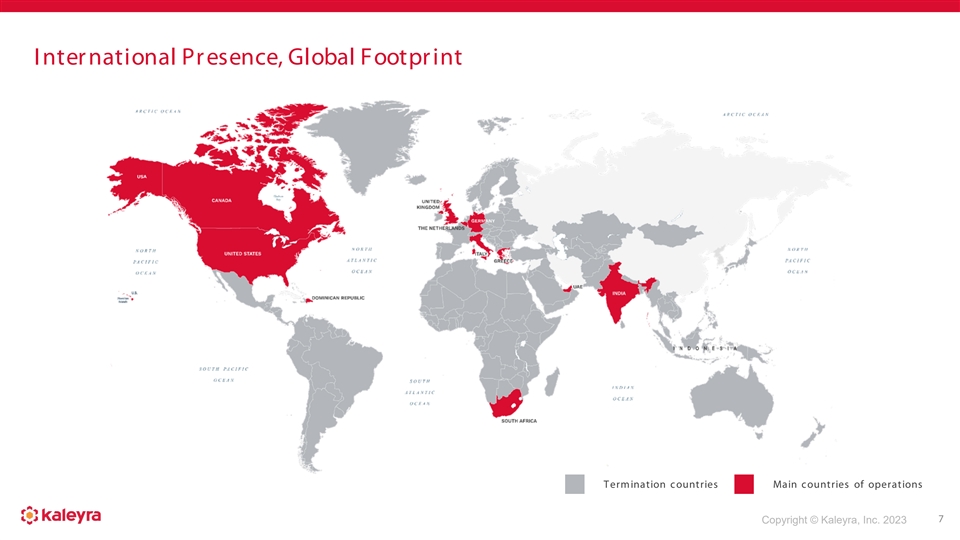

I nter national Pr esence, Global Footpr int Termination countries Main countries of operations 7 Copyright © Kaleyra, Inc. 2023

Enter pr ise-Focused and E xper ienced in H ighly-R egulated Sector s Some of Our Customers Highlights of the Year - Dec 2022 : Kaleyra announces a new slate of W hats App c hatbots - Dec 2022 : Kaleyra Partners With Fincons To Transform Digital Collaboration In Banking For Flowe - Oct 2022: Kaleyra to Provide SMS Services for Amazon Pay India - Jul 2022 : Kaleyra Powers Video Communication For Moneyfarm - Jun 2022 : Kaleyra Helps Italy's Santagostino Build Remote Health Coach to Improve Accessibility and Assistance - Feb 2022 : Kaleyra Partners with Bosch Group to Power Communications for its Mobility Solutions in India - Jan 2022 : Kaleyra Provides Innovative Banking Video Communications for Banca Sella's New Wealth Management Platform - Jan 2022 : Kaleyra's CPaaS Solutions Supported India's Rapidly E xpanding Unicorn Startup Ecosystem 8 Copyright © Kaleyra, Inc. 2023

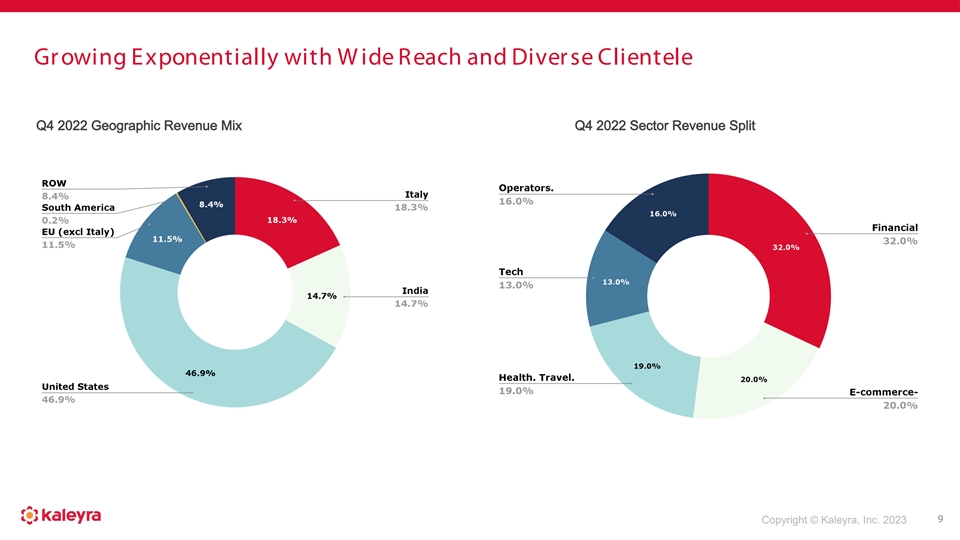

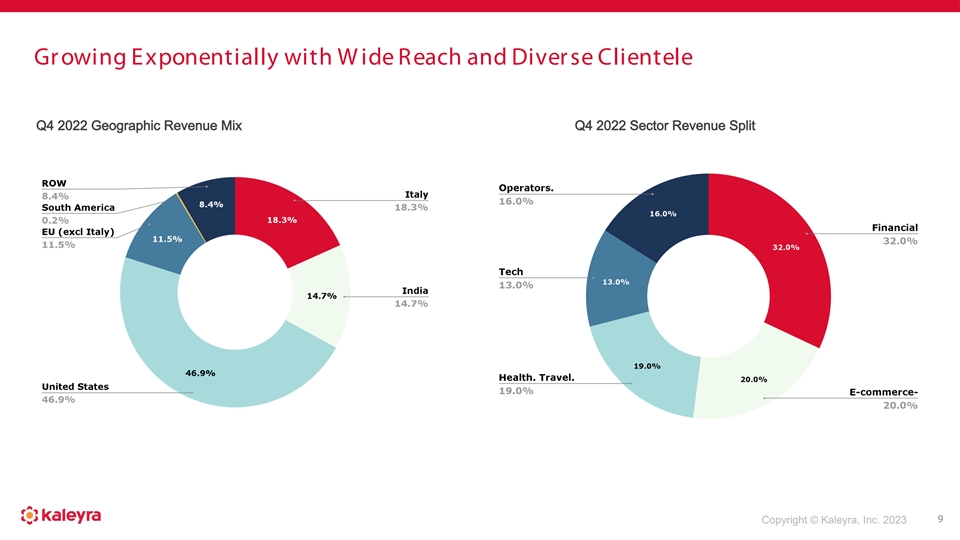

Gr owing E xponentially with W ide R each and Diver se Clientele Q4 2022 Geographic Revenue Mix Q4 2022 Sector Revenue Split 9 Copyright © Kaleyra, Inc. 2023

T op-N otch Business & Pr oduct Par tner ships: * Also wor ks with: *Kaleyra is a proud member of Oracle PartnerNetwork and a provider of integrations to Oracle Marketing solutions. Kaleyra is also powered by Oracle Cloud Infrastructure with the goal to offer improved security, better service- level agreements, global scalability, and faster deploym ent. 10 Copyright © Kaleyra, Inc. 2023

E xceptional Standar d for T r usted Ser vice and I ndustr y-Specific Compliance Kaleyra is committed to providing trusted, transparent, and high- quality service. Customer satisfaction is key – Kaleyra’s dedicated team of professionals offers prompt, around- the- clock assistance. Retention is high – the average engagement tenure is >10 years for international clientele and >15 years for banking customers. 11 Copyright © Kaleyra, Inc. 2023

Globally R ecognized for E xcellent Pr oducts, Customer Ser vice, and Secur ity 12 Copyright © Kaleyra, Inc. 2023

Financial Over view Q4 2022 13

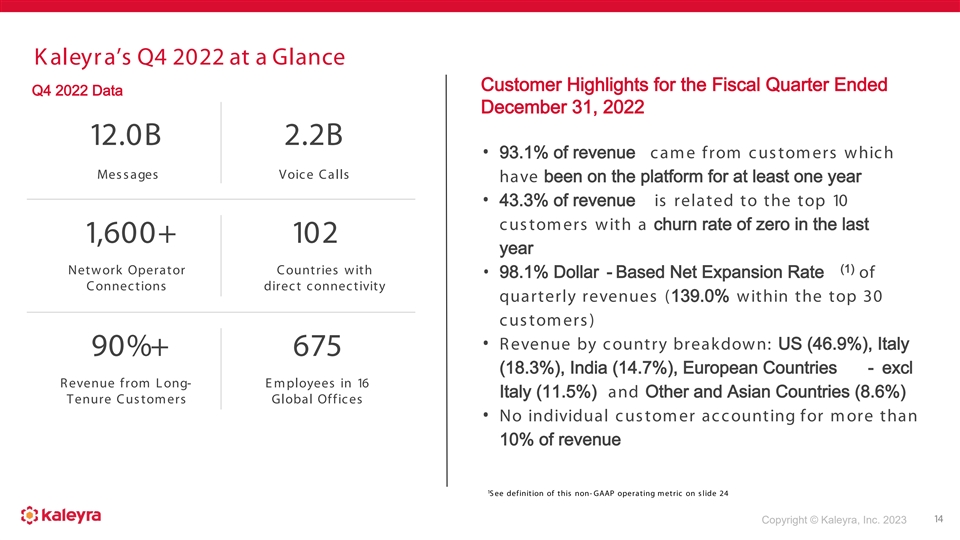

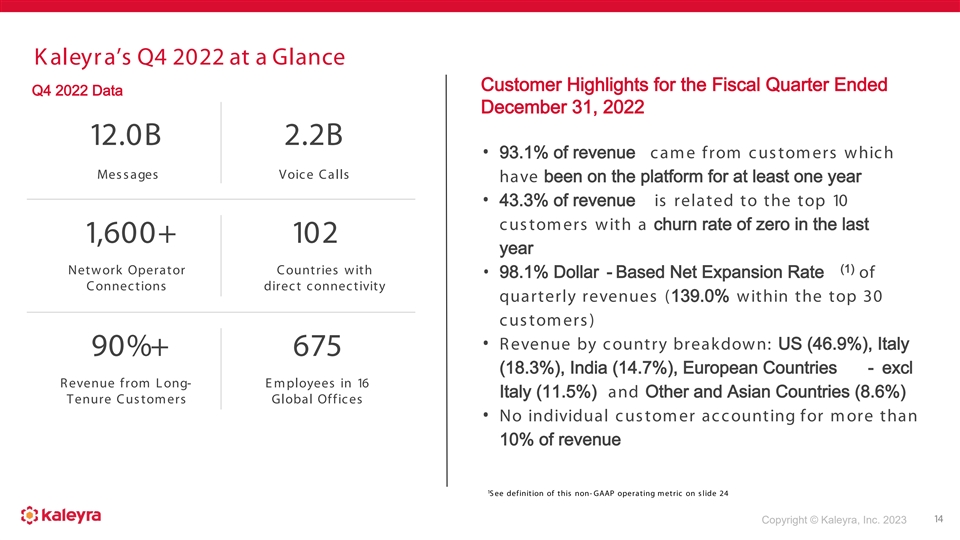

K aleyr a’s Q4 2022 at a Glance Customer Highlights for the Fiscal Quarter Ended Q4 2022 Data December 31, 2022 12.0B 2.2B • 93.1% of revenue came from customers which Mes s ages Voice Calls have been on the platform for at least one year • 43.3% of revenue is related to the top 10 customers with a churn rate of zero in the last 1,600+ 102 year (1) Network Operator Countries with • 98.1% Dollar - Based Net Expansion Rate of C onnec tions direct connectivity quarterly revenues (139.0% within the top 30 c ustom ers) • Revenue by country breakdown: US (46.9%), Italy 90%+ 675 (18.3%), India (14.7%), European Countries - excl Revenue from Long- Employees in 16 Italy (11.5%) and Other and Asian Countries (8.6%) Tenure Customers Global Offices • No individual customer accounting for more than 10% of revenue 1 See definition of this non- GAAP operating metric on slide 24 14 Copyright © Kaleyra, Inc. 2023

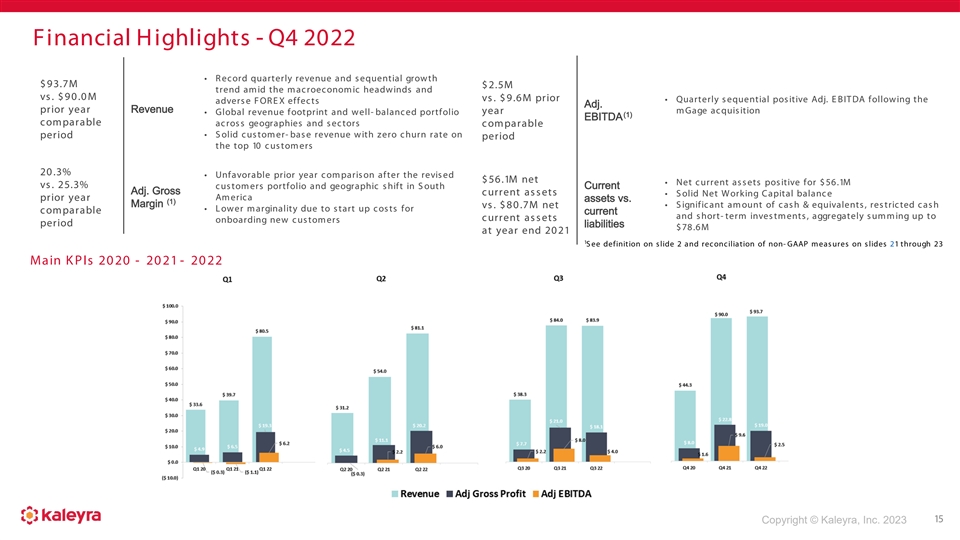

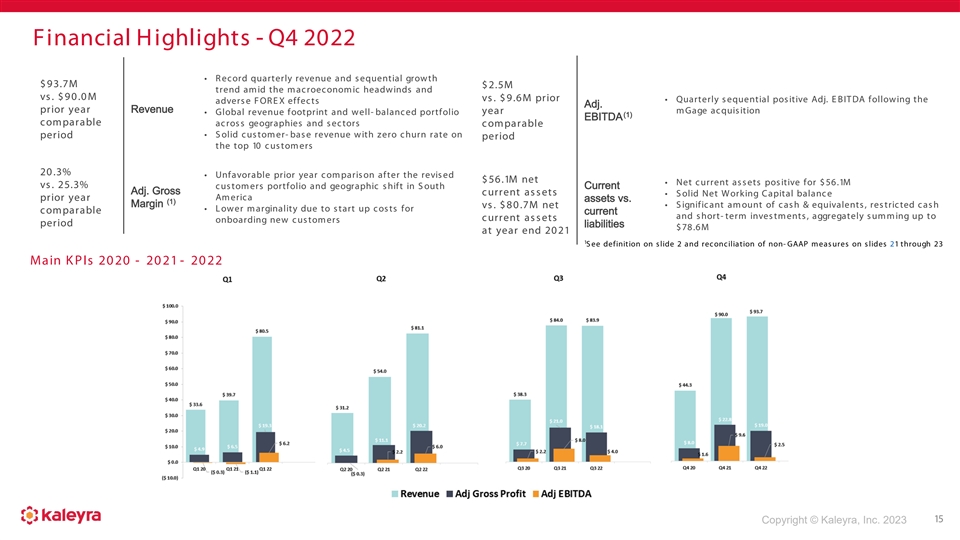

Financial H ighlights - Q4 2022 • Record quarterly revenue and sequential growth $ 93.7M $ 2.5M trend amid the macroeconomic headwinds and vs. $90.0M vs. $9.6M prior • Quarterly sequential positive Adj. EBITDA following the adverse FOREX effects Adj. prior year Revenue mGage acquisition • Global revenue footprint and well- balanced portfolio year (1) EBITDA c om parable across geographies and sectors c om parable • Solid customer- base revenue with zero churn rate on period period the top 10 customers 20 .3% • Unfavorable prior year comparison after the revised $56.1M net • Net current assets positive for $56.1M vs. 25.3% customers portfolio and geographic shift in South Current Adj. Gross current assets • Solid Net Working Capital balance Am eric a prior year assets vs. (1) Margin vs. $80.7M net • Significant amount of cash & equivalents, restricted cash • Lower marginality due to start up costs for c om parable current and short- term investments, aggregately summing up to current assets onboarding new customers period liabilities $ 78.6M at year end 2021 1 See definition on slide 2 and reconciliation of non- GAAP measures on slides 21 through 23 Main KPIs 2020 - 20 21 - 20 22 TO UPDATE 15 Copyright © Kaleyra, Inc. 2023

Led by a Seasoned T eam of E xecutives with Deep I ndustr y Exper tise N icola J r V itto Dar io Caloger o Giacomo Dall’Aglio M aur o Car obene EVP, Chief Product Officer Chief Executive Officer* EVP, Chief Financial Officer EVP, Chief Business Officer Geoff Gr auer Filippo M onastr a Zephr in Lasker Colin Gillis EVP, Operations & Customer Success SVP, Chief People Officer SVP, Marketing & Strategic Alliances Vice President of Investor Relations Copyright © Kaleyra, Inc. 2023 16 *Kaleyra announced CEO transition plan, December 12th 2022

Thank You Investor Contacts: For further details, scan this QR code: Colin Gillis Vice President of Investor Relations c olin.gillis @ kaleyra.c om investors@kaleyra.com Shannon Devine MZ Group | Managing Director – MZ North America Copyright © Kaleyra, Inc. 2023 Direct: 203- 741- 8811 Mobile: 203- 858- 1945 s hannonvine@ m zgroup.us

Appendix 18

Quar ter ly Consolidated Statements of Oper ations The following table shows the quarterly unaudited condensed consolidated statements of operations prepared in accordance with US GAAP. 19 Copyright © Kaleyra, Inc. 2023

Consolidated Balance Sheets Note: Figures derived from US GAAP financials, except as otherwise indicated. 20 Copyright © Kaleyra, Inc. 2023

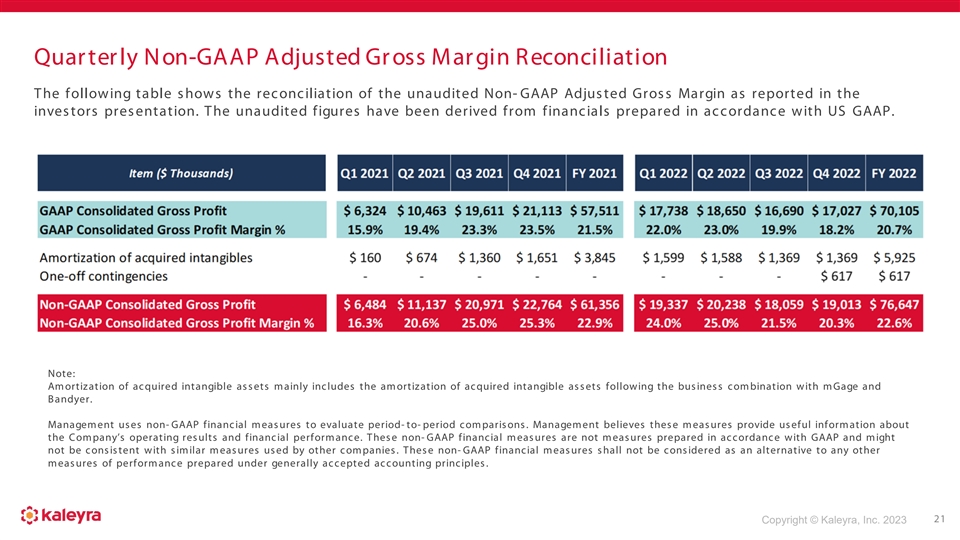

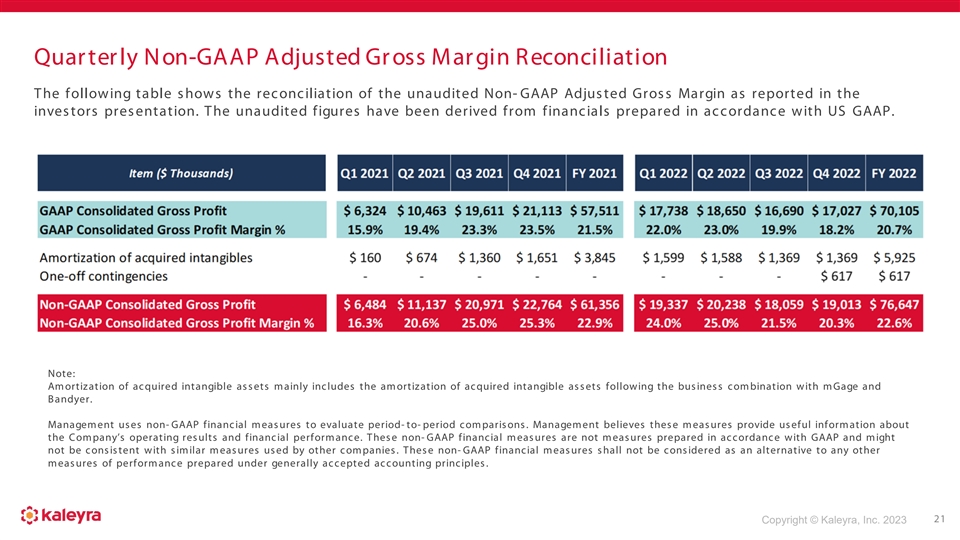

Quarterly N on-GAAP Adjusted Gr oss M ar gin R econciliation The following table shows the reconciliation of the unaudited Non- GAAP Adjusted Gross Margin as reported in the investors presentation. The unaudited figures have been derived from financials prepared in accordance with US GAAP. Note: Amortization of acquired intangible assets mainly includes the amortization of acquired intangible assets following the busines s combination with mGage and B andyer. Management uses non- GAAP financial measures to evaluate period- to- period comparisons. Management believes these measures provide useful information about the Company’s operating results and financial performance. These non- GAAP financial measures are not measures prepared in accordance with GAAP and might not be consistent with similar measures used by other companies. These non- GAAP financial measures shall not be considered as an alternative to any other measures of performance prepared under generally accepted accounting principles. 21 Copyright © Kaleyra, Inc. 2023

Quar ter ly Adjusted E BI T DA R econciliation The following table shows the reconciliation of the unaudited Adjusted EBITDA as reported in the investors presentation. The unaudited figures have been derived from financials prepared in accordance with US GAAP. Note: Management uses non- GAAP financial measures to evaluate period- to- period comparisons. Management believes these measures provide useful information about the Company’s operating results and financial performance. These non- GAAP financial measures are not measures prepared in accordance with GAAP and might not be consistent with similar measures used by other companies. These non- GAAP financial measures shall not be considered as an alternative to any other measures of performance prepared under generally accepted accounting princ iples . 22 Copyright © Kaleyra, Inc. 2023

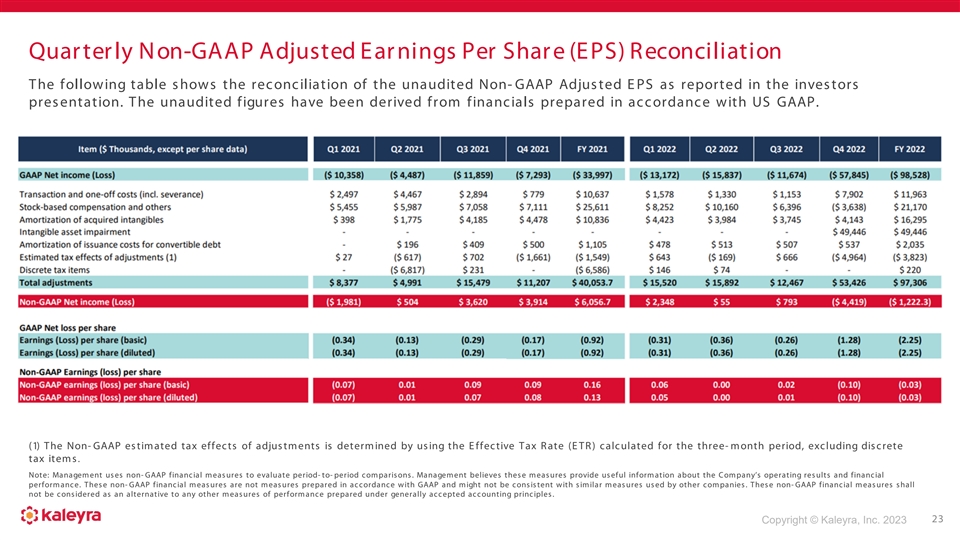

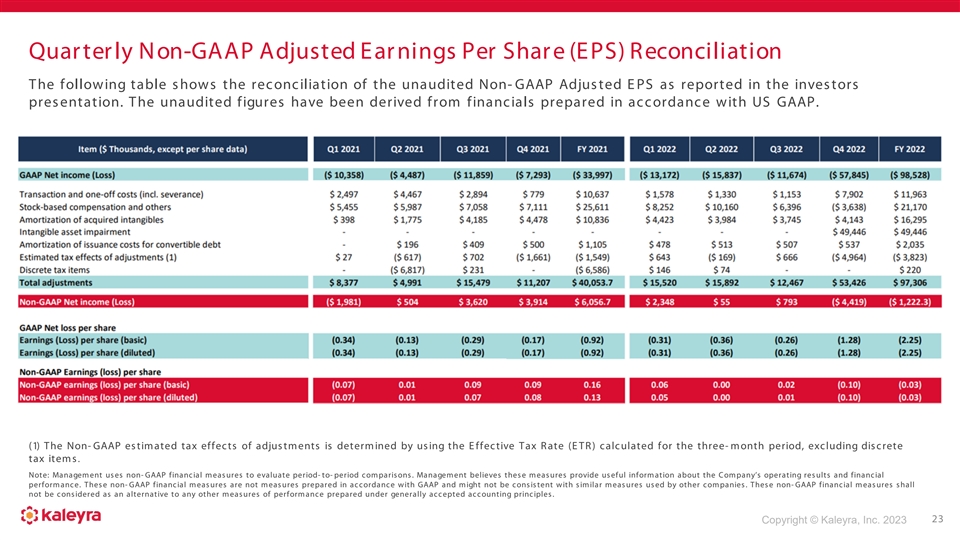

Quarterly N on-GAAP Adjusted E ar nings Per Shar e (E PS) R econciliation The following table shows the reconciliation of the unaudited Non- GAAP Adjusted EPS as reported in the investors presentation. The unaudited figures have been derived from financials prepared in accordance with US GAAP. (1) The Non- GAAP estimated tax effects of adjustments is determined by using the Effective Tax Rate (ETR) calculated for the three- month period, excluding discrete tax items . Note: Management uses non- GAAP financial measures to evaluate period- to- period comparisons. Management believes these measures provide useful information about the Company’s operating results and financial performance. These non- GAAP financial measures are not measures prepared in accordance with GAAP and might not be consistent with similar measures used by other companies. These non- GAAP financial measures shall not be considered as an alternative to any other measures of performance prepared under generally accepted accounting principles . 23 Copyright © Kaleyra, Inc. 2023

Oper ating Metr ics Dollar- Based Net Expansion Rate. Kaleyra’s ability to drive growth and generate incremental revenue depends, in part, on the Company’s ability to maintain and grow its relationships with Active Existing Customer Accounts and to increase their use of the platform. An important way in which Kaleyra has historically tracked performance in this area is by measuring the Dollar- Based Net Expansion Rate for those customer accounts. Kaleyra’s Dollar- Based Net Expansion Rate increases when such customer accounts increase their usage of a product, extend their usage of a product to new applications or adopt a new product. Kaleyra’s Dollar- B as ed Net Expansion Rate decreases when such customer accounts cease or reduce their usage of a product or when the Company lowers usage prices on a product. Kaleyra believes that measuring Dollar- Based Net Expansion Rate provides a more meaningful indication of the performance of the Company’s efforts to increase revenue from existing customers. To calculate the Dollar- Based Net Expansion Rate, the Company first identifies the cohort of customer accounts that were customer accounts in the same quarter of the prior year. The Dollar- Based Net Expansion Rate is the quotient obtained by dividing the revenue generated from that cohort in a quarter, by the revenue generated from that same cohort in the corresponding quarter in the prior year. Active Existing Customer Accounts. Kaleyra believes that the number of Active Customer Accounts is an important indicator of the growth of its business, the market acceptance of its platform and future revenue trends. Kaleyra defines an Active Customer Account at the end of any reporting period as an individual account, as identified by a unique account identifier, for which Kaleyra has recognized revenue in the period. 24 Copyright © Kaleyra, Inc. 2023

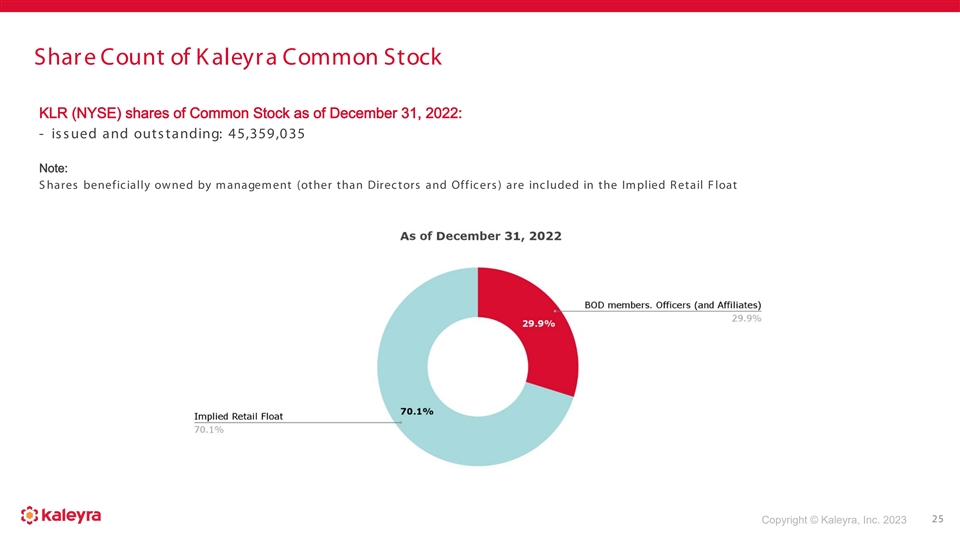

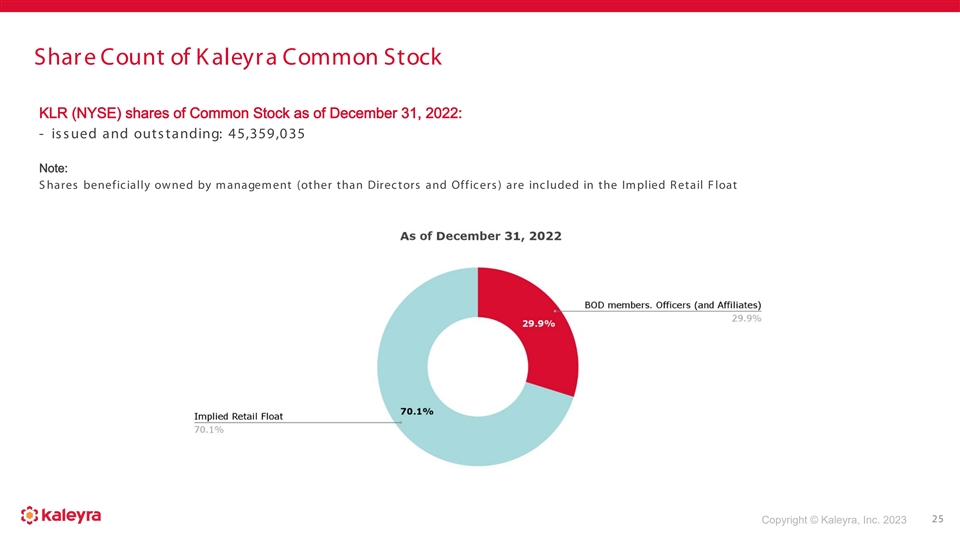

Shar e Count of K aleyr a Common Stock KLR (NYSE) shares of Common Stock as of December 31, 2022: - issued and outstanding: 45,359,035 Note: Shares beneficially owned by management (other than Directors and Officers) are included in the Implied Retail Float 25 Copyright © Kaleyra, Inc. 2023