UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

(Amendment No. 1)

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23306

Collaborative Investment Series Trust

500 Damonte Ranch, Parkway Building 700, Unit 700 Reno, Nevada 89521

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: (440) 922-0066

Date of fiscal year end: September 30

Date of reporting period: September 30, 2024

This amended Form N-CSR filing replaces the registrant's Form N-CSR, as previously filed under accession number 0001839882-24-044322. The filing has been amended to remove “(Unaudited)” from headers within the Annual Financial Statements and Other Information section.

Item 1. Reports to Stockholders.

Goose Hollow Tactical Allocation ETF

GHTA ︳Cboe BZX Exchange, Inc.

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about Goose Hollow Tactical Allocation ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at http://www.gham.co. You can also request this information by contacting us at 1-866-898-6447. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Goose Hollow Tactical Allocation ETF | $122 | 1.11% |

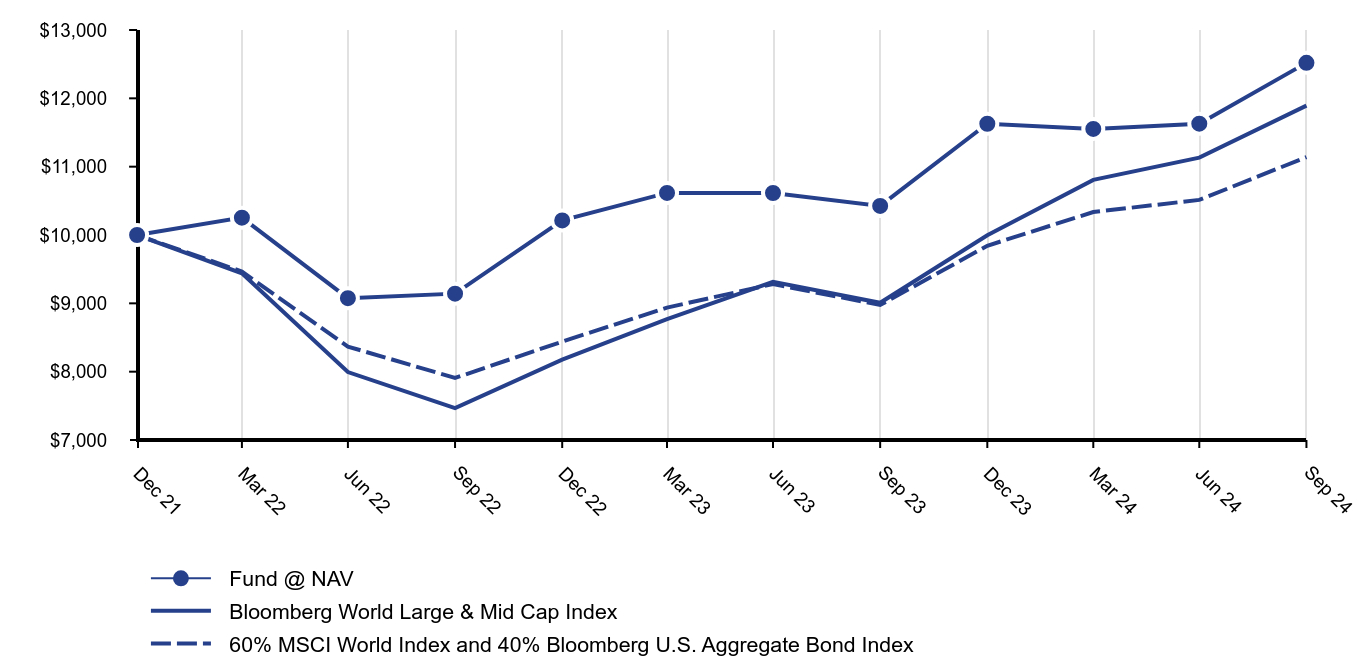

How did the Fund perform last year?

The Fund returned 20.07% for the fiscal year ended September 30, 2024, underperforming its benchmark, MSCI World Large & Mid Cap Index, which returned 32.04%

Positive contributors included tactical trades in global equity markets such as South Africa and Poland, benefiting from stronger growth and political shifts. Agency mortgages, long-dated treasuries, and treasury floaters gained from lower inflation. However, hedges in sectors like Semiconductors, SPX, and NASDAQ weighed on performance. Additionally, Chinese equities underperformed due to weak stimulus measures and economic challenges.

Fund performance based on $10,000 initial investment

| Fund @ NAV | Bloomberg World Large & Mid Cap Index | 60% MSCI World Index and 40% Bloomberg U.S. Aggregate Bond Index |

|---|

| Dec 21 | $10,000 | $10,000 | $10,000 |

| Mar 22 | $10,254 | $9,440 | $9,465 |

| Jun 22 | $9,076 | $7,995 | $8,367 |

| Sep 22 | $9,142 | $7,467 | $7,908 |

| Dec 22 | $10,214 | $8,176 | $8,440 |

| Mar 23 | $10,616 | $8,770 | $8,938 |

| Jun 23 | $10,615 | $9,314 | $9,282 |

| Sep 23 | $10,426 | $9,008 | $8,976 |

| Dec 23 | $11,628 | $9,995 | $9,843 |

| Mar 24 | $11,553 | $10,807 | $10,336 |

| Jun 24 | $11,629 | $11,132 | $10,514 |

| Sep 24 | $12,519 | $11,894 | $11,140 |

Average Annual Total Returns

| 1 Year | Since Fund Inception (11/16/2021) |

|---|

| Fund @ NAV | 20.07% | 7.84% |

| Bloomberg World Large & Mid Cap Index | 32.04% | 6.04% |

| 60% MSCI World Index & 40% Bloomberg Barclays US Agg Bond Index | 24.10% | 3.96% |

Past performance is not a good predictor of future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Net Assets | $40,037,153 |

| Number of Portfolio Holdings | 15 |

| Net Investment Advisory Fees | $203,685 |

| Portfolio Turnover Rate | 129% |

What did the Fund invest in?

| Investments | Percentage of Total Investments (%) |

|---|

| Common Stocks | 8.1 |

| Exchange-Traded Funds | 88.5 |

| Purchased Options Contracts | 0.0 |

| Preferred Stocks | 3.4 |

| Total | 100.0 |

This is a summary of certain changes to the Fund since May 17, 2024. For complete information, you may review the Fund's next prospectus, which we expect to be available by February 1, 2025 or upon request at 1-866-898-6447.

The expense limitation for the Fund pursuant to an Operating Expenses Limitation Agreement changed from 0.99% to 1.85%.

Effective July 8, 2024, Foreside Fund Services, LLC no longer serves as the distributor to the Fund. Paralel Distributors, LLC serves as the distributor to the Fund.

Goose Hollow Tactical Allocation ETF

Additional information about the Fund (e.g. Annual Financial Statements and Additional Information, holdings, proxy voting information, Prospectus and Statement of Additional Information) is available:

Annual Shareholder Report — September 30, 2024

On the Fund's website: https://www.gham.co,

or upon request, by calling 1-866-898-6447.

Goose Hollow Multi-Strategy Income ETF

GHMS ︳Cboe BZX Exchange, Inc.

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about Goose Hollow Multi-Strategy Income ETF (the "Fund") for the period of November 14, 2023 to September 30, 2024. You can find additional information about the Fund at https://ghms.gham.co. You can also request this information by contacting us at 1-866-898-6447. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs since inception?*

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Goose Hollow Multi-Strategy Income ETF | $92 | 1.00% |

* Expenses for a full reporting period would be higher

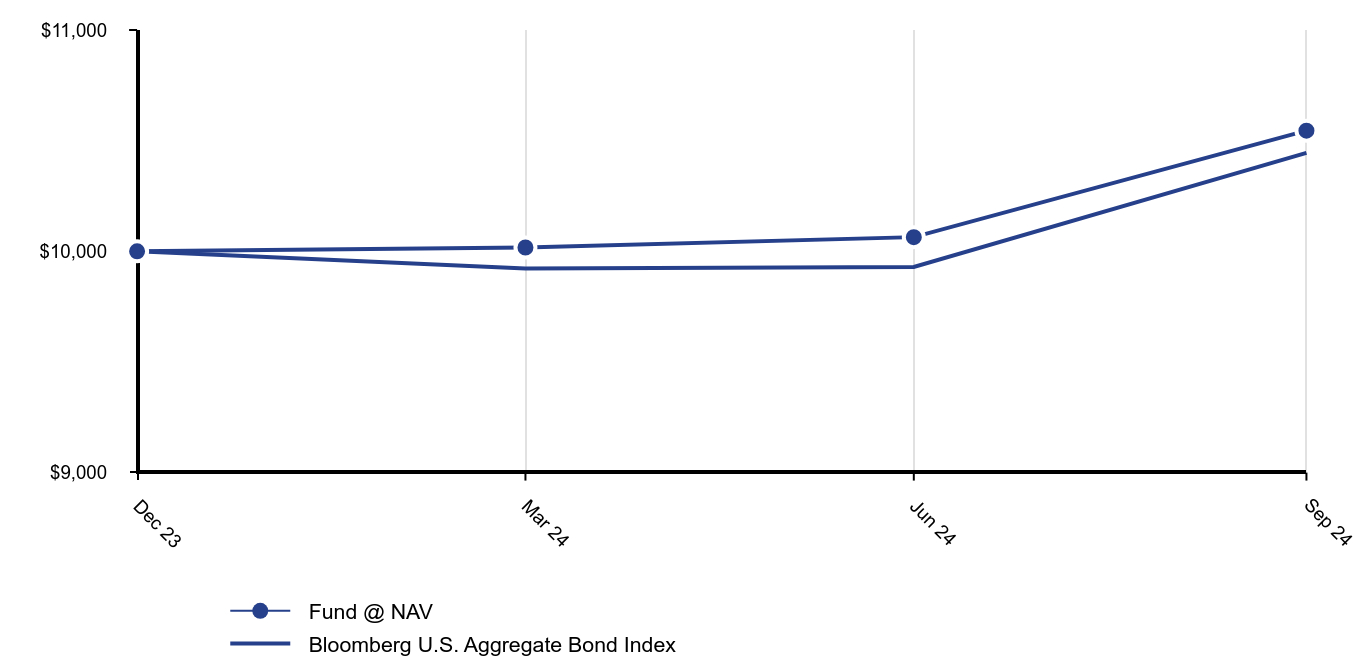

How did the Fund perform since inception?

The Fund returned 9.09% since inception (November 14, 2023), for the period ending September 30, 2024, underperforming the Bloomberg U.S. Aggregate Bond Index, which returned 10.41% during the same period.

A global rally in rates contributed to the Fund’s performance. Short-dated treasuries provided steady coupon income, and various positions benefited from inflation coming down this year, including in inflation-linked bonds, treasury floaters, and variable-rate preferreds. The Fund benefited from appreciation in mortgage REITS, and found attractive yields in emerging market debt. The Fund’s hedge against interest rate volatility detracted from performance using CMS curve caps.

Fund performance based on $10,000 initial investment

| Fund @ NAV | Bloomberg U.S. Aggregate Bond Index |

|---|

| Dec 23 | $10,000 | $10,000 |

| Mar 24 | $10,017 | $9,922 |

| Jun 24 | $10,064 | $9,929 |

| Sep 24 | $10,545 | $10,445 |

Average Annual Total Returns

| Since Fund Inception (11/14/2023) |

|---|

| Fund @ NAV | 9.09% |

| Bloomberg U.S. Aggregate Bond Index | 9.78% |

Past performance is not a good predictor of future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Net Assets | $18,033,146 |

| Number of Portfolio Holdings | 18 |

| Net Investment Advisory Fees | $- |

| Portfolio Turnover Rate | 35% |

What did the Fund invest in?

| Investments | Percentage of Total Investments (%) |

|---|

| Closed-End Funds | 21.3 |

| Exchange-Traded Funds | 68.7 |

| Preferred Stocks | 10.0 |

| Total | 100.0 |

This is a summary of certain changes to the Fund since May 29, 2024. For complete information, you may review the Fund's next prospectus, which we expect to be available by February 1, 2025 or upon request at 1-866-898-6447.

Dividends from net investment income, if any, are declared and paid semi-annually by the Fund.

Effective July 8, 2024, Foreside Fund Services, LLC no longer serves as the distributor to the Fund. Paralel Distributors LLC serves as the distributor to the Fund.

Goose Hollow Multi-Strategy Income ETF

Additional information about the Fund (e.g. Annual Financial Statements and Additional Information, holdings, proxy voting information, Prospectus and Statement of Additional Information) is available:

Annual Shareholder Report — September 30, 2024

On the Fund's website:https://ghms.gham.co,

or upon request, by calling 1-866-898-6447.

MFUL ︳Cboe BZX Exchange, Inc.

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about Mindful Conservative ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at http://www.mohrfunds.com. You can also request this information by contacting us at 1-866-464-6608. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Mindful Conservative ETF | $113 | 1.08% |

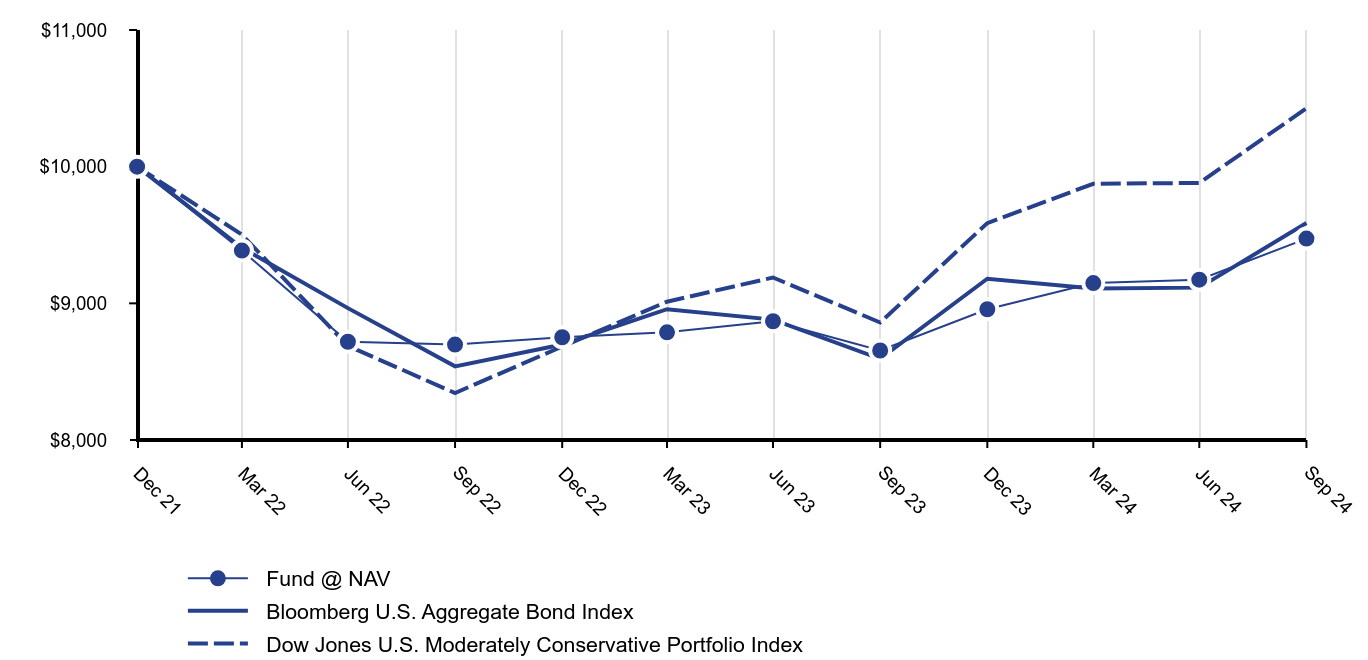

How did the Fund perform last year?

The Fund returned 9.47%, for the fiscal year ended September 30, 2024, underperforming its benchmark, the Dow Jones U.S. Moderately Conservative Portfolio Index, which returned 17.68% for the period.

The Federal Reserve’s rate cut and easing inflation contributed to broader stock gains. Globally, interest rate policy also influenced markets, with notable moves in Japan and China. The fixed income market also rallied, largely due to the Federal Reserve's interest rate cuts and signs of slower inflation and employment growth in the U.S. Higher yielding and longer-duration sectors outperformed as confidence grew in the Federal Reserve's ability to manage the economy while curbing inflation. The Fund participated in the fixed income gains while benefiting from a broader equity market participation in its more conservative equity holdings.

Underperformance could be attributed to the benchmark’s greater weighting in equities and its higher risk profile.

Fund performance based on $10,000 initial investment

| Fund @ NAV | Bloomberg U.S. Aggregate Bond Index | Dow Jones U.S. Moderately Conservative Portfolio Index |

|---|

| Dec 21 | $10,000 | $10,000 | $10,000 |

| Mar 22 | $9,386 | $9,407 | $9,503 |

| Jun 22 | $8,719 | $8,965 | $8,689 |

| Sep 22 | $8,698 | $8,539 | $8,344 |

| Dec 22 | $8,752 | $8,699 | $8,684 |

| Mar 23 | $8,788 | $8,957 | $9,012 |

| Jun 23 | $8,869 | $8,881 | $9,189 |

| Sep 23 | $8,655 | $8,594 | $8,860 |

| Dec 23 | $8,957 | $9,180 | $9,587 |

| Mar 24 | $9,148 | $9,109 | $9,875 |

| Jun 24 | $9,173 | $9,115 | $9,881 |

| Sep 24 | $9,474 | $9,588 | $10,427 |

Average Annual Total Returns

| 1 Year | Since Fund Inception (11/2/2021) |

|---|

| Fund @ NAV | 9.47% | -2.36% |

| Bloomberg U.S. Aggregate Bond Index | 11.57% | -1.45% |

| Dow Jones U.S. Moderately Conservative Portfolio Index | 17.68% | 1.47% |

Past performance is not a good predictor of future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Net Assets | $46,444,927 |

| Number of Portfolio Holdings | 16 |

| Net Investment Advisory Fees | $405,717 |

| Portfolio Turnover Rate | 314% |

What did the Fund invest in?

| Investments | Percentage of Total Investments (%) |

|---|

| Exchange-Traded Funds | 100.0 |

| Total | 100.0 |

This is a summary of certain changes to the Fund since July 22, 2024. For complete information, you may review the Fund's next prospectus, which we expect to be available by February 1, 2025 or upon request at 1-866-464-6608.

Foreside Fund Services, LLC no longer serves as the distributor to the Fund. Paralel Distributors, LLC serves as the distributor to the Fund.

Effective August 30, 2024, dividends from net investment income, if any, are declared and paid quarterly by the Fund.

Additional information about the Fund (e.g. Annual Financial Statements and Additional Information, holdings, proxy voting information, Prospectus and Statement of Additional Information) is available:

Annual Shareholder Report — September 30, 2024

On the Fund's website: https://www.mohrfunds.com/mful-mindful-conservative-etf, or upon request, by calling 1-866-464-6608.

RULE ︳Cboe BZX Exchange, Inc.

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about Adaptive Core ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at http://www.mohrfunds.com. You can also request this information by contacting us at 1-866-464-6608. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Adaptive Core ETF | $131 | 1.20% |

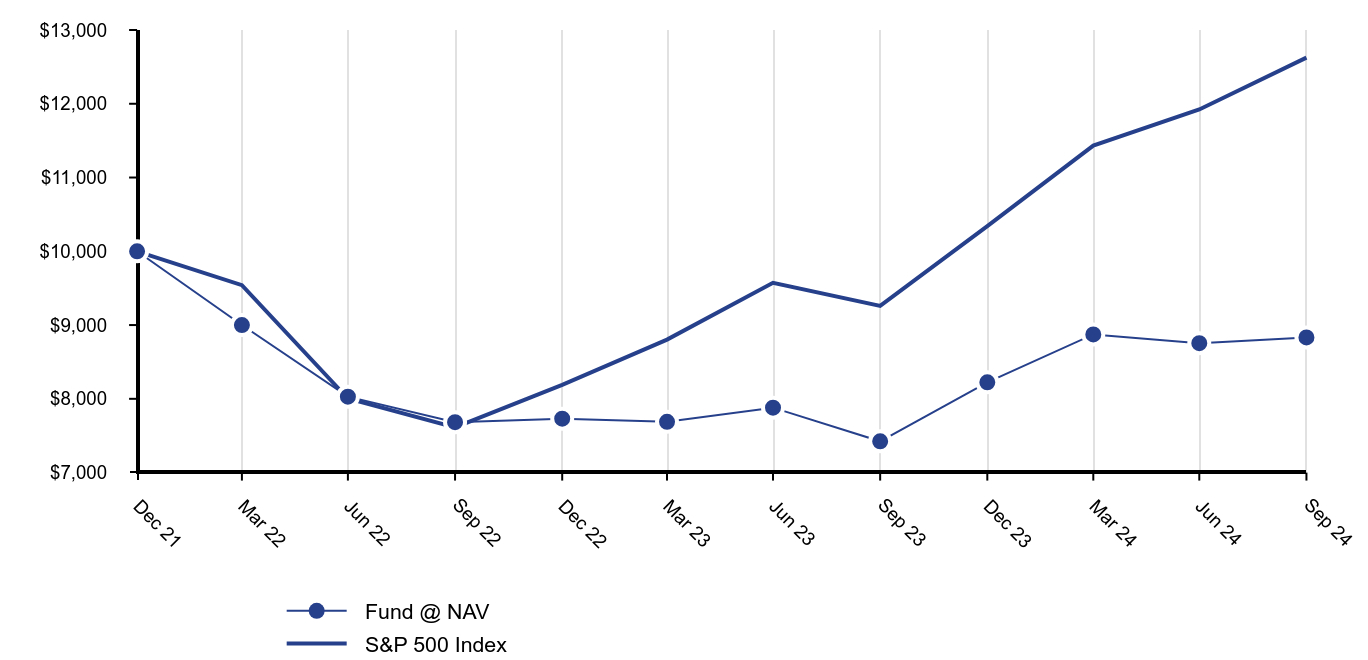

How did the Fund perform last year?

The Fund returned 18.97%, for the fiscal year ended September 30, 2024, underperforming its benchmark, the S&P 500 Index, which returned 36.35% for the period.

• The anticipation and then reality of Federal Reserve rate cuts came mostly as no surprise and generally aided broader market gains. The Fund was well positioned to capture gains in value-oriented constituents without concentration in the magnificent seven stocks as market leadership shifted throughout the year within market caps and styles.

• Any underperformance could be attributed to the Fund having a more value-oriented constituency and not having concentration in the top technology stocks.

Fund performance based on $10,000 initial investment

| Fund @ NAV | S&P 500 Index |

|---|

| Dec 21 | $10,000 | $10,000 |

| Mar 22 | $9,000 | $9,540 |

| Jun 22 | $8,029 | $8,004 |

| Sep 22 | $7,683 | $7,613 |

| Dec 22 | $7,731 | $8,189 |

| Mar 23 | $7,688 | $8,803 |

| Jun 23 | $7,880 | $9,572 |

| Sep 23 | $7,424 | $9,259 |

| Dec 23 | $8,224 | $10,342 |

| Mar 24 | $8,873 | $11,433 |

| Jun 24 | $8,754 | $11,923 |

| Sep 24 | $8,832 | $12,625 |

Average Annual Total Returns

| 1 Year | Since Fund Inception (11/2/2021) |

|---|

| Fund @ NAV | 18.97% | -3.80% |

| S&P 500 Index | 36.35% | 9.52% |

Past performance is not a good predictor of future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Net Assets | $27,915,713 |

| Number of Portfolio Holdings | 35 |

| Net Investment Advisory Fees | $273,935 |

| Portfolio Turnover Rate | 451% |

What did the Fund invest in?

| Investments | Percentage of Total Investments (%) |

|---|

| Common Stocks | 82.2 |

| Exchange-Traded Funds | 17.8 |

| Total | 100.0 |

This is a summary of certain changes to the Fund since July 22, 2024. For complete information, you may review the Fund's next prospectus, which we expect to be available by February 1, 2025 or upon request at 1-866-464-6608.

Foreside Fund Services, LLC no longer serves as the distributor to the Fund. Paralel Distributors, LLC serves as the distributor to the Fund.

Effective August 30, 2024, dividends from net investment income, if any, are declared and paid quarterly by the Fund.

Additional information about the Fund (e.g. Annual Financial Statements and Additional Information, holdings, proxy voting information, Prospectus and Statement of Additional Information) is available:

Annual Shareholder Report — September 30, 2024

On the Fund's website: https://www.mohrfunds.com/rule-adaptive-core-etf, or upon request, by calling 1-866-464-6608.

SNAV ︳Cboe BZX Exchange, Inc.

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about Mohr Sector Nav ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at http://www.mohrfunds.com. You can also request this information by contacting us at 1-866-464-6608. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Mohr Sector Nav ETF | $126 | 1.04% |

How did the Fund perform last year?

The Fund returned 23.70%, for the year ended September 30, 2024, underperforming its benchmark, the Morningstar US Large-Mid Cap Index, which returned 36.30% for the year.

• While U.S. stocks continued their upward trajectory throughout the year, market leadership shifted within sectors. The Federal Reserve’s rate cut and easing inflation contributed to broader stock gains, benefiting rate-sensitive sectors like utilities and real estate. Sector selection played an important role in performance along with the ability to pick up gains from market indexes like SPY and RSP.

• The biggest detractor in performance was the lack of market-cap concentration among the sector and index allocations.

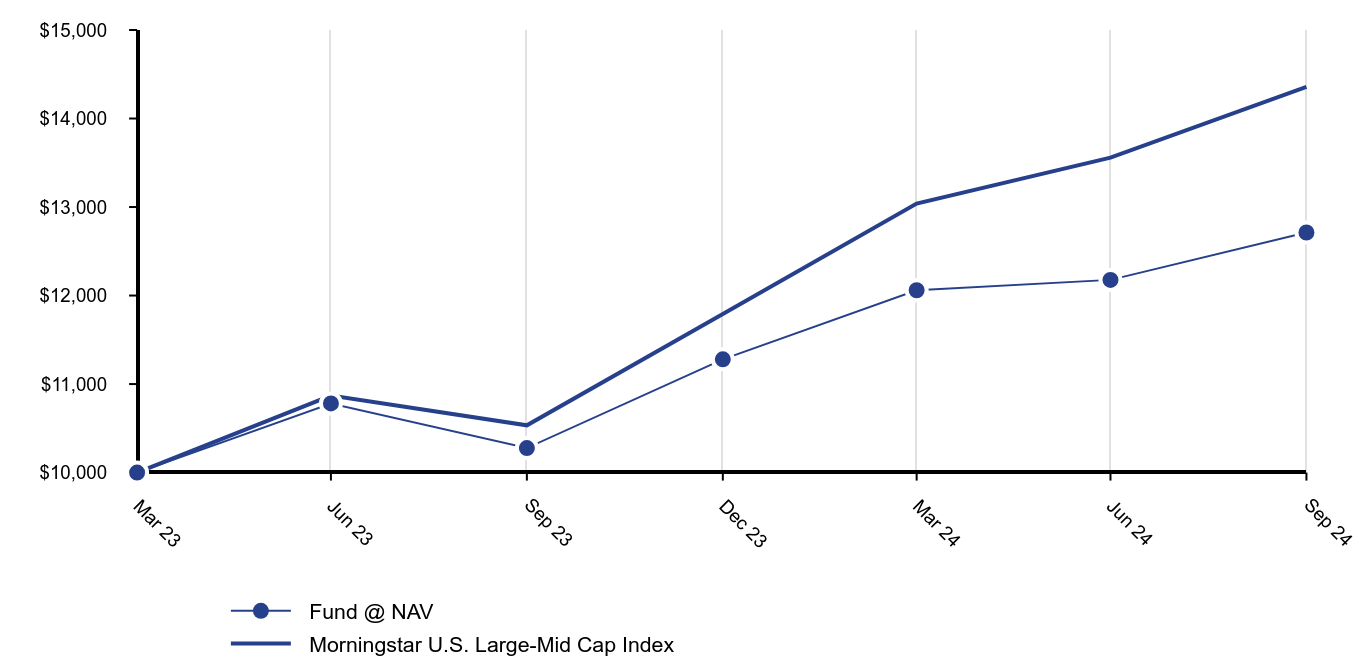

Fund performance based on $10,000 initial investment

| Fund @ NAV | Morningstar U.S. Large-Mid Cap Index |

|---|

| Mar 23 | $10,000 | $10,000 |

| Jun 23 | $10,781 | $10,870 |

| Sep 23 | $10,277 | $10,534 |

| Dec 23 | $11,279 | $11,792 |

| Mar 24 | $12,060 | $13,039 |

| Jun 24 | $12,177 | $13,558 |

| Sep 24 | $12,712 | $14,357 |

Average Annual Total Returns

| 1 Year | Since Fund Inception (1/10/2023) |

|---|

| Fund @ NAV | 23.70% | 15.40% |

| Morningstar U.S. Large-Mid Cap Index | 36.30% | 27.18% |

Past performance is not a good predictor of future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Net Assets | $64,261,593 |

| Number of Portfolio Holdings | 10 |

| Net Investment Advisory Fees | $339,623 |

| Portfolio Turnover Rate | 523% |

What did the Fund invest in?

| Investments | Percentage of Total Investments (%) |

|---|

| Exchange-Traded Funds | 100.0 |

| Total | 100.0 |

This is a summary of certain changes to the Fund since July 22, 2024. For complete information, you may review the Fund's next prospectus, which we expect to be available by February 1, 2025 or upon request at 1-866-464-6608.

Foreside Fund Services, LLC no longer serves as the distributor to the Fund. Paralel Distributors, LLC serves as the distributor to the Fund.

Effective August 30, 2024, dividends from net investment income, if any, are declared and paid quarterly by the Fund.

Additional information about the Fund (e.g. Annual Financial Statements and Additional Information, holdings, proxy voting information, Prospectus and Statement of Additional Information) is available:

Annual Shareholder Report — September 30, 2024

On the Fund's website: https://www.mohrfunds.com/snav-mohr-sector-nav-etf, or upon request, by calling 1-866-464-6608.

Rareview Dynamic Fixed Income ETF

RDFI ︳Cboe BZX Exchange, Inc.

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about Rareview Dynamic Fixed Income ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.rareviewcapital.com/etfs/. You can also request this information by contacting us at 1-888-783-8637.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Rareview Dynamic Fixed Income ETF | $172 | 1.50% |

How did the Fund perform last year?

The Fund returned 29.33%, for the fiscal year ended September 30, 2024, outperforming its benchmark, the Bloomberg U.S. Aggregate Bond Index, which returned 11.57% for the year.

• Lower U.S. interest rates and a shift from a tightening to easing cycle by the Federal Reserve contributed to performance.

• Overweight exposure to emerging market local currency debt contributed to relative performance as high carry currencies outperformed other fixed income assets.

• Overweight exposure to securitized debt contributed to relative performance as spreads are relatively wider than other high grade fixed income.

• Security selection within each asset class contributed to positive relative performance.

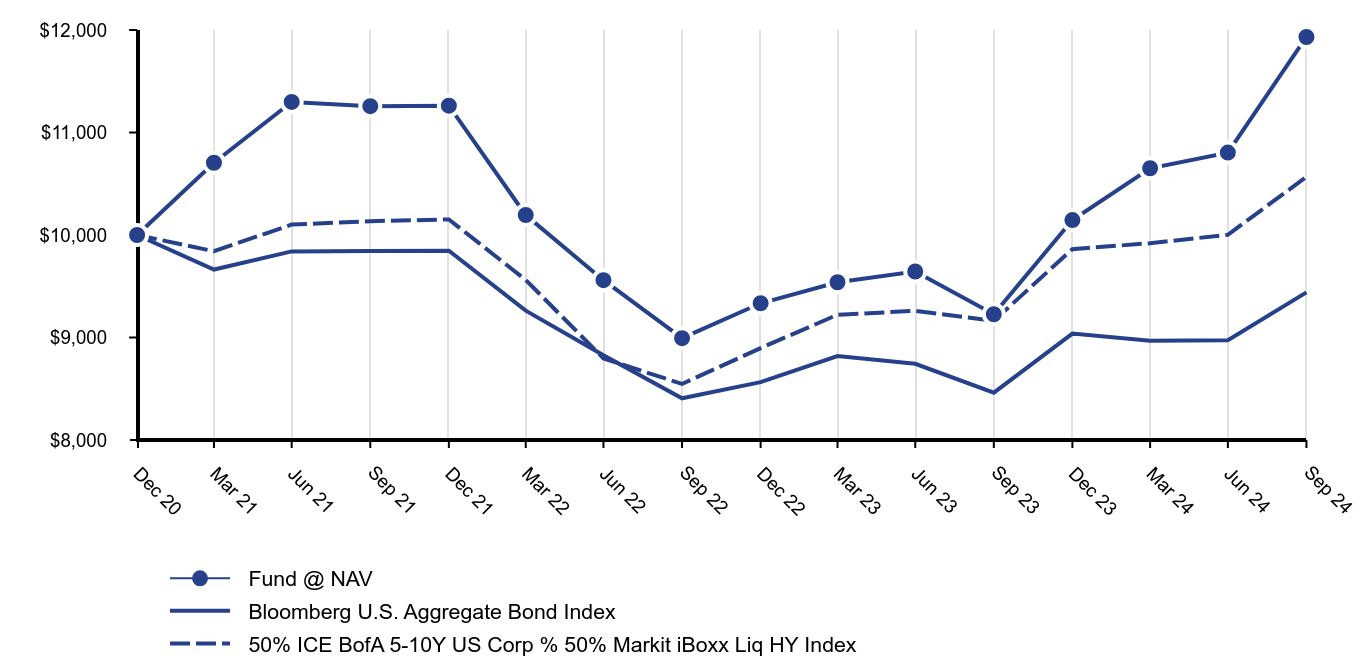

Fund performance based on $10,000 initial investment

| Fund @ NAV | Bloomberg U.S. Aggregate Bond Index | 50% ICE BofA 5-10Y US Corp % 50% Markit iBoxx Liq HY Index |

|---|

| Dec 20 | $10,000 | $10,000 | $10,000 |

| Mar 21 | $10,705 | $9,663 | $9,842 |

| Jun 21 | $11,298 | $9,840 | $10,102 |

| Sep 21 | $11,257 | $9,845 | $10,135 |

| Dec 21 | $11,262 | $9,846 | $10,152 |

| Mar 22 | $10,195 | $9,262 | $9,562 |

| Jun 22 | $9,559 | $8,827 | $8,796 |

| Sep 22 | $8,994 | $8,407 | $8,547 |

| Dec 22 | $9,334 | $8,565 | $8,897 |

| Mar 23 | $9,539 | $8,819 | $9,222 |

| Jun 23 | $9,644 | $8,744 | $9,260 |

| Sep 23 | $9,227 | $8,462 | $9,163 |

| Dec 23 | $10,146 | $9,038 | $9,862 |

| Mar 24 | $10,651 | $8,968 | $9,920 |

| Jun 24 | $10,804 | $8,974 | $10,002 |

| Sep 24 | $11,932 | $9,440 | $10,568 |

Average Annual Total Returns

| 1 Year | Since Fund Inception (10/20/2020) |

|---|

| Fund @ NAV | 29.33% | 6.81% |

| Bloomberg U.S. Aggregate Bond Index | 11.57% | -1.22% |

| 50% ICE BofA 5-10Y Corp & 50% Markit iBoxx Liq HY Index | 15.33% | 2.22% |

Past performance is not a good predictor of future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Net Assets | $54,114,995 |

| Number of Portfolio Holdings | 32 |

| Net Investment Advisory Fees | $361,904 |

| Portfolio Turnover Rate | 151% |

What did the Fund invest in?

| Investments | Percentage of Total Investments (%) |

|---|

| Closed-End Funds | 85.9 |

| Common Stocks | 4.0 |

| Exchange-Traded Funds | 9.7 |

| Purchased Options Contracts | 0.4 |

| Total | 100.0 |

There were no material fund changes during the reporting period.

Rareview Dynamic Fixed Income ETF

Additional information about the Fund (e.g. Annual Financial Statements and Additional Information, holdings, proxy voting information, Prospectus and Statement of Additional Information) is available:

Annual Shareholder Report — September 30, 2024

On the Fund's website: https://rareviewcapital.com/dynamic-fixed-income-etf/, or upon request, by calling 1-888-783-8637.

Rareview Tax Advantaged Income ETF

RTAI ︳Cboe BZX Exchange, Inc.

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about Rareview Tax Advantaged Income ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.rareviewcapital.com/etfs/. You can also request this information by contacting us at 1-888-783-8637.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Rareview Tax Advantaged Income ETF | $145 | 1.25% |

How did the Fund perform last year?

The Fund returned 31.20%, for the fiscal year ended September 30, 2024, outperforming its benchmark, the Bloomberg Barclays U.S. Municipal Index, which returned 10.37% for the period.

• Lower US interest rates and a shift from a tightening to easing cycle by the Federal Reserve contributed to performance.

• Positive convexity from callable municipal bonds contributed to relative performance of the Fund.

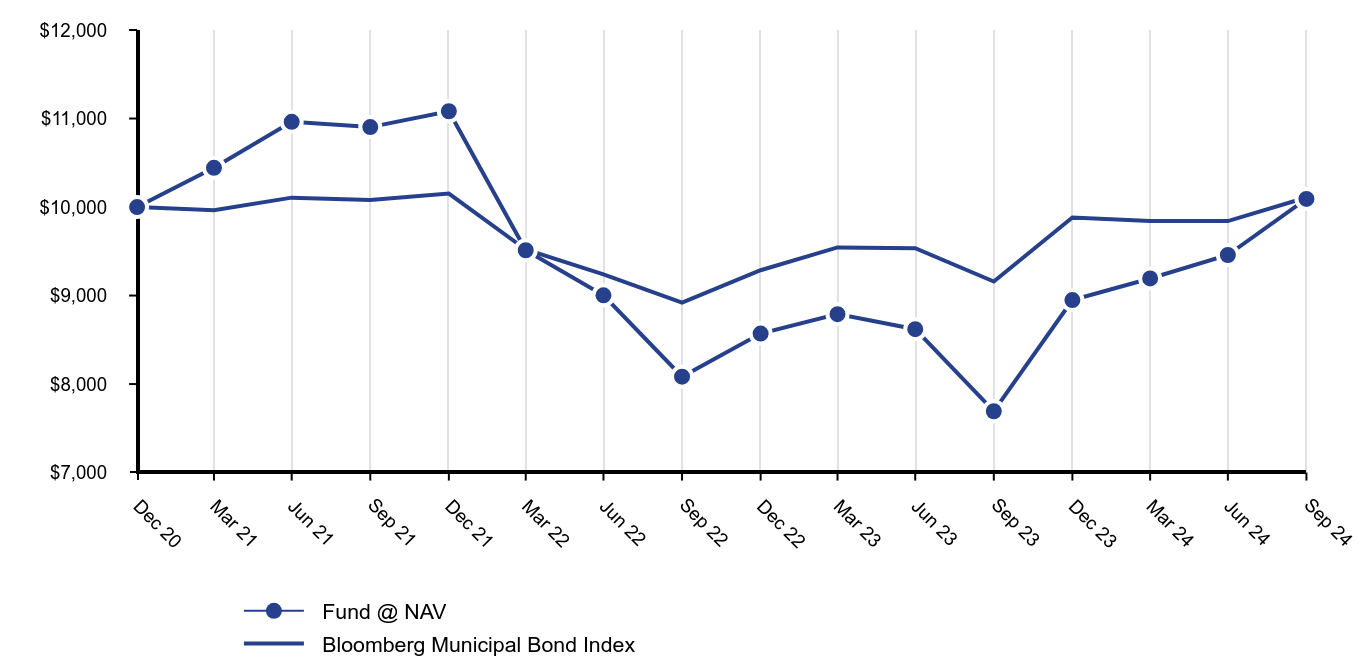

Fund performance based on $10,000 initial investment

| Fund @ NAV | Bloomberg Municipal Bond Index |

|---|

| Dec 20 | $10,000 | $10,000 |

| Mar 21 | $10,443 | $9,965 |

| Jun 21 | $10,963 | $10,106 |

| Sep 21 | $10,903 | $10,079 |

| Dec 21 | $11,082 | $10,152 |

| Mar 22 | $9,512 | $9,520 |

| Jun 22 | $9,002 | $9,240 |

| Sep 22 | $8,083 | $8,920 |

| Dec 22 | $8,570 | $9,286 |

| Mar 23 | $8,790 | $9,544 |

| Jun 23 | $8,620 | $9,534 |

| Sep 23 | $7,693 | $9,158 |

| Dec 23 | $8,949 | $9,881 |

| Mar 24 | $9,193 | $9,843 |

| Jun 24 | $9,458 | $9,841 |

| Sep 24 | $10,092 | $10,108 |

Average Annual Total Returns

| 1 Year | Since Fund Inception (10/20/2020) |

|---|

| Fund @ NAV | 31.20% | 1.48% |

| Bloomberg Municipal Bond Index | 10.37% | 0.83% |

Past performance is not a good predictor of future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Net Assets | $21,025,886 |

| Number of Portfolio Holdings | 11 |

| Net Investment Advisory Fees | $65,071 |

| Portfolio Turnover Rate | 37% |

What did the Fund invest in?

| Investments | Percentage of Total Investments (%) |

|---|

| Closed-End Funds | 100.0 |

| Total | 100.0 |

There were no material fund changes during the reporting period.

Rareview Tax Advantaged Income ETF

Additional information about the Fund (e.g. Annual Financial Statements and Additional Information, holdings, proxy voting information, Prospectus and Statement of Additional Information) is available:

Annual Shareholder Report — September 30, 2024

On the Fund's website:https://rareviewcapital.com/tax-advantaged-income-etf/, or upon request, by calling 1-888-783-8637.

Rareview Systematic Equity ETF

RSEE ︳Cboe BZX Exchange, Inc.

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about Rareview Systematic Equity ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.rareviewcapital.com/etfs/. You can also request this information by contacting us at 1-888-783-8637.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Rareview Systematic Equity ETF | $154 | 1.35% |

How did the Fund perform last year?

The Fund returned 28.51%, for the fiscal year ended September 30, 2024, underperforming its benchmark, the MSCI All Country World Index, which returned 32.35% for the period.

• The Fund used long-term and short-term behavior models to take long and short positions. The Fund seeks to add value by owning regional markets when expected returns are positive and taking defensive positions when expected returns are negative.

• Performance was bifurcated. The Fund outperformed MSCI EAFE, U.S. Small Cap, and MSCI Emerging Market Equities. The Fund underperformed U.S. Large Cap Equities.

• The underperformance is primarily the result of the benchmark composition of the MSCI ACWI Index. The MSCI ACWl is predominantly a large cap index with a measured allocation to emerging markets.

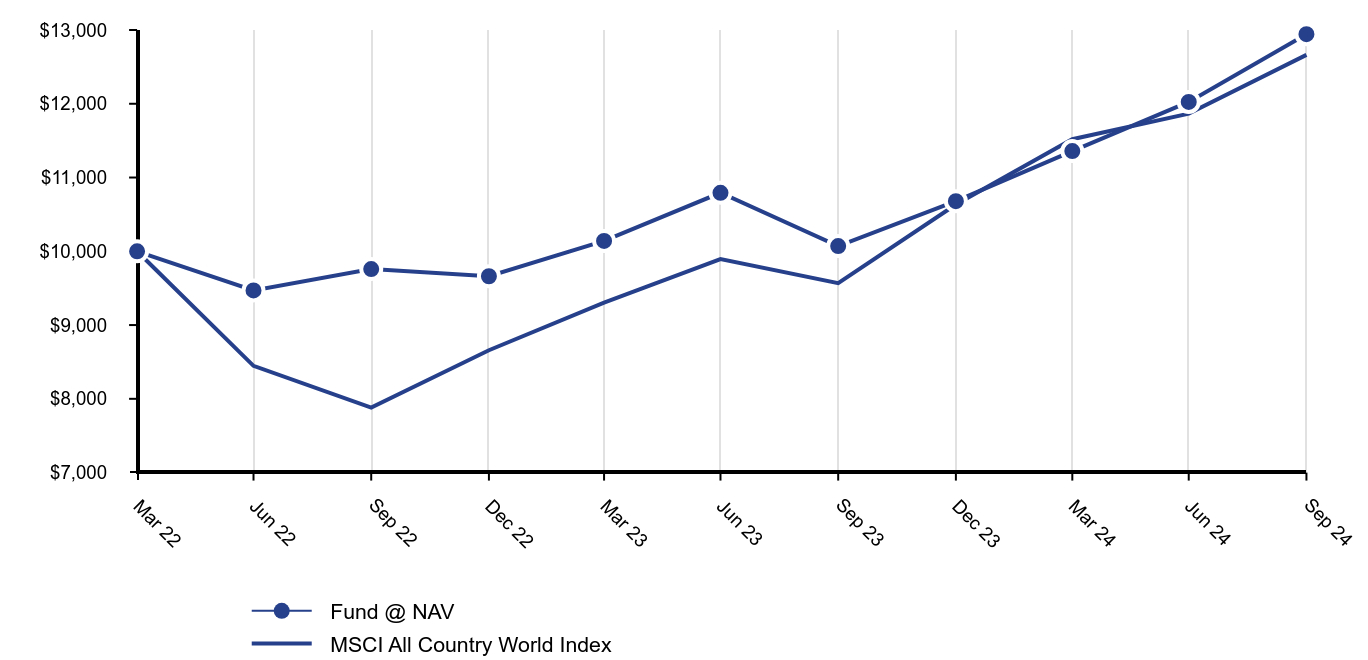

Fund performance based on $10,000 initial investment

| Fund @ NAV | MSCI All Country World Index |

|---|

| Mar 22 | $10,000 | $10,000 |

| Jun 22 | $9,470 | $8,447 |

| Sep 22 | $9,759 | $7,881 |

| Dec 22 | $9,662 | $8,659 |

| Mar 23 | $10,140 | $9,304 |

| Jun 23 | $10,793 | $9,894 |

| Sep 23 | $10,071 | $9,568 |

| Dec 23 | $10,680 | $10,634 |

| Mar 24 | $11,358 | $11,519 |

| Jun 24 | $12,025 | $11,866 |

| Sep 24 | $12,943 | $12,663 |

Average Annual Total Returns

| 1 Year | Since Fund Inception (1/20/2022) |

|---|

| Fund @ NAV | 28.51% | 10.29% |

| MSCI All Country World Index | 32.35% | 8.56% |

Past performance is not a good predictor of future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Net Assets | $59,598,974 |

| Number of Portfolio Holdings | 6 |

| Net Investment Advisory Fees | $382,307 |

| Portfolio Turnover Rate | 126% |

What did the Fund invest in?

| Investments | Percentage of Total Investments (%) |

|---|

| Exchange-Traded Funds | 100.0 |

| Total | 100.0 |

There were no material fund changes during the reporting period.

Rareview Systematic Equity ETF

Additional information about the Fund (e.g. Annual Financial Statements and Additional Information, holdings, proxy voting information, Prospectus and Statement of Additional Information) is available:

Annual Shareholder Report — September 30, 2024

On the Fund's website: https://rareviewcapital.com/systematic-equity-etf/,

or upon request, by calling 1-888-783-8637.

Rareview Total Return Bond ETF

RTRE ︳Cboe BZX Exchange, Inc.

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about Rareview Total Return Bond ETF (the "Fund") for the period of May 31, 2024 to September 30, 2024. You can find additional information about the Fund at www.rareviewcapital.com/etfs/. You can also request this information by contacting us at 1-888-783-8637.

What were the Fund's costs since inception?*

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Rareview Total Return Bond ETF | $23 | 0.67% |

* Expenses for a full reporting period would be higher

| Net Assets | $24,268,144 |

| Number of Portfolio Holdings | 112 |

| Net Investment Advisory Fees | $- |

| Portfolio Turnover Rate | 39% |

What did the Fund invest in?

| Investments | Percentage of Total Investments (%) |

|---|

| Asset - Backed Securities | 2.1 |

| Collateralized Mortgage Obligations | 9.6 |

| Corporate Bonds | 28.1 |

| Exchange-Traded Funds | 8.3 |

| Municipal Bonds | 0.9 |

| Preferred Stocks | 0.2 |

| Treasury Bill | 4.9 |

| Treasury Notes | 13.0 |

| U.S. Government Agency Mortgages | 31.8 |

| Yankee Dollars | 1.1 |

| Total | 100.0 |

There were no material fund changes during the reporting period.

Rareview Total Return Bond ETF

Additional information about the Fund (e.g. Annual Financial Statements and Additional Information, holdings, proxy voting information, Prospectus and Statement of Additional Information) is available:

Annual Shareholder Report — September 30, 2024

On the Fund's website: https://rareviewcapital.com/total-return-bond-etf/,

or upon request, by calling 1-888-783-8637.

The SPAC and New Issue ETF

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about The SPAC and New Issue ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at http://www.spcxetf.com. You can also request this information by contacting us at 1-866-904-0406. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| The SPAC and New Issue ETF | $192 | 1.89% |

How did the Fund perform last year?

The Fund returned 2.87%, for the fiscal year ended September 30, 2024, underperforming its benchmark, the Index IQ Merger Arbitrage Index, which returned 3.70% for the period.

The Fund was up 2.87% for the year. Over the year, the SPAC market continues to be challenging. There are few SPAC IPOs, few SPAC deal announcements, and the current SPACs aren’t trading nearly as much as they did during the height of the SPAC market. The Fund has continued to find SPACs trading below cash in trust and our strategy remains the same: scour the SPAC landscape for SPACs trading below trust and raise cash by selling SPACs trading above cash in trust.

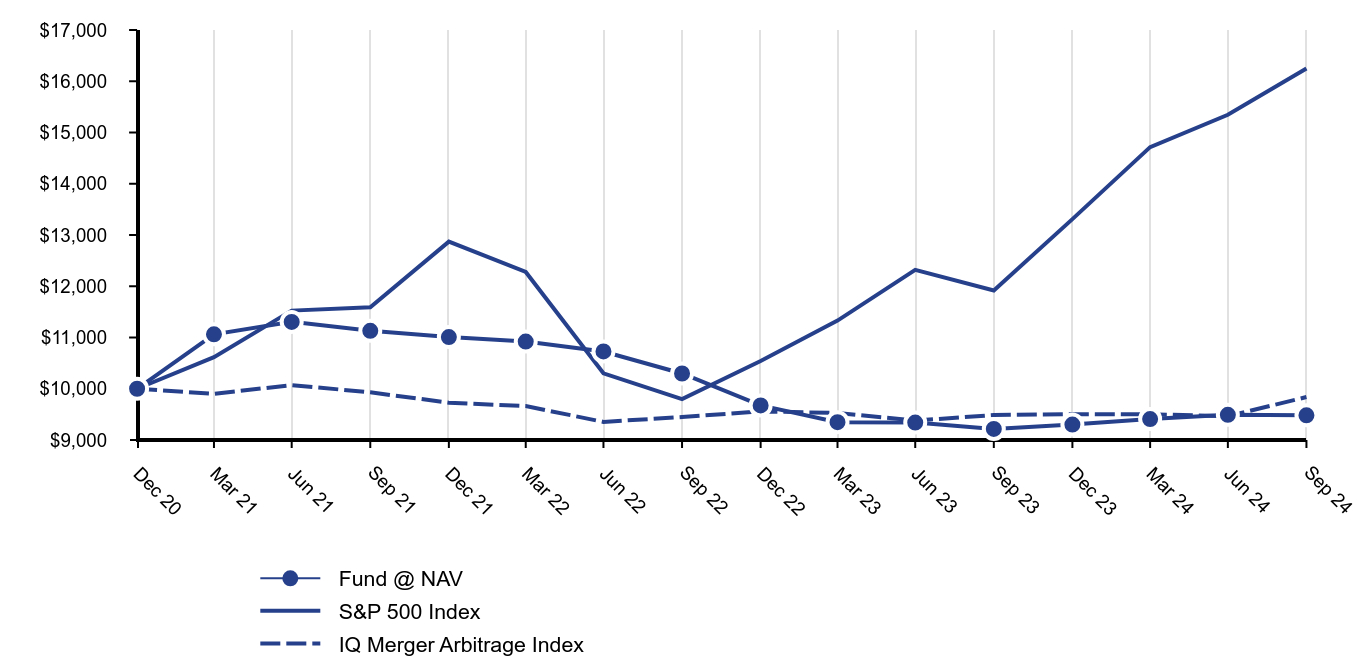

Fund performance based on $10,000 initial investment

| Fund @ NAV | S&P 500 Index | IQ Merger Arbitrage Index |

|---|

| Dec 20 | $10,000 | $10,000 | $10,000 |

| Mar 21 | $11,063 | $10,617 | $9,900 |

| Jun 21 | $11,305 | $11,525 | $10,072 |

| Sep 21 | $11,130 | $11,592 | $9,930 |

| Dec 21 | $11,008 | $12,871 | $9,729 |

| Mar 22 | $10,920 | $12,279 | $9,662 |

| Jun 22 | $10,728 | $10,302 | $9,354 |

| Sep 22 | $10,298 | $9,799 | $9,449 |

| Dec 22 | $9,675 | $10,540 | $9,558 |

| Mar 23 | $9,349 | $11,330 | $9,528 |

| Jun 23 | $9,340 | $12,320 | $9,380 |

| Sep 23 | $9,217 | $11,917 | $9,487 |

| Dec 23 | $9,301 | $13,310 | $9,505 |

| Mar 24 | $9,409 | $14,715 | $9,503 |

| Jun 24 | $9,491 | $15,346 | $9,466 |

| Sep 24 | $9,481 | $16,249 | $9,838 |

Average Annual Total Returns

| 1 Year | Since Fund Inception (12/15/2020) |

|---|

| Fund @ NAV | 2.87% | -0.57% |

| S&P 500 Index | 36.35% | 14.17% |

| IQ Merger Arbitrage Index | 3.70% | -0.28% |

Past performance is not a good predictor of future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Net Assets | $11,221,373 |

| Number of Portfolio Holdings | 68 |

| Net Investment Advisory Fees | $56,668 |

| Portfolio Turnover Rate | 274% |

What did the Fund invest in?

| Investments | Percentage of Total Investments (%) |

|---|

| Common Stocks | 98.5 |

| Private Investments | 1.1 |

| Rights | 0.1 |

| Warrants | 0.3 |

| Total | 100.0 |

The expense limitation agreement was terminated on February 1, 2024.

The SPAC and New Issue ETF

Additional information about the Fund (e.g. Annual Financial Statements and Additional Information, holdings, proxy voting information, Prospectus and Statement of Additional Information) is available:

Annual Shareholder Report — September 30, 2024

On the Fund's website: http://www.spcxetf.com,

or upon request, by calling 1-866-904-0406.

(b) Not applicable.

Item 2. Code of Ethics.

As of the end of the period covered by this report, the Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or a third party (the “Code of Ethics”). During the period covered by this report, there were no amendments, nor did the Registrant grant any waivers, including any implicit waivers, from any provision of the Code of Ethics. The Code of Ethics is attached hereto as Exhibit 19(a)(1) of this Form.

Item 3. Audit Committee Financial Expert.

The Registrant’s Board of Trustees has determined that the Registrant has at least one “audit committee financial expert” (as defined in Item 3 of Form N-CSR) serving on its audit committee. Fred Stoleru is an “audit committee financial expert” and is “independent” (as each term is defined in Item 3 of Form N-CSR).

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees. Fees for audit services provided to the Registrant were $143,250 and $149,500 for the fiscal years ended September 30, 2024, and 2023, respectively. |

| (b) | Audit-Related Fees. The aggregate fees billed in each of the last two fiscal years for audit-related services by the principal accountant that are reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this item were $0 and $0 for the fiscal years ended September 30, 2024 and 2023, respectively. |

(c) Tax Fees. Fees for tax services, which consisted of income and excise tax compliance services, were $33,000 and $31,000 for the fiscal years ended September 30, 2024 and 2023, respectively.

(d) All Other Fees. Fees for other services totaled $0 and $0 for the fiscal years ended September 30, 2024 and 2023, respectively.

(e) (1) The Registrant’s Audit Committee has adopted Pre-Approval Policies and Procedures. The Audit Committee must pre-approve all audit services and non-audit services that the principal accountant provides to the Registrant. The Audit Committee must also pre-approve any engagement of the principal accountant to provide non-audit services to the Registrant’s investment adviser, or any affiliate of the adviser that provides ongoing services to the Registrant, if such non-audit services directly impact the Registrant’s operations and financial reporting.

(2) No services described in items (b) were pre-approved by the Audit Committee pursuant to Rule 2 01(c)(7)(i)(c) of Regulation S-X.

(f) All of the work in connection with the audit of the Registrant during the years ended September 30, 2024 and 2023 was performed by full-time employees of the Registrant’s principal accountant.

(g) The aggregate fees billed by the principal accountant for non-audit services to the Registrant, the Registrant’s investment adviser and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant were $0 and $0 for the years ended September 30, 2024 and 2023, respectively.

(h) The Registrant’s Audit Committee has considered whether the provision of non-audit services that were rendered to the Registrant’s investment adviser, and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal auditor’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) The Schedule of Investments in Securities of unaffiliated issuers is included as part of the Financial Statements filed under Item 7(a) of this Form.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a)

Annual Financial Statements and Other Information

Goose Hollow Tactical Allocation ETF (GHTA)

Goose Hollow Multi-Strategy Income ETF (GHMS)

September 30, 2024

See notes which are an integral part of the Financial Statements.

Annual Financial Statements and Other Information | 3

Portfolio of InvestmentsSeptember 30, 2024

Goose Hollow Tactical Allocation ETF

| | | | | |

| Shares | | | Fair Value ($) | |

| Common Stock — 7.7% | | |

| Financials — 7.7% | | |

| 293,650 | | AGNC Investment Corp. | 3,071,579 | |

| Total Common Stock (Cost $3,035,333) | 3,071,579 | |

| | | | | |

| Exchange-Traded Funds — 84.3% | | |

| 13,264 | | abrdn Physical Palladium Shares ETF(b) | 1,215,778 | |

| 132,455 | | Goose Hollow Multi-Strategy Income ETF(c) | 3,542,509 | |

| 10,000 | | iShares 20+ Year Treasury Bond ETF | 981,000 | |

| 123,138 | | iShares China Large-Cap ETF | 3,913,326 | |

| 50,000 | | iShares Ethereum Trust ETF | 983,500 | |

| 130,110 | | iShares MSCI Hong Kong ETF | 2,427,853 | |

| 62,269 | | iShares MSCI Mexico ETF | 3,344,468 | |

| 42,764 | | iShares MSCI Thailand ETF | 2,962,690 | |

| 63,854 | | iShares Treasury Floating Rate Bond ETF | 3,231,012 | |

| 211,106 | | Quadratic Interest Rate Volatility and Inflation Hedge ETF | 4,063,791 | |

| 13,410 | | SPDR Bloomberg 1-3 Month T-Bill ETF | 1,231,172 | |

| 25,770 | | Vanguard Long-Term Treasury ETF | 1,585,886 | |

| 85,089 | | WisdomTree Floating Rate Treasury Fund | 4,273,169 | |

| Total Exchange-Traded Funds (Cost $32,305,902) | 33,756,154 | |

| | | |

| Purchased Options Contracts — 0.0%(a)(d) | | |

| Total Purchased Options Contracts (Cost $40,588) | 7,050 | |

| | | |

| Preferred Stock — 3.3% | | |

| 305,553 | | Federal National Mortgage Association(b) | 1,307,767 | |

| Total Preferred Stock (Cost $1,127,212) | 1,307,767 | |

| | | |

| Total Investments — 95.3% (Cost $36,509,035) | 38,142,550 | |

| Other Assets in Excess of Liabilities — 4.7% | 1,894,603 | |

| Net Assets — 100.0% | 40,037,153 | |

(a) Represents less than 0.05%.

(b) Non-income producing security.

(c) Affiliated security. See Note 3.

(d) See Portfolio of Purchased Options Contracts.

ETF — Exchange-Traded Fund

MSCI — Morgan Stanley Capital International

SPDR — Standard & Poor’s Depositary Receipts

See notes which are an integral part of the Financial Statements.

Annual Financial Statements and Other Information | 4

Portfolio of Investments (continued)September 30, 2024

Goose Hollow Tactical Allocation ETF

Written Options Contracts

Exchange-traded options contracts written as of September 30, 2024 were as follows:

| | | | | | | |

Description | Put/Call | Number of Contracts | Notional Amount (000)($)(a) | Premiums

Received ($) | Strike

Price ($) | Expiration Date | Value ($) |

Vaneck Semiconductor ETF Options | Put | 100 | 1,550 | 31,467 | 155.00 | 12/23/24 | (4,600) |

(Total Premiums Received $31,467) | (4,600) |

Purchased Options Contracts

Exchange-traded options contracts purchased as of September 30, 2024 were as follows:

| | | | | | | | |

Description | Put/Call | Number of Contracts | Notional

Amount

(000)($)(a) | Cost ($) | Strike

Price ($) | Expiration Date | Value ($) |

Vaneck Semiconductor ETF Options | Put | 50 | 875 | 28,754 | 175.00 | 12/23/24 | 5,575 |

Vaneck Semiconductor ETF Options | Put | 50 | 725 | 11,834 | 145.00 | 12/23/24 | 1,475 |

(Total Cost $40,588) - 0.0%(b) | | | | 40,588 | | | 7,050 |

(a) Notional amount is expressed as the number of contracts multiplied by contract size multiplied by the strike price of the underlying asset.

(b) Represents less than 0.05%.

See notes which are an integral part of the Financial Statements.

Annual Financial Statements and Other Information | 5

Portfolio of InvestmentsSeptember 30, 2024

Goose Hollow Multi-Strategy Income ETF

| | | | | |

| Shares | | | Fair Value ($) | |

| Closed-End Funds — 20.9% | | |

| 46,460 | | Aberdeen Asia-Pacific Income Fund, Inc. | 808,404 | |

| 193,705 | | Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. | 976,272 | |

| 104,492 | | Saba Capital Income & Opportunities Fund II | 889,227 | |

| 74,020 | | Templeton Emerging Markets Income Fund | 431,537 | |

| 47,483 | | Virtus Stone Harbor Emerging Markets Income Fund | 248,811 | |

| 40,959 | | Western Asset Emerging Markets Debt Fund, Inc. | 416,963 | |

| Total Closed-End Funds (Cost $3,597,798) | 3,771,214 | |

| | | | | |

| Exchange-Traded Funds — 67.4% | | |

| 54,353 | | Global X Variable Rate Preferred ETF | 1,307,190 | |

| 12,912 | | JPMorgan Ultra-Short Income ETF | 655,155 | |

| 56,249 | | Quadratic Interest Rate Volatility and Inflation Hedge ETF | 1,082,793 | |

| 67,921 | | SPDR FTSE International Government Inflation-Protected Bond ETF | 2,736,537 | |

| 37,110 | | Vanguard Mortgage-Backed Securities ETF | 1,751,963 | |

| 30,793 | | Vanguard Short-Term Treasury ETF | 1,817,403 | |

| 55,826 | | Vanguard Total International Bond ETF | 2,806,931 | |

| Total Exchange-Traded Funds (Cost $12,063,027) | 12,157,972 | |

| | | |

| Preferred Stocks — 9.8% | | |

| Financials — 9.8% | | |

| 12,886 | | AGNC Investment Corp., Series C | 332,974 | |

| 15,648 | | AGNC Investment Corp., Series F | 383,689 | |

| 12,860 | | Annaly Capital Management, Inc. | 325,872 | |

| 13,970 | | Rithm Capital Corp., Series A | 354,559 | |

| 14,616 | | Rithm Capital Corp., Series B | 373,293 | |

| | 1,770,387 | |

| Total Preferred Stocks (Cost $1,709,017) | 1,770,387 | |

| | | |

| Total Investments — 98.1% (Cost $17,369,842) | 17,699,573 | |

| Other Assets in Excess of Liabilities — 1.9% | 333,573 | |

| Net Assets — 100.0% | 18,033,146 | |

ETF — Exchange-Traded Fund

FTSE — Financial Times Stock Exchange

SPDR — Standard & Poor’s Depositary Receipts

See notes which are an integral part of the Financial Statements.

Annual Financial Statements and Other Information | 6

Statement of Assets and LiabilitiesSeptember 30, 2024

| | | |

| Goose Hollow Tactical Allocation ETF | Goose Hollow Multi-Strategy Income ETF | |

Assets: | | | |

Investments, at value

(Cost $33,036,932 and $17,369,842) | $34,600,041 | $17,699,573 | |

Affiliated investments, at value

(Cost $3,472,103 and $— ) | 3,542,509 | — | |

Cash | 1,835,255 | 129,238 | |

Deposits at brokers for derivative contracts | 97,112 | 206,623 | |

Dividends and interest receivable | 35,238 | 29,227 | |

Receivable due from sub-administrator | — | 12,977 | |

Prepaid expenses and other assets | 513 | 182 | |

Total Assets | 40,110,668 | 18,077,820 | |

Liabilities: | | | |

Written options at value

(Premiums received $31,467 and $—) | 4,600 | — | |

Payable due to advisor | — | 3,700 | |

Accrued expenses: | | | |

Advisory | 21,993 | — | |

Administration | 4,839 | 2,723 | |

Custodian | 238 | 378 | |

Fund accounting | 14,610 | 13,671 | |

Legal and audit | 20,151 | 19,262 | |

Trustee | 1,200 | 800 | |

Other | 5,884 | 4,141 | |

Total Liabilities | 73,515 | 44,674 | |

Net Assets | $40,037,153 | $18,033,146 | |

Net Assets consist of: | | | |

Paid-in Capital | $38,119,962 | $17,516,606 | |

Total Distributable Earnings (Loss) | 1,917,191 | 516,540 | |

Net Assets | $40,037,153 | $18,033,146 | |

| | | |

Net Assets: | $40,037,153 | $18,033,146 | |

Shares of Beneficial Interest Outstanding (unlimited number of shares authorized, no par value): | 1,350,000 | 675,000 | |

Net Asset Value (offering and redemption price per share): | $29.66 | $26.72 | |

See notes which are an integral part of the Financial Statements.

Annual Financial Statements and Other Information | 7

Statement of OperationsFor the year ended September 30, 2024

| | | | |

| Goose Hollow Tactical

Allocation ETF | | Goose Hollow

Multi-Strategy

Income ETF(a) | |

Investment Income: | | | | |

Dividend income | 1,337,351 | | 621,085 | |

Affiliated dividend income | 42,534 | | — | |

Interest income | 2,586 | | 6,623 | |

Total Investment Income | 1,382,471 | | 627,708 | |

Expenses: | | | | |

Advisory | 318,543 | | 71,005 | |

Administration | 56,213 | | 21,848 | |

Compliance services | 9,000 | | 7,500 | |

Custodian | 1,706 | | 1,286 | |

Offering costs | — | | 4,489 | |

Fund accounting | 82,022 | | 31,619 | |

Legal and audit | 34,065 | | 26,556 | |

Listing Fee | — | | 5,058 | |

Printing | 6,797 | | 5,751 | |

Treasurer | 2,700 | | 1,575 | |

Trustee | 4,800 | | 3,200 | |

Other | 16,342 | | 7,591 | |

Total Expenses before fee reductions | 532,188 | | 187,478 | |

Expenses contractually waived and/or reimbursed by the Advisor | (91,708 | ) | (77,799 | ) |

Expenses voluntarily waived by the Advisor(b) | (23,150 | ) | — | |

Total Net Expenses | 417,330 | | 109,679 | |

Net Investment Income (Loss) | 965,141 | | 518,029 | |

Realized and Unrealized Gains (Losses)

from Investments: | | | | |

Net realized gains (losses) from investment transactions | (778,689 | ) | (31,096 | ) |

Net realized gains (losses) from affiliated funds transactions | 112,644 | | — | |

Net realized gains (losses) from in-kind transactions | 3,620,743 | | 63,033 | |

Net realized gains (losses) from affiliated in-kind transactions | 18,578 | | — | |

Net realized gains (losses) from written options transactions | 88,258 | | — | |

Change in unrealized appreciation (depreciation) on investments | 3,028,572 | | 329,731 | |

Change in unrealized appreciation (depreciation) on affiliated funds | 70,406 | | — | |

Change in unrealized appreciation (depreciation) on written options | 26,867 | | — | |

Net Realized and Unrealized Gains (Losses) from Investments: | 6,187,379 | | 361,668 | |

Change in Net Assets Resulting From Operations | $7,152,520 | | $879,697 | |

(a) For the period from the commencement of operations on November 14, 2023 through September 30, 2024.

(b) See Note 3 in the Notes to Financial Statements.

See notes which are an integral part of the Financial Statements.

Annual Financial Statements and Other Information | 8

Statements of Changes in Net Assets

| | | | | | |

| Goose Hollow Tactical Allocation ETF | | Goose Hollow Multi-Strategy Income ETF |

| Year ended

September 30, 2024 | | Year ended

September 30, 2023 | | For the period

November 14, 2023(a)

through

September 30, 2024 |

From Investment Activities: | | | | | | |

Operations: | | | | | | |

Net investment income (loss) | $965,141 | | $691,196 | | $518,029 | |

Net realized gains (losses) from investment, affiliated funds, written options and in-kind transactions | 3,061,534 | | 1,735,648 | | 31,937 | |

Change in unrealized appreciation (depreciation) on investments, affiliated funds and written options | 3,125,845 | | (957,398 | ) | 329,731 | |

Change in net assets resulting from operations | 7,152,520 | | 1,469,446 | | 879,697 | |

Distributions to

Shareholders From: | | | | | | |

Earnings | (981,366 | ) | (81,324 | ) | (300,623 | ) |

Change in net assets from distributions | (981,366 | ) | (81,324 | ) | (300,623 | ) |

Capital Transactions: | | | | | | |

Proceeds from shares issued | 31,900,662 | | 54,105,372 | | 21,345,999 | |

Cost of shares redeemed | (39,114,945 | ) | (24,982,337 | ) | (3,891,927 | ) |

Change in net assets from capital transactions | (7,214,283 | ) | 29,123,035 | | 17,454,072 | |

Change in net assets | (1,043,129 | ) | 30,511,157 | | 18,033,146 | |

Net Assets: | | | | | | |

Beginning of period | 41,080,282 | | 10,569,125 | | — | |

End of period | $40,037,153 | | $41,080,282 | | $18,033,146 | |

Share Transactions: | | | | | | |

Issued | 1,150,000 | | 2,125,000 | | 825,000 | |

Redeemed | (1,425,000 | ) | (975,000 | ) | (150,000 | ) |

Change in shares | (275,000 | ) | 1,150,000 | | 675,000 | |

(a) Commencement of operations.

See notes which are an integral part of the Financial Statements.

Annual Financial Statements and Other Information | 9

| | | | | | |

Goose Hollow Tactical Allocation ETF | Year ended

September 30, 2024 | Year ended

September 30, 2023 | November 16, 2021(a)

through

September 30, 2022 |

Net Asset Value, Beginning of Period | $25.28 | | $22.25 | | $24.63 | |

| | | | | | |

Net Investment Income (Loss)(b) | 0.70 | | 0.55 | | 0.06 | |

Net Realized and Unrealized Gains (Losses) on Investments | 4.32 | (d) | 2.58 | (c) | (2.34 | ) |

Total from Investment Activities | 5.02 | | 3.13 | | (2.28 | ) |

| | | | | | |

Distributions from Net Investment Income | (0.48 | ) | (0.06 | ) | (0.10 | ) |

Distributions from Net Realized Gains on Investments | (0.16 | ) | (0.04 | ) | — | |

Total Distributions | (0.64 | ) | (0.10 | ) | (0.10 | ) |

Net Asset Value, End of Period | $29.66 | | $25.28 | | $22.25 | |

Net Assets at End of Period (000’s) | $40,037 | | $41,080 | | $10,569 | |

| | | | | | |

Total Return at NAV(d)(e) | 20.07 | % | 14.05 | % | (9.30 | )% |

| | | | | | |

Ratio of Net Expenses to

Average Net Assets(f)(g) | 1.11 | % | 0.89 | % | 0.84 | % |

Ratio of Gross Expenses to

Average Net Assets(f)(g)(h) | 1.42 | % | 1.39 | % | 3.51 | % |

Ratio of Net Investment Income (Loss) to Average Net Assets(f)(i) | 2.58 | % | 2.12 | % | 0.28 | % |

Portfolio Turnover(e)(j) | 129 | % | 450 | % | 392 | % |

(a) Commencement of operations.

(b) Calculated using the average shares method.

(c) Realized and unrealized gains per share are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not accord with the aggregate gains and losses in the Statement of Operations due to share transactions for the period.

(d) Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, if any, and redemption on the last day of the period at net asset value. This percentage is not an indication of the performance of a shareholder’s investment in the Fund based on market value due to differences between the market price of the shares and the net asset value per share of the Fund.

(e) Not annualized for periods less than one year.

(f) Annualized for periods less than one year.

(g) Excludes expenses of the investment companies in which the Fund invests.

(h) If applicable, certain fees were waived and/or reimbursed. If such waivers/reimbursements had not occurred, the ratio would have been as indicated.

(i) Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. The ratio does not include net investment income of the underlying investment companies.

(j) Excludes the impact of in-kind transactions.

See notes which are an integral part of the Financial Statements.

Annual Financial Statements and Other Information | 10

Financial Highlights (continued)

| | |

Goose Hollow Multi-Strategy Income ETF | November 14, 2023(a)

through

September 30, 2024 |

Net Asset Value, Beginning of Period | $25.00 | |

| | |

Net Investment Income (Loss)(b) | 1.08 | |

Net Realized and Unrealized Gains (Losses) on Investments(c) | 1.17 | |

Total from Investment Activities | 2.25 | |

| | |

Distributions from Net Investment Income | (0.53 | ) |

Distributions from Net Realized Gains on Investments | — | |

Total Distributions | (0.53 | ) |

Net Asset Value, End of Period | $26.72 | |

Net Assets at End of Period (000’s) | $18,033 | |

| | |

Total Return at NAV(d)(e) | 9.09 | % |

| | |

Ratio of Net Expenses to Average Net Assets(f)(g) | 1.00 | % |

Ratio of Gross Expenses to Average Net Assets(f)(g)(h) | 1.71 | % |

Ratio of Net Investment Income (Loss) to Average Net Assets(f)(i) | 4.72 | % |

Portfolio Turnover(e)(j) | 35 | % |

(a) Commencement of operations.

(b) Calculated using the average shares method.

(c) Realized and unrealized gains per share are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not accord with the aggregate gains and losses in the Statement of Operations due to share transactions for the period.

(d) Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, if any, and redemption on the last day of the period at net asset value. This percentage is not an indication of the performance of a shareholder’s investment in the Fund based on market value due to differences between the market price of the shares and the net asset value per share of the Fund.

(e) Not annualized for periods less than one year.

(f) Annualized for periods less than one year.

(g) Excludes expenses of the investment companies in which the Fund invests.

(h) If applicable, certain fees were waived and/or reimbursed. If such waivers/reimbursements had not occurred, the ratio would have been as indicated.

(i) Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. The ratio does not include net investment income of the underlying investment companies.

(j) Excludes the impact of in-kind transactions.

Annual Financial Statements and Other Information | 11

Notes to Financial StatementsSeptember 30, 2024

(1) Organization

Collaborative Investment Series Trust (the “Trust”) was organized on July 26, 2017 as a Delaware statutory trust. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as an open-end management investment company and thus is determined to be an investment company for accounting purposes. The Trust is comprised of several funds and is authorized to issue an unlimited number of shares of beneficial interest (“Shares”) in one or more series representing interests in separate portfolios of securities. The accompanying financial statements are those of Goose Hollow Tactical Allocation ETF and Goose Hollow Multi-Strategy Income ETF (each a “Fund” and collectively, the “Funds”). The Funds are diversified actively-managed exchange-traded funds. The Funds’ prospectus provides a description of the Funds’ investment objectives, policies, and strategies. The assets of the Funds are segregated and a shareholder’s interest is limited to the Fund in which shares are held. Goose Hollow Multi-Strategy Income ETF commenced operations on November 14, 2023.

Under the Trust’s organizational documents, its officers and Board of Trustees (the “Board”) are indemnified against certain liabilities arising out of the performance of their duties to the Funds. In addition, in the normal course of business, the Trust may enter into contracts with vendors and others that provide for general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust. However, based on experience, the Trust expects that risk of loss to be remote.

(2) Significant Accounting Policies

Shares of the Funds are listed and traded on the Cboe BZX Exchange, Inc. (‘’Cboe’’). Market prices for the Shares may be different from their net asset value (‘’NAV’’). The Funds issue and redeem Shares on a continuous basis at NAV only in large blocks of Shares, currently 25,000 Shares, called Creation Units (‘’Creation Units’’). Creation Units are issued and redeemed principally in-kind for securities included in a specified universe. Once created, Shares generally trade in the secondary market at market prices that change throughout the day in amounts less than a Creation Unit. Shares of each Fund may only be purchased or redeemed by certain financial institutions (‘’Authorized Participants’’). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with Paralel Distributors LLC (the ‘’Distributor’’). Most retail investors do not qualify as Authorized Participants nor have the resources to buy and sell whole Creation Units. Therefore, they are unable to purchase or redeem the shares directly from the Funds.

Annual Financial Statements and Other Information | 12

Notes to Financial Statements (continued)September 30, 2024

The following is a summary of significant policies consistently followed by each Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (‘’GAAP’’). Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (‘’FASB’’) Accounting Standards Codification Topic 946 ‘’Financial Services - Investment Companies’’ including Accounting Standards Update 2013-08. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

For the period ended September 30, 2024, Goose Hollow Multi-Strategy Income ETF will be reimbursed $12,977 from the Sub-administrator as a result of an accounting error. This is included as a Receivable due from sub-administrator on the Fund’s Statement of Assets and Liabilities.

A. Investment Valuations

The Funds hold investments at fair value. Fair value is defined as the price that would be expected to be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The valuation techniques used to determine fair value are further described below.

Security values are ordinarily obtained through the use of independent pricing services in accordance with Rule 2a-5 under the 1940 Act pursuant to procedures adopted by the Board. Pursuant to these procedures, the Funds may use a pricing service, bank, or broker-dealer experienced in such matters to value the Funds’ securities. If market quotations are not readily available, securities will be valued at their fair market as determined using the fair value procedures approved by the Board. The Board has delegated the execution of these procedures to the Advisor as fair value designee. The fair valuation process is designed to value the subject security at the price the Funds would reasonably expect to receive upon its current sale. Additional consideration is given to securities that have experienced a decrease in the volume or level of activity or to circumstances that indicate that a transaction is not orderly.

The Trust uses a three-tier fair value hierarchy that is dependent upon the various “inputs” used to determine the value of the Funds’ investments. The valuation techniques described below maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. These inputs are summarized in the three broad levels listed below

• Level 1 - Quoted prices in active markets for identical assets that the Funds have the ability to access.

• Level 2 - Other observable pricing inputs at the measurement date (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Annual Financial Statements and Other Information | 13

Notes to Financial Statements (continued)September 30, 2024

• Level 3 - Significant unobservable pricing inputs at the measurement date (including the Funds’ own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing investments are not necessarily an indication of the risk associated with investing in those investments.

Exchange-traded funds (“ETFs”) and preferred stocks traded on a recognized securities exchange are valued at that day’s last traded price or official closing price, as applicable, on the exchange where the fund is primarily traded. Funds and preferred stocks traded on a recognized exchange for which there were no sales on that day may be valued at the last traded price. In each of these situations, valuations are typically categorized as Level 1 in the fair value hierarchy.

Exchange-traded futures contracts are valued at their settlement price on the exchange on which they are traded and are typically categorized as Level 1 in the fair value hierarchy. Exchange-traded options contracts are valued at the last quoted sales price on the primary exchange for that option as recorded by an approved pricing vendor. If an option is not traded on the valuation date, exchange traded options are valued at the composite price. Composite option pricing calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is traded.

The Funds did not hold any Level 2 or Level 3 investments as of September 30, 2024.

The following table summarizes the Funds’ investments, based on their valuation inputs, as of September 30, 2024, while the breakdown, by category, of investments is disclosed in the Portfolio of Investments for the Funds:

| | | | | | | |

| Level 1 | | Total Investments |

Goose Hollow Tactical Allocation ETF | | | | | | | |

Common Stock(a) | | $3,071,579 | | | | $3,071,579 | |

Exchange-Traded Funds | | 33,756,154 | | | | 33,756,154 | |

Purchased Option Contracts | | 7,050 | | | | 7,050 | |

Preferred Stock | | 1,307,767 | | | | 1,307,767 | |

Total Investments | | $38,142,550 | | | | $38,142,550 | |

Other Financial Instruments(a) | | | | | | | |

Liabilities | | | | | | | |

Written Option Contracts | | (4,600 | ) | | | (4,600 | ) |

Total Other Financial Instruments | | $38,137,950 | | | | $38,137,950 | |

Goose Hollow Multi-Strategy Income ETF | | | | | | | |

Closed-End Funds | | 3,771,214 | | | | 3,771,214 | |

Exchange-Traded Funds | | 12,157,972 | | | | 12,157,972 | |

Preferred Stocks | | 1,770,387 | | | | 1,770,387 | |

Total Investments | | $17,699,573 | | | | $17,699,573 | |

(a) Please see the Portfolio of Investments for Industry classifications.

Annual Financial Statements and Other Information | 14

Notes to Financial Statements (continued)September 30, 2024

B. Security Transactions and Related Income

Investment transactions are accounted for no later than the first calculation of the NAV on the business day following the trade date. For financial reporting purposes, however, security transactions are accounted for on the trade date on the last business day of the reporting period. Securities’ gains and losses are calculated on the identified cost basis. Interest income and expenses are accrued daily. Dividends and dividend expense, less foreign tax withholding, if any, are recorded on the ex-dividend date. Investment income from non-U.S. sources received by the Funds is generally subject to non-U.S. withholding taxes at rates ranging up to 30%. Such withholding taxes may be reduced or eliminated under the terms of applicable U.S. income tax treaties. The Funds may be subject to foreign taxes on gains in investments or currency repatriation. The Funds accrue such taxes, as applicable, based on its current interpretation of tax rules in the foreign markets in which they invest.

The Funds may own shares of ETFs that may invest in real estate investments trusts (‘’REITs’’) and master limited partnerships (‘’MLPs’’) which report information on the source of their distributions annually. Distributions received from investments in REITs or MLPs in excess of income from underlying investments are recorded as realized gain and/or as a reduction to the cost of the ETF.

C. Cash

Idle cash may be swept into various interest-bearing overnight demand deposits and is classified as cash on the Statements of Assets and Liabilities. The Fund maintains cash in bank deposit accounts which, at times, may exceed the United States federally insured limit of $250,000. Amounts swept overnight are available on the next business day.

D. Dividends and Distributions to Shareholders

Distributions are recorded on the ex-dividend date. The Goose Hollow Tactical Allocation ETF intends to distribute to its shareholders net investment income and net realized capital gains, if any, at least annually. The Goose Hollow Multi Strategy Income ETF intends to distribute to its shareholders net investment income and net realized capital gains, if any, at least semi-annually. The amount of dividends from net investment income and net realized gains is determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary or permanent in nature. To the extent these differences are permanent in nature (e.g., distributions and income received from pass-through investments), such amounts are reclassified within the capital accounts based on their nature for federal income tax purposes; temporary differences do not require reclassification.

Annual Financial Statements and Other Information | 15

Notes to Financial Statements (continued)September 30, 2024

In addition, the Funds may utilize equalization accounting for tax purposes and designate earnings and profits, including net realized gains distributed to shareholders on redemption of shares, as a part of the dividends paid deduction for income tax purposes. These reclassifications have no effect on net assets or net asset values per share.

E. Allocation of Expenses

Expenses directly attributable to a fund are charged to that fund. Expenses not directly attributable to a fund are allocated proportionally among all funds within the Trust in relation to the net assets of each fund or on another reasonable basis.

F. Derivative Instruments:

All open derivative positions at year end are reflected on each Fund’s Portfolio of Investments. The following is a description of the derivative instruments utilized by the Funds, including the primary underlying risk exposure related to each instrument type.

Futures Contracts:

The Funds may enter into futures contracts for the purpose of hedging existing portfolio securities or securities they intend to purchase against fluctuations in fair value caused by changes in prevailing market interest conditions. Upon entering into futures contracts, the Funds are required to pledge to the broker an amount of cash and/or other assets equal to a certain percentage of the contract amount (initial margin deposit). Subsequent payments, known as “variation margin”, are made or received each day, depending on the daily fluctuations in the fair value of the underlying security. The Funds recognize an unrealized gain or loss equal to the daily variation margin. Should market conditions move unexpectedly, the Funds may not achieve the anticipated benefits of the futures contracts and may realize a loss. Futures contracts involve, to varying degrees, elements of market risk (generally equity price risk related to stock futures, interest rate risk related to bond futures and foreign currency risk related to currency futures) and exposure to loss in excess of the amounts reflected on the Statements of Assets and Liabilities as variation margin. The primary risks associated with the use of futures contracts are the imperfect correlation between the change in market value of the securities held by the Funds and the prices of futures contracts, the possibility of an illiquid market, and the inability of the counterparty to meet the terms of the contract. The Funds did not hold any futures during the year and did not hold any futures at September 30, 2024.

Options Contracts:

Purchased Options – The Funds pay a premium which is included in “Investments, at value” on the Statements of Assets and Liabilities and marked to market to reflect the current value of the option. Premiums paid for purchasing options that expire are treated as realized losses. When a put option is exercised or closed, premiums paid for purchasing options are offset

Annual Financial Statements and Other Information | 16

Notes to Financial Statements (continued)September 30, 2024

against proceeds to determine the realized gain/loss on the transaction. The Funds bear the risk of loss of the premium and change in value should the counterparty not perform under the contract.

Written Options – The Funds receive a premium which is recorded as a liability and is subsequently adjusted to the current value of the options written. Premiums received from writing options that expire are treated as realized gains. Premiums received from writing options that expire are treated as realized gains. Premiums received from writing options that are either exercised or closed are offset against the proceeds received or the amount paid on the transaction to determine realized gains or losses. The risk associated with writing an option is that the Funds bear the market risk of an unfavorable change in the price of an underlying asset and are required to buy or sell an underlying asset under the contractual terms of the option at a price different from the current value.

The gross notional amount of purchased and written options outstanding as of September 30, 2024, and the monthly average notional amount for these contracts for the year ended September 30, 2024 were as follows:

| | |

| Outstanding Notional Amount (000) | Monthly Average Notional Amount (000) |

Purchased Options: | | |

Goose Hollow Tactical Allocation ETF | $1,600 | $4,374 |

Written Options Contracts: | | |

Goose Hollow Tactical Allocation ETF | (1,550) | (4,081) |

Summary of Derivative Instruments:

The following is a summary of the fair value of derivative instruments on the Statements of Assets and Liabilities, categorized by risk exposure, as of September 30, 2024:

| | |

| Assets | Liabilities |

| Investments, at Value for

Purchased Options | Written Options, at Value |

Equity Risk Exposure | | |

Goose Hollow Tactical Allocation ETF | $7,050 | $4,600 |

Annual Financial Statements and Other Information | 17

Notes to Financial Statements (continued)September 30, 2024

The following is a summary of the effect of derivative instruments on the Statements of Operations, categorized by risk exposure, for the year ended September 30, 2024:

| | | | |

| Net Realized Gains (Losses) from | Net Change in Unrealized Appreciation (Depreciation) on Derivatives Recognized as a Result from Operations |

| Purchased Options(a) | Written Options | Purchased Options(b) | Written Options |

Currency Risk Exposure: | | | | |

Goose Hollow Tactical Allocation ETF | $(57,747) | $11,002 | $ — | $ — |

Equity Risk Exposure: | | | | |

Goose Hollow Tactical Allocation ETF | (131,392) | 71,105 | (11,584) | 26,867 |

Commodity Rate Risk Exposure: | | | | |

Goose Hollow Tactical Allocation ETF | (18,249) | 6,151 | — | — |

(a) These are included with realized gains (losses) from investment transactions on the Statements of Operations.

(b) These are included with change in unrealized appreciation (depreciation) on investments on the Statements of Operations.

(3) Investment Advisory and Other Contractual Services

A. Investment Advisory Fees

Goose Hollow Capital Management, LLC (the “Advisor”), serves as the Funds’ investment advisor pursuant to an investment advisory agreement. Subject at all times to the oversight and approval of the Board, the Advisor is responsible for the overall management of the Funds. Each Fund pays the Advisor the management fee, based on a percentage of its average daily net assets, calculated daily and paid monthly.

| |

| Management

Fee Rate |

Goose Hollow Tactical Allocation ETF | 0.85% |

Goose Hollow Multi-Strategy Income ETF | 0.65% |

The Advisor has contractually agreed to reduce its fees and to reimburse expenses, at least through January 31, 2025 to ensure that Net Annual Fund Operating Expenses (exclusive of any (i) front-end or contingent deferred loads, (ii) portfolio transaction and other investment-related costs (including brokerage fees and commissions), (iii) acquired fund fees and expenses, (iv) fees and expenses associated with instruments in other collective investment vehicles or derivative instruments (including for example options

Annual Financial Statements and Other Information | 18

Notes to Financial Statements (continued)September 30, 2024

and swap fees and expenses); (v) borrowing costs (such as interest and dividend expenses on securities sold short), (vi) taxes, (vii) other fees related to underlying investments, (such as option fees and expenses or swap fees and expenses); or (viii) extraordinary expenses such as litigation (which may include indemnification of Fund officers and trustees or contractual indemnification of Fund service providers (other than the Advisor) will not exceed the following:

| |

| Expense Cap |

Goose Hollow Tactical Allocation ETF | 1.85%(a) |

Goose Hollow Multi-Strategy Income ETF | 1.00% |

(a) Prior to June 1, 2024, the expense cap was 0.99%.