EXHIBIT 4.1

| |

| Hall structured finance II, LLC |

| |

| SUBSCRIPTION DOCUMENTS |

| |

| [ ] 2017 |

| |

Hall Structured Finance II, LLC

Subscription Instructions

Please read carefully the Offering Circular dated _________, 2017, and all exhibits and supplements thereto (the “Offering Circular”) before deciding to subscribe. Any terms not defined herein shall have the meanings ascribed such terms in the Offering Circular. Subscriptions to purchase 8% Debentures (as defined in the Offering Circular the “Debentures”) of Hall Structured Finance II, LLC (the “Company”) may be made only by means of the completion, delivery and acceptance of the subscription documents in this package (the “Subscription Documents”) by taking the following steps:

| · | Complete the Subscription Documents, which include: |

| o | Subscriber Information Form: Complete all requested information; |

| o | Subscription Agreement: Date and sign the signature page. Note that subscriptions by individual retirement accounts (IRAs) require the signature of the qualified IRA custodian or trustee; and |

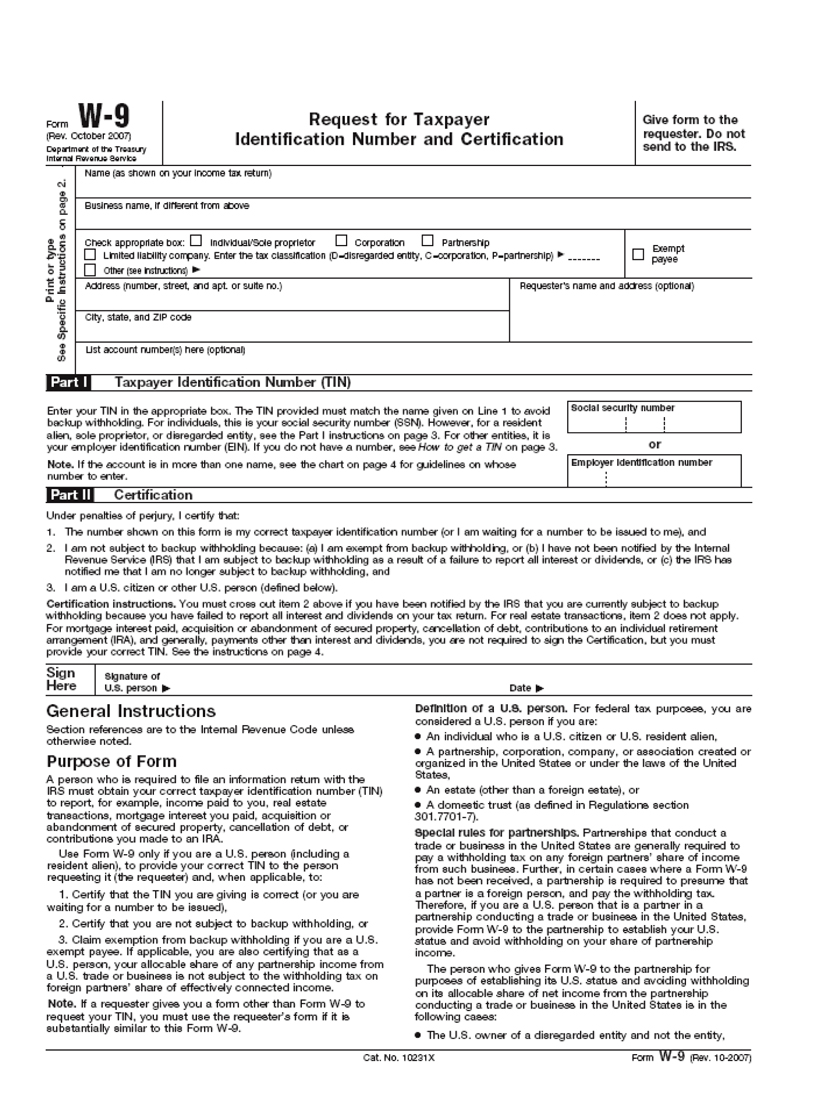

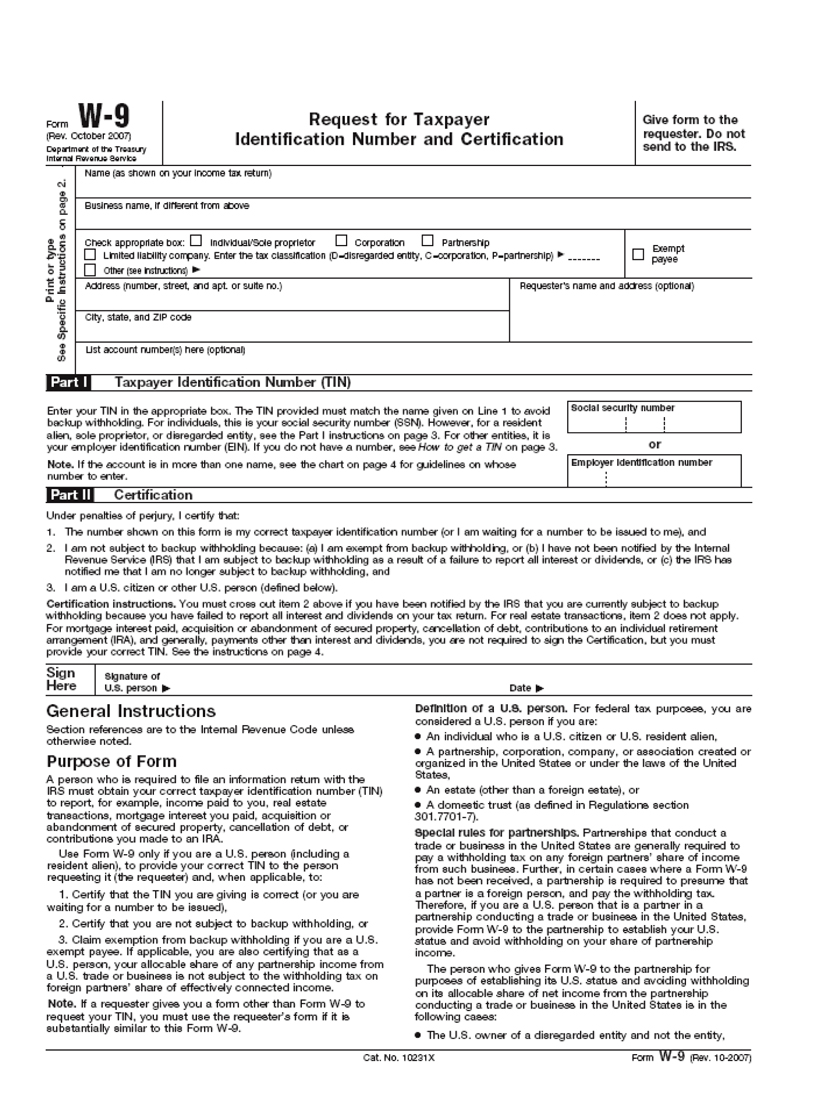

| o | IRS Form W-9: Complete and sign IRS Form W-9 to certify your tax identification number. If you are not a U.S. person, you must instead complete the appropriate IRS Form W-8. Attached hereto as Appendix B is the Form W-9 (Rev. October 2007) from the Department of the Treasury Internal Revenue Service. For the appropriate Form W-8 and an updated Form W-9, please go towww.irs.gov. Ken lets delete this part if there are no foreign investors allowed. |

| · | Deliver the completed Subscription Documents; and |

| · | Make payment of the Subscription Amount. |

After completion of the above, the Company must accept the Subscription in order for Subscription Documents to be complete.

Additional information regarding these Subscription Documents and the subscription process is set out below.

Delivery Instructions.Subscription Documents should be delivered to the following address:

All Subscription Documents will be returned to the Subscriber if this subscription is not accepted.

Subscription Instructions

Evidence of Authorization.Subscribers (other than natural persons subscribing for their own account) may be required to submit the following evidence of authorization:

| (1) | Corporation:certified corporate resolutions authorizing the subscription and identifying the corporate officer(s) empowered to sign the Subscription Documents. |

| (2) | Partnership:partnership certificate (in the case of limited partnerships) or partnership agreement identifying the general partners. |

| (3) | Limited liability company: certificate of formation or operating agreement identifying the members and managers, if any. |

| (4) | Trust:trust agreement or relevant portions thereof showing appointment and authority of trustee(s). |

| (5) | Employeebenefit plan (including individual retirement account): certificate of the trustee or an appropriate officer certifying that the subscription has been authorized and identifying the individual empowered to sign the Subscription Documents. |

Entities may be requested to furnish other or additional documentation evidencing their authority to invest in the Debentures. The Debentures will be subject to that certain Debenture Purchase Agreement, by and among the holders of the Debentures and the Company (the “Purchase Agreement”).

Subscription Payments; Closing Date.Payments for the amounts subscribed (not less than $20,000 unless otherwise agreed in advance by the Company), are suggested to be made by wire transfer to an account designated by the Company, which shall initially be as shown below, but if you prefer to send a check please send to the address noted earlier in the Delivery Instructions section.

Wire Instruction:

| | To: | [______________________] |

| | ABA No.: | [______________________] |

| | F/C/T: | [______________________] |

| | Account No.: | [______________________] |

| | Reference: | [Subscriber Name] |

Acceptance of Subscriptions.The acceptance of subscriptions is within the absolute discretion of the Company, which may require additional information prior to making a determination. The Company will seek to notify the Subscriber of its acceptance or rejection of the subscription prior to the date of subscription. If the subscription is rejected, the Company will promptly refund (without interest) to the Subscriber any subscription payments received by the Company.

Additional Information.For additional information concerning subscriptions, prospective investors should contact Mark Blocher (telephone: (214) 269-9517) at the office of the Company.

Subscription Instructions

Hall Structured Finance II, LLC

Privacy Policy

The Company takes precautions to maintain the privacy of personal information concerning the Company’s current and prospective individual Subscribers. These precautions include the adoption of certain procedures designed to maintain and secure such Subscribers’ nonpublic personal information from inappropriate disclosure to third parties. Federal regulations require the Company to inform Subscribers of this privacy policy.

The Company collects nonpublic personal information about its Subscribers from the following sources:

| · | Information the Company receives from a Subscriber in these Subscription Documents or other related documents or forms; |

| · | Information about a Subscriber’s transactions with the Company, its affiliates, or others; and |

| · | Information the Company may receive from a consumer reporting agency. |

The Company does not disclose any nonpublic personal information about its prospective, existing or former Subscribers to anyone, except as permitted or required by law and regulation.

The Company restricts access to nonpublic personal information about its Subscribers to those employees and agents of the Company who need to know that information in order to provide services to its Subscribers. The Company may also disclose such information to its affiliates and to service providers and financial institutions that provide services to the Company. The Company will require such third party service providers and financial institutions to protect the confidentiality of the Subscribers’ nonpublic personal information and to use the information only for purposes for which it is disclosed to them. The Company maintains physical, electronic, and procedural safeguards that comply with federal standards to safeguard the Subscribers’ nonpublic personal information and which the Company believes are adequate to prevent unauthorized disclosure of such information.

If you have any questions concerning this privacy policy, please contact Mark Blocher (telephone: (214) 269-9517) at the office of the Company.

Privacy Policy

Hall Structured Finance II, LLC

Subscriber Information Form

Part a of this Subscriber Information Form is divided into three sections. All subscribers are required to complete section i. Subscribers who are natural persons or grantor trusts must complete section ii. All other subscribers must complete section iii.

all subscribers must complete the subscriber qualification questions inPart b.

| PART A –SUBSCRIBER INFORMATION |

| |

| SECTION I. TO BE COMPLETED BY ALL SUBSCRIBERS |

1. Identity of Subscriber

| Name(s): | | |

| | | |

| | | |

| | | |

| Please check the box that describes the beneficial owner(s) for whose account the Debentures are being purchased. |

| |

| ¨ | Individual | | | |

| ¨ | Joint (spouses) | | | |

| ¨ | Joint (other) | | | |

| ¨ | Personal trust (taxable to grantor) | | | |

| ¨ | Personal trust (other) | | | |

| ¨ | Individual retirement account | | | |

| ¨ | Business entity (other) | | | |

| | | | | |

| | If “Other” describe below | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Subscriber Information Form

2. Contact Information

| Primary Contact for Notices and Communications | |

| | | |

| Name: | | |

| | | |

| Mailing Address: | | |

| | | |

| | | |

| | | |

| Telephone: | | |

| | | |

| Fax: | | |

| | | |

| E-mail: | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Please set forth below the names of persons authorized by the Subscriber to give and receive instructions between the Company and the Subscriber together with their respective signatures. Such persons are the only persons so authorized until further written notice to the Company signed by one or more of such persons.

3. Remitting Bank or Financial Institution

The preferred method for making payments on subscriptions is to pay in full by wire transfer of readily available funds to the account of the Company on or before the business day prior to the proposed date of the subscription. If you wish to pay by check please refer to the Delivery Instructions section earlier. For wire transfers, please identify the bank or other financial institution (the “Wiring Institution”) from which the Subscriber’s funds will be wired. Note that any amounts paid to the Subscriber will be paid to the same account from which its subscription funds were originally remitted, unless the Company agrees otherwise.

Subscriber Information Form

| Name of Wiring Institution: | |

| | |

| Address: | |

| | |

| | |

| | |

| | |

| | |

| ABA, Chips or SWIFT Number: | |

| | |

| Account Name: | |

| | |

| Account Number: | |

| | |

| For Benefit of: | |

| [Subscriber Name] | |

| | |

| Account Representative: | |

| | |

| Telephone: | |

| | |

4. Electronic Delivery of Reports and Other Communications

The Company may make reports and other communications available in electronic form, such as E-mail or by posting on a web site (with notification of the posting by E-mail). Do you consent to receive deliveries of reports and other communications from the Company (including annual and other updates of our consumer privacy policies and procedures) exclusively in electronic form without separate mailing of paper copies?

5. Information regarding Actual Ownership of the Debentures

Is the Subscriber subscribing for the Debentures as agent, nominee, trustee, partner or otherwise on behalf of, for the account of or jointly with any other person or entity?

Note: If the above question was answered “Yes,” please provide identifying information or contact the Company:

| SECTION II. ADDITIONAL QUESTIONS FOR NATURAL PERSONS, INDIVIDUAL RETIREMENT ACCOUNTS OR GRANTOR TRUSTS |

| |

1. Please indicate desired type of ownership interest

| ¨ | Individual | ¨ | IRA - Individual Retirement Account |

| ¨ | Joint | ¨ | Grantor Trust |

2. State of Residence

Indicate the state where Subscriber has his or her principal residence:

Note: If you are married and live in a community property state, both you and your spouse must sign the Signature Page of the Subscription Agreement. Community property states are Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Puerto Rico, Texas, Washington and Wisconsin.

Subscriber Information Form

3. Tax Information

Is the Subscriber or trust grantor a United States citizen or permanent resident of the United States?

SocialSecurity Number: _________________________

4. Joint Subscriptions

If you are subscribing with another person, please answer the following questions:

| (a) | Please indicate type of ownership interest: |

| ¨ | Joint Tenants (rights of survivorship) |

| ¨ | Tenants in common (no rights of survivorship) |

| (b) | If you are subscribing with another person, please answer the following questions: |

| (i) | is the other person a United States citizen or permanent resident of the United States? |

| (ii) | please provide the other person’s U.S. Social Security number: ______________________________ |

5. Individual Retirement Account Investors

| (a) | If the Subscriber is subscribing as a trustee or custodian for an individual retirement account, is the Subscriber a qualified IRA custodian or trustee? |

| (b) | Name of qualified IRA trustee or custodian: |

| | | |

| | | |

6. Grantor Trust Investors

| (a) | Please indicate whether the Subscriber, for federal income tax purposes, files now or has ever filed a tax or information return, as a partnership, as a “grantor” trust or (if the Subscriber is a U.S. Company) as an “S Company” under Sections 1361-1379 of the Internal Revenue Code of 1986, as amended (the “Code”). |

| (b) | If the answer is “Yes,” will the investment in the Debentures represent more than 75% of the assets of the Subscriber? |

Subscriber Information Form

| SECTION III. ADDITIONAL QUESTIONS FOR ENTITIES AND NON-GRANTOR TRUSTS |

1. Organizational Data

| (a) | Legal form of entity: | | |

| |

| (b) | Jurisdiction of organization: | | |

| |

| (c) | Year of organization: | | |

| |

| (d) | Briefly identify the Subscriber’s primary business: | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | |

| (e) | Total number of shareholders, partners or other holders of equity or beneficial interests or other securities (including any debt securities other than short term paper of the Subscriber) (If the number is more than 100, it is sufficient to respond “more than 100.”): |

| | | |

| | | |

2. Benefit Plan Accounts

| (a) | Is the Subscriber (1) an employee benefit plan subject to the fiduciary provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), (2) a “plan” subject to Section 4975 of the Internal Revenue Code of 1986, as amended (the “Code”), (3) an entity that otherwise constitutes a “benefit plan investor” within the meaning of any Department of Labor regulation promulgated under Section 3(42) of ERISA, (a party described in (1), (2), or (3), a “plan”), or (4) an entity whose underlying assets include “plan assets” for purposes of ERISA by reason of a Plan’s investment in the Subscriber (a “Plan Asset Entity”)? |

| (b) | Is the Subscriber a Plan that is both voluntary and contributory? |

| (c) | Have beneficiaries of the Plan been provided the opportunity to decide individually whether or not to participate, or the extent of their participation, in the Plan’s investment in the Debentures (i.e., have beneficiaries of the Plan been permitted to determine whether their capital will form part of the specific capital invested by the Plan in the Debentures)? |

| (d) | Is the Subscriber either (1) an insurance company general account the underlying assets of which include “plan assets” for purposes of ERISA or (2) a Plan Asset Entity? |

If the answer is “Yes”, the maximum percentage of the Subscriber constituting “plan assets” will be:

Subscriber Information Form

3. Regulated Institutions

Is the Subscriber a regulated institution that is subject to legal or regulatory restrictions or limitations on the nature of its investments (such as a bank or an insurance company)?

If the answer is “Yes,” has the Subscriber verified that the proposed subscription is in compliance with applicable laws and regulations?

4. Tax Information

| (a) | Employer identification number: |

| | | |

| (b) | Indicate the annual date on which the Subscriber’s taxable year ends for purposes of reporting federal income tax or filing information returns: |

| | | |

| (c) | Please indicate whether the Subscriber, for federal income tax purposes, files now or has ever filed a tax or information return, as a partnership, as a “grantor” trust or (if the Subscriber is a U.S. Company) as an “S Company” under Sections 1361-1379 of the Code. |

If the answer is “Yes,” will the investment in the Debentures represent more than 75% of the assets of the Subscriber?

| (d) | Is the Subscriber exempt from federal income tax (e.g., a qualified employee benefit plan or trust, retirement account, charitable remainder trust, or a charitable foundation or other tax-exempt organization described in Section 501(c)(3) of the Code)? |

Subscriber Information Form

| PART B –SUBSCRIBER QUALIFICATION |

Subscriptions will be accepted only from persons who qualify as eligible investors within the meaning of applicable federal and state securities regulations. Unless otherwise indicated, responses should be given by reference to the specific person for whose account the Debentures are being acquired. The Subscriber may be required to provide such further information and execute and deliver such documents as the Company may reasonably request to verify that the Subscriber qualifies as an eligible investor.

| QUALIFIED PURCHASER STATUS |

I understand that to purchase Debentures, I must either (1) be an “accredited investor,” as such term is defined in Rule 501 of Regulation D promulgated under the Securities Act or (2) limit my investment in the Debentures to a maximum of (a) 10% of my net worth or annual income, whichever is greater, if I am a natural person or (b) 10(% of my revenues or net assets, which is greater, for my most recently completed fiscal year, if I am a non-natural person.I also understand that if I qualify under clause (2) above, I do not need to be an “accredited investor” in order to participate in the Offering.

I understand that if I am a natural person I should determine my net worth for purposes of these representations by calculating the difference between my total assets and total liabilities. I understand this calculation must exclude the value of my primary residence and any indebtedness secured by my primary residence (up to an amount equal to the value of my primary residence). In the case of fiduciary accounts, net worth and/or income suitability requirements may be satisfied by the beneficiary of the account or by the fiduciary, if the fiduciary directly or indirectly provides funds for the purchase of the Debentures.

I hereby represent and warrant that I meet the qualifications to purchase Debentures because (please mark one):

__ I am a natural person, and the aggregate purchase price for the Debentures I am purchasing in the Offering does not exceed 10% of my net worth or annual income, whichever is greater.

__ I am a non-natural person, and the aggregate purchase price for the Debentures I am purchase in this Offering does not exceed 10% of my revenues or net assets, whichever is greater for my most recently completed fiscal year.

__ I am an accredited investor.

If you marked that you are an accredited investor, please identify which of the categories of “accredited investor” applies to you by checking the appropriate box below.

Subscriber Information Form

| ACCREDITED INVESTOR STATUS |

If you checked the “accredited investor” box above, please indicate under which of the following tests you qualify. (Please checkall that apply.)

FOR NATURAL PERSONS:

| ¨ | The Subscriber is anatural personwhose individual net worth, or joint net worth with that person's spouse, at the time of purchase exceeds $1,000,000,excluding the value of the Subscriber’s primary residence.1 |

| ¨ | The Subscriber is anatural person with individual income (without including any income of the Subscriber’s spouse) in excess of $200,000 or joint income with that person’s spouse of $300,000, in each of the two most recent years and who reasonably expects to reach the same income level in the current year. |

FOR ENTITIES:

| ¨ | The Subscriber is anentitywith total assets in excess of $5,000,000 that was not formed for the purpose of investing in the Debentures and is one of the following: |

| ¨ | a limited liability company; |

| ¨ | a tax-exempt organization described in Section 501(c)(3) of the Code. |

| ¨ | The Subscriber is a personal (non-business) trust, other than an employee benefit trust, with total assets in excess of $5,000,000 that was not formed for the purpose of investing in the Debentures and whose decision to invest in the Debentures has been directed by a person who has such knowledge and experience in financial and business matters that he is capable of evaluating the merits and risks of the investment. |

| ¨ | The Subscriber is an employee benefit plan within the meaning of Title I of ERISA, (including an individual retirement account) which satisfies at least one of the following conditions: |

| ¨ | it has total assets in excess of $5,000,000; |

| ¨ | the investment decision is being made by a plan fiduciary that is a bank, savings and loan association, insurance company or registered investment adviser; or |

| ¨ | it is a self-directed plan (i.e., a tax-qualified defined contribution plan in which a participant may exercise control over the investment of assets credited to his or her account) and the decision to invest is made by those participants investing, and each such participant qualifies as an accredited investor. |

| 1 | An individual need not deduct from his or her net worth the amount of mortgage debt secured by an excluded primary residence, except to the extent that the amount of the mortgage liability exceeds the fair value of the residence. |

Subscriber Information Form

| ¨ | The Subscriber is an employee benefit plan established and maintained by a state, its political subdivisions or any agency or instrumentality of a state or its political subdivisions, that has total assets in excess of $5,000,000. |

| ¨ | The Subscriber is licensed, or subject to supervision, by federal or state examining authorities such as a “bank,” “savings and loan association,” “insurance company,” or “small business investment company” (as such terms are used and defined in 17 CFR §230.501(a)) or is an account for which a bank or savings and loan association is subscribing in a fiduciary capacity. |

| ¨ | The Subscriber is registered with the Securities and Exchange Commission as a broker or dealer or an investment company; or has elected to be treated or qualifies as a “business development company” (within the meaning of Section 2(a)(48) of the Investment Company Act of 1940, as amended (the “Investment Company Act”), or Section 202(a)(22) of the Investment Advisers Act of 1940, as amended). |

| ¨ | The Subscriber is an entity in whichall of the equity owners are persons described above. |

Subscriber Information Form

Hall Structured Finance II, LLC

Subscription Agreement

Hall Structured Finance II, LLC

2323 Ross Avenue, Suite 200

Dallas, Texas 75201

Attention: Mark Blocher

Ladies and Gentlemen:

(a) The undersigned (the “Subscriber”) hereby acknowledges having (i) received and read the current Offering Circular, as supplemented from time to time (the “Offering Circular”), of Hall Structured Finance II, LLC, a Texas limited liability company (the “Company”), and the Debenture Purchase Agreement, the form of which is attached asExhibit A thereto (the “DebenturePurchase Agreement”) (ii) been given the opportunity to (A) ask questions of, and receive answers from, the Company or one of its affiliates, concerning the terms and conditions of the offering and other matters pertaining to an investment in the 8% Debentures (as defined in the Offering Circular, the “Debentures”) of the Company and (B) obtain any additional information that the Company can acquire without unreasonable effort or expense that is necessary to evaluate the merits and risks of an investment in the Debentures. Any terms not defined herein shall have the meanings ascribed such terms in the Offering Circular.

(b) Appendix A hereto contains the definitions of certain capitalized terms used but not otherwise defined herein and should be read by the Subscriber prior to entering into this Subscription Agreement.

| 2. | Subscription Commitment |

(a) The Subscriber hereby irrevocably subscribes for a Debenture in the aggregate principal amount set forth on the signature page hereto and agrees to contribute such amount in cash as set forth in the Purchase Agreement. Such amount shall be payable in full in readily available funds by wire transfer to the bank account of the Company on or before the business day prior to the proposed date of subscription or by check to the address noted in the Delivery Instructions section.

(b) The Subscriber understands that this subscription is not binding on the Company until accepted by the Company, and may be rejected, in whole or in part, by the Company in its absolute discretion. If and to the extentrejected, the Company shall return to the Subscriber, without interest or deduction, any payment tendered by the Subscriber, and the Company and the Subscriber shall have no further obligation to each other hereunder.

| 3. | Representations, Warranties and Covenants – All Investors |

To induce the Company to accept this subscription, the Subscriber hereby makes the following representations,warrantiesand covenants to the Company:

(a) The information set forth in the subscriber information form attached hereto, which shall be considered an integral part of this Subscription Agreement (the “Subscriber Information Form”), including, without limitation, the information furnished by the Subscriber to the Company regarding whether Subscriber qualifies as (i) an “accredited investor” as that term is defined in Rule 501 under Regulation D promulgated under the Securities Act of 1933, as amended (the “Securities Act”) and/or (ii) a “qualified purchaser” as that term is defined in Regulation A promulgated under the Securities Act, is accurate and complete as of the date hereof, and the Subscriber will promptly notify the Company of any change in such information. The Subscriber consents to the disclosure of any such information, and any other information furnished to the Company, to any governmental authority, or self-regulatory organization or, to the extent required by law or deemed (subject to applicable law) by the Company to be in the best interest of the Company, to any other person.

Subscription Agreement

(b) Except as disclosed in the accompanying Subscriber Information Form, the Subscriber is acquiring the Debentures for the Subscriber’s own account, does not have any contract, undertaking or arrangement with any person or entity to sell, transfer or grant a participation with respect to any of the Debentures, and is not acquiring the Debentures with a view to or for sale in connection with any distribution of the Debentures.

(c) The Subscriber or an advisor or consultant relied upon by the Subscriber in reaching a decision to subscribe has such knowledge and experience in financial, tax and business matters as to enable the Subscriber or such advisor or consultant to evaluate the merits and risks of an investment in the Debentures (including the risks set forth in the Offering Circular) and to make an informed investment decision with respect thereto.

(d) In formulating a decision to invest in the Debentures, the Subscriber has not relied or acted on the basis of any representations or other information purported to be given on behalf of the Company except as set forth in the Offering Circular (it being understood that no person has been authorized by the Company to furnish any such representations or other information).

(e) If the Subscriber is a natural person, the Subscriber is qualified to purchase the Debentures and has the legal capacity to execute, deliver and perform this Subscription Agreement and the Purchase Agreement.

(f) If the Subscriber is a corporation, partnership, limited liability company, trust or other entity, it has the requisite power and authority to execute and deliver this Subscription Agreement and the Purchase Agreement and perform its obligations set forth herein and therein, including, without limitation, to purchase the Debentures; the person signing this Subscription Agreement on behalf of such entity has been duly authorized by such entity to do so; and this Subscription Agreement has been duly executed and delivered on behalf of the Subscriber and is the valid and binding agreement of the Subscriber, enforceable against the Subscriber in accordance with its terms. In addition, such Subscriber will, upon request of the Company, deliver any documents, including an opinion of counsel to the Subscriber, evidencing the existence of the Subscriber, the legality of an investment in the Debentures and the authority of the person executing this Subscription Agreement on behalf of the Subscriber which may be requested by the Company.

(g) The Subscriber has carefully reviewed and understands the various risks of an investment in the Debentures, including, without limitation, the risks set forth under the caption “Risk Factors” set forth in the Offering Circular, as well as the fees and conflicts of interest to which the Company is subject, as set forth therein. The Subscriber hereby consents and agrees to the payment of the fees so described to the parties identified as the recipients thereof, and to such conflicts of interest.

(h) The Subscriber represents and warrants that no holder of any beneficial interest in the Debentures (each a “Beneficial Interest Holder”) and, in the case of a Subscriber which is an entity, no Related Person is:

| (1) | A person or entity whose name appears on the List of Specially Designated Nationals and Blocked Persons maintained by the Office of Foreign Asset Control from time to time; |

| (2) | A Foreign Shell Bank; or |

| (3) | A person or entity resident in or whose subscription funds are transferred from or through an account in a Non-Cooperative Jurisdiction. |

TheSubscriber agrees promptly to notify the Company or the person appointed by the Company to administer its anti-money laundering program, if applicable, of any change in information affecting this representation and covenant.

(i) The Subscriber represents that (except as otherwise disclosed to the Company in writing):

| (1) | Neither it, any Beneficial Interest Holder nor any Related Person (in the case of a Subscriber that is an entity) is a Senior Foreign Political Figure, any member of a Senior Foreign Political Figure’s Immediate Family or any Close Associate of a Senior Foreign Political Figure; |

Subscription Agreement

| (2) | Neither it, any Beneficial Interest Holder nor any Related Person (in the case of a Subscriber that is an entity) is resident in, or organized or chartered under the laws of, a jurisdiction that has been designated by the Secretary of the Treasury under Section 311 or 312 of the USA PATRIOT Act as warranting special measures due to money laundering concerns; |

| (3) | Its subscription funds do not originate from, nor will they be routed through, an account maintained at a Foreign Shell Bank, an “offshore bank,” or a bank organized or chartered under the laws of a Non-Cooperative Jurisdiction. |

(j) The Subscriber acknowledges and agrees that any amounts paid to it will be paid to the same account from which its subscription funds were originally remitted, unless the Company agrees otherwise.

(k) If the Subscriber is purchasing the Debentures as agent, representative, intermediary/nominee or in any similar capacity for any other person, or is otherwise requested to do so by the Company, it shall provide a copy of its anti-money laundering policies (“AML Policies”) to the Company. The Subscriber represents that it is in compliance with its AML Policies, its AML Policies have been approved by counsel or internal compliance personnel have been reasonably informed of anti-money laundering policies and their implementation, and it has not received a deficiency letter, negative report or any similar determination regarding its AML Policies from independent accountants, internal auditors or some other person responsible for reviewing compliance with its AML Policies.

(l) The Subscriber is able to bear the economic risk of this investment and, without limiting the generality of the foregoing, is able to hold this investment for an indefinite period of time. The Subscriber has adequate means to provide for the Subscriber’s current needs and personal contingencies and has a sufficient net worth to sustain the loss of the Subscriber’s entire investment in the Company.

(m) The amount of Debentures being purchased by the Subscriber does not exceed 10% of the greater of the Subscriber’s annual income or net worth (for natural persons), or 10% of the greater of Subscriber’s annual revenue or net assets at fiscal year-end (for non-natural persons).

(n) The Subscriber has had an opportunity to ask questions of the Company or anyone acting on its behalf and to receive answers concerning the terms of this Subscription Agreement, the Debenture Purchase Agreement and the Debentures, as well as about the Company and its business generally, and to obtain any additional information that the Company possesses or can acquire without unreasonable effort or expense, that is necessary to verify the accuracy of the information contained in this Subscription Agreement. Further, all such questions have been answered to the full satisfaction of the Subscriber.

(o) The Subscriber agrees to provide any additional documentation the Company may reasonably request, including documentation as may be required by the Company to form a reasonable basis that the Subscriber qualifies as an “accredited investor” as that term is defined in Rule 501 under Regulation D promulgated under the Securities Act, or otherwise as a “qualified purchaser” as that term is defined in Regulation A promulgated under the Securities Act, or as may be required by the securities administrators or regulators of any state, to confirm that the Subscriber meets any applicable minimum financial suitability standards and has satisfied any applicable maximum investment limits.

(p) The Subscriber understands that no state or federal authority has scrutinized this Subscription Agreement or the Debentures offered pursuant hereto, has made any finding or determination relating to the fairness for investment of the Debentures, or has recommended or endorsed the Debentures, and that the Debentures have not been registered or qualified under the Securities Act or any state securities laws, in reliance upon exemptions from registration thereunder.

(q) The Subscriber understands that the Manager has not been registered under the Investment Company Act of 1940. In addition, the Subscriber understands that the Manager is not registered as an investment adviser under the Investment Advisers Act of 1940, as amended.

Subscription Agreement

(r) The Subscriber is subscribing for and purchasing the Debentures without being furnished any offering literature, other than the Offering Circular, the Purchase Agreement and this Subscription Agreement, and such other related documents, agreements or instruments as may be attached to the foregoing documents as exhibits or supplements thereto, or as the Subscriber has otherwise requested from the Company in writing, and without receiving any representations or warranties from the Company or its agents and representatives other than the representations and warranties contained in said documents, and is making this investment decision solely in reliance upon the information contained in said documents and upon any investigation made by the Subscriber or Subscriber’s advisors.

(s) The Subscriber represents and warrants that the execution and delivery of this Subscription Agreement, the consummation of the transactions contemplated thereby and hereby and the performance of the obligations thereunder and hereunder will not conflict with or result in any violation of or default under any provision of any other agreement or instrument to which the Subscriber is a party or any license, permit, franchise, judgment, order, writ or decree, or any statute, rule or regulation, applicable to the Subscriber. The Subscriber confirms that the consummation of the transactions envisioned herein, including, but not limited to, the Subscriber’s Purchase, will not violate any foreign law and that such transactions are lawful in the Subscriber’s country of citizenship and residence.

| 4. | Representations, Warranties and Covenants – ERISA Investors |

If the Subscriber is, or is acting on behalf of, an employee benefit plan (a “Plan”) which is subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), or Section 4975 of the Internal Revenue Code of 1986, as amended (the “Code”), to induce the Company to accept this subscription, the Subscriber hereby makes the following additional representations, warranties and covenants to the Company:

(a) The person executing this Subscription Agreement on behalf of the Subscriber either is a “named fiduciary” (within the meaning of ERISA) of the Subscriber, or is acting on behalf of a named fiduciary of the Subscriber pursuant to a proper delegation of authority.

(b) The person executing this Subscription Agreement on behalf of the Subscriber represents and warrants on behalf of such person or the Subscriber, as applicable, as follows:

| (1) | The Subscriber is (w) an employee benefit plan subject to the fiduciary provisions of ERISA, (x) a “plan” subject to Section 4975 of the Code, (y) an entity that otherwise constitutes a “benefit plan investor” within the meaning of any Department of Labor regulation promulgated under Section 3(42) of ERISA (a party described in (w), (x) or (y) is referred to as a “Plan”) or (z) any entity whose underlying assets include “plan assets” for purposes of ERISA by reason of a Plan’s investment in the Subscriber (a “Plan Asset Entity”). |

| (2) | The execution and delivery of this Subscription Agreement and the consummation of the transactions contemplated hereunder, and in the Offering Circular and the Debenture Purchase Agreement will not result in a breach or violation of any charter or organizational documents pursuant to which the Subscriber was formed, or any statute, rule, regulation or order of any court or governmental agency or body having jurisdiction over the Subscriber or any of its assets, or in any material respect, any mortgage, indenture, contract, agreement or instrument to which the Subscriber is a party or otherwise subject. |

| (3) | The investment in the Debentures is permitted by the documents of the Subscriber and such documents permit the Subscriber to invest in entities that will engage in the investment program described in the Offering Circular. |

Subscription Agreement

(c) The Subscriber is not in any way affiliated with (i.e., does not own or control, is not owned or controlled by, nor is under common ownership or control with) any person or entity which will receive compensation, directly or indirectly, from the Company, as specifically identified and described in the Offering Circular.

(d) The Subscriber acknowledges and agrees that the decision to invest in the Debentures and the review of the terms of the Debentures must be made solely and independently by a fiduciary of the Subscriber who has no affiliation with the Company or any of its affiliates or employees, without relying on any recommendation of the Company or any of its affiliates or employees as a primary basis for its decision.

(e) The appropriate fiduciaries of the Subscriber have considered the investment in light of the risks relating thereto and fiduciary responsibility provisions of ERISA applicable to the Subscriber and have determined that, in view of such considerations, the investment is appropriate for the Subscriber and is consistent with such fiduciaries’ responsibilities under ERISA, and the appropriate fiduciaries: (i) are responsible for the Subscriber’s decision to invest in the Debentures, including the determination that such investment is consistent with the requirement imposed by Section 404 of ERISA that employee benefit plan investments be diversified so as to minimize the risk of large losses; (ii) are independent of the Company and any of its affiliates and employees and of any person or entity that will receive compensation, whether directly or indirectly, from the Company, as specifically identified and described in the Offering Circular; (iii) are qualified and authorized to make such investment decision; and (iv) in making such decision, have not relied on the recommendation of the Company or any of its affiliates or employees.

(f) The Subscriber through the appropriate fiduciaries has been given the opportunity to discuss the Subscriber’s investment in the Debentures, and the structure and operation of the Company with the Company and has been given all information that the Subscriber or the appropriate fiduciaries have requested and which the Subscriber or the appropriate fiduciaries deemed relevant to the Subscriber’s decision to purchase the Debentures.

5. Representations, Warranties and Covenants – Insurance Company General Account and Plan Asset Entity Investors

(a) If the Subscriber is acquiring the Debentures with the assets of the general account of an insurance company, the Subscriber represents, warrants and covenants that on each day the Subscriber owns the Debentures either (i) the assets of such general account are not considered to be plan assets within the meaning of Department of Labor Regulations Section 2510.3-101 or Department of Labor regulations issued pursuant to Section 401(c)(1)(A) of ERISA, or (ii) the execution and delivery of this Subscription Agreement, and the acquisition and redemption of the Debentures, is exempt from the prohibited transaction rules of Section 406(a) of ERISA and Section 4975(c)(1)(A) (D) of the Code by virtue of Department of Labor Prohibited Transaction Class Exemption 95-60 or some other exemption of such rules.

(b) By signing this Subscription Agreement, each Subscriber that is either a Plan Asset Entity or using the assets of an insurance company general account hereby covenants that if, after its initial acquisition of the Debentures, at any time during any calendar month the percentage of the assets of such general account (as reasonably determined by the Subscriber) or Plan Asset Entity, as applicable, that constitute “plan assets” for purposes of Title I of ERISA or Section 4975 of the Code exceeds the maximum percentage limit specified by the Subscriber in Question 2(d) of Section III of the Subscriber Information Form, then such Subscriber shall promptly notify the Company of such occurrence and the Company may require the Subscriber to withdraw or dispose of all or a portion of the Debentures held in such general account or by such Plan Asset Entity, as applicable, by the end of the next following calendar month (or such other time as maybe determined by the Company).

6. Indemnification

The Subscriber understands the meaning and legal consequences of the representations, warranties, agreements, covenants and confirmations set out above and agrees that the subscription made hereby, if accepted by the Company, will be accepted in reliance thereon. The Subscriber agrees to indemnify and hold harmlessthe Company and its affiliates, and the partners, members, managers, stockholders, other beneficial owners, officers, directors and employees of any of the foregoing (the “Indemnified Persons”)from and against any and all loss, damage, liability or expense, including reasonable costs and attorneys’ fees and disbursements, which an Indemnified Person may incur by reason of, or in connection with, any representation or warranty made herein (or in the accompanying Subscriber Information Form) not having been true when made, any misrepresentation made by the Subscriber or any failure by the Subscriber to fulfill any of the covenants or agreements set forth herein, in the Subscriber Information Form or in any other document provided by the Subscriber to the Company.

Subscription Agreement

7. Miscellaneous

(a) The Subscriber agrees that neither this Subscription Agreement, nor any of the Subscriber’s rights or interest herein or hereunder, is transferable or assignable by the Subscriber, and further agrees that the transfer or assignment of any Debentures acquired pursuant hereto shall be made only (i) with the prior written consent of the Company and (ii) in accordance with the provisions hereof, the Indenture and all applicable laws.

(b) The Subscriber agrees that, except as permitted by applicable law, it may not cancel, terminate or revoke this Subscription Agreement or any agreement of the Subscriber made hereunder, and that this Subscription Agreement shall survive the death or legal disability of the Subscriber and shall be binding upon the Subscriber’s heirs, executors, administrators, successors and assigns.

(c) All of the representations, warranties, covenants, agreements, indemnities and confirmations set out above and in the Subscriber Information Form shall survive the acceptance of the subscription made herein and the issuance of the Debentures.

(d) This Subscription Agreement together with the Subscriber Information Form constitutes the entire agreement between the parties hereto with respect to the subject matter hereof and may be amended only by a writing executed by both parties.

(e) Within ten (10) days after receipt of a written request therefor from the Company, the Subscriber agrees to provide such information and to execute and deliver such documents as the Company may deem reasonably necessary to comply with any and all laws and ordinances to which the Company is or may be subject.

(f) The Subscriber agrees to keep confidential, and not to make any use of (other than for purposes reasonably related to its investment in the Debentures) or disclose to any person, any information or matter relating to the Company and its affairs and any information or matter related to any investment of the Company (other than disclosure to the Subscriber’s authorized representatives); provided that (i) the Subscriber may make such disclosure to the extent that (x) the information to be disclosed is publicly known at the time of proposed disclosure by the Subscriber, (y) the information otherwise is or becomes legally known to the Subscriber other than through disclosure by the Company or the Subscriber, or (z) such disclosure is required by law or in response to any governmental agency request or in connection with an examination by any regulatory authority; provided that such agency, regulatory authority or association is aware of the confidential nature of the information disclosed; (ii) the Subscriber may make such disclosure to its Beneficial Interest Holders to the extent required under the terms of its arrangements with such persons; and (iii) the Subscriber will be permitted, after written notice to the Company, to correct any false or misleading information that becomes public concerning the Subscriber’s relationship to the Company. Prior to making any disclosure required by law, the Subscriber shall use its best efforts to notify the Company of such disclosure. Prior to any disclosure to any authorized representative or Beneficial Interest Holder, the Subscriber shall advise such persons of the confidentiality obligations set forth herein and each such person shall agree to be bound by such obligations. Notwithstanding the foregoing, the Subscriber may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of an investment in the Debentures and all materials of any kind (including opinions or other tax analyses) that are provided in connection with this Subscription Agreement to the Subscriber relating to such tax treatment or tax structure.

Subscription Agreement

8. Notices

Any notice required or permitted to be given to the Subscriber in relation to the Company shall be sent to the address specified in Part A, Section I. of the Subscriber Information Form or to such other address as the Subscriber designates by written notice received by the Company.

9. Governing Law

This Subscription Agreement shall be governed by the laws of the State of Texas.

[SIGNATURE PAGE FOLLOWS]

Subscription Agreement

SIGNATURE PAGE

(Complete and sign)

By signing below, the Subscriber (1) confirms that the information contained in the Subscriber Information Form is accurate and complete and (2) agrees to the terms of the Subscription Agreement and the Debenture Purchase Agreement.

| Dated: ___________, 20__ | Amount of Subscription | |

| | | | |

| | US$ | | |

| | | Issued in increments of $5,000 | |

| | Name of Subscriber | |

| | | |

| | Signature | |

| | | |

| | Name and title or representative

capacity, if applicable | |

| | Name of Spouse | |

| | (if a natural person and purchasing jointly) | |

| | | |

| | Signature of Spouse | |

| | (if a natural person and purchasing jointly) | |

The Subscriber’s subscription is accepted, subject to the provisions of the Subscription Agreement and the Purchaser Agreement.

| | HALL STRUCTURED FINANCE II, LLC |

| | | |

| | By: | |

| | Name: | |

| | Title: | |

Dated: _____________, 20___

Signature Page

APPENDIX a

Definitions

Close Associate: With respect to a Senior Foreign Political Figure, a person who is widely and publicly known internationally to maintain an unusually close relationship with the Senior Foreign Political Figure; includes a person who is in a position to conduct substantial domestic and international financial transactions on behalf of the Senior Foreign Political Figure.

FATF: The Financial Action Task Force on Money Laundering.

Foreign Bank: An organization that (a) is organized under the laws of a country outside the United States; (b) engages in the business of banking; (c) is recognized as a bank by the bank supervisory or monetary authority of the country of its organization or principal banking operations; (d) receives deposits to a substantial extent in the regular course of its business; and (e) has the power to accept demand deposits, but does not include the U.S. branches or agencies of a foreign bank.

Foreign Shell Bank: A Foreign Bank without a Physical Presence in any country; does not include a Regulated Affiliate.

Government Entity: Any government or any state, department or other political subdivision thereof, or any governmental body, agency, authority or instrumentality in any jurisdiction exercising executive, legislative, regulatory or administrative functions of or pertaining to government.

Immediate Family: With respect to a Senior Foreign Political Figure, typically includes the political figure’s parents, siblings, spouse, children and in-laws.

Non-Cooperative Jurisdiction: Any foreign country or territory that has been designated as non-cooperative with international anti-money laundering principles or procedures by an intergovernmental group or organization, such as FATF, of which the United States is a member and with which designation the United States representative to the group or organization continues to concur. See http://www1.oecd.org/fatf/NCCT_en.htm for FATF’s list ofnon-cooperative countries and territories.

Physical Presence: A place of business that is maintained by a Foreign Bank and is located at a fixed address, other than solely a post office box or an electronic address, in a country in which the Foreign Bank is authorized to conduct banking activities, at which location the Foreign Bank: (a) employs one or more individuals on a full-time basis; (b) maintains operating records related to its banking activities; and (c) is subject to inspection by the banking authority that licensed the Foreign Bank to conduct banking activities.

Publicly Traded Company: An entity whose securities are listed on a recognized securities exchange or quoted on an automated quotation system in the U.S. or country other than a Non-Cooperative Jurisdiction or a wholly-owned subsidiary of such an entity.

Qualified Plan: A tax qualified pension or retirement plan in which at least 100 employees participate that is maintained by an employer that is organized in the U.S. or is a U.S. Government Entity.

Regulated Affiliate: A Foreign Shell Bank that: (a) is an affiliate of a depository institution, credit union, or Foreign Bank that maintains a Physical Presence in the U.S. or a foreign country, as applicable; and (b) is subject to supervision by a banking authority in the country regulating such affiliated depository institution, credit union, or Foreign Bank.

Related Person: With respect to any entity, any interest holder, director, senior officer, trustee, beneficiary or grantor of such entity; provided that in the case of an entity that is a Publicly Traded Company or a Qualified Plan, the term “Related Person” shall exclude any interest holder holding less than 5% of any class of securities of such Publicly Traded Company and beneficiaries of such Qualified Plan.

Senior Foreign Political Figure: A senior official in the executive, legislative, administrative, military or judicial branches of a non-U.S. government (whether elected or not), a senior official of a major non-U.S. political party, or a senior executive of a non-U.S. government-owned Company. In addition, a Senior Foreign Political Figure includes any Company, business or other entity that has been formed by, or for the benefit of, a Senior Foreign Political Figure.

USA PATRIOT Act: The Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism (USA PATRIOT Act) Act of 2001 (Pub. L. No. 107-56).

APPENDIX B

W-9

(See Attached)

Form W-9 Print or type see specific instructions on page 2. (Rev. october 2007) Department of the Treasury Internal revenue service Request for Taxpayer Identification Number and Certification Give form to the requester. Do not send to the IRS. Name (as shown on your Income tax return) Business name, if different from above Check appropriate box:¨individual sole proprietor¨Corporation¨Partnership¨Limited liability company. Enter the tax classification (D-disregarded entity, C-corporation, P-partnership)¨other (see instruction) Exempt payee Address (number, street and apt. or suite no.) Requester's name and address (optional) City, state, and ZIP code List account number(s) here (optional) Part I Taxpayer Identification Number (TIN) Enter your TIN in the appropriate box. The TIN provided must match the name given on Line 1 to avoid backup withholding For individuals, this is your social security number (SSN). However, for a resident Social security number alien, sole proprietor, or disregarded entity, see the Part I instructions on page 3. For other entities, it is your employer identification number (EIN). If you do not have a number, see How to get a TIN on page 3. or Note, If the account is in more than one name, see the chart on page 4 for guidelines on whose number to enter. Employer Identification number Part II Certification Under penalties of perjury, I certify that: 1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and 2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (lRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and 3. I am a U.S. citizen or other U.S. person (defined below). Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply . For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the Certification, but you must provide your correct TIN. See the instructions on page 4. Sign Here Signature of U.S. person Date General Instructions Section references are to the Internal Revenue Code unless otherwise noted. Purpose of Form A person who is required to file an information return with the IRS must obtain your correct taxpayer identification number (TIN) to report, for example, income paid to you, real estate transactions, mortgage interest you paid, acquisition or abandonment of secured proparty, cancellation of debt, or contributions you made to an IRA. Use Form W-9 only if you are a U.S. person (Including a resident alien), to provide your correct TIN to the person requesting it (the requester) and, when applicable, to: 1. Certify that the TIN you are giving is correct (or you are waiting for a number to be issued), 2. Certify that you are not subject to backup withholding, or 3. Claim exemption from backup withholding if you are a U.S. exempt payee. If applicable, you are also certifying that as a U.S. person, your allocable share of any partnership income from a U.S. trade or business is not subject to the withholding tax on foreign partners' share of effectively connected income. Note. If a requester gives you a form other than Form W-9 to request your TIN, you must use the requester’s form if it is substantially similar to this Form W-9. Definition of a U.S. person. For federal tax purposes, you are considered a U.S. person if you are: * An individual who is a U.S. citizen or U.S. resident alien, A partnership, corporation, company, or association created or organized in the United States or under the laws of the United States, * An estate (other than a foreign estate), or * A domestic trust (as defined in Regulations section 301.7701-7). Special rules for partnerships. Partnerships that conduct a trade or business in the United States are generally required to pay a withholding tax on any foreign partners' share of income from such business. Further, in certain cases where a Form W-9 has not been received, a partnership is required to presume that a partner is a foreign person, and pay the withholding tax. Therefore, if you are a U.S. person that is a partner in a partnership conducting a trade or business in the United States, provide Form W-9 to the partnership to establish your U.S. status and avoid withholding on your share of partnership income. The person who gives Form W-9 to the partnership for purposes of establishing its U.S. status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the United States is in the following cases: The U.S. owner of a disregarded entity and not the entity. Cat. NO. 10231X Form W-9 (Rev. 10-2007)

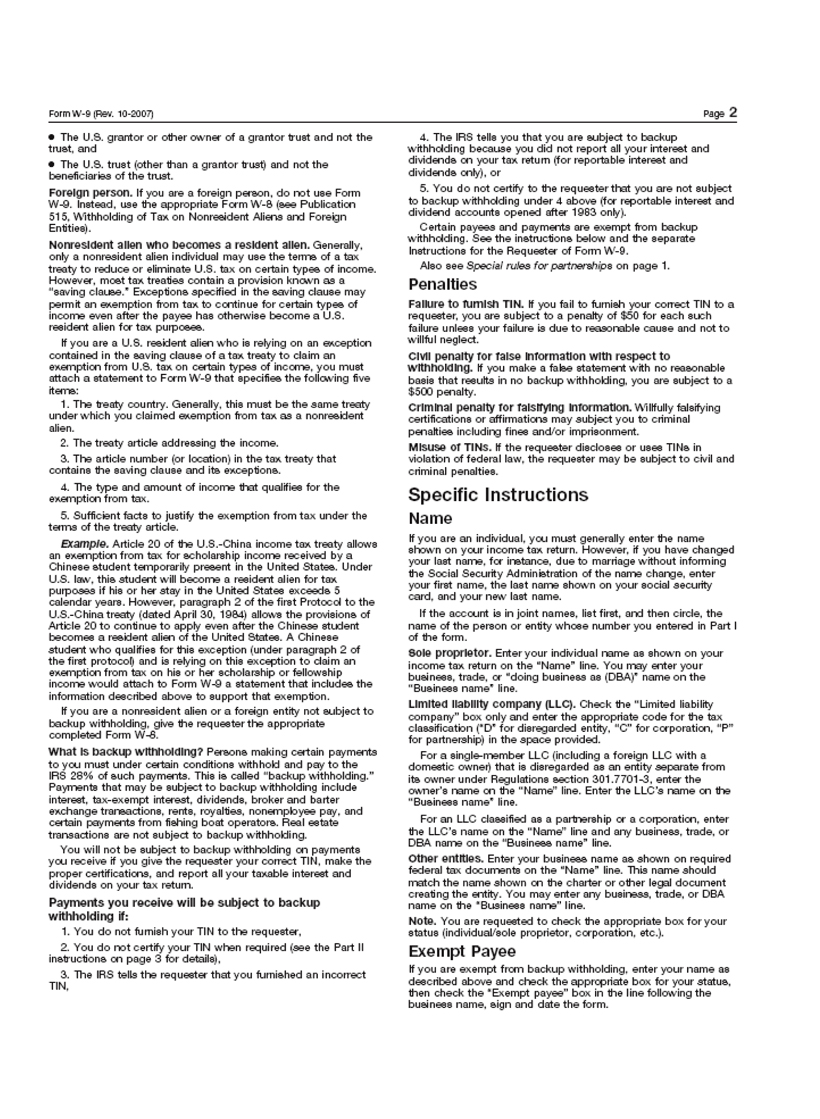

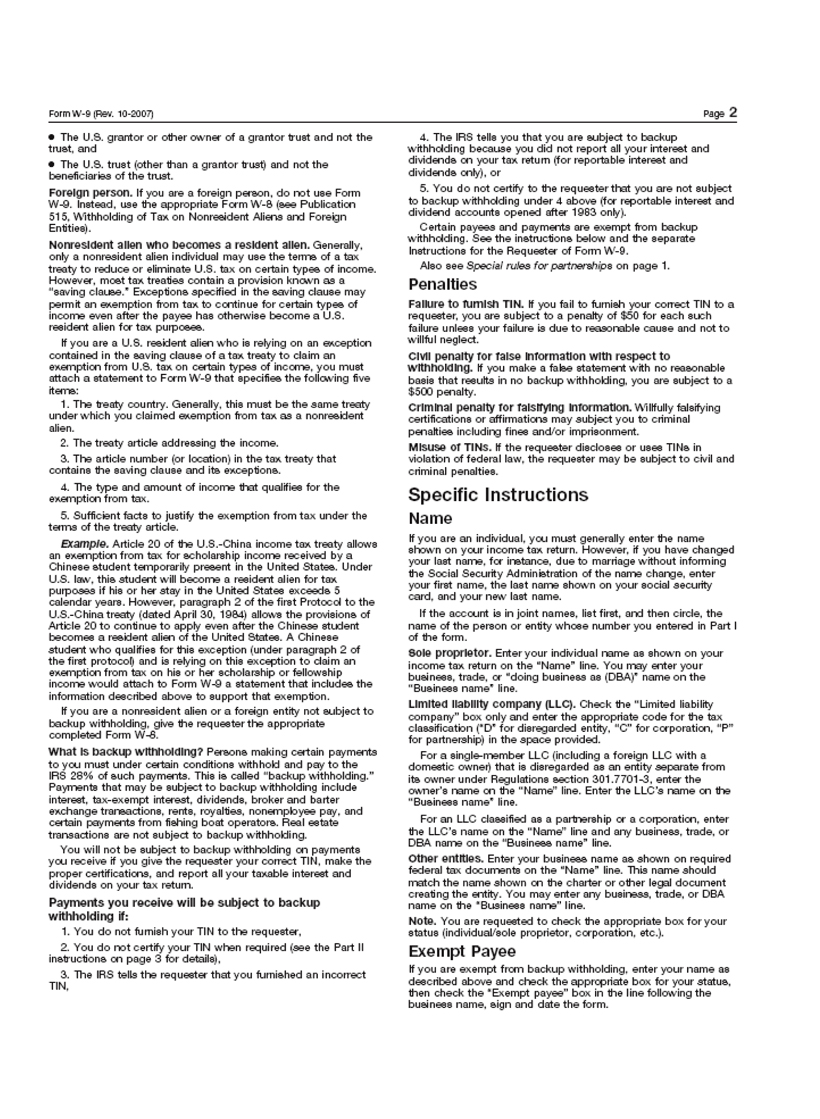

Form W-9 (Rev. 10-2007)· The U.S. grantor or other owner of a grantor trust and not the trust, and· The U.S. trust (other than a grantor trust) and not the beneficiaries of the trust. Foreign person. If you are a foreign person, do not use Form W-9. Instead, use the appropriate Form W-8 (see Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entities). Nonresident alien who becomes a resident alien. Generally, only a nonresident alien individual may use the terms of a tax treaty to reduce or eliminate U.S. tax on certain types of income. However, most tax treaties contain a provision known as a “saving clause.” Exceptions specified in the saving clause may permit an exemption from tax to continue for certain types of income even after the payee has otherwise become a U.S. resident alien for tax purposes. If you are a U.S. resident alien who is relying on an exception contained in the saving clause of a tax treaty to claim an exemption from U.S. tax on certain types of income, you must attach a statement to Form W-9 that specifies the following five items: 1. The treaty country. Generally, this must be the same treaty under which you claimed exemption from tax as a nonresident alien. 2. The treaty article addressing the income. 3. The article number (or location) in the tax treaty that contains the saving clause and its exceptions. 4. The type and amount of income that qualifies for the exemption from tax. 5. Sufficient facts to justify the exemption from tax under the terms of the treaty article. Example. Article 20 of the U.S.-China income tax treaty allows an exemption from tax for scholarship income received by a Chinese student temporarily present in the United States. Under U.S. law, this student will become a resident alien for tax purposes if his or her stay in the United States exceeds 5 calendar years. However, paragraph 2 of the first Protocol to the U.S.-China treaty (dated April 30, 1984) allows the provisions of Article 20 to continue to apply even after the Chinese student becomes a resident alien of the United States. A Chinese student who qualifies for this exception (under paragraph 2 of the first protocol) and is relying on this exception to claim an exemption from tax on his or her scholarship or fellowship income would attach to Form W-9 a statement that includes the information described above to support that exemption. If you are a nonresident alien or a foreign entity not subject to backup withholding, give the requester the appropriate completed Form W-8. What is backup withholding? Persons making certain payments to you must under certain conditions withhold and pay to the IRS 28% of such payments. This is called “backup withholding.” Payments that may be subject to backup withholding include interest, tax-exempt interest, dividends, broker and barter exchange transactions, rents, royalties, nonemployee pay, and certain payments from fishing boat operators. Real estate transactions are not subject to backup withholding. You will not be subject to backup withholding on payments you receive if you give the requester your correct TIN, make the proper certifications, and report all your taxable interest and dividends on your tax return. Payments you receive will be subject to backup withholding if: 1. You do not furnish your TIN to the requester, 2. You do not certify your TIN when required (see the Part II instructions on page 3 for details), 3. The IRS tells the requester that you furnished an incorrect TIN, Page 2 4. The IRS tells you that you are subject to backup withholding because you did not report all your interest and dividends on your tax return (for reportable interest and dividends only), or 5. You do not certify to the requester that you are not subject to backup withholding under 4 above (for reportable interest and dividend accounts opened after 1983 only). Certain payees and payments are exempt from backup withholding. See the instructions below and the separate Instructions for the Requester of Form W-9. Also see Special rules for partnerships on page 1. Penalties Failure to furnish TIN, If you fail to furnish your correct TIN to a requester, you are subject to a penalty of $50 for each such failure unless your failure is due to reasonable cause and not to willful neglect. Civil penalty for false Information with respect to withholding. If you make a false statement with no reasonable basis that results in no backup withholding, you are subject to a $500 penalty. Criminal penalty for falsifying information. Willfully falsifying certifications or affirmations may subject you to criminal penalties including fines and/or imprisonment. Misuse of TINS. If the requester discloses or uses TINs in violation of federal law, the requester may be subject to civil and criminal penalties. Specific Instructions Name If you are an individual, you must generally enter the name shown on your income tax return. However, if you have changed your last name, for instance, due to marriage without informing the Social Security Administration of the name change, enter your first name, the last name shown on your social security card, and your new last name. If the account is in joint names, list first, and then circle, the name of the person or entity whose number you entered in Part I of the form. Sole proprietor. Enter your individual name as shown on your income tax return on the “Name” line. You may enter your business, trade, or “doing business as (DBA)' name on the “Business name' line. Limited liability company (LLC). Check the “Limited liability company” box only and enter the appropriate code for the tax classification (“D” for disregarded entity, “C” for corporation, “P” for partnership) in the space provided. For a single-member LLC (including a foreign LLC with a domestic owner) that is disregarded as an entity separate from its owner under Regulations section 301.7701-3, enter the owner’s name on the “Name” line. Enter the LLC’s name on the “Business name” line. For an LLC classified as a partnership or a corporation, enter the LLC’s name on the “Name” line and any business, trade, or DBA name on the “Business name” line. Other entitles. Enter your business name as shown on required federal tax documents on the “Name” line. This name should match the name shown on the charter or other legal document creating the entity. You may enter any business, trade, or DBA name on the “Business name” line. Note. You are requested to check the appropriate box for your status (individual/sole proprietor, corporation, etc.). Exempt Payee If you are exempt from backup withholding, enter your name as described above and check the appropriate box for your status, then check the “Exempt payee” box in the line following the business name, sign and date the form.

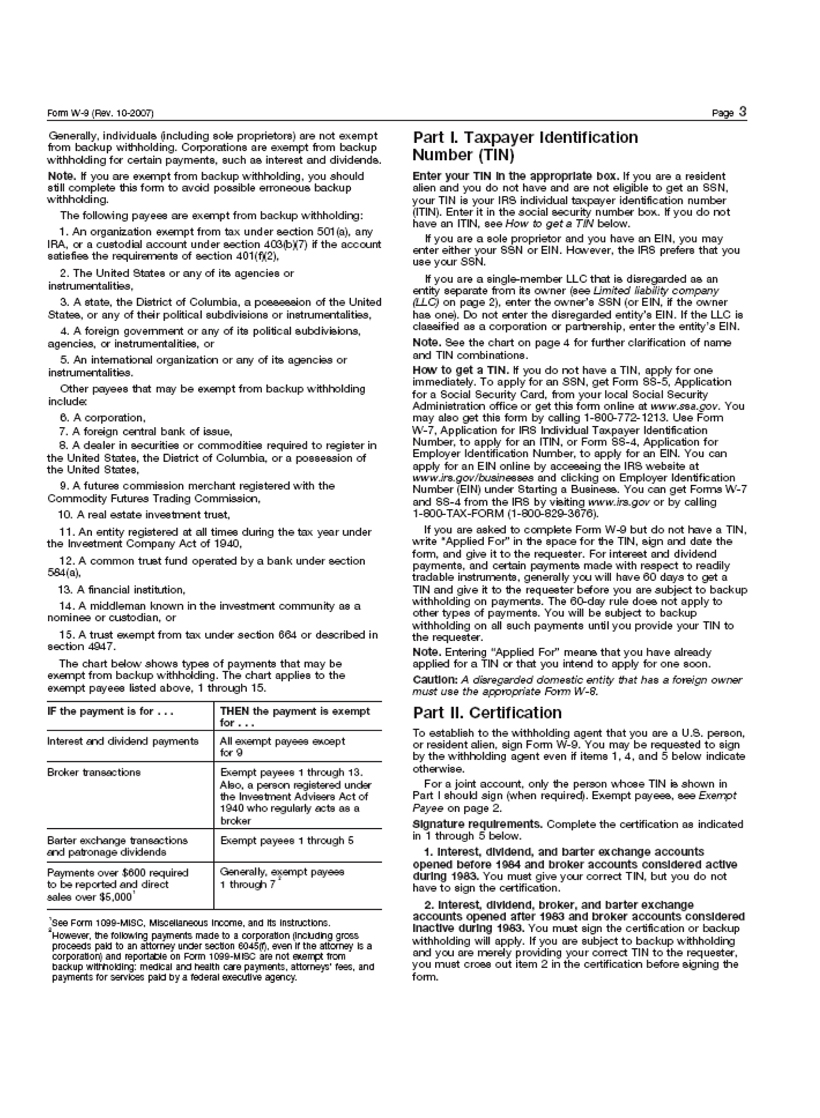

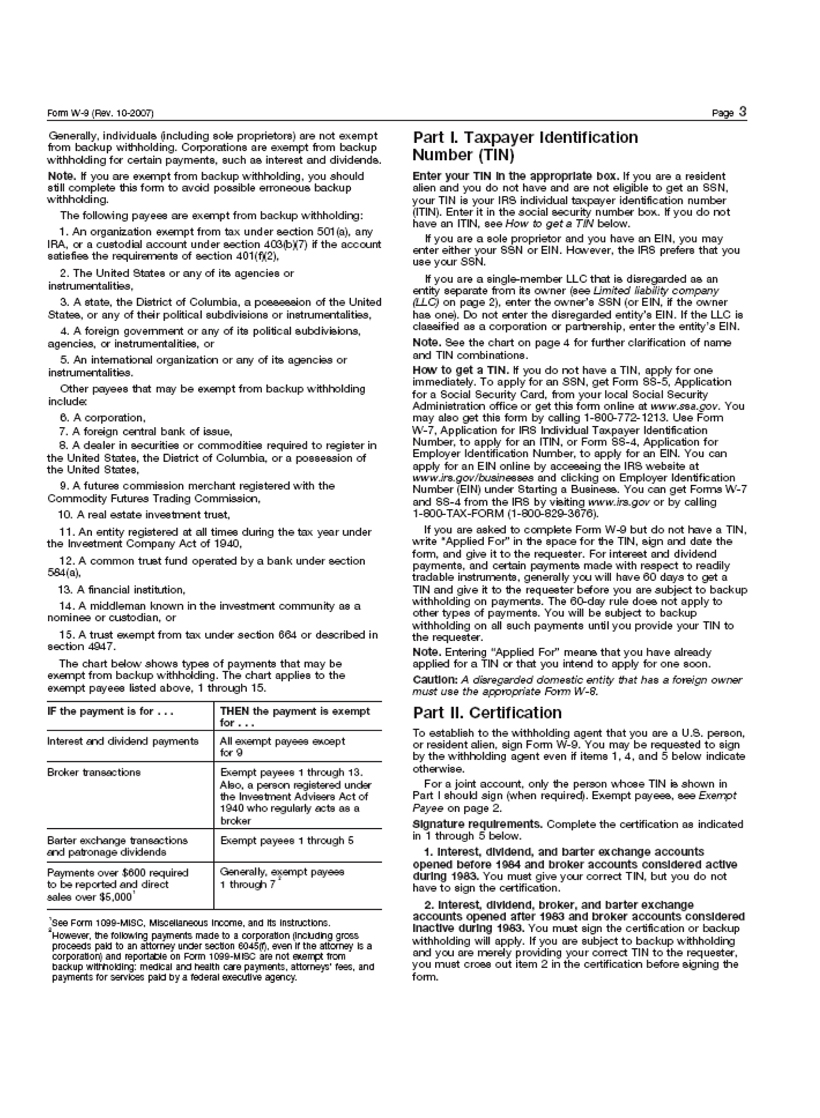

Form W-9 (Rev. 10-2007) Page 3 Generally, individuals (including sole proprietors) are not exempt from backup withholding. Corporations are exempt from backup withholding for certain payments, such as interest and dividends. Note. If you are exempt from backup withholding, you should still complete this form to avoid possible erroneous backup withholding. The following payees are exempt from backup withholding: 1. An organization exempt from tax under section 501(a), any IRA, or a custodial account under section 403(b) (7) if the account satisfies the requirements of section 401(f)(2). 2. The United States or any of its agencies or instrumentalities, 3. A state, the District of Columbia, a possession of the United States, or any of their political subdivisions or instrumentalities, 4. A foreign government or any of its political subdivisions, agencies, or instrumentalities, or 5. An international organization or any of its agencies or instrumentalities. Other payees that may be exempt from backup withholding include: 6. A corporation, 7. A foreign central bank of issue, 8. A dealer in securities or commodities required to register in the United States, the District of Columbia, or a possession of the United States, 9. A futures commission merchant registered with the Commodity Futures Trading Commission, 10. A real estate investment trust, 11. An entity registered at all times during the tax year under the Investment Company Act of 1940, 12. A common trust fund operated by a bank under section 584(a), 13. A financial institution, 14. A middleman known in the investment community as a nominee or custodian, or 15. A trust exempt from tax under section 664 or described in section 4947. The chart below shows types of payments that may be exempt from backup withholding. The chart applies to the exempt payees listed above, 1 through 15. IF the payment is for... THEN the payment is exempt for ... Interest and dividend payments All exempt payees except for 9 Broker transactions Exempt payees 1 through 13. Also, a person registered under the Investment Advisers Act of 1940 who regularly acts as a broker Barter exchange transactions and patronage dividends Exempt payees 1 through 5 Payments over $600 required to be reported and direct sales over $5,0001 Generally, exempt payees 1 through 7 1 See Form 1099-MISC, Miscellaneous income, and its Instructions. 2 However, the following payments made to a corporation (including gross proceeds paid to an attorney under section 6045(f), even if the attorney is a corporation) and reportable on Form 1099-MISC are not exempt from backup withholding: medical and health care payments, attorneys' fees, and payments for services paid by a federal executive agency. Part I. Taxpayer Identification Number (TIN) Enter your TIN In the appropriate box. If you are a resident alien and you do not have and are not eligible to get an SSN, your TIN is your IRS individual taxpayer identification number (ITIN). Enter it in the social security number box. If you do not have an ITIN, see How to get a TIN below. If you are a sole proprietor and you have an EIN, you may enter either your SSN or EIN. However, the IRS prefers that you use your SSN. If you are a single-member LLC that is disregarded as an entity separate from its owner (see Limited liability company (LLC) on page 2), enter the owner's SSN (or EIN, if the owner has one). Do not enter the disregarded entity’s EIN. If the LLC is classified as a corporation or partnership, enter the entity's EIN. Note, See the chart on page 4 for further clarification of name and TIN combinations. How to get a TIN. If you do not have a TIN, apply for one immediately. To apply for an SSN, get Form SS-5, Application for a Social Security Card, from your local Social Security Administration office or get this form online at www.irs.gov. You may also get this form by calling 1-800-772-1213. Use Form W-7, Application for IRS Individual Taxpayer Identification Number, to apply for an ITIN, or Form SS-4, Application for Employer Identification Number, to apply for an EIN. You can apply for an EIN online by accessing the IRS website at www.irs.gov/businesses and clicking on Employer Identification Number (EIN) under Starting a Business. You can get Forms W-7 and SS-4 from the IRS by visiting www.irs.gov or by calling 1-800-TAX-FORM (1-800-829-3676). If you are asked to complete Form W-9 but do not have a TIN, write “Applied For” in the space for the TIN, sign and date the form, and give it to the requester. For interest and dividend payments, and certain payments made with respect to readily tradable instruments, generally you will have 60 days to get a TIN and give it to the requester before you are subject to backup withholding on payments. The 60-day rule does not apply to other types of payments. You will be subject to backup withholding on all such payments until you provide your TIN to the requester. Note. Entering "Applied For” means that you have already applied for a TIN or that you intend to apply for one soon. Caution: A disregarded domestic entity that has a foreign owner must use the appropriate Form W-8. Part II. Certification To establish to the withholding agent that you are a U.S. person, or resident alien, sign Form W-9. You may be requested to sign by the withholding agent even if items 1, 4, and 5 below indicate otherwise. For a joint account, only the person whose TIN is shown in Part I should sign (when required). Exempt payees, see Exempt Payee on page 2. Signature requirements. Complete the certification as indicated in 1 through 5 below. 1. interest, dividend, and barter exchange accounts opened before 1964 and broker accounts considered active during 1983. You must give your correct TIN, but you do not have to sign the certification. 2. interest dividend, broker, and barter exchange accounts opened after 1983 and broker accounts considered inactive during 1983. You must sign the certification or backup withholding will apply. If you are subject to backup withholding and you are merely providing your correct TIN to the requester, you must cross out item 2 in the certification before signing the form.

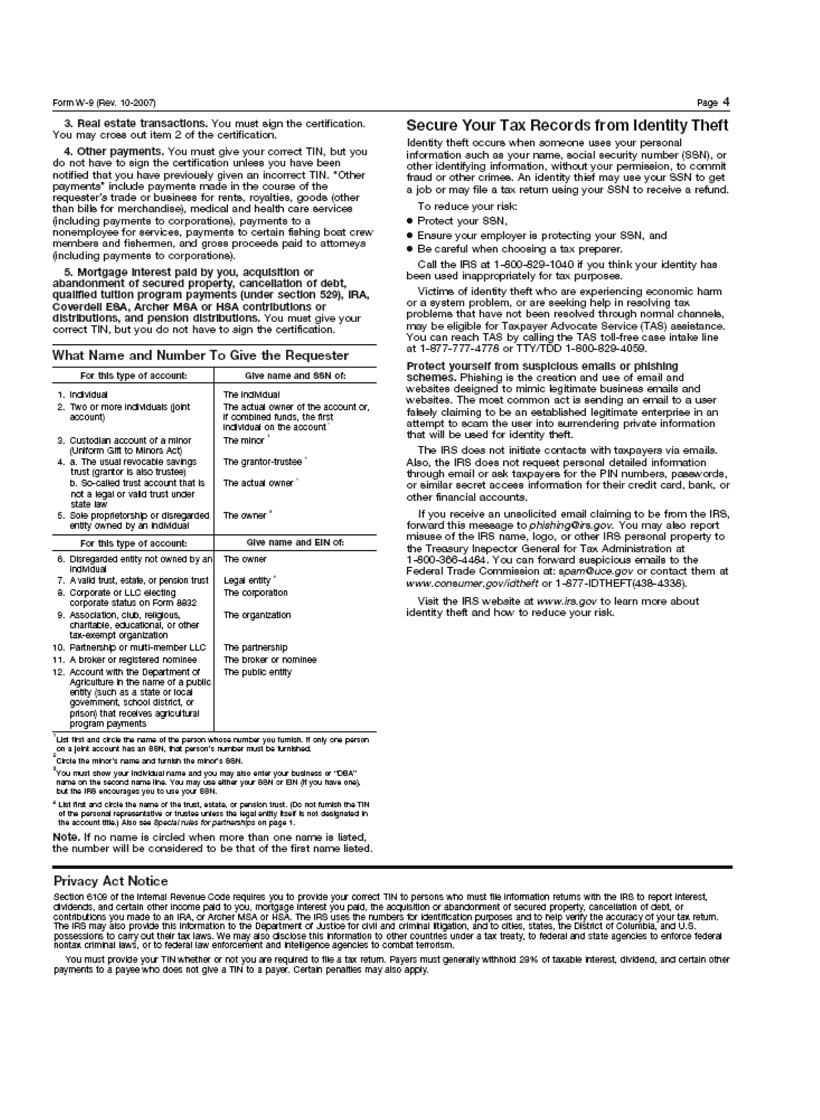

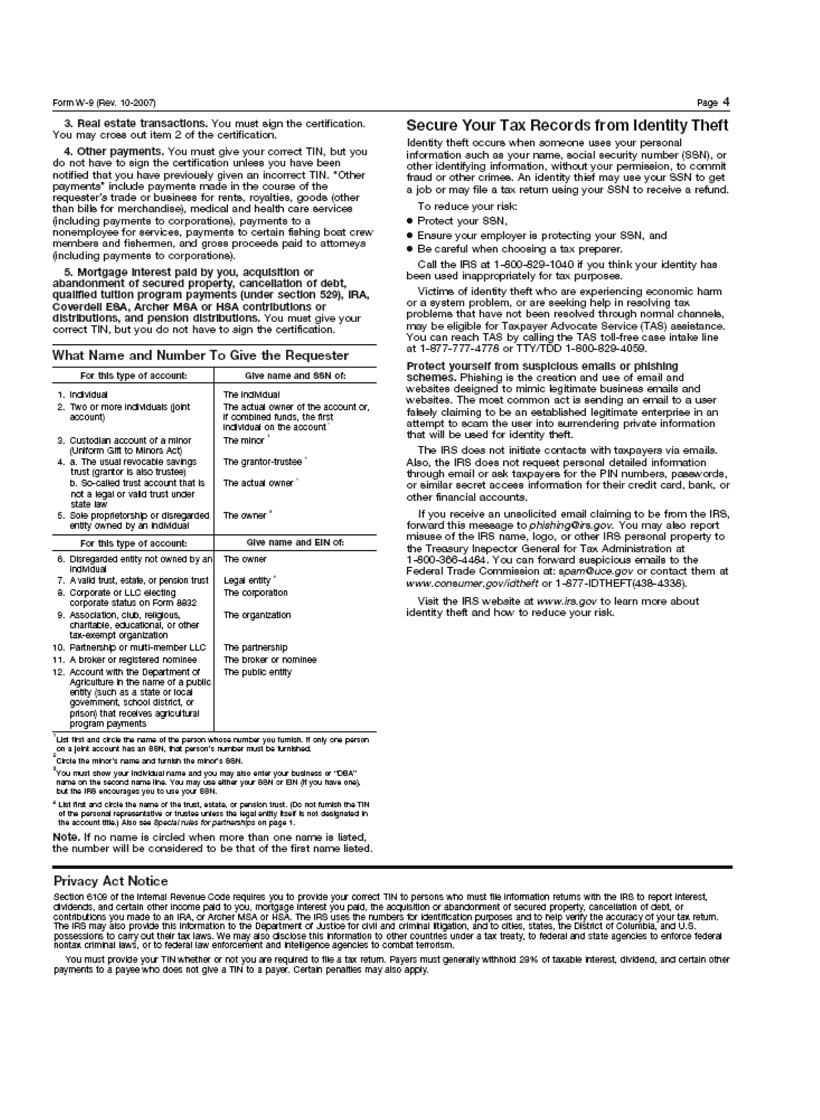

Form W-9 (Rev. 10-2007) Page 43.Real estate transactions. You must sign the certification. You may cross out item 2 of the certification. 4.Other payments. You must give your correct TIN, but you do not have to sign the certification unless you have been notified that you have previously given an incorrect TIN. “Other payments” include payments made in the course of the requester's trade or business for rents, royalties, goods (other than bills for merchandise), medical and health care services (including payments to corporations), payments to a nonemployee for services, payments to certain fishing boat crew members and fishermen, and gross proceeds paid to attorneys (including payments to corporations). 5.Mortgage Interest paid by you. acquisition or abandonment of secured property, cancellation of debt, qualified tuition program payments (under section 529), ira. coverdell ESA, Archer MSA or HSA contributions or distributions, and pension distributions. You must give your correct TIN, but you do not have to sign the certification. What Name and Number To Give the Requester For this type of account: Give name and SSN of: 1.individual 2.Two or more Individuals (joint account) 3.Custodian account of a minor (Uniform Gift to Minors Act) 4.a. The usual revocable savings trust (grantor is also trustee) b. So-called trust account that is not a legal or valid trust under state law 5. Sole proprietorship or disregarded entity owned by an individual The individual The actual owner of the account or, if combined (funds, the first individual on the account The minor' The grantor-trustee The actual owner' The owner For this type of account: glve name and ElN of: 6.Disregarded entity not owned by an individual 7.A valid trust, estate, or pension trust 8.Corporate or LLC electing corporate status on Form 8832 9. Association, club, religious, charitable, educational, or other tax-exempt organization 10.Partnership or multi-member LLC 11.A broker or registered nominee 12.Account with the Department: of Agriculture in the name of a public entity (such as a state or local government, school district, or prison) that receives agricultural program payments The owner Legal entity' The corporation The organization The partnership The broker or nominee The public entity 1 List first and circle the name of the person whose number you furnish. if only one person on a |oint account has an SSN, that person's number must be furnished. 2 Circle the minor's name and furnish the minor's SSN. 3 you must show your individual name and you may also enter your business or "DBA." name on the second name line. You may use either your SSN or EIN (if you have one) but the IRS encourages you to use your SSN. 4 List first and circle the name of the trust, estate, or pension trust. (do not furnish the TIN of the Personal representative or trustee unless the legal entity issuer is not designated in the account title). Also see special rules for partnerships on page 1. Note. If no name is circled when more than one name is listed, the number will be considered to be that of the first name listed.Secure Your Tax Records from Identity Theft Identity theft occurs when someone uses your personal information such as your name, social security number (SSN), or other identifying information, without your permission, to commit fraud or other crimes. An identity thief may use your SSN to get a job or may file a tax return using your SSN to receive a refund. To reduce your risk: •Protect your SSN, •Ensure your employer is protecting your SSN, and •Be careful when choosing a tax preparer. Call the IRS at 1-800-829-1040 if you think your identity has been used inappropriately for tax purposes. Victims of identity theft who are experiencing economic harm or a system problem, or are seeking help in resolving tax problems that have not been resolved through normal channels, may be eligible for Taxpayer Advocate Service (TAS) assistance. You can reach TAS by calling the TAS toll-free case intake line at 1-877-777-4778 or TTY/TDD 1-800-829-4059. Protect yourself from suspicious emails or phishing schemes. Phishing is the creation and use of email and websites designed to mimic legitimate business emails and websites. The most common act is sending an email to a user falsely claiming to be an established legitimate enterprise in an attempt to scam the user into surrendering private information that will be used for identity theft. The IRS does not initiate contacts with taxpayers via emails. Also, the IRS does not request personal detailed information through email or ask taxpayers for the PIN numbers, passwords, or similar secret access information for their credit card, bank, or other financial accounts. If you receive an unsolicited email claiming to be from the IRS, forward this message to phishing@irs.gov. You may also report misuse of the IRS name, logo, or other IRS personal property to 1-800-366-4484. You can forward suspicious emails to the Federal Trade Commission at: spam@uce.gov or contact them atwww.consumer.gov/idtheftor 1 -877-IDTH EFT(438-4338). Visit the IRS website atwww.irs.govto learn more about identity theft and how to reduce your risk. Privacy Act notice. Section 6109 of the internal revenue code requires you to provide your correct TIN to persons who must file information returns with the IRS to report interest, dividends, and certain other income paid to you, mortgage interest you paid, the acquisition or abandonment of secured property, cancellation of debt, or contributions you made to an IRA, or Archer MSA or HAS. The IRS uses the numbers for identification purposes and to help verify the accuracy of your tax return. The Irs may also provide this information to the department of justice for civil and criminal litigation, and to cities, states, the district of Columbia, and u.s possessions to carry out their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism. You must provide your tin whether or not you are required to file a tax return. Payers must generally withhold 29% of taxable interest, dividend, and certain other payments to a payee who does not give a tin to a payer. Certain penalties ma also apply.