UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

The Walt Disney Company

(Name of Registrant as Specified In Its Charter)

Blackwells Capital LLC

Blackwells Onshore I LLC

Jason Aintabi

Craig Hatkoff

Leah Solivan

Jessica Schell

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On March 11, 2024, Blackwells Capital LLC (“Blackwells”) issued a press release and a presentation regarding the relationship between The Walt Disney Company (the “Company”) and ValueAct Capital Management, L.P. A copy of each of the press release and the presentation is attached hereto as Exhibit 1 and Exhibit 2, respectively.

Also on March 11, 2024, Blackwells posted on its website, https://TheFutureOfDisney.com, a copy of its demand to inspect the records of the Company pursuant the Section 220 of the Delaware General Corporate Law, dated February 16, 2024 (the “Demand”), and the Company’s response to the Demand, dated February 26, 2026 (the “Demand Response”). A copy of each of the Demand and the Demand Response is attached hereto as Exhibit 3 and Exhibit 4, respectively.

Certain Information Concerning Participants

Blackwells Onshore I LLC, Blackwells Capital LLC, Jason Aintabi, Craig Hatkoff, Jessica Schell and Leah Solivan (collectively, the “Participants”) are participants in the solicitation of proxies from the shareholders of the Company for the 2024 Annual Meeting of Shareholders (the “Annual Meeting”). On February 6, 2024, the Participants filed with the U.S. Securities and Exchange Commission (the “SEC”) their definitive proxy statement and accompanying GREEN Proxy Card in connection with their solicitation of proxies from the shareholders of the Company for the Annual Meeting. ALL SHAREHOLDERS OF THE COMPANY ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT, THE ACCOMPANYING GREEN PROXY CARD AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY THE PARTICIPANTS, AS THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS AND THEIR DIRECT OR INDIRECT INTERESTS IN THE COMPANY, BY SECURITY HOLDINGS OR OTHERWISE. The definitive proxy statement and an accompanying GREEN proxy card will be furnished to some or all of the Company’s shareholders and are, along with other relevant documents, publicly available at no charge on the SEC’s website at http://www.sec.gov/. In addition, the Participants will provide copies of the definitive proxy statement without charge, when available, upon request. Requests for copies should be directed to Blackwells Onshore I LLC.

Exhibit 1

Blackwells Capital Reveals Failure by the Disney Board to Disclose in this Proxy Fight that

ValueAct Has Earned Fees from Managing Disney Pension Funds since 2013

Urges Shareholders to Disregard ValueAct’s Endorsement of the Board

Questions Whether the Board Violated ERISA laws as well as Disney’s Code of Ethics

NEW YORK, NY, March 11, 2024 – Blackwells Capital LLC (together with its affiliates, “Blackwells” or “we”) today issued a letter and issued a presentation, which is available at www.TheFutureOfDisney.com, to fellow shareholders regarding the need for boardroom enhancement at The Walt Disney Company (NYSE: DIS).

We invite all shareholders to learn more about our nominees and mission at www.TheFutureOfDisney.com.

The full letter to shareholders follows:

Dear Fellow Disney Shareholder:

As you may know, on January 3, 2024, The Walt Disney Company (“Disney” or the “Company”) issued a press release announcing an “Information-Sharing Arrangement” between the Company and ValueAct Capital Management, L.P. (“ValueAct”). The press release contained a glowing endorsement by ValueAct of Disney’s board of directors (the “Board”) and management of Disney.

The Board has repeatedly trumpeted ValueAct’s endorsement in proxy materials mailed to millions of shareholders, press releases, letters to shareholders, one-off engagements with shareholders, and in a recent presentation delivered to proxy advisory firm, Institutional Shareholder Services (“ISS”). 1

Blackwells diligence revealed that the Board failed to disclose in the press release that ValueAct or its affiliates have been managing over $350 million of Disney’s pension fund assets, and that ValueAct has been earning fees ranging from approximately $55 million to $95 million for the services provided to Disney’s pension fund since as early as 2013.2

ValueAct’s management of Disney’s pension funds is not disclosed anywhere in any of the referenced communications. Meanwhile, Disney’s entire shareholder franchise population has been led to believe that ValueAct provided its independent and unqualified support of the Board independently.

We believe shareholders should consider the following:

| ● | Can this Board believe that shareholders are able to evaluate the significance of ValueAct’s endorsement without a full understanding of the relationship? |

| ● | Did the Board know about ValueAct’s management of Disney’s pension funds prior to authorizing the January 3rd press release? |

| o | If yes, how could they hide this information from shareholders? |

| o | Did the Audit Committee of the Board review this matter in advance? |

| 1 | See, e.g., soliciting materials filed on DEFA14 by Disney with the Securities Exchange Commission on March 11, 2024, February 14, 2024, February 12, 2024, February 5, 2024, February 1, 2024. |

| 2 | See, Schedule C to Form 5500 of The Walt Disney Company Retirement Plan Master Trust for fiscal years 2013 through 2022. In each year beginning in 2013, ValueAct (and/or its affiliates) has been disclosed as an entity receiving compensation in connection with services to the plan on Schedule C of The Walt Disney Company Retirement Plan Master Trust’s Form 5500. |

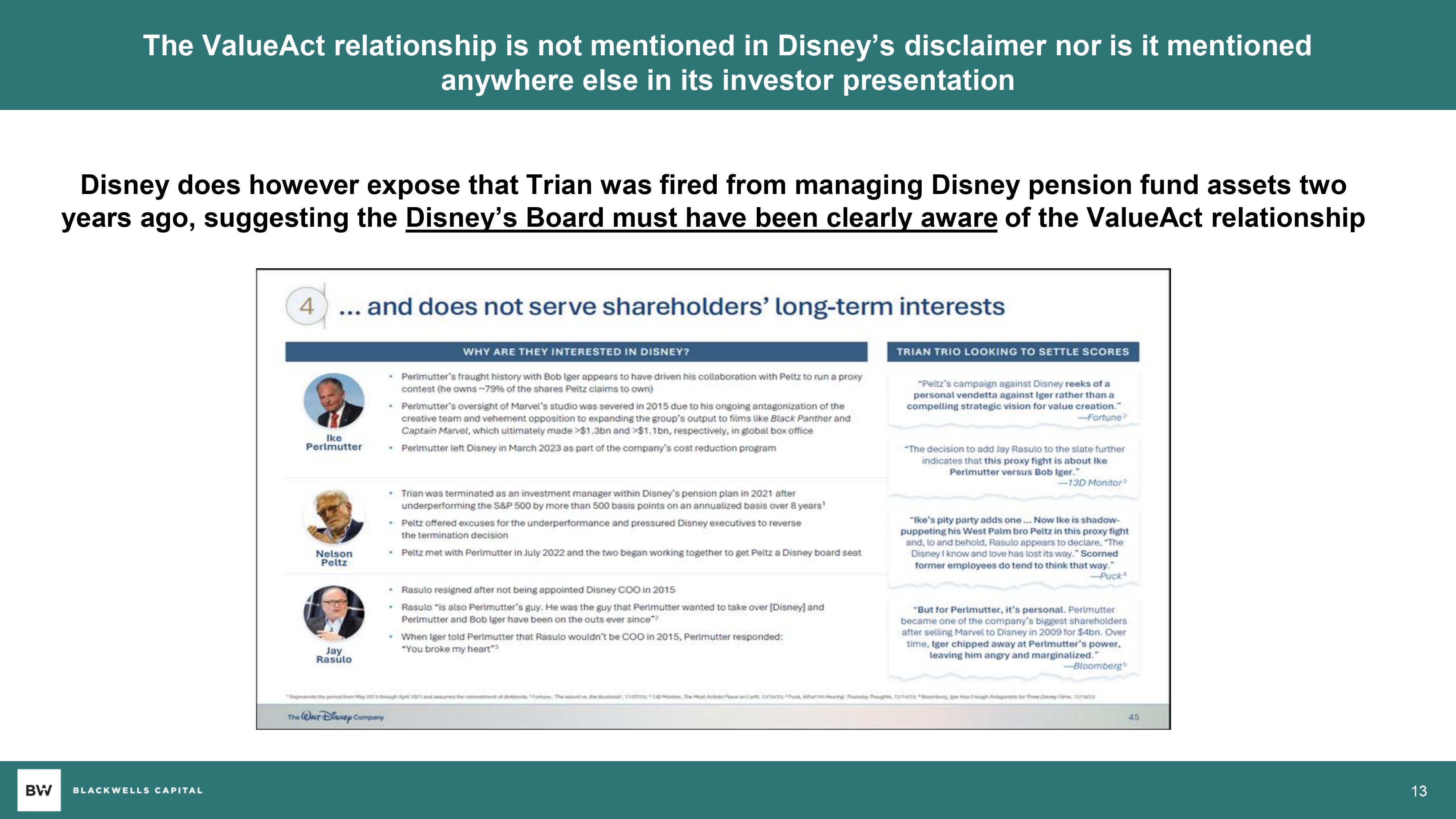

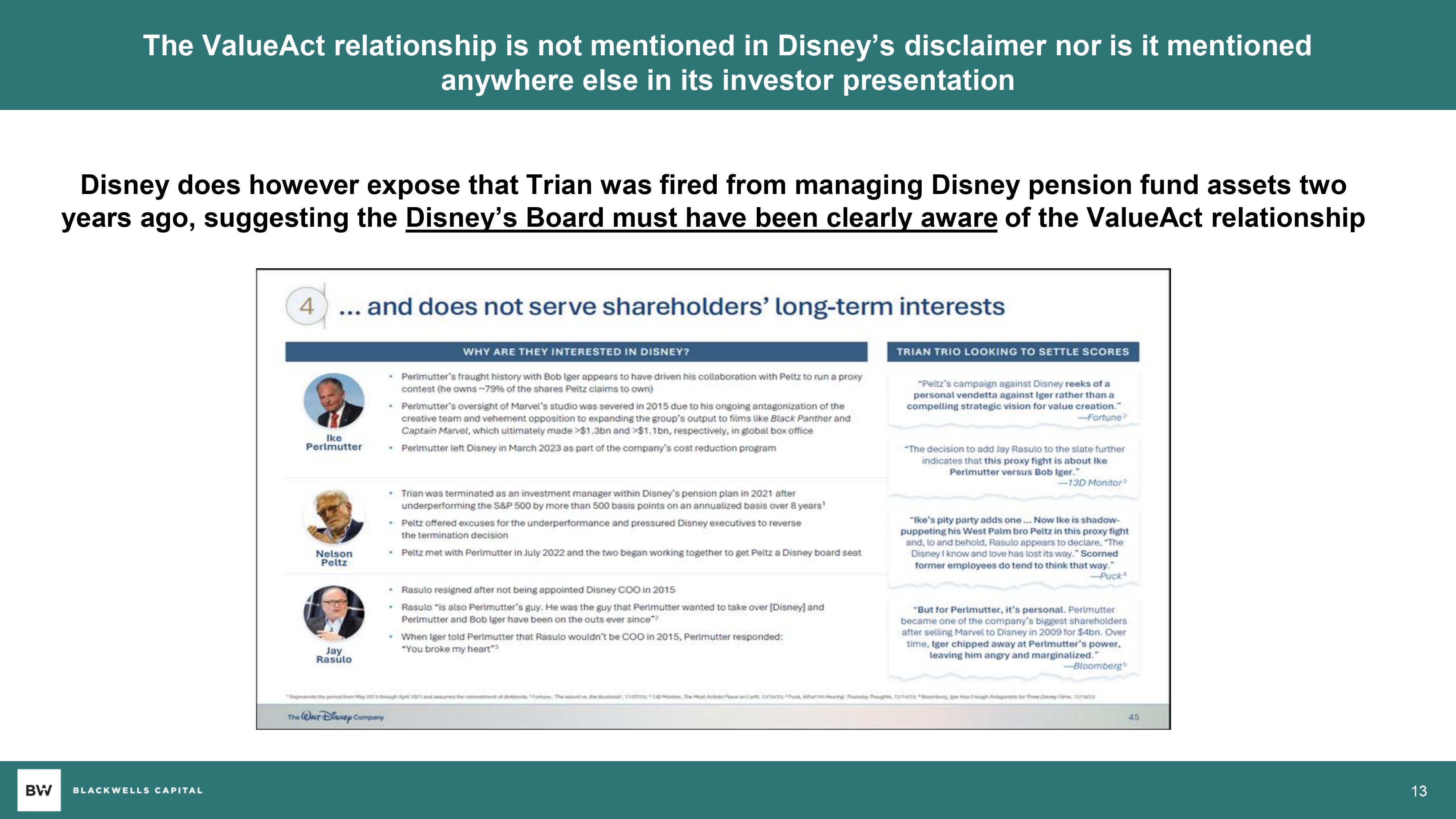

| ● | How could the Board not know of this relationship when their own investor presentation dated March 11, 2024, mentions Trian’s identical role in managing Disney pension fund assets? |

| ● | Why didn’t ValueAct and its principal, Mason Morfit, insist on disclosing ValueAct’s management of Disney’s pension funds in the January 3 press release—when, as fiduciaries to these funds, they certainly knew about these facts? |

| o | Why didn’t Mr. Morfit mention these important facts in his presentation in support of the Board in front of hundreds of attendees at the Council of Institutional Investors conference last week? |

| ● | Did the Board violate Disney’s Code of Ethics3 and commitment to transparency4 by failing to disclose ValueAct’s management of Disney’s pension funds after publicly accepting ValueAct’s endorsement? |

On numerous occasions, Blackwells has publicly demanded disclosure of Disney’s relationship with ValueAct, including the release of the Information-Sharing Agreement. On February 16, 2024, Blackwells submitted a formal demand under Delaware law that this information be made available to Blackwells.5 The Board denied our demand, asserting that we had not explained sufficiently our reasons to believe the Company’s relationship with ValueAct might be important.6

The Information-Sharing Agreement, the information shared under it, and details of the pre-existing, and current, Disney/ValueAct relationship is material information for shareholders. Blackwells’ diligence is proof positive that these disclosures must be made immediately.

We urge fellow shareholders to join us in demanding that the Board immediately take all necessary steps to file updated proxy materials with full disclosure of the ValueAct arrangement—so that shareholders can have the information needed to cast votes that are fully informed.

Blackwells has nominated three incredibly qualified nominees for election at Disney’s 2024 annual meeting of shareholders (the “Annual Meeting”): Craig Hatkoff, Jessica Schell and Leah Solivan. Our nominees add expertise in the needed areas of content, media, technology and best in class governance.

For more information about our campaign, including our thoughts on improving governance such that Disney will limit future issues like the ValueAct one, please visit www.TheFutureOfDisney.com.

Sincerely,

Jason Aintabi

Chief Investment Officer

Blackwells Capital LLC

To learn more about Blackwells’ three nominees Jessica Schell, Craig Hatkoff and Leah Solivan, fellow Disney shareholders are encouraged to visit www.TheFutureOfDisney.com. Blackwells campaign website includes materials for shareholders to evaluate and help make the most informed voting decisions possible.

| 3 | See, The Walt Disney Company, Code of Business Conduct and Ethics For Directors at page 1. “Directors must avoid conflicts of interest. …[for example] (iv) accepting, or having a member of a Director’s immediate family accept, a gift from persons or entities that deal with the Company, in cases where the gift is being made in order to influence the Directors’ actions as a member of the Board, or where acceptance of the gift could otherwise reasonably create the appearance of a conflict of interest.” |

| 4 | See, The Walt Disney Company Standards of Business Conduct at page 14. “Our policies are designed to…promote transparency—we don’t engage in any activity that would compromise our professional judgment or suggest favorable or preferential treatment.” |

| 5 | See, Blackwells’ Demand to The Walt Disney Company under Section 220 of the Delaware General Corporation Law, dated February 16, 2024, available at https://thefutureofdisney.com/wp-content/uploads/2024/03/Blackwells-DIS-ValueAct-220-Demand.pdf. |

| 6 | See, The Walt Disney Company’s Response Letter, dated February 26, 2024, available at https://thefutureofdisney.com/wp-content/uploads/2024/03/Blackwells-220-Demand-Response-Signed-1.pdf. |

Please vote your proxy today on the GREEN universal proxy card “FOR” each of the Blackwells nominees and the Blackwells proposal.

If you have any questions about voting your proxy or need replacement proxy materials, contact:

Morrow Sodali LLC

+1 (800) 662-5200 (toll-free for shareholders)

+1 (203) 658-9400 (call collect for banks, brokers, trustees and other nominees)

Blackwells@morrowsodali.com

About Blackwells Capital

Blackwells Capital was founded in 2016 by Jason Aintabi, its Chief Investment Officer. Since that time, it has made investments in public securities, engaging with management and boards, both publicly and privately, to help unlock value for stakeholders, including shareholders, employees and communities. Throughout their careers, Blackwells’ principals have invested globally on behalf of leading public and private equity firms and have held operating roles and served on the boards of media, energy, technology, insurance and real estate enterprises. For more information, please visit www.blackwellscap.com.

Contacts

Media:

Gagnier Communications

Dan Gagnier & Riyaz Lalani

646-569-5897

blackwells@gagnierfc.com

Shareholders:

Morrow Sodali

Michael Verrechia & William Dooley

(800) 662-5200

blackwells@morrowsodali.com

IMPORTANT ADDITIONAL INFORMATION

Blackwells Onshore I LLC, Blackwells Capital LLC, Jason Aintabi, Craig Hatkoff, Jessica Schell and Leah Solivan (collectively, the “Participants”) are participants in the solicitation of proxies from the shareholders of The Walt Disney Company (the “Company”) for the 2024 Annual Meeting of Shareholders. On February 6, 2024, the Participants filed with the U.S. Securities and Exchange Commission (the “SEC”) their definitive proxy statement and accompanying GREEN Proxy Card in connection with their solicitation of proxies from the shareholders of the Company for the 2024 Annual Meeting of Shareholders. All shareholders of the Company are advised to read the definitive proxy statement, the accompanying GREEN proxy card and other documents related to the solicitation of proxies by the Participants, as they contain important information, including additional information related to the Participants and their direct or indirect interests in the Company, by security holdings or otherwise.

The definitive proxy statement and an accompanying GREEN proxy card will be furnished to some or all of the Company’s shareholders and is, along with other relevant documents, publicly available at no charge on the SEC’s website at http://www.sec.gov/. In addition, the Participants will provide copies of the definitive proxy statement without charge, when available, upon request. Requests for copies should be directed to Blackwells Onshore I LLC.

Exhibit 2

Blackwells Reveals ValueAct’s Management of Disney’s Pension Funds The Walt Disney Company (NYSE: DIS) MARCH 2024 THEFUTUREOFDISNEY.COM Shareholders Should Disregard ValueAct’s Endorsement of the Board

The views expressed in this presentation (the “Presentation”) represent the opinions of Blackwells Capital LLC and/or certain of its affiliates (“Blackwells”) and the investment funds it manages that hold shares in The Walt Disney Company (the “Company”, “Disney” or “DIS”) . The Presentation is for informational purposes only, and it does not have regard to the specific investment objective, financial situation, suitability or particular need of any specific person who may receive the Presentation and should not be taken as advice on the merits of any investment decision . The views expressed in the Presentation represent the opinions of Blackwells and are based on publicly available information with respect to the Company and from other third - party reports . Blackwells recognizes that there may be confidential information in the possession of the Company that could lead it or others to disagree with Blackwells’ conclusions . Blackwells reserves the right to change any of its opinions expressed herein at any time as it deems appropriate and disclaims any obligation to notify the market or any other party of any such change, except as required by law . The information contained herein is current only as of the date of this Presentation . Blackwells disclaims any obligation to update the information or opinions contained herein . Certain financial projections and statements made herein have been derived or obtained from filings made with the U . S . Securities and Exchange Commission (“SEC”) or other regulatory authorities and from other third - party reports . Neither Blackwells nor any of its affiliates shall be responsible or have any liability for any misinformation contained in any SEC or other regulatory filing or third - party report . Select figures included in this Presentation have not been calculated using generally accepted accounting principles (“GAAP”) and have not been audited by independent accountants . Such figures may vary from GAAP accounting in material respects and there can be no assurance that the unrealized values reflected within such materials will be realized . This Presentation does not recommend the purchase or sale of any security, and should not be construed as legal, tax, investment or financial advice, and the information contained herein should not be taken as advice on the merits of any investment decision . The information contained in this Presentation is provided merely as information, and this Presentation is not intended to be, nor should it be construed as, an offer to sell or a solicitation of an offer to buy any security . Funds, investment vehicles, and accounts managed by Blackwells currently beneficially own shares of common stock, par value $ 0 . 01 per share, of the Company (“Shares”) . These funds, investment vehicles, and accounts are in the business of trading – buying and selling – securities and intend to continue trading in the securities of the Company . You should assume such funds, investment vehicles, and accounts will from time to time sell all or a portion of their holdings of the Company in open market transactions or otherwise, buy additional Shares (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls, swaps or other derivative instruments relating to such Shares, regardless of the views expressed in this Presentation . Blackwells reserves the right to take any actions with respect to investments in the Company as it may deem appropriate, including, but not limited to, communicating with the Company’s management, the Company’s board of directors, other investors and shareholders, stakeholders, industry participants, and/or interested or relevant parties about the Company or seeking representation constituting a minority of the Company’s board of directors, and to change its intentions with respect to its investments in the Company at any time and disclaims any obligation to notify the market or any other party of any such changes or actions, except as required by law . Although Blackwells believes the statements made in this Presentation are substantially accurate in all material respects and do not omit to state material facts necessary to make those statements not misleading, Blackwells makes no representation or warranty, express or implied, as to the accuracy or completeness of those statements or any other written or oral communication it makes with respect to the Company and any other companies mentioned, and each of Blackwells, the other Participants (as defined below) and their respective affiliates expressly disclaim any liability relating to those statements or communications (or any inaccuracies or omissions therein) . Thus, shareholders and others should conduct their own independent investigation and analysis of those statements and communications and of the Company and any other companies to which those statements or communications may be relevant . This Presentation contains forward - looking statements . All statements contained herein that are not clearly historical in nature or that necessarily depend on future events are forward - looking, and the words “anticipate,” “believe,” “expect,” “potential,” “could,” “intend,” “project,” “will,” “may,” “would,” “opportunity,” “estimate,” “plan,” and similar expressions are generally intended to identify forward - looking statements . The projected results and statements contained herein that are not historical facts are based on current expectations, speak only as of the date of these materials and involve risks, uncertainties and other factors that may cause actual results, performances or achievements to be materially different from any future results, performances or achievements expressed or implied by such projected results and statements . Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which entail risks and uncertainties and are beyond the control of Blackwells . 2 Though this Presentation may contain projections, nothing in this Presentation is, or is intended to be, a prediction of the future trading price or market value of securities of the Company . Accordingly, there is no assurance or guarantee with respect to the prices at which any securities of the Company will trade, and such securities may not trade at prices that may be implied herein . The estimates, projections and potential impact of the opportunities identified by Blackwells herein are based on assumptions that Blackwells believes to be reasonable as of the date of the Presentation, but there can be no assurance or guarantee that (i) any of the proposed actions set forth in this Presentation will be completed, (ii) the actual results or performance of the Company will not differ, and such differences may be material, or (iii) any of the assumptions provided in this Presentation are accurate . There can be no assurance that the projected results or forward - looking statements included herein will prove to be accurate, and therefore actual results could differ materially from those set forth in, contemplated by, or underlying these forward - looking statements . In light of the significant uncertainties inherent in the projected results and forward - looking statements included herein, the inclusion of such information should not be regarded as a representation as to future results or that the objectives and strategic initiatives expressed or implied by such projected results and forward - looking statements will be achieved . Blackwells will not undertake and specifically declines any obligation to disclose the results of any revisions that may be made to any projected results or forward - looking statements herein to reflect events or circumstances after the date of such projected results or statements or to reflect the occurrence of anticipated or unanticipated events . Blackwells has neither sought nor obtained the consent from any other third party to use any statements or information contained herein that have been obtained or derived from statements made or published by such third parties, nor has it paid for any such statements . Any such statements or information should not be viewed as indicating the support of such third parties for the views expressed herein . Blackwells does not endorse third - party estimates or research which are used in this Presentation, and such use is solely for illustrative purposes . No warranty is made that data or information, whether derived or obtained from filings made with the SEC or any other regulatory agency or from any third party, are accurate . Past performance is not an indication of future results . This Presentation may contain citations or links to articles and/or videos (collectively, “Media”) . The views and opinions expressed in such Media or those of the author(s)/speaker(s) referenced or quoted in such Media, unless specifically noted otherwise, do not necessarily represent the opinions of Blackwells . All registered or unregistered service marks, trademarks and trade names referred to in this Presentation are the property of their respective owners, and Blackwells’ use herein does not imply an affiliation with or endorsement by, the owners of these service marks, trademarks and trade names . Some of the materials in this Presentation are copyrighted by Blackwells and portions are copyrighted by others and are used with their permission . Blackwells Onshore I LLC, Blackwells Capital LLC, Jason Aintabi, Craig Hatkoff, Jessica Schell and Leah Solivan (collectively, the “Participants”) are participants in the solicitation of proxies from the shareholders of the Company for the 2024 Annual Meeting of Shareholders (the “Annual Meeting”) . On February 6 , 2024 , the Participants filed with the SEC their definitive proxy statement and accompanying GREEN Proxy Card in connection with their solicitation of proxies from the shareholders of the Company for the 2024 Annual Meeting . All shareholders of the Company are advised to read the definitive proxy statement, the accompanying GREEN proxy card and other documents related to the solicitation of proxies by the Participants, as they contain important information, including additional information related to the Participants and their direct or indirect interests in the Company, by security holdings or otherwise . The definitive proxy statement and an accompanying GREEN proxy card will be furnished to some or all of the Company’s shareholders and are, along with other relevant documents, publicly available at no charge on the SEC’s website at http : //www . sec . gov/ . In addition, the Participants will provide copies of the definitive proxy statement without charge, when available, upon request . Requests for copies should be directed to Blackwells Onshore I LLC . Disclaimer

ValueAct Presentation, March 7, 2024 Disney Presentation to ISS, March 11, 2024 The Disney Board continues to flaunt ValueAct’s endorsement and Information - Sharing Arrangement entered into during a contentious 3 - way proxy battle… Disney Press Release, January 3, 2024 “Disney is the world’s leading entertainment company. It has the best intellectual property, sports brand and parks & experiences assets in the industry. As legacy technologies transition to digital platforms, we believe Disney can lead the media industry forward. We could not be more excited to partner with Bob and the Board to help create long - term sustainable shareholder value” Mason Morfit Co - Chief Executive Officer and Chief Investment Officer Disney Letter to Shareholders, February 1, 2024 “Overall, our progress and building strategy have been recognized by investor ValueAct Capital, which supports the Board’s recommended nominees. Disney is the world’s leading entertainment company. It has the best intellectual property, sports brand and parks & experiences assets in the industry. As legacy technologies transition to digital platforms, we believe Disney can lead the media industry forward.” Mason Morfit Co - Chief Executive Officer and Chief Investment Officer Disney Press Release, January 3, 2024 The Walt Disney Company and ValueAct Capital Enter Into Information - Sharing Arrangement To Facilitate Strategic Consultation During Company’s Transformation Investment Firm Will Support the Disney Board’s Slate of Director Nominees at 2024 Annual Meeting Disney’s Website 3 “Disney is the world’s leading entertainment company. It has the best intellectual property, sports brand and parks & experiences assets in the industry. As legacy technologies transition to digital platforms, we believe Disney can lead the media industry forward. We could not be more excited to partner with Bob and the Board to help create long - term sustainable shareholder value.” Mason Morfit Co - Chief Executive Officer and Chief Investment Officer

…While failing to disclose that ValueAct (1) has managed hundreds of millions of dollars of Disney’s pension fund assets for over a decade (1) Includes funds managed by ValueAct’s affiliates. Source: Company filings on Form 5500, filed with the Department of Labor. The Form 5500 for fiscal year 2022 was signed by Pascale Thomas, Disney’s Vice President of Employee Benefits and Well - being and Eugene Holmes, Disney’s Assistant General Counsel and Benefits Counsel. 1 4

54 151 155 165 250 364 352 448 355 2020 2021 2022 ($ millions) 1 2014 2015 2016 2017 2018 2019 (1) Includes funds managed by ValueAct’s affiliates. Source: Company filings on Form 5500, filed with the Department of Labor. Filings on Form 5500 have not yet Market Value Of Disney’s Pension’s Investments Managed By ValueAct (1) Can shareholders evaluate the veracity and significance of ValueAct’s endorsement without a full understanding of the relationship between ValueAct and Disney? Blackwells suspects ValueAct continues to manage Disney pension fund assets in 2023 and 2024 been filed by Disney for 2023 and 2024 5

2 5 9 17 22 46 60 88 95 Estimated Cumulative Fees (1)(2) 2014 2015 2016 2017 2018 2019 2020 2021 2022 Did the Board raise ValueAct’s endorsement to ISS without mentioning ValueAct’s management of Disney’s pension funds? Did the Board know about ValueAct’s management of funds prior to authorizing the January 3rd press release? 1 2 2023. This estimate assumes a management fee of 2% of the current value of the investment and a performance - based fee of 20% of net profits. 6 (1) Includes fees potentially earned by ValueAct’s affiliates. (2) Blackwells estimated the cumulative fees based on how asset management and performance - based fees are disclosed on ValueAct's Form ADV Part 2A, filed with the SEC as of March 29, Are Disney shareholders meant to believe that ValueAct’s support is independent and unqualified? ($ millions)

Source: Company website; Company filings. Compensation Committee Charter of The Walt Disney Company Disney Hourly Savings and Investment Plan, Registration Statement on Form S - 8, dated 3/20/2019 Definitive Proxy Statement of The Walt Disney Company, dated 2/1/2024 The Walt Disney Company Form 10 - K, dated 11/21/2023 The Walt Disney Company Form 11 - K, dated 6/22/2023 The Compensation Committee, the Investment and Administrative Committee and Disney’s CFO approved and/or had oversight of the ValueAct investment 7

Source: Disney Standards of Business Conduct; voteDisney.com; Definitive Proxy Statement filed by Disney on February 2, 2024. https://impact.disney.com/app/uploads/Current/TWDC - Standards - of - Business - Conduct.pdf “Our policies are designed to… [p]romote transparency – we don’t engage in any activity that would compromise our professional judgment or suggest favorable or preferential treatment” - Disney Standards of Business Conduct 8 Is the Board violating Disney’s commitment to its shareholders? Are you involved in decisions regarding our Company and a financial institution? If you play a role in establishing or managing a relationship between our Company and any financial institution, you may not enter into any transaction with – or receive any benefit or opportunity from – the institution that isn’t generally available to other customers or clients .

The Information Sharing Agreement demonstrates poor shareholder responsiveness, and clear governance failures Source: Disney Standards of Business Conduct; Disney Code Of Business Conduct And Ethics For Directors, as available on the Disney website. Source: https:/ /w w w.dol.gov/sites/dolgov/files/ebsa/about - ebsa/our - activities/resource - center/faqs/coi - rules - and - exemptions - part - 1.pdf Source: https:/ /w w w.napa - net.org/sites/napa - net.org/files/WP%20 - %20Conflicts%20of%20Interest.pdf “Directors must avoid conflicts of interest . A conflict of interest occurs when an individual’s private interest interferes in any was with the interests of the company … A conflict of interest may also arise when a Director … receives improper personal benefits as a result of his or her position in the Company … ” “[T]he following are examples of conflicts of interest : … (iv) accepting … a gift from persons or entities that deal with the Company, in cases where the gift is being made in order to influence Directors’ actions as a member of the Board, or where acceptance of the gift could otherwise reasonably create the appearance of a conflict of interest . ” “We recognize that our continued success depends upon a commitment to conduct business with honesty , integrity and in compliance with the law … ” “We do what’s right and take responsibility for our actions to protect … our shareholders . ” Did the Board violate Disney’s Code Of Business Conduct And Ethics, Standards Of Business Conduct, and the Employee Retirement Income Security Act of 1974 (ERISA)? ERISA † 406 (b) – Fiduciary self dealing ERISA † 406 (b) focuses on benefits the fiduciaries themselves receive . It prohibits fiduciaries from three basic types of conduct : (1) Dealing with the assets of the plan for his own interest or for his own account. (2) Acting adverse to the plan in a transaction involving the plan (3) Receiving consideration from a party dealing with the plan in a transaction involving plan assets. CONFLICT OF INTEREST FAQS (PART I - EXEMPTIONS) U.S. Department of Labor Employee Benefits Security Administration October 27, 2016 New Exemptions and Amendments to Existing Exemptions Under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”) and the Internal Revenue 9 Code of 1986, as amended (the “Code”), parties providing fiduciary investment advice to plan sponsors, plan participants, and IRA owners are not permitted to receive payments creating conflicts of interest without complying with protective conditions in a prohibited transaction exemption (“PTE”).

Source: Regulations 14a - 6(g); 14a - 2(b)(1)(ix); 14a - 101 of the Securities Exchange Act of 1934, as amended. Should shareholders consider the almost $100 million dollars paid by Disney to ValueAct as motivation for ValueAct to have endorsed the Disney Board in the midst of a 3 - way proxy battle? Should ValueAct be considered a “Participant” in this solicitation under SEC Rules? An exempt solicitation is… 10

Council of Institutional Investors LinkedIn Post, March 6, 2024 ValueAct’s “Core Values” Source: Value Act Website, “Core Values.”; PX14A6G filed by ValueAct with the SEC on March 7, 2024. ValueAct’s silence on the topic is deafening Why didn’t Mr. Morfit mention these important facts in his presentation in support of the Board in front of hundreds of attendees at the Council of Institutional Investors conference this week or in ValueAct’s presentation, filed with the SEC on March 7? 1 Why didn’t ValueAct and its principal, Mason Morfit, insist on disclosing ValueAct’s management of Disney’s pension funds in the January 3 press release — when, as fiduciaries to these funds, they certainly knew about these facts? 2 11

Source: PX14A6G filed by ValueAct on March 7, 2024, Slides 2, 19. (1) Includes fees potentially earned by ValueAct’s affiliates. Neither ValueAct’s 594 - word disclaimer nor its ‘commitment rationalization’ slide mention that ValueAct has managed and earned fees (1) from Disney’s pension fund assets since 2013 12

The ValueAct relationship is not mentioned in Disney’s disclaimer nor is it mentioned anywhere else in its investor presentation Disney does however expose that Trian was fired from managing Disney pension fund assets two years ago, suggesting the Disney’s Board must have been clearly aware of the ValueAct relationship 13

Blackwells’ continued efforts to eliminate information asymmetry January 22, 2024 Blackwells files Preliminary Proxy Statement for Disney’s 2024 Annual Meeting “Demands Disney share information equally with all shareholders, not just ValueAct . ” “On a related note, we remain particularly disappointed that Disney has entered into an information sharing agreement with ValueAct . ” “We therefore also demand that Disney agree to make public all information that is shared with ValueAct under the so - called ‘information sharing agreement’.” February 6, 2024 Blackwells files Definitive Proxy Statement for Disney’s 2024 Annual Meeting and releases letter to fellow shareholders “Moreover, recent concerns surrounding an information sharing agreement between Disney and ValueAct , are proof positive that independent and new perspectives are necessary.” “We intend to ensure for all shareholders that this arrangement is terminated or that shareholders are given the same access to information that ValueAct seems to enjoy.” February 16, 2024 Blackwells sent a demand letter to inspect records of Disney and ValueAct’s relationship Blackwells demanded to inspect Disney’s records pursuant to its rights under Section 220 of the Delaware General Corporation Law to inspect the records related to the “certain Information - Sharing Agreement between the Company and ValueAct Capital Management, L.P. which agreement is the general subject of a Company press release dated on or about January 3, 2024” February 26, 2024 Disney responded to Blackwells Books and Records Demand stating that there was no reason to inspect Disney replied to Blackwells’ books and records demand stating that in order to inspect the books relating to ValueAct , Blackwells would need to “show by a preponderance of the evidence that a credible basis exists upon which wrongdoing or mismanagement can be inferred” because the “stated purpose is to investigate alleged wrongdoing.” March 11, 2024 Blackwells discloses potentially significant governance failures at Disney with respect to the ValueAct relationship Blackwells diligence reveals that the Board failed to disclose that ValueAct has been managing over $350 million of Disney’s pension fund assets , and that ValueAct has been earning fees ranging from approximately $55 million to $95 million for the services provided to Disney’s pension fund since as early as 2013. 14

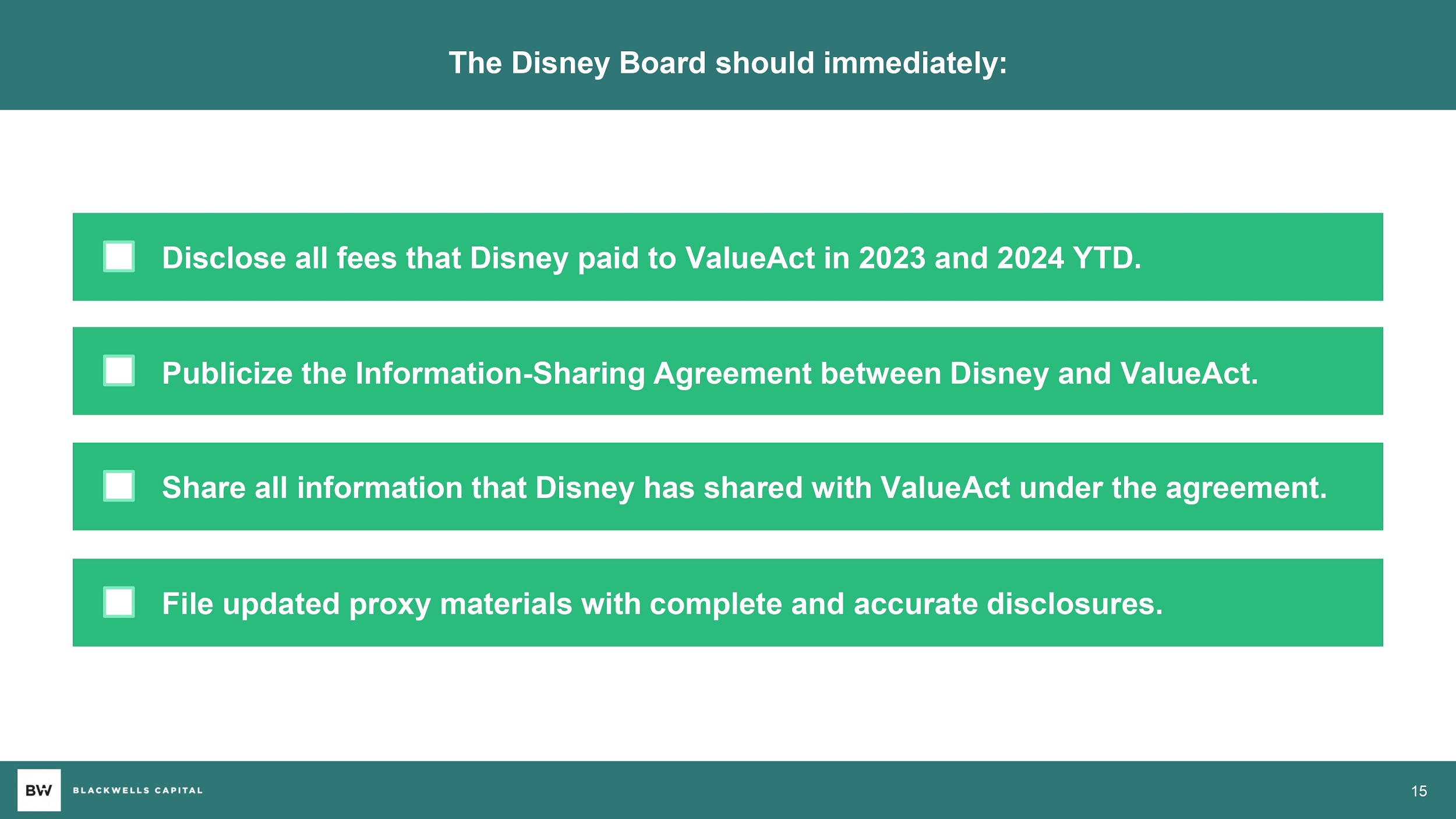

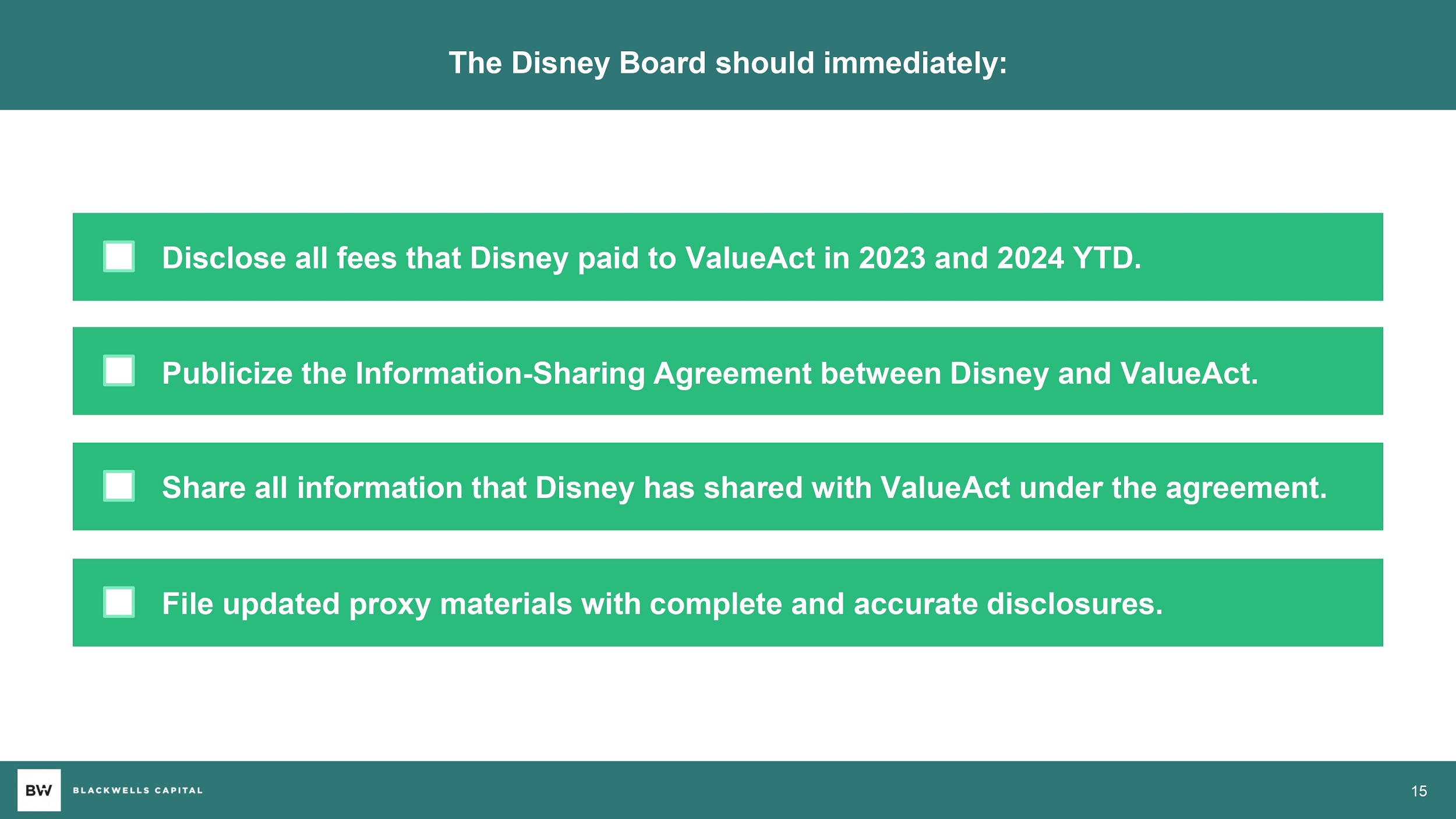

Disclose all fees that Disney paid to ValueAct in 2023 and 2024 YTD. The Disney Board should immediately: File updated proxy materials with complete and accurate disclosures. Publicize the Information - Sharing Agreement between Disney and ValueAct. Share all information that Disney has shared with ValueAct under the agreement. 15

Exhibit 3

February 16, 2024

BY EMAIL AND OVERNIGHT MAIL

The Walt Disney Company

500 South Buena Vista Street

Burbank, California 91521

Attn: Jolene Negre, Associate General Counsel and Secretary

| Re: | Demand to Inspect Records of The Walt Disney Company

Pursuant to Section 220 of the Delaware General Corporation Law |

Dear Ms. Negre:

Blackwells Onshore I LLC, a Delaware limited liability company (“Blackwells”), is the record owner of 100 shares (such shares, the “Blackwells Shares”) of common stock, $0.01 par value per share, of The Walt Disney Company, a Delaware corporation (the “Company”). As the record holder of the Blackwells Shares, Blackwells hereby demands (the “Demand”), pursuant to Section 220 of the Delaware General Corporation Law (the “DGCL”), during the usual hours for business, to inspect the following books, records and documents of the Company and to make and/or receive copies or extracts therefrom:

| (a) | That certain Information-Sharing Agreement between the Company and ValueAct Capital Management, L.P. (“ValueAct”), which agreement is the general subject of a Company press release dated on or about January 3, 2024 (the “Information-Sharing Agreement”). |

| (b) | Any and all board-of-directors-level documents or materials, including without limitation minutes of any meeting of the board of directors (the “Board”) or any committee of the Board (a “Board Committee”), presentation materials, memoranda, or other documents made available to the Board or a Board Committee (“Board-Level Materials”), that describe, reflect or discuss the Information-Sharing Agreement in any way, including without limitation (i) the purpose(s) of the Information-Sharing Agreement; (ii) the reason(s) for or against entering into the Information-Sharing Agreement; (iii) the selection of ValueAct as the counterparty to the Information-Sharing Agreement (including the consideration of other potential counterparties); (iv) the timing of the Information-Sharing Agreement; (v) communications among the Company’s directors and senior management of the Information-Sharing Agreement (including its implementation and actions to be taken or refrained from pursuant to the Information-Sharing Agreement); (vi) the costs or expenses associated with entering into or performing the Company’s obligations under the Information-Sharing Agreement; and, (vii) the relevance of the Information-Sharing Agreement to the Company’s upcoming annual meeting of stockholder currently scheduled for April 3, 2024 (the “Annual Meeting”), and Company communications with stockholders concerning the Annual Meeting. |

Blackwells Capital

400 Park Avenue, 4th Floor, New York, NY 10022

| (c) | Any information that the Company has shared with ValueAct covered by or pursuant to the Information-Sharing Agreement. |

| (d) | All public statements of the Company (whether in a press release, public statement, or public filing, on an investor call, or otherwise) that include within them statements by ValueAct, whether or not issued pursuant to the Information-Sharing Agreement, including without limitation (i) public statements that include quotations or comments that purport to come from ValueAct; (ii) the reason(s) for the inclusion of ValueAct quotations or comments within the public statements of the Company (such public statements, the “ValueAct Statements”). |

| (e) | Any Board-Level Materials that concern or discuss any public statement called for by item (c). |

The purpose of this Demand is to enable Blackwells, on behalf of itself, its affiliates, and the participants in its ongoing solicitation of stockholder proxies for the Annual Meeting, to assess whether (1) the Company’s solicitation of stockholder proxies for the Annual Meeting is proceeding without full and appropriate disclosure of the Information-Sharing Agreement, its context and related matters, and (2) the Company’s directors and members of senior management have breached one or more duties to stockholders such as their duty of candor to stockholders with respect to the Information-Sharing Agreement and public statements that have resulted from it. Additionally, this Demand is to enable Blackwells to communicate with the Company’s other stockholders concerning the Information-Sharing Agreement, the ValueAct Statements, and their relevant context and to enable Blackwells to determine whether it would be appropriate to seek an audience with the Board to discuss its solicitation of stockholder proxies for the Annual Meeting.

Blackwells notes that the Company is referring to and utilizing statements from ValueAct as part of its solicitation of stockholder proxies for the Annual Meeting, and it is doing so without having disclosed the Information-Sharing Agreement, how that agreement came to be, what information the Company has shared with ValueAct and why, or other facts that would provide meaningful context to (1) the ValueAct Statements and (2) the extent to which stockholders should or should not rely on the ValueAct Statements. Blackwells has called upon the Company to disclose the Information-Sharing Agreement publicly so that stockholders have information necessary to making informed decisions about how to vote their shares on matters related to their interests as stockholders, including without limitation, in connection with the election of directors and submission of proposals at the Annual Meeting. In light of the foregoing, Blackwells has a credible basis to conclude that the Board and senior management engaged in wrongdoing in connection with solicitation of proxies for the Annual Meeting. The documents demanded for inspection will further inform and provide relevant context to Blackwells’ understanding of this issue and the Board’s and senior management’s motivations in making the deficient disclosures. The Board’s and senior management’s actions to omit disclosing the Information-Sharing Agreement and critical context to it is harming the stockholder franchise by in effect asking stockholders to vote without full information. As a result, the votes currently being collected may be tainted in ways that could render the vote at the Annual Meeting subject to challenge and, depending on what information the Company has withheld from disclosure, to a determination that the stockholder vote is invalid.

Blackwells demands that modifications, additions or deletions to or from any and all information referred to in items (a) through (e) be immediately furnished as such modifications, additions or deletions become available to the Company or its agents or representatives.

Blackwells is already a party to a confidentiality agreement with the Company dated February 9, 2024 (the “NDA”); and Blackwells confirms that terms of that NDA will cover any documents or other materials produced to Blackwells pursuant to this Demand. To facilitate the Company’s prompt response to the Demand, Blackwells consents to the redaction from responsive Board-Level Materials of content unrelated to the Information-Sharing Agreement or ValueAct. In lieu of producing the documents requested in this Demand, the Company may publicly disclose the Information-Sharing Agreement and issue a supplement to its definitive proxy statement dated February 1, 2024 and related to the Annual Meeting to provide the information concerning the Information-Sharing Agreement, ValueAct, and the Company’s relationship with ValueAct noted in items (a) through (d) above.

Blackwells requests that the information identified above be produced to Blackwells through the persons designated in the next paragraph no later than the close of business on Monday, February 26, 2024. This is consistent with Section 220 of the DGCL, which requires the Company to respond to this Demand and make available the requested materials within five (5) business days of the Demand. If the Company fails to respond by the close of business on February 26, 2024, or if the Company refuses the Demand, Blackwells reserves the right to file an action in the Court of Chancery of the State of Delaware to compel the Company’s compliance.

Signature Page Follows

Blackwells hereby designates and authorizes Jason Aintabi and Kelly A Mitten of Blackwells, Lawrence S. Elbaum and C. Patrick Gadson of Vinson & Elkins L.L.P., and any other persons designated by them or Blackwells, acting singly or in combination, to conduct the inspection and copying requested by this Demand. Please advise Mr. Aintabi at [personal information redacted] and Ms. Mitten at [personal information redacted] as promptly as practicable within the timeframe specified under Section 220 when and where the items requested in this Demand will be made available to Blackwells. If the Company contends that this Demand is incomplete or is otherwise deficient in any respect, please notify Blackwells immediately in writing, setting forth the facts that the Company contends support its position and specifying any additional information that the Company believes is required from Blackwells. Absent such prompt notice, Blackwells will assume that the Company agrees that this Demand complies in all respects with the DGCL’s requirements. Blackwells reserves the right to withdraw or modify this Demand at any time, and more generally reserves all of its legal and equitable rights and remedies.

| | Very truly yours, |

| | |

| | Blackwells Onshore I LLC |

| | | |

| | By: | /s/ Jason Aintabi |

| | Name: | Jason Aintabi |

| | Title: | President and Secretary |

[Affidavit Omitted]

Exhibit 4

Kevin J. Orsini

korsini@cravath.com

T+1-212-474-1596

New York

February 26, 2024

Blackwells Onshore I LLC 8 Del. C. § 220 Demand for Inspection of Books and Records

Dear Mr. Elbaum and Mr. Gadson:

We represent The Walt Disney Company (“Disney” or the “Company”) and write in response to your client’s letter dated February 16, 2024, to Jolene Negre, Associate General Counsel and Secretary, on behalf of Blackwells Onshore I LLC (“Blackwells” or “stockholder”), demanding to inspect certain Company documents under 8 Del. C. § 220 (the “Demand”).

To obtain inspection of corporate books and records, a stockholder must first demonstrate that it has a proper purpose for making its demand. 8 Del. C. § 220(b). The stockholder “must do more than state, in a conclusory manner, a generally accepted proper purpose”; it must say “what it will do with the information, or an end to which that investigation may lead”. W. Coast Mgmt. & Cap., LLC v. Carrier Access Corp., 914 A.2d 636, 646 (Del. Ch. 2006).

Where, as here, a stockholder’s stated purpose is to investigate alleged wrongdoing, the stockholder must show by a preponderance of the evidence that a credible basis exists upon which wrongdoing or mismanagement can be inferred. Seinfeld v. Verizon Commc’ns, Inc., 909 A.2d 117, 123 (Del. 2006) (explaining that for a Section 220 demand, a stockholder must show “some evidence” to suggest “a credible basis from which the Court of Chancery can infer there is possible mismanagement that would warrant further investigation”). Delaware corporations are entitled “to deny requests for inspections that are based only upon suspicion or curiosity”. Id. at 118. Demands cannot be justified simply by intoning allegations of mismanagement, wrongdoing or breaches of fiduciary duty; rather, to demonstrate a specific proper purpose and meet the credible basis standard, a stockholder must come forward with “documents, logic, testimony or otherwise” that suggest “there are legitimate issues of wrongdoing”. Sec. First Corp. v. U.S. Die Casting & Dev. Co., 687 A.2d 563, 568 (Del. 1997). This is “a burden the plaintiff seeking inspection must bear; it is not a formality”. Haque v. Tesla Motors, Inc., C.A. No. 12651-VCS, 2017 WL 448594, at *4 (Del. Ch. Feb. 2, 2017).

Requests for inspection must also be narrowly tailored to the stated purpose; books and records that are not necessary and essential to that purpose need not be produced. Brehm v. Eisner, 746 A.2d 244, 266 (Del. 2000) (“[P]laintiffs may seek relevant books and records of the corporation under Section 220 of the Delaware General Corporation Law, if they can ultimately bear the burden of showing a proper purpose and make specific and discrete identification, with rifled precision, of the documents sought.”); Espinoza v. Hewlett-Packard Co., 32 A.3d 365, 371 (Del. 2011) (explaining that a demanding stockholder has the burden “to show that the specific books and records he seeks to inspect are ‘essential to [the] accomplishment of the stockholder’s articulated purpose for the inspection’” (quoting Thomas & Betts Corp. v. Leviton Mfg. Co., 681 A.2d 1026, 1035 (Del. 1996))).

| | | | |

| NEW YORK | LONDON | WASHINGTON, D.C. | CRAVATH, SWAINE & MOORE LLP |

| Worldwide Plaza | CityPoint | 1601 K Street NW | |

| 825 Eighth Avenue | One Ropemaker Street | Washington, D.C. 20006-1682 | |

| New York, NY 10019-7475 | London EC2Y 9HR | T+1-202-869-7700 | |

| T+1-212-474-1000 | T+44-20-7453-1000 | F+1-202-869-7600 | |

| F+1-212-474-3700 | F+44-20-7860-1150 | | |

As discussed further below, the Demand does not support inspection rights because it fails to satisfy any of these foregoing requirements.

| A. | The Demand Fails To State a Proper Purpose That Would Merit Inspection Because It Lacks Evidence Supporting a Credible Basis To Infer Wrongdoing. |

Blackwells purportedly seeks to investigate: (i) the alleged withholding of “the Information-Sharing Agreement” between Disney and ValueAct Capital Management L.P. and (ii) alleged “breach[ ] [of] one or more duties to stockholders such as their duty of candor to stockholders with respect to the Information-Sharing Agreement and public statements that have resulted from it”. (Demand at 2.) But a demand brought for the purpose of investigating potential wrongdoing must contain evidence to establish “a credible basis from which the Court of Chancery [could] infer there is possible mismanagement that would warrant further investigation”. Seinfeld, 909 A.2d at 123.

The Demand offers no evidence of a credible basis to infer wrongdoing. Nor is there any such basis. Blackwells takes issue with the Company “referring to and utilizing statements from ValueAct as part of its solicitation of stockholder proxies for the Annual Meeting”. (Demand at 2.) Without any further support, your client alleges that there is a “credible basis to conclude that the Board and senior management engaged in wrongdoing in connection with solicitation of proxies for the Annual Meeting”. (Demand at 3.) Your client’s conclusory assertions and broad speculation of wrongdoing are insufficient to support the requested “indiscriminate fishing expedition”. Lebanon Cnty. Emps.’ Ret. Fund v. AmerisourceBergen Corp., C.A. No. 2019-0527-JTL, 2020 WL 132752, at *8 (Del. Ch. Jan. 13, 2020) (“To protect the corporation from ‘indiscriminate fishing expeditions’ and from demands grounded in nothing more than curiosity, ‘[a] mere statement of a purpose to investigate possible general mismanagement, without more, will not entitle a shareholder to broad § 220 inspection relief’”) (quoting Seinfeld, 909 A.2d at 122)); Okla. Firefighters Pension & Ret. Sys. v. Amazon.com, Inc., C.A. No. 2021-0484-LWW, 2022 WL 1760618, at *1 (Del. Ch. June 1, 2022) (denying plaintiff’s demand because it “amount[ed] to a fishing expedition and lack[ed] the precision [Delaware] law requires”). Stated simply, this is nothing more than an impermissible fishing expedition.

| B. | The Requested Documents Are Not Necessary and Essential to Any Stated Purposes. |

Even if the Demand articulated a proper purpose, your client still would not be entitled to inspect the documents requested because the requests are overbroad in time and scope. Under Section 220, the stockholder making the demand “bears the burden of proving that each category of books and records is essential to the accomplishment of the stockholder’s articulated purpose for the inspection”. Sec. First Corp., 687 A.2d at 569. The Demand fails to articulate how “[a]ny and all board-of-directors-level documents or materials” that “describe, reflect or discuss the Information-Sharing Agreement in any way”,”[a]ny information that the Company has shared with ValueAct covered by” the agreement, “[a]ll public statements of the Company . . . that include within them statements by ValueAct” and “[a]ny Board-Level Materials that concern or discuss any [of those] public statements” (Demand at 1-2), are essential to accomplish the stated purposes. See Woods, Trustee of Avery L. Woods Trust v. Sahara Enters., Inc., C.A. No. 2020-0153-JTL, 2020 WL 4200131, at *16 (Del. Ch. July 22, 2020) (noting that a request for “all documents” concerning a topic “is more akin to discovery in plenary litigation than a Section 220 request”); see also Saito v. McKesson HBOC, Inc., 806 A.2d 113, 114 (Del. 2002) (noting that Section 220 “does not open the door to the wide ranging discovery that would be available in support of litigation”); Brehm, 746 A.2d at 266 (stating that plaintiffs bear the burden to make requests that are “specific and discrete”).

The scope of the Demand is thus not narrowly tailored to meet the stockholder’s articulated purpose or “circumscribed with rifled precision” as required under Delaware law. Sec. First Corp., 687 A.2d at 569-70.

* * *

In sum, for all the reasons stated above, the Company has adequate grounds to reject the Demand.

The Company does not concede the accuracy of the characterizations or factual allegations contained in the Demand, and nothing in this letter, shall be interpreted as an admission that your client’s Demand states a proper purpose for inspection or as a waiver or forfeiture of any argument, objection or contention by the Company concerning: (i) the sufficiency, propriety and/or scope of your client’s Demand or (ii) any of the underlying facts and events discussed therein.

| Regards, |

| | |

| | /s/ Kevin J. Orsini |

| | Kevin J. Orsini |

| | |

| Lawrence S. Elbaum, Esq. | |

| C. Patrick Gadson, Esq. | |

| Vinson & Elkins LLP | |

| 1114 Avenue of the Americas | |

| 32nd Floor | |

| New York, NY 10036 | |

| | |

| BY EMAIL | |