- ACET Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Adicet Bio (ACET) 8-KEntry into a Material Definitive Agreement

Filed: 29 Apr 20, 8:33am

resTORbio and Adicet Bio Merger April 29, 2020 Exhibit 99.2

Forward-Looking Statements This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding: the expected structure, timing and completion of the proposed merger transaction, future product development plans and projected timelines for the initiation and completion of preclinical and clinical trials; the potential for the results of ongoing preclinical or clinical trials and the efficacy of either party’s drug candidates; the potential market opportunities and value of drug candidates; future product development and regulatory strategies, including with respect to specific indications; the combined company’s future financial performance, results of operations or sufficiency of capital resources to fund operating requirements; future NASDAQ listing; expectations regarding the combined company’s focus, operations, resources and development plan; expectations regarding synergies resulting from the proposed merger transaction; the executive and board structure of the combined company; expectations of the potential impact of COVID-19 on strategy, future operations, and the timing of clinical trials and timing related to Adicet Bio, Inc.'s (“Adicet”) future clinical trials; and the potential payment of proceeds pursuant to the CVRs (as defined herein) . The use of words such as, but not limited to, “believe,” “expect,” “estimate,” “project,” “intend,” “future,” “potential,” “continue,” “may,” “might,” “plan,” “will,” “should,” “seek,” “anticipate,” or “could” and other similar words or expressions are intended to identify forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, our clinical results and other future conditions. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. There can be no assurance that the parties will be able to complete the proposed merger transaction on the anticipated terms, or at all. Such forward-looking statements are subject to a number of material risks and uncertainties including but not limited to: (i) risks associated with resTORbio, Inc.’s (“resTORbio”) ability to obtain the stockholder approval required to consummate the proposed merger transaction and the timing of the closing of the proposed merger transaction, including the risks that a condition to closing would not be satisfied within the expected timeframe or at all or that the closing of the proposed merger transaction will not occur; (ii) the outcome of any legal proceedings that may be instituted against the parties and others related to the merger agreement; (iii) unanticipated difficulties or expenditures relating to the proposed merger transaction, the response of business partners and competitors to the announcement of the proposed merger transaction, and/or potential difficulties in employee retention as a result of the announcement and pendency of the proposed merger transaction; (iv) the length of time necessary to consummate the proposed merger transaction may be longer than anticipated; (v) resTORbio’s continued listing on the NASDAQ Global Market until closing of the proposed merger transaction; (vi) the combined company’s listing on the NASDAQ Global Market after closing of the proposed merger transaction; (vii) the adequacy of the combined company’s capital to support its future operations and its ability to successfully initiate and complete clinical trials; (viii) the nature, strategy and focus of the combined company; (ix) the difficulty in predicting the time and cost of development of resTORbio’s product candidates; (x) the executive management and board structure of the combined company; (xi) the risk that any potential payment of proceeds pursuant to the CVRs may not be distributed at all or result in any value to resTORbio’s stockholders; (xii) Adicet’s plans to develop and commercialize its product candidates, including ADI-001; (xiii) the timing of initiation of Adicet’s planned clinical trials; (xiv) the timing of the availability of data from Adicet’s clinical trials; (xv) the timing of any planned investigational new drug application or new drug application; (xvi) Adicet’s plans to research, develop and commercialize its current and future product candidates; (xvii) Adicet’s ability to enter into new collaborations, and to fulfill its obligations under any such collaboration agreements; (xviii) the clinical utility, potential benefits and market acceptance of Adicet’s product candidates; (xix) Adicet’s commercialization, marketing and manufacturing capabilities and strategy; (xx) Adicet’s ability to identify additional products or product candidates with significant commercial potential; (xxi) developments and projections relating to Adicet’s competitors and its industry; (xxii) the impact of government laws and regulations; (xxiii) Adicet’s ability to protect its intellectual property position; (xxiv) Adicet’s estimates regarding future revenue, expenses, capital requirements and need for additional financing following the proposed merger transaction; and (xxv) those risks detailed in resTORbio’s most recent Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”), as well as discussions of potential risks, uncertainties, and other important factors in our subsequent filings with the SEC. Any forward-looking statement speaks only as of the date on which it was made. Neither we, nor our affiliates, advisors or representatives, undertake any obligation to publicly update or revise any forward-looking statement, whether as result of new information, future events or otherwise, except as required by law. Industry and Market Information Information regarding market share, market position and industry data pertaining to Adicet’s, resTORbio’s and the combined company’s business contained in this presentation consists of estimates based on data and reports compiled by industry professional organizations and analysts and Adicet’s and resTORbio’s knowledge of their industry. Although Adicet and resTORbio believe the industry and market data to be reliable, this information could prove to be inaccurate. You should carefully consider the inherent risks and uncertainties associated with the market and other industry data contained in this presentation. Forward-looking information obtained from third-party sources is subject to the same qualifications and the additional uncertainties as the other forward-looking statements in this presentation.

Regulation M-A Legend Important Additional Information About the Proposed Merger and Where to Find It This communication relates to the proposed merger transaction involving resTORbio, Inc. (“resTORbio”) and Adicet Bio, Inc. (“Adicet”) and may be deemed to be solicitation material in respect of the proposed merger transaction. In connection with the proposed merger transaction, resTORbio will file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including a registration statement on Form S-4 (the “Form S-4”) that will contain a proxy statement (the “Proxy Statement”) and prospectus. This communication is not a substitute for the Form S-4, the Proxy Statement or for any other document that resTORbio may file with the SEC and or send to resTORbio’s stockholders in connection with the proposed merger transaction. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF RESTORBIO ARE URGED TO READ THE FORM S-4, THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT RESTORBIO, THE PROPOSED MERGER TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Form S-4, the Proxy Statement and other documents filed by resTORbio with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed by resTORbio with the SEC will also be available free of charge on resTORbio’s website at www.restorbio.com, or by contacting resTORbio’s Investor Relations at 212-362-1200. Participants in the Solicitation resTORbio, Adicet and their respective directors and certain of their executive officers may be considered participants in the solicitation of proxies from resTORbio’s stockholders with respect to the proposed merger transaction under the rules of the SEC. Information about the directors and executive officers of resTORbio is set forth in its Annual Report on Form 10-K for the year ended December 31, 2019, which was filed with the SEC on March 12, 2020, its proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on March 27, 2020 and in subsequent documents filed with the SEC. Additional information regarding the persons who may be deemed participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in the Form S-4, the Proxy Statement and other relevant materials to be filed with the SEC when they become available. You may obtain free copies of this document as described above. No Offer or Solicitation This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities nor a solicitation of any vote or approval with respect to the proposed transaction or otherwise. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Deal Rationale Potential Best-In-Class Allogeneic CAR-T Cell Therapy with Significant Commercial Opportunity First Mover Advantage in the Field of Gamma-Delta CAR-T Cell Therapy Differentiated and Innovative Gamma Delta CAR-T Cell Pipeline Proprietary Intracellular Tumor-Selective Targeting Platform for Solid Tumors Potential to Capitalize the Platform in Oncology and Other Indications Leadership Team With Significant Operational and Development Expertise Established Partnership with Regeneron Post-merger entity well capitalized into 2022

resTORbio/Adicet Bio Merger Close expected 2H 2020 New company expected to be listed on NASDAQ (ticker TBD) Board of Directors expected to include five designated by Adicet + one from resTORbio + CEO On a pro forma basis, Adicet equityholders are expected to own approximately 75% of the combined company and current resTORbio equityholders are expected to own approximately 25% of the combined company

Post Merger Leadership Team Chen Schor President and CEO Stewart Abbot, PhD Chief Scientific and Operating Officer Carrie Krehlik Chief Human Resource Officer Lloyd Klickstein, MD, PhD Chief Innovation Officer Francesco Galimi, MD, PhD Chief Medical Officer

Adicet Strategic Priorities* *Additional guidance provided after deal close File IND for ADI-001 CD20 gamma-delta CAR-T Initiate Phase 1 clinical study in non-Hodgkin’s lymphoma File IND for ADI-002 GPC3 gamma-delta CAR-T Initiate Phase 1 in hepatocellular carcinoma Expand pipeline in oncology and other diseases Achieve milestones from collaboration with REGN

About Adicet Bio Founded in 2015 with $44M Series A financing Completed $80M Series B financing in September 2019 Developing off-the-shelf, engineered allogeneic γδ T cell therapy for oncology indications and other diseases cGMP-compliant manufacturing from healthy donors Proprietary intracellular tumor-selective targeting platform: T Cell Receptor-like monoclonal antibodies (TCR-L) for treatment of solid tumors Strategic partnership with Regeneron

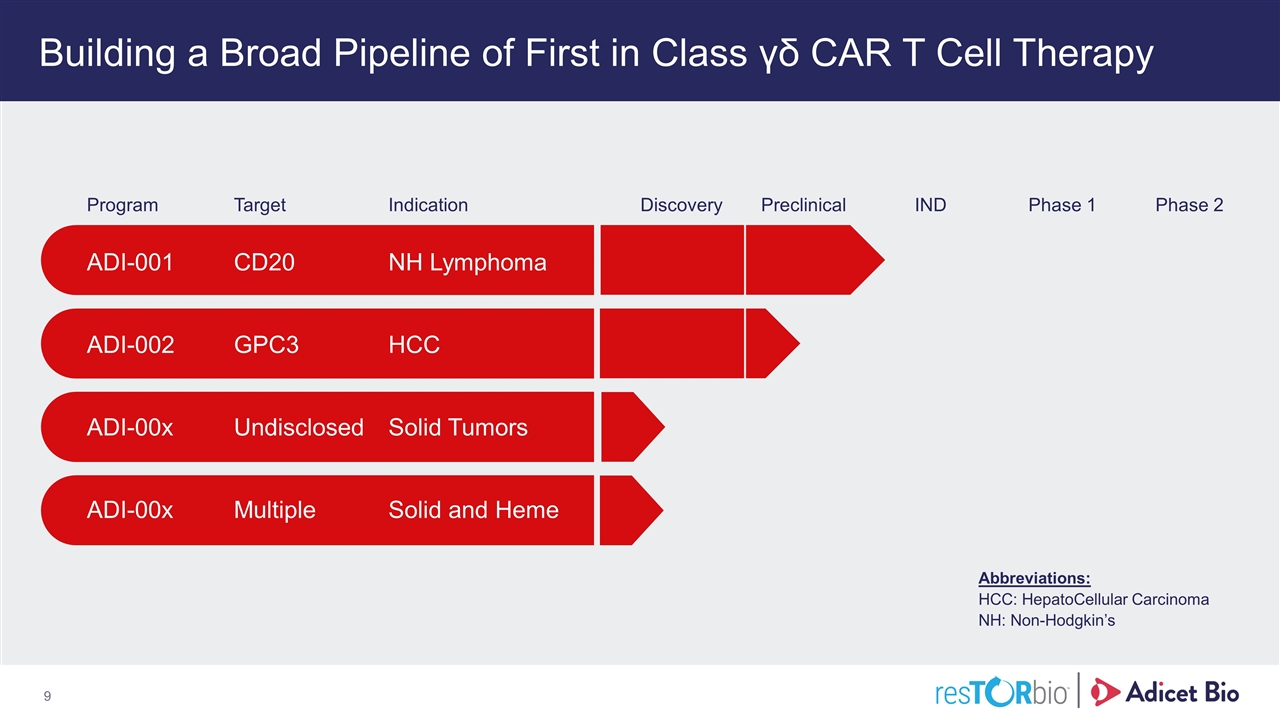

Building a Broad Pipeline of First in Class γδ CAR T Cell Therapy Abbreviations: HCC: HepatoCellular Carcinoma NH: Non-Hodgkin’s Program Target Indication Discovery Preclinical IND Phase 1 Phase 2 ADI-001 CD20 NH Lymphoma ADI-002 GPC3 HCC ADI-00x Undisclosed Solid Tumors ADI-00x Multiple Solid and Heme

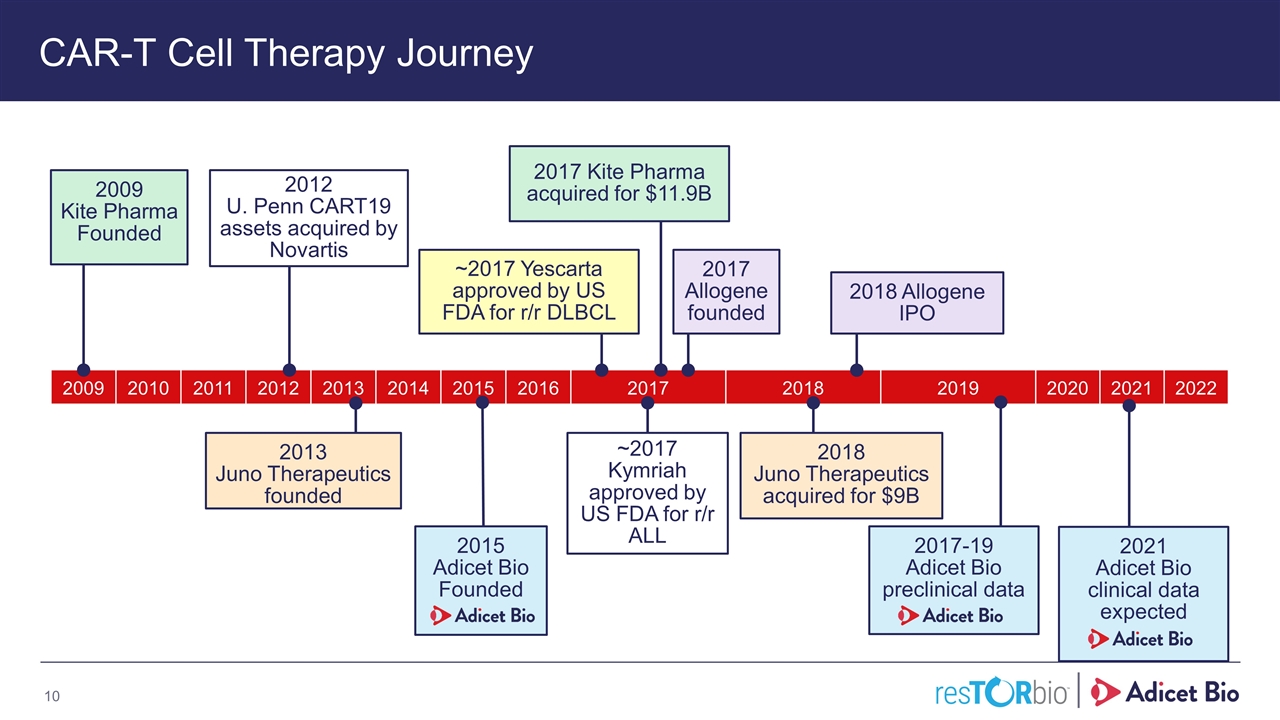

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 CAR-T Cell Therapy Journey 2015 Adicet Bio Founded ~2017 Yescarta approved by US FDA for r/r DLBCL 2012 U. Penn CART19 assets acquired by Novartis 2017 Kite Pharma acquired for $11.9B 2013 Juno Therapeutics founded 2009 Kite Pharma Founded 2017-19 Adicet Bio preclinical data 2021 Adicet Bio clinical data expected 2018 Allogene IPO 2018 Juno Therapeutics acquired for $9B 2017 Allogene founded Adicet Bio Confidential ~2017 Kymriah approved by US FDA for r/r ALL

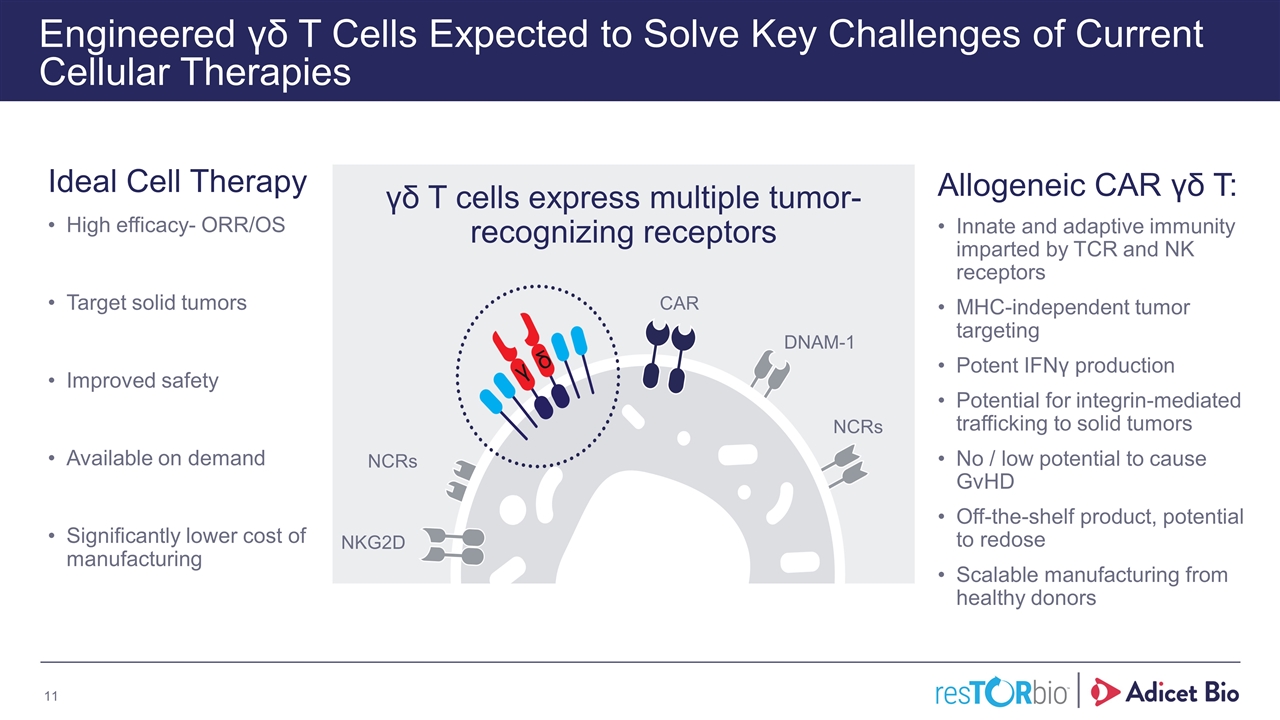

Engineered γδ T Cells Expected to Solve Key Challenges of Current Cellular Therapies Ideal Cell Therapy High efficacy- ORR/OS Target solid tumors Improved safety Available on demand Significantly lower cost of manufacturing Allogeneic CAR γδ T: Innate and adaptive immunity imparted by TCR and NK receptors MHC-independent tumor targeting Potent IFNγ production Potential for integrin-mediated trafficking to solid tumors No / low potential to cause GvHD Off-the-shelf product, potential to redose Scalable manufacturing from healthy donors γδ T cells express multiple tumor-recognizing receptors CAR DNAM-1 NCRs NCRs NKG2D γ δ

Improving Cancer Immunotherapy Presence of γδ T Cells Observed to Strongly Correlate with Positive Clinical Outcomes Meraviglia et al. 2017 Improved Disease Free Progression Colorectal Cancer γδ T cell hi γδ T cell lo γδ T cell lo / IFNγ lo Pan-Cancer: Improved Overall Prognosis Gentles et al. 2015 Godder et al. 2007 Post-HSCT Improved Survival γδ T cell hi γδ T cell lo Overall Survival

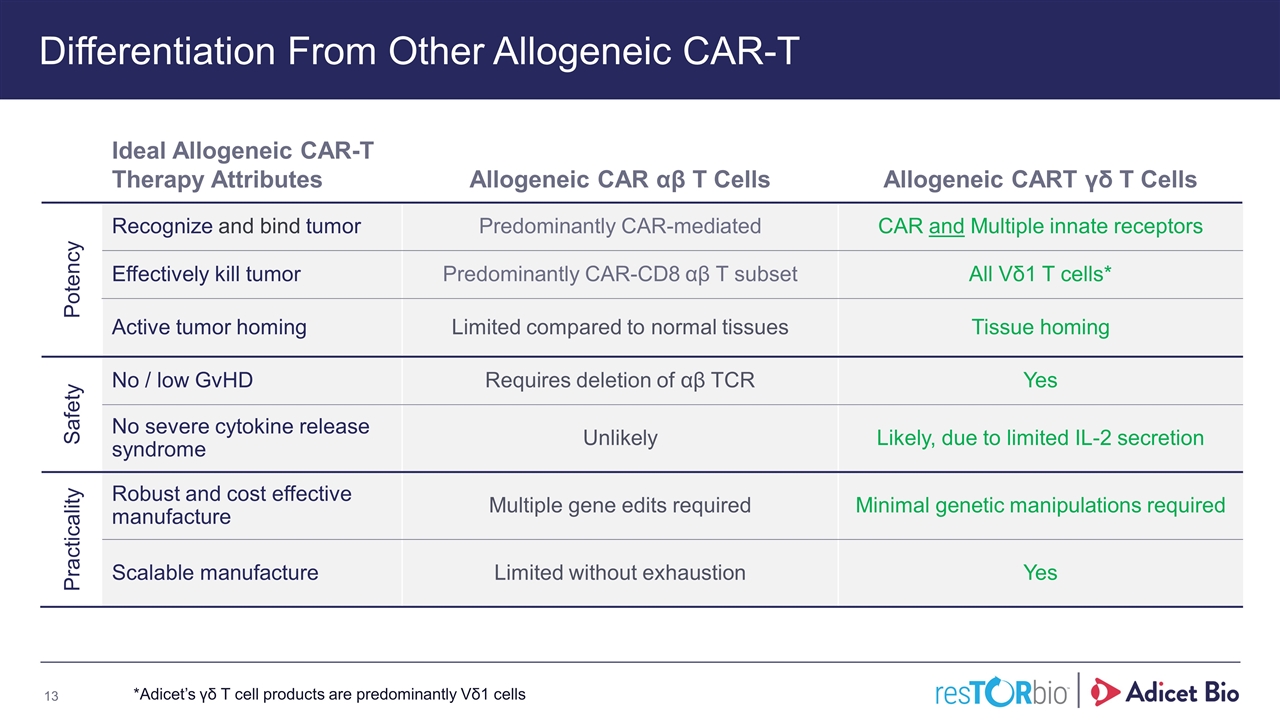

Differentiation From Other Allogeneic CAR-T Ideal Allogeneic CAR-T Therapy Attributes Allogeneic CAR αβ T Cells Allogeneic CART γδ T Cells Potency Recognize and bind tumor Predominantly CAR-mediated CAR and Multiple innate receptors Effectively kill tumor Predominantly CAR-CD8 αβ T subset All Vδ1 T cells* Active tumor homing Limited compared to normal tissues Tissue homing Safety No / low GvHD Requires deletion of αβ TCR Yes No severe cytokine release syndrome Unlikely Likely, due to limited IL-2 secretion Practicality Robust and cost effective manufacture Multiple gene edits required Minimal genetic manipulations required Scalable manufacture Limited without exhaustion Yes *Adicet’s γδ T cell products are predominantly Vδ1 cells

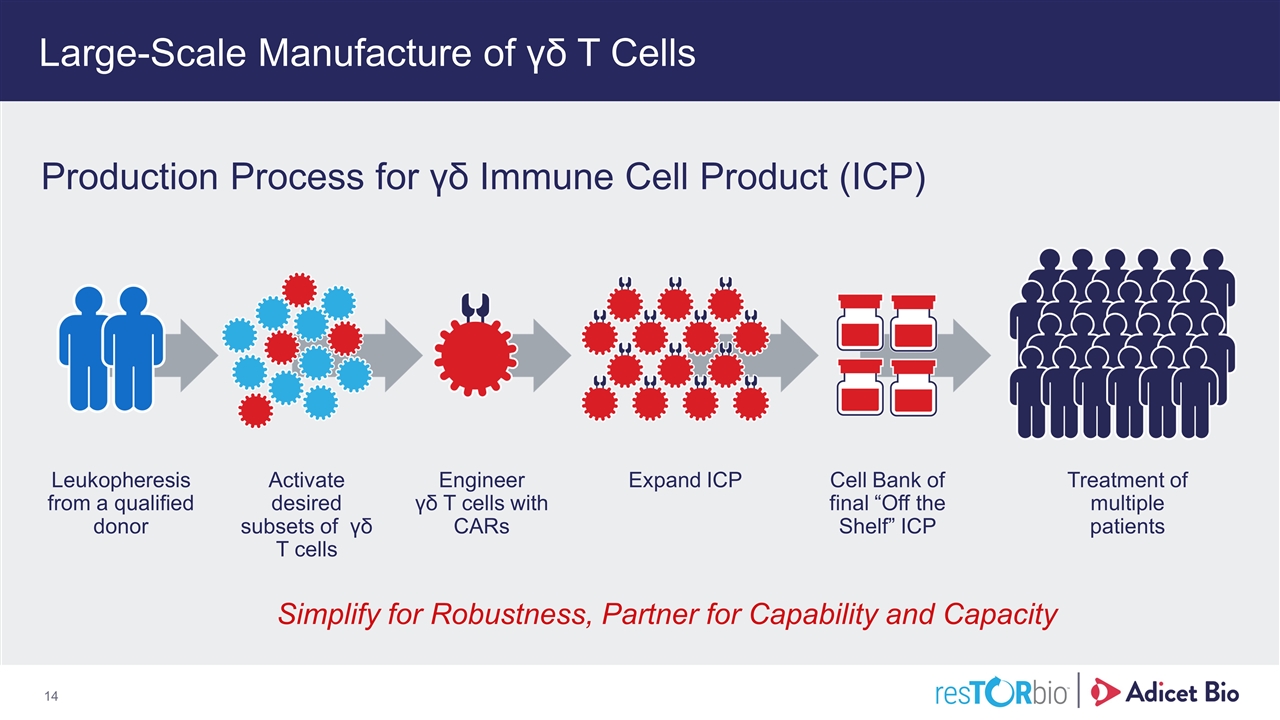

Large-Scale Manufacture of γδ T Cells Simplify for Robustness, Partner for Capability and Capacity Leukopheresis from a qualified donor Activate desired subsets of γδ T cells Engineer γδ T cells with CARs Expand ICP Cell Bank of final “Off the Shelf” ICP Treatment of multiple patients Production Process for γδ Immune Cell Product (ICP)

Adicet’s Platform Advantages Adicet is developing a rich pipeline of near-clinical γδ T cell therapy assets γδ T cells represent a highly active cellular immunotherapy platform γδ T cells represent a universal, off-the-shelf approach to cancer treatment Adicet’s approach is highly differentiated from potential competitors Adicet is developing enabling, scalable and proprietary cGMP-compliant manufacturing processes

ADI-001: Allogeneic (CD20-CAR-γδ T Cell)

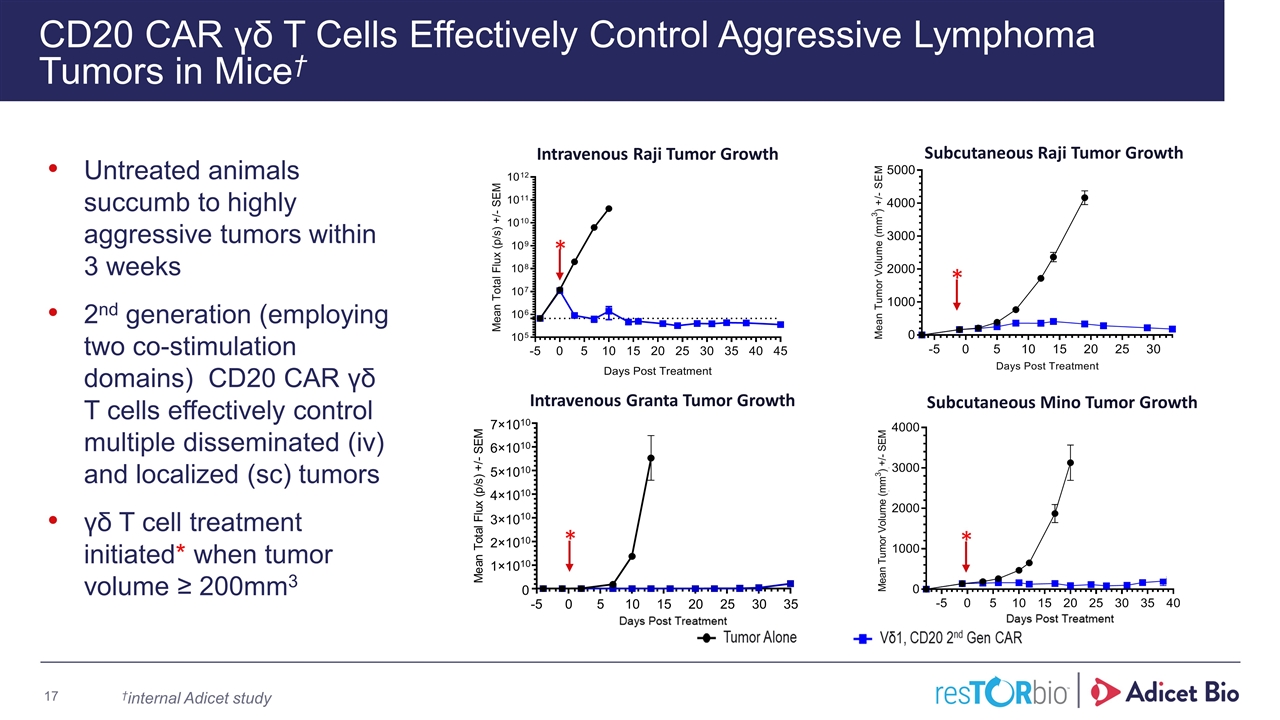

CD20 CAR γδ T Cells Effectively Control Aggressive Lymphoma Tumors in Mice† Untreated animals succumb to highly aggressive tumors within 3 weeks 2nd generation (employing two co-stimulation domains) CD20 CAR γδ T cells effectively control multiple disseminated (iv) and localized (sc) tumors γδ T cell treatment initiated* when tumor volume ≥ 200mm3 Subcutaneous Mino Tumor Growth -5 0 5 10 15 20 25 30 35 0 1×10 10 2×10 10 3×10 10 4×10 10 5×10 10 6×10 10 7×10 10 M e a n T o t a l F l u x ( p / s ) + / - S E M Subcutaneous Raji Tumor Growth Intravenous Granta Tumor Growth Intravenous Raji Tumor Growth * * * * †internal Adicet study

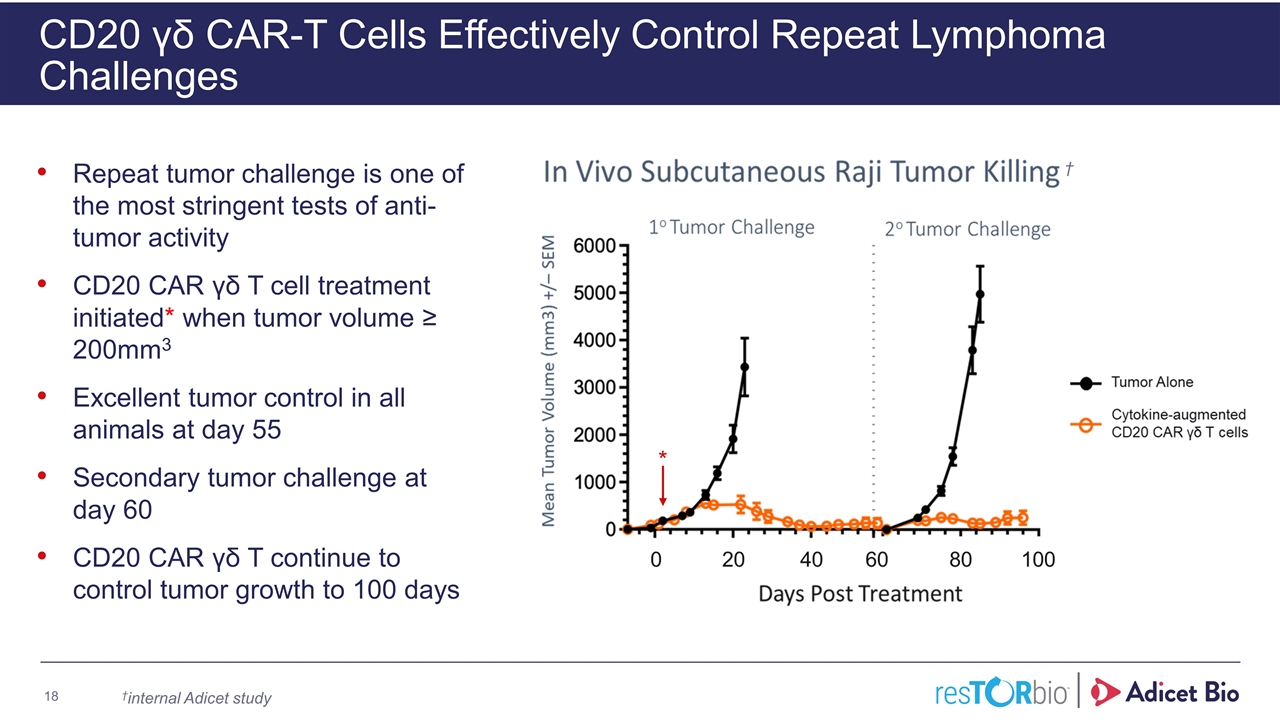

CD20 γδ CAR-T Cells Effectively Control Repeat Lymphoma Challenges Repeat tumor challenge is one of the most stringent tests of anti-tumor activity CD20 CAR γδ T cell treatment initiated* when tumor volume ≥ 200mm3 Excellent tumor control in all animals at day 55 Secondary tumor challenge at day 60 CD20 CAR γδ T continue to control tumor growth to 100 days * †internal Adicet study †

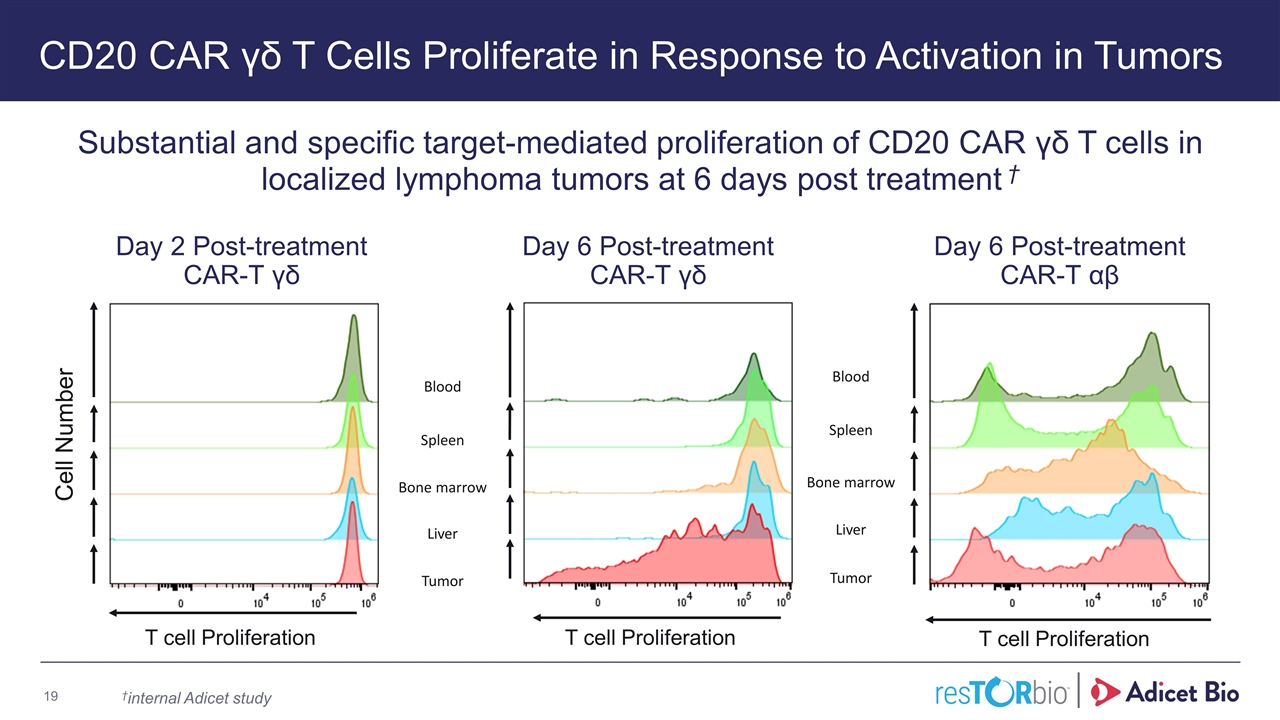

CD20 CAR γδ T Cells Proliferate in Response to Activation in Tumors Substantial and specific target-mediated proliferation of CD20 CAR γδ T cells in localized lymphoma tumors at 6 days post treatment † Blood Spleen Liver Bone marrow Tumor Cell Number T cell Proliferation Day 2 Post-treatment CAR-T γδ Day 6 Post-treatment CAR-T γδ Blood Spleen Liver Tumor Bone marrow T cell Proliferation T cell Proliferation Day 6 Post-treatment CAR-T αβ †internal Adicet study

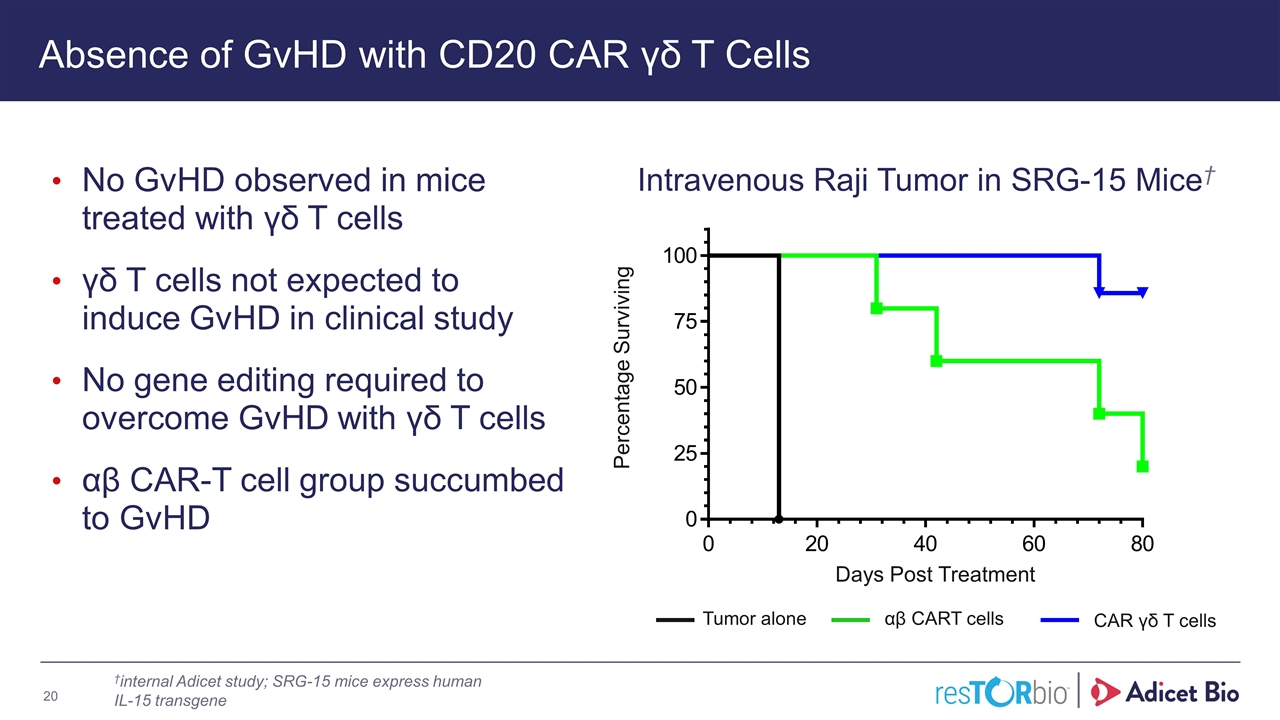

Intravenous Raji Tumor in SRG-15 Mice† Absence of GvHD with CD20 CAR γδ T Cells No GvHD observed in mice treated with γδ T cells γδ T cells not expected to induce GvHD in clinical study No gene editing required to overcome GvHD with γδ T cells αβ CAR-T cell group succumbed to GvHD αβ CART cells CAR γδ T cells Tumor alone Days Post Treatment Percentage Surviving †internal Adicet study; SRG-15 mice express human IL-15 transgene

Clinical Development of ADI-001 Phase 1 study design NHL patients relapsing from 2 or more prior lines of treatment ~3 cohorts for dose escalation/safety Up to 50 patients at the selected dose Single treatment with ADI-001 Option for retreatment in select patients Pivotal study likely in DLBCL and/or MCL Target product profile of ADI-001 (CD20 CAR γδ T cells derived from healthy donor) Effective (ORR, PFS/OS) in CD20 expressing NHL Significantly lower cytokine release syndrome No GvHD

ADI-001 Status Pre-IND meeting completed IND application enabling activities in process ADI-001 IND application preparation in process Proposed ADI-001 clinical trial design well received by key centers and KOLs Preparations for ADI-001 Phase 1 Clinical study underway

Additional Pipeline in Solid Tumors: ADI-002

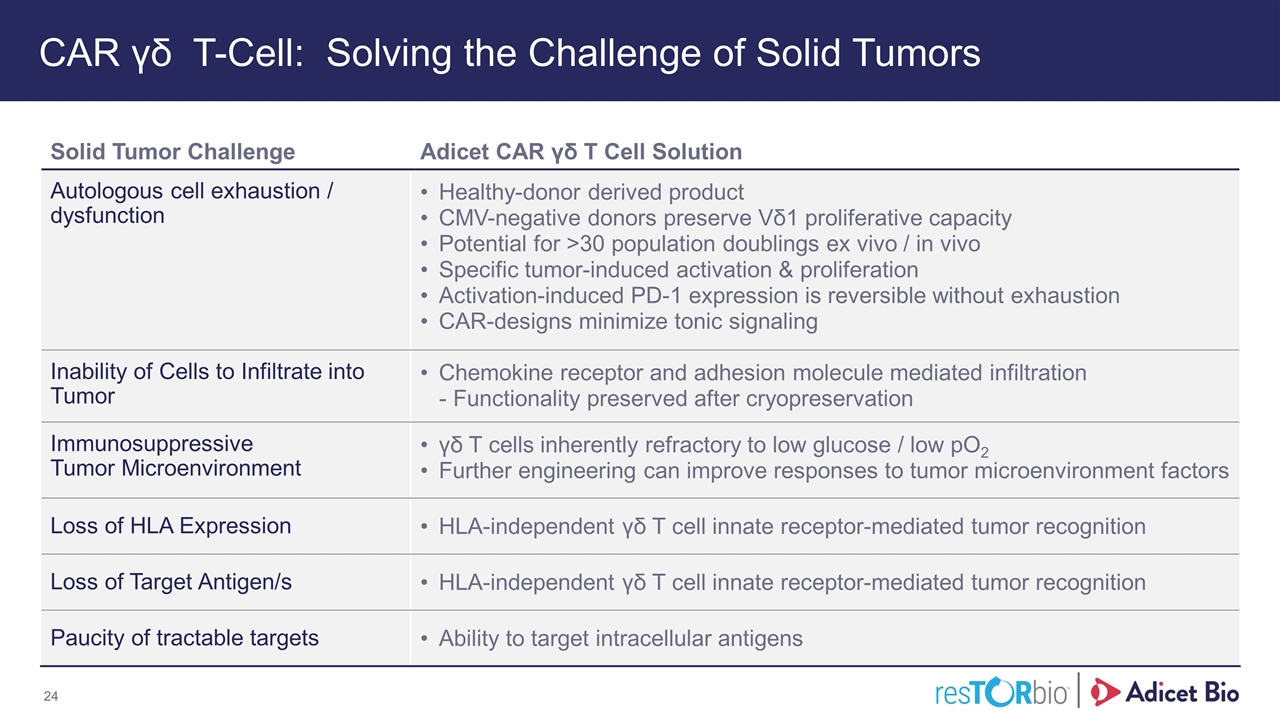

CAR γδ T-Cell: Solving the Challenge of Solid Tumors Solid Tumor Challenge Adicet CAR γδ T Cell Solution Autologous cell exhaustion / dysfunction Healthy-donor derived product CMV-negative donors preserve Vδ1 proliferative capacity Potential for >30 population doublings ex vivo / in vivo Specific tumor-induced activation & proliferation Activation-induced PD-1 expression is reversible without exhaustion CAR-designs minimize tonic signaling Inability of Cells to Infiltrate into Tumor Chemokine receptor and adhesion molecule mediated infiltration - Functionality preserved after cryopreservation Immunosuppressive Tumor Microenvironment γδ T cells inherently refractory to low glucose / low pO2 Further engineering can improve responses to tumor microenvironment factors Loss of HLA Expression HLA-independent γδ T cell innate receptor-mediated tumor recognition Loss of Target Antigen/s HLA-independent γδ T cell innate receptor-mediated tumor recognition Paucity of tractable targets Ability to target intracellular antigens

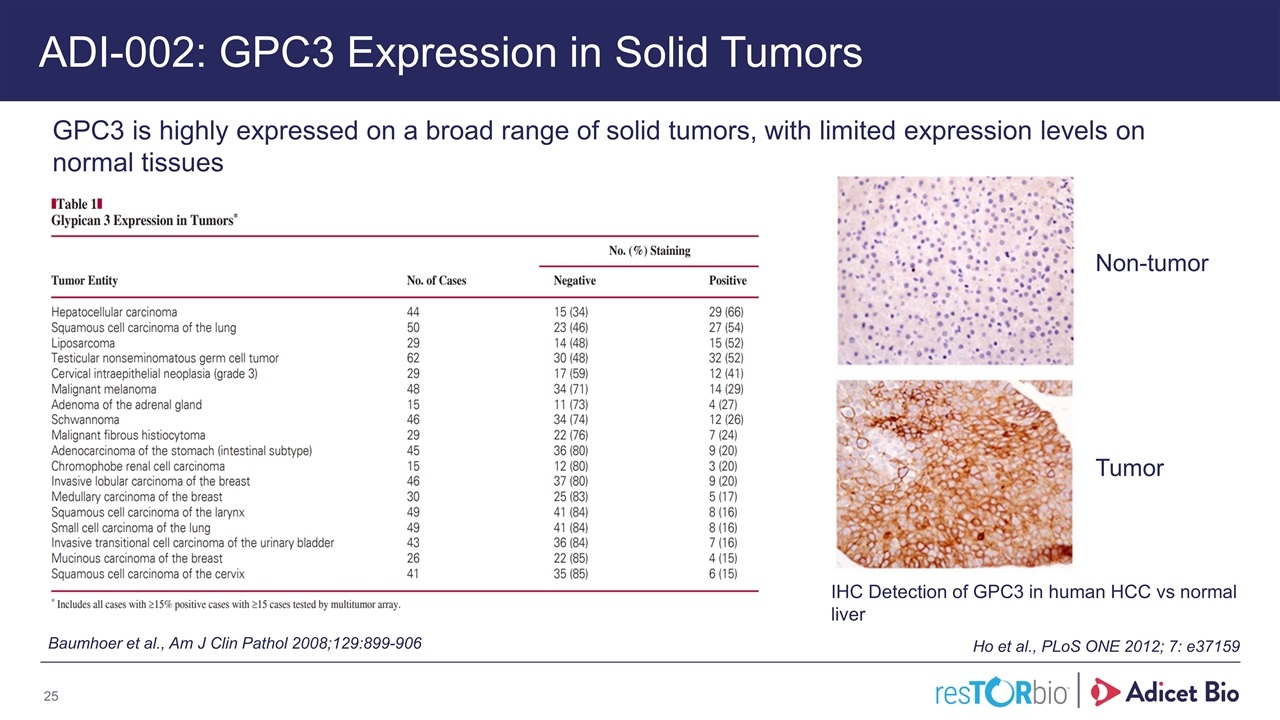

ADI-002: GPC3 Expression in Solid Tumors Baumhoer et al., Am J Clin Pathol 2008;129:899-906 Ho et al., PLoS ONE 2012; 7: e37159 IHC Detection of GPC3 in human HCC vs normal liver GPC3 is highly expressed on a broad range of solid tumors, with limited expression levels on normal tissues Adicet Bio Confidential Tumor Non-tumor

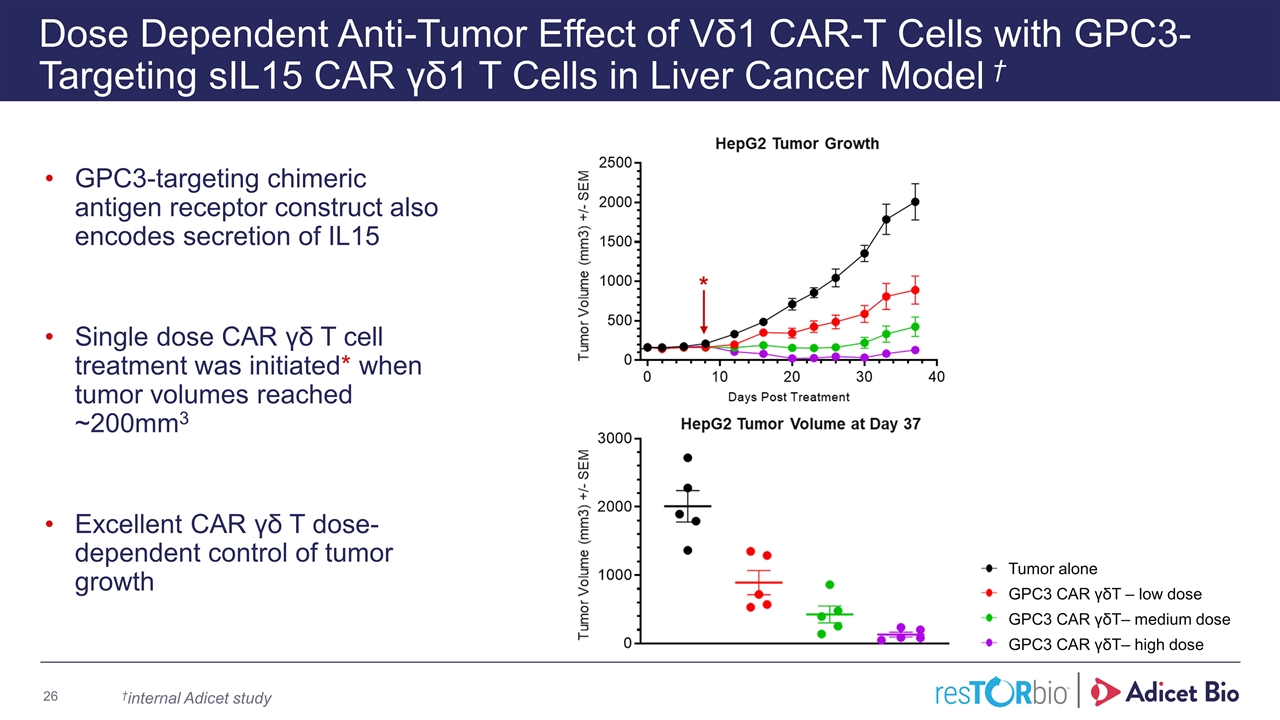

Dose Dependent Anti-Tumor Effect of Vδ1 CAR-T Cells with GPC3-Targeting sIL15 CAR γδ1 T Cells in Liver Cancer Model † GPC3-targeting chimeric antigen receptor construct also encodes secretion of IL15 Single dose CAR γδ T cell treatment was initiated* when tumor volumes reached ~200mm3 Excellent CAR γδ T dose-dependent control of tumor growth Tumor alone GPC3 CAR γδT – low dose GPC3 CAR γδT– medium dose GPC3 CAR γδT– high dose Adicet Bio Confidential †internal Adicet study

Adicet’s Advantage of ADI-002 in HCC Potential to address low target tumor densities CAR-dependent and CAR-independent tumor targeting Optimizing γδ T cells to overcome tumor microenvironment-mediated immunosuppression Enhancing persistence of CAR-γδ T cells Favorable preclinical results Opportunities in multiple tumor types Adicet Bio Confidential

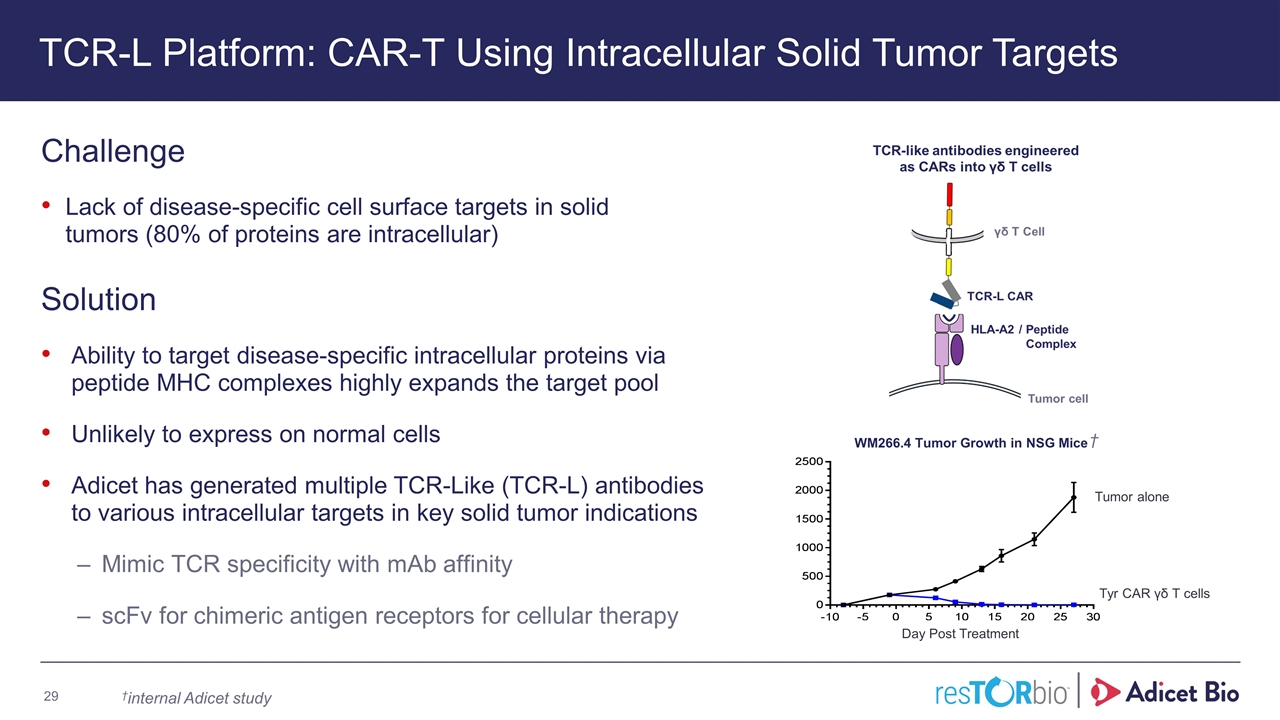

TCR-L Platform: Intracellular Solid Tumor Targets

TCR-L Platform: CAR-T Using Intracellular Solid Tumor Targets Challenge Lack of disease-specific cell surface targets in solid tumors (80% of proteins are intracellular) Solution Ability to target disease-specific intracellular proteins via peptide MHC complexes highly expands the target pool Unlikely to express on normal cells Adicet has generated multiple TCR-Like (TCR-L) antibodies to various intracellular targets in key solid tumor indications Mimic TCR specificity with mAb affinity scFv for chimeric antigen receptors for cellular therapy Tyr CAR γδ T cells Tumor alone Day Post Treatment WM266.4 Tumor Growth in NSG Mice †internal Adicet study †

Deal Rationale Potential Best-In-Class Allogeneic CAR-T Cell Therapy with Significant Commercial Opportunity First Mover Advantage in the Field of Gamma-Delta CAR-T Cell Therapy Differentiated and Innovative Gamma Delta CAR-T Cell Pipeline Proprietary Intracellular Tumor-Selective Targeting Platform for Solid Tumors Potential to Capitalize the Platform in Oncology and Other Indications Leadership Team With Significant Operational and Development Expertise Established Partnership with Regeneron Post-merger entity well capitalized into 2022

RTB101: Potent Target of rapamycin complex 1 (TORC1) inhibitor

RTB101 Expect to continue the development of RTB101 for a COVID-19 related indication, with clinical data expected by Q1 2021. The terms of the merger agreement contemplate that a contingent value right (a “CVR”) will be distributed to resTORbio stockholders as of the effective time of the merger, entitling CVR holders to receive net proceeds from the commercialization, if any, received from a third party commercial partner of the product candidate RTB101.