REPAY Investor Presentation November 2019 Exhibit 99.2

Disclaimer On July 11, 2019 (the “Closing Date”), Thunder Bridge Acquisition, Ltd. (“Thunder Bridge”) and Hawk Parent Holdings LLC (“Hawk Parent”) completed their previously announced business combination under which Thunder Bridge acquired Hawk Parent, upon which Thunder Bridge changed its name to Repay Holdings Corporation (“REPAY” or the “Company”). Unless otherwise indicated, information provided in this presentation (a) that relates to any periods ended prior to the Closing Date reflect that of Hawk Parent prior to the Business Combination, (b) that relates to any period ended September 30, 2019 reflect the combination of (i) Hawk Parent for the periods from either January 1, 2019 or July 1, 2019 through July 10, 2019 and (ii) REPAY for the period from the Closing Date through September 30, 2019. Such combination reflects a simple arithmetic addition of the relevant periods. The historical financial information of Thunder Bridge prior to the Business Combination has not been reflected in any financial information of Hawk Parent. The Company’s filings with the Securities and Exchange Commission (“SEC”), which you may obtain for free at the SEC’s website at http://www.sec.gov, discuss some of the important risk factors that may affect REPAY’s business, results of operations and financial condition. Forward-Looking Statements This presentation (the “Presentation”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about future financial and operating results, our plans, objectives, expectations and intentions with respect to future operations, products and services; and other statements identified by words such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “believe,” “intend,” “plan,” “projection,” “outlook” or words of similar meaning. These forward-looking statements include, but are not limited to, statements regarding REPAY’s industry and market sizes, future opportunities for REPAY and REPAY’s estimated future results, including the full year 2019 outlook. Such forward-looking statements are based upon the current beliefs and expectations of REPAY’s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. Actual results and the timing of events may differ materially from the results anticipated in these forward-looking statements. In addition to factors previously disclosed in prior reports filed with the SEC and those identified elsewhere in this Presentation, the following factors, among others, could cause actual results and the timing of events to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: a delay or failure to realize the expected benefits from the Business Combination; a delay or failure to integrate and realize the benefits of the TriSource acquisition and any difficulties associated with operating in the back-end processing markets in which REPAY does not have any experience; a delay or failure to integrate and realize the benefits of the APS Payments acquisition and any difficulties associated with marketing products and services in the B2B vertical market in which REPAY does not have any experience; changes in the payment processing market in which REPAY competes, including with respect to its competitive landscape, technology evolution or regulatory changes; changes in the vertical markets that REPAY targets; risks relating to REPAY’s relationships within the payment ecosystem; risk that REPAY may not be able to execute its growth strategies, including identifying and executing acquisitions; risks relating to data security; changes in accounting policies applicable to REPAY; and the risk that REPAY may not be able to develop and maintain effective internal controls. Actual results, performance or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions on which those forward-looking statements are based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance as projected financial information and other information are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other factors, many of which are beyond REPAY’s control. All information set forth herein speaks only as of the date hereof in the case of information about REPAY or the date of such information in the case of information from persons other than REPAY, and REPAY disclaims any intention or obligation to update any forward looking statements as a result of developments occurring after the date of this Presentation. Forecasts and estimates regarding REPAY’s industry and end markets are based on sources it believes to be reliable, however there can be no assurance these forecasts and estimates will prove accurate in whole or in part. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. Use of Projections This Presentation contains financial forecasts with respect to, among other things, REPAY’s total revenue, gross profit, annual card payment volume, Adjusted EBITDA and certain ratios and other metrics derived therefrom for the fiscal year 2019. These unaudited financial projections have been provided by REPAY’s management, and REPAY’s independent auditors have not audited, reviewed, compiled, or performed any procedures with respect to the unaudited financial projections for the purpose of their inclusion in this Presentation and, accordingly, do not express an opinion or provide any other form of assurance with respect thereto for the purpose of this Presentation. These unaudited financial projections should not be relied upon as being necessarily indicative of future results. The inclusion of the unaudited financial projections in this Presentation is not an admission or representation by the Company that such information is material. The assumptions and estimates underlying the unaudited financial projections are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the unaudited financial projections. There can be no assurance that the prospective results are indicative of the future performance of the Company or that actual results will not differ materially from those presented in the unaudited financial projections. Inclusion of the unaudited financial projections in this Presentation should not be regarded as a representation by any person that the results contained in the unaudited financial projections will be achieved. Industry and Market Data The information contained herein also includes information provided by third parties, such as market research firms. In particular, REPAY has commissioned independent research reports from Stax Inc. (“Stax”) and Ernst & Young LLP (“EY” or “EY Parthenon”) for market and industry information to be used by REPAY. Neither of REPAY nor its affiliates and any third parties that provide information to REPAY, such as market research firms, guarantee the accuracy, completeness, timeliness or availability of any information. Neither REPAY nor its affiliates and any third parties that provide information to REPAY, such as market research firms, such as Stax and EY, are responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or the results obtained from the use of such content. Neither REPAY nor its affiliates give any express or implied warranties, including. but not limited to, any warranties of merchantability or fitness for a particular purpose or use, and they expressly disclaim any responsibility or liability for direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees or losses (including lost income or profits and opportunity costs) in connection with the use of the information herein. Non-GAAP Financial Measures This Presentation includes certain non-GAAP financial measures that REPAY’s management uses to evaluate its operating business, measure its performance and make strategic decisions. Adjusted EBITDA is a non-GAAP financial measure that represents net income prior to interest expense, depreciation and amortization, as adjusted to add back certain non-cash and non-recurring charges, such as loss on extinguishment of debt, non-cash change in fair value of contingent consideration, share-based compensation charges, transaction expenses, management fees, legacy commission related charges, employee recruiting costs, loss on disposition of property and equipment, other taxes, strategic initiative related costs and other non-recurring charges. Adjusted Net Income is a non-GAAP financial measure that represents net income prior to amortization of acquisition-related intangibles, as adjusted to add back certain non-cash and non-recurring charges, such as loss on extinguishment of debt, non-cash change in fair value of contingent consideration, transaction expenses, share-based compensation expense, management fees, legacy commission related charges, employee recruiting costs, loss on disposition of property and equipment, strategic initiative related costs and other non-recurring charges. REPAY believes that Adjusted EBITDA and Adjusted Net Income provide useful information to investors and others in understanding and evaluating its operating results in the same manner as management. However, Adjusted EBITDA and Adjusted Net Income are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for net income, operating profit, or any other operating performance measure calculated in accordance with GAAP. Using these non-GAAP financial measure to analyze REPAY’s business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant. In addition, although other companies in REPAY’s industry may report measures titled Adjusted EBITDA, Adjusted Net Income or similar measures, such non-GAAP financial measures may be calculated differently from how REPAY calculates its non-GAAP financial measures, which reduces their overall usefulness as comparative measures. Because of these limitations, you should consider Adjusted EBITDA and Adjusted Net Income alongside other financial performance measures, including net income and our other financial results presented in accordance with GAAP. This Presentation includes forecasted 2019 Adjusted EBITDA for REPAY. This Presentation does not provide a reconciliation of this forward-looking, non-GAAP financial measure to the most directly comparable GAAP financial measure because calculating the components would involve numerous estimates and judgments that are unduly burdensome to prepare and may imply a degree of precision that would be confusing or potentially misleading to investors. No Offer or Solicitation This Presentation is for informational purposes only and is neither an offer to sell or purchase, nor a solicitation of an offer to sell, buy or subscribe for any securities, nor shall there be any sale, issuance or transfer or securities in any jurisdiction in contravention of applicable law.

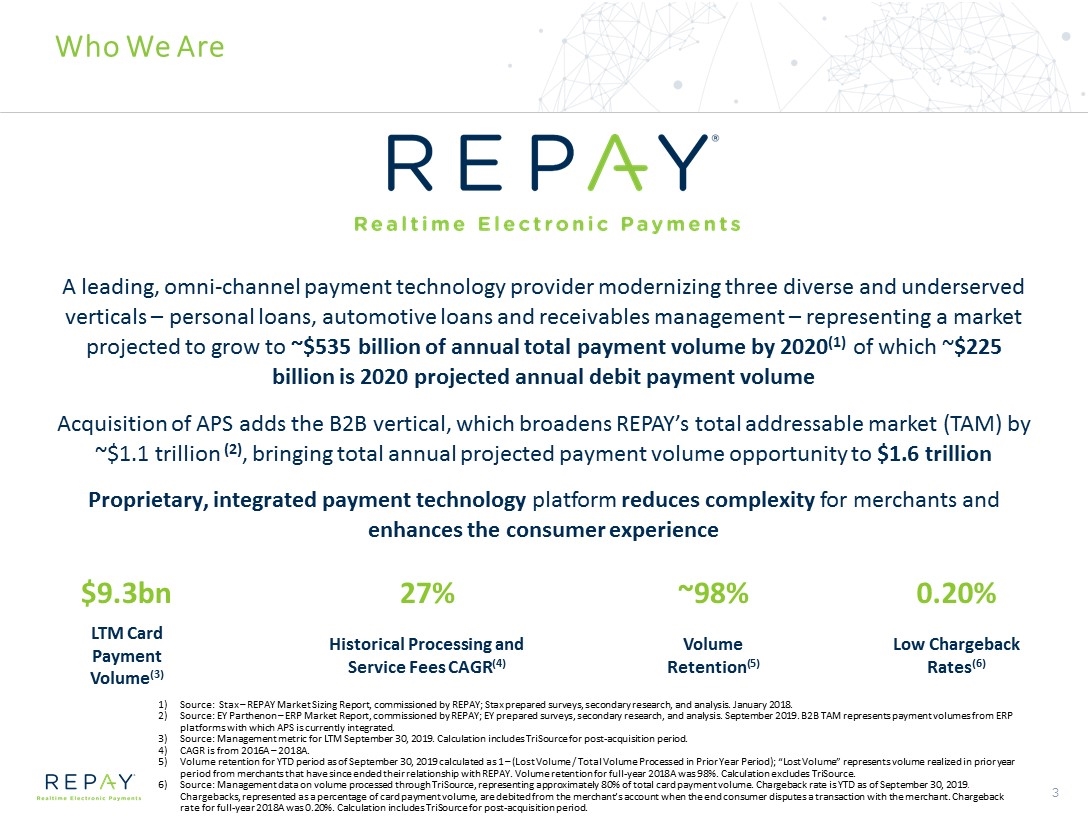

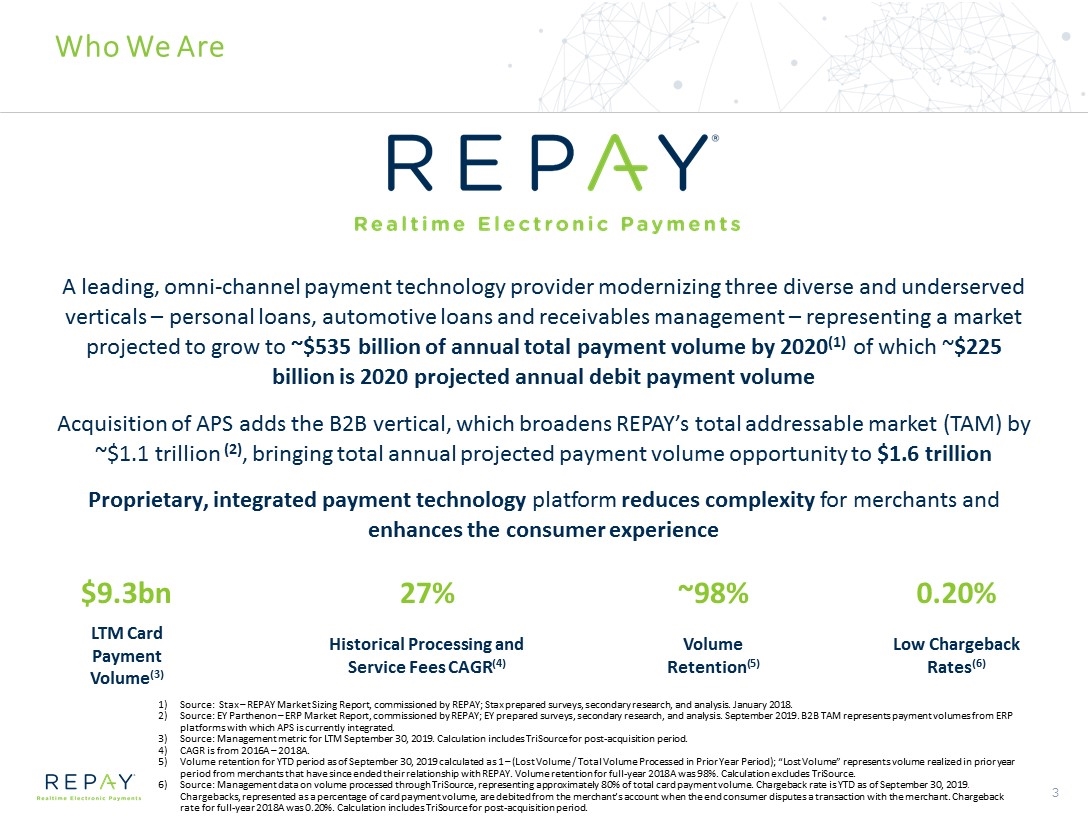

Low Chargeback Rates(6) 0.20% Historical Processing and Service Fees CAGR(4) 27% Who We Are Source: Stax – REPAY Market Sizing Report, commissioned by REPAY; Stax prepared surveys, secondary research, and analysis. January 2018. Source: EY Parthenon – ERP Market Report, commissioned by REPAY; EY prepared surveys, secondary research, and analysis. September 2019. B2B TAM represents payment volumes from ERP platforms with which APS is currently integrated. Source: Management metric for LTM September 30, 2019. Calculation includes TriSource for post-acquisition period. CAGR is from 2016A – 2018A. Volume retention for YTD period as of September 30, 2019 calculated as 1 – (Lost Volume / Total Volume Processed in Prior Year Period); “Lost Volume” represents volume realized in prior year period from merchants that have since ended their relationship with REPAY. Volume retention for full-year 2018A was 98%. Calculation excludes TriSource. Source: Management data on volume processed through TriSource, representing approximately 80% of total card payment volume. Chargeback rate is YTD as of September 30, 2019. Chargebacks, represented as a percentage of card payment volume, are debited from the merchant’s account when the end consumer disputes a transaction with the merchant. Chargeback rate for full-year 2018A was 0.20%. Calculation includes TriSource for post-acquisition period. A leading, omni-channel payment technology provider modernizing three diverse and underserved verticals – personal loans, automotive loans and receivables management – representing a market projected to grow to ~$535 billion of annual total payment volume by 2020(1) of which ~$225 billion is 2020 projected annual debit payment volume Acquisition of APS adds the B2B vertical, which broadens REPAY’s total addressable market (TAM) by ~$1.1 trillion (2), bringing total annual projected payment volume opportunity to $1.6 trillion Proprietary, integrated payment technology platform reduces complexity for merchants and enhances the consumer experience LTM Card Payment Volume(3) $9.3bn Volume Retention(5) ~98%

REPAY’s Business Strengths and Strategies A Leading, Omni-Channel Payment Technology Provider Capitalizing on the Large, Underserved Market Opportunities in Existing and New Verticals Card and Debit Payments Underpenetrated in Existing Verticals REPAY Has Built a Leading Platform Based on Vertical Expertise Next-Generation Technology Supported by Robust Infrastructure Key Software Integrations Supplement REPAY’s Differentiated Sales Strategy Attractive and Diverse Client Base Demonstrated Ability to Acquire and Integrate Businesses Multiple Growth Opportunities Successful Leadership Team with Deep Industry Expertise 1 2 3 4 5 7 6 9 8

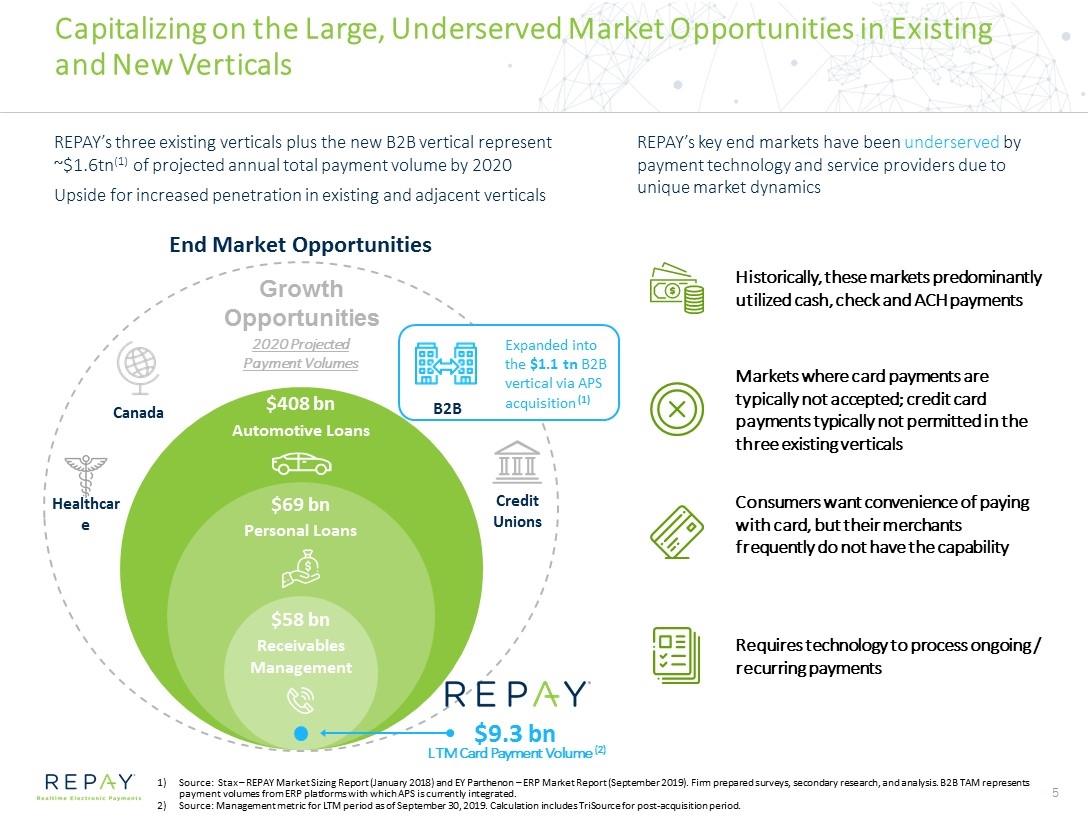

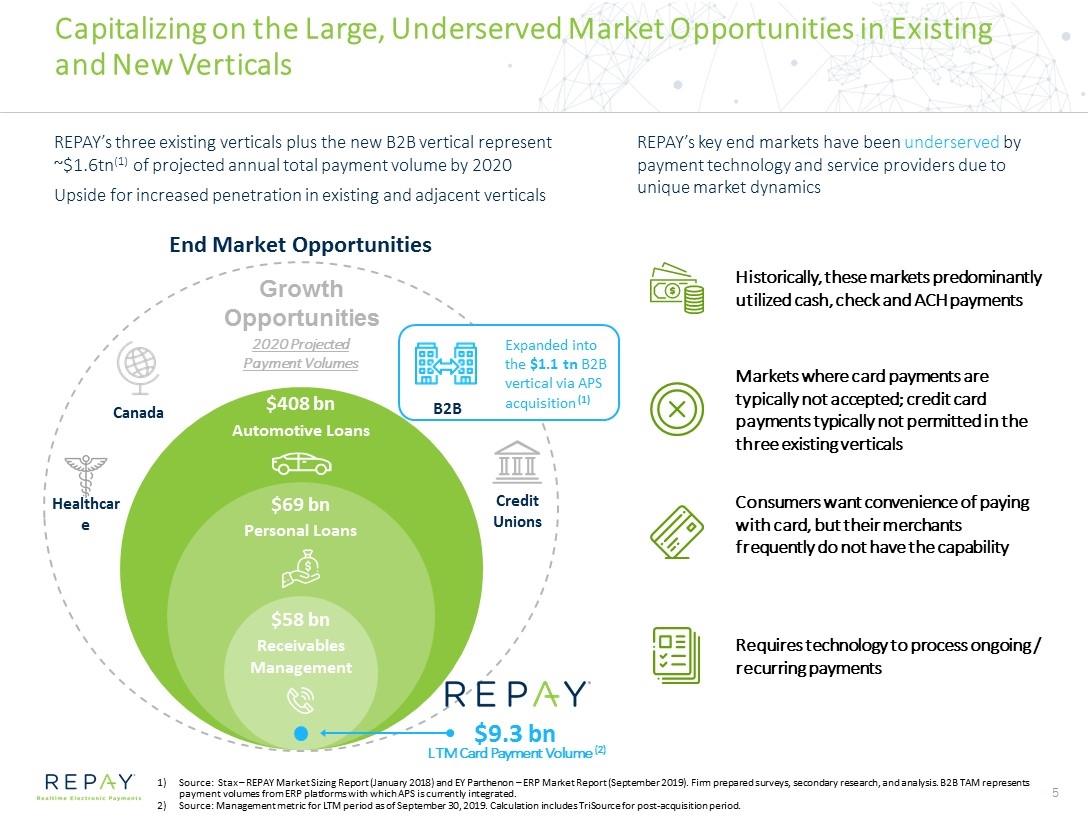

Growth Opportunities $408 bn Automotive Loans $69 bn Personal Loans $58 bn Receivables Management Capitalizing on the Large, Underserved Market Opportunities in Existing and New Verticals Source: Stax – REPAY Market Sizing Report (January 2018) and EY Parthenon – ERP Market Report (September 2019). Firm prepared surveys, secondary research, and analysis. B2B TAM represents payment volumes from ERP platforms with which APS is currently integrated. Source: Management metric for LTM period as of September 30, 2019. Calculation includes TriSource for post-acquisition period. REPAY’s three existing verticals plus the new B2B vertical represent ~$1.6tn(1) of projected annual total payment volume by 2020 Upside for increased penetration in existing and adjacent verticals REPAY’s key end markets have been underserved by payment technology and service providers due to unique market dynamics Historically, these markets predominantly utilized cash, check and ACH payments Consumers want convenience of paying with card, but their merchants frequently do not have the capability Requires technology to process ongoing / recurring payments Markets where card payments are typically not accepted; credit card payments typically not permitted in the three existing verticals LTM Card Payment Volume (2) End Market Opportunities Healthcare B2B Credit Unions Canada $9.3 bn 2020 Projected Payment Volumes Expanded into the $1.1 tn B2B vertical via APS acquisition (1)

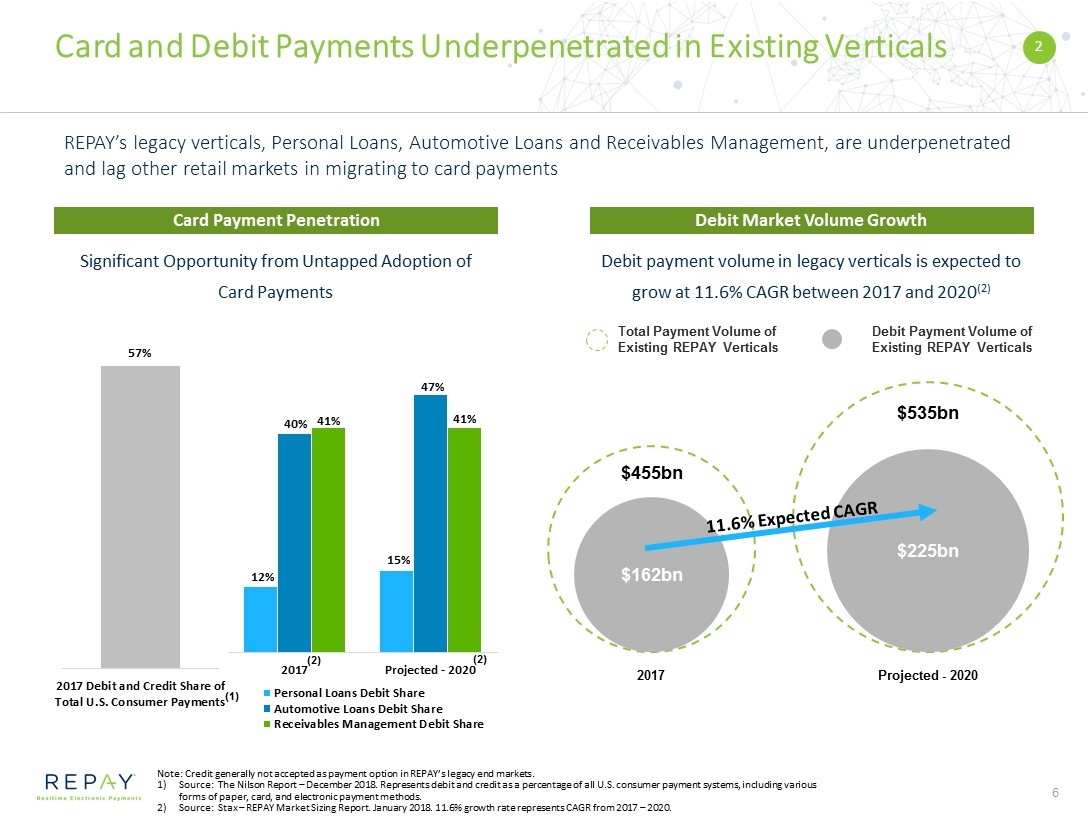

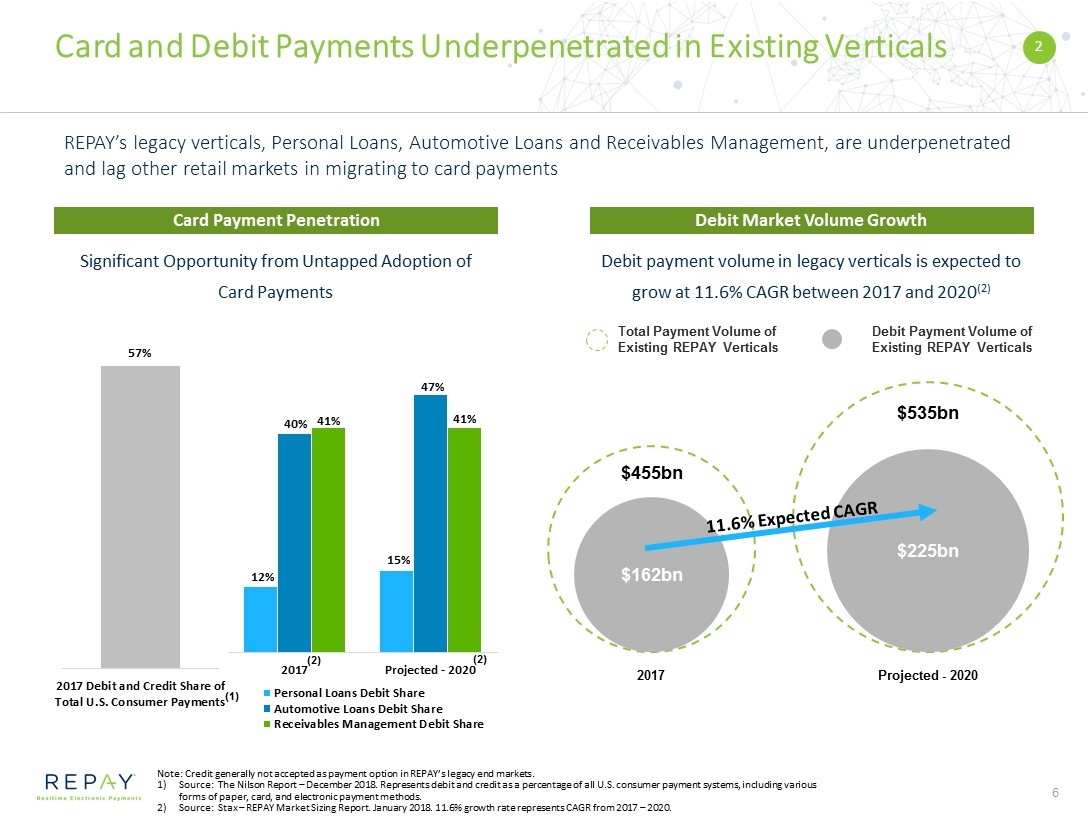

Card Payment Penetration Card and Debit Payments Underpenetrated in Existing Verticals Note: Credit generally not accepted as payment option in REPAY’s legacy end markets. Source: The Nilson Report – December 2018. Represents debit and credit as a percentage of all U.S. consumer payment systems, including various forms of paper, card, and electronic payment methods. Source: Stax – REPAY Market Sizing Report. January 2018. 11.6% growth rate represents CAGR from 2017 – 2020. REPAY’s legacy verticals, Personal Loans, Automotive Loans and Receivables Management, are underpenetrated and lag other retail markets in migrating to card payments Significant Opportunity from Untapped Adoption of Card Payments (1) (2) 2 Debit Market Volume Growth Debit payment volume in legacy verticals is expected to grow at 11.6% CAGR between 2017 and 2020(2) Projected - 2020 2017 Debit Payment Volume of Existing REPAY Verticals Total Payment Volume of Existing REPAY Verticals $162bn $455bn $225bn $535bn 11.6% Expected CAGR (2)

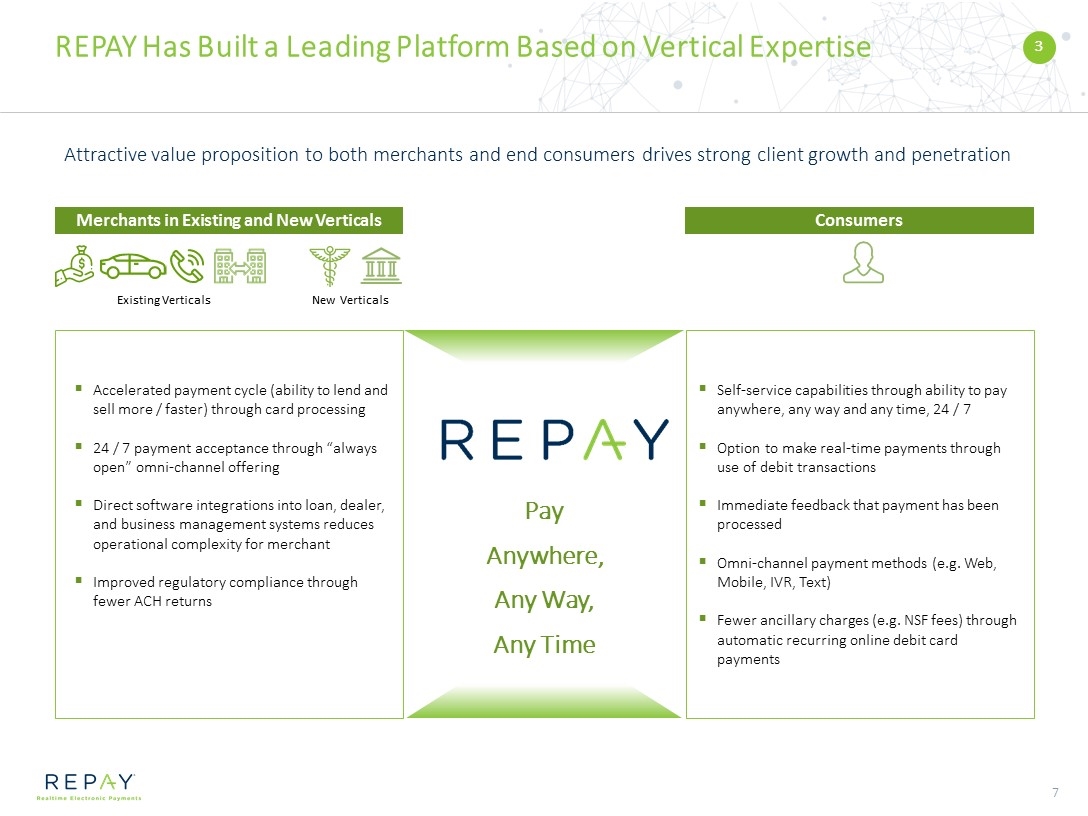

Attractive value proposition to both merchants and end consumers drives strong client growth and penetration REPAY Has Built a Leading Platform Based on Vertical Expertise Merchants in Existing and New Verticals Consumers Pay Anywhere, Any Way, Any Time Accelerated payment cycle (ability to lend and sell more / faster) through card processing 24 / 7 payment acceptance through “always open” omni-channel offering Direct software integrations into loan, dealer, and business management systems reduces operational complexity for merchant Improved regulatory compliance through fewer ACH returns Self-service capabilities through ability to pay anywhere, any way and any time, 24 / 7 Option to make real-time payments through use of debit transactions Immediate feedback that payment has been processed Omni-channel payment methods (e.g. Web, Mobile, IVR, Text) Fewer ancillary charges (e.g. NSF fees) through automatic recurring online debit card payments 3 Existing Verticals New Verticals

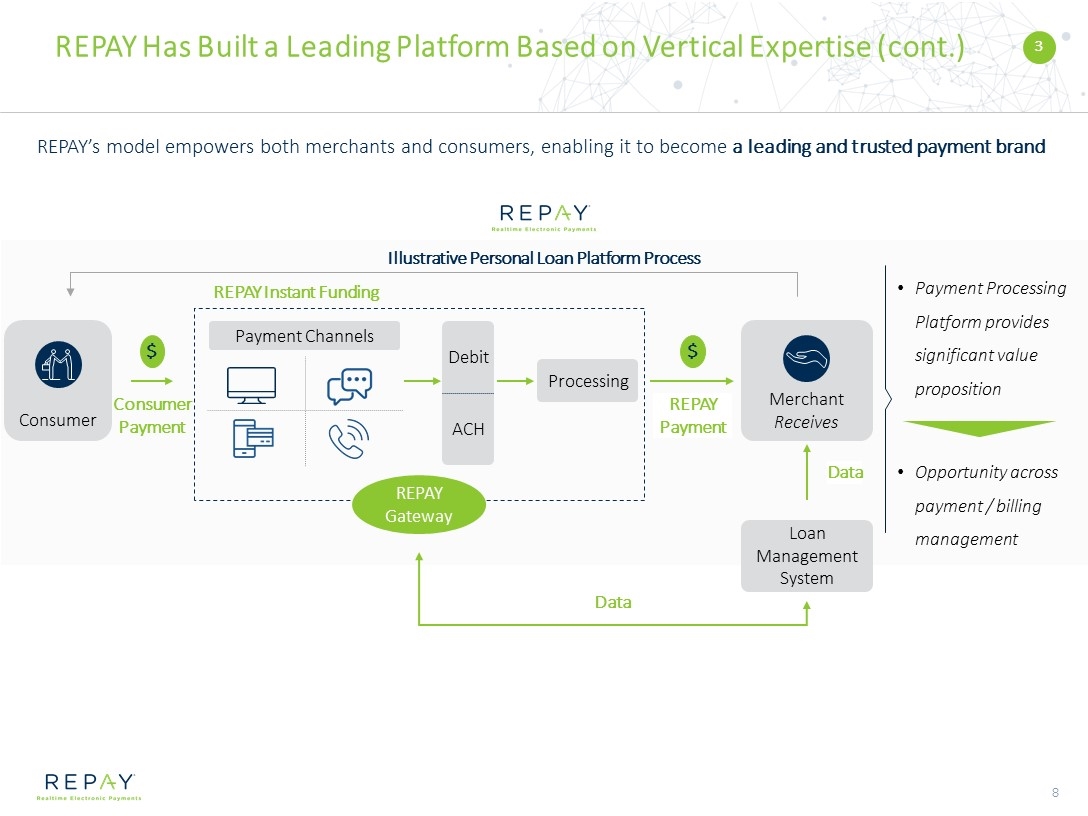

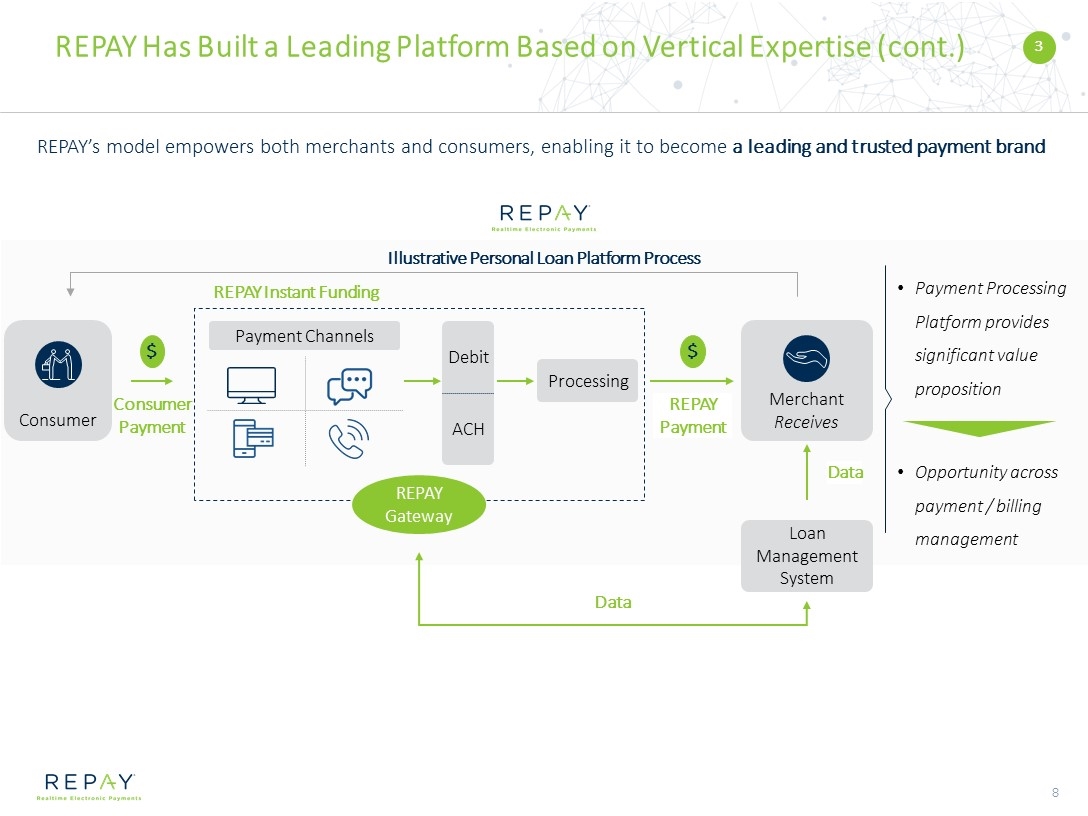

Payment Processing Platform provides significant value proposition Opportunity across payment / billing management Payment Channels Debit REPAY Instant Funding Consumer Merchant Receives REPAY Has Built a Leading Platform Based on Vertical Expertise (cont.) 3 REPAY’s model empowers both merchants and consumers, enabling it to become a leading and trusted payment brand Debit Processing Loan Management System Data $ REPAY Payment Data REPAY Gateway Illustrative Personal Loan Platform Process Consumer Payment $ ACH

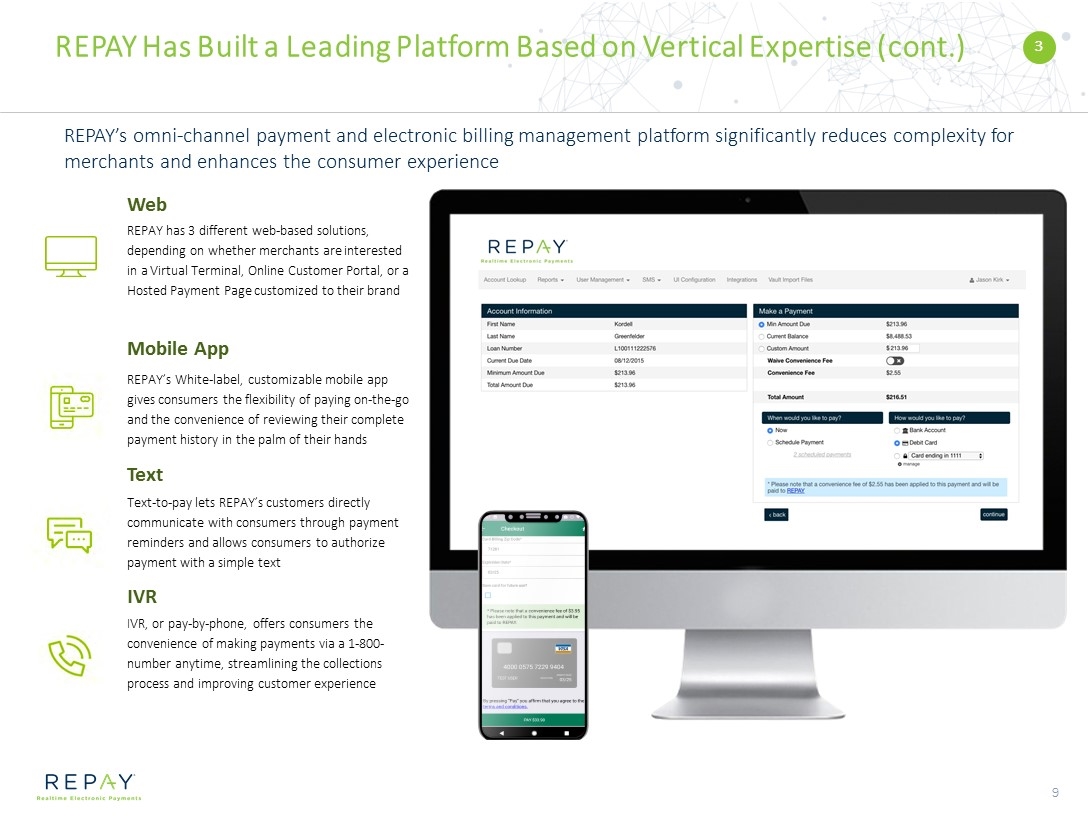

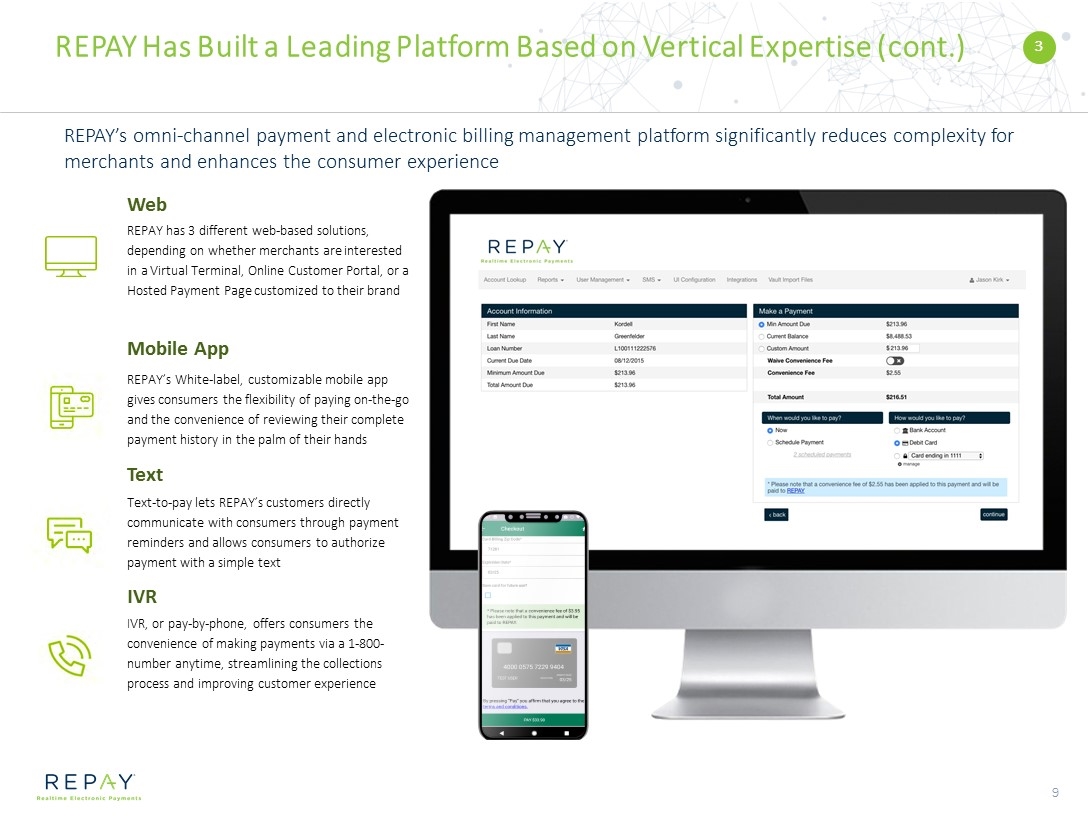

REPAY has 3 different web-based solutions, depending on whether merchants are interested in a Virtual Terminal, Online Customer Portal, or a Hosted Payment Page customized to their brand Web REPAY Has Built a Leading Platform Based on Vertical Expertise (cont.) REPAY’s omni-channel payment and electronic billing management platform significantly reduces complexity for merchants and enhances the consumer experience REPAY’s White-label, customizable mobile app gives consumers the flexibility of paying on-the-go and the convenience of reviewing their complete payment history in the palm of their hands Mobile App Text-to-pay lets REPAY’s customers directly communicate with consumers through payment reminders and allows consumers to authorize payment with a simple text Text IVR, or pay-by-phone, offers consumers the convenience of making payments via a 1-800- number anytime, streamlining the collections process and improving customer experience IVR 3

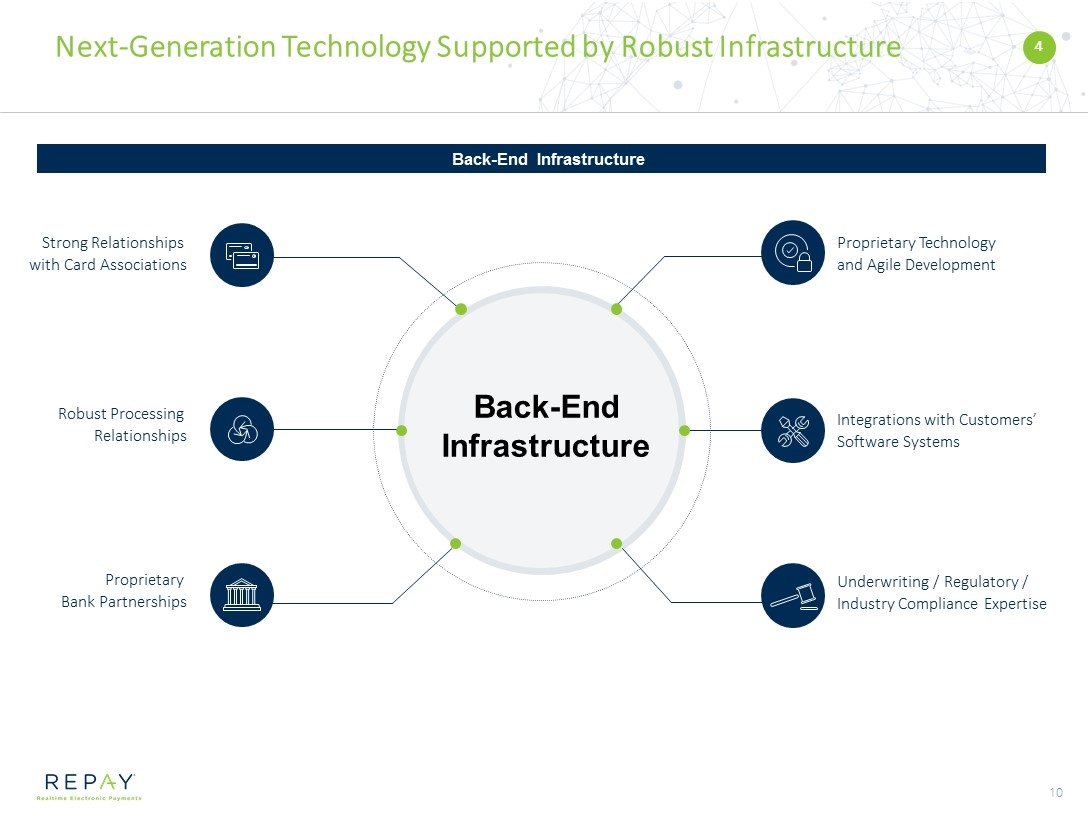

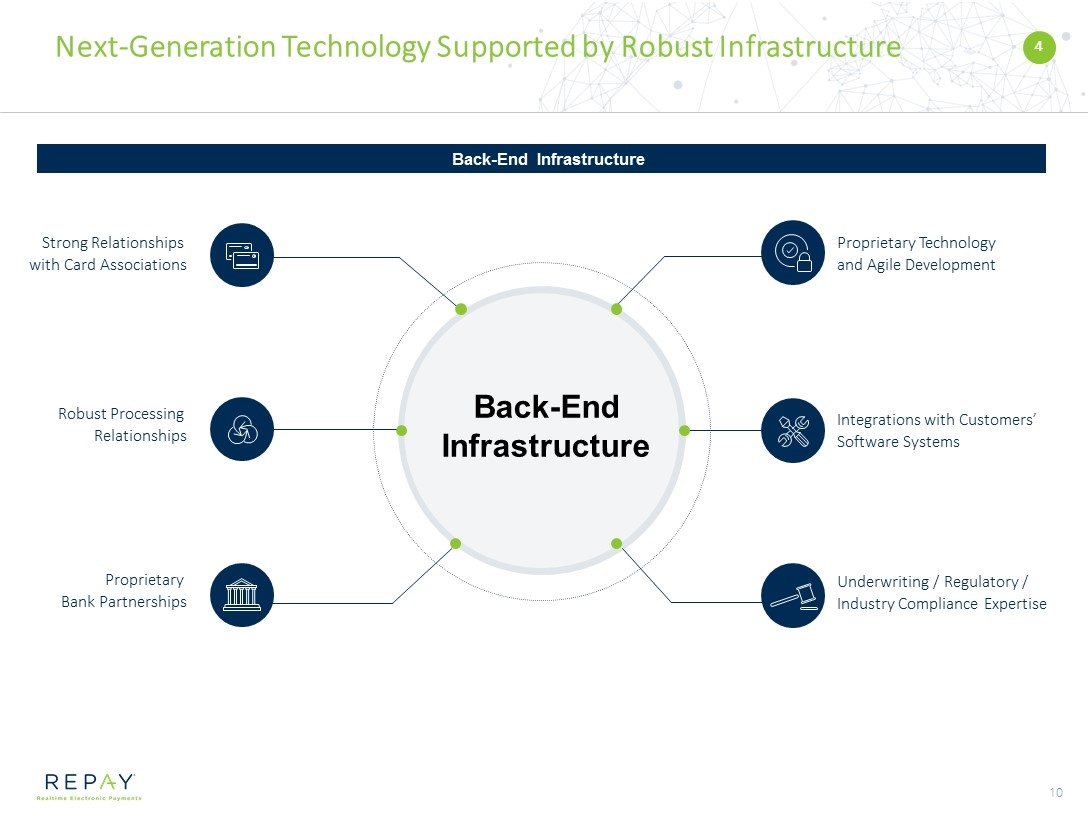

Next-Generation Technology Supported by Robust Infrastructure 4 Proprietary Technology and Agile Development Integrations with Customers’ Software Systems Underwriting / Regulatory / Industry Compliance Expertise Strong Relationships with Card Associations Proprietary Bank Partnerships Robust Processing Relationships Back-End Infrastructure Back-End Infrastructure

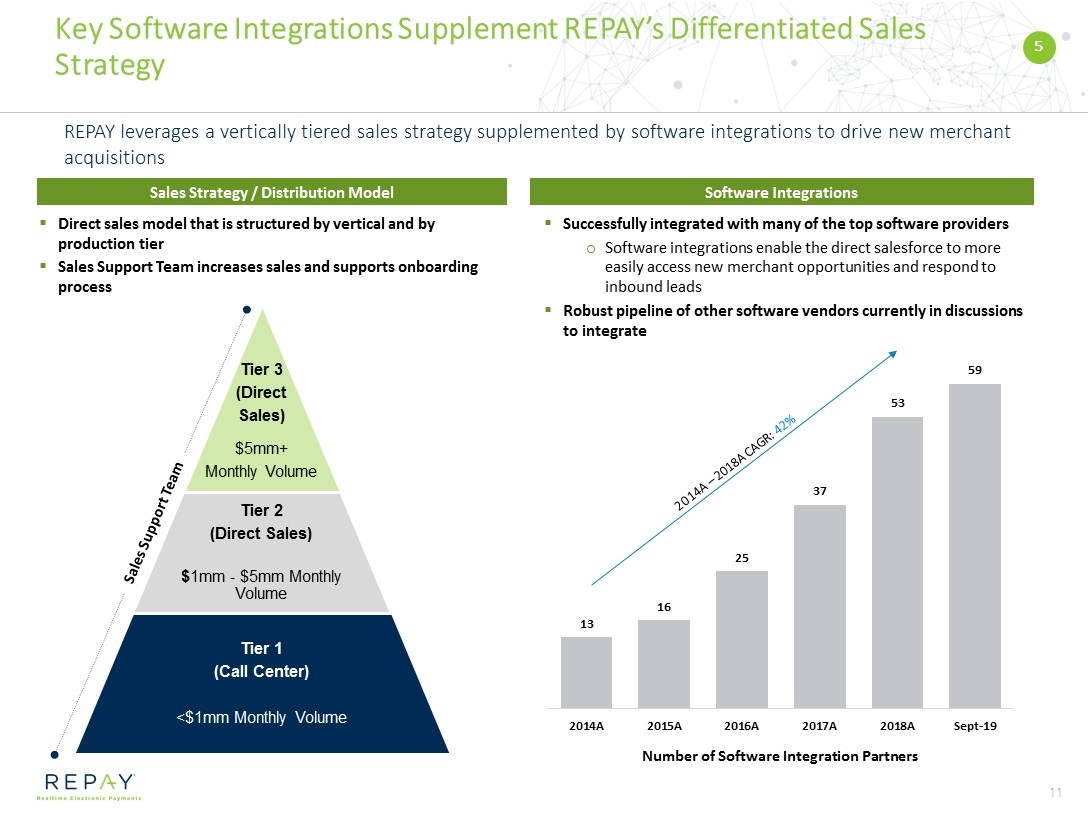

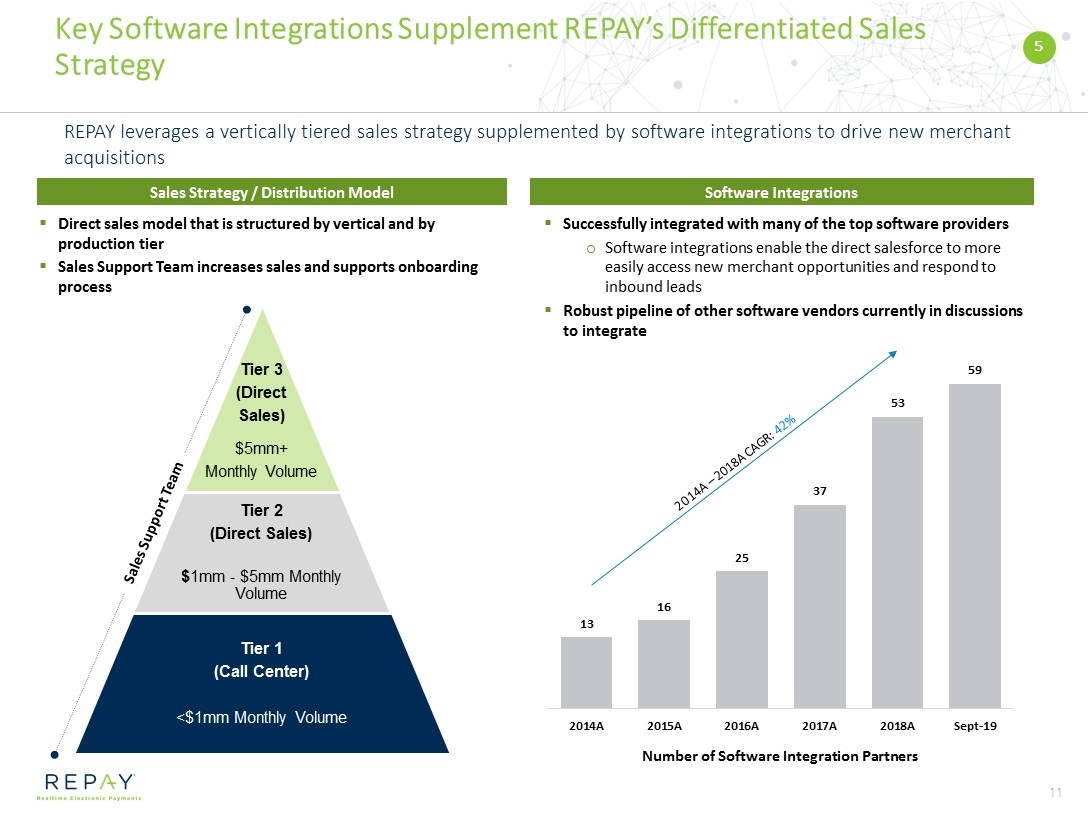

REPAY leverages a vertically tiered sales strategy supplemented by software integrations to drive new merchant acquisitions Software Integrations Key Software Integrations Supplement REPAY’s Differentiated Sales Strategy Direct sales model that is structured by vertical and by production tier Sales Support Team increases sales and supports onboarding process Sales Strategy / Distribution Model Sales Support Team Successfully integrated with many of the top software providers Software integrations enable the direct salesforce to more easily access new merchant opportunities and respond to inbound leads Robust pipeline of other software vendors currently in discussions to integrate 2014A – 2018A CAGR: 42% 5 Number of Software Integration Partners Tier 3 (Direct Sales) $5mm+ Monthly Volume Tier 1 (Call Center) <$1mm Monthly Volume Tier 2 (Direct Sales) $ 1mm - $5mm Monthly Volume

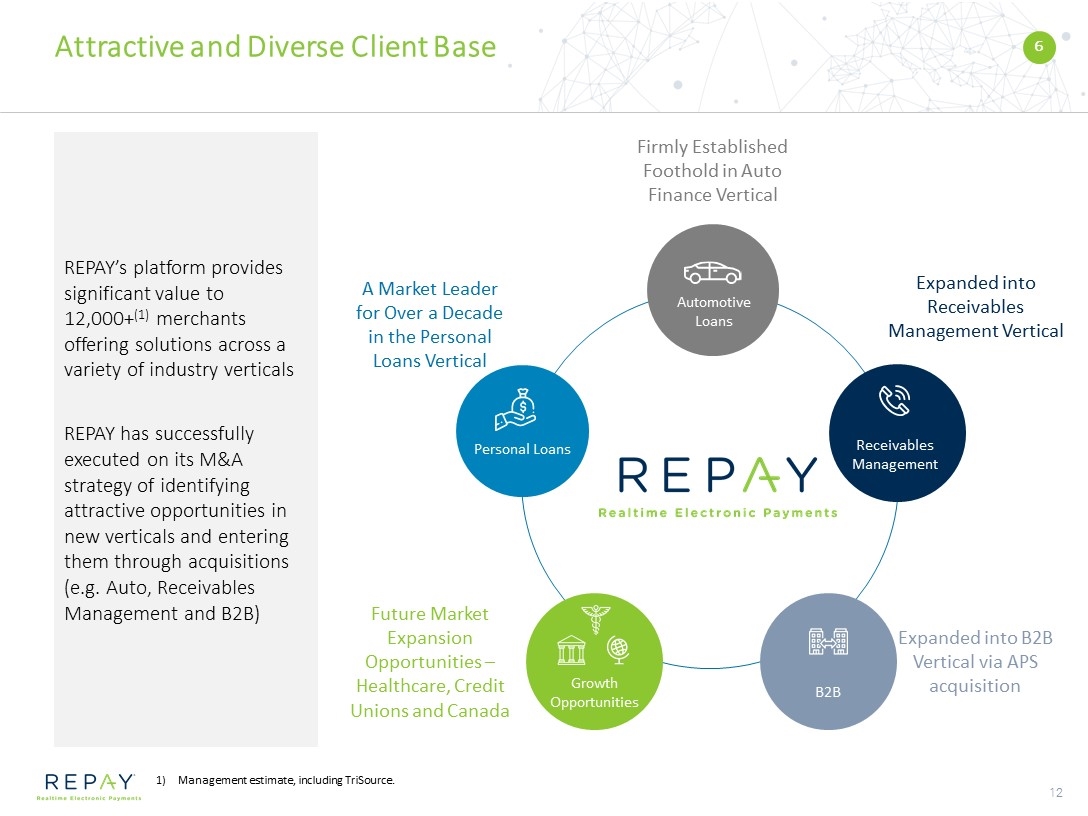

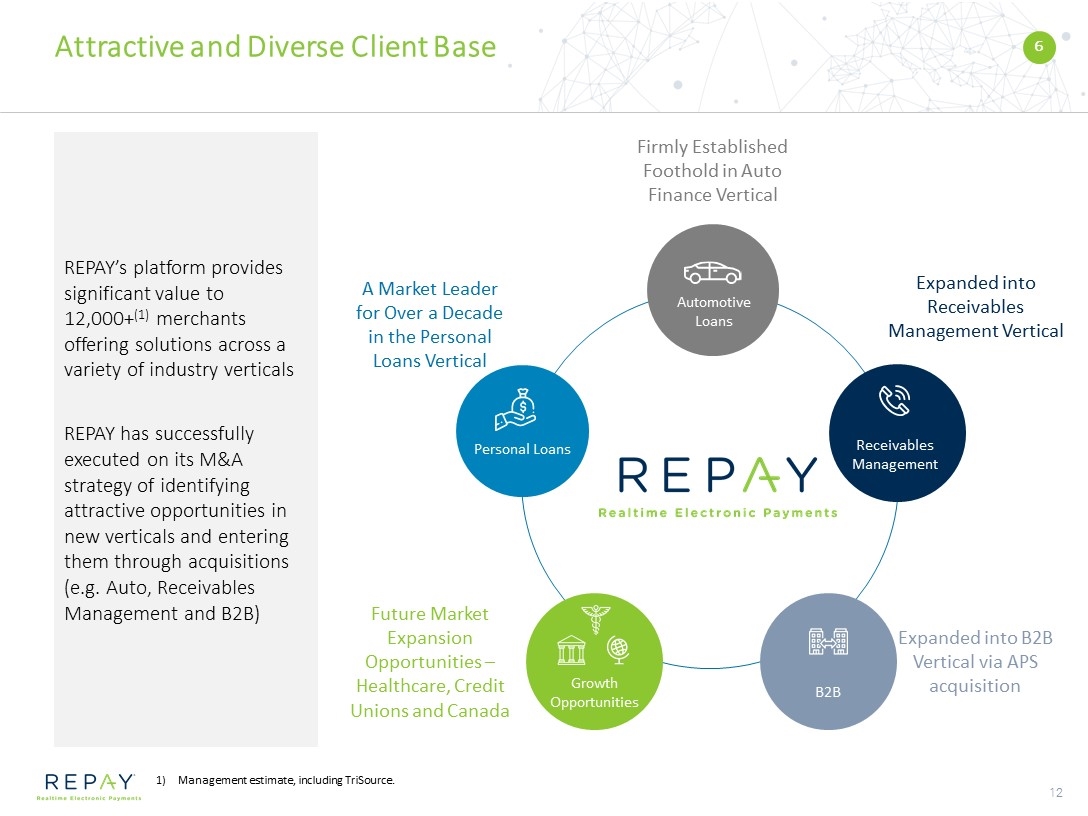

Growth Opportunities Receivables Management Attractive and Diverse Client Base A Market Leader for Over a Decade in the Personal Loans Vertical Firmly Established Foothold in Auto Finance Vertical Future Market Expansion Opportunities – Healthcare, Credit Unions and Canada Personal Loans Automotive Loans Expanded into Receivables Management Vertical 6 B2B Expanded into B2B Vertical via APS acquisition REPAY’s platform provides significant value to 12,000+(1) merchants offering solutions across a variety of industry verticals REPAY has successfully executed on its M&A strategy of identifying attractive opportunities in new verticals and entering them through acquisitions (e.g. Auto, Receivables Management and B2B) Management estimate, including TriSource.

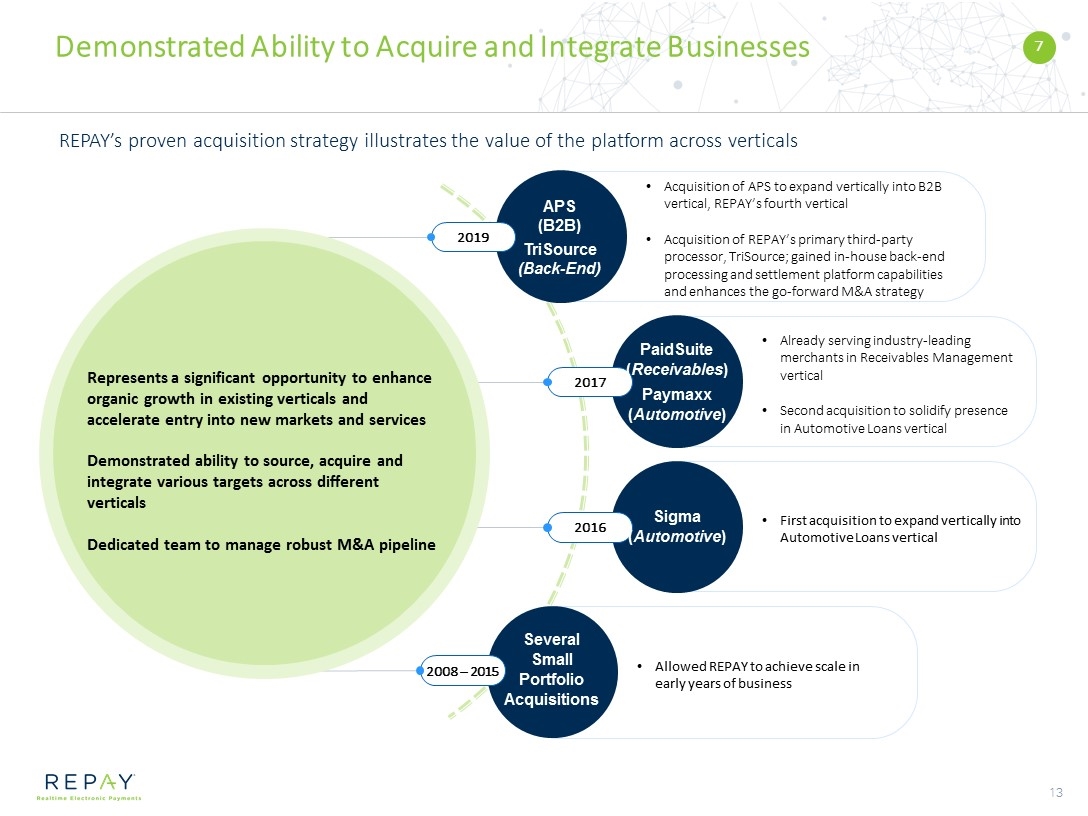

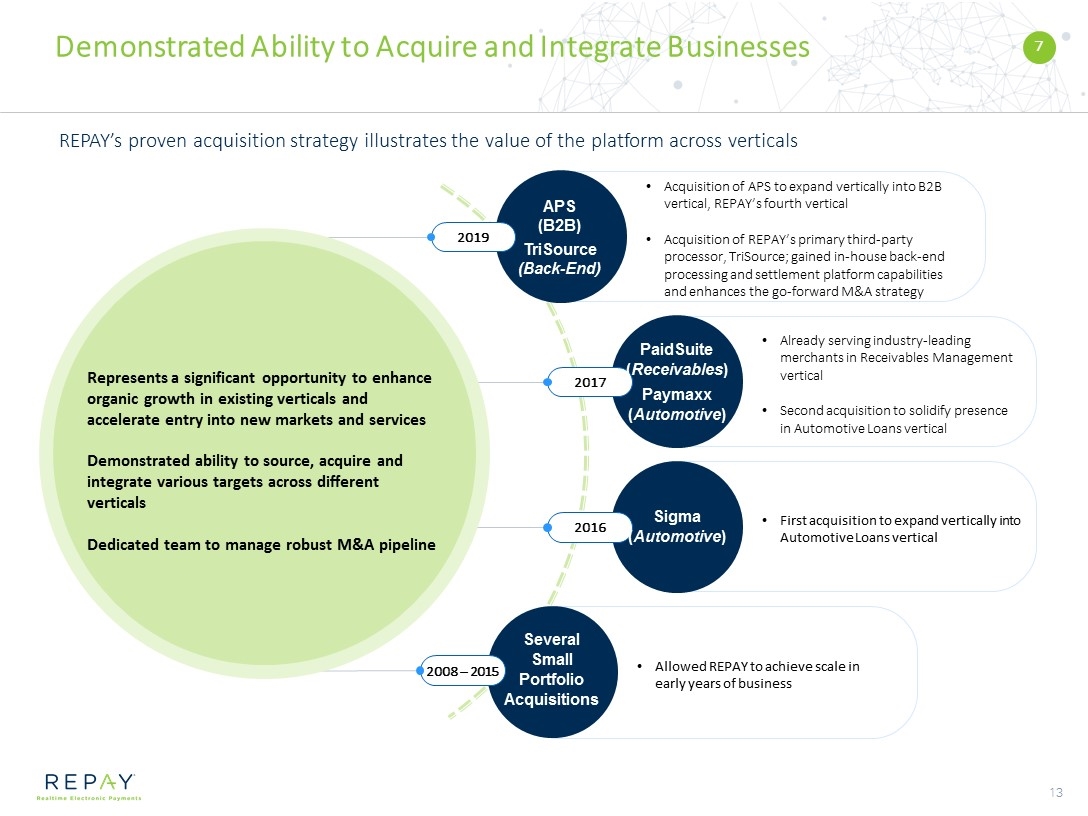

Demonstrated Ability to Acquire and Integrate Businesses 7 REPAY’s proven acquisition strategy illustrates the value of the platform across verticals 2019 APS (B2B) TriSource (Back-End) Acquisition of APS to expand vertically into B2B vertical, REPAY’s fourth vertical Acquisition of REPAY’s primary third-party processor, TriSource; gained in-house back-end processing and settlement platform capabilities and enhances the go-forward M&A strategy Several Small Portfolio Acquisitions Allowed REPAY to achieve scale in early years of business 2008 – 2015 2016 Sigma (Automotive) First acquisition to expand vertically into Automotive Loans vertical 2017 PaidSuite (Receivables) Paymaxx (Automotive) Already serving industry-leading merchants in Receivables Management vertical Second acquisition to solidify presence in Automotive Loans vertical Represents a significant opportunity to enhance organic growth in existing verticals and accelerate entry into new markets and services Demonstrated ability to source, acquire and integrate various targets across different verticals Dedicated team to manage robust M&A pipeline

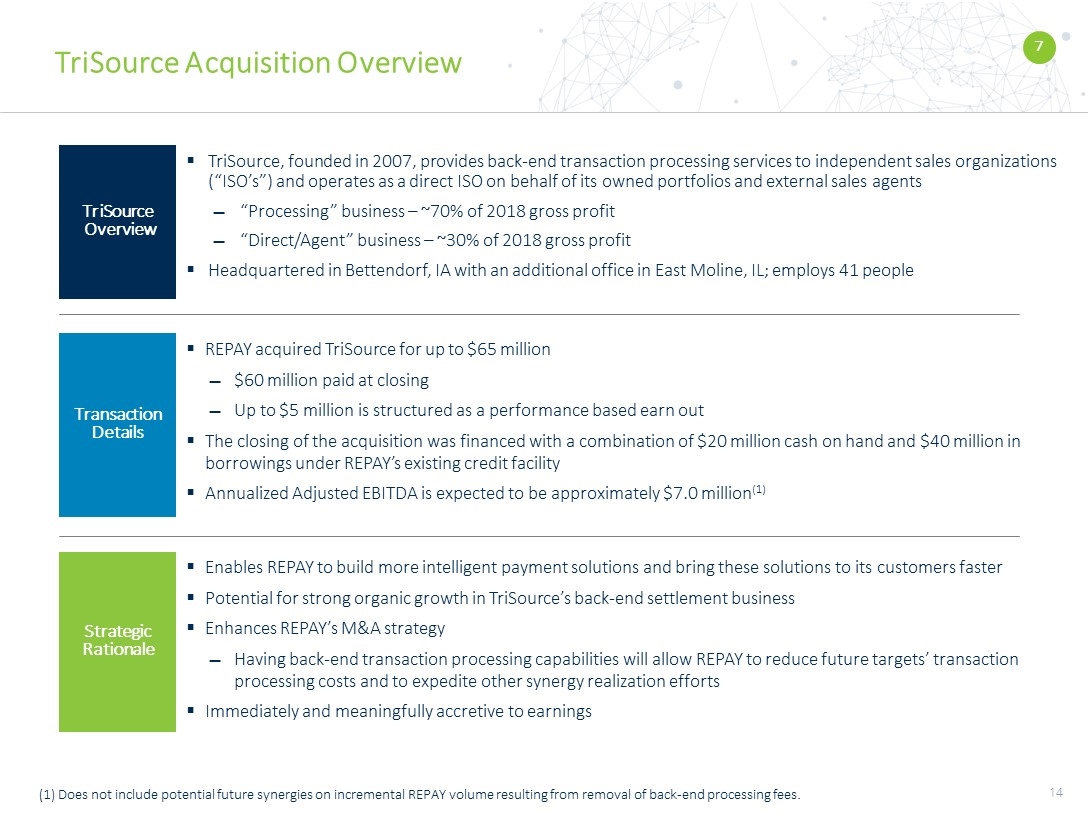

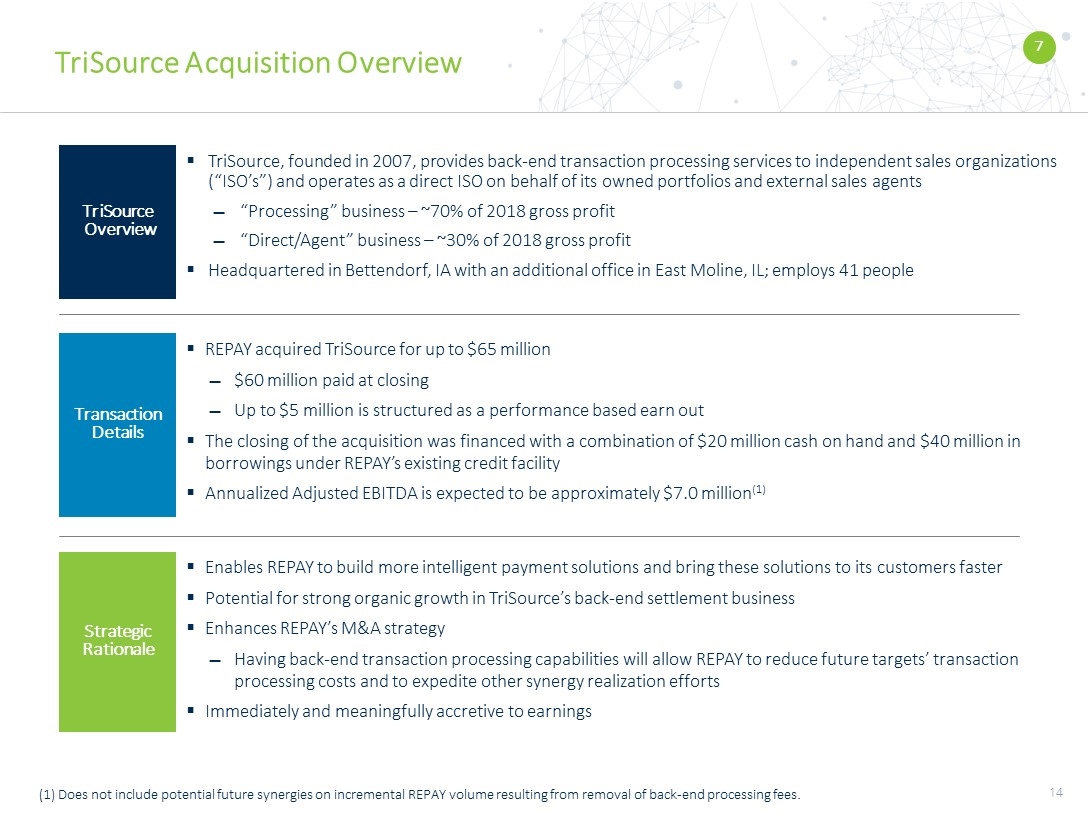

TriSource Acquisition Overview TriSource, founded in 2007, provides back-end transaction processing services to independent sales organizations (“ISO’s”) and operates as a direct ISO on behalf of its owned portfolios and external sales agents “Processing” business – ~70% of 2018 gross profit “Direct/Agent” business – ~30% of 2018 gross profit Headquartered in Bettendorf, IA with an additional office in East Moline, IL; employs 41 people REPAY acquired TriSource for up to $65 million $60 million paid at closing Up to $5 million is structured as a performance based earn out The closing of the acquisition was financed with a combination of $20 million cash on hand and $40 million in borrowings under REPAY’s existing credit facility Annualized Adjusted EBITDA is expected to be approximately $7.0 million(1) Enables REPAY to build more intelligent payment solutions and bring these solutions to its customers faster Potential for strong organic growth in TriSource’s back-end settlement business Enhances REPAY’s M&A strategy Having back-end transaction processing capabilities will allow REPAY to reduce future targets’ transaction processing costs and to expedite other synergy realization efforts Immediately and meaningfully accretive to earnings (1) Does not include potential future synergies on incremental REPAY volume resulting from removal of back-end processing fees. Strategic Rationale Transaction Details TriSource Overview 7

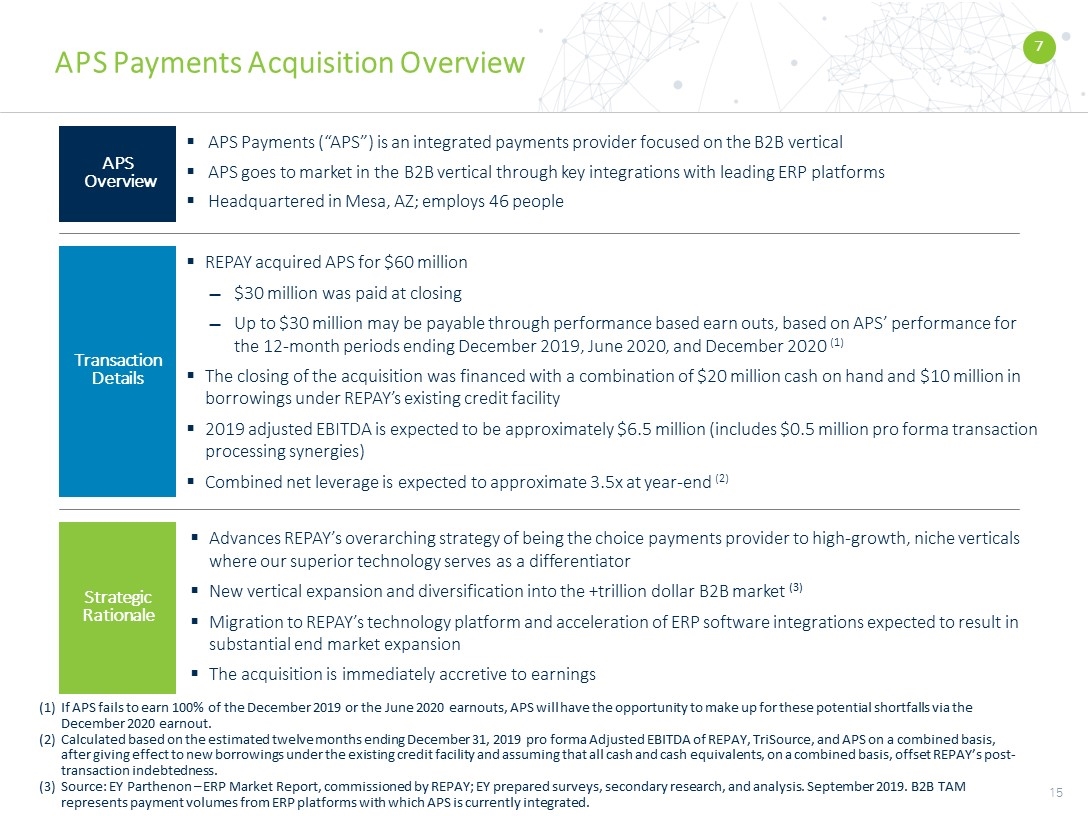

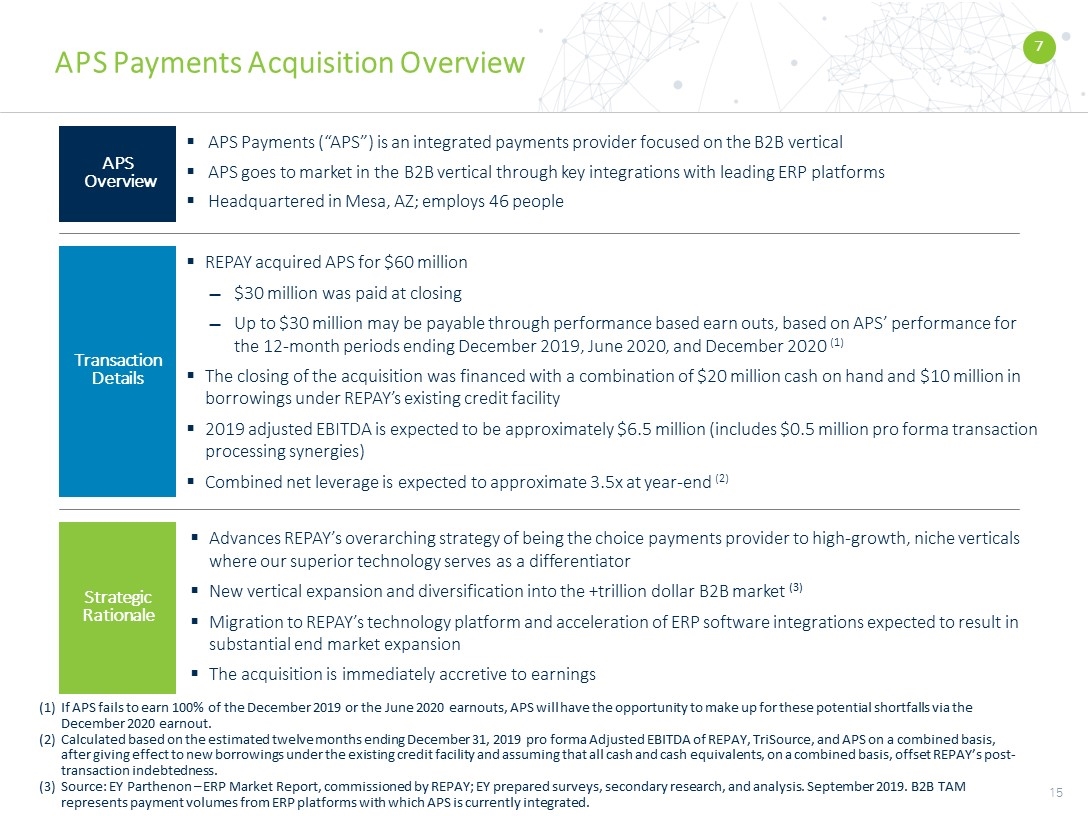

APS Payments Acquisition Overview Strategic Rationale Transaction Details APS Overview APS Payments (“APS”) is an integrated payments provider focused on the B2B vertical APS goes to market in the B2B vertical through key integrations with leading ERP platforms Headquartered in Mesa, AZ; employs 46 people REPAY acquired APS for $60 million $30 million was paid at closing Up to $30 million may be payable through performance based earn outs, based on APS’ performance for the 12-month periods ending December 2019, June 2020, and December 2020 (1) The closing of the acquisition was financed with a combination of $20 million cash on hand and $10 million in borrowings under REPAY’s existing credit facility 2019 adjusted EBITDA is expected to be approximately $6.5 million (includes $0.5 million pro forma transaction processing synergies) Combined net leverage is expected to approximate 3.5x at year-end (2) Advances REPAY’s overarching strategy of being the choice payments provider to high-growth, niche verticals where our superior technology serves as a differentiator New vertical expansion and diversification into the +trillion dollar B2B market (3) Migration to REPAY’s technology platform and acceleration of ERP software integrations expected to result in substantial end market expansion The acquisition is immediately accretive to earnings If APS fails to earn 100% of the December 2019 or the June 2020 earnouts, APS will have the opportunity to make up for these potential shortfalls via the December 2020 earnout. Calculated based on the estimated twelve months ending December 31, 2019 pro forma Adjusted EBITDA of REPAY, TriSource, and APS on a combined basis, after giving effect to new borrowings under the existing credit facility and assuming that all cash and cash equivalents, on a combined basis, offset REPAY’s post-transaction indebtedness. Source: EY Parthenon – ERP Market Report, commissioned by REPAY; EY prepared surveys, secondary research, and analysis. September 2019. B2B TAM represents payment volumes from ERP platforms with which APS is currently integrated. 7

Multiple Growth Opportunities REPAY’s leading platform and attractive market opportunity position it to build on its record of robust growth and profitability Expand Usage and Increase Adoption Future Market Expansion Opportunities Strategic M&A Acquire New Merchants in Existing Verticals Leverage platform and capabilities to expand into: New market verticals such as Healthcare, B2B and Credit Unions Canada Strategic acquisitions to continue successful penetration into markets with a need for debit solutions Leverage sales and marketing engine to convert near-term pipeline Majority of REPAY’s new merchants are “greenfield” opportunities Increase penetration of existing client base Operational Efficiencies As the business continues to scale, REPAY expects to become increasingly efficient with higher margins Execute on Existing Business Broaden Addressable Market 8

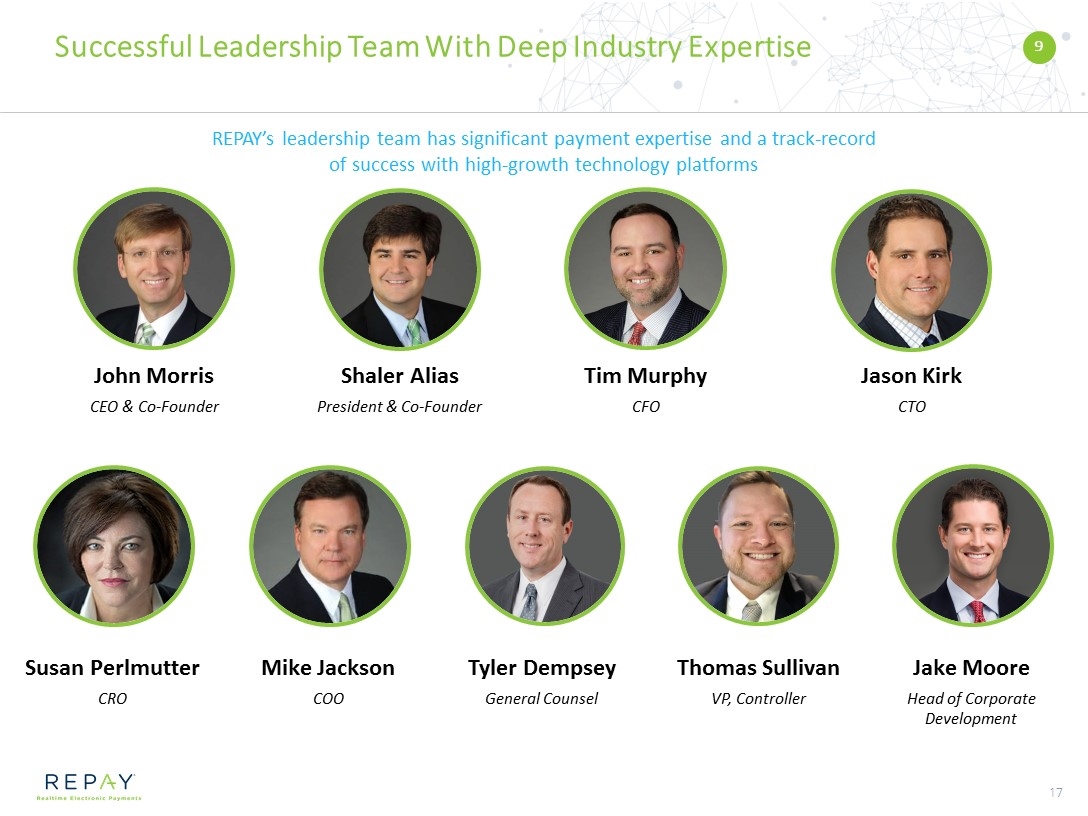

Successful Leadership Team With Deep Industry Expertise 9 Susan Perlmutter CRO Mike Jackson COO Thomas Sullivan VP, Controller Jake Moore Head of Corporate Development Tyler Dempsey General Counsel REPAY’s leadership team has significant payment expertise and a track-record of success with high-growth technology platforms John Morris CEO & Co-Founder Shaler Alias President & Co-Founder Tim Murphy CFO Jason Kirk CTO

Highly Knowledgeable and Experienced Board of Directors 9-member Board of Directors comprised of industry veterans and influential leaders in the financial services and payment industries 9 John Morris CEO & Co-Founder Shaler Alias President & Co-Founder Jeremy Schein Managing Director, Corsair Richard Thornburgh Managing Director, Corsair William Jacobs(1) Former SEVP, Mastercard Peter Kight Founder of CheckFree Paul Garcia Former Chairman and CEO, Global Payments Bob Hartheimer Former Managing Director, Promontory Maryann Goebel Former CIO, Fiserv William Jacobs also currently serves as a member of the board of directors of Global Payments Inc. and as the chairman of the board of directors of Green Dot Corporation.

REPAY Financial Overview

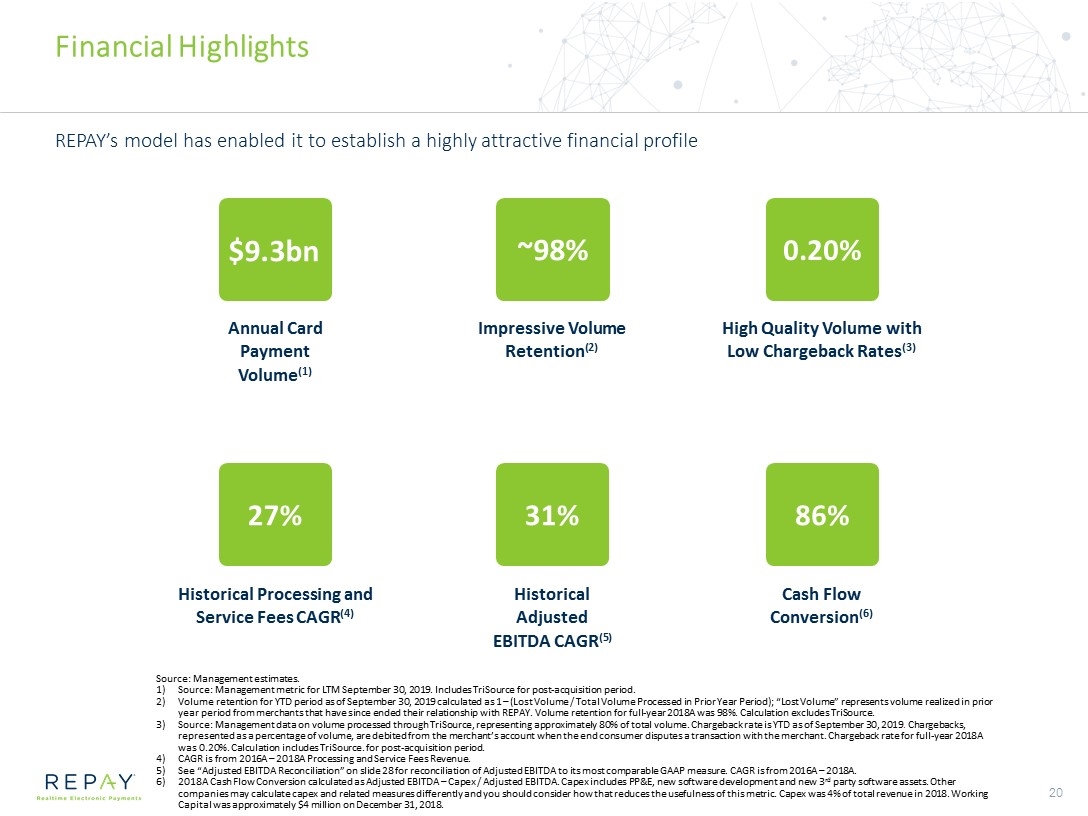

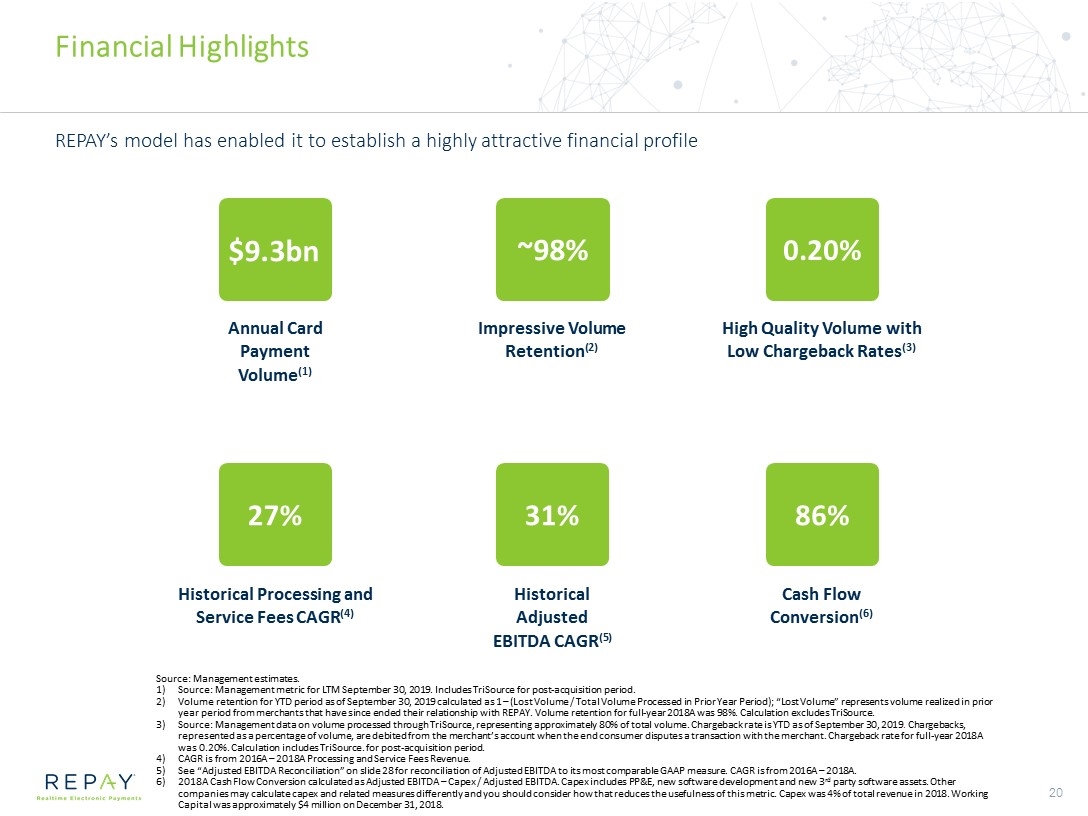

Financial Highlights Source: Management estimates. Source: Management metric for LTM September 30, 2019. Includes TriSource for post-acquisition period. Volume retention for YTD period as of September 30, 2019 calculated as 1 – (Lost Volume / Total Volume Processed in Prior Year Period); “Lost Volume” represents volume realized in prior year period from merchants that have since ended their relationship with REPAY. Volume retention for full-year 2018A was 98%. Calculation excludes TriSource. Source: Management data on volume processed through TriSource, representing approximately 80% of total volume. Chargeback rate is YTD as of September 30, 2019. Chargebacks, represented as a percentage of volume, are debited from the merchant’s account when the end consumer disputes a transaction with the merchant. Chargeback rate for full-year 2018A was 0.20%. Calculation includes TriSource. for post-acquisition period. CAGR is from 2016A – 2018A Processing and Service Fees Revenue. See “Adjusted EBITDA Reconciliation” on slide 28 for reconciliation of Adjusted EBITDA to its most comparable GAAP measure. CAGR is from 2016A – 2018A. 2018A Cash Flow Conversion calculated as Adjusted EBITDA – Capex / Adjusted EBITDA. Capex includes PP&E, new software development and new 3rd party software assets. Other companies may calculate capex and related measures differently and you should consider how that reduces the usefulness of this metric. Capex was 4% of total revenue in 2018. Working Capital was approximately $4 million on December 31, 2018. REPAY’s model has enabled it to establish a highly attractive financial profile $9.3bn Annual Card Payment Volume(1) ~98% Impressive Volume Retention(2) 0.20% High Quality Volume with Low Chargeback Rates(3) 27% Historical Processing and Service Fees CAGR(4) Historical Adjusted EBITDA CAGR(5) 31% Cash Flow Conversion(6) 86%

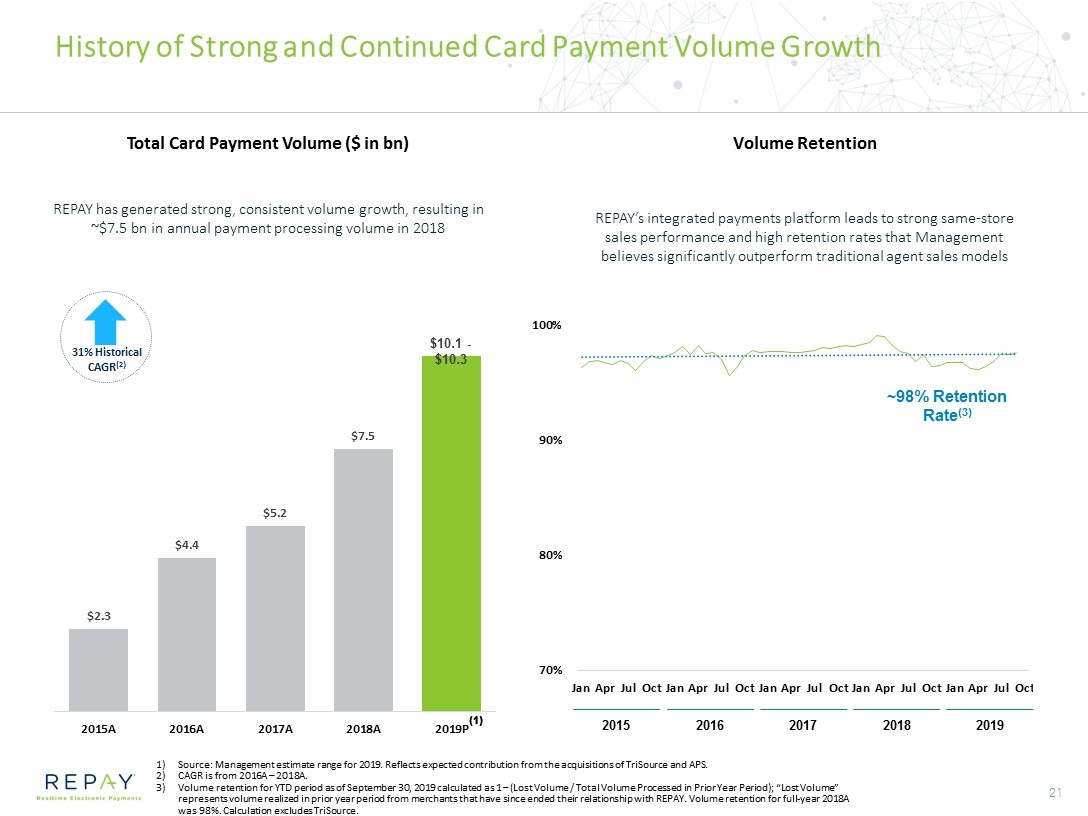

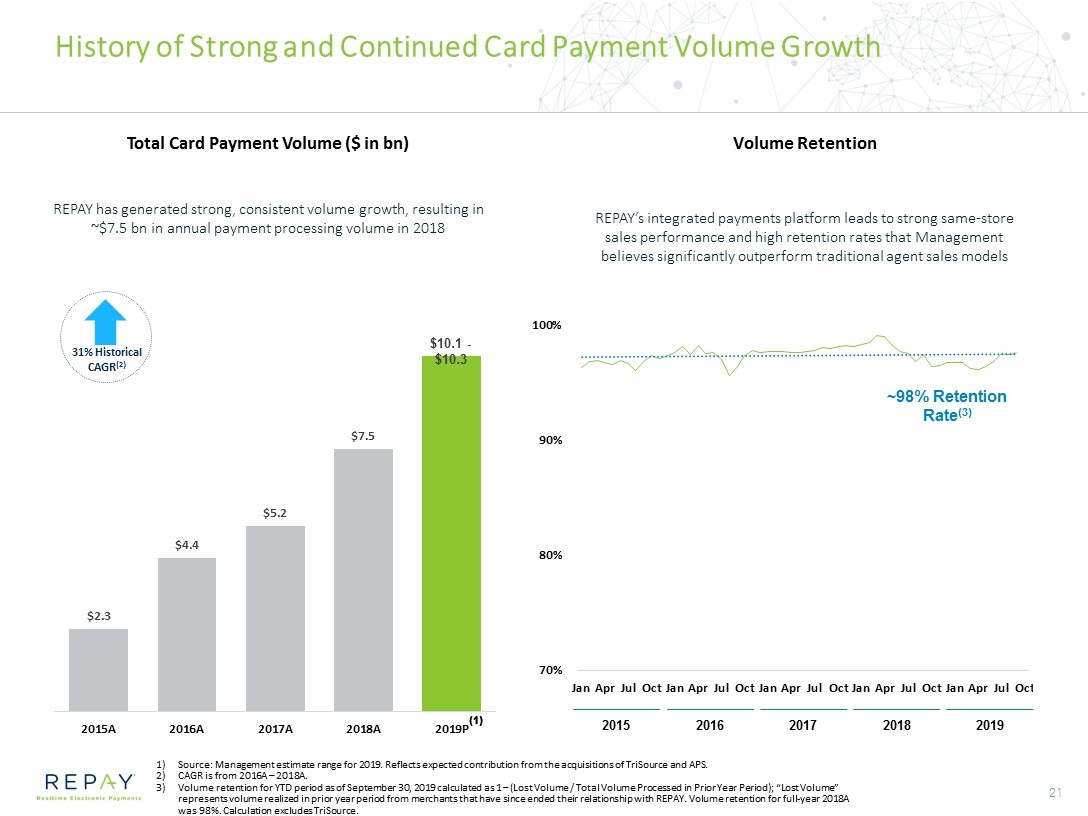

History of Strong and Continued Card Payment Volume Growth REPAY has generated strong, consistent volume growth, resulting in ~$7.5 bn in annual payment processing volume in 2018 Total Card Payment Volume ($ in bn) Volume Retention REPAY’s integrated payments platform leads to strong same-store sales performance and high retention rates that Management believes significantly outperform traditional agent sales models ~98% Retention Rate(3) 2015 (1) 31% Historical CAGR(2) (1) Source: Management estimate range for 2019. Reflects expected contribution from the acquisitions of TriSource and APS. CAGR is from 2016A – 2018A. Volume retention for YTD period as of September 30, 2019 calculated as 1 – (Lost Volume / Total Volume Processed in Prior Year Period); “Lost Volume” represents volume realized in prior year period from merchants that have since ended their relationship with REPAY. Volume retention for full-year 2018A was 98%. Calculation excludes TriSource. $10.1 - $10.3 2016 2017 2018 2019

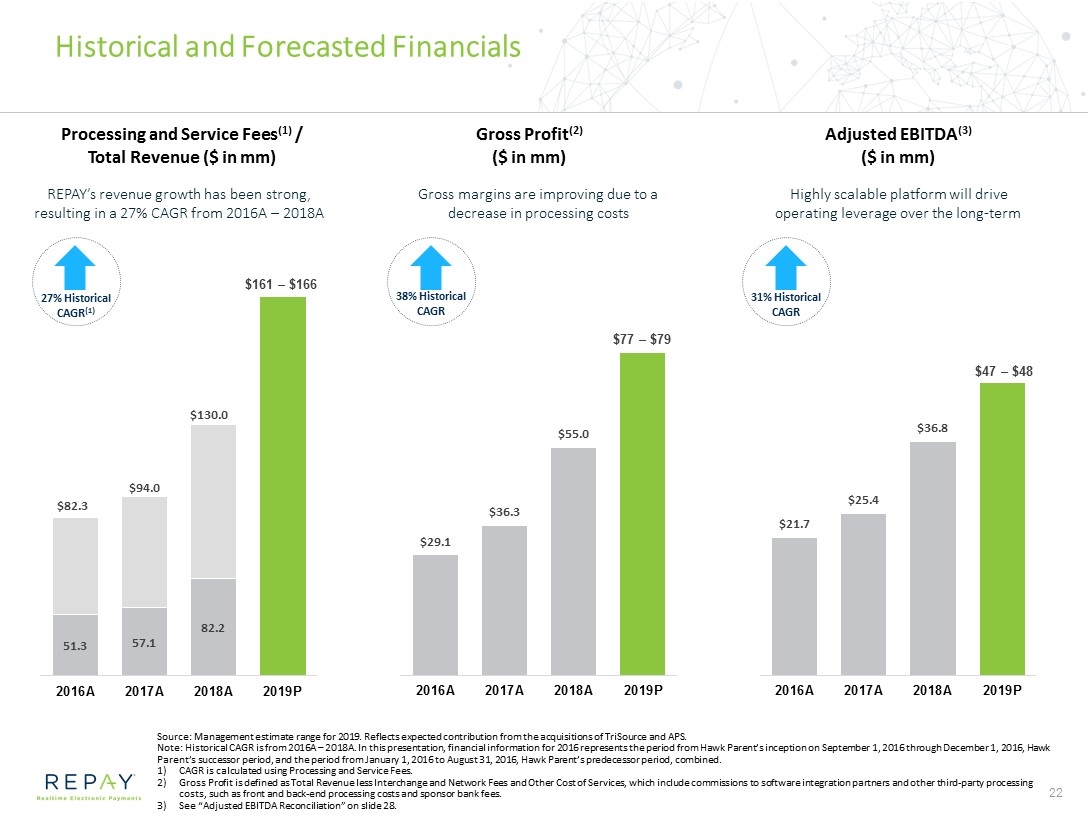

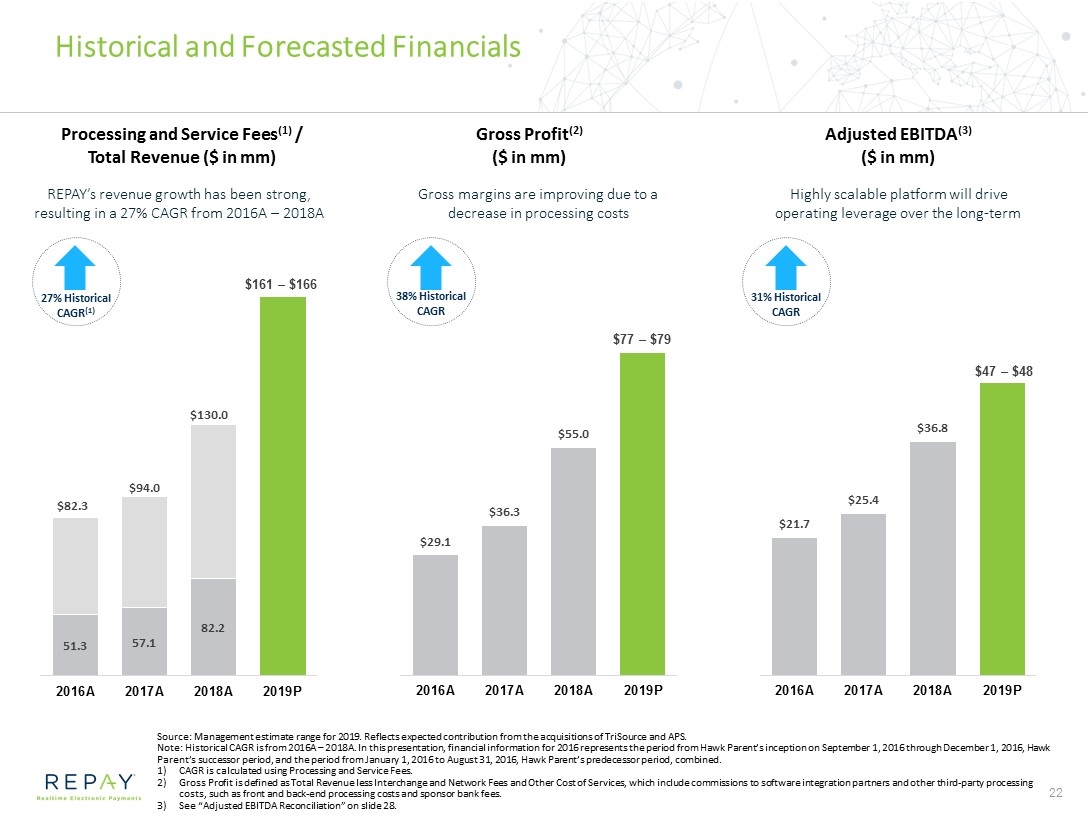

Historical and Forecasted Financials Gross Profit(2) ($ in mm) Gross margins are improving due to a decrease in processing costs Source: Management estimate range for 2019. Reflects expected contribution from the acquisitions of TriSource and APS. Note: Historical CAGR is from 2016A – 2018A. In this presentation, financial information for 2016 represents the period from Hawk Parent’s inception on September 1, 2016 through December 1, 2016, Hawk Parent’s successor period, and the period from January 1, 2016 to August 31, 2016, Hawk Parent’s predecessor period, combined. CAGR is calculated using Processing and Service Fees. Gross Profit is defined as Total Revenue less Interchange and Network Fees and Other Cost of Services, which include commissions to software integration partners and other third-party processing costs, such as front and back-end processing costs and sponsor bank fees. See “Adjusted EBITDA Reconciliation” on slide 28. Adjusted EBITDA(3) ($ in mm) Highly scalable platform will drive operating leverage over the long-term REPAY’s revenue growth has been strong, resulting in a 27% CAGR from 2016A – 2018A Processing and Service Fees(1) / Total Revenue ($ in mm) 38% Historical CAGR 27% Historical CAGR(1) $161 – $166 31% Historical CAGR $77 – $79 $47 – $48

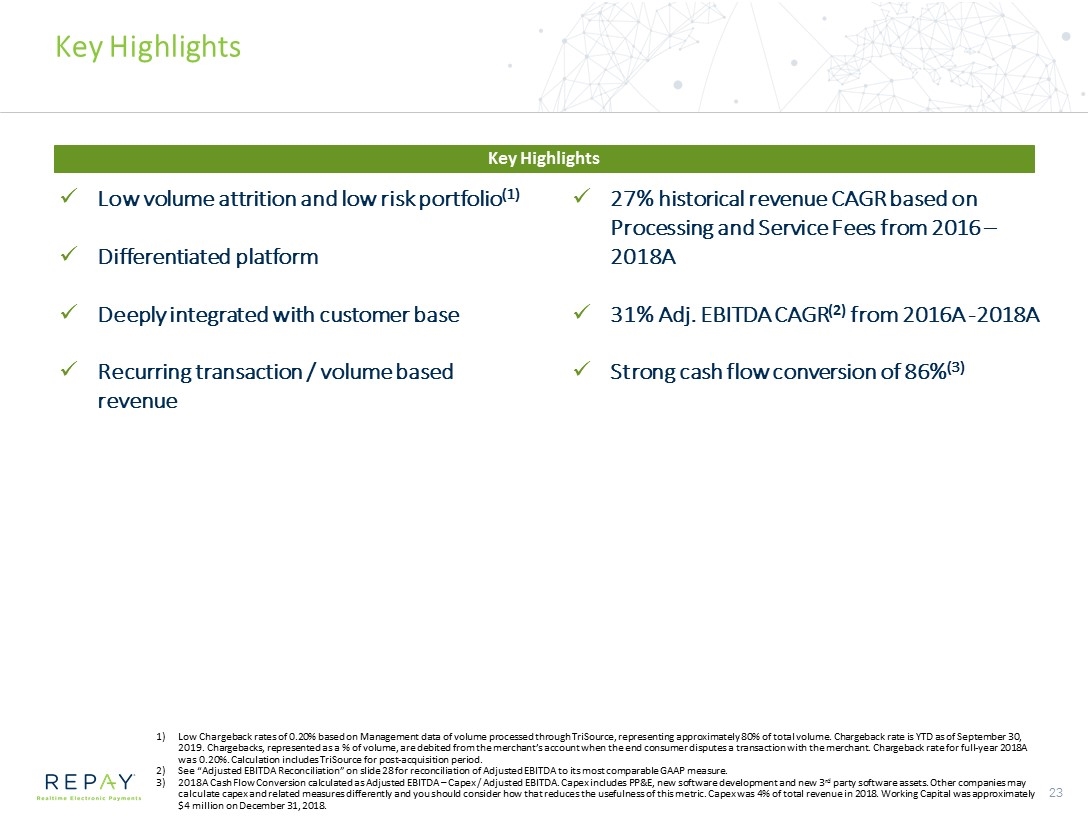

Key Highlights Low Chargeback rates of 0.20% based on Management data of volume processed through TriSource, representing approximately 80% of total volume. Chargeback rate is YTD as of September 30, 2019. Chargebacks, represented as a % of volume, are debited from the merchant’s account when the end consumer disputes a transaction with the merchant. Chargeback rate for full-year 2018A was 0.20%. Calculation includes TriSource for post-acquisition period. See “Adjusted EBITDA Reconciliation” on slide 28 for reconciliation of Adjusted EBITDA to its most comparable GAAP measure. 2018A Cash Flow Conversion calculated as Adjusted EBITDA – Capex / Adjusted EBITDA. Capex includes PP&E, new software development and new 3rd party software assets. Other companies may calculate capex and related measures differently and you should consider how that reduces the usefulness of this metric. Capex was 4% of total revenue in 2018. Working Capital was approximately $4 million on December 31, 2018. Low volume attrition and low risk portfolio(1) Differentiated platform Deeply integrated with customer base Recurring transaction / volume based revenue 27% historical revenue CAGR based on Processing and Service Fees from 2016 –2018A 31% Adj. EBITDA CAGR(2) from 2016A -2018A Strong cash flow conversion of 86%(3) Key Highlights

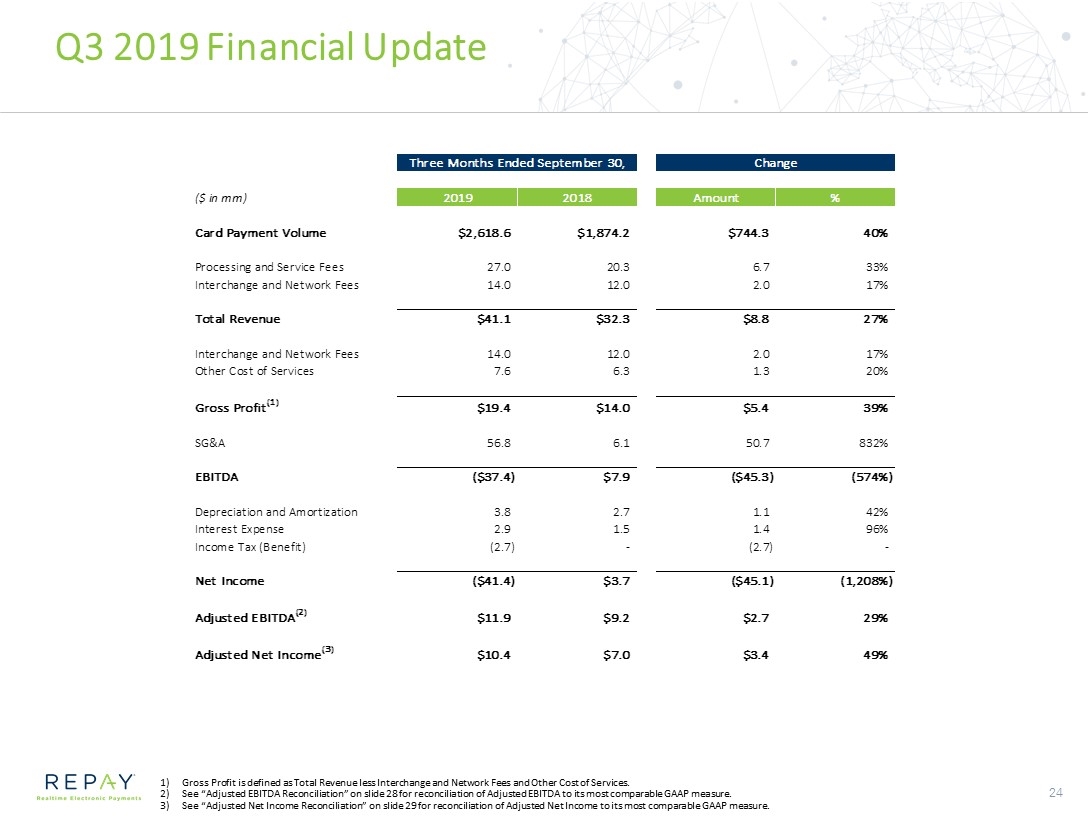

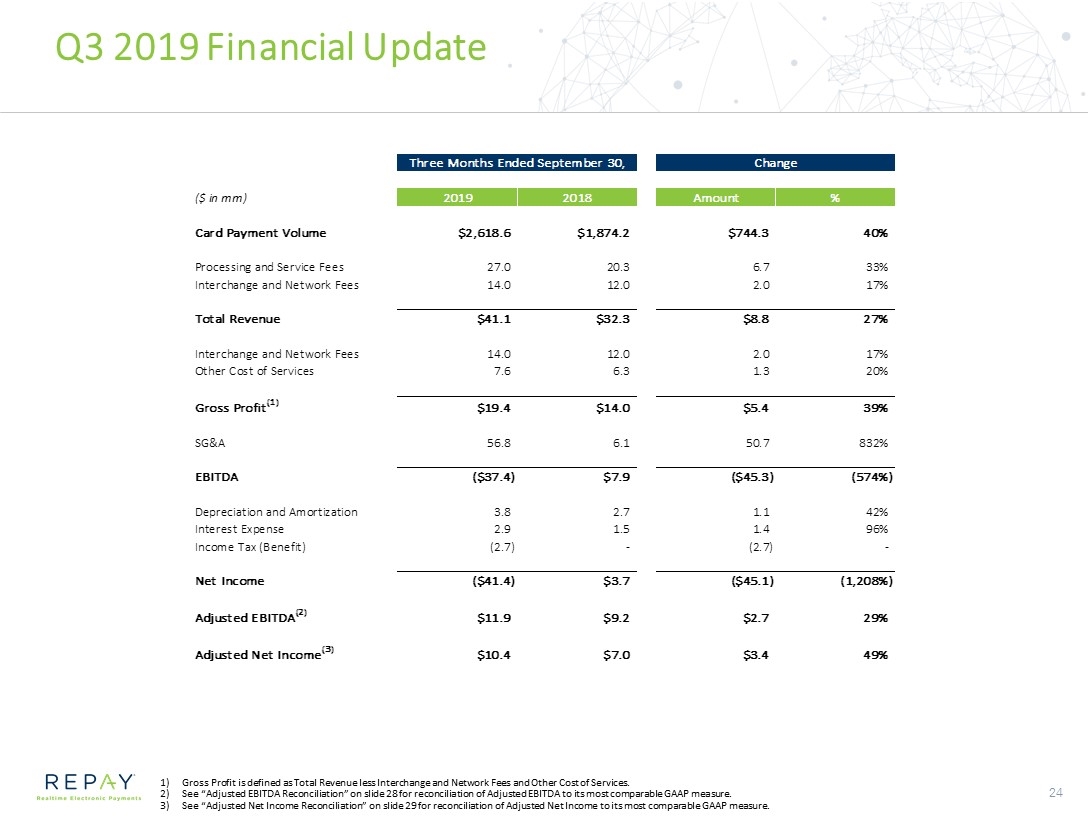

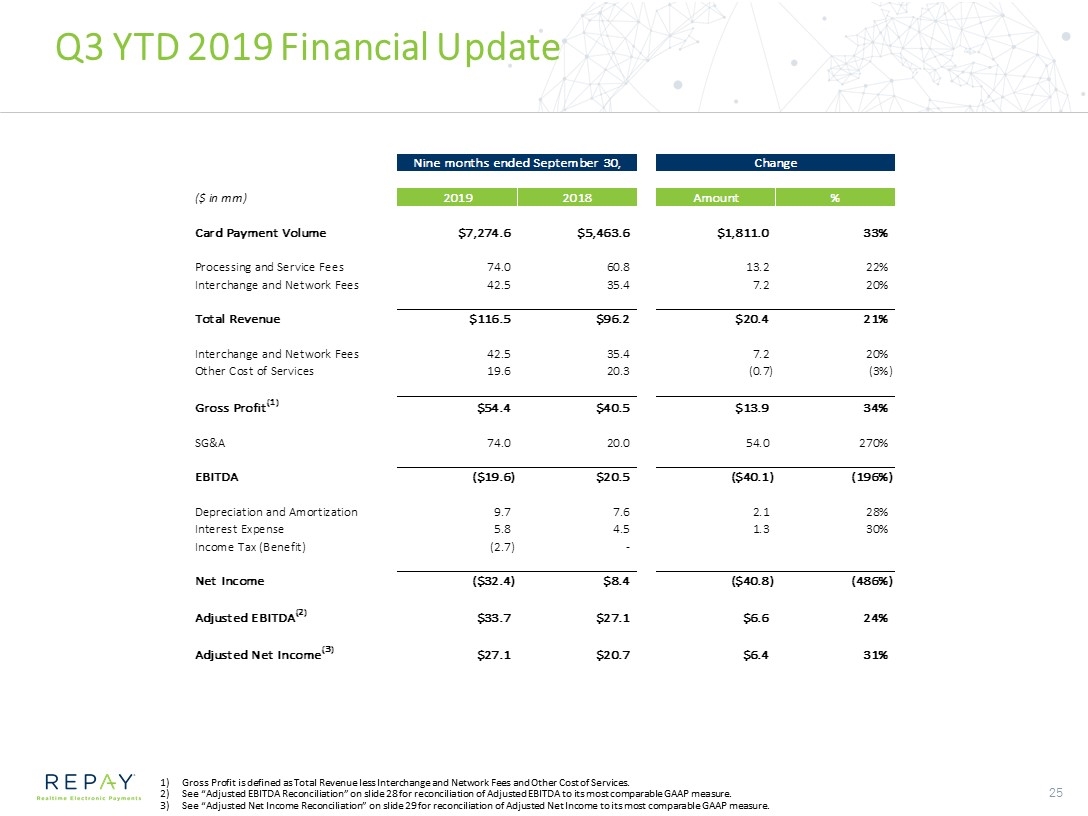

Q3 2019 Financial Update Gross Profit is defined as Total Revenue less Interchange and Network Fees and Other Cost of Services. See “Adjusted EBITDA Reconciliation” on slide 28 for reconciliation of Adjusted EBITDA to its most comparable GAAP measure. See “Adjusted Net Income Reconciliation” on slide 29 for reconciliation of Adjusted Net Income to its most comparable GAAP measure.

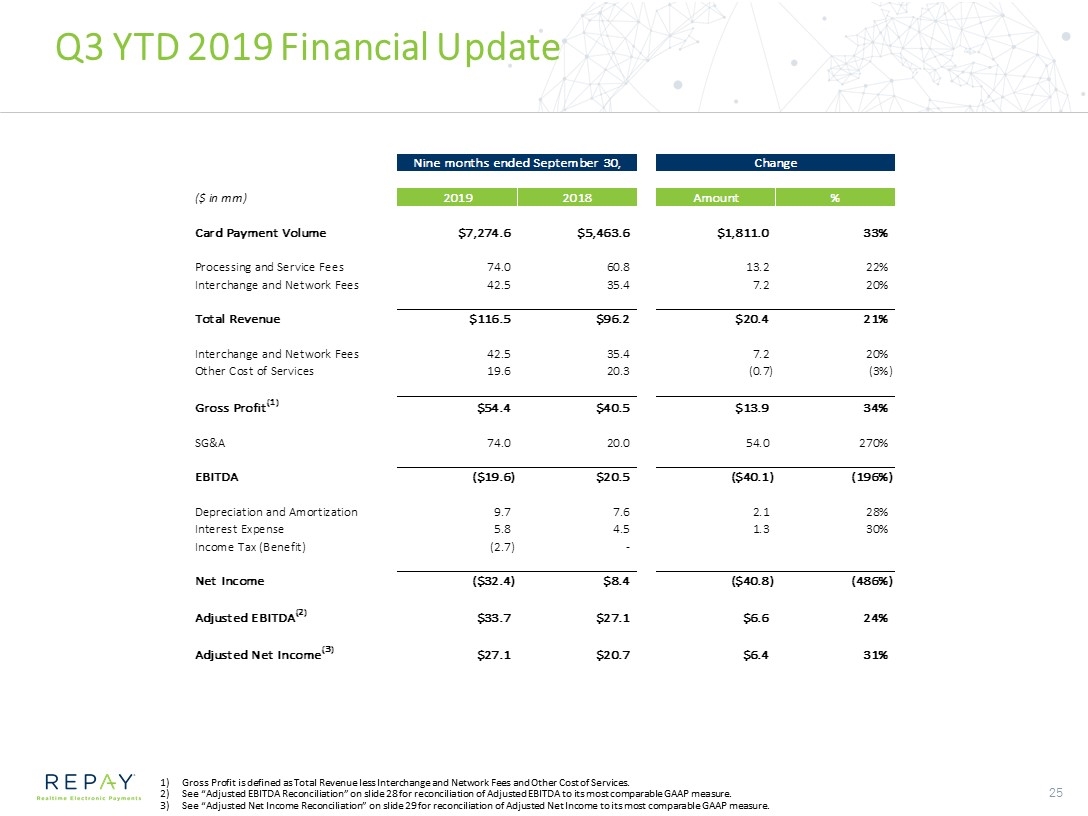

Q3 YTD 2019 Financial Update Gross Profit is defined as Total Revenue less Interchange and Network Fees and Other Cost of Services. See “Adjusted EBITDA Reconciliation” on slide 28 for reconciliation of Adjusted EBITDA to its most comparable GAAP measure. See “Adjusted Net Income Reconciliation” on slide 29 for reconciliation of Adjusted Net Income to its most comparable GAAP measure.

Appendix

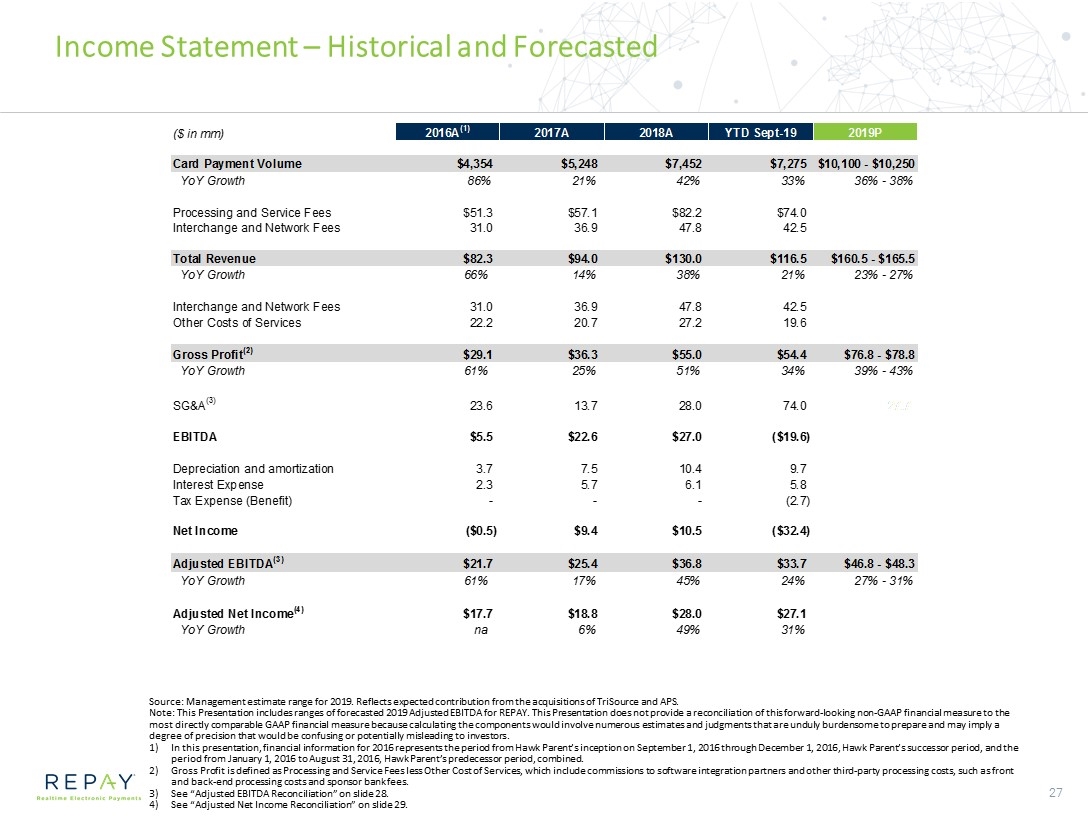

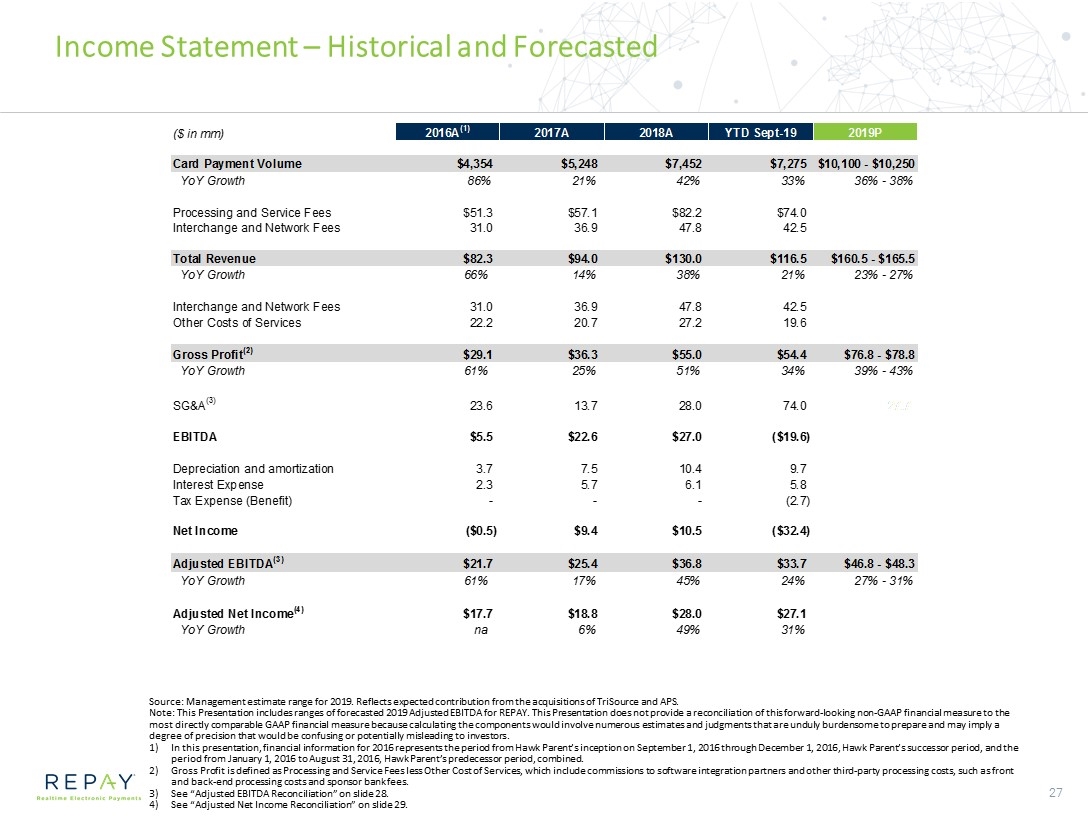

Income Statement – Historical and Forecasted Source: Management estimate range for 2019. Reflects expected contribution from the acquisitions of TriSource and APS. Note: This Presentation includes ranges of forecasted 2019 Adjusted EBITDA for REPAY. This Presentation does not provide a reconciliation of this forward-looking non-GAAP financial measure to the most directly comparable GAAP financial measure because calculating the components would involve numerous estimates and judgments that are unduly burdensome to prepare and may imply a degree of precision that would be confusing or potentially misleading to investors. In this presentation, financial information for 2016 represents the period from Hawk Parent’s inception on September 1, 2016 through December 1, 2016, Hawk Parent’s successor period, and the period from January 1, 2016 to August 31, 2016, Hawk Parent’s predecessor period, combined. Gross Profit is defined as Processing and Service Fees less Other Cost of Services, which include commissions to software integration partners and other third-party processing costs, such as front and back-end processing costs and sponsor bank fees. See “Adjusted EBITDA Reconciliation” on slide 28. See “Adjusted Net Income Reconciliation” on slide 29.

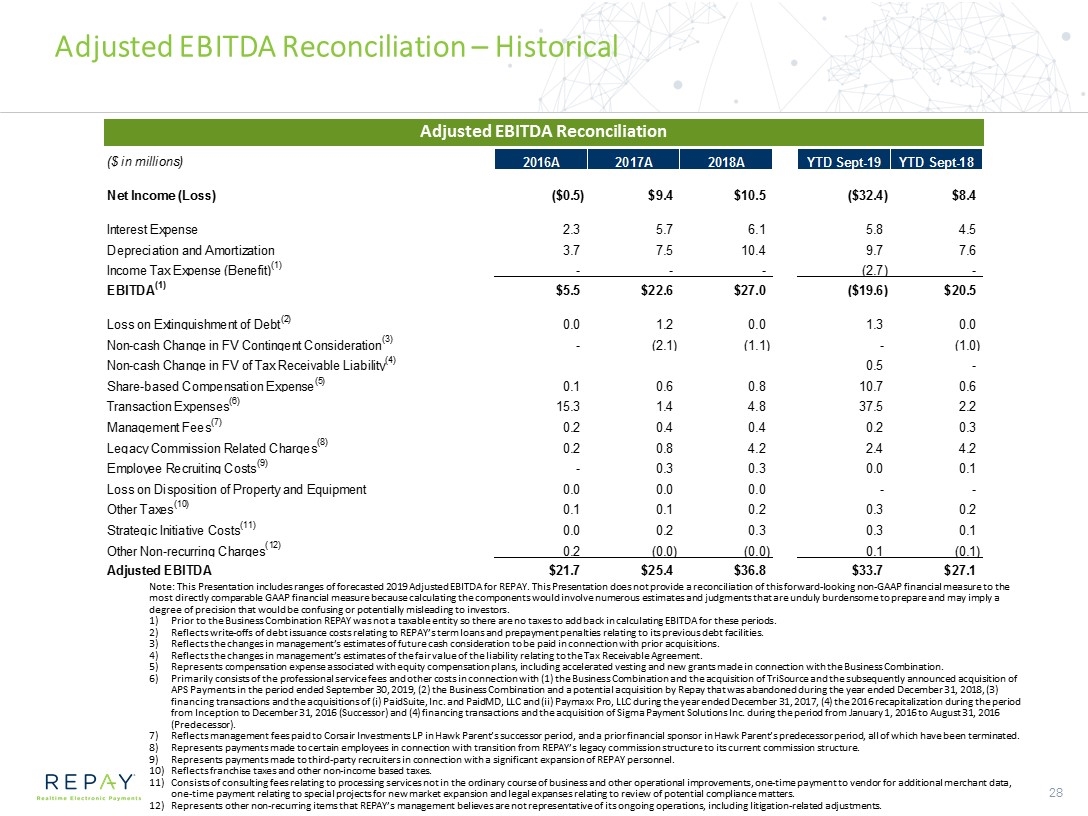

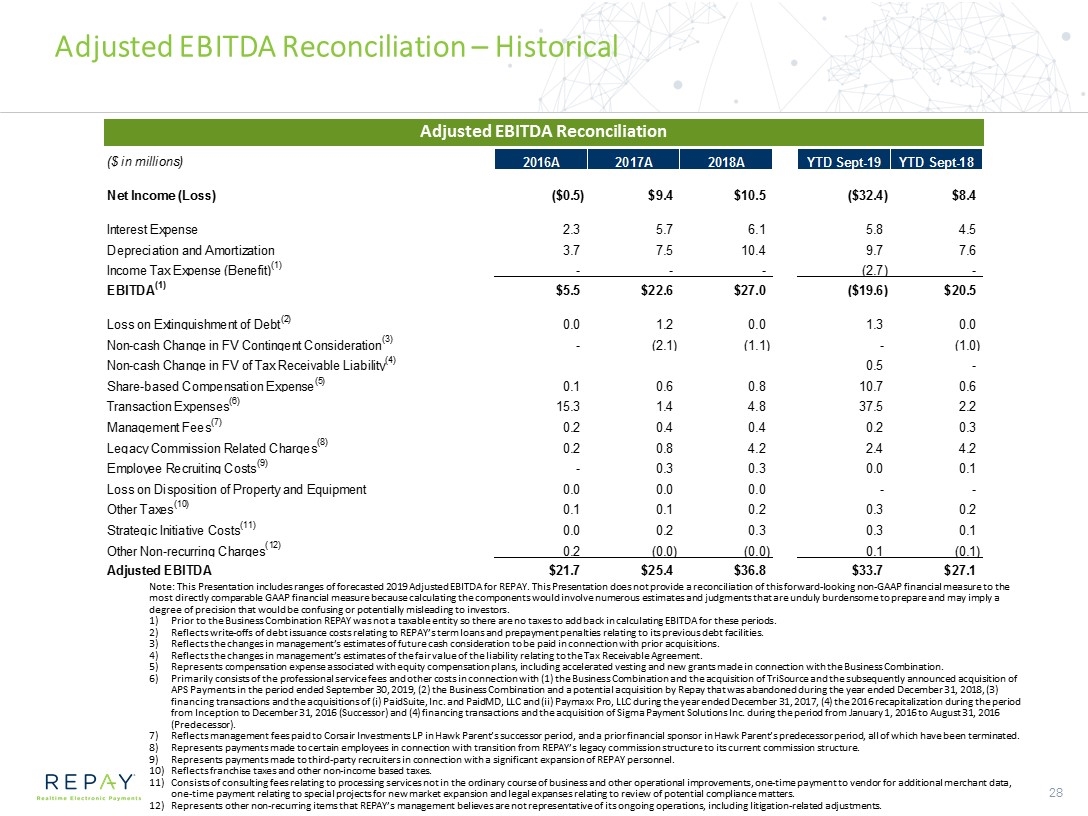

Adjusted EBITDA Reconciliation – Historical Note: This Presentation includes ranges of forecasted 2019 Adjusted EBITDA for REPAY. This Presentation does not provide a reconciliation of this forward-looking non-GAAP financial measure to the most directly comparable GAAP financial measure because calculating the components would involve numerous estimates and judgments that are unduly burdensome to prepare and may imply a degree of precision that would be confusing or potentially misleading to investors. Prior to the Business Combination REPAY was not a taxable entity so there are no taxes to add back in calculating EBITDA for these periods. Reflects write-offs of debt issuance costs relating to REPAY’s term loans and prepayment penalties relating to its previous debt facilities. Reflects the changes in management’s estimates of future cash consideration to be paid in connection with prior acquisitions. Reflects the changes in management’s estimates of the fair value of the liability relating to the Tax Receivable Agreement. Represents compensation expense associated with equity compensation plans, including accelerated vesting and new grants made in connection with the Business Combination. Primarily consists of the professional service fees and other costs in connection with (1) the Business Combination and the acquisition of TriSource and the subsequently announced acquisition of APS Payments in the period ended September 30, 2019, (2) the Business Combination and a potential acquisition by Repay that was abandoned during the year ended December 31, 2018, (3) financing transactions and the acquisitions of (i) PaidSuite, Inc. and PaidMD, LLC and (ii) Paymaxx Pro, LLC during the year ended December 31, 2017, (4) the 2016 recapitalization during the period from Inception to December 31, 2016 (Successor) and (4) financing transactions and the acquisition of Sigma Payment Solutions Inc. during the period from January 1, 2016 to August 31, 2016 (Predecessor). Reflects management fees paid to Corsair Investments LP in Hawk Parent’s successor period, and a prior financial sponsor in Hawk Parent’s predecessor period, all of which have been terminated. Represents payments made to certain employees in connection with transition from REPAY’s legacy commission structure to its current commission structure. Represents payments made to third-party recruiters in connection with a significant expansion of REPAY personnel. Reflects franchise taxes and other non-income based taxes. Consists of consulting fees relating to processing services not in the ordinary course of business and other operational improvements, one-time payment to vendor for additional merchant data, one-time payment relating to special projects for new market expansion and legal expanses relating to review of potential compliance matters. Represents other non-recurring items that REPAY’s management believes are not representative of its ongoing operations, including litigation-related adjustments. Adjusted EBITDA Reconciliation

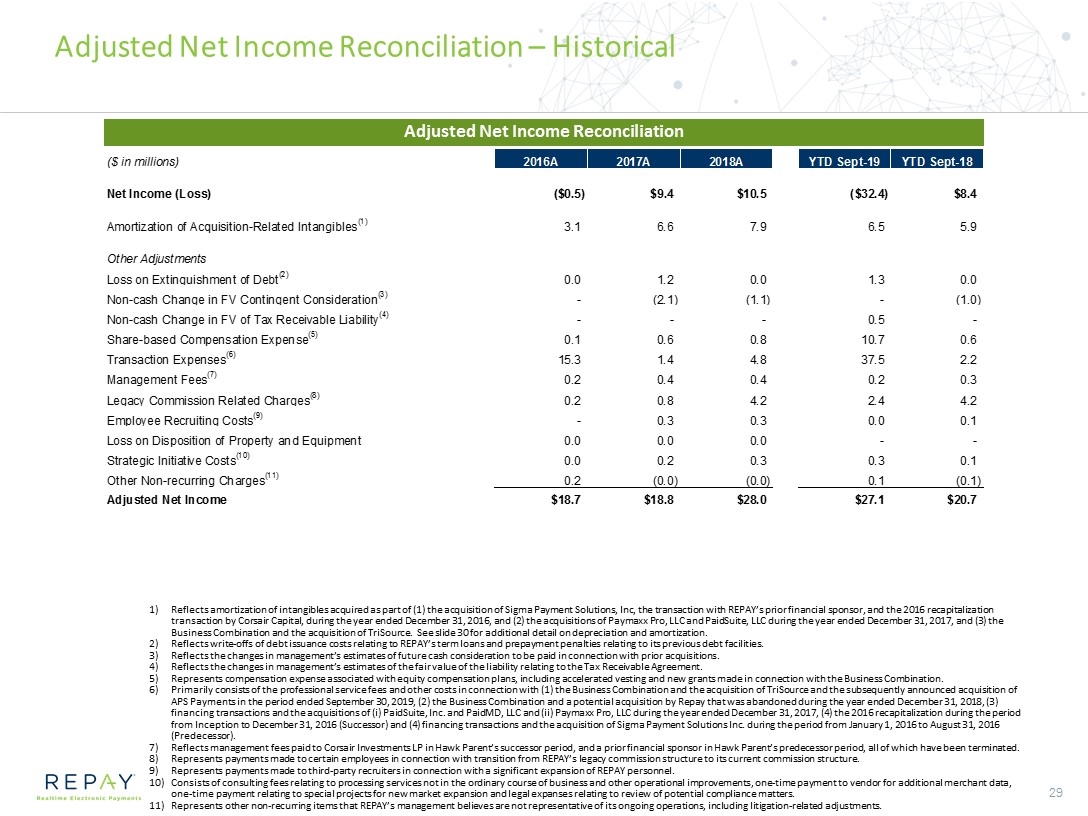

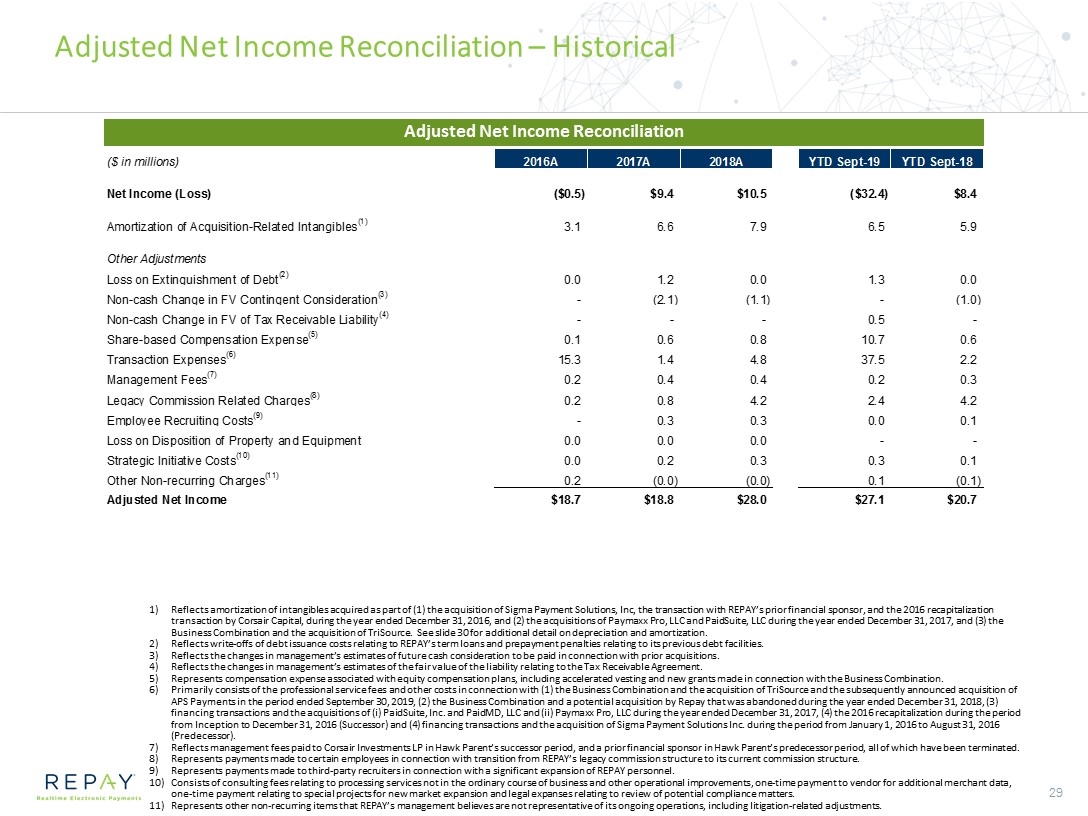

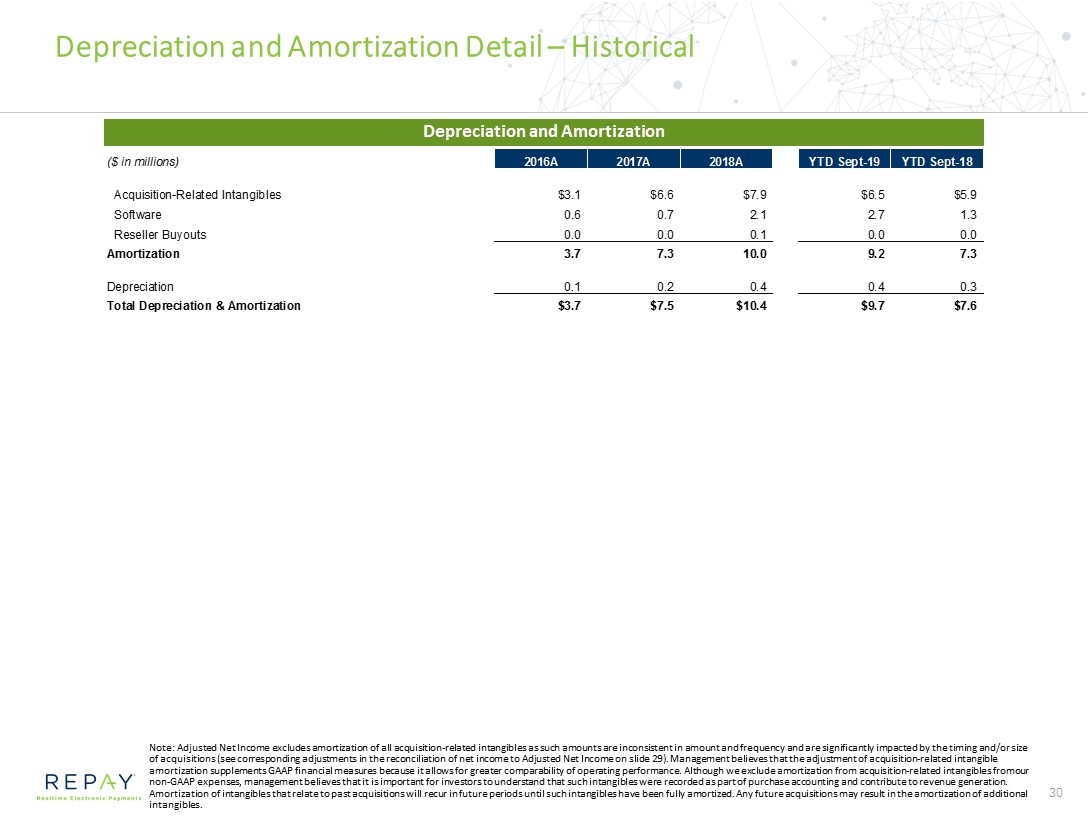

Adjusted Net Income Reconciliation – Historical Reflects amortization of intangibles acquired as part of (1) the acquisition of Sigma Payment Solutions, Inc, the transaction with REPAY’s prior financial sponsor, and the 2016 recapitalization transaction by Corsair Capital, during the year ended December 31, 2016, and (2) the acquisitions of Paymaxx Pro, LLC and PaidSuite, LLC during the year ended December 31, 2017, and (3) the Business Combination and the acquisition of TriSource. See slide 30 for additional detail on depreciation and amortization. Reflects write-offs of debt issuance costs relating to REPAY’s term loans and prepayment penalties relating to its previous debt facilities. Reflects the changes in management’s estimates of future cash consideration to be paid in connection with prior acquisitions. Reflects the changes in management’s estimates of the fair value of the liability relating to the Tax Receivable Agreement. Represents compensation expense associated with equity compensation plans, including accelerated vesting and new grants made in connection with the Business Combination. Primarily consists of the professional service fees and other costs in connection with (1) the Business Combination and the acquisition of TriSource and the subsequently announced acquisition of APS Payments in the period ended September 30, 2019, (2) the Business Combination and a potential acquisition by Repay that was abandoned during the year ended December 31, 2018, (3) financing transactions and the acquisitions of (i) PaidSuite, Inc. and PaidMD, LLC and (ii) Paymaxx Pro, LLC during the year ended December 31, 2017, (4) the 2016 recapitalization during the period from Inception to December 31, 2016 (Successor) and (4) financing transactions and the acquisition of Sigma Payment Solutions Inc. during the period from January 1, 2016 to August 31, 2016 (Predecessor). Reflects management fees paid to Corsair Investments LP in Hawk Parent’s successor period, and a prior financial sponsor in Hawk Parent’s predecessor period, all of which have been terminated. Represents payments made to certain employees in connection with transition from REPAY’s legacy commission structure to its current commission structure. Represents payments made to third-party recruiters in connection with a significant expansion of REPAY personnel. Consists of consulting fees relating to processing services not in the ordinary course of business and other operational improvements, one-time payment to vendor for additional merchant data, one-time payment relating to special projects for new market expansion and legal expanses relating to review of potential compliance matters. Represents other non-recurring items that REPAY’s management believes are not representative of its ongoing operations, including litigation-related adjustments. Adjusted Net Income Reconciliation

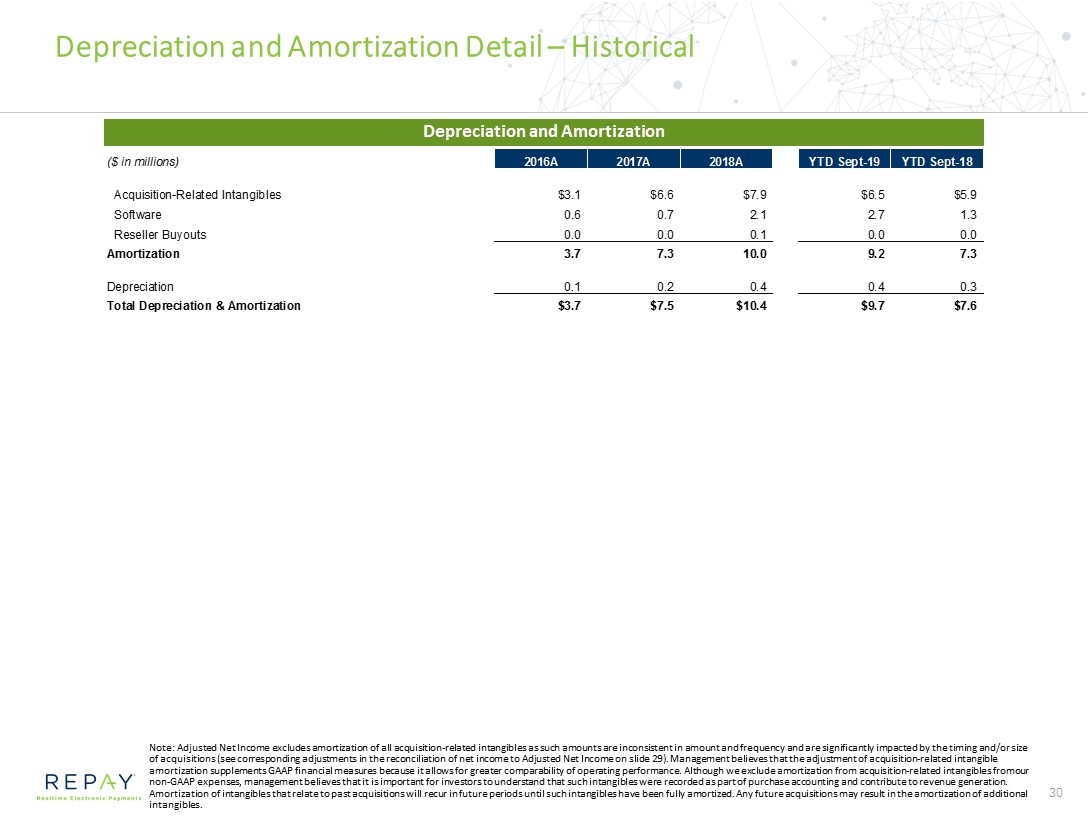

Depreciation and Amortization Detail – Historical Note: Adjusted Net Income excludes amortization of all acquisition-related intangibles as such amounts are inconsistent in amount and frequency and are significantly impacted by the timing and/or size of acquisitions (see corresponding adjustments in the reconciliation of net income to Adjusted Net Income on slide 29). Management believes that the adjustment of acquisition-related intangible amortization supplements GAAP financial measures because it allows for greater comparability of operating performance. Although we exclude amortization from acquisition-related intangibles from our non-GAAP expenses, management believes that it is important for investors to understand that such intangibles were recorded as part of purchase accounting and contribute to revenue generation. Amortization of intangibles that relate to past acquisitions will recur in future periods until such intangibles have been fully amortized. Any future acquisitions may result in the amortization of additional intangibles. Depreciation and Amortization

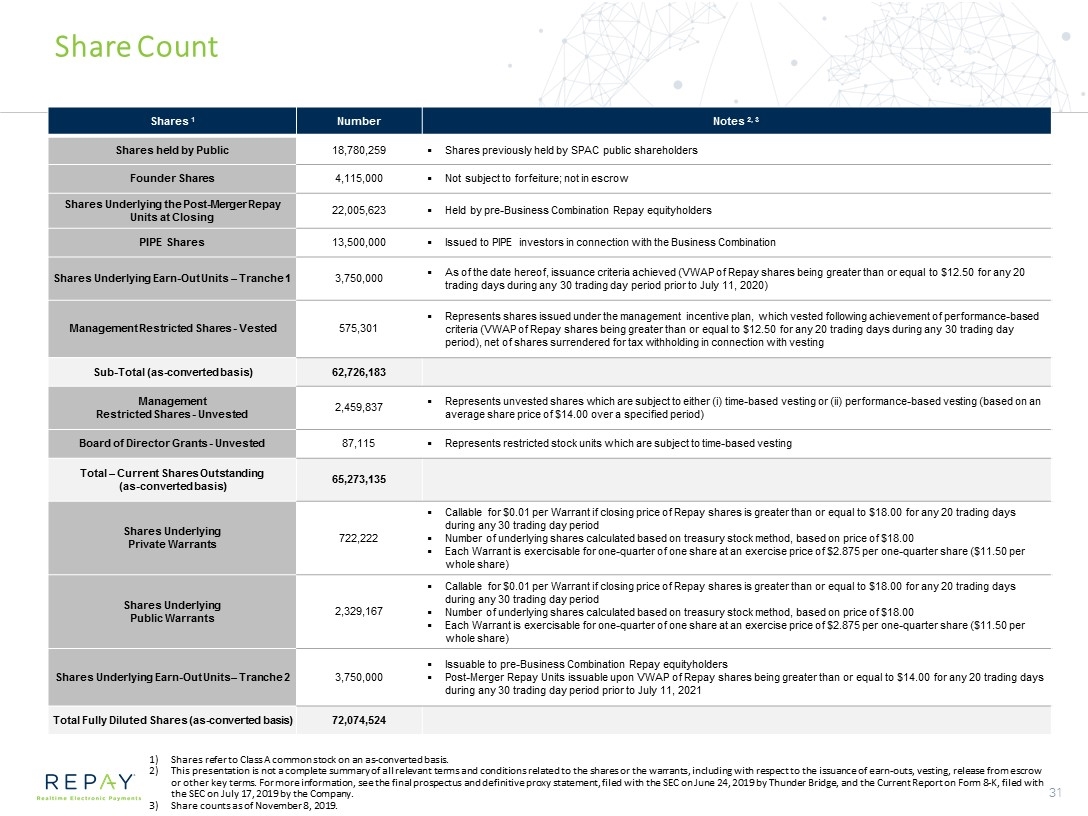

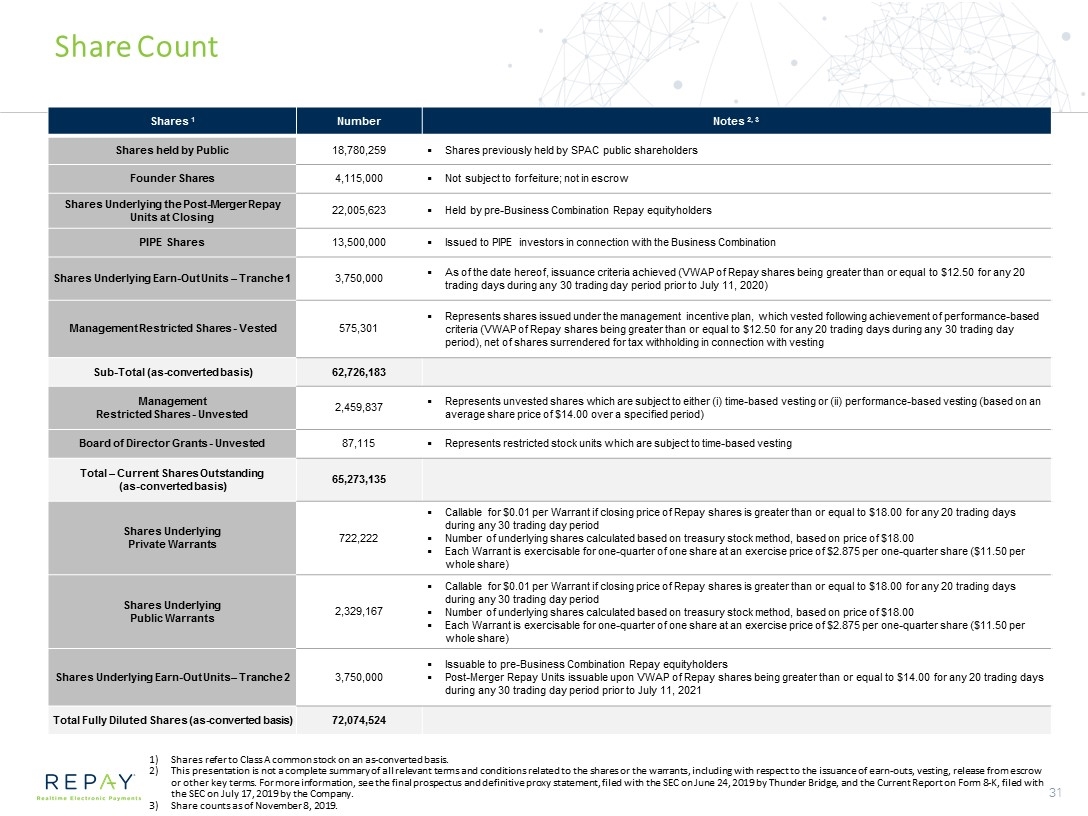

Share Count Shares refer to Class A common stock on an as-converted basis. This presentation is not a complete summary of all relevant terms and conditions related to the shares or the warrants, including with respect to the issuance of earn-outs, vesting, release from escrow or other key terms. For more information, see the final prospectus and definitive proxy statement, filed with the SEC on June 24, 2019 by Thunder Bridge, and the Current Report on Form 8-K, filed with the SEC on July 17, 2019 by the Company. Share counts as of November 8, 2019. Shares 1 Number Notes 2, 3 Shares held by Public 18,780,259 Shares previously held by SPAC public shareholders Founder Shares 4,115,000 Not subject to forfeiture; not in escrow Shares Underlying the Post-Merger Repay Units at Closing 22,005,623 Held by pre-Business Combination Repay equityholders PIPE Shares 13,500,000 Issued to PIPE investors in connection with the Business Combination Shares Underlying Earn-Out Units – Tranche 1 3,750,000 As of the date hereof, issuance criteria achieved (VWAP of Repay shares being greater than or equal to $12.50 for any 20 trading days during any 30 trading day period prior to July 11, 2020) Management Restricted Shares - Vested 575,301 Represents shares issued under the management incentive plan, which vested following achievement of performance-based criteria (VWAP of Repay shares being greater than or equal to $12.50 for any 20 trading days during any 30 trading day period), net of shares surrendered for tax withholding in connection with vesting Sub-Total (as-converted basis) 62,726,183 Management Restricted Shares - Unvested 2,459,837 Represents unvested shares which are subject to either (i) time-based vesting or (ii) performance-based vesting (based on an average share price of $14.00 over a specified period) Board of Director Grants - Unvested 87,115 Represents restricted stock units which are subject to time-based vesting Total – Current Shares Outstanding (as-converted basis) 65,273,135 Shares Underlying Private Warrants 722,222 Callable for $0.01 per Warrant if closing price of Repay shares is greater than or equal to $18.00 for any 20 trading days during any 30 trading day period Number of underlying shares calculated based on treasury stock method, based on price of $18.00 Each Warrant is exercisable for one-quarter of one share at an exercise price of $2.875 per one-quarter share ($11.50 per whole share) Shares Underlying Public Warrants 2,329,167 Callable for $0.01 per Warrant if closing price of Repay shares is greater than or equal to $18.00 for any 20 trading days during any 30 trading day period Number of underlying shares calculated based on treasury stock method, based on price of $18.00 Each Warrant is exercisable for one-quarter of one share at an exercise price of $2.875 per one-quarter share ($11.50 per whole share) Shares Underlying Earn-Out Units– Tranche 2 3,750,000 Issuable to pre-Business Combination Repay equityholders Post-Merger Repay Units issuable upon VWAP of Repay shares being greater than or equal to $14.00 for any 20 trading days during any 30 trading day period prior to July 11, 2021 Total Fully Diluted Shares (as-converted basis) 72,074,524