- NVT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K/A Filing

nVent Electric (NVT) 8-K/AOther Events

Filed: 11 Apr 18, 12:00am

Exhibit 99.1

Dear Pentair Shareholder:

On May 9, 2017, we announced a plan to separate our Water business and our Electrical business into two independent, publicly-traded companies. The separation will occur through aspin-off of a newly formed company named nVent Electric plc, which will contain our Electrical business. Pentair, the existing publicly-traded company, will continue to own our Water business. Both companies will benefit from leading positions in their respective industries, well-recognized brands, attractive margin profiles, strong cash flow generation and compelling growth opportunities.

To implement the separation, Pentair will transfer its Electrical business to nVent, and in return, nVent will issue ordinary shares to Pentair shareholders, pro rata to their respective holdings. Each Pentair shareholder will receive one nVent ordinary share for each Pentair ordinary share held as of the close of business on April 17, 2018, the record date for the distribution. The distribution will generally betax-free to Pentair shareholders for U.S. federal income tax purposes, except for cash received in lieu of fractional shares.

No vote of Pentair shareholders is required for the distribution. You do not need to take any action to receive nVent ordinary shares to which you are entitled as a Pentair shareholder, and you do not need to pay any consideration or surrender or exchange your Pentair shares.

I encourage you to read the attached information statement, which is being provided to all Pentair shareholders who hold Pentair ordinary shares on the record date for the distribution. The information statement describes the separation in detail and contains important business and financial information about nVent.

I believe the separation provides tremendous opportunities for our businesses and our shareholders, as we work to continue building long-term shareholder value. We appreciate your continuing support of Pentair, and look forward to your future support of both companies.

Sincerely,

Randall J. Hogan

Chairman and Chief Executive Officer

Pentair plc

April 9, 2018

Dear Future nVent Shareholder:

I am pleased to welcome you as a future shareholder of nVent, whose shares we intend to list on the New York Stock Exchange under the symbol “NVT”.

We are a leading global provider of electrical connection and protection solutions. We believe our inventive electrical solutions enable safer systems and ensure a more secure world. Our breadth of high performance products and solutions, depth of industry expertise across our premier brands, and global footprint enable us to solve our customers’ demanding problems, improving their utilization, lowering their costs, and minimizing downtime.

As an independent, publicly-traded company, we believe we will be well-positioned to execute our growth strategy focused on customer experience, product innovation and international growth. We have a proven track record of successfully integrating and delivering value from acquisitions and we will look to pursue a disciplined acquisition strategy in the future to complement our growth.

Our talented senior management team with experience at Pentair and other leading industrial companies, along with our deeply-committed employees, are dedicated to building upon our culture of customer focus, operational excellence and continuous improvement.

We believe our strengths and discipline will translate into an attractive return for you, our shareholders.

I invite you to learn more about nVent and our strategic initiatives by reading the attached information statement. Thank you in advance for your support as a future shareholder of nVent.

Sincerely,

Beth A. Wozniak

Chief Executive Officer

nVent Electric plc

INFORMATION STATEMENT

nVent Electric plc

This information statement is being furnished in connection with the distribution of ordinary shares of nVent Electric plc (“nVent”), which will hold the Electrical business of Pentair plc (“Pentair”), to Pentair shareholders.

For each Pentair ordinary share you hold of record as of the close of business on April 17, 2018, the record date for the distribution (the “record date”), you will receive one nVent ordinary share. You will receive cash in lieu of any fractional nVent ordinary shares that you would have received after application of the above ratio. We expect nVent ordinary shares to be distributed to you on April 30, 2018. We refer to the date of the distribution of nVent ordinary shares as the “distribution date.” As discussed under “The Separation—Trading Between the Record Date and Distribution Date,” if you sell your Pentair ordinary shares in the“regular-way” market after the record date and before the distribution date, you also will be selling your right to receive nVent ordinary shares in connection with the separation.

The distribution is intended to betax-free to Pentair shareholders for U.S. federal income tax purposes, except for cash received in lieu of fractional shares. The distribution is subject to certain conditions, including the continued validity of the private letter ruling from the U.S. Internal Revenue Service (“IRS”) and the receipt of an opinion of Deloitte Tax LLP confirming that the distribution and certain related transactions will qualify fornon-recognition of gain or loss to Pentair and its shareholders pursuant to Section 355 and related provisions of the Internal Revenue Code of 1986, as amended (the “Code��), except to the extent of cash received in lieu of fractional shares.

No vote of Pentair shareholders is required in connection with the distribution. Therefore, you are not being asked for a proxy, and you are requested not to send us a proxy, in connection with the distribution. You do not need to pay any consideration, exchange or surrender your existing Pentair ordinary shares or take any other action to receive your nVent ordinary shares.

There is no current trading market for nVent ordinary shares, although we expect that a limited market, commonly known as a “when-issued” trading market, will develop on or shortly before the record date for the distribution, and we expect“regular-way” trading of nVent ordinary shares to begin on the first trading day following the completion of the separation. We have received authorization to list nVent ordinary shares on the New York Stock Exchange (“NYSE”) under the symbol “NVT.” Following the distribution, Pentair will continue to trade on the NYSE under the symbol “PNR.”

In reviewing this information statement, you should carefully consider the matters described under “Risk Factors” beginning on page 23.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

This document is not a prospectus within the meaning of the Companies Act 2014 of Ireland (as amended), the Prospectus Directive (2003/71/EC) Regulations 2005 of Ireland (as amended) or the Prospectus Rules issued by the Central Bank of Ireland. No offer of shares to the public is made, or will be made, that requires the publication of a prospectus pursuant to Irish prospectus law within the meaning of the above legislation. This document has not been approved or reviewed by or registered with the Central Bank of Ireland or any other competent authority or regulatory authority in the European Economic Area. This document does not constitute investment advice or the provision of investment services within the meaning of the European Communities (Markets in Financial Instruments) Regulations 2007 of Ireland (as amended) or the Markets in Financial Instruments Directive (2004/39/EC). Neither Pentair nor nVent is an authorized investment firm within the meaning of the European Communities (Markets in Financial Instruments) Regulations 2007 of Ireland (as amended) or the Markets in Financial Instruments Directive (2004/39/EC) and the recipients of this document should seek independent legal and financial advice in determining their actions in respect of or pursuant to this document.

The date of this information statement is April 9, 2018.

This information statement will be made publicly available at www.materialnotice.com beginning April 9, 2018, and notices of this information statement’s availability will be first sent to Pentair shareholders on or about April 9, 2018.

| Page | ||||

| 1 | ||||

| 9 | ||||

| 23 | ||||

| 45 | ||||

| 46 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 56 | ||||

| 60 | ||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 69 | |||

| 89 | ||||

| 91 | ||||

| 99 | ||||

| 115 | ||||

| 142 | ||||

| 143 | ||||

| 151 | ||||

| 155 | ||||

| 157 | ||||

| 159 | ||||

Security Ownership of Certain Beneficial Owners and Management | 161 | |||

| 163 | ||||

| 181 | ||||

| F-1 | ||||

NOTE REGARDING THE USE OF CERTAIN TERMS, TRADEMARKS, TRADE NAMES AND SERVICE MARKS

Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement about nVent assumes the completion of all of the transactions referred to in this information statement in connection with the separation and distribution. Unless the context otherwise requires, references in this information statement to “nVent,” “we,” “us,” “our” and “our company” refer to nVent Electric plc, an Irish public limited company, and its subsidiaries. Unless the context otherwise requires, references to the “Electrical business” refer to the business and operations of Pentair’s Electrical business as they were historically managed as part of Pentair and its subsidiaries prior to the completion of the separation. References in this information statement to “Pentair” refer to Pentair plc, an Irish public limited company, and its subsidiaries, including the Electrical business prior to completion of the separation. References in this information statement to the “separation” refer to the separation of the Electrical business from Pentair and the creation, as a result of the distribution, of an independent, publicly-traded company, nVent, which will hold the assets and liabilities associated with the Electrical business after the distribution. References in this information statement to the “distribution” refer to the distribution on Pentair ordinary shares outstanding on the record date that will be satisfied by nVent’s issuance of its ordinary shares to the persons entitled to receive the distribution. References to “dollars” or “$” refer to U.S. dollars. References to “U.S.” refer to the United States of America and references to “U.K.” refer to the United Kingdom.

We own or have rights to use the trademarks, trade names and service marks that we use in conjunction with the operation of our business. We own or have rights to use the following trademarks that appear in this information statement: “Caddy,” “Erico,” “Hoffman,” “nVent,” “Raychem,” “Schroff” and “Tracer”. These

i

trademarks are registered trademarks or the subject of pending trademark applications in the U.S. and other jurisdictions. We license the “Raychem” trademark from a third party. Each trademark, trade name or service mark of any other company appearing in this information statement is, to our knowledge, owned by such other company. Solely for convenience, the trademarks, trade names and service marks referred to in this information statement are listed without the® and ™ symbols, but we will assert, to the fullest extent under applicable law, our right to use such trademarks, service marks and trade names.

ii

QUESTIONS AND ANSWERS ABOUT THE SEPARATION

What is nVent and why is Pentair distributing nVent ordinary shares? | nVent was incorporated in Ireland on May 30, 2017 for the purpose of holding Pentair’s Electrical business following the separation. The separation of Pentair’s Electrical business from Pentair and the distribution of nVent ordinary shares to Pentair shareholders are intended to provide you with equity investments in two separate companies that will be able to focus on each of their respective businesses. We expect that the separation will result in enhanced long-term performance of each business for the reasons discussed in “The Separation—Reasons for the Separation.” |

Why am I receiving this document? | Pentair is delivering this document to you because you are a holder of Pentair ordinary shares. If you are a holder of Pentair ordinary shares as of the close of business on April 17, 2018, the record date of the distribution, you are entitled to receive one nVent ordinary share for each Pentair ordinary share that you hold at the close of business on such date. This document will help you understand how the separation will affect your investment in Pentair and your investment in nVent after the separation. |

How will the separation work? | Currently, all of nVent’s issued shares are held beneficially by an Irish corporate services provider (which is not a subsidiary of Pentair). Prior to the transfer by Pentair to nVent of the Electrical business, which will occur prior to the distribution, we will have no business operations. Pentair will transfer its Electrical business to us in return for which we will issue nVent ordinary shares to Pentair shareholders, pro rata to their respective holdings. For the purposes of Irish law, this will be treated as Pentair having made a dividend in specie, or anon-cash dividend, to its shareholders. In connection with these transactions, we will acquire by surrender the shares currently held by the Irish corporate services provider referred to above for no consideration, following which we will cancel these shares. Immediately following the distribution, the persons entitled to receive nVent ordinary shares in the distribution will own all of the outstanding nVent ordinary shares. |

Why is the separation of nVent structured in this manner? | Pentair believes that a distribution of nVent ordinary shares that istax-free to Pentair shareholders for U.S. federal income tax purposes is an efficient way to separate the Electrical business of Pentair in a manner that will create long-term value for Pentair, nVent, and their respective shareholders. |

What is the record date for the distribution? | The record date for the distribution will be April 17, 2018. |

When will the distribution occur? | We expect the distribution of nVent ordinary shares to occur on April 30, 2018, to holders of record of Pentair ordinary shares at the close of business on the record date. |

1

What do shareholders need to do to participate in the distribution? | Pentair shareholders as of the record date will not be required to take any action to receive nVent ordinary shares in the distribution, but you are urged to read this entire information statement carefully. No shareholder approval of the distribution is required. You are not being asked for a proxy. You do not need to pay any consideration, exchange or surrender your existing Pentair ordinary shares or take any other action to receive your nVent ordinary shares. The distribution will not affect the number of outstanding Pentair ordinary shares or any rights of Pentair shareholders, although immediately following the distribution, we expect the market value of each outstanding Pentair ordinary share to be lower than the“regular-way” trading price of such shares immediately prior to the distribution because the trading price will no longer reflect the value of the Electrical business held by nVent. |

Will I receive physical certificates representing nVent ordinary shares following the separation? | No. Following the separation, we will not issue physical certificates representing nVent ordinary shares. If you own Pentair ordinary shares as of the close of business on the record date, Pentair, with the assistance of Computershare Trust Company, N.A., the distribution agent (“Computershare”), will electronically distribute nVent ordinary shares to you in book-entry form by way of registration in the “direct registration system” (if you hold the shares in your own name as a registered shareholder) or to your bank or brokerage firm on your behalf or through the systems of the Depository Trust Company (“DTC”) (if you hold the shares through a bank or brokerage firm that uses DTC). Computershare will mail you a book-entry account statement that reflects your nVent ordinary shares, or your bank or brokerage firm will credit your account for the nVent ordinary shares. See “The Separation—When and How You Will Receive nVent Ordinary Shares in the Distribution.” |

How many nVent ordinary shares will I receive in the distribution? | You will receive one nVent ordinary share for each Pentair ordinary share you hold as of the close of business on the record date. Based on approximately 178.3 million Pentair ordinary shares outstanding as of March 5, 2018, a total of approximately 178.3 million nVent ordinary shares will be distributed. For additional information on the distribution, see “The Separation.” |

Will nVent issue fractional ordinary shares in the distribution? | No. We will not issue fractional shares in the distribution. Fractional shares that Pentair shareholders would otherwise have been entitled to receive will be aggregated and sold in the public market by the distribution agent. The aggregate net cash proceeds of these sales will be distributed pro rata (based on the fractional share such holder would otherwise be entitled to receive) to those shareholders who would otherwise have been entitled to receive fractional shares. |

2

Recipients of cash in lieu of fractional shares will not be entitled to any interest on the amounts paid in lieu of fractional shares. |

What are the conditions to the distribution? | The distribution is subject to the following conditions, among others: |

| • | the continued validity of the private letter ruling from the IRS, which remains in full force and effect and has not been modified or amended in any material respect adversely affecting the intendedtax-free treatment of the distribution and certain related transactions; |

| • | the receipt of a tax opinion dated as of the distribution date from Deloitte Tax LLP, in form and substance acceptable to Pentair, which tax opinion will rely on the effectiveness of the IRS ruling, substantially to the effect that, subject to the accuracy of, and compliance with, certain representations, assumptions and covenants, for U.S. federal income tax purposes, the distribution and certain related transactions will qualify fornon-recognition of gain or loss to Pentair and its shareholders pursuant to Section 355 and related provisions of the Code, except to the extent of cash received in lieu of fractional shares; |

| • | the internal restructuring transactions and the transfer of assets and liabilities to nVent contemplated by the separation and distribution agreement to be completed prior to the distribution shall have been completed; |

| • | the debt financing contemplated to be obtained in connection with the separation, as described in the separation and distribution agreement, having been obtained; |

| • | the transaction agreements relating to the separation shall have been duly executed and delivered by the parties; |

| • | no order, injunction or decree issued by any governmental authority or other legal restraint or prohibition preventing the consummation of the separation, the distribution or any of the related transactions being in effect; |

| • | any actions and filings necessary or appropriate under applicable U.S. federal, U.S. state or other securities laws shall have been taken or made, and, where applicable, have become effective or been accepted by the applicable governmental authority; |

| • | any governmental approvals necessary to consummate the separation, the distribution and related transactions will have been obtained and be in full force and effect; |

| • | the separation and distribution shall not violate or result in a breach of applicable law or any material contract of Pentair or nVent or any of their respective subsidiaries; |

| • | the approval for listing on the NYSE of nVent ordinary shares to be delivered to the Pentair shareholders in the distribution having been obtained, subject to official notice of issuance; |

| • | the U.S. Securities and Exchange Commission (the “SEC”) declaring effective the registration statement of which this |

3

information statement forms a part, with no order suspending the effectiveness of the registration statement in effect and no proceedings for such purposes pending before or threatened by the SEC; |

| • | the mailing (or delivery by electronic means) of this information statement to the holders of Pentair ordinary shares as of the record date for the distribution; and |

| • | no other event or development existing or having occurred that, in the judgment of Pentair’s board of directors, in its sole discretion, makes it inadvisable to effect the separation, the distribution and other related transactions. |

| We cannot assure you that any or all of these conditions will be met. For a complete discussion of all of the conditions to the distribution, see “The Separation—Conditions to the Distribution.” |

What is the expected date of completion of the separation? | The completion and timing of the separation is dependent upon the satisfaction of a number of conditions. We expect nVent ordinary shares to be distributed on April 30, 2018 to the holders of record of Pentair ordinary shares at the close of business on the record date. However, no assurance can be provided as to the timing of the separation or that all conditions to the separation will be met. |

Can Pentair decide to cancel the distribution even if all of the conditions have been met? | Yes. The distribution is subject to the satisfaction or waiver of certain conditions. See “The Separation—Conditions to the Distribution.” Until the distribution has occurred, Pentair has the right to terminate the distribution, even if all of the conditions are satisfied, if at any time the board of directors of Pentair determines that the distribution is not in the best interests of Pentair and its shareholders or that market conditions or other circumstances are such that it is not advisable at that time to separate the Electrical business from the remainder of Pentair. |

What if I want to sell my Pentair ordinary shares or my nVent ordinary shares? | You should consult with your financial advisors, such as your broker, bank, other nominee or tax advisor. If you decide to sell any Pentair ordinary shares before the distribution date, you should make sure your broker, bank or other nominee understands whether you want to sell your Pentair ordinary shares with or without your entitlement to nVent ordinary shares pursuant to the distribution. |

What is“regular-way” and“ex-distribution” trading? | Beginning on or shortly before the record date and continuing up to and through the distribution date, it is expected that there will be two markets in Pentair ordinary shares: a“regular-way” market and an“ex-distribution” market. Pentair ordinary shares that trade in the“regular-way” market will trade with an entitlement to nVent ordinary |

4

shares distributed pursuant to the distribution. Pentair ordinary shares that trade in the“ex-distribution” market will trade without an entitlement to nVent ordinary shares distributed pursuant to the distribution. Pentair cannot predict the trading prices of its ordinary shares before, on or after the distribution date. |

Where will I be able to trade nVent ordinary shares? | We have received authorization to list nVent ordinary shares on the NYSE under the symbol “NVT.” We anticipate that trading in nVent ordinary shares will begin on a “when-issued” basis on or shortly before the record date and will continue up to and through the distribution date and that“regular-way” trading in nVent ordinary shares will begin on the first trading day following the completion of the separation. If trading begins on a “when-issued” basis, you may purchase or sell nVent ordinary shares up to and through the distribution date, but your transaction will not settle until after the distribution date. We cannot predict the trading prices of nVent ordinary shares before, on or after the distribution date. |

What will happen to the listing of Pentair ordinary shares? | Pentair ordinary shares will continue to trade on the NYSE after the distribution under the symbol “PNR.” |

Will the number of Pentair ordinary shares that I own change as a result of the distribution? | No. The number of Pentair ordinary shares that you own will not change as a result of the distribution. |

Will the distribution affect the market price of my Pentair ordinary shares? | Yes. As a result of the distribution, Pentair expects the trading price of Pentair ordinary shares immediately following the distribution to be lower than the“regular-way” trading price of such shares immediately prior to the distribution because the trading price will no longer reflect the value of the Electrical business held by nVent. There can be no assurance that the aggregate market value of the Pentair ordinary shares and the nVent ordinary shares following the separation will be higher or lower than the market value of Pentair ordinary shares if the separation and distribution did not occur. This means, for example, that the combined trading prices of one Pentair ordinary share and one nVent ordinary share after the distribution may be equal to, greater than or less than the trading price of one Pentair ordinary share before the distribution. |

What are the material U.S. federal income tax consequences of the separation? | The distribution is conditioned on the continued validity of the private letter ruling received by Pentair from the IRS on certain issues relating to the qualification of the distribution and certain related transactions astax-free under Section 355 and related provisions of the Code. This condition requires that the IRS ruling remain in full force and effect and not be modified or amended in any respect adversely affecting the |

5

intendedtax-free treatment of the distribution and certain related transactions. The distribution is further conditioned on the receipt of a tax opinion from Deloitte Tax LLP, in form and substance acceptable to Pentair, which tax opinion will rely on the effectiveness of the IRS ruling, substantially to the effect that, for U.S. federal income tax purposes, the distribution and certain related transactions will qualify fornon-recognition of gain or loss to Pentair and its shareholders pursuant to Section 355 and related provisions of the Code, except to the extent of cash received in lieu of fractional shares. See “The Separation—Conditions to the Distribution.” Assuming that the distribution satisfies the requirements necessary fornon-recognition of gain or loss to Pentair’s shareholders under Section 355 of the Code, for U.S. federal income tax purposes, except for gain realized on the receipt of cash paid in lieu of fractional shares, no gain or loss generally will be recognized by, or be includible in the income of, a holder of Pentair ordinary shares solely as a result of the receipt of nVent ordinary shares in the distribution. You should, however, consult your own tax advisor as to the particular tax consequences to you. The U.S. federal income tax consequences of the separation are described in more detail under “Material U.S. Federal Income Tax Consequences.” |

How will I determine my tax basis for U.S. federal income tax purposes in the Pentair ordinary shares I continue to hold and the nVent ordinary shares I receive in the distribution? | Assuming that the distribution istax-free to Pentair shareholders, except for cash received in lieu of fractional shares, your tax basis for U.S. federal income tax purposes in the Pentair ordinary shares held by you immediately prior to the distribution will be allocated between such Pentair ordinary shares and the nVent ordinary shares received by you in the distribution (including any fractional share deemed received) in proportion to the relative fair market values of each immediately following the distribution. Pentair will provide its shareholders with information to enable them to compute their tax basis in both the Pentair and nVent ordinary shares. This information will be posted on Pentair’s website, www.pentair.com. |

What are the material Irish tax consequences of the separation? | The distribution will not give rise to Irish stamp duty for Pentair shareholders. Irish stamp duty may, depending on the manner in which the nVent ordinary shares are held, be payable in respect of transfers of nVent ordinary shares after the separation. You should consult your own tax advisor as to the particular tax consequences to you. The Irish tax consequences of the separation are described in more detail under “Material Irish Tax Consequences.” |

What are the material U.K. tax consequences of the separation? | Pentair shareholders should generally not be liable for U.K. tax on income or chargeable gains in respect of the acquisition of nVent ordinary shares in connection with the distribution. You should |

6

consult your own tax advisor as to the particular tax consequences to you. The U.K. tax consequences of the separation are described in more detail under “Material U.K. Tax Consequences.”

What will nVent’s relationship be with Pentair following the separation? | We will enter into a separation and distribution agreement with Pentair to effect the separation and provide a framework for nVent’s relationship with Pentair after the separation and will enter into various other agreements, including a tax matters agreement, a transition services agreement and an employee matters agreement. These agreements will provide for the separation between nVent and Pentair of the assets, employees, liabilities and obligations (including its property, tax matters, environmental matters and employee benefit matters) of Pentair and its subsidiaries attributable to periods prior to, at and after nVent’s separation from Pentair and will govern the relationship between nVent and Pentair subsequent to the completion of the separation. For additional information regarding the separation and distribution agreement and other transaction agreements, see “Risk Factors—Risks Relating to the Separation” and “Certain Relationships and Related Person Transactions—Agreements with Pentair.” |

Who will manage nVent after the separation? | We will benefit from a management team with an extensive background in the Electrical business. Led by Randall J. Hogan, who will be ournon-executive Chairman of the Board after the separation, and Beth A. Wozniak, who will be our Chief Executive Officer after the separation, our management team will possess deep knowledge of, and extensive experience in, its industry. None of the management and directors of nVent will be directors or employees of Pentair following the separation. For more information regarding our management and directors, see “Management” and “Directors.” |

Are there risks associated with owning nVent ordinary shares? | Yes. Our business is subject to both general and specific risks relating to our business, the industry in which we operate, our ongoing contractual relationships with Pentair and our status as a separate, publicly-traded company. There also are risks relating to the separation, certain tax matters, our jurisdiction of incorporation and ownership of nVent ordinary shares. These risks are described in the “Risk Factors” section of this information statement beginning on page 23. You are encouraged to read that section carefully. |

Does nVent plan to pay dividends? | We currently anticipate paying a regular cash dividend. The declaration and payment of any dividends in the future will be subject to the sole discretion of our board of directors and will depend upon many factors. See “Dividends.” |

Will nVent incur any debt prior to or at the time of the distribution? | Yes. nVent Finance S.à r.l., which will be a wholly-owned subsidiary of nVent after the separation and which we refer to as “nVent Finance,” has issued $800.0 million of senior unsecured notes, |

7

consisting of $300.0 million of 3.950% senior notes due 2023 and $500.0 million of 4.550% senior notes due 2028. In addition, nVent Finance has entered into a credit agreement with a syndicate of banks providing for a five-year $200.0 million senior unsecured term loan facility, which we expect will be drawn upon prior to the completion of the separation, and a five-year $600.0 million senior unsecured revolving credit facility, which we expect will be undrawn upon the completion of the separation. Pursuant to these financing arrangements, we expect to have approximately $1.0 billion of indebtedness upon completion of the separation. In connection with the separation, nVent Finance will transfer to Pentair all cash in excess of $50.0 million of nVent and its subsidiaries, including cash from the net proceeds of this indebtedness, as consideration for the contribution of the assets of the Electrical business to nVent Finance by Pentair. We expect that Pentair will use the proceeds of such cash transfer to repay certain outstanding debt of Pentair. See “Description of Material Indebtedness” and “Risk Factors—Risks Relating to the Separation.” |

Who will be the distribution agent, transfer agent and registrar for the nVent ordinary shares? | Computershare will be the distribution agent, transfer agent and registrar for nVent ordinary shares. For questions relating to the transfer or mechanics of the distribution, you should contact: |

| Computershare |

250 Royall Street

Canton, MA 02021

(877)498-8861

Where can I find more information about Pentair and nVent? | Before the distribution, if you have any questions relating to Pentair’s business performance, you should contact: |

| Pentair plc |

Investor Relations

5500 Wayzata Boulevard, Suite 600

Minneapolis, MN 55416

(763)656-5575

| After the distribution, nVent shareholders who have any questions relating to our business performance should contact us at: |

| nVent Electric plc |

Investor Relations

1665 Utica Avenue

St. Louis Park, MN 55416

(763)656-1880

| The nVent investor website www.nVent.com/investors will be operational as of April 30, 2018. |

8

The following is a summary of material information discussed in this information statement. This summary may not contain all of the details concerning the separation or other information that may be important to you. To better understand the separation and our business and financial position, you should carefully review this entire information statement. Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement about nVent assumes the completion of all of the transactions referred to in this information statement in connection with the separation and distribution. Unless the context otherwise requires, references in this information statement to “nVent,” “we,” “us,” “our” and “our company” refer to nVent Electric plc, an Irish public limited company, and its subsidiaries. Unless the context otherwise requires, references to the “Electrical business” refer to the business and operations of Pentair’s Electrical business as they were historically managed as part of Pentair and its subsidiaries prior to completion of the separation. References in this information statement to “Pentair” refer to Pentair plc, an Irish public limited company, and its subsidiaries, including the Electrical business prior to completion of the separation. References in this information statement to the “separation” refer to the separation of the Electrical business from Pentair and the creation, as a result of the distribution, of an independent, publicly-traded company, nVent, which will hold the assets and liabilities associated with the Electrical business after the distribution. References in this information statement to the “distribution” refer to the dividend on Pentair ordinary shares outstanding on the record date that will be satisfied by nVent’s issuance of its ordinary shares to the persons entitled to receive the dividend.

The Company

nVent is a leading global provider of electrical connection and protection solutions. We believe our inventive electrical solutions enable safer systems and ensure a more secure world. We design, manufacture, market, install, and service high performance products and solutions that connect and protect some of the world’s most sensitive equipment, buildings, and critical processes. We offer a comprehensive range of enclosures, electrical connections and fastening, and thermal management solutions across industry-leading brands that are recognized globally for quality, reliability, and innovation. Our principal office is in London, United Kingdom and our management office in the United States is in Minneapolis, Minnesota. We were incorporated under the laws of Ireland on May 30, 2017.

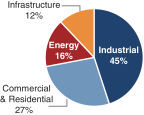

Our broad range of products and solutions connect and protect our customers’ mission-critical equipment from hazardous conditions, improving their utilization, lowering costs, and minimizing downtime. The cost of our products typically represents a small proportion of the total cost of our customers’ end systems as well as the potential cost of failure that our products help avoid. We have a portfolio of premier, industry-leading brands, including Caddy, Erico, Hoffman, Raychem, Schroff, and Tracer, some of which have a history spanning over 100 years, that cover a wide range of verticals, including Industrial, Commercial & Residential, Energy, and Infrastructure.

Our roots within Pentair trace back to the acquisition of Federal-Hoffman Corporation in 1988, which included the Hoffman enclosures brand. From that starting point we have grown both organically and via acquisition. Our Enclosures business first applied lean principles within the organization in the 1990s, leveraging its culture of customer service and operational excellence. In 2012, Pentair merged with Tyco International Ltd.’s Flow Control division, which included our Thermal Management business and the Raychem brand, a global leader in heat tracing solutions. In 2015, Pentair acquired ERICO Global Company, a leading global manufacturer of superior engineered electrical and fastening products, which operates as our Electrical & Fastening Solutions business, broadening our product offering and enabling us to provide additional global solutions to our combined customers.

We aim to continue our journey as “One nVent” organization, with unified focus on commercial excellence, digital transformation, scaled and integrated technology, including Internet of Things (“IoT”), and global

9

presence and capabilities. As we scale our capabilities under our umbrella brand of nVent, we expect to expand our products and solutions and continue to differentiate our company by creating solutions that solve problems for our customers.

Our strategy and culture is grounded in the values and purpose of Pentair. From Pentair Integrated Management System (“PIMS”), we have derived a set of lean growth and talent management processes, designed to improve business performance, evaluate growth opportunities, and develop and retain employees. Through consistent application of these processes, we have been able to foster a culture of innovation, retain focus on the customer, and profitably grow our business. We will continue to use and improve these processes as an independent company to continue to drive sustained and profitable growth.

We estimate that the size of the global industries we serve was $60 billion in 2017 revenue. Those industries are highly fragmented, which provides us with attractive opportunities to execute our growth strategies.

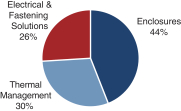

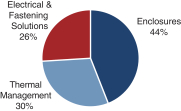

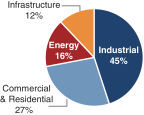

nVent 2017 Sales Breakdown—$2.1 billion | ||||

By Segment | By Geography | By Vertical | ||

|  |  | ||

We are a global business operating across a diverse range of industries. We support our customers with a workforce of 8,600 employees around the world. We operate domestically and internationally with over 50 sales offices and over 30 manufacturing and distribution centers across North America, Europe, Asia, Australia, and South America. We leverage our global workforce and footprint to respond to our customers’ requirements for consistent, high quality and innovative solutions.

10

We sell our products both through distributors and direct to customer channels. We have a diverse distribution network with over 8,000 channel partners, ranging from electrical distributors to maintenance contractors. Our Electrical & Fastening Solutions, Enclosures—Hoffman brand and Thermal Management—Commercial and Infrastructure products are principally sold through distributors. In addition, our Thermal Management— Industrial and Enclosures—Schroff brand products are primarily sold direct to customers, ranging from leading blue-chip companies to independentsub-contractors. We have long lasting relationships with our distributors and customers.

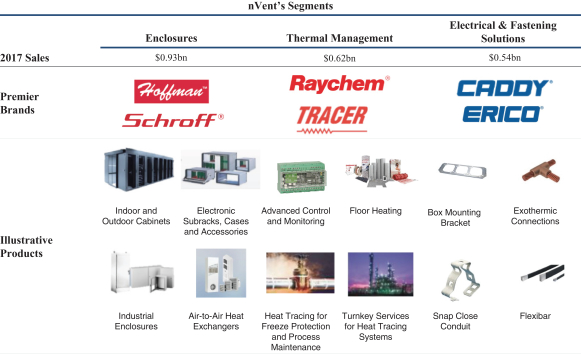

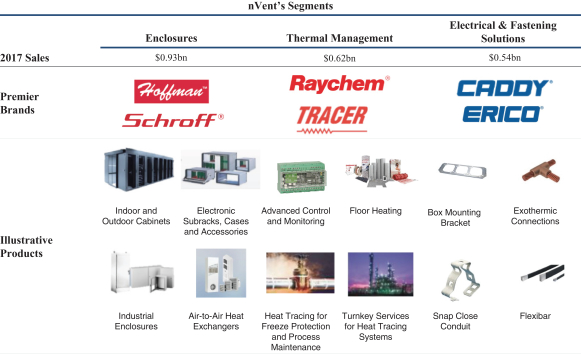

We operate across three segments: Enclosures, Thermal Management, and Electrical & Fastening Solutions, which contributed 44 percent, 30 percent, and 26 percent to our sales in 2017, respectively.

Enclosures: Enclosures provides innovative solutions that protect, connect, and manage heat in critical electronics, communication, control, and power equipment. From metallic andnon-metallic enclosures to cabinets, subracks, and backplanes, it offers the physical infrastructure to host, connect, and protect server and network equipment, as well as indoor and outdoor protection for broadband voice, data, and video surveillance applications in Industrial, Infrastructure, Commercial, and Energy verticals. In 2017, Enclosures had sales of $0.93 billion.

Thermal Management: Thermal Management provides electric thermal solutions that connect and protect critical buildings, infrastructure, industrial processes, and people. Its thermal management systems include heat tracing, floor heating, fire-rated and specialty wiring, sensing, and snow melting andde-icing solutions for use in Energy, Industrial, Commercial & Residential, and Infrastructure verticals. Its highly reliable and easy to install solutions lower total cost of ownership to building owners, facility managers, operators, and end users. In 2017, Thermal Management had sales of $0.62 billion.

Electrical & Fastening Solutions: Electrical & Fastening Solutions provides fastening solutions that connect and protect electrical and mechanical systems and civil structures. Its engineered electrical and fastening products are used across a wide range of verticals, including Commercial, Industrial, Infrastructure, and Energy. In 2017, Electrical & Fastening Solutions had sales of $0.54 billion.

11

Competitive Strengths

We believe we differentiate ourselves through the following competitive strengths, including:

Leading Provider of Inventive Solutions that Connect and Protect Sensitive Equipment and Maximize Customer Efficiency

We are a leading global provider of inventive solutions that connect and protect our customers’ mission-critical processes and equipment. We believe our comprehensive product offering, ability to customize solutions to unique customer requirements, and track record of superior quality, performance, and reliability positions us as a“go-to” electrical and thermal connection and protection solutions provider. Our products are critical components of our customers’ systems and relied upon to perform in challenging environments where cost of failure is high and our product cost is low. Furthermore, we enhance efficiency of our customers’ processes by improving utilization, lowering installation and maintenance costs, and minimizing downtime through industry-leading product performance.

Strong Industry Positions, Global Footprint and Leading Brands

We benefit from leading industry positions across our Enclosures, Thermal Management, and Electrical & Fastening Solutions segments. Our leadership positions are supported by the breadth of our global footprint, with product development, manufacturing, and distribution capabilities that enable us to meet local market requirements. Our global reach has facilitated entry into new markets and provides the infrastructure and experience to accelerate growth internationally.

We have a portfolio of premier brands, including Caddy, Erico, Hoffman, Raychem, Schroff, and Tracer, with long-standing reputations for innovation, quality, and reliability. We are a leading innovator in many of the spaces in which we operate. We developed the first self-regulating heating cable for industrial use, which automatically adjusts power output to compensate for temperature changes. We also developed the Hoffman Watershed, which was the firstfit-for-purpose enclosure for the food & beverage industry to protect critical equipment in heavy wash-down applications.

Diversified Across Products, Verticals, Brands, Channels, and Customers

We offer a diverse range of electrical connection and protection products with sales distributed across a broad range of verticals, brands, channels, and customers. We offer several product lines including communications & electronics protection, controls & electrical protection, industrial heat tracing, and thermal building solutions that are sold across the Industrial, Commercial & Residential, Energy and Infrastructure verticals.

Attractive Margins and Strong Cash Flow Generation

We benefit from industry-leading margins and a track record of strong cash flow generation. Over the past three years, our combined segment income margins1 have consistently been over 19 percent, maintained through our culture of operational efficiency and our global footprint. We have consistently generated strong cash flow from operations and free cash flow.1 Implementation of our lean, growth, and talent management processes across our organization helps to ensure we are continually improving and building sustainable performance and helps us maintain a culture of operational excellence and continuous improvement.

| 1 | Combined segment income margin and free cash flow arenon-GAAP measures. See “—Other Financial Measures” for more information regardingnon-GAAP measures, including a reconciliation to the relevant GAAP measure. |

12

Experienced Management Team with a Proven Track Record of Integrating Acquisitions

We are led by a senior management team with an average of over 20 years of industry experience with Pentair and other leading industrial companies. We benefit from our team’s industry knowledge and track record of successful product innovation and financial performance. Additionally, our senior management team has extensive experience executing and integratingbolt-on and transformational acquisitions. Our team was instrumental in the successful integration of Erico and delivery on cost synergy targets within the envisaged time frame.

Growth Strategies

Pursue Continued Growth Transformation and Business Optimization Through “One nVent” Organization

We stand to benefit from our continued evolution and integration as “One nVent” organization and organic growth focused transformation. Through adopting acustomer-led orientation and an enhanced digital strategy across our segments and brands, we aim to achieve commercial excellence and improve customer experience by making it easier and faster for customers to search, select, price and quote our products. We believe a unified approach to our customers will enhance our lead generation capabilities, enable cross-selling opportunities for our sales force, and increase our share of customers’ wallets. We expect further integration across nVent and aim to accelerate our product innovation as we encourage technology sharing across our business.

Capitalize on Identified Organic Growth Opportunities

We have identified several high-potential sectors where we see opportunities to deliver the breadth of our company-wide capabilities to drive continued organic growth. In Commercial, we seek to become our customers’ global connection and protection partner with solutions that are easy to install, deliver productivity and ensure safety and reliability. In Infrastructure, we aim to provide a unified go to market approach with solutions that optimize efficiency through innovation and customer service, with connection and protection solutions. In Industrial, we aim to innovate and create differentiation with specified products for ourend-users that enhance reliability and reduce the maintenance costs of our products.

Product Innovation to Leverage Attractive Global Secular Trends

We plan to continue to invest in the development of innovative products and solutions that take advantage of key secular trends, including rising safety standards, the IoT, building automation, and increasing efficiency and regulatory requirements. Rising safety standards globally, including in fire protection and seismic standards, call for innovative solutions that enable our customers to meet those standards in a cost-efficient manner. For example, we recently launched the world’s firstlow-smoke,zero-halogen fire-rated wiring that meets enhanced fire protection standards while reducing space requirements and total project cost.

The growth in smart products and connected solutions requires an ever increasing number of enclosures designed to exact specifications and high tolerances. For example, we offer a smart and scalable cooling solution for data centers that reduces energy consumption and results in substantial cost savings for customers. We expect to increase product differentiation and average selling prices in all of our segments through building automated and connected devices.

Grow Globally in Europe and Developing Regions

We aim to grow our global presence both in Europe and through selective investments in developing regions. In Europe, we are targeting expansion of product categories and brands that have strong positions in North America but remain underpenetrated in Europe. We plan to expand our regional team, enhance channel coverage including

13

expanding our digital platform, and differentiate our products and solutions by focusing on product flexibility and technical expertise. For example, to meet heightened fire resistance standards in Germany, we developed a fire-rated, metal pressure clip that meets standards, prevents cable damage and allows for easy installation in tight spaces.

In developing regions, we plan to enhance our existing local capabilities and focus on creating localized products and solutions to better serve our customers. For example, we believe significant infrastructure development initiatives in Asia present substantial opportunities for us to expand across our segments. We aim to invest across our supply chain and position our product roadmap around key growth verticals in these regions to capitalize on growth opportunities.

Accelerate Growth Through TargetedBolt-on Acquisitions

Our company is built on a history of successful strategic acquisitions that evidence our integration capabilities. We believe we have developed a strong pipeline of compelling acquisition candidates that complement existing products, expand geographic reach, and enhance our technical expertise and capabilities. We believe our industry standing, culture of operational excellence, and M&A integration experience position us well to continue to pursue disciplined strategic acquisitions.

Summary of Risk Factors

An investment in nVent ordinary shares is subject to a number of risks, including risks relating to our business, risks relating to the separation, risks relating to our jurisdiction of incorporation in Ireland and tax residency in the U.K. and risks relating to nVent ordinary shares. The following list of risk factors is not exhaustive. Please read the information in the section entitled “Risk Factors” for a more thorough description of these and other risks.

Risks Relating to Our Business

| • | General global economic and business conditions affect demand for our products. |

| • | We compete in attractive markets with a high level of competition, which may result in pressure on our profit margins and limit our ability to maintain or increase the market share of our products. |

| • | Volatility in currency exchange rates could have a material adverse effect on our financial condition, results of operations and cash flows. |

| • | Our future growth is dependent upon our ability to adapt our products, services and organization to meet the demands of local markets in both developed and emerging economies and by developing or acquiring new technologies that achieve market acceptance with acceptable margins. |

| • | A sustained downturn in the energy industry, due to oil and gas prices decreasing or otherwise, could decrease demand for some of our products and services. |

| • | We may not be able to identify, finance and complete suitable acquisitions and investments, and any completed acquisitions and investments could be unsuccessful or consume significant resources. |

| • | We may not achieve some or all of the expected benefits of our business initiatives. |

| • | Our success depends on attracting and retaining qualified personnel. |

| • | Our backlog may fluctuate and material amounts of cancellations or reductions of orders or a failure to deliver our backlog on time could affect our future sales. |

| • | Our future revenue depends in part on our ability to bid and win new contracts. |

14

| • | We are exposed to political, regulatory, economic and other risks that arise from operating a multinational business. |

| • | Violations of the U.S. Foreign Corrupt Practices Act and similar anti-corruption laws outside the U.S. could have a material adverse effect on us. |

| • | Our failure to satisfy international trade compliance regulations, and changes in U.S. government sanctions, could have a material adverse effect on us. |

| • | A material disruption at any of our manufacturing facilities could cause us to be unable to meet customer demands or increase our costs. |

| • | We may experience material cost and other inflation. |

| • | A disruption in the availability, price or quality of products or materials that we manufacture and source from various countries throughout the world could have a material adverse effect on our results of operations. |

| • | Our Thermal Management segment’s dependence on subcontractors and third party suppliers and manufacturers with respect to projects could have a material adverse effect on us. |

| • | Our Thermal Management segment may lose money on fixed-price contracts, and it is exposed to liquidated damages charges in many of its customer contracts. |

| • | Intellectual property challenges may hinder our ability to develop, engineer and market our products, and we may incur significant costs in our efforts to successfully avoid, manage, defend and litigate intellectual property matters. |

| • | Changes in U.S. administrative policy, including changes to existing trade agreements, could have a material adverse effect on us. |

| • | We have significant goodwill and intangible assets and future impairment of our goodwill and intangible assets could have a material adverse effect on our results of operations. |

| • | Deterioration in the credit quality of our customers could have a material adverse effect on us. |

| • | Seasonality of sales and weather conditions could have a material adverse effect on our financial results. |

| • | We are exposed to potential environmental laws, liabilities and litigation. |

| • | We are exposed to certain regulatory and financial risks related to climate change. |

| • | Increased information technology security threats and computer crime pose a risk to our systems, networks, products and services, and we are exposed to potential regulatory, financial and reputational risks relating to the protection of our data. |

| • | We may be negatively impacted by litigation, including product liability claims. |

| • | Our share price may fluctuate significantly. |

Risks Relating to the Separation

| • | We have no history operating as an independent company. We may be unable to make, on a timely or cost-effective basis, the changes necessary to operate as an independent company, and we may experience increased costs after the separation. |

| • | Our historical and pro forma financial information is not necessarily representative of the results that we would have achieved as a separate, publicly-traded company and may not be an accurate indicator of our future results of operations. |

15

| • | As an independent, publicly-traded company, we may not enjoy the same benefits that we did as a segment of Pentair. |

| • | We may not achieve some or all of the expected benefits of the separation, and the separation may materially adversely affect our business. |

| • | As we build our information technology infrastructure and transition our data to our own systems, we could incur substantial additional costs and experience temporary business interruptions. |

| • | Our accounting and other management systems and resources may not be adequately prepared to meet the financial reporting and other requirements to which we will be subject following the separation and distribution. |

| • | Pentair may fail to perform under various transaction agreements that will be executed as part of the separation or we may fail to have necessary systems and services in place where certain of the transaction agreements expire. |

| • | Potential indemnification liabilities to Pentair pursuant to the transaction agreements could materially adversely affect us. |

| • | We may have received more favorable terms from unaffiliated third parties than the terms we will receive in our agreements with Pentair. |

| • | Challenges in the commercial and credit environment may materially adversely affect our ability to issue debt on acceptable terms and our future access to capital. |

| • | After the separation, we will have indebtedness, which could restrict our ability to pay dividends and have a negative impact on our financing options and liquidity position. |

| • | We may need additional financing in the future to meet our capital needs or to make acquisitions, and such financing may not be available on favorable or acceptable terms, and may be dilutive to existing shareholders. |

| • | If the distribution fails to qualify as atax-free transaction for U.S. federal income tax purposes, then nVent, Pentair and Pentair shareholders could be subject to significant tax liability or tax indemnity obligations. |

| • | We might not be able to engage in desirable strategic transactions and equity issuances following the distribution because of restrictions relating to U.S. federal income tax requirements fortax-free distributions. |

| • | We will share responsibility for certain of our and Pentair’s income tax liabilities for tax periods prior to and including the distribution date. |

Risks Relating to our Jurisdiction of Incorporation in Ireland and Tax Residency in the U.K.

| • | We are subject to changes in law and other factors that may not allow us to maintain a worldwide effective corporate tax rate that is competitive in our industry. |

| • | A change in nVent’s tax residency could have a negative effect on our future profitability, and may trigger taxes on dividends or exit charges. |

| • | Legislative action in the U.S. could materially adversely affect us. |

| • | There is no guarantee that the High Court of Ireland approval of the creation of distributable reserves required for the payment of dividends to our shareholders will be forthcoming. |

| • | Irish law differs from the laws in effect in the U.S. and may afford less protection to holders of our securities. |

16

| • | Irish law imposes restrictions on certain aspects of capital management. |

| • | Transfers of nVent ordinary shares may be subject to Irish stamp duty. |

| • | nVent ordinary shares, received by means of a gift or inheritance, could be subject to Irish capital acquisitions tax. |

Risks Relating to nVent Ordinary Shares

| • | We cannot be certain that an active trading market for nVent ordinary shares will develop or be sustained after the distribution, and following the distribution, our share price may fluctuate significantly. |

| • | A number of nVent ordinary shares are or will be eligible for future sale, which may cause our share price to decline. |

| • | We cannot guarantee the timing, amount or payment of dividends on nVent ordinary shares. |

| • | Your percentage of ownership in nVent may be diluted in the future. |

| • | Certain provisions in our articles of association, among other things, could prevent or delay an acquisition of us, which could decrease our share price. |

The Separation

On May 9, 2017, Pentair announced a plan to separate its Water business and its Electrical business into two independent, publicly-traded companies. Pentair also announced it anticipated that the transaction will be in the form of aspin-off of nVent by Pentair to its shareholders that will betax-free for U.S. federal income tax purposes.

nVent was incorporated in Ireland on May 30, 2017,for the purpose of holding Pentair’s Electrical business following the separation. Currently, all of our issued shares are held beneficially by an Irish corporate services provider.

On April 3, 2018, the Pentair board of directors approved the transfer of Pentair’s Electrical business to us in return for which we will issue nVent ordinary shares to Pentair shareholders on the basis of one nVent ordinary share for each Pentair ordinary share held on the record date, subject to the satisfaction of the conditions to the distribution.

Immediately prior to the distribution, Pentair will transfer its Electrical business to us in return for which we will issue nVent ordinary shares to Pentair shareholders, pro rata to their respective holdings. Prior to the transfer by Pentair to us of the Electrical business, we will have no business operations. In connection with these transactions, we will acquire by surrender the shares currently held by the Irish corporate services provider referred to above for no consideration, following which we will cancel these shares. Immediately following the distribution, the persons entitled to receive nVent ordinary shares in the distribution will own all of the outstanding nVent ordinary shares.

On April 30, 2018, the expected distribution date, each person who holds Pentair ordinary shares at the close of business on the record date will receive one nVent ordinary share for each Pentair ordinary share held at the close of business on the record date, as described below. You will receive cash in lieu of any fractional nVent ordinary shares which you would have received after the application of the above ratio. Immediately following the distribution, the persons entitled to receive nVent ordinary shares in the distribution will own all of the outstanding nVent ordinary shares. You will not be required to make any payment, surrender or exchange your

17

Pentair ordinary shares or take any other action to receive your nVent ordinary shares in the distribution. The distribution of nVent ordinary shares as described in this information statement is subject to the satisfaction or waiver of certain conditions. For a more detailed description of these conditions, see “The Separation—Conditions to the Distribution.”

Our Post-Separation Relationship with Pentair

In connection with the separation, we and Pentair will enter into a separation and distribution agreement and various other agreements, including a tax matters agreement, a transition services agreement and an employee matters agreement. These agreements will provide a framework for our relationship with Pentair after the separation and provide for the allocation between us and Pentair of Pentair’s assets, employees, liabilities and obligations (including its property, tax matters, environmental matters and employee benefit matters) attributable to periods prior to, at and after our separation from Pentair. For additional information regarding the separation and distribution agreement and other transaction agreements, see “Risk Factors—Risks Relating to the Separation” and “Certain Relationships and Related Person Transactions—Agreements with Pentair.”

Reasons for the Separation

The Pentair board of directors determined that the creation of two independent, publicly-traded companies, with nVent operating Pentair’s Electrical businesses, and Pentair operating its Water businesses is in the best interests of Pentair and its shareholders for a number of reasons, including that such separation is expected to:

| • | Create two companies that will benefit from leading positions in their respective industries, well-recognized brands, attractive margin profiles, strong cash flow generation and compelling growth opportunities. |

| • | Enable enhanced strategic focus and simplified corporate structure with improved clarity into business performance and growth opportunities for management of each company to focus on their respective businesses and opportunities for long-term growth and profitability. |

| • | Provide each company with greater flexibility to pursue their own strategies for growth, both organic and through acquisitions, and capital allocation without having to consider the potential impact on the businesses of the other company. |

| • | Create two independent capital structures that are expected to be well-capitalized and have the financial profile and management talent to be successful, profitable and sustainable independent companies and afford each company direct access to the debt and equity capital markets to fund their respective growth strategies and to establish an appropriate capital structure for their business needs. |

| • | Increase business transparency and provide a clearer investment thesis for investors to allow evaluation of the separate investment identities of each company, including the distinct merits, performance and future prospects of their respective businesses, and provide investors with a more targeted investment opportunity. |

| • | Enhance each company’s flexibility to establish appropriate compensation policies, including equity-based compensation policies that are reflective of the performance of its operations and are designed to attract and retain skilled employees. |

The Pentair board of directors also considered a number of potentially negative factors in evaluating the separation, including:

| • | The potential loss of operational synergies from operating as a consolidated entity, as we will need to make investments to replicate or outsource from other providers certain facilities, systems, infrastructure and personnel to which we will no longer have access after our separation from Pentair. |

18

| • | The potential increased costs for each of the companies operating as stand-alone companies, including costs related to initiatives to develop our independent ability to operate without access to Pentair’s existing operational and administrative infrastructure. |

| • | The potential exposure to operating in fewer industries thereby reducing the ability to mitigate downturns in one business against the others. |

| • | The potential disruptions to each company’s respective business as a result of the separation, which will require significant amounts of management’s time and effort. |

| • | The risk that Pentair would not achieve the expected benefits of the separation. |

| • | The risk that Pentair may not be able to successfully execute the separation. |

| • | The incurrence of one-time costs of the separation, including financial advisor, accounting, legal and other advisor costs, recruiting and relocation costs associated with hiring new key senior management personnel, and costs related to establishing a new brand identity in the marketplace. |

For more information, see the sections entitled “The Separation—Reasons for the Separation” and “Risk Factors—Risks Related to the Separation” included elsewhere in this information statement. In determining to pursue the separation, the Pentair board of directors concluded that the potential benefits of the separation outweighed these factors.

nVent Corporate Information

The address of our principal office is The Mille, 1000 Great West Road, 8th Floor (East), London, TW8 9DW, United Kingdom. Our management office in the United States will be located at 1665 Utica Avenue, St. Louis Park, Minnesota 55416. Our website is www.nVent.com. Our website and the information contained therein or connected thereto shall not be deemed to be incorporated herein, and you should not rely on any such information in making an investment decision.

Reason for Furnishing this Information Statement

This information statement is being furnished solely to provide information to Pentair shareholders who will receive nVent ordinary shares in the distribution. It is not, and is not to be construed as, an inducement or encouragement to buy or sell any of our securities. The information contained in this information statement is believed by us to be accurate as of the date set forth on its cover. Changes may occur after that date and neither Pentair nor nVent will update this information except in the normal course of their respective disclosure obligations and practices.

This document is not a prospectus within the meaning of the Companies Act 2014 of Ireland (as amended) (the “Irish Companies Act”), the Prospectus Directive (2003/71/EC) Regulations 2005 of Ireland (as amended) or the Prospectus Rules issued by the Central Bank of Ireland. No offer of shares to the public is made, or will be made, that requires the publication of a prospectus pursuant to Irish prospectus law within the meaning of the above legislation. This document has not been approved or reviewed by or registered with the Central Bank of Ireland or any other competent authority or regulatory authority in the European Economic Area. This document does not constitute investment advice or the provision of investment services within the meaning of the European Communities (Markets in Financial Instruments) Regulations 2007 of Ireland (as amended) or the Markets in Financial Instruments Directive (2004/39/EC). Neither Pentair nor nVent is an authorized investment firm within the meaning of the European Communities (Markets in Financial Instruments) Regulations 2007 of Ireland (as amended) or the Markets in Financial Instruments Directive (2004/39/EC) and the recipients of this document should seek independent legal and financial advice in determining their actions in respect of or pursuant to this document.

19

Summary Historical and Unaudited Pro Forma Combined Financial Data

The following table sets forth summary historical combined financial data for nVent for the periods indicated below. The summary combined statement of income data for each of the years ended December 31, 2017, 2016 and 2015, and the combined balance sheet data as of December 31, 2017 and 2016 set forth below are derived from our audited combined financial statements included in the “Index to Financial Statements” section of this information statement.

Our historical combined financial statements include general corporate expenses of Pentair that were not historically charged to nVent for certain support functions that are provided on a centralized basis, such as expenses related to executive management, finance, audit, legal, information technology, human resources, communications, facilities and employee benefits and compensation. These costs may not be representative of the future costs we will incur as an independent, publicly-traded company. In addition, our historical combined financial statements do not reflect changes that we expect to experience in the future as a result of the separation, including changes in the financing, operations, cost structure and personnel needs of our business. Consequently, the historical financial data included herein may not be indicative of our future performance and does not necessarily reflect what our financial position and results of operations would have been had we been operating as a stand-alone public company during the periods presented, including changes that will occur in our operations and capitalization as a result of the separation.

The unaudited pro forma combined statement of income data for the year ended December 31, 2017 gives effect to the separation as if it had occurred on January 1, 2017, the first day of fiscal year 2017. The unaudited pro forma combined balance sheet data as of December 31, 2017 gives effect to the separation as if it had occurred on December 31, 2017. The pro forma adjustments are based upon available information and assumptions that nVent believes are reasonable. The summary unaudited pro forma combined financial statements have been presented for informational purposes only. The statements are not necessarily indicative of our results of operations or financial condition had the separation been completed on the date assumed. Also, they may not reflect the results of operations or financial condition which would have resulted had we been operating as an independent, publicly-traded company during such periods. In addition, they are not necessarily indicative of our future results of operations or financial condition. Please see the notes to the unaudited pro forma combined financial statements included elsewhere in this information statement for a discussion of adjustments reflected in the unaudited pro forma combined financial statements.

20

The summary combined financial data presented below should be read in conjunction with “Selected Historical Combined Financial Data,” “Unaudited Pro Forma Combined Financial Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our combined financial statements and accompanying notes included in the “Index to Financial Statements” section of this information statement.

| Years ended December 31 | ||||||||||||||||

In millions | Pro Forma 2017 (unaudited) | 2017 | 2016 | 2015 | ||||||||||||

Combined Statement of Income Data | ||||||||||||||||

Net sales | $ | 2,097.9 | $ | 2,097.9 | $ | 2,116.0 | $ | 1,809.3 | ||||||||

Income before income taxes | 284.7 | 313.3 | 315.0 | 265.9 | ||||||||||||

Net income | 331.3 | 361.7 | 259.1 | 210.1 | ||||||||||||

| As of December 31 | ||||||||||||

In millions | Pro Forma 2017 (unaudited) | 2017 | 2016 | |||||||||

Combined Balance Sheet Data | ||||||||||||

Total assets | $ | 4,750.1 | $ | 4,725.0 | $ | 4,493.8 | ||||||

Total debt | 991.5 | — | — | |||||||||

Total equity | 2,824.9 | 3,791.3 | 3,485.7 | |||||||||

Other Financial Measures

We believe that certainnon-GAAP measures, such as combined segment income, combined segment income margin and free cash flow, when presented in conjunction with comparable GAAP measures, are useful because they are appropriate measures for evaluating our operating performance or liquidity. These measures should be considered in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. Thenon-GAAP financial measures presented below may not be comparable to similarly titled measures reported by other companies.

21

We believe segment income and segment income margin are important measures of operating performance because the measures exclude amounts that we do not consider part of our core operating results when assessing performance. Management uses segment income and segment income margin to evaluate our historical and prospective financial performance and trends as well as our performance relative to competitors and peers. In addition, segment income is used as a criterion to measure and pay compensation-based incentives. The following table presents a reconciliation of combined income before income taxes to combined segment income and combined operating income margin to combined segment income margin:

| Years ended December 31 | ||||||||||||

In millions | 2017 | 2016 | 2015 | |||||||||

Net sales | $ | 2,097.9 | $ | 2,116.0 | $ | 1,809.3 | ||||||

|

|

|

|

|

| |||||||

Income before income taxes | 313.3 | 315.0 | 265.9 | |||||||||

Interest expense | 0.2 | 1.4 | 1.1 | |||||||||

|

|

|

|

|

| |||||||

Operating income | 313.5 | 316.4 | 267.0 | |||||||||

% of net sales (operating income margin) | 14.9 | % | 15.0 | % | 14.8 | % | ||||||

Restructuring and other | 13.0 | 12.3 | 15.7 | |||||||||

Intangible amortization | 61.4 | 60.8 | 31.6 | |||||||||

Inventory step-up | — | — | 35.7 | |||||||||

Pension and other post-retirement mark-to-market (gain) loss | (3.0 | ) | 10.8 | (12.5 | ) | |||||||

Deal related costs and expenses | — | — | 14.0 | |||||||||

Trade name impairment | 16.4 | 13.3 | — | |||||||||

Separation costs | 16.1 | — | — | |||||||||

|

|

|

|

|

| |||||||

Segment income | $ | 417.4 | $ | 413.6 | $ | 351.5 | ||||||