- PAE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

PAE (PAE) DEFA14AAdditional proxy soliciting materials

Filed: 1 Nov 19, 9:31am

Exhibit 99.2

PAE Investor Presentation October 2019

Disclaimer This presentation is for informational purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instruments of PAE Holding Corporation (“PAE” or the “Company”) or Gores Holdings III, Inc. (“Gores”) or any of PAE’s or Gores’ affiliates’ securities (as such term is defined under U.S. federal securities laws). This presentation has been prepared to assist interested parties in making their own evaluation with respect to the proposed business combination and for no other purpose. PAE and Gores assume no obligation to update or keep current the information contained in this presentation, to remove any outdated information or to expressly mark it as being outdated. No securities commission or securities regulatory authority or other regulatory body or authority in the United States or any other jurisdiction has in any way passed upon the merits of, or the accuracy and adequacy of, this presentation. You should not construe the contents of this presentation as legal, accounting, business or tax advice and you should consult your own professional advisors as to the legal, accounting, business, tax, financial and other matters contained herein. No representation or warranty, express or implied, is or will be given by Gores nor PAE or any of their affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of the information in this presentation (including as to the accuracy or reasonableness of statements, estimates, targets, projections, assumptions or judgments) or any other written, oral or other communications transmitted or otherwise made available to any party in the course of its evaluation of a possible transaction. Accordingly, none of Gores and PAE or any of their respective affiliates, directors, officers, employees, or advisers or any other person shall be liable for any direct, indirect, or consequential loss or damages suffered by any person as a result of relying on any statement in or omission from this presentation and any such liability is expressly disclaimed. Certain information contained herein has been derived from sources prepared by third parties. While such information is believed to be reliable for the purposes used herein, none of Gores’, PAE’s, their respective affiliates, nor Gores’, PAE’s or their affiliates’ directors, officers, employees, members, partners, shareholders, or agents makes any representation or warranty with respect to the accuracy of such information. Use of Projections This presentation contains financial forecasts with respect to certain financial measurements of PAE, including, but not limited to PAE’s projected Revenue, Free Cash Flow and Adjusted EBITDA for PAE’s fiscal years 2019 through 2021. Neither Gores’ independent auditors, nor the independent registered public accounting firm of PAE, audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections should not be relied upon as being necessarily indicative of future results. Neither Gores nor PAE undertakes any commitment to update or revise the projections, whether as a result of new information, future events or otherwise. In this presentation, certain of the above-mentioned projected information has been repeated (in each case, with an indication that the information is an estimate and is subject to the qualifications presented herein), for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of Gores or PAE or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward-looking statements include projected financial information. Such forward-looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of Gores, PAE or the combined company after completion of any proposed business combination are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to: (1) the inability to complete the transactions contemplated by the proposed business combination; (2) the inability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition, and the ability of the combined business to grow and manage growth profitably; (3) costs related to the proposed business combination; (4) changes in applicable laws or regulations; (5) the inability to successfully retain or recruit officers, key employees or directors following the proposed business combination; (6) effects of Gores’ public securities’ liquidity and trading; (7) the market’s reaction to the proposed business combination; (8) the lack of a market for Gores’ securities; (9) Gores’ and PAE’s financial performance following the proposed business combination; (10) the possibility that PAE or Gores may be adversely affected by other economic, business, and/or competitive factors; and (11) other risks and uncertainties indicated from time to time in the final prospectus of Gores, including those under “Risk Factors” therein, and other documents filed or to be filed with the Securities and Exchange Commission by Gores. You are cautioned not to place undue reliance upon any forward-looking statements, including the projections, which speak only as of the date made. Neither Gores nor PAE undertake any commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Accordingly, forward-looking statements, including any projections or analysis, should not be viewed as factual and should not be relied upon as an accurate prediction of future results. The forward-looking statements contained in this presentation are based on our current expectations and beliefs concerning future developments and their potential effects on Gores and PAE. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Accordingly, you should not put undue reliance on these statements. Industry and Market Data In this presentation, Gores and PAE rely on and refer to information and statistics regarding market shares in the sectors in which PAE competes and other industry data. Gores and PAE obtained this information and statistics from third-party sources, including reports by market research firms. Gores and PAE have supplemented this information where necessary with information from discussions with PAE customers and its own internal estimates, taking into account publicly available information about other industry participants and PAE’s management’s best view as to information that is not publicly available. Use ofNon-GAAP Financial Measures This presentation includesnon-GAAP financial measures, including Pro Forma (PF) Revenue, earnings before interest, taxes, depreciation and amortization (“EBITDA”), Adjusted EBITDA, Pro Forma Adjusted EBITDA and Free Cash Flow (“FCF”). Pro Forma Revenue adjusts for the restructured ASC contract to normalize historical performance relative to new contract terms. Adjusted EBITDA is defined as EBITDA, as adjusted as described in this presentation for historical costs and estimated cost savings and synergies. Pro Forma Adjusted EBITDA is defined as Adjusted EBITDA, as described in this presentation as adjusted for the restructured ASC Contract, estimated public company costs and other pro forma cost savings. Free Cash Flow is defined as EBITDA minus capital expenditures. PAE believes that thesenon-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to PAE’s financial condition and results of operations. PAE’s management uses thesenon-GAAP measures to compare PAE’s performance to that of prior periods for trend analyses, for purposes of determining management incentive compensation, and for budgeting and planning purposes. These measures are used in monthly financial reports prepared for management and PAE’s board of directors. Gores and PAE believe that the use of thesenon-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. Management of PAE does not consider thesenon-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. Other companies may calculatenon-GAAP measures differently, and therefore thenon-GAAP measures of PAE included in this presentation may not be directly comparable to similarly titled measures of other companies. Additional Information In connection with the proposed business combination between PAE and Gores, Gores intends to file with the SEC a preliminary proxy statement and will mail a definitive proxy statement and other relevant documentation to Gores stockholders. This investor presentation does not contain all the information that should be considered in the proposed business combination. It is not intended to form any basis of any investment decision or any other decision in respect to the proposed business combination. Gores stockholders and other interested persons are advised to read, when available, the preliminary proxy statement and any amendments thereto, and the definitive proxy statement in connection with Gores’ solicitation of proxies for the special meeting to be held to approve the transactions contemplated by the proposed business combination because these materials will contain important information about PAE, Gores and the proposed transactions. The definitive proxy statement will be mailed to Gores stockholders as of a record date to be established for voting on the proposed business combination when it becomes available. Stockholders will also be able to obtain a copy of the preliminary proxy statement and definitive proxy statement once they are available, without charge, at the SEC’s website at https://www.sec.gov/ or by directing a request to Gores Holdings III, Inc., c/o The Gores Group LLC, 9800 Wilshire Boulevard, Beverly Hills, CA 90212, attention: Jennifer Kwon Chou (jchou@gores.com). This presentation shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed business combination. Participants in the Solicitations Gores and its directors and officers may be deemed participants in the solicitation of proxies of Gores stockholders in connection with the proposed business combination. Gores stockholders and other interested persons may obtain, without charge, more detailed information regarding directors and officers of Gores in Gores Annual Report on Form10-K for the fiscal year ended December 31, 2018, which was filed with the SEC on March 18, 2019. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Gores’ stockholders in connection with the proposed business combination will be included in the proxy statement Gores intends to file with the SEC. 1

Presenters and Senior Leadership PAE Gores Holdings III John Heller Charles Peiffer Alec Gores Mark Stone CEO CFO Sponsor / Director Sponsor / Director Joined PAE in December Joined PAE in April 2014 Chairman of Gores CEO of Gores Holdings III 2013 Holdings III Previously SVP and CFO Previously CEO of Gores Led the company’s organic at IAP Worldwide Solutions. Founder, Chairman and Holdings, Inc. and Gores and inorganic growth from Prior to IAP, served as VP CEO of The Gores Group Holdings II, Inc. and Board $1.3bn of revenue when he of Finance and CFO at member of Hostess joined to over $2.5bn today Fluid Technologies ($3.5bn More than 35 years of Brands, Inc. segment of ITT1), where he experience as an Previously SVP and COO successfully integrated 8 entrepreneur, operator and Member of The Gores of Engility1 following its acquisitions in 6 years private equity investor Group Investmentspin-off fromL-3 Committee and previously Communications1 Has held other leadership Has invested in more than President of Gores’ roles at Avaya 100 portfolio companies worldwide operations Served 5 years in U.S. Communications1, Lucent through varying Army in various leadership Technologies1, macroeconomic Served as Executive positions as a logistics AlliedSignal1, Martin environments Chairman and/or CEO of officer Marietta and GE1 several Gores portfolio companies 1 Represents position(s) held at company when publicly listed 2 Note: Gores Holdings III is a separate entity from The Gores Group. The Gores Group makes no representations of the information contained within, nor should this information be considered if making an investment decision with regard to the Gores Group and its affiliated funds/family office operations

Overview of Gores Holdings III and Platinum Equity Gores Holdings III Platinum Equity Success to date on first two SPACs: Gores Holdings and its Founded in 1995, headquartered in Beverly Hills with principal acquisition of Hostess Brands (“Hostess”) as well as Gores offices in New York, Greenwich, Boston, London and Singapore Holdings II and its acquisition of Verra Mobility (“Verra”) $19bn in AUM; closed fourth fund with $6.5bn Hostess and Verra stock prices were up 62% and 34%, respectively, 6 months after each deal closed1 Completed more than 250 acquisitions As part of these transactions, Gores was successful at raising a $350mm and $400mm PIPE for Hostess and Verra, Current portfolio includes approximately 40 companies respectively representing over $30bn in revenue Strong history of acquiring market-leading businesses and creating long-term, sustainable value through organic growth, M&A and operational improvements Gores Group Heritage30-year track record of successful investments across multiple sectors Raised over $4 billion of capital across multiple private equity funds 49 corporate divestitures completed to date Headquarters in Beverly Hills with offices in Boulder, CO European Business 1 Calculated using $10.00 share price 3 Note: Gores Holdings III is a separate entity from The Gores Group. The Gores Group makes no representations of the information contained within, nor should this information be considered if making an investment decision with regard to the Gores Group and its affiliated funds/family office operations

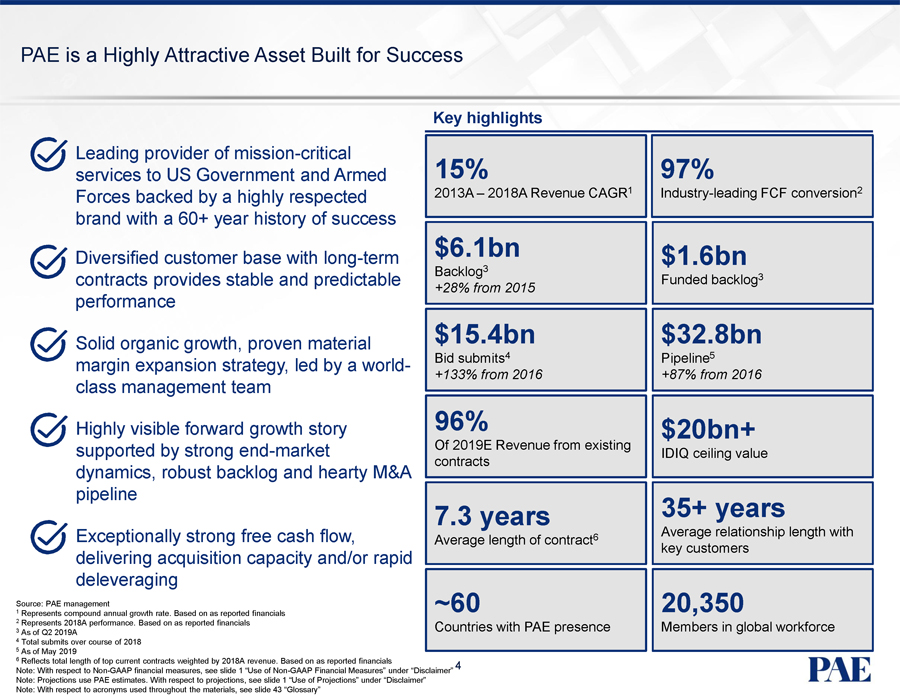

PAE is a Highly Attractive Asset Built for Success Key highlights Leading provider of mission-critical services to US Government and Armed 15% 97% Forces backed by a highly respected 2013A – 2018A Revenue CAGR1 Industry-leading FCF conversion2 brand with a 60+ year history of success Diversified customer base with long-term $6.1bn $1.6bn Backlog3 Funded backlog3 contracts provides stable and predictable +28% from 2015 performance Solid organic growth, proven material $15.4bn $32.8bn Bid submits4 Pipeline5 margin expansion strategy, led by a world- +133% from 2016 +87% from 2016 class management team Highly visible forward growth story 96% $20bn+ supported by strongend-market Of 2019E Revenue from existing IDIQ ceiling value contracts dynamics, robust backlog and hearty M&A pipeline 7.3 years 35+ years Average relationship length with Exceptionally strong free cash flow, Average length of contract6 key customers delivering acquisition capacity and/or rapid deleveraging Source: PAE management ~60 20,350 1 Represents compound annual growth rate. Based on as reported financials 2 Represents 2018A performance. Based on as reported financials Countries with PAE presence Members in global workforce 3 As of Q2 2019A 4 Total submits over course of 2018 5 As of May 2019 6 Reflects total length of top current contracts weighted by 2018A revenue. Based on as reported financials 4 Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under “Disclaimer” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer” Note: With respect to acronyms used throughout the materials, see slide 43 “Glossary”

Agenda 1 Business Overview 2 Growth Strategy 3 Financial Detail 4 Transaction Summary 5

1. Business Overview

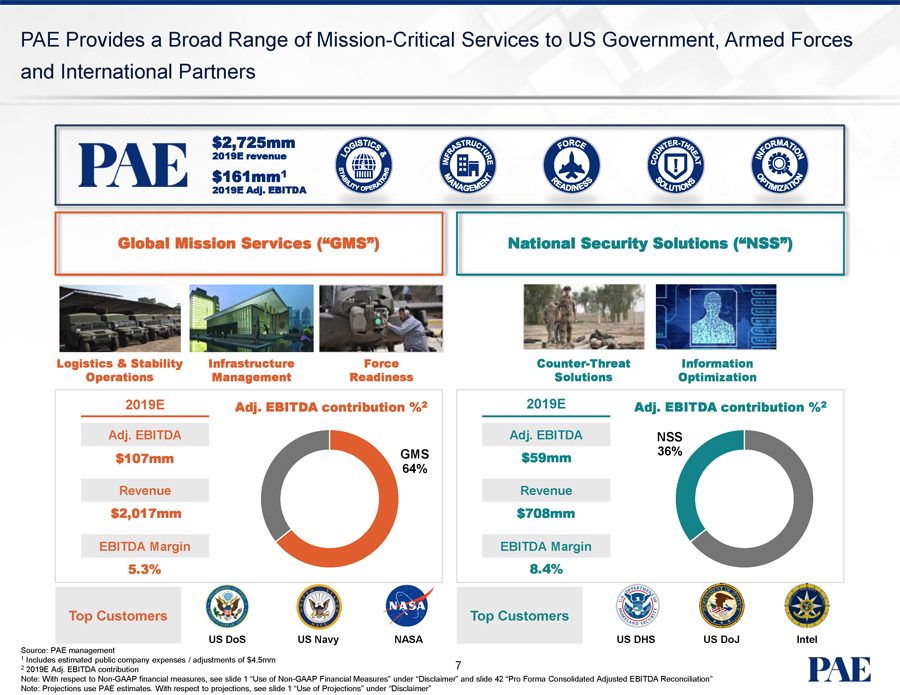

PAE Provides a Broad Range of Mission-Critical Services to US Government, Armed Forces and International Partners $2,725mm 2019E revenue $161mm1 2019E Adj. EBITDA Global Mission Services (“GMS”) National Security Solutions (“NSS”) Logistics & Stability Infrastructure Force Counter-Threat Information Operations Management Readiness Solutions Optimization 2019E Adj. EBITDA contribution %2 2019E Adj. EBITDA contribution %2 Adj. EBITDA Adj. EBITDA NSS $107mm GMS $59mm 36% 64% Revenue Revenue $2,017mm $708mm EBITDA Margin EBITDA Margin 5.3% 8.4% Top Customers Top Customers US DoS US Navy NASA US DHS US DoJ Intel Source: PAE management 1 Includes estimated public company expenses / adjustments of $4.5mm 2 2019E Adj. EBITDA contribution 7 Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

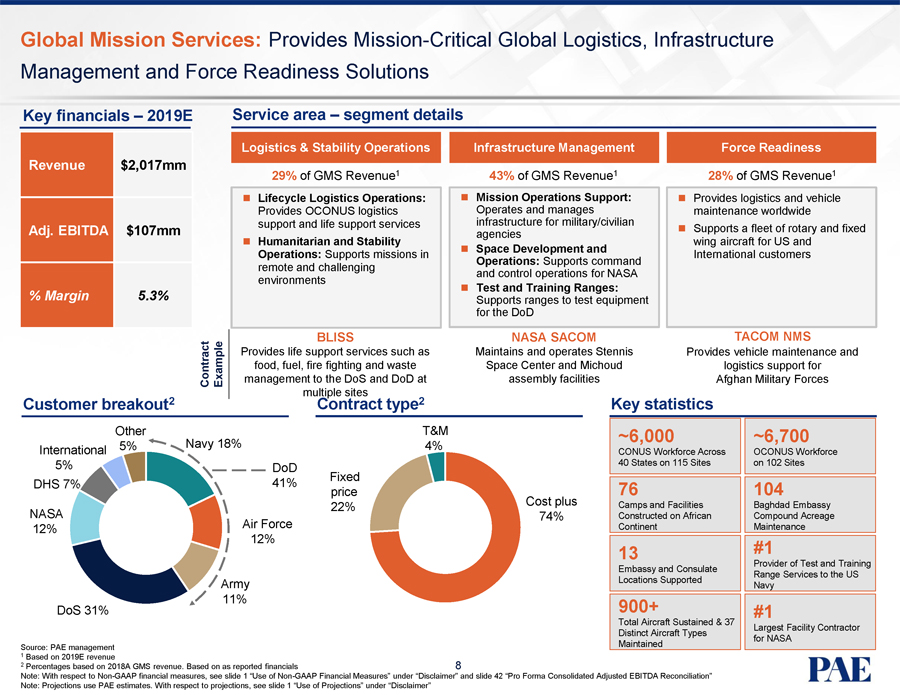

Global Mission Services: Provides Mission-Critical Global Logistics, Infrastructure Management and Force Readiness Solutions Key financials – 2019E Service area – segment details Logistics & Stability Operations Infrastructure Management Force Readiness Revenue $2,017mm 29% of GMS Revenue1 43% of GMS Revenue1 28% of GMS Revenue1 Lifecycle Logistics Operations: Mission Operations Support: Provides logistics and vehicle Provides OCONUS logistics Operates and manages maintenance worldwide support and life support services infrastructure for military/civilian Adj. EBITDA $107mm Supports a fleet of rotary and fixed agencies Humanitarian and Stability wing aircraft for US and Space Development and Operations: Supports missions in International customers Operations: Supports command remote and challenging and control operations for NASA environments Test and Training Ranges: % Margin 5.3% Supports ranges to test equipment for the DoD BLISS NASA SACOM TACOM NMS Provides life support services such as Maintains and operates Stennis Provides vehicle maintenance and food, fuel, fire fighting and waste Space Center and Michoud logistics support for Contract Example management to the DoS and DoD at assembly facilities Afghan Military Forces multiple sites Customer breakout2 Contract type2 Key statistics Other T&M ~6,000 ~6,700 5% Navy 18% 4% International CONUS Workforce Across OCONUS Workforce 5% DoD 40 States on 115 Sites on 102 Sites Fixed DHS 7% 41% 76 104 price Cost plus Camps and Facilities Baghdad Embassy 22% NASA 74% Constructed on African Compound Acreage 12% Air Force Continent Maintenance 12% 13 #1 Provider of Test and Training Embassy and Consulate Range Services to the US Army Locations Supported Navy DoS 31% 11% 900+ Total Aircraft Sustained & 37 #1 Largest Facility Contractor Distinct Aircraft Types for NASA Source: PAE management Maintained 1 Based on 2019E revenue 2 Percentages based on 2018A GMS revenue. Based on as reported financials 8 Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

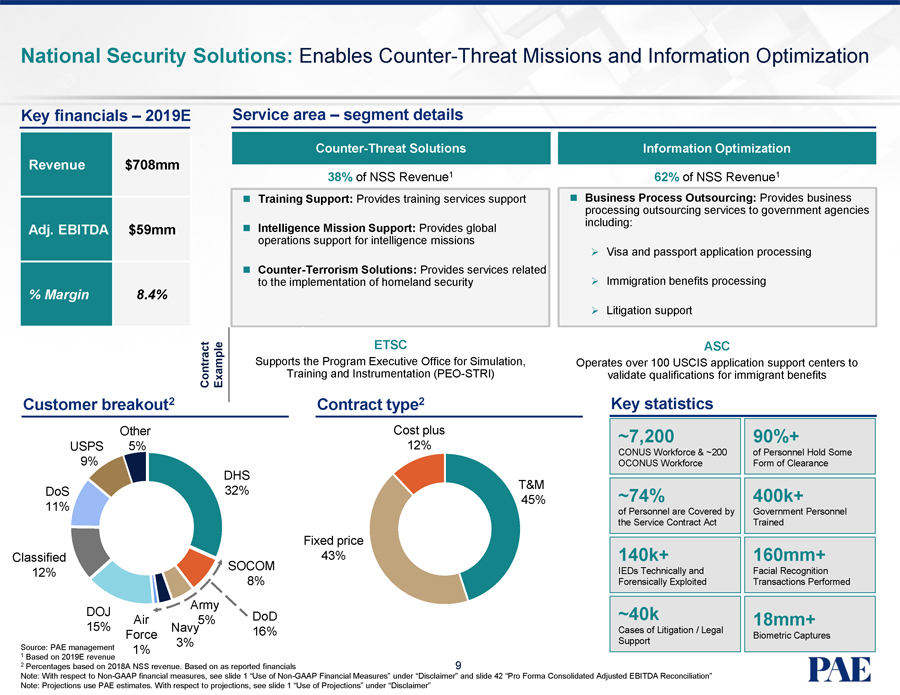

National Security Solutions: Enables Counter-Threat Missions and Information Optimization Key financials – 2019E Service area – segment details Counter-Threat Solutions Information Optimization Revenue $708mm 38% of NSS Revenue1 62% of NSS Revenue1 Training Support: Provides training services support Business Process Outsourcing: Provides business processing outsourcing services to government agencies including: Adj. EBITDA $59mm Intelligence Mission Support: Provides global operations support for intelligence missions ïƒ~ Visa and passport application processing Counter-Terrorism Solutions: Provides services related to the implementation of homeland securityïƒ~ Immigration benefits processing % Margin 8.4% ïƒ~ Litigation support ETSC ASC Supports the Program Executive Office for Simulation, Operates over 100 USCIS application support centers to Contract Example Training and Instrumentation(PEO-STRI) validate qualifications for immigrant benefits Customer breakout2 Contract type2 Key statistics Other Cost plus ~7,200 90%+ USPS 5% 12% CONUS Workforce & ~200 of Personnel Hold Some 9% OCONUS Workforce Form of Clearance DHS T&M DoS 32% ~74% 400k+ 45% 11% of Personnel are Covered by Government Personnel the Service Contract Act Trained Fixed price Classified SOCOM 43% 140k+ 160mm+ 12% IEDs Technically and Facial Recognition 8% Forensically Exploited Transactions Performed Army DOJ DoD ~40k Air 5% 18mm+ 15% Navy 16% Cases of Litigation / Legal Biometric Captures Force 3% Support Source: PAE management 1% 1 Based on 2019E revenue 2 Percentages based on 2018A NSS revenue. Based on as reported financials 9 Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

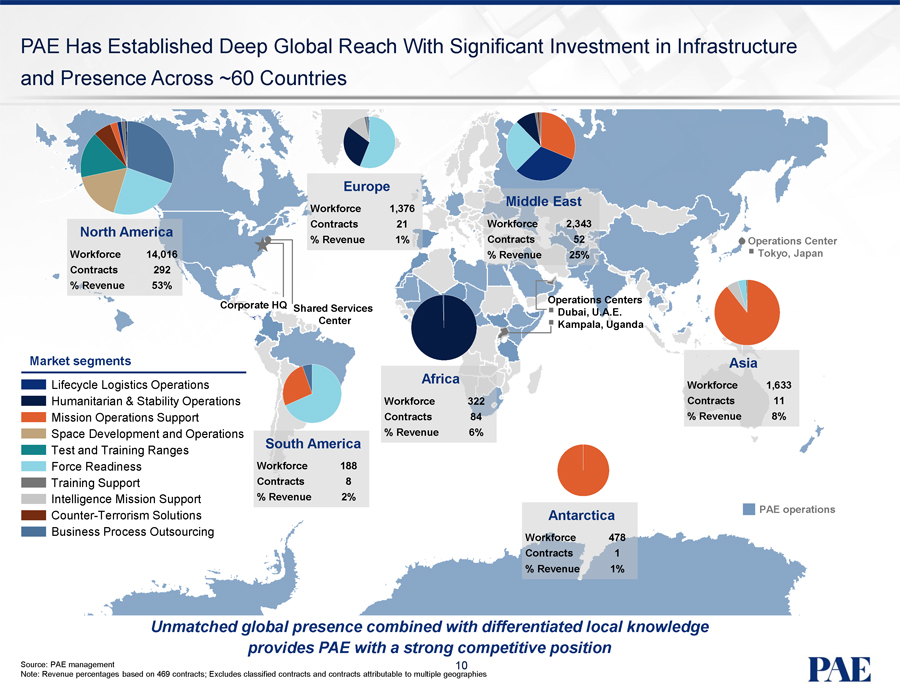

PAE Has Established Deep Global Reach With Significant Investment in Infrastructure and Presence Across ~60 Countries Europe Middle East Workforce 1,376 Contracts 21 Workforce 2,343 North America % Revenue 1% Contracts 52 Operations Center Workforce 14,016 % Revenue 25% Tokyo, Japan Contracts 292 % Revenue 53% Operations Centers Corporate HQ Shared Services Center Dubai, U.A.E. Kampala, Uganda Market segments Asia Africa Lifecycle Logistics Operations Workforce 1,633 Humanitarian & Stability Operations Workforce 322 Contracts 11 Mission Operations Support Contracts 84 % Revenue 8% Space Development and Operations % Revenue 6% South America Test and Training Ranges Force Readiness Workforce 188 Training Support Contracts 8 Intelligence Mission Support % Revenue 2% PAE operations Counter-Terrorism Solutions Antarctica Business Process Outsourcing Workforce 478 Contracts 1 % Revenue 1% Unmatched global presence combined with differentiated local knowledge provides PAE with a strong competitive position Source: PAE management 10 Note: Revenue percentages based on 469 contracts; Excludes classified contracts and contracts attributable to multiple geographies

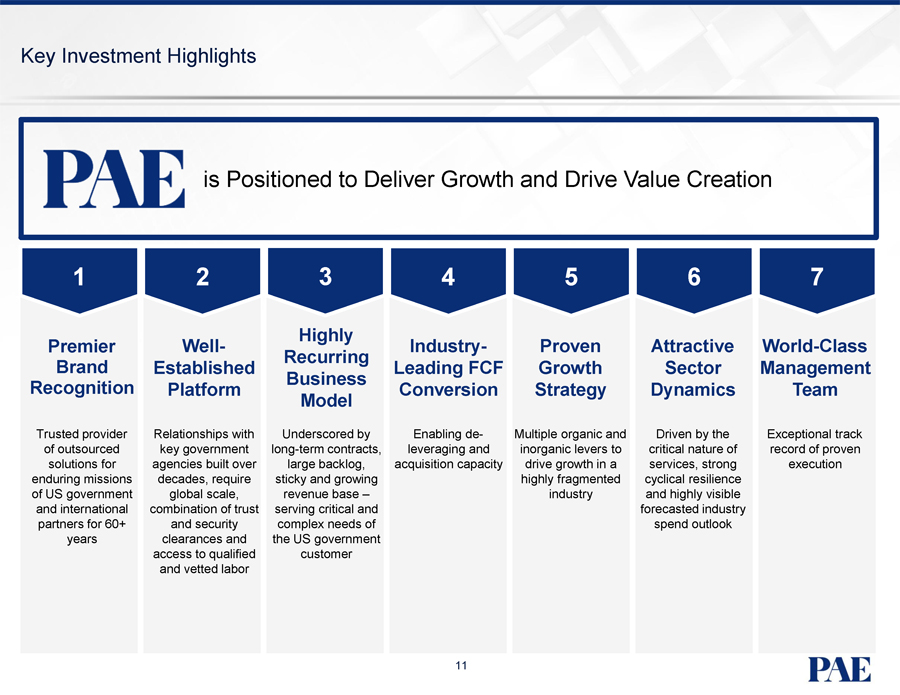

Key Investment Highlights Positioned to Deliver Growth and Drive Value Creation 1 2 3 4 5 6 7 Highly Premier Well- Industry- Proven Attractive World-Class Recurring Brand Established Leading FCF Growth Sector Management Business Recognition Platform Conversion Strategy Dynamics Team Model Trusted provider Relationships with Underscored by Enabling de- Multiple organic and Driven by the Exceptional track of outsourced key government long-term contracts, leveraging and inorganic levers to critical nature of record of proven solutions for agencies built over large backlog, acquisition capacity drive growth in a services, strong execution enduring missions decades, require sticky and growing highly fragmented cyclical resilience of US government global scale, revenue base – industry and highly visible and international combination of trust serving critical and forecasted industry partners for 60+ and security complex needs of spend outlook years clearances and the US government access to qualified customer and vetted labor 11

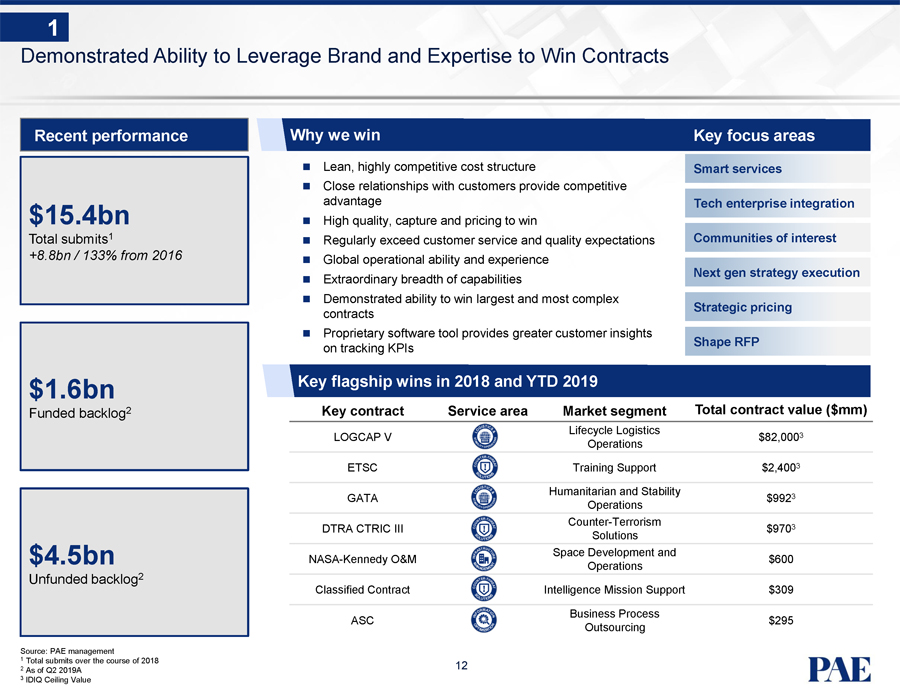

1 Demonstrated Ability to Leverage Brand and Expertise to Win Contracts Recent performance Why we win Key focus areas Lean, highly competitive cost structure Smart services Close relationships with customers provide competitive advantage Tech enterprise integration $15.4bn High quality, capture and pricing to win Total submits1 Regularly exceed customer service and quality expectations Communities of interest +8.8bn / 133% from 2016 Global operational ability and experience Next gen strategy execution Extraordinary breadth of capabilities Demonstrated ability to win largest and most complex Strategic pricing contracts Proprietary software tool provides greater customer insights Shape RFP on tracking KPIs $1.6bn Key flagship wins in 2018 and YTD 2019 Funded backlog2 Key contract Service area Market segment Total contract value ($mm) Lifecycle Logistics LOGCAP V Operations $82,0003 ETSC Training Support $2,4003 Humanitarian and Stability GATA Operations $9923 Counter-Terrorism DTRA CTRIC III Solutions $9703 Space Development and $4.5bn NASA-Kennedy O&M $600 Operations Unfunded backlog2 Classified Contract Intelligence Mission Support $309 Business Process ASC $295 Outsourcing Source: PAE management 1 Total submits over the course of 2018 2 12 As of Q2 2019A 3 IDIQ Ceiling Value

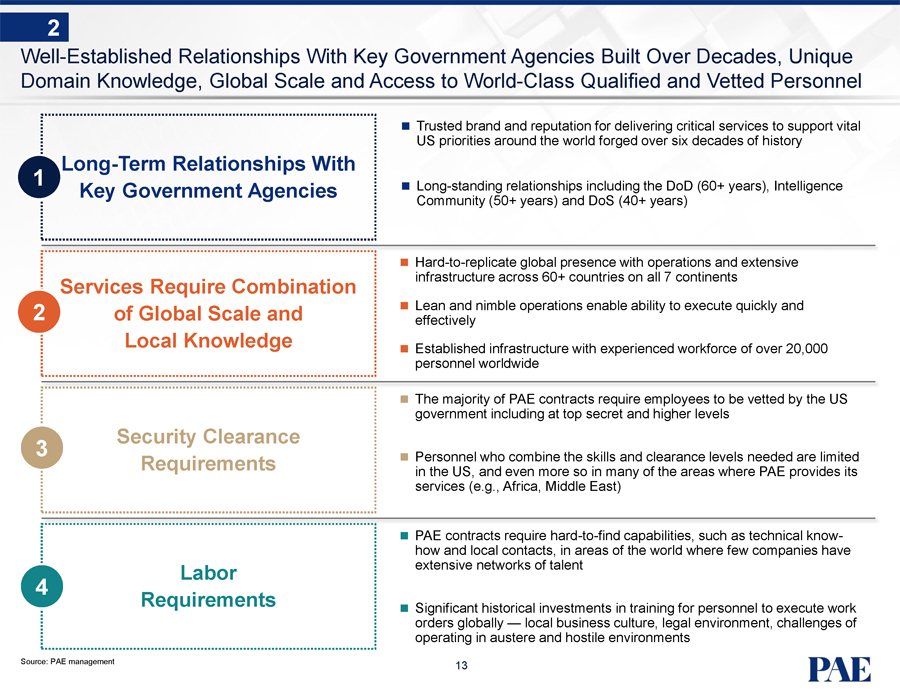

2 Well-Established Relationships With Key Government Agencies Built Over Decades, Unique Domain Knowledge, Global Scale and Access to World-Class Qualified and Vetted Personnel Trusted brand and reputation for delivering critical services to support vital US priorities around the world forged over six decades of history Long-Term Relationships With 1 Long-standing relationships including the DoD (60+ years), Intelligence Key Government Agencies Community (50+ years) and DoS (40+ years)Hard-to-replicate global presence with operations and extensive Services Require Combination infrastructure across 60+ countries on all 7 continents 2 of Global Scale and Lean and nimble operations enable ability to execute quickly and effectively Local Knowledge Established infrastructure with experienced workforce of over 20,000 personnel worldwide The majority of PAE contracts require employees to be vetted by the US government including at top secret and higher levels Security Clearance 3 Personnel who combine the skills and clearance levels needed are limited Requirements in the US, and even more so in many of the areas where PAE provides its services (e.g., Africa, Middle East) PAE contracts requirehard-to-find capabilities, such as technical knowhow and local contacts, in areas of the world where few companies have Labor extensive networks of talent 4 Requirements Significant historical investments in training for personnel to execute work orders globally — local business culture, legal environment, challenges of operating in austere and hostile environments Source: PAE management 13

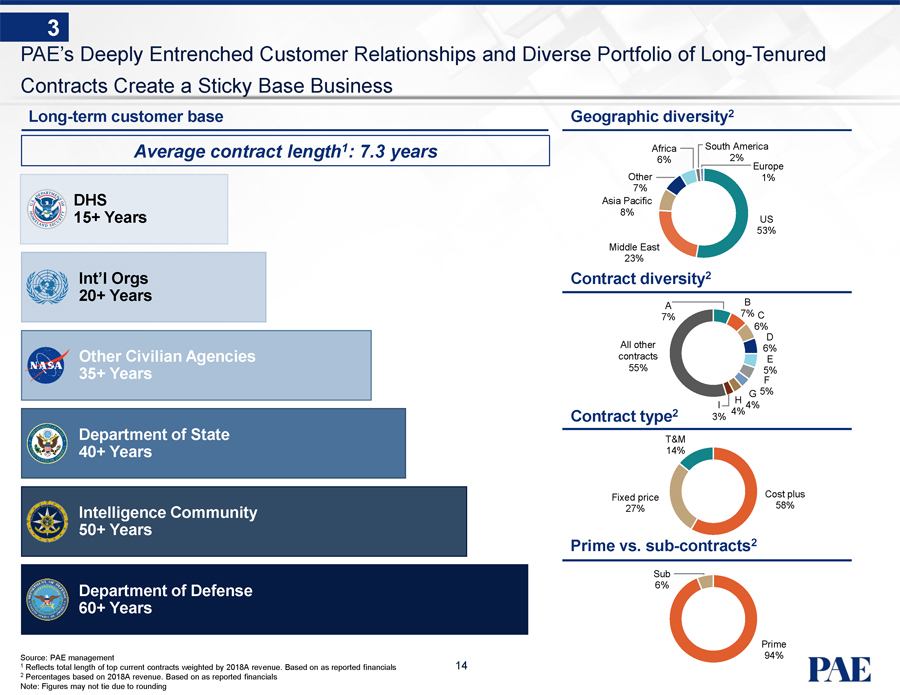

3 PAE’s Deeply Entrenched Customer Relationships and Diverse Portfolio of Long-Tenured Contracts Create a Sticky Base Business Long-term customer base Geographic diversity2 Average contract length1: 7.3 years Africa South America 6% 2% Europe Other 1% 7% DHS Asia Pacific 8% 15+ Years US 53% Middle East 23% Int’l Orgs Contract diversity2 20+ Years A B 7% 7% C 6% D All other 6% Other Civilian Agencies contracts E 35+ Years 55% 5% F H G 5% I 4% 2 4% Contract type 3% Department of State T&M 40+ Years 14% Fixed price Cost plus Intelligence Community 27% 58% 50+ Years Prime vs.sub-contracts2 Sub Department of Defense 6% 60+ Years Prime Source: PAE management 94% 1 Reflects total length of top current contracts weighted by 2018A revenue. Based on as reported financials 14 2 Percentages based on 2018A revenue. Based on as reported financials Note: Figures may not tie due to rounding

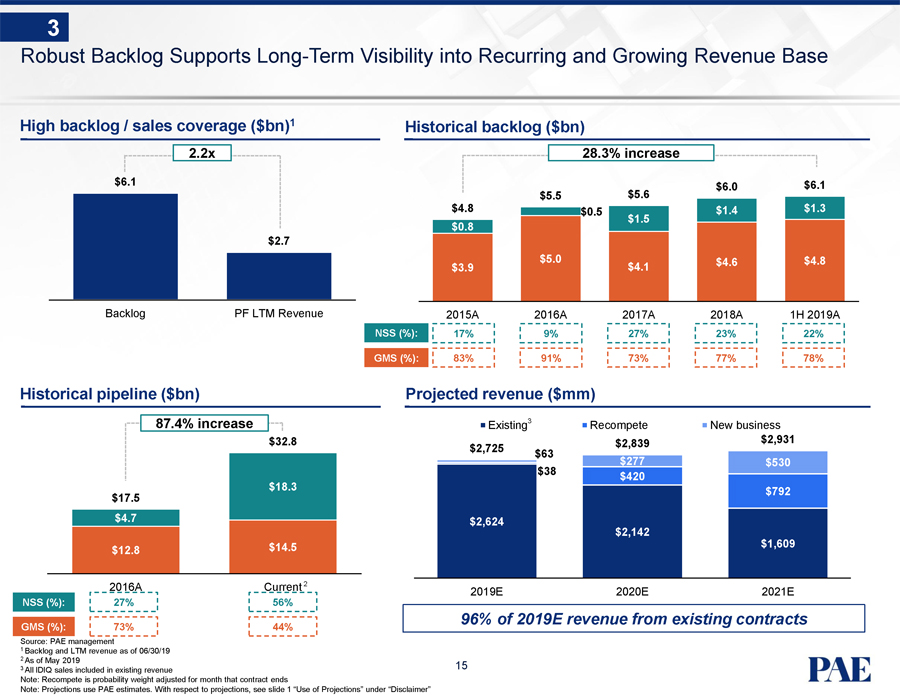

3 Robust Backlog Supports Long-Term Visibility into Recurring and Growing Revenue Base High backlog / sales coverage ($bn)1 Historical backlog ($bn) 2.2x 28.3% increase $6.1 $6.1 $6.0 $5.5 $5.6 $4.8 $0.5 $1.4 $1.3 $1.5 $0.8 $2.7 $5.0 $4.6 $4.8 $3.9 $4.1 Backlog PF LTM Revenue 2015A 2016A 2017A 2018A 1H 2019A NSS (%): 17% 9% 27% 23% 22% GMS (%): 83% 91% 73% 77% 78% Historical pipeline ($bn) Projected revenue ($mm) 87.4% increase Existing3 Recompete New business $32.8 $2,839 $2,931 $2,725 $63 $38 $277 $530 $420 $18.3 $792 $17.5 $4.7 $2,624 $2,142 $14.5 $1,609 $12.8 2016A Current 2 2019E 2020E 2021E NSS (%): 27% 56% 96% of 2019E revenue from existing contracts GMS (%): 73% 44% Source: PAE management 1 Backlog and LTM revenue as of 06/30/19 2 As of May 2019 3 All IDIQ sales included in existing revenue 15 Note: Recompete is probability weight adjusted for month that contract ends Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

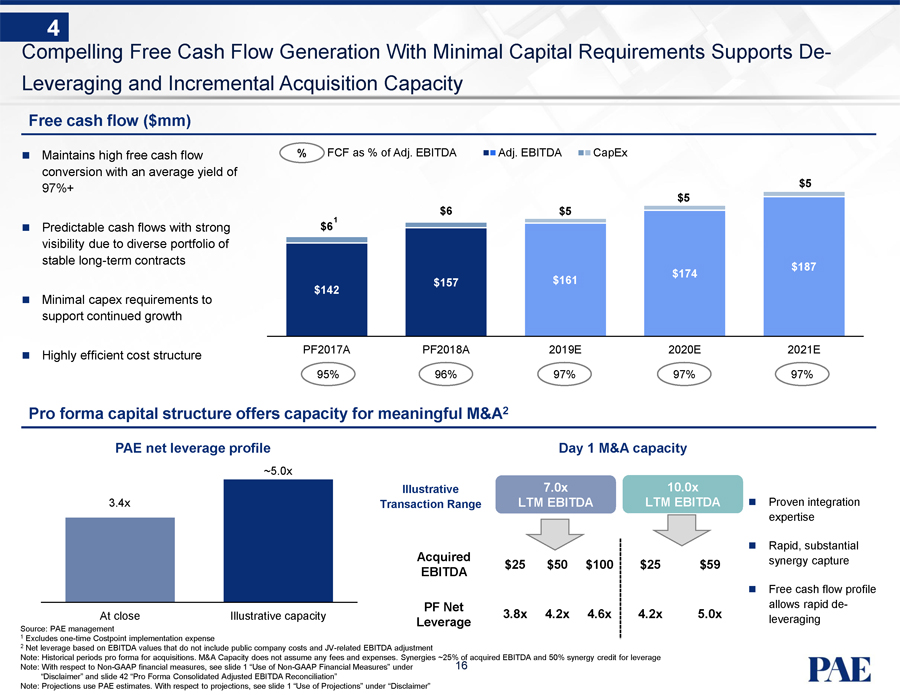

4 Compelling Free Cash Flow Generation With Minimal Capital Requirements SupportsDe-Leveraging and Incremental Acquisition Capacity Free cash flow ($mm) Maintains high free cash flow % FCF as % of Adj. EBITDA Adj. EBITDA CapEx conversion with an average yield of 97%+ $5 $5 $6 $5 1 Predictable cash flows with strong $6 visibility due to diverse portfolio of stable long-term contracts $187 $174 $142 $157 $161 Minimal capex requirements to support continued growth PF2017A PF2018A 2019E 2020E 2021E Highly efficient cost structure 95% 96% 97% 97% 97% Pro forma capital structure offers capacity for meaningful M&A2 PAE net leverage profile Day 1 M&A capacity ~5.0x Illustrative 7.0x 10.0x 3.4x Transaction Range LTM EBITDA LTM EBITDA Proven integration expertise Rapid, substantial Acquired synergy capture $25 $50 $100 $25 $59 EBITDA Free cash flow profile PF Net allows rapidde-At close Illustrative capacity 3.8x 4.2x 4.6x 4.2x 5.0x leveraging Leverage Source: PAE management 1 Excludesone-time Costpoint implementation expense 2 Net leverage based on EBITDA values that do not include public company costs andJV-related EBITDA adjustment Note: Historical periods pro forma for acquisitions. M&A Capacity does not assume any fees and expenses. Synergies ~25% of acquired EBITDA and 50% synergy credit for leverage Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under 16 “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

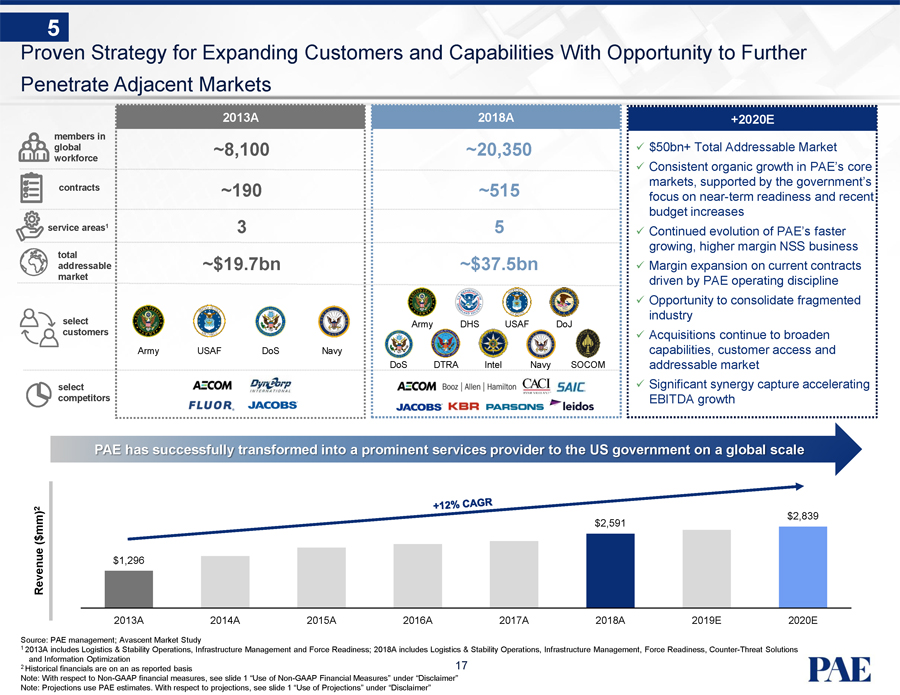

5 Proven Strategy for Expanding Customers and Capabilities With Opportunity to Further Penetrate Adjacent Markets 2013A 2018A +2020E members in global ~8,100 ~20,350 $50bn+ Total Addressable Market workforce  Consistent organic growth in PAE’s core markets, supported by the government’s contracts ~190 ~515 focus on near-term readiness and recent budget increases service areas1 3 5 Continued evolution of PAE’s faster total growing, higher margin NSS business addressable ~$19.7bn ~$37.5bn Margin expansion on current contracts market driven by PAE operating discipline Opportunity to consolidate fragmented industry select Army DHS USAF DoJ customers Acquisitions continue to broaden Army USAF DoS Navy capabilities, customer access and DoS DTRA Intel Navy SOCOM addressable market select Significant synergy capture accelerating competitors EBITDA growth PAE has successfully transformed into a prominent services provider to the US government on a global scale 2 $2,839 mm) $2,591 ( $ Revenue $1,296 2013A 2014A 2015A 2016A 2017A 2018A 2019E 2020E Source: PAE management; Avascent Market Study 1 2013A includes Logistics & Stability Operations, Infrastructure Management and Force Readiness; 2018A includes Logistics & Stability Operations, Infrastructure Management, Force Readiness, Counter-Threat Solutions and Information Optimization 2 Historical financials are on an as reported basis 17 Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under “Disclaimer” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

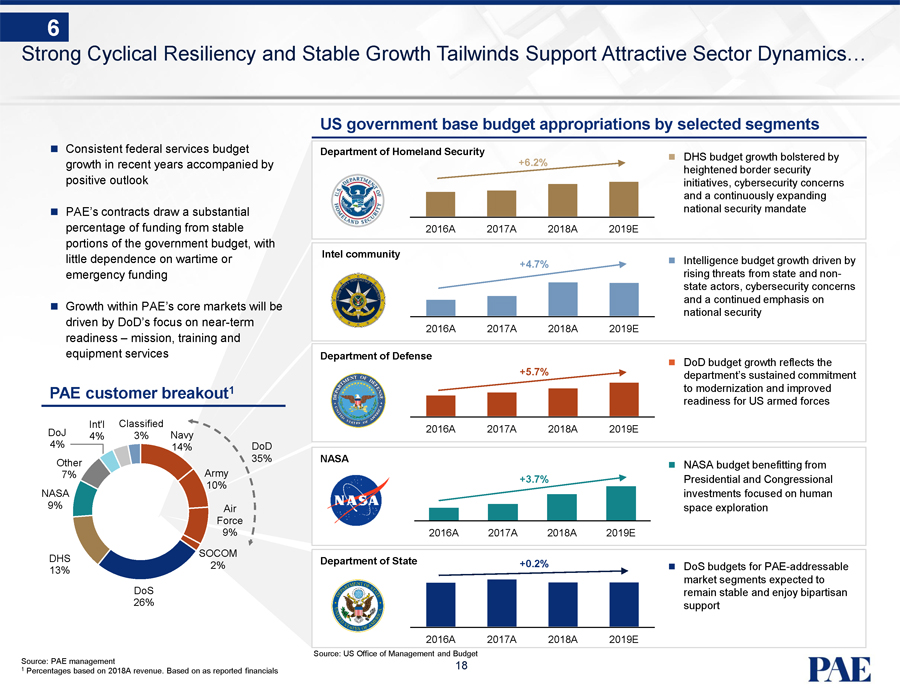

6 Strong Cyclical Resiliency and Stable Growth Tailwinds Support Attractive Sector Dynamics… US government base budget appropriations by selected segments Consistent federal services budget Department of Homeland Security DHS budget growth bolstered by growth in recent years accompanied by +6.2% positive outlook heightened border security initiatives, cybersecurity concerns and a continuously expanding PAE’s contracts draw a substantial national security mandate percentage of funding from stable 2016A 2017A 2018A 2019E portions of the government budget, with little dependence on wartime or Intel community +4.7% Intelligence budget growth driven by emergency funding rising threats from state andnon-state actors, cybersecurity concerns and a continued emphasis on Growth within PAE’s core markets will be driven by DoD’s focus on near-term national security 2016A 2017A 2018A 2019E readiness – mission, training and equipment services Department of Defense +5.7% DoD budget growth reflects the department’s sustained commitment PAE customer breakout1 to modernization and improved readiness for US armed forces Int’l Classified DoJ 2016A 2017A 2018A 2019E 4% 4% 3% Navy 14% DoD Other 35% NASA NASA budget benefitting from 7% Army +3.7% Presidential and Congressional 10% NASA investments focused on human 9% Air space exploration Force 9% 2016A 2017A 2018A 2019E SOCOM DHS Department of State 2% +0.2% DoS budgets forPAE-addressable 13% market segments expected to DoS remain stable and enjoy bipartisan 26% support 2016A 2017A 2018A 2019E Source: US Office of Management and Budget Source: PAE management 18 1 Percentages based on 2018A revenue. Based on as reported financials

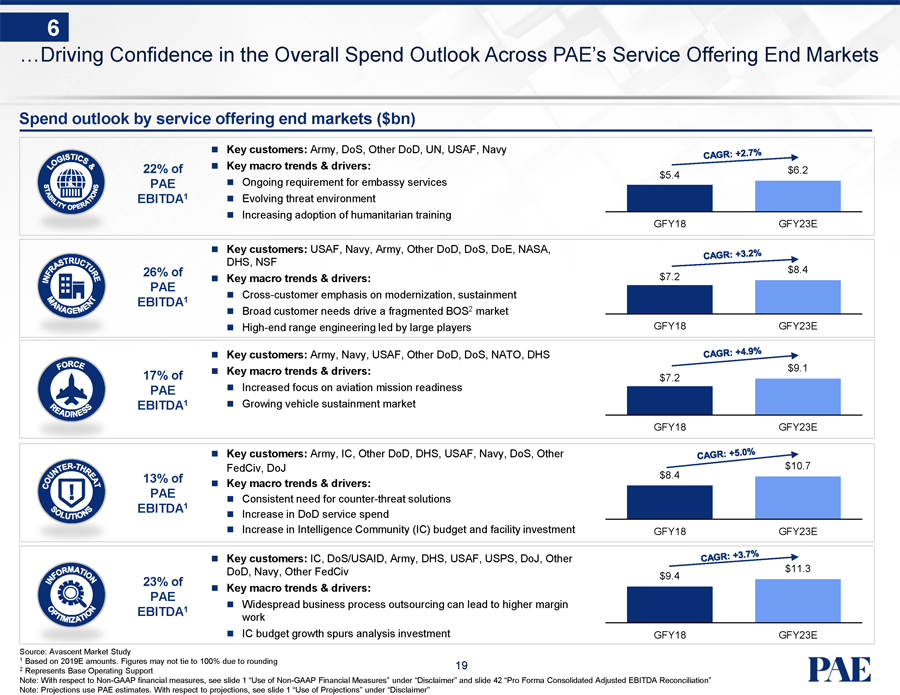

6 …Driving Confidence in the Overall Spend Outlook Across PAE’s Service Offering End Markets Spend outlook by service offering end markets ($bn) Key customers: Army, DoS, Other DoD, UN, USAF, Navy 22% of Key macro trends & drivers: $5.4 $6.2 PAE Ongoing requirement for embassy services EBITDA1 Evolving threat environment Increasing adoption of humanitarian training GFY18 GFY23E Key customers: USAF, Navy, Army, Other DoD, DoS, DoE, NASA, DHS, NSF 26% of $8.4 PAE Key macro trends & drivers: $7.2 Cross-customer emphasis on modernization, sustainment EBITDA1 Broad customer needs drive a fragmented BOS2 marketHigh-end range engineering led by large players GFY18 GFY23E Key customers: Army, Navy, USAF, Other DoD, DoS, NATO, DHS Key macro trends & drivers: $9.1 17% of $7.2 PAE Increased focus on aviation mission readiness EBITDA1 Growing vehicle sustainment market GFY18 GFY23E Key customers: Army, IC, Other DoD, DHS, USAF, Navy, DoS, Other FedCiv, DoJ $8.4 $10.7 13% of Key macro trends & drivers: PAE Consistent need for counter-threat solutions EBITDA1 Increase in DoD service spend Increase in Intelligence Community (IC) budget and facility investment GFY18 GFY23E Key customers: IC, DoS/USAID, Army, DHS, USAF, USPS, DoJ, Other DoD, Navy, Other FedCiv $11.3 $9.4 23% of Key macro trends & drivers: PAE Widespread business process outsourcing can lead to higher margin EBITDA1 work IC budget growth spurs analysis investment GFY18 GFY23E Source: Avascent Market Study 1 Based on 2019E amounts. Figures may not tie to 100% due to rounding 2 19 Represents Base Operating Support Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

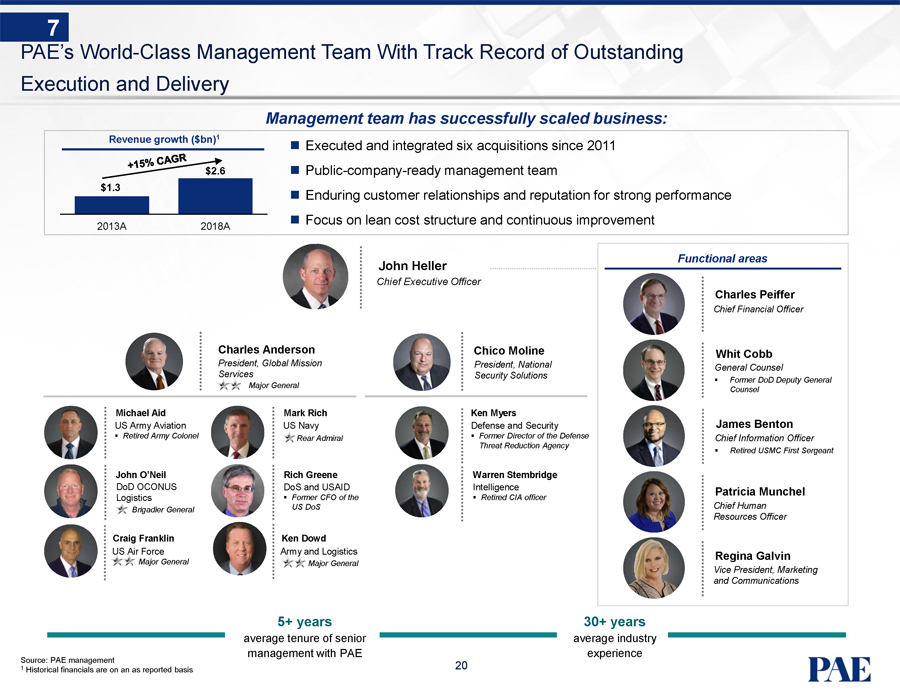

7 PAE’s World-Class Management Team With Track Record of Outstanding Execution and Delivery Management team has successfully scaled business: Revenue growth ($bn)1 Executed and integrated six acquisitions since 2011 $2.6 Public-company-ready management team $1.3 Enduring customer relationships and reputation for strong performance Focus on lean cost structure and continuous improvement 2013A 2018A Functional areas John Heller Chief Executive Officer Charles Peiffer Chief Financial Officer Charles Anderson Chico Moline Whit Cobb President, Global Mission President, National General Counsel Services Security Solutions Former DoD Deputy General Major General Counsel Michael Aid Mark Rich Ken Myers US Army Aviation US Navy Defense and Security James Benton Retired Army Colonel Rear Admiral Former Director of the Defense Chief Information Officer Threat Reduction Agency Retired USMC First Sergeant John O’Neil Rich Greene Warren Stembridge DoD OCONUS DoS and USAID Intelligence Patricia Munchel Logistics Former CFO of the Retired CIA officer US DoS Chief Human Brigadier General Resources Officer Craig Franklin Ken Dowd US Air Force Army and Logistics Regina Galvin Major General ajor General Vice President, Marketing and Communications 5+ years 30+ years average tenure of senior average industry management with PAE experience Source: PAE management 1 Historical financials are on an as reported basis 20

2. Growth Strategy

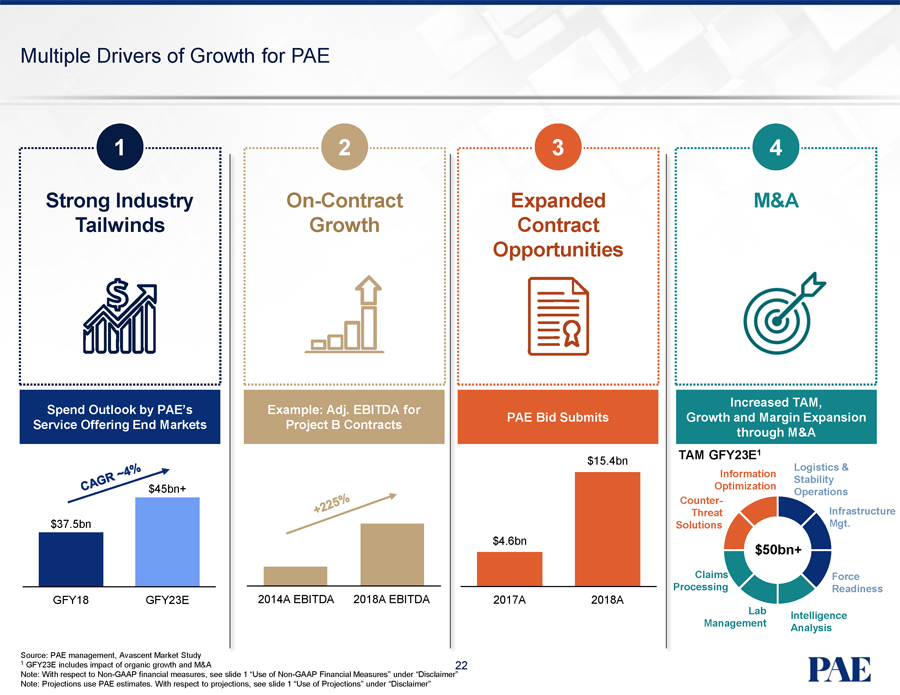

Multiple Drivers of Growth for PAE 1 2 3 4 Strong IndustryOn-Contract Expanded M&A Tailwinds Growth Contract Opportunities Increased TAM, Spend Outlook by PAE’s Example: Adj. EBITDA for PAE Bid Submits Growth and Margin Expansion Service Offering End Markets Project B Contracts through M&A TAM GFY23E1 $15.4bn Logistics & Information Stability $45bn+ Optimization Counter- Operations Threat Infrastructure $37.5bn Solutions Mgt. $4.6bn $50bn+ Claims Force Processing Readiness GFY18 GFY23E 2014A EBITDA 2018A EBITDA 2017A 2018A Lab Intelligence Management Analysis Source: PAE management, Avascent Market Study 1 GFY23E includes impact of organic growth and M&A 22 Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under “Disclaimer” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

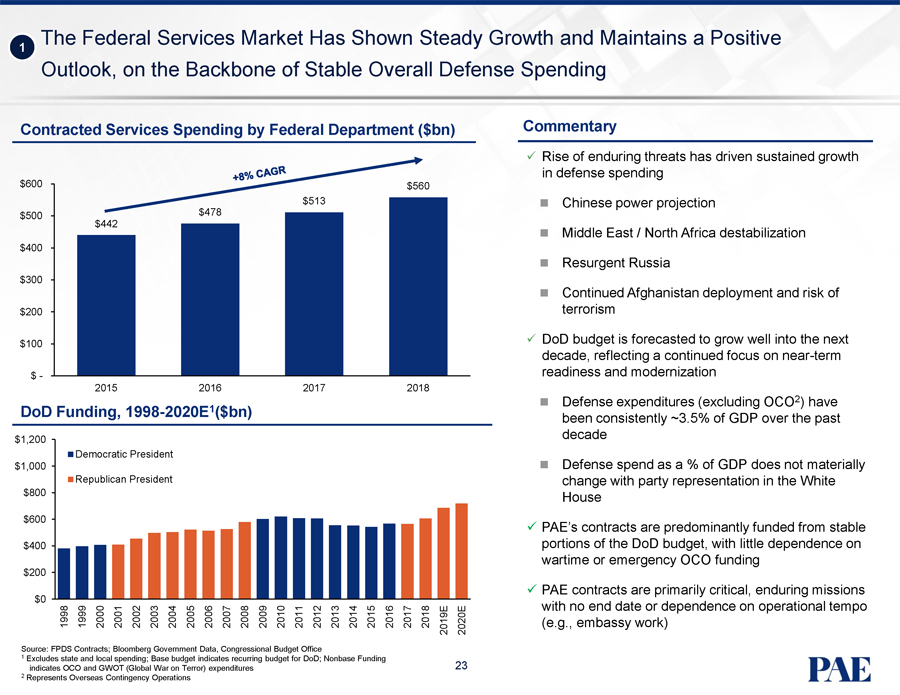

The Federal Services Market Has Shown Steady Growth and Maintains a Positive 1 Outlook, on the Backbone of Stable Overall Defense Spending Contracted Services Spending by Federal Department ($bn) Commentary  Rise of enduring threats has driven sustained growth in defense spending $600 $560 $513 Chinese power projection $500 $478 $442 Middle East / North Africa destabilization $400 Resurgent Russia $300 Continued Afghanistan deployment and risk of $200 terrorism $100 DoD budget is forecasted to grow well into the next decade, reflecting a continued focus on near-term $ - readiness and modernization 2015 2016 2017 2018 Defense expenditures (excluding OCO2) have DoD Funding, 1998-2020E1($bn) been consistently ~3.5% of GDP over the past $1,200 decade Democratic President Defense spend as a % of GDP does not materially $1,000 Republican President change with party representation in the White $800 House $600  PAE’s contracts are predominantly funded from stable $400 portions of the DoD budget, with little dependence on wartime or emergency OCO funding $200  PAE contracts are primarily critical, enduring missions $0 with no end date or dependence on operational tempo 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019E 2020E (e.g., embassy work) Source: FPDS Contracts; Bloomberg Government Data, Congressional Budget Office 1 Excludes state and local spending; Base budget indicates recurring budget for DoD; Nonbase Funding indicates OCO and GWOT (Global War on Terror) expenditures 23 2 Represents Overseas Contingency Operations

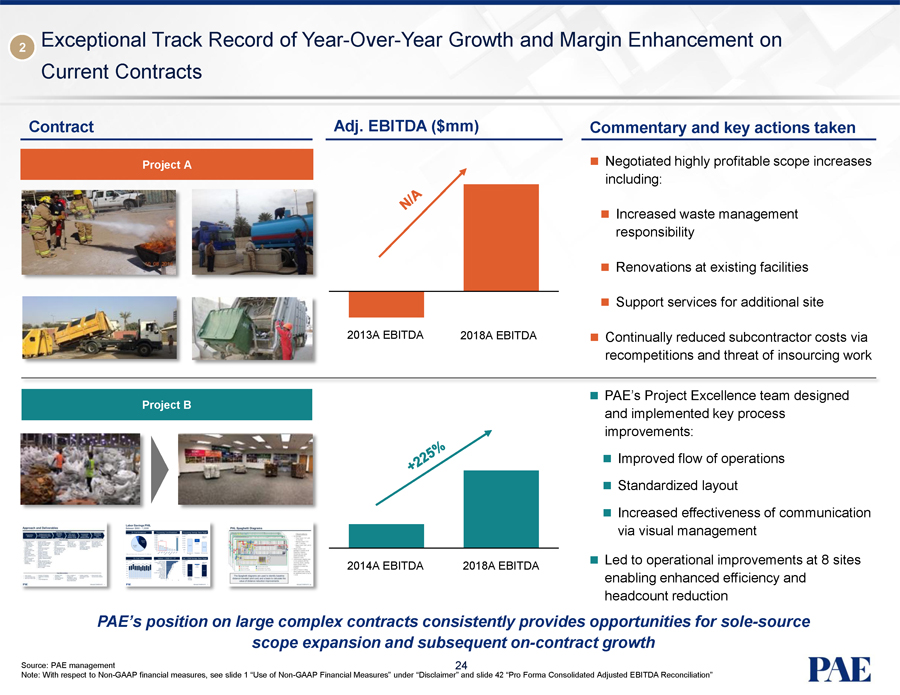

2 Exceptional Track Record of Year-Over-Year Growth and Margin Enhancement on Current Contracts Contract Adj. EBITDA ($mm) Commentary and key actions taken Project A Negotiated highly profitable scope increases including: Increased waste management responsibility Renovations at existing facilities Support services for additional site 2013A EBITDA 2018A EBITDA Continually reduced subcontractor costs via recompetitions and threat of insourcing work PAE’s Project Excellence team designed Project B and implemented key process improvements: Improved flow of operations Standardized layout Increased effectiveness of communication via visual management Led to operational improvements at 8 sites 2014A EBITDA 2018A EBITDA enabling enhanced efficiency and headcount reduction PAE’s position on large complex contracts consistently provides opportunities for sole-source scope expansion and subsequenton-contract growth Source: PAE management 24 Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation”

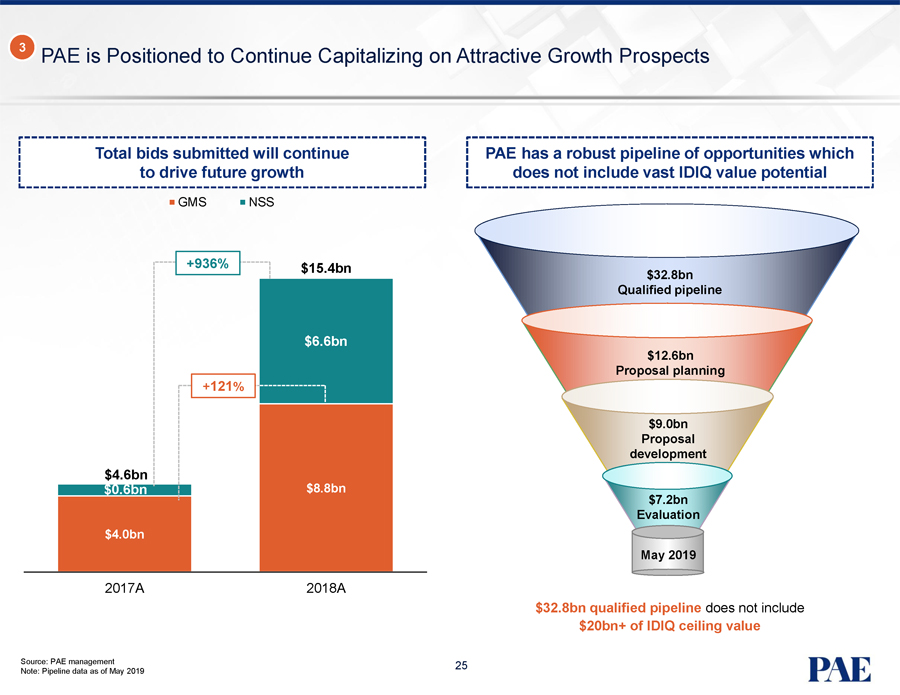

3 PAE is Positioned to Continue Capitalizing on Attractive Growth Prospects Total bids submitted will continue PAE has a robust pipeline of opportunities which to drive future growth does not include vast IDIQ value potential GMS NSS +936% $15.4bn $32.8bn Qualified pipeline $6.6bn $12.6bn Proposal planning +121% $9.0bn Proposal development $4.6bn $0.6bn $8.8bn $7.2bn Evaluation $4.0bn May 2019 2017A 2018A $32.8bn qualified pipeline does not include $20bn+ of IDIQ ceiling value Source: PAE management 25 Note: Pipeline data as of May 2019

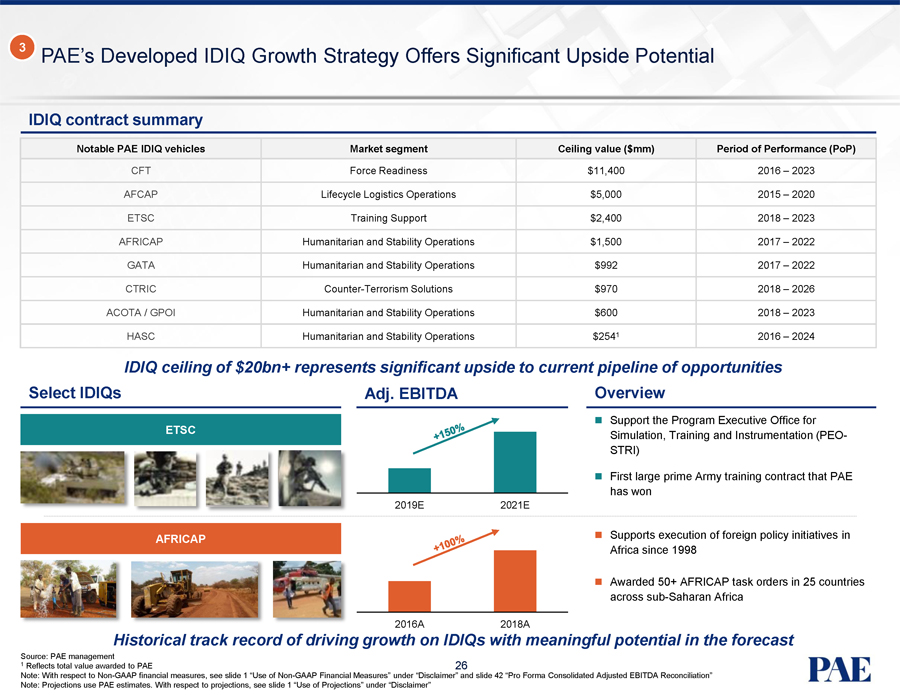

3 PAE’s Developed IDIQ Growth Strategy Offers Significant Upside Potential IDIQ contract summary Notable PAE IDIQ vehicles Market segment Ceiling value ($mm) Period of Performance (PoP) CFT Force Readiness $11,400 2016 – 2023 AFCAP Lifecycle Logistics Operations $5,000 2015 – 2020 ETSC Training Support $2,400 2018 – 2023 AFRICAP Humanitarian and Stability Operations $1,500 2017 – 2022 GATA Humanitarian and Stability Operations $992 2017 – 2022 CTRIC Counter-Terrorism Solutions $970 2018 – 2026 ACOTA / GPOI Humanitarian and Stability Operations $600 2018 – 2023 HASC Humanitarian and Stability Operations $2541 2016 – 2024 IDIQ ceiling of $20bn+ represents significant upside to current pipeline of opportunities Select IDIQs Adj. EBITDA Overview ETSC Support the Program Executive Office for Simulation, Training and Instrumentation(PEO-STRI) First large prime Army training contract that PAE has won 2019E 2021E AFRICAP Supports execution of foreign policy initiatives in Africa since 1998 Awarded 50+ AFRICAP task orders in 25 countries acrosssub-Saharan Africa 2016A 2018A Historical track record of driving growth on IDIQs with meaningful potential in the forecast Source: PAE management 1 Reflects total value awarded to PAE 26 Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

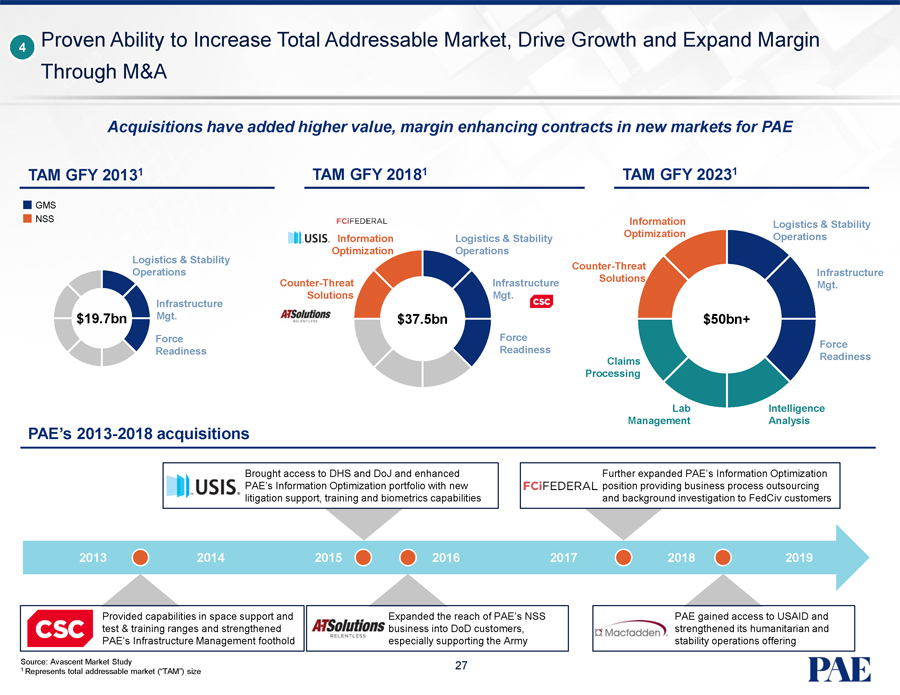

4 Proven Ability to Increase Total Addressable Market, Drive Growth and Expand Margin Through M&A Acquisitions have added higher value, margin enhancing contracts in new markets for PAE TAM GFY 20131 TAM GFY 20181 TAM GFY 20231 GMS NSS Information Optimization Logistics & Stability Information Logistics & Stability Operations Logistics & Stability Optimization Operations Counter-Threat Operations Infrastructure Solutions Counter-Threat Infrastructure Mgt. Infrastructure Solutions Mgt. $19.7bn Mgt. $37.5bn $50bn+ Force Force Force Readiness Readiness Readiness Claims Processing Lab Intelligence Management Analysis PAE’s 2013-2018 acquisitions Brought access to DHS and DoJ and enhanced Further expanded PAE’s Information Optimization PAE’s Information Optimization portfolio with new position providing business process outsourcing litigation support, training and biometrics capabilities and background investigation to FedCiv customers 2013 2014 2015 2016 2017 2018 2019 Provided capabilities in space support and Expanded the reach of PAE’s NSS PAE gained access to USAID and test & training ranges and strengthened business into DoD customers, strengthened its humanitarian and PAE’s Infrastructure Management foothold especially supporting the Army stability operations offering Source: Avascent Market Study 27 1 Represents total addressable market (“TAM”) size

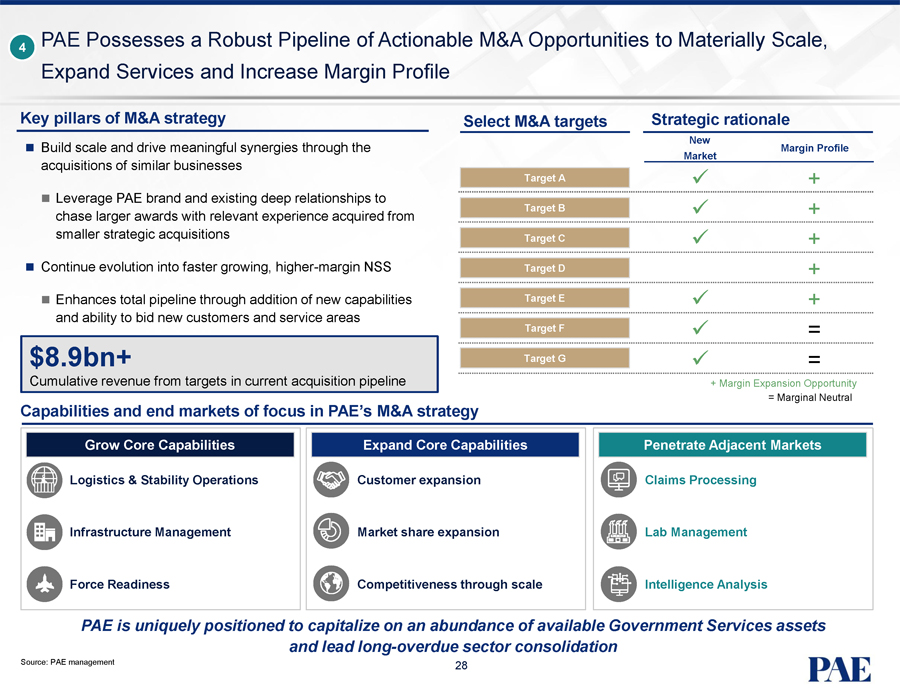

4 PAE Possesses a Robust Pipeline of Actionable M&A Opportunities to Materially Scale, Expand Services and Increase Margin Profile Key pillars of M&A strategy Select M&A targets Strategic rationale New Build scale and drive meaningful synergies through the Margin Profile Market acquisitions of similar businesses Target A + Leverage PAE brand and existing deep relationships to Target B + chase larger awards with relevant experience acquired from smaller strategic acquisitions Target C + Continue evolution into faster growing, higher-margin NSS Target D + Enhances total pipeline through addition of new capabilities Target E + and ability to bid new customers and service areas Target F = $8.9bn+ Target G = Cumulative revenue from targets in current acquisition pipeline + Margin Expansion Opportunity = Marginal Neutral Capabilities and end markets of focus in PAE’s M&A strategy Grow Core Capabilities Expand Core Capabilities Penetrate Adjacent Markets Logistics & Stability Operations Customer expansion Claims Processing Infrastructure Management Market share expansion Lab Management Force Readiness Competitiveness through scale Intelligence Analysis PAE is uniquely positioned to capitalize on an abundance of available Government Services assets and lead long-overdue sector consolidation Source: PAE management 28

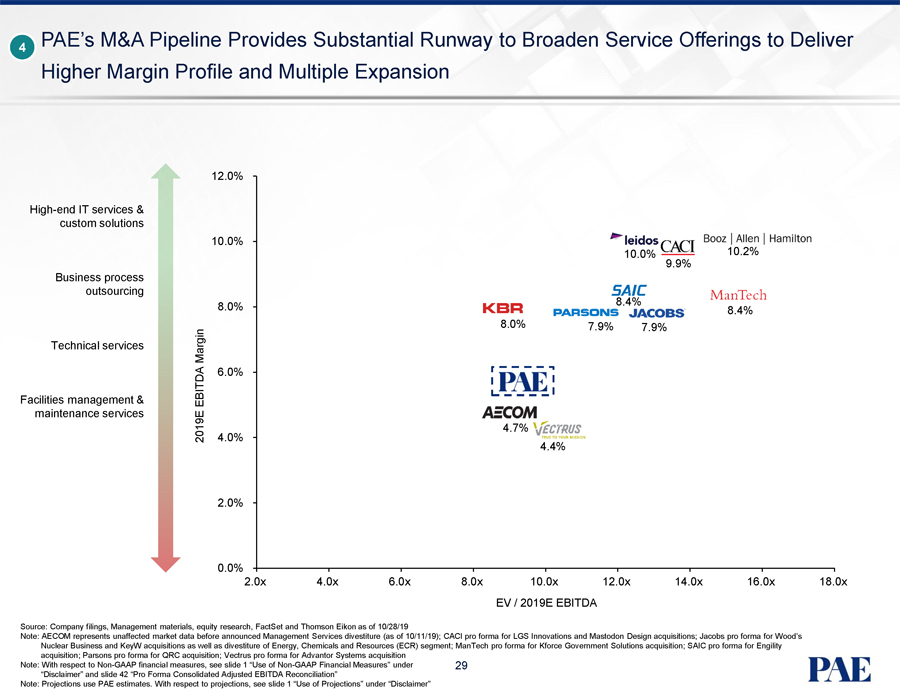

4 PAE’s M&A Pipeline Provides Substantial Runway to Broaden Service Offerings to Deliver Higher Margin Profile and Multiple Expansion 12.0%High-end IT services & custom solutions 10.0% 10.0% 9.9% Business process outsourcing 8.4% 8.0% 8.4% 8.0% 7.9% 7.9% Technical services Margin 6.0% Facilities management & EBITDA maintenance services 2019E 4.0% 4.7% 4.4% 2.0% 0.0% 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x 16.0x 18.0x EV / 2019E EBITDA Source: Company filings, Management materials, equity research, FactSet and Thomson Eikon as of 10/28/19 Note: AECOM represents unaffected market data before announced Management Services divestiture (as of 10/11/19); CACI pro forma for LGS Innovations and Mastodon Design acquisitions; Jacobs pro forma for Wood’s Nuclear Business and KeyW acquisitions as well as divestiture of Energy, Chemicals and Resources (ECR) segment; ManTech pro forma for Kforce Government Solutions acquisition; SAIC pro forma for Engility acquisition; Parsons pro forma for QRC acquisition; Vectrus pro forma for Advantor Systems acquisition Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under 29 “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

3. Financial Detail

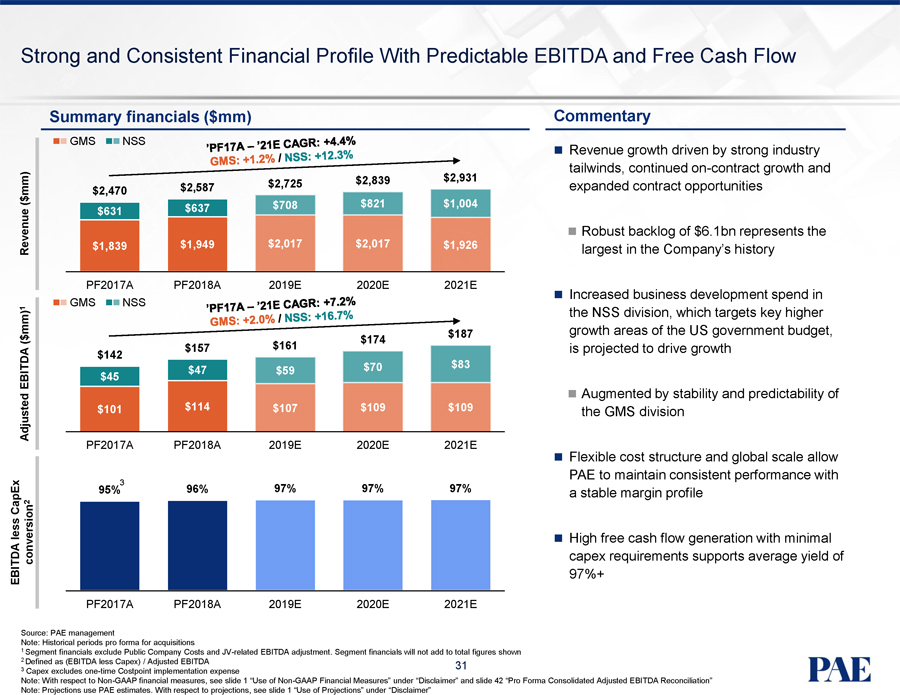

Strong and Consistent Financial Profile With Predictable EBITDA and Free Cash Flow Summary financials ($mm) Commentary GMS NSS Revenue growth driven by strong industry tailwinds, continuedon-contract growth and $2,839 $2,931 $2,587 $2,725 expanded contract opportunities mm) $2,470 ( $ $821 $1,004 $631 $637 $708 Robust backlog of $6.1bn represents the Revenue $1,839 $1,949 $2,017 $2,017 $1,926 largest in the Company’s history PF2017A PF2018A 2019E 2020E 2021E Increased business development spend in 1 GMS NSS mm) the NSS division, which targets key higher $187 growth areas of the US government budget, ( $ $174 $157 $161 is projected to drive growth $142 $70 $83 $47 $59 EBITDA $45 Augmented by stability and predictability of Adjusted $101 $114 $107 $109 $109 the GMS division PF2017A PF2018A 2019E 2020E 2021E Flexible cost structure global scale allow and PAE to maintain consistent performance with 3 95% 96% 97% 97% 97% a stable margin profile CapEx 2 less High free cash flow generation with minimal conversion capex requirements supports average yield of EBITDA 97%+ PF2017A PF2018A 2019E 2020E 2021E Source: PAE management Note: Historical periods pro forma for acquisitions 1 Segment financials exclude Public Company Costs andJV-related EBITDA adjustment. Segment financials will not add to total figures shown 2 Defined as (EBITDA less Capex) / Adjusted EBITDA 31 3 Capex excludesone-time Costpoint implementation expense Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

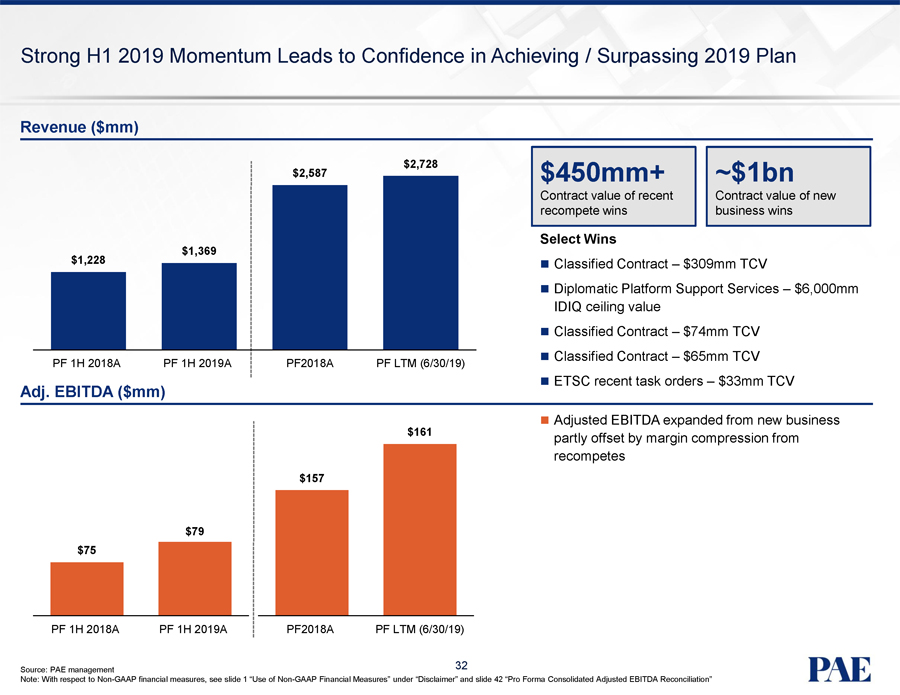

Strong H1 2019 Momentum Leads to Confidence in Achieving / Surpassing 2019 Plan Revenue ($mm) $2,728 $2,587 $450mm+ ~$1bn Contract value of recent Contract value of new recompete wins business wins Select Wins $1,369 $1,228 Classified Contract – $309mm TCV Diplomatic Platform Support Services – $6,000mm IDIQ ceiling value Classified Contract – $74mm TCV Classified Contract – $65mm TCV PF 1H 2018A PF 1H 2019A PF2018A PF LTM (6/30/19) ETSC recent task orders – $33mm TCV Adj. EBITDA ($mm) Adjusted EBITDA expanded from new business $161 partly offset by margin compression from recompetes $157 $79 $75 PF 1H 2018A PF 1H 2019A PF2018A PF LTM (6/30/19) Source: PAE management 32 Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation”

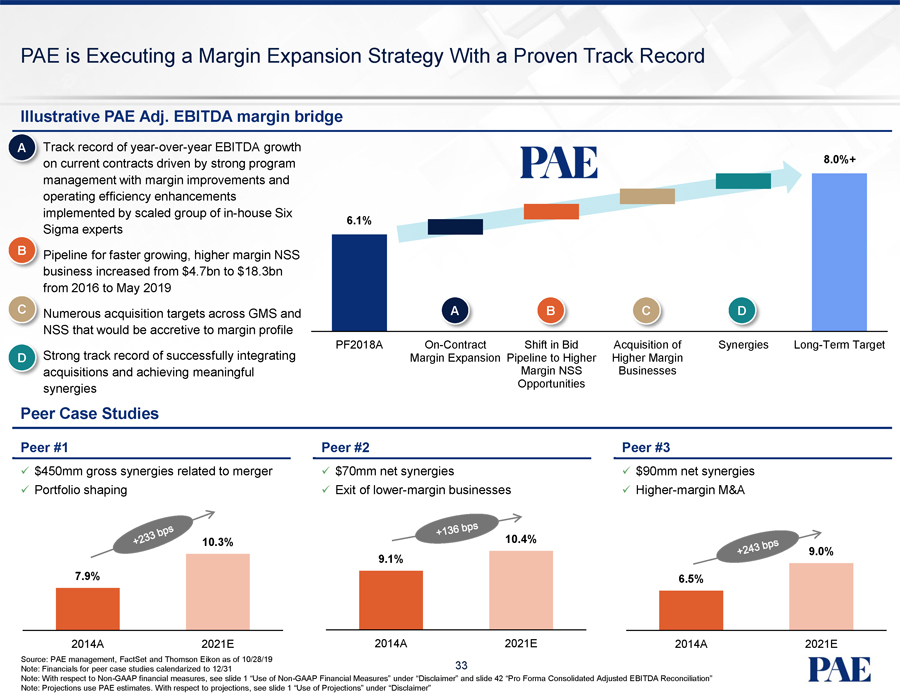

PAE is Executing a Margin Expansion Strategy With a Proven Track Record Illustrative PAE Adj. EBITDA margin bridge A Track record of year-over-year EBITDA growth on current contracts driven by strong program 8.0%+ management with margin improvements and operating efficiency enhancements implemented by scaled group ofin-house Six 6.1% Sigma experts B Pipeline for faster growing, higher margin NSS business increased from $4.7bn to $18.3bn from 2016 to May 2019 C Numerous acquisition targets across GMS and A B C D NSS that would be accretive to margin profile Strong track record of successfully integrating PF2018AOn-Contract Shift in Bid Acquisition of Synergies Long-Term Target D Margin Expansion Pipeline to Higher Higher Margin acquisitions and achieving meaningful Margin NSS Businesses synergies Opportunities Peer Case Studies Peer #1 Peer #2 Peer #3  $450mm gross synergies related to merger $70mm net synergies $90mm net synergies Portfolio shaping Exit of lower-margin businesses Higher-margin M&A 10.3% 10.4% 9.0% 9.1% 7.9% 6.5% 2014A 2021E 2014A 2021E 2014A 2021E Source: PAE management, FactSet and Thomson Eikon as of 10/28/19 Note: Financials for peer case studies calendarized to 12/31 33 Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

4. Transaction Summary

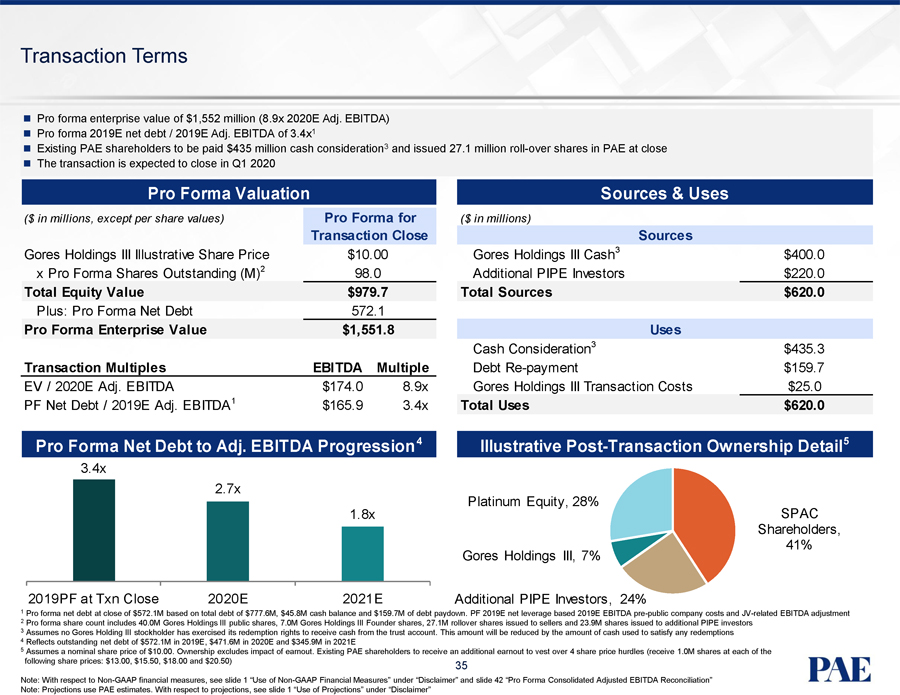

Transaction Terms Pro forma enterprise value of $1,552 million (8.9x 2020E Adj. EBITDA) Pro forma 2019E net debt / 2019E Adj. EBITDA of 3.4x1 Existing PAE shareholders to be paid $435 million cash consideration3 and issued 27.1 million roll-over shares in PAE at close The transaction is expected to close in Q1 2020 Pro Forma Valuation Sources & Uses ($ in millions, except per share values) Pro Forma for ($ in millions) Transaction Close Sources Gores Holdings III Illustrative Share Price $10.00 Gores Holdings III Cash3 $400.0 x Pro Forma Shares Outstanding (M)2 98.0 Additional PIPE Investors $220.0 Total Equity Value $979.7 Total Sources $620.0 Plus: Pro Forma Net Debt 572.1 Pro Forma Enterprise Value $1,551.8 Uses Cash Consideration3 $435.3 Transaction Multiples EBITDA Multiple DebtRe-payment $159.7 EV / 2020E Adj. EBITDA $174.0 8.9x Gores Holdings III Transaction Costs $25.0 PF Net Debt / 2019E Adj. EBITDA1 $165.9 3.4x Total Uses $620.0 Pro Forma Net Debt to Adj. EBITDA Progression4 Illustrative Post-Transaction Ownership Detail5 3.4x 2.7x Platinum Equity, 28% SPAC 1.8x Shareholders, 41% Gores Holdings III, 7% 2019PF at Txn Close 2020E 2021E Additional PIPE Investors, 24% 1 Pro forma net debt at close of $572.1M based on total debt of $777.6M, $45.8M cash balance and $159.7M of debt paydown. PF 2019E net leverage based 2019E EBITDApre-public company costs andJV-related EBITDA adjustment 2 Pro forma share count includes 40.0M Gores Holdings III public shares, 7.0M Gores Holdings III Founder shares, 27.1M rollover shares issued to sellers and 23.9M shares issued to additional PIPE investors 3 Assumes no Gores Holding III stockholder has exercised its redemption rights to receive cash from the trust account. This amount will be reduced by the amount of cash used to satisfy any redemptions 4 Reflects outstanding net debt of $572.1M in 2019E, $471.6M in 2020E and $345.9M in 2021E 5 Assumes a nominal share price of $10.00. Ownership excludes impact of earnout. Existing PAE shareholders to receive an additional earnout to vest over 4 share price hurdles (receive 1.0M shares at each of the following share prices: $13.00, $15.50, $18.00 and $20.50) 35 Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

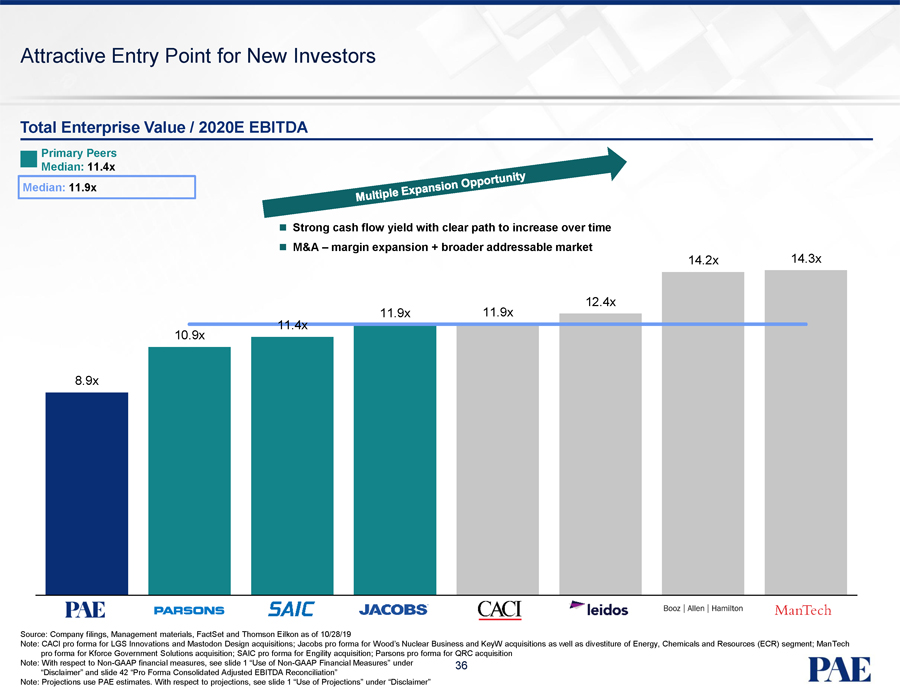

Attractive Entry Point for New Investors Total Enterprise Value / 2020E EBITDA Primary Peers Median: 11.4x Median: 11.9x Strong cash flow yield with clear path to increase over time M&A – margin expansion + broader addressable market 14.2x 14.3x 11.9x 11.9x 12.4x 11.4x 10.9x 8.9x Source: Company filings, Management materials, FactSet and Thomson Eilkon as of 10/28/19 Note: CACI pro forma for LGS Innovations and Mastodon Design acquisitions; Jacobs pro forma for Wood’s Nuclear Business and KeyW acquisitions as well as divestiture of Energy, Chemicals and Resources (ECR) segment; ManTech pro forma for Kforce Government Solutions acquisition; SAIC pro forma for Engility acquisition; Parsons pro forma for QRC acquisition Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under 36 “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

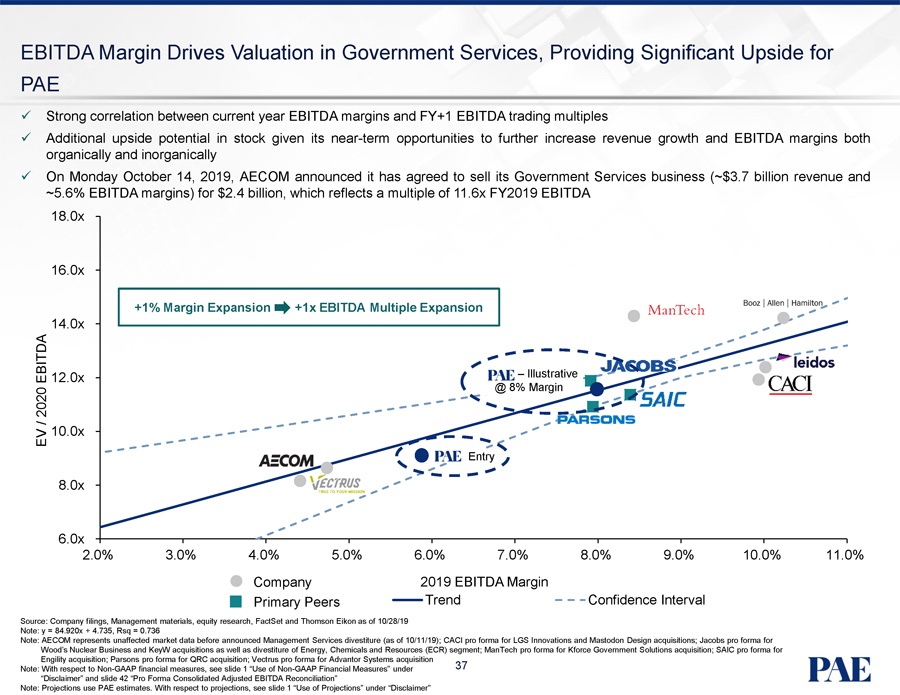

EBITDA Margin Drives Valuation in Government Services, Providing Significant Upside for PAE  Strong correlation between current year EBITDA margins and FY+1 EBITDA trading multiples  Additional upside potential in stock given its near-term opportunities to further increase revenue growth and EBITDA margins both organically and inorganically On Monday October 14, 2019, AECOM announced it has agreed to sell its Government Services business (~$3.7 billion revenue and ~5.6% EBITDA margins) for $2.4 billion, which reflects a multiple of 11.6x FY2019 EBITDA 18.0x 16.0x +1% Margin Expansion +1x EBITDA Multiple Expansion 14.0x EBITDA 12.0x Illustrative 2020 @ 8% Margin / EV 10.0x Entry 8.0x 6.0x 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% Company 2019 EBITDA Margin Primary Peers Trend Confidence Interval Source: Company filings, Management materials, equity research, FactSet and Thomson Eikon as of 10/28/19 Note: y = 84.920x + 4.735, Rsq = 0.736 Note: AECOM represents unaffected market data before announced Management Services divestiture (as of 10/11/19); CACI pro forma for LGS Innovations and Mastodon Design acquisitions; Jacobs pro forma for Wood’s Nuclear Business and KeyW acquisitions as well as divestiture of Energy, Chemicals and Resources (ECR) segment; ManTech pro forma for Kforce Government Solutions acquisition; SAIC pro forma for Engility acquisition; Parsons pro forma for QRC acquisition; Vectrus pro forma for Advantor Systems acquisition Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under 37 “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

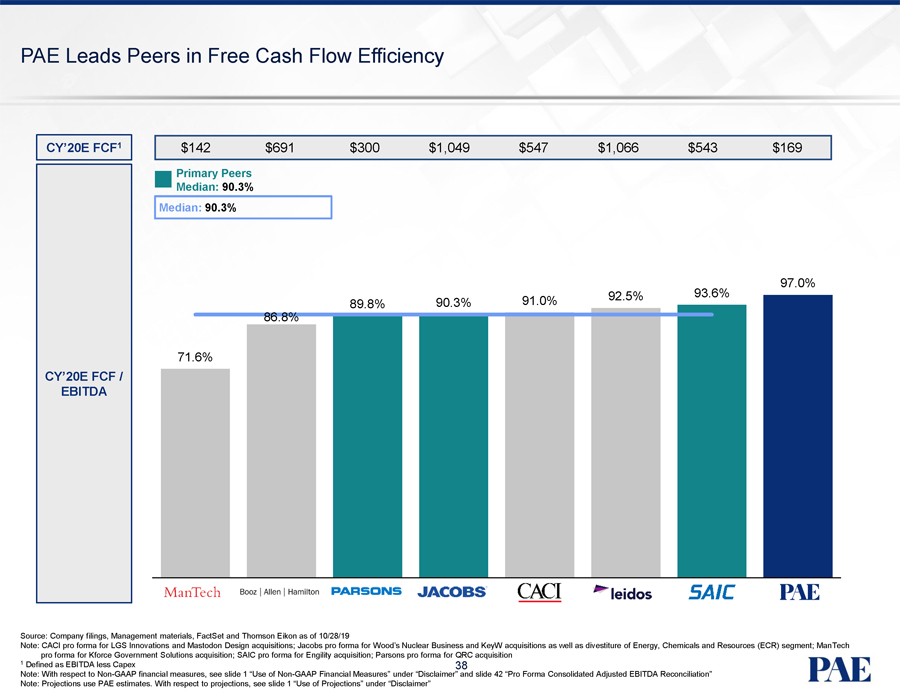

PAE Leads Peers in Free Cash Flow Efficiency CY’20E FCF1 $142 $691 $300 $1,049 $547 $1,066 $543 $169 Primary Peers Median: 90.3% Median: 90.3% 97.0% 92.5% 93.6% 89.8% 90.3% 91.0% 86.8% 71.6% CY’20E FCF / EBITDA Source: Company filings, Management materials, FactSet and Thomson Eikon as of 10/28/19 Note: CACI pro forma for LGS Innovations and Mastodon Design acquisitions; Jacobs pro forma for Wood’s Nuclear Business and KeyW acquisitions as well as divestiture of Energy, Chemicals and Resources (ECR) segment; ManTech pro forma for Kforce Government Solutions acquisition; SAIC pro forma for Engility acquisition; Parsons pro forma for QRC acquisition 1 Defined as EBITDA less Capex 38 Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

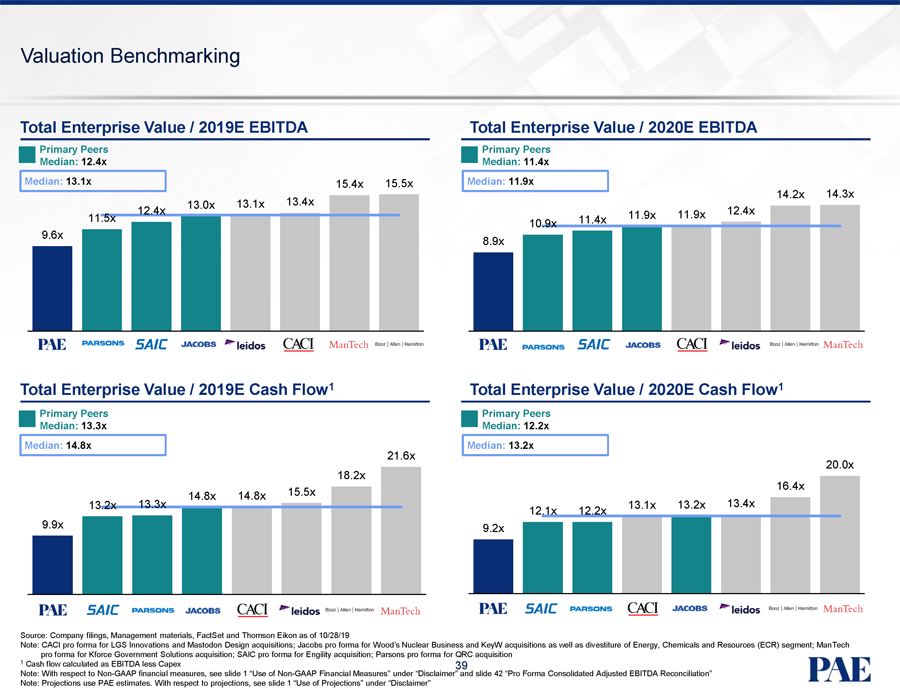

Valuation Benchmarking Total Enterprise Value / 2019E EBITDA Total Enterprise Value / 2020E EBITDA Primary Peers Primary Peers Median: 12.4x Median: 11.4x Median: 13.1x 15.4x 15.5x Median: 11.9x 14.2x 14.3x 13.0x 13.1x 13.4x 12.4x 11.9x 11.9x 12.4x 11.5x 11.4x 10.9x 9.6x 8.9x Total Enterprise Value / 2019E Cash Flow1 Total Enterprise Value / 2020E Cash Flow1 Primary Peers Primary Peers Median: 13.3x Median: 12.2x Median: 14.8x Median: 13.2x 21.6x 20.0x 18.2x 16.4x 14.8x 14.8x 15.5x 13.2x 13.3x 13.1x 13.2x 13.4x 12.1x 12.2x 9.9x 9.2x Source: Company filings, Management materials, FactSet and Thomson Eikon as of 10/28/19 Note: CACI pro forma for LGS Innovations and Mastodon Design acquisitions; Jacobs pro forma for Wood’s Nuclear Business and KeyW acquisitions as well as divestiture of Energy, Chemicals and Resources (ECR) segment; ManTech pro forma for Kforce Government Solutions acquisition; SAIC pro forma for Engility acquisition; Parsons pro forma for QRC acquisition 1 Cash flow calculated as EBITDA less Capex 39 Note: With respect toNon-GAAP financial measures, see slide 1 “Use ofNon-GAAP Financial Measures” under “Disclaimer” and slide 42 “Pro Forma Consolidated Adjusted EBITDA Reconciliation” Note: Projections use PAE estimates. With respect to projections, see slide 1 “Use of Projections” under “Disclaimer”

I. Appendix: Supplemental Materials

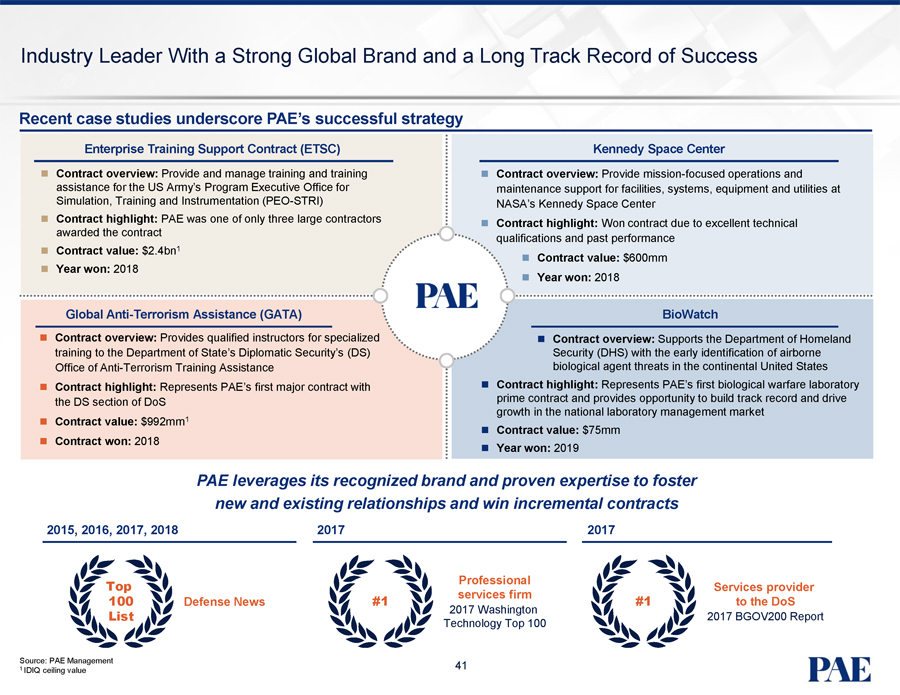

Industry Leader With a Strong Global Brand and a Long Track Record of Success Recent case studies underscore PAE’s successful strategy Enterprise Training Support Contract (ETSC) Kennedy Space Center Contract overview: Provide and manage training and training Contract overview: Provide mission-focused operations and assistance for the US Army’s Program Executive Office for maintenance support for facilities, systems, equipment and utilities at Simulation, Training and Instrumentation(PEO-STRI) NASA’s Kennedy Space Center Contract highlight: PAE was one of only three large contractors Contract highlight: Won contract due to excellent technical awarded the contract qualifications and past performance Contract value: $2.4bn1 Contract value: $600mm Year won: 2018 Year won: 2018 Global Anti-Terrorism Assistance (GATA) BioWatch Contract overview: Provides qualified instructors for specialized Contract overview: Supports the Department of Homeland training to the Department of State’s Diplomatic Security’s (DS) Security (DHS) with the early identification of airborne Office of Anti-Terrorism Training Assistance biological agent threats in the continental United States Contract highlight: Represents PAE’s first major contract with Contract highlight: Represents PAE’s first biological warfare laboratory the DS section of DoS prime contract and provides opportunity to build track record and drive Contract value: $992mm1 growth in the national laboratory management market Contract value: $75mm Contract won: 2018 Year won: 2019 PAE leverages its recognized brand and proven expertise to foster new and existing relationships and win incremental contracts 2015, 2016, 2017, 2018 2017 2017 Top Professional Services provider services firm 100 Defense News #1 #1 to the DoS 2017 Washington List 2017 BGOV200 Report Technology Top 100 Source: PAE Management 41 1 IDIQ ceiling value

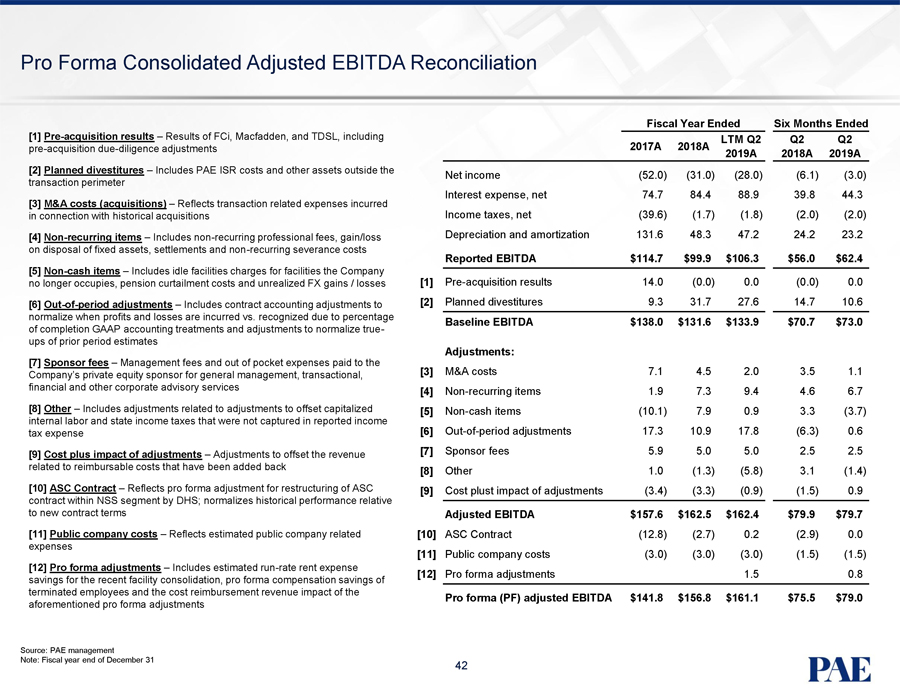

Pro Forma Consolidated Adjusted EBITDA Reconciliation Fiscal Year Ended Six Months Ended [1]Pre-acquisition results – Results of FCi, Macfadden, and TDSL, including LTM Q2 Q2 Q2pre-acquisitiondue-diligence adjustments 2017A 2018A 2019A 2018A 2019A [2] Planned divestitures – Includes PAE ISR costs and other assets outside the Net income (52.0) (31.0) (28.0) (6.1) (3.0) transaction perimeter [3] M&A costs (acquisitions) – Reflects transaction related expenses incurred Interest expense, net 74.7 84.4 88.9 39.8 44.3 in connection with historical acquisitions Income taxes, net (39.6) (1.7) (1.8) (2.0) (2.0) [4]Non-recurring items – Includesnon-recurring professional fees, gain/loss Depreciation and amortization 131.6 48.3 47.2 24.2 23.2 on disposal of fixed assets, settlements andnon-recurring severance costs Reported EBITDA $114.7 $99.9 $106.3 $56.0 $62.4 [5]Non-cash items – Includes idle facilities charges for facilities the Company no longer occupies, pension curtailment costs and unrealized FX gains / losses [1]Pre-acquisition results 14.0 (0.0) 0.0 (0.0) 0.0 [6]Out-of-period adjustments – Includes contract accounting adjustments to [2] Planned divestitures 9.3 31.7 27.6 14.7 10.6 normalize when profits and losses are incurred vs. recognized due to percentage Baseline EBITDA $138.0 $131.6 $133.9 $70.7 $73.0 of completion GAAP accounting treatments and adjustments to normalizetrue-ups of prior period estimates Adjustments: [7] Sponsor fees – Management fees and out of pocket expenses paid to the Company’s private equity sponsor for general management, transactional, [3] M&A costs 7.1 4.5 2.0 3.5 1.1 financial and other corporate advisory services [4]Non-recurring items 1.9 7.3 9.4 4.6 6.7 [8] Other – Includes adjustments related to adjustments to offset capitalized [5]Non-cash items (10.1) 7.9 0.9 3.3 (3.7) internal labor and state income taxes that were not captured in reported income tax expense [6]Out-of-period adjustments 17.3 10.9 17.8 (6.3) 0.6 [9] Cost plus impact of adjustments – Adjustments to offset the revenue [7] Sponsor fees 5.9 5.0 5.0 2.5 2.5 related to reimbursable costs that have been added back [8] Other 1.0 (1.3) (5.8) 3.1 (1.4) [10] ASC Contract – Reflects pro forma adjustment for restructuring of ASC [9] Cost plust impact of adjustments (3.4) (3.3) (0.9) (1.5) 0.9 contract within NSS segment by DHS; normalizes historical performance relative to new contract terms Adjusted EBITDA $157.6 $162.5 $162.4 $79.9 $79.7 [11] Public company costs – Reflects estimated public company related [10] ASC Contract (12.8) (2.7) 0.2 (2.9) 0.0 expenses [11] Public company costs (3.0) (3.0) (3.0) (1.5) (1.5) [12] Pro forma adjustments – Includes estimatedrun-rate rent expense [12] Pro forma adjustments 1.5 0.8 savings for the recent facility consolidation, pro forma compensation savings of terminated employees and the cost reimbursement revenue impact of the Pro forma (PF) adjusted EBITDA $141.8 $156.8 $161.1 $75.5 $79.0 aforementioned pro forma adjustments Source: PAE management Note: Fiscal year end of December 31 42

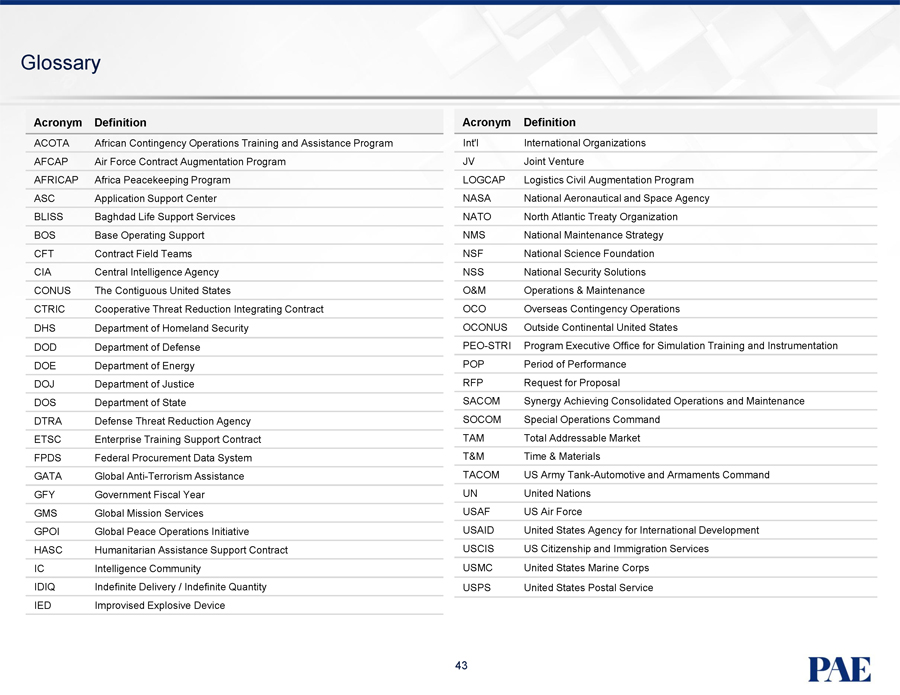

Glossary Acronym Definition Acronym Definition ACOTA African Contingency Operations Training and Assistance Program Int’l International Organizations AFCAP Air Force Contract Augmentation Program JV Joint Venture AFRICAP Africa Peacekeeping Program LOGCAP Logistics Civil Augmentation Program ASC Application Support Center NASA National Aeronautical and Space Agency BLISS Baghdad Life Support Services NATO North Atlantic Treaty Organization BOS Base Operating Support NMS National Maintenance Strategy CFT Contract Field Teams NSF National Science Foundation CIA Central Intelligence Agency NSS National Security Solutions CONUS The Contiguous United States O&M Operations & Maintenance CTRIC Cooperative Threat Reduction Integrating Contract OCO Overseas Contingency Operations DHS Department of Homeland Security OCONUS Outside Continental United States DOD Department of DefensePEO-STRI Program Executive Office for Simulation Training and Instrumentation DOE Department of Energy POP Period of Performance DOJ Department of Justice RFP Request for Proposal DOS Department of State SACOM Synergy Achieving Consolidated Operations and Maintenance DTRA Defense Threat Reduction Agency SOCOM Special Operations Command ETSC Enterprise Training Support Contract TAM Total Addressable Market FPDS Federal Procurement Data System T&M Time & Materials GATA Global Anti-Terrorism Assistance TACOM US Army Tank-Automotive and Armaments Command GFY Government Fiscal Year UN United Nations GMS Global Mission Services USAF US Air Force GPOI Global Peace Operations Initiative USAID United States Agency for International Development HASC Humanitarian Assistance Support Contract USCIS US Citizenship and Immigration Services IC Intelligence Community USMC United States Marine Corps IDIQ Indefinite Delivery / Indefinite Quantity USPS United States Postal Service IED Improvised Explosive Device 43