- FSRNQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Fisker (FSRNQ) PRE 14APreliminary proxy

Filed: 25 Mar 24, 8:17am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Fisker Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

[●], 2024

Dear Stockholder:

You are cordially invited to attend a special meeting of stockholders of Fisker Inc. (the “Company”). The special meeting will be held on Wednesday, April 24, 2024 at 8:00 a.m., Pacific Time, online via live webcast available at www.virtualshareholdermeeting.com/FSR2024SM2 (such meeting, including any adjournment or postponement thereof, the “Special Meeting”) for the following purposes:

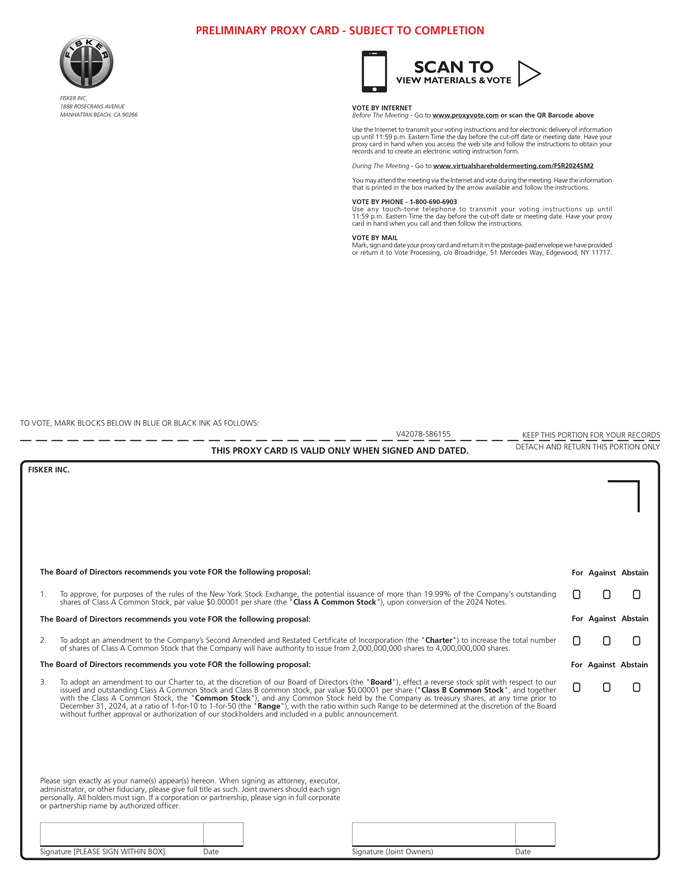

1. To approve, for purposes of the rules of the New York Stock Exchange (the “NYSE”), the potential issuance of more than 19.99% of the outstanding shares of Class A Common Stock, par value $0.00001 per share (the “Class A Common Stock”), upon conversion of the 2024 Notes as described below (the “Stock Issuance Proposal”);

2. To adopt an amendment to the Company’s Second Amended and Restated Certificate of Incorporation, as amended (the “Charter”) to increase the total number of shares of Class A Common Stock that the Company will have authority to issue from 2,000,000,000 shares to 4,000,000,000 shares (the “Authorized Shares Proposal”); and

3. To adopt an amendment to our Charter to, at the discretion of our Board of Directors (the “Board”), effect a reverse stock split (the “Reverse Stock Split”) with respect to our issued and outstanding Class A Common Stock and Class B common stock, par value $0.00001 per share (“Class B Common Stock”, and together with the Class A Common Stock, the “Common Stock”), and any Common Stock held by the Company as treasury shares, at any time prior to December 31, 2024, at a ratio of 1-for-10 to 1-for-50 (the “Range”), with the ratio within such Range to be determined at the discretion of the Board without further approval or authorization of our stockholders and included in a public announcement (the “Reverse Stock Split Proposal”, and, collectively with the Stock Issuance Proposal and the Authorized Shares Proposal, the “Proposals”).

The forms of amendments implementing the Authorized Shares Proposal and the Reverse Stock Split Proposal are attached to this proxy statement as Annex A and Annex B, respectively.

The Reverse Stock Split Proposal is being submitted to the Company’s stockholders in order to increase the trading price of our Class A Common Stock to meet the minimum per share price requirement for continued listing on the NYSE.

The Stock Issuance Proposal and the Authorized Share Proposal are being submitted to the Company’s stockholders in connection with the transaction described below, which contemplates potential issuances of additional shares of Class A Common Stock by the Company upon conversion of the 2024 Notes (as defined below), which would require approval of our stockholders pursuant to Section 312.03 of the NYSE Listing Manual.

On March 18, 2024, the Company entered into a financing commitment and term sheet (the “Commitment”) with an investor (the “Investor”) providing for the sale of up to $166.67 million in aggregate principal amount of senior secured convertible notes (the “2024 Notes”). The 2024 Notes will have a 10% original issue discount for gross proceeds of up to $150 million (the “Investment Amount”).

The 2024 Notes will be sold pursuant to a definitive securities purchase agreement (the “SPA”) and issued in four tranches, with the first tranche (the “First Tranche”) in an investment amount equal to $35 million and the remaining three tranches (each, an “Additional Draw”) in equal amounts up to the Investment Amount. The Company expects to enter into the SPA (such date, the “SPA Signing Date”) and enter into the First

Tranche on or after April 1, 2024 subject to negotiation and execution of definitive documentation and other applicable closing conditions.

The 2024 Notes will accrue interest at a rate equal to the 3-month secured overnight financing rate (“3-month SOFR”) plus 12% per annum, payable at the Maturity Date (as defined below). In addition, the Company will pay interest on any overdue principal, installments of interest and Undrawn Investment Fees (as defined below) at a rate equal to 3% per annum in excess of the then-applicable interest rate on the 2024 Notes.

A fee to the Investor on the undrawn portion of the Investment Amount will accrue daily until, but excluding, the date of the applicable closing at an interest rate of the 3-month SOFR plus 4% per annum, payable at the Maturity Date (the “Undrawn Investment Fee”). The Undrawn Investor Fee with respect to the First Tranche commenced on the date of the Commitment. The Undrawn Investor Fee with respect of each Additional Draw shall commence upon confirmation or waiver by the Investor of certain closing conditions. In the event that no 2024 Notes are issued by the Maturity Date, the accrued Undrawn Investment Fee will be paid to the Investor in cash on such date.

All amounts due under the 2024 Notes will be convertible at any time, in whole or in part, at the Investor’s option, into shares of Class A Common Stock at the then-applicable Conversion Price (as defined below), plus all accrued and unpaid interest and Undrawn Investment Fees (as defined below) with respect to such portion of such principal amount of Notes, subject to applicable securities laws and exchange limitations.

The conversion price for the 2024 Notes (the “Conversion Price”) will be equal to the Market Price (as defined below) on the SPA Signing Date. However, if the Investor elects to convert the 2024 Notes on the Maturity Date, and the Market Price as of the Maturity Date is lower than the Conversion Price, then the Conversion Price will be reset to such Market Price.

For purposes of the 2024 Notes, “Market Price” will mean the lowest daily volume weighted average price (“VWAP”) for the Class A Common Stock on the NYSE during the five trading day period immediately preceding the applicable date, but in no event greater than the lowest daily VWAP of the Class A Common Stock on the applicable date.

The 2024 Notes will provide for full-ratchet anti-dilution protection and contain standard conversion rate adjustments upon the occurrence of certain events including, but not limited to, dividend payments, change of control, distributions, stock splits, reverse stock splits or combinations.

The 2024 Notes will mature upon the earlier of (i) three (3) months from the date of issuance of the First Tranche, (ii) the effective date of a registration statement for the primary sale of registered securities by the Company, or (iii) July 31, 2024 (such date, the “Maturity Date”).

The number of shares of Class A Common Stock underlying the 2024 Notes cannot be conclusively determined as of the date of this proxy statement. While such number is uncertain, for illustrative purposes, 1,253,157,894 shares of Class A Common Stock are issuable from time to time upon conversion or otherwise under the 2024 Notes, assuming we issue the full amount of the 2024 Notes, any interest and Undrawn Investment Fees are paid in cash, and such 2024 Notes are converted at an illustrative Conversion Price of $0.133 (the closing stock price as of March 19, 2024), which would exceed the threshold set forth under Section 312.03 of the NYSE Listing Manual.

The Board of directors of the Company (the “Board”) has: (a) approved, adopted and ratified the consummation by the Company of the transactions described above and (b) recommended that the Company’s stockholders approve the Proposals at the Special Meeting. Accordingly, the Board recommends that you vote “FOR” each of the Proposals.

The close of business on April 1, 2024 is the record date for determining stockholders who are entitled to receive notice of, and to vote at, the Special Meeting. This Notice of Special Meeting and the accompanying

proxy statement are first being distributed on or about [ ], 2024. Our principal executive offices are located at 1888 Rosecrans Avenue, Manhattan Beach, California 90266.

To provide convenient access and promote attendance and participation at the Special Meeting, we will hold the Special Meeting virtually. Stockholders may attend the Special Meeting by logging in at www.virtualshareholdermeeting.com/FSR2024SM2. Please see page 4 of this proxy statement for additional information regarding participation in the Special Meeting.

Your vote is very important to us. Please submit your proxy as soon as possible to ensure that your shares are represented at the Special Meeting.

You can ensure your shares are represented at the Special Meeting if you are a stockholder of record by promptly voting electronically over the Internet or by returning your completed proxy card in the pre-addressed, postage-paid return envelope, or, if your shares are held in street name, by returning your completed voting instruction card to your broker. The proxy is solicited on behalf of the Board.

Sincerely,

Henrik Fisker

Chairman of the Board, President and Chief Executive Officer

| Page | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 9 | ||||

| 11 | ||||

| 13 | ||||

| 15 | ||||

| 23 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 28 | |||

| 31 | ||||

Annual Meeting Advance Notice Requirements and Stockholder Proposals | 31 | |||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| A-1 | ||||

| B-1 | ||||

i

We are furnishing you this proxy statement (the “Proxy Statement”) in connection with a special meeting of the stockholders of the Company that will be held on Wednesday, April 24, 2024 at 8:00 a.m., Pacific Time (such meeting, including any adjournment or postponement thereof, the “Special Meeting”). The Special Meeting will be conducted online via live webcast.

The Special Meeting can be accessed via the Internet by visiting www.virtualshareholdermeeting.com/FSR2024SM2. The information contained in, or that can be accessed through, our website is not a part of, or incorporated by reference in, this Proxy Statement.

Unless stated otherwise or the context indicates otherwise, references to “Fisker,” “we,” “us” and “our” are to the business of Fisker Inc., a Delaware corporation, and references to the “Company” are to Fisker Inc. alone.

1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Proxy Statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are forward-looking and as such are not historical facts. These forward-looking statements include, without limitation, statements regarding future financial performance, business strategies, expansion plans, future results of operations, estimated revenues, losses, projected costs, prospects, plans and objectives of management. These forward-looking statements are based on our management’s current expectations, estimates, projections and beliefs, as well as a number of assumptions concerning future events, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this proxy statement, words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “would” and variations thereof and similar words and expressions are intended to identify such forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained herein are based on our current expectations and beliefs concerning future developments and their potential effects on our business. There can be no assurance that future developments affecting our business will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” under Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (as supplemented by our other reports subsequently filed with the SEC). Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all such risk factors, nor can we assess the effect of all such risk factors on our business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

The forward-looking statements made by us in this proxy statement speak only as of the date of this proxy statement. Except to the extent required under the federal securities laws and rules and regulations of the U.S. Securities and Exchange Commission (“SEC”), we disclaim any obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. In light of these risks and uncertainties, there is no assurance that the events or results suggested by the forward-looking statements will in fact occur, and you should not place undue reliance on these forward-looking statements.

2

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

The following are answers to some questions that you, as a stockholder, may have regarding the Special Meeting and the Proposals. The Company urges you to carefully read the remainder of this Proxy Statement because the information in this section does not provide all the information that might be important to you with respect to the Special Meeting and the Proposals.

1. Why am I receiving these proxy materials?

You are receiving this Proxy Statement and proxy card from the Company because, at the close of business on April 1, 2024, the record date for the Special Meeting, you were a holder of record of shares of Common Stock of the Company. This Proxy Statement describes the matters that will be presented for your consideration at the Special Meeting. It also gives you information concerning the matters to assist you in making an informed decision. We are calling the Special Meeting to approve the Authorized Shares Proposal, the Reverse Stock Split Proposal and the Stock Issuance Proposal.

2. What am I voting on?

The Company’s stockholders are being asked to approve:

| • | for purposes of the rules of the NYSE, the potential issuance of more than 19.99% of the outstanding shares of Class A Common Stock upon conversion of the 2024 Notes; |

| • | an amendment to the Charter to increase the total number of shares of Class A Common Stock that the Company will have authority to issue from 2,000,000,000 shares to 4,000,000,000 shares; and |

| • | an amendment to our Charter to, at the discretion of our Board, effect a reverse stock split with respect to our issued and outstanding Common Stock and any Common Stock held by the Company as treasury shares, at any time prior to December 31, 2024, at a ratio of 1-for-10 to 1-for-50, with the ratio within such Range to be determined at the discretion of the Board without further approval or authorization of our stockholders and included in a public announcement. |

The forms of amendment implementing the Authorized Shares Proposal and Reverse Stock Split Proposal are attached to this Proxy Statement as Annex A and Annex B, respectively.

3. What will happen if the Proposals are not approved?

Unless we obtain the approval of our stockholders in accordance with the rules and regulations of the NYSE, a maximum of 19.99% of the outstanding shares of our Class A Common Stock on the SPA Signing Date will be issuable upon conversion or otherwise pursuant to the terms of the 2024 Notes. Until stockholder approval is obtained, any share issuances that will be required pursuant to the terms of the 2024 Notes in excess of 19.9% of the number of shares of common stock outstanding on the SPA Signing Date (or otherwise limited by NYSE rules and regulations) will be cash settled according to standard market price formulation. If we are unable to obtain approval of the Authorized Shares Proposal, we will be unable to issue shares of Class A Common Stock upon conversion of the 2024 Notes to the extent such issuance would exceed the total number of shares authorized pursuant to our Charter.

If we are unable to issue shares of Class A Common Stock upon conversion of the 2024 Notes, on the terms currently contemplated, we may consider strategic alternatives to strengthen our liquidity position. These alternatives may include (subject to market conditions) capital markets transactions, repurchases, redemptions, exchanges or other refinancings of our existing debt, in or out of court restructurings, the potential issuance of equity securities, the potential sale of additional assets and businesses and/or other strategic transactions and/or other measures. These alternatives involve significant uncertainties, potential significant delays, costs and other risks, and there can be no assurance that any of these alternatives will be available on acceptable terms, or at all, in the current market environment or in the foreseeable future.

3

If we are unable to obtain approval of the Reverse Stock Split Proposal, we may be unable to maintain the listing of our common stock on the NYSE, which could adversely affect the liquidity and marketability of our common stock.

4. Does the Board and the Company’s management support the Proposals?

The Board and the Company’s management support the Proposals and believe them to be in the best interests of the Company and our stockholders. Pursuant to that certain voting agreement dated as of March 18, 2024, entered into by and between Fisker and certain stockholders representing the majority of the voting power (the “Voting Agreement”), certain stockholders of the Company have agreed that they will vote in favor of the Stock Issuance Proposal and the Authorized Share Proposal. As a result of these commitments, we expect that the Proposals will receive a sufficient number of votes at the Special Meeting to ensure that they are each approved. If the Proposals are not approved, we may need to consider other alternatives that may or may not be available to us to strengthen our liquidity position. These alternatives may include (subject to market conditions) capital markets transactions, repurchases, redemptions, exchanges or other refinancings of our existing debt, in or out of court restructurings, the potential issuance of equity securities, the potential sale of additional assets and businesses, or other strategic transactions and measures. These alternatives involve significant uncertainties, potential significant delays, costs and other risks, and there can be no assurance that any of these alternatives will be available on acceptable terms, or at all, in the current market environment or in the foreseeable future.

The Board recommends that you vote in favor of the Proposals at the Special Meeting.

5. How will the Special Meeting be conducted?

The Special Meeting will be conducted online via live webcast. Stockholders may attend the meeting regardless of location.

6. How can I participate in the Special Meeting?

The Special Meeting will be conducted virtually via live webcast available at www.virtualshareholdermeeting.com/FSR2024SM2. You are entitled to participate in the Special Meeting if you were a stockholder on April 1, 2024 (the “Record Date”) or hold a valid proxy for the Special Meeting.

To be admitted to the Special Meeting via live webcast, you must enter the 16-digit control number found next to the label “Control Number” on your Notice/proxy card. If you do not have your 16-digit control number, you will be able to login as a guest but will not be able to vote your shares during the Special Meeting.

You may begin to log in to the meeting platform beginning at 7:45 a.m., Pacific Time, on April 24, 2024. The meeting will begin promptly at 8:00 a.m., Pacific Time, on April 24, 2024.

7. What if I experience technical difficulties?

If you encounter any technical difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number posted on the Virtual Stockholder Meeting log in page. Technical support will be available starting at 7:45 a.m., Pacific Time on April 24, 2024.

8. Who is entitled to vote at the Special Meeting?

Stockholders of record as of the close of business on the Record Date are entitled to receive notice of, to attend and participate, and to vote at the Special Meeting. At the close of business on the Record Date, there were [●] shares of Class A Common Stock and 132,354,128 shares of Class B Common Stock outstanding and entitled to vote.

4

Stockholder of Record: Shares Registered in Your Name

If your shares are registered directly in your name with our transfer agent, Computershare Trust Company (“Computershare”), you are considered the stockholder of record with respect to those shares, and the Notice or these proxy materials will be sent directly to you by Fisker.

Beneficial Owner of Shares Held in Street Name: Shares Registered in the Name of a Broker or Nominee

If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the “beneficial owner” of shares held in “street name” and the Notice or these proxy materials were forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. Because you are not the stockholder of record, you

may not vote your shares at the Special Meeting unless you request and obtain a valid proxy from the organization that holds your shares giving you the right to vote the shares at the Special Meeting. Beneficial owners must obtain a valid proxy from the organization that holds their shares and present it to Computershare at least three business (3) days in advance of the Special Meeting.

9. Who is soliciting my vote pursuant to this Proxy Statement and who will bear the cost of this proxy solicitation?

The proxy for the Special Meeting is being solicited on behalf of our Board. We will pay the cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. We may, on request, reimburse brokerage firms and other nominees for their expenses in forwarding proxy materials to beneficial owners. In addition to soliciting proxies by mail, we expect that our directors, officers and employees may solicit proxies in person or by telephone or facsimile. None of these individuals will receive any additional or special compensation for doing this, although we may reimburse these individuals for their reasonable out-of-pocket expenses. We do not expect to, but have the option to, retain a proxy solicitor. If you choose to access the proxy materials or vote via the Internet or by phone, you are responsible for any Internet access or phone charges you may incur.

10. How can I vote my shares of Common Stock at the Special Meeting?

You may vote by mail or follow any alternative voting procedure (such as telephone or internet voting) described on your proxy card. To use an alternative voting procedure, follow the instructions on each Notice and/or proxy card that you receive. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may:

| • | vote by telephone or through the internet—in order to do so, please follow the instructions shown on your Notice or proxy card; |

| • | vote by mail—if you request or receive a paper proxy card and voting instructions by mail, simply complete, sign and date the enclosed proxy card and return it before the meeting in the pre-paid envelope provided; or |

| • | vote in person at the Special Meeting virtually—you may virtually attend and participate in the Special Meeting online at www.virtualshareholdermeeting.com/FSR2024SM2 and vote your shares electronically before the polls close during the Special Meeting. To participate and vote in the Special Meeting, you will need your 16-digit control number. |

Votes submitted by telephone or through the internet must be received by 11:59 p.m. Eastern Time, on April 23, 2024. Submitting your proxy, whether by telephone, through the internet or by mail if you request or

5

received a paper proxy card, will not affect your right to vote in person should you decide to attend and participate in the meeting virtually.

Beneficial Owner: Shares Registered in the Name of a Broker or Other Nominee

If you are not the stockholder of record, please refer to the voting instructions provided by your nominee to direct it how to vote your shares. Your vote is important. To ensure that your vote is counted, complete and mail the voting instruction card provided by your brokerage firm, bank, or other nominee as directed by your nominee. To electronically vote in person at the meeting online, you must obtain a legal proxy from your nominee. Follow the instructions from your nominee included with our proxy materials or contact your nominee to request a proxy form. Your vote is important. Whether or not you plan to participate in the Special Meeting, we urge you to vote by proxy to ensure that your vote is counted.

11. What are my voting choices?

You may vote “FOR” or “AGAINST” or you may “ABSTAIN” from voting on any proposal to be voted on at the Special Meeting. Your shares will be voted as you specifically instruct. If you sign your proxy card without giving specific instructions on how your shares are to be voted at the Special Meeting, your shares will be voted in accordance with the recommendation of the Board in favor of each Proposal presented at the Special Meeting.

12. Can I change or revoke my vote after I return my proxy card?

You may change your vote or revoke your proxy at any time prior to the taking of the vote or the polls closing at the Special Meeting.

If you are the stockholder of record, you may change your vote by:

| • | granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described above (and until the applicable deadline for each method); |

| • | providing a written notice of revocation to Fisker’s Corporate Secretary at Fisker Inc., 1888 Rosecrans Avenue, Manhattan Beach, California 90266, prior to your shares being voted; or |

| • | participating in the Special Meeting and voting electronically online at www.virtualshareholdermeeting.com/FSR2024SM2. Participation alone at the Special Meeting will not cause your previously granted proxy to be revoked unless you specifically vote during the meeting online at www.virtualshareholdermeeting.com/FSR2024SM2. |

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

13. What vote is required for approval of the Proposals?

The Company’s bylaws (the “Bylaws”) provide that the holders of a majority in voting power of the issued and outstanding shares of the capital stock of the Company and entitled to vote at the Special Meeting, present in person or represented by proxy, constitute a quorum for the transaction of business at the Special Meeting. Shares that are authorized to be voted on or to abstain on any matter presented at the Special Meeting, or that are held by stockholders who are present at the Special Meeting, are counted as present and entitled to vote and are therefore included for purposes of determining whether a quorum is present at the Special Meeting. If you hold your Class A Common Stock or Class B Common Stock through a broker, the broker may be prevented from voting shares held in your brokerage account if you have not given the broker voting instructions with respect to your shares (resulting in what is referred to as a “broker non-vote”). Thus, it is important that you vote your

6

shares to ensure that they are represented on all matters presented at the Special Meeting. For each of the proposals, the voting standard that will be applied to determine whether the proposals have been adopted, the Board’s recommendation, and treatment of abstentions and broker non-votes are as follows:

| Voting Item | Board | Voting Standard | Treatment of | Expected Treatment | ||||

| Proposal 1 – Stock Issuance Proposal | FOR | Majority in voting power of votes cast by holders of Common Stock | No effect | No effect | ||||

| Proposal 2 – Authorized Shares Proposal | FOR | Majority in voting power of the issued and outstanding shares of Common Stock | Same effect as a vote AGAINST the Proposal | Same effect as a vote AGAINST the Proposal | ||||

| Proposal 3 – Reverse Stock Split Proposal | FOR | Majority in voting power of the issued and outstanding shares of Common Stock | Same effect as a vote AGAINST the Proposal | Same effect as a vote AGAINST the Proposal | ||||

14. Am I entitled to dissenters’ rights or appraisal rights?

None of the Company’s stockholders are entitled to dissenters’ or appraisal rights with respect to any of the Proposals being submitted to the stockholders at the Special Meeting.

15. What happens if I do not respond or if I respond and fail to indicate my voting preference?

If you fail to attend the Special Meeting or are not represented by proxy at the Special Meeting, your shares will not be counted toward establishing a quorum for the Special Meeting, which requires that stockholders holding at least a majority of the voting power of the shares of our issued and outstanding Class A Common Stock and our Class B Common Stock (voting together as a single class), entitled to vote are present at the Special Meeting or represented by proxy.

If you respond and do not indicate your voting preference, your shares will be voted in accordance with the recommendation of the Board in favor of each Proposal presented at the Special Meeting.

16. Can I vote on other matters?

The Special Meeting has been called only to consider and vote on the approval of the Proposals. Under the Bylaws, no other matters may be considered at the Special Meeting if they are not included in this Proxy Statement, which serves as the notice of the Special Meeting.

17. Why were my proxy materials included in the same envelope as other people at my address?

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process is commonly referred to as “householding.”

7

Brokers with account holders who are Fisker stockholders may be householding our proxy materials. A single set of proxy materials may be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that it will be householding communications to your address, householding will continue until you are notified otherwise or until you notify your broker or Fisker that you no longer wish to participate in householding.

If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement, you may (1) notify your broker, (2) direct your written request to: Investor Relations, Fisker Inc., 1888 Rosecrans Avenue, Manhattan Beach, California 90266 or (3) contact our Investor Relations department by email at fisker_ir@fiskerinc.com. Stockholders who receive multiple copies of the Proxy Statement at their address and would like to request householding of their communications should contact their broker. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the Proxy Statement to a stockholder at a shared address to which a single copy of the document was delivered.

18. What do I need to do now?

We urge you to read this Proxy Statement carefully and then either vote online at www.virtualshareholdermeeting.com/FSR2024SM2 by following the voting instructions on the proxy card or mail your dated and signed proxy card in the enclosed return envelope as soon as possible so that your shares can be voted in connection with the Special Meeting.

19. Who can help answer my other questions?

If you have more questions on the Proposals or voting, or if you need additional copies of this Proxy Statement or the enclosed proxy card you should contact Fisker’s Corporate Secretary at Fisker Inc., 1888 Rosecrans Avenue, Manhattan Beach, California 90266.

8

PURPOSE OF THE SPECIAL MEETING; BACKGROUND OF THE PROPOSALS

Background

Fisker is building a technology-enabled, capital-light automotive business model that we believe will be among the first of its kind and aligned with the future state of the automotive industry. This involves innovations in vehicle development, customer experience, and sales and service that improve the personal mobility experience through technological innovation, ease of use and flexibility. The Company brings the legendary design and product development expertise of Henrik Fisker—the visionary behind such iconic vehicles as the BMW Z8 sports car and the famed Aston Martin DB9 and V8 Vantage—to deliver high quality, sustainable, affordable electric vehicles that create a strong emotional connection with customers. Central to our business model is the Fisker Flexible Platform Agnostic Design, a proprietary process that allows the design and development of a vehicle to be adapted to any given EV platform in the specific segment size. The process focuses on creating industry leading vehicle designs that can be adapted to match the crucial hard points on an EV platform initially developed by a third-party. This, combined with rapid decision-making, focused supply chain management and outsourced manufacturing, reduces development cost and time to market, creating a new business model for the industry and one that gives Fisker a significant advantage in bringing vehicles to market faster, more efficiently, and with more modern and advanced technology than many competitors.

Fisker has produced approximately 1,000 vehicles in 2024 through March 15, and has delivered approximately 1,300 globally in that same timeframe.

The company has approximately 4,700 vehicles in its current inventory, carried over from 2023 and including 2024 production. While it has not completed an NRV analysis for 2024, Fisker believes the completed vehicle value for its inventory as of March 15, 2024, is in excess of $200 million.

Fisker will pause production for six weeks starting the week of March 18, 2024, to align inventory levels and progress strategic and financing initiatives.

Transaction

On March 18, 2024, the Company entered into a financing commitment and term sheet with an investor providing for the sale of up to $166.67 million in aggregate principal amount of senior secured convertible notes. The 2024 Notes will have a 10% original issue discount for gross proceeds of up to $150 million.

The 2024 Notes will be sold pursuant to a definitive securities purchase agreement and issued in four tranches, with the first tranche in an investment amount equal to $35 million and the remaining three tranches in equal amounts up to the Investment Amount. The Company expects to enter into the SPA and issue the First

Tranche on or after April 1, 2024, subject to negotiation and execution of definitive documentation and other applicable closing conditions

The 2024 Notes will accrue interest at a rate equal to the 3-month secured overnight financing rate plus 12% per annum, payable at the Maturity Date. In addition, the Company will pay interest on any overdue principal, installments of interest and Undrawn Investment Fees at a rate equal to 3% per annum in excess of the then-applicable interest rate on the 2024 Notes.

A fee to the Investor on the undrawn portion of the Investment Amount will accrue daily until, but excluding, the date of the applicable closing at an interest rate of the 3-month SOFR plus 4% per annum, payable at the Maturity Date. The Undrawn Investor Fee with respect to the First Tranche commenced on the date of the Commitment. The Undrawn Investor Fee with respect of each Additional Draw shall commence upon confirmation or waiver by the Investor of certain closing conditions. In the event that no 2024 Notes are issued by the Maturity Date, the accrued Undrawn Investment Fee will be paid to the Investor in cash on such date.

9

All amounts due under the 2024 Notes will be convertible at any time, in whole or in part, at the Investor’s option, into shares of Class A Common Stock at the then-applicable Conversion Price, plus all accrued and unpaid interest and Undrawn Investment Fees with respect to such portion of such principal amount of Notes, subject to applicable securities laws and exchange limitations.

The conversion price for the 2024 Notes will be equal to the Market Price on the SPA Signing Date. However, if the Investor elects to convert the 2024 Notes on the Maturity Date, and the Market Price as of the Maturity Date is lower than the Conversion Price, then the Conversion Price will be reset to such Market Price.

For purposes of the 2024 Notes, “Market Price” will mean the lowest daily volume weighted average price for the Class A Common Stock on the NYSE during the five trading day period immediately preceding the applicable date, but in no event greater than the lowest daily VWAP of the Class A Common Stock on the applicable date.

The 2024 Notes will provide for full-ratchet anti-dilution protection and contain standard conversion rate adjustments upon the occurrence of certain events including, but not limited to, dividend payments, change of control, distributions, stock splits, reverse stock splits or combinations.

The 2024 Notes will mature upon the earlier of (i) three (3) months from the date of issuance of the First Tranche, (ii) the effective date of a registration statement for the primary sale of registered securities by the Company, and (iii) July 31, 2024.

The number of shares of Class A Common Stock underlying the 2024 Notes cannot be conclusively determined as of the date of this proxy statement. While such number is uncertain, for illustrative purposes, 1,253,157,894 shares of Class A Common Stock are issuable from time to time upon conversion or otherwise under the 2024 Notes, assuming we issue the full amount of the 2024 Notes, any interest and Undrawn Investment Fees are paid in cash, and such 2024 Notes are converted at an illustrative Conversion Price of $0.133 (the closing stock price as of March 19, 2024), which would exceed the threshold set forth under Section 312.03 of the NYSE Listing Manual.

Recommendation of the Board

The Board (a) approved, adopted and ratified the consummation by the Company of the transactions described above; and (b) recommended that the Company’s stockholders approve the Proposals at the Special Meeting.

The Board recommends that you vote “FOR” each of the Proposals.

10

PROPOSAL 1—THE STOCK ISSUANCE PROPOSAL

The Board approved and recommends that the Company’s stockholders adopt a proposal to approve, for purposes of the rules of NYSE, the potential issuance of more than 19.99% of the outstanding shares, of Class A Common Stock upon conversion of the 2024 Notes. The number of shares of Class A Common Stock underlying the 2024 Notes cannot be conclusively determined as of the date of this proxy statement. While such number is uncertain, for illustrative purposes, 1,253,157,894 shares of Class A Common Stock are issuable from time to time upon conversion or otherwise under the 2024 Notes, assuming we issue the full amount of the 2024 Notes, any interest and Undrawn Investment Fees are paid in cash, and such 2024 Notes are converted at an illustrative Conversion Price of $0.133 (the closing stock price as of March 19, 2024), which would exceed the threshold set forth under Section 312.03 of the NYSE Listing Manual.

Reason for Request for Stockholder Approval

The Class A Common Stock is listed on NYSE and, as a result, the Company is subject to the rules and regulations of NYSE. Section 312.03 of the NYSE Listing Manual requires an issuer to obtain stockholder approval prior to the issuance of common stock in any transaction or series of related transactions, if, among other things: (i) the common stock has, or will have upon issuance, voting power equal to or in excess of 20% of the voting power outstanding before the issuance of such stock; or (ii) the number of shares of common stock to be issued is, or will be upon issuance, equal to or in excess of 20% of the number of shares of common stock outstanding before the issuance of common stock.

The approval of the Company’s stockholders is required because, in the event that the Investor elects to convert the 2024 Notes, the Company will be required to issue more than 19.99% of its currently outstanding Class A Common Stock in connection therewith.

The additional shares of Class A Common Stock that are proposed to be issued upon conversion of the 2024 Notes will have the same rights and privileges as the shares of Class A Common Stock currently authorized and outstanding. Holders of Common Stock are not entitled to preemptive rights to purchase Class A Common Stock or other securities or to cumulative voting rights in relation to the proposed issuance of shares of Class A Common Stock in connection with the conversion described above.

The Board believes that authorizing the issuance of additional shares of Class A Common Stock upon conversion of the 2024 Notes is fair to and in the best interests of the Company and the Company’s stockholders. For more information on the 2024 Notes and the transaction generally, see, “Purpose of the Special Meeting; Background of the Proposals.”

Effect of Vote in Favor for the Stock Issuance Proposal

A vote in favor of the Stock Issuance Proposal is a vote in favor of approving, for purposes of the rules of the NYSE, the issuance of shares of Class A Common Stock upon conversion of the 2024 Notes in an amount that exceeds 19.99% of its currently outstanding Class A Common Stock before the issuance of the Class A Common Stock upon conversion of the 2024 Notes. Approval of the Stock Issuance Proposal will allow us to, subject to the satisfaction of other conditions (including the approval of the Authorized Shares Proposal), issue shares of Class A Common Stock upon conversion of the 2024 Notes.

Approval of the Stock Issuance Proposal will not affect the rights of current holders of outstanding shares of Class A Common Stock. Approval will, however, allow us to, subject to the satisfaction of other conditions, issue a significant number of additional shares of Class A Common Stock. In the event that the 2024 Notes are converted into shares of Class A Common Stock, the issuance of such shares is expected to cause a significant dilution in the relative percentage interests of our current stockholders. Sales of substantial amounts of Class A Common Stock in the public market, or the perception that these sales could occur, coupled with the increase in

11

the outstanding number of shares of Class A Common Stock relative to shares of Class A Common Stock currently outstanding, could cause the market price of Class A Common Stock to decline. See “Security Ownership of Certain Beneficial Owners and Management” and “Risk Factors.”

Effect of Not Obtaining Required Vote for Approval of the Stock Issuance Proposal

If we are unable to obtain approval of the Stock Issuance Proposal, we will be unable to issue shares of Class A Common Stock upon conversion of the 2024 Notes, as applicable, to the extent such issuance would exceed 19.99% of the outstanding shares of our Class A Common Stock. If we are unable to issue shares of Class A Common Stock upon conversion of the 2024 Notes, as applicable, on the terms currently contemplated, we may consider strategic alternatives to strengthen our liquidity position. These alternatives may include (subject to market conditions) capital markets transactions, repurchases, redemptions, exchanges or other refinancings of our existing debt, in or out of court restructurings, the potential issuance of equity securities, the potential sale of additional assets and businesses and/or other strategic transactions and/or other measures. These alternatives involve significant uncertainties, potential significant delays, costs and other risks, and there can be no assurance that any of these alternatives will be available on acceptable terms, or at all, in the current market environment or in the foreseeable future.

Required Vote

Approval of the Stock Issuance Proposal requires the affirmative vote of the holders of a majority in voting power of the votes cast by holders of Common Stock. Abstentions and broker non-votes, if any, will have no effect on the vote on the Stock Issuance Proposal.

Pursuant to the Voting Agreement, certain stockholders of the Company have agreed that they will vote in favor of the Stock Issuance Proposal. As a result of these commitments, we expect that the Stock Issuance Proposal will receive a sufficient number of votes at the Special Meeting to ensure that it is approved.

Recommendation of the Board

THE BOARD RECOMMENDS YOU VOTE “FOR” APPROVAL OF THE STOCK ISSUANCE PROPOSAL.

12

PROPOSAL 2—THE AUTHORIZED SHARES PROPOSAL

The Board approved, declared advisable and recommends that the Company’s stockholders approve a proposal to amend the Charter, in the form attached to this Proxy Statement as Annex A, to increase the total number of shares of Class A Common Stock that the Company will have authority to issue from 2,000,000,000 shares to 4,000,000,000 shares.

Reason for Request for Stockholder Approval

Article IV of the Charter currently authorizes the Company to issue 2,165,000,000 shares of total capital stock, comprising 2,000,000,000 shares of Class A Common Stock, 150,000,000 shares of Class B Common Stock and 15,000,000 shares of preferred stock, par value $0.00001 per share (the “Preferred Stock”). At the close of business on the Record Date, there were [●] shares of Class A Common Stock outstanding.

The increase in authorized shares of Class A Common Stock will enable the Company to have the reserves required pursuant to the terms of the 2024 Notes. We have not proposed the increase in the authorized number of shares of Class A Common Stock with the intention of using the additional shares for anti-takeover purposes, although we could theoretically use the additional shares to make more difficult or to discourage an attempt to acquire control of the Company.

The form of amendment implementing the Authorized Share Proposal is attached to this Proxy Statement as Annex A.

Effect of Vote in Favor of the Authorized Shares Proposal

If the Authorized Shares Proposal is approved by the Company’s stockholders, the Company intends to file an amendment to its Charter with the Secretary of State of Delaware as soon as practicable thereafter. The Board may, at any time prior to effectiveness, abandon such amendment without further action by the stockholders or the Board (even if the requisite stockholder vote is obtained).

Adoption of the amendment to the Charter would increase the number of shares of Class A Common Stock that the Company will have authority to issue from 2,000,000,000 to 4,000,000,000 shares and, as a result, increase the number of shares of capital stock that the Company will have authority to issue from 2,165,000,000 shares to 4,165,000,000. The number of shares of Class B Common Stock and Preferred Stock that the Company is authorized to issue would remain 150,000,000 shares and 15,000,000 shares, respectively. The amendment to the Charter would amend and restate the text of Article IV of the Charter to read in full as follows:

“The total number of shares of all classes of stock that the Corporation has authority to issue is 4,165,000,000, consisting of three classes: 4,000,000,000 shares of Class A Common Stock, $0.00001 par value per share (“Class A Common Stock”), 150,000,000 shares of Class B Common stock, $0.00001 par value per share (“Class B Common Stock” and together with the Class A Common Stock, the “Common Stock”) and 15,000,000 shares of Preferred Stock, $0.00001 par value per share (“Preferred Stock”).”

The additional shares of Class A Common Stock authorized by the amendment to the Charter would become part of the existing class of the Class A Common Stock and, if and when issued, would have the same rights and privileges as the shares of Class A Common Stock currently authorized and outstanding. The amendment to the Charter will not affect the par value of the Class A Common Stock, which will remain at $0.00001 per share. The additional shares of Class A Common Stock authorized by the amendment to the Charter would not (and the shares of Class A Common Stock currently outstanding do not) entitle the holders thereof to preemptive rights to purchase Class A Common Stock or other securities or to cumulative voting rights.

Approval of the Authorized Shares Proposal will allow us to, subject to the satisfaction of other conditions (including the approval of the Stock Issuance Proposal), have the reserves required pursuant to the terms of the 2024 Notes to issue the shares of Class A Common Stock underlying the 2024 Notes.

13

Effect of Not Obtaining Required Vote for Approval of the Authorized Shares Proposal

If we are unable to obtain approval of the Authorized Shares Proposal, we will be unable to issue shares of Class A Common Stock upon conversion of the 2024 Notes to the extent such issuance would exceed the total number of shares authorized pursuant to our Charter. If we are unable to issue shares of Class A Common Stock upon conversion of the 2024 Notes, as applicable, on the terms currently contemplated, we may consider strategic alternatives to strengthen our liquidity position. These alternatives may include (subject to market conditions) capital markets transactions, repurchases, redemptions, exchanges or other refinancings of our existing debt, in or out of court restructurings, the potential issuance of equity securities, the potential sale of additional assets and businesses and/or other strategic transactions and/or other measures. These alternatives involve significant uncertainties, potential significant delays, costs and other risks, and there can be no assurance that any of these alternatives will be available on acceptable terms, or at all, in the current market environment or in the foreseeable future.

Required Vote

The Authorized Share Proposal will be adopted if it is approved by the affirmative vote of the holders of a majority of the voting power of the issued and outstanding Common Stock entitled to vote thereon. Abstentions and broker non-votes, if any, will have the same effect as a vote AGAINST the Authorized Shares Proposal.

Pursuant to the Voting Agreement, certain stockholders of the Company have agreed that they will vote in favor of the Authorized Share Proposal. As a result of these commitments, we expect that the Authorized Share Proposal will receive a sufficient number of votes at the Special Meeting to ensure that it is approved.

Recommendation of the Board

THE BOARD RECOMMENDS YOU VOTE “FOR” APPROVAL OF THE AUTHORIZED SHARES PROPOSAL.

14

PROPOSAL 3—THE REVERSE STOCK SPLIT PROPOSAL

Article IV of the Charter currently authorizes the Company to issue 2,165,000,000 shares of total capital stock, comprising 2,000,000,000 shares of Class A Common Stock, 150,000,000 shares of Class B Common Stock and 15,000,000 shares of Preferred Stock.

Our Board has approved, subject to stockholder approval, an amendment to the Charter to, at the discretion of the Board, effect the Reverse Stock Split of our Common Stock at a ratio of 1-for-10 to 1-for-50, including any shares held by the Company as treasury shares, at any time prior to December 31, 2024, with the exact ratio within such Range to be determined by our Board at its discretion without further approval or authorization of our stockholders and included in a public announcement. The primary goal of the Reverse Stock Split is to increase the per share market price of our Common Stock to meet the minimum per share price requirements for continued listing on the NYSE. We believe that a range of Reverse Stock Split ratios provides us with the most flexibility to achieve the desired results of the Reverse Stock Split. The Reverse Stock Split is not intended as, and will not have the effect of, a “going private transaction” covered by Rule 13e-3 promulgated under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). The Reverse Stock Split is not intended to modify the rights of existing stockholders in any material respect.

If the Reverse Stock Split Proposal is approved by our stockholders and the Reverse Stock Split is effected, up to every 50 shares of our outstanding Common Stock would be combined and reclassified into one (1) share of Common Stock.

The Reverse Stock Split, if effected, will not change the number of authorized shares of our Common Stock or Preferred Stock, or the par value of our Common Stock or Preferred Stock.

The actual timing for implementation of the Reverse Stock Split would be determined by the Board based upon its evaluation as to when such action would be most advantageous to the Company and its stockholders, but must be implemented before December 31, 2024. Notwithstanding approval of the Reverse Stock Split Proposal by our stockholders, the Board will have the sole authority to elect whether or not and when to amend our Charter to effect the Reverse Stock Split. If the Reverse Stock Split Proposal is approved by our stockholders, the Board will make a determination as to whether effecting the Reverse Stock Split is in the best interests of the Company and its stockholders in light of, among other things, our ability to increase the trading price of our Class A Common Stock to meet the minimum stock price standards of the NYSE without effecting the Reverse Stock Split, the per share price of the Class A Common Stock immediately prior to the Reverse Stock Split and the expected stability of the per share price of the Class A Common Stock following the Reverse Stock Split. If the Board determines that it is in the best interests of the Company and its stockholders to effect the Reverse Stock Split, it will determine the ratio of the Reverse Stock Split. For additional information concerning the factors the Board will consider in deciding whether to effect the Reverse Stock Split, see “—Determination of the Reverse Stock Split Ratio” and “—Board Discretion to Effect the Reverse Stock Split.”

The text of the proposed amendment to our Charter to effect the Reverse Stock Split is included as Annex B to this Proxy Statement. If the Reverse Stock Split Proposal is approved by our stockholders, we will have the authority to file such Charter amendment with the Secretary of State of the State of Delaware, which will become effective upon its filing or the effective time set forth in the amendment. The Board has determined that the amendment is advisable and in the best interests of the Company and its stockholders and has submitted the amendment for consideration by our stockholders at the Special Meeting.

Reason for the Reverse Stock Split Proposal

We are submitting this proposal to our stockholders for approval in order to increase the trading price of our Class A Common Stock to meet the minimum per share bid price requirement for continued listing on the NYSE. We believe increasing the trading price of our Class A Common Stock may also assist in our capital-raising efforts by making our Class A Common Stock more attractive to a broader range of investors. Accordingly, we believe that the Reverse Stock Split is in our stockholders’ best interests.

15

We believe that the Reverse Stock Split, if necessary, is our best option to meet the criteria to satisfy the minimum per share bid price requirement for continued listing on the NYSE. The NYSE requires, among other criteria, that the Company maintain a continued price of at least $1.00 per share. On the Record Date, the last reported sale price of our Class A Common Stock on the NYSE was $[ ] per share. A decrease in the number of outstanding shares of our Class A Common Stock resulting from the Reverse Stock Split should, absent other factors, assist in ensuring that the per share market price of our Class A Common Stock remains above the requisite price for continued listing. However, we cannot provide any assurance that our minimum bid price would remain over the minimum bid price requirement of the NYSE following the Reverse Stock Split.

In addition, as noted above, we believe that the Reverse Stock Split and the resulting increase in the per share price of our Class A Common Stock could encourage increased investor interest in our Class A Common Stock and promote greater liquidity for our stockholders. A greater price per share of our Class A Common Stock could allow a broader range of institutions to invest in our Class A Common Stock (namely, funds that are prohibited or discouraged from buying stocks with a price below a certain threshold), potentially increasing marketability, trading volume and liquidity of our Class A Common Stock. Many institutional investors view stocks trading at low prices as unduly speculative in nature and, as a result, avoid investing in such stocks. We believe that the Reverse Stock Split will provide flexibility to make our Class A Common Stock a more attractive investment for these institutional investors, which we believe will enhance the liquidity for the holders of our Class A Common Stock and may facilitate future sales of our Class A Common Stock. The Reverse Stock Split could also increase interest in our Class A Common Stock for analysts and brokers who may otherwise have policies that discourage or prohibit them in following or recommending companies with low stock prices. Additionally, because brokers’ commissions on transactions in low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of our Class A Common Stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher.

Effect of Vote in Favor of the Reverse Stock Split Proposal

Effects of the Reverse Stock Split on Issued and Outstanding Shares. If the Reverse Stock Split is effected, it will reduce the total number of issued and outstanding shares of Common Stock, including any shares held by the Company as treasury shares, by a Reverse Stock Split ratio of 1-for-10 to 1-for-50. Accordingly, each of our stockholders will own fewer shares of Common Stock as a result of the Reverse Stock Split. However, the Reverse Stock Split will affect all stockholders uniformly and will not affect any stockholder’s percentage ownership interest in the Company, except to the extent that the Reverse Stock Split would result in fractional shares in the Reverse Stock Split, which will be cashed out as described below. Therefore, voting rights and other rights and preferences of the holders of Common Stock will not be affected by the Reverse Stock Split (other than as a result of the treatment of fractional shares). Common Stock issued pursuant to the Reverse Stock Split will remain fully paid and nonassessable, and the par value per share of common stock will remain $0.00001.

As of the Record Date, approximately [ ] shares of our Common Stock were outstanding including [ ] shares of our Class A Common Stock and 132,354,128 shares of our Class B Common Stock. For purposes of illustration, if the Reverse Stock Split is effected at a ratio of 1-for-30, the number of issued and outstanding shares of Common Stock after the Reverse Stock Split would be approximately [ ] shares, including [ ] shares of Class A Common Stock.

Effects of the Reverse Stock Split on Outstanding Equity Awards and Plans. If the Reverse Stock Split is effected, the terms of equity awards granted under our 2020 Equity Incentive Plan (“EIP”) and 2020 Employee Stock Purchase Plan (“ESPP”, and together with the EIP, the “Equity Plans”), including the per share exercise price of options and the number of shares issuable under such options, will be proportionally adjusted to maintain their economic value, subject to adjustments for any fractional shares as described herein. In addition, the total number of shares of Class A Common Stock that may be the subject of future grants under the Equity Plans, as well as any plan limits on the size of such grants will be adjusted and proportionately decreased as a result of the Reverse Stock Split.

16

Effects of the Reverse Stock Split on Voting Rights. Proportionate voting rights and other rights of the holders of Common Stock would not be affected by the Reverse Stock Split (other than as a result of the treatment of fractional shares). For example, a holder of 1% of the voting power of the outstanding Common Stock immediately prior to the effective time of the Reverse Stock Split would continue to hold 1% of the voting power of the outstanding Common Stock after the Reverse Stock Split (other than as a result of the treatment of fractional shares).

Effects of the Reverse Stock Split on Regulatory Matters. We are subject to the periodic reporting and other requirements of the Exchange Act. The Reverse Stock Split will not affect our obligation to publicly file financial and other information with the SEC.

Effects of the Reverse Stock Split on Authorized Share Capital. The total number of shares of capital stock that we are authorized to issue will not be affected by the Reverse Stock Split.

Effects of the Reverse Stock Split on the Number of Shares of Common Stock Available for Future Issuance. By reducing the number of shares outstanding without reducing the number of shares of available but unissued Common Stock, the Reverse Stock Split will increase the number of authorized but unissued shares. The Board believes the increase is appropriate for use to fund the future operations of the Company. Although the Company does not have any pending acquisitions for which shares are expected to be used, the Company may also use authorized shares in connection with the financing of future acquisitions.

Although the Reverse Stock Split would not have any dilutive effect on our stockholders, the Reverse Stock Split without a reduction in the number of shares authorized for issuance would reduce the proportion of shares owned by our stockholders relative to the number of shares authorized for issuance, giving the Board an effective increase in the authorized shares available for issuance, in its discretion. The Board from time to time may deem it to be in the best interests of the Company to enter into transactions and other ventures that may include the issuance of shares of our common stock. If the Board authorizes the issuance of additional shares subsequent to the Reverse Stock Split, the dilution to the ownership interest of our existing stockholders may be greater than would occur had the Reverse Stock Split not been effected.

Treatment of Fractional Shares in the Reverse Stock Split

No fractional shares will be issued in connection with the Reverse Stock Split. Stockholders of record who otherwise would be entitled to receive fractional shares will be entitled to an amount in cash (without interest or deduction) equal to the fraction of one share to which such stockholder would otherwise be entitled multiplied by the closing price of our Class A Common Stock on the NYSE on the date on which the effective time of the Reverse Stock Split occurs. Except for the right to receive the cash payment in lieu of fractional shares, stockholders will not have any voting, dividend or other rights with respect to the fractional shares they would otherwise be entitled to receive.

Stockholders should be aware that, under the escheat laws of the various jurisdictions where stockholders may reside, where we are domiciled, and where the funds will be deposited, sums due for fractional interests that are not timely claimed after the effective date of the Reverse Stock Split may be required to be paid to the designated agent for each such jurisdiction, unless correspondence has been received by us or the exchange agent concerning ownership of such funds within the time permitted in such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds will have to seek to obtain them directly from the state to which they were paid.

With respect to awards granted under the Equity Plans, the number of shares of Common Stock issuable thereunder will be rounded down to the nearest whole share of Common Stock, in order to comply with the requirements of Sections 409A and 424 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”).

17

Determination of the Reverse Stock Split Ratio

The Board believes that stockholder approval of a range of potential Reverse Stock Split ratios is in the best interests of our Company and stockholders because it is not possible to predict market conditions at the time the Reverse Stock Split would be implemented. We believe that a range of Reverse Stock Split ratios provides us with the most flexibility to achieve the desired results of the Reverse Stock Split. The Reverse Stock Split ratio to be selected by our Board will be not more than 1-for-50.

The selection of the specific Reverse Stock Split ratio will be based on several factors, including, among other things:

| • | our ability to maintain the listing of our Class A Common Stock on the NYSE; |

| • | the per share price of our Class A Common Stock immediately prior to the Reverse Stock Split; |

| • | the expected stability of the per share price of our Class A Common Stock following the Reverse Stock Split; |

| • | the likelihood that the Reverse Stock Split will result in increased marketability and liquidity of our Class A Common Stock; |

| • | prevailing market conditions; |

| • | general economic conditions in our industry; and |

| • | our market capitalization before and after the Reverse Stock Split. |

We believe that granting our Board the authority to set the ratio for the Reverse Stock Split is essential because it allows us to take these factors into consideration and to react to changing market conditions. If the Board chooses to implement the Reverse Stock Split, we will make a public announcement regarding the determination of the Reverse Stock Split ratio.

Board Discretion to Effect the Reverse Stock Split

If the Reverse Stock Split Proposal is approved by our stockholders, the Reverse Stock Split will only be effected upon a determination by the Board, in its sole discretion, that filing the Charter amendment to effect the Reverse Stock Split is in the best interests of our Company and stockholders. This determination by the Board will be based upon a variety of factors, including those discussed under “—Determination of the Reverse Stock Split Ratio” above. We expect that the primary focus of the Board in determining whether or not to file the Reverse Stock Split Charter amendment will be whether we will be able to obtain and maintain a continued price of at least $1.00 per share of our Class A Common Stock on the NYSE without effecting the Reverse Stock Split.

Effective Time of the Reverse Stock Split

If the Reverse Stock Split Proposal is approved by our stockholders, the Reverse Stock Split would become effective, if at all, when the Reverse Stock Split Charter amendment is filed with the office of the Secretary of State of the State of Delaware or at the effective time set forth in the Reverse Stock Split Charter amendment. However, notwithstanding approval of the Reverse Stock Split Proposal by our stockholders, the Board will have the sole authority to elect whether or not and when to amend our Charter to effect the Reverse Stock Split; provided, however, the implementation of such amendment shall be before December 31, 2024.

Effect on Registered “Book-Entry” Holders of Common Stock

Holders of Common Stock may hold some or all of their Common Stock electronically in book-entry form (“street name”) under the direct registration system for securities. These stockholders will not have stock

18

certificates evidencing their ownership. They are, however, provided with a statement reflecting the number of shares of Common Stock registered in their accounts. If you hold registered Class A Common Stock in book-entry form, you do not need to take any action to receive your post-split shares, if applicable.

Appraisal Rights

Under the Delaware General Corporation Law, our stockholders are not entitled to appraisal or dissenter’s rights with respect to the Reverse Stock Split, and we will not independently provide our stockholders with any such rights.

Regulatory Approvals

The Reverse Stock Split will not be consummated, if at all, until after approval of our stockholders is obtained. We are not obligated to obtain any governmental approvals or comply with any state or federal regulations in order to effect the Reverse Stock Split other than the filing of the Reverse Stock Split Charter amendment with the Secretary of State of the State of Delaware.

Accounting Treatment of the Reverse Stock Split

If the Reverse Stock Split is effected, the par value per share of our each of our Class A Common Stock and Class B Common Stock will remain unchanged at $0.00001. Accordingly, on the effective date of the Reverse Stock Split, the stated capital on our consolidated balance sheets attributable to our Common Stock will be reduced in proportion to the size of the Reverse Stock Split ratio, and the additional paid-in-capital account will be increased by the amount by which the stated capital is reduced. Our stockholders’ equity, in the aggregate, will remain unchanged. Per share net income or loss will be increased because there will be fewer shares of Class A Common Stock outstanding. Any Common Stock held in treasury will be reduced in proportion to the Reverse Stock Split ratio. The Company does not anticipate that any other accounting consequences, including changes to the amount of stock-based compensation expense to be recognized in any period, will arise as a result of the Reverse Stock Split.

Certain Material U.S. Federal Income Tax Consequences of the Reverse Stock Split to U.S. Holders

The following discussion is a summary of certain material U.S. federal income tax consequences of the Reverse Stock Split applicable to U.S. holders (as defined below). This discussion does not purport to be a complete analysis of all potential tax consequences that may be relevant to a U.S. holder. The effects of U.S. federal tax laws other than U.S. federal income tax laws, such as estate and gift tax laws, and any applicable state, local or non-U.S. tax laws are not discussed. This discussion is based on the Code, United States Treasury Regulations promulgated thereunder (whether final, temporary or proposed) (the “Treasury Regulations”), judicial decisions, and published rulings and administrative pronouncements of the IRS, in each case as available and in effect as of the date hereof. These authorities may change or be subject to differing interpretations. Any such change or differing interpretation may be applied retroactively in a manner that could adversely affect a U.S. holder. We have not sought and do not intend to seek any rulings from the IRS regarding the matters discussed below. There can be no assurance the IRS or a court will not take a position contrary to that discussed below regarding the tax consequences of the Reverse Stock Split. Furthermore, no opinion of counsel has been or will be rendered with respect to the tax consequences of the Reverse Stock Split.

This discussion is limited to U.S. holders that hold Common Stock as a “capital asset” within the meaning of Section 1221 of the Code (generally, property held for investment). This discussion does not address all U.S. federal income tax consequences relevant to a U.S. holder’s particular circumstances, including the impact of the alternative minimum tax, the rules related to “qualified small business stock” within the meaning of Section 1202

19

of the Code or the Medicare contribution tax on net investment income. In addition, it does not address consequences relevant to U.S. holders subject to special rules, including, without limitation:

| • | Certain U.S. expatriates and former citizens or long-term residents of the United States; |

| • | U.S. holders whose functional currency is not the U.S. dollar; |

| • | persons holding Common Stock as part of a hedge, straddle or other risk reduction strategy or as part of a conversion transaction or other integrated investment; |

| • | banks, insurance companies, and other financial institutions; |

| • | real estate investment trusts or regulated investment companies; |

| • | brokers, dealers or traders in securities; |

| • | corporations that accumulate earnings to avoid U.S. federal income tax; |

| • | S corporations, partnerships or other entities or arrangements treated as partnerships for U.S. federal income tax purposes (and investors therein); |

| • | tax-exempt organizations or governmental organizations; |

| • | persons deemed to sell Common Stock under the constructive sale provisions of the Code; |

| • | persons required to accelerate the recognition of any item of gross income with respect Common Stock as a result of such income being recognized on an applicable financial statement; |

| • | beneficial owners of Company Stock that are not U.S. Holders; or |

| • | persons who hold or received Class A Common Stock pursuant to the exercise of any employee stock option or otherwise as compensation; and tax-qualified retirement plans. |

For purposes of this discussion, “U.S. holder” is a beneficial owner of Company Stock that for U.S. federal income tax purposes is:

| • | An individual who is a citizen or resident of the United States, as determined for U.S. federal income tax purposes; |

| • | A corporation (or other entity taxable as a corporation for U.S. federal income tax purposes) created or organized under the laws of the United States or any state thereof or the District of Columbia; |

| • | A trust, the substantial decisions of which are controlled by one or more United States persons and which is subject to the primary supervision of a United States court, or a trust that has validly elected under applicable Treasury regulations to be treated as a United States person for U.S. federal income tax purposes; or |

| • | An estate that is subject to U.S. federal income tax on its income regardless of source. |

If an entity or arrangement that is treated as a partnership for U.S. federal income tax purposes holds Common Stock, the tax treatment of a partner in the partnership will generally depend on the status of the partner, the activities of the partner and the partnership and certain determinations made at the partner and partnership levels. This discussion does not address the tax consequences to any such partner or partnership. Accordingly, partnerships holding Common Stock and the partners in such partnerships should consult their tax advisors regarding the U.S. federal income tax consequences to them.

THIS DISCUSSION IS FOR INFORMATION PURPOSES ONLY AND IS NOT TAX ADVICE. IN ADDITION, THE U.S. FEDERAL INCOME TAX TREATMENT OF THE BENEFICIAL OWNERS OF

20