- HHR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

DRS Filing

HeadHunter (HHR) DRSDraft registration statement

Filed: 12 Dec 17, 12:00am

As confidentially submitted to the Securities and Exchange Commission on December 11, 2017

This draft registration statement has not been publicly filed with the United States Securities and Exchange Commission and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FormF-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Zemenik Trading Limited(1)

(Exact Name of Registrant as Specified in its Charter)

Not Applicable

(Translation of Registrant’s Name into English)

| Cyprus | 7370 | Not Applicable | ||

(State or other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Dositheou, 42

Strovolos, 2028, Nicosia

Cyprus

+357-22-418200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Cogency Global Inc.

10 E. 40th Street, 10th floor

New York, NY 10016

+1-800-600-9540

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

J. David Stewart Latham & Watkins LLP Ul. Gasheka 6 Ducat III, Office 510 Moscow, 125047 Russia +7-495-785-1234 | David C. Boles Latham & Watkins (London) LLP 99 Bishopsgate London EC2M 3XF United Kingdom +44-20-7710-1000 | Darina Lozovsky White & Case LLP 5 Old Broad Street London EC2N 1DW United Kingdom +44-20-7532-1000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company. ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

| ||||

Title of Each Class of Securities to be Registered(1) | Proposed Maximum Offering Price(2)(3) | Amount of Registration Fee(4) | ||

Ordinary shares, per share | $ | $ | ||

| ||||

| ||||

| (1) | American depositary shares issuable upon deposit of the ordinary shares registered hereby will be registered under a separate registration statement on FormF-6 (RegistrationNo. 333- ). Each American depositary share represents ordinary share(s). |

| (2) | Includes the aggregate offering price of additional ordinary shares represented by American depositary shares that the underwriters have an option to purchase. |

| (3) | Estimated solely for purpose of calculating the amount of registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended. |

| (4) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

| (1) | Prior to the completion of this offering, Zemenik Trading Limited will be converted from a private limited company incorporated in Cyprus into a public limited company incorporated in Cyprus, and we will change our corporate name from Zemenik Trading Limited pursuant to a special resolution at a general meeting of the shareholders to HeadHunter Group PLC. The legal effect of the conversion of Zemenik Trading Limited under Cypriot law will be limited to the change of legal form. |

The information in this preliminary prospectus is not complete and may be changed. The Selling Shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and the Selling Shareholders are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2017

PRELIMINARY PROSPECTUS

American Depositary Shares

Zemenik Trading Limited

American Depositary Shares Representing

Ordinary Shares

$ per ADS

This is the initial public offering of American Depositary Shares, or ADSs, of Zemenik Trading Limited, a private limited company organized under the laws of Cyprus. Each ADS will represent ordinary share(s). Our existing shareholders, Highworld Investments Limited, a subsidiary of Elbrus Capital Fund II, L.P. and Elbrus Capital Fund IIB, L.P. (together, “Elbrus Capital”), and ELQ Investors VIII Limited, a subsidiary of GS Group Inc. (together with Highworld Investments Limited, the “Selling Shareholders”), are offering of our ADSs in this offering. We will not receive any proceeds from the sale of ADSs by the Selling Shareholders. We currently expect the initial public offering price to be between $ and $ per ADS.

The underwriters may also exercise their option to purchase up to additional ADSs from the Selling Shareholders at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

We intend to apply to have our ADSs listed on under the symbol “HHR.”

We are a “controlled company” under the corporate governance rules of . See “Management—Controlled Company Exemption.”

We are both an “emerging growth company” and a “foreign private issuer” under applicable U.S. Securities and Exchange Commission rules and will be eligible for reduced public company disclosure requirements. See “Prospectus Summary—Implications of Being an ‘Emerging Growth Company’ and a ‘Foreign Private Issuer.’”

Investing in our ADSs involves risks. See “Risk Factors” beginning on page 19.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per ADS | Total | |||||||

Initial Public Offering Price | $ | $ | ||||||

Underwriting Discount(1) | $ | $ | ||||||

Proceeds to the Selling Shareholders (before expenses) | $ | $ | ||||||

| (1) | We refer you to “Underwriting (Conflicts of Interest)” for additional information regarding underwriting compensation. |

The underwriters expect to deliver the ADSs to purchasers on or about , 2018 through the book-entry facilities of The Depository Trust Company.

| Morgan Stanley | Credit Suisse | VTB Capital |

BofA Merrill Lynch

, 2018

| * | Data as of June 30, 2017 |

| † | Data for the six months ended June 30, 2017 |

| 1 | ||||

| 19 | ||||

| 55 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| 62 | ||||

| 67 | ||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 75 | |||

| 111 | ||||

| 131 | ||||

| 135 | ||||

| 141 | ||||

| 143 | ||||

| 147 | ||||

| 163 | ||||

| 165 | ||||

| 172 | ||||

| 186 | ||||

| 193 | ||||

| 194 | ||||

| 194 | ||||

| 195 | ||||

| 196 | ||||

| F-1 |

For investors outside the United States: Neither we, the Selling Shareholders nor the underwriters have taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our ADSs and the distribution of this prospectus outside the United States.

We are incorporated in Cyprus, and a majority of our outstanding securities are owned bynon-U.S. residents. Under the rules of the U.S. Securities and Exchange Commission (“SEC”) we are currently eligible for treatment as a “foreign private issuer.” As a foreign private issuer, we will not be required to file periodic reports and financial statements with the SEC as frequently or as promptly as domestic registrants whose securities are registered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

We are responsible for the information contained in this prospectus. Neither we nor the Selling Shareholders have authorized anyone to provide you with different information, and neither we nor the Selling Shareholders take responsibility for any other information others may give you. We, the Selling Shareholders, and the underwriters are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than its date regardless of the time of delivery of this prospectus or of any sale of the ADSs.

i

ABOUT THIS PROSPECTUS

Except where the context otherwise requires or where otherwise indicated, the terms “Zemenik,” “HeadHunter,” the “Company,” “Group,” “we,” “us,” “our,” “our company” and “our business” refer to Zemenik Trading Limited, together with its consolidated subsidiaries as a consolidated entity, during the Successor periods described below, and to Headhunter FSU Limited, together with its consolidated subsidiaries as a consolidated entity, during the Predecessor period described below.

All references in this prospectus to “rubles,” “RUB” or “P” refer to Russian rubles, the terms “dollar,” “USD” or “$” refer to U.S. dollars and the terms “€” or “euro” refer to the currency introduced at the start of the third stage of European economic and monetary union pursuant to the treaty establishing the European Community, as amended.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

We report under International Financial Reporting Standards (“IFRS”) as adopted by the International Accounting Standards Board (the “IASB”). None of our financial statements were prepared in accordance with generally accepted accounting principles in the United States. We present our consolidated financial statements in rubles.

On February 24, 2016, Zemenik Trading Limited acquired all of the outstanding equity interests of Headhunter FSU Limited (the “Acquisition”) from Mail.Ru Group Limited (LSE: MAIL) (“Mail.Ru”). As a result, the financial information provided in this registration statement is financial information of Headhunter FSU Limited when labeled as “Predecessor” and financial information of Zemenik Trading Limited when labeled as “Successor” to indicate whether such information relates to the period preceding the Acquisition or the period succeeding the Acquisition, respectively. Due to the change in the basis of accounting resulting from the Acquisition, the consolidated financial statements for the Predecessor periods and the consolidated financial statements for the Successor periods included elsewhere in this prospectus are not necessarily comparable.

Prior to the completion of this offering, Zemenik Trading Limited will be converted from a private limited company incorporated in Cyprus into a public limited company incorporated in Cyprus and we will change our corporate name from Zemenik Trading Limited pursuant to a special resolution at a general meeting of the shareholders to HeadHunter Group PLC. The legal effect of the conversion of Zemenik Trading Limited under Cypriot law will be limited to the change of legal form. Following such corporate conversion, the historical consolidated financial statements of Zemenik Trading Limited included in this registration statement will become the historical consolidated financial statements of HeadHunter Group PLC.

In this prospectus, we define (i) the Successor period for the six months ended June 30, 2017 as the “Successor 2017 Interim Period,” (ii) the Predecessor period from January 1 to February 23, 2016 as the “Predecessor 2016 Stub Period,” (iii) the Successor period from February 24 to June 30, 2016 as the “Successor 2016 Interim Period,” (iv) the Successor period from February 24 to December 31, 2016 as the “Successor 2016 Period,” (v) the Predecessor year ended December 31, 2015 as the “Predecessor 2015 Period” and (vi) the Predecessor year ended December 31, 2014 as the “Predecessor 2014 Period.”

In order to improve the comparability of the year ended December 31, 2016 to the Predecessor 2015 Period and the Successor 2017 Interim Period to the six months ended June 30, 2016, we have included supplemental unauditedpro forma consolidated financial information of the Group for the year ended December 31, 2016 and the six months ended June 30, 2016, respectively, in each case as if the Acquisition had occurred on January 1, 2016. See“Unaudited Pro Forma Consolidated Financial Data.” The supplemental unauditedpro forma consolidated financial information of the Group for the year ended December 31, 2016 and six months ended June 30, 2016 has been prepared solely for the purpose of this prospectus and is not prepared in the ordinary course of our financial reporting and has not been audited or reviewed by our Independent Registered Public Accounting Firm. The supplemental unauditedpro forma consolidated financial information of the Group for the

ii

year ended December 31, 2016 and the six months ended June 30, 2016 has been presented for illustrative purposes only and does not purport to represent what our financial results would have actually been had the Acquisition occurred on January 1, 2016, nor does it purport to project our financial results for any future period or our financial condition at any future date.

Use ofNon-IFRS Financial Measures

Certain parts of this prospectus containnon-IFRS financial measures, including EBITDA, Adjusted EBITDA and Adjusted Net Income. We define:

| • | EBITDA as net income or net loss plus: (1) income tax expense; (2) net interest income or expense; and (3) depreciation and amortization. |

| • | Adjusted EBITDA as net income or net loss plus: (1) income tax expense; (2) net interest income or expense; (3) depreciation and amortization; (4) transaction costs related to business combinations; and (5) gain on the disposal of subsidiary. |

| • | Adjusted Net Income as net income or net loss plus: (1) transaction costs related to the Acquisition; (2) gain on the disposal of subsidiary; (3) transaction costs related to the disposal of subsidiary; (4) amortization of intangible assets recognized upon the Acquisition and (5) the tax effect of the adjustment described in (4). |

EBITDA, Adjusted EBITDA and Adjusted Net Income are used by our management to monitor the underlying performance of the business and its operations. EBITDA, Adjusted EBITDA and Adjusted Net Income are used by different companies for differing purposes and are often calculated in ways that reflect the circumstances of those companies. You should exercise caution in comparing EBITDA, Adjusted EBITDA and Adjusted Net Income as reported by us to EBITDA, Adjusted EBITDA and Adjusted Net Income as reported by other companies. EBITDA, Adjusted EBITDA and Adjusted Net Income are unaudited and have not been prepared in accordance with IFRS or any other generally accepted accounting principles.

EBITDA, Adjusted EBITDA and Adjusted Net Income are not measurements of performance under IFRS or any other generally accepted accounting principles, and you should not consider EBITDA, Adjusted EBITDA or Adjusted Net Income as an alternative to net income, operating profit or other financial measures determined in accordance with IFRS or other generally accepted accounting principles. EBITDA, Adjusted EBITDA and Adjusted Net Income have limitations as analytical tools, and you should not consider them in isolation. Some of these limitations are:

| • | EBITDA, Adjusted EBITDA and Adjusted Net Income do not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments, |

| • | EBITDA, Adjusted EBITDA and Adjusted Net Income do not reflect changes in, or cash requirements for, our working capital needs, and |

| • | the fact that other companies in our industry may calculate EBITDA, Adjusted EBITDA and Adjusted Net Income differently than we do, which limits their usefulness as comparative measures. |

Accordingly, prospective investors should not place undue reliance on EBITDA, Adjusted EBITDA, Adjusted Net Income or the othernon-IFRS financial measures contained in this prospectus.

iii

We obtained the industry, market and competitive position data in this prospectus from our own internal estimates and research as well as from publicly available information, industry and general publications and research, surveys and studies conducted by third parties. There are a number of studies that address either specific market segments, or regional markets, within our industry. However, given the rapid changes in our industry and the markets in which we operate, no industry research that is generally available covers some of the trends we view as key to understanding our industry and our place in it, such as the traffic on job and employment websites worldwide and in Russia in particular.

We believe that it is important that we maintain as broad a view on industry developments as possible. We have retained consultants to prepare general industry and market studies for us, including individual analyses of the online recruitment markets in the markets in which we operate, including the report called “Online recruitment landscape in Russia” by J’Son & Partners the report called “Report on Brand Recognition” by Socis MR Rus and the report called “Research on Loyalty and Satisfaction of LLC Headhunter Clients” by Ipsos Comcon. Where we refer to “Ipsos” throughout this prospectus, this reference is to the Ipsos Comcon report, which is based on the results of the “HeadHunter customer satisfaction” research conducted in November 2016 by Ipsos Komkon LLC in Russian cities with 1,004 participating representatives from companies that are current customers of the Company, consisting of employees responsible for staff recruitment and directly interacting with the Company. The Company provided the employee database used by Ipsos Komkon LLC.

To assist us in formulating our business plan and in anticipation of this offering, we retained J’Son & Partners in 2017 to provide an independent view of the online recruitment landscape in Russia, including an overview of recent macroeconomic and labor market dynamics, the evolution of the recruitment market over time and analysis of its underlying trends and potential growth factors, an assessment of the current competitive landscape and other relevant topics. In connection with the preparation of the J’Son & Partners’ report, we furnished to J’Son & Partners certain historical information about our company and some data available on the competitive environment. J’Son & Partners, in conjunction with third-party experts with extensive experience in the Russian recruitment business, conducted research in preparation of the report, including a study of market reports prepared by other parties and a study of a broad range of secondary sources including other market reports, association and trade press publications, other databases and other sources. We use the data contained in J’Son & Partners’ report to assist us in describing the nature of our industry and our position in it.

Due to the evolving nature of our industry and competitors, we believe that it is difficult for any market participant, including us, to provide precise data on the market or our industry. However, we believe that the market and industry data we present in this prospectus provide accurate estimates of the market and our place in it. Industry publications and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as other forward-looking statements in this prospectus.

TRADEMARKS, SERVICE MARKS AND TRADENAMES

We have proprietary rights to trademarks used in this prospectus that are important to our business, many of which are registered under applicable intellectual property laws.

Solely for convenience, the trademarks, service marks, logos and trade names referred to in this prospectus are without the® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names. This prospectus contains additional trademarks, service marks and trade names of others, which are the property of their respective owners. All trademarks, service marks and trade names appearing in this prospectus are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

iv

This summary highlights information contained in more detail elsewhere in this prospectus. This summary may not contain all the information that may be important to you, and we urge you to read this entire prospectus carefully, including the “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and our consolidated audited and condensed consolidated unaudited financial statements, including the notes thereto, included in this prospectus, before deciding to invest in our ADSs.

Overview

We are the leading online recruitment platform in Russia and the Commonwealth of Independent States (“CIS”) and focus on connecting job seekers with employers. We offer potential employers and recruiters paid access to our extensive curriculum vitae (“CV”) database and job postings platform. We also provide both job seekers and employers with a broad range of human resource (“HR”) value added services (“VAS”). Our brand and the strength of our platform allow us to generate significant traffic, over 87% of which was free for us as of August 2017 according to our internal data, and we were the third most visited job and employment website globally as of September 1, 2017, according to the latest available data from SimilarWeb. Our CV database contained 15.2 million, 19.2 million, 23.0 million and 25.1 million CVs as of December 31, 2014, 2015, 2016 and June 30, 2017, respectively, and our platform hosted a daily average of more than 288,000, 304,000, 363,000 and 366,000 job postings in the years ended December 31, 2014, 2015 and 2016 and the six months ended June 30, 2017, respectively. For the years ended December 31, 2014, 2015 and 2016 and the six months ended June 30, 2017, our platform averaged 13.5 million, 16.3 million, 16.7 million and 17.1 million unique visitors per month, respectively, according to LiveInternet.

Our user base consists primarily of job seekers who use our products and services to discover new career opportunities. The majority of the services we provide to job seekers are free. Our customer base consists primarily of businesses using our CV database and job posting service to fill vacancies inside their organizations.

The quality and quantity of CVs in our database attract an increasing number of customers, which leads to more job seekers turning to us as their primary recruitment and related services provider, creating a powerful network effect that has allowed us to continuously solidify our market leadership and increase the gap between us and our competitors.

Our customers also increasingly use our HR VAS. Our portfolio of VAS is constantly evolving, allowing us to meet the developing needs of our customer base, which we believe has a positive impact on our retention rates and revenue per customer. We are working to expand the range of services we offer to create a comprehensive, integrated full-scale HR platform, which we believe will not only allow us to capture each link of the recruitment value chain, from sourcing candidates for our customers,pre-selecting them and onboarding them once selected, but also to expand into other HR activities such as HR workflow management, compensation and benefits, education, assessment and others.

We were founded in 2000 and have successfully established a strong, trusted brand and the leading market position, which have enabled us to achieve significant growth in recent years. We had a total of over 120,000 paying customers on our platform for the six months ended June 30, 2017. We have a highly diversified customer base, representing the majority of the industries active in the Russian economy. Our brand awareness is one of the highest among the Russian online recruitment players, according to Socis MR Rus, which, coupled with a nationwide sales force and broad customer reach, creates barriers for new entrants to our markets.

1

We engage with job seekers and employers via our desktop sites, mobile sites and mobile applications. Since launch, our mobile applications have been downloaded 8.1 million times cumulatively as of June 30, 2017, and our mobile platforms currently account for the majority of our traffic. Our scalable technology platform utilizes an increasingly clear and simple user interface enhanced by our search engine, which is powered by artificial intelligence (“AI”) and machine learning algorithms.

Our total revenue wasP3,109 million,P3,104 million,P453 million,P3,287 million,P3,740 million andP2,176 million in the Predecessor 2014 Period, the Predecessor 2015 Period, the Predecessor 2016 Stub Period, the Successor 2016 Period, thepro forma year ended December 31, 2016 and the Successor 2017 Interim Period, respectively. In addition to our growth, we have consistently maintained strong profitability and high cash conversion.

Our Industry

Russia is the 12th largest economy in the world, with a GDP of $1,283 billion in 2016 according to the World Bank, and was the 9th most populous country, with a population of 147 million as of December 31, 2016, according to the Federal State Statistics Service (“Rosstat”). Following an economic downturn in 2014 and 2015, Russia is expected to return to economic growth in 2017, according to the Ministry of Economic Development (“MED”). Russia has the largest Internet audience among European countries with 82 million users in the summer of 2017, and an Internet penetration rate of approximately 70% of the population above 18 years old, according to the Fund Public Opinion (“FOM”). The Internet has become an integral part of Russian consumers’ lifestyle, resulting in many activities and services, including job search, migrating online.

Although Russia had a large labor force of approximately 76.6 million people on average in 2016 according to Rosstat, local businesses are experiencing a shortage of employees, which translates into a low unemployment rate, high turnover of employees and wage growth above real GDP growth. Competition for human capital supported the rapid expansion of job advertising services industry in the past decade. At the same time, as Internet usage becomes ubiquitous, job searching is moving online and increasingly to mobile platforms, and both employers and job seekers are rapidly adopting online services.

Recovery of the Russian Economy

The Russian economy demonstrated a return to positive growth in 2017 due to strong oil prices, high personal consumption and decreasing inflation and interest rates. Russia experienced 1.5% real GDP growth in the first half of 2017, as compared to the first half of 2016, according to Rosstat. The MED expects Russia’s GDP to grow at approximately 2.1% to 2.3% CAGR in real terms from 2017 to 2020, supported by the recovery in domestic demand as result of easing financial conditions and improving consumer confidence.

Large Internet Audience and Ubiquitous Internet Usage

Russia’s Internet audience has experienced significant growth over the last decade, bolstered by economic growth, the increasing affordability of personal computers and mobile devices and substantial investments in broadband infrastructure. According to the FOM, Russia’s monthly Internet audience was approximately 82 million users in the summer of 2017, translating into an Internet penetration rate of approximately 70%, of the population above 18 years old, almost tripling the levels from July 2007.

The significant growth in Internet penetration rates has resulted in the shift of everyday activities of consumers and businesses online, further supported by the availability of websites and mobile applications catering to the various needs of consumers and businesses and an expansion in the range of services offered online, including job search.

2

Shift of Marketing Expenditure Online

As Internet usage is rapidly growing and consumers are spending more time online and on mobile devices, a larger share of marketing budgets is being allocated to online media. In Russia, the share of total marketing spend on TV, newspapers, outdoor, radio and other offline media declined from 88% in 2010 to 62% in 2016, while the share of advertising budgets allocated to online media increased from 12% in 2010 to 38% in 2016, according to the Association of Communication Agencies of Russia. Despite significant growth over the last six years, the online advertising market in Russia is far from realizing its full potential. For example, the share of marketing budgets spent online is significantly lower than the same share in China (53% in 2016) or the United Kingdom (55% in 2016), according to Zenith.

Russian Labor Market Structure and Fundamentals Support Growing Competition for Human Capital

The Russian labor market has historically had a number of fundamental characteristics that have resulted in a shortage of highly skilled and talented employees, high turnover of employees and real wage growth exceeding real GDP growth and consumer inflation rates. Although employee turnover and real wages declined during the last economic downturn, the fundamental market characteristics remain largely intact and are expected to continue to support strong competition for human capital, resulting in increased marketing spending on job advertising as the economy rebounds.

Growing Popularity of Online Recruitment Services

Historically, Russian companies looked for talent using offline recruitment services such as print classifieds, local newspapers, recruitment events and offline job advertising. As the use of Internet services among businesses and employees has increased, job advertising and HCM services have started migrating online and to mobile platforms. According to J’Son & Partners, the share of job postings advertised online is expected to increase from 20% in 2016 to 37% by 2020.

Russian Online Recruitment Market Size

According to J’Son & Partners, the Russian online recruitment market returned to growth in 2016 after a year of stagnation driven by the economic downturn in 2014 and 2015. J’Son & Partners estimates that the size of the market was approximatelyP6.2 billion in 2016 and expects it to grow at a CAGR of 22.8% and reach approximatelyP14.2 billion by 2020. This growth is expected to be primarily driven by a combination of an increase in the number of small and medium enterprises using online recruitment services, wider adoption of online recruitment in the Russian regions and the enhanced monetization of online recruitment services. Online recruitment platforms accounted for approximately 62% of total recruitment spend in Russia in 2016 and are expected to reach 76% of total spend by 2020, based on J’Son & Partners’ estimates. The share of recruitment spend by other online channels, mainly represented by professional social networks and social media, decreased from 6.2% in 2015 to 3.3% in 2017, following the blocking of LinkedIn in Russia. By 2020, J’Son & Partners expects the share of other online channels to increase to 6.4% of the Russian online recruitment market.

3

Our Strengths

We are the leading online recruitment platform in Russia and CIS and provide a broad range of HR services. We operate in a high growth market, as HR services globally are undergoing continuous digitalization and the Russian market remains significantly underpenetrated in terms of the share of online recruitment spend relative to GDP. We believe the following competitive strengths have contributed to our success.

Number one online recruitment platform in Russia with a leading position in other CIS countries

We are the leading online recruitment platform in Russia, focusing on facilitating the recruitment process and connecting millions of job seekers with hundreds of thousands of employers annually. We are also the leading player in Kazakhstan and Belarus and are among the top three players in Kyrgyzstan and Uzbekistan, which makes us a leader in online recruitment in the CIS region.

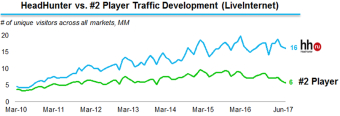

We have more visible CVs in our database and more job postings on our platform than any of our direct competitors. We are also among the most visited online recruitment websites in our markets, with 17.1 million unique monthly visitors (“UMVs”) coming to our website on average during the six months ended June 30, 2017, which is approximately three times more than our closest peer, according to LiveInternet. We enjoy strong user traffic dynamics and are the third largest job and employment website based on this metric globally, according to the latest data available from SimilarWeb as of October 1, 2017.

Our strong operational performance has contributed to our clear number one position in the Russian market by revenue, which was almost three times higher than that of our closest online peer in the year ended December 31, 2016, according to J’Son & Partners.

Powerful network effect reinforcing our market leading position

Our extensive, high quality CV database (the owners of 15 million CVs, or more than 80% of our total visible CVs, have applied at least once for a job posting in the last two years), large database of job postings relevant to job seekers and significant user traffic create a strong network effect as employers and job seekers tend to use job classifieds resources that offer the widest range of options and the highest efficiency. This creates a cycle that reinforced our market leadership position and increased the gap between us and our competitors, despite the economic downturn in Russia in 2014 and 2015, as demonstrated by the following key performance metrics:

| • | Job postings: The number of job postings on our website grew at a CAGR of 12% from 2014 to 2016. |

| • | CVs: The number of visible CVs in our database increased at a CAGR of 24% from 2014 to 2016. |

| • | User traffic: The number of UMVs to our website increased at a CAGR of 11% from 2014 to 2016, while the gap with our nearest competitor based on this metric increased by 2.7 million UMVs, or 44%, according to LiveInternet. This gap has increased by approximately seven times since 2010, as demonstrated by the chart below. |

4

We believe that our strong leadership position is highly defensible, and that it is becoming increasingly difficult for our competitors to overcome this competitive moat, as demonstrated by our consistent revenue growth linked to the growth of our key operating metrics presented above.

Most recognized brand and nationwide technology-empowered sales function creating strong customer relationships

We believe that our brand and our sales function are distinct competitive advantages as we expand our product offering and enter new market segments.

As one of the first online recruitment platforms in Russia (operating since 2000), we have established “HeadHunter” as a strong brand withtop-of-mind brand awareness of 35%, which differentiates us from our competitors. Our nearest competitor hadtop-of-mind brand awareness of 27%, and other market participants hadtop-of-mind brand awareness in the single digits, according to Socis MR Rus as of June 2017. We were ranked first among career-focused websites in Russia by SimilarWeb as of October 1, 2017 based on user traffic. According to our internal data, as of August 2017, 47% of our traffic is direct, which includestype-in traffic and traffic from email distributions, and 87% of our traffic is free as of August 2017, which demonstrates strong user affinity for our brand and the high organic liquidity of our platform. We intend to further increase the popularity of our brand and user loyalty through the efficient use of TV and online advertising in our markets and by focusing on the high quality of our user experience and customer service.

Our sales function consists of a sales force with an established and extensive presence across Russia and the CIS, a well-developed customer support function and a fully integrated customer relationship management (“CRM”) platform, incorporating predictive analytics tools.

As of June 30, 2017, our sales force consisted of 214 sales professionals making it, we believe, one of the largest and most experienced sales forces in the market, and has helped us to become the online recruiting platform of choice for Russian employers. We have also created strong relationships with the corporate HR departments of some of our Key Accounts dating back more than 10 years, positioning us to successfully cross sell and upsell our existing and developing HR VAS. Our sales team is efficiently organized and strategically placed in Moscow, St. Petersburg and other regional offices, and is further specialized by industry and customer type. We have 96 professionals, for example, who are dedicated to selling services to Small and Medium Accounts and 76 professionals covering Key Accounts, each with specialized expertise and training. This structure allows us to provide truly local, individualized high quality service to our customers.

Our CRM system serves as a powerful tool for our sales function. It is linked to our main platform and, combined with predictive analytics tools, provides real time analysis of customer activity on our website and suggests relevant actions to our sales force.

The performance of our sales function has contributed to the growth in the number of customers paying for our services, while average revenue per customer (“ARPC”) within each annual customer vintage has been increasing over the last decade.

Robust business model generating diversified and growing revenue streams from a loyal customer base

Our business model is built around three key pillars of monetization: subscription-based access to our CV database, job posting fees and HR VAS. Our diversified revenue stream, including highly predictable, recurring subscription-based fees (for CV database access or bundled subscriptions) that accounted for 57% of our total revenue in 2016, allowed us to increase our revenue at a compound annual rate of 9.7% from 2014 to 2016 (including the economic downturn period in Russia), resulting in total revenue ofP3.7 billion in thepro forma year ended December 31, 2016.

5

We believe that our business model provides a substantial degree of protection from the volatility of economic cycles. Our customers are spread across many sectors of the Russian economy, diversifying our exposure and protecting our revenue from downturns and unfavorable developments in any single sector. Furthermore, our customer mix in Russia is becoming increasingly diverse, as the number of Small and Medium Accounts increased as a percentage of our total customer base (Small and Medium Accounts revenue grew by 55% in the Successor Interim 2017 Period compared to thepro forma six months ended June 30, 2016, while revenue from our Key Accounts grew by 26% in the same periods). The number of CVs in our database increased during the economic downturn in 2014 and 2015, which has generated increased monetization opportunities during economic recoveries as employers are attracted to a greater pool of active job seekers on our platform.

We strive to maintain and further improve our high standards of customer service. According to a customer survey conducted by Ipsos in December 2016, our Net Promoter Score reached 68 points, which reflects our relentless focus on customer satisfaction. Our business model and customer-oriented approach allow us to maintain high rates of customer retention (for example, from 2010 to 2016, on average, 84% of Key Accounts returned in the year following their first purchase), while increasing ARPC (35% median CAGR for Key Accounts and 42% median CAGR for Small and Medium Accounts, where the median CAGR is defined as the median revenue CAGR from 2010 to 2016 within each customer vintage). Given the relatively low cost of our services, underpinned by the relatively low elasticity of demand for our services, we believe there is still significant room for increased monetization.

Superior profitability and cash flow generation profile

Capitalizing on our leading market position and the strong network effect, our scalable, asset-light, capital-efficient operating model allows us to expand our service offering and geographical footprint in our existing markets and increase our revenue from a growing customer base without significant investments, while maintaining negative working capital as we receive payments from customers for a number of our services in advance. This is reflected in our attractive profitability and cash conversion profile, both in the Russian and in the global context. Our Adjusted EBITDA margin in thepro forma year ended December 31, 2016 was 45%, and we believe that, considering the high operating leverage of our business and inspired by the example of the leading international players in their respective markets, we have significant further upside in margins as we further grow our market share and revenue base. We also achieved a healthy cash conversion ratio of 91% in thepro forma year ended December 31, 2016 (defined as Adjusted EBITDA less capital expenditures divided by Adjusted EBITDA, where capital expenditures consist of property and equipment additions, additions arising from internal development and other additions of intangible assets), which helps us to execute our growth strategy without additional external funding.

Best positioned to capture evolving opportunities in Human Capital Management (“HCM”)

Our experience in interacting with our extensive customer base and thousands of corporate HR specialists provides us with a deep understanding of our customers’ needs and gives us an opportunity to offer additional services to help them better track, hire and retain employees. We have created an evolving portfolio of HCM products, which we believe will allow us to increase customer engagement, customer retention and ARPC.

We have produced and are continuing to develop a number of HCM products and services with the goal of increasing our leadership in online recruiting process management and further penetrating HR budgets. We aim to be a“one-stop” solution for HR professionals and have developed products and services for recruitment, training and development, online assessment and compensation and benefits functions, all supported by our advanced HR analytics tools. Our Software-as-a-Service (“SaaS”)-based applicant tracking system (“ATS”) product, Talantix, which we launched in March 2017, has been gaining traction among our customer base. As of June 30, 2017, it was already used by 388 customers. We are further developing Talantix to serve as a unified hub for HCM services in the future, which we believe will help us get even closer to our customers, better understand their needs and challenges and enhance our customer experience and loyalty.

6

Our sales force is highly experienced in understanding HR systems and requirements, and how HR budgets are planned and spent by different types of corporate customers. Armed with this expertise and technology, our sales professionals are also strongly incentivized to successfully sell value added services via a motivation system designed to increase and realize the upsell potential of HCM products and services.

We believe that developing alternative models of engagement with our customers, such as ourcost-per-click (“CPC”) based ClickMe product and our freelance HR specialist market place, will further enhance our monetization opportunities as the job recruitment market evolves and keep us ahead of the competition in terms of our ability to efficiently react to changing market requirements and shift to an alternative business model if needed.

While we continue to develop our portfolio of HCM products, we believe that the number and quality of products we currently offer to our customers exceed our competitors’ current offerings. We consider our HCM portfolio to be a distinct competitive advantage, which helps us protect our revenue from competition and retain our customers through closer engagement, and we will continue investing in creating a comprehensive suite of HCM products.

Strong technology foundation and scalable infrastructure to support future growth

We have developed a sophisticated technology platform, focused on scalability and security, which allows us to create additional value, to improve monetization of our products and maintain our competitive edge.

Scalable and robust proprietary platform.Our IT infrastructure was built to be highly agile and scalable enabling us to expand our product portfolio while significantly growing our user base. The scalability of our technology platform allows us to handle large volumes of traffic without significant incremental capital investment. In addition, we do not use third-party proprietary IT tools to avoid vendor lock, and instead we utilize well known and proven open source tools.

Continuously improving technology Key Performance Indicators (“KPIs”).We work to the highest technology standards and aim to constantly improve our platform. The number of technical bugs per release decreased by 27% in the six months ended June 30, 2017 compared to the six months ended June 30, 2016. Business continuity for our customers is paramount to us, and we have demonstrated a 99.91% average uptime rate in the year ended December 31, 2016. We create different types of user interfaces for different users and simplify user interface forms depending on the context, which we believe improves conversion rates and increases monetization.

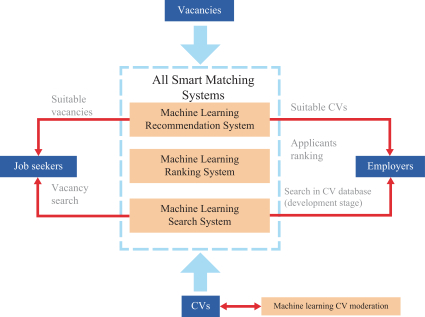

Extensively employing machine learning algorithms and artificial intelligence at all key stages of interaction with job seekers and customers.AI lies at the core of our platform, moderating 100% of incoming CVs (with 68% of all CVs ultimately approved for publication by AI in the six months ended June 30, 2017) and we use machine learning algorithms to rank CVs in our database and match candidates with the relevant vacancies. As a result, we save on costs associated with CV moderation while improving conversion throughout the job seeker’s funnel, thereby increasing the value of core services to our customers and laying a solid base for monetization enhancement.

Best mobile solution for job seekers and customers.We believe we are the leading HR mobile platform in Russia, with the majority of our traffic currently coming from mobile users. With both customers and job seekers increasingly demandingon-the-go andon-demand access to recruiting and HR services, we consider our mobile platform to be a strategic pillar of our business. We continuously enhance the user experience on our mobile apps and as of November 2017, our mobile app was ranked among the top business-related applications in iOS and Android appstore-generated lists in Russia, and since launch, our mobile applications have been downloaded 8.1 million times cumulatively as of June 30, 2017 and growing by 79% compared to June 30, 2016.

7

Data protection and security.We take protection of job seekers’ personal data and customers’ corporate data extremely seriously. All data between our servers and customers’ browsers is transmitted over secure protocols. We use monitoring and protection services to limit potential hacking attacks. Our application and database servers are located on an internal network that is isolated from the Internet and is additionally protected by a dual firewall. We perform regular penetration testing under multiple scenarios. Roskomnadzor inspects our compliance with applicable personal data processing laws, and we fully comply with all such requirements.

Strong and experienced management team backed by reputable international shareholder base

Our experienced management team has a proven track record of delivering on our focused and ambitious strategy as evidenced by our operating and financial results. Since 2010, our management has successfully grown the traffic gap between us and our key competitors, guided us through periods of macroeconomic uncertainty, defended our market positions against aggressive new market entrants and positioned us as the undisputed market leader in Russia and the CIS. We believe that our management team has a proven ability to identify key market opportunities, as demonstrated by our success in introducing AI and machine learning into HR processes, capturing the mobile trend and moving our services further into HR funnels, and has positioned us to capitalize on global HR trends as they gain relevance in our market.

We also benefit from the strong support of our shareholders—Elbrus Capital and GS Group Inc.—who bring best international practices and insights into our strategic development and corporate governance.

We believe that the skills, industry knowledge and operating expertise of our senior executives, combined with the support of our shareholders, provide us with a distinct competitive advantage as we continue to grow.

Our Growth Strategy

Consistent with the examples of the leading online classified businesses in both developed and emerging markets with certain “winner takes all” characteristics, we aim to continue growing faster than the Russian online recruitment market, thereby increasing our market share while maintaining profitability. To achieve our goals, we have designed our strategy around the following pillars:

Implement focused geographical expansion through deeper penetration into Russian regions

We plan to capitalize on the relatively low penetration level for online recruitment services in Russia, where the online recruitment sector accounted for only approximately 10% of the total job advertising market in 2016, according to J’Son & Partners, compared to selected developed markets in 2016 (e.g., 30% in Australia and 25% in Germany, according to J’Son & Partners). We were the leader by number of CVs in 73% of Russian regions as of June 28, 2017, and these regions collectively accounted for 77% of the Russian population, according to Rosstat data. We aim to continue expanding into Russian regions, focusing on cities with more than 100,000 inhabitants, where we believe high growth opportunities in our industry exist due to the ongoing shift from offline to online. The CAGR of our number of customers in the Russian regions, excluding Moscow and St. Petersburg, was 33% from 2014 to 2016, compared to 13% in Moscow and St. Petersburg during the same period, which demonstrates the importance of the regional focus of our geographical expansion strategy.

Besides benefiting from a steadily growing online recruitment market, we aim to gain market share from other regional and multi-regional online job classifieds platforms due to our strong competitive advantages, including our highly trained, local sales force, ability to publish job postings and CVs across broad geographies, technological edge and expansion of social media, TV and other marketing programs to further increase our brand awareness and engagement of job seekers and customers.

8

Continue expansion in attractive customer and job seeker segments

Increase the share of Small and Medium Accounts

We aim to substantially increase the number of Small and Medium Accounts on our platform, which we believe represent the most underpenetrated segment of the Russian job classifieds market. The number of our Small and Medium Accounts grew at a CAGR of 22% from 2014 to 2016, reaching approximately 97,000 accounts for the year ended December 31, 2016, while the number of Key Accounts grew on average by 6% during the same period, reaching approximately 15,000 accounts for the year ended December 31, 2016. Furthermore, the number of Small and Medium Accounts grew by 57% in the six months ended June 30, 2017, compared to the six months ended June 30, 2016.

Our key initiatives in this regard include:

| • | attracting additional candidates from regions and industries that are relevant to our Small and Medium Accounts; |

| • | increasing the effectiveness and engagement level of the Small and Medium Accounts-focused part of our sales function; |

| • | implementing offline and online advertising campaigns at a more granular, targeted level; and |

| • | simplifying and adopting our platform to better meet the needs of small and medium businesses (with a particular focus on onboarding requirements and user interface). |

Increase the share of blue collar job seekers and job postings

We aim to diversify our job seeker base and increase the number of blue collar professionals using our platform, who we believe are a segment of the Russian online job seeker market that has historically been hard to reach online and therefore represents significant potential. Our key initiatives in this regard include:

| • | further simplifying the CV preparation and application processes; |

| • | focusing on offline marketing channels, which have proven to be effective to date in attracting blue collar job seekers; |

| • | considering potential acquisitions of smaller competitors who have historically focused on blue collar job seekers; and |

| • | increasing and diversifying job vacancies posted on our platform. |

We believe these steps will allow us to better match the supply and demand for jobs in the Russian economy and simultaneously tap the fast growing segments of the industry.

Enhanced customer monetization potential

We believe there is significant untapped monetization potential in our business due to the relatively low costs of our services to our customers, in both absolute terms and compared to foreign markets, which we believe leads to relatively low elasticity of demand, particularly from large enterprises. We aim to further enhance our monetization opportunities in order to close the gap in our pricing, measured by annual revenue per UMV, between us and global industry peers. We have a demonstrated track record of increasing customer monetization in all corporate segments during the last decade.

We believe that these efforts will be further supported by our pricing power stemming from our clear market leadership position, which we expect to maintain and increase due to the continuing network effect described above.

9

We expect Russian labor market dynamics to further help us enhance monetization, as labor is expected to become a scarcer resource in Russia in the medium term. According to J’Son & Partners, the economically active population is expected to decrease from 76.6 million on average in 2016 to 75.2 million in 2020 according to Rosstat,which we believe should increase customer engagement and demand for online recruitment services.

We are continuously working on additional monetization opportunities by tailoring our product portfolio to offer our Key Accounts premium levels of existing and new services, as well as adapting pricing policies to suit particular customer segments.

Maintain technological edge across all platforms and ensure the best customer experience

We aim to sustain our technological leadership by capitalizing on our powerful AI and machine learning algorithms, growing our presence in the mobile space and developing newHR-related technologies, while ensuring a high level of data security and personal information protection.

We will continue to extensively use and develop AI technology and machine learning algorithms at all key stages of interaction with job seekers and employers, such as sales lead generation, CV flow moderation and our Smart Matching system. We aim to use our Smart Matching system to process and approve an even higher percentage of incoming CVs without manual intervention. Our main goals for our AI and machine learning algorithms are to further enhance smart search and matching functionality in job postings and our CV database, improve the quality of delivered value units and thereby increase the number of hirings facilitated by our platform.

We plan to pursue a platform agnostic approach and boost usage of our mobile platform by developing and improving access to a larger range of our services on “all screens.” Growing mobile internet and smartphone penetration in Russia is a major trend, and we aim to leverage this development to further increase our customer and job seeker reach. We consider mobile expansion to be not only a natural evolution of our desktop audience, but also a way to expand our ability to access such job seekers and customers who prefer mobile to desktop use. As of June 30, 2017, 37% of registered job seekers used our mobile platform only (including both mobile website and apps), while 43% used the desktop only. We continuously seek to enhance the functionality of our mobile platform. Our mobile app for job seekers now provides full functionality and we continue to add functionality to our mobile app for customers. As a result, we see a growing share of our traffic from mobile devices, reaching 52% for the six months ended June 30, 2017, and improving conversions of mobile traffic into applications from job seekers.

We continuously seek to improve our technology to meet the changing demands of our customers and job seekers. We focus on optimizing and simplifying our user interfaces and customizing them to meet the specific needs of particular user categories to further improve conversion rates and increase monetization. We also intend to introduce new features that we believe will resonate with our customers and job seekers. Currently, we are in the process of developing and introducing features such as mobile geo search, deeper HR data analytics, programmatic ads and ads auction sales, enrichment of applicant data and others.

We will continue applying stringent information security standards and consistently putting our IT systems through stress and access testing under different scenarios to meet new security IT challenges and to ensure the privacy and safety of our job seekers’ and customers’ data.

10

Continue evolution of our services into a comprehensive HCM platform

We plan to continue transforming our business into an integrated full-scale HCM platform by expanding the range of our HR VAS. We aim to increase revenue generated by our HR VAS in the medium term, driven by the development of the HR services market in Russia and by implementing the following key initiatives:

| • | continuously rolling out our SaaS-based ATS product, Talantix, and its enhanced functionality, leading to its increased adoption by our customers, expanding the breadth and depth of HR function coverage; |

| • | leveraging the expertise of our sales force to upsell HR VAS to our customer base; |

| • | increasing managerial and product development focus on HR VAS; and |

| • | developing additional HR VAS tailored to our Key Accounts’ and customers’ needs inpre-hire, hire and post-hire stages of recruitment, including online assessment and post-hire education, interview process, HR analytics and online salary comparison tools, applicants HR scoring and others. |

Corporate Information

We were incorporated in Cyprus on May 28, 2014 under the Cyprus Companies Law, Cap. 113 as Zemenik Trading Limited, and our registered office is located at 42 Dositheou Street, Strovolos, Nicosia, Cyprus.

The principal executive office of our key operating subsidiary, Headhunter LLC, is located at 9/10 Godovikova Street, Moscow, 129085 Russia. The telephone number at this address is +7 495974-6427. Our website address is www.hh.ru. The information contained on, or that can be accessed through, our website is not a part of, and shall not be incorporated by reference into, this prospectus. We have included our website address as an inactive textual reference only.

Risks Associated with our Business

Our business is subject to a number of risks that you should be aware of before making an investment decision. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth in the “Risk Factors” section of this prospectus in deciding whether to invest in our securities. Among these important risks are the following:

| • | significant competition in our markets; |

| • | our ability to maintain and enhance our brand; |

| • | our ability to improve our user experience, product offerings and technology platform to attract and retain job seekers; |

| • | our ability to respond effectively to industry developments; |

| • | our dependence on job seeker traffic to our websites; |

| • | our reliance on Russian Internet infrastructure; |

| • | global political and economic stability; |

| • | privacy and data protection concerns; |

| • | our ability to successfully remediate the existing material weaknesses in our internal control over financial reporting and our ability to establish and maintain an effective system of internal control over financial reporting; |

11

| • | our ability to effectively manage our growth; and |

| • | our ability to attract, train and retain key personnel and other qualified employees. |

Implications of Being an “Emerging Growth Company” and a “Foreign Private Issuer”

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”). As such, we are eligible, for up to five years, to take advantage of certain exemptions from various reporting requirements that are applicable to other publicly traded entities that are not emerging growth companies. These exemptions include:

| • | the ability to present more limited financial data, including presenting only two years of audited financial statements and only two years of selected financial data in the registration statement onForm F-1 of which this prospectus is a part; |

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”); |

| • | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board (“PCAOB”), regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| • | not being required to submit certain executive compensation matters to stockholder advisory votes, such as“say-on-pay,”“say-on-frequency” and“say-on-golden parachutes;” and |

| • | not being required to disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the completion of this offering or such earlier time that we are no longer an emerging growth company. As a result, we do not know if some investors will find our ADSs less attractive. The result may be a less active trading market for our ADSs, and the price of our ADSs may become more volatile.

Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 13(a) of the Exchange Act for complying with new or revised accounting standards. We are choosing to irrevocably opt out of this extended transition period and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required fornon-emerging growth companies. Under federal securities laws, our decision to opt out of the extended transition period is irrevocable.

We will remain an emerging growth company until the earliest of: (i) the last day of the first fiscal year in which our annual gross revenue exceeds $1.07 billion; (ii) the last day of the fiscal year during which the fifth anniversary of the date of this offering occurs; (iii) the date that we become a “large accelerated filer” as defined in Rule12b-2 under the Exchange Act, which would occur if the market value of our ADSs that are held bynon-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter; or (iv) the date on which we have issued more than $1.00 billion innon-convertible debt securities during any three-year period.

Upon consummation of this offering, we will report under the Exchange Act as anon-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a

12

foreign private issuer under the Exchange Act we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| • | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| • | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form10-Q containing unaudited financial and other specific information, or current reports on Form8-K, upon the occurrence of specified significant events. |

Both foreign private issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company, but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither an emerging growth company nor a foreign private issuer.

Status as a “Controlled Company”

Upon the completion of this offering, our shareholders, Highworld Investments Limited, an investment vehicle associated with Elbrus Capital, and ELQ Investors VIII Limited, an investment vehicle associated with GS Group Inc., will collectively own ordinary shares, representing % of the voting power of our issued and outstanding shares. As a result, we will remain a “controlled company” within the meaning of the listing rules and therefore we are eligible for, and, in the event we no longer qualify as a foreign private issuer, we intend to rely on, certain exemptions from the corporate governance listing requirements, of . See “Management—Controlled Company Exemption.”

13

The Offering

ADSs offered by the Selling Shareholders | ADSs, each representing ordinary share(s). |

Ordinary shares to be outstanding after this offering | ordinary shares. |

Option to purchase additional ADSs | The Selling Shareholders have granted the underwriters an option to purchase up to additional ADSs within 30 days of the date of this prospectus. |

American Depositary Shares | The underwriters will deliver our ordinary shares in the form of ADSs. Each ADS, which may be evidenced by an American Depositary Receipt (“ADR”) represents an ownership interest in of our ordinary share(s). As an ADS holder, we will not treat you as one of our shareholders. The depositary, , will be the holder of the ordinary shares underlying your ADSs. |

| You will have ADS holder rights as provided in the deposit agreement. Under the deposit agreement, you may only vote the ordinary shares underlying your ADSs if we ask the depositary to request voting instructions from you. The depositary will pay you the cash dividends or other distributions, if any, it receives on our ordinary shares after deducting its fees and expenses and applicable withholding taxes. You may need to pay a fee for certain services, as provided in the deposit agreement. |

| You are entitled to the delivery of the ordinary shares underlying your ADSs upon the surrender of such ADSs, the payment of applicable fees and expenses and the satisfaction of applicable conditions set forth in the deposit agreement. |

| To better understand the terms of the ADSs, you should carefully read “Description of American Depositary Shares.” We also encourage you to read the deposit agreement, the form of which is attached as an exhibit to the registration statement of which this prospectus forms a part. The Selling Shareholders are offering ADSs so that our company can be quoted on the and investors will be able to trade our securities and receive dividends on them in U.S. dollars. |

Depositary

Use of proceeds | The Selling Shareholders will receive all of the net proceeds from the sale of the ADSs. We will not receive any proceeds from the sale of ADSs by the Selling Shareholders. |

Dividend policy | We have historically paid dividends and while we have not yet adopted a formal dividend policy, we currently expect that we will continue to do so from time to time in the future. Any future |

14

determination regarding the payment of a dividend will depend on many factors, including the availability of distributable profits, our liquidity and financial position, our future growth initiatives and strategic plans, including possible acquisitions, restrictions imposed by our financing arrangements, tax considerations and other relevant factors. If we declare dividends on our ordinary shares, the depositary will pay you the cash dividend and other distributions it receives on our ordinary shares, after deducting its fees and expenses. See “Dividend Policy.” |

Risk factors | See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should consider before deciding to invest in our ordinary shares. |

Lock-up agreements | We have agreed with Morgan Stanley & Co. LLC, as representative of the several underwriters, subject to certain exceptions, not to sell or dispose of any of our ADSs or securities convertible into or exchangeable or exercisable for our ADSs until 180 days after the date of this prospectus. All of our shareholders, consisting of the Selling Shareholders, our executive officers and our board members have agreed to similar lockup restrictions for a period of 180 days. See “Underwriting (Conflicts of Interest).” |

Pre-emptive rights | Under the law of Cyprus, existing holders of shares in Cypriot public companies are entitled topre-emptive rights on the issue of new shares in that company (if shares are issued for cash consideration). In addition, our shareholders authorized the disapplication of pre-emptive rights for a period of five years from the date of the consummation of this offering. See “Description of Share Capital and Articles of Association—Pre-emptive Rights.” |

Listing | We intend to apply to list our ADSs on , or under the symbol “HHR.” |

Unless otherwise indicated, all information contained in this prospectus assumes or gives effect to:

| • | no exercise by the underwriters of their option to purchase additional ADSs in this offering; and |

| • | an initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus. |

15

Corporate and Capital Structure

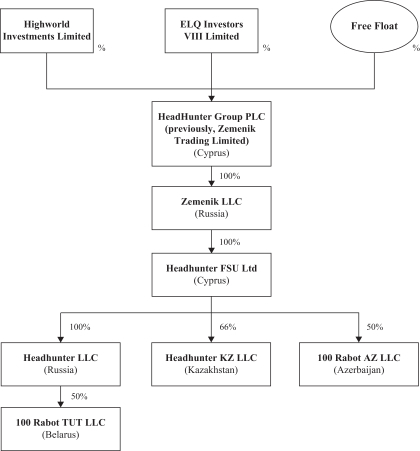

Historically, Headhunter FSU Limited, an entity incorporated in Cyprus, acted as a holding company for all of our operating subsidiaries. Zemenik Trading Limited was incorporated on May 28, 2014 and was subsequently acquired by Highworld Investments Limited, an investment vehicle associated with Elbrus Capital, and ELQ Investors VIII Limited, an investment vehicle associated with GS Group Inc. On February 24, 2016 (the “Acquisition Date”), Zemenik Trading Limited acquired all of the outstanding equity interests of HeadhunterFSU Limited from Mail.Ru.

Prior to the completion of this offering, Zemenik Trading Limited will be converted from a private limited company incorporated in Cyprus into a public limited company incorporated in Cyprus, and we will change our corporate name from Zemenik Trading Limited pursuant to a special resolution at a general meeting of the shareholders to HeadHunter Group PLC. The legal effect of the conversion of Zemenik Trading Limited under Cypriot law will be limited to the change of legal form. In addition, we have agreed on high level terms to divest the business through which we conduct our operations in Ukraine and, therefore, do not expect our current Ukrainian subsidiary, Headhunter LLC, to be part of our corporate structure upon the completion of this offering.

The following diagram illustrates our corporate structure following the completion of this offering:

16

Summary Consolidated Historical and Pro Forma Financial and Other Data

The following tables present our summary consolidated financial and other data as of and for the periods indicated. The summary consolidated statements of operations data for: (i) the Predecessor 2016 Stub Period, (ii) the Successor 2016 Period, (iii) the Predecessor 2015 Period and (iv) the Predecessor 2014 Period, and the summary consolidated balance sheet data as of December 31, 2014 and 2015 (Predecessor), and 2016 (Successor) are derived from our audited consolidated financial statements included elsewhere in this prospectus. Our historical audited results are not necessarily indicative of the results that should be expected in any future period.

The summary consolidated statements of operations data for the Successor 2016 Interim Period and the Successor 2017 Interim Period, and the summary consolidated balance sheet data as of June 30, 2017, are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. We have prepared our unaudited consolidated financial statements on the same basis as our audited consolidated financial statements and have included all adjustments, consisting only of normal recurring adjustments that, in our opinion, are necessary to present fairly the financial information set forth in those statements. The results for any interim period are not necessarily indicative of the results that may be expected for the full year, and our historical unaudited results are not necessarily indicative of the results that should be expected in any future period.