0000004904aep:AppalachianPowerCompanyMemberaep:RegulatoryLiabilityPaysAReturnMemberaep:RegulatoryLiabilityPendingFinalDeterminationIncludingNettingMember2023-12-310000004904us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310000004904aep:IndianaMichiganPowerCompanyMemberaep:SpentNuclearFuelandDecommissioningTrustsMemberaep:DomesticMember2023-01-012023-12-310000004904aep:AEPTexasInc.Memberus-gaap:VariableInterestEntityPrimaryBeneficiaryMemberaep:RestorationFundingMember2023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to_________

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commission | | Registrants; | | | | I.R.S. Employer |

| File Number | | Address and Telephone Number | | States of Incorporation | | Identification Nos. |

| | | | | | | | | | | |

| 1-3525 | | AMERICAN ELECTRIC POWER CO INC. | | New York | | 13-4922640 |

| 333-221643 | | AEP TEXAS INC. | | Delaware | | 51-0007707 |

| 333-217143 | | AEP TRANSMISSION COMPANY, LLC | | Delaware | | 46-1125168 |

| 1-3457 | | APPALACHIAN POWER COMPANY | | Virginia | | 54-0124790 |

| 1-3570 | | INDIANA MICHIGAN POWER COMPANY | | Indiana | | 35-0410455 |

| 1-6543 | | OHIO POWER COMPANY | | Ohio | | 31-4271000 |

| 0-343 | | PUBLIC SERVICE COMPANY OF OKLAHOMA | | Oklahoma | | 73-0410895 |

| 1-3146 | | SOUTHWESTERN ELECTRIC POWER COMPANY | | Delaware | | 72-0323455 |

| | | 1 Riverside Plaza, | Columbus, | Ohio | 43215-2373 | | | | |

| | | Telephone | (614) | 716-1000 | | | | | | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | |

| Registrant | | Title of each class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| American Electric Power Company Inc. | | Common Stock, $6.50 par value | | AEP | | The NASDAQ Stock Market LLC |

| | | | | | |

Securities registered pursuant to Section 12(g) of the Act: None

| | | | | | | | | | | | | | |

| Indicate by check mark if the AEP Texas Inc., AEP Transmission Company, LLC and Public Service Company of Oklahoma, are well-known seasoned issuers, as defined in Rule 405 of the Securities Act. | Yes | x | No | ¨ |

| | | | |

| Indicate by check mark if American Electric Power Company, Inc., Appalachian Power Company, Indiana Michigan Power Company, Ohio Power Company and Southwestern Electric Power Company are well-known seasoned issuers, as defined in Rule 405 of the Securities Act. | Yes | ¨ | No | x |

| | | | |

| Indicate by check mark if the registrants are not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. | Yes | ¨ | No | x |

| | | | |

| Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. | Yes | x | No | ¨ |

| | | | |

| Indicate by check mark whether the registrants have submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | Yes | x | No | ¨ |

| | | | | | | | | | | | | | | | | | | | | | | |

| Indicate by check mark whether American Electric Power Company, Inc. is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| | |

| Large Accelerated filer | x | Accelerated filer | ☐ | Non-accelerated filer | ☐ | | |

| | | | | | | | |

| Smaller reporting company | ☐ | Emerging growth company | ☐ | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Indicate by check mark whether AEP Texas Inc., AEP Transmission Company, LLC, Appalachian Power Company, Indiana Michigan Power Company, Ohio Power Company, Public Service Company of Oklahoma and Southwestern Electric Power Company are large accelerated filers, accelerated filers, non-accelerated filers, smaller reporting companies, or emerging growth companies. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| | | |

| Large Accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | x | | |

| | | | | | | | |

| Smaller reporting company | ☐ | Emerging growth company | ☐ | | | | |

| | | | | | | | | | | | | | | | | |

| If an emerging growth company, indicate by check mark if the registrants have elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

| | ☐ | | | |

| | | | | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. |

| | x | | | |

| If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. |

|

| | ¨ | | | |

| Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). |

| | ¨ | | | |

| | | | | | | | | | | | | | | | | | | | |

| Indicate by check mark whether the registrants are shell companies (as defined in Rule 12b-2 of the Exchange Act). | | Yes | ☐ | | No | x |

AEP Texas Inc., AEP Transmission Company, LLC, Appalachian Power Company, Indiana Michigan Power Company, Ohio Power Company, Public Service Company of Oklahoma and Southwestern Electric Power Company meet the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and are therefore filing this Form 10-K with the reduced disclosure format specified in General Instruction I(2) to such Form 10-K.

| | | | | | | | | | | | | | |

| | | Aggregate Market Value of Voting and Non-Voting Common Equity Held by Nonaffiliates of the Registrants as of June 30, 2024 the Last Trading Date of the Registrants' Most Recently Completed Second Fiscal Quarter | | Number of Shares of Common Stock Outstanding of the Registrants as of December 31, 2024 |

| American Electric Power Company, Inc. | | 46,757,322,914 | | 532,907,715 | |

| | | | | ($6.50 par value) |

| AEP Texas Inc. | | None | | 100 | |

| | | | ($0.01 par value) |

| AEP Transmission Company, LLC (a) | | None | | NA |

| | | | |

| Appalachian Power Company | | None | | 13,499,500 | |

| | | | | (no par value) |

| Indiana Michigan Power Company | | None | | 1,400,000 | |

| | | | | (no par value) |

| Ohio Power Company | | None | | 27,952,473 | |

| | | | | (no par value) |

| Public Service Company of Oklahoma | | None | | 9,013,000 | |

| | | | | ($15 par value) |

| Southwestern Electric Power Company | | None | | 3,680 | |

| | | | | ($18 par value) |

(a)100% interest is held by AEP Transmission Holdco.

NA Not applicable.

Note on Market Value of Common Equity Held by Nonaffiliates

American Electric Power Company, Inc. owns all of the common stock of AEP Texas Inc., Appalachian Power Company, Indiana Michigan Power Company, Ohio Power Company, Public Service Company of Oklahoma and Southwestern Electric Power Company and, indirectly, all of the LLC membership interest in AEP Transmission Company, LLC (see Item 12 herein).

Documents Incorporated By Reference

| | | | | | | | |

| Description | | Part of Form 10-K into which Document is Incorporated |

| | | |

| Portions of Proxy Statement of American Electric Power Company, Inc. for 2025 Annual Meeting of Shareholders. | | Part III |

This combined Form 10-K is separately filed by American Electric Power Company, Inc., AEP Texas Inc., AEP Transmission Company, LLC, Appalachian Power Company, Indiana Michigan Power Company, Ohio Power Company, Public Service Company of Oklahoma and Southwestern Electric Power Company. Information contained herein relating to any individual registrant is filed by such registrant on its own behalf. Except for American Electric Power Company, Inc., each registrant makes no representation as to information relating to the other registrants.

You can access financial and other information at AEP’s website, including AEP’s Principles of Business Conduct, certain committee charters and Principles of Corporate Governance. The address is www.AEP.com. Investors can obtain copies of our SEC filings from this site free of charge, as well as from the SEC website at www.sec.gov.

TABLE OF CONTENTS

| | | | | | | | |

Item

Number | | Page

Number |

| | Glossary of Terms | |

| | Forward-Looking Information | |

| | |

| PART I |

| 1 | Business | |

| | General | |

| | Business Segments | |

| | Vertically Integrated Utilities | |

| | Transmission and Distribution Utilities | |

| | AEP Transmission Holdco | |

| | Generation & Marketing | |

| | Executive Officers of AEP | |

| 1A | Risk Factors | |

| 1B | Unresolved Staff Comments | |

| 1C | Cybersecurity | |

| 2 | Properties | |

| | Generation Facilities | |

| | | |

| | Title to Property | |

| | | |

| | Construction Program | |

| | Potential Uninsured Losses | |

| 3 | Legal Proceedings | |

| 4 | Mine Safety Disclosure | |

| | |

| PART II |

| 5 | Market for Registrants’ Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

| 6 | Reserved | |

| 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| 7A | Quantitative and Qualitative Disclosures about Market Risk | |

| 8 | Financial Statements and Supplementary Data | |

| 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| 9A | Controls and Procedures | |

| 9B | Other Information | |

| 9C | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |

| | |

| PART III | |

| 10 | Directors, Executive Officers and Corporate Governance | |

| 11 | Executive Compensation | |

| 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| 13 | | |

| 14 | Principal Accounting Fees and Services | |

| | |

| PART IV |

| 15 | Exhibits and Financial Statement Schedules | |

| | Financial Statements | |

| 16 | Form 10-K Summary | |

| | Signatures | |

| | Index of Financial Statement Schedules | |

| | Exhibit Index | |

GLOSSARY OF TERMS

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below.

| | | | | | | | |

| Term | | Meaning |

| | | |

| AEGCo | | AEP Generating Company, an AEP electric utility subsidiary. |

| AEP | | American Electric Power Company, Inc., an investor-owned electric public utility holding company which includes American Electric Power Company, Inc. (Parent) and majority-owned consolidated subsidiaries and consolidated affiliates. |

| AEP Credit | | AEP Credit, Inc., a consolidated VIE of AEP which securitizes accounts receivable and accrued utility revenues for affiliated electric utility companies. |

| AEP Development Services, LLC | | AEP Development Services, LLC, a consolidated VIE of AEP formed for the purpose of developing, constructing, and installing energy projects for the regulated operating companies of AEP. |

| AEP East Companies | | APCo, I&M, KGPCo, KPCo, OPCo and WPCo. |

| AEP Energy | | AEP Energy, Inc., a wholly-owned retail electric supplier for customers in Ohio, Illinois and other deregulated electricity markets throughout the United States. |

| AEP Energy Supply, LLC | | A nonregulated holding company for AEP’s competitive generation, wholesale and retail businesses, and a wholly-owned subsidiary of AEP. |

| AEP OnSite Partners | | A division of AEP Energy Supply, LLC that builds, owns, operates and maintains customer solutions utilizing existing and emerging distributed technologies. |

| AEP Renewables | | A division of AEP Energy Supply, LLC that develops and/or acquires large scale renewable projects that are backed with long-term contracts with creditworthy counter parties. |

| AEP System | | American Electric Power System, an electric system, owned and operated by AEP subsidiaries. |

| AEP Texas | | AEP Texas Inc., an AEP electric utility subsidiary. AEP Texas engages in the transmission and distribution of electric power to retail customers in west, central and southern Texas. |

| AEP Transmission Holdco | | AEP Transmission Holding Company, LLC, a wholly-owned subsidiary of AEP. |

| AEP Wind Holdings, LLC | | Acquired in April 2019 as Sempra Renewables LLC, develops, owns and operates, or holds interests in, wind generation facilities in the United States. |

| AEPEP | | AEP Energy Partners, Inc., a subsidiary of AEP dedicated to wholesale marketing and trading, hedging activities, asset management and commercial and industrial sales in deregulated markets. |

| | |

| AEPSC | | American Electric Power Service Corporation, an AEP service subsidiary providing management and professional services to AEP and its subsidiaries. |

| AEPTCo | | AEP Transmission Company, LLC, a wholly-owned subsidiary of AEP Transmission Holdco, is an intermediate holding company that owns the State Transcos. |

| AEPTCo Parent | | AEP Transmission Company, LLC, the holding company of the State Transcos within the AEPTCo consolidation. |

| AEPTHCo | | AEP Transmission Holding Company, LLC, a subsidiary of AEP, an intermediate holding company that owns transmission operations joint ventures and AEPTCo. |

| AFUDC | | Allowance for Equity Funds Used During Construction. |

| AGR | | AEP Generation Resources Inc., a competitive AEP subsidiary in the Generation & Marketing segment. |

| ALJ | | Administrative Law Judge. |

| | |

| | |

| AOCI | | Accumulated Other Comprehensive Income. |

| APCo | | Appalachian Power Company, an AEP electric utility subsidiary. APCo engages in the generation, transmission and distribution of electric power to retail customers in the southwestern portion of Virginia and southern West Virginia. |

| Appalachian Consumer Rate Relief Funding | | Appalachian Consumer Rate Relief Funding LLC, a wholly-owned subsidiary of APCo and a consolidated VIE formed for the purpose of issuing and servicing securitization bonds related to the under-recovered ENEC deferral balance. |

| APTCo | | AEP Appalachian Transmission Company, Inc., a wholly-owned AEPTCo transmission subsidiary. |

| APSC | | Arkansas Public Service Commission. |

| | |

| | | | | | | | |

| Term | | Meaning |

| | | |

| ARO | | Asset Retirement Obligations. |

| ASU | | Accounting Standards Update. |

| ATM | | At-the-Market. |

| BHE | | Berkshire Hathaway Energy. |

| CAA | | Clean Air Act. |

| CAMT | | Corporate Alternative Minimum Tax. |

| | |

| | |

| CCR | | Coal Combustion Residual. |

| CEO | | Chief Executive Officer. |

| CLECO | | Central Louisiana Electric Company, a nonaffiliated utility company. |

CO2 | | Carbon dioxide and other greenhouse gases. |

| | |

| | |

| CODM | | Chief Operating Decision Maker. |

| Cook Plant | | Donald C. Cook Nuclear Plant, a two-unit, 2,296 MW nuclear plant owned by I&M. |

| | |

| CRES Provider | | Competitive Retail Electric Service providers under Ohio law that target retail customers by offering alternative generation service. |

| CSAPR | | Cross-State Air Pollution Rule. |

| CSPCo | | Columbus Southern Power Company, a former AEP electric utility subsidiary that was merged into OPCo effective December 31, 2011. |

| | |

| CWIP | | Construction Work in Progress. |

| DCC Fuel | | DCC Fuel XIV, DCC Fuel XV, DCC Fuel XVI, DCC Fuel XVII, DCC Fuel XVIII, DCC Fuel XIX and DCC Fuel XX consolidated VIEs formed for the purpose of acquiring, owning and leasing nuclear fuel to I&M. |

| | |

| DHLC | | Dolet Hills Lignite Company, LLC, a wholly-owned lignite mining subsidiary of SWEPCo. |

| DIR | | Distribution Investment Rider. |

| Diversion | | Diversion, acquired in December 2024, consists of 201 MWs of wind generation in Texas. |

| DOE | | U. S. Department of Energy. |

| EIS | | Energy Insurance Services, Inc., a nonaffiliated captive insurance company and consolidated VIE of AEP. |

| ELG | | Effluent Limitation Guidelines. |

| ENEC | | Expanded Net Energy Cost. |

| Equity Units | | AEP’s Equity Units issued in August 2020 and March 2019. |

| ERCOT | | Electric Reliability Council of Texas regional transmission organization. |

| ESP | | Electric Security Plans, a PUCO requirement for electric utilities to adjust their rates by filing with the PUCO. |

| ETT | | Electric Transmission Texas, LLC, an equity interest joint venture between AEP Transmission Holdco and Berkshire Hathaway Energy Company formed to own and operate electric transmission facilities in ERCOT. |

| Excess ADIT | | Excess accumulated deferred income taxes. |

| FAC | | Fuel Adjustment Clause. |

| FASB | | Financial Accounting Standards Board. |

| Federal EPA | | United States Environmental Protection Agency. |

| FERC | | Federal Energy Regulatory Commission. |

| FGD | | Flue Gas Desulfurization or scrubbers. |

| FIP | | Federal Implementation Plan. |

| FTR | | Financial Transmission Right, a financial instrument that entitles the holder to receive compensation for certain congestion-related transmission charges that arise when the power grid is congested resulting in differences in locational prices. |

| GAAP | | Generally Accepted Accounting Principles in the United States of America. |

| GHG | | Greenhouse gas. |

| G&M | | Generation & Marketing. |

| | | | | | | | |

| Term | | Meaning |

| | | |

| I&M | | Indiana Michigan Power Company, an AEP electric utility subsidiary. I&M engages in the generation, transmission and distribution of electric power to retail customers in northern and eastern Indiana and southwestern Michigan. |

| IMTCo | | AEP Indiana Michigan Transmission Company, Inc., a wholly-owned AEPTCo transmission subsidiary. |

| IRA | | On August 16, 2022 President Biden signed into law legislation commonly referred to as the “Inflation Reduction Act” (IRA). |

| IRC | | Internal Revenue Code. |

| IRP | | Integrated Resource Plan. |

| IRS | | Internal Revenue Service. |

| ITC | | Investment Tax Credit. |

| IURC | | Indiana Utility Regulatory Commission. |

| KGPCo | | Kingsport Power Company, an AEP electric utility subsidiary. KGPCo provides electric service to retail customers in Kingsport, Tennessee and eight neighboring communities in northeastern Tennessee. |

| KPCo | | Kentucky Power Company, an AEP electric utility subsidiary. KPCo engages in the generation, transmission and distribution of electric power to retail customers in eastern Kentucky. |

| KPSC | | Kentucky Public Service Commission. |

| KTCo | | AEP Kentucky Transmission Company, Inc., a wholly-owned AEPTCo transmission subsidiary. |

| kV | | Kilovolt. |

| KWh | | Kilowatt-hour. |

| Liberty | | Liberty Utilities Co., a subsidiary of Algonquin Power & Utilities Corporation. |

| LPSC | | Louisiana Public Service Commission. |

| MATS | | Mercury and Air Toxic Standards. |

| Maverick | | Maverick, part of the North Central Wind Energy Facilities, consists of 287 MWs of wind generation in Oklahoma. |

| MISO | | Midcontinent Independent System Operator. |

| Mitchell Plant | | A two unit, 1,560 MW coal-fired power plant located in Moundsville, West Virginia. The plant is jointly owned by KPCo and WPCo. |

| MMBtu | | Million British Thermal Units. |

| MPSC | | Michigan Public Service Commission. |

| MTM | | Mark-to-Market. |

| MW | | Megawatt. |

| MWh | | Megawatt-hour. |

| NAAQS | | National Ambient Air Quality Standards. |

| NCWF | | North Central Wind Energy Facilities, a joint PSO and SWEPCo project, which includes three Oklahoma wind facilities totaling approximately 1,484 MWs of wind generation. |

| NERC | | North American Electric Reliability Corporation. |

| Net Zero | | Represents net-zero Scope 1 and Scope 2 GHG emissions by 2045. |

| NMRD | | New Mexico Renewable Development, LLC. |

| Nonutility Money Pool | | Centralized funding mechanism AEP uses to meet the short-term cash requirements of certain nonutility subsidiaries. |

| | |

| NOL | | Net operating losses. |

| NOLC | | Net operating loss carryforward. |

NOx | | Nitrogen Oxide. |

| | |

| NRC | | Nuclear Regulatory Commission. |

| | |

| OATT | | Open Access Transmission Tariff. |

| OCC | | Corporation Commission of the State of Oklahoma. |

| | |

| | |

| OHTCo | | AEP Ohio Transmission Company, Inc., a wholly-owned AEPTCo transmission subsidiary. |

| | |

| | | | | | | | |

| Term | | Meaning |

| | | |

| OKTCo | | AEP Oklahoma Transmission Company, Inc., a wholly-owned AEPTCo transmission subsidiary. |

| OPCo | | Ohio Power Company, an AEP electric utility subsidiary. OPCo engages in the transmission and distribution of electric power to retail customers in Ohio. |

| OPEB | | Other Postretirement Benefits. |

| Operating Agreement | | Agreement, dated January 1, 1997, as amended, by and among PSO and SWEPCo governing generating capacity allocation, energy pricing, and revenues and costs of third-party sales. AEPSC acts as the agent. |

| OTC | | Over-the-counter. |

| OVEC | | Ohio Valley Electric Corporation, which is 43.47% owned by AEP. |

| Parent | | American Electric Power Company, Inc., the equity owner of AEP subsidiaries within the AEP consolidation. |

| | |

| PCA | | Power Coordination Agreement among APCo, I&M, KPCo and WPCo. |

| PFD | | Proposal for Decision. |

| PJM | | Pennsylvania – New Jersey – Maryland regional transmission organization. |

| PLR | | Private Letter Ruling. |

| PM | | Particulate Matter. |

| PPA | | Power Purchase Agreement. |

| | |

| PSA | | Purchase and Sale Agreement. |

| PSO | | Public Service Company of Oklahoma, an AEP electric utility subsidiary. PSO engages in the generation, transmission and distribution of electric power to retail customers in eastern and southwestern Oklahoma. |

| PTC | | Production Tax Credit. |

| PUCO | | Public Utilities Commission of Ohio. |

| PUCT | | Public Utility Commission of Texas. |

| | |

| | |

| Registrant Subsidiaries | | AEP subsidiaries which are SEC registrants: AEP Texas, AEPTCo, APCo, I&M, OPCo, PSO and SWEPCo. |

| Registrants | | SEC registrants: AEP, AEP Texas, AEPTCo, APCo, I&M, OPCo, PSO and SWEPCo. |

| REP | | Texas Retail Electric Provider. |

| Restoration Funding | | AEP Texas Restoration Funding LLC, a wholly-owned subsidiary of AEP Texas and a consolidated VIE formed for the purpose of issuing and servicing securitization bonds related to storm restoration in Texas primarily caused by Hurricane Harvey. |

| Risk Management Contracts | | Trading and non-trading derivatives, including those derivatives designated as cash flow and fair value hedges. |

| Rockport Plant | | A generation plant, jointly-owned by AEGCo and I&M, consisting of two 1,310 MW coal-fired generating units near Rockport, Indiana. |

| ROE | | Return on Equity. |

| RPM | | Reliability Pricing Model. |

| RTO | | Regional Transmission Organization, responsible for moving electricity over large interstate areas. |

| Sabine | | Sabine Mining Company, a lignite mining company that is a consolidated VIE for AEP and SWEPCo. |

| | |

| SEC | | U.S. Securities and Exchange Commission. |

| Sempra Renewables LLC | | Sempra Renewables LLC, acquired in April 2019 (subsequently renamed as AEP Wind Holdings LLC), consists of 724 MWs of wind generation and battery assets in the United States. |

| | |

| SIP | | State Implementation Plan. |

| SNF | | Spent Nuclear Fuel. |

SO2 | | Sulfur dioxide. |

| SPP | | Southwest Power Pool regional transmission organization. |

| SSO | | Standard service offer. |

| | | | | | | | |

| Term | | Meaning |

| | | |

| State Transcos | | AEPTCo’s seven wholly-owned, FERC regulated, transmission only electric utilities, which are geographically aligned with AEP's existing utility operating companies. |

| Storm Recovery Funding | | SWEPCo Storm Recovery Funding LLC, a wholly-owned subsidiary of SWEPCo and consolidated VIE formed for the purpose of issuing and servicing securitization bonds related to storm restoration in Louisiana. |

| Sundance | | Sundance, acquired in April 2021 as part of the North Central Wind Energy Facilities, consists of 199 MWs of wind generation in Oklahoma. |

| SWEPCo | | Southwestern Electric Power Company, an AEP electric utility subsidiary. SWEPCo engages in the generation, transmission and distribution of electric power to retail customers in northeastern and panhandle of Texas, northwestern Louisiana and western Arkansas. |

| SWTCo | | AEP Southwestern Transmission Company, Inc., a wholly-owned AEPTCo transmission subsidiary. |

| TA | | Transmission Agreement, effective November 2010, among APCo, I&M, KGPCo, KPCo, OPCo and WPCo with AEPSC as agent. |

| Tax Reform | | On December 22, 2017, President Trump signed into law legislation referred to as the “Tax Cuts and Jobs Act” (the TCJA). The TCJA includes significant changes to the Internal Revenue Code of 1986, including a reduction in the corporate federal income tax rate from 35% to 21% effective January 1, 2018. |

| TCA | | Transmission Coordination Agreement dated January 1, 1997, by and among, PSO, SWEPCo and AEPSC, in connection with the operation of the transmission assets of the two public utility subsidiaries. |

| T&D | | Transmission and Distribution Utilities. |

| Transition Funding | | AEP Texas Central Transition Funding III LLC, a wholly-owned subsidiary of AEP Texas and consolidated VIE formed for the purpose of issuing and servicing securitization bonds related to restructuring legislation in Texas. |

| Transource Energy | | Transource Energy, LLC, a consolidated VIE formed for the purpose of investing in utilities which develop, acquire, construct, own and operate transmission facilities in accordance with FERC-approved rates. |

| Traverse | | Traverse, part of the North Central Wind Energy Facilities, consists of 998 MWs of wind generation in Oklahoma. |

| | |

| Turk Plant | | John W. Turk, Jr. Plant, a 650 MW coal-fired plant in Arkansas that is 73% owned by SWEPCo. |

| UMWA | | United Mine Workers of America. |

| UPA | | Unit Power Agreement. |

| Utility Money Pool | | Centralized funding mechanism AEP uses to meet the short-term cash requirements of certain utility subsidiaries. |

| VIE | | Variable Interest Entity. |

| Virginia SCC | | Virginia State Corporation Commission. |

| VIU | | Vertically Integrated Utilities. |

| WPCo | | Wheeling Power Company, an AEP electric utility subsidiary. WPCo provides electric service to retail customers in northern West Virginia. |

| WVPSC | | Public Service Commission of West Virginia. |

| WVTCo | | AEP West Virginia Transmission Company, Inc., a wholly-owned AEPTCo transmission subsidiary. |

.

FORWARD-LOOKING INFORMATION

This report made by the Registrants contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. Many forward-looking statements appear in “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations,” but there are others throughout this document which may be identified by words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “will,” “should,” “could,” “would,” “project,” “continue” and similar expressions, and include statements reflecting future results or guidance and statements of outlook. These matters are subject to risks and uncertainties that could cause actual results to differ materially from those projected. Forward-looking statements in this document are presented as of the date of this document. Except to the extent required by applicable law, management undertakes no obligation to update or revise any forward-looking statement. Among the factors that could cause actual results to differ materially from those in the forward-looking statements are:

| | | | | |

| • | Changes in economic conditions, electric market demand and demographic patterns in AEP service territories. |

| • | The economic impact of increased global conflicts and trade tensions, and the adoption or expansion of economic sanctions, tariffs or trade restrictions. |

| • | Inflationary or deflationary interest rate trends. |

| • | New legislation adopted in the states in which we operate that alters the regulatory framework or that prevents the timely recovery of costs and investments. |

| • | Volatility and disruptions in financial markets precipitated by any cause, including fiscal and monetary policy, turmoil related to federal budget or debt ceiling matters or instability in the banking industry; particularly developments affecting the availability or cost of capital to finance new capital projects and refinance existing debt. |

| • | The availability and cost of funds to finance working capital and capital needs, particularly (a) if expected sources of capital such as proceeds from the sale of assets, subsidiaries and tax credits and anticipated securitizations do not materialize or do not materialize at the level anticipated, and (b) during periods when the time lag between incurring costs and recovery is long and the costs are material. |

| • | Shifting demand for electricity. |

| • | The impact of extreme weather conditions, natural disasters and catastrophic events such as storms, drought conditions and wildfires that pose significant risks including potential litigation and the inability to recover significant damages and restoration costs incurred. |

| • | Limitations or restrictions on the amounts and types of insurance available to cover losses that might arise in connection with natural disasters or operations. |

| • | The cost of fuel and its transportation, the creditworthiness and performance of parties who supply and transport fuel and the cost of storing and disposing of used fuel, including coal ash and SNF. |

| • | The availability of fuel and necessary generation capacity and the performance of generation plants. |

| • | The ability to recover fuel and other energy costs through regulated or competitive electric rates. |

| • | The ability to build or acquire generation (including from renewable sources), transmission lines and facilities (including the ability to obtain any necessary regulatory approvals and permits) to meet the demand for electricity at acceptable prices and terms, including favorable tax treatment, cost caps imposed by regulators and other operational commitments to regulatory commissions and customers for generation projects, and to recover all related costs. |

| • | The disruption of AEP’s business operations due to impacts on economic or market conditions, costs of compliance with potential government regulations, electricity usage, supply chain issues, customers, service providers, vendors and suppliers caused by pandemics, natural disasters or other events. |

| • | New legislation, litigation or government regulation, including changes to tax laws and regulations, oversight of nuclear generation, energy commodity trading and new or modified requirements related to emissions of sulfur, nitrogen, mercury, carbon, soot or PM and other substances that could impact the continued operation, cost recovery and/or profitability of generation plants and related assets. |

| • | The impact of federal tax legislation, including potential changes to existing tax incentives, on results of operations, financial condition, cash flows or credit ratings. |

| • | The risks before, during and after generation of electricity associated with the fuels used or the by-products and wastes of such fuels, including coal ash and SNF. |

| • | Timing and resolution of pending and future rate cases, negotiations and other regulatory decisions, including rate or other recovery of new investments in generation, distribution and transmission service and environmental compliance. |

| • | Resolution of litigation or regulatory proceedings or investigations. |

| • | The ability to efficiently manage and recover operation, maintenance and development project costs. |

| • | Prices and demand for power generated and sold at wholesale. |

| • | Changes in technology, particularly with respect to energy storage and new, developing, alternative or distributed sources of generation. |

| | | | | |

| • | The ability to recover through rates any remaining unrecovered investment in generation units that may be retired before the end of their previously projected useful lives. |

| • | Volatility and changes in markets for coal and other energy-related commodities, particularly changes in the price of natural gas. |

| • | The impact of changing expectations and demands of customers, regulators, investors and stakeholders, including development, adoption, and use of artificial intelligence by us, our customers and our third party vendors and evolving expectations related to environmental, social and governance concerns. |

| • | Changes in utility regulation and the allocation of costs within RTOs including ERCOT, PJM and SPP. |

| • | Changes in the creditworthiness of the counterparties with contractual arrangements, including participants in the energy trading market. |

| • | Actions of rating agencies, including changes in the ratings of debt. |

| • | The impact of volatility in the capital markets on the value of the investments held by the pension, OPEB, captive insurance entity and nuclear decommissioning trust and the impact of such volatility on future funding requirements. |

| • | Accounting standards periodically issued by accounting standard-setting bodies. |

| • | Other risks and unforeseen events, including wars and military conflicts, the effects of terrorism (including increased security costs), embargoes, cybersecurity threats, labor strikes impacting material supply chains, global information technology disruptions and other catastrophic events. |

| • | The ability to attract and retain the requisite work force and key personnel. |

The forward-looking statements of the Registrants speak only as of the date of this report or as of the date they are made. The Registrants expressly disclaim any obligation to update any forward-looking information, except as required by law. For a more detailed discussion of these factors, see “Risk Factors” in Part I of this report.

The Registrants may use AEP’s website as a distribution channel for material company information. Financial and other important information regarding the Registrants is routinely posted on and accessible through AEP’s website at www.aep.com/investors/. In addition, you may automatically receive email alerts and other information about the Registrants when you enroll your email address by visiting the “Email Alerts” section at www.aep.com/investors/.

Company Website and Availability of SEC Filings

Our principal corporate website address is www.aep.com. Information on our website is not incorporated by reference herein and is not part of this Form 10-K. We make available free of charge through our website our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after such documents are electronically filed with, or furnished to, the SEC. The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding AEP.

PART I

ITEM 1. BUSINESS

GENERAL

Overview and Description of Major Subsidiaries

AEP was incorporated under the laws of the State of New York in 1906 and reorganized in 1925. It is a public utility holding company that owns, directly or indirectly, all of the outstanding common stock of its public utility subsidiaries and varying percentages of other subsidiaries.

The service areas of AEP’s public utility subsidiaries cover portions of the states of Arkansas, Indiana, Kentucky, Louisiana, Michigan, Ohio, Oklahoma, Tennessee, Texas, Virginia and West Virginia. Transmission networks are interconnected with extensive distribution facilities in the territories served. The public utility subsidiaries of AEP have traditionally provided electric service, consisting of generation, transmission and distribution, on an integrated basis to their retail customers. Restructuring laws in Michigan, Ohio and the ERCOT area of Texas have caused AEP public utility subsidiaries in those states to unbundle previously integrated regulated rates for their retail customers.

The member companies of AEP have contractual, financial and other business relationships with the other member companies, such as participation in AEP savings and retirement plans and tax returns, sales of electricity and transportation and handling of fuel. The member companies of AEP also obtain certain accounting, administrative, information systems, engineering, financial, legal, maintenance and other services at cost from a common provider, AEPSC.

As of December 31, 2024, the subsidiaries of AEP had a total of 16,330 employees. Because it is a holding company rather than an operating company, AEP has no employees.

Summary information related to AEP subsidiary operating companies as of December 31, 2024 is shown in the table below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | AEP Texas | | AEPTCo | | APCo | | I&M | | KGPCo (a) | | KPCo | | OPCo (b) | | PSO | | SWEPCo | | WPCo |

| | | | | | | | | | | | | | | | | | | | |

| State of Incorporation | | Delaware, 1925 | | Delaware, 2006 | | Virginia, 1926 | | Indiana, 1907 | | Virginia, 1917 | | Kentucky, 1919 | | Ohio,

1907 | | Oklahoma, 1913 | | Delaware, 1912 | | West Virginia, 1883 |

| AEP Reportable Segment | | Transmission and Distribution Utilities | | AEP Transmission Holdco | | Vertically Integrated Utilities | | Vertically Integrated Utilities | | Vertically Integrated Utilities | | Vertically Integrated Utilities | | Transmission and Distribution Utilities | | Vertically Integrated Utilities | | Vertically Integrated Utilities | | Vertically Integrated Utilities |

| RTO Affiliation | | ERCOT | | (c) | | PJM | | PJM | | PJM | | PJM | | PJM | | SPP | | SPP | | PJM |

| Approximate Number of Retail Customers | | 1,122,000 | | (c) | | 969,000 | | 617,000 | | 50,000 | | 163,000 | | 1,539,000 | | 584,000 | | 555,000 | | 41,000 |

| | | | | | | | | | | | | | | | | | | | |

| Number of Employees | | 1,598 | | (c) | | 1,613 | | 2,069 | | 47 | | 279 | | 1,594 | | 1,044 | | 1,314 | | 229 |

| | | | | | | | | | | | | | | | | | | | |

(a)KGPCo does not own any generating facilities and purchases electric power from APCo for distribution to its customers.

(b)OPCo purchases energy and capacity at auction to serve generation service customers who have not switched to a competitive generation supplier.

(c)AEPTCo is a holding company for the State Transcos. Five State Transcos are members of PJM and two State Transcos are members of SPP. Neither AEPTCo nor its subsidiaries have any employees. Instead, AEPSC and certain AEP utility subsidiaries provide services to these entities.

Service Company Subsidiary

AEPSC is a service company subsidiary that provides accounting, administrative, information systems, engineering, financial, legal, maintenance and other services at cost to AEP subsidiaries. The executive officers of AEP and certain of the executive officers of its public utility subsidiaries are employees of AEPSC. As of December 31, 2024, AEPSC had 6,237 employees.

Principal Industries Served

The following table illustrates the principal industries and wholesale electric markets served by AEP’s public utility subsidiaries.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | AEP Texas | | APCo | | I&M | | KGPCo | | KPCo | | OPCo | | PSO | | SWEPCo | | WPCo |

| Principal Industries Served: | | | | | | | | | | | | | | | | | | |

| Petroleum and Coal Products Manufacturing | | X | | | | | | | | X | | X | | X | | X | | |

| Chemical Manufacturing | | X | | X | | X | | X | | X | | X | | | | X | | X |

| Oil and Gas Extraction | | X | | | | | | | | X | | | | X | | X | | |

| Pipeline Transportation | | X | | X | | | | | | X | | X | | X | | | | X |

| Primary Metal Manufacturing | | X | | X | | X | | | | | | X | | | | | | X |

| Data Processing (a) | | X | | | | X | | | | | | X | | | | | | |

| Coal-Mining | | | | X | | | | | | X | | | | | | | | X |

| Paper Manufacturing | | | | X | | | | X | | | | | | X | | X | | |

| Transportation Equipment | | | | | | X | | | | | | | | | | | | X |

| Plastics and Rubber Products | | | | | | X | | X | | | | X | | X | | | | |

| Fabricated Metals Product Manufacturing | | | | | | X | | | | | | | | | | | | |

| Food Manufacturing | | | | | | | | | | | | | | | | X | | |

| | | | | | | | | | | | | | | | | | |

| Supply and Market Electric Power at Wholesale to: | | | | | | | | | | | | | | | | | | |

| Other Electric Utility Companies | | | | X | | X | | | | X | | | | X | | X | | X |

| Rural Electric Cooperatives | | | | X | | X | | | | | | | | | | X | | |

| Municipalities | | | | X | | X | | | | X | | | | X | | X | | |

| Other Market Participants | | | | X | | X | | | | X | | | | X | | X | | X |

(a)Primarily includes data centers and cryptocurrency operations.

Public Utility Subsidiaries by Jurisdiction

The following table illustrates certain regulatory information with respect to the jurisdictions in which the public utility subsidiaries of AEP operate:

| | | | | | | | | | | | | | | | | |

| Principal Jurisdiction | | AEP Utility Subsidiaries Operating in that Jurisdiction | | Authorized Return on Equity (a) |

| Arkansas | | SWEPCo | | 9.50 | % | |

| | | | | |

| FERC | | AEPTCo - PJM | | 10.35 | % | (b) |

| | AEPTCo - SPP | | 10.50 | % | |

| | | | | |

| Indiana | | I&M | | 9.85 | % | |

| | | | | |

| Kentucky | | KPCo | | 9.75 | % | |

| | | | | |

| Louisiana | | SWEPCo | | 9.50 | % | |

| | | | | |

| Michigan | | I&M | | 9.86 | % | |

| | | | | |

| Ohio | | OPCo | | 9.70 | % | |

| | | | | |

| Oklahoma | | PSO | | 9.50 | % | |

| | | | | |

| Tennessee | | KGPCo | | 9.50 | % | |

| | | | | |

| Texas | | AEP Texas | | 9.76 | % | |

| | SWEPCo | | 9.25 | % | (c) |

| | | | | |

| Virginia | | APCo | | 9.75 | % | |

| | | | | |

| West Virginia | | APCo | | 9.75 | % | |

| | | WPCo | | 9.75 | % | |

(a)Identifies the predominant current authorized ROE, and may not include other, less significant, permitted recovery. Actual ROE varies from authorized ROE.

(b)In December 2022, the FERC issued an order removing the 50 basis point RTO incentive from OHTCo transmission formula rates effective February 2022, reducing OHTCo’s authorized ROE to 9.85%.

(c)In February 2022, as part of the 2020 Texas Base Rate Case, SWEPCo filed a motion for rehearing with the PUCT alleging several errors in the final order, which included a challenge of the approved ROE. In April 2022, the PUCT denied the motion for rehearing. In May 2022, SWEPCo filed a petition for review with the Texas District Court seeking a judicial review of the several errors challenged in the PUCT’s final order. See “2020 Texas Base Rate Case” section of Note 4 for additional information.

CLASSES OF SERVICE

AEP and subsidiaries recognize revenues from customers for retail and wholesale electricity sales and electricity transmission and distribution delivery services. AEP’s subsidiaries within the Vertically Integrated Utilities, Transmission and Distribution Utilities, AEP Transmission Holdco and Generation & Marketing segments derive revenue from the following sources: Retail Revenues, Wholesale and Competitive Retail Revenues, Other Revenues from Contracts with Customers and Alternative Revenues. For further information relating to the sources of revenue for the Registrants, see Note 20 - Revenues from Contracts with Customers for additional information.

FINANCING

General

AEP subsidiaries generally use short-term debt to finance working capital needs. Short-term debt may also be used to finance acquisitions, construction and redemption or repurchase of outstanding securities until such needs can be financed with long-term funding. In recent history, short-term funding needs have been provided for by cash from operations, AEP’s commercial paper program and term loan issuances. Funds are made available to subsidiaries under the AEP corporate borrowing program. Certain public utility subsidiaries of AEP also sell accounts receivable to provide liquidity. Sources of long-term funding include issuance of long-term debt, long-term asset securitizations, leasing agreements, hybrid securities or common stock. See “Financial Condition” section of Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional information.

AEP’s revolving credit agreements (which backstop the commercial paper program) include covenants and events of default typical for these types of facilities, including a maximum debt-to-total capitalization test. In addition, the acceleration of AEP’s payment obligations, or the obligations of certain of its major subsidiaries, prior to maturity under any other agreement or instrument relating to debt outstanding in excess of $100 million, would cause an event of default under the credit agreements. As of December 31, 2024, AEP was in compliance with its debt covenants. With the exception of a voluntary bankruptcy or insolvency, any event of default has either or both a cure period or notice requirement before termination of the applicable agreement. A voluntary bankruptcy or insolvency of AEP or one of its significant subsidiaries would be considered an immediate termination event. See “Financial Condition” section of Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional information.

AEP’s subsidiaries have also utilized, and expect to continue to utilize, additional financing arrangements, such as securitization financings and leasing arrangements.

ENVIRONMENTAL AND OTHER MATTERS

General

AEP subsidiaries are currently subject to regulation by federal, state and local authorities with regard to air and water-quality control, solid and hazardous waste disposal and other environmental matters, and are subject to zoning and other regulation by local authorities. The current and proposed environmental laws and regulations discussed below will have an impact on AEP’s operations. Management continues to monitor developments in these regulations and evaluate the economic feasibility and refine cost estimates for compliance. AEP is unable to predict changes in regulations, regulatory guidance, legal interpretations, policy positions and implementation actions that may result from the change in Presidential administrations. For additional information on the laws and regulations discussed below, see “Environmental Issues” section of Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Clean Air Act Requirements (CAA)

The CAA establishes a comprehensive program to protect and improve the nation’s air quality and control sources of air emissions. The states implement and administer many of these programs and could impose additional or more stringent requirements. The primary regulatory programs that continue to drive investments in AEP’s existing generating units include: (a) periodic revisions to NAAQS and the development of SIPs to achieve more stringent standards, (b) implementation of the regional haze program by the states and the Federal EPA, (c) regulation of hazardous air pollutant emissions under MATS, (d) implementation and review of CSAPR and (e) the Federal EPA’s regulation of GHG emissions from fossil generation under Section 111 of the CAA.

Clean Water Act Requirements

The Federal EPA’s ELG rule for generating facilities establishes limits for FGD wastewater, fly ash and bottom ash transport water and flue gas mercury control wastewater, which are to be implemented through each facility’s wastewater discharge permit. In April 2024, the Federal EPA finalized further revisions to the ELG rule that establish a zero liquid discharge standard for FGD wastewater, bottom ash transport water, and managed combustion residual leachate, as well as more stringent discharge limits for unmanaged combustion residual leachate. The revised rule provides a new compliance alternative that would eliminate the need to install zero liquid discharge systems for facilities that comply with the 2020 rule’s control technology requirements and commit by December 31, 2025 to retire by 2034. Management is evaluating the compliance alternatives in the rule, taking into consideration the requirements of the other new rules and their combined impacts to operations. Several appeals have been filed with various federal courts challenging the 2024 ELG rule. SWEPCo has also challenged the rule, by filing a joint appeal with a utility trade association in which AEP participates. The various appeals have been consolidated before the United States Court of Appeals for the Eighth Circuit. SWEPCo and the utility trade association filed a motion to stay the rule during the litigation. In October 2024, the court denied the motion. Management cannot predict the outcome of the litigation.

Coal Ash Regulation

The Federal EPA’s CCR Rule regulates the disposal and beneficial re-use of CCR, including fly ash and bottom ash created from coal-fired generating units and FGD gypsum generated at some coal-fired plants. As originally promulgated, the rule applied to active and inactive CCR landfills and surface impoundments at facilities of active electric utility or independent power producers.

In April 2024, the Federal EPA finalized revisions to the CCR Rule to expand the scope of the rule to include inactive impoundments at inactive facilities (“legacy CCR surface impoundments”) as well as to establish requirements for currently exempt solid waste management units that involve the direct placement of CCR on the land (“CCR management units”). The Federal EPA is requiring that owners and operators of legacy surface impoundments comply with all of the existing CCR Rule requirements applicable to inactive CCR surface impoundments at active facilities, except for the location restrictions and liner design criteria. The rule establishes compliance deadlines for legacy surface impoundments to meet regulatory requirements, including a requirement to initiate closure within five years after the effective date of the final rule. The rule requires evaluations to be completed at both active facilities and inactive facilities with one or more legacy surface impoundments. Closure may be accomplished by applying an impermeable cover system over the CCR material (“closure in place”) or the CCR material may be excavated and placed in a compliant landfill (“closure by removal”). Groundwater monitoring and other analysis over the next three years will provide additional information on the planned closure method. AEP evaluated the applicability of the rule to current and former plant sites and recorded incremental ARO of $674 million in the second quarter of 2024 based on initial cost estimates primarily reflecting compliance with the rule through closure in place and future groundwater monitoring requirements pursuant to the revised CCR Rule.

As further groundwater monitoring and other analysis is performed, management expects to refine the assumptions and underlying cost estimates used in recording the ARO. These refinements may include, but are not limited to, changes in the expected method of closure, changes in estimated quantities of CCR at each site, the identification of new CCR management units, among other items. These future changes could have a material impact on the ARO and materially reduce future net income and cash flows and further impact financial condition.

Climate Change, CO2 Regulation and Energy Policy

In April 2024, the Administrator of the Federal EPA signed new GHG standards and guidelines for new and existing fossil-fuel fired sources. The rule relies on carbon capture and sequestration and natural gas co-firing as means to reduce CO2 emissions from coal fired plants and carbon capture and sequestration or limited utilization to reduce CO2 emissions from new gas turbines. The rule also offers early retirement of coal plants in lieu of carbon capture and storage as an alternative means of compliance. A number of parties filed petitions for review of the rule in the U.S. Court of Appeals for the D.C. Circuit. AEP is in the early stages of evaluating and identifying the best strategy for complying with this rule while ensuring the adequacy of resources to meet customer needs. The Federal EPA’s new GHG rule is directed at the fossil-fuel fired electric utility industry and could force AEP to close additional coal-fired generation facilities earlier than their estimated useful life. If AEP is unable to recover the costs of its investments, it would reduce future net income and cash flows and impact financial condition.

Other Environmental Issues and Matters

The Comprehensive Environmental Response, Compensation and Liability Act of 1980 imposes costs for environmental remediation upon owners and previous owners of sites, as well as transporters and generators of hazardous material disposed of at such sites. See “The Comprehensive Environmental Response Compensation and Liability Act (Superfund) and State Remediation” section of Note 6 for additional information.

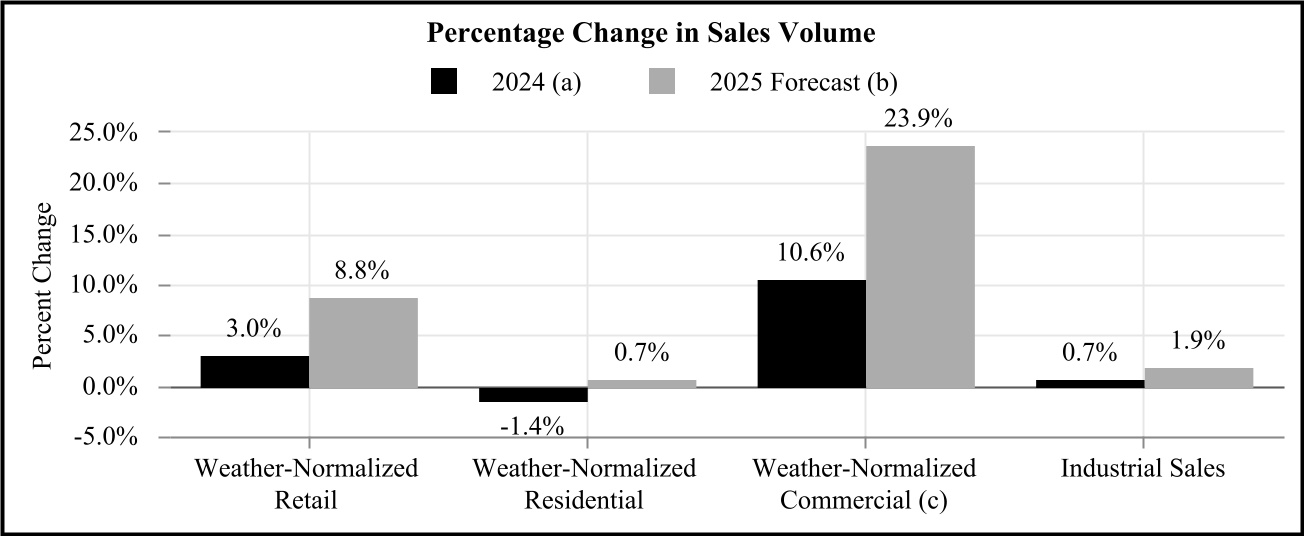

Electric Industry Transformation

The electric utility industry is in the midst of an historic transformation, driven by large load growth in the commercial customer class from data processing loads, changing customer needs, evolving public policies, stakeholder demands, demographics, competitive offerings, technologies and commodity prices.

AEP is committed to providing reliable affordable power to its customers. To achieve this, AEP and its subsidiaries routinely meet with state regulators and key stakeholders to understand their needs for both dispatchable and renewable generation resources. This process evaluates, amongst other things, future supply and demand fundamentals, the economic aspects of investments, grid reliability and resilience, regulations and evolving RTO requirements, the advancement of generation technologies, and market impacts and constraints. As part of the regulatory process, AEP routinely submits IRPs in various regulatory jurisdictions to address future generation needs. The objective of the IRPs is to recommend future generation and capacity resources that provide the most cost-efficient and reliable power to customers.

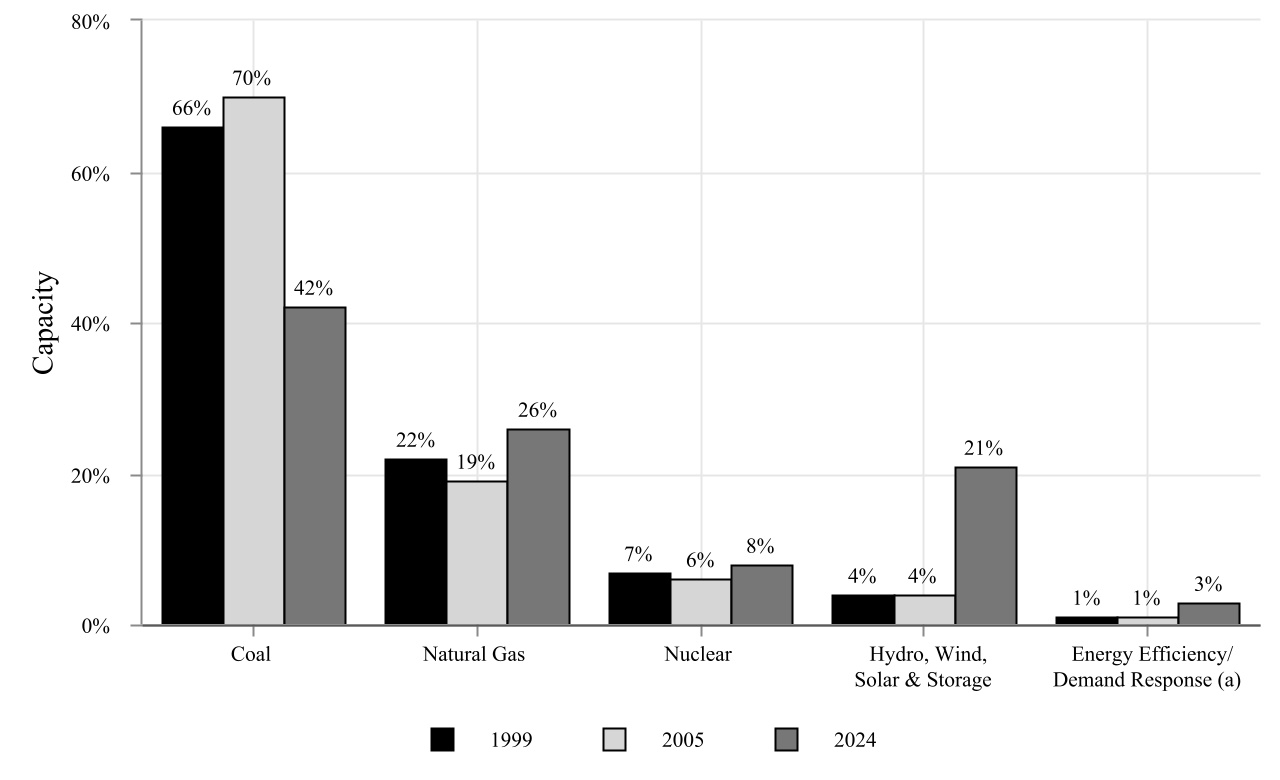

As of December 31, 2024, AEP’s generating capacity included owned and PPA capacity of approximately 23,200 MWs and 5,300 MWs, respectively. The graph below summarizes AEP’s generating capacity by resource type for the years 1999, 2005 and 2024:

(a) Energy Efficiency/Demand Response represents avoided capacity rather than physical assets.

Corporate Governance

In response to environmental issues and in connection with its assessment of AEP’s strategic plan, the Board of Directors continually reviews the risks posed by new environmental rules and requirements that could alter the retirement date of coal-fired generation assets. The Board of Directors is informed of new environmental regulations and proposed environmental regulations or legislation that would significantly affect AEP. In addition, the Board holds extended meetings twice a year to provide extra time for a more robust review of the Company’s strategy, including discussions about carbon and carbon risk. The Board’s Committee on Directors and Corporate Governance oversees AEP’s annual Corporate Sustainability Report, which includes information about AEP’s environmental, social, governance and financial performance.

HUMAN CAPITAL MANAGEMENT

Attracting, developing and retaining high-performing employees with the skills and experience needed to serve our customers efficiently and effectively is crucial to AEP’s growth and competitiveness and is central to our long-term strategy. AEP invests in employees and continues to build a high performance and inclusive culture that inspires leadership, encourages innovative thinking and welcomes everyone.

The following table shows AEP’s number of employees by subsidiary as of December 31, 2024:

| | | | | | | | |

| Subsidiary | | Number of Employees |

| AEPSC | | 6,237 | |

| AEP Texas | | 1,598 | |

| APCo | | 1,613 | |

| I&M | | 2,069 | |

| KGPCo | | 47 | |

| KPCo | | 279 | |

| OPCo | | 1,594 | |

| PSO | | 1,044 | |

| SWEPCo | | 1,314 | |

| WPCo | | 229 | |

| Other (a) | | 306 | |

| Total AEP | | 16,330 | |

(a) Primarily relates to AEP Energy employees.

Of AEP’s 16,330 employees, less than 1% are Traditionalists (born before 1946), approximately 12% are Baby Boomers (born 1946-1964), approximately 37% are Generation X (born 1965-1980), approximately 42% are Millennials (born 1981-1996) and less than 9% are Generation Z (born after 1996). As of December 31, 2024, women comprised approximately 20% of AEP’s total workforce, approximately 21% of AEP’s total workforce was represented by racially or ethnically diverse employees and approximately 25% of AEP’s total workforce was represented by labor unions.

Safety

Safety is integral to our culture and is one of AEP’s core values. AEP is dedicated to ensuring the safety of our employees, contractors, customers and the communities we serve. AEP has policies, procedures, programs, training and initiatives in place to help ensure a safety conscious work environment. We are committed to fundamentally embed layers of protection in the work we do. This includes focusing our efforts to prevent serious injuries and fatalities, strengthening pre-job briefing effectiveness, learning from safety incidents, providing appropriate training and education and improving proactive safety initiatives and data analysis to identify and address potential performance gaps.

| | | | | | | | | | | | | | |

| Safety Metric | | 2024 | | 2023 |

| DART | | 0.556 | | 0.384 |

| TRIR | | 0.913 | | 0.690 |

AEP’s employee Days Away, Restricted and Transferred (DART) rate and Total Recordable Incident Rate (TRIR) increased in 2024. A DART event is an event that results in one or more lost days, one or more restricted days, or results in an employee transferring to a different job within the company. The DART rate is a mathematical calculation (number of DART events multiplied by 200,000 and divided by total YTD hours worked) that describes the number of injuries per 100 full-time employees annually. A recordable event is a work-related event that results in death, days away from work, restricted work or transfer to another job, medical treatment beyond first aid, loss of consciousness or a significant injury or illness diagnosed by a physician or other licensed health care professional. TRIR is a mathematical calculation (number of recordable events multiplied by 200,000 and divided by total year to date hours worked) that describes the number of incidents per 100 full-time employees annually. In response to these challenges, AEP is recommitting to fundamental principles of excellence by integrating human performance fundamentals into our operational practices to ensure a safer work environment for all.

Culture and Inclusion

At AEP, we believe in doing the right thing every time for our customers and each other and that culture serves as the foundation for our success. We recognize that an engaged, collaborative and inclusive workforce helps us better serve our employees, customers, suppliers and other key stakeholders. AEP views a culture as a core business value that is centered on performance, accountability and developing our employees. As a strategic priority, our commitment to culture and inclusion is guided by three principles:

•Ensuring leaders are held accountable for fostering an inclusive environment and culture.

•Promoting an inclusive culture where all employees can thrive.

•Supporting the communities we serve so they will prosper.

AEP’s culture and inclusion progress is measured through our annual Employee Voice Survey. The Employee Voice Survey is an opportunity for employees to provide feedback about their experience at AEP. It also serves as a means for the company to understand how we can foster a workplace focused on performance, accountability, efficiency, and customer orientation. 2024 marks our eleventh consecutive year of formally surveying employees about their experience at AEP.

Training and Professional Development

Attracting, developing, and retaining high-performing employees with the skills and experience needed to serve our customers efficiently and effectively is crucial to AEP’s growth and long-term strategy. At AEP, we are preparing our workforce for the future by providing opportunities to learn new skills and engaging higher education institutions to better prepare the next generation of workers. AEP offers co-op and internship programs in partnership with high schools, technical/vocational schools and colleges across our 11-state service territory. AEP also provides a broad range of training and assistance that supports lifelong learning and development. This includes operational skills training, professional training, leadership development, educational assistance, ongoing performance coaching, and other forms of training that offer developmental pathways for employees.

Compensation and Benefits

AEP is committed to the well-being of our employees, and we offer programs to foster employee financial security, physical and emotional health, and social connectedness. We provide market-competitive compensation and benefits, including medical and dental coverage, life insurance, and well-being programs that support our employees and their families. Nearly all AEP employees participate in an annual incentive program that rewards individual performance and achievement of business goals, fostering a high-performance culture. AEP also offers paid time off in the form of vacation, holidays, sick time, and parental leave.

BUSINESS SEGMENTS

AEP’s Reportable Segments

AEP’s primary business is the generation, transmission and distribution of electricity. Within its Vertically Integrated Utilities segment, AEP centrally dispatches generation assets and manages its overall utility operations on an integrated basis because of the substantial impact of cost-based rates and regulatory oversight applicable to each public utility subsidiary. Intersegment sales and transfers are generally based on underlying contractual arrangements and agreements. AEP’s reportable segments are as follows:

•Vertically Integrated Utilities

•Transmission and Distribution Utilities

•AEP Transmission Holdco

•Generation & Marketing

The remainder of AEP’s activities is presented as Corporate and Other, which is not considered a reportable segment. See Note 9 - Business Segments for additional information on AEP’s segments.

Seasonality

The consumption and delivery of electric power is generally seasonal which impacts the results of operations of AEP’s reportable segments. In many parts of the country, demand for power peaks during the hot summer months, with market prices also peaking at that time. In other areas, power demand peaks during the winter. The pattern of this fluctuation may change due to the nature and location of AEP’s facilities and the terms of power sale contracts into which AEP enters. In addition, AEP has historically sold and delivered less power, and consequently earned less income, when weather conditions are milder. Unusually mild weather in the future could diminish AEP’s results of operations. Conversely, unusually extreme weather conditions could increase AEP’s results of operations.

VERTICALLY INTEGRATED UTILITIES

GENERAL

AEP’s vertically integrated utility operations are engaged in the generation, transmission and distribution of electricity for sale to retail and wholesale customers through assets owned and operated by AEGCo, APCo, I&M, KGPCo, KPCo, PSO, SWEPCo and WPCo. AEPSC, as agent for AEP’s public utility subsidiaries, performs marketing, generation dispatch, fuel procurement and power-related risk management and trading activities on behalf of each of these subsidiaries.

ELECTRIC GENERATION

Facilities

As of December 31, 2024, AEP’s vertically integrated public utility subsidiaries owned approximately 23,200 MWs of generation. See Item 2 – Properties for more information regarding the generation capacity of vertically integrated public utility subsidiaries.

Fuel Supply

The following table shows the owned and leased generation sources by type (including wind purchase agreements), on an actual net generation (MWhs) basis, used by the Vertically Integrated Utilities:

| | | | | | | | | | | | | | | | | |

| | 2024 | | 2023 | | 2022 |

| Coal and Lignite | 40% | | 37% | | 43% |

| Nuclear | 22% | | 22% | | 21% |

| Natural Gas | 22% | | 22% | | 19% |

| Renewables | 16% | | 19% | | 17% |

An increase/decrease in one or more generation types relative to previous years reflects changes in resource mix and price changes in one or more fuel commodity sources relative to the pricing of other fuel commodity sources. AEP’s overall 2024 fossil fuel costs for the Vertically Integrated Utilities increased 3.2% on a dollar per MMBtu basis from 2023.

Coal and Lignite

AEP’s Vertically Integrated Utilities procure coal under a combination of purchasing arrangements, including long-term contracts, and spot agreements with various producers and marketers. Coal consumption increased 12.7% in 2024 from 2023.

Management projects that the Vertically Integrated Utilities will be able to secure and transport coal of adequate quality and quantities to operate their coal fired units. As of December 31, 2024, through subsidiaries, AEP owns, leases or controls 2,934 railcars, 296 barges, 4 towboats and a coal handling terminal with approximately 18 million tons of annual capacity to move and store coal for use in AEP generating facilities. AEP will procure additional railcar and barge/towboat capacity as needed based on demand.

Although coal prices remained stable for all of 2024 the market price for coal is greater than historical prices (excluding 2021 and 2022), due to the higher cost incurred by the suppliers to mine coal over the last few years. Coal prices may see a fluctuation in the next few years as utilities begin to reenter the market as high inventories decline and as forecasted demand for electricity increases. AEP’s strategy for purchasing coal includes maintaining a target inventory level by layering in supplies over time to help with reducing price volatility. The price paid for coal delivered in 2024 decreased approximately 3.5% from 2023 mainly due to the completion of higher priced coal supply agreements that were agreed to in 2021 and 2022 when coal market pricing was stronger. The decrease in the delivered cost of coal should continue into 2025 as some higher priced agreements ended in 2024. With AEP’s strategy of layering tons into the coal portfolio the prices over the next few years will continue to fluctuate with the coal market.

The following table shows the amount of coal and lignite delivered to the Vertically Integrated Utilities’ plants during the past three years and the average delivered price of coal and lignite purchased by the Vertically Integrated Utilities:

| | | | | | | | | | | | | | | | | |

| | 2024 | | 2023 | | 2022 |

| Total coal and lignite delivered to the plants (in millions of tons) | 16.5 | | 20.9 | | 20.4 | |

| Average cost per ton of coal and lignite delivered | $ | 62.05 | | | $ | 64.31 | | | $ | 56.16 | |

The coal supplies at the Vertically Integrated Utilities plants vary from time to time depending on various factors, including, but not limited to, consumption rates driven by the demand for electric power, unit outages, transportation limitations or delays, space limitations, labor issues, supplier outages and issues and weather conditions, all of which may impact production, consumption or deliveries. As of December 31, 2024 and 2023, the Vertically Integrated Utilities’ coal inventory was approximately 71 days and 82 days of full load burn, respectively. Inventory levels remained high in 2024 due to mild weather conditions and continued low natural gas prices. Management expects inventory levels to remain elevated in 2025 due to many of these same factors. While inventory targets vary by plant and are changed as necessary, the current coal inventory target for the Vertically Integrated Utilities is approximately 35 days of full load burn.

Natural Gas

The Vertically Integrated Utilities consumed approximately 155 billion cubic feet of natural gas during 2024 for generating power. This represents an increase of 6.7% from 2023. Several of AEP’s natural gas-fired units are connected to at least two pipelines, which allows greater access to competitive supplies and improves delivery reliability. From a natural gas supply perspective, the Vertically Integrated Utilities secure forward month, fixed price baseload supply, prompt month baseload supply, and pursue daily spot market purchases or sales (to balance daily positions). From a natural gas transportation perspective, the Vertically Integrated Utilities utilize firm and interruptible transportation capacity. Furthermore, SWEPCo and PSO utilize firm natural gas storage, which supports price stability and provides additional surety of natural gas supply. AEP’s natural gas supply, transportation and storage transactions are competitively bid and are based on applicable market prices.

The following table shows the amount of natural gas delivered to the Vertically Integrated Utilities’ plants during the past three years and the average delivered price of natural gas purchased by the Vertically Integrated Utilities:

| | | | | | | | | | | | | | | | | |

| | 2024 | | 2023 | | 2022 |

| Total natural gas delivered to the plants (in billions cubic feet) | 155.0 | | | 146.0 | | | 126.0 | |

| Average delivered price per MMBtu of purchased natural gas | $ | 3.05 | | | $ | 2.69 | | | $ | 6.94 | |

Nuclear

I&M has made commitments to meet the current nuclear fuel requirements of the Cook Plant. I&M has made and will make purchases of uranium in various forms in the spot, short-term, mid-term and long-term markets.

For purposes of the storage of high-level radioactive waste in the form of SNF, I&M completed modifications to its SNF storage pool in the early 1990’s. I&M entered into an agreement to provide for onsite dry cask storage of SNF to permit normal operations to continue. I&M is scheduled to conduct further dry cask loading and storage projects on an ongoing periodic basis. The year of expiration of each NRC Operating License is 2034 for Unit 1 and 2037 for Unit 2. Management has started the application process for license extensions for both units that would extend Unit 1 and Unit 2 to 2054 and 2057, respectively.

Nuclear Waste and Decommissioning

As the owner of the Cook Plant, I&M has a significant future financial commitment to dispose of SNF and decommission and decontaminate the plant safely. The cost to decommission a nuclear plant is affected by NRC regulations and the SNF disposal program. The most recent decommissioning cost study was completed in 2024. According to that study, stated in 2024 undiscounted dollars, the estimated cost of decommissioning and disposal of low-level radioactive waste was $2.4 billion, with additional ongoing costs of $7 million per year for post decommissioning storage of SNF and an eventual cost of $45 million for the subsequent decommissioning of the SNF storage facility. As of December 31, 2024 and 2023, the total decommissioning trust fund balance for the Cook Plant was approximately $4 billion and $3.5 billion, respectively. The balance of funds available to eventually decommission Cook Plant will differ based on contributions and investment returns. The ultimate cost of retiring the Cook Plant may be materially different from estimates and funding targets as a result of the:

•Escalation of various cost elements (including, but not limited to, general inflation and the cost of energy).

•Further development of regulatory requirements governing decommissioning.

•Technology available at the time of decommissioning differing significantly from that assumed in studies.

•Availability of nuclear waste disposal facilities.

•Availability of a United States Department of Energy facility for permanent storage of SNF.

Accordingly, management is unable to provide assurance that the ultimate cost of decommissioning the Cook Plant will not be significantly different than current projections. AEP will seek recovery from customers through regulated rates if actual decommissioning costs exceed projections. See the “Nuclear Contingencies” section of Note 6 - Commitments, Guarantees and Contingencies for additional information with respect to nuclear waste and decommissioning.

Low-Level Radioactive Waste

The Low-Level Waste Policy Act of 1980 mandates that the responsibility for the disposal of low-level radioactive waste rests with the individual states. Low-level radioactive waste consists largely of ordinary refuse and other items that have come in contact with radioactive materials. Michigan does not currently have a disposal site for such waste available. I&M cannot predict when such a site may be available. However, the states of Utah and Texas have licensed low-level radioactive waste disposal sites which currently accept low-level radioactive waste from Michigan waste generators. There is currently no set date limiting I&M’s access to either of these facilities. The Cook Plant has a facility onsite designed specifically for the storage of low-level radioactive waste. In the event that low-level radioactive waste disposal facility access becomes unavailable, it can be stored onsite at this facility.

Counterparty Risk Management

The Vertically Integrated Utilities segment also sells power and enters into related energy transactions with wholesale customers and other market participants. As a result, counterparties and exchanges may require cash or cash related instruments to be deposited on transactions as margin against open positions. As of December 31, 2024, counterparties posted approximately $16 million in cash, cash equivalents or letters of credit with AEPSC for the benefit of AEP’s public utility subsidiaries (while, as of that date, AEP’s public utility subsidiaries posted approximately $201 million with counterparties and exchanges). Since open trading contracts are valued based on market prices of various commodities, exposures change daily. See the “Quantitative and Qualitative Disclosures About Market Risk” section of Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional information.

Certain Power Agreements

I&M