compared to $285,000 for the three months ended September 30, 2016, an increase of $46,000, or 16.1%. The increase was primarily due to the increased number of accounts and transactions tied to continued growth in loans and deposits.

Data processing and communication expense for the nine months ended September 30, 2017 was $997,000 compared to $781,000 for the nine months ended September 30, 2016, an increase of $216,000, or 27.7%. The increase was primarily due to the increased number of accounts and transactions tied to continued growth in loans and deposits.

Professional fees, which include legal, accounting, and other fees such as internal audits, was $149,000 for the three months ended September 30, 2017 compared to $177,000 for three months ended September 30, 2016, a decrease of $28,000 or 15.8%. The decrease was primarily due to higher cost incurred during the third quarter of 2016 associated with the formation of OP Bancorp as a bank holding company and the completion of the transactions under which Open Bank became a wholly-owned subsidiary of OP Bancorp.

Professional expense for the nine months ended September 30, 2017 was $435,000 compared to $518,000 for the nine months ended September 30, 2017, a decrease of $83,000, or 16.0%. The decrease was primarily due to higher cost incurred during the first half of 2016 associated with the Public Company Accounting Oversight Board (“PCAOB”) standards audits for years 2016 and 2015 in anticipation of the SEC registration.

Promotion and advertising expense for the three months ended September 30, 2017 was $158,000 compared to $148,000 for the same period in 2016, an increase of $10,000 or 6.8%. The increase was consistent with a continued growth of our loans and deposits. Promotion and advertising expense for the nine months ended September 30, 2017 was $458,000 compared to $456,000 for the same period in 2016, an increase of $2,000 or 0.4%.

Directors’ fees and expenses for the three months ended September 30, 2017 was $202,000 compared to $192,000 for the same period in 2016, an increase of $10,000 or 5.2%. Directors’ fees and expenses include a monthly retainer fee, reimbursement for traveling and other expenses, and stock-based expenses relating to equity awards granted in prior years under our equity plans to our directors. Directors’ fees were increased in March 2017.

Directors’ fees and expenses for the nine months ended September 30, 2017 was $598,000 compared to $574,000 for the same period in 2016, an increase of $24,000 or 4.2%. Directors’ fees and expenses include a monthly retainer fee, reimbursement for traveling and other expenses, and stock-based expenses relating to equity awards granted in prior years under our equity plans to our directors. Directors’ fees were increased in March 2017.

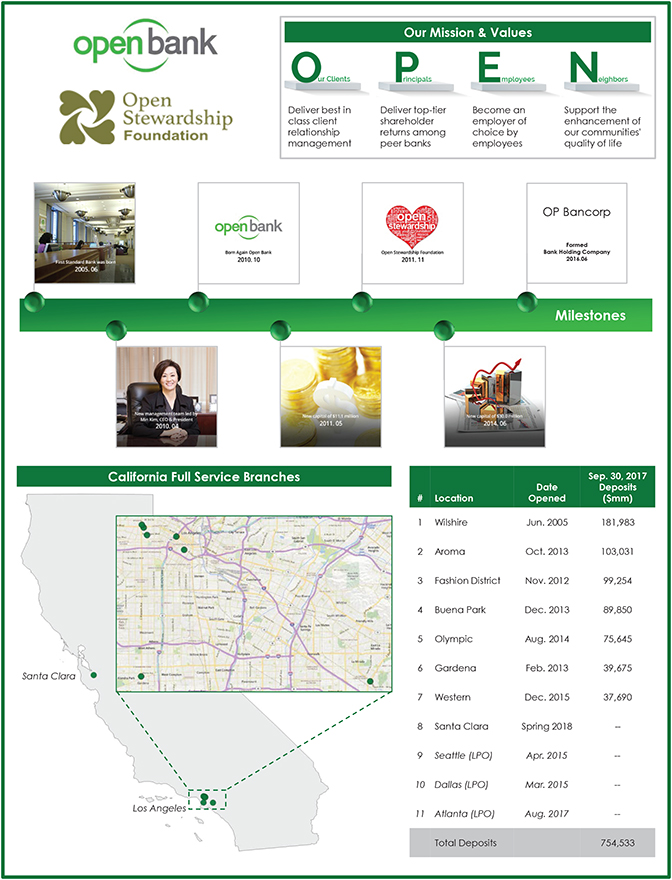

Foundation donation and other contributions for the three months ended September 30, 2017 was $284,000 compared to $205,000 for the same period of 2016, an increase of $79,000, or 38.5%. The increase was due to increased donation accruals for Open Stewardship Foundation, which is tied to our income. On an annual basis, we donate 10% of our consolidated net income after taxes to the Foundation.

Foundation donation and other contributions for the nine months ended September 30, 2017 was $752,000 compared to $518,000 for the same period of 2016, an increase of $234,000, or 45.2%. The increase was consistent with the corresponding increase in net income.

Other expenses increased $2,000, or 0.7%, to $269,000 for the three months ended September 30, 2017, compared to $267,000 for the same period of 2017.

Other expenses increased $72,000, or 9.7% to $813,000 for the nine months ended September 30, 2017, compared to $741,000 for the nine months ended September 30, 2016. The increase was primarily due to increased business development expenses in the first half of 2017.

63