- OPBK Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

FWP Filing

OP Bancorp (OPBK) FWPFree writing prospectus

Filed: 20 Mar 18, 12:00am

Initial Public Offering March 2018 Free Writing Prospectus Filed Pursuant to Rule 433 Registration Statement No. 333-223444 Dated March 20, 2018

This presentation has been prepared by OP Bancorp solely for informational purposes based on its own information, as well as information from public sources. This presentation has been prepared to assist interested parties in making their own evaluation of OP Bancorp and does not purpose to contain all of the information that may be relevant. In all cases, interested parties should conduct their own investigation and analysis of the Company and the data set forth in this presentation and other information provided by or on behalf of OP Bancorp. This presentation does not constitute an offer to sell, nor a solicitation of an offer to buy, any securities of OP Bancorp by any person in any jurisdiction in which it is unlawful for such person to make sure an offering or solicitation. Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of the securities of OP Bancorp or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. Except as otherwise indicated, this presentation speaks as of the date hereof. The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of OP Bancorp after the date hereof. Certain of the information contained herein may be derived from information provided by industry sources. The Company believes that such information is accurate and that the sources from which it has been obtained are reliable. OP Bancorp cannot guarantee the accuracy of such information and has not independently verified such information. This presentation contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “might,” “should,” “could,” “predict,” “potential,” “believe,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “strive,” “projection,” “goal,” “target,” “outlook,” “aim,” “would,” “annualized” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward looking statements are not guarantees of future performance and are subject to risks, assumptions, estimates and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. A number of important factors could cause our actual results to differ materially from those indicated in these forward-looking statements, including the following: risk factors described under the heading “Risk Factors” in the Company’s registration statement on Form S-1, filed with the Securities and Exchange Commission. This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of certain non-GAAP financial measures are provided in this presentation. OP Bancorp has filed a registration statement (including a prospectus), which is preliminary and subject to completion, with the Securities and Exchange Commission for the offering to which this presentation relates. Before you invest, you should read the prospectus in that registration statement and the other documents that the Company has filed with the Securities and Exchange Commission carefully and in their entirety for more complete information about OP Bancorp and the offering. You may obtain these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, OP Bancorp, or any other underwriter or dealer participating in the offering, will arrange to send you the prospectus if you request it by contacting Keefe, Bruyette & Woods, Inc., a Stifel Company, 787 Seventh Avenue, Fourth Floor, New York, NY 10019, Attention: Equity Capital Markets or by calling (800) 966-1559 or by contacting D.A. Davidson & Co., 8 Third Street North, Great Falls, MT 59401, Attention: Equity Syndicate or by calling (800) 332-5915. Offering Disclosure

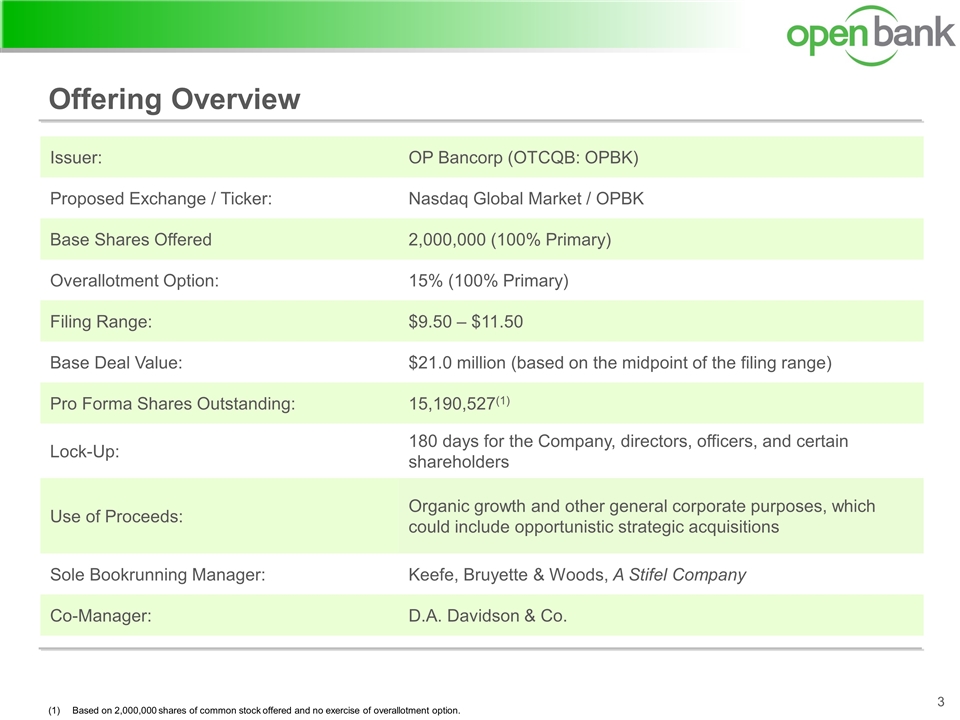

Offering Overview Issuer: OP Bancorp (OTCQB: OPBK) Proposed Exchange / Ticker: Nasdaq Global Market / OPBK Base Shares Offered 2,000,000 (100% Primary) Overallotment Option: 15% (100% Primary) Filing Range: $9.50 – $11.50 Base Deal Value: $21.0 million (based on the midpoint of the filing range) Pro Forma Shares Outstanding: 15,190,527(1) Lock-Up: 180 days for the Company, directors, officers, and certain shareholders Use of Proceeds: Organic growth and other general corporate purposes, which could include opportunistic strategic acquisitions Sole Bookrunning Manager: Keefe, Bruyette & Woods, A Stifel Company Co-Manager: D.A. Davidson & Co. Based on 2,000,000 shares of common stock offered and no exercise of overallotment option.

Today’s Presenters Min J. Kim President & Chief Executive Officer Christine Y. Oh Executive VP & Chief Financial Officer

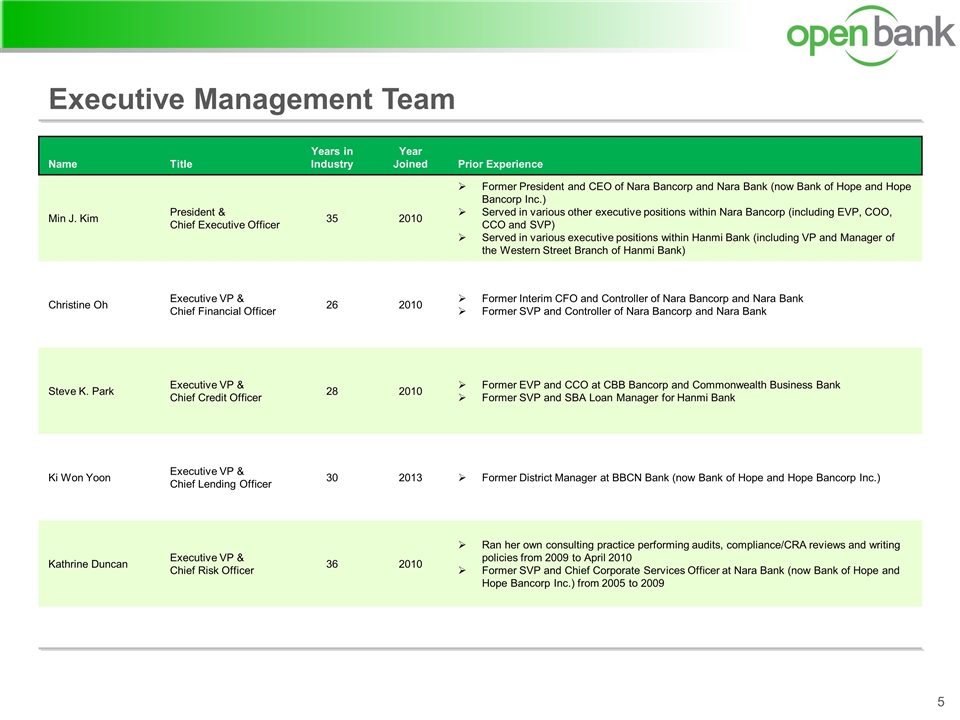

Executive Management Team Name Title Years in Industry Year Joined Prior Experience Min J. Kim President & Chief Executive Officer 35 2010 Former President and CEO of Nara Bancorp and Nara Bank (now Bank of Hope and Hope Bancorp Inc.) Served in various other executive positions within Nara Bancorp (including EVP, COO, CCO and SVP) Served in various executive positions within Hanmi Bank (including VP and Manager of the Western Street Branch of Hanmi Bank) Christine Oh Executive VP & Chief Financial Officer 26 2010 Former Interim CFO and Controller of Nara Bancorp and Nara Bank Former SVP and Controller of Nara Bancorp and Nara Bank Steve K. Park Executive VP & Chief Credit Officer 28 2010 Former EVP and CCO at CBB Bancorp and Commonwealth Business Bank Former SVP and SBA Loan Manager for Hanmi Bank Ki Won Yoon Executive VP & Chief Lending Officer 30 2013 Former District Manager at BBCN Bank (now Bank of Hope and Hope Bancorp Inc.) Kathrine Duncan Executive VP & Chief Risk Officer 36 2010 Ran her own consulting practice performing audits, compliance/CRA reviews and writing policies from 2009 to April 2010 Former SVP and Chief Corporate Services Officer at Nara Bank (now Bank of Hope and Hope Bancorp Inc.) from 2005 to 2009

Key Investment Highlights Proven Track Record of Organic and Profitable Growth Experienced Management Team Personal Relationship-Based Service Strong Community Relationships Strong Risk Management Practices and Disciplined Credit Quality Management Efficient and Scalable Banking Platform

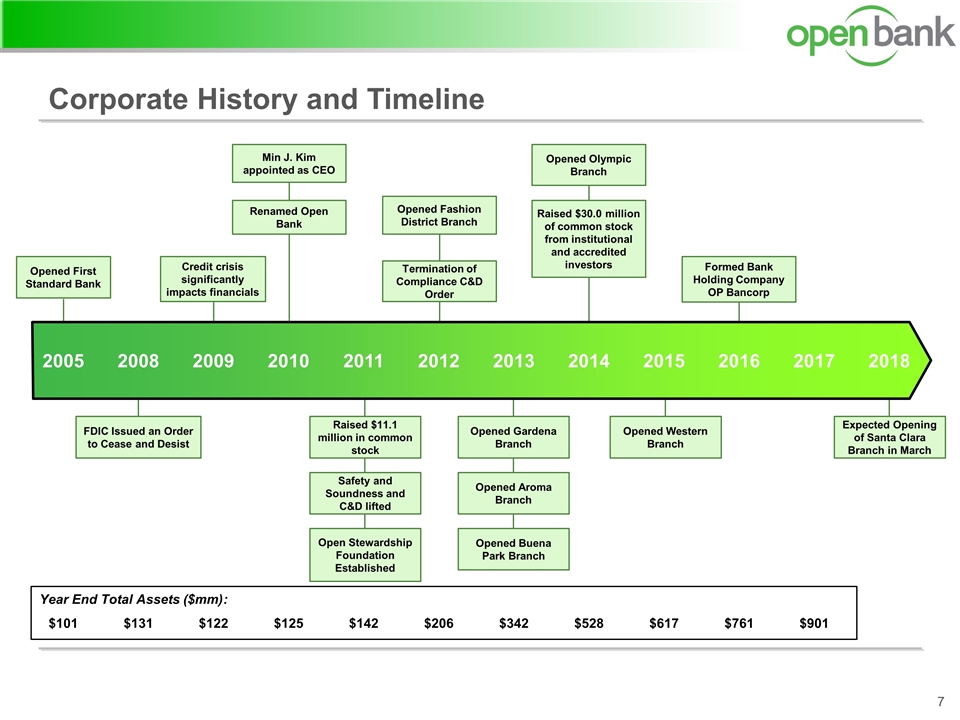

Corporate History and Timeline Credit crisis significantly impacts financials FDIC Issued an Order to Cease and Desist 2005 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Opened First Standard Bank Min J. Kim appointed as CEO Renamed Open Bank Safety and Soundness and C&D lifted Raised $11.1 million in common stock Open Stewardship Foundation Established Opened Fashion District Branch Termination of Compliance C&D Order Opened Aroma Branch Opened Gardena Branch Opened Buena Park Branch Opened Olympic Branch Raised $30.0 million of common stock from institutional and accredited investors Opened Western Branch Formed Bank Holding Company OP Bancorp 2018 Expected Opening of Santa Clara Branch in March $101 $131 $122 $125 $142 $206 $342 $528 $617 $761 $901 Year End Total Assets ($mm):

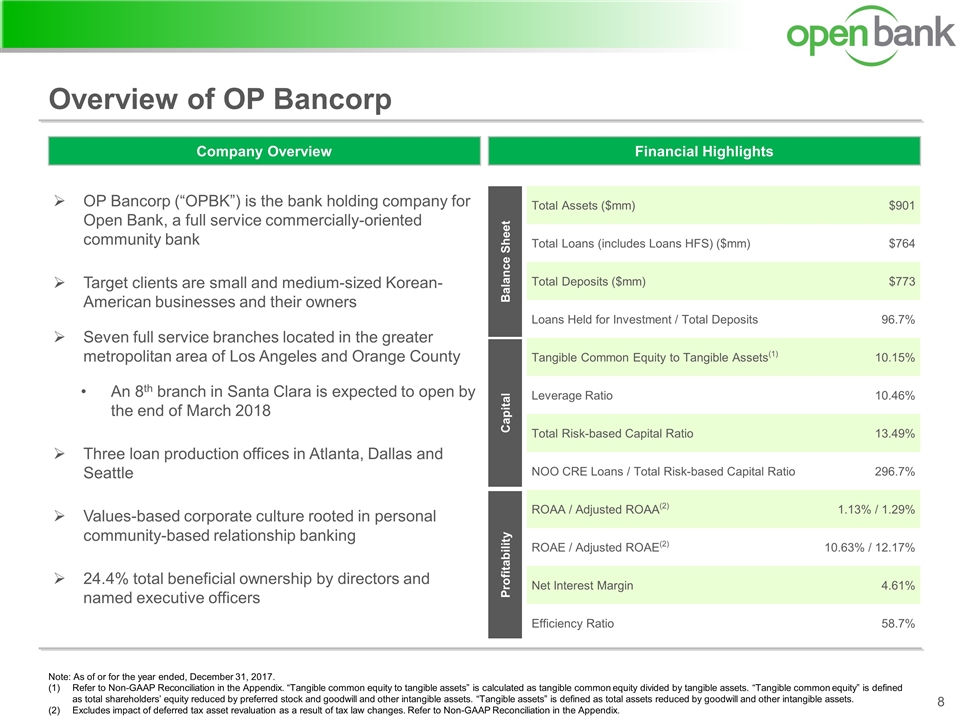

Note: As of or for the year ended, December 31, 2017. Refer to Non-GAAP Reconciliation in the Appendix. “Tangible common equity to tangible assets” is calculated as tangible common equity divided by tangible assets. “Tangible common equity” is defined as total shareholders’ equity reduced by preferred stock and goodwill and other intangible assets. “Tangible assets” is defined as total assets reduced by goodwill and other intangible assets. Excludes impact of deferred tax asset revaluation as a result of tax law changes. Refer to Non-GAAP Reconciliation in the Appendix. Overview of OP Bancorp Company Overview OP Bancorp (“OPBK”) is the bank holding company for Open Bank, a full service commercially-oriented community bank Target clients are small and medium-sized Korean-American businesses and their owners Seven full service branches located in the greater metropolitan area of Los Angeles and Orange County An 8th branch in Santa Clara is expected to open by the end of March 2018 Three loan production offices in Atlanta, Dallas and Seattle Values-based corporate culture rooted in personal community-based relationship banking 24.4% total beneficial ownership by directors and named executive officers Financial Highlights Total Assets ($mm) $901 Total Loans (includes Loans HFS) ($mm) $764 Total Deposits ($mm) $773 Loans Held for Investment / Total Deposits 96.7% Tangible Common Equity to Tangible Assets(1) 10.15% Leverage Ratio 10.46% Total Risk-based Capital Ratio 13.49% NOO CRE Loans / Total Risk-based Capital Ratio 296.7% ROAA / Adjusted ROAA(2) 1.13% / 1.29% ROAE / Adjusted ROAE(2) 10.63% / 12.17% Net Interest Margin 4.61% Efficiency Ratio 58.7% Balance Sheet Capital Profitability

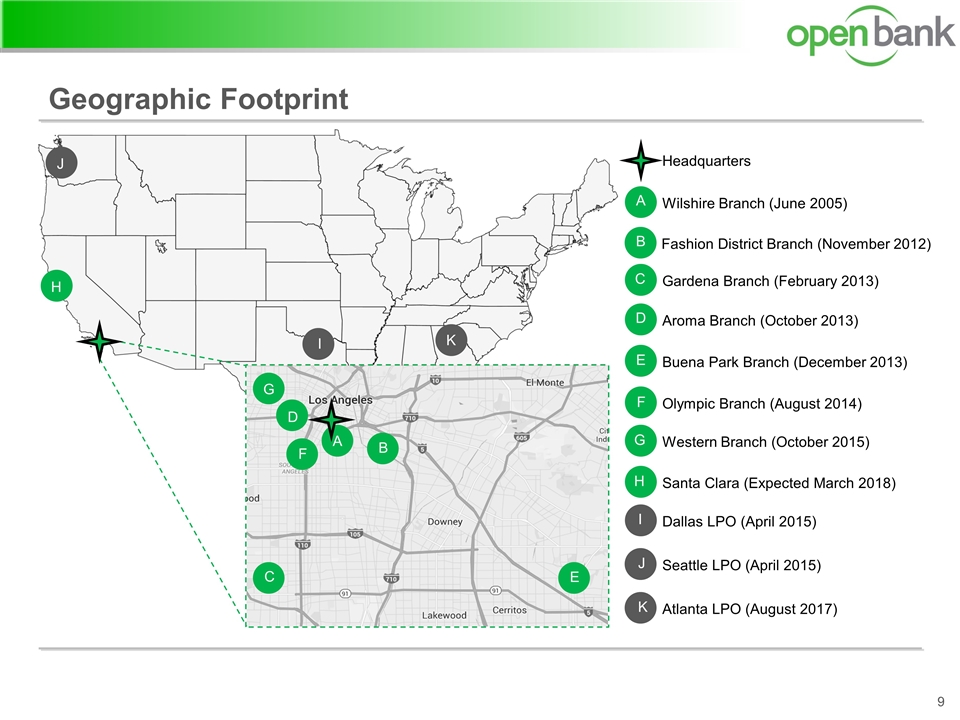

Geographic Footprint Headquarters Wilshire Branch (June 2005) Fashion District Branch (November 2012) Gardena Branch (February 2013) Aroma Branch (October 2013) Buena Park Branch (December 2013) Olympic Branch (August 2014) Western Branch (October 2015) Dallas LPO (April 2015) Seattle LPO (April 2015) C D A B E F G I J K Atlanta LPO (August 2017) D A B F C E G Santa Clara (Expected March 2018) H H I J K

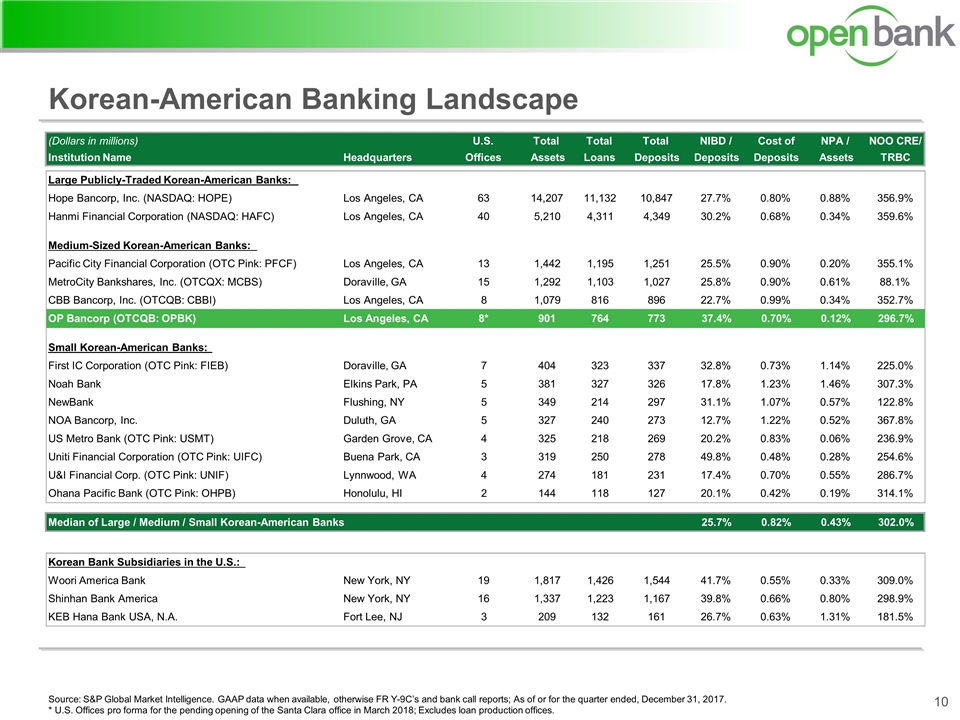

Source: S&P Global Market Intelligence. GAAP data when available, otherwise FR Y-9C’s and bank call reports; As of or for the quarter ended, December 31, 2017. * U.S. Offices pro forma for the pending opening of the Santa Clara office in March 2018; Excludes loan production offices. Korean-American Banking Landscape (Dollars in millions) U.S. Total Total Total NIBD / Cost of NPA / NOO CRE/ Institution Name Headquarters Offices Assets Loans Deposits Deposits Deposits Assets TRBC Large Publicly-Traded Korean-American Banks: Hope Bancorp, Inc. (NASDAQ: HOPE) Los Angeles, CA 63 14,207 11,132 10,847 27.7% 0.80% 0.88% 356.9% Hanmi Financial Corporation (NASDAQ: HAFC) Los Angeles, CA 40 5,210 4,311 4,349 30.2% 0.68% 0.34% 359.6% Medium-Sized Korean-American Banks: Pacific City Financial Corporation (OTC Pink: PFCF) Los Angeles, CA 13 1,442 1,195 1,251 25.5% 0.90% 0.20% 355.1% MetroCity Bankshares, Inc. (OTCQX: MCBS) Doraville, GA 15 1,292 1,103 1,027 25.8% 0.90% 0.61% 88.1% CBB Bancorp, Inc. (OTCQB: CBBI) Los Angeles, CA 8 1,079 816 896 22.7% 0.99% 0.34% 352.7% OP Bancorp (OTCQB: OPBK) Los Angeles, CA 8* 901 764 773 37.4% 0.70% 0.12% 296.7% Small Korean-American Banks: First IC Corporation (OTC Pink: FIEB) Doraville, GA 7 404 323 337 32.8% 0.73% 1.14% 225.0% Noah Bank Elkins Park, PA 5 381 327 326 17.8% 1.23% 1.46% 307.3% NewBank Flushing, NY 5 349 214 297 31.1% 1.07% 0.57% 122.8% NOA Bancorp, Inc. Duluth, GA 5 327 240 273 12.7% 1.22% 0.52% 367.8% US Metro Bank (OTC Pink: USMT) Garden Grove, CA 4 325 218 269 20.2% 0.83% 0.06% 236.9% Uniti Financial Corporation (OTC Pink: UIFC) Buena Park, CA 3 319 250 278 49.8% 0.48% 0.28% 254.6% U&I Financial Corp. (OTC Pink: UNIF) Lynnwood, WA 4 274 181 231 17.4% 0.70% 0.55% 286.7% Ohana Pacific Bank (OTC Pink: OHPB) Honolulu, HI 2 144 118 127 20.1% 0.42% 0.19% 314.1% Median of Large / Medium / Small Korean-American Banks 25.7% 0.82% 0.43% 302.0% Korean Bank Subsidiaries in the U.S.: Woori America Bank New York, NY 19 1,817 1,426 1,544 41.7% 0.55% 0.33% 309.0% Shinhan Bank America New York, NY 16 1,337 1,223 1,167 39.8% 0.66% 0.80% 298.9% KEB Hana Bank USA, N.A. Fort Lee, NJ 3 209 132 161 26.7% 0.63% 1.31% 181.5%

Operating Strategies 1. 2. 3. 4. 5. 6. Leverage the Open Bank Franchise in Korean-American Communities Leverage Public Company Status Focus on Organic Growth and Branch Expansion Increase Lower Cost Deposit Balances Preserve Asset Quality Through Disciplined Lending Practices Expand and Diversify Commercial Lending

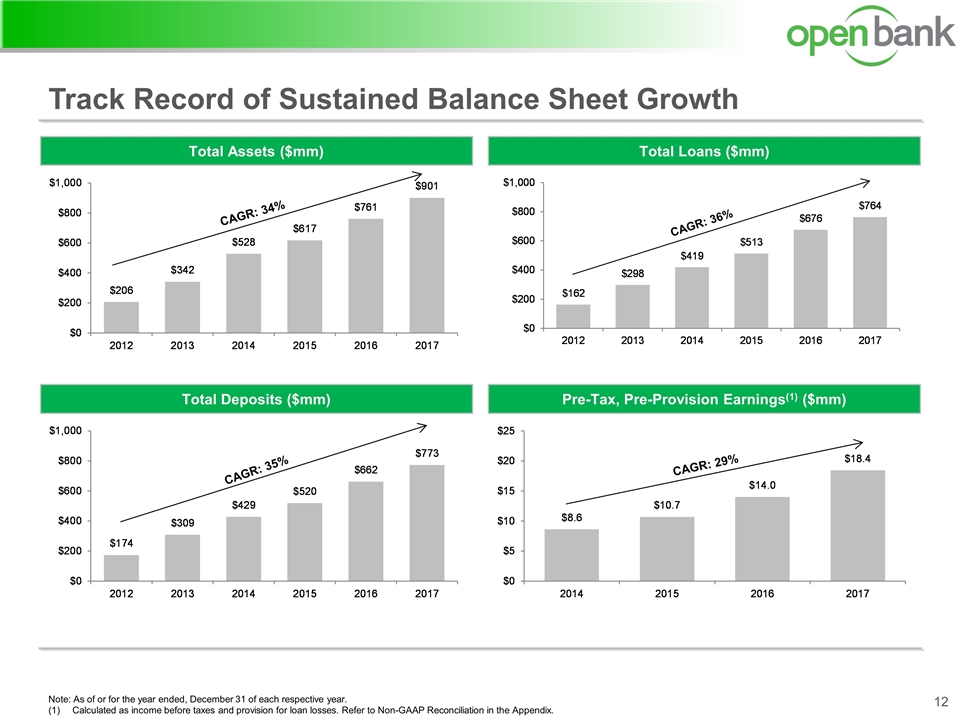

Track Record of Sustained Balance Sheet Growth Total Loans ($mm) Total Assets ($mm) Pre-Tax, Pre-Provision Earnings(1) ($mm) Total Deposits ($mm) Note: As of or for the year ended, December 31 of each respective year. Calculated as income before taxes and provision for loan losses. Refer to Non-GAAP Reconciliation in the Appendix.

Commitment and Involvement in the Community The Open Stewardship Foundation was established in October 2011 Committed to contributing 10% of OPBK’s annual consolidated net income after taxes to the Foundation Foundation has donated over $2.9 million to over 120 local non-profits Management has strong ties and relationships within the Korean-American communities OPBK’s community commitment distinguishes the Company from competitors Enhances and expands business relationships within the Korean-American communities “To become the leading Korean-American community-based commercial bank in the Korean-American communities we serve, to meet the financial needs of underserved small and medium-sized business and individuals and to give back to these communities.”

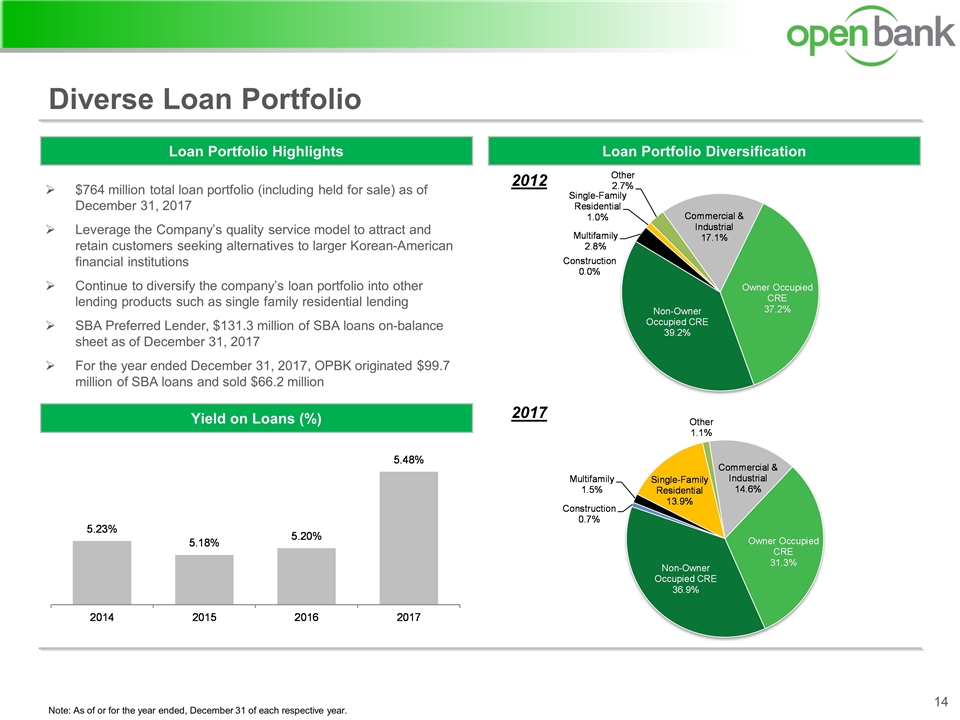

Note: As of or for the year ended, December 31 of each respective year. Diverse Loan Portfolio Loan Portfolio Diversification Loan Portfolio Highlights Yield on Loans (%) $764 million total loan portfolio (including held for sale) as of December 31, 2017 Leverage the Company’s quality service model to attract and retain customers seeking alternatives to larger Korean-American financial institutions Continue to diversify the company’s loan portfolio into other lending products such as single family residential lending SBA Preferred Lender, $131.3 million of SBA loans on-balance sheet as of December 31, 2017 For the year ended December 31, 2017, OPBK originated $99.7 million of SBA loans and sold $66.2 million 2012 2017

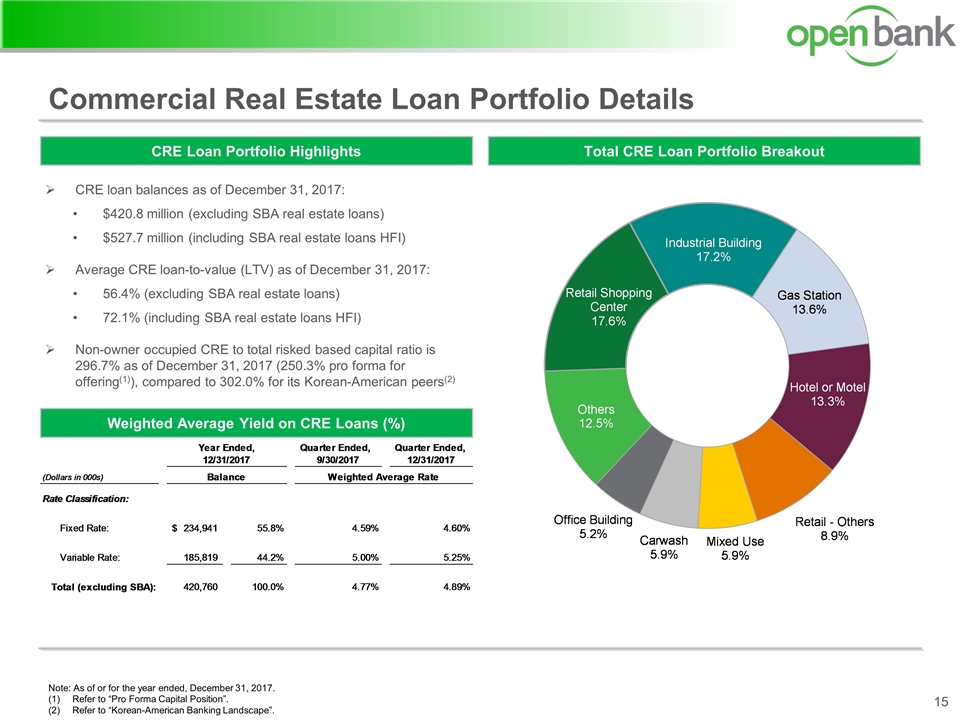

Note: As of or for the year ended, December 31, 2017. Refer to “Pro Forma Capital Position”. Refer to “Korean-American Banking Landscape”. Commercial Real Estate Loan Portfolio Details Total CRE Loan Portfolio Breakout CRE Loan Portfolio Highlights CRE loan balances as of December 31, 2017: $420.8 million (excluding SBA real estate loans) $527.7 million (including SBA real estate loans HFI) Average CRE loan-to-value (LTV) as of December 31, 2017: 56.4% (excluding SBA real estate loans) 72.1% (including SBA real estate loans HFI) Non-owner occupied CRE to total risked based capital ratio is 296.7% as of December 31, 2017 (250.3% pro forma for offering(1)), compared to 302.0% for its Korean-American peers(2) Weighted Average Yield on CRE Loans (%)

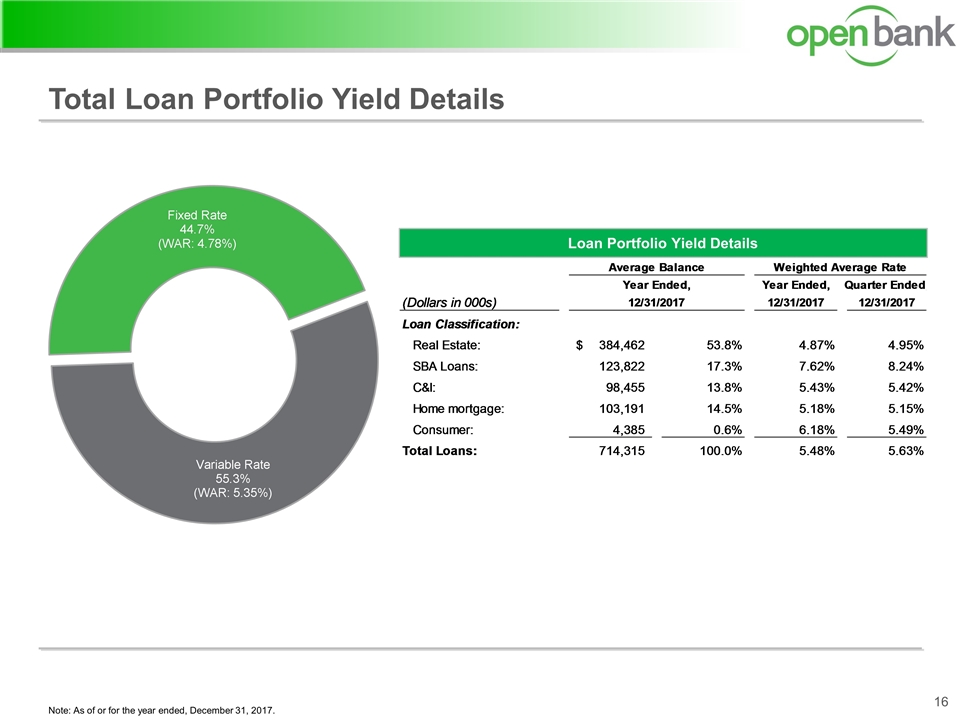

Total Loan Portfolio Yield Details Loan Portfolio Yield Details Note: As of or for the year ended, December 31, 2017.

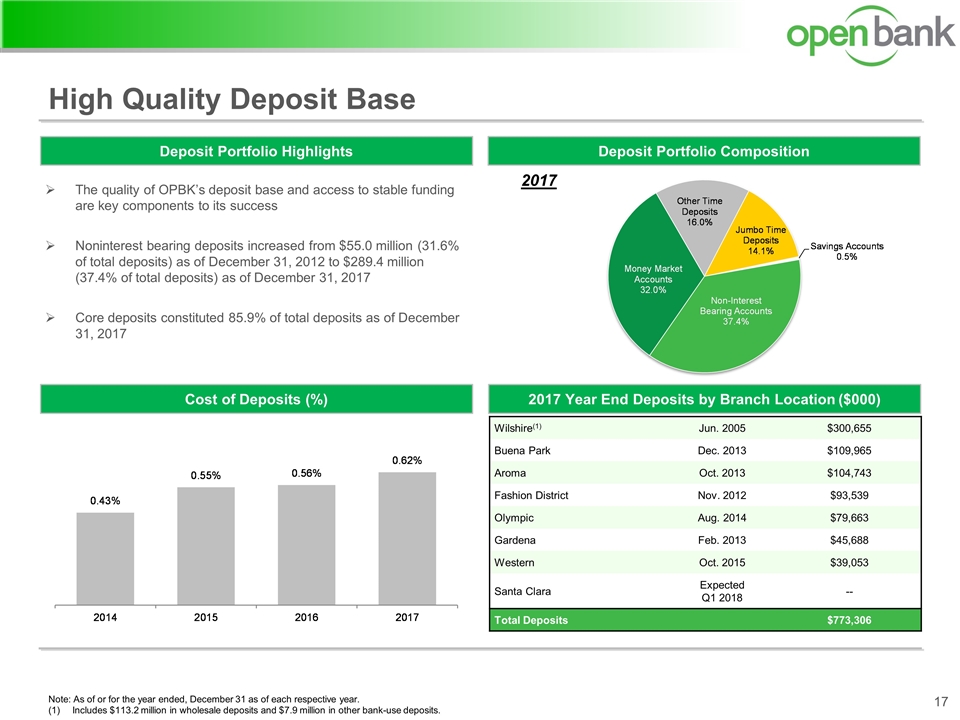

Note: As of or for the year ended, December 31 as of each respective year. Includes $113.2 million in wholesale deposits and $7.9 million in other bank-use deposits. High Quality Deposit Base Deposit Portfolio Composition Deposit Portfolio Highlights Cost of Deposits (%) The quality of OPBK’s deposit base and access to stable funding are key components to its success Noninterest bearing deposits increased from $55.0 million (31.6% of total deposits) as of December 31, 2012 to $289.4 million (37.4% of total deposits) as of December 31, 2017 Core deposits constituted 85.9% of total deposits as of December 31, 2017 Wilshire(1) Jun. 2005 $300,655 Buena Park Dec. 2013 $109,965 Aroma Oct. 2013 $104,743 Fashion District Nov. 2012 $93,539 Olympic Aug. 2014 $79,663 Gardena Feb. 2013 $45,688 Western Oct. 2015 $39,053 Santa Clara Expected Q1 2018 -- Total Deposits $773,306 2017 Year End Deposits by Branch Location ($000) 2017

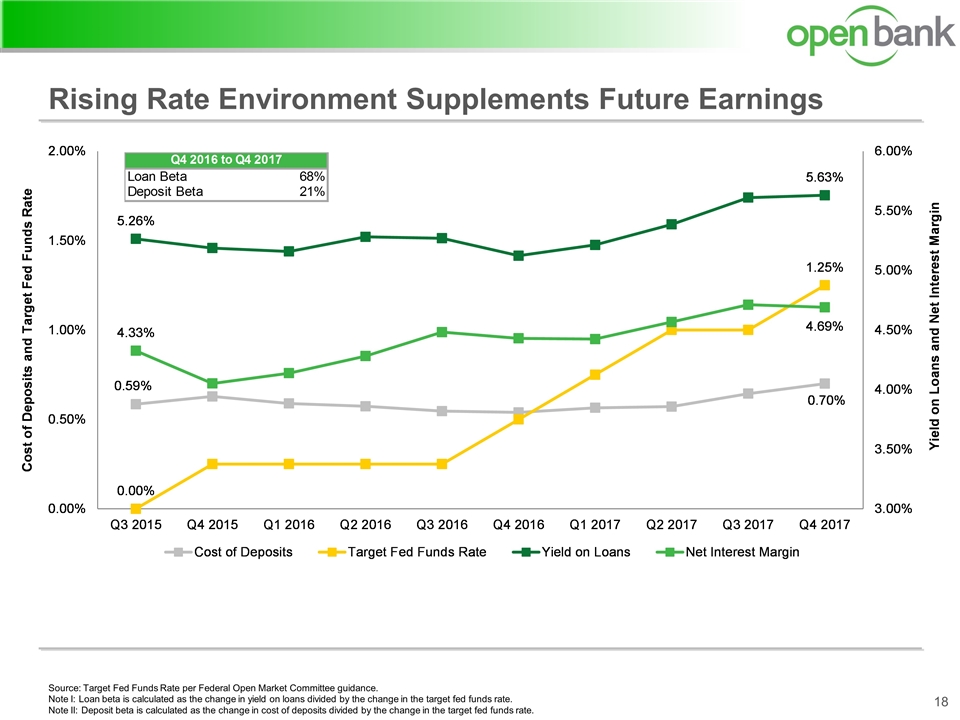

Source: Target Fed Funds Rate per Federal Open Market Committee guidance. Note I: Loan beta is calculated as the change in yield on loans divided by the change in the target fed funds rate. Note II: Deposit beta is calculated as the change in cost of deposits divided by the change in the target fed funds rate. Rising Rate Environment Supplements Future Earnings

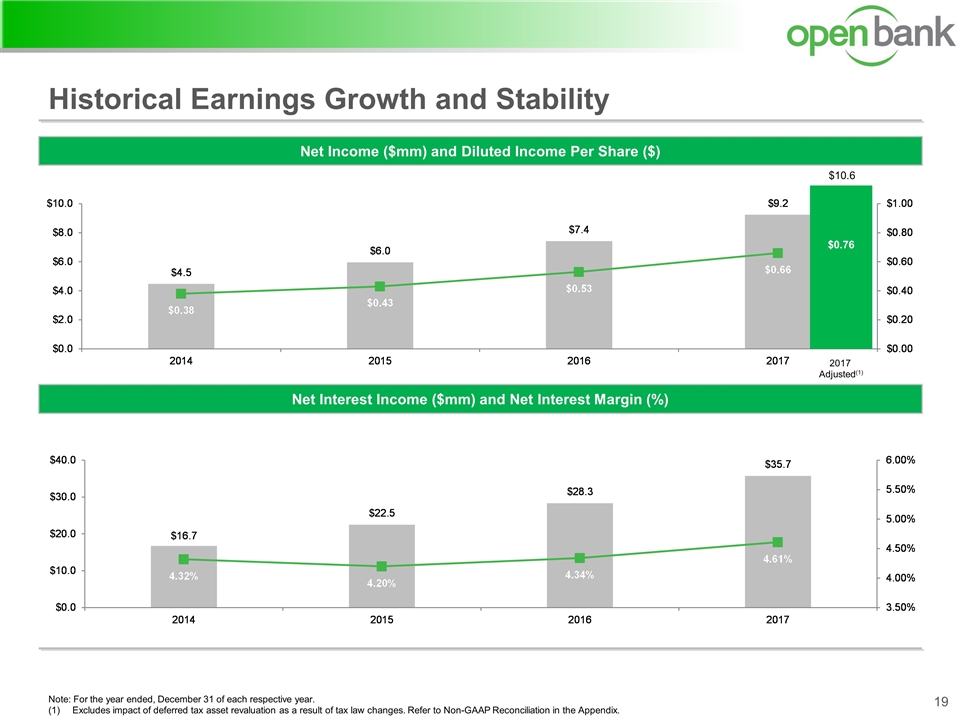

Note: For the year ended, December 31 of each respective year. Excludes impact of deferred tax asset revaluation as a result of tax law changes. Refer to Non-GAAP Reconciliation in the Appendix. Historical Earnings Growth and Stability Net Income ($mm) and Diluted Income Per Share ($) Net Interest Income ($mm) and Net Interest Margin (%) 2017 Adjusted(1) $10.6 $0.76

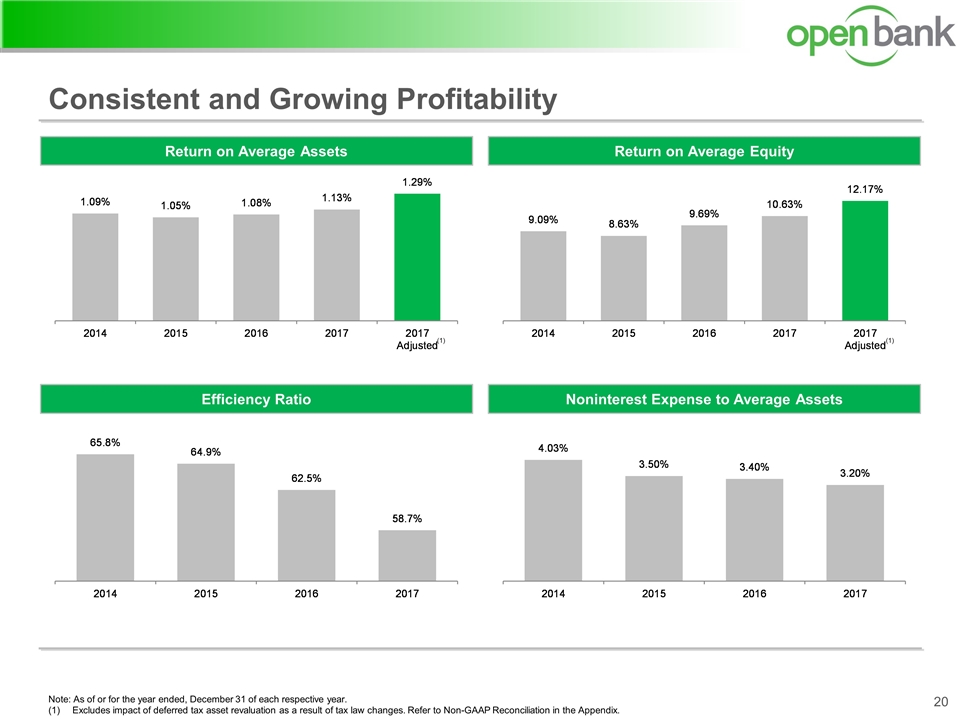

Consistent and Growing Profitability Return on Average Equity Return on Average Assets Noninterest Expense to Average Assets Efficiency Ratio (1) (1) Note: As of or for the year ended, December 31 of each respective year. Excludes impact of deferred tax asset revaluation as a result of tax law changes. Refer to Non-GAAP Reconciliation in the Appendix.

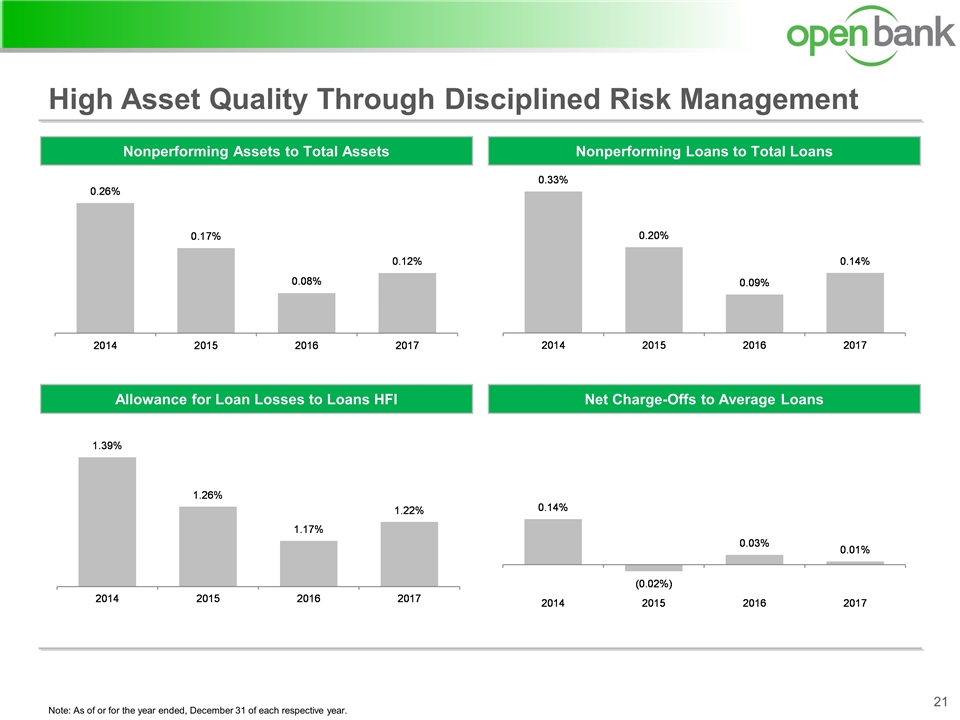

Note: As of or for the year ended, December 31 of each respective year. High Asset Quality Through Disciplined Risk Management Nonperforming Loans to Total Loans Nonperforming Assets to Total Assets Net Charge-Offs to Average Loans Allowance for Loan Losses to Loans HFI

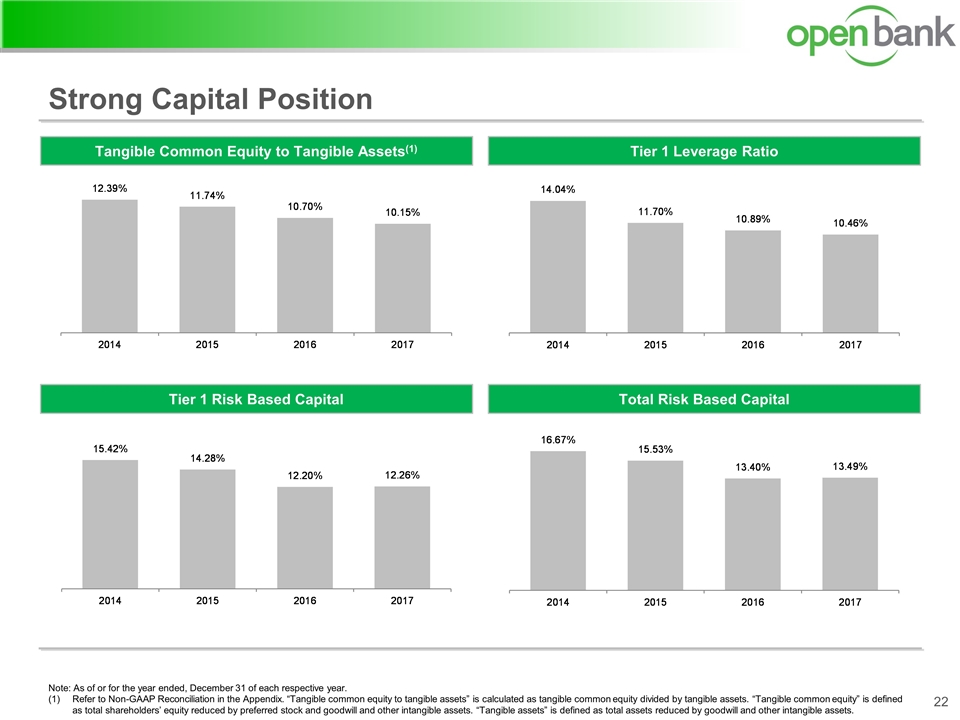

Note: As of or for the year ended, December 31 of each respective year. Refer to Non-GAAP Reconciliation in the Appendix. “Tangible common equity to tangible assets” is calculated as tangible common equity divided by tangible assets. “Tangible common equity” is defined as total shareholders’ equity reduced by preferred stock and goodwill and other intangible assets. “Tangible assets” is defined as total assets reduced by goodwill and other intangible assets. Strong Capital Position Tier 1 Leverage Ratio Tangible Common Equity to Tangible Assets(1) Tier 1 Risk Based Capital Total Risk Based Capital

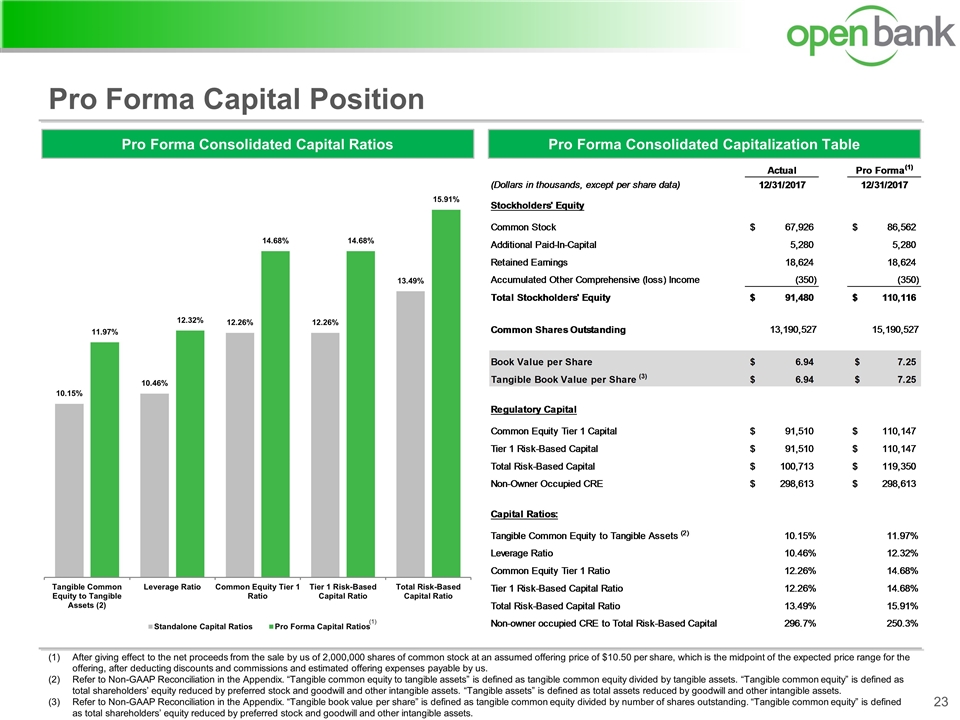

After giving effect to the net proceeds from the sale by us of 2,000,000 shares of common stock at an assumed offering price of $10.50 per share, which is the midpoint of the expected price range for the offering, after deducting discounts and commissions and estimated offering expenses payable by us. Refer to Non-GAAP Reconciliation in the Appendix. “Tangible common equity to tangible assets” is defined as tangible common equity divided by tangible assets. “Tangible common equity” is defined as total shareholders’ equity reduced by preferred stock and goodwill and other intangible assets. “Tangible assets” is defined as total assets reduced by goodwill and other intangible assets. Refer to Non-GAAP Reconciliation in the Appendix. “Tangible book value per share” is defined as tangible common equity divided by number of shares outstanding. “Tangible common equity” is defined as total shareholders’ equity reduced by preferred stock and goodwill and other intangible assets. Pro Forma Capital Position Pro Forma Consolidated Capitalization Table Pro Forma Consolidated Capital Ratios (1)

Key Investment Highlights Proven Track Record of Organic and Profitable Growth Experienced Management Team Personal Relationship-Based Service Strong Community Relationships Strong Risk Management Practices and Disciplined Credit Quality Management Efficient and Scalable Banking Platform

Appendix

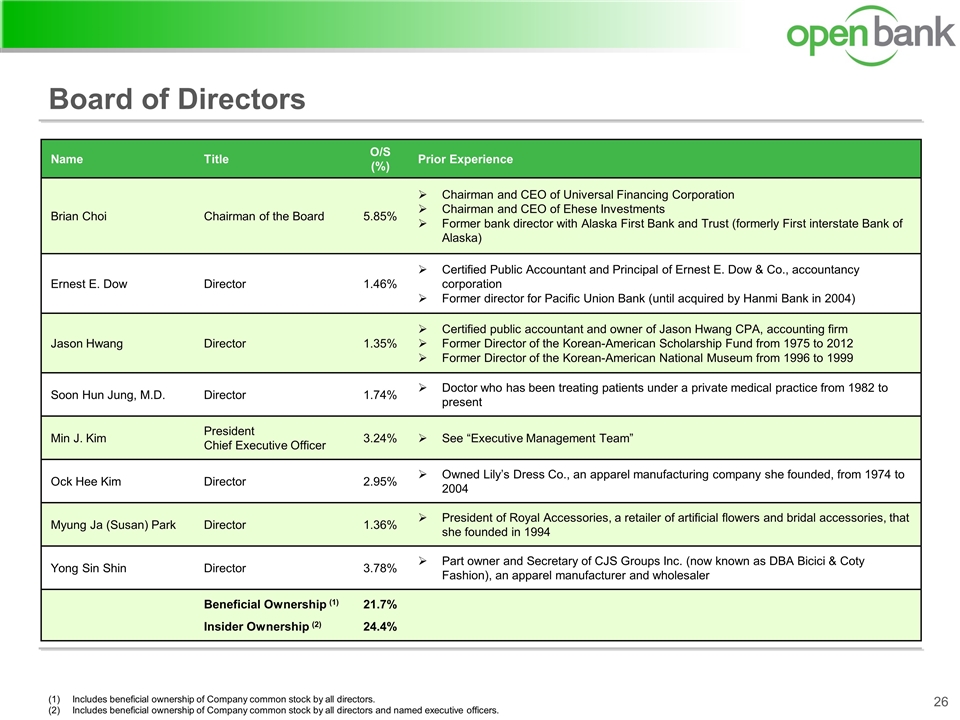

Includes beneficial ownership of Company common stock by all directors. Includes beneficial ownership of Company common stock by all directors and named executive officers. Board of Directors Name Title O/S (%) Prior Experience Brian Choi Chairman of the Board 5.85% Chairman and CEO of Universal Financing Corporation Chairman and CEO of Ehese Investments Former bank director with Alaska First Bank and Trust (formerly First interstate Bank of Alaska) Ernest E. Dow Director 1.46% Certified Public Accountant and Principal of Ernest E. Dow & Co., accountancy corporation Former director for Pacific Union Bank (until acquired by Hanmi Bank in 2004) Jason Hwang Director 1.35% Certified public accountant and owner of Jason Hwang CPA, accounting firm Former Director of the Korean-American Scholarship Fund from 1975 to 2012 Former Director of the Korean-American National Museum from 1996 to 1999 Soon Hun Jung, M.D. Director 1.74% Doctor who has been treating patients under a private medical practice from 1982 to present Min J. Kim President Chief Executive Officer 3.24% See “Executive Management Team” Ock Hee Kim Director 2.95% Owned Lily’s Dress Co., an apparel manufacturing company she founded, from 1974 to 2004 Myung Ja (Susan) Park Director 1.36% President of Royal Accessories, a retailer of artificial flowers and bridal accessories, that she founded in 1994 Yong Sin Shin Director 3.78% Part owner and Secretary of CJS Groups Inc. (now known as DBA Bicici & Coty Fashion), an apparel manufacturer and wholesaler Beneficial Ownership (1) Insider Ownership (2) 21.7% 24.4%

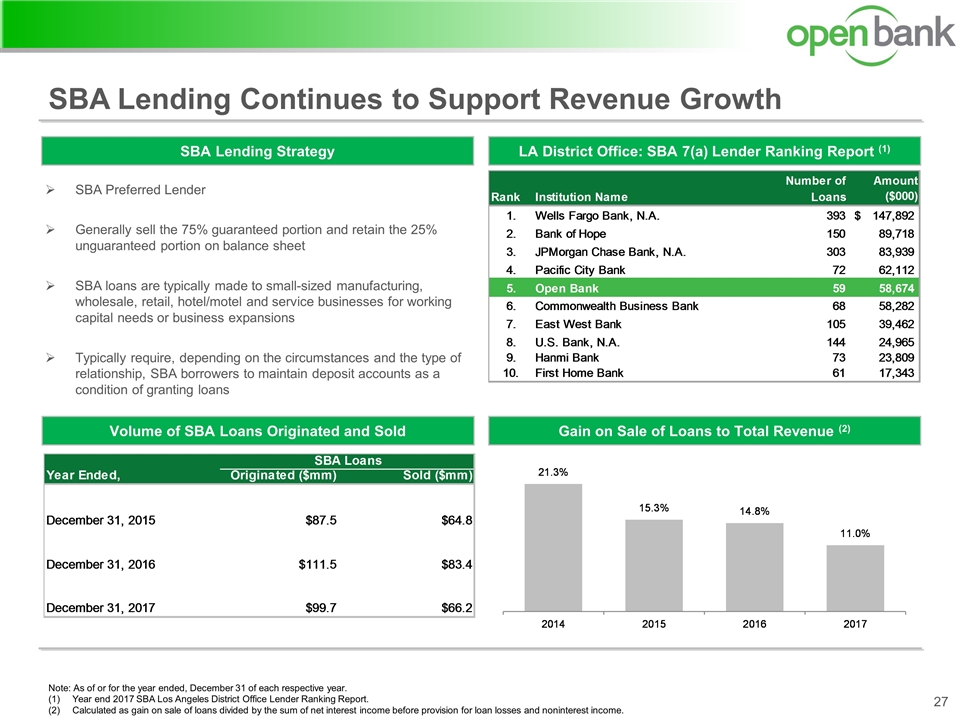

Note: As of or for the year ended, December 31 of each respective year. Year end 2017 SBA Los Angeles District Office Lender Ranking Report. Calculated as gain on sale of loans divided by the sum of net interest income before provision for loan losses and noninterest income. SBA Lending Continues to Support Revenue Growth LA District Office: SBA 7(a) Lender Ranking Report (1) Gain on Sale of Loans to Total Revenue (2) SBA Lending Strategy SBA Preferred Lender Generally sell the 75% guaranteed portion and retain the 25% unguaranteed portion on balance sheet SBA loans are typically made to small-sized manufacturing, wholesale, retail, hotel/motel and service businesses for working capital needs or business expansions Typically require, depending on the circumstances and the type of relationship, SBA borrowers to maintain deposit accounts as a condition of granting loans Volume of SBA Loans Originated and Sold

The Company uses two approaches to model interest rate risk: Earnings at Risk, or EAR, and Economic Value of Equity, or EVE Under EAR, net interest income is modeled utilizing various assumptions for assets and liabilities, and derivatives EVE measures the period end market value of assets minus the market value of liabilities and the change in this value as rates change. Note: As of December 31, 2017. Interest Rate Risk Analysis Interest Rate Risk to Earnings (EVE) Interest Rate Risk to Earnings (EAR)

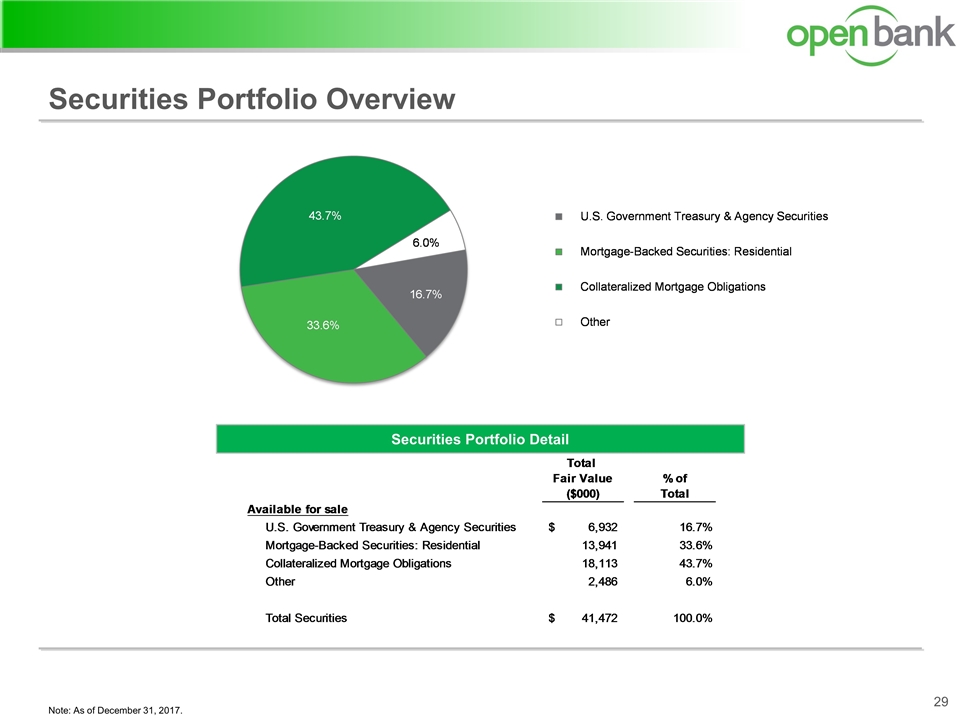

Note: As of December 31, 2017. Securities Portfolio Overview Securities Portfolio Detail

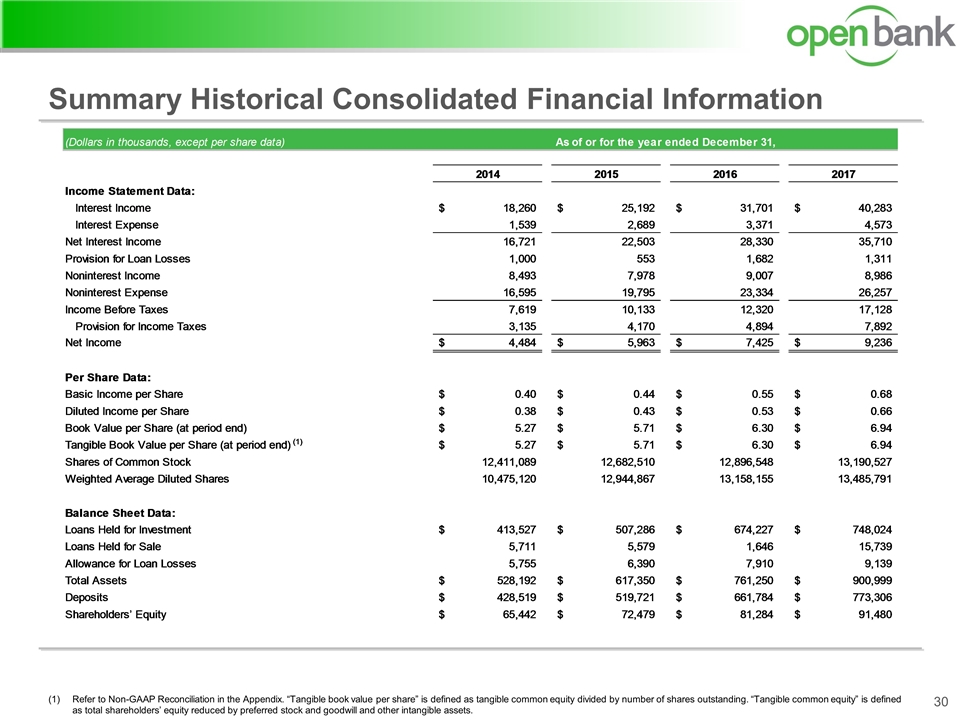

Refer to Non-GAAP Reconciliation in the Appendix. “Tangible book value per share” is defined as tangible common equity divided by number of shares outstanding. “Tangible common equity” is defined as total shareholders’ equity reduced by preferred stock and goodwill and other intangible assets. Summary Historical Consolidated Financial Information

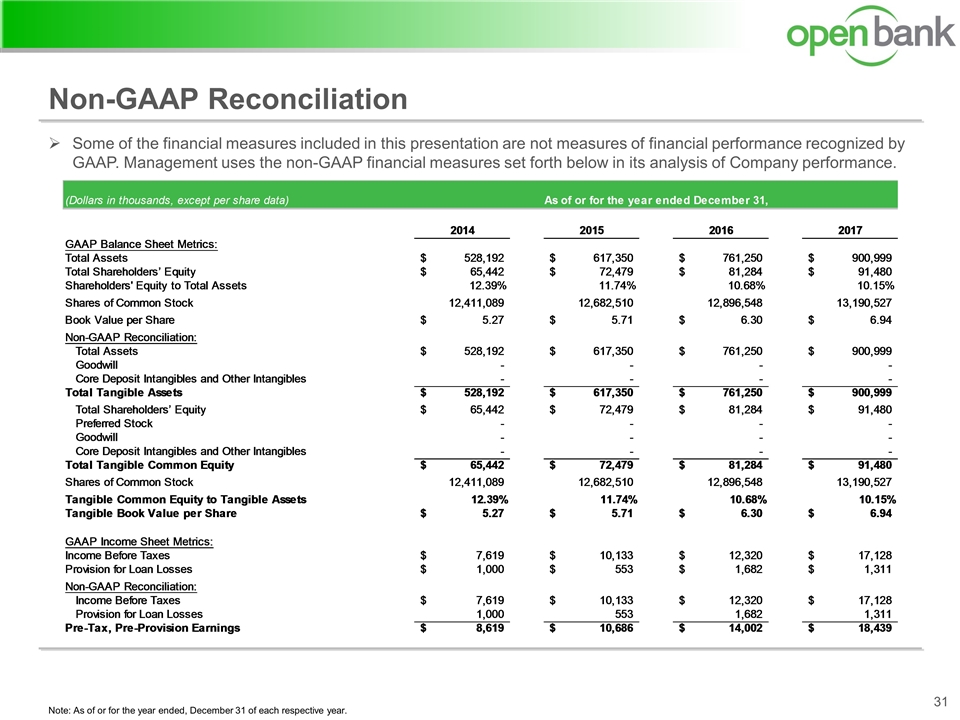

Note: As of or for the year ended, December 31 of each respective year. Non-GAAP Reconciliation Some of the financial measures included in this presentation are not measures of financial performance recognized by GAAP. Management uses the non-GAAP financial measures set forth below in its analysis of Company performance.

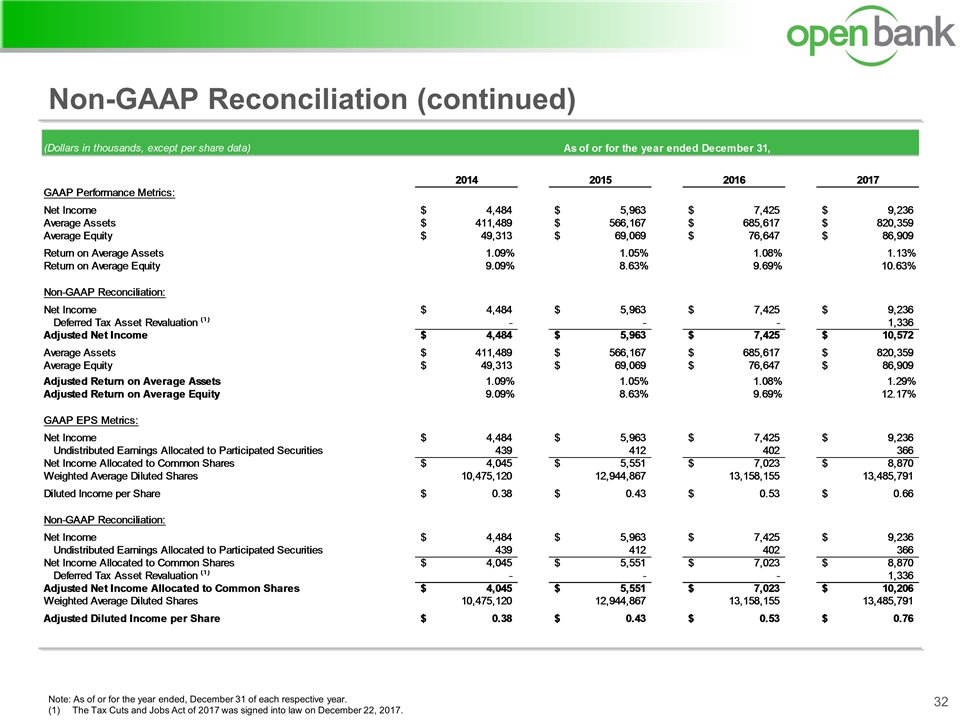

Note: As of or for the year ended, December 31 of each respective year. The Tax Cuts and Jobs Act of 2017 was signed into law on December 22, 2017. Non-GAAP Reconciliation (continued)