Data processing and communication expense for 2017 was $1.3 million compared to $1.1 million for 2016, an increase of $236,000, or 21.7%. This increase was primarily due a continued growth in our loans and deposits.

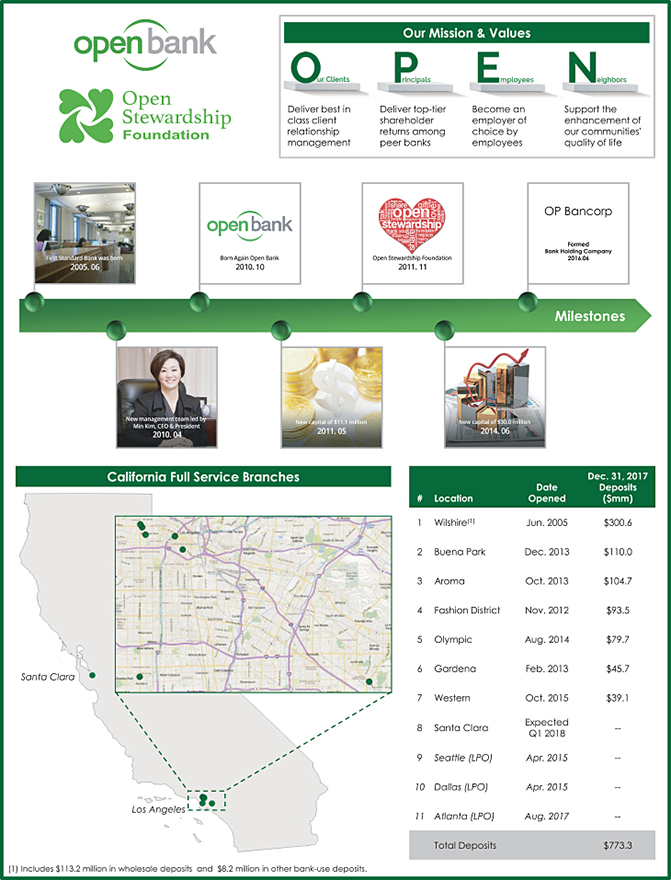

Professional fees for 2017 were $589,000 compared to $684,000 for 2016, a decrease of $95,000, or 13.9%. This decrease was primarily due to the costs incurred in 2016 associated with the formation of OP Bancorp as a bank holding company and the completion of the transactions under which Open Bank became a wholly-owned subsidiary of OP Bancorp, offset by the professional fees incurred in the fourth quarter of 2017 attributable to this offering.

FDIC insurance and regulatory assessment expense for 2017 was $377,000 compared to $369,000 for 2016, an increase of $8,000 or 2.2%. This increase was primarily due to an increase in our FDIC insurance and DBO regulatory assessment as the size of our assets continued to grow.

Promotion and advertising expense for 2017 was $631,000 compared to $557,000 for 2016, an increase of $74,000 or 13.3%. The increase was consistent with a continued growth of our loans and deposits.

Directors’ fees and expenses for 2017 were $796,000 compared to $758,000 for 2016, an increase of $38,000 or 5.0%. Directors’ fees and expenses include a monthly retainer fee, reimbursement for travel and other expenses, and stock-based expenses relating to equity awards granted in prior years under our equity plans to our directors. Directors’ fees and expenses (not including stock-based expenses) for 2017 was $365,000 compared to $327,000 in 2016, an increase of $38,000, or 11.5%. The increase was due to the increase in directors’ monthly retainer fees in 2017. Directors’ stock-based expenses for 2017 and 2016 were $431,000.

Our aggregate donations to the Foundation and other charitable and community contributions for 2017 were $954,000 compared to $745,000 for 2016, an increase of $209,000, or 28.1%. The increase was due to increased donation accruals for Open Stewardship Foundation, which is directly proportionate to the growth in our after tax income. On an annual basis, we donate 10% of our consolidated net income after taxes to the Foundation.

Other expenses for 2017 were $1.2 million compared to $964,000 in 2016, an increase of $232,000, or 24.1%. The increase was primarily due to increased operating expenses and customer service expenses.

Income Tax Expense

Income tax expense was $7.9 million in 2017 compared to $4.9 million in 2016. The increase in income tax expense was related to growth in pre-tax income and a revaluation of deferred tax assets of $1.3 million, as discussed below. Effective tax rates were 46.1% and 39.7% in 2017 and 2016, respectively.

On December 22, 2017, H.R.1, commonly known as the Tax Cuts and Jobs Act (the “Tax Act”), was signed into law, which among other items reduces the federal corporate tax rate to 21% from 34%, effective January 1, 2018. U.S. generally accepted accounting principles require companies to revalue certain tax-related assets as of the date of enactment of the new legislation with resulting tax effects accounted for in the reporting period of enactment. As a result, we performed an analysis to determine the impact of the revaluation of the net deferred tax asset. The value of the deferred tax asset was reduced by $1.3 million, and recorded as tax expense for the year ended December 31, 2017.

Some items of income and expense are recognized in different years for tax purposes than when applying generally accepted accounting principles leading to timing differences between our actual tax liability, and the amount accrued for this liability based on book income. These temporary differences comprise the “deferred” portion of our tax expense or benefit, which accumulates on our books as a deferred tax asset or deferred tax liability until such time as they reverse.

59