Investor Presentation January 8, 2020 NYSE: CVIA Exhibit 99.1

Forward Looking Statements Forward-Looking Statements This presentation contains forward-looking statements intended to qualify for the protection of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. The words “anticipate,” “estimate,” “expect,” “objective,” “goal,” “project,” “intend,” “plan,” “believe,” “will,” “should,” “may,” “target,” “forecast,” “guidance,” “outlook” and similar expressions generally identify forward-looking statements. Similarly, descriptions of the Company’s objectives, strategies, plans, goals or targets are also forward-looking statements. Forward-looking statements are based upon management’s then-current views and assumptions regarding future events and operating performance that may ultimately prove to be inaccurate. Although management believes the expectations expressed in forward-looking statements are based on reasonable assumptions within the bounds of its knowledge, forward-looking statements involve risks, uncertainties and other factors which may materially affect the Company’s business, financial condition, results of operations or liquidity. Forward-looking statements are not guarantees of future performance and actual results may differ materially from those discussed in the forward-looking statements as a result of various factors, including, but not limited to, the risks discussed in the Risk Factors section of the Company’s Annual Report on Form 10-K as filed with the Securities and Exchange Commission (“SEC”) on March 22, 2019; and the other factors discussed from time to time in the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the SEC. This release should be read in conjunction with such filings, and you should consider all of such risks, uncertainties and other factors carefully in evaluating forward-looking statements. Pro Forma Information and Non-GAAP Financial Measures This presentation includes pro forma financial results which include the combined results of operations for Fairmount Santrol and Unimin for periods preceding the June 1, 2018 merger. This presentation also includes non-GAAP financial measures, including segment contribution margin, EBITDA, adjusted EBITDA and other measures identified as “adjusted” results. Please refer to the Appendix for a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measures. Management believes this supplemental financial information enhances an investor’s understanding of Covia’s financial performance as it excludes those items which impact comparability of operating trends. The non-GAAP financial information should not be considered in isolation or viewed as a substitute for measures of performance calculated in accordance with GAAP, but should be viewed in addition to the results as reported by Covia. The inclusion of non-GAAP financial information as used in this presentation is not necessarily comparable to other similarly titled measures of other companies due to the potential inconsistencies in the method of presentation and items considered.

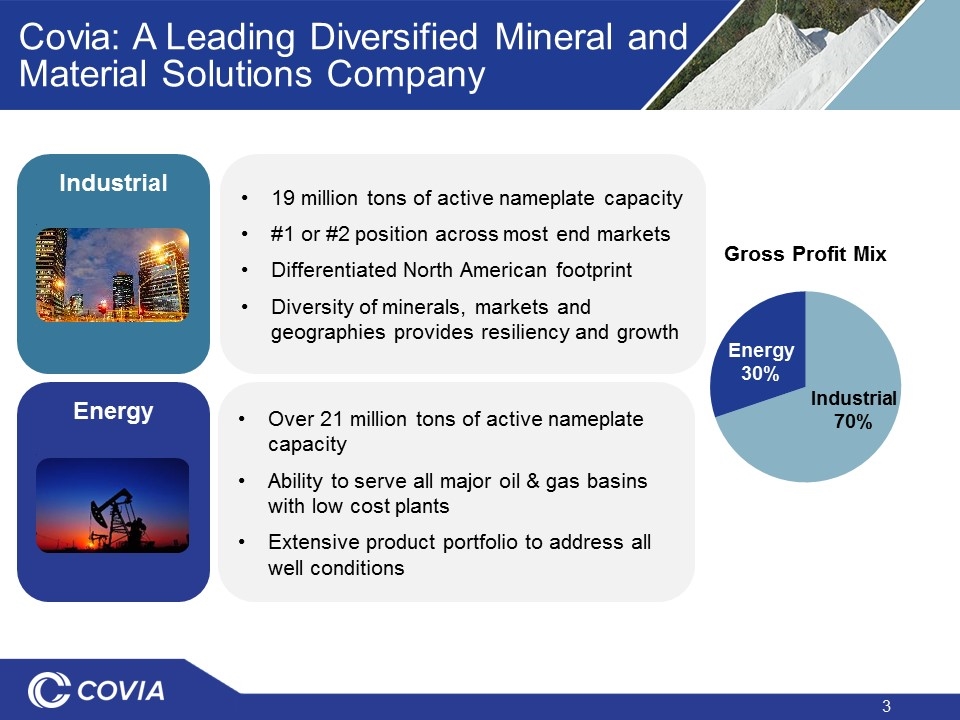

Covia: A Leading Diversified Mineral and Material Solutions Company Energy Over 21 million tons of active nameplate capacity Ability to serve all major oil & gas basins with low cost plants Extensive product portfolio to address all well conditions Industrial 19 million tons of active nameplate capacity #1 or #2 position across most end markets Differentiated North American footprint Diversity of minerals, markets and geographies provides resiliency and growth Industrial 70% Energy 30% Gross Profit Mix

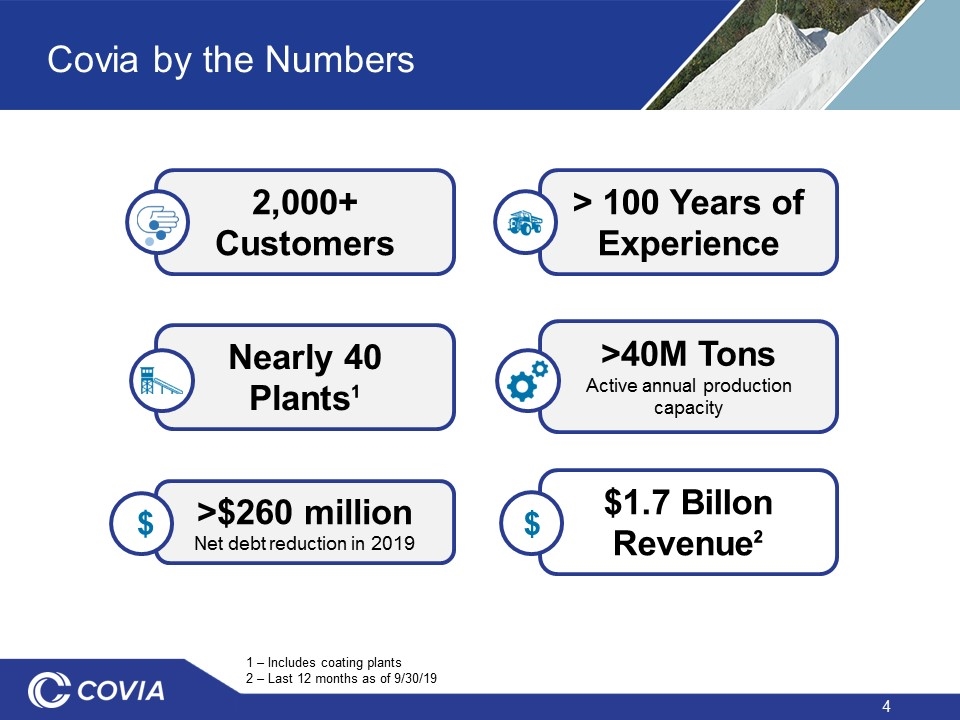

Covia by the Numbers 2,000+ Customers Nearly 40 Plants¹ > 100 Years of Experience >40M Tons Active annual production capacity $1.7 Billon Revenue² 1 – Includes coating plants 2 – Last 12 months as of 9/30/19 >$260 million Net debt reduction in 2019 $ $

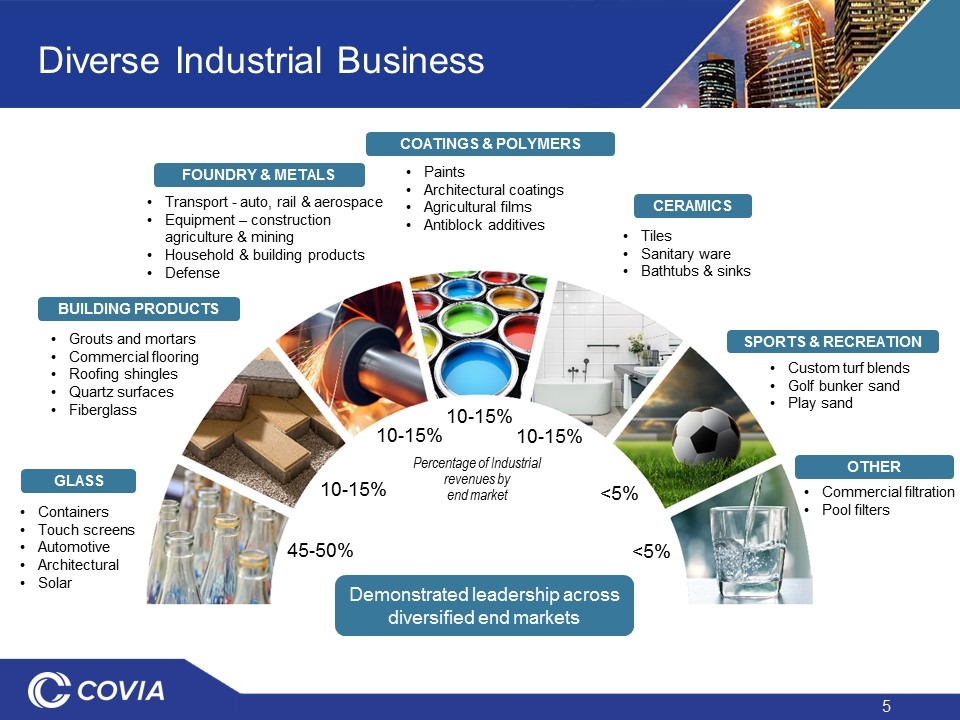

Diverse Industrial Business Containers Touch screens Automotive Architectural Solar Tiles Sanitary ware Bathtubs & sinks Demonstrated leadership across diversified end markets Grouts and mortars Commercial flooring Roofing shingles Quartz surfaces Fiberglass Transport - auto, rail & aerospace Equipment – construction agriculture & mining Household & building products Defense Paints Architectural coatings Agricultural films Antiblock additives Custom turf blends Golf bunker sand Play sand Commercial filtration Pool filters GLASS BUILDING PRODUCTS FOUNDRY & METALS COATINGS & POLYMERS SPORTS & RECREATION OTHER CERAMICS 10-15% 10-15% <5% Percentage of Industrial revenues by end market <5% 10-15% 10-15% 45-50%

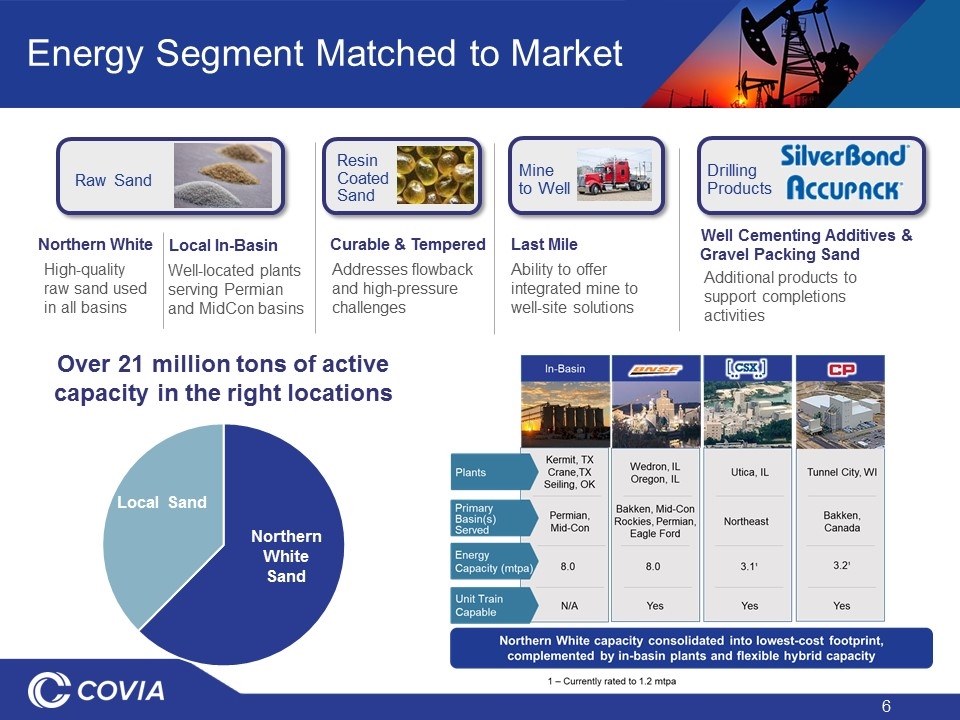

Size and Scale Local In-Basin Northern White Curable & Tempered Well Cementing Additives & Gravel Packing Sand Energy Segment Matched to Market Raw Sand Resin Coated Sand Drilling Products Well-located plants serving Permian and MidCon basins High-quality raw sand used in all basins Addresses flowback and high-pressure challenges Additional products to support completions activities Mine to Well Last Mile Ability to offer integrated mine to well-site solutions Over 21 million tons of active capacity in the right locations

Executing on Our Strategy Strengthen Balance Sheet $240M divestiture of non-core assets Generated ~$70M of operating cash flow³ Reduced capex more than 60% vs. prior year³ Lowered SG&A 31% from peak level Consolidation of production into lowest cost assets Idled 15 million tons of capacity Closed / idled 16 terminals Reduced rail car fleet by 2,800 cars² Commissioned 8 million tons of local capacity REPOSITION Energy Segment Grow Industrial 170 basis point expansion in gross margin YTD¹ 350k tons capacity expansion in Mexico in early 2020 Over $260 million net debt reduction in 2019 1 – On a pro forma basis 2 – LTM 9/30/19 3 – YTD 9/30/19

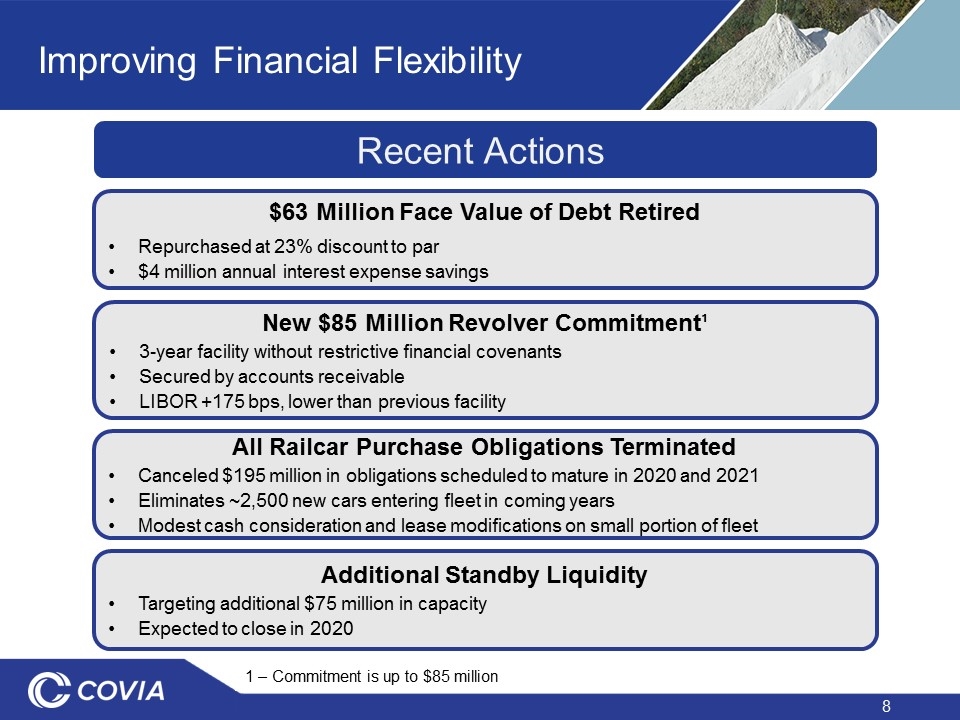

Improving Financial Flexibility Recent Actions New $85 Million Revolver Commitment¹ 3-year facility without restrictive financial covenants Secured by accounts receivable LIBOR +175 bps, lower than previous facility All Railcar Purchase Obligations Terminated Canceled $195 million in obligations scheduled to mature in 2020 and 2021 Eliminates ~2,500 new cars entering fleet in coming years Modest cash consideration and lease modifications on small portion of fleet Additional Standby Liquidity Targeting additional $75 million in capacity Expected to close in 2020 $63 Million Face Value of Debt Retired Repurchased at 23% discount to par $4 million annual interest expense savings 1 – Commitment is up to $85 million

Financial Transition Slide FINANCIALS and OUTLOOK

Third Quarter 2019 Results In millions Industrial Energy Total Company Volumes (tons) 3.6 4.2 7.8 Revenue $185.6 $223.3 $409.0 Gross Profit $59.1 $17.7¹ $76.7¹ Contribution Margin $59.1 $24.6¹ $83.6¹ SG&A -- -- $35.6² Adjusted EBITDA -- -- $43.2 1 - Includes negative impact of $1.9 mm lease expense from lease accounting standard change 2 – Includes $2.3 million in non-cash stock compensation expenses

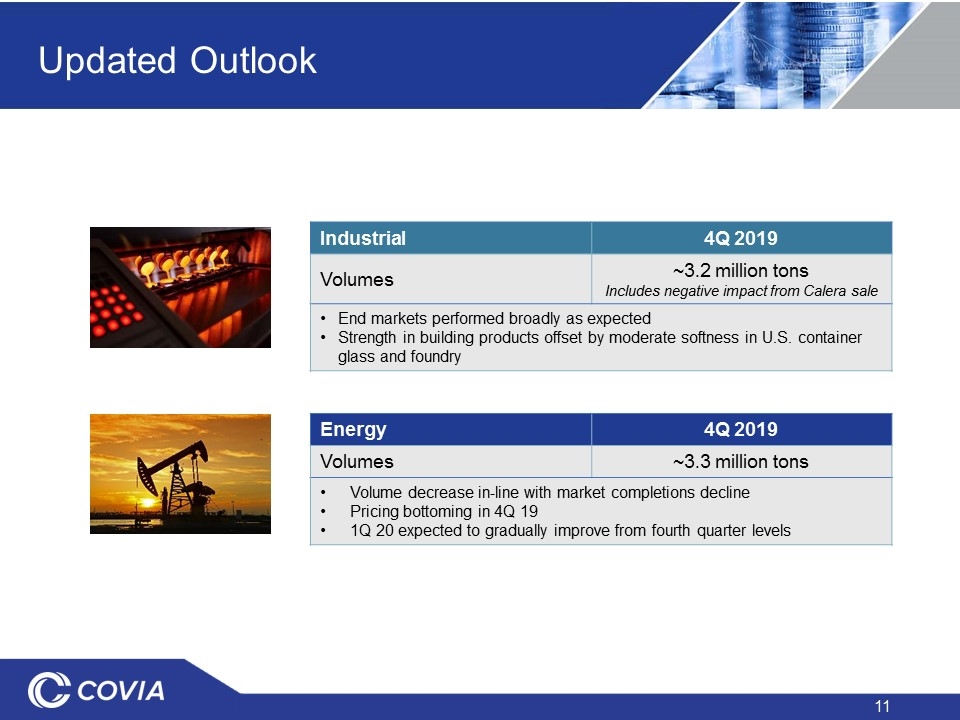

Updated Outlook Industrial 4Q 2019 Volumes ~3.2 million tons Includes negative impact from Calera sale End markets performed broadly as expected Strength in building products offset by moderate softness in U.S. container glass and foundry Energy 4Q 2019 Volumes ~3.3 million tons Volume decrease in-line with market completions decline Pricing bottoming in 4Q 19 1Q 20 expected to gradually improve from fourth quarter levels

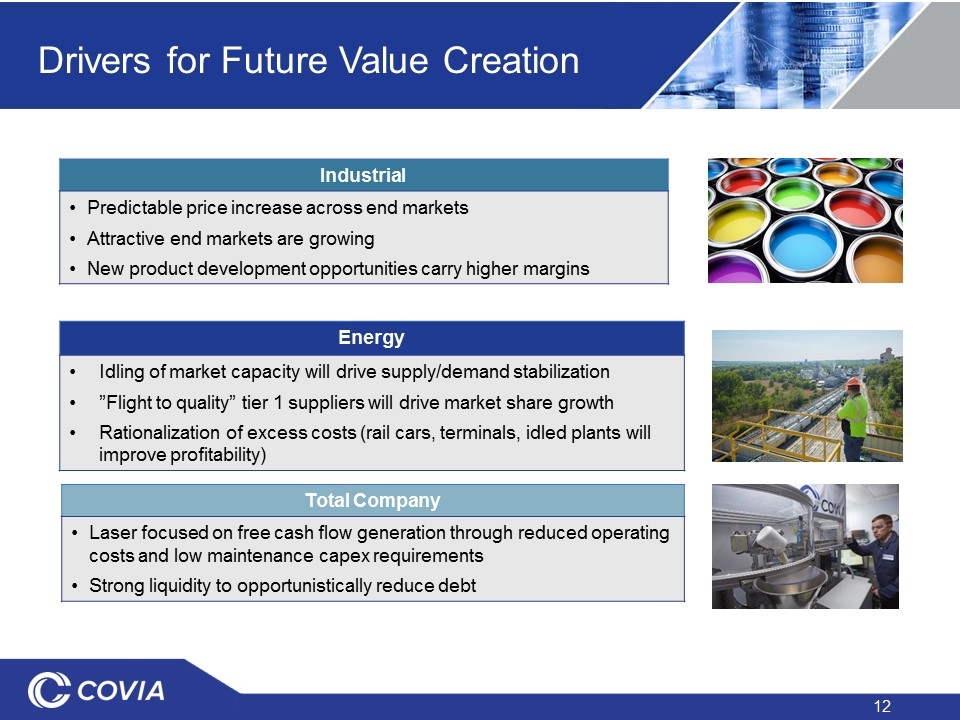

Drivers for Future Value Creation Industrial Predictable price increase across end markets Attractive end markets are growing New product development opportunities carry higher margins Energy Idling of market capacity will drive supply/demand stabilization ”Flight to quality” tier 1 suppliers will drive market share growth Rationalization of excess costs (rail cars, terminals, idled plants will improve profitability) Total Company Laser focused on free cash flow generation through reduced operating costs and low maintenance capex requirements Strong liquidity to opportunistically reduce debt

Appendix

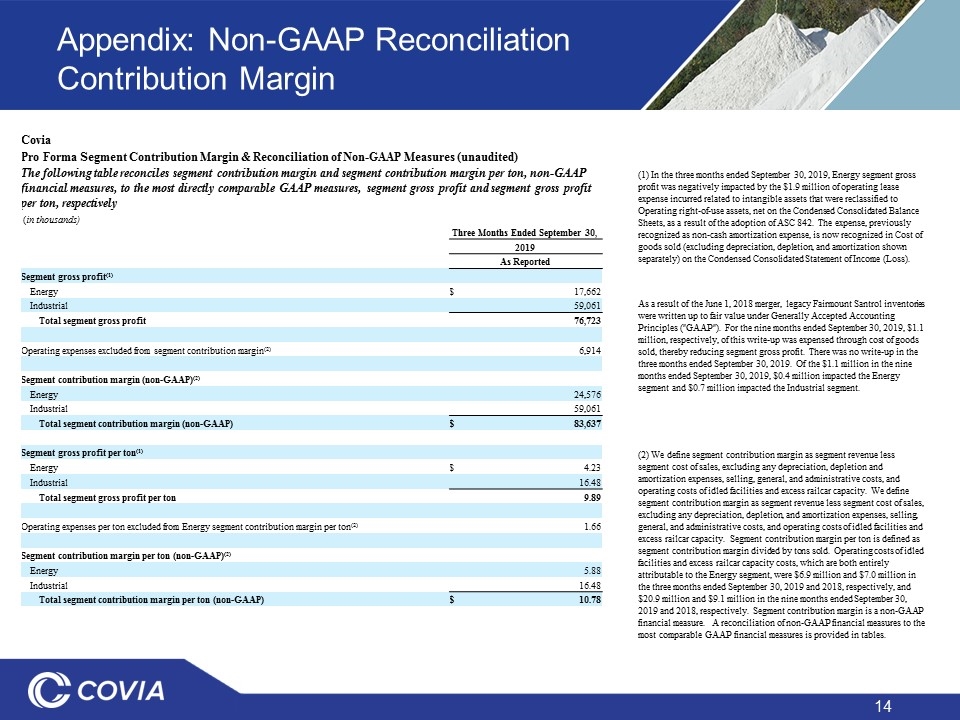

Appendix: Non-GAAP Reconciliation Contribution Margin Covia Pro Forma Segment Contribution Margin & Reconciliation of Non-GAAP Measures (unaudited) The following table reconciles segment contribution margin and segment contribution margin per ton, non-GAAP financial measures, to the most directly comparable GAAP measures, segment gross profit and segment gross profit per ton, respectively (in thousands) Three Months Ended September 30, 2019 As Reported Segment gross profit(1) Energy $ 17,662 Industrial 59,061 Total segment gross profit 76,723 Operating expenses excluded from segment contribution margin(2) 6,914 Segment contribution margin (non-GAAP)(2) Energy 24,576 Industrial 59,061 Total segment contribution margin (non-GAAP) $ 83,637 Segment gross profit per ton(1) Energy $ 4.23 Industrial 16.48 Total segment gross profit per ton 9.89 Operating expenses per ton excluded from Energy segment contribution margin per ton(2) 1.66 Segment contribution margin per ton (non-GAAP)(2) Energy 5.88 Industrial 16.48 Total segment contribution margin per ton (non-GAAP) $ 10.78 (1) In the three months ended September 30, 2019, Energy segment gross profit was negatively impacted by the $1.9 million of operating lease expense incurred related to intangible assets that were reclassified to Operating right-of-use assets, net on the Condensed Consolidated Balance Sheets, as a result of the adoption of ASC 842. The expense, previously recognized as non-cash amortization expense, is now recognized in Cost of goods sold (excluding depreciation, depletion, and amortization shown separately) on the Condensed Consolidated Statement of Income (Loss). As a result of the June 1, 2018 merger, legacy Fairmount Santrol inventories were written up to fair value under Generally Accepted Accounting Principles ("GAAP"). For the nine months ended September 30, 2019, $1.1 million, respectively, of this write-up was expensed through cost of goods sold, thereby reducing segment gross profit. There was no write-up in the three months ended September 30, 2019. Of the $1.1 million in the nine months ended September 30, 2019, $0.4 million impacted the Energy segment and $0.7 million impacted the Industrial segment. (2) We define segment contribution margin as segment revenue less segment cost of sales, excluding any depreciation, depletion and amortization expenses, selling, general, and administrative costs, and operating costs of idled facilities and excess railcar capacity. We define segment contribution margin as segment revenue less segment cost of sales, excluding any depreciation, depletion, and amortization expenses, selling, general, and administrative costs, and operating costs of idled facilities and excess railcar capacity. Segment contribution margin per ton is defined as segment contribution margin divided by tons sold. Operating costs of idled facilities and excess railcar capacity costs, which are both entirely attributable to the Energy segment, were $6.9 million and $7.0 million in the three months ended September 30, 2019 and 2018, respectively, and $20.9 million and $9.1 million in the nine months ended September 30, 2019 and 2018, respectively. Segment contribution margin is a non-GAAP financial measure. A reconciliation of non-GAAP financial measures to the most comparable GAAP financial measures is provided in tables.

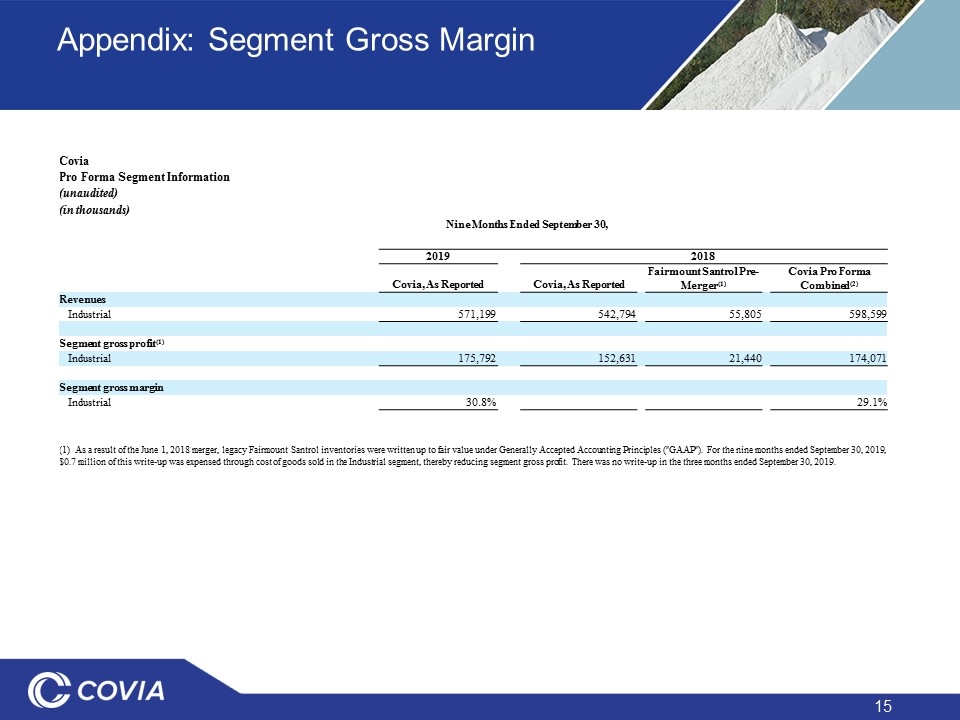

Appendix: Segment Gross Margin Covia Pro Forma Segment Information (unaudited) (in thousands) Nine Months Ended September 30, 2019 2018 Covia, As Reported Covia, As Reported Fairmount Santrol Pre-Merger(1) Covia Pro Forma Combined(2) Revenues Industrial 571,199 542,794 55,805 598,599 Segment gross profit(1) Industrial 175,792 152,631 21,440 174,071 Segment gross margin Industrial 30.8% 29.1% (1) As a result of the June 1, 2018 merger, legacy Fairmount Santrol inventories were written up to fair value under Generally Accepted Accounting Principles ("GAAP"). For the nine months ended September 30, 2019, $0.7 million of this write-up was expensed through cost of goods sold in the Industrial segment, thereby reducing segment gross profit. There was no write-up in the three months ended September 30, 2019.

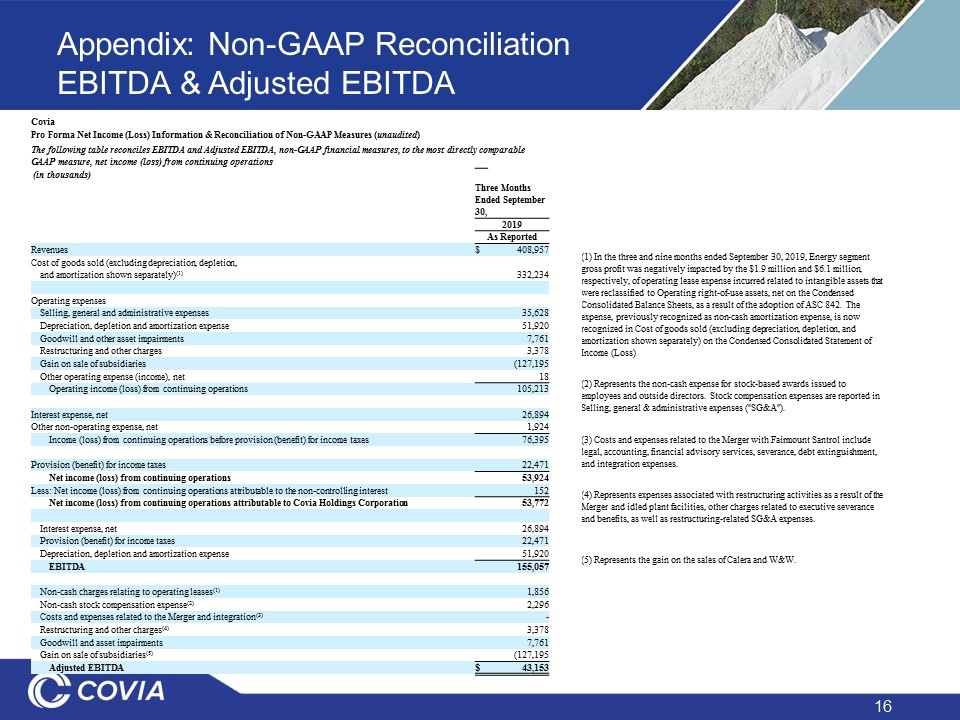

Appendix: Non-GAAP Reconciliation EBITDA & Adjusted EBITDA Covia Pro Forma Net Income (Loss) Information & Reconciliation of Non-GAAP Measures (unaudited) The following table reconciles EBITDA and Adjusted EBITDA, non-GAAP financial measures, to the most directly comparable GAAP measure, net income (loss) from continuing operations (in thousands) Three Months Ended September 30, 2019 As Reported Revenues $ 408,957 Cost of goods sold (excluding depreciation, depletion, and amortization shown separately)(1) 332,234 Operating expenses Selling, general and administrative expenses 35,628 Depreciation, depletion and amortization expense 51,920 Goodwill and other asset impairments 7,761 Restructuring and other charges 3,378 Gain on sale of subsidiaries (127,195 Other operating expense (income), net 18 Operating income (loss) from continuing operations 105,213 Interest expense, net 26,894 Other non-operating expense, net 1,924 Income (loss) from continuing operations before provision (benefit) for income taxes 76,395 Provision (benefit) for income taxes 22,471 Net income (loss) from continuing operations 53,924 Less: Net income (loss) from continuing operations attributable to the non-controlling interest 152 Net income (loss) from continuing operations attributable to Covia Holdings Corporation 53,772 Interest expense, net 26,894 Provision (benefit) for income taxes 22,471 Depreciation, depletion and amortization expense 51,920 EBITDA 155,057 Non-cash charges relating to operating leases(1) 1,856 Non-cash stock compensation expense(2) 2,296 Costs and expenses related to the Merger and integration(3) - Restructuring and other charges(4) 3,378 Goodwill and asset impairments 7,761 Gain on sale of subsidiaries(5) (127,195 Adjusted EBITDA $ 43,153 (1) In the three and nine months ended September 30, 2019, Energy segment gross profit was negatively impacted by the $1.9 million and $6.1 million, respectively, of operating lease expense incurred related to intangible assets that were reclassified to Operating right-of-use assets, net on the Condensed Consolidated Balance Sheets, as a result of the adoption of ASC 842. The expense, previously recognized as non-cash amortization expense, is now recognized in Cost of goods sold (excluding depreciation, depletion, and amortization shown separately) on the Condensed Consolidated Statement of Income (Loss) (2) Represents the non-cash expense for stock-based awards issued to employees and outside directors. Stock compensation expenses are reported in Selling, general & administrative expenses ("SG&A"). (3) Costs and expenses related to the Merger with Fairmount Santrol include legal, accounting, financial advisory services, severance, debt extinguishment, and integration expenses. (4) Represents expenses associated with restructuring activities as a result of the Merger and idled plant facilities, other charges related to executive severance and benefits, as well as restructuring-related SG&A expenses. (5) Represents the gain on the sales of Calera and W&W.

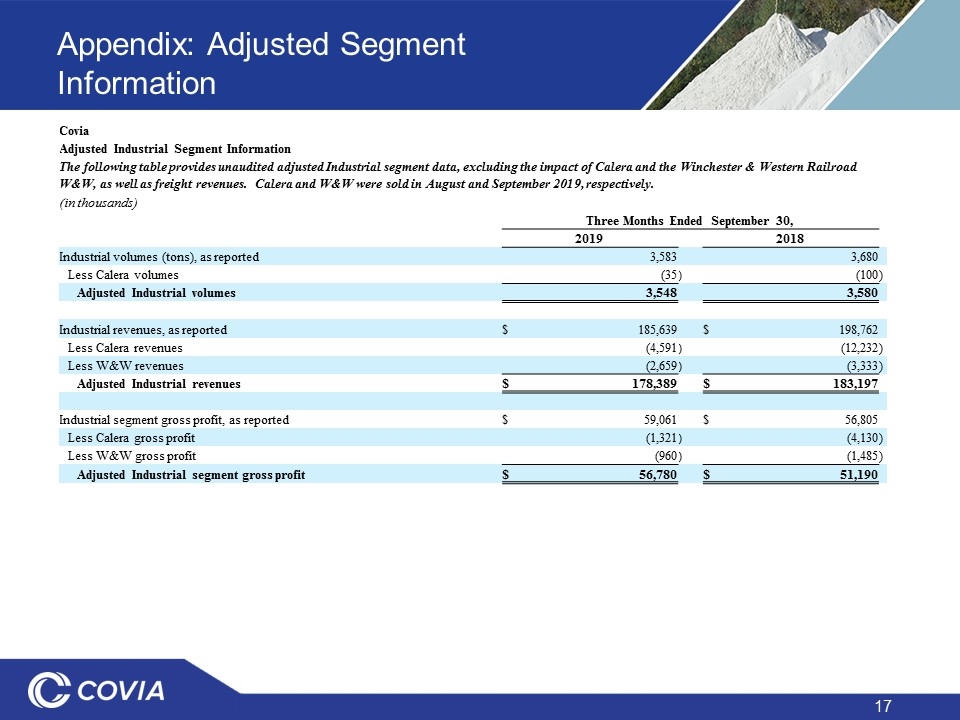

Appendix: Adjusted Segment Information Covia Adjusted Industrial Segment Information The following table provides unaudited adjusted Industrial segment data, excluding the impact of Calera and the Winchester & Western Railroad W&W, as well as freight revenues. Calera and W&W were sold in August and September 2019, respectively. (in thousands) Three Months Ended September 30, 2019 2018 Industrial volumes (tons), as reported 3,583 3,680 Less Calera volumes (35 ) (100 ) Adjusted Industrial volumes 3,548 3,580 Industrial revenues, as reported $ 185,639 $ 198,762 Less Calera revenues (4,591 ) (12,232 ) Less W&W revenues (2,659 ) (3,333 ) Adjusted Industrial revenues $ 178,389 $ 183,197 Industrial segment gross profit, as reported $ 59,061 $ 56,805 Less Calera gross profit (1,321 ) (4,130 ) Less W&W gross profit (960 ) (1,485 ) Adjusted Industrial segment gross profit $ 56,780 $ 51,190