n

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

or

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-38510

COVIA HOLDINGS CORPORATION

(Exact name of registrant as specified in its charter)

Delaware | | 13-2656671 |

(State or Other Jurisdiction | | (I.R.S. Employer |

of Incorporation or Organization) | | Identification No.) |

3 Summit Park Drive, Suite 700

Independence, Ohio 44131

(Address of Principal Executive Offices) (Zip Code)

(800) 255-7263

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Securities Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock | CVIA | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Securities Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer | ☐ | | Accelerated filer | ☒ |

Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

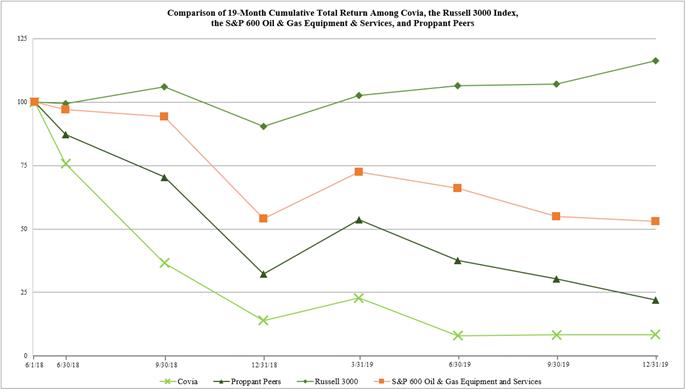

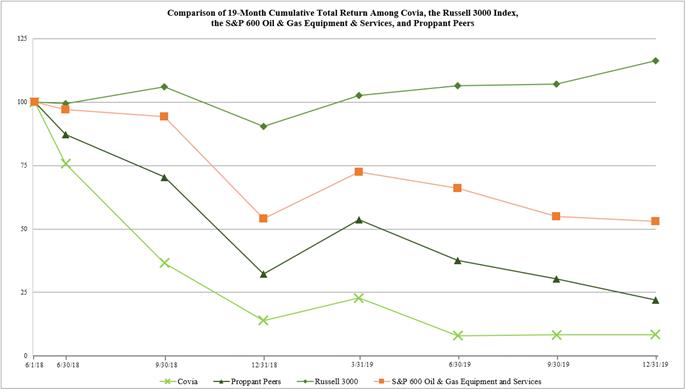

The aggregate market value of shares of common stock, par value $0.01 per share (“Common Stock”) held by non-affiliates of the registrant computed by reference to the last sales price, $1.96 as reported on the New York Stock Exchange, of such common stock as of the closing of trading on June 28, 2019: $76,748,710

Number of shares of Common Stock outstanding as of March 9, 2020: 132,023,251

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement relating to the registrant’s Annual Meeting of Shareholders to be held on May 21, 2020, which will be filed within 120 days of the end of the registrant’s fiscal year ended December 31, 2019 (“Proxy Statement”), are incorporated by reference into Part III of this Form 10-K to the extent described therein.

Covia Holdings Corporation and Subsidiaries

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2019

Table of Contents

2

PART I

Various terms used in this Annual Report on Form 10-K (this “Report”) are defined to simplify the presentation of information. Unless stated otherwise or the context otherwise requires, the terms “we,” “us,” “our,” “Covia,” and “Company” refer to Covia Holdings Corporation and its consolidated subsidiaries. In addition, “Unimin” refers to Unimin Corporation, which is now known as Covia Holdings Corporation, and “Fairmount Santrol” refers to Fairmount Santrol Holdings Inc., which is now known as Bison Merger Sub I, LLC.

Unless otherwise noted, references to a particular year are to our fiscal year, which corresponds to the calendar year ended or ending on December 31 of the same year. For example, a reference to “2019” is a reference to the year ended December 31, 2019.

Special Note of Caution Regarding Forward-Looking Statements

Certain information included in this Report or in other materials we have filed or will file with the Securities and Exchange Commission (“SEC”) (as well as information included in oral statements or other written statements made or to be made by us) contains or may contain forward-looking statements, including, but not limited to, statements regarding our future financial performance and financial condition. Similarly, all statements we make relating to our strategies, plans, goals, objectives, and targets, as well as our estimates and projections of results, sales, earnings, costs, expenditures, cash flows, growth rates, initiatives, and the outcomes or impacts of pending or threatened litigation or regulatory actions are also forward-looking statements. Words such as “anticipate,” “estimate,” “expect,” “objective,” “goal,” “project,” “intend,” “plan,” “believe,” “assume,” “will,” “should,” “may,” “can have,” “likely,” “target,” “forecast,” “guide,” “guidance,” “outlook,” “seek,” “strategy,” “future,” and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements involve a number of risks and uncertainties. Any forward-looking statements that we make herein and in future reports and statements are not guarantees of future performance, and actual results may differ materially from those in such forward-looking statements as a result of various risk factors. Please see “Item 1A – Risk Factors” in Part I of this Report for more information regarding those risk factors.

Any forward-looking statement speaks only as of the date made. Except as required by applicable law, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. However, any further disclosures made on related subjects in our subsequent reports on Forms 10-K, 10-Q and 8-K should be consulted. This discussion is provided as permitted by the Private Securities Litigation Reform Act of 1995, and all of our forward-looking statements are expressly qualified in their entirety by the cautionary statements contained or referenced in this section.

ITEM 1. BUSINESS

Our Company

Business Overview

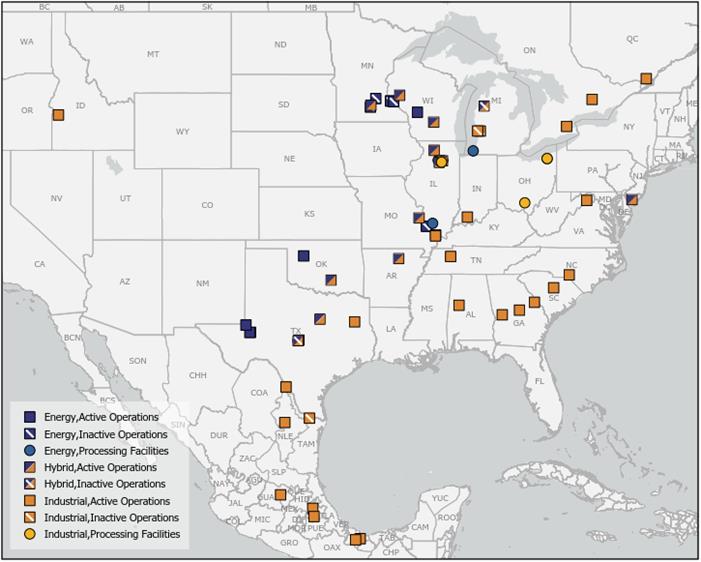

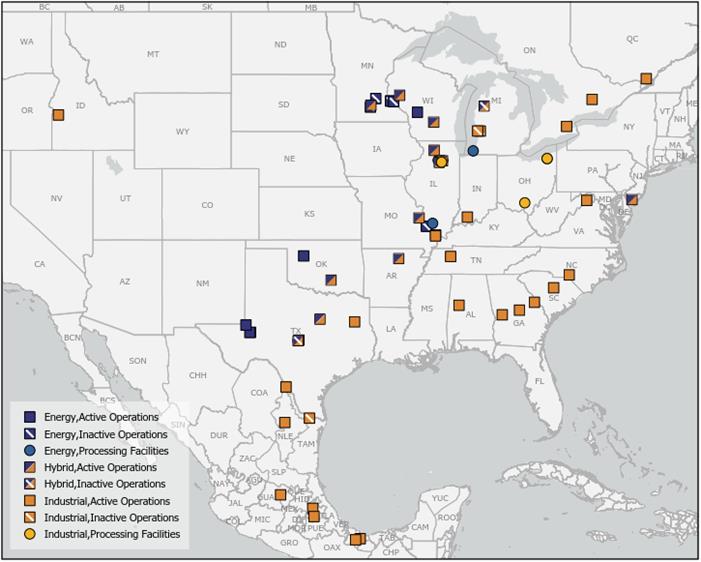

Covia, a Delaware corporation incorporated in 1970, is a leading provider of diversified mineral-based and material solutions for the Industrial and Energy markets in North America and around the world. We produce a wide range of specialized silica sand, feldspar, nepheline syenite, calcium carbonate, clay, and kaolin products for use in the glass, ceramics, coatings, foundry, polymers, construction, water filtration, sports and recreation, and oil and gas markets. We currently have 36 active mining facilities with over 40 million tons of annual mineral processing capacity. Our mining and coating facilities span North America and have many sites in close proximity to our customer base.

Our operations are organized into two segments based on the primary end markets we serve – Energy and Industrial. Our Energy segment offers the oil and gas industry a comprehensive portfolio of raw frac sand, value-added proppants, well-cementing additives, gravel-packing media and drilling mud additives, and a fully-integrated, last mile logistic service which delivers product directly to the well site. Our Energy segment products serve hydraulic fracturing operations in the U.S., Canada, Argentina, Mexico, China, and northern Europe. The Energy segment represented approximately 54% of our total revenues for 2019.

Our Industrial segment provides whole-grain, value-added, and custom-blended products to the glass, ceramics, coatings, foundry, polymers, construction, water filtration, sports and recreation, and various other industries, primarily in North America. The Industrial segment represented approximately 46% of total revenues for 2019.

We believe our segments are complementary. Our ability to sell to a wide range of customers across multiple end markets allows us to improve the recovery of our reserve base within our mining operations and to partially insulate the cyclicality of our earnings.

3

Corporate Information

We are publicly traded on the New York Stock Exchange (“NYSE”) under the ticker symbol “CVIA.” Our corporate headquarters is located at 3 Summit Park Drive, Suite 700, Independence, Ohio 44131. Our telephone number is (800) 255-7263. Our website is located at www.coviacorp.com. We make available free of charge on or through our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), as well as our proxy materials filed pursuant to Section 14 of the Exchange Act, as soon as reasonably practicable after we file such reports or materials with, or furnish such reports or materials, to the SEC. The information on our website is not incorporated by reference in or considered to be a part of this Report. The SEC maintains a website, www.sec.gov, which contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Covia was founded through the Combination of Unimin and Fairmount Santrol

On June 1, 2018 (“Merger Date”), Unimin completed a business combination (“Merger”) whereby Fairmount Santrol merged into a wholly-owned subsidiary of Unimin and ceased to exist as a separate corporate entity. Immediately following the consummation of the Merger, Unimin changed its name to Covia Holdings Corporation and began operating under that name. The common stock of Fairmount Santrol was delisted from the NYSE prior to the market opening on June 1, 2018, and Covia commenced trading under the ticker symbol “CVIA” on that date. Upon the consummation of the Merger, the former stockholders of Fairmount Santrol (including holders of certain Fairmount Santrol equity awards) received, in the aggregate, $170 million in cash consideration and approximately 35% of the common stock of Covia. Approximately 65% of the outstanding shares of Covia common stock was owned by SCR-Sibelco NV (“Sibelco”), the parent company of Unimin prior to the Merger, as of December 31, 2019.

In connection with the Merger, we redeemed approximately 18.5 million shares of Unimin common stock from Sibelco in exchange for an amount in cash equal to approximately (i) $660 million plus interest accruing at 5.0% per annum for the period from September 30, 2017 through June 1, 2018 less (ii) $170 million in cash paid to Fairmount Santrol stockholders.

In connection with the Merger, we also completed a debt refinancing transaction, with Barclays Bank PLC as administrative agent (“Barclays”), by entering into a $1.65 billion senior secured term loan (“Term Loan”) and a $200 million revolving credit facility (“Revolver”). The proceeds of the Term Loan were used to repay the indebtedness of Unimin and Fairmount Santrol and to pay the cash portion of the Merger consideration and expenses related to the Merger. We voluntarily canceled the Revolver, effective on December 31, 2019. Under the terms of the Term Loan agreement, we pledged as collateral our mining and processing facilities within the U.S. (“Guarantor Subs”) and 65% of the equity interest of our foreign operations (“Non-Guarantor Subs”) as collateral. For more information regarding the termination of the Revolver, see “Item 7 – Management’s Discussion and Analysis – Liquidity and Capital Resources.”

As a condition to the Merger, Unimin contributed certain assets of its Electronics segment, including $31.0 million of cash to Sibelco North America, Inc. (“HPQ Co.”), a newly-formed wholly owned subsidiary of Unimin, in exchange for all of the capital stock of HPQ Co. and the assumption by HPQ Co. of certain liabilities. Unimin distributed all of the stock of HPQ Co. to Sibelco in exchange for 169,550 shares (or 15.1 million shares subsequent to the stock split, described in Note 7 in the Notes to our Consolidated Financial Statements) of Unimin common stock held by Sibelco.

Costs and expenses incurred related to the Merger are recorded in Other non-operating expense, net in the accompanying Consolidated Statements of Income and include legal, accounting, valuation and financial advisory services, integration and other costs totaling $0.9 million, $51.1 million, and $19.3 million for 2019, 2018, and 2017, respectively.

Unimin was determined to be the acquirer in the Merger for accounting purposes, and the historical financial statements and the historical amounts included in the notes to our consolidated financial statements relate to Unimin. The Consolidated Statements of Income for 2018 includes the results of Fairmount Santrol from the Merger Date. The Consolidated Balance Sheet at December 31, 2018 reflects Covia. The presentation of information for periods prior to the Merger Date are not fully comparable to the presentation of information for periods presented after the Merger Date because the results of operations for Fairmount Santrol are not included in such information prior to the Merger Date.

4

Discontinued Operations

On May 31, 2018, prior to and as a condition to the closing of the Merger, Unimin contributed certain assets comprising its global high purity quartz business in exchange for all of the stock of HPQ Co. and the assumption by HPQ Co. of certain liabilities. Unimin distributed 100% of the stock of HPQ Co. to Sibelco in exchange for 169,550 shares (or 15.1 million shares subsequent to the stock split) of Unimin common stock held by Sibelco. HPQ Co. is presented as discontinued operations in our Consolidated Financial Statements.

As part of the disposition of HPQ Co., Covia and HPQ Co. entered into an agreement that governs their respective rights, responsibilities, and obligations relating to tax liabilities, the filing of tax returns, the control of tax contests, and other tax matters (the “Tax Matters Agreement”). Under the Tax Matters Agreement, Covia and HPQ Co. (and their affiliates) are responsible for income taxes required to be reported on their respective separate and group tax returns; however, HPQ Co. is responsible for any unpaid income taxes attributable to the HPQ Co. business prior to May 31, 2018, as well as any unpaid non-income taxes as of May 31, 2018 attributable to the HPQ Co. business (whether arising prior to May 31, 2018 or not). Covia is responsible for all other non-income taxes. Covia and HPQ Co. will equally bear any transfer taxes imposed in this transaction. Rights to refunds in respect of taxes will be allocated in the same manner as the responsibility for tax liabilities.

Seasonality

Our business is affected to some extent by seasonal fluctuations that impact our production levels and our customers’ business needs. For example, demand for many of the products sold by our Industrial segment in the construction and coatings sectors tends to correlate with construction activity, which is lowest in the fourth quarter due to seasonal shift in construction driven by adverse weather conditions. Additional volumes sold by our Energy segment tend to be slower in the first and fourth quarter compared to the second and third quarter. Inclement weather may also cause temporary slowdowns for our customers, which may impact our sales volumes. A majority of our facilities are all-weather facilities capable of various levels of production throughout the year.

Employees

As of December 31, 2019, we had approximately 2,633 employees. We believe that we maintain good relations with our workforce and maintain an active dialogue with employees. We provide salaried and hourly employees a comprehensive benefits package, including medical, life and accident insurance, incentive bonus programs and a 401(k) plan with an employer match and discretionary employer contribution, company pension (for certain employees) as well as various employee training and development programs that have been developed internally or through a third party.

As of December 31, 2019, approximately 35% of our employees were parties to collective bargaining contracts covered under approximately 25 union agreements in the U.S., Canada and Mexico. We believe we have strong relationships with and maintain an active dialogue with union representatives. We have historically been able to successfully extend and renegotiate collective bargaining agreements as they expire. We have not experienced a significant work stoppage or strike at any of our facilities in nearly 20 years.

Energy Segment Overview

Advances in oil and gas extraction techniques, such as horizontal drilling and hydraulic fracturing, have allowed for significantly greater extraction of oil and gas trapped within shale formations. The hydraulic fracturing process consists of pumping fluids down a well at pressures sufficient to create fractures in the targeted hydrocarbon-bearing rock formation in order to increase the flow rate of hydrocarbons from the well. A granular material, called proppant, is suspended and transported in the fluid and fills the fracture, propping it open once high-pressure pumping stops. The proppant-filled fracture creates a conductive channel through which the hydrocarbons may flow more freely from the formation into the wellbore and then to the surface. Proppants therefore perform the vital function of promoting the flow, or conductivity, of hydrocarbons over the productive life of a well. In fracturing a well, operators select a proppant that is transportable into the fracture, is compatible with frac and wellbore fluids, permits acceptable cleanup of frac fluids and can resist proppant flowback. In addition, the proppant must be resistant to crushing under the earth’s closure stress and reservoir temperature. Our Energy segment serves customers in the oil and gas industry, providing a variety of proppants and other oilfield minerals for use in hydraulic fracturing in, primarily, the U.S. and Canada. The oil and natural gas proppant industry is comprised of businesses involved in the mining or manufacturing, distribution and sale of the propping agents used in hydraulic fracturing, the most widely used method for stimulating increased production from lower permeability oil and natural gas reservoirs.

5

Frac Sand Extraction, Processing, and Distribution

Raw frac sand is a naturally occurring mineral that we mine and process. While the specific extraction method that we utilize depends primarily on the geologic conditions, we mine most of our raw frac sand using conventional open-pit extraction methods. The composition, depth, and chemical purity of the sand also dictate the processing method and equipment utilized. After extraction, raw frac sand is washed with water to remove fine impurities such as clay and organic particles, with additional procedures used when contaminants are not easily removable. The final steps in our production process involve the drying and screening of the raw frac sand according to mesh size.

We ship most frac sand in bulk from the processing facility to customers by truck, rail or barge. Because transportation costs may represent a significant portion of the overall delivered product cost, shipping in large quantities, particularly when shipping over long distances, provides a significant cost advantage to the suppliers, which highlights the importance of rail or barge access for low cost delivery. As a result, our facility location and logistics capabilities are an important consideration for suppliers and customers.

Energy Proppant Market

There are three primary types of proppant that are utilized in the hydraulic fracturing process: raw frac sand, coated sand and manufactured ceramic beads. Our customers generally choose among these proppant types based on the geology of the reservoir, expected well pressures, proppant flowback concerns, and product cost. Given the price differences between the various proppant products and well-specific considerations, oil and natural gas exploration and production (“E&P”) and oilfield service (“OFS”) companies are continually evaluating the cost and conductivity of the various proppants that we provide in order to best address the geology of the well and to maximize well productivity and economic returns.

Our Energy Products and Services

We offer a broad suite of proppant products designed to address nearly all well environments and related down-hole challenges faced by our customers. Revenues in our Energy segment are generally derived from the sale of raw sand plus the sale of certain value-added products.

Northern White Frac Sand. Our Northern White frac sand is produced from geologically mature quartz arenite sands mined from deposits located primarily in the northern half of the U.S. These reserves are generally characterized by high purity, structural integrity, significant roundness and sphericity, and low turbidity.

In-Basin “Local” Frac Sand. Our in-basin “local” reserves are located in West Texas and Oklahoma. Our local frac sand has less crush strength, less sphericity, and lower silica content relative to our Northern White products, however, is suitable in certain well environments. These reserves are in close proximity to the Permian, Eagle Ford, and Mid-Continental basins, which provides them with a significant transportation cost advantage relative to Northern White frac sand sourced from more distant locations.

Value-Added Products. We coat a portion of our sand with resin to enhance certain performance characteristics. Our value-added proppants are generally used in higher temperature and higher pressure well environments and are marketed to end users who require increased conductivity in higher pressure wells, high crush resistance, and/or enhanced flow back control in order to enhance the productivity of their wells.

Our resin coated sand products are sold as both tempered (or pre-cured) and curable (or bonding) products. Curable coated sand bonds down hole as the formation heat causes neighboring coated sand grains to polymerize with one another holding proppant into place. This mitigates the risk of proppant flowing back out of the fracture when the oil or natural gas well commences production. For certain resin products, the resin’s chemical properties are triggered by the introduction of an activator into the frac fluid. We formulate, manufacture, and sell activators, which work with the specific chemistry of our resins. Tempered products do not require activation because they are not intended to bond, rather they are designed to bring additional strength to the proppant.

Our DST™ dust suppression technology is a coating applied to sand to minimize the risk of silica dust exposure, which is regulated by the U.S. Occupational Safety and Health Administration (“OSHA”).

Our silica-based well cementing additives keep cement strong, bonding cement together even under acidic conditions, and reduce strength retrogression in well temperatures greater than 230°F. We market these additives as SilverBond®.

6

Our silica-based gravel packing sands are high quality monocrystalline and reduce the production of reservoir sands while still producing hydrocarbons. We market these sands as Accupack®.

Last Mile Logistics Solutions. We have contracted with last mile logistics (“LML”) providers to offer an integrated mine-to-well solution to our customers. Through these relationships, we lease systems from the LML providers, allowing us to offer multiple LML options to our customers, such as silos or boxes, based on their preferences.

In selecting LML partners, we have focused on those that can provide high volume of proppant per truck load, minimized well pad footprint, fast unloading times and strong safety records.

Industrial Segment Overview

Our Industrial segment’s products are sold to customers in the glass, construction, ceramics, foundry, coatings, polymers, sports and recreation, filtration and various other industries. The sales in our Industrial segment correlate strongly with overall economic activity levels in the U.S. and Mexico as reflected in the gross domestic product (“GDP”), unemployment levels, vehicle production and growth in the housing market.

Industrial Markets and Products

Glass.

We offer one of the largest multi-facility and multi-product mineral portfolios serving the North American glass market. We believe that our longstanding customer relationships, reputation for consistent quality and operating capabilities provide us with a competitive advantage. The glass market includes three primary sub-markets: container glass; flat glass; and fiberglass. Our primary product for sale to the each of these sub-markets into the glass market is produced from high silica content sand deposits throughout North America, however, we also supply the glass industry with nepheline syenite and other mineral additives to be used in fiberglass products and other applications. Glass batch formulations determine the raw material requirements of the glass manufacturer and differ based upon the requirements of the end-use product.

The main products we supply for container glass production are whole grain silica, ground silica, feldspar and nepheline syenite. Container glass is primarily comprised of bottles and demand in the U.S. tends to follow U.S. gross domestic product growth and has driven stable volumes for suppliers of silica, feldspar and nepheline syenite. In Mexico, growth in the worldwide consumption of beer produced and bottled in Mexico has increased the demand by Mexican breweries for glass bottles, which has increased demand for high-quality silica sand.

The flat glass sub-market is primarily comprised of automotive glass and windows for residential and commercial applications. The main product we supply into the flat glass industry is whole grain silica.

The fiberglass sub-market produces fine filament fiber used in fiberglass reinforced plastic, which is used in watercrafts, automobiles and other industrial applications as well as the production of fiberglass for home and business insulation. The main products we supply to the fiberglass industry include ground silica and fiberglass grade kaolin.

Ceramics. The ceramics manufacturing market includes a diverse mix of products. The main types of ceramics produced include sanitaryware (e.g., toilets, wash basins, pedestals, bidets, urinals, sinks and bathtubs), clay brick and tiles (frequently used in residential construction). Sanitaryware is made primarily with clay (ball clay or China clay), quartz and feldspar. The majority of sanitaryware sold in the U.S. is produced in Mexico, while the ceramic tile industry has continued to grow as Italian manufacturers have established production facilities in the U.S.

We supply the ceramics market with nepheline syenite, granular silica, potassium feldspar, pressing clays, ceramic casting clays, refractory grade clays, plastic forming clays and sodium feldspar. Additionally, we distribute Ukrainian and United Kingdom ball clays, potassium feldspar from India and French pebbles used as grinding media. We believe that our low-cost production and geographic proximity to many of our customers, combined with a broad product offering, are major factors contributing to our competitive position in the ceramics market.

7

Construction. The construction market, driven by urbanization, new home construction, remodeling and repair, and commercial buildings, drives demand for many of our products, such as carpet backings and roofing tiles. Customers in the construction market seek suppliers who can offer multi-product mineral offerings, multi-plant production capabilities, diversified and low-cost logistics solutions and superior customer and technical service. Understanding the features of our products and the benefits they deliver to our customers’ processes and products are key characteristics that have made us a leading minerals supplier to the construction market. Customers also seek reliable and consistent suppliers of minerals, which vary by size, shape, chemistry or other physical characteristics. We believe we are well-situated to serve customers in the construction industry due to our mine locations and manufacturing footprint, which we believe provide broad geographic coverage and access to customers either by truck or rail.

Coatings. The architectural and industrial coatings market includes coatings and specialty materials for customers in a wide array of end uses, including industrial equipment and components, packaging material, aircraft and marine equipment and automotive original equipment. Paint and coatings manufacturers also serve commercial and residential new build and maintenance customers by supplying coatings to painting and maintenance contractors and directly to consumers for decoration and maintenance. The architectural coatings industry is highly competitive and consists of several large firms with global presence and many smaller firms serving local or regional customers. Price, product performance, technology, cost effectiveness, quality and technical and customer service are major competitive factors in the industrial, automotive OEM, packaging coatings and coatings services businesses. Our coatings products in North America include nepheline syenite, microcrystalline silica, kaolin and silica.

Polymers. Polymers are chemical compounds or a mixture of compounds formed by polymerization and consisting essentially of repeating structural units. Because of their low density and their ability to be shaped and molded at relatively low temperatures compared to traditional materials such as metals, polymers are widely used across several industrial markets. Parts and components that have traditionally been made of wood, metal, ceramic or glass are now being redesigned with polymers.

Packaging, construction, transportation and electrical & electronic (“E&E”) are the four largest polymer sub-markets. While packaging is the largest application in terms of volume, applications such as construction, transportation and E&E offer more value with intense use of additives and fillers.

The usage of our products, particularly nepheline syenite, in polymer markets has been growing due to a number of factors, including an expanded customer base as a result of approval of food-contact applications by the U.S. Food and Drug Administration and development of new products in composites, color concentrates and building and construction products (window and door frames, vinyl sidings and fencing). Our products for the polymers market include nepheline syenite, calcium carbonate, crystalline silica and kaolin.

Foundry and Metallurgical. We currently supply the foundry market with multiple grades of sands for molding and core-making applications, with products sold primarily in the U.S., Canada, Mexico, Japan, and China. Foundry sands are characterized by high purity, round and sub-angular sands precisely screened to perform under a variety of metal casting conditions. These factors dictate the refractory level and physical characteristics of the mold and core, which have a significant effect on the quality of the castings produced in the foundry. We also supply resin binders which provide the necessary bonding of molds and cores in casting applications and are designed to improve overall productivity and environmental conditions in the workplace. We supply foundries with metallurgical consumables, which are required by all metal refining and casting operations.

Our silica sand foundry activities are typically local by nature and developed in conjunction with other industries to maximize productivity and profitability of existing assets. Foundry sand availability in North America is strongly influenced by heavy industries, including glass, automotive, equipment and oil and gas. We serve the foundry market through multiple product offerings, including our silica, resin coated sand, and refractory grade clays.

Sports and Recreation. We are a leading supplier of various turf and landscape infill products to contractors, municipalities, nurseries, and mass merchandisers. Our turf-related products are used in multiple major sporting facilities, including First Energy Stadium and Progressive Field in Ohio, PNC Park in Pennsylvania, Notre Dame Stadium in Indiana, and ADPRO Sports Training Center Fieldhouse in New York. In addition, we are a significant supplier of bunker sand, top dressing sands, and all-purpose sands to golf courses and landscape contractors throughout North America. Our sands are also supplied to horse tracks and training facilities. We also provide colored sand to a variety of major retailers for use as play sand and arts and crafts.

8

Product Delivery

Among the most important purchasing criteria of our customers is the ability to deliver products upon demand at the desired time and location at the lowest possible cost. We have a comprehensive and diversified supply chain network, which we believe provides us a competitive advantage. Our size and scale provide broad supply chain flexibility, which we optimize on a weekly basis using leading technology. Our logistics network includes distribution terminals in all major oil and gas basins, as well as selected locations to serve Industrial customers.

Many of our facilities are situated with access to five Class 1 railroads providing direct service to every major oil and gas basin in the U.S. as well as transport significant industrial volumes long distances to customers. To serve these locations and customers, we have access to a fleet of railcars and are one of the few North American mineral producers capable of Class 1 railroad deliveries in each of North America’s major oil and gas producing basins. We generally ship products to either a customer-owned terminal location or a Covia owned or operated terminal, where products are stored until provided to a customer, or to one of our processing facilities for value-added processing. The direct rail access of our processing and distribution facilities reduces handling costs and lead-times while enhancing production throughput, resulting in improved responsiveness to our customers.

Last Mile Logistics Solutions. We have arrangements with third parties to provide our customers with last mile logistics (“LML”). Through these arrangements, we lease systems from LML providers, and offer our customers an integrated mine-to-well site solution. The arrangements also allow us to offer multiple LML options to our customers, such as silos or boxes, based on their preferences.

In selecting LML providers, we have focused on those that can provide high volume of proppant per truck load, minimized well pad footprint, fast unloading times and strong safety records.

Raw Materials

Our products depend on the availability of certain raw materials, including natural gas or propane, resins and additives, bagging supplies, and other raw materials. These raw materials are readily available from a variety of sources and we are not dependent on any one supplier of raw materials. See “Part I, Item 2 – Properties” of this Report for additional information regarding the sources of our mineral products.

Our Customers

Our strategy has been to partner with the largest companies in the markets they serve. The strength of our customer base is driven by our collaborative approach to product innovation and development, reputation for high quality, the consistency and reliability of our products and the scale of our operations and logistics network. We currently serve approximately 2,000 customers across a variety of industries in the U.S., Canada, Mexico and the rest of the world. A significant portion of our sales by volume is derived from customers with whom we have long-term relationships. In 2019, no customers exceeded 10% of revenues. In 2018, one customer exceeded 10% of revenues. This customer accounted for 13% of our revenues in 2018. A large portion of our Energy segment sales are generated by a limited number of customers, and the loss of, or a significant reduction in purchases by, our largest customers could adversely affect our operations. Top customers may not continue to purchase the same levels of product in the future due to a variety of reasons, notwithstanding any contract requirements.

We primarily sell products under supply agreements with terms that vary by customer. Certain of our supply agreements require the customer to purchase a specified percentage of its product requirements from us. Other agreements require the customer to purchase a minimum volume from us. These minimum volume contracts often require the customer to pay us specified liquidated damages if the purchased volume does not meet the required minimums. Specific custom orders are generally filled upon request, and backlog is not a material factor.

Intellectual Property

Our intellectual property consists primarily of patents, trade secrets, know-how, and trademarks. Our trademarks include, but are not limited to, our name Covia™ and products such as DSTTM, Unifrac®, Minex®, Glassil®, Propstar®, Imsil®, Granusil®, Puresil®, HyperProp®, and CoolSet®. We hold numerous U.S. and foreign-granted patents that are still in force as well as many U.S. and foreign patent applications that are pending. The majority of our patents have an expiration date after 2025.

9

We believe that our extensive experience, trade secrets and know-how with a variety of different products enables us to offer our customers a wide range of proppants for their particular application. We operate laboratories in the U.S. and Mexico, which provide mineral processing, analytics and materials research for product and application development across the oil and gas, glass, ceramics, coatings and polymers industries. The staffing across of our laboratories include professionals in analytical chemistry, mineral processing, mineralogy, inorganic chemistry, material science, coatings science, polymer science and related fields. We also employ technical sales personnel covering our core target industries.

Competition

In our Energy segment, we compete with numerous large and small producers operating across all of the major frac sand producing regions of North America. Our main competitors in the raw frac sand industry include Atlas Sand Company, LLC; Badger Mining Corporation; Black Mountain Silica; CARBO Ceramics, Inc.; Emerge Energy Services LP; Hi-Crush Inc.; Signal Peak Silica, LLC; Smart Sand Inc.; Superior Silica; and U.S. Silica Holdings, Inc. Our main competitors in the coated products industry include Atlas Resin Proppants LLC; CARBO Ceramics, Inc.; Momentive Performance Materials Inc.; Signal Peak Silica, LLC; Vista Sands; and U.S. Silica Holdings, Inc. The most important competitive factors in our Energy segment are reliability of supply, price, customer relationships, supply chain management, processing quality, performance, sand and proppant characteristics, transportation capabilities, and proximity of supply to a customer’s well site.

In our Industrial segment, we compete with large diversified companies but also with smaller, local producers on product quality, product consistency and reliably delivering products at a competitive price. Competitors may produce minerals similar to those sold by us or they may produce substitute products that offer similar functionality. In our Industrial segment, we compete primarily against 3M; A.F. Gelhar Co., Inc.; Active Minerals; Astra; Badger Mining Corporation; Capital Sand Company, Inc.; Cimbar; Custom Grinders; Florida Rock Industries; G3 Enterprises; Granite Mountain; Imerys; J.M. Huber; J.R. Simplot; Lane Mountain Company; Lhoist; Manley Bros. of Indiana, Inc.; Mavisa; Minerali; Old Hickory; Omya; Short Mountain Silica; Sierra Silica; The Nugent Sand Co., Inc.; U.S. Silica Holdings, Inc.; and Whibco of New Jersey, Inc.

Regulation and Legislation

Mining and Workplace Safety

Federal Regulation

The U.S. Mine Safety and Health Administration (“MSHA”) is the primary regulatory organization governing the commercial silica mining industry. Accordingly, MSHA regulates quarries, surface mines, underground mines, and the industrial mineral processing facilities associated with quarries and mines. MSHA administers the provisions of the Federal Mine Safety and Health Act of 1977 (the “Mine Act”) and enforces compliance with mandatory safety and health standards. As part of MSHA’s oversight, representatives perform at least two unannounced inspections annually for each above-ground facility. To date, these inspections have not resulted in any citations for material violations of MSHA standards.

We also are subject to the requirements of OSHA and comparable state statutes that regulate the protection of the health and safety of workers. In addition, the OSHA Hazard Communication Standard requires that information be maintained about hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and the public. OSHA regulates users of commercial silica and provides detailed regulations requiring employers to protect employees from overexposure to silica through the enforcement of permissible exposure limits.

We adhere to an occupational health program aimed at controlling exposure to silica dust, which includes dust sampling, a respiratory protection program, medical surveillance, training, and other components. Our safety program is designed to ensure compliance with the standards of our Occupational Health and Safety Manual and MSHA regulations. For both health and safety issues, extensive training is provided to employees. We have safety committees at our plants consisting of salaried and hourly employees. We perform annual internal health and safety audits and conduct annual crisis management drills to test our plants’ abilities to respond to various situations. Our corporate health and safety department administers health and safety programs with the assistance of plant local environmental, health and safety coordinators.

10

Environmental Matters

We and our competitors are subject to extensive governmental regulation on, among other things, matters such as permitting and licensing requirements, plant and wildlife protection, hazardous materials, air and water emissions, and environmental contamination and reclamation. A variety of federal, state, and local agencies implement and enforce these regulations.

Federal Regulation

At the federal level, we may be required to obtain permits under Section 404 of the Clean Water Act from the U.S. Army Corps of Engineers for the discharge of dredged or fill material into waters of the U.S., including wetlands and streams, in connection with our operations. We also may be required to obtain permits under Section 402 of the Clean Water Act from the U.S. Environmental Protection Agency (“EPA”) (or the relevant state environmental agency in states where the permit program has been delegated to the state) for discharges of pollutants into waters of the U.S., including discharges of wastewater or storm water runoff associated with construction activities. Failure to obtain these required permits or to comply with their terms could subject us to administrative, civil and criminal penalties as well as injunctive relief.

The U.S. Clean Air Act (the “CAA”) and comparable state laws regulate emissions of various pollutants through air emissions permitting programs and the imposition of other requirements, such as monitoring and reporting requirements. These regulatory programs may require us to install expensive emissions abatement equipment, modify our operational practices and obtain permits for our existing operations. Before, commencing construction on a new or modified source of air emissions, such laws may require us to obtain pre-approval for the construction or modification of certain projects or facilities extended to produce or significantly increase air emissions. In addition, air permits are required for all of our processing and terminal operations, and certain of our frac sand mining operations that result in the emission of regulated air contaminants. Obtaining air emissions permits may delay the development or continued performance of our operations. As a result, we may be required to incur increased capital and operating costs because of these regulations. We could be subject to administrative, civil, and criminal penalties as well as injunctive relief for noncompliance with air permits or other requirements of the CAA and comparable state laws and regulations.

Methane, a primary component of natural gas, and carbon dioxide, a byproduct of the burning of natural gas, are examples of greenhouse gases (“GHGs”). In recent years, the U.S. Congress has considered legislation to reduce emissions of GHGs.

Independent of the U.S. Congress, the EPA has adopted regulations controlling GHG emissions under its existing authority under the CAA. In 2009, the EPA officially published its findings that emissions of carbon dioxide, methane and other GHGs present an endangerment to human health and the environment because emissions of such gases are, according to the EPA, contributing to warming of the earth’s atmosphere and other climatic changes. These findings by the EPA allow the agency to proceed with the adoption and implementation of regulations that would restrict emissions of GHGs under existing provisions of the CAA. In 2010, the EPA published a final rule expanding its existing GHG emissions reporting rule for certain petroleum and natural gas facilities that emit 25,000 metric tons or more of carbon dioxide equivalent per year. We are subject to annual GHG reporting obligations for our operations in Wedron, Illinois; Nephton, Ontario, Canada; Saint Canut, Quebec, Canada; Canoitas, Mexico; and Jaltipan, Mexico locations.

As part of our operations, we utilize or store petroleum products and other substances such as diesel fuel, lubricating oils, and hydraulic fluid. We are subject to regulatory programs pertaining to the storage, use, transportation, and disposal of these substances, including Spill Prevention, Control and Countermeasure planning requirements. Spills or releases may occur in the course of our operations, and we could incur substantial costs and liabilities as a result of such spills or releases, including those relating to claims for damage or injury to property and persons. Additionally, some of our operations are located on properties that historically have been used in ways that resulted in the release of contaminants, including hazardous substances, into the environment, and we could be held liable for the remediation of such historical contamination. The U.S. Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”) and comparable state laws impose joint and several liability, without regard to fault or legality of conduct, on classes of persons who are considered to be responsible for the release of hazardous substances into the environment. These persons include the owner or operator of the site where the release occurred and anyone who disposed or arranged for the disposal of a hazardous substance released at the site. Under CERCLA, such persons may be subject to liability for the costs of cleaning up the hazardous substances, for damages to natural resources, and for the costs of certain health studies. In addition, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the hazardous substances released into the environment.

In the course of our operations, we generate industrial solid wastes that may be regulated as hazardous wastes. The Resource Conservation and Recovery Act (“RCRA”) and comparable state statutes regulate the generation, transportation, treatment, storage,

11

disposal, and cleanup of hazardous and non-hazardous wastes. The EPA and the individual states, to which the EPA has delegated portions of the RCRA program for local implementation, administer the RCRA program.

In September 2013, the EPA issued RCRA consent orders to several companies, including us, in connection with historic contamination of residential drinking water wells near our Wedron, Illinois facility. The EPA identified benzene and other volatile organic compounds in some drinking water wells, some (including benzene) in excess of established standards. The consent orders required the companies to analyze conditions at their sites to determine whether operations at their sites are potential sources of groundwater contamination. We completed the study for our site, and our consultant submitted a site conditions report to the EPA in August 2014, which report concluded that our operations at the site are not a source of groundwater impacts in the Wedron community. The report recommended that no further work should be required under the consent order. In March 2015, the EPA issued a letter to us stating that we have completed all work required under the consent order to the EPA’s satisfaction, and our obligations under the consent order have now been satisfied. We have also performed environmental investigation and remediation activities under oversight of the Illinois Environmental Protection Agency (“IEPA”) at a removed underground storage tank (“UST”) system at the Wedron facility south of residential areas of the community. The investigation report approved by the IEPA concluded that the petroleum constituents reported in the groundwater in the Wedron community are not related to the former UST system. We have performed limited soil removal at the location of the former UST system pursuant to a Corrective Action Plan approved by the IEPA. The IEPA has approved the closure of this site, which is documented through a No Further Remediation Letter issued by the Agency. The No Further Remediation Letter has been recorded with the local County Recorder of Deeds and includes deed restrictions which will limit this portion of the Wedron property to industrial use in perpetuity.

Although we do not directly engage in hydraulic fracturing activities, we supply sand-based proppants to hydraulic fracturing operators in the oil and natural gas industry. Hydraulic fracturing involves the injection of water, sand, and chemicals, under pressure, into the formation to fracture the surrounding rock and stimulate production. The hydraulic fracturing process is typically regulated by state or local governmental authorities. However, the practice of hydraulic fracturing has become controversial in some areas and is undergoing increased scrutiny. Several federal agencies and regulatory authorities are investigating the potential environmental impacts of hydraulic fracturing and whether additional regulation may be necessary. The EPA has asserted limited federal regulatory authority over hydraulic fracturing and has indicated it may seek to further expand its regulation of hydraulic fracturing. The Bureau of Land Management has proposed regulations applicable to hydraulic fracturing conducted on federal and Indian oil and gas leases. The U.S. Congress has from time to time considered the adoption of legislation to provide for federal regulation of hydraulic fracturing. In addition, various state, local, and foreign governments have implemented, or are considering, increased regulatory oversight of hydraulic fracturing through additional permitting requirements, operational restrictions, disclosure requirements, and temporary or permanent bans on hydraulic fracturing in certain areas such as environmentally sensitive watersheds. Numerous states have imposed disclosure requirements on hydraulic fracturing well owners and operators. Some local governments have adopted and others may seek to adopt ordinances prohibiting or regulating the time, place, and manner of drilling activities in general or hydraulic fracturing activities within their jurisdictions.

The adoption of new laws, regulations, or enforcement policies at the federal, state, local, or foreign levels imposing reporting obligations on, or otherwise limiting or delaying, the hydraulic fracturing process could make it more difficult to complete oil and natural gas wells, increase our customers’ costs of compliance and doing business, and otherwise adversely affect the hydraulic fracturing services they perform, which could negatively impact demand for our sand-based proppants.

Our operations may also be subject to broad environmental review under the National Environmental Policy Act (“NEPA”). NEPA requires federal agencies to evaluate the environmental impact of all “major federal actions” significantly affecting the quality of the human environment. The granting of a federal permit for a major development project, such as a mining operation, may be considered a “major federal action” that requires review under NEPA. Therefore, our projects may require review and evaluation under NEPA. As part of this evaluation, the federal agency considers a broad array of environmental impacts, including, among other things, impacts on air quality, water quality, wildlife (including threatened and endangered species), historical and archeological resources, geology, socioeconomics and aesthetics. NEPA also requires the consideration of alternatives to the project. The NEPA review process, especially the preparation of a full environmental impact statement, can be time consuming and expensive. The purpose of the NEPA review process is to inform federal agencies’ decision-making on whether federal approval should be granted for a project and to provide the public with an opportunity to comment on the environmental impacts of a proposed project. Although NEPA only requires that an environmental evaluation be conducted and does not mandate a result, a federal agency could decide to deny a permit, or impose certain conditions on its approval, based on its environmental review under NEPA, or a third party may challenge the adequacy of a NEPA review and thereby delay the issuance of a federal permit or approval.

12

Federal agencies granting permits for our operations also must consider impacts to endangered and threatened species and their habitat under the Endangered Species Act. We also must comply with and are subject to liability under the Endangered Species Act, which prohibits and imposes stringent penalties for the harming of endangered or threatened species and their habitat. Some of our operations are conducted in areas where protected species or their habitats are known to exist. In these areas, we may be obligated to develop and implement plans to avoid potential adverse effects to protected species and their habitats, and we may be prohibited from conducting operations in certain locations or during certain times, such as breeding and nesting seasons, when our operations could have an adverse effect on the species. Federal agencies also must consider a project’s impacts on historic or archeological resources under the National Historic Preservation Act, and we may be required to conduct archeological surveys of project sites and to avoid or preserve historical areas or artifacts.

State and Local Regulation

Because our operations are located in numerous states, we are also subject to a variety of different state and local environmental review and permitting requirements. Some states in which our projects are located or are being developed have state laws similar to NEPA; thus our development of new sites or the expansion of existing sites may be subject to comprehensive state environmental reviews even if it is not subject to NEPA. In some cases, the state environmental review may be more stringent than the federal review. Our operations may require state law-based permits in addition to federal or local permits, requiring state agencies to consider a range of issues, many the same as federal agencies, including, among other things, a project’s impact on wildlife and their habitats, historic and archaeological sites, aesthetics, agricultural operations, and scenic areas. Some states also have specific permitting and review processes for commercial silica mining operations, and states may impose different or additional monitoring or mitigation requirements than federal agencies. The development of new sites and our existing operations also are subject to a variety of local environmental and regulatory requirements, including land use, zoning, building, and transportation requirements.

Some local communities have expressed concern regarding silica sand mining operations. These concerns have generally included exposure to ambient silica sand dust, truck traffic, water usage, and blasting. In response, certain state and local communities have developed or are in the process of developing regulations or zoning restrictions intended to minimize dust from getting airborne, controlling the flow of truck traffic, significantly curtail the amount of practicable area for mining activities, requiring compensation to local residents for potential impacts of mining activities and, in some cases, banning the issuance of new permits for mining activities. To date, we have not experienced any material impact to our existing mining operations or planned capacity expansions as a result of these types of concerns.

Planned expansion of our mining and production capacity or construction and operation of related facilities in new communities could be more significantly impacted by increased regulatory activity. Difficulty or delays in obtaining or inability to obtain new mining permits or increased costs of compliance with future state and local regulatory requirements could have a material negative impact on our ability to grow our business. In an effort to minimize these risks, we continue to be engaged with local communities in order to grow and maintain strong relationships with residents and regulators.

Costs of Compliance

We may incur significant costs and liabilities as a result of environmental, health, and safety requirements applicable to our activities. Failure to comply with environmental laws and regulations may result in the assessment of administrative, civil and criminal penalties, imposition of investigatory, cleanup and site restoration costs and liens, the denial or revocation of permits or other authorizations, and the issuance of injunctions to limit or cease operations. Compliance with these laws and regulations may also increase the cost of the development, construction and operation of our projects and may prevent or delay the commencement or continuance of a given project. In addition, claims for damages to persons or property may result from environmental and other impacts of our activities. In addition, the clear trend in environmental regulation is to place more restrictions on activities that may affect the environment, and thus, any changes in, or more stringent enforcement of, these laws and regulations that result in more stringent and costly pollution control equipment, waste handling, storage, transport, disposal, or remediation requirements could have a material adverse effect on our operations and financial position.

The process for performing environmental impact studies and reviews for federal, state, and local permits for our operations involves a significant investment of time and monetary resources. We cannot control the permit approval process. We cannot predict whether all permits required for a given project will be granted or whether such permits will be the subject of significant opposition. The denial of a permit essential to a project or the imposition of conditions with which it is not practicable or feasible to comply could impair or prevent our ability to develop a project. Significant opposition by neighboring property owners, members of the public or other third parties, as well as any delay in the environmental review and permitting process, could impair or delay our ability to develop or

13

expand a project. Additionally, the passage of more stringent environmental laws could impair our ability to develop new operations and have an adverse effect on our financial condition and results of operations.

ITEM 1A. RISK FACTORS

Our business, financial condition, results of operations, cash flows, prospects and the market value of our securities are subject to numerous risks, many of which are driven by factors that we cannot control. If any of the following risks actually occur, our business, financial condition, results of operations, cash flows, prospects and the market value of our securities may be materially and adversely affected. Other factors beyond those listed below, including factors unknown to us and factors known to us which we have not currently determined to be material, could also adversely affect our business, financial condition, results of operations, cash flows, prospects and the market value of our securities. Also see “Special Note of Caution Regarding Forward-Looking Statements” above.

Risks Related to Our Business

Our business and financial performance depend in part on the level of activity in the oil and gas industries.

Approximately 54% of our revenues for 2019 were derived from sales to companies in the oil and gas industries. As a result, our operations depend, in part, on the levels of activity in oil and gas exploration, development and production. More specifically, the demand for the proppants we produce is closely related to the number of oil and gas wells completed in geological formations where sand-based proppants are used in hydraulic fracturing activities. These activity levels are affected by both short- and long-term trends in oil and gas prices, among other factors.

Industry conditions that impact the activity levels of oil and natural gas producers and proppant sales are influenced by numerous factors over which we have no control, including:

| • | governmental regulations, including the policies of governments regarding the exploration for and production and development of their oil and natural gas reserves; |

| • | global weather conditions and natural disasters; |

| • | worldwide political, military and economic conditions; |

| • | the cost of producing and delivering oil and natural gas; |

| • | development of alternative energy sources; |

| • | changes in demand for proppants, including the types of proppants used; and |

| • | the ability of the oil and gas industry to comply with OSHA standards for respirable dust. |

In recent years, oil and gas prices and, therefore, the level of exploration, development and production activity, have experienced significant fluctuations. Worldwide economic, political and military events, including war, terrorist activity, events in the Middle East and initiatives by the Organization of the Petroleum Exporting Countries (“OPEC”) and other large non-OPEC producers have contributed, and are likely to continue to contribute, to price and volume volatility. Additionally, warmer than normal winters in North America and other weather patterns may adversely impact the short-term demand for natural gas and, therefore, demand for our products. Reduction in demand for natural gas to generate electricity could also adversely impact the demand for frac sand.

Any significant reduction in oil and natural gas prices would generally depress the level of oil and natural gas exploration, development, production and well completion activity, which could result in a corresponding decline in the demand for the frac sand we produce. Such a decline could result in Covia selling fewer tons of frac sand at lower prices or selling lower priced products, which would have a material adverse effect on our business, results of operations and financial condition. When demand for frac sand increases, there may not be a corresponding increase in the prices for our products and our customers may not switch back to higher-priced products, which could have a material adverse effect on our results of operations and financial condition. The commercial development of economically-viable alternative energy sources could have a similar effect. In addition, the price we receive for sales of frac sand may be impacted by short-term fluctuations in the demand for frac sand, and any negative fluctuations in this demand could have an adverse effect on our results of operations and cash flows.

14

Any future decreases in the rate at which oil and natural gas reserves are discovered or developed may have a material adverse effect on our business and financial condition, even in a stronger oil and natural gas price environment.

Our business is subject to the volatility in oil pricing.

Previously, the Energy Information Administration (“EIA”) assumed OPEC members and partner countries would voluntarily limit oil production in 2020 and 2021, in efforts to maintain balance in global oil markets. As a result of the March 2020 OPEC and partners meeting, the EIA no longer assumes such production management from OPEC members or partner countries. This will have a significant impact on the global oil and gas markets and present near-term supply and pricing pressures as lower forecast crude oil prices may lead to lower U.S. crude oil production, drilling, and completion activity, and lower demand for proppant. This may adversely affect our business, financial condition, results of operations, cash flows, and prospects.

Our operations are subject to the seasonal and/or cyclical nature of our customers’ businesses, which could adversely affect our results of operations.

The substantial majority of our sales are to customers in industries that have historically been seasonal, such as glassmaking, construction and foundry, and/or cyclical, such as the oil and natural gas industry. During periods of economic slowdown, such customers often reduce their production rates and capital expenditures and defer or cancel pending projects. Such developments occur even among customers that are not experiencing financial difficulties. For example, we sell more of our products in the second and third quarters to customers who operate in the Industrial segment due to the seasonal rise in construction driven by more favorable weather conditions. We sell fewer of our products in the first and fourth quarters due to reduced construction and recreational activity largely as a result of adverse weather conditions. As a result, our results of operations may fluctuate on a quarterly basis and relative to corresponding periods in prior years, and any of these factors could adversely affect our business and cause our results of operations to decline.

We cannot predict or control the factors that affect demand for our products. Negative developments in the above factors, among others, could cause the demand for industrial and recreational sand to decline, which could adversely affect our business, financial condition, results of operations, cash flows and prospects.

Due to the inherent risks of our customers’ businesses, our results may be adversely affected.

Demand for industrial minerals is driven to a large extent by the construction and automotive industries. For example, demand for flat glass depends on the automotive and commercial and residential construction and remodeling industries, demand for commercial silica used to manufacture building products is driven primarily by demand in the construction industry and demand for foundry silica substantially depends on the rate of automobile, light truck and heavy equipment production as well as construction. Other factors influencing the demand for industrial minerals include (i) the substitution of plastic or other materials for glass, (ii) competition from offshore producers of glass products, (iii) changes in demand for our products due to technological innovations and (iv) prices, availability and other factors relating to our products.

We cannot predict or control the factors that affect demand for our products. Negative developments in the above factors, among others, could cause the demand for industrial and recreational sand to decline, which could adversely affect our business, financial condition, results of operations, cash flows and prospects.

Continued weakness in the industries we serve has had, and may in the future have, an adverse effect on sales of our products and our results of operations. A continued or renewed economic downturn in one or more of the industries or geographic regions that we serve, or in the worldwide economy, could cause actual results of operations to differ materially from historical and expected results.

A lack of dependable or available transportation services or infrastructure could have a material adverse effect on our business.

We have contracts with rail, truck, ship and barge services to move materials from our mines to our production facilities and to move products on to our customers. We also have arrangements with third parties to provide our customers with last mile logistics. Any significant delays, disruptions or the unavailability of transportation systems and services caused by, among other things, labor disputes, strikes, lock-outs, lack of maintenance, human error or malfeasance, accidents, transportation delays, mechanical difficulties, shortages of trucks, ships or barges, train derailments, bottlenecks, adverse weather conditions, earthquakes, storms, flooding, drought, other natural disasters or environmental events, increased railcar congestion or other events could have a material adverse effect on

15

our business. In addition, these events could temporarily impair our ability to supply customers through our logistics network of rail-based terminals or the ability of customers to take delivery and, in certain circumstances, constitute a force majeure event under our customer contracts, permitting customers to suspend taking delivery of and paying for our products.

We depend on rail transportation to transport our products.

Our business depends significantly on rail transportation. A significant disruption of the rail transportation services utilized by us or our customers could materially and adversely affect our business and results of operations.

From time to time, high demand and unusually adverse weather conditions may cause rail congestion, delays and logistical problems. Rail congestion may affect our ability to supply our products to customers in a timely or cost-effective manner, particularly in situations where our facilities are not located close to customer locations.

In addition to the products we supply, railcars transport many types of products across various industries. If railcar owners sell or lease railcars to our competitors or to companies operating in other industries, we may not have enough railcars to transport our products.

Our failure to properly anticipate our customers’ rail transportation needs or to effectively expend capital on our railcar fleet could result in us losing business to our competitors.

In many cases, we rely on third parties to maintain the rail lines from our facilities to the national rail network, and any failure by those third parties to maintain the lines could impede our delivery of products, impose additional costs on Covia and have a material adverse effect on our business, results of operations and financial condition.

We have a large fleet of leased railcars which results in substantial fixed costs to our business. An oversized fleet relative to the demand for our product to be shipped via railroad or fleet costs which exceed the market rates for similar equipment may have a material adverse effect on our business and financial condition.

Our rail fleet primarily consists of covered sand hoppers which are used primarily to transport sand-based products. The largest use of our rail fleet is to transport our Northern White product within our Energy segment to customers. Our fleet consists of leases with maturity dates that, in some cases, extend beyond 2030. As a result of the reduction in demand for Northern White sand, a number of our leased railcars are no longer in use and are stored on track at our idled facilities or at third party locations. Additionally, the market decline for Northern White sand has caused a significant oversupply of available railcars in the market making it difficult to sub-lease excess railcars. The oversupply of these cars has also caused the market lease rates for railcars to decline significantly. Competitors who are able to procure railcars based on market lease rates today may have a cost advantage relative to Covia. The costs and liabilities associated with unused railcars can be substantial and may include storage costs, switching fees, freight costs and maintenance or repair costs. Furthermore, our railcars are stored at multiple locations with varying restrictions at each site. If we are unable to return railcars within the parameters required by the applicable lease, we may be considered in breach and incur significant costs as a result. These factors resulted in our reporting a substantial impairment in 2020 related to our right-of-use assets related to railcars.

We depend on trucking to transport a significant portion of our products, particularly in areas of increasing demand for our products. A shortage of available truck drivers and difficulty in truck driver recruitment and retention may have a material adverse effect on our business.

In addition to our rail network, we depend on trucking services, particularly in areas in which our customers’ activity has rapidly increased resulting in spikes in demand for transportation. For example, we have significant demand from the Permian Basin in West Texas. As a result, there is high demand for qualified truck drivers to supply the goods necessary to support the increased activity in West Texas at a time when unemployment in the region is low, putting significant pressure on the supply of available qualified truck drivers. Any delay or inability to secure the personnel and services necessary to deliver our products to customers in high activity areas in a timely and cost-effective manner could cause customers to use a competitor and could have a material adverse effect on our business, results of operations and financial condition.

The U.S. trucking industry periodically experiences a shortage of qualified drivers, sometimes during periods of economic expansion in which alternative employment opportunities are more plentiful and freight demand increases, or alternatively during periods of

16

economic downturns, in which unemployment benefits might be extended and financing may be limited for independent contractors who seek to purchase equipment or for students who seek financial aid for driving school. Our independent contractors are responsible for paying for their own equipment, fuel and other operating costs, and significant increases in these costs could cause them to seek higher compensation from us or seek other opportunities within or outside the trucking industry.

The U.S. trucking industry also suffers from a high driver turnover rate. If we are unable to attract qualified independent contractors, we could be forced to, among other things, limit our growth, decrease the number of tractors in service, adjust independent contractor compensation, or pay higher rates to third-party truckload carriers, which could adversely affect our profitability and results of operations if not offset by a corresponding increase in customer rates.

Increasing logistics and transportation costs could reduce our revenues by causing our customers to reduce production or seek products from competitors or by impairing our ability to deliver products to customers.

Transportation, handling and related costs, including freight charges, fuel surcharges, transloading fees, switching fees, railcar lease costs, demurrage costs and storage fees, tend to be a significant component of our total delivered cost of sales. In many instances, transportation costs can represent up to 70% of the delivered cost of our products. As a result, the cost of transportation is a critical factor in a customer’s purchasing decision. The high relative cost of transportation related expense tends to favor manufacturers located closely to the customer. Increased costs that cannot be passed on to customers could impair our ability to deliver products economically to customers or to expand our customer base. In addition, our competitors may be able to deliver products to our customers with lower transportation costs, which, in certain cases, may result in us losing business.

We transport significant volumes of minerals across long distances and international borders. Any increases in our logistics costs, as a result of increases in the price of oil or otherwise, would increase our costs and the prices of our products. In addition, any increases in customs or tariffs, as a result of changes to existing trade agreements between countries or otherwise, could increase our costs, the prices of our products to customers or decrease our margins. Such increases could harm our competitive position and could have a material adverse effect on our business, results of operations and financial condition.

Geographic shifts in demand could negatively impact our business.